Don't wanna be here? Send us removal request.

Text

Large Cap Stocks under 1000rs

0 notes

Text

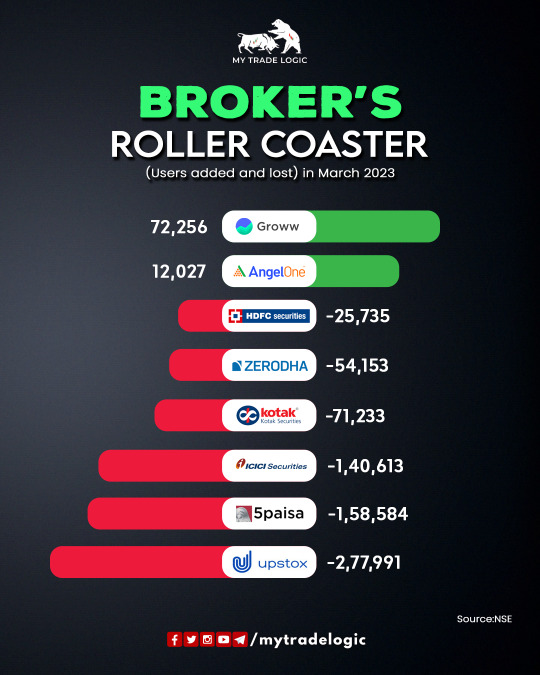

Broker's Roller Coaster in India | My Trade Logic

0 notes

Text

What is the weightage of stock in Bank Nifty index?

See, it depends on which stock's weightage you want to know. Since there are many stocks in Bank Nifty, however majorly, there are 12. So if you want to know the weight of those 12 stocks, here is their list. Have a look.

Bank Stocks Weightages HDFCBANK 27.04% ICICIBANK 23.03% KOTAKBANK 11.72% SBIN 11.27% AXISBANK 11.18% INDUSINDBK 5.58% AUBANK 2.69% BANDHANBNK 1.98% BANKBARODA 1.84% FEDERALBNK 1.68% IDFCFIRSTB 1.08% PNB 0.91%

Now that you know the weightage of stocks in the Bank Nifty index, the question is which one has the highest. To find out, watch the video now!

0 notes

Text

Which stock has more weightage in Bank Nifty?

If you search for this information online, you will find many websites where you will get a related explanation. But if you want to know from My Trade Logic, we can't leave you hanging like that without answering. So, see, Bank Nifty is a group of 12 stocks in which you will find banks like HDFC, ICICI, Kotak, SBI, AXIS, AUBANK, IndusInd, BANDHAN BANK, BANKBARODA, FEDERAL BANK, IDFCFIRSTB, and PNB.

These are all bank stocks starting with HDFC ICICI to ending at IDFCFIRSTB and PNB. It means that it is indeed a group of bank stocks. Still, the question remains which Bank Nifty stocks have more weightage? You need to refer to this video for a complete explanation. Here is the link:

youtube

0 notes

Text

How does NSE select stocks for the NIFTY 50 Index?

As per My Trade Logic, it is based on market capitalization and trading index as measured by average daily turnover. Rest, if you also want to know which of those stocks have maximum weightage in Nifty 50, then do watch this video.

youtube

0 notes

Text

How to stop overtrading?

You can stop overtrading with the help of this simple way suggested by My Trade Logic. Let us find out.

Suppose you succeed in the first trade. You are no longer in danger in the second trade. Therefore, you can put your money in stop loss, and by the end of the day, you will close in neutral.

The second possibility is to suppose your stop loss hits in the first and the second. So you will have the option of either winning or losing or giving a stop loss. But if you hit the stop loss here again, it means you hit it twice. And if the second trade went in your favor. All you have to do is set your target equal to the first stop loss, and then you can recover your loss.

If you want to learn more and particularly that genuine way, watch this video.

youtube

0 notes

Text

How do I overcome over trading in the stock market?

There is an easy and reliable method that many well-known trades recommend to overcome overtrading. Take a maximum of 2 trades in a day, whether you win or lose both. It might seem you illogical at this point. But there is a logic for it.

Suppose you are in profit in your first trade. Then you have no risk in your second trade. So as much money you earned in the first trade, you can put that money as a stop loss and exit in neutral by the end of the day.

Now suppose your stop loss hits, and again, the same possibility you either earn profit or be in loss or you can also apply stop loss. But if the stop loss hits again here, it means your stop loss hits two times. However, if the second trade goes in your favor, all you have to do is set your target equal to the first stop loss, and then you can recover your loss.

But then, if you took the 3rd trade also, you will see the first stop loss and also the loss in the second trade. So this means if there is a 50-50 loss in both trades, you must recover the loss of 100 rupees.

So remember to take a maximum of two trades. To learn more about it in detail, this video by My Trade Logic will be quite helpful. Watch now!

youtube

0 notes

Text

What can be the result of overtrading?

Do you find it difficult to relax while the market is active? Do you also believe that I have improved my ability to read the market once you make a profit? Do you often calculate profit and loss in your head? Do you engage in excessive trading and find it difficult to stop? These are the signs of overtrading.

Now the question is, what can happen due to this? See, first of all, you can trade up to a limit. If you trade more than that, your mind will not work. There will even come a situation when you start taking revenge from the market only to recover the money you have lost by overtrading. But unfortunately, that will not happen; instead, you will end the day with a significant loss.

However, if you want to stop this as soon as possible, there are ways to avoid it suggested by My Trade Logic. Watch this video now, and it will help you.

youtube

0 notes

Link

0 notes

Link

0 notes

Link

2 notes

·

View notes

Link

0 notes

Link

0 notes

Text

How Can Traders Use Volatility For Trading? – My Trade Logic

Since volatility is the rate at which a stock's price rises or falls over time. Understanding volatility has become a need for every trader. Let's start with volatility, which can help you make a lot of money. Then we'll look at how you may leverage volatility to increase your trading profits. So, where do we begin? Continue scrolling.

If we look at it from the standpoint of a newcomer, it signifies how volatile the market is and how much movement you may expect. During a market shift, the volatility of a particular stock or index may be present. It means that if the volatility of Nifty is high, the chances of breaking down highs and lows of Nifty and the possibilities of an improved rally are also high. You can learn volatility in many ways, as explained by My Trade Logic. Without using any indicators, there is a simple approach to calculating volatility. To do so, you must examine the price of the stock and the ATR (Average True Value). When the volatility of the stock is low, it indicates that volatility is low and the particular stock is not yet ready to skyrocket. Furthermore, as traders, our only aim is to make money and more money. My Trade Logic says that using an indicator to determine volatility is another option. Here, you can use the VIX indicator; dedicated to volatility- you can use it to your advantage, but keep in mind that it has a range. If this range is less than 15 or between 10 and 15, the indication is unlikely to fall below this level. A strong rally could occur in either direction, and you should be ready for it.

youtube

If you want to know how to use volatility- it's simple. After you've grasped the concept of volatility, you'll need to learn how to read the VIX indicator, the open interest, and the volatility move in lockstep with the trend. Keep in mind that you should never trade without a stop loss. You will be left with nothing if you assume a specific risk in volatility and trade without a stop loss.

0 notes

Text

What is Volatility- How to learn & profit from it | My Trade Logic

Today, we've made yet another educational video for you. In this video, we'll talk about a crucial topic: volatility. You've probably heard or read somewhere that whoever understands market volatility makes a lot of money. As a result, we'll discuss volatility, how to earn as a trader despite it, and how to profit more at a higher risk. So, let us get started, shall we? Here we go.

Many traders in the market, we believe, are aware of the concept of volatility but are unsure how to use it. When we talk about volatility in the context of beginner traders, we're talking about how volatile the market is and how much significant movement you may expect. During a market change, the volatility of a particular stock or index may be apparent. It means if the volatility of Nifty is high, the chances of breaking down the highs and lows of Nifty are equally high, as are the chances of a strong rally.

Volatility has significant rewards due to the large move. If the move is in your favour—100 to 200, 200 to 300—you won't even realize when your option price moves, and you'll make a significant profit. However, if you have a terrible day or make a stupid choice, and the movement is in the opposite direction, you'll lose a lot of money. It is something you must remember.

You can learn about volatility in a variety of ways. There is, however, a straightforward approach for learning how to calculate volatility without the use of indicators. Take a look at the stock's price first, then the ATR. ATR stands for Average True Value. Let us say if you have a 100 rupee stock and its OI is increasing at 110, 120, 130, and so on, and the reverse is at 90, 70, or even 80, it indicates that the stock's volatility is increasing. The OI will not fluctuate significantly if the volatility of a stock is modest, as it is in the 100 rupee stocks 101, 102, 103, and 110. It shows that volatility is low and that these equities aren't yet ready to take off. Our main goal as traders is to make money and make more money. Nothing, especially for option buyers or future traders, is more important than volatility to make a big profit. When there is more volatility in the options market, the premium you pay on the option price climbs drastically since the risk of the options also rises.

If the Bank Nifty is trading at 35000 and the market volatility is high, the strike price will be 35500 or perhaps 36000, which is highly expensive on the call side due to the high volatility expectation. Take a look at the data from February 1st for an example. It was budget day, and strike prices of 1500, 2000, 2500, 3000, and higher were becoming unaffordable. As a result, none of the buyers can make a purchase. You can learn more about it in the video below.

youtube

Another alternative is to use an indicator as a method of determining volatility. In the Indian Stock market, the VIX indicator is used for this in particular, which is committed to volatility. So you can take advantage of it and keep in mind that the VIX indicator has a range. If the VIX is less than 15 or between 10 and 15, it suggests VIX will not fall below that level. A big rally could occur in either direction, and you should be well prepared. As VIX approaches its inverse, such as 40 or 35, the chances of advancing beyond it diminish. From there, the market will either be flat or sideways, due to which your best bet will be to buy. As a result of the premium decay, you will lose money.

Traders, the main goal of today's video is to show you how to profit from volatility. If VIX is low, as we said before, you should set a VIX level, understand the market mood, and determine whether the market is in a bullish or bearish trend. If the market is in a downturn, it is in pause mode, which suggests that another huge bearish trend could start from here, or the market could reverse rapidly. When the market shifts to any side, a trader might profit handsomely by buying a call or a put.

How can you avoid this? It's time to purchase if the VIX is 35 or 40, and if you're buying as a swing trader for 2-days, 4-days, or 5-days, theta day will be pretty quick from there. If the expiration date approaches, the VIX will continue to fall, inventiveness will plummet, and the market will move less, resulting in significant losses.

So the simple message you can take from here is that no one can stop you from booking profit if you understand volatility, particularly how to read VIX, read OI, and shift volatility along with the market trend, as we told in the video. You can make a lot of money with volatility. It's important to remember that you should never trade without a stop loss. You will be left with nothing if you work a specific risk in volatility without a stop loss. Your account will get nil, and you will be unable to execute the trade owing to a lack of cash, which you will regret.

0 notes

Text

Futures and Options Trading in The Stock Market - My Trade Logic

What are future and options? Are stock futures and options the same? What factors do you need to consider before trading in futures and options? Futures are contracts that allow you to trade an investment instrument at a specific price and on a set date in the future. In general, it is a wager placed on the instrument price in the future. That is why it is known as futures trading. This trading happens with a futures contract that specifies the details of future trading.

My Trade Logic says you can do futures trading in many ways. It includes trading commodities, currencies, and stocks with futures trading. There are two parties involved in future trading: a seller and a buyer. Both sides attempt to forecast the value of an instrument till a particular date.

On the other hand, options are a type of derivative. What makes them different from futures is that it allows a buyer or seller the right to buy or sell a particular asset at a specific price but not the obligation to do so.

Are futures and options the same? No. Many people confuse futures and options, although they are not the same in terms of the obligations they impose on individuals. An investor in a futures contract should follow up on a contract by a due date already set. On the other hand, the rights of an individual in an options contract are to do so.

To purchase or sell an underlying security futures contract follows up with a set date at a predetermined price. On the other hand, an options contract allows a buyer to do so.

Factors to consider before trading in the future and options You agree to a contract when you trade futures that any stock will go above or below a particular price. So, what do you have in mind for the future? You will acquire something if you believe it will increase in value. If its value decreases, you will sell it. The money margin is now the most critical factor you need to keep in mind whenever you trade in the future.

What is the money margin, exactly? According to My Trade Logic, it's a term that means you don't have to risk everything for something. My Trade Logic says that you can trade by paying a percentage of the total amount.

When your options run out of time, the expiration date becomes weekly, and you only have a monthly expiration date left. The second type of option you have is- call and put. These are the only alternatives that are still available.

If you think the market will go up, you can buy a call, and if you think the market will go up and down, you can buy a put.

Another thing you may do is sell options. If the market falls, you must sell the call option when selling options. Now, we've talked a lot about futures and options, and we're sure you've gained a lot of knowledge from this blog. Even so, if you want to learn more about it, watch this video right now!

youtube

0 notes

Text

Should you invest in LIC IPO or not? - My Trade Logic

These days one thing is being searched a lot in the market, and it is about the IPO of LIC – What is the launch date of LIC IPO, what is going to be its valuation, whether you should invest in it or not, how much one should invest and if not, then why not? My Trade Logic will be discussing all this today and will do its best to address all your queries. Also, we hope that you will get all your answers by the end of this blog. So stay with us.

First of all, if we talk about the market sentiment, both global and Indian markets are running weak. So is this the right time to invest in IPOs, especially the IPO of LIC, given the government plays an equal role in these offerings as investors? The first question that arises from all this is- when the IPO of LIC will announce. See, the IPO of LIC is likely to hit public this month and will be open for anchor investors soon. Retail investors can also start investing in LIC IPO in the next few days. Although, LIC is instructing its policyholders to link their PAN cards to their policies to become eligible for LIC IPO shares.

The second point which My Trade Logic wants to let you know is what is going to be its valuation? See, the total capital you can expect is in the range of 60,000 - 80,000 crores, and with this, it will be the largest in Indian market history. A few months ago, PAYTM IPO was also issued with a valuation of 18000 crores, making it the largest IPO in the country. So, you can expect that it will shatter this record.

On the other hand, if we talk about all the big IPOs, they have failed to please the investors. If we check PAYTM, we can see that it experienced almost 50% downfall within 2-3 weeks only. So here it is also going on the back of the mind that whatever the issue price of LIC will be if it is higher, it should not replicate the PAYTM scenario here, and there should not be a significant drop from the issue price. Invest in LIC IPO or Not?

As a result, before you invest, you should be aware of some facts, such as government control over LIC. Yes, the government has always had some control over LIC, whether it comes to finance, assignment of shares, or control over the whole system. As a result, where the government is more involved, the expansion of privatization in the freedom scenario is always a concern.

So you’ll have to evaluate if the government’s control will be more, and whether you should invest in it or not; the final decision will be yours. The second point which My Trade Logic wants you to consider is the market participation of LIC is dwindling because, in the year 2000, when insurance privatization happened, a steady decline was seen in LIC participation. Before 2000, there was only one superpower in the policy market: LIC, followed by HDFC, SBI, ICICI. LIC shares experienced a consistent drop since the expansion of companies, which has affected the returns.

youtube

Another point to consider as per My Trade Logic is that LIC is reliant on its agents. We see most of the agents inside LIC across the country, and 94% policy conversion has become possible with the help of agents. So it could be a negative for them somewhere because they are so reliant on their agents. Also, LIC is lagging behind other insurance companies in technology-based marketing. Apart from that, the benefit of profit holders has decreased because, formerly, LIC used to distribute about 95% of its profit to its policyholders, and ultimately it divided its earnings into two divisions. A part of it goes to the policyholder while the rest goes to the investor. As a result, we will notice that there will be profit diversion to some level, which may cause misunderstanding.

0 notes