Note

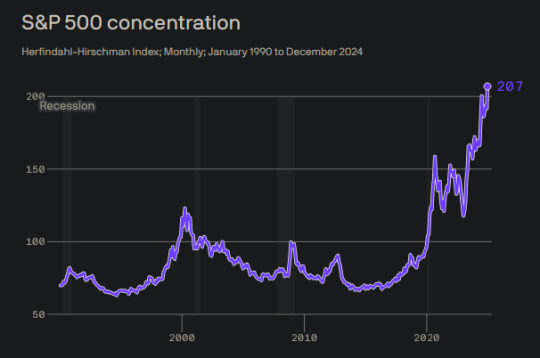

That seems likely, Looking at this report's Exhibit 3:

Up to 2022, of those charted, only IT seems to creep up significantly post 2020

(The thesis of the paper is that after periods of high concentration, equal-weighted (as opposed to cap-weighted) indexes do better)

I don't mean to be dense, but can you say a little more about why argumate's take on anti-trust law as a bulwark against communism is particularly bad?

I mean, the idea that laissez-faire capitalism inherently leads to increasing business concentration, ultimately culminating in one company running everything, is not new. It’s the basis of Marxism, where the idea is to speed the process along, skipping the part in the middle where everyone is increasingly impoverished.

It’s flawed in that there aren’t increasing returns to scale all the way up. When a conglomerate becomes too large, it becomes sluggish and either spins off parts of itself at the behest of the shareholders or is subject to being outcompeted. And there has been quite a lot written about how the “predatory pricing” strategy is not nearly as prevalent or (particularly) profitable as people seem to think it is.

The idea of one company gradually vacuuming up everything just isn’t a realistic fear, so it’s foolish to defend antitrust law on that ground.

That’s separate from the idea that antitrust is necessary to encourage competition and low prices in certain, limited industries that have the right conditions to form natural monopolies. Which I’m also skeptical of, but it’s a lot more sensible in theory.

#taking things at face value#time to short#jk dont do that#there should be some way to short markets without unlimited downside

85 notes

·

View notes

Note

It looks like we've done it! Concentration has gone above 200 for once (looks like the same chart/metric as what voxette-uk had previously, just extended forward in time ~5 years) We haven't had these numbers since the '60s.

I don't mean to be dense, but can you say a little more about why argumate's take on anti-trust law as a bulwark against communism is particularly bad?

I mean, the idea that laissez-faire capitalism inherently leads to increasing business concentration, ultimately culminating in one company running everything, is not new. It’s the basis of Marxism, where the idea is to speed the process along, skipping the part in the middle where everyone is increasingly impoverished.

It’s flawed in that there aren’t increasing returns to scale all the way up. When a conglomerate becomes too large, it becomes sluggish and either spins off parts of itself at the behest of the shareholders or is subject to being outcompeted. And there has been quite a lot written about how the “predatory pricing” strategy is not nearly as prevalent or (particularly) profitable as people seem to think it is.

The idea of one company gradually vacuuming up everything just isn’t a realistic fear, so it’s foolish to defend antitrust law on that ground.

That’s separate from the idea that antitrust is necessary to encourage competition and low prices in certain, limited industries that have the right conditions to form natural monopolies. Which I’m also skeptical of, but it’s a lot more sensible in theory.

#only argumate can bring back regularly the voices of those who left us#i do miss voxette#hope they are doing well after law school

85 notes

·

View notes

Text

We regret to inform all involved that they lied In fact, the article by Human Rights Watch opens with September 17 marks three years since the Taliban banned secondary education for girls in Afghanistan, shortly after their return to power in August 2021.

diversity win! muslim women finally allowed to wear hijab after being freed from american bikini yoke by taliban!

#alice evans please finish writing your book#it is a shame that when the second wave feminists won at home#they didn't follow up with a global crusade

83 notes

·

View notes

Text

(stolen form unknown tumblr; reproduced by memory) Your ship captain of seventen years has a parrot daemon, and you ever wondered if he married the sea after his daemon settled, for the joke. Until one day a pirate ship came close enough to board, and a whale erupts from the sea.

Wishing he had seen more of life before taking on such a big commitment, local sailor Marcus Haines told reporters Tuesday that he regretted getting married to the sea so young. “I was so captivated by those big blue waves that I never stopped to consider whether I was rushing into things with the briny deep,” said the contemplative mariner, admitting that he sometimes wondered whether he might have ended up as a forester or even a mountaineer if he’d given himself more time to explore in his youth.

Full Story

632 notes

·

View notes

Audio

since i only ever send rick rolls to ppl i figured id just post one for all my followers for april fools day this year to save myself the effort

happy april fools y’all

241K notes

·

View notes

Text

I wonder if this is more prevalent among among Chinese (and to some extent Japanese) speakers, where the syllabary bears no relation to the pronunciation.

I have been fortunate enough to have my books turned into audiobooks, but there's a moment that makes me deeply embarrassed, which is when they ask me how things are pronounced.

I don't know how things are pronounced. They're just words on the page. I don't say them in my head when I write.

So I sit there trying to say words like I've never said a single word in my life, and it always sounds very wrong, because these were meant to be a collection of letters rather than a collection of sounds. I am attempting to work out the phonics from first principles.

#language#i'm losing this as I age#used to never misspell words#since nearly all words are written-first

139 notes

·

View notes

Text

We argued nuclear power out of Taiwan!

We once argued it out of Germany, but the tides have turned!

You can't argue against a technology. No one has ever, ever, in the history of humanity, argued a technology out of existence. The closest we've come are nukes and human genetic engineering. Nukes exist and multiple countries have massive arsenals of them, but we've agreed not to use them because it would mean humanity's utter destruction. Human genetic engineering cuts right to the heart of a bunch of ethical questions about health, equality, identity, and so on, and also up until very recently genetic engineering has been a long and extremely expensive process. We'll see how long human genetic engineering remains taboo now that it's getting cheaper and easier. But these are absolute outliers. In the vast, vast majority of cases, I mean literally in virtually every single case, when people fight a new technology—for any reason—they loose.

There is no tenable "anti-AI art" position, just like there was never a tenable anti-loom position, or anti-railroad position, or anti-horseless carriage position. These things were doomed to fail absolutely from day one, as soon as the technology existed, and anti-AI art is doomed to fail just as utterly and completely. There is just no path here, if this is what you've hitched your wagon to I really do not know what to tell you.

4K notes

·

View notes

Text

what prevents us from just saying "non-black", etc, for 4c?

Join me at patreon.com/CardboardCrack for extra comics, looks behind the scenes, and more!

59 notes

·

View notes

Text

Just need a bigger one of those

if you had to pass a camel through the eye of a needle it would be easier if it was a dromedary (one hump) than a bactrian camel (two humps), right

64 notes

·

View notes

Text

Ah, what I meant was that, according to the original post, the net transaction here is that low-risk consumers are getting paid by using credit cards, and high-risk consumers are paying to use credit cards. Some of the latter's payment ends up in the hands of the former. This is (kind of) analogous to the low-risk consumers an interaction where the low-risk consumers lend to the high-risk ones. The low risk consumers get cash and the high risk consumers get credit (and the card issuer borrows money to pay for things by convincing banks that the debt is good due to a mix of low risk consumers nearly always pays and the low risk consumers are charged appropriate interest). But regardless of my potential misreadings (which is not unlikely), the idea that high risk consumers are in some sense paying low risk consumers (via credit card company policies/rebates) don't appear to be true, according to the cited paper. Both low-risk and high-risk consumers are profitable customers in their own right, to the credit card company. Somehow, it's only the middle-risk consumers that are a loss.

was thinking about how these two viewpoints which seem on their surface to be diametrically opposed are reflections of a deeper truth, something tied to that oft-cited Boots Theory - not having money is expensive and having money is cheap, etc etc

and to vren's point, this is not the result of rigging or malfeasance, it emerges from simple, mathematical alignments of incentives at each layer of the system - credit card issuers provide the service of absorbing risk to payment recipients in exchange for fees and the service of lending to high-risk consumers (ie, poor people) in exchange for interest, but the people they most need to attract, low-risk consumers (ie, rich people, who spend a lot more money), have nothing to gain from the system as presented, so they must be wooed by giving them a cut of the system's proceeds in the form of cash back.

and the net result of this wholly natural system is that poor people pay to use the system and rich people are paid to use it! credit cards are far from unique in this regard - both wealth and the lack of it have this tendency to compound, all across the economy.

there are real advantages to financialization, to all the ways debt and lending enable greater resource utilization, greater investment, etc - before i leaned into the social democrat label i referred to myself as a market socialist - and yet it seems a mathematical inevitably that, when left to their own devices, these systems will create drastic inequality. and if you believe, as i do, that regardless of questions of merit or desert or even fairness, inequality is poison to the fabric of society, then the problem you have to solve is a rather thorny one.

87 notes

·

View notes

Text

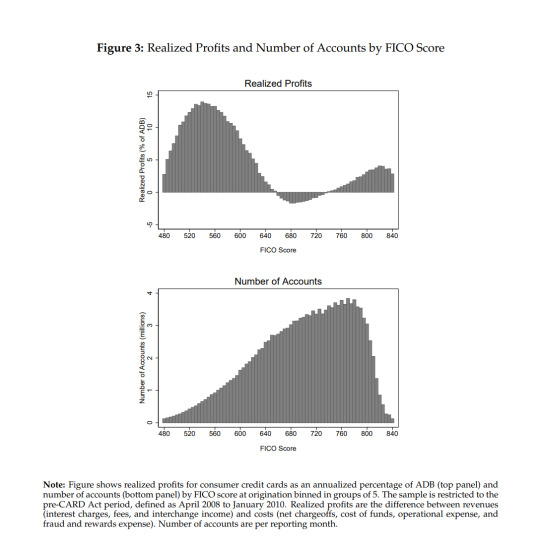

The gist of the post seems to be that, credit cards form a loan system where low-risk consumers lend money to high-risk consumers, for something close to an interest. This seems, anodyne? But perhaps this is not even true (or I'm missing something). REGULATING CONSUMER FINANCIAL PRODUCTS: EVIDENCE FROM CREDIT CARDS, (Figure 3 reproduced below)

It looks like those with credit scores > ~740 are profitable customers that don't need subsidization. That is, if you could form a credit card company that only approved people with >740 credit score, you'd do just fine.

The same could be said of higher-risk customers, with scores <~630. It's the customers in between that loses the credit card companies money and need to be subsidized. I cannot guess as to why they are accepted as customers (okay, my best guess is that the particular credit range is unstable, and customers either move towards a higher score or a lower score).

was thinking about how these two viewpoints which seem on their surface to be diametrically opposed are reflections of a deeper truth, something tied to that oft-cited Boots Theory - not having money is expensive and having money is cheap, etc etc

and to vren's point, this is not the result of rigging or malfeasance, it emerges from simple, mathematical alignments of incentives at each layer of the system - credit card issuers provide the service of absorbing risk to payment recipients in exchange for fees and the service of lending to high-risk consumers (ie, poor people) in exchange for interest, but the people they most need to attract, low-risk consumers (ie, rich people, who spend a lot more money), have nothing to gain from the system as presented, so they must be wooed by giving them a cut of the system's proceeds in the form of cash back.

and the net result of this wholly natural system is that poor people pay to use the system and rich people are paid to use it! credit cards are far from unique in this regard - both wealth and the lack of it have this tendency to compound, all across the economy.

there are real advantages to financialization, to all the ways debt and lending enable greater resource utilization, greater investment, etc - before i leaned into the social democrat label i referred to myself as a market socialist - and yet it seems a mathematical inevitably that, when left to their own devices, these systems will create drastic inequality. and if you believe, as i do, that regardless of questions of merit or desert or even fairness, inequality is poison to the fabric of society, then the problem you have to solve is a rather thorny one.

#finance#wish i had the brains to do finance#i don't have the correct mental habits like asking “where's the risk transfer”

87 notes

·

View notes

Text

Is that a Moire Effect? Why would it show up here? (it even spins! not an artifact of my monitor / CSS orientations!)

spin this wheel of all the pokemon. you now have to fight this pokemon. just you and it, bare-knuckle

#scizor#gen 5 OU king#I try to run recalling that it is slower than Scizor#it uses STAB Technician Bullet Punch#i perish

33K notes

·

View notes

Text

youtube

OK my favorite moment in Taiwanese msuic history is when two Taiwanese musicians sued the German band Enigma for using a sample from one of their songs without paying them.

The reason I love it so much is that the Enigma song is called “Return to Innocence”, and it’s heavily based around the sample from the Taiwanese musicians, who are singing a Taiwanese aboriginal folk song (they are aboriginal themselves). I think it’s so stupid to use their folk song to symbolize return to innocence. And the Taiwanese musicians suing Enigma ruins the symbolism so perfectly.

“Return to Innocence” is the evil twin of “Sisters” by A-Mei, a song that came out two years later (the Enigma song came out 1994, the A-mei song came out 1996). A-Mei’s song is also a pop song which features traditional Taiwanese aboriginal singing. The symbolism is different–the song is about home, familiarity, and the cycles of nature. WHich makes sense I guess because A-Mei is aboriginal herself–but she’s a pop singer, not a folk singer, someone else is doing the folk singing.

77 notes

·

View notes

Text

👍

👍🏻

👍🏼

i am as white as a white american can get and the thought of using the white color emojis sickens me to the bone. bitch if you dont make me simpsons yellow

67K notes

·

View notes

Text

With the recent oil price plummet, and rampant cheating in OPEC+, Saudi Arabia will have to try very hard to build the non-default desert megaproject: unused monument in the sand.

gotta hand it to Saudi Arabia's urban planning department. nobody else has the combination of huge revenues and absolute autocratic control to even conceive of the wild shit MBS keeps announcing.

#what a waste#how's the other 2030 projects going#21 billion in esports#buying physical sports teams#yep that's sound economics#gotta give it to bonesaw man for letting women drive and attend theatre though

700 notes

·

View notes

Text

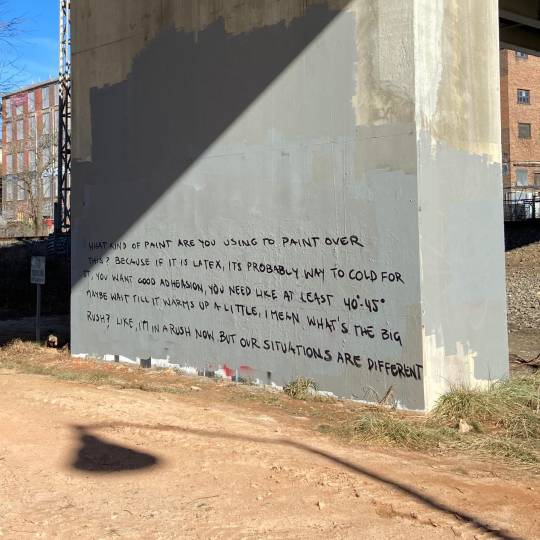

how did they fit all the words on the wall in justified spacing, while in a hurry?

121K notes

·

View notes