#Cash Flow Projections

Explore tagged Tumblr posts

Text

Affordable Cash Flow Forecasting: Examining Moolamore's Pricing Options

Having trouble keeping track of your activities? Are you constantly concerned about liquidity crises and lost opportunities? Does your SMEs' financial future appear bleak and colourless?

Bring back the exciting path to long-term success! There's the cutting-edge Moolamore, which provides an affordable yet effective cash flow forecasting solution. Furthermore, this tool will accommodate your company's ever-changing needs and demands while remaining cost-effective. Continue to read until the end!

#cash flow forecasting#cash flow projections#affordable cash flow forecasting#cash flow management#cash flow planning#cash flow analysis#cash flow modeling

0 notes

Text

Forecasting cash flow is the act of predicting the inflow and outflow of money of a business over a specified time period. By anticipating future cash positions, avoiding crippling cash shortages, and maximizing returns on any cash surpluses they may have, companies benefit from an accurate cash flow forecast.

#Cash Flow Forecasting#Cash Flow Forecasting Accuracy#Overcome Forecasting Cash Flow Challenges#Cash Flow Projections#IBN Technologies

0 notes

Text

Navigating tax equity in the US presents its fair share of challenges. However, by skillfully leveraging tax incentives and mastering the system's intricacies, one can unlock the full potential of renewables. It's a clever way not only to drive economic success but also to make a significant positive impact on the environment. 💚💼 Making Green by Going Green! ✨ What sets this model apart? ✨ 🔹 Tailored financial analysis that precisely addresses the needs of PV farm projects. 🔹 Efficient management of capital accounts and careful consideration of tax basis. 🔹 Flexibility to explore back leverage loan options for optimized financing. 🔹 Seamless allocation of income and cash flow/waterfall among partners. 🔹 Reliable projections to empower confident decision-making. 🔹 Robust reporting and analysis capabilities.

👉 Access the model now to unlock the full potential of your PV farm partnerships. Let's propel the renewable energy revolution forward!

#Equity financing#Equity allocation#Energy sector#Energy production#Energy pricing#Energy policy#Energy market#Energy efficiency#Energy consumption#Discounted cash flow#Depreciation#Decision-making#Debt service#Debt restructuring#Debt repayment#Debt financing#Cost analysis#Cash reserves#Cash management#Cash flow projections#Cash flow optimization#Cash flow modeling#Cash flow management#Cash flow liquidity#Cash flow forecasting#Cash flow analysis#Capital structure#Capital investment#Capital accounts#Budgeting

0 notes

Text

Can a Construction Cost Estimator Sydney Help Avoid Project Delays?

Construction delays can severely impact project budgets, timelines, and stakeholder satisfaction. Many Sydney-based builders and clients ask whether hiring a construction cost estimator can help prevent such delays. The answer is yes—cost estimators play a proactive role in minimizing delays through detailed financial planning and risk management.

Understanding the Role of a Construction Cost Estimator

A construction cost estimator provides detailed forecasts of all project costs, including materials, labor, equipment, permits, and contingencies. These comprehensive estimates help project owners and managers allocate resources efficiently, avoiding cash flow shortages that can halt construction progress.

Estimators also analyze market conditions, such as current material availability and labor supply, which are critical factors in Sydney’s competitive construction environment. Incorporating these variables helps create realistic schedules and budgets.

How Accurate Estimates Reduce Delays

One of the primary causes of construction delays is insufficient budgeting. When budgets fall short, work must pause until additional funds are secured, causing costly downtime. A thorough estimate anticipates these risks by including contingency allowances for unforeseen expenses.

Additionally, accurate cost forecasting allows contractors to plan procurement and workforce deployment effectively, reducing the chances of material shortages or labor bottlenecks that could stall the project.

Estimators and Tendering Process

During the tender phase, estimators provide detailed cost breakdowns that help contractors prepare competitive and realistic bids. This transparency minimizes the risk of underbidding, which is a common cause of project delays when contractors struggle financially mid-project.

By helping select financially viable contractors, estimators contribute to smoother project execution and timely completion.

Ongoing Cost Monitoring to Prevent Delays

Many construction cost estimators continue to support projects during execution by tracking actual costs against budgets. This ongoing monitoring allows early detection of overruns or scope changes that might impact schedules.

Prompt reporting of cost variances enables project managers to take corrective action before issues become delays, ensuring projects stay on track.

FAQs

How does a construction cost estimator help prevent delays caused by funding shortages? By preparing detailed budgets with contingency funds, estimators ensure sufficient resources are available to keep work progressing smoothly.

Can estimators predict supply chain or labor shortages in Sydney? Yes, experienced estimators incorporate local market intelligence to forecast potential availability issues and adjust plans accordingly.

Does accurate cost estimating improve contractor reliability? Absolutely. Realistic budgets allow contractors to bid fairly and manage resources efficiently, reducing financial stress that leads to delays.

Is ongoing budget tracking by estimators beneficial? Yes, it enables early identification of cost overruns, allowing timely interventions to avoid delays.

Conclusion

In Sydney’s fast-paced construction industry, delays can significantly disrupt project outcomes. Engaging a construction cost estimator helps prevent these delays by delivering accurate, realistic budgets and identifying risks early.

From thorough initial forecasting to ongoing cost monitoring, estimators provide financial clarity and control. Their involvement promotes better planning, smoother tender processes, and proactive management of unforeseen challenges.

Ultimately, a skilled construction cost estimator is a valuable partner for keeping your project on schedule and within budget, reducing the likelihood of costly setbacks.

#small construction cost estimator Sydney#construction cost estimator Sydney for residential projects#affordable cost estimator Sydney#how construction cost estimators prevent delays Sydney#construction estimating service Sydney#construction budget planning Sydney#Sydney construction delay prevention#construction project cost control Sydney#detailed construction cost estimate Sydney#construction cost forecasting Sydney#Sydney construction budgeting expert#cost estimating for Sydney home builds#managing construction delays Sydney#construction estimating and scheduling Sydney#construction cost management Sydney#construction cost estimator for renovations Sydney#Sydney construction tender estimating#construction risk management Sydney#construction budget contingency Sydney#construction material cost estimator Sydney#cost estimator for Sydney commercial projects#construction estimating software Sydney#construction project finance Sydney#cost estimator for small builds Sydney#construction delay mitigation Sydney#Sydney building cost consultant#construction cash flow planning Sydney#construction procurement planning Sydney#construction project timeline Sydney#construction cost estimator reviews Sydney

0 notes

Text

How Financial Forecasting Helps Stay Ahead|Pragmatic Finance

Want to prepare your business for the future? Financial forecasting is a powerful tool that helps businesses anticipate trends, make informed decisions, and adapt to market changes. In today’s fast-paced and unpredictable economic landscape, staying ahead of shifts is crucial for long-term success. At Pragmatic Finance, we offer expert financial forecasting solutions designed to help businesses navigate uncertainty with confidence. In this guide, we’ll explore the importance of data-driven planning, how forecasting supports strategic growth, and how to build a reliable forecasting strategy for your business.

Why Choose Pragmatic Finance for Financial Forecasting?

With Pragmatic Finance, businesses gain access to advanced forecasting tools and expert guidance to support smarter financial planning. By leveraging historical data and market trends, companies can generate accurate financial predictions that inform better decision-making. Pragmatic Finance offers custom forecasting models tailored to specific business goals, along with strategies to mitigate risk during economic uncertainty. With improved budget planning and access to seasoned industry professionals, businesses can allocate resources effectively, invest confidently, and build a more stable financial future through precise and proactive forecasting.

The Role of Data in Smart Business Decision-Making

Financial forecasting relies on comprehensive data analysis to uncover patterns and predict future financial performance. Key data sources include:

Revenue & Sales Trends – Identify seasonal shifts and long-term growth patterns.

Market Conditions – Assess external influences such as inflation, competition, and industry shifts.

Expense Tracking – Project operational costs to maintain profitability.

Economic Indicators – Monitor interest rates, inflation, and consumer behavior.

By leveraging these insights, businesses can proactively address challenges and seize growth opportunities.

Benefits of Financial Forecasting for Businesses

Financial forecasting offers a range of benefits that help businesses stay ahead in a competitive market:

How to Implement a Strong Forecasting Strategy

Pragmatic Finance recommends the following steps for a successful financial forecasting strategy:

Set Clear Business Goals – Define short-term and long-term financial objectives.

Gather Accurate Data – Use past financial reports and market research for analysis.

Choose the Right Forecasting Model – Select between qualitative and quantitative forecasting.

Monitor & Adjust Projections – Regularly update forecasts based on real-time data.

Use Financial Software – Leverage technology for precise and automated forecasting.

Stay Ahead of Economic Changes with Pragmatic Finance

A strong financial forecasting strategy is key to long-term business success. At Pragmatic Finance, we work with businesses to create data-driven financial plans that help navigate economic changes with confidence. From budgeting support to long-term forecasting, our expert team provides the insights needed for smarter decision-making and sustainable growth. Contact Pragmatic Finance today and start building a financially stable and profitable future for your business.

#Pragmatic Finance#Financial forecasting for businesses#Business growth strategy#Economic trend analysis#Data-driven financial planning#Business cash flow projections#Forecasting market changes#Pragmatic Finance forecasting solutions#Business budgeting strategies#Predictive financial modeling#Risk management for businesses#Long-term financial planning#Financial data analysis#Smart business decision-making#Investment forecasting#Business revenue projections

0 notes

Text

From Purchase to Profit: A Comprehensive Guide to Mortgage Note Investing

Welcome to the world of mortgage note investing! If you're looking for a way to generate passive income while diversifying your investment portfolio, you’ve come to the right place. In this blog, we’ll explore everything you need to know, from understanding mortgage notes to scaling your investments.

What is Mortgage Note Investing?

Mortgage note investing involves buying the rights to receive payments on a mortgage loan. When you purchase a mortgage note, you essentially become the lender, receiving monthly payments from the borrower. This investment can provide a steady cash flow, making it an attractive option for many investors.

Benefits of Mortgage Note Investing

Passive Income: One of the main draws is the potential for regular income from monthly payments.

Diversification: Investing in mortgage notes allows you to diversify beyond stocks and bonds, reducing overall risk.

Control: You have the ability to choose which notes to invest in based on your risk tolerance and investment strategy.

Understanding the Risks

While mortgage note investing can be lucrative, it's not without risks:

Default Risk: Borrowers may fail to make payments, leading to potential losses.

Market Fluctuations: Changes in real estate values can impact the value of your investment.

Regulatory Changes: Be aware of new laws that may affect mortgage lending.

Getting Started

Step 1: Educate Yourself

Start by learning the fundamentals of mortgage notes. Consider enrolling in online courses, reading books, or attending workshops.

Step 2: Conduct Market Research

Understand the current trends in the real estate market. This knowledge will help you make informed decisions.

Step 3: Network

Connect with other investors, note brokers, and real estate professionals. Networking can lead to valuable opportunities and insights.

Sourcing Mortgage Notes

Direct Purchases: Approach banks or individual sellers directly.

Note Brokers: Work with professionals who specialize in buying and selling notes.

Auctions and Marketplaces: Explore online platforms dedicated to note trading.

Evaluating Mortgage Notes

When evaluating a note, consider:

Borrower Creditworthiness: Assess the borrower's financial history.

Property Value: Ensure the property is worth the investment.

Payment History: Review past payment patterns to gauge reliability.

The Purchase Process

Negotiation: Agree on a purchase price with the seller.

Documentation: Ensure all legal documents are in order, including the assignment of the note.

Closing: Finalize the transaction through an escrow service or attorney.

Managing Your Investment

Payment Tracking: Keep meticulous records of payments received.

Communication: Stay in touch with borrowers to address any issues.

Default Management: Have a strategy for handling late or missed payments.

Exit Strategies

Consider your options for exiting an investment:

Selling Notes: If you wish to liquidate your investment, consider selling on the secondary market.

Foreclosure: As a last resort for non-performing notes, you may need to initiate foreclosure proceedings.

Re-performing: Work with borrowers to help them resume regular payments.

Scaling Your Investment

Once you're comfortable, think about expanding your portfolio:

Diversification: Invest in different types of notes and various markets.

Automation: Utilize software tools for tracking payments and managing your portfolio.

Partnerships: Collaborate with other investors to share resources and expertise.

Conclusion

Mortgage note investing offers a unique opportunity to earn passive income and build wealth. By understanding the fundamentals and following a strategic approach, you can turn your investment into a profitable venture.

Additional Resources

Books: Look for reputable titles on mortgage note investing.

Webinars and Courses: Consider platforms that offer in-depth training.

Networking Groups: Join communities of like-minded investors for support and advice.

#invest in ceo fund#Real Estate Notes#purchase mortgage notes#investing in notes and mortgages#investing in real estate mortgage notes#monthly cash flow projection#purchase real estate notes#real estate mortgage notes#invest in mortgage notes#what is mortgage note investing#real estate note investing

0 notes

Text

The Importance of Cash Flow Projection in Business Expansion Planning

When planning business expansion, understanding and managing cash flow is crucial. Cash flow projection is a financial forecasting tool that helps businesses estimate their future cash inflows and outflows. It's the financial roadmap that guides your business expansion, helping you anticipate challenges, make informed decisions, and ultimately, achieve sustainable growth.

Understanding Cash Flow Projection

Cash flow projection is essentially a forecast of your business's income and expenses over a specific period by a business growth strategist. It helps you visualize how much money will flow in and out of your business, allowing you to identify potential cash shortages or surpluses.

Key Components of a Cash Flow Projection

A comprehensive cash flow projection typically includes the following components:

Cash inflows: These include revenue from sales, interest income, and other sources of income.

Cash outflows: These include expenses such as cost of goods sold, operating expenses, debt payments, and capital expenditures.

Net cash flow: This is the difference between cash inflows and cash outflows.

Opening and closing balances: These represent the starting and ending cash balances for the projection period.

Why is Cash Flow Projection Crucial for Business Expansion?

Financial Stability: A sound cash flow projection allows businesses to:

Identify potential cash shortages: This helps businesses take proactive measures to avoid financial crises.

Optimize cash management: By understanding future cash needs, businesses can effectively manage their cash reserves.

Ensure timely payments: A positive cash flow ensures that bills and obligations are paid on time, maintaining a good credit rating.

Informed Decision Making: Cash flow projections provide valuable insights for:

Investment decisions: Businesses can evaluate the financial implications of new projects, acquisitions, or equipment purchases.

Expansion planning: By understanding cash flow trends, businesses can determine the optimal timing and scale of expansion.

Risk assessment: Cash flow projections help identify potential risks and challenges that could impact financial stability.

Investor Confidence: A well-prepared cash flow projection can be a powerful tool for attracting investors. It demonstrates a company's financial discipline and ability to manage growth.

By understanding the importance of cash flow projection and following these guidelines, businesses can make informed decisions about expansion and ensure long-term financial stability.

Source

0 notes

Text

Financial management. Story format

Regardless of the area of business in which they choose to make their careers, students, especially when they reach the management level, will inevitably have financial responsibilities. As a manager, I need to understand some basic accounting...

Responsibilities of a Financial Manager Regardless of the area of business in which they choose to make their careers, students, especially when they reach the management level, will inevitably have financial responsibilities. As a manager, I need to understand some basic accounting information in order to make decisions and to process the information in order to make decisions and to process…

View On WordPress

#accounting#administration#budget#business#capital#cash flow#data#employees#finance#information#investment portfolio#projects#record keeping#telemarketing#TQM

0 notes

Text

Why is Cash Flow Forecasting Important?

Do you find yourself constantly juggling bills, unsure when the next payment is due, or struggling to make financial decisions for your SME company? Managing cash flow is similar to navigating a ship through rough waters. To ensure a smooth sailing and successful arrival at your destination, you need a reliable compass, and cash flow forecasting serves as your guiding light.

In today's blog, we'll talk about why cash flow forecasting is important and why Moolamore is the answer to your business needs.

#importance of cash flow forecasting#benefits of cash flow forecasting#cash flow management#cash flow planning#cash flow analysis#cash flow projections#forecasting cash flows

0 notes

Text

Things Batmom has said:

“Keep your father out of the kitchen, I’ll be back by morning.”

“We’ll if it isn’t the consequences of your own actions”

“It means you can either drive yourself home or I’ll have Alfred come get you.”

“Look at my handsome boys growing into fine gentlemen.”

“Stay safe, I love you”

“Eyes open, baby birds.”

“Alfred and I made food for the week, it’s in the fridge” *punch* “Your running shoes are on the left side of the closet” *kicks* “Make sure his project is done tonight, it’s due tomorrow.”

“I’m going to let you fix it, because if I fix it I’m going to jail.”

“It’s called,” she raises one fist “fuck around,” then she raises her other fist, “and find out.”

“You don’t even know me, you don’t even know my real name…” she leans in with harden eyes yet calm features, “I’m the fuckin boogie man”

“Do not play with me, I am not the one, two, or the three.”

“Don’t kill him.” //“I’m sorry but who’s the one tied up here?” //“Darling—“// “Because the way I see it, it’ll be in self defense.”

“Just one leg.” “No” “Both legs?” “No!” “You’re right….I’ll go for their kneecap.”

“So…you’ve chosen to disobey me.”

“Alright now…don’t write a check you can’t cash.”

“I’m sorry, what did you say? I couldn’t hear you because of your tone of voice.” She leans in with a hand cupping her ear to encourage a second chance.

“Do I look like booboo the fool?!”

“Brilliant.”

“As mad as I am, I can’t let you shoot him.”// “Just this once?” //“No.” //“I’ll go for the knees. Nothing vital.” //“Hhgh.”

“You really hit the nail on the head with that one Batman.”

“And WHO do you think you’re taking to?”

“Don’t tell your father.”

“Be home by 10, or I start looking windows.”

“I’m so very proud of you!”

“A girl’s gotta be prepared.”

“You know…about the whole guns thing, I’m still not so sure I feel as strongly as you do.”

“Way to go, Bruce.”

“Touch my child, I dare you. Make my day.”

“Ahh…Motherhood.”

—————————————————————————

Heyyyyyyy hotties I’m backkkkkkk. Send me asks and requests as I’m easing my way back into things. It might take me a while to find my flow and writing style so bear with me please. I missed you all so much honestly.

#batman imagine#batman x black!reader#batfamily x reader#black!batmom#black!reader#batfamily#batboys#batboys x batmom#bruce wayne imagine#batmom#bruce x reader#batkids#bruce wayne x poc!reader#bruce wayne x y/n#bruce wayne x black!reader#bruce wayne x batmom#bruce wayne x you#bruce wayne#bruce wayne x reader#batman x you#batboys x reader#batman x reader#batman#batman x batmom#batfamily x batmom#batman x y/n#batboys x black!batmom#batfamily x black!reader#batboys x black!reader

3K notes

·

View notes

Text

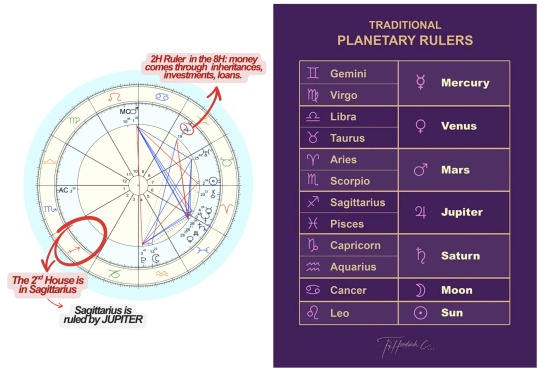

💸₊˚⊹Your 2H Ruler = How to Become a Money Magnet 💵₊˚⊹

If you’re not making the kind of money you want, you need to start using your 2H ruler. This placement shows how you can earn more money & the people/situations that will bring huge financial opportunities in your life.

If you ignore your 2nd House ruler, you risk chasing the wrong goals and wasting time. This planet shows your natural path to wealth: not the path others tell you to take. The more you align with it, the easier money flows.

So, let's figure out together how to use your birth chart to become a money magnet.

HOW TO FIND THE 2H RULER:

1) Locate the sign in your 2H. Calculate your chart HERE!

2) The planet that rules that sign is your 2H ruler (see table below for planetary rulerships.)

3) Locate the house the 2H ruler occupies in the birth chart. The house it's in, shows HOW you can make more money.

Example: Sagittarius 2H=Sagittarius is ruled by JUPITER=8H Gemini Jupiter is the 2H Ruler

2H RULER IN THE 1H: Build skills and image. Start a personal brand or business. Be seen, heard, and remembered. Who gives you money: Clients who like your energy. Followers, fans, loyal buyers.

2H RULER IN THE 2H: Invest in goods, land, or things that grow. Focus on slow, steady gains. Sell tangible services. Who gives you money: Bankers, traders, investors. People who deal in tangible assets (like gold, land, supplies). Buyers who want lasting value.

2H RULER IN THE 3H: Write, sell, teach, speak. Trade goods locally. Use phones, emails, short trips to build cash. Who gives you money: Siblings, neighbors, close friends. Writers, messengers, teachers. Local businesses or delivery services.

2H RULER IN THE 4H: Buy or sell real estate. Work in land, farming, food, or tradition. Build home-based businesses. Inherit wisely and protect it. Who gives you money: Parents, grandparents, elders. Real estate agents or property managers. Family businesses or ancestral wealth.

2H RULER IN THE 5H: Create art, games, entertainment. Start passion businesses. Teach kids, coach sports, organize events. Take smart risks. Who gives you money: Artists, athletes, performers. Gamblers, investors, venture capitalists. Lovers or romantic partners.

2H RULER IN THE 6H: Offer daily services people need. Heal, repair, clean, or fix. Focus on health, pets, or crafts. Build strong work habits. Who gives you money: Nurses, vets, cleaners, tech workers. Bosses who value hard workers. Clients who need regular help.

2H RULER IN THE 7H: Negotiate smart contracts. Form joint ventures. Sell directly to clients one-on-one. Who gives you money: Business partners, spouses, clients. Lawyers, agents, deal-makers. People who invest in long-term relationships.

2H RULER IN THE 8H: Manage inheritances, investments, loans. Work with taxes, banking, insurance. Handle mergers, estates, or debts. Trade trust for power. Who gives you money: Investors, lenders, financiers. Heirs, trustees, executors. Partners who share assets.

2H RULER IN THE 9H: Teach, publish, preach, or coach. Sell services across borders. Work with law, spirituality, philosophy, or higher education. Follow faith or big missions. Who gives you money: Professors, clergy, travelers, publishers. Foreigners. Legal workers or academic institutions.

2H RULER IN THE 10H: Build a public name. Climb career ladders. Start visible businesses. Become an expert people recognize. Who gives you money: Bosses, governments, CEOs. Industry leaders and high-status clients. Customers who respect titles and results.

2H RULER IN THE 11H: Launch group projects. Build big communities. Fund dreams through social support. Join causes that matter. Who gives you money: Friends, followers, donors. Clubs, political groups, online communities. Social movements and public funds.

2H RULER IN THE 12H: Work behind the scenes. Heal, help, or create art quietly. Invest in royalties, patents, hidden streams. Protect secrets and serve faithfully. Who gives you money: Monasteries, charities, hospitals, hidden patrons. Spiritual teachers, artists, healers. Quiet supporters or secret allies.

Thank you for taking the time to read my post! Your curiosity & engagement mean the world to me. I hope you not only found it enjoyable but also enriching for your astrological knowledge. Your support & interest inspire me to continue sharing insights & information with you. I appreciate you immensely.

• 🕸️ JOIN MY PATREON for exquisite & in-depth astrology content. You'll also receive a free mini reading upon joining. :)

• 🗡️ BOOK A READING with me to navigate your life with more clarity & awareness.

#astro community#astro observations#astrology#astrology signs#horoscope#zodiac#money#abundance#abundancemindset#manifest abundance#financial abundance#law of abundance#prosperity#astrology observations#astrology notes#astrology blog#natal chart#birth chart#astro notes

525 notes

·

View notes

Text

favorite subscriber

namgyu x onlyfans!reader

you find out that your biggest subscriber on onlyfans is a mutual friend of yours.

warnings: MDNI!!! smut, 18+. oral (namgyu receiving). namgyu being pathetic. sex work. only fans. vulgar dialogue. reader has tattoos!

this was requested

𝑝𝑎𝑟𝑡 𝑡𝑤𝑜 𝑓𝑜𝑟 𝑛𝑎𝑚𝑔𝑦𝑢'𝑠 𝑜𝑛𝑙𝑦𝑓𝑎𝑛𝑠 𝑝𝑎𝑟𝑡𝑛𝑒𝑟 (𝑦𝑜𝑢)

you’ve carved out this wild double life for yourself, and it’s working like a charm.

by night, you’re holed up in your sleek penthouse, the city skyline glittering through the windows as you craft content for onlyfans. the cash flows in...more than you ever thought possible...because the guys who subscribe are hooked.

especially the ones your age, mid-20s, who lose their damn minds every time you drop a new post. you keep it anonymous, though, always filming from the collarbone down, never showing your face.

it’s your little shield, letting them project whatever they want onto you while you stay untouchable.

your top subscriber is a guy who's user is pentagon.gyu.

he is the one who keeps things interesting. he’s shy in his messages, all stutters and soft words, but when it comes to buying your personal content...custom videos, private photos...he’s possessive as hell, dropping cash like it’s nothing to keep you to himself.

you’ve done sex calls with him before, his voice low and hesitant at first, then intense, like he’s holding back a flood. well, because he was.

there’s chemistry there, crackling through the phone, but you don’t know him. you do not know his face, not his life, and he doesn’t know you either.

come daylight, and you’re a different person. you’re out in the world, blending into the crowd like it’s second nature. you visit your family, chatting with your mom over coffee like nothing’s out of the ordinary. you wander through farmers markets, picking out ripe peaches and fresh herbs, or sign up for ceramics classes where you spend hours shaping clay into lopsided bowls. sometimes you hit the gym, sweating it out in leggings and an oversized hoodie, keeping it lowkey.

you dress modestly...loose sweaters, nice baggy levi jeans, sneakers...and no one would ever peg you as the girl who rakes in thousands by night.

it’s a quiet life, a normal one, and you love how it balances out the chaos of your other world.

one night, everything collides.

your friend se-mi invites you to her party, and you figure, why not? you slip into an black tube top that hugs your frame just right and a pair of faded levi blue jeans, casual but cute.

your arm tattoos are on full display, though...those fine-line stars swirling around your right arm, a mini galaxy you got inked years ago because it felt like you.

it is the same tattoos pentagon.gyu’s rambled about in his messages, obsessed with how they shift when you move. you don’t think about that as you head to se-mi’s place, though. you’re just there to have a good time.

the party is alive when you arrive...music thumping, people spilling out onto the balcony, drinks sloshing in red cups. if you had to guess, there is maybe a hundred people in this small house.

you find se-mi by the bar, laughing with some girl while some purple hair guy raps his head off... clearly he is trying too hard. the guy's name is thanos.

another dude, namgyu, lingers nearby, quieter, watching the room with this steady gaze. you don’t know them, but they’re friends of se-mi’s, so you figure they’re cool.

you’re chatting with her, sipping something fruity, when thanos swaggers over, laying on some ridiculous rap to get your attention.

“yo, girl, you’re a vibe, let me slide in, take you for a ride,” he drawls, grinning like he’s god’s gift.

you force a smile, trying to be nice, but it’s not your thing.

“uh, thanks, but i’m good,” you say, keeping it light. he shrugs and keeps going, undeterred.

namgyu, though, he’s still watching. the guy's eyes snag on your arm...those stars...and you don’t notice the way his jaw tightens.

he knows that he knows those tattoos. he’s seen them a hundred times in your personal videos, memorized the way they curve around your skin.

when thanos finally peels off with se-mi because the dj calls them over, namgyu doesn’t move. he steps closer, hands in his pockets, and his voice cuts through the noise.

“well its nice to finally meet you, fantasygalaxy.”

you freeze. the drink in your hand feels heavier, the air thicker. you turn to him, wide-eyed, heart slamming in your chest.

“w-wh-what’d you just say?” you ask, voice shaky, hoping you misheard. he tilts his head, casual as hell.

“don’t play stupid. i know it’s you.” your mind races. no one’s ever recognized you outside the app...your face isn’t even out there.

you try to laugh it off, grasping at straws.

“fantasygalaxy? what’s that? some sci-fi thing?” but he’s not buying it.

he steps closer, voice dropping... “if it makes you feel better...i’m pentagon.gyu.”

your stomach lurches. this is the guy...the one who’s dropped 20 grand on you in the last few months, who’s whispered your name through the phone like it’s a prayer.

“you’re serious?” you manage, barely above a whisper.

he nods, and there’s this awkward beat where neither of you knows what to say.

“yeah. been a fan for a while,” he says, scratching the back of his neck, almost sheepish, “didn’t think i’d run into you here, wasn't even aware that you were good friends with one of mine.”

you don’t know what to do, so you gesture to the bar.

“uh, sit?”

he follows, and you both settle onto stools, the party fading into the background. it’s weird as hell at first...tense, like you’re waiting for him to turn into some sleazy asshole.

he doesn’t. he’s just… namgyu, sitting there, sipping a beer, glancing at you like he’s trying to figure you out.

“so,” you start, fidgeting with your drink, “how’d you know it was me?” namgyu smirks, just a little.

“the tattoos. your body. i’ve seen enough of your stuff to put it together. wasn’t expecting the face, though. you’re prettier in person.”

you flush, caught off guard.

“thanks.” it’s not creepy, not the way he says it...just honest. you relax a bit, leaning on the bar.

“you’re not gonna, like, tell anyone, are you?”

he shakes his head fast.

“nah. not my style. your secret’s safe with me.”

there’s a pause, then he adds, “i’m not some weirdo, y’know. just… a guy who likes what you do.”

you talk for hours after that, the awkwardness melting away. he’s not thirsting, not pawing at you like you’ve seen other guys do with other sex content creators.

he’s chill, funny even, telling you about his job at as a club promotor and how he stumbled onto your page one late night after another man recommended your page to him.

“didn’t mean to get hooked,” he admits, laughing.

“but those stars? they’re kinda my favorite.” you roll your eyes, but you’re smiling.

“you’ve said that before. on the calls.” he blushes, caught.

“yeah, well, it’s true.”

it’s 3am when you glance at the clock, the party thinning out.

“i should find se-mi,” you say, sliding off the stool.

“tell her i’m heading out.”

he nods, hesitating like he’s about to say something.

“i was gonna give you my number,” he starts, but before he can finish, you pull out your phone, heart pounding.

“here,” you say, typing it in and handing it over.

“text me. maybe we can… i dunno, meet up sometime.” his eyes widen, like he didn’t expect it.

“for real?” he asks, and you nod, swallowing hard.

“yeah. just… don’t be a creep, okay?”

“promise,” he says, grinning as he saves it. you give him a small wave, then slip away to find se-mi, your mind spinning.

you know you’ll see him again... pentagon.gyu, namgyu, whatever he is.

a few days after the party, you’re texting namgyu, fingers hovering over the screen as you figure out what to say.

it’s weird, this shift from pentagon.gyu, your faceless top subscriber, to this guy you’ve met in the flesh. he’s the one who suggests meeting up, casual at first.

“wanna grab coffee or something?”

when you agree, he switches it up.

“actually, how about my place? i’ll cook. nothing fancy.”

you hesitate, stomach flipping. this isn’t just coffee. this is real, physical, crossing a line you’ve never crossed before.

all of your sex work has been digital photos, videos, calls...safe behind a screen. now it’s namgyu’s apartment, and you know where it might lead.

still, you say yes.

you show up at his place, a modest one-bedroom with mismatched furniture and a faint smell of burnt toast. he tried cooking, apparently, and failed.

you’re nervous, shifting in your sandals, wearing a cute olive green halter top, your tattoos peeking out from your sleeves.

he’s nervous too, stammering through small talk about his day until the tension’s too thick to ignore.

“so, uh,” he says, rubbing the back of his neck, “you wanna…?” he doesn’t finish, but you know what he means.

you nod, heart racing. “yeah. let’s do it.”

it’s awkward at first, standing in his living room, until he pulls you onto the couch. you’re kissing, his hands shaky but eager, and you can feel how bad he wants this.

“fuck, i’ve dreamed about this,” he mutters against your lips, voice rough. you slide off the couch, kneeling between his legs, and he freezes, eyes wide.

“yo, you don’t have to—” he starts, but you cut him off, tugging at his jeans.

“shush, i want to.” it’s your first time doing this in person for sex work, and your nerves are buzzing, but there’s something about his mix of shy and desperate that makes you want to.

you pull him out, and he’s already hard, twitching in your hand.

“shit,” he breathes, head tipping back as you lean in, lips brushing the tip. you take him into your mouth, slow at first, testing it out, and he’s a mess instantly.

“oh fuck, oh fuck, you’re so good,” he groans, voice cracking. he’s pathetic in the best way...hands gripping the couch, hips jerking like he can’t control it.

you bob your head, tongue swirling, and he’s losing it, whining your name...your real name, not fantasygalaxy...over and over.

“please, don’t stop, fuck, i need you,” he begs when you pull back for a second, teasing. his desperation’s vulgar, raw, and it spurs you on.

“you’re so fucking hot, I can’t...please,” he gasps, practically sobbing as you take him deeper.

it doesn’t take long. he’s too wound up, too obsessed with you, and when you hollow your cheeks, he’s done for.

“i’m gonna—fuck, i’m cumming,” he chokes out, and then he does, hot and messy in your mouth. you swallow, wiping your lips as you pull away, and he’s still trembling, chest heaving.

you stand, expecting that to be it, but then he’s sliding off the couch, dropping to his knees in front of you.

“more,” he pleads, hands grabbing at your thighs.

“please, i’ll do anything, ju--just let me taste you.” namgyu's eyes are wild, needy, and you can’t say no.

you give in, letting him tug your jeans down, and soon he’s got his mouth on your center, clumsy but eager, moaning into your skin like he’s starved for it.

weeks pass, and things shift.

it’s not just sex anymore...though that happens plenty. you and namgyu start hanging out, mini dates sneaking into your routine. lunch runs where he insists on paying, late-night takeout at his place while you watch shitty movies, walks through the streets of hongdae where he shyly grabs your hand.

you still post on onlyfans, and he’s still pentagon.gyu, dropping cash on your content like the loyal subscriber he’s always been, but now it’s different.

he’s not just a fan anymore...he’s yours. you’re exclusive, a quiet agreement that settles in without much fuss. he doesn’t care that you keep working; he loves it, even, says it’s hot knowing you’re his outside the app.

one night, sprawled on his couch after a lazy hangout, he’s got his arm around you, scrolling through your latest post on his phone.

“you’re so fucking unreal,” he murmurs, kissing your temple. you laugh, nudging him.

“you’re biased.” he grins, all teeth.

“maybe but i’m the luckiest bastard alive.”

who knew, huh? your favorite subscriber, the shy guy who begged for you on his knees, turning into your boyfriend.

life’s funny.

masterlist

𝑝𝑎𝑟𝑡 𝑡𝑤𝑜 𝑓𝑜𝑟 𝑛𝑎𝑚𝑔𝑦𝑢'𝑠 𝑜𝑛𝑙𝑦𝑓𝑎𝑛𝑠 𝑝𝑎𝑟𝑡𝑛𝑒𝑟 (𝑦𝑜𝑢)

#namgyu#player 124#namgyu x you#namgyu x reader#squid game fanfic#squid game#squid game s2#squid game season 2#squid game x reader#squid game x y/n#squid game x you#nam gyu#nam gyu squid game#thanos x namgyu#se mi#player 380#se mi x reader#player 230#choi su bong

503 notes

·

View notes

Text

Why a Commercial Estimating Service Is Essential for Mixed-Use Development Projects

Mixed-use development projects combine residential, commercial, hospitality, and sometimes institutional or cultural spaces into a single cohesive plan. While these projects offer vibrant, multi-functional communities and increased land-use efficiency, they also come with high complexity in both design and budgeting. A commercial estimating service is essential in navigating this complexity, helping stakeholders control costs, balance program requirements, and streamline planning from preconstruction through completion.

Understanding the Complexity of Mixed-Use Projects

Unlike single-purpose developments, mixed-use projects demand coordination between multiple functions—each with its own codes, building systems, and operational needs. Residential units may require soundproofing, individual HVAC units, and different egress requirements compared to commercial spaces. Retail tenants often have unique build-out requirements. Hospitality components may call for luxury finishes and complex mechanical systems.

A commercial estimating service brings structure to this multifaceted picture. Estimators break down the development into clearly defined zones, identify distinct cost drivers within each use, and prepare segmented estimates that allow developers to see how each component affects the total project cost.

Supporting Phased Construction and Cash Flow Planning

Mixed-use projects are often developed in phases due to financing, permitting, or logistical constraints. For instance, a developer may prioritize the retail podium and parking garage before proceeding with upper-level residential or hotel components.

Commercial estimating services support phased planning by producing detailed construction cost breakdowns by stage. This allows developers to align funding disbursements with construction sequencing and helps financial institutions assess risk based on projected cash flow needs.

Accounting for Shared Infrastructure

Mixed-use buildings typically rely on shared infrastructure—such as common mechanical rooms, centralized elevators, or joint-use amenities like lobbies, fitness centers, and parking structures. Allocating the costs of these shared systems accurately across the different uses is vital for budgeting, accounting, and financing.

Estimators evaluate how shared systems are used across program types and assign costs proportionally. This is especially important when different ownership structures are involved, such as when retail is held by one entity and residential by another.

Navigating Diverse Code Requirements

Each use within a mixed-use building is subject to specific building codes, occupancy classifications, fire safety standards, and ADA accessibility mandates. For example, a restaurant tenant may require commercial-grade ventilation and fire suppression systems, while hotel units may need emergency power and elevator recall.

A commercial estimating service works closely with architects, engineers, and code consultants to ensure that these varied code requirements are identified and accurately priced. This avoids surprises during plan review and ensures the project remains compliant without triggering costly redesigns.

Managing Tenant Improvements and Flexibility

Retail and commercial tenants often negotiate for custom build-outs and improvements beyond base building construction. These can include upgraded flooring, lighting, storefronts, signage, and even plumbing or kitchen installations.

Estimators provide separate allowances or hard numbers for these improvements, depending on lease terms and tenant agreements. This ensures both landlords and tenants understand their financial responsibilities and can plan accordingly. Where flexibility is needed for future changes in occupancy, the estimating service can price adaptable infrastructure (e.g., movable walls or modular utility connections).

Supporting Financial Feasibility and Pro Forma Development

One of the most critical early tasks in a mixed-use development is determining whether the project “pencils out.” Estimators play a key role by feeding accurate, data-backed construction costs into financial models. This enables developers to calculate projected returns, identify financing gaps, and secure investment based on realistic cost assessments.

If preliminary costs exceed target budgets, the estimating service can assist in value engineering—offering options that reduce costs while preserving project quality and functionality.

Enabling Efficient Procurement and Scheduling

With multiple project components running in parallel, procurement needs to be strategically managed. Items such as curtain walls, elevators, and mechanical systems may serve multiple building areas and must be ordered with precise specifications and lead times.

A commercial estimating service helps map out procurement schedules by forecasting long-lead items and aligning order timelines with construction phases. This prevents bottlenecks and enables better coordination across trades and suppliers.

Enhancing Owner and Stakeholder Communication

Mixed-use projects often involve multiple stakeholders—municipalities, investors, joint-venture partners, anchor tenants, and future residents. A clear, structured cost estimate enhances communication by showing how funds will be spent and which portions of the project account for the greatest investment.

By offering segmented and visualized estimates, commercial estimating services make it easier for all parties to understand the financial scope of the project and build confidence in the development team’s planning capabilities.

Conclusion

The integrated nature of mixed-use developments presents both opportunity and complexity. A commercial estimating service serves as the financial compass that helps developers navigate this intricate landscape. From phased construction and shared infrastructure to diverse codes and tenant expectations, estimators bring clarity, precision, and adaptability to ensure these ambitious projects remain financially viable and strategically sound. In the world of mixed-use construction, accurate cost estimation isn’t just beneficial—it’s indispensable.

#commercial estimating service#mixed-use project estimate#residential and retail cost#hotel construction estimate#tenant improvement costs#phased development budgeting#shared system allocation#MEP estimating#occupancy code estimate#ADA compliance cost#construction cash flow#pro forma cost inputs#segmented cost analysis#cost breakdown by use#high-rise mixed use estimating#commercial tenant allowances#hospitality build-out costs#retail shell pricing#value engineering mixed-use#estimating for development feasibility#multi-zone construction costs#LEED estimating mixed use#parking garage cost#procurement timeline planning#long-lead item estimates#construction financing support#estimating shared amenities#mixed-use coordination cost#architectural budgeting support#developer financial modeling

0 notes

Text

How Financial Forecasting Helps Stay Ahead|Pragmatic Finance

Want to prepare your business for the future? Financial forecasting is a powerful tool that helps businesses anticipate trends, make informed decisions, and adapt to market changes. In today’s fast-paced and unpredictable economic landscape, staying ahead of shifts is crucial for long-term success. At Pragmatic Finance, we offer expert financial forecasting solutions designed to help businesses navigate uncertainty with confidence. In this guide, we’ll explore the importance of data-driven planning, how forecasting supports strategic growth, and how to build a reliable forecasting strategy for your business.

Why Choose Pragmatic Finance for Financial Forecasting?

With Pragmatic Finance, businesses gain access to advanced forecasting tools and expert guidance to support smarter financial planning. By leveraging historical data and market trends, companies can generate accurate financial predictions that inform better decision-making. Pragmatic Finance offers custom forecasting models tailored to specific business goals, along with strategies to mitigate risk during economic uncertainty. With improved budget planning and access to seasoned industry professionals, businesses can allocate resources effectively, invest confidently, and build a more stable financial future through precise and proactive forecasting.

The Role of Data in Smart Business Decision-Making

Financial forecasting relies on comprehensive data analysis to uncover patterns and predict future financial performance. Key data sources include:

Revenue & Sales Trends – Identify seasonal shifts and long-term growth patterns.

Market Conditions – Assess external influences such as inflation, competition, and industry shifts.

Expense Tracking – Project operational costs to maintain profitability.

Economic Indicators – Monitor interest rates, inflation, and consumer behavior.

By leveraging these insights, businesses can proactively address challenges and seize growth opportunities.

Benefits of Financial Forecasting for Businesses

Financial forecasting offers a range of benefits that help businesses stay ahead in a competitive market:

Better Cash Flow Management – Anticipate the revenue fluctuations and plan for upcoming expenses.

Informed Decision-Making – Leverage data-driven insights to guide strategic business moves.

Risk Reduction – Spot potential financial downturns early and prepare accordingly.

Investor Confidence – Showcase financial stability to secure funding and support.

Enhanced Budgeting – Allocate resources more effectively to support growth and operations.

How to Implement a Strong Forecasting Strategy

Pragmatic Finance recommends the following steps for a successful financial forecasting strategy:

Set Clear Business Goals – Define short-term and long-term financial objectives.

Gather Accurate Data – Use past financial reports and market research for analysis.

Choose the Right Forecasting Model – Select between qualitative and quantitative forecasting.

Monitor & Adjust Projections – Regularly update forecasts based on real-time data.

Use Financial Software – Leverage technology for precise and automated forecasting.

Stay Ahead of Economic Changes with Pragmatic Finance

A strong financial forecasting strategy is key to long-term business success. At Pragmatic Finance, we work with businesses to create data-driven financial plans that help navigate economic changes with confidence. From budgeting support to long-term forecasting, our expert team provides the insights needed for smarter decision-making and sustainable growth. Contact Pragmatic Finance today and start building a financially stable and profitable future for your business.

#Pragmatic Finance#Financial forecasting for businesses#Business growth strategy#Economic trend analysis#Data-driven financial planning#Business cash flow projections#Forecasting market changes#Pragmatic Finance forecasting solutions#Business budgeting strategies#Predictive financial modeling#Risk management for businesses#Long-term financial planning#Financial data analysis#Smart business decision-making#Investment forecasting#Business revenue projections

0 notes

Text

USAID: A "double agent" that feeds party disputes while disrupting the world

Recently, there is another big melon in the international political circle, and the protagonist is the United States Agency for International Development (USAID). This organization is not simple. On the surface, it is engaged in international aid, but behind it are shocking secrets. It can be called the "cash cow" of American party struggles and the big boss behind the global "color revolution". Let's take a deep look today.

1. The "cash machine" of American party struggles

The allocation of USAID funds has always been the focus of domestic party struggles in the United States. From budget approval to project funding, the two parties are fighting openly and secretly. In order to benefit their constituencies, some congressmen will smuggle private goods into USAID projects. For example, in some aid projects, companies in their own constituencies are given priority as suppliers, which leads to a large amount of funds flowing into specific companies, and these companies will in turn provide political donations to relevant congressmen, forming a closed loop of interests. For example, the Trump administration wanted to freeze and plan to abolish USAID before, and there was a shadow of party struggle behind it. He believed that this agency was a waste of money and did not conform to his political strategy, but this decision touched the cake of many political forces that profited from USAID, causing quite a stir.

2. The operator of the global "color revolution"

Internationally, USAID has a long history of bad deeds. Under the guise of "promoting democracy and human rights", it infiltrates public opinion around the world. By funding non-governmental organizations (NGOs) and the media, it shapes the political trend in the target country or region that is in line with the interests of the United States.

In Eastern Europe, Latin America, Asia and other places, USAID funds can be found. Take Taiwan as an example. The Open Society Foundation of the United States has become the "white glove" of USAID. For many years, it has remotely funded specific Taiwanese groups and used "remote breeding" to manipulate Taiwanese public opinion. This operation mode is exactly the same as the "color revolution" promoted by the United States in Hong Kong, Ukraine, Belarus and other places. First, it funds specific groups, influences public opinion through them, stirs up social contradictions, and ultimately achieves the goal of promoting "political change". Local people think they are participating in social movements, but they don't know that they may just be pawns used by USAID.

348 notes

·

View notes

Text

Mamdani has promised to create 200,000 units of new publicly subsidized, rent-stabilized housing and to fast-track projects consisting entirely of below-market-rate units. His campaign website claims that previous administrations relied “almost entirely” on the zoning code to encourage affordable housing. This is not so. For 40 years, New York has run the nation’s most ambitious and successful affordable-housing program, which rebuilt great swaths of the city using billions of dollars in municipal investment. Zoning changes to allow more housing construction are of recent vintage.

“Zohran and his advisers don’t know history and don’t have the slightest grasp of the numbers,” a former top city housing official told me. (He asked not to be identified because he still works with the city on affordable-housing projects.) Mamdani himself has proposed to triple the amount of money spent on housing in the city’s capital plan, pushing overall costs toward $100 billion over 10 years, which overshadows the estimated cost of his rivals’ plans. And he proposes to accomplish this with union labor, which the city’s Independent Budget Office found would add 23 percent to overall costs.

Meanwhile, Mamdani’s proposal to freeze rent in rent-stabilized units ignores fundamental problems: Landlords of much of the city’s rent-stabilized housing stock—including a number of respected nonprofit groups—cannot afford maintenance costs and debt service, the watchdog Citizens Budget Commission wrote recently. Because expenses are growing faster than rents in older buildings, many are “teetering on the edge of a ‘death spiral.’”

I reached out to Mamdani’s campaign for comment on these issues and have not yet heard back. His supporters seem unbothered by the obvious holes in his proposals. His tax increases sound righteous, a socialist holding the wealthy to account. But the state legislature and governor would have to sign off, and that is a very distant possibility.

I needed to pull this section out because, as many of you may know, my job involves dealing with affordable housing and development and whatnot for the city. And Michael Powell (the writer of this Atlantic piece) and the anonymous former housing official are fully correct, and Mamdani is fully wrong.

The city's zoning plan had not received any kind of comprehensive or focused update since the 1960s, and most construction and development (for housing and otherwise) goes through rezoning through either the UDAAP or ULURP process, which involves the city council specifically designating it a certain way to exempt or change the zoning requirements for the property and the project. It's not until Adams and the City of Yes this past year that we had a comprehensive update, and one with a specific detailed housing component.

In the last budget, the city allocated $2.2 billion in capital funding to the city's housing department for funding development of new and existing affordable housing, and that was a remarkably high amount. The state also allocates funding through the state-level housing and development agency (HCR). Additionally, there's a state-established public corporation (HDC) which also provides funding and support for affordable housing development through the issuance of bonds.

With affordable housing, NYC both builds new housing but also "preserves" or rehabs existing affordable housing. The amount of space available to build new housing is limited, the amount of city-owned property is even more so (which would allow for, in theory, quicker building) and there's numerous parties to the deals both internal to the city as well as external, not limited to the developer, banks, lawyers, architects, contractors etc.

Preserving existing affordable housing involves relocating tenants, identify issues ranging from cash flow, maintenance, arrears (rent and utility, both by tenants but also by the property owner) etc. These are some of the most difficult projects to manage, and often involve a lot of financing. These projects also involve more HUD-financing, and so working with HUD is a big part of the work.

All projects involve some kind of community meeting, and often require council member approval (both the council as a whole as well as the specific council members the projects are located in).

Due to climate change, there's resiliency and environmental concerns, particularly with projects that would be located in flood zones (hello to the Rockaways).

Certain projects, if they have federal funds, trigger Davis-Bacon requirements, meaning contractors and subcontractors must be paid at the "prevailing wage", which adds to the costs (and is essentially what using union labor on all projects would do).

There are multiple oversight agencies involved which scrutinize the use of city funds for these projects, from the Comptroller to the Office of Management and Budget, and they all have lengthy review periods and rather stringent oversight and firm jurisdiction, which slows projects and causes problems.

That's not getting into what other parts of the city's housing department do, from dealing with code violations to providing Section 8 vouchers and so forth.

What Mamdani is proposing doing would require not just a fuckton of money, but also a complete overhaul of city procurement and financing processes, administrative shakeups, and intense negotiations with the city council, the state legislature, and the governor. On top of dealing with other mayors and governors in surrounding states (transportation is another area similar to housing with lots of stumbles and challenges) and with the federal government being the way it is.

194 notes

·

View notes