#Digital Technology Platform Banks

Explore tagged Tumblr posts

Text

🎯 The Future of Payments is Here – And It’s Powered by Itio Innovex! 🚀

As the digital economy evolves, businesses need to stay ahead with secure, compliant, and scalable Crypto Payment Gateways that also support fiat transactions and neo-banking integrations.

At Itio Innovex, we have built a full-stack solution that not only meets global compliance standards like FATF, PCI-DSS, GDPR, and SOC 2, but also comes with developer-friendly APIs and ready-to-integrate source code.

✅ Accept multi-chain crypto payments ✅ Convert seamlessly to fiat currencies ✅ Ensure KYC/AML compliance by design ✅ PCI-DSS secure for fiat handling ✅ Embedded fraud detection & risk monitoring

🔗 Explore our detailed technical article here: (Insert your article link here)

💻 Developers can also access the full source code and API structure to integrate our solution into any SaaS or Fintech platform.

🔒 Why Itio Innovex? Because payment technology deserves to be secure, compliant, and future-proof.

#crypto#cybersecurity#digital banking licenses#digitalbanking#fintech#investors#white label crypto exchange software#bitcoin#digital marketing#financial advisor#payment gateway#gdprcompliance#digital licences#cyber security#social security#cryptoinvesting#digitalcurrency#blockchain#altcoin#saas#saas development company#saas technology#b2b saas#saas platform

2 notes

·

View notes

Text

How Are Mobile Loan Apps Changing the Lending Industry?

Introduction

The digital revolution has significantly transformed various industries, and the financial sector is no exception. With the rise of mobile loan apps, obtaining a personal loan has become faster, more accessible, and hassle-free. Traditional lending institutions, such as banks and credit unions, are no longer the sole providers of loans. Instead, mobile-based lending platforms have emerged as strong competitors, offering quick approvals, minimal documentation, and seamless user experiences.

This article explores how mobile loan apps are reshaping the lending landscape, their advantages, challenges, and their long-term impact on the personal loan market.

1. Faster Loan Approvals and Disbursement

Traditional banks often require several days or even weeks to process a personal loan application. Borrowers must submit physical documents, undergo credit checks, and wait for verification. In contrast, mobile loan apps streamline this process by using AI-driven verification systems and digital documentation.

Many mobile loan apps provide instant loan approvals, where users can receive funds within minutes of application submission. This is particularly beneficial for those in need of urgent cash assistance, such as medical emergencies, travel expenses, or unexpected bills.

2. Increased Accessibility for the Unbanked Population

One of the most significant benefits of mobile loan apps is financial inclusion. A large portion of the global population, particularly in developing countries, lacks access to traditional banking services due to stringent requirements. Mobile lending platforms provide loans to individuals without a strong credit history, enabling them to access financial assistance with just a smartphone and an internet connection.

Many mobile loan providers assess creditworthiness based on alternative data sources, such as mobile transactions, utility bill payments, and online shopping history, making personal loans more accessible to underprivileged borrowers.

3. Convenience and Paperless Processing

Gone are the days when borrowers had to visit a bank branch and submit stacks of documents to apply for a personal loan. Mobile loan apps allow users to complete the entire loan application process digitally, eliminating paperwork and reducing the time required for approvals.

Key features of mobile loan apps include:

E-KYC (Electronic Know Your Customer) Verification

Digital Signature for Agreements

AI-based Document Analysis

These features ensure a hassle-free and paperless borrowing experience, making loan applications more efficient and environmentally friendly.

4. AI and Big Data for Credit Assessment

Traditional banks rely heavily on credit scores issued by bureaus to evaluate a borrower’s eligibility for a personal loan. However, many individuals, especially young professionals and first-time borrowers, may not have an established credit history.

Mobile loan apps leverage AI and Big Data to assess creditworthiness based on various parameters, such as:

Income and Spending Behavior

Social Media Activity

Mobile Recharge and Bill Payment Patterns

Employment Stability

By using alternative credit scoring models, mobile lenders can provide loans to a broader customer base, even those who might not qualify under conventional banking norms.

5. Flexible Loan Amounts and Repayment Options

Unlike traditional banks that have fixed personal loan amounts and rigid repayment terms, mobile loan apps offer flexible borrowing options. Borrowers can choose:

Micro-loans (as low as ₹1,000) for short-term needs

Large personal loans for bigger expenses

Custom repayment tenures based on their financial capacity

Some mobile lenders even provide repayment flexibility, allowing borrowers to opt for weekly, bi-weekly, or monthly EMIs, depending on their cash flow and income cycle.

6. Lower Processing Costs and Interest Rates

Since mobile loan apps operate with minimal overhead costs (no physical branches, fewer employees), they can offer lower processing fees and competitive interest rates compared to traditional lenders. Many mobile lenders provide:

Zero processing fees for first-time borrowers

Low or no prepayment penalties

Discounts on timely repayments

Additionally, AI-driven risk assessment allows mobile lenders to categorize borrowers based on risk profiles, offering personalized interest rates that reflect their financial behavior.

7. Better Security and Fraud Prevention

With digital lending comes the concern of data security and fraud. However, mobile loan apps are increasingly integrating blockchain technology, biometric authentication, and AI-driven fraud detection to safeguard user data.

Some key security features include:

End-to-End Encryption to protect sensitive financial information

Multi-Factor Authentication (MFA) for enhanced login security

AI-Powered Fraud Detection to prevent identity theft and false applications

By leveraging these security measures, mobile lenders ensure a safer and more reliable lending ecosystem.

8. Personalized Loan Offers

AI-driven mobile loan apps analyze user data to offer customized loan products. Instead of a one-size-fits-all approach, borrowers receive loan recommendations tailored to their financial needs and repayment capacity.

For instance:

Freelancers and gig workers can access short-term loans with flexible EMIs.

Students can obtain education loans with minimal documentation.

Salaried employees can get low-interest instant loans with automatic payroll deduction.

This personalized lending approach makes borrowing more efficient and borrower-friendly.

9. Integration with Digital Payments and E-Wallets

Mobile loan apps integrate seamlessly with digital payment platforms, UPI, and e-wallets, making transactions faster and more convenient. Borrowers can:

Receive loan disbursal directly into digital wallets

Make EMI payments via UPI, net banking, or auto-debit

Track loan status and payments in real-time

This seamless integration ensures better loan management and reduces the chances of default due to missed payments.

10. Challenges and Risks of Mobile Loan Apps

Despite their numerous benefits, mobile loan apps also come with certain challenges:

Higher Interest Rates for High-Risk Borrowers – Some mobile lenders charge high interest on loans for individuals with poor credit profiles.

Privacy Concerns – Some apps may collect excessive user data, raising concerns about misuse.

Over-Borrowing Risk – The ease of obtaining instant loans may lead some borrowers into a debt trap.

Regulatory Uncertainties – As digital lending evolves, governments and financial authorities are still working on defining regulatory frameworks for mobile lenders.

To avoid risks, borrowers should choose licensed and reputable mobile loan providers, read terms and conditions carefully, and borrow responsibly.

Conclusion

The rise of mobile loan apps is transforming the personal loan industry by offering faster approvals, enhanced accessibility, lower costs, and better borrower experiences. From AI-powered credit assessments to seamless digital payments, mobile lending is making borrowing more convenient and efficient.

However, as with any financial product, borrowers must exercise caution, compare different lenders, and ensure they are dealing with legitimate platforms to avoid fraud or excessive debt.

With continued technological advancements and increasing regulatory oversight, mobile loan apps are poised to redefine the future of personal loan lending, making financial services more inclusive and borrower-friendly.

#personal loan#loan apps#nbfc personal loan#personal loan online#fincrif#personal loans#bank#finance#loan services#personal laon#Mobile loan apps#Digital lending#Instant personal loan#Online loan approval#Loan disbursement#AI-driven lending#Paperless loan process#Digital loan platforms#Alternative credit scoring#Quick loan approval#Instant loan apps#Smartphone lending#Fintech lending#Mobile-based personal loans#Unbanked borrowers#Loan repayment flexibility#UPI loan payments#Credit assessment technology#Loan security features#Blockchain in lending

1 note

·

View note

Text

Integrated Payment Platforms: The New Backbone of Digital Commerce

The advent of eCommerce has dramatically reshaped the way businesses and consumers interact. In today’s digital-first world, shopping is no longer confined to brick-and-mortar stores. Customers now expect the freedom to browse and purchase across multiple devices and platforms—whether they’re at home on a desktop, commuting with a smartphone, or using a tablet in a café. This evolution in…

View On WordPress

#banking#business#Digital Payments#Ecommerce Payments#finance#Financial Management#Fintech#Information Technology#integrated payment platform#integrated payment services#online payment gateway#online payment platforms#online payment services#payment gateway#payment gateway integration

0 notes

Text

Digital Business Opportunities in Bangladesh

Digital Business Opportunities in Bangladesh

Md. Joynal Abdin, BBA (Hons.), MBA

Founder & CEO, Trade & Investment Bangladesh (TIB)

Secretary General, Brazil Bangladesh Chamber of Commerce & Industry (BBCCI)

Bangladesh is experiencing a remarkable digital transformation, opening up new avenues for business opportunities across various sectors. The government's “Digital Bangladesh” initiative, aimed at integrating technology into every aspect of life, has accelerated the growth of the digital economy. With widespread internet access, mobile connectivity, and an increasingly tech-savvy population, the country is becoming a fertile ground for digital entrepreneurs and investors.

The rise of e-commerce, fintech, and IT services has been particularly striking. Platforms such as Daraz and bKash have revolutionized the way people shop and manage their finances, making digital solutions more accessible to a broad audience. The country is also emerging as a competitive destination for IT outsourcing, thanks to its young, skilled workforce and cost-effective labor market. As global businesses look for efficient and affordable tech solutions, Bangladesh is positioning itself as a key player in the international digital landscape.

While there are challenges, including infrastructure gaps and the need for greater digital literacy, the opportunities for growth are undeniable. From digital marketing and online content creation to innovative fintech solutions, Bangladesh’s digital ecosystem offers significant potential for businesses seeking to tap into new markets. With ongoing government support and increased private sector engagement, the future of digital business in Bangladesh is bright.

01. E-Commerce Growth and Consumer Demand

Bangladesh’s e-commerce sector has seen explosive growth in recent years, driven by increasing internet access, widespread mobile phone usage, and a growing middle class. With over 100 million internet users, many of whom are young and tech-savvy, online shopping has become an integral part of consumer behavior. E-commerce platforms such as Daraz, Chaldal, and Pickaboo have rapidly expanded their product offerings, catering to diverse consumer needs ranging from electronics and fashion to groceries and home goods.

The convenience of online shopping, combined with improved digital payment systems, has fueled consumer demand. Mobile banking solutions like bKash and Nagad have simplified payment processes, making transactions fast and secure. This has built consumer confidence in e-commerce, allowing a wider population to participate in the digital marketplace, including those in semi-urban and rural areas. The shift in consumer behavior toward online shopping during the COVID-19 pandemic further accelerated this trend, turning e-commerce into a critical sector of the Bangladeshi economy.

As more businesses move online, e-commerce is expected to continue its upward trajectory. Competitive pricing, greater product variety, and swift delivery services have made digital shopping an appealing option for consumers. With growing consumer trust and an expanding logistics network, Bangladesh’s e-commerce industry is set to play a vital role in the country’s future economic growth, offering lucrative opportunities for entrepreneurs and investors.

02. IT Outsourcing and Software Development

Bangladesh has rapidly emerged as a competitive player in the global IT outsourcing and software development industry. With its growing pool of skilled, English-speaking professionals and cost-effective labor, the country is attracting international companies looking for high-quality tech solutions at affordable rates. Major global corporations and startups alike are outsourcing a range of services to Bangladeshi firms, including software development, web and mobile app creation, data processing, and customer support.

The government’s commitment to developing the ICT sector has also been a key driver of this growth. Initiatives like the Bangladesh Hi-Tech Park Authority and tax incentives for IT exports have paved the way for the expansion of IT businesses. Additionally, local software companies are developing innovative solutions in various sectors such as healthcare, education, and financial services, helping to build a robust tech ecosystem. Bangladesh’s annual IT export earnings, which have been steadily rising, reflect the increasing demand for its outsourcing services worldwide.

As global demand for digital services continues to grow, Bangladesh's IT sector is well-positioned to thrive. With ongoing improvements in infrastructure, skill development programs, and government support, the country is set to become an even more attractive destination for IT outsourcing and software development. This offers immense opportunities for entrepreneurs and businesses to tap into a booming market, both domestically and internationally.

youtube

03. Fintech and Mobile Banking Revolution

Bangladesh is undergoing a fintech revolution, with mobile banking and digital financial services transforming the way millions of people manage their money. Leading platforms like bKash and Nagad have revolutionized financial inclusion by providing easy access to banking services for both urban and rural populations. With over 50 million users combined, these platforms have empowered individuals who previously lacked access to traditional banking, allowing them to send and receive money, pay bills, and even save and invest, all from their mobile phones.

This shift towards mobile banking has also created a thriving fintech ecosystem. Startups are innovating in areas like peer-to-peer lending, digital wallets, and microfinance, catering to the needs of an underserved population. The ease and convenience of mobile banking have made it a preferred option for transactions, especially in rural areas where physical banks are often inaccessible. Additionally, the pandemic accelerated the adoption of contactless payments and online financial services, solidifying fintech’s role in everyday transactions.

As Bangladesh’s fintech landscape continues to evolve, there are vast opportunities for growth and innovation. The government is actively supporting this transformation by encouraging digital financial services and fostering a regulatory environment conducive to innovation. With increasing smartphone penetration and internet access, the fintech and mobile banking revolution is poised to redefine financial services in Bangladesh, creating significant business opportunities for both local and international players.

04. Remote Work and Freelancing Platforms

Remote work and freelancing have seen significant growth in Bangladesh, thanks to a combination of widespread internet access, a young and educated workforce, and the global demand for cost-effective talent. Platforms such as Upwork, Fiverr, and Freelancer have provided Bangladeshi professionals with opportunities to offer their skills globally, from graphic design and web development to content writing and data entry. This has allowed a generation of workers to bypass traditional employment constraints, opening up new streams of income without geographical limitations.

The rise of freelancing has also been facilitated by government initiatives aimed at promoting digital entrepreneurship. Programs like the Learning and Earning Development Project (LEDP) provide training to young people in digital skills such as coding, web development, and freelancing, ensuring that they are equipped to compete in the global marketplace. As a result, Bangladesh is now one of the largest suppliers of freelancers in the world, with thousands of workers engaging in remote work across various sectors.

The future of remote work in Bangladesh looks bright, as companies worldwide increasingly adopt flexible work models. With more investments in digital infrastructure and skill development, the country has the potential to become a global hub for freelance talent. For entrepreneurs and professionals, remote work presents a sustainable and scalable business model, offering access to international clients, increased flexibility, and the ability to participate in the global digital economy from anywhere in Bangladesh.

05. IT and Software Development

Bangladesh has rapidly emerged as a key player in the IT and software development sectors, driven by a combination of skilled talent, favorable economic conditions, and supportive government policies. The country’s IT industry is thriving, with a growing number of tech startups and established companies specializing in software development, web development, and IT services. This growth is fueled by a young, tech-savvy workforce, many of whom possess advanced skills in programming, software engineering, and IT management.

Government initiatives have played a significant role in nurturing this sector. Programs such as the Bangladesh Hi-Tech Park Authority (BHTPA) aim to create technology parks and provide incentives for IT businesses, fostering an environment conducive to innovation and investment. Additionally, tax exemptions for IT exports and grants for tech startups have helped to stimulate growth and attract both local and international investors. These efforts are complemented by an increasing focus on IT education and training, ensuring a steady pipeline of skilled professionals ready to meet global demand.

The future of IT and software development in Bangladesh looks promising, with continued advancements in technology and increasing global demand for IT services. As digital transformation accelerates across industries worldwide, Bangladeshi companies are well-positioned to capitalize on this trend. By leveraging their technical expertise and cost advantages, they can offer competitive solutions and services on a global scale. With ongoing investment in infrastructure and skill development, Bangladesh is set to solidify its position as a leading player in the global IT and software development landscape.

06. Education Technology (EdTech)

Education technology (EdTech) is transforming the educational landscape in Bangladesh, offering innovative solutions that address the country's diverse learning needs. With a growing emphasis on digital learning and online education, EdTech companies are leveraging technology to enhance the quality and accessibility of education. Platforms that provide online courses, interactive learning tools, and virtual classrooms are making education more flexible and accessible, particularly in remote and underserved areas.

Bangladesh’s EdTech sector has been bolstered by government initiatives and private sector investments aimed at integrating technology into the educational system. Programs like the National ICT Policy and the Digital Bangladesh initiative have created a supportive environment for the growth of EdTech startups. These efforts are complemented by increasing smartphone penetration and internet access, which are facilitating the adoption of digital learning solutions across the country.

Looking ahead, the future of EdTech in Bangladesh appears promising. The continued expansion of digital infrastructure and the growing demand for innovative learning solutions are driving the development of new educational technologies. As more institutions and learners embrace digital tools, opportunities for EdTech companies to expand and innovate will continue to grow. This sector has the potential to revolutionize education in Bangladesh, providing personalized learning experiences, bridging educational gaps, and preparing students for the demands of the digital economy.

07. HealthTech and Telemedicine

HealthTech and telemedicine are rapidly evolving sectors in Bangladesh, revolutionizing the way healthcare services are delivered and accessed. The rise of digital health solutions is addressing critical gaps in the healthcare system, particularly in rural and underserved areas where access to medical facilities and specialists is limited. Platforms offering teleconsultations, remote diagnostics, and health monitoring are making it easier for individuals to receive medical care without the need for physical visits to healthcare facilities.

Telemedicine services in Bangladesh have gained significant traction, driven by the need for accessible and affordable healthcare solutions. Initiatives like the government's telemedicine program, which connects patients with doctors through digital platforms, have been instrumental in expanding healthcare access. Additionally, startups and healthTech companies are developing innovative solutions such as mobile health applications, electronic health records, and remote patient monitoring systems, further enhancing the efficiency and reach of healthcare services.

The future of HealthTech and telemedicine in Bangladesh is bright, with continued advancements in technology and growing investment in digital health solutions. As internet access and smartphone usage continue to rise, telemedicine is expected to become an even more integral part of the healthcare landscape. The potential for integrating AI, machine learning, and big data analytics into healthcare systems offers exciting opportunities for improving patient outcomes and streamlining healthcare delivery. By leveraging these technologies, Bangladesh has the chance to transform its healthcare system, making high-quality medical care more accessible and effective for all its citizens.

08. Smart Agriculture and Agritech

Smart agriculture and agritech are emerging as transformative forces in Bangladesh’s agricultural sector, promising to enhance productivity, sustainability, and efficiency. With agriculture being a cornerstone of the Bangladeshi economy, the adoption of advanced technologies is crucial for addressing challenges such as limited arable land, fluctuating weather patterns, and the need for increased food security. Agritech solutions are leveraging innovations like IoT (Internet of Things), AI (Artificial Intelligence), and big data to revolutionize farming practices and improve yields.

Smart agriculture technologies are enabling farmers to make data-driven decisions through the use of sensors, drones, and precision farming tools. These technologies provide real-time insights into soil health, weather conditions, and crop growth, allowing for more efficient resource management and better pest and disease control. For instance, soil sensors can monitor moisture levels and nutrient content, while drones can assess crop health and detect issues early, leading to more precise and timely interventions.

The Bangladeshi government and private sector are increasingly investing in agritech to support sustainable agricultural practices. Initiatives such as digital platforms for agricultural extension services and government-backed subsidies for technology adoption are helping farmers access modern tools and techniques. Additionally, startups and agritech companies are developing innovative solutions like automated irrigation systems, climate-resilient crop varieties, and market linkages that connect farmers with buyers more effectively.

Looking ahead, the potential for smart agriculture and agritech in Bangladesh is vast. By continuing to embrace technological advancements and fostering a supportive environment for innovation, the country can enhance agricultural productivity, ensure food security, and support the livelihoods of millions of farmers. As these technologies evolve, they promise to drive significant improvements in the agricultural sector, contributing to a more sustainable and prosperous future for Bangladesh.

09. Digital Marketing and Content Creation

The rise of social media and internet access has propelled digital marketing and content creation into one of the most lucrative business opportunities in Bangladesh. As more businesses shift online, the demand for targeted digital marketing strategies has surged. Platforms like Facebook, YouTube, and Instagram are widely used by consumers, making them essential channels for businesses looking to reach specific demographics. Companies are investing heavily in social media marketing, search engine optimization (SEO), and pay-per-click advertising to increase visibility and drive sales.

Content creation, including video production, blogging, and influencer marketing, has also become a vital part of brand promotion. Influencers and content creators, particularly on platforms like TikTok and YouTube, are playing an increasingly important role in shaping consumer preferences. Businesses are collaborating with these influencers to create engaging, personalized content that resonates with audiences and drives customer engagement. This shift in marketing tactics has opened up new avenues for creative professionals in Bangladesh to thrive in digital storytelling and content creation.

For entrepreneurs and freelancers, the digital marketing and content creation space offers tremendous growth potential. Whether it's running digital campaigns, offering SEO services, or creating compelling visual content, there’s a high demand for professionals who can help brands stand out in an increasingly crowded online marketplace. As more businesses recognize the importance of a strong digital presence, opportunities in this sector are expected to grow even further, making it a promising field for innovation and entrepreneurship in Bangladesh.

youtube

Government Support and Policy

The Bangladeshi government has played a crucial role in fostering the growth of the digital economy by implementing supportive policies and initiatives aimed at encouraging innovation and entrepreneurship. The "Digital Bangladesh" vision, launched in 2009, has been a cornerstone of the country's strategy to integrate technology across all sectors, from education and healthcare to business and governance. This long-term digital transformation plan has provided the foundation for creating a robust infrastructure that supports digital business opportunities.

One of the key areas of government support is the IT sector, where companies enjoy various incentives, including tax exemptions for IT exports, grants for startups, and the establishment of high-tech parks across the country. The Bangladesh Hi-Tech Park Authority (BHTPA) has been instrumental in developing dedicated spaces for IT and tech companies, fostering innovation hubs, and attracting foreign investment. Policies designed to ease business regulations, improve access to finance, and streamline export processes are also helping digital businesses scale efficiently.

Additionally, the government has launched programs to enhance digital literacy and technical skills, ensuring the workforce is equipped to meet the demands of a rapidly changing digital economy. Initiatives such as the Learning and Earning Development Project (LEDP) provide training in freelancing, coding, and other digital skills, empowering young entrepreneurs and professionals to participate in the global digital market. As a result of these policies, Bangladesh has seen rapid growth in sectors like e-commerce, fintech, and IT services, creating a favorable environment for digital business ventures to thrive.

Challenges and Future Prospects

Despite the promising growth of Bangladesh’s digital economy, several challenges need to be addressed for it to reach its full potential. One of the primary obstacles is infrastructure development. While internet penetration has significantly increased, many rural areas still lack reliable high-speed internet, limiting access to digital services and e-commerce. The country’s digital payment systems, though expanding, also face issues with cybersecurity and fraud, which can hinder trust in online transactions. Additionally, many businesses still struggle with the transition to digital due to a lack of expertise and digital literacy, particularly in small and medium-sized enterprises (SMEs).

Another challenge is regulatory complexity. While the government has introduced policies to encourage digital growth, certain bureaucratic processes, inconsistent enforcement of regulations, and issues like intellectual property protection remain concerns for entrepreneurs and foreign investors. Moreover, the digital skills gap continues to be a barrier, as many potential employees lack the training necessary to meet the demands of the rapidly evolving digital landscape.

Despite these challenges, the future prospects of Bangladesh’s digital economy are bright. With continued investment in infrastructure, improvements in digital literacy, and government support for innovation, the country is well-positioned to become a digital leader in South Asia. The growing middle class, increasing mobile phone penetration, and the entrepreneurial spirit of the youth will continue to drive demand for digital services. As sectors like e-commerce, fintech, and IT outsourcing expand, Bangladesh has the potential to become a regional hub for digital business, unlocking significant economic growth and opportunities for the next generation of entrepreneurs.

Closing Remarks:

Bangladesh stands at the threshold of a digital revolution, with immense potential to become a leading player in the global digital economy. The country's rapid advancements in e-commerce, fintech, IT outsourcing, and digital marketing, supported by favorable government policies and an entrepreneurial spirit, have laid a strong foundation for future growth. While challenges such as infrastructure development, digital literacy, and regulatory hurdles remain, these obstacles also present opportunities for innovation and investment.

The continued expansion of digital services and technologies will not only boost the economy but also empower millions of people across urban and rural areas. With a young, dynamic population ready to embrace change, Bangladesh’s digital future is bright. Entrepreneurs, businesses, and investors who tap into this evolving landscape will be well-positioned to shape the next wave of growth, contributing to a prosperous and digitally connected Bangladesh.

#E-Commerce Growth Bangladesh#Fintech Innovation Bangladesh#IT Outsourcing Bangladesh#Digital Marketing Bangladesh#Mobile Banking Solutions#Freelancing Platforms Bangladesh#EdTech Solutions Bangladesh#HealthTech Developments#Smart Agriculture Technology#Tech Startups Bangladesh#Youtube

1 note

·

View note

Text

DADJ Global offers a comprehensive suite of services tailored to meet your business needs. From strategic consulting to innovative technology solutions, we are your trusted partner for success. Explore our diverse range of services designed to elevate your business to new heights.

#accounting#investment banking#website#businessconsulting#businessstrategy#businessdevelopment#datagovernance#data strategy#Data platforms#advanced analytics#technology#information technology#tax services#corporate finance#digital platforms#cloud modernization

0 notes

Text

The Crypto Plot Against America’s Gold Reserves

The crypto “industry” was one of the biggest spenders in the 2024 election. It practically single-handedly bought a U.S. Senate seat in Ohio, turfing out labor’s most reliable senator, Sherrod Brown, with $40 million in advertising. And it convinced Donald Trump to make a 180 with a big sack of campaign contributions. Back in 2021, Trump said crypto was a “scam,” but now he has his own coin, his media site is in discussions to buy a crypto exchange, and he’s fully bought into the claims that the industry is overregulated.

So now that crypto has bought great political influence, it’s time to cash in. How might this happen? The basic idea is to turn the American government into the biggest crypto bag-holder of all time. If the plan goes through, hundreds of billions of dollars of public assets will be spent or leveraged to buy a million Bitcoins, allowing the tiny minority of Bitcoin moguls to finally cash out their holdings into real money. It would be one of the biggest upward transfers of wealth in world history.

[...] Crypto shill Sen. Cynthia Lummis (R-WY) proposes the Treasury issue new gold certificates based on the market price [of American gold reserves], and use the resulting cash—$677 billion at current prices—to buy up Bitcoins. In total, her bill would require the government to buy up 200,000 Bitcoins a year for five years, until a “strategic reserve” of a million would be accumulated.

This is revealing on several levels. The whole ideology of cryptocurrency is that it’s supposed to be outside the alleged corruption of governments or the extant financial system. Instead of transactions taking place on platforms run by Wall Street and regulated by the D.C. swamp, fiercely independent crypto entrepreneurs would build new businesses doing … something … out in a fresh economic Wild West.

So why on earth would buccaneering crypto people want the government scooping up a million Bitcoins—or about 5 percent of all that exist? The reason is obvious: so paper Bitcoin billionaires can cash out their holdings into real money without tanking the market. [...] The fundamental value of Bitcoin is zero. Even by crypto standards, the coin is terrible.

[...] Therefore, for early Bitcoin adopters sitting on vast piles of purely speculative assets, there is a huge structural need to get new suckers into the market. For anyone concerned about the corrosive role of money in politics, think about what this means: The crypto industry spent something on the order of $100 million in this election to install a government that will lure sacrificial lambs to a digital asset slaughterhouse, and make a handful of big Bitcoin hoarders generationally wealthy in the exchange.

[...] No one has deeper pockets than the federal government. No need to directly pick the pockets of suckers looking for a get-rich-quick scheme if you can pick everyone’s pockets indirectly by looting a vast store of treasure held in trust for the American people. It’s a logical end point for a technology whose sole meaningful use case is enabling criminal extortion and money laundering: finally carrying out the bank robber’s dream of draining the value in Fort Knox.

152 notes

·

View notes

Text

✨PART OF FORTUNE IN SIGNS AND HOUSES SERIES: 10TH HOUSE✨

Credit: Tumblr blog @astroismypassion

ARIES PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Aries and Capricorn Sun people in your life. You can earn money via marketing or work in dynamic and fast-paced industries, via coaching, sports management, fitness entrepreneurship, coaching and mentoring services in connection with career development, leadership skills, personal empowerment, via work in innovation management, technology development, product development, especially emerging industries. You find abundance when you are bold, take risks, focus on ambitious goals, cultivate independence, build a strong public image and when you embrace leadership qualities.

TAURUS PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Taurus and Capricorn Sun people in your life. You can earn money via work in finance, banking, investment, wealth management. Or via working as a realtor, property manager, real estate developer, via curating, selling or managing art collections, working as a chef, restaurateur or food critic. You find abundance in work in hospitality (managing hotels, resorts, spas), via work in landscape architecture or gardening, interior design, or as a performer, producer or manager, through farming, agricultural management or sustainable food production or creating an eco-friendly business. You feel abundant when you are focused on stability, value quality, when you are patient and persistent.

GEMINI PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Gemini and Capricorn Sun people in your life. You can earn money via work as a journalist, writer, editor, public relations, marketing, working as PR specialist, brand manager, social media strategist, work as a teacher, lecturer, educational content creator, via writing content for blogs, websites or online platforms connected with technology, lifestyle, business. You find abundance when you write books (fiction or non-fiction), via work in technology sector, via technical writing, UX writing or product management, via event planning and work as a sales representative, account manager or business strategist. You feel abundant when you network actively, when you keep learning and embrace versatility.

CANCER PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Cancer and Capricorn Sun people in your life. You can earn money via work in healthcare as a nurse, doctor or therapist, work in interior design or home décor, helping others create comfortable and nurturing spaces, work as a chef, baker or food critic, via handmade furniture, textiles or pottery, engaging in childcare, daycare management or family support services, via work in real estate, helping families find their ideal home. You feel abundant when you use emotional intelligence, emphasize nurturing and care.

LEO PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Leo and Capricorn Sun people in your life. You can earn money via pursuing a career in acting on stage, in film or on television, working as a musician, singer or performer, via directing or producing theatrical productions, films or TV shows, work in television, radio or digital broadcasting, you could work as a host, anchor or presenter, designer, stylist, model, painter, sculptor or graphic designer.

VIRGO PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Virgo and Capricorn Sun people in your life. You can earn money via offering personalized health and wellness service. You can offer remote fitness coaching, such as offering personalized fitness plans and virtual training sessions. You could work in mental health professions, like counselling or psychology, work as a nutritionist, dietitian, work as a proofreader or editor, work with biology, chemistry, environmental science, mathematics or with language or having an IT role (system analysis, IT support or cybersecurity). You feel abundant when you develop organizational skills, use analytical skills and when you seek structured environments.

LIBRA PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Libra and Capricorn Sun people in your life. You can earn money via offering dance classes, via work in art curation, gallery management or the fines arts, helping to showcase and promote artists and their work, via a career in human resources, focusing on employee relations, conflict resolution, via talent management, recruitment or career coaching. You feel abundant when you work in fashion design, graphic design, visual arts, brand management and marketing. You feel abundant when you aim for balance and harmony, emphasize fairness and justice.

SCORPIO PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Scorpio and Capricorn Sun people in your life. You can earn money via forensic accounting, crisis counselling or support services, via a career in scientific research, forensic science, medical research, psychology, surgery, oncology, energy healing, finance, technology or wellness, via art therapy and filmmaking. You feel abundant when you embrace transformation, healing, use psychological insight, when you pursue authority and expertise.

SAGITTARIUS PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Sagittarius and Capricorn Sun people in your life. You can earn money via travel blogging, vlogging or becoming a travel consultant. You find abundance via academic research, publishing, by becoming a travel consultant, tour guide, work in the tourism industry, work connected with educational, human rights and cultural exchange, via career as a spiritual teacher, counsellor, life coach, via theological or philosophical work, writing or teaching. You feel abundant when you cultivate optimism or enthusiasm, seek global or cultural perspectives, pursue knowledge or education and embrace exploration and travel.

CAPRICORN PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Capricorn Sun people in your life. You find abundance via work as a financial advisor or analyst, accounting, as a property developer, manager or investor, via work in property management, overseeing rental properties, commercial spaces or large residential complexes, via civil engineering, work in educational administration (school or college management). You feel abundant when you focus on long-term goals and value pragmatism and responsibility.

AQUARIUS PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Aquarius and Capricorn Sun people in your life. You can earn money via buying and selling collectibles (stamps, coins, vintage items), creating eco-friendly products or services (zero-waste goods, sustainable fashion). You may also find abundance in esports coaching by offering coaching services for aspiring professional gamers. You feel abundant via work in scientific research, in fields like physics, astronomy, biotechnology and environmental science, work in roles focused on research and development, via digital marketing. You feel abundant when you are pursuing unconventional paths, via networking with like-minded individuals and align with social causes.

PISCES PART OF FORTUNE IN THE 10TH HOUSE

You feel the most abundant when you have Pisces and Capricorn Sun people in your life. You can earn money via work in music as a composer, musician or performer, via a career in painting, illustration, sculpture or other visual arts, via hospice work, via work in non-profit sector, focusing on causes related to humanitarian aid, environmental conservation or social justice, work in hospitality, such as hotel management or event planning, via cultural exchange, guided tours or spiritual retreats. You feel abundant when you embrace your creative talents, cultivate compassion and empathy, when you explore spiritual and esoteric interests and when you focus on meaningful impact.

Credit: Tumblr blog @astroismypassion

#astrology#astroismypassion#astro notes#astroblr#astro community#astro note#astro observations#natal chart#astrology blog#chart reading#part of fortune in the 10th house#pof in the 10th house#aries pof#taurus pof#cancer pof#gemini pof#taurus#cancer#scorpio#pisces#aries#sagittarius#cancer part of fortune#libra part of fortune#scorpio part of fortune#sagittarius part of fortune#capricorn part of fortune#aquarius part of fortune#aquarius pof#capricorn pof

126 notes

·

View notes

Text

World War III: No Tanks, Just Technology and Economy ⚔️🌍

World War III is here, but it's not being fought with weapons; it's being fought through technology and the economy. Since Trump launched the trade tariff war, countries have been inspired to fight by imposing taxes to weaken their enemies. For example, China is now imposing taxes on Canada. And the real battle will soon be over artificial intelligence. Pluto in Aquarius is initiating this technological transformation, but it is with Uranus in Gemini that things will truly explode.

(by the way, I love this Gif... imagine doing this to your enemy lol... Me and my sister we fight like this... Just kidding )

Uranus in Gemini: Breakups and Revolutions in Communication

Uranus, the planet of revolutions, will disrupt communication between nations. Alliances will break apart overnight, and an old enemy could become a new ally. This will be an era where countries not only fight to develop cutting-edge AI but also to control data and infrastructure.

Hackers and Social Media Control

Hackers will become key players, targeting strategic targets like governments and banks rather than individuals. Meanwhile, social media platforms like TikTok could be controlled by governments, turning these platforms into tools of power.

Education and Work: Virtual and Automated

Education and work will become largely virtual, as you already know. AI will dominate learning systems and professional environments, making everything more automated and connected. The skills needed to survive in this digital world will focus on mastering new technologies.

Money itself will no longer be given in paper; it's already virtual. So, if you want my opinion, since cryptocurrency is already virtual, it will gain more importance now. When Uranus is in Taurus, Taurus is materialistic, Paper money is important, but not in Gemini.

In conclusion, war is no longer on the battlefield but in the digital world! Data will be the new territories to conquer. Thus, the economy—such as taxes, cryptocurrencies, and technology—such as data and innovation, are tools of power and domination in themselves. We no longer need weapons.

Share your opinion, let me know what you think:)

20 notes

·

View notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

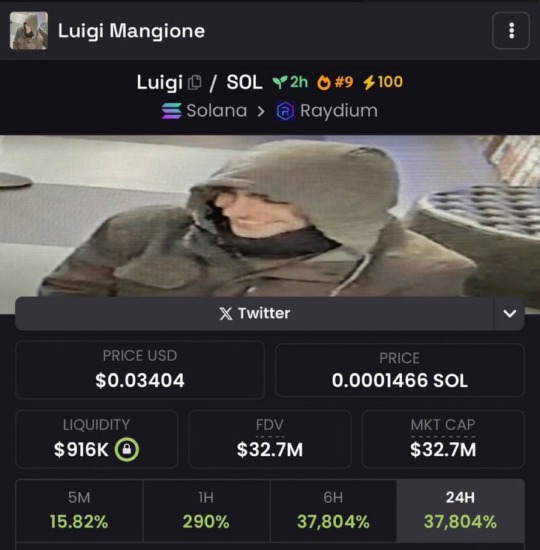

Here’s an example for meme coins:

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

28 notes

·

View notes

Text

The Rise of Crypto Casinos: A New Era in Gambling

The gambling industry has undergone a remarkable transformation over the centuries, evolving from rudimentary dice games in ancient civilizations to the glitzy casinos of Las Vegas. Today, the rise of the crypto casino represents a new chapter in this storied history, blending cutting-edge blockchain technology with the timeless thrill of wagering. Platforms like Jups.io are at the forefront of this revolution, offering players a secure, transparent, and decentralized gaming experience that traditional casinos struggle to match. This article explores how crypto casinos emerged, their technological foundations, and why they are reshaping the gambling landscape.

The origins of gambling trace back thousands of years, with evidence of dice games in Mesopotamia and betting on chariot races in ancient Rome. These early forms of gambling were social activities, often tied to cultural or religious events. Fast forward to the 17th century, when the first modern casinos appeared in Europe, formalizing gambling into structured venues. The 20th century saw the rise of Las Vegas and Atlantic City, where opulent casinos became synonymous with luxury and risk. However, these traditional setups had limitations—centralized operations, high fees, and concerns over fairness. Enter the crypto casino, a game-changer that leverages blockchain to address these issues.

Cryptocurrency, pioneered by Bitcoin in 2009, introduced a decentralized financial system that prioritized security and anonymity. By the mid-2010s, developers recognized the potential of integrating blockchain with online gambling, giving birth to the crypto casino model. Unlike traditional online casinos, which rely on centralized servers and fiat currencies, crypto casinos operate on blockchain networks, ensuring transparency through immutable ledgers. Jups.io exemplifies this model, offering games like slots, poker, and roulette, all powered by cryptocurrencies such as Bitcoin and Ethereum. Players can verify the fairness of each game through provably fair algorithms, a feature that builds trust in an industry often plagued by skepticism.

The technological underpinnings of crypto casinos are what set them apart. Blockchain ensures that every transaction—whether a deposit, wager, or withdrawal—is recorded transparently, reducing the risk of fraud. Smart contracts, self-executing agreements coded on the blockchain, automate payouts and game outcomes, eliminating the need for intermediaries. This not only lowers operational costs but also allows platforms like Jups.io to offer competitive bonuses and lower house edges. Moreover, the use of cryptocurrencies enables near-instant transactions, a stark contrast to the delays often experienced with bank transfers in traditional online casinos.

The appeal of crypto casinos extends beyond technology. They cater to a global audience, unrestricted by geographic boundaries or banking regulations. Players from regions with strict gambling laws can participate anonymously, thanks to the pseudonymous nature of cryptocurrencies. Additionally, crypto casinos attract tech-savvy younger generations who value innovation and digital assets. The integration of decentralized finance (DeFi) principles, such as staking rewards or yield farming, into some platforms adds another layer of engagement, blurring the lines between gaming and investment.

However, the rise of crypto casinos is not without challenges. Regulatory uncertainty looms large, as governments grapple with how to oversee decentralized platforms. Volatility in cryptocurrency markets can also affect players’ bankrolls, though stablecoins like USDT are increasingly used to mitigate this risk. Despite these hurdles, the trajectory of crypto casinos points upward, driven by relentless innovation and growing adoption.

In conclusion, the crypto casino represents a bold fusion of gambling’s rich history with the transformative power of blockchain. Platforms like Jups.io are leading the charge, offering players an unparalleled blend of security, fairness, and excitement. As cryptocurrency continues to permeate mainstream finance, crypto casinos are poised to redefine the future of gambling, one block at a time.

13 notes

·

View notes

Text

“No prior President has ever abased himself more abjectly before a tyrant” Were the words spoken by the late Senator from Arizona, John McCain after the July 2018 summit between President Trump and Russian president Vladimir Putin. His fellow Arizonan Senator Jeff Flake would say, “I never thought I would see the day when our American President would stand on the stage with the Russian President and place blame on the United States for Russian aggression. This is shameful.”

McCain would pass away from an aggressive brain cancer on August 25, 2018. His fellow statesmen would not seek reelection, giving a lengthy em passionate speech condemning “new normal” of the Trump era, saying, “the personal attacks, the threats against principles, freedoms, and institutions; the flagrant disregard for truth or decency, the reckless provocations, most often for the pettiest and most personal reasons, reasons having nothing whatsoever to do with the fortunes of the people that we have all been elected to serve.”

Look at those pictures of Donald Trump! Have you ever seen that lack of overbearing arrogance on his face before!? Putin either makes him soil his diaper with fear, he has dirt on Trump, or our tiny handed tyrant is in love! This has little to do with what we’ll dive into but, just happened to run across Flake’s announcement for not seeking reelection. It was pretty good! Anyway…

With our short attention spans and constant distractions, we may only remember a phrase when we associate the word Russia, and the word Trump. That being the former President’s response to a reporter, saying “Oh! Russia Russia Russia”, that’s my word association image anyway. But yes. Russia Russia Russia.

We’ll go in a reverse chronologicalish order, or most relevant recent order, or whatever order it ends up as. There’s a lot to cover, see how long you make it… 😆

Trump has long had affairs overseas, and no, not the kind he’s known for, but business dealings. After making a series of bad decisions in the later 80’s early 90’s American banks were hesitant to loan to Trump. As it turns out, the Kremlin had their eye on Trump, and had Czech spies working for the Kremlin covertly tail him as early as 1987. Throughout the years Trump Would rely on Russian assistance quite often. From the financial and business side to the political and personal side.

Upon the merger of Trump’s, Truth Social and Digital World Acquisition Corp, Truth Social became, Trump Media and Technology Group. Before the merger Truth Social had been hemorrhaging money, showing significant losses on all quarterly reports.

In late 2021 the social media platform seemed as if it was doomed. In December of 2021, a Christmas miracle occurred in the form of two loans totaling eight million dollars, acting as a lifeline to the failing site.

These loans came as one for $2 million and another $6 million. The $2 million loan was from Paxum Bank, an entity tied with Russian President Vladimir Putin. Paxum Bank is partially owned by a man named Anton Postolnikov, who is related to a man named Aleksandr Smirinov (not the same As Alexander Smirinov that tried to relay Russian misinformation to the FBI, and was subsequently arrested for doing so in the House, Biden impeachment inquiry, political theater headed by James Comer of KY, but a different Smirinov) a former Russian government official, who runs Rosmorport, a Russian shipping company. There was $6 million loan paid by a separate entity by the name of ES Family Trust, who’s director at the time was the very same man who held the title of director at Paxum Bank, the same bank who loaned the smaller $2 million loan. You almost need a poster board with pictures, some tacks and yarn with that one!

In 2023 prosecutors in the U.S. Attorney’s Office for the Southern District of New York began an investigation into the Russian based financial backing and Trump Media and Technology Group (TMTG). The case is still ongoing.

We’re going to skip out of order here because this is already lacking brevity, so. Let’s turn to the end of Trump’s presidency, in the waning days, after the insurrection, Jan 16-20th.

After the disgraceful behavior Trump had engaged in upon losing the 2020 election to Joe Biden, Trump and his remaining staff were scrambling to exit the White House. On Jan the 18th, just two days from Biden’s inauguration, Trump requested the delivery of a binder.

This ten inch thick, treasure trove of documents contained some of the United States most closely guarded information and secrets. So much so that even lawmakers and congressional aides with top secret clearance could only view the binder, and information within, at the Central Intelligence Agency’s (CIA) headquarters in Langley Virginia. Inside were the highest levels of confidentiality and secret information from the United States, its allies, and top secret NATO intelligence as well. It was a collection on Russia, assets working for or against the Kremlin, sources, methods in which the U.S. government received its information and even an assessment of the Russian President Vladimir V. Putin.

Trump’s request was carried out under the care of the Presidents Chief of Staff Mark Meadows. Trump’s sociopathic narcissist disorder caused the exiting, disgraced President to feel the need to declassify a host of documents, including the FBI’s investigation into himself and Russia.

White House lawyers and aides hurriedly redacted names, dates, locations as fast as they could knowing the erratic behavior of Trump. His top administration officials would attempt to block the publication of the classified information. The day before leaving office, on Jan 19th, despite pleas from White House officials, aides and staff, as well as out of spite, Trump issued the declassification of nearly all the sensitive material, putting the lives of agents, informants, and sources in jeopardy. Multiple copies of the initial redacted version were printed out and were set to be distributed throughout Washington to Republicans in Congress and to right wing media outlets. The copies that did get sent out were quickly recovered by White House lawyers, demanding that further redactions were necessary.

Minutes before the inauguration of President elect Biden, Meadows rushed to get approval from the Justice Department, hand delivering the redacted copy for final approval.

Suspiciously, in all the chaos of the final 48 hours, and Trump’s temper tantrum, the original, unredacted, ten inch thick binder of the most sensitive material regarding the U.S. and its allies went missing. There’s a redacted copy in the National Archives, but the whereabouts of the original binder remains a mystery.

During the hearings on the criminality that occurred in Trump’s final weeks in office, aide, Cassidy Hutchinson testified that she saw Chief of Staff MarkMeadows leave the White House with the binder, suggesting that her assumption was that he had put the top secret information in a safe, located at his home.

This brings us to our next act… Of sedition.

The declassification and illegal retention of the world’s most secretive binder was not the only act of treason Trump would engage in. After his loss in November and into December Trump had authorized the removal and transport of dozens of boxes of classified information, state secrets, nuclear secrets, U.S. and its allies war plans to various properties he owned.

The FBI was aware of the taking of the documents, after requesting their return several times a warrant was issued to Trump’s Florida “home” Mar-a-lago. It was coordinated out of respect, safety and to not make a spectacle of the raid, that Trump would not be present when the FBI searched his club/home.

What the FBI found was dozens of boxes containing the classified documents as well as other trinkets like magazines and newspaper articles, strewn around, knocked over and spilling in various locations such as a closet, bathroom, his youngest child Barrons’s room and a hidden room containing surveillance equipment for the property.

In thier assessment of the evidence they found 43 empty folders with tabs labeled, Classified, 28 empty folders labeled, Return to Staff Secretary or Military Aide. In the boxes, folders that weren’t empty included, 18 documents marked, Top Secret, 54 marked as, secret, 31 marked as, Confidential, and 11,179 other Government documents, some with photos that weren’t marked.

This case is the most egregious act of sedition of American President in our nations history. A Special Prosecutor, Jack Smith, was tasked by the DOJ of heading the case. In a stunning move of partisanship and a complete disregard of standing Jurisprudence, Federal Judge Aileen Cannon, a Trump appointee, would go against 50 years of precedent and dismiss the case under the grounds the the special counsel was improperly funded. The American people would be denied their right to get the truth about who, what, when and why these documents were retained, missing, and in the condition they were found. The binder talked about earlier was not in the trove of documents found at Mar-a-lago, its location remains unknown.

So yea! Russia Russia Russia… There’s SO much more Russian ties, scandals, shady business dealings to show but. If this is nearly as long to read as it was to write, I’m proud you made it all the way through.

I’ve been saying it for years, Trump is a Russian asset, I even made a bet saying in 20 years if it doesn’t come out that Trump was a Russian asset I owed this person a sloppy, dentureless blowjob (because I’ll be kinda old in 20 years and I assume I’ll have dentures).

Don’t be conned by Americans most notorious conman and give him the chance to steal and share even more of our state secrets. Vote Kamala Harris for President. Blue down ballot for real change in our country.

I may finish this and post the whole thing from 2013 to what we dove in to on my substack, which I’ll try to remember to leave a link in the comments section. Until next time. Let’s hope for the sake of our democracy Trump loses here in 2024 or maybe I’ll see some of you f*cks in Gitmo 😉😅😆☮️🇺🇸

#election 2024#traitor trump#vote blue#politics#kamala harris#donald trump#republicans#news#the left#gop#russia#trump is a threat to democracy#trump is a traitor#vote kamala#kamala for president#kamala 2024#trump vance 2024#women voters#vote vote vote#please vote#harris walz 2024#harris waltz#democracy#freedom#free press#free speech#democrats#america#american people#we the people

23 notes

·

View notes

Text

#crypto#cybersecurity#digital banking licenses#digitalbanking#fintech#white label crypto exchange software#investors#bitcoin#digital marketing#financial advisor#itioinnovex#paymentgateway#saas#saas development company#saas technology#b2b saas#saas platform#software#information technology#digitaltransformation#techinnovation

0 notes

Text

Can Blockchain Technology Improve Personal Loan Approvals?

The financial sector is rapidly evolving with new technologies, and blockchain is one of the most promising innovations transforming the personal loan industry. Traditionally, loan approvals have been time-consuming, requiring manual document verification, credit score analysis, and financial background checks. Blockchain technology is changing this by making the process faster, more secure, and more transparent.

With blockchain, lenders can streamline identity verification, enhance credit risk assessment, and prevent fraud, making personal loans more accessible and efficient. In this article, we explore how blockchain is improving loan approvals and why it could be the future of digital lending.

🔗 For hassle-free personal loan applications, visit FinCrif Personal Loan.

1. How Blockchain Enhances Loan Approvals

Faster and More Reliable Identity Verification

One of the biggest hurdles in personal loan approvals is verifying a borrower’s identity. Traditional Know Your Customer (KYC) processes require applicants to submit documents such as Aadhaar, PAN, and bank statements, which banks manually verify. This process can take several days, causing delays.

Blockchain eliminates redundant verification by storing identity records in a tamper-proof, decentralized ledger. Once an identity is verified and recorded on the blockchain, it can be accessed by lenders instantly, reducing processing time and ensuring authenticity.

Alternative Credit Scoring for Faster Loan Approvals

Many individuals struggle to get personal loans due to a lack of credit history or low CIBIL scores. Traditional lenders primarily rely on credit bureau scores, which do not always provide a complete picture of a borrower's financial behavior.

Blockchain allows lenders to use alternative data sources, such as utility bill payments, mobile phone transactions, and online spending patterns, to assess creditworthiness. This makes personal loans accessible to self-employed individuals, gig workers, and those without a strong credit history.

Automated Loan Processing with Smart Contracts

A smart contract is a self-executing agreement stored on a blockchain that automatically enforces the terms of a loan when certain conditions are met. These contracts eliminate the need for human intervention, making loan approvals much faster.

For example, once a borrower's identity and financial records are verified, a smart contract can instantly approve the loan and trigger fund disbursement. This removes bureaucratic delays, helping borrowers access funds within minutes instead of days.

2. Improved Security and Fraud Prevention

Prevention of Identity Theft and Fake Applications

One of the biggest challenges in personal lending is fraud. Many loan scams involve forged documents, fake identities, or manipulated financial records. Blockchain prevents fraud by ensuring that all transactions and data entries are permanent, transparent, and tamper-proof.

Lenders can verify borrower details on a shared blockchain network, making it impossible for fraudsters to manipulate loan applications. This enhances trust and reduces the risk of defaults.

Eliminating Credit Report Manipulation

In the current system, borrowers can sometimes manipulate their credit reports by temporarily improving their credit utilization before applying for a loan. Blockchain stores real-time financial data, making it impossible to alter past records. This ensures that lenders always have an accurate financial picture of borrowers, reducing lending risks.

3. Faster Loan Disbursement with Blockchain

In traditional lending, once a loan is approved, it may take several days for funds to be transferred due to interbank processes and verification checks. Blockchain speeds up disbursal by enabling direct peer-to-peer transactions without intermediary banks.

With blockchain-based digital wallets, borrowers can receive loan amounts instantly after approval, making it a game-changer for emergency loans and urgent financial needs.

🔗 Looking for a quick loan disbursal? Explore FinCrif Personal Loan.

4. Transparency and Reduced Loan Processing Costs

Lower Processing Fees for Borrowers

Loan processing involves multiple intermediaries, such as credit bureaus, third-party verifiers, and bank officers, each adding costs that are passed on to borrowers. Blockchain eliminates many of these middlemen by automating verification and reducing paperwork.

This leads to lower processing fees and better interest rates, making personal loans more affordable.

Complete Transparency in Loan Terms

Many borrowers struggle with hidden charges, fluctuating interest rates, and complex loan agreements. Blockchain ensures absolute transparency by recording all loan terms on an immutable ledger. Borrowers can access their loan history, EMI schedules, and outstanding balances without worrying about unexpected changes in loan conditions.

5. Challenges in Implementing Blockchain for Personal Loans

Despite its advantages, blockchain adoption in personal lending faces challenges, including regulatory concerns and technical barriers.

Regulatory Uncertainty: Many governments are still developing policies on blockchain-based lending, which slows adoption.

Integration with Existing Banking Systems: Most financial institutions operate on centralized databases, making integration with decentralized blockchain networks complex.

User Awareness: Many borrowers are unfamiliar with blockchain technology and may hesitate to trust a fully automated loan approval system.

However, as blockchain regulations become clearer and financial institutions invest in digital transformation, these challenges are expected to decrease.

6. The Future of Blockchain in Personal Loan Approvals

As blockchain technology continues to evolve, it will play an even bigger role in making personal loans more accessible, secure, and efficient. Some expected advancements include:

Instant Global Loan Access: Borrowers will be able to apply for and receive loans across borders without waiting for traditional bank approvals.

AI and Blockchain Integration: Combining artificial intelligence with blockchain will further enhance loan approvals by analyzing borrower behavior in real-time.

Decentralized Lending Platforms: More peer-to-peer (P2P) lending models will emerge, allowing borrowers to connect directly with lenders, bypassing traditional banks.

🔗 Be part of the future of lending! Explore AI-powered loan solutions at FinCrif Personal Loan.

Blockchain technology has the potential to redefine personal loan approvals by making them faster, more transparent, and secure. By reducing reliance on credit bureaus, enabling instant identity verification, and preventing fraud, blockchain can improve financial accessibility for millions of borrowers.

While challenges remain, the future of personal lending is increasingly digital. As blockchain adoption grows, borrowers can expect lower costs, faster approvals, and a more efficient lending experience.

For a seamless and secure personal loan application, visit FinCrif Personal Loan and explore the latest AI-driven financial solutions.

#Blockchain in personal loans#Blockchain loan approval#Blockchain technology in lending#Personal loan blockchain#Faster loan approvals with blockchain#Blockchain-based lending#Secure loan processing#Decentralized lending platforms#Smart contracts for loans#Instant loan approvals#How blockchain improves lending#Blockchain in financial services#Digital lending with blockchain#Alternative credit scoring with blockchain#AI and blockchain in loans#Fraud prevention in personal loans#Transparent loan processing#Peer-to-peer lending blockchain#Future of blockchain in banking#Secure identity verification for loans#finance#loan apps#personal loans#loan services#personal loan#fincrif#personal loan online#nbfc personal loan#bank#personal laon

0 notes

Text

Digital Banking Platform Market: Trends, Growth, and Future Outlook

In today’s fast-paced digital world, the financial sector has undergone significant transformation, driven by the rapid adoption of technology and the changing expectations of consumers. A Digital Banking Platform (DBP) is at the forefront of this revolution, providing financial institutions with the tools needed to offer comprehensive online and mobile banking services. By integrating with core…

View On WordPress

#banking#banking as a service platform#bfsi#Blockchain technology#business#Business Intelligence#digital banking#digital banking platform#Digital Banking Platform Market#finance#Fintech#fintech integration#mobile banking#mobile banking platform#online banking#online banking platforms

0 notes

Text

2024 team sponsors recap!

this is completely irrelevant to F1 but i study and do these stuffs for a living sooo 😩😩 2023 sponsors are based on the sponsors that are there at the beginning of the season (new sponsors that join in the middle of the season will be classified as 2024's)

Mercedes AMG Petronas F1 Team:

New sponsors: Whatsapp, Luminar (American tech company), SAP (German software company), nuvei (Canadian credit card services), Sherwin Williams (American painting company) 2024 data last update: 2024/02/14

Old sponsors that left: Monster Energy, Pure Storage (American technology company), fastly (American cloud computing services), Axalta (American painting company), Eight sleep (American mattresses company) 2023 data last update: 2023/01/07

Oracle Red Bull Racing F1 Team:

New sponsors: Yeti (American cooler manufacturer, joined later in 2023), APL (American footwear/athletic apparel manufacturer, joined later in 2023), CDW (American IT company, joined later in 2023), Sui (American tech app by Mysten Labs, joined later in 2023), Patron Tequila (Mexican alcoholic beverages company, joined later in 2023) 2024 data last update: 2024/02/15

Old sponsors that left: CashApp, Walmart, Therabody (American wellness technology company), Ocean Bottle (Norwegian reusable bottle manufacturer), PokerStars (Costa Rican gambling site), Alpha Tauri (? no info if they're official partners or not but Austrian clothing company made by Red Bull), BMC (Switzerland bicycle/cycling manufacturer), Esso (American fuel company, subsidiary of ExxonMobil), Hewlett Packard Enterprise (American technology company) 2023 data last update: 2023/03/07

More: Esso is a subsidiary of Mobil so there's possibility they merged or something

Scuderia Ferrari:

New sponsors: VGW Play (Australian tech game company, joined later in 2023), DXC Technology (American IT company, joined later in 2023), Peroni (Italian brewing company), Z Capital Group/ZCG (American private asset management/merchant bank company), Celsius (Swedish energy drink manufacturer) 2024 data last update: 2024/02/15

Old sponsors that left: Mission Winnow (American content lab by Phillip Morris International aka Marlboro), Estrella Garcia (Spanish alcoholic beverages manufacturer), Frecciarossa (Italian high speed train company) 2023 data last update: 2023/02/16

More: Mission Winnow is a part of Phillip Morris International. They are no longer listed as team sponsor but PMI is listed instead.

(starting here, 2023 data last update is 2023/02/23 and 2024 data last update is 2024/02/15)

McLaren F1 Team: (Only McLaren RACING's data is available idk if some of these are XE/FE team partners but anw..)

New sponsors: Monster Energy, Salesforce (American cloud based software company, joined later in 2023), Estrella Garcia (Spanish alcoholic beverages manufacturer), Dropbox (American file hosting company), Workday (American system software company, joined later in 2023), Ecolab (American water purification/hygiene company), Airwallex (Australian financial tech company), Optimum Nutrition (American nutritional supplement manufacturer), Halo ITSM (American software company, joined later in 2023), Udemy (American educational tech company, joined later in 2023), New Era (American cap manufacturer, joined in 2023), K-Swiss (American shoes manufacturer, joined later in 2023), Alpinestars (Italian motorsports safety equipment manufacturer)

Old sponsors that left: DP World (Emirati logistics company), EasyPost (American shipping API company), Immersive Labs (UK cybersecurity training company?), Logitech, Mind (UK mental health charity), PartyCasino (UK? online casino site), PartyPoker (American? gambling site), Sparco (Italian auto part & accessory manufacturer), Tezos (Switzerland crypto company)