#cryptographic evolution

Explore tagged Tumblr posts

Text

Listen: https://open.spotify.com/episode/1eTOLpikrD5l46uHachtpA "**Title: The Future of Cybersecurity: Confronting the Quantum Challenge** In a world where our digital lives are woven into the very fabric of our existence, the stakes have never been higher. As we increasingly rely on the internet for everything from banking to meeting friends, a quiet revolution is brewing just beyond the horizon. It's a revolution led by the powerful yet unpredictable force of quantum computing, and if we don’t prepare, our online security could hang by a thread. At the heart of our current cybersecurity measures are cryptographic systems that hinge on the complexity of certain mathematical challenges: think factoring giant prime numbers and solving discrete logarithms. These tasks are, at least for now, insurmountable for even the most advanced classical computers. This cryptographic shield protects our personal information, financial transactions, and even our national secrets. But what happens if quantum computers, with their ability to operate on a completely different mathematical plane, can break through these defenses? Enter Deirdre Connolly, a leading force in the realm of post-quantum cryptography. Connolly is not just waiting for the inevitable arrival of quantum machines; she's paving the way for a future where the integrity of our data remains intact, even in the face of unprecedented computational power. During her recent discussion with Cindy Cohn and Jason Kelley from the Electronic Frontier Foundation, Connolly sheds light on crucial aspects of this complex yet captivating subject. So, what does the future hold? For one, we’re still grappling with the full potential of quantum computing. This uncertainty isn't a reason to panic—it's a clarion call for forward-thinking innovations in cryptography. Preparedness is key, and acknowledging that we can’t yet predict how quantum computers will evolve is exactly why we must invest in post-quantum strategies now. One pressing concern is the ominous specter of “Harvest Now, Decrypt Later” attacks. This is when malicious actors stockpile encrypted data today, waiting for the quantum tools of tomorrow to crack those codes. Fortunately, proactive measures are already underway to safeguard our information against these threats. What’s refreshing about Connolly’s work is her belief in a collaborative future. The quest for post-quantum resilience requires a blend of cryptographic collaboration, competition, and community engagement. It won't be a linear journey, and various pathways will need exploration to uncover methods that will stand strong against quantum onslaughts. You might wonder how preparing for post-quantum cryptography compares to the challenges we faced with the Y2K bug. The verdict is both reassuring and unsettling: while the Y2K fix brought a visible change, the hope is that post-quantum cryptography will create seamless transitions, unnoticed by the end users. The best-case scenario is that you won't even have to think about it—that your online safety remains intact as technology evolves around you. And the good news? You don't need a background in mathematics to grasp the importance of these developments. Connolly’s expertise and insights deliver not just information but a vision for what cybersecurity could and should look like in the quantum age. Deirdre Connolly is not just a name—she’s a vanguard in research and practical cryptography at Sandbox AQ, and her work promises to be instrumental in shaping a future where we can navigate the digital landscape with confidence. As we stand on the brink of a quantum revolution, the questions loom large, but so too do the possibilities. With pioneers like Connolly leading the way, we can embrace the future of encryption, ready to defend our digital worlds against whatever challenges lie ahead. The next chapter in cybersecurity is unfolding, and it’s a story that demands our attention."

#podcasts#How to Fix the Internet#quantum resilience#digital fortifications#cryptographic evolution#privacy warfare#future-proofing security

0 notes

Text

What is Blockchain? 10 Simple Ways to Understand the Technology

Blockchain technology, once a niche concept primarily associated with cryptocurrencies like Bitcoin, has rapidly evolved into a revolutionary innovation with the potential to reshape countless industries. At its heart, blockchain is a distributed ledger technology (DLT) that provides a secure, transparent, and immutable way to record transactions and information. It’s more than just the backbone…

#beyond cryptocurrency#blockchain algorithms#blockchain applications#blockchain basics#blockchain benefits#blockchain chain#blockchain challenges#blockchain consensus#blockchain definition#blockchain ecosystem#blockchain evolution#blockchain explained#blockchain for beginners#blockchain for business#blockchain for finance#blockchain for government#blockchain for logistics#blockchain future#blockchain implementation#blockchain innovation#blockchain network#blockchain nodes#blockchain security#blockchain technology#blockchain use cases#blockchain validation#blocks in blockchain#consensus mechanism#cryptographic hash#cryptography blockchain

1 note

·

View note

Text

Hasbro PR rep confirms TYT ending

In an email to the Twitter user My Little Pony Facts (@MLPonyFacts) on September 17, a Hasbro PR representative confirmed that My Little Pony: Tell Your Tale is ending, and the final episode will be released on October 17.

We have independently verified that this email is real; see below for details.

This means that the only two remaining episodes should be season 2 episodes 22 and 23, to be released on October 3 and October 17 respectively. This matches the most pessimistic estimate that we could previously make.

Following two seasons of exciting, slice of life content, My Little Pony: Tell Your Tale is drawing to a close. My Little Pony: Tell Your Tale has entertained fans around the world with magical adventures, while delivering positive messages about the value of diversity, inclusion, and friendship. As the series wraps up, our fans can continue to enjoy My Little Pony through innovative toys, games, and licensed consumer products that create joy and community for fans of all ages. This isn’t the end of the journey for My Little Pony – stay tuned for more magical adventures to come. The series will remain available for audiences worldwide, with both seasons available on the My Little Pony: Tell Your Tale YouTube channel and series 1 currently streaming on Netflix. New episodes of My Little Pony: Tell Your Tale will air bi-weekly until October 17, 2024.

Separately, Hasbro has confirmed that a "total brand evolution" will come in 2026, and that MLP licensing through 2025 will be focused on retro/nostalgia.

Currently, we don't know of any G5 content that will be released after My Little Pony: The Storm of Zephyr Heights issue 3, which will be published on November 20, 2024. However, IDW freelance artist Natalie Haines has said that there are still more G5 comics in the works.

Verification of the email

While My Little Pony Facts posted screenshots of the email on Twitter on September 18, we decided to wait until we could verify the information ourselves before making this post. Thanks to their cooperation, we have been able to do that.

Most modern emails contain a DKIM cryptographic signature; only the email domain's server can generate the signature, but the recipient can verify it using the server's public key.

Since My Little Pony Facts sent us the original email file that they received, we were able to independently verify the DKIM signature. This means that the email was sent to them from a hasbro.com user, and that the contents were not tampered with. We used the Python package dkimpy to check this.

We also separately emailed Hasbro about this topic on September 19. This post will be updated if we receive a response from Hasbro.

70 notes

·

View notes

Text

Navigate the New Rules of ZATCA e-Invoicing Phase 2

The digital shift in Saudi Arabia’s tax landscape is picking up speed. At the center of it all is ZATCA e-Invoicing Phase 2—a mandatory evolution for VAT-registered businesses that brings more structure, security, and real-time integration to how invoices are issued and reported.

If you’ve already adjusted to Phase 1, you’re halfway there. But Phase 2 introduces new technical and operational changes that require deeper preparation. The good news? With the right understanding, this shift can actually help streamline your business and improve your reporting accuracy.

Let’s walk through everything you need to know—clearly, simply, and without the technical overwhelm.

What Is ZATCA e-Invoicing Phase 2?

To recap, ZATCA stands for the Zakat, Tax and Customs Authority in Saudi Arabia. It oversees tax compliance in the Kingdom and is driving the movement toward electronic invoicing through a phased approach.

The Two Phases at a Glance:

Phase 1 (Generation Phase): Started in December 2021, requiring businesses to issue digital (structured XML) invoices using compliant systems.

Phase 2 (Integration Phase): Began in January 2023, and requires companies to integrate their invoicing systems directly with ZATCA for invoice clearance or reporting.

This second phase is a big leap toward real-time transparency and anti-fraud efforts, aligning with Vision 2030’s goal of building a smart, digital economy.

Why Does Phase 2 Matter?

ZATCA isn’t just ticking boxes—it’s building a national infrastructure where tax-related transactions are instant, auditable, and harder to manipulate. For businesses, this means more accountability but also potential benefits.

Benefits include:

Reduced manual work and paperwork

More accurate tax reporting

Easier audits and compliance checks

Stronger business credibility

Less risk of invoice rejection or disputes

Who Must Comply (and When)?

ZATCA isn’t pushing everyone into Phase 2 overnight. Instead, it’s rolling out compliance in waves, based on annual revenue.

Here's how it’s working:

Wave 1: Companies earning over SAR 3 billion (Started Jan 1, 2023)

Wave 2: Businesses making over SAR 500 million (Started July 1, 2023)

Future Waves: Will gradually include businesses with lower revenue thresholds

If you haven’t been notified yet, don’t relax too much. ZATCA gives companies a 6-month window to prepare after they're selected—so it’s best to be ready early.

What Does Compliance Look Like?

So, what exactly do you need to change in Phase 2? It's more than just creating digital invoices—now your system must be capable of live interaction with ZATCA’s platform, FATOORA.

Main Requirements:

System Integration: Your invoicing software must connect to ZATCA’s API.

XML Format: Invoices must follow a specific structured format.

Digital Signatures: Mandatory to prove invoice authenticity.

UUID and Cryptographic Stamps: Each invoice must have a unique identifier and be digitally stamped.

QR Codes: Required especially for B2C invoices.

Invoice Clearance or Reporting:

B2B invoices (Standard): Must be cleared in real time before being sent to the buyer.

B2C invoices (Simplified): Must be reported within 24 hours after being issued.

How to Prepare for ZATCA e-Invoicing Phase 2

Don’t wait for a formal notification to get started. The earlier you prepare, the smoother the transition will be.

1. Assess Your Current Invoicing System

Ask yourself:

Can my system issue XML invoices?

Is it capable of integrating with external APIs?

Does it support digital stamping and signing?

If not, it’s time to either upgrade your system or migrate to a ZATCA-certified solution.

2. Choose the Right E-Invoicing Partner

Many local and international providers now offer ZATCA-compliant invoicing tools. Look for:

Local support and Arabic language interface

Experience with previous Phase 2 implementations

Ongoing updates to stay compliant with future changes

3. Test in ZATCA’s Sandbox

Before going live, ZATCA provides a sandbox environment for testing your setup. Use this opportunity to:

Validate invoice formats

Test real-time API responses

Simulate your daily invoicing process

4. Train Your Staff

Ensure everyone involved understands what’s changing. This includes:

Accountants and finance officers

Sales and billing teams

IT and software teams

Create a simple internal workflow that covers:

Who issues the invoice

How it gets cleared or reported

What happens if it’s rejected

Common Mistakes to Avoid

Transitioning to ZATCA e-Invoicing Phase 2 isn’t difficult—but there are a few traps businesses often fall into:

Waiting too long: 6 months isn’t much time if system changes are required.

Relying on outdated software: Non-compliant systems can cause major delays.

Ignoring sandbox testing: It’s your safety net—use it.

Overcomplicating the process: Keep workflows simple and efficient.

What Happens If You Don’t Comply?

ZATCA has teeth. If you’re selected for Phase 2 and fail to comply by the deadline, you may face:

Financial penalties

Suspension of invoicing ability

Legal consequences

Reputation damage with clients and partners

This is not a soft suggestion—it’s a mandatory requirement with real implications.

The Upside of Compliance

Yes, it’s mandatory. Yes, it takes some effort. But it’s not all downside. Many businesses that have adopted Phase 2 early are already seeing internal benefits:

Faster approvals and reduced invoice disputes

Cleaner, more accurate records

Improved VAT recovery processes

Enhanced data visibility for forecasting and planning

The more digital your systems, the better equipped you are for long-term growth in Saudi Arabia's evolving business landscape.

Final Words: Don’t Just Comply—Adapt and Thrive

ZATCA e-invoicing phase 2 isn’t just about avoiding penalties—it’s about future-proofing your business. The better your systems are today, the easier it will be to scale, compete, and thrive in a digital-first economy.

Start early. Get the right tools. Educate your team. And treat this not as a burden—but as a stepping stone toward smarter operations and greater compliance confidence.

Key Takeaways:

Phase 2 is live and being rolled out in waves—check if your business qualifies.

It requires full system integration with ZATCA via APIs.

Real-time clearance and structured XML formats are now essential.

Early preparation and testing are the best ways to avoid stress and penalties.

The right software partner can make all the difference.

2 notes

·

View notes

Text

Bitcoin Mining

The Evolution of Bitcoin Mining: From Solo Mining to Cloud-Based Solutions

Introduction

Bitcoin mining has come a long way since its early days when individuals could mine BTC using personal computers. Over the years, advancements in technology and increasing network difficulty have led to the rise of more sophisticated mining methods. Today, cloud mining solutions like NebuMine are revolutionizing cryptocurrency mining by making it more accessible and efficient. This article explores the journey of Bitcoin mining, from solo efforts to large-scale cloud mining operations.

The Early Days of Bitcoin Mining

In the beginning, Bitcoin mining was simple. Miners could use regular CPUs to solve cryptographic puzzles and validate transactions. However, as more participants joined the network, mining difficulty increased, leading to the adoption of more powerful GPUs.

As BTC mining grew, miners began forming mining pools to combine computing power and share rewards. This shift marked the transition from individual mining to more collective efforts in cryptocurrency mining.

The Rise of ASIC Mining

The introduction of Application-Specific Integrated Circuits (ASICs) in Bitcoin mining changed the game completely. These highly specialized machines offered unmatched efficiency, significantly increasing mining power while consuming less energy than GPUs.

However, ASICs also made mining more competitive, pushing small-scale miners out of the market. This led to the rise of large mining farms, further centralizing BTC mining operations.

The Shift to Cloud Mining

As the mining landscape became more challenging, cloud mining emerged as a viable alternative. Instead of investing in expensive hardware, users could rent mining power from platforms like NebuMine, enabling them to participate in Bitcoin mining without technical expertise or maintenance costs.

Cloud mining offers several advantages:

Accessibility: Users can start crypto mining without purchasing expensive equipment.

Scalability: Miners can adjust their computing power based on market conditions.

Convenience: No need for hardware setup, electricity costs, or cooling management.

With platforms like NebuMine, cloud mining has become a practical way for individuals and businesses to engage in BTC mining and Ethereum mining without the hassle of traditional setups.

Ethereum Mining and the Future of Crypto Mining

While Bitcoin mining has dominated the industry, Ethereum mining has also played a crucial role in the crypto space. With Ethereum’s shift to Proof-of-Stake (PoS), many miners have sought alternatives, further driving interest in cloud mining services.

Cryptocurrency mining continues to evolve, with new innovations such as AI-driven mining optimization and decentralized mining pools shaping the future. Platforms like NebuMine are at the forefront of this transformation, making cloud mining more accessible, efficient, and sustainable.

Conclusion

The evolution of Bitcoin mining highlights the industry's rapid advancements, from solo mining to industrial-scale operations and now cloud mining. As technology continues to advance, cloud mining solutions like NebuMine are paving the way for the future of cryptocurrency mining, making it easier for users to participate in BTC mining and Ethereum mining without technical barriers.

Check out our website to get more information about Cryptocurrency mining!

#Bitcoin mining#Cloud mining#Crypto mining#BTC mining#Ethereum mining#Cryptocurrency mining#SoundCloud

2 notes

·

View notes

Text

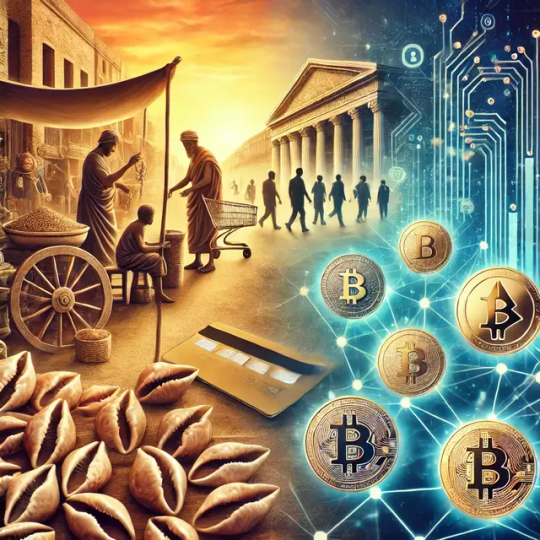

From Seashells to Satoshis: The Evolution of Money

Picture an ancient marketplace, where the currency jingling in your pouch might not be coins at all, but seashells. For centuries, cowrie shells were prized for their shiny appeal and rarity, transforming them into one of humanity’s earliest forms of money. Over time, these shells gave way to metals—iron, copper, silver, and gold—that gleamed with an unmistakable allure. Soon enough, our ancestors decided that lugging heavy gold and silver everywhere was a bit too cumbersome, so they started stamping metals into more convenient coins. This was the moment rulers realized something fundamental: whoever controls the mint, controls the economy. It wasn’t long before some couldn’t resist the temptation to mix cheaper metals in, keeping the gold for themselves. Those sneaky tactics brought about a new kind of challenge—trust.

Civilizations continued to experiment with what they could use as a medium of exchange, but ultimately, the golden standard took hold in many parts of the world. Gold’s scarcity, durability, and shiny mystique made it perfect for coins. That system thrived, yet society yearned for the next innovative step: paper currency. People quickly discovered that thin, foldable, and easy-to-carry notes were far superior to a pocketful of metal, and so governments printed paper money backed by vaults of precious metal. With the rise of fiat currency, the day came when the promise that these notes could be traded for gold or silver fizzled out entirely. Suddenly, many currencies were worth something simply because a central authority claimed so, and people believed it—or at least went along with the collective delusion. This arrangement flourished as economies globalized, but it also planted the seeds of modern financial headaches, like inflation and incessant money printing.

Still, the convenience of paper money was unmatched—until credit cards and online banking arrived. With a simple swipe or a tap on an app, individuals could pay for things in a purely digital sense. Transactions happened at lightspeed, all orchestrated by a network of banks and payment processors. Yet that centralization, which at first looked efficient, also created single points of failure. If banks had technical issues or simply felt your transaction was “suspicious,” access to your funds could vanish faster than you could say “insufficient funds.”

Enter Bitcoin, launched by the mysterious Satoshi Nakamoto. The idea behind Bitcoin was to create a system that didn’t require permission or trust in any single authority. Think of it as the next stage in the evolution of money—just like going from shells to gold, gold to paper, and paper to digital banking, the concept of decentralized digital coins felt like a natural leap. Here, the currency isn’t printed arbitrarily by a central bank; it’s “mined” through solving cryptographic puzzles. More importantly, every transaction is recorded on a public ledger called the blockchain, ensuring transparency, security, and an unwavering limit on the total supply.

Some critics argue that cryptocurrencies are too volatile or still too complex for mainstream adoption. Others worry about the energy consumed in mining. Yet, even those skeptics acknowledge that Bitcoin and other digital assets have ignited a global conversation. The very fact that governments and big financial institutions are grappling with how to regulate or incorporate crypto is proof that we’ve reached a tipping point. Humanity has always been restless when it comes to improving its systems, especially the system of money.

From shells in the marketplace to cryptographic tokens on the internet, the thread connecting us across history is innovation. We are constantly reimagining how to store and exchange value. The real question is not whether money will evolve once more—it’s how quickly this new chapter will redefine our personal freedoms, our economic structures, and the ways we trust one another. Will we cling to old traditions until they crumble, or embrace a future where blockchains, decentralized finance, and digital currencies reshape how we think about worth itself?

In the grand tapestry of civilization, money isn’t just coins and notes; it’s a story we tell ourselves about trust, power, and possibility. As we move ever closer to a world shaped by digital networks, the ancient shells on a faraway beach remind us that the idea of value is never fixed—it’s created, adapted, and refined. And now, in the age of Bitcoin, we’re just beginning to write the next chapter.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#MoneyEvolution#Blockchain#DigitalCurrency#FinancialRevolution#BitcoinEducation#CryptoHistory#FutureOfFinance#Decentralization#BitcoinFixesThis#SeashellsToSatoshis#MoneyMatters#EconomicFreedom#Hyperbitcoinization#SoundMoney#Finance#MoneyTalks#CryptoMindset#FiatVsBitcoin#financial experts#unplugged financial#financial empowerment#financial education#globaleconomy

3 notes

·

View notes

Text

How Cross-Chain Bridges Are Expanding the DeFi Ecosystem

In the rapidly evolving world of decentralized finance (DeFi), cross-chain bridges have emerged as critical infrastructure connecting previously isolated blockchain ecosystems. These technological marvels are breaking down barriers between networks, creating a more interconnected and efficient DeFi landscape. As DeFi development continues to accelerate, understanding the role and impact of these bridges becomes essential for investors, developers, and users alike.

What Are Cross-Chain Bridges?

Cross-chain bridges are protocols that enable the transfer of digital assets and information between different blockchain networks. Think of them as actual bridges connecting islands in an archipelago - each island (blockchain) has its own unique resources and communities, but bridges allow people and goods to move freely between them, creating a unified ecosystem.

In technical terms, these bridges facilitate the wrapping or locking of a token on one blockchain and minting an equivalent representation on another. This interoperability solves one of the biggest challenges in the blockchain space: the inability of different networks to communicate with each other.

The Evolution of DeFi Through Bridge Technology

The DeFi ecosystem began primarily on Ethereum, but high gas fees and scalability issues pushed developers and users to explore alternative blockchains like Binance Smart Chain, Solana, Avalanche, and Polygon. This migration created a fragmented landscape where liquidity and users were spread across multiple chains.

Cross-chain bridges emerged as the solution to this fragmentation. By enabling assets to move seamlessly between chains, bridges help:

Consolidate liquidity across multiple blockchains

Allow users to leverage the strengths of different networks

Enable dApps to access wider user bases

Reduce congestion on overloaded networks

Popular Cross-Chain Bridge Solutions

Several bridges have gained prominence in the DeFi development space:

Multichain (formerly Anyswap): A cross-chain router protocol that enables the flow of multiple tokens across different blockchains. Its architecture supports dozens of chains with minimal slippage.

Portal by Wormhole: Built initially for Solana-Ethereum transfers, Portal now supports multiple chains including Terra, BSC, and Polygon. Its validator network ensures secure cross-chain messaging.

Polygon Bridge: Connects Ethereum to Polygon, allowing users to escape high gas fees while maintaining connection to Ethereum's security and ecosystem.

Avalanche Bridge: Facilitates transfers between Ethereum and Avalanche, designed for speed and lower costs.

Arbitrum Bridge: An optimistic rollup solution that bridges Ethereum assets to Arbitrum's Layer 2 network.

The Technical Challenges of Bridge Development

Building reliable cross-chain bridges involves overcoming significant technical hurdles:

Security Concerns

Bridges represent attractive targets for hackers as they often hold substantial funds in escrow. The 2022 Wormhole exploit ($320 million) and Ronin Bridge hack ($625 million) demonstrated the security risks inherent in bridge architectures.

Security measures in modern bridge development include:

Multisig governance

Time-locked transactions

Threshold signature schemes

Regular security audits

Trustlessness vs. Efficiency

Bridge developers face a fundamental tradeoff between trustlessness and efficiency. Trustless bridges use cryptographic verification on the destination chain, ensuring security but increasing complexity and cost. Trusted bridges rely on external validators, offering better performance but introducing potential points of failure.

Finality Differences

Different blockchains have varying finality times (when transactions become irreversible). Bridges must account for these differences to prevent double-spending attacks or premature asset releases.

Economic Impact on the DeFi Ecosystem

Cross-chain bridges have dramatically reshaped the DeFi landscape:

Liquidity Unification

By allowing capital to flow between chains, bridges help unify previously isolated liquidity pools. This improves capital efficiency across the entire DeFi ecosystem, enabling better trading experiences and more stable lending platforms.

Yield Optimization

Users can seamlessly move assets to wherever they can get the best yields. This competitive aspect forces protocols to offer better rates and services, benefiting end users.

Risk Distribution

Bridges allow users to distribute risk across multiple networks rather than concentrating everything on a single blockchain. This approach can protect against chain-specific risks.

The Future of Cross-Chain DeFi Development

As bridge technology matures, several trends are emerging:

Layer-0 Solutions

Rather than building bridges between existing chains, some projects are developing foundational layers that enable native interoperability. Cosmos with its Inter-Blockchain Communication protocol (IBC) and Polkadot with its parachains represent this approach to DeFi development.

Standardization Efforts

Industry initiatives are working toward standardized bridge protocols, which would improve security and user experience across the ecosystem. This could lead to bridges being considered critical infrastructure rather than standalone projects.

Modular Blockchain Architecture

The future may see more blockchains designed with modularity in mind, where specific functions (execution, settlement, data availability) are handled by specialized chains connected through purpose-built bridges.

Conclusion

Cross-chain bridges represent a fundamental evolution in DeFi development, transforming a collection of isolated blockchain islands into an interconnected financial ecosystem. While technical challenges remain, particularly around security and trust models, the trajectory is clear: the future of DeFi will be multichain, with bridges serving as the connective tissue.

For developers, this means designing with interoperability in mind from the start. For users, it means unprecedented access to diverse financial products across multiple chains. And for the ecosystem as a whole, it means a more resilient, efficient, and accessible financial system that can truly challenge traditional finance.

As bridge technology continues to evolve, it will further break down barriers between chains, creating a seamless experience where the underlying blockchain becomes increasingly invisible to end users. The focus will shift from which chain you're using to what you're trying to accomplish—a sign of a maturing ecosystem ready for mainstream adoption.

#game#mobile game development#multiplayer games#metaverse#nft#vr games#blockchain#gaming#unity game development

1 note

·

View note

Text

Solana vs. Ethereum: Why Solana Takes the Lead in 2024

The blockchain space has witnessed remarkable evolution over the past decade, and among the contenders for dominance in the realm of smart contracts and decentralized applications (dApps), Ethereum and Solana have emerged as two prominent players. Both networks have carved out significant niches, but as we advance into 2024, Solana is increasingly making a case for itself as the leader in the blockchain ecosystem. In this blog, we’ll delve into the reasons why Solana is gaining traction over Ethereum, focusing on aspects such as scalability, transaction costs, and the burgeoning opportunities for token creation.

The Ethereum Legacy

Ethereum, launched in 2015 by Vitalik Buterin, has been a pioneer in the blockchain space, introducing the world to the concept of smart contracts and decentralized applications. Its pioneering spirit earned it the title of the leading platform for building dApps and issuing tokens. Ethereum’s native token, ETH, has become synonymous with blockchain innovation, and the Ethereum Virtual Machine (EVM) has set a standard for interoperability and developer ease.

However, Ethereum’s growth has not been without its challenges. The network has faced issues related to scalability, high transaction fees, and slower transaction speeds, particularly during periods of high demand. These limitations have become increasingly apparent as the number of users and applications on the Ethereum network has surged.

The Rise of Solana

Solana, founded in 2017 by Anatoly Yakovenko, has quickly emerged as a formidable competitor to Ethereum. Solana’s promise lies in its ability to address some of the critical issues that have plagued Ethereum, offering a unique approach to blockchain technology that emphasizes speed, scalability, and cost-efficiency.

1. Scalability and Speed

One of the most significant advantages that Solana offers is its impressive scalability. Solana’s unique consensus mechanism, Proof of History (PoH), works in conjunction with Proof of Stake (PoS) to achieve high throughput and low latency. This allows Solana to process thousands of transactions per second (TPS), a stark contrast to Ethereum’s current capacity, which handles around 30 TPS.

PoH is essentially a cryptographic time-stamping mechanism that orders transactions and ensures the network’s integrity without requiring extensive computational work. This results in faster block times and a more efficient network overall. For developers and users, this means significantly reduced transaction times and enhanced user experiences, making Solana an attractive platform for high-frequency trading and real-time applications.

2. Cost Efficiency

Transaction fees on Ethereum have been a notorious pain point for users. During periods of network congestion, fees can soar to exorbitant levels, which can be a significant barrier for both developers and end-users. In contrast, Solana has been designed to minimize transaction costs. With its high throughput and efficient consensus mechanisms, Solana can offer transactions at a fraction of the cost compared to Ethereum.

This cost efficiency is a game-changer for the broader adoption of blockchain technology. Lower transaction fees mean that small-scale transactions become viable, encouraging the growth of microtransactions and expanding the use cases for blockchain applications.

Token Creation on Solana vs. Ethereum

The ability to create and manage tokens is a crucial aspect of any blockchain platform, and both Ethereum and Solana offer robust frameworks for token creation.

Ethereum’s ERC-20 and ERC-721 Standards

Ethereum’s dominance in token creation is largely attributed to its ERC-20 and ERC-721 standards. The ERC-20 standard has become the go-to protocol for fungible tokens, while ERC-721 introduced the concept of non-fungible tokens (NFTs). These standards have been widely adopted, and many successful projects have been built on Ethereum using these protocols.

However, Ethereum’s token creation process can sometimes be hindered by its scalability issues. High gas fees and slower transaction times can affect the efficiency of token issuance and management.

Solana’s SPL Tokens

Solana’s token creation ecosystem is streamlined through its SPL (Solana Program Library) token standard. SPL tokens offer a more efficient alternative to Ethereum’s ERC standards. They benefit from Solana’s high throughput and low transaction costs, making token creation and transactions more cost-effective and faster.

Additionally, Solana’s SPL token framework supports a wide range of functionalities, from simple fungible tokens to complex assets. This flexibility allows developers to leverage Solana’s capabilities to build innovative token-based applications without worrying about prohibitive fees or slow transaction times.

The Ecosystem and Developer Experience

A thriving ecosystem and developer support are critical for the success of any blockchain platform. Ethereum has established a robust ecosystem with numerous tools, libraries, and a strong developer community. However, as the Ethereum network has grown, so have its complexities, which can pose challenges for new developers.

Solana, on the other hand, has made significant strides in building a developer-friendly ecosystem. Its focus on speed and efficiency extends to its developer tools and resources. Solana provides comprehensive documentation, developer support, and a growing suite of tools designed to simplify the development process. This user-centric approach has fostered an enthusiastic community of developers and entrepreneurs eager to build on the Solana blockchain.

Adoption and Real-World Use Cases

The real-world application of blockchain technology is a crucial factor in determining a platform’s long-term viability. Ethereum has seen extensive adoption across various industries, including finance, gaming, and art. Its established presence in the NFT space and DeFi (Decentralized Finance) sector speaks to its influence and reach.

Solana, while newer, has also made significant inroads into real-world applications. Its high performance and low costs have attracted a range of projects, from decentralized finance platforms to NFT marketplaces. Solana’s ability to handle high transaction volumes efficiently makes it an appealing choice for applications requiring rapid and cost-effective transaction processing.

Future Prospects

Also We done tons of research and found amazing platform, Solana Launcher, Here you can generate your own memecoins tokens on solana in just less than three seconds without any coding knowledge. Just visit that platform, If you have any daubt Feel Free to ask!!!

As we move further into 2024, Solana’s potential to lead the blockchain space continues to grow. Its innovative approach to scalability, cost efficiency, and token creation positions it as a compelling alternative to Ethereum. While Ethereum remains a powerful and influential platform, Solana’s advantages in transaction speed and costs, coupled with its developer-friendly ecosystem, make it a strong contender for the future of blockchain technology.

Both Ethereum and Solana are likely to continue evolving and influencing the blockchain landscape. However, Solana’s advancements and practical solutions to some of the inherent challenges faced by Ethereum give it a distinct edge as we look towards the future of decentralized applications and token creation.

In conclusion, Solana’s impressive scalability, cost efficiency, and developer-friendly environment have positioned it as a leading force in the blockchain space. For those looking to leverage blockchain technology in 2024 and beyond, Solana offers a promising alternative that addresses many of the limitations of its predecessors, paving the way for a new era of innovation and growth in the decentralized world.

2 notes

·

View notes

Text

What Is Blockchain Technology?

In the dynamic landscape of technology, Blockchain has emerged as a revolutionary force, fundamentally transforming the way we perceive and engage with digital transactions. In this comprehensive guide, we will unravel the intricacies of Blockchain technology, exploring its core principles, applications, and its pivotal role in the creation of digital currencies such as Bitcoin.

1. Understanding What Is Blockchain Technology:

At its core, Blockchain is a decentralized and distributed ledger technology that records transactions across a network of computers. The term “Blockchain” is derived from the way data is structured, forming a chain of blocks, each containing a list of transactions. What sets Blockchain apart is its transparency, security, and the absence of a central authority, making it a paradigm shift in how we approach data integrity and trust in digital interactions.

2. The Building Blocks of Blockchain:

To comprehend the essence of Blockchain, it’s essential to delve into its foundational elements. Blocks, cryptographic hash functions, and consensus algorithms play a crucial role in maintaining the integrity of the chain. These building blocks collectively contribute to the secure and transparent nature of Blockchain, ensuring that once a block is added, it becomes an immutable part of the chain.

3. Decentralization and Trust:

One of the revolutionary aspects of Blockchain is its decentralized nature. Unlike traditional centralized systems, where a single authority oversees transactions, Blockchain relies on a network of nodes, each maintaining a copy of the ledger. This decentralization ensures that no single entity has control over the entire network, fostering a trustless environment where transactions are validated through consensus mechanisms.

4. Applications Beyond Bitcoin:

While Bitcoin is the pioneering application of Blockchain technology, its potential extends far beyond digital currencies. From supply chain management to healthcare records, Blockchain is disrupting various industries by providing a secure and transparent platform for data management. Understanding the diverse applications of Blockchain is crucial in grasping its transformative impact on modern systems.

5. Bitcoin and Blockchain Synergy:

Bitcoin, the first and most well-known cryptocurrency, relies on Blockchain technology for its operation. Transactions on the Bitcoin network are recorded in blocks, forming the immutable Blockchain. The symbiotic relationship between Bitcoin and Blockchain showcases the inseparable connection between digital currencies and the underlying technology, emphasizing their role in shaping the future of financial transactions.

6. Overcoming Challenges:

As with any groundbreaking technology, Blockchain faces challenges on its path to widespread adoption. Scalability, energy consumption, and regulatory frameworks are among the hurdles that the technology must address. Acknowledging these challenges is essential for the continued evolution and integration of Blockchain into various sectors.

Conclusion:

In conclusion, Blockchain technology stands as a pillar of innovation, reshaping the way we interact with digital information and transactions. From its decentralized architecture to its applications beyond Bitcoin, understanding the fundamentals of Blockchain is paramount in navigating the future of a digitally connected world. Embrace the transformative power of Blockchain, and witness the evolution of secure, transparent, and trustless digital ecosystems.

3 notes

·

View notes

Text

NFTs and Beyond: The Evolution of Digital Ownership at the Blockchain

In latest years, Non-Fungible Tokens (NFTs) have transformed the idea of digital ownership, marking a brand new era of blockchain innovation. NFTs are particular virtual property that constitute ownership or authenticity of particular gadgets or content material, verifiable at the blockchain. This article explores the evolution of NFTs and their effect on digital possession.

Definition of NFTs

NFTs are awesome digital belongings that certify ownership or authenticity of a specific item or content. Each NFT is precise and verifiable at the blockchain, making it best for representing digital collectibles, artwork, and other assets.

Overview of Blockchain Technology

Blockchain serves as the inspiration for NFTs, providing a decentralized and immutable ledger for recording transactions. It is a allotted database that continues a constantly growing listing of statistics, or blocks, connected collectively in a chronological chain. This ledger guarantees transparency, protection, and censorship resistance, allowing the creation and transfer of digital assets correctly.

The Rise of NFTs

NFTs trace their origins to early blockchain experiments like Colored Coins and Rare Pepes. However, it become the release of CryptoKitties in 2017 that brought NFTs into the mainstream. Since then, the NFT ecosystem has seen large boom, marked by way of milestones along with the introduction of standards like ERC-721 and ERC-1155 and top notch events like Beeple’s $sixty nine million sale of a virtual artwork.

Understanding the Hype Surrounding NFTs

The hype round NFTs may be attributed to their novelty, shortage, and ability for democratizing get admission to to virtual assets. NFTs have captured the creativeness of creators, creditors, and customers, imparting new avenues for monetization and ownership inside the virtual realm.

Understanding Digital Ownership

Traditional ownership relates to tangible property, at the same time as virtual possession pertains to intangible belongings saved in digital form, like cryptocurrencies and NFTs. Establishing virtual possession offers demanding situations because of the borderless and pseudonymous nature of blockchain transactions, requiring robust security measures and regulatory oversight.

Role of Blockchain in Digital Ownership

Blockchain generation performs a important position in permitting and safeguarding virtual ownership via offering a obvious, tamper-proof, and decentralized ledger. Through cryptographic techniques and consensus algorithms, blockchain networks make sure the integrity and immutability of digital property, facilitating peer-to-peer transactions.

Exploring the Use Cases of NFTs

NFTs have found applications in artwork, gaming, and tokenizing real-global belongings. They have revolutionized the art enterprise through supplying artists with new approaches to monetize their work and engage with a global audience. In gaming, NFTs allow players to very own and change in-game belongings, developing new monetization opportunities and participant-pushed economies.

Conclusion

Advancements in NFT and blockchain technologies have reshaped the digital possession panorama, supplying progressive answers for creators, creditors, and investors. From artwork to gaming to real-global assets, NFTs have the capability to revolutionize possession and switch mechanisms, democratizing get admission to to wealth and possibilities.

2 notes

·

View notes

Text

Why Blockchain is Essential for Web3 Development

The internet is undergoing a massive transformation. As we move from Web2 where centralized platforms dominate to Web3, the focus is shifting toward decentralization, user ownership, and transparency. At the core of this new evolution lies blockchain technology, a foundational layer that powers many of Web3’s revolutionary features.

In this blog, we’ll explore what makes blockchain essential for Web3 development and why it’s at the heart of the internet’s next generation.

Understanding Web3

Web3 is the third version of the internet, designed on a decentralized architecture that doesn’t rely on central authority but empowers the people. Unlike Web2, where platforms and data are controlled by big tech companies, Web3 supports a peer-to-peer community in which users enjoy direct ownership of their digital identity, assets, and communication. Professional Web3 development services are essential for businesses looking to build decentralized applications that ensure transparency, privacy, and true user control in the evolving digital landscape.

What is Blockchain Technology?

Blockchain is the classical distributed ledger technology, where transactions are captured securely, immutable, and transparently. It comprises data blocks, which are cryptographically connected and qualified using a network of computers (nodes).

Why Blockchain is the Foundation of Web3

Decentralization

One of the major characteristics of Web3 is decentralization, and it is due to blockchain that it is a thing. With a traditional system, data is held by central authorities, and this is a source of weakness such as censorship, downtimes, and manipulation. By spreading control and data among a worldwide network of nodes that operate as blocks, blockchain eliminates the occurrence of single points of failure and returns power to the people.

Security

Blockchain is secure by design since it utilizes cryptographic algorithms and consensus. The blockchain ledger is tamper-proof and every transaction that is recorded on it is encrypted and goes back to the previous one. Such consensus protocols as Proof of Work (PoW) and Proof of Stake (PoS) guarantee that the network will not accept malicious actions, and developers and users can live in a secure ecosystem.

Transparency and Trust

Blockchain’s transparent nature enables anyone to verify and audit all transactions recorded on the network. Such transparency will instill trust in participants because there is no need to use intermediaries or central consistency check processes to ensure transactions are valid. It creates an atmosphere in which there is responsibility in the design of systems and applications.

User Empowerment

The idea behind Web3 envisions a digital environment where users have full ownership and control over their assets, identities, and personal data. Blockchain makes it possible due to decentralized wallets and identity protocol support. In contrast to centralized platforms, where user-data are stored, and managed, blockchain guarantees that people can exercise complete control over access, transfer and use of their personal and digital data.

Smart Contracts

Smart contracts are automated programs on the blockchain that execute predefined tasks when specific criteria are met. In Web3, they play a very critical role as they remove the middlemen, lower the costs, and guarantee the execution of agreements and logic publicly and impartially. Applications in these smart contracts make most of the decentralized applications (dApps) reliable and autonomous.

Key Use Cases of Blockchain in Web3

Blockchain is not limited to a theory anymore since it is already in use in several sectors of the Web3 universe. The best real-life applications are as follows:

Decentralized Finance (DeFi)

DeFi is transforming the financial sector and redefining how people operate in the financial market by eliminating the traditional banking systems and replacing them with blockchain-based smart contracts. Assets can be lent, borrowed, incurred interest, or transacted without requiring trust of either a bank (or other financial intermediary). This makes financial services available to anyone as long as they have access to the internet and crypto wallet.

NFTs and Digital Ownership

Non-Fungible Tokens (NFTs) give their owners the possibility to prove authenticity and own digital assets, including art, music, virtual land, and in-game items. Each NFT is traceable and transferable, which is guaranteed in blockchain and opens a new variety of ways that creators can monetize their content and collectors can hold and exercise value.

DAOs (Decentralized Autonomous Organizations)

The DAOs involve blockchain-oriented smart contracts to direct their operations and decision-making with no central leadership. Governance tokens enable the members of a DAO to vote on what the project should do, how to distribute money, etc. This promotes transparency, responsibility, and development driven by the community.

Decentralized Identity

Blockchain makes it possible to use self-sovereign identity systems where users can manage their own digital identity. The users will be able to just share what is necessary rather than using the centralized services to log in and be verified. This is less risky of data loss and more confidential and autonomous.

Industry dApps

Decentralized applications in the industry of repeating blockchain include application in games, healthcare, supply chain, and real estate. To take the example of gaming, blockchain ensures that in-game players can actually have ownership over their items. In health care, it guarantees secure interoperable patient records. In many sectors, blockchain-linked dApps are giving tamper-proof solutions within the environment that are secured and efficient.

Conclusion

Web3 is powered by blockchain that brings the decentralization, security and transparency required to enable a user centered digital ecosystem. It makes possible trustless communication, self-control of identity, smart contracts, and true ownership of digital property, which have been core attributes that separate Web3 with the centralized Web2 system. With the evolution towards a transparent and fair internet, blockchain will no longer be a piece of enabling technology, but a key prerequisite to unlocking the characteristics of Web3.

#web3#web3 development#web3 development company#web3 development services#web3 development solutions

0 notes

Text

The Role of AI Smart Contract Development in the Decentralized Economy

The decentralized economy is a new paradigm based on distributed technologies that eliminates intermediaries, operating as a peer-to-peer, transparent, and code-governed system. Its foundational pillars include blockchain for immutable record-keeping, tokenized incentives, distributed ledgers, and community governance via DAOs. This framework democratizes control, rooting trust in cryptographic truth.

A significant evolution within this economy is the integration of artificial intelligence (AI) into smart contract systems. Unlike traditional, deterministic smart contracts, AI-powered smart contracts are predictive, adaptive, and continuously evolving. They incorporate machine learning, natural language processing, predictive analytics, and real-time data interpretation to analyze nuanced inputs, adapt to changing environments, and make data-driven decisions.

When enhanced with AI, Web3 smart contracts become semi-autonomous agents capable of self-optimization, semantic understanding, and adaptive risk management. These AI-enhanced smart contracts offer critical advantages for the decentralized world, including autonomous governance, operational agility, data-driven execution, and predictive compliance.

Their transformative applications span various sectors: in DeFi for adaptive rates and algorithmic trading; in real estate for automated due diligence; in insurance for smart policies; and in supply chain for dynamic delivery terms.

Consequently, smart contract development services are evolving beyond simple scriptwriting to create full-stack blockchain solutions that seamlessly incorporate AI. These services now include custom Solidity development with AI APIs, on-chain/off-chain AI orchestration, and continuous optimization. Justtry Technologies is highlighted as a leading smart contract development company specializing in AI-augmented Web3 solutions, emphasizing AI-driven protocol customization and real-time contract analytics across DeFi, NFT, and enterprise sectors.

The fusion of AI and blockchain represents a shift towards systems that are not only decentralized but also self-aware, with AI smart contracts poised to become the operational brain of the decentralized economy, continuously learning and responding in real-time.

#smart contract development company#smart contract development#smart contracts#smart tech#technology#blockchain development#web3 development#blockchain development services

0 notes

Text

Top Web3 Use Cases Transforming Industries in 2025

Web3, the next evolution of the internet, is reshaping industries through decentralization, transparency, and user empowerment. Unlike Web2, which relies on centralized platforms, Web3 leverages blockchain technology, smart contracts, and decentralized applications (dApps) to create a trustless and peer-to-peer ecosystem. In 2025, Web3’s transformative impact can be seen across several sectors, driving innovation and efficiency at an unprecedented scale.

What Is Web3 and Why Does It Matter in 2025?

Web3 represents a shift from platform-centric to user-centric internet models. It empowers individuals with ownership over digital assets, data, and identities using blockchain and cryptographic technologies. In 2025, Web3 is crucial because it enables more secure, transparent, and fair systems across various industries. From decentralized finance to tokenized real estate and gaming, Web3 disrupts traditional paradigms and fosters greater autonomy, privacy, and value exchange.

How Is DeFi Disrupting Traditional Finance?

Decentralized Finance (DeFi) is one of Web3’s most impactful applications. In 2025, DeFi platforms will offer services like lending, borrowing, staking, and trading without intermediaries such as banks or brokers. By using smart contracts, DeFi reduces transaction costs and increases access to financial services globally. Users maintain control over their funds, and innovations such as yield farming and liquidity pools create new revenue streams. DeFi also enhances financial inclusion, especially in regions underserved by traditional banking systems.

How Does Web3 Enhance Supply Chain Transparency?

Web3 significantly improves supply chain management by enabling real-time tracking and verification of goods. Blockchain ensures that every step in the supply chain is recorded immutably, fostering transparency and accountability. In 2025, industries like food, pharmaceuticals, and luxury goods are using Web3 solutions to combat fraud, ensure product authenticity, and optimize logistics. Smart contracts automate compliance and payments, reducing human error and operational delays.

Are DAOs the Future of Organizational Governance?

Decentralized Autonomous Organizations (DAOs) are transforming how decisions are made in 2025. DAOs operate on blockchain-based governance models, allowing stakeholders to vote on proposals and shape the future of projects directly. They eliminate hierarchical management structures, promote transparency, and align incentives among participants. DAOs are being adopted in everything from venture capital and social communities to nonprofit organizations and public goods funding.

Conclusion

As Web3 continues to evolve, its impact on industries is becoming profound and irreversible. From finance to supply chains and governance, decentralized technologies are redefining operational norms. Osiz Technologies, a leading Web3 development company, offers innovative, scalable, and customized Web3 solutions. Our DeFi, DAOs, or blockchain-powered logistics empower businesses to harness the full potential of Web3 and thrive in the decentralized future.

#Web3Dev#CryptoSolutions#NFTIndia#OsizTech#BlockchainApps#CryptoUK#DeFiPlatform#MetaverseDev#Web3Experts#usa#uk

0 notes

Text

Kubernetes Embraces Future-Proof Security with Post-Quantum TLS

The rapid evolution of technology brings both opportunities and challenges, particularly in the realm of cybersecurity. As quantum computing advances, traditional encryption methods face new vulnerabilities, prompting the need for innovative solutions. Kubernetes, the leading platform for container orchestration, has taken a significant step forward by integrating Post-Quantum Support for TLS, ensuring that its users can stay ahead of emerging threats. This development marks a pivotal moment for organizations relying on Kubernetes to secure their applications and data in a quantum-ready world.

Why Post-Quantum Security Matters

The Quantum Computing Threat

Quantum computers, with their ability to perform complex calculations at unprecedented speeds, pose a potential risk to current cryptographic standards. Algorithms like RSA and ECC, which underpin much of today’s secure communication, could become obsolete once quantum computers reach sufficient maturity. This looming challenge has driven the cybersecurity community to explore post-quantum cryptography (PQC), a set of algorithms designed to withstand quantum attacks.

The Role of TLS in Modern Security

Transport Layer Security (TLS) is the backbone of secure communication on the internet, protecting data as it travels between servers and clients. By incorporating Post-Quantum Support for TLS, Kubernetes ensures that its ecosystem remains resilient against future quantum-based threats. This proactive approach allows organizations to safeguard sensitive information, from financial transactions to personal data, without disruption.

Kubernetes’ Journey to Post-Quantum TLS

A Strategic Move for Future-Proofing

Kubernetes has long been a cornerstone for managing containerized workloads, offering scalability and flexibility for enterprises worldwide. The introduction of post-quantum TLS support reflects Kubernetes’ commitment to staying at the forefront of technological innovation. By adopting quantum-resistant algorithms, Kubernetes is preparing its users for a future where quantum computing could redefine security standards.

Collaborative Efforts in Implementation

The integration of post-quantum TLS into Kubernetes didn’t happen overnight. It required collaboration between the Kubernetes community, cryptography experts, and standards bodies like NIST (National Institute of Standards and Technology). NIST’s ongoing efforts to standardize post-quantum cryptographic algorithms have provided a foundation for Kubernetes to build upon, ensuring that the selected algorithms are both secure and practical for real-world applications.

How Post-Quantum TLS Enhances Kubernetes

Strengthening Cluster Communication

In a Kubernetes cluster, nodes, pods, and services constantly communicate to deliver seamless application performance. These interactions rely on TLS to ensure data confidentiality and integrity. With Post-Quantum Support for TLS, Kubernetes enhances the security of these communications, protecting against potential quantum-based attacks that could compromise cluster operations.

Supporting Hybrid and Multi-Cloud Environments

Many organizations deploy Kubernetes across hybrid and multi-cloud environments, where data traverses diverse networks. Post-quantum TLS ensures that these environments remain secure, even as quantum computing capabilities evolve. This is particularly critical for industries like finance, healthcare, and e-commerce, where data breaches can have severe consequences.

Benefits for Organizations Using Kubernetes

Future-Ready Security

By adopting post-quantum TLS, Kubernetes users gain peace of mind knowing their infrastructure is prepared for the quantum era. This forward-thinking approach minimizes the need for costly and disruptive upgrades down the line, allowing organizations to focus on innovation rather than security overhauls.

Maintaining Compliance and Trust

Regulatory frameworks like GDPR, HIPAA, and PCI-DSS emphasize the importance of robust data protection. Post-quantum TLS support helps Kubernetes users meet these standards by ensuring that their encryption methods remain secure against emerging threats. This not only aids compliance but also builds trust with customers and stakeholders.

Seamless Integration with Existing Workflows

One of Kubernetes’ strengths is its ability to integrate new features without disrupting existing workflows. The implementation of post-quantum TLS is designed to be backward-compatible, meaning organizations can adopt this enhanced security without overhauling their current setups. This smooth transition is a testament to Kubernetes’ user-centric design.

Challenges in Adopting Post-Quantum TLS

Balancing Performance and Security

While post-quantum algorithms offer enhanced security, they can be computationally intensive compared to traditional methods. Kubernetes developers have worked to optimize these algorithms to minimize performance impacts, but organizations may need to evaluate their infrastructure to ensure compatibility with post-quantum TLS.

The Learning Curve for Teams

Transitioning to post-quantum cryptography may require teams to familiarize themselves with new concepts and tools. Kubernetes’ extensive documentation and community support play a crucial role in helping organizations navigate this shift, ensuring that developers and IT professionals can implement post-quantum TLS effectively.

Preparing for a Quantum-Safe Future

Steps for Organizations to Take

To fully leverage Kubernetes’ Post-Quantum Support for TLS, organizations should start by assessing their current security posture. This includes identifying critical workloads that rely on TLS and prioritizing their transition to post-quantum algorithms. Regular updates and patches from the Kubernetes community will also be essential to stay aligned with the latest advancements in post-quantum cryptography.

Staying Informed on Quantum Developments

The field of quantum computing is evolving rapidly, and so are the standards for post-quantum cryptography. Organizations should stay engaged with industry updates, particularly from organizations like NIST, to ensure they’re using the most secure and up-to-date algorithms. Kubernetes’ active community forums and conferences are excellent resources for staying informed.

The Broader Impact on the Tech Ecosystem

Setting a Precedent for Other Platforms

Kubernetes’ adoption of post-quantum TLS sets a powerful example for other open-source and proprietary platforms. By prioritizing quantum-ready security, Kubernetes encourages the broader tech ecosystem to take proactive steps toward safeguarding their systems. This ripple effect could accelerate the adoption of post-quantum cryptography across industries.

Fostering Innovation in Cybersecurity

The integration of post-quantum TLS into Kubernetes is more than a technical upgrade; it’s a catalyst for innovation. It encourages developers, researchers, and organizations to explore new ways to secure data in an increasingly complex digital landscape. As quantum computing continues to advance, Kubernetes’ leadership in this space positions it as a trusted partner for secure, scalable infrastructure.

Looking Ahead: The Future of Kubernetes Security

Continuous Evolution of Security Standards

Kubernetes’ commitment to post-quantum TLS is just one part of its broader security strategy. As new threats emerge, the platform will likely continue to integrate cutting-edge solutions to protect its users. This forward-looking approach ensures that Kubernetes remains a reliable choice for organizations navigating the complexities of modern IT environments.

Empowering Organizations Worldwide

By equipping users with Post-Quantum Support for TLS, Kubernetes empowers organizations to build and deploy applications with confidence. Whether managing a small startup or a global enterprise, Kubernetes users can trust that their data is protected by some of the most advanced cryptographic standards available.

The introduction of post-quantum TLS support in Kubernetes is a game-changer for organizations seeking to secure their applications in a quantum-ready world. By addressing the challenges of quantum computing head-on, Kubernetes demonstrates its commitment to innovation, security, and user trust. As businesses continue to rely on Kubernetes for their containerized workloads, this new layer of protection ensures they can operate with confidence, knowing their data is safeguarded against future threats. Embracing Post-Quantum Support for TLS is not just a technical upgrade—it’s a strategic investment in the future of secure computing.

#KubernetesSecurity#PostQuantumTLS#QuantumSafe#CloudNativeSecurity#Cybersecurity#DevSecOps#FutureProofing#Encryption#TLS

0 notes

Text

The Quiet Revolution: How eSIM Technology Is Transforming Smartphones in 2025

For decades, the SIM card has quietly powered mobile connectivity—a tiny plastic chip that served as the gateway to our digital lives.

Most of us remember poking around with paperclips to eject SIM trays, swapping cards between phones, and the panic of misplacing one. That once-familiar ritual is now becoming a thing of the past.

An enormous transformation is unfolding within the very core of our personal tech. This shift is being led by a powerful innovation that’s redefining how we connect to mobile networks. eSIM technology isn’t just an upgrade—it’s a complete reengineering of how connectivity works in the digital age. At its core, this change marks a significant leap in how smartphones are built, used, and integrated into our lives.

As of Thursday, July 24, 2025, the impact of eSIM is no longer abstract. It’s a daily reality for hundreds of millions of smartphone users globally.

The leap from physical SIM cards to embedded digital alternatives represents a foundational change. Its ripple effects can be seen in smartphone design, consumer choice, global mobility, data security, and the broader Internet of Things (IoT) ecosystem.

Understanding this transition is vital to grasping the next era of mobile technology. This article explores the depth of this revolution—from how eSIMs work under the hood to how they’re rewriting the rules of modern connectivity.

The eSIM era promises a future of flexibility, minimalism, and borderless access. Its influence is only just beginning, and it’s already clear: eSIMs are altering the course of mobile technology in lasting ways. This isn’t just a tech trend—it’s a milestone in mobile evolution.

Table of Contents

A Farewell to the Physical SIM: How We Got Here

To appreciate the full impact of eSIMs, it’s important to understand the legacy they’re replacing. The traditional SIM (Subscriber Identity Module) was revolutionary in its day—allowing mobile accounts to be portable, separate from the hardware.

The earliest SIM cards appeared in the early 1990s, developed by German firm Giesecke & Devrient. They were the size of a credit card (1FF) and designed to authenticate users securely through a combination of IMSI and cryptographic keys.

As mobile phones became more compact, SIM cards also evolved:

Despite these iterations, the basic physical limitations persisted—leading to the need for a smarter solution. These challenges paved the way for eSIMs:

The industry needed a solution that offered the same secure authentication—without the physical baggage. Enter the embedded SIM.

What Is an eSIM? A Deeper Technical Dive

The term “eSIM” stands for “embedded SIM,” but its impact runs deeper than the name suggests. Far from being just a digital version of a physical card, it’s a secure hardware and software framework that redefines the user-network relationship.

At its core, an eSIM is a tamper-proof chip, typically in the MFF2 format, permanently integrated into a device’s motherboard. It functions as a Secure Element (eSE), capable of safely storing multiple carrier profiles and sensitive credentials.

What truly powers the eSIM revolution is Remote SIM Provisioning (RSP)—a secure architecture developed by the GSMA to allow users to activate or switch carriers over the air.

Here’s how it works:

Two common activation methods exist:

This seamless provisioning process eliminates the need for physical SIM cards entirely—making it clear how eSIM technology is transforming smartphones starting from the very first setup.

The Core Revolution: 7 Key Ways eSIM Technology Is Transforming Smartphones

The evolution from a removable plastic SIM card to a secure, remotely programmable chip embedded within the phone is more than just a hardware tweak—it’s a fundamental change rippling across the entire smartphone ecosystem. Below are seven impactful ways in which eSIM technology is transforming smartphones in 2025, each a clear reflection of how our mobile future is being redefined.

1. Unlocking New Possibilities in Smartphone Design

One of the clearest transformations brought on by eSIM technology is its influence on smartphone hardware design. Engineers have long battled for internal space—and removing the SIM card slot is a major victory.

2. Making Connectivity More Seamless and User-Centric

From the user’s perspective, eSIM technology brings an unprecedented level of simplicity and flexibility to mobile connectivity—arguably one of its most noticeable impacts.

3. Shaking Up the Telecom Industry with Greater Consumer Power

eSIMs aren’t just changing phones—they’re disrupting the business models of telecom providers.

In the past, switching carriers required acquiring and inserting a new SIM card—an inconvenience that kept many consumers locked into existing plans. With eSIM, that barrier disappears entirely.

This democratization of mobile service is a major byproduct of the eSIM revolution—shifting power from corporations to consumers.

4. Revolutionizing Travel with Global, Instant Connectivity

Frequent travelers are among the biggest beneficiaries of eSIM’s flexibility.

5. Building Stronger Defenses Against Security Threats

Another crucial benefit of eSIM technology lies in its ability to enhance digital security—making smartphones less vulnerable to physical and social engineering attacks.

As privacy becomes a bigger concern globally, eSIM’s role in making smartphones safer is more critical than ever.

6. Fueling the Growth of the Internet of Things (IoT)

eSIM’s benefits extend far beyond phones. Its small size, low power demands, and remote programmability make it a perfect fit for the expanding world of IoT.

7. Transforming How Businesses Manage Mobile Fleets

For enterprises, eSIMs offer a game-changing way to manage corporate smartphones and tablets at scale.

This level of automation and control streamlines operations for global businesses, proving once again how eSIMs are reshaping smartphones for both consumers and professionals alike.

The Global eSIM Adoption Landscape in 2025

By mid-2025, the global shift toward eSIM is no longer a distant trend—it’s a measurable and accelerating reality. While the pace of adoption varies by region, the trajectory is clear and consistent: eSIM is becoming the default standard for mobile connectivity.

The growing global footprint of eSIM-capable devices is undeniable proof of how this technology is transforming the smartphone landscape at scale.

Barriers and Challenges to a SIM-Free World

While the benefits of eSIM are numerous, the transition has not been entirely smooth. These growing pains are a key part of the story as the mobile world moves toward a fully digital SIM ecosystem.

Despite these obstacles, innovation continues to remove friction, making it easier for eSIM to fully replace physical SIMs over the next few years.

The Next Step: iSIM and the Future of Connectivity

While eSIM is transforming today’s smartphones, the future is already taking shape in the form of iSIM, or Integrated SIM. This next-gen technology builds on the foundations of eSIM but takes integration a step further by embedding the SIM functionality directly into the device’s main processor (SoC).

iSIM is the logical evolution of what eSIM started: a move toward invisible, software-based connectivity that requires no user intervention and very little hardware.

Conclusion: A Digital Shift That’s Here to Stay

What began as a replacement for a tiny plastic card has evolved into one of the most important transformations in smartphone history. The move to eSIM is not just about saving space—it’s about rethinking how connectivity fits into our devices, our lives, and the infrastructure of modern communication.

This quiet revolution has touched everything: from stronger, portless phone designs and instant carrier switching, to more secure devices and global travel without roaming anxiety. It has also reshaped the competitive landscape for telecom providers and laid the groundwork for the Internet of Things to flourish.

By July 2025, eSIM is not a future concept—it’s the new normal. The physical SIM card that connected us for decades is being retired, replaced by smarter, more flexible technology built directly into our devices.

And yet, this transformation is only the beginning. As we look to iSIM and beyond, one thing is clear: the way we connect to the world is evolving rapidly. The invisible infrastructure powered by eSIM is what makes that future possible—quietly, powerfully, and permanently reshaping the smartphone as we know it.

0 notes

Text

Sam Altman Warns of AI Voice Fraud Crisis in Banking

OpenAI CEO Sam Altman has issued a stark warning to the global financial sector, calling out the growing threat of AI-powered voice fraud that can bypass traditional security systems. Speaking at a Federal Reserve conference in Washington, Altman described the current reliance on voiceprint authentication as “crazy” in today’s AI landscape.

“AI has fully defeated that,” Altman said, referring to voice-based verification systems still used by some banks to authenticate users.