#digital wallets

Explore tagged Tumblr posts

Text

How Gen Z Is Investing Differently (And Smarter) in 2025

By Midtowns | July 2025 Who Is Gen Z? Gen Z includes those born between 1997 and 2012 — the digital-native generation that grew up with smartphones, Wi-Fi, and YouTube. Now in their 20s and early 30s, Gen Z is reshaping investing in bold, unconventional, and surprisingly smart ways. What Makes Gen Z Different in Investing? Unlike millennials or Gen X, Gen Z: ✅ Learns from YouTube,…

View On WordPress

#Budget Investing#Crypto for Beginners#Digital Wallets#Financial Literacy#Fintech Apps India#Gen Z Finance#Global Stocks#How to Invest in 20s#Indian Stock Market#Investing Trends 2025#Investment Portfolio India#Mutual Funds India#Passive Income for Gen Z#Personal Finance for Youth#Sustainable Investing

1 note

·

View note

Text

PalmPay’s Strategic Move: Aiming for Up to $100 Million to Propel Financial Inclusion in Africa

PalmPay, a prominent African fintech company, is reportedly in discussions to raise between $50 million and $100 million in a Series B funding round. This initiative underscores the company’s commitment to expanding its digital financial services across the continent, aiming to bridge the gap between traditional banking systems and the unbanked population.

Understanding PalmPay’s Fundraising Initiative

PalmPay, established in 2019, has rapidly positioned itself as a key player in Africa’s digital banking landscape. The company’s current endeavor to secure substantial funding is a strategic move aimed at enhancing its service offerings and extending its reach to underserved communities. This initiative is particularly significant in a continent where a large portion of the population remains unbanked, and digital financial solutions can play a transformative role.

Timeline and Strategic Planning Behind the Funding Effort

The discussions for this funding round have emerged as part of PalmPay’s broader strategy to solidify its market presence and accelerate growth. Since its inception, PalmPay has been focused on providing user-friendly digital financial services, and this funding effort is a continuation of that mission. The company aims to utilize the raised capital to invest in technology, expand its agent network, and introduce new financial products tailored to the needs of its diverse user base.

Founding Visionaries and Their Mission

PalmPay was launched with the backing of Chinese investors, including Transsion, a leading mobile phone manufacturer. The founders envisioned a platform that leverages technology to provide accessible and inclusive financial services. Their mission has been to address the financial needs of the unbanked and underbanked populations in Africa, offering services such as bill payments, airtime top-ups, and instant money transfers.

Significance of the Funding in the Current Financial Landscape

Securing up to $100 million in funding is a testament to PalmPay’s robust growth and the confidence investors have in its business model. In a region where fintech is rapidly evolving, this funding positions PalmPay to compete effectively, innovate continuously, and contribute significantly to the digital transformation of financial services in Africa.

Impact on Communities and Financial Inclusion

By expanding its services and reach, PalmPay aims to play a pivotal role in promoting financial inclusion across Africa. The company’s efforts are expected to empower individuals and small businesses by providing them with the tools and resources necessary to participate fully in the economy. This aligns with broader developmental goals of reducing poverty and fostering economic growth through inclusive financial systems.

Future Prospects and Expansion Plans

Looking ahead, PalmPay intends to deepen its footprint in existing markets and explore opportunities in new regions. The company is focused on continuous innovation, aiming to introduce more personalized and efficient financial solutions. Collaborations with other financial institutions and fintech companies are also on the horizon, as PalmPay seeks to build a comprehensive and integrated financial ecosystem.

Strategic Business Implications of the Funding

The infusion of capital is expected to enable PalmPay to enhance its technological infrastructure, ensuring a seamless and secure user experience. Additionally, it will support the expansion of its agent network, facilitating greater accessibility to financial services in remote areas. The funding will also allow PalmPay to diversify its product offerings, potentially introducing services like microloans and insurance, thereby catering to a broader range of financial needs.

Read More : PalmPay’s Strategic Move: Aiming for Up to $100 Million to Propel Financial Inclusion in Africa

#PalmPay#fintech#Africa#financial inclusion#digital payments#Series B funding#mobile banking#emerging markets#Nigeria#Transsion Holdings#fintech expansion#underbanked communities#mobile finance#transaction growth#digital wallets#user acquisition#Bangladesh#African startups#financial technology

0 notes

Text

Loyalty Programs of Tomorrow: The Role of AI, Blockchain, and Digital Wallets

The Evolution of Loyalty Programs

Loyalty programs have been a cornerstone of customer engagement for decades, evolving from simple stamp cards to sophisticated digital loyalty solutions. Traditional programs focused on rewarding repeat purchases, but today’s consumers demand more personalization and convenience. With the rise of AI, blockchain, and digital wallets, the future of loyalty is set to be more engaging, secure, and seamless than ever. Loyalty innovation is transforming the way brands interact with their customers, with platforms like Nector.io leading the charge in redefining digital loyalty.

The Rise of AI in Personalized Loyalty Experiences

Artificial intelligence is revolutionizing AI-powered loyalty by enabling businesses to offer personalized loyalty experiences. AI-driven customer segmentation, predictive analytics, and machine learning help brands understand customer behavior, offering targeted rewards and promotions that resonate with individual preferences. Platforms like Nector.io loyalty use data-driven loyalty insights to enhance engagement and drive higher retention rates. With AI, brands can deliver tailored customer experiences, ensuring that loyalty programs remain relevant and effective.

Blockchain Technology: Building Trust and Transparency

Blockchain loyalty programs offer decentralized loyalty ecosystems that enhance security, transparency, and trust. Unlike traditional loyalty programs that are prone to fraud and point expiration issues, blockchain-powered loyalty solutions leverage smart contracts and loyalty tokens to provide a more secure and seamless experience. Brands can issue crypto rewards, ensuring customers have full ownership of their points and enabling easy redemption. Nector.io integrates blockchain technology to build a fraud-resistant loyalty ecosystem where customers and brands benefit from improved security and flexibility.

Digital Wallets: Seamless Integration and Redemption

Digital wallets and mobile wallets have revolutionized loyalty program integration, making it easier for customers to earn and redeem rewards. With the rise of contactless payments and platforms like Apple Pay and Google Pay, businesses can offer seamless digital redemption experiences. The convenience of loyalty apps and omnichannel loyalty solutions enhances the overall customer experience, ensuring rewards are accessible anytime, anywhere. Nector.io integration allows businesses to sync their loyalty programs with mobile payments, driving higher engagement and retention.

Integrating Referral Programs with Future Loyalty Tech

Referral programs are an essential part of modern customer acquisition strategies. With AI-powered referrals and blockchain referrals, businesses can create advocate marketing campaigns that reward loyal customers for spreading the word. Digital wallet rewards make it easier for users to receive and redeem referral incentives. Platforms like Nector.io referral provide viral marketing tools and referral tracking features that drive organic growth and loyalty referrals.

The Role of Reviews and Feedback in Modern Loyalty

Customer reviews and feedback integration play a crucial role in optimizing loyalty programs. Brands leveraging customer sentiment analysis and AI-driven insights can fine-tune their rewards structures based on real user experiences. Social proof, ratings, and online reputation management significantly impact customer experience, making it essential for businesses to integrate Nector.io reviews for a data-driven approach to loyalty.

Case Studies: Companies Leading the Way

Several brands have successfully implemented AI loyalty, blockchain loyalty, and digital wallet loyalty solutions. Case studies show how companies using Nector.io have achieved remarkable customer engagement and business results. Businesses across industries—from retail to hospitality—are adopting cutting-edge loyalty technology to stay ahead.

Challenges and Considerations for Implementation

While the future of loyalty programs is promising, businesses must navigate challenges like data privacy, security, and regulatory compliance (e.g., GDPR). Implementation challenges, technology adoption, and risk management require careful planning. Blockchain security, digital wallet security, and AI-driven data protection measures must be in place to ensure smooth loyalty program integration.

Nector.io: Your Partner in Future-Proofing Loyalty

As a leading loyalty platform, Nector.io provides AI-powered loyalty, blockchain loyalty, and digital wallet integration solutions tailored for modern businesses. With advanced customer engagement strategies, customer retention tools, and seamless loyalty technology, Nector.io helps brands future-proof their loyalty programs. Request a demo today to explore innovative loyalty solutions.

Conclusion: The Future is Now

The future of loyalty lies in the integration of AI, blockchain, and digital wallets, creating more secure, engaging, and customer-friendly experiences. As businesses strive for loyalty innovation, embracing these technologies will be key to business growth and long-term success. With platforms like Nector.io, brands can leverage next-gen loyalty program trends to enhance customer engagement and retention. Now is the time to embrace the future of loyalty programs!

Connect with us for more insights👇🏻

#Loyalty Programs#Blockchain#Digital Wallets#Evolution of Loyalty Programs#Rise of AI#Loyalty Experiences

0 notes

Text

Top 8 Primary Factors that Increasing Online Payments in the UAE

Online payments are rapidly transforming commerce in the UAE, driven by increased card penetration, E-commerce growth, and a tech-savvy young population. Government support and enhanced security features make digital transactions more convenient and secure for both consumers and businesses. As cashless initiatives gain momentum, the UAE is poised to lead the way in creating a modern, digital economy.

The rise of online payments is transforming how we shop and manage our money, making life much simpler for everyone. With just a few taps on your smartphone, you can easily purchase anything you need, from groceries to clothes, all without the hassle of cash. This shift not only makes shopping convenient but also offers greater security, as many digital payment options come with advanced safety features. Businesses are jumping on board, providing various online payment methods that cater to customer preferences and making the checkout process smoother. As technology evolves, online payments are becoming faster and more user-friendly, attracting even more users. Let’s dive into the top eight factors driving this exciting change in online payments!

#payment gateway#uae#business#Online payments#digital payments#contactlesspayments#digital wallets#best payment gateway providers in UAE#Online payments UAE#Payment gateway in UAE#payment methods in dubai#Payment solution sharjah

0 notes

Text

emotionally constipated but so aesthetically devastating. that’s my andrew minyard.

#i present to you#andrew minyard#look at him#cigarettes never looked this emotionally devastating#this man is a crime and i’d still die for him#softly unapproachable#the face of an angel#andrew being his true emotional self#yes I added the b&w version for those who might want andrew in their wallet#aftg andrew#aftg tsc#aftg tfc#aftg fandom#aftg#aftg fanart#andrew minyard fanart#the foxhole court#digital art#plz be nice im highly sensitive#the raven king#the kings men#all for the game#all for the gay#im obsessed with a man (a little ashamed but it’s okay he’s fictional)

4K notes

·

View notes

Text

Best Branded Wallets for Men: Top Luxurious Collection Of 2024

In the world of men’s fashion, a wallet is more than just a place to keep your cash and cards; it’s an extension of your style and a marker of success. It plays a subtle but important role in your daily life, from important meetings and nights out to casual errands and weekend getaways. A well-chosen wallet can make a statement about who you are and how you carry yourself. With 2024 offering an exceptional variety of branded wallets, now is the exact time to explore your options. Read more by clicking below link.

#leather wallets#digital wallets#human wallet#mens fashions#mensbags#menswear#travelbags#weekenderbags#luxury bags#bags

0 notes

Text

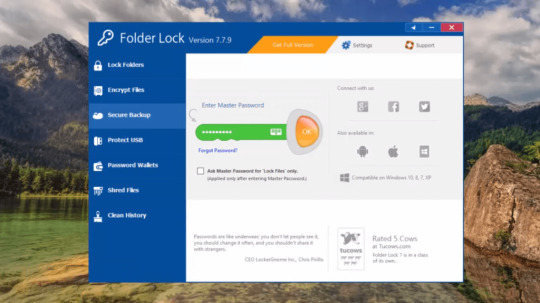

Folder Lock

If you have folders and files that you want to keep private, consider using Folder Lock. Unlike My Lockbox, it isn’t a free app, but it offers excellent configuration options and numerous methods to protect important and private documents from prying eyes. Folder Lock is a complete solution for keeping your personal files encrypted and locked, while automatically and in real-time backing up…

View On WordPress

#Data Encryption#Digital Wallets#Encryption Software#File Locking#File Management#File Security#File Shredding#password protection#Portable Security#privacy protection#Secure Backup#Windows Security

0 notes

Text

#Mobile Wallet App Development#flutter app development#hire flutter developer#Mobile Wallet App#mobile wallet application#Digital wallets#global mobile payments#startup app development#Flutter app development company#mobile wallet revolution#Custom App Development#flutter mobile app developer

0 notes

Text

Demystifying Digital Wallets: Everything You Need to Know About Mobile Payments

In the rapidly evolving landscape of digital finance, mobile payments and digital wallets have become buzzwords, reshaping the way consumers interact with money. From the convenience of cashless transactions to the security of encrypted data, digital wallets are at the forefront of the financial technology revolution. In this comprehensive guide, we will demystify digital wallets, exploring their…

View On WordPress

0 notes

Text

Dynamic Collaboration: Klaytn and Finschia Join Forces to Enhance the Blockchain Ecosystem

The blockchain landscape in Asia is set for a major transformation as Klaytn Foundation and Finschia Foundation propose an ambitious merger. This strategic move aims to unite Klaytn and Finschia blockchains into a single, unified mainnet, potentially creating Asia's largest Web3 ecosystem. With over 250 million digital wallets and a network hosting more than 420 decentralized applications (DApps), the merger seeks to redefine the blockchain space in the region.

The merged blockchain will support both Ethereum Virtual Machine (EVM) and CosmWasm, emphasizing the integration of technologies to enhance user experience and network capabilities. By connecting Web3 assets from LINE and Kakao's messaging platforms, the collaboration aims to extend its influence across Asia, capitalizing on the strengths of these leading technologies.

At the heart of this merger lies the transition to a new native coin. The foundations plan to move from KLAY and FNSA tokens to a fresh native coin, implementing innovative tokenomics. This approach includes a lower base inflation rate and a 3-layer burning model, fostering a stable economic environment within the blockchain. The burning model, especially the burning of a substantial portion of non-circulating KLAY, aligns with the concept of Zero Reserve Tokenomics, aiming to discourage inflation and enhance deflation with increased network activity.

Beyond the technical aspects, the merger envisions establishing a large decentralized Web3 governance structure in Asia. This governance model seeks to fortify network security and decentralization through permissionless validation. The foundations are eyeing expansion into new sectors like real-world asset (RWA) tokenization, GameFi, and DeFi, signaling an integration of traditional digital platforms with blockchain technology.

The Klaytn Community Town Hall, scheduled for January 19, 2024, will play a pivotal role in unveiling further details of this transformative proposal. Subsequently, the discussion and voting period from January 26 to February 2, 2024, will allow stakeholders to actively participate in shaping the future of this consolidated Web3 ecosystem.

#Klaytn#Finschia#blockchain merger#unified mainnet#Web3 ecosystem#digital wallets#decentralized applications#DApps#Ethereum Virtual Machine#CosmWasm#tokenomics#Zero Reserve Tokenomics#decentralized governance#cryptotale

0 notes

Text

Harnessing FinTech: The Future of Personal Finance for Young Adults

🚀 Are you ready to revolutionize your financial world? Dive into our latest article, 'Embracing the Future: How FinTech is Revolutionizing Personal Finance for Millennials'! 🌐

The Rise of Mobile BankingMobile banking has transformed the banking experience. According to a report by Business Insider, over 76% of Americans used mobile banking in 2022. These apps offer features like instant transfers, digital check deposits, and budget tracking, providing young adults with unprecedented control over their finances. Budgeting and Expense Tracking AppsBudgeting apps have…

View On WordPress

#Budgeting Apps#cryptocurrency#Cybersecurity#Digital Payments#Digital Wallets#Financial Management Tools#Financial Security#Financial Technology Trends#FinTech#Millennial Investing#Mobile Banking#personal finance#robo-advisors#Young Adult Finance

0 notes

Text

And nothing bad ever happened.

#sigh do y’all think Byakyua had a photo of Senku with him when he went to space#he gives me the energy of a dad with a bunch of photos of his kids in his wallet#anyway the are still making me crazy#just shamelessly reusing the photo idea I did for a previous drawing LOOOL#art#digital art#my art#fanart#drawing#ishigami senku#senku#dcst fanart#dcst#ishigami byakuya#dr stone

2K notes

·

View notes

Text

Gomining Earn Bitcoin

No excessive hardware or crazy expensive equipment to mine crypto. Earn Bitcoin through owning NFTs. Try the 7 day free trial with no worries of entering credit card info. Choose from a selection NFTs to buy when you want to continue your journey as low as under $50. Be sure to use my link below.

#crypto mining#crypto earning#referral codes#referral links#driskolestate#Gomining#NFT#Bitcoin#crypto staking#gmt token#fyp#for your page#free trial#cryptocurrency#digital wallets

0 notes

Text

Discover the future of seamless and secure payments with digital wallets! This insightful article delves into the evolving landscape of contactless transactions, highlighting the convenience and security offered by digital wallet solutions. Learn how these wallets are reshaping payment experiences, from enhanced user authentication to simplified checkout processes. Explore the potential for wider adoption across industries and regions, transforming the way we handle transactions. Stay ahead in the world of fintech and explore the promising future of contactless payments through digital wallets.

0 notes

Text

Top 5 Challenges in Mobile Wallet App Development and How to Overcome Them

The world has already gone mobile, and our wallets are following suit.

Digital wallets are the most convenient and useful man-made invention in this century, eliminating the need for carrying hard cash or chequebooks or card transactions everywhere. All you need is to make sure your bank account is linked to a wallet app, specifically designed for transactions, and you’re good to go.

With the global mobile payments market projected to reach about $23 trillion by the next year, there is no reason why people wouldn’t flock to build their own mobile wallet apps. The key, however, is to actually build them from scratch.

This comprehensive guide will help you understand the key areas of mobile app custom development, from idea inception to launch.

Understanding The Market And Your Audience

Every idea begins somewhere, and when you build something while targeting an audience or a specific market, it starts with understanding your audience’s needs and demands in the specific niche. Researching the mobile wallet landscape is the first step before taking a deep dive into mobile wallet app development.

Analyze the already existing players in the arena, and then try to make sense of the apps’ functionalities, as well as shortcomings. This would include all kinds of global wallet apps as well as regional apps.

Your research questions should be catered to your audiences; like if there are any redundant functionalities, any issues with UI, or any niche problems that need addressing. This is what your mobile wallet app will be offering to your audience- better functionalities to be on board.

DEFINING YOUR APP’S CORE FEATURES

Doing primary market research is always key to establish a clear understanding of the audience needs that aren’t being met in the current mobile wallet market, and the functionalities that they have become familiar with, so any other UI wouldn’t do for those. This is key to defining your mobile wallet app’s core features.

Of course, there are the absolutely essential features that you cannot do without, like:

Security:

There is nothing more important in a finance related app than security and encrypted data related to financial information of your mobile wallet app users. Ensure to pay extra attention to the layers of security as well as the authentication features – especially when dealing with larger amounts.

Payment Methods:

There are different methods that people use to pay their dues- normally, credit or debit cards. Integrating such information allows for smoother transactions and allows the user to not worry about punching in the information over and over again. And since not everyone might have credit cards, debit card users also enjoy the same benefits of the mobile wallet app.

Bill Payments:

Bill payment is another crucial need of mobile wallet users. Every month, a good chunk of any person’s salary goes towards bill payments. Integrating such features like mobile recharges, electricity bills, insurance payments, etc. are crucial for a user to fully accept the mobile wallet payment system- bringing in more audience for your app.

Budgeting and Tracking:

This is a feature not usually found in all mobile wallet apps. Budgeting and tracking would allow a unique experience for people who don’t usually keep track of their money flow. Integrating this simple feature into your app, with multiple categories to help a student, an employed, a freelancer, or an investor track their finances would definitely get you more users for your mobile wallet app.

Flutter: For A User-Centric Experience

Here’s the exciting part- Development phase! While every app’s development phase brings in new challenges and breathes life to incepted ideas, the framework on which you build your app is also important- for uniqueness, time-efficiency, cross-platform use, and more.

Here’s why investing in a Flutter app development company can help you build one of the best mobile wallet apps ever:

FASTER DEVELOPMENT:

Time is perhaps more crucial than actual currency in today’s day and age, and the most solid reason to choose Flutter for your mobile wallet app. The best feature of the flutter framework that helps you build interactive and smooth apps is the Hot Reload feature – allowing you to see real-time changes in your code.

REDUCED COSTS:

By using Flutter- notorious for its cross-platform seamless performance, you effectively reduce both the cost and the time required to develop an app that works on both iOS and Android.

INTUITIVE UX/UI:

Any Flutter app development company will make sure that the UX as well as UI for the mobile wallet app that you are building has a smooth and intuitive UI, for user ease and trust, especially with the app security.

Designing Your Mobile Wallet App: App Flow, UI, And Security Audits

While designing a mobile wallet app, there are a few crucial things that should be considered:

SIMPLE INTERFACE:

The simpler your app’s UI is, the better experience your users will have. A clean, uncluttered and intuitive UI is the key to making sure your users have a good experience with the app.

Apart from this, it is also crucial to integrate some tutorials and FAQs that people can refer to if they are unable to access a feature or do not know how to authenticate a payment.

BIOMETRIC AUTHENTICATION:

This one’s a no-brainer. If you aren’t making use of digital fingerprints or facial recognitions for secure logins and transactions, you may be risking your users’ sensitive data.

REAL-TIME TRANSACTION TRACKING:

A secure connection with banks ensures that users are immediately notified, via messages or emails, about any and every transaction and transfer that they have made. This ensures complete financial transparency- building trust within the app.

Before the launch of your mobile wallet app, crucial audits are a must. This includes performance and functionality testing to ensure the app works smoothly across different Operating systems and devices, and to evaluate the responsiveness of the app when under load. Security testing will entail testing any vulnerabilities that need to be fixed before launch.

Launching Your Mobile App

Deploying a new mobile wallet app in the market is no easy feat. It requires careful planning and strategizing to make sure it reaches your target audience. For this, you’ll need to leverage:

PRE-LAUNCH MARKETING:

This will involve generating some buzz around your new mobile wallet app through social media campaigns, targeted ads, and even influencer partnerships.

APP-STORE OPTIMIZATION:

Drafting compelling descriptions that include relevant keywords for SEO, and using multiple high-quality previews of your app will definitely help your app get discovered quickly after the launch.

Conclusion

The mobile wallet revolution is here to stay. There is no two-ways about the fact that constant innovation is key to conquering any market.

By understanding the key aspects of building a mobile wallet app mentioned in this guide, you’ll be able to break into the market with a great mobile wallet app. As for making it thrive, make sure to stay ahead on the latest financial trends like blockchain integration to make your app stand out.

#flutter app development#hire flutter developer#Mobile Wallet App Development#Mobile Wallet App#mobile wallet application#Digital wallets#global mobile payments#app’s development#Flutter app development company#performance and functionality testing#mobile wallet revolution#Custom App Development

0 notes