#dodd-frank

Explore tagged Tumblr posts

Text

Exploring Democratic Strategies with Rahm Emanuel

Exploring Different Futures for the Democratic Party In our previous episode, we had an insightful conversation with Faz Shakir, the former campaign manager for Bernie Sanders. We delved into whether the principles of “Bernieism” could provide a viable path forward for the Democratic Party. However, I mentioned at the outset that we would be presenting a contrasting viewpoint, and here it is.…

#2024 elections#Affordable Care Act#Barack Obama#Bernie Sanders#Democratic Party#Democratic victories#Dodd-Frank#elections#political commentary#political strategy#Rahm Emanuel

0 notes

Text

Liz Dye at Public Notice:

The Trump administration has taken a sledgehammer to much of the federal government. But at the Consumer Financial Protection Bureau (CFPB), which is tasked with shielding Americans from the depredations of the financial industry, a bloodless coup threatens to obliterate an entire federal agency without a trace. Within days of being confirmed, Treasury Secretary Scott Bessent ordered CFPB employees to suspend all enforcement actions, supervisory activity, and any rules not yet finalized, including one that would have capped credit card late fees at $8. Last week he handed the reins to Russ Vought, the newly confirmed head of the Office of Management and Budget (OMB). Vought immediately put the entire staff on administrative leave, locked them out of the office, and informed Congress that he was zeroing out the agency’s budget. “CFPB RIP” tweeted Elon Musk, whose DOGE stooges had burrowed into the abandoned agency and were busily picking over its remains.

You can judge a man by the quality of his enemies

Conservatives have been gunning for CFPB since 2011 when Sen. Elizabeth Warren more or less willed it into existence. The agency was established as part of the 2010 Dodd-Frank Act, a landmark consumer protection bill passed in the aftermath of the Great Recession to ensure that unregulated financial behemoths would quit crashing the economy at regular intervals. Since then, it has recovered more than $20 billion for consumers and crafted federal rules to protect Americans from getting ripped off. The agency is despised by everyone from payday lenders, to credit card companies, to the goons at Project 2025. And Elon Musk, who would like to turn Ex-Twitter into a banking app which would be regulated by CFPB, is no fan either.

The Trump/Musk co-”Presidency” destroys a vital watchdog agency in the CFPB to spite Elizabeth Warren.

See Also:

Wonkette: Why Americans (But Not Banks) Love The Consumer Financial Protection Bureau

#Consumer Financial Protection Bureau#CFPB#Elizabeth Warren#Russ Vought#Elon Musk#DOGE#Musk Coup#Scott Bessent#Dodd Frank Act#Great Recession#Project 2025

39 notes

·

View notes

Text

How to screw up a whistleblower law

I'm touring my new, nationally bestselling novel The Bezzle! Catch me THIS WEDNESDAY (Apr 17) in CHICAGO, then Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

Corporate crime is notoriously underpoliced and underprosecuted. Mostly, that's because we just choose not to do anything about it. American corporations commit crimes at 20X the rate of real humans, and their crimes are far worse than any crime committed by a human, but they are almost never prosecuted:

https://pluralistic.net/2021/10/12/no-criminals-no-crimes/#get-out-of-jail-free-card

We can't even bear to utter the words "corporate crime": instead, we deploy a whole raft of euphemisms like "risk and compliance," and that ole fave, the trusty "white-collar crime":

https://pluralistic.net/2021/12/07/solar-panel-for-a-sex-machine/#a-single-proposition

The Biden DOJ promised it would be different, and they weren't kidding. The DOJ's antitrust division is kicking ass, doing more than the division has done in generations, really swinging for the fences:

https://pluralistic.net/2024/03/22/reality-distortion-field/#three-trillion-here-three-trillion-there-pretty-soon-youre-talking-real-money

Main Justice – the rest of the DOJ – promised that it would do the same. Deputy AG Lisa Monaco promised an end to those bullshit "deferred prosecution agreements" that let corporate America literally get away with murder. She promised to prosecute companies and individual executives. She promised a lot:

https://pluralistic.net/2024/03/22/reality-distortion-field/#three-trillion-here-three-trillion-there-pretty-soon-youre-talking-real-money

Was she serious? Well, it's not looking good. Monaco's number two gnuy, Benjamin Mizer, has a storied career – working for giant corporations, getting them off the hook when they commit eye-watering crimes:

https://prospect.org/justice/2024-04-09-reform-groups-lack-of-corporate-prosecutions-doj/

Biden's DOJ is arguably more tolerant of corporate crime than even Trump's Main Justice. In 2021, the DOJ brought just 90 cases – the worst year in a quarter-century. 2022's number was 99, and 2023 saw 119. Trump's DOJ did better than any of those numbers in two out of four years. And back in 2000, Justice was bringing more than 300 corporate criminal prosecutions.

Deputy AG Monaco just announced a new whistleblower bounty program: cash money for ratting out your crooked asshole co-worker or boss. Whistleblower bounties are among the most effective and cheapest way to bring criminal prosecutions against corporations. If you're a terrified underling who can't afford to lose your job after narcing out your boss, the bounty can outweigh the risk of industry-wide blacklisting. And if you're a crooked co-conspirator thinking about turning rat on your fellow criminal, the bounty can tempt you into solving the Prisoner's Dilemma in a way that sees the crime prosecuted.

So a new whistleblower bounty program is good. We like 'em. What's not to like?

Sorry, folks, I've got some bad news:

https://www.corporatecrimereporter.com/news/200/stephen-kohn-on-the-justice-department-plan-to-offer-whistleblower-awards/

As the whistleblower lawyer Stephen Kohn points out to Russell Mokhiber of Corporate Crime Reporter, Monaco's whistleblower bounty program has a glaring defect: it excludes "individuals who were involved with the crime." That means that the long-suffering secretary who printed the boss's crime memo and put it in the mail is shit out of luck – as is the CFO who's finally had enough of the CEO's dirty poker.

This is not how other whistleblower reward programs work: the SEC and CFTC whistleblower programs do not exclude people involved with the crime, and for good reason. They want to catch kingpins, not footsoldiers – and the best way to do that is to reward the whistleblower who turns on the boss.

This isn't a new idea! It's in the venerable False Claims Act, an act that signed into law by President Abraham Lincoln. As Kohn says, making "accomplices" eligible to participate in whistleblower rewards is how you get people like his client, who relayed a bribe on behalf of his boss, to come forward. As Lincoln said in 1863, the purpose of a whistleblower law is to entice conspirators to turn on one another. Like Honest Abe said, "it takes a rogue to catch a rogue."

And – as Kohn says – we've designed these programs so that masterminds can't throw their minor lickspittles under the buss and collect a reward: "I know of no case where the person who planned or initiated the fraud under any of the reward laws ever got a dime."

Kohn points out that under Monaco, the DOJ just ignores the rule that afford anonymity to whistleblowers. That's a big omission – the SEC got 18,000 confidential claims in 2023. Those are claims that the DOJ can't afford to miss, given their abysmal, sub-Trump track record on corporate crime prosecutions.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/15/whistleblown/#lisa-monaco

163 notes

·

View notes

Text

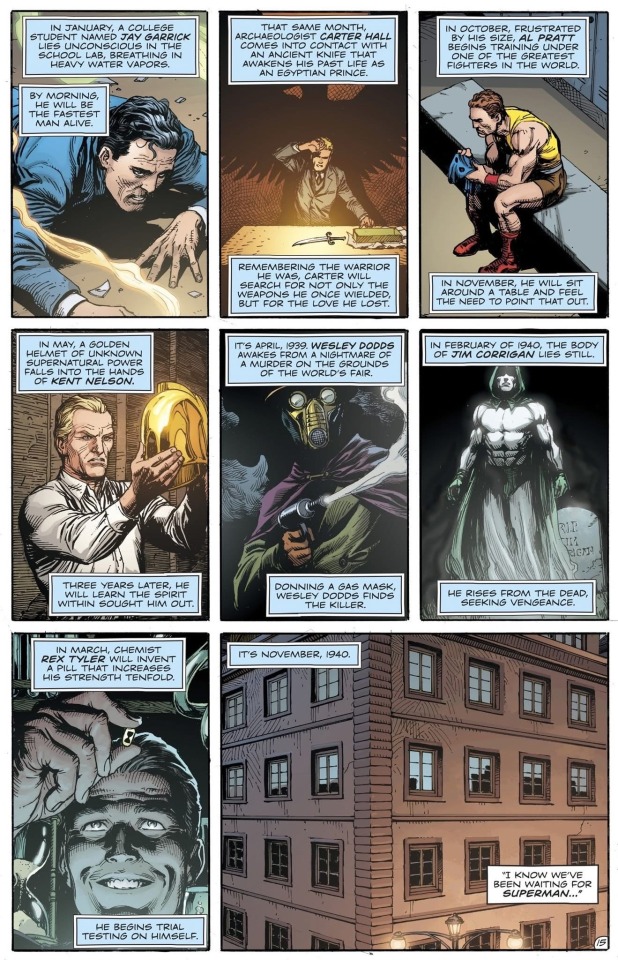

Gary Frank and Geoff Johns depict the rise of the JSA in Doomsday Clock

#jsa#justice society of america#hourman#the sandman#spectre#doctor fate#al pratt#the atom#jay garrick#the flash#carter hall#hawkman#wesley dodds#rex tyler#gary frank#doomsday clock

13 notes

·

View notes

Text

i'm not even a board certified obama defender but bro is cooking nothing here. bullshit or not, legislation which will put millions of people out of their jobs will never pass. this is not an Obama Thee Liberal problem, it's a legitimate policy question. this is clear to legislators but apparently not so much to people who post online for a living

#an off-ramp from the current arrangement will need to be devised#and will cost a lot of money#the wonks will have to be called in. it will be a whole thing.#like YOU come up with a solution then. YOU run for office.#see if you get reelected when you're a yea vote for forcing millions out of their jobs.#i won't even lie obama is a skilled legislator and i hadn't thought about the issue like this. he's an intelligent man. no 🧢.#i am a Full Employment Shill but i hadn't thought of it like this--as govt spending to create employment in the private sector#nathan robinson: dresses/talks like an 1950s english businessman. got timothee at home looking ass; 0 elections won#no legislation passed#Obamna: president for 8 years. CFPB. ACA. Dodd-Frank. Congress Understander. Unemployment considerer.

13 notes

·

View notes

Text

The director and stars of SMARTY (1934): Robert Florey, Edward Everett Horton, Claire Dodd, Frank McHugh, Joan Blondell, and Warren Williams.

#robert florey#edward everett horton#claire dodd#frank mchugh#joan blondell#warren william#behind the scenes#classic movies

10 notes

·

View notes

Text

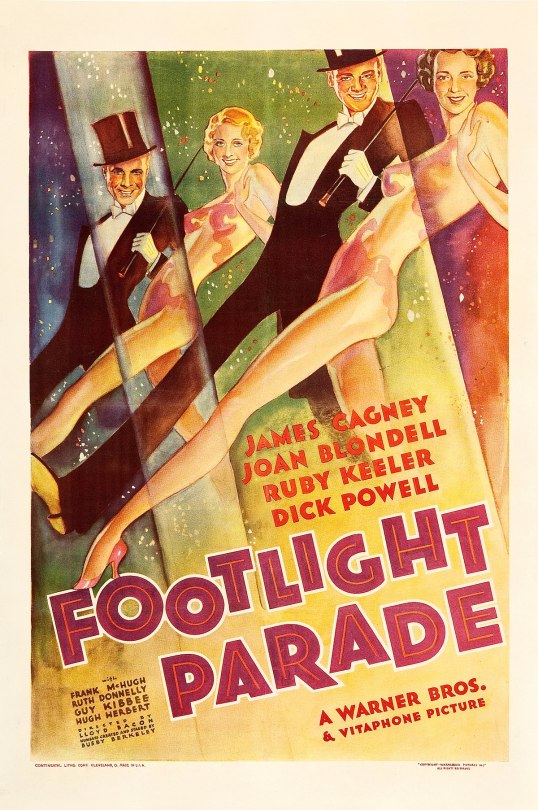

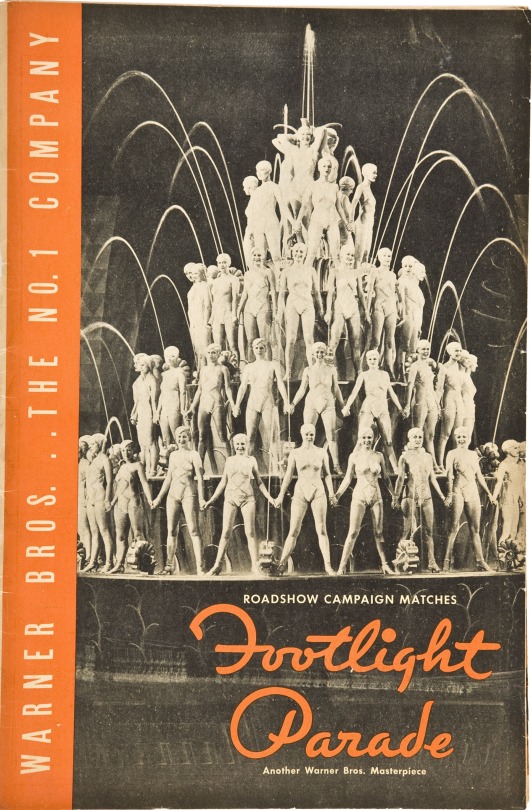

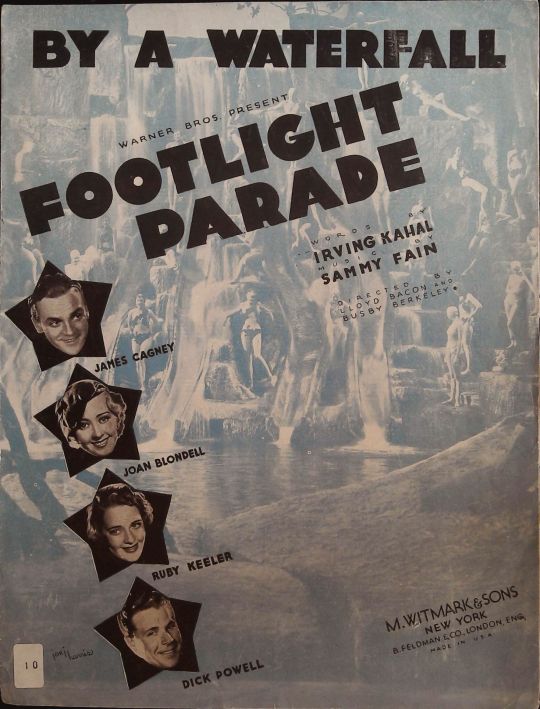

Footlight Parade (1933) Lloyd Bacon

December 4th 2023

#footlight parade#1933#lloyd bacon#james cagney#joan blondell#ruby keeler#dick powell#frank mchugh#claire dodd#guy kibbee#hugh herbert#arthur hohl#ruth donnelly#paul porcasi#busby berkeley#pre-code

8 notes

·

View notes

Text

Conflict Minerals Compliance & CMRT Reporting Software | Certivo's AI-Powered Platform

Certivo’s AI-powered platform simplifies Conflict Minerals Compliance by automating CMRT reporting and ensuring end-to-end transparency in your supply chain. Designed to meet Dodd-Frank Section 1502 compliance, our solution validates smelters, flags high-risk materials, and supports responsible mineral sourcing initiatives. Whether you're managing thousands of suppliers or preparing for an audit, Certivo ensures alignment with global conflict minerals regulations—reducing risk, effort, and cost. Built for modern compliance teams, our platform empowers you to act proactively, not reactively. Stay ethical, efficient, and audit-ready—always.

#AI-powered conflict minerals compliance software#CMRT reporting automation tool#Responsible mineral sourcing platform#Conflict minerals audit readiness solution#Dodd-Frank Section 1502 compliance software#Conflict minerals regulations reportin#Ethical sourcing compliance platform#Smelter validation and compliance automation#Supply chain transparency for conflict minerals#Conflict minerals compliance for manufacturers

0 notes

Text

47th President's Control Over CFPB: Legal Implications Explained

CFPB Under Threat: 47th President’s Authority Questioned In a controversial development, the newly appointed Treasury Secretary Scott Bessent has directed the Consumer Financial Protection Bureau (CFPB) to suspend much of its ongoing activities, prompting a fierce debate regarding the legality and implications of such actions. Established by Congress in 2010 in response to the financial crisis,…

#agency oversight#CFPB#consumer advocacy#consumer protection#Dodd-Frank Act#federal government#financial regulations#presidential authority

0 notes

Text

What is Market Manipulation?

The financial market is supposed to be a place where investors put their hard-earned money to work. Market manipulation disrupts the playing field, undermining the integrity of financial systems and causing a great deal of harm to investors. Between 2020 and 2022, the United States recovered $2.7 billion from market manipulation incidents. What Does Market Manipulation Mean? The stock market…

#business#CFTC#crime#Dodd-Frank Wall Street Reform Act#False Claims Act#government#legal#market manipulation#SEC#Whistleblower

0 notes

Text

Piper Mclean seeing another trend blow up online does what does best and gathers her friends for a video. Once again the internet loses it's mind and the video has internet conspiracy theorist talking for weeks.

Piper: God, I’m so hungry… I’m so hungry I could eat Tía Callida Leo: My aunt who put me in a fireplace to burn!!??

Leo: I am soooo hungry. I want to eat a whole Sammy Valdez. Hazel: My childhood crush who died???

Hazel: I’m really hungry. So hungry I think I could eat Magnus Chase Annabeth: I’m sorry… My Cousin Who Died?

Annabeth: I’m really hungry. I feel like I could eat an entire Thalia Grace Jason: My long-lost sister Thalia!?

Jason: Wow, I’m so hungry. Hungry enough, I could eat Emily Zhang Frank: …my mom who died in combat…?

Frank: I’m so hungry right now. I’m hungry enough that I could eat a Mrs. Dodds. Percy: The teacher everyone told me I hallucinated for 6 months!?

Percy: Man,I’m really hungry. I’m so hungry I bet I could eat Bianca Di Angelo Nico: MY DEAD SISTER!?

#percy jackson#percy jackson and the olympians#annabeth chase#piper mclean#leo valdez#hazel levesque#jason grace#frank zhang#nico di angelo

287 notes

·

View notes

Text

Favorite art at the Modern Art Museum of Fort Worth

Painter's Forms II by Philip Guston

Untitled by Joan Mitchel

Fred'stouch by Frank Bowling

Waiting for Samson by Frank Bowling

Sun Dial by Lucy Dodd

O Renascer de uma nova vida by Sophia Loeb

Ornament for Extraordinary Architecture by Kamrooz Aram

Murmur & Black Darkness by Lorna Simpson

These final hours embrace at last; this is our ending, this is our past. by Robyn O'Neil

54 notes

·

View notes

Text

Other than classic market manipulation, it should be a direct violation of the Dodd-Frank Act (the 'Eddie Murphy Law'). It has a provision to prevent trading on unreleased government information.

Regardless of whether the stock market was tanked intentionally, anyone who knew the government had ordered pausing tarriffs before it was announced, who then proceeded to buy stocks because of it, would be violating the Act.

On April 7, a reporter asked President Donald Trump if he would be open to pausing tariffs to allow for negotiation. Trump said, “Well, we're not looking at that.”

White House Press Secretary Karoline Leavitt said April 7 that the idea that Trump was going to issue a 90-day pause was “fake news.”

On April 9, Trump announced a 90-day pause on some tariffs, lowering the amount for all partners to 10%. He excluded China.

(continue reading)

(source) (source) (source) (source) (source) (source)(source) (source)

#Nicknamed the Eddie Murphy Law because one of the things it outlawed was the very thing the main characters did in the movie Trading Places.#Namely‚ they had access to an unreleased government agricultural report which would affect the price of orange futures.#Knowing the content of the report before anyone else‚ they were able to trade in orange futures to their own benefit.#They even manipulated other market traders to maximise their profits.#One thing Dodd-Frank did was to ban this practice.#Me‚ I'm annoyed that anyone bought that this was to make up for trade deficits.#If we apply the Trump Tarriff formula to Australia‚ we should've gotten a -50% rate. US has a powerful surplus with us.#If the goal was to eliminate deficit‚ US customs should have been paying consumers to buy Australian.#Instead we get hit with a 10% tariff because we won't compromise biosecurity‚ cultural minimums in broadcasting‚#or weaken our trade position with pharmacutical companies‚ and happen to sell five times as much coal to China as the US.#And frustratingly it's being pushed as a weakenss of our current PM that he isn't doing more to 'fix the problem.'#Which- if everyone keeps chewing the line- could lead to another round of conservative government in Australia at the upcoming election.#Hopefully the backflipping on Trump's side has made our PM look good for freaking out.

54 notes

·

View notes

Text

Scott grew up in Baltimore, in the nineteen-eighties and nineties, “thinking that the government was an honorable place to work.” His grandfathers were Westinghouse engineers who conducted state-funded research. His parents were public-school music teachers. “Kids used to make fun of me for carrying a violin,” he told me. In college, he joined the R.O.T.C. and later entered the Air Force. He met his wife, a nuclear missileer, at their shared duty station in California. They both left active duty, but he continued to serve in the Air Force Reserve and went on to law school.

In 2013, he got a job as an attorney-investigator at the Consumer Financial Protection Bureau, the federal agency that monitors and investigates banks, payday lenders, debt collectors, and other businesses. The C.F.P.B. was established in 2010, under the Dodd-Frank Act, which sought to prevent the kinds of mortgage scams and unregulated investments that had led to the Great Recession. “My specialty was delinquent-loan services, people struggling to get mortgage modifications,” Scott said. (He asked to use a pseudonym because he is not permitted to speak with the press.) Later, he joined a team that focusses on servicemembers, a population that’s particularly vulnerable to predatory practices because of the nature of their work—modest but dependable income, frequent relocation, peer pressure to buy “the biggest truck.” A lot of enlisteds get married young and have kids young, or have to support their parents. “They are getting money for the first time,” he told me. “They get preyed on.”

Scott liked the idea of helping the military community, and knew that his own status as a veteran had given him an advantage at the C.F.P.B. “It got me in the door,” he said, though he still had to take an entrance exam. Veterans often receive a preference in government hiring and promotions, which partly explains why they make up about thirty per cent of the federal workforce. “The preference tries to put us back where we would be, had we not served,” Scott said. “It levels the playing field.”

He has worked for the C.F.P.B. ever since. The agency has sued companies for persuading veterans to sell their pension and disability payments, for charging military families more than thirty-six per cent interest on pawn loans, and for misleading servicemembers to take costly cash-out refinance loans on their homes. He recalled cases in which a debt collector had lingered outside someone’s house, pretending that his cellphone was a police walkie-talkie, or gone through the drive-thru of a Taco Bell to harass someone working the window. Since its founding, the C.F.P.B. has recovered more than three hundred million dollars in damages to military personnel and veterans.

I visited Scott last week at his home about an hour away from D.C. He looks the part of an airman: tall, fit, and fastidiously groomed. The house was also big and spotless, save for the area occupied by two yappy Chihauahas. He showed me the dining room, which doubles as his office. Next to his work laptop was a bound copy of the Fair Credit Reporting Act, whose worn lime-green cover was signed, in Sharpie, by one of the creators of the C.F.P.B.:

Keep ’em honest Elizabeth Warren

In early February, the Trump Administration had shut down the agency headquarters. Elon Musk pronounced it dead—“RIP CFPB,” he wrote on X—as his DOGE operation dug into the computer systems. “Employees should not come into the office,” Russell Vought, an outspoken critic of financial regulation and the C.F.P.B.’s new acting director, wrote in an “AllHands” e-mail. “Employees should stand down from performing any work task.” He then fired ten per cent of the bureau and oversaw a “wholesale termination of the contracts needed to keep the C.F.P.B. running,” a procurement staffer stated in a recent affidavit. Vought’s plan to terminate nearly everyone at the agency “within 36 hours” was halted by a federal judge.

Scott was spared but put on administrative leave. He could do little more than check his e-mail and wait. Normally he would be analyzing the complaints submitted by servicemembers, organizing outreach events, and discussing emerging concerns with colleagues at the Department of Defense and the Department of Veterans Affairs. Now nothing was getting done.

Several time zones west, in Honolulu, a financial coach and military spouse named Heidi Clemons was feeling alarmed by the news about the C.F.P.B. The packet of materials she gave to servicemembers and families was filled with links and references to the agency. “We’re trying to point our servicemembers to the most trusted information—historic, government-backed, lasting, not scam-based or profit-based,” she told me. Suddenly, in February, the links led to a “Page Not Found” message. All the YouTube explainers were gone. “It was a hot mess,” she said. “We had to pull the C.F.P.B. from all our resourcing.” Though the website was later restored, she didn’t want to take the risk of sending people to “a dead-end link.” “The impact of shutting down the C.F.P.B. on our servicemembers—it’s huge,” she said.

Scott had been to that part of Oahu for military exercises. Fort Shafter sits between the misty, dark-green mountains of the Ko’olau Range and the Ke’ehi Lagoon. “There’s a lot of sleazy businesses,” he said. Cash for gold, title loans, pawnshops. There are high-tech temptations, too: crypto and various money-making schemes on Venmo, Zelle, and other peer-to-peer payment apps.

Military personnel have long been vulnerable to shady enterprises and cons. Twenty years ago, the Government Accountability Office conducted a study for the Defense Department, based on “continuing concerns about servicemembers’ use of predatory consumer loans.” The report found that these products could lead to “severe negative consequences for the military as a whole (e.g., decreases in unit readiness and morale) as well as for the servicemembers themselves (e.g., criminal and adverse personnel actions, including possible discharge from the military).” Clemons told me that she had one client whose husband had stolen her identity; that another, a Reservist, owed money to a loan shark; and that apartment complexes near the base were having military applicants “waive away their rights” under the Servicemembers Civil Relief Act, which allows active-duty renters to break their lease when necessary. In 2023, of the eighty-four thousand or so complaints submitted by servicemembers to the C.F.P.B., the second-highest number came from Hawaii.

Earlier this year, a unit based at Fort Shafter—the 9th Mission Support Command of the Army Reserve (motto: “Pride of the Pacific”)—had asked for a C.F.P.B. representative to staff a booth at an upcoming resource fair for soldiers and their families. Scott arranged for a co-worker to be there with plenty of bureau literature and swag. The event took place on March 1st, but the rep never showed up—because no one was allowed to work. “They didn’t know where we were,” Scott said.

On Sunday, March 2nd, Scott and other remaining staffers received a confusing e-mail from Mark Paoletta, the C.F.P.B.’s chief legal officer:

On behalf of Acting Director Vought, I am writing to you to ensure that everyone is carrying out any statutorily required work, as he set forth in his February 8th email. … Employees should be performing work that is required by law and do not need to seek prior approval to do so.

A month earlier, Vought’s message had clearly said not to perform “any work” at all. Scott and other C.F.P.B. employees concluded that this new directive was an attempt to rewrite the story for purposes of litigation. A lawsuit filed by the workers’ union alleged that by issuing a stop-work order to all staff the Administration had violated the Dodd-Frank Act. A hearing was scheduled for the following day. “They’re trying to develop cover for the court case,” Scott told me.

Meanwhile, the invitation to do what was “statutorily required” let him resume some of his work. “I currently have three hundred and twenty-three unread e-mails,” he told me. “Usually, I try to clear them out as fast as I can.” We were in his dining room, sitting at a table covered in delicate white lace. He sipped coffee from a Pentagon mug. The complaint system for servicemembers and veterans had continued to function through the pause, though with noticeable glitches, and Scott was finally able to download the latest data. “Our all-time record is ten thousand complaints for any month,” he said. “And then January was nineteen thousand!” A lot of the submissions had to do with credit reporting. Late last year, the C.F.P.B. had forced Navy Federal, a credit union with a large presence on military installations, to return eighty-one million dollars in overdraft fees to consumers. Scott guessed that the settlement had prompted fresh complaints about other institutions.

But he wasn’t able to track the complaints as he normally would. Typically, when a complaint comes in, it is both reviewed by the C.F.P.B. and routed to the relevant financial company, which is then obligated to respond, and often does so through e-mail with an attached PDF. The many contracts Vought had cancelled, however, included one “with a software company who would scan all our documents for viruses,” Scott explained. “So, now we’re not able to open attachments.” What this meant, he continued, was that “Nobody’s monitoring, right now, to make sure the responses are timely or that they’re complete.” He shrugged.

We got in the car and drove southeast, past the main gate of Fort Meade, past a Northrop Grumman campus, past a strip mall advertising cheap tax preparation. “Some people get loans against their tax refunds—I worry about that,” he told me. I asked him what the Federal Trade Commission or the Department of Defense might do to help members of the military, if the C.F.P.B. no longer could. “I mean, not a lot,” Scott said. “For some things, the servicemembers could go to their JAG”—the military’s law department—“and the JAG might write a letter, but that’s about all they’re going to do.”

Enough of the agency was still intact that Scott believed it could be brought back to life. The day after my visit, a federal judge in Maryland ruled that thousands of fired federal workers, including those at the C.F.P.B., would have to be temporarily reinstated; the Trump Administration appealed the order. Some probationary workers subsequently received a “notice of rehiring” that put them on paid administrative leave. Though Scott had recently interviewed for jobs in a city prosecutor’s office and at a credit union in need of a compliance officer, he still hoped to return to the bureau. “If this blows over, I can come back,” he said. He hated to think what would happen if the agency went away completely. “You’re going to see a boom and bust in crypto. You might see a recession,” he told me. “We’re gonna see foreclosures. People forget that. People don’t remember what that’s like.” ♦

The New Yorker is committed to coverage of the federal workforce. Are you a current or former federal employee with information to share? Please use your personal device to contact us via e-mail ([email protected]) or Signal (ID: etammykim.54).

49 notes

·

View notes

Text

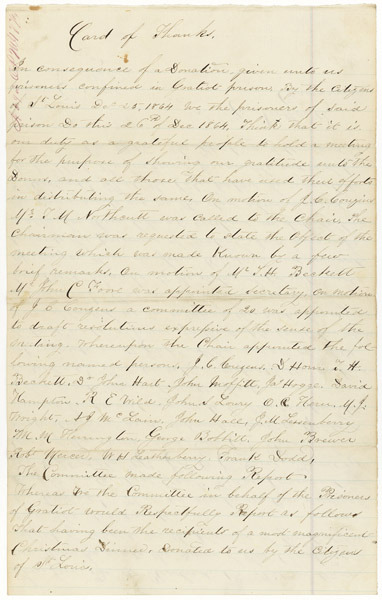

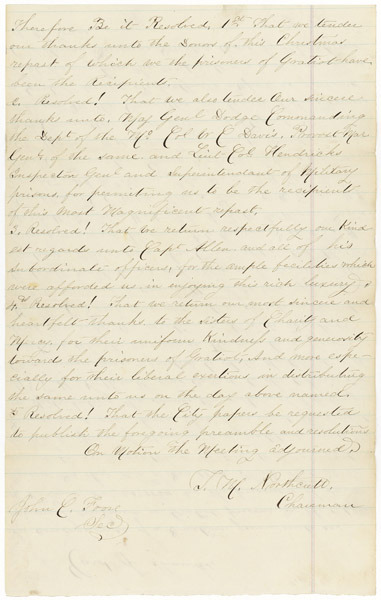

Card of Thanks from Confederate Prisoners of War Thanking Residents for Christmas Gifts

Record Group 393: Records of U.S. Army Continental CommandsSeries: Letters Received

[handwritten]

Card of Thanks

In consequence of a Donation given unto us

prisoners confined in [illegible] prison by the citizens

of St. Louis Dec. 25, 1864, we the prisoners of said

prison Do this 26th Dec 1864, Think that it is

our duty as a grateful people to hold a meeting

for the purpose of showing our gratitude unto the

Donors, and all those that have used their efforts

in distributing the same. On motion of J. C. Couzins

Mr. T. M. Northcutt was called to the chair. The

chairman was requested to state the object of the

meeting which was made known by a few

brief remarks. On motion of Mr. T. H. Beckett,

Mr. John C. F[illegible] was appointed Secretary, on motion

of J. E. E[illegible] a committee of 20 was appointed

to draft resolutions expressive of the sense of the

[illegible]ing. Thereupon the Chair appointed the following

named persons: J. C. Couzins, D Howe, T. H.

Beckett, Dr. John Hart, John Moffitt, J. Hoggs, David

Hampton, R. E. Wild, John Lowry, O. R. Horn, [Y?]. J.

Wright, [S. J.?] McLain, John Hall, J. M. L[illegible],

M. M. Harrington, George [Bobhill?], John Brewer,

R. G. [Mercer?], W. H. L[illeible]berry, Frank Dodd.

The Committee made following Report:

Whereas we the Committee in behalf of the Prisoners

of Gratiot would Respectfully Report as follows.

That having been the recipient of a most magnificent

Christmas Dinner, Donated to us by the citizens

of St. Louis. Therefore Be it Resolved 1st That we tender

our thanks unto the Donors of this Christmas

repast of which we the prisoners of Gratiot have

been the Recipients.

2nd Resolved! That we also tender Our sincere

thanks unto Maj Genl Dodge Commanding

the Dept of the Mo. Col W. C. Davis Provost Mar

Genl of the same and Lieut Col Hendricks

Inspector Genl and Superintendent of Military

prisons for permitting us to be the recipient

of this most magnificent repast.

3rd Resolved! That we return respectfully our kindest

regards unto Capt Allen and all of his

subordinate officers for the amble facilites which

were afforded us in enjoying this with luxury.

4th Resolved! That we return our most sincere and

heartfelt thanks to the Sisters of Charity and

Mercy for their uniform kindness and generosity

toward the prisoners of Gratiot, And more especially

for their liberal exertions in distributing

the same unto us on the day above named.

5th Resolved! That the City papers be requested

to publish the forgoing preamble and resolutions.

On motion the meeting adjourned.

S. M. Northcutt

Chairman

John C. F[illegible]

Sec

54 notes

·

View notes

Text

regulate these firms out of existence i really mean it. i don't care what it takes

5 notes

·

View notes