Don't wanna be here? Send us removal request.

Text

Bank Fixed Deposit Rates – A Complete Guide to Growing Your Savings

When it comes to safe and reliable savings options, bank fixed deposit rates often come first. Whether you're planning for short-term goals or long-term financial stability, fixed deposits (FDs) offer guaranteed returns with low risk. This guide will help you understand how bank fixed deposit rates work, how to find the best FD interest rates, and how to create an FD easily.

What Are Bank Fixed Deposit Rates?

Bank fixed deposit rates refer to the interest a bank pays on your deposited money over a fixed period. You deposit a lump sum for a specific time, and the bank pays you interest based on the agreed rate. At the end of the term, you get back your original amount along with the earned interest.

FDs are considered one of the safest investment options because they are not subject to market fluctuations. The rate you get when you open the FD stays the same until maturity.

Factors That Influence Bank Fixed Deposit Rates

Several factors affect the current FD rates offered by banks:

Repo Rate: Set by the RBI, this influences lending and deposit rates across banks.

Deposit Tenure: Longer tenures usually offer better interest rates.

Type of Bank: Private banks may offer higher rates than public-sector ones to attract customers.

Customer Profile: Senior citizens generally receive 0.25% to 0.75% extra on the best FD rates.

How to Choose the Best FD Interest Rates

Finding the best FD interest rates requires a bit of comparison and research. Here are a few tips:

Compare rates online from various banks and NBFCs.

Use FD calculators to understand returns on different tenures.

Choose banks offering the best FD rates in banks with flexible payout options (monthly, quarterly, or at maturity).

Consider tax-saving FDs if you're looking for long-term options with tax benefits under Section 80C.

How to Create an FD Online or Offline

Creating an FD is easy and can be done in just a few minutes:

To Create FD Online:

Log in to your mobile banking or internet banking.

Navigate to the “Create FD” or “Open Fixed Deposit” section.

Enter the amount, tenure, and payout type.

Confirm and submit the request.

To Create FD Offline:

Visit your nearest bank branch.

Fill out the FD application form.

Submit KYC documents and deposit the amount.

Collect your FD receipt or passbook entry.

Benefits of Choosing the Best FD Rates

Fixed and guaranteed returns

Low-risk investment ideal for conservative savers

Senior citizen benefits with higher rates

Flexible tenure options from 7 days to 10 years

Loan facility against FD if needed

Tips to Maximize Your FD Returns

FD Laddering: Split your investment into multiple FDs with different tenures to benefit from changing current FD rates.

Compare frequently to get the best rates on FD.

Reinvest the maturity amount if rates improve.

Conclusion

Understanding and comparing bank fixed deposit rates is key to growing your savings smartly. By keeping track of current FD rates, using calculators, and exploring the best FD interest rates, you can make the most of this safe investment option. Start today and secure your financial future.

#fd rates#fd returns#fd transfer account#fd transfer status#flexible fd#highest fd interest rate bank#highest fd rates in bank#instant fd account setup#latest fd interest rates#latest fd rates#monthly interest on fd

0 notes

Text

Unlock the Power of Mobile Banking Apps: Top Features You Should Know

In the digital age, mobile banking apps have become an essential tool for managing personal finances. Whether you’re checking your balance, making an instant UPI payment, or setting up a fixed deposit, mobile banking apps provide the convenience and security you need to handle all your banking tasks from your smartphone.

In this article, we’ll dive into the most valuable features of mobile banking apps and why you should make them a part of your financial routine.

What Makes Mobile Banking Apps So Popular?

Mobile banking apps have changed the way we think about banking. Gone are the days when you had to visit a branch for basic transactions. Now, everything can be done with just a few taps on your smartphone.

The popularity of mobile banking apps lies in their ability to offer secure, convenient, and real-time banking services. These apps are designed to simplify tasks like transferring money, paying bills, opening savings accounts, and more—right at your fingertips.

Key Features of Mobile Banking Apps

Feature

Benefit

Instant UPI Payments

Send money instantly using UPI apps to anyone, anytime, with no charges.

Account Management

Easily view your balance, recent transactions, and statements at any time.

Bill Payments

Pay utility bills, recharge your phone, and even pay for online purchases.

Fixed Deposit Setup

Open an instant FD account with a few taps and start earning interest.

Loan Application

Apply for personal loans or overdraft facilities directly through the app.

How to Make Payments with Mobile Banking Apps

One of the standout features of mobile banking apps is the ability to make UPI payments. Unified Payments Interface (UPI) allows you to transfer money directly between bank accounts without any delay, whether it's for a personal transaction or a business payment.

Here’s how to make a payment:

Open the Mobile Banking App: Launch your mobile banking app and log in securely using your credentials.

Go to the UPI Section: Find the UPI payments section, where you’ll be prompted to enter the recipient’s phone number or UPI ID.

Enter Payment Details: Specify the amount you want to send and the reason for payment (if necessary).

Confirm and Send: Once you’ve reviewed the details, confirm the transaction with your secure PIN or biometrics. Your payment will be processed instantly.

Benefits of Using Mobile Banking Apps

1. 24/7 Access to Your Account

One of the most significant benefits of mobile banking apps is the ability to access your account anytime, anywhere. You don’t need to wait for banking hours or visit a branch to check your balance or perform any other transactions. Whether you're traveling or at home, your bank is always just a tap away.

2. Instant Payments

Gone are the days of waiting for payments to clear. With UPI payments, you can send and receive money in real-time, ensuring that your financial transactions are processed instantly.

3. Secure Transactions

Banks employ high-level encryption and other security measures to ensure that all your transactions via the mobile app are secure. Most apps also offer features like two-factor authentication (2FA) and biometric login to protect your account.

4. Convenient Savings and Investment

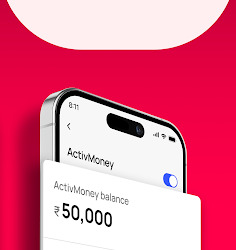

Whether you want to set up an instant FD, open a zero balance account, or simply track your savings, mobile banking apps make it easy to manage your finances and invest securely from anywhere.

How to Set Up an Instant Fixed Deposit via Mobile Banking App

Setting up a fixed deposit using your mobile banking app is quick and hassle-free. Here’s how you can do it:

Open the Mobile Banking App: Login to your bank’s app.

Navigate to the FD Section: Find the section for Fixed Deposits under the investment options.

Choose Your FD Type and Tenure: Select the type of fixed deposit (tax-saving or regular) and the tenure (from a few months to years).

Enter the Investment Amount: Specify the amount you want to invest.

Confirm and Complete the Process: Review the details and confirm. Your FD account will be set up instantly, and you'll start earning interest right away.

How Secure is Mobile Banking?

Security is one of the biggest concerns when it comes to digital banking. Banks ensure that their mobile banking apps are safe by using cutting-edge technology:

Encryption: All your personal and financial data is encrypted to prevent unauthorized access.

Two-Factor Authentication: Many apps require an extra layer of security with OTPs or biometric verification (fingerprint/face recognition) to ensure only you can access your account.

Real-Time Alerts: Stay informed with real-time alerts for every transaction, so you can quickly spot any unauthorized activity.

Fraud Detection: Banks employ advanced fraud detection systems that analyze your transactions and flag anything suspicious.

Conclusion

Mobile banking apps have become a staple for managing personal finances due to their convenience, security, and range of features. From UPI payments and bill payments to instant FD setup, these apps provide a seamless banking experience that’s accessible anytime, anywhere.

By embracing mobile banking, you can save time, enjoy secure transactions, and gain real-time access to your finances. Start using a mobile banking app today and experience the future of banking at your fingertips.

#bank fd#bank fd interest rates#bank fd rates#bank fixed deposit rates#bank khata#bank online account open#bank online application#best banking app#best fd account interest rate#best fd credit card#best fd interest rates#best fd rates#best fd rates in bank#best fixed deposit rates#best interest rate for fixed deposit#best mobile banking app#best online account opening#best rates on fd#check balance#check bank account balance

0 notes

Text

Correcting UPI Transfers: How to Handle Wrong Transfers or Pending Payments

Recently, you have seen everyone using the UPI transaction app. This transaction has created more changes in recent days. UPI money transfer app has transformed the way money is transferred, offering instant, seamless, and secure payments directly from your smartphone. Dealing with a wrong UPI transfer or a pending payment can be incredibly frustrating. Have you accidentally sent money to the wrong account? Or else facing delays in a transaction? Not to worry! There are clear steps you can take to resolve these problems and recover your funds. Ready to take control and fix your UPI payment issues? Stay here to handle incorrect transfers or pending payments.

What is an Incorrect Money Transfer?

UPI accounts allow the transaction to be completed within seconds. An incorrect money transfer occurs when funds are mistakenly sent to the wrong person instead of the intended recipient. Unlike some other payment methods, UPI transfers directly credit the money to the receiver's bank account, making it challenging to reverse or cancel.

What to Do When You Make a Wrong Money Transfer with UPI?

Reach out to your bank immediately and raise a wrong credit chargeback. Provide them with the UTR number of the payment.

If the recipient holds an account with your bank, your bank can directly contact them to request a reversal.

If the recipient's account is with another bank, your bank can only assist as a facilitator. Visit the recipient's bank branch and speak with the manager to request assistance.

The reversal can only occur if the recipient agrees. If they consent, expect the funds to be returned to your account within 7 days.

If the recipient does not respond or the issue remains unresolved, file a complaint on the NPCI portal.

If the complaint remains unresolved after 30 days, approach the Banking Ombudsman to escalate the matter.

What is a Pending Transaction?

A pending transaction refers to a payment that is in a pending state after the money has been deducted. This situation can arise when the payment is completed on your end but not received by the recipient, the payment stays pending, or the transaction is canceled, but the funds are not yet returned.

What to Do When Your Payment is in Pending Status?

Your money is secure, and you will receive it shortly.

Use the online transaction app to report the issue and track the progress.

Allow 48 hours for your bank to update the payment status. If successful, the money will be deposited into the recipient's account. If the payment fails, expect a reversal to your account within 3–5 business days.

Contact your bank directly with the UTR number to raise a complaint for quicker resolution.

After the stipulated time, escalate the issue on the PhonePe app for further assistance and appropriate action.

The Bottom Line

Dealing with incorrect UPI transfers or pending payments can be stressful, but understanding the steps to rectify these issues makes the process smoother. By taking immediate action for incorrect UPI money transfer, you can effectively manage and resolve these problems. Ready to tackle your UPI payment issues? Follow these steps to regain control and ensure your funds are secure.

#online account opening bank#net banking app#mobile banking application#best banking app#open a bank account online#fd account app#opening account online#open a new bank account online#online open saving account#best online account opening#online open saving bank account#open a free bank account#digital account app#bank online account#opening a bank account#bank online#bank khata#open new bank account online#apply for savings account online

0 notes

Text

Starting an Online Business with UPI: How It Helps

The Unified Payments Interface is India’s major step toward a cashless society. It is a payment system that allows users to connect multiple bank accounts to one smartphone app. It also provides fund transfers without needing IFSC codes and bank account numbers. If you add the UPI money transfer app to your business, it’s easy to transfer your money. Ensure you have a smartphone, active bank account, mobile phone, and bank account that are both connected and have better internet access. Here are some key advantages of UPI with business.

Small transaction:

UPI payments allow small shopkeepers and consumers to conduct low-cost transactions. Comparing a Visa and Master card can charge some fee of 1-2% of the transaction amount, UPI transactions are entirely free of cost. This leads to higher savings over the longer term.

Expand your customer:

UPI can help you expand your customer reach. If you have one or two payment options, it affects your business and your customers. Recently, many people have been using UPI accounts to make payments. By including UPI in your business operations, you can connect with several customers and expand your business.

Many accounts with one app:

UPI has allowed you to manage all your bank accounts with a single app anywhere. You don’t need to use various types of apps, just link your bank account to a UPI app. However, you must choose a default bank account, so if anyone pays to your UPI ID, the amount is directly deposited to that account.

Real-time monitoring:

One of the key features of UPI is real-time transaction monitoring. As a small business owner, you can easily track your payments and expenses. Which helps to improve your financial management. With the help of the UPI app, you can maintain a clear and current financial status and improve your financial performance. Also, you can address the problems.

Safe and secure:

Payments can only be transferred from a mobile phone in which your SIM card or mobile number is registered with your bank account. If you are making a UPI payment, you need to verify your secret PIN. The major advantage of UPI is that it makes transactions fast and secure. UPI features like two-factor authentication and encryption can protect against fraudulent activities.

Better than wallet:

Online banking is better than a wallet because you can’t put a lot of money into your wallet. But in online bank accounts, you can save a lot of amounts and use it everywhere. Wallets don’t let business owners earn interest on their balance, but with UPI, your money stays in your bank account. This way, you earn interest on the money you keep in the bank.

Final words: The points mentioned above demonstrate that UPI offers many advantages for your business. It is safe to use UPI as a payment method because it has excellent security features. With UPI payments, your customers can make the fastest money transfers, providing peace of mind for you and your customers.

#online upi#online upi payment app#online zero balance account#online zero balance bank account opening#open a bank account#open a bank account online#open a bank account online free#open a free bank account#open a new bank account#open a new bank account online#open a savings account#open a zero balance account#open a zero balance account online#open account instantly#open account online#open bank account app#open fd#open fd online#open instant account#open instant zero balance account#open new bank account#open new bank account online#open new savings account#open online savings account#open online zero balance account#open saving account#open savings bank account online#open zero balance account#open zero balance account online instantly#open zero balance bank account

0 notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#fd fixed deposit#fd account yearly#online fd app#quick fd account creation#fd account benefits#best fd credit card#best fd account interest rate#fd easy#fd rates#fd investments#best fd rates in bank#best fd interest rates#current fd rates#best rates on fd#fd deposit app#highest fd interest rate bank#highest fd rates in bank#latest fd rates

0 notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#online 0 balance account opening#online savings account opening#new bank account open#open new bank account online#open saving account#online open saving bank account#open a bank account online free#online saving bank account#0 bank account opening#instant bank account#zero balance account app#opening a bank account#bank account opening process#online savings bank account#bank account opening procedure#bank online account open#zero balance account open online

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open fd#create fd#fd deposit app#online fd app#bank fd#online fd#fd app#upi apps#pay upi#open fd online#fix deposit#upi payments#upi app#upi payment app#easy net banking app#scan and pay#scan to pay#upi pay#upi earning app#upi transfer#upi new app

0 notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#digital account#app upi mobile banking#upi enabled app#upi net banking app#fd account yearly#quick fd account#mobile banking account#upi mobile banking app#safe mobile banking#fast mobile banking#mobile banking account app#phone banking#net banking app upi#banking mobile upi#upi net banking#contactless banking#fd easy#mobilebanking app upi#upi account check#open fd

0 notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#mobile banking account#upi mobile banking app#safe mobile banking#fast mobile banking#mobile banking account app#phone banking#net banking app upi#banking mobile upi#upi net banking#contactless banking#fd easy#mobilebanking app upi#upi account check#open fd#digital account#app upi mobile banking#upi enabled app#upi net banking app#fd account yearly#quick fd account

2 notes

·

View notes