Don't wanna be here? Send us removal request.

Text

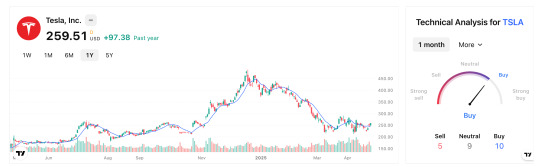

What are the potential risks for Tesla in the next few years?

Tesla's K-line is drawn with dreams, but account profits and losses require real money #Tesla #TSLA #stocks #Mask

1. Execution Risks

Cybertruck Production: Stainless-steel exoskeleton adds 30% cost premium; annual output of 250k units may lag behind Rivian’s R1T (150k in 2024).

Optimus Scaling: Prototype costs $150k/unit vs. $20k target; delayed commercialization to 2026.

2. Regulatory and Legal Challenges

Autopilot Scrutiny: NHTSA’s 2024 probe into 736 crashes could mandate recalls or FSD restrictions.

EU Tariffs: 25% tariffs on Chinese-made EVs threaten Berlin Gigafactory’s $4B/year revenue.

3. Market Saturation and Competition

Price Wars: BYD’s Seagull ($10k) pressures Tesla’s ASP; Model 3 discounts hit 15% in China.

Legacy OEMs: Toyota’s solid-state battery (2027 launch) targets 500-mile range, challenging Tesla’s 4680 roadmap.

4. Leadership and Liquidity Risks

Musk’s Influence: Dual-class stock structure concentrates power; legal battles (e.g., 2024 Delaware lawsuit) risk governance instability.

Debt Maturities: $12B due by 2026; rising rates could increase refinancing costs by $500M/year.

0 notes

Text

Based on quantitative ratings, today's stock: NYSE:LYV

Live Nation Entertainment (NYSE: LYV) remains a dominant force in the global live entertainment industry, leveraging its vertically integrated model spanning concert promotion, venue operations, and ticketing via Ticketmaster. This report analyzes LYV’s financial trajectory, competitive positioning, and stock market outlook through 2025 and beyond, incorporating critical metrics such as revenue growth, margin trends, and ESG risk profiles. With a current price of $152.32 (as of February 2025) trading at a 17% premium to Morningstar’s $130 fair value estimate, LYV presents a nuanced opportunity for growth-oriented investors despite near-term valuation concerns.

0 notes

Text

How to Interpret the 2025 Outlook: A Step-by-Step Guide

1. Analyze Valuation Ratios

Compare price-to-earnings (P/E), price-to-book (P/B), and price-to-FVE ratios.

Example: CME Group’s 2025E P/E of 23.7 suggests moderate valuation relative to its earnings growth (1.6% revenue growth forecast).

2. Evaluate Economic Sensitivity

Sectors like banking thrive in steep yield curve environments. Post-election policies (e.g., Republican-led M&A friendliness) could boost investment banks like Goldman Sachs (ROE: 13.2% in 2025E).

3. Monitor Earnings Revisions

Companies with upward earnings revisions often outperform.

Example: Arista Networks’ AI-driven growth momentum positions it for EPS increases, aligning with its "Undervalued" star rating.

4. Assess Macro Risks

The Federal Reserve’s rate-cut pace and inflation trends will impact interest-sensitive sectors. Charles Schwab’s 2025 outlook notes that a gradual rate-cut trajectory could stabilize net interest income for banks.

2025 Stock Market Outlook

0 notes

Text

What Is the Stock Market 2025 Outlook and How Should Investors Navigate It?

The stock market 2025 outlook refers to the collective analysis, forecasts, and expectations for equity markets in the year 2025. It encompasses projections about economic conditions, corporate earnings, sector trends, geopolitical influences, and monetary policies that could shape market performance. This outlook is critical for investors to align portfolios with emerging opportunities and risks. Below, we break down its definition, significance, and practical applications—supported by real-world examples from leading analysts and institutions.

0 notes

Text

What Is Stock Market Outlook and How to Interpret It for Investment Success?

The stock market outlook refers to the collective analysis and forward-looking assessment of market conditions, trends, and drivers that influence equity valuations. It synthesizes macroeconomic factors, geopolitical events, sector-specific dynamics, and investor sentiment to project potential opportunities and risks. Analysts use this outlook to determine whether markets (or individual stocks) are undervalued, fairly valued, or overvalued relative to their intrinsic worth.

0 notes

Text

Apple's quantitative rating is a bit low, is it still worth buying?

0 notes

Text

A new website is launched, focusing on stock value investment research and analysis, and it is completely free

1 note

·

View note