#Gold Mining Market Challenges

Text

Unveiling The Gold Mining Market: Trends, Insights, And Key Players

Introduction

Gold mining is a critical sector in the global economy, driven by the enduring value and demand for gold as a precious metal. This article delves into the dynamics of the Gold Mining Market, exploring its trends, growth drivers, challenges, and key players shaping the industry landscape.

Understanding the Gold Mining Market

Gold mining involves the extraction of gold from the earth's crust through various methods, including surface mining, underground mining, and placer mining. Gold has been prized for centuries for its intrinsic value, serving as a store of wealth, a hedge against economic uncertainty, and a component of luxury goods and jewelry.

Gold Mining Market Research Reports

Market research reports provide valuable insights into the gold mining industry, offering analyses of market trends, production statistics, exploration activities, and regulatory developments. These reports assist investors, mining companies, and policymakers in making informed decisions regarding investment, expansion, and policy formulation.

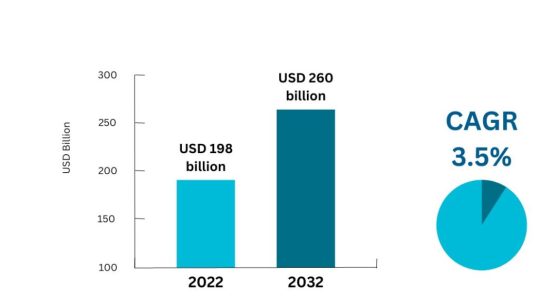

Gold Mining Market Size

The global gold mining market is substantial, with billions of dollars invested annually in exploration, development, and production. According to recent data, The global gold mining industry was valued at approximately USD 353 billion in 2020. Gold production totaled over 3,000 metric tons in the same year, with major gold-producing countries including China, Australia, Russia, and the United States.

The market size is expected to grow steadily in the coming years, driven by factors such as increasing demand for gold in jewelry, investment, and technology sectors.

Gold Mining Market Trends

Several trends are shaping the gold mining market, including:

Technological Innovation: Advances in mining technologies, such as automation, artificial intelligence, and data analytics, are enhancing efficiency, safety, and productivity in gold mining operations. Innovative extraction methods and processing techniques are also improving recovery rates and reducing environmental impacts.

Sustainable Practices: There is a growing emphasis on sustainable mining practices in the gold mining industry. Companies are increasingly adopting eco-friendly technologies, implementing biodiversity conservation measures, and engaging with local communities to ensure responsible mining operations.

Exploration and Discovery: Despite being a mature industry, gold mining continues to benefit from ongoing exploration efforts aimed at discovering new gold deposits. Remote sensing technologies, geological modeling, and geochemical analysis are facilitating the identification of prospective areas for gold exploration.

Gold Mining Market Growth

The gold mining market is experiencing steady growth, driven by factors such as:

Safe-Haven Demand: Gold is often perceived as a safe-haven asset during times of economic uncertainty, geopolitical tensions, and currency fluctuations. As a result, demand for gold tends to increase during periods of market volatility, supporting the growth of the gold mining industry.

Investment Demand: Gold serves as an attractive investment option, offering diversification benefits and hedging against inflation and currency devaluation. Institutional investors, central banks, and retail investors allocate significant capital to gold-backed exchange-traded funds (ETFs), physical gold holdings, and gold mining equities, driving demand for gold and stimulating mining activities.

Gold Mining Market Challenges

Despite its growth prospects, the gold mining industry faces several challenges, including:

Environmental Regulations: Gold mining operations have significant environmental impacts, including habitat destruction, water pollution, and land degradation. Regulatory requirements related to environmental protection, biodiversity conservation, and mine closure are becoming increasingly stringent, posing compliance challenges and increasing operational costs for mining companies.

Cost Pressures: Rising production costs, labor shortages, and fluctuations in energy and commodity prices can exert pressure on the profitability of gold mining operations. Companies must optimize their operations, implement cost-saving measures, and invest in technological innovation to remain competitive in a challenging operating environment.

Social License to Operate: Community relations and stakeholder engagement are critical for obtaining and maintaining a social license to operate in the gold mining industry. Companies must address social and cultural concerns, respect indigenous rights, and mitigate social and environmental impacts to secure community support and regulatory approvals for their mining projects.

Key Players in the Gold Mining Market

The Gold Mining Market is dominated by several major players, including:

Newmont Corporation: Newmont is one of the world's largest gold mining companies, with operations in multiple countries and a diverse portfolio of gold assets.

Barrick Gold Corporation: Barrick Gold is a leading gold producer, with mines located in North and South America, Africa, and the Asia-Pacific region.

AngloGold Ashanti Limited: AngloGold Ashanti is a global gold mining company, with operations in Africa, the Americas, and Australia.

Polyus PJSC: Polyus is the largest gold producer in Russia and one of the top gold mining companies globally, with significant reserves and production capacity.

Kinross Gold Corporation: Kinross Gold operates mines in North and South America, West Africa, and Russia, producing gold and silver.

These key players leverage their operational expertise, financial resources, and exploration capabilities to maintain their competitive positions in the global gold mining market.

Conclusion

The gold mining market remains a vital component of the global economy, driven by enduring demand for gold across various sectors. Despite facing challenges such as environmental regulations and cost pressures, the industry continues to grow, supported by technological innovation, investment demand, and exploration efforts. As the industry evolves, collaboration, sustainability, and responsible mining practices will be essential for ensuring the long-term viability and success of the gold mining sector.

#Gold Mining Industry#Global Gold Mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Companies in India#Gold Mining Companies#Gold Mining in Alaska#Gold Mining Equipment#Gold Mining Tools#Gold Mining Industry Research Reports#Gold Mining Market Challenges#Gold Mining Market Research Reports#Gold Mining Market Emerging Trends#Gold Mining Market Outlook#Gold Mining Market Major Players

0 notes

Text

Shining Perspectives of the Gold Mining Industry, Industry Growth and Outlook

Exploring the vast expanse of the Global Gold Mining Market requires a nuanced understanding of its dynamics, challenges, emerging trends, and the key players steering the industry. In this comprehensive dive, we unravel the intricacies of the Gold Mining Market, shedding light on its analysis, growth prospects, challenges, and emerging trends.

Gilded Perspectives: Analyzing the Global Gold Mining Market

The Global Gold Mining Market serves as a cornerstone in the mining industry, shaped by economic trends, geopolitical factors, and the relentless pursuit of the precious metal. Analyzing its multifaceted nature provides valuable insights for industry stakeholders and investors alike. Gold Mining Market Analysis reveals a robust landscape influenced by factors such as global economic stability and currency fluctuations. The Global Gold Mining Market witnesses consistent growth, driven by increased demand for gold in jewelry, technology, and as a safe-haven investment. The Gold Mining Market Size is poised to reach USD 150 billion by 2025, showcasing an annual growth rate of 8%.

The Golden Growth Trajectory: Unraveling Market Size and Share

Understanding the size and share dynamics of the Gold Mining Market is pivotal for investors seeking profitable ventures and industry players navigating competitive landscapes. The Gold Mining Market Share is distributed among key players, with established mining conglomerates holding a dominant position. The Gold Mining Market Size is buoyed by the emergence of new mining operations and technological advancements. Major players like Company X and Company Y collectively command a 30% share of the Global Gold Mining Market.

Gold Mining Market Trends

Navigating the trends shaping the Gold Mining Market unveils opportunities for industry participants and underscores the need for adaptability in a dynamic environment. Evolving consumer preferences and sustainable mining practices emerge as prominent Gold Mining Market Trends. Technological integration, including AI and data analytics, is revolutionizing operational efficiency in the Gold Mining Industry. Investments in sustainable mining technologies have witnessed a 20% annual increase, indicative of the industry's commitment to responsible practices.

Gold Mining Market Hurdles

The path to prosperity in the Gold Mining Market is not without challenges. Identifying and mitigating these challenges is imperative for sustained growth. Gold Mining Market Challenges include regulatory complexities, environmental concerns, and fluctuations in gold prices. Adapting to stringent environmental regulations and community engagement pose ongoing challenges in the Gold Mining Industry. Regulatory compliance costs have surged by 18% annually for Gold Mining companies globally.

Emerging Trends: The Shifting Sands of the Gold Mining Market

Exploring the horizon of emerging trends in the Gold Mining Market unveils potential avenues for innovation and growth. Gold Mining Market Emerging Trends encompass the integration of blockchain technology for transparent supply chain management. Resurgence in artisanal and small-scale mining practices emerges as a noteworthy trend in the Global Gold Mining Market. Artisanal and small-scale mining operations contribute to 15% of the total gold production globally.

A Glimpse of Gold Mining in India: Opportunities and Challenges

Delving into the nuances of Gold Mining in India adds a regional perspective to the global narrative. Gold Mining Market in India is witnessing increased exploration activities and government initiatives to boost domestic production. Challenges in land acquisition, regulatory hurdles, and community engagement are critical aspects of the Gold Mining Landscape in India. India's gold consumption is projected to grow at a rate of 7% annually, signaling robust demand.

Conclusion: Navigating the Golden Landscape

In conclusion, the Global Gold Mining Market stands as a testament to the intricate interplay of economic, environmental, and geopolitical factors. Analyzing its vast landscape provides stakeholders with the tools to navigate challenges, capitalize on emerging trends, and contribute to the sustainable growth of the industry.

#Gold Mining Industry#Global Gold Mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Market Trends#Gold Mining Market Value#Gold Mining Market in India#Gold Mining Market#Gold Mining Market Challenges#Gold Mining Market Emerging Trends#Gold Mining Market Outlook#Gold Mining Industry Research Reports#Gold Mining Market Research Reports#Gold Mining Market Major Players

0 notes

Text

"Gilded Strategies: Navigating the Gold Market in 2023 for Golden Returns"

youtube

Are you seeking a reliable and stable investment opportunity to diversify your portfolio and hedge against inflation? Look no further than the gold market. Investing in gold has been a cornerstone choice for investors throughout centuries, owing to its enduring value and global appeal. In this comprehensive guide, we delve into the world of gold investing, offering insights to help you make informed decisions to grow your wealth over time. Whether you're a seasoned investor or just beginning your journey, this article is your ultimate resource for understanding the golden touch and maximizing your investments.

1. Understanding the Basics

Gold investing is not merely for pirates and treasure hunters; it's a serious investment strategy with the potential to safeguard your wealth and achieve financial goals. Before delving into the gold market, it's crucial to grasp the fundamentals. Gold is a commodity traded on global markets, much like stocks, bonds, or oil. Its value fluctuates based on various factors, including supply and demand, economic conditions, geopolitical events, and environmental factors.

2. Hedge Against Inflation

Gold serves as a hedge against inflation, preserving purchasing power during times of economic uncertainty. As the cost of living rises, the value of paper currency diminishes, making gold an attractive store of value. During crises such as wars, recessions, or pandemics, gold often emerges as a safe-haven asset, witnessing record-high prices as investors seek stability.

3. Diversification

Gold helps diversify investment portfolios, mitigating risk by spreading investments across different asset classes. Its unique behavior compared to stocks and bonds allows it to act as a counterbalance, potentially enhancing overall returns and reducing volatility.

4. Stability

Unlike stocks or bonds, gold exhibits relative stability over time due to its finite supply and historical reputation as a store of value. This stability offers protection for investors' wealth, providing a reliable source of returns amidst market fluctuations.

5. Investment Strategies

There are several avenues for investing in gold, including physical gold, gold ETFs, gold mining stocks, and gold futures. Each option comes with its pros and cons, catering to diverse investor preferences and risk appetites.

6. Physical Gold

Investing in physical gold, such as coins, bars, or jewelry, offers tangible ownership and control. However, storing and insuring physical gold can be costly, and liquidity may pose challenges.

7. Gold ETFs

Gold exchange-traded funds (ETFs) provide exposure to physical gold without the hassle of storage. They offer liquidity and convenience, although fees and market fluctuations can impact their value.

8. Gold Mining Stocks

Investing in gold mining stocks allows investors to benefit from gold price appreciation and company success. Yet, these stocks are subject to operational risks and regulatory challenges associated with mining operations.

9. Gold Futures

Gold futures contracts enable investors to speculate on gold prices without owning the physical asset. However, they require a high level of expertise and entail complex risks associated with futures trading.

10. Future Trends and Challenges

Emerging trends such as increasing demand from emerging economies and the rise of sustainable investing could shape the future of the gold market. However, challenges like competition from cryptocurrencies and the impact of climate change on mining operations warrant attention.

In conclusion, investing in gold offers a myriad of benefits, including diversification, stability, and a hedge against inflation. By understanding the basics, exploring different investment vehicles, and staying abreast of market trends, investors can potentially capitalize on the golden opportunities that the market presents. Remember, while gold investment can be rewarding, it's essential to conduct thorough research and assess risk before making investment decisions. With the right knowledge and strategy, you can unlock the golden touch in your investment portfolio.

Get More taste of opulent luxury at

#Gold investing#diversification#hedge against inflation#stability in commodities#ETFs#mining stocks#futures#emerging economies#sustainable investing#market trends#challenges in wealth preservation#portfolio management for financial goals#precious metals#risk assessment#informed decisions#GoldInvesting #Diversification #InflationHedge #ETFs #MiningStocks #EmergingEconomies #SustainableInvesting #MarketTrends #WealthPreservation #PreciousMetals #RiskAssessment #FinancialGoals #PortfolioManagement #InvestmentStrategy

youtube

#Gold investing#diversification#hedge against inflation#stability in commodities#ETFs#mining stocks#futures#emerging economies#sustainable investing#market trends#challenges in wealth preservation#portfolio management for financial goals#precious metals#risk assessment#informed decisions#GoldInvesting#Diversification#InflationHedge#MiningStocks#EmergingEconomies#SustainableInvesting#MarketTrends#WealthPreservation#PreciousMetals#RiskAssessment#FinancialGoals#PortfolioManagement#InvestmentStrategy#Youtube

0 notes

Text

Winter bucket list

Making a cute chocolate station. Look for inspo on Pinterest.

Write your Christmas wishlist. I'll upload mine soon!

Try new coffee recipes. Like adding cinnamon or syrups.

Plan your holiday outfits. Plan ahead to reduce stress! :)

Go ice skating. Maybe go with some friends!

Bake some Christmas cookies. Come up with cute designs to decorate them! <3

Decorate your room. I'm going for a Pink, White, and Gold theme again.

Get a cute winter manicure. Maybe some snowflakes and glitter!

Buy a Christmas-scented candle. My favourites are Yankees!

Spend an evening reading poetry books. Cuddled up in a fluffy blanket in front of the fireplace...

Make a snow angel. And take a picture of it!

None stop listening to Christmas music. I do it every year...

Write letters to your loved ones. Maybe to your friends who live far away! <3

Go see the Nutcracker. One of my winter traditions! :)

Host a Hot Chocolate get-together. You can also play some card or board games. <3

Have a Christmas movie marathon. No explanation needed. Essential.

Donate clothes, toys, and money to charity.

Visit a Christmas market. I love Christmas markets <3

Go gift shopping. Start early, so you don't get stressed.

Do some volunteer work. Maybe at a shelter! :)

Go for long walks in the snow. Cuddled up in a warm, large scarf...

Try knitting a chunky sweater. Take the challenge, haha.

Take a candlelight bubble bath. You can also read a book to relax even further.

Buy some adorable earmuffs. Totally in and super cute!

Practice making pretty and fancy bows. I see gift wrapping as competition; fancy bows Always get bonus points!

Host a gingerbread house competition. Fun and also a bit messy, haha.

Review your 2022 goals and make a 2023 vision board.

I hope everyone has been feeling well, and I wish all of you a beautiful Christmas time! Spread some love and positivity <33

As always, Please feel free to add more suggestions in the comments!

✩‧₊*:・love ya ・:*₊‧✩

#aesthetic#coquette#dream girl#girl blogger#it girl#pink blog#that girl#pinterest#pink pilates princess#malusokay#winter#christmas#xmas 2022#angelcore#angelic#health and wellness#angel aesthetic#coquettecore#dollete aesthetic#dollette#bucketlist#feminine aesthetic

1K notes

·

View notes

Text

Costume time!

Okay, you know what, I want to share this process and I've chosen y'all to suffer with me.

SO! A friend of mine doesn't have a spooky show to produce this year, and so is putting all his energy into a cool-ass halloween event (Fancy paper invites, puzzles to solve, challenges, games, seances, etc). The whole thing is themed around this fake secret society that we're all now part of, and the dress cose and we're being encouraged to come up with cool fancy clothes/outfits to match the theme to come in. Best description I can come up with for this theme is "Fancy witchy-vampire" (Like, think VtM, but witchier).

THAT SAID. I'm still out of a job, so, I've got to be strategic. AND I've got the itch to make things. Even better. (More past the cut!)

I don't have photos for a lot of these earlier decisions and stages, sorry. BUT I go through my closet and costume tubs (the for-fun-or-cosplay costumes as well as the circus/performing ones) and have a nice closet-runway to figure out what I'm starting with and settle on this one burgundy satin wrap top with big-ass sleeves that I love. . .that unfortunately doesn't go with much that I have in my wardrobe that vibes with the theme. (There's like. . .one or two things it works with, but I want to be FANCIER). So I sketch around and come up with an idea based around this shirt (and a statement necklace collar I have that was some of the best $5 I've ever spent)

I have this old dress I'd bought at a flea market years ago and had altered to be an overskirt for a hoop skirt, and then it's been worn as a bustle with the bodice tucked away more times than it's felt hoops. It's a similar color as the top, so I figured I'd finally take the bodice off it, pull it in to be something I could walk in that wouldn't trail on teh ground, and I could set it under a corset in the center. Bing-bang-boom! Genius!

No. The skirt and the shirt were similar-but-different enough colors and textures that they clashed. Damnit. Well, I can ditch the skirt and figure out the rest! Some skinny moto pants. A decorative corset - I could embroider a corset (Myr no), or, ooh, use gold appliques (Okay, more realistic, proceed).

Next step was to mock things up as I'm trying to find what I want without purchasing a bunch of shit, which got me to this:

Okay okay okay. Cool, I've got a direction (that's not the shirt, but it's the closest I coudl find online to use, so I used it). Now for the endless internet and thrift store (No fingers, not thirst store, dear god) and internet thrift store searching to find me some cool-ass pants and a corset and some shoes that'll work with this. You'll notice, though that my statement necklace has been swapped out for cool-strappy-thing. Because statement necklace-collar is geometric and GOOD LUCK finding geometric applique.

Harder than I expected. Took me a couple months to find things that weren't lots of money that I could afford. BUT I EVENTUALLY DID IT. This included buying multiple corsets with the intention of returning things. Benefits of modern shopping.

The happy "lets try everything on" day was this weekend!

SO FAR SO GOOD. Took a poll from friends and the short corset is the winner. It's definitely the best constructed of the three, though the pants aren't QUITE high enough waist to be able to wear under it without some adjustments. But it'll do. The shoes turned out to be dark brown instead of black, so I need to see about making them black (and fixing them so the tongue doesn't decide to go deep diving towards my toes.) Other things to do: bring in the wrists of those sleeves some, they're a bit too big (Here they're clipped with bobby pins), decorate the corset, maybe add some gold detailing onto the pants? They've got that gold ridging along the thighs that you find on moto-pants, but that's absolutely invisible most of the time, so I think if I just brush some gold paint along the tops of those ridges, it'll make them pop in a good way.

You'll note that none of these photos have the strappy-thingy, and instead we're back to the statement necklace-collar. Turns out the differece between the image I found on the internet and teh shirt I own is enough that you BARELY SEE the strappy. Also, I decided that instead of using applique, I'd buy some gold paint, make a design that'd work, and paint it on the corset. Only time will reveal whether this was a good or a bad idea.

Other thing this showed me is that this doesn't feel FANCY enough. So I'm coming back to that half-skirt idea. This time, though I'm thinking about something sheer - either a burgundy to match the top, or a black with gold accents (OR A FULL DESIGN?!?!?!).

Last night I got flat photos of the corset for figuring out the design, since the shape I was working with in my sketches doesn't match the chosen corset shape. Pls to enjoy some of the designs I was playing with:

Proooooobably going to see about adjusting the eye design. I think it fits the theme best.

Last night I started on the alternations by taking in the waist of the pants. Please have this photo that happened 30 seconds before my thread was attacked.

82 notes

·

View notes

Text

TESFest Day 3: Teeth

Hi everyone, I got this idea and couldn't get it out of my head! I'd also like to dedicate this piece to @argisthebulwark as it features their special guy Brynjolf. You've brought me so much joy with your writing so I wanted to begin to return the favour with this short little piece <3 (also Brynjolf is so fun to write I'm def gonna write more with him).

Prompt: Teeth

Tagging: @tes-summer-fest

Words: 498

Warnings: T, suggestive but not much.

The Cistern was a buzz with celebration in honour of the newest recruit’s latest job. It hadn’t been an easy one, that’s why Brynjolf assigned it to them; they had shown a natural talent that day in the Market. And after a few jobs, the Master Thief figured they could take on something a bit more intense.

The job involved a trip to Solitude, into the East Empire Company headquarters to locate some documents of a visiting company member. From there, they were instructed to steal the documents from the safe, as well as steal a necklace. Whether or not they were interested in cleaning the place out, he left that up to them. He also added a little… challenge, if they found themselves so inclined.

“Ey, supposedly the man has two gold teeth” he said. They turned their head quickly in his direction.

“Is that a challenge Brynjolf?” He shoots them a grin and places a hand on the small of their back as he passes by.

“Think of it as a chance to prove your stuff.”

Whether or not they ‘proved their stuff’ remained to be seen, but they did succeed in getting the necklace and the document from the headquarters with none the wiser. And for that Brynjolf was impressed. After a few rounds of drinks, they wander over to him. Their normal saunter exaggerated due to their success.

“I suppose congratulations are in order, well done.”

“The pleasure is all mine Brynjolf.” They offer him a small bow complete with a wide grin on their face. “But don’t think I forgot about your little challenge.” Oh he’s intrigued. Dipping to the side pockets of their guild armour, they pull out two pieces of gold that shine in the candlelight of the Cistern.

“You even managed to take the man’s teeth, I gotta say I’m impressed.” Brynjolf took both teeth in his hands, tossing them slightly in the air. “Any chance you’ll tell me how you walked out without him noticing?” They catch the teeth mid-air.

“Oh you know me Brynjolf, I never kiss and tell.” They gave him a smirk while brushing their hand slowly across his armour. He decides to match their energy by grabbing the hand on his chest, placing a chaste kiss on it.

“Is that so?” They hum a bit under his touch, placing one hand on his side and moving the other from his face to shoulder.

“Everyone’s gotta have their secrets, you of all people should know that Brynjolf.” Just as he was going to make a move, close the distance between them, they slink away. He lets his eyes linger on their form a little too long, as he watches them rejoin their friends. It is only when he reaches into his side pocket, does Brynjolf know something is missing. They had pickpocketed him! Brynjolf lets out a dry chuckle, serves me right for letting my guard down. This new recruit was sure going above in beyond.

#tesblr#my writing#skyrim fanfic#skyrim fanfiction#tesfest23#brynjolf#brynjolf x reader#x reader#x reader fanfic#skyrim x reader

96 notes

·

View notes

Text

This post is long! Everything under the cut!

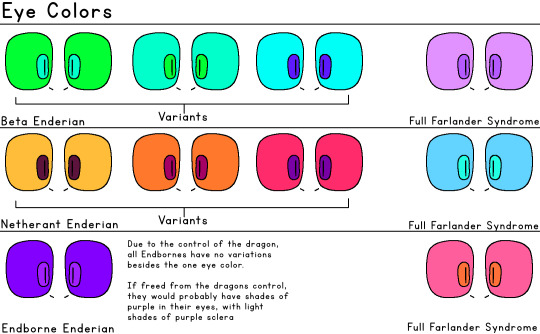

Overall Information

The two subclasses Beta and Netherant are remnants of the Enderians who escaped the End before the dragon came to power, with them evolving to fit their environment after centuries

eye contact is seen as a challenge to combat, but Endbornes are the only ones who become instantly enraged

the subclasses Netherant and Beta have been known to crossbreed, though this is not without chances for defects

Beta / Cavedweller

Shortest of the Enderian Subspecies, around 5'11, so they can traverse caves better

Lives mostly in caves, mostly in Lush biomes or close to the Deep Dark, in small communities.

thick fur on feet to muffle noises

excellent hearing

green and blue parts glow in the dark

Short blunt horns, mostly used for sparring or light mining

slightly resistant to water

piebaldism is more common than other subspecies

has cool blues and cool purples in their palettes

extremely skittish

no back spines

splotch-like patterns

Netherant Enderians

Midsize, average height 6'5" to traverse the nether's lower roofs and foliage

live all over the Nether, mostly in the crimson and warped forests

warmer colored to match the Nether palette

orange/yellow parts can be bioluminescent

excellent heat resistance

large bulky horns built for defense and sparring

-lives mostly in small villages on cliffs or near the Nether roof

most disagreements are solved through regulated fighting

prone to exploration

patterns are striped, like a tiger

True / Endborne Enderians

Tallest of the subclasses, average around 7'4"

all Endborne are influenced by the Ender Dragon, making them drones for Her.

some travel to the Overworld, but most stay to the end

highly aggressive towards other subclasses

nomadic

long, thin horns, mostly decorative

colored only in shades of purple and purple-blacks

patterns are dotted or circular

(Remember: You can mix spike colors and pattern placement to your discretion. Everything in these documents is a BASELINE for your creative designs!)

Trading between Beta and Netherants

Trading between the subclasses is common, and even encouraged! due to the Nether being full of potion ingredients, quartz, gold, and other things that are hard for Betas to get, and the Overworld having resources like vegetables, fruits, colorful dyes, and ores like diamonds and iron that are hard for Netherants to get.

Normally, in Netherant and Beta villages, there will be portals leading to the other side, where these villages will develop around trading goods back and forth, allowing for both sides to thrive, relationships to form, and holidays and traditions to be recognized and proformed.

Basically, a giant, enderman themed Farmer's Market

Clothing

Enderborne Enderians, due to becoming drones for The Ender Dragon, normally do not wear ornate clothing with patterns like their subspecies counterparts. This isn't seen as a issue, due to Enderians naturally not having any secondary sex characteristics, due to their way of reproduction not involving sexual activity

Netherant Enders normally wear clothing that is warm toned, with breathable fabric, with little layering, with patterns that are angular or boxy

Golden jewelry and leather bracelets and chokers and similar items are worn commonly.

Colors like brown, orange, red, and white, warm purples and shades between are the standard

Beta Enders have slightly more baggy and thick clothing, with colors more on the cooler side, ranging in blues and green and cooler purples are common. their patterns are swirly and wave-like

Iron jewelry is common, with dangly piercings and necklaces

Elytra?

Elytra are a common clothing/mobility aid among Enderians, which are craftable through rituals.

It's a very expensive ritual, and it's normally preformed by village elders, giving each Enderian a elytra when they come of age.

Elytra are seen as the most important garment a Enderian has, and they care for them almost religiously

Mending and Unbreaking III are commonly put on Elytra to make them highly durable

Body Painting

Body painting is common, normally done for formal events, parties and celebrations, but there are Enderians who paint their bodies casually as well, and this is accepted. There are sections of enderian bodies made on or off limits depending on the event, but as the formality of the event increases, so does the amount of patterning on the body.

Holidays

Lots of Player holidays have been adopted by Enderian cultures, especially as cultures mix and grow with time, but there is one Enderian holiday, basically the mother of all parties…

the Longest Night Festival!

This festival takes place on the Winter Solstice, which is the longest night of the year. Enderians will gather in their villages and around portals linking Beta and Netherant villages, where Enderians will host large parties full of food, drinking, dancing, and gift giving.

Enderians will wear ornate costumes (similar to masquerade balls), and bring out their finest paints and jewels.

Enderians will sell/trade moon themed gifts and foods, and tell stories passed down from generations ago about the moon, stars, and the Home Dimension…the End.

Expect tons of fireworks and bonfires!

It's said to be bad luck to wear anything sun-related on Longest Night. It's almost a insult!

Reproduction

Enderians have no real sexual organs, so their reproduction takes a odd turn…through their mouth!

Ender pearls, the core of a Enderian's teleporting, also acts as eggs. Once a month, similar as human ovulation cycles, Enderians will develop a second ender pearl, which they will regurgitate. Enderian mouths open that wide for that reason. (even though it does work as intimidation!)

Enderians will bring up the pearl, holding it in their jaws, before giving the baseball-sized pearl to their partner, who will pierce it with their hollow canine teeth, and fill it with their blood (not painful). This creates the two halves required to make a whole. The pearl will grow in size to accommodate the growing hatchling

Sadly, this means enderians with WPS are infertile when it comes to pearls…

There is a growing number of Enderians who will give their pearls up for donation (similar to sperm banks? Egg donors? Think that)

It's seen as lewd for a Enderian to drop their jaws fully in public

Endborne Genetics

Due to Endbornes being inherently hostile towards the other subspecies of Enderians, it is common for Endborne deaths from other Enderians

What's been happening as of late, Enderians from the two subspecies will draw blood from the dead Endborne and take the blood and inject it into a donor pearl, creating Endborne hybrids!

Disorders and Defects

Warped Pearl Syndrome (WPS) is a defect where the ender pearl develops incorrectly, normally causing a ender pearl to look warped or twisted

This disorder causes teleporting to be extremely difficult or unstable, normally causing what would be a stable, normal teleport to become erratic, making the affected Enderian warp in short, fast, uncontrollable spurts, which causes pearl pains, and short fainting spells due to the stress put on the enderian.

Causes

-Family History

-Severe injury to the pearl early in life

-Farlander Syndrome

Piebaldism / White Spotting

This is mostly a cosmetic defect that causes irregular white patches of skin on a enderian. This shows no internal harm or side effects, but it makes them easier to spot, and they are sometimes seen as more "exotic"

Causes

-Family History

-Being a Beta (it's more common in Beta and Beta hybrids)

-Farlander Syndrome

Early Hatchling / Premature Hatching

Sometimes, a enderian will hatch from their egg early, which can cause defects and irregular development. Normally it causes Enderians to develop slower in their early years, but they catch up as they grow. They are also normally shorter than normal

Farlander Syndrome

It's said that if one travels too far from home, they will encounter someplace called the Farlands, a land of warped terrain and strange creatures…

It was said to be false, but then Enderians came from these "Farlands" changed. Their normally dark coats turn white, and their eyes turn different colors and shades. In some cases, their pearls will warp and twist into unusablity. If they stay there too long, it seems their minds corrupt as well.

Mild cases of Farlander Syndrome will cause changes in eye color, and will cause post-birth piebaldism. There is no known cure

...phew, that's all I have for now, If you have any ideas for my version of Enderman/Enderians, please comment!

#art#original art#artwork#minecraft oc#minecraft#mineblr#enderman#enderman oc#enderman headcanons#minecraft enderman#headcanon#character design#character art#art by me#original character#species design#furry#sfw furry#furry art#furry oc#furry fandom#furries#anthro

37 notes

·

View notes

Text

Kayhi808 Masterlist

Bucky Barnes (Winter Soldier) Masterlist

Second Chances - Billy Russo (Completed)

Reader started off as casually dating Billy Russo, but things change once she decides she deserves more.

Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7, Part 8, Part 9, Part 10

Second Chance Xmas, Christmas Bill

More Than Our Scars Master List- Billy Russo (Completed)

Billy Russo (Season 2) AU- Billy had a mission to take down Kingpin that went sideways & left him scarred & injured. One night he comes across Reader, who is also a victim of Wilson "Kingpin" Fisk. Together they'll topple New York's biggest crime lord.

Hurry Home - Billy Russo (Completed)

Billy leaves on a mission and returns to a destroyed life

Part 1 , Part 2, Part 3

Return Home - Billy Russo

Billy and Reader meet up years later. Can they repair what was once destroyed?

Part 1, Part 2, Part 3

Challenge Accepted - Billy Russo (Completed)

What started off as a long distance, friends with benefits relationship, changes once you move to NYC to advance your career.

Billy Mine Master List - Billy Russo (Completed)

Juliet's loved Billy since she was 3 years old. Life chose different paths for them, but fate brings them back together 20yrs later.

The Assassin- Billy Russo (Completed)

Part 1, Part 2, Part 3, Part 4

Perfect Match - Masterlist

You are kidnapped by Billy, one of the best assassins in the world because your father double crossed him on a deal. Your grandfather is head of the Luciano crime family & you are determined to supersede you father as the next head of the family, but you need a husband to rule by your side.

What Happens in Vegas...

...Stays in Vegas

Company Party

Part 1 , Part 2

One-shots:

Birthday Pickup - Billy Russo

Valentine's Day - Billy Russo

Gold Rush -Billy Russo

Farmers Market - Billy Russo

Betrayed - Billy Russo

Legends - Billy Russo

Only By 1000% & 1000% Better - Billy Russo

I'll Survive - Billy Russo

Poor Planning - Billy Russo

Pretty - Billy Russo, Pretty 2 , Pretty 3

Collision - Billy Russo

Asks:

Betrayed 2

Mandy's Sweater Weather Challenge

Krewe of Boo - Bucky Barnes

You Were Never Mine - Billy Russo (Marines)

Rainy Days - Billy Russo

The Darkling's Pet - Part 1, Part 2, Part 3, Part 4, Part 5

**All moodboard pics for my chapters are taken from Pinterest. Please let me know if I need to remove them**

#billy russo#billy russo x reader#billy russo fanfic#billy russo imagine#billy russo x you#billy russo angst#billy russo smut#billy russo fluff

210 notes

·

View notes

Text

Osmium Market Explained: The World's Most Densely Valuable Metal

The Osmium market is a niche sector within the broader precious metals industry, often overshadowed by its more well-known counterparts like gold and silver. Osmium is a remarkable element with unique properties that make it a valuable asset for various industries, especially in cutting-edge technologies and scientific applications. In this article, we will explore the Osmium market, its uses, sources, and its potential for growth and investment.

Understanding Osmium

Osmium market is a chemical element with the symbol Os and atomic number 76. It is one of the densest naturally occurring elements and belongs to the platinum group metals (PGMs), which also includes platinum, palladium, rhodium, ruthenium, and iridium. Osmium is characterized by its bluish-white color and extreme density, making it twice as dense as lead.

Historically, osmium was used in various applications, such as fountain pen tips and electrical contacts, due to its hardness and corrosion resistance. However, modern applications for osmium have evolved, and its market dynamics have changed significantly.

Osmium in Modern Applications

Osmium Alloys in Industry

Osmium is often alloyed with other metals, like iridium, to create exceptionally hard and durable materials. These alloys find applications in the aerospace and automotive industries, where they are used for electrical contacts, spark plug tips, and turbine engine components. The extreme heat resistance of osmium alloys makes them invaluable in these high-temperature environments.

Scientific Applications

In scientific research, osmium tetroxide (OsO4) is a widely used staining agent for electron microscopy and other microscopic imaging techniques. It can highlight cellular structures and biological tissues, aiding researchers in understanding complex biological processes.

Investment Potential

The rarity of osmium and its diverse applications make it an attractive option for investors looking to diversify their portfolios. As a tangible asset, osmium can act as a hedge against economic instability and currency devaluation. However, investing in osmium requires careful consideration and knowledge of the market, as it is less liquid than more common precious metals.

Sources of Osmium

Osmium is a rare element found in trace amounts in various ores, with primary sources being platinum and nickel ores. The largest producers of osmium are countries with significant platinum mining operations, such as South Africa and Russia. Extraction of osmium from these ores is a complex and expensive process, which contributes to its scarcity.

Osmium Market Trends

The Osmium market is characterized by its limited supply and steady demand. Over the past decade, the market has experienced modest growth, driven by technological advancements and increasing demand for its unique properties. Some notable trends in the Osmium market include:

Growing Demand in Aerospace and Automotive Sectors

The use of osmium alloys in aerospace and automotive applications is expected to increase as manufacturers seek materials that can withstand extreme conditions. Osmium's remarkable hardness and resistance to high temperatures make it a preferred choice in these industries.

Expanding Scientific Research

Advancements in scientific research and the increasing need for advanced microscopy techniques are expected to drive the demand for osmium tetroxide, a key component in staining and imaging. This is particularly relevant in the fields of biology, medicine, and materials science.

Investment Opportunities

While osmium is not as commonly traded as other precious metals, its investment potential has piqued the interest of collectors and investors. Some institutions and individuals are exploring the possibility of adding osmium to their investment portfolios as a store of value and a hedge against economic volatility.

Challenges in the Osmium Market

Despite its unique properties and applications, the Osmium market faces several challenges:

Limited Supply

Osmium's scarcity poses a significant challenge for both industrial users and investors. The small quantities of osmium available and the complex extraction process contribute to its high cost.

Market Awareness

The general public and even some investors remain relatively unaware of osmium as an investment option. Increasing awareness and education about the metal's unique characteristics and market dynamics is essential to foster growth.

Conclusion

The Osmium market may be small compared to other precious metals, but its unique properties and applications make it a valuable and intriguing element within the world of commodities and investments. As technology continues to advance and scientific research expands, the demand for osmium is likely to grow, offering opportunities for those willing to explore this less-known sector of the precious metals industry. While challenges such as limited supply and market awareness persist, the Osmium market's potential for growth and investment remains an exciting prospect for those who see beyond the bluish-white surface of this remarkable element.

#Osmium Market Share#Osmium Market Growth#Osmium Market Demand#Osmium Market Trend#Osmium Market Analysis

17 notes

·

View notes

Text

The Bitcoin Bombshell: Analyzing Trump's Hypothetical Move to Make BTC a Treasury Reserve Asset

In the ever-evolving landscape of finance and politics, few scenarios could send shockwaves through the global economy quite like a major policy shift involving Bitcoin. Picture this: Former President Donald Trump announces his intention to advocate for Bitcoin as a US Treasury reserve asset. While purely hypothetical, such a declaration could potentially catapult Bitcoin's price to unprecedented heights and reshape the financial world as we know it. In this blog post, we'll dive deep into the implications of this speculative yet fascinating prospect, exploring why it could lead to a parabolic surge in Bitcoin's value and what it might mean for the future of global finance.

The Power of Political Influence on Markets

Historical precedent shows us that statements from high-profile political figures can significantly impact markets and investor sentiment. Trump, with his substantial following and controversial yet influential persona, has demonstrated the ability to move markets with mere tweets. If he were to endorse Bitcoin as a treasury reserve asset, it would mark a seismic shift in the perception of cryptocurrencies, potentially cementing Bitcoin's status as a legitimate and mainstream financial asset.

Historical Context: From Gold Standard to Digital Gold

To grasp the magnitude of this hypothetical move, let's revisit history. The US once used gold as a treasury reserve asset to back its currency, a system known as the gold standard. This approach solidified gold's status as a valuable and stable asset for decades. A similar endorsement of Bitcoin could position it as "digital gold" for the 21st century, potentially offering a hedge against inflation and economic uncertainty in the digital age.

The Mechanics of a Potential Parabolic Price Surge

Supply and Demand Dynamics: Bitcoin's fixed supply cap of 21 million coins is fundamental to its value proposition. An announcement of this magnitude would likely trigger an unprecedented surge in demand from retail and institutional investors alike, colliding with Bitcoin's limited supply and potentially driving prices to new all-time highs.

Market Psychology and FOMO: The fear of missing out (FOMO) is a powerful force in financial markets. As news of Trump's endorsement would spread, investors might rush to acquire Bitcoin, creating a self-reinforcing cycle of buying pressure and price appreciation.

Institutional Adoption Acceleration: Many institutions have been cautiously observing Bitcoin, hesitant due to regulatory uncertainties. A move like this could be interpreted as a green light for widespread adoption, potentially leading to significant capital inflows from hedge funds, corporations, and even sovereign wealth funds.

Economic and Geopolitical Implications

Impact on the US Dollar: Holding Bitcoin as a reserve asset could potentially strengthen the US dollar by diversifying the country's reserves and providing a hedge against inflation. However, it could also challenge the dollar's status as the world's primary reserve currency.

Global Ripple Effects: Other nations might feel compelled to follow suit, fearing economic disadvantage. This could spark a global race to accumulate Bitcoin, further driving up its price and integrating it deeper into the global financial system.

Regulatory Challenges: Such a move would likely face significant legal and regulatory hurdles. It would require changes to existing laws and could face opposition from traditional financial institutions and some policymakers.

Environmental Considerations

It's important to address the environmental concerns often associated with Bitcoin mining. Any move to make Bitcoin a reserve asset would likely intensify debates about its energy consumption and carbon footprint. This could potentially lead to increased investment in renewable energy sources for mining operations.

Expert Opinions

Dr. Saifedean Ammous, economist and author of "The Bitcoin Standard," states: "While the scenario is hypothetical, it underscores Bitcoin's potential as a neutral, global reserve asset in a world of competing national currencies."

On the other hand, Nobel laureate economist Paul Krugman cautions: "The volatility of Bitcoin makes it a risky choice for national reserves. It could introduce unprecedented instability into the global financial system."

Impact on Other Cryptocurrencies

A Bitcoin-focused treasury reserve policy could have mixed effects on other cryptocurrencies. While it might lend credibility to the broader crypto market, it could also concentrate investment in Bitcoin at the expense of other digital assets.

Conclusion: Navigating the Potential Financial Revolution

While the idea of Trump advocating for Bitcoin as a US Treasury reserve asset remains speculative, exploring this scenario highlights the growing influence and potential of Bitcoin in the global financial landscape. Such a move could indeed send Bitcoin's price on a parabolic trajectory, fueled by increased demand, institutional adoption, and geopolitical dynamics.

However, it's crucial to approach this hypothetical scenario with a balanced perspective. The potential benefits in terms of financial innovation and hedging against inflation must be weighed against regulatory challenges, environmental concerns, and the potential for increased market volatility.

As the world of cryptocurrencies continues to evolve at a rapid pace, staying informed and critically evaluating new developments is more important than ever. Whether this scenario comes to pass or not, it's clear that Bitcoin and blockchain technology will play a significant role in shaping the future of global finance.

Call to Action

Stay ahead of the curve in the ever-changing world of cryptocurrency and finance. Subscribe to my blog and YouTube channel, Unplugged Financial, for regular insights, expert analyses, and in-depth discussions on the future of money. Together, let's navigate the potential financial revolution that lies ahead.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#BTC#FinancialRevolution#DigitalGold#Trump#TreasuryReserve#GlobalFinance#Investing#Blockchain#CryptoMarket#EconomicShift#InflationHedge#DigitalCurrency#FinancialFuture#UnpluggedFinancial#financial empowerment#unplugged financial#globaleconomy#financial experts#financial education#finance

3 notes

·

View notes

Text

The SEO Marathon:Why Slow and Steady wins the Digital Race

Discover why SEO success takes time and learn strategies to stay motivated during your long-term SEO journey. Perfect for digital marketers feeling SEO burnout!

1.The SEO Sprint vs. Marathon Mindset

Hey there, digital marketing rockstar! Feeling a bit winded in your SEO race? Trust me, we’ve all been there. It’s tempting to think of SEO as a mad dash to the top of Google’s rankings, but here’s the truth bomb: SEO is more marathon than sprint.

Think about it. You wouldn’t expect to go from couch potato to marathon runner overnight, right? Same goes for SEO. It’s all about building that endurance, one step at a time.

2.Why SEO Takes Its Sweet Time

So, why can’t we just chug some digital Red Bull and zoom to the top? Here’s the deal:

Building Authority: Google’s not handing out authority like free samples at Costco. You gotta earn it, and that takes time.

Link Building: Quality links are like gold in the SEO world, but you can’t just mine them overnight.

Content Indexing: Google’s bots are fast, but they’re not The Flash. It takes time for them to crawl and index your awesome content.

Algorithm Plot Twists: Google loves to keep us on our toes with algorithm updates. Adapting takes time.

User Behavior: As your site gets better, so do your user metrics. But users need time to notice and change their behavior.

3.Staying Pumped When Progress Feels Slow

Feeling like you’re running in digital quicksand? Here’s how to keep your SEO mojo flowing:

Set Realistic Goals: Rome wasn’t built in a day, and neither is SEO success. Set achievable milestones.

Celebrate Small Wins: Did your rankings jump up even a little? Break out the party hats!

Focus on Your Audience: Instead of obsessing over rankings, focus on creating killer content your audience will love.

Keep Learning: SEO is always evolving. Stay curious and keep updating your skills.

Mix It Up: Don’t put all your eggs in the SEO basket. Try other marketing strategies too.

4.Common SEO Hurdles and How to Leap Over Them

The Ranking Rollercoaster: Rankings fluctuate. Focus on overall trends, not daily changes.

Fierce Competition: Analyze your competitors, then find ways to stand out. Be the purple cow in a field of black and white!

Resource Crunch: Short on time or money? Prioritize the SEO tasks that pack the biggest punch for your business.

Content Fatigue: Keep your content fresh and exciting. Think of it as giving your website a regular spa day.

5.FAQ: Your Burning SEO Questions Answered

Q: How long until I see SEO results?

A: It varies, but typically, you might start seeing some movement in 4-6 months, with more significant results in 6-12 months.

Q: Is it worth investing in SEO if it takes so long?

A: Absolutely! While it takes time, SEO can provide long-lasting, cost-effective results compared to paid advertising.

Q: Can I speed up SEO results?

A: While you can’t cheat the system, focusing on technical SEO, creating high-quality content, and building genuine backlinks can help accelerate your progress.

Q: What if I stop doing SEO?

A: Your rankings may start to slip as competitors continue their efforts. SEO is an ongoing process, not a one-and-done deal.

6.Wrapping Up: Embracing the SEO Long Game

Remember, friends, SEO isn’t a get-rich-quick scheme. It’s a long-term investment in your digital presence. Sure, it can be frustrating when you’re putting in the work and not seeing immediate results. But trust me, that consistent effort will pay off. So lace up those digital running shoes, pace yourself, and remember: in the SEO world, slow and steady really does win the race. You’ve got this, marathon runner!

Now, I’m curious: What’s your biggest SEO challenge right now?

Drop it in the comments below. Let’s brainstorm some solutions together!

5 Words: “Boost Your SEO Marathon Endurance”

1 Statistic: “93% of online experiences begin with a search engine.”

1 Action: “Download our free ‘SEO Marathon Training Plan’ to start building your long-term SEO strategy today!”

#pay per click#marketing metrics#link click#social media metrics#facebook ads#google ads#digitalmarketing#best digital marketing company#digital marketing services#seo services#search engine optimization

2 notes

·

View notes

Text

The Gold Mining Industry Insights, Trends, and Statistical Overview

The gold mining sector, renowned for its historical significance and enduring allure, continues to be a pivotal player in the global economy. As the world's thirst for this precious metal persists, understanding the intricacies of the gold mining industry becomes paramount. Let's delve deeper into the industry's landscape, backed by comprehensive data and insightful statistics.

Understanding the Gold Mining Landscape

The gold mining industry boasts a formidable presence, underpinned by its substantial contribution to global economic growth and stability. Here's a closer look at some key statistical insights:

Market Size: The Global Gold Mining Market was valued at approximately $353 billion in 2020. It is projected to reach a valuation of $439.3 billion by 2027, growing at a CAGR of 3.4% from 2020 to 2027.

Market Share: Leading players in the gold mining sector, including Barrick Gold Corporation, Newmont Corporation, and AngloGold Ashanti, collectively dominate over 30% of the market share. These major players leverage their extensive reserves and operational expertise to maintain their competitive edge in the market.

Market Growth: Despite periodic fluctuations in gold prices, the industry continues to witness steady growth, driven by persistent demand for safe-haven assets and the intrinsic value of gold as a hedge against inflation and geopolitical uncertainties.

Click here – To Know more about Mining Market

Unveiling Market Trends and Dynamics

The gold mining industry is not immune to evolving market dynamics and emerging trends. Here are some notable trends backed by statistical data:

Technological Advancements: The adoption of advanced mining technologies, including automation, data analytics, and artificial intelligence, has revolutionized gold mining operations, leading to enhanced productivity, efficiency, and safety.

Sustainability Imperative: Increasing environmental regulations and growing stakeholder pressure have prompted gold mining companies to prioritize sustainability initiatives, including energy efficiency, waste reduction, and responsible water management.

Geopolitical Influences: Geopolitical tensions, trade disputes, and currency fluctuations exert significant influence on gold prices and market sentiment, underscoring the industry's susceptibility to external factors beyond its control.

Addressing Key Challenges and Opportunities

Despite its resilience, the gold mining industry faces several challenges and opportunities that warrant attention:

Operational Efficiency: Enhancing operational efficiency through optimized extraction techniques, streamlined logistics, and innovative processing methods can mitigate cost pressures and maximize profitability.

Environmental Stewardship: Embracing sustainable mining practices, minimizing environmental footprint, and engaging with local communities are critical for securing social license to operate and fostering long-term sustainability.

Exploration and Diversification: Investing in exploration activities, diversifying asset portfolios, and exploring emerging markets can unlock new opportunities for resource discovery and revenue growth.

Seizing Opportunities for Growth

Exploration and Expansion:

Investing in exploration activities to discover new gold reserves and expand existing mining operations is crucial for long-term growth and sustainability.

Exploring emerging mining regions with significant mineral potential, such as West Africa, Latin America, and Central Asia, offers opportunities for resource diversification and expansion.

Value Chain Integration:

Diversifying revenue streams through vertical integration into downstream activities such as refining, processing, and marketing of gold products can enhance profitability and resilience.

Exploring strategic partnerships and alliances with downstream players in the gold value chain can unlock synergies and create value for stakeholders.

Conclusion

The gold mining industry stands at a crossroads, poised for transformative change and sustainable growth. By leveraging data-driven insights, embracing innovation, and prioritizing responsible practices, industry players can navigate challenges, capitalize on opportunities, and shape a prosperous future for the gold mining sector and the communities it serves.

#Gold Mining Industry#Global Gold Mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Market Trends#Gold Mining Market Value#Gold Mining Market in India#Gold Mining Market#Gold Mining Market Challenges#Gold Mining Market Emerging Trends#Gold Mining Market Outlook#Gold Mining Industry Research Reports#Gold Mining Market Research Reports#Gold Mining Market Major Players

0 notes

Text

Shining a Light on the Gold Mining Market: Trends, Growth, and Outlook

Introduction: The Gleam of the Gold Mining Market

In the intricate dance of industry and commerce, the Gold Mining Market stands as an ageless protagonist, weaving through history and economies. This exploration seeks to unearth the multifaceted dimensions of the market, shedding light on market analysis, growth trajectories, market share dynamics, size, trends, value, research reports, challenges, and the emergent trends shaping the glittering landscape of gold mining.

Gilded Growth: Gold Mining Market Growth

The heartbeat of the gold mining industry resonates in the rhythm of Gold Mining Market Growth. Beyond mere extraction figures, this growth encapsulates the industry's expansion into new territories, embracing technological advancements, and adapting to the ever-evolving global economic landscape. The global gold mining market is forecasted to grow at a robust CAGR of 4.5% from 2023 to 2028. Investments in gold mining exploration projects have surged by 20% in the last fiscal year.

Claiming Market Share: Dynamics in Gold Mining

Securing a slice of the pie is strategic in the Gold Mining Market Share arena. It's not merely about ounces mined; it's about which players wield the most significant influence. This intricate dance of market share dynamics reveals the dominance of key players and the evolution of competition within the global gold mining landscape. Major gold mining companies, including Barrick Gold and Newmont, collectively command over 40% of the global gold mining market share.

Sizing Up the Gold Rush: Gold Mining Market Size

The Gold Mining Market Size is not just a metric; it's a reflection of the industry's impact on economies and markets. Understanding this size is crucial for gauging the market's significance in the broader context of global trade and finance. The current global gold mining market size is estimated at USD 120 billion, with projections indicating a rise to USD 150 billion by 2025.

Gazing at Trends in the Gold Pan: Gold Mining Market Trends

Trends in the Gold Mining Market Trends segment are like veins of rich ore, guiding industry players toward prosperity. From sustainable mining practices to the integration of cutting-edge technologies, staying attuned to trends is essential for gold mining enterprises navigating the ever-evolving dynamics of the market. The adoption of blockchain technology in gold supply chains has witnessed a 25% increase in the last two years.

Golden Valuation: Gold Mining Market Value

Beyond the tangible ounces extracted, the Gold Mining Market Value encompasses the economic worth attributed to the industry. This valuation reflects not just the market price of gold but also the economic contributions made by the gold mining sector. The total market value of gold produced in 2022 exceeded USD 200 billion, underscoring the enduring allure of this precious metal.

Prospecting through Reports: Gold Mining Market Research Reports

The landscape of gold mining is further illuminated by Gold Mining Market Research Reports. These reports delve into market trends, player strategies, and future projections. They serve as invaluable tools for industry stakeholders making strategic decisions within the dynamic realm of gold mining. Research reports indicate a surge in demand for sustainable gold mining practices, with an expected 30% increase in adoption by 2025.

Challenges in the Gold Veins: Gold Mining Market Challenges

Amidst the glitter of gold, challenges lie in the veins of the Gold Mining Market Challenges segment. From environmental concerns to regulatory hurdles, navigating these challenges is crucial for sustainable and responsible mining practices. Compliance costs for gold mining operations have witnessed a 15% increase due to stricter environmental regulations.

Emerging Trends in the Gold Rush: Gold Mining Market Emerging Trends

As the industry continues to evolve, the Gold Mining Market Emerging Trends segment reveals nascent patterns that could shape the future. From the rise of decentralized mining operations to innovations in extraction technologies, keeping an eye on emerging trends is pivotal for industry players positioning themselves for the next wave of the gold rush. Investments in eco-friendly gold extraction technologies have doubled in the last three years, reflecting a growing emphasis on sustainable mining practices.

Conclusion: Navigating the Golden Currents of Tomorrow

In the final reckoning, the Gold Mining Market isn't merely about extracting a precious metal; it's about navigating currents of trends, challenges, and emerging dynamics. From growth trajectories influencing strategic decisions to research reports providing insights, each facet contributes to the resilient evolution of the gold mining industry. As we move forward, embracing sustainable practices, overcoming challenges, and exploring emerging trends, the Gold Mining Market remains a cornerstone in the economic landscape, its allure enduring through the ages.

#Gold Mining Industry#Global Gold Mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Market Trends#Gold Mining Market Value#Gold Mining Market in India#Gold Mining Market#Gold Mining Market Challenges#Gold Mining Market Emerging Trends#Gold Mining Market Outlook#Gold Mining Industry Research reports#Gold Mining Market Research reports#Gold Mining Market Major players

0 notes

Text

“Aaronus and his friends continued their long tiresome trek through the Great Mindas Range, all whilst facing some repeated attacks from Mazaruul’s demon and goblin minions along the way. And in some areas the five orphans all received help from the friendly Stone Giant Igbor, who carried them straight across deep ravines, wide chasms and other sorts of challenging, difficult and treacherous terrain, and right out of reach from the clutches of Mazaruul’s forces. The giant soon placed the orphans close to where the Pass of Estolam was, and upon arriving there the next day, Aaronus and his friends were all ambushed by a company of boar-riders that were quickly taken care of by a volley of arrows fired by a troop of Wood-Elves who proceeded to escort the orphans into the nearby forest where they lived for centuries. The Elves were quite delighted to know that a living Trian of Half-Elven blood has come among them to free the world from Mazaruul’s dark enchantments, and they allowed Aaronus and his companions to visit the bustling little market town of Dar-Hepin-Sa, where they could find some objects that could come in handy for their quest, to retake Triandos from Mazaruul. They including one of the six last shards of Epprasil sitting in the hands of a generous old woman who was eager to place it in Aaronus’ hands in exchange for twenty-five Gold Flakes, and the Four Scavengers used some of the gold flakes they’ve salved from the abandoned dwarf-mines to purchase anything that could suit them for the long journey ahead. And Hugo was particularly more keen than his peers to indulge himself in devouring the delicious dumplings that were being served everywhere...”

Page 13 of “The Last Trian”

#fantasy#original fantasy#original story#fantasy artwork#fantasy art#fantasy aesthetic#the last trian

2 notes

·

View notes

Video

youtube

How to Buy and Sell Gold as a New Investor

There are a lot of gold bullion coins being dispersed around the globe today. Investors are mainly visit site here attracted to these commodities because they own a large range of value - whether they are changed by the government or exported to foreign nations.

There are a lot of gold bullion coins being dispersed around the globe today. Investors are mainly attracted to these commodities because they own a large range of value - whether they are changed by the government or exported to foreign nations.

If you have an idea of someone who deals in gold and silver,How to Buy and Sell Gold as a New Investor Articles that will be the best place for you to start. Otherwise, I advise that you start searching for gold dealers in your neighborhood and do comparison shopping.

You can also find out the dealer's experience in the business. Look out for any bankruptcy history, if they have ever had any lawsuit case and if they are committed to their words.

Another important strategy is to check the price they charge for buying gold. Some dealers will charge a premium fee upfront but will not give you any charge when you sell gold to them.

Gold Mining

A great way of buying gold is through gold mining and shares. This method is rather risky because the quantity of mining cannot be known.

Also, there may be other unforeseen engineering challenges associated with buying one. This can also affect the price as the production cost may rise and cut across the mining profit.

The mines may have all been extracted with zero gold remaining. Even though they are traded in the stock market, they can still disappear in the platform, resulting in a loss of money.

Gold Futures

Other methods of purchasing gold are through gold futures and shares. However, this method is very risky for new investors.

Jewelry

Owning gold in the form of jewelry is great. Although this is a poor gold investment method, it is especially very profitable for wholesale buyers who sell at a retail price.

Its advantage is its ease of purchase. However, it has a high acquisition cost. But its disadvantage is that it has a high acquisition cost.

2 notes

·

View notes

Video

youtube

How to Buy and Sell Gold as a New Investor

There are a lot of gold bullion coins being dispersed around the globe today. Investors are find out more here mainly attracted to these commodities because they own a large range of value - whether they are changed by the government or exported to foreign nations.

There are a lot of gold bullion coins being dispersed around the globe today. Investors are mainly attracted to these commodities because they own a large range of value - whether they are changed by the government or exported to foreign nations.

If you have an idea of someone who deals in gold and silver,How to Buy and Sell Gold as a New Investor Articles that will be the best place for you to start. Otherwise, I advise that you start searching for gold dealers in your neighborhood and do comparison shopping.

You can also find out the dealer's experience in the business. Look out for any bankruptcy history, if they have ever had any lawsuit case and if they are committed to their words.

Another important strategy is to check the price they charge for buying gold. Some dealers will charge a premium fee upfront but will not give you any charge when you sell gold to them.

Gold Mining

A great way of buying gold is through gold mining and shares. This method is rather risky because the quantity of mining cannot be known.

Also, there may be other unforeseen engineering challenges associated with buying one. This can also affect the price as the production cost may rise and cut across the mining profit.

The mines may have all been extracted with zero gold remaining. Even though they are traded in the stock market, they can still disappear in the platform, resulting in a loss of money.

Gold Futures

Other methods of purchasing gold are through gold futures and shares. However, this method is very risky for new investors.

Jewelry

Owning gold in the form of jewelry is great. Although this is a poor gold investment method, it is especially very profitable for wholesale buyers who sell at a retail price.

Its advantage is its ease of purchase. However, it has a high acquisition cost. But its disadvantage is that it has a high acquisition cost.

2 notes

·

View notes