Text

After all this melodrama over digital advertising

Digital advertising is getting disrupted and there is no threshold of eloquent journalists expressing outrage that can change it.

Apologies.

The morality of the situation, despite heated appearances, is irrelevant.

Its just melodrama. (or maybe ultra-drama ;)

Both sides of the ad blocker op-ed - 1) the blockers are evil side and 2) the advertising is evil side - both irrelevant.

Stated without all the drama - the digital advertising model is very broken and consumers are expressing their interests behaviorally.

Or as @epstein said on Twitter:

Surprisingly little talk about the ethics of mobile ad blocking at my local ice cream shop.

So if its not an ethical issue, then what?

Simply, its a technology issue, a user experience issue and a business issue.

Solving the problem will be difficult and the solutions will be sophisticated, brilliant and elegant.

Publishers do not seem committed, smart or creative enough to innovate solutions so they aren't going to be the ones to do it.

Move over guys and scale down because Facebook, Google, Apple and maybe Amazon are going to figure this out and they're going to leverage the solution economically.

No hard feelings just business.

8 notes

·

View notes

Text

Joining Bank of the Ozarks

This is my first full week as the Director of Social Media at Bank of the Ozarks and I am elated to be here!

For those of you who might not be familiar, Bank of the Ozarks has been the top performing bank in the nation for multiple years running. This is no coincidence given the quality of the leaders, the strategy they are deploying and the positivity they project and instill.

For years now, I have been focusing my energy and career on the secular shift away from hierarchical publishing models and towards technology driven networks.

In that regard, we are planning to do some pretty cool stuff so stay tuned.

25 notes

·

View notes

Text

Moving on

July 6 will be my last day at Yahoo.

It has been an incredible honor working here with such wonderful people and so I am grateful.

Special thank you to Tae Kim, Aaron Task, Glenn Fannick and the incredible cast of Finance Contributors we have assembled.

I am leaving to pursue an amazing opportunity but more on that in mid-July.

14 notes

·

View notes

Text

Here’s Conor Sen’s latest. He bends my brain every time...

Asian Immigration, the $15 Minimum Wage and the Housing Shortage

The biggest demographic change in the US since the peak of the housing boom has been the changing composition of immigrants in the US. If we think about the immigration debate in the US over the past 10-15 years, it’s implied that we’re talking about Hispanic immigration. We talk about securing our borders, building a wall along the Mexican border, drug cartels, and controversial laws like Arizona’s a few years ago.

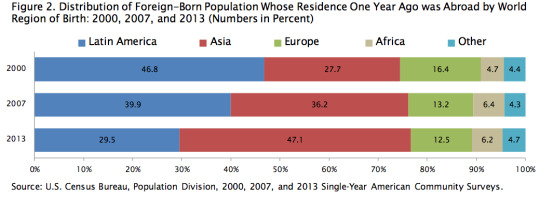

But the nature of immigration has changed. In 2000 the prior year’s immigrant representation was 47% Hispanic and 28% Asian. By 2013 those numbers had nearly reversed.

As the WSJ article points out, the growth is being led by Chinese and Indian 20-somethings, who represent over 40% of the international student body in the United States now, over 375,000 students in 2013-14.

To see what kind of impact they’re having in certain industries, take a look at the names on Columbia’s 2015 graduation list for their masters degree in statistics program.

For decades the socioeconomic impact of globalization meant, in the US, a flood of cheap Hispanic service sector workers (agriculture, construction, housecleaners, landscapers, etc) coming in, and middle class manufacturing jobs going out (to Asia).

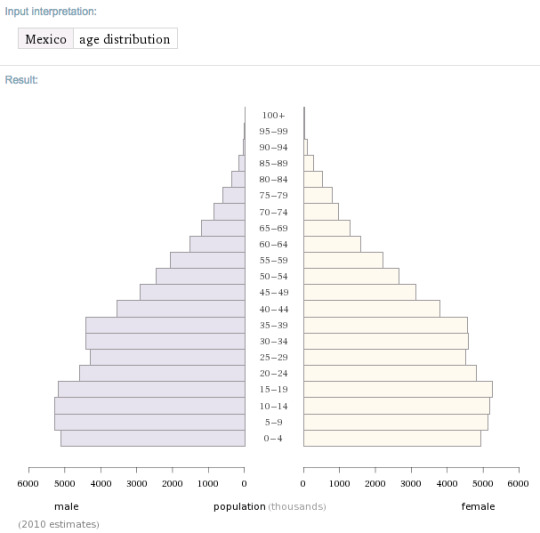

But now we’ve entered a new era. Due to economic growth and development in Mexico, birthrates have slowed and they’re not sending as many cheap workers to the US.

At the same time, birthrates have slowed in Asia and wages have skyrocketed. This makes it less favorable for US and transnational companies to outsource jobs from the US to Asia, and as Asia has gotten wealthier it’s producing more and more students willing to able to move to the US to pursue higher education and good jobs here.

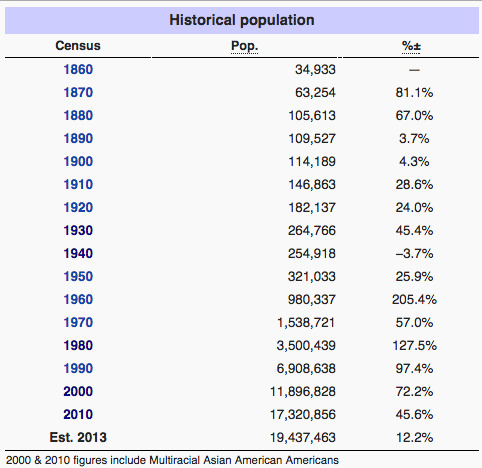

The number of Asians in the US has grown from 3.5 million in 1980 to almost 20 million in 2013. We added 5 million in the 1990′s, 5.4 million in the 2000′s, and we’re on pace for 7 million in the 2010′s – growth is accelerating.

By 2040 we could have 40 million Asians living in the US, a doubling from current levels. We need to start thinking about what this means socioeconomically.

It probably means more lawsuits over perceived higher ed quotas for Asians. I’ve said that eventually either Harvard will be 50% Asian, or Asians will vote Republican.

The benefits of Hispanic immigration tended to accrue to cosmopolitan urbans – cheap labor to serve them but no competition for the kinds of jobs, houses, and schools they sought – while the costs fell on rural and Sun Belt whites. The new trend may have the opposite effect, as the decline in Hispanic immigration drives up the cost of low level labor while the new Asian immigrants compete for the same kinds of housing and schools the upper-middle class seek.

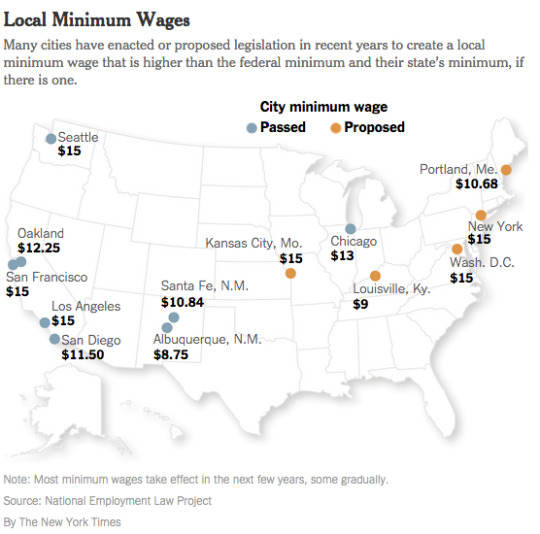

And I can’t help but notice that the $15 minimum wage fight has gathered the most momentum on West Coast cities where Asians are driving up the cost of housing/living and the decline in Hispanic immigration is leading to a scarcity of low end labor, giving that class of labor bargaining power.

Will this turn the upper-middle class against immigration? Will Asians start being subject to the kind of negative ethnic biases Hispanic immigrants have suffered from in high cost coastal cities? Watch this trend. And if you live in a city with good infrastructure, stronger higher ed institutions, and cheap land that Asians haven’t found yet – they will.

9 notes

·

View notes

Text

Here’s one of many cool things Verizon/AOL could do right away

Everyone is very busy discussing AOL’s focus on programmatic ad buying and video as rationales for Verizon’s announced purchase of the digital media company.

But there are several ways Verizon can leverage AOL quickly and smartly that are less obvious, incrementally positive and, taken together, likely worth much more than the sum of parts.

Here’s one simple example of how Verizon might promptly leverage AOL content and content delivery via Verizon Wireless.

From Bloatware to Mustware

In a month, my two year wireless contract will expire and I will go to the Verizon store to renew it the same way that tens of millions of others do. I will claim my subsidized smartphone complete with loads of bloatware that I have no use for but accept for the cheap phone.

Bloatware, for those who might not be aware, is the name of the software your wireless carrier pre-installs on your new handlheld device without you asking for it. Usually, it does not work great and really just takes up space.

I usually uninstall most of the pre-installed Verizon Android apps as they are more of a nuisance than anything of value. Verizon (and other carriers) is simply forcing its apps on me because they are selling me the contract and the device and so they can.

But what if Verizon built a suite of awesome apps that delivered information to me that I actually wanted in a way that was convenient instead of intrusive?

Mustware.

That would be a game changer.

Enter Alpha

At this moment, there are initiatives at AOL like Alpha which is co-directed by Peter Rojas and Ryan Block. If you don’t know who these guys are, take a minute and click on their names.

AOL Alpha is a small group that focuses on building new mobile applications that aim to “create experiences that help people connect with each other and the world around them.”

AOL Alpha could easily shift focus just a bit to begin conceptualizing and designing applications that will serve the purpose of delighting a captured audience rather than annoying them.

With a concrete purpose, they are more than prepared to build awesome and useful stuff. And with a captured built-in audience, Rojas and Block could do it with a bit of swagger.

Imagine for a moment if I walked in to the Verizon Store for my biennial contract renewal pilgrimage and, when booting up my new device, was greeted by a suite of awesome applications that curated AOL content I actually wanted in a format that was intuitive and fun instead of clunky.

This is the kind of stuff that will fly under the radar of most who comment on this deal, but its something that will improve Verizon product for users and make them less dependent on the likes of Google and Facebook who appear more intent everyday on housing the world’s digital content.

9 notes

·

View notes

Text

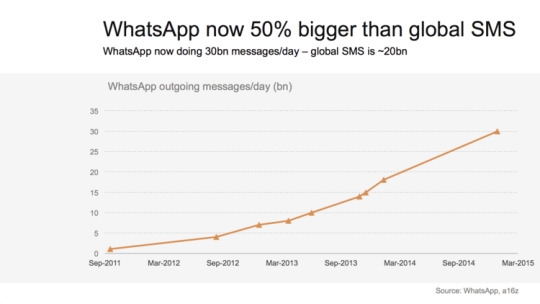

Facebook’s Whatsapp 50% larger than the world’s SMS traffic

“In a recent post, Benedict Evans of Andreessen Horowitz read into the announcement from Whatsapp that the company’s 700 million monthly active users are sending 30 billion messages a day. Aside from justifying Facebook’s acquisition at $22 billion last year, the numbers are important in a more general way, because the global SMS system passes only 20 billion messages per day. Yes, Whatsapp — just a single messaging app — is 50% larger than the world’s SMS traffic.”

—

A New Era of Messaging — Work Futures — Medium

#FridayFunFact2: very impressive numbers from WhatsApp!

10 notes

·

View notes

Text

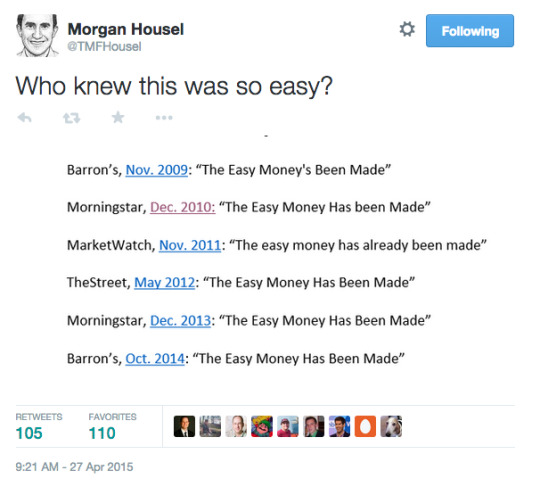

“The easy money has been made”

My pal Morgan Housel tweeted the following this morning:

Genius.

I don’t necessarily blame the authors of these past articles either. They might be writing what they truly believe and the market is taxing both intellectually and emotionally.

The lesson though is to take what others say with a grain of salt, do the work and stick to your own plan if it is a good one.

10 notes

·

View notes

Link

“That’s why this thing is going to fail miserably.”

Nailed it.

Melissa Leon speaking with Death Cab for Cutie frontman Ben Gibbard:

In the music world, another issue has emerged regarding artists’ compensation from streaming platforms. Jay Z recently unveiled plans for his own subscription streaming service, Tidal, which aims to “forever change the course of music history” by offering high-fidelity audio to customers for up to $20 a month, higher royalty rates for musicians—and a share of the company for an endless parade of high-profile artists like Rihanna, Kanye West, Madonna, Jack White, Daft Punk, Arcade Fire and Beyoncé (none of whom seem strapped for cash). Gibbard says the service is dead on arrival.

“If I had been Jay Z, I would have brought out ten artists that were underground or independent and said, ‘These are the people who are struggling to make a living in today’s music industry. Whereas this competitor streaming site pays this person 15 cents for X amount of streams, that same amount of streams on my site, on Tidal, will pay that artist this much,’” Gibbard says. “I think they totally blew it by bringing out a bunch of millionaires and billionaires and propping them up onstage and then having them all complain about not being paid.”

“There was a wonderful opportunity squandered to highlight what this service would mean for artists who are struggling and to make a plea to people’s hearts and pocketbooks to pay a little more for this service that was going to pay these artists a more reasonable streaming rate,” he continues. “And they didn’t do it. That’s why this thing is going to fail miserably.”

Amen.

187 notes

·

View notes

Photo

Lauren Indvik’s take on what the fashion industry thinks about Apple Watch

This is a must-read piece for the army of those obsessed by all things $AAPL from the Ginsu sharp editor in chief at Fashionista.

For the Fashion Set, the Jury Is Still Out on the Apple Watch

31 notes

·

View notes

Text

This is a reblog of Mark Dow’s Tumblr Post. Mark is a hedge fund manager and economist. You can find his excellent Tumblr here and follow him on Twitter here.

Photo Credit: Joe Shlabotnick

The Federal Reserve, on Avalanche Patrol

In September of last year the Fed laid out in rough terms which tools it intends to use in the normalization process and the order in which it plans to use them. Of course, as has been its hallmark post-crisis and as evidenced in its most recent Minutes, the Fed has indicated it’s ready to adjust its plans as and if needed.

Nonetheless, there has been a fair amount of discussion around the Fed’s preference to begin the normalization sequence with hikes in the policy rate, as opposed to letting its balance sheet start to run off first. This post aims to lay out in simple terms why the Fed is approaching normalization in this fashion.

You have to start with where the Fed sees the risks.

The Fed is not worried about the economy overheating. True, there is a legitimate debate over the degree of slack remaining in an improving labor market. But demography, technology and globalization, in some admixture, have conspired to cloud this picture. In fact, it has made the issue so hard to call that the Fed has effectively let the other half of its mandate, inflation, cast the deciding vote. And so far inflation continues to come out on the side of slack.

The Fed is not worried about the balance sheet or excess reserves, either. These are means to an end, not ends in and of themselves. Moreover, the risks to an enlarged balance sheet have been over-imagined at every stage of the post-crisis period, whereas the damage that higher long term rates could do to a recovery that never quite gets to liftoff is arguably very real. Again, there is simply not enough optimism in the US economy or global economy for overheating to be the preponderant risk.

What the Fed has begun to worry about is financial stability—even if not as an imminent threat. Its concerns are one part risk management, one part the ghost of crises past. FOMC members understand that financial excesses are a positive function of time. Stability sooner or later breeds instability. And the longer rates stay very low, the greater the risk they become built into the current financial architecture and baked into our extrapolations. Once you get to such a point, an eventual normalization becomes a lot riskier, in terms of both financial dislocations and economic activity.

Also, perhaps even more than the rest of us, the Fed fears a repeat of the 2013 Taper Tantrum—not to mention 1994. For this reason, it is useful to think of the Fed’s mindset here as being like that of the avalanche patrol at a ski resort. You detonate your tools in order to see if there are any avalanches out there to be triggered. You don’t know if there are any out there, but you know the longer you wait, the larger the risks grow in probability and magnitude. In essence, it’s just good risk management.

In short, if the risk is overheating, you want to influence the cost of economic borrowing. If the risk is financial stability, you want to affect the cost of leverage. In this case, the policy rate is the place to start because it controls the cost of leverage, whereas encouraging a steep yield curve by first letting the book run off adversely hits the cost of borrowing.

This is not to suggest policy rates should be the primary tool with which to manage financial stability risk. Adequate capitalization and a robust and flexible regulatory framework have to be the first lines of defense. And, it’s also true that risk appetite can at times be stubbornly insensitive to the price of money—as we saw in the 2005-07 period and as we have seen on the other end of the spectrum over the last handful of years. However, the policy rate can be used to signal, to keep us on our toes, and to help clear the slopes now so as to lower the risk of triggering a larger and potentially destabilizing avalanche later.

17 notes

·

View notes

Text

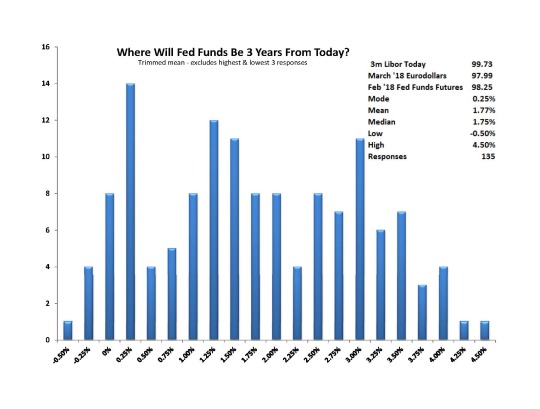

The following is a reblog from David Schawel’s excellent Tumblr. David is a fixed-income portfolio manager in Raleigh, North Carolina.

What the Twitter "dots" are telling us about rate hikes

Right now the market is obsessed with figuring out if and when the Fed is going to raise interest rates. Rate participants closely watch the Fed’s “dot plot” which shows the midpoint of the target range for the fed funds rate by year. The March dot plot released shows the end of 2016 with a median of 1.75% and the end of 2017 at 3.125% - both lower than the projections released in December. Even after this downward revision a large difference exists versus the market as futures are pricing in substantially lower rates than the dots indicate.

Enter the Twitter fed funds survey in which I asked followers to tell me where Fed Funds will be three years from today. 135 responses were used after trimming the highest and lowest three answers. The survey results are very close to what March 2018 Eurodollar futures (H8 contract) is pricing. More interesting though is the distribution and what it might be telling us about the different schools of thought.

Aside from a fun exercise, I hoped this survey would shed some light on the differences of how the market is viewing rates going forward versus the Fed. Here are a few things it might be telling us:

1. There appears to be two very distinct ideological camps in the responses. Roughly 20% of respondents see fed funds at or below 0.25% in three years while 35% see rates at or above 2.50%. The mean & median were both ~1.75% but the largest amount of responses were elsewhere - and the composition tells us important things.

On one hand you have the everything is going back to “normal�� camp where participants likely point to month after month of strong employment gains, encouraging underlying trends of income gains, and inflation muted by commodity driven disinflationary pressures.

The other camp likely believes some or all of the following: the Fed will be unable to raise rates while maintaining stability, we’re in a period of secular stagnation, international factors take a rate hike off the table, and the natural real rate of interest is now much lower than pre-crisis.

2. One faction of market respondents will be proven to be wrong and this could be painful for them. Pricing assets assuming multiple years of zero interest rates when 3-4% materializes would be a big miss. Similarly, it’s conceivable that macro bulls could throw in the towel with another year of rates grinding here and the Fed unable to lift off. Both groups can’t be right.

3. There’s likely a recency bias: The pendulum swings quickly among Fed prognosticators. In mid January among plunging oil and European problems we saw 2y USTs fall to 0.40% and a June rate hike seemed unfathomable (yes, I said that too). Then in early March a huge payroll report sent 2y USTs above 0.70% and suddenly a June hike was a lock. Now only a few weeks later we have Fed minutes that show a lower GDP forecast without a 3% handle in sight, along with a lower “dot plot” as described above. The worry du jour today is the strengthening US dollar and the Fed’s relative tightening versus other central bank’s who have the pedal down. Whichever camp you’re in, it pays to remember how short of a memory the market has with respect to this topic.

16 notes

·

View notes

Text

Must-listen for content creators: BuzzFeed’s Jonah Peretti at SXSW

SXSW hid the full audio to this gem of a speech on SoundCloud and at the time of this posting it has all of 22 listens.

Meanwhile, Jonah Peretti is inarguably at the front edge of how content is getting broadcast and spreading today.

I put this in the category of *Must-Listen* for those who are creating/editing digital content and advertising.

4 notes

·

View notes

Text

Live streaming video is going to be huge, good for Twitter

This is a guest post by Howard Lindzon who is an investor and entrepreneur. He is the founder of Social Leverage, Wall Strip and StockTwits. He makes early stage investments in social media and financial technology companies. You can find his irreverent blog here and follow him on Twitter here.

Over the last few weeks a small Israeli company called ‘Meerkat’ has stormed the mobile video scene. I can’t fully explain the phenomenon, but the app is at the top of Apple’s best curated stream and sure to break into the top 150 ‘free’ apps in the app store. I have been using the product and it is awesome. It is intimate, fun, simple and powerful.

Last month Twitter ($TWTR) bought a startup called Periscope (for a reported $100 million) and the product has not even launched. I have used the beta product and it is awesome. The good news is that Wall Street does not know it exists. Maybe 1,000-2,000 people are using it and when I tried it the first time I bought some Twitter stock. Periscope will be easy to monetize if it launches and scales smoothly.

I am really excited for livestreaming video from my iPhone. I feel like a kid with a new toy. It is a feature/product that will launch new creative stars and change the way news is seen.

Livestreaming video is not new, but timing is everything. The iPhone 6 and 6+ really matter and Twitter turns 9 years old this week. Without Twitter’s global and real-time reach, we would still just be uploading to YouTube.

I don’t know how Google ($GOOGL) and their Hangouts have missed the revolution, but they have for now.

It is also a dream come true for Verizon ($VZ), AT&T ($T) and T-Mobile ($TMUS). This month Verizon will hit me for 20MB and just a few months ago I was hard pressed to hit 6 MB.

Of course, for most people the sticker shock of the data increases along with battery drain may slow the growth, but I like the risk/reward.

As for vertical use cases, the financial markets will never be the same. I won’t get into the specifics right now as I am busy making my own notes and organizing all my product thoughts, but this won’t be kind to cable and incumbents.

The millennials have one more reason to turn off their TV’s.

15 notes

·

View notes

Text

I participated in the Social Finance panel at the Quinnipiac GAME V Forum with Dorothy, Jim & Josh. We’ve done this panel for a few years already and its particularly special to us I think because the students are highly engaged and they push us to think through novel questions much more than the older crowds.

We were asked about social web and identity development and I found myself talking about something I had written about years ago on my old eightfatswine Tumblr.

During my reply to the question, I thought to myself, “I still feel strongly about this topic, I still stand by the basic premise and, as a matter of fact, constructivism has been and continues to be a guide in terms of how I approach expression and identity development in a world of ubiquitous and free personal/social publishing.”

So here’s a reblog of the original from a good six plus years ago. Have a great weekend.

The Constructivist Revolution and New Media

Early psychoanalytic models were deterministic. That is they espoused a view of human nature as being mostly at the whims of forces beyond people’s control whether these forces were internal (needs, desires and conflicts) or external (war. political, socio-economic). Some of the more recent dynamic models have run counter to a deterministic view. One in particular called constructivism arose out of the cognitive revolution and suggests that humans have much more control over identity development, the ways in which they perceive and act in the world and in turn the ways in which they are perceived by others. The gist is that we construct our own realities through the narratives we create, the frames we incorporate, the actions we take, the relationships we foster and the ideas we express. I’m a constructivist in a big way. I don’t fault the determinists and understand that at the time such theories were built people actually had much less control of their lives due to political and technological limitations. I bring all this up because I am observing and participating in a revolution based in part on web technologies which promote expression and the sharing of ideas. Many more people than ever before now have the opportunity and the medium to define themselves internally and to the world. Specifically, I am talking about web based publishing platforms from Wordpress to Tumblr to Twitter. People can now take the effort to craft their identity and evolve it over time through the expression of their ideas. What’s more we can do this in a global public space in which others might respond with their own ideas ensuing a dialog which has the potential to inform, inspire, provoke and ultimately foster knowledge and relationships. Its no small thing that this more powerful capacity to construct, communicate and interact with others across the globe comes along at precisely a moment in history in which centralized idea power authorities are deteriorating. I include in this old guard governments, religious authorities, large media based and other institutions as well as financial institutions. All one needs to do is log in and consistently over time engage a process of expressing ideas in the present while allowing others to likewise respond in good faith with their own best ideas. The upshot is that thinkers across an endless variety of subjects who engage might arise and initiate new knowledge systems which are meritocratic. Along the way, leaders will emerge who have been vetted more purely than ever before. We are a witness to and a part of a constructivist revolution in which individuals now have the power to define themselves with their best thoughts.

4 notes

·

View notes

Photo

Matt Bai on creating a Yelp for teachers

This is such a wonderful and creative piece from Matt. He writes:

How is it that the business of teaching has somehow eluded the most ubiquitous and influential form of evaluation in modern America? I’m talking about consumer feedback.

... if you’re under, say, 50, and use a computer or a smartphone (which most people at all income levels do), chances are you don’t spend money on much of anything without consulting the wisdom of user reviews.

We review books and cribs on Amazon.com, movies and apps on iTunes. You can rate the Uber driver who just took you home from a bar. You can judge the reliability of a seller on eBay, or the table service of a neighborhood restaurant on Yelp, or the integrity of an appliance repairman on Angie’s List — before he walks into your home.

About the only thing you can’t easily find out online, in fact, is which seventh-grade math teacher is best for your kid. Ask the parents at any bus stop which teachers have lost their energy for the job or can’t control their tempers, and you’ll find out pretty quickly that they know better than anyone else. But there’s no mechanism for parents to pool that knowledge or to make the school system respond to it.

Maybe what we need, and what teachers should welcome, isn’t the data on the test scores and “value-added” rankings that some parents are demanding — or, at least, not that alone. What we need is for some tech entrepreneur to come up with a Yelp or an Angie’s List for public schools, because the amalgamated voice of the consumer is the most powerful kind of accountability in American life.

A Yelp for teachers

In Virginia, a parent named Brian Davison is suing the state because it won’t release the ratings that public school teachers get based on the test scores of their students.

Maybe that data isn’t what we need, says Yahoo News’s Matt Bai. Instead, what if someone built a Yelp or an Angie’s List for public schools?

Read more here.

25 notes

·

View notes

Photo

Finance Contributors Madness Pool Is In Effect!

We’ve created a special Tourney Pick ‘em Pool for finance contributors and anyone else who wants to play.

Its free and incredibly easy to join, simply click HERE and fill out a bracket.

Deadline to complete a bracket is March 19th at 12:15PM ET.

3 notes

·

View notes

Text

Here’s a reblog of a fascinating thought piece by Union Square Ventures’ Albert Wenger.

The Misunderstood Self Driving Car

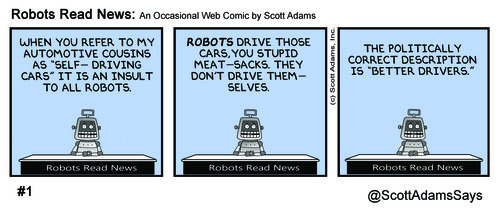

Yesterday I saw a funny cartoon about self driving cars by Scott Adams from the perspective of a robot with an attitude:

When I discuss the impact of automation on the labor market I sometimes run into the argument that self driving cars are still years away and that there are a lot of edge cases to solve before they will replace human drivers.

That argument makes it appear as if there was some distinct moment in the future where we finally say “hurrah, the self driving car is completely finished” and that there will be no impact until then. But that is not how technology progresses.

Instead, technology tends to arrive piecemeal in fits and starts. And it has an impact all along the way already. The same is true for self driving cars. We already have some key components that have entered the market: the most impactful one has been GPS based navigation (which has now come to pretty much every car courtesy of smartphones). While this doesn’t automate the driving per se it does take over a crucial bit which is figuring out how to get from A to B. And that means that cheaper labor can now be substituted for trained labor in driving taxis and limousines!

What will be the next big step? Well one possibility is remote driving. Suppose you have a self driving car but it can’t handle certain edge cases, like getting stumped on a New York city street that’s blocked by an oil delivery truck (we’ve all been there). Instead of having to be able to solve a situation like that completely autonomously one can envision a future of driver pools that stands by whenever a self driving car needs an assist. Here technology provides leverage — a single driver might now be able to “supervise” multiple cars. And of course that driver could be in a low cost part of the country.

This has of course already happened although not yet with cars — the US military has many new drone pilots who have never logged an hour of flight in a real plane. And drones can keep themselves up in the air and takeoff and land by themselves. So even the number of pilot hours relatively to flight hours has already changed. And while I don’t know anything about military pay, in commercial aviation the impact of automation has helped drive down airline pilot pay at the 75% percentile from $150K in 1999 to $100K in 2011.

So let’s please not pretend that we shouldn’t think about labor market consequences of self driving cars because fully autonomous cars en masse are still years away. The impact of what is becoming possible will be felt all along the way.

198 notes

·

View notes