Text

This Is Your Last Chance to Dump Netflix Stock

By Stephen McBride

As you may have heard, Netflix (NFLX) bombed on earnings results this week.

The company fell short of its growth target by more than two million subscriptions. And for the first time in eight years, it reported a subscriber loss in the US.

The stock plunged more than 10% on the news.

Last July I wrote explaining why Netflix was in big trouble. If you sold Netflix after reading that essay, nice call—you sold on the highs and avoided the bloodbath.

If you still own Netflix or you’re tempted to “buy the dip,” please don’t.

Netflix Investors Live in Fantasyland

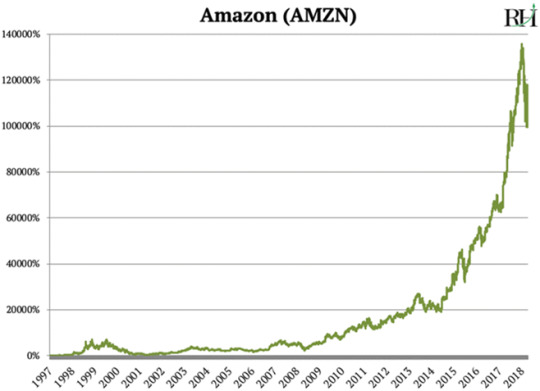

It has exploded 5,600% in the past 10 years, outperforming even mighty Amazon (AMZN) by more than 2X.

Everyone, including me, thinks Netflix’s video service is great. I’ll happily admit that Netflix is a great business.

But it’s a lousy stock.

The problems start with valuation. Even after plummeting more than 10%, Netflix is dangerously overpriced. It has a price/earnings (P/E) ratio of 140, compared to the S&P 500’s of 22.

Why have investors bid it up to this absurd price? The argument goes something like this…

Netflix has gained 100+ million subscribers in the past five years and will continue adding millions every quarter for years to come. Revenue will skyrocket, which will turn the company into a cash-generating machine, and its stock will “grow into its valuation.”

Using simple math, I’m going to show you why anyone who believes this is living in fantasyland.

Netflix Has 151 Million Paying Subscribers Today

Roughly 60 million of them are in the US, with the other 91 million scattered around the world.

According to the US Census Bureau, there are 127 million households in America. Which means around 47% of US households already have a Netflix subscription.

Big Four accounting firm Deloitte found that 55%, or 70 million, US households subscribe to a streaming service. So even if every streaming household were to subscribe to Netflix, that’s only another 10 million “potential” customers.

That’s a pretty low ceiling from where Netflix currently stands.

Netflix Is Already Struggling to Acquire New Subscribers

In the first six months of this year, the company spent $590 million on marketing in the US—25% more than what it spent last year. It acquired 2.7 million new paying subscribers, which works out to a cost of just over $219 per new user.

That’s a huge 336% jump from the $65 cost per new user it enjoyed just two years ago.

Netflix’s standard package costs $12.99/month. At a customer acquisition cost of $219, it takes almost 17 months to break even on a new user. And keep in mind its acquisition costs are rising rapidly.

Can International Subscriber Growth Save Netflix?

In the past year, Netflix has added more than 5X as many international subscribers as US ones. The company expects most of its growth to come from international markets. So this is by far the most important segment to watch.

Until last year, Netflix’s subscriber growth rate had risen at around 17% per year. But its growth seems to have stalled. Last quarter, it added just 2.8 million international subscribers compared to 4.6 million in Q2 2018.

To get back on track, it must add over 30 million new users this year, 35 million in 2020… and 40 million in 2021.

My research shows it will probably struggle to add even three million new subscribers/year in the saturated US market. Which means nearly all of this growth must come from international markets.

It All Comes Down to Content

Remember, Netflix has achieved its incredible growth by blowing up the TV distribution model. It ate the lunch of cable companies that used to be the gatekeepers of what people watch.

But as I explained last year, distribution isn’t all that important anymore. Thanks to the internet, we can watch practically anything we want anytime we want. Great content is what really matters today.

Netflix has proven it can make good content for a US audience. But to achieve international success, it needs to do so in countries as diverse as France, India, Mexico, and Brazil.

For the most part, TV is a “local” thing. Americans like to watch American shows. Brazilians like to watch Brazilian shows. Which means NFLX must make “local hits” to attract the masses in these countries.

So far, it has failed at this. Frankly I don’t know if it’s even possible for one company to become a content expert across a dozen different countries with a dozen different languages.

But even if it is possible, Netflix doesn’t have the cash to pull it off.

Netflix Spends Billions on Content

Netflix spent a jaw-dropping $12 billion on content last year alone, up 33% from $9 billion in 2017. Its spending on content has grown significantly faster than the rate at which its sales have grown.

This new content has helped bring in 28 million international subscribers in the past year. But it has come at a massive cost. The $12 billion it spent developing content last year dwarfs the $1.2 billion in profit it earned in 2018.

NFLX has been borrowing to make up the difference. Its debt has exploded from $3.3 billion in 2017 to $10.3 billion today.

Netflix Is Worth Half of Today’s Price

Today, Netflix trades for $324. Based on its profit forecasts and the average valuation in its industry, its “fair value” is around $120. The average valuation in its industry, by the way, is 40X earnings. So valuing it this way isn’t exactly conservative.

Still… I’ll entertain the idea that Netflix stock deserves a nice premium. It does have a stellar management team, explosive growth, and has pulled off some incredible accomplishments.

If we’re generous, Netflix is worth maybe… MAYBE… $200–$220 a share.

Problem is, that’s still 30% below its current price.

Lots of people will read this essay and conclude that Netflix is a good short.

Don’t do it. Don’t short Netflix.

As you can plainly see from its 140 P/E ratio, Netflix stock isn’t driven by fundamentals. It’s driven by the enthusiasm of investors, which is totally unpredictable.

There are much easier and smarter ways to make money in the markets than shorting a stock powered by the lofty dreams of investors.

Get my report "The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money". These stocks will hand you 100% gains as they disrupt whole industries. Get your free copy here.

0 notes

Text

This Technology Everyone Laughed Off Is Quietly Changing the World

By Stephen McBride

One of my most painful memories as a kid was having my braces tightened.

The orthodontist would grip his pliers, clamp down on the metal wire cemented to my teeth, and crank.

I’m happy to have straight teeth today... but man did those things hurt.

And they were embarrassing too. Especially during those young teen years when self-confidence is fragile. There was just no good way to hide a mouthful of metal...

So Long, Metal Braces

Ever notice you don’t see metal braces all that much anymore?

Align Technology (ALGN) answered the prayers of millions of teenagers by creating “invisible” braces.

Instead of shiny metal brackets cemented to your teeth, Align’s Invisaligns are made of transparent plastic. It sold over 80 million pairs last year.

Invisalign was a godsend for people with crooked teeth. Not only could they fix your smile with far less pain and embarrassment. They made early investors rich!

In the past decade, Align’s revenue has soared 530% to $1.97 billion. In the same time its stock has soared 3,400%, as you can see here.

Why It Took 40+ Years to Invent Plastic Braces

Modern metal braces have been around since the 1970s. You might wonder, why did it take 40+ years to invent plastic ones?

The answer is we didn’t have the technology. Align disrupted orthodontics with 3D printing.

In short, a dentist can now scan your mouth, create a digital “map” of your teeth, then 3D “print” a customized mold.

3D printers “print” objects similar to how an inkjet prints on paper. You might remember the Super Bowl-level hype in 3D printing stocks a couple of years ago.

As I explained last year, promoters claimed that every American would soon have a 3D printer, just like we have paper printers today.

Investors ate it up and plowed billions into 3D printing stocks. 3D Systems (DDD), the largest 3D printing company, exploded to a 900% gain in two years.

But back then, these printers could make only flimsy plastic trinkets with little use. When investors realizedthey were duped by overhype, 3D Systems plunged 92%.

The 3D printing sector still hasn’t recovered. After five years being stuck in the mud, most investors think the opportunity to profit from 3D printing stocks is long gone.

The 3D Printing Revolution Has Just Begun

3D printers have come a long way in the last five years. Today they make important products for some of the world’s largest companies.

For example, defense contractor Boeing (BA) now 3D prints thousands of titanium parts for its 787 Dreamliner. They’ve helped shave $3 million off the cost of each plane.

And General Motors (GM) teamed up with 3D-printing software leader Autodesk (ADSK). Together they created a 3D-printed car seat bracket. It’s 20% stronger and 40% lighter than the old seat bracket. And it’s made from only one part instead of eight.

3D-printed parts are often lighter, more efficient, less expensive, and more precise than anything humans could create before. Plus they’re totally customizable. This is allowing companies to reinvent how things are made.

For example, 3D printing is disrupting dentures.

No two human mouths are identical. So, like braces, dentures require total customization.

Anyone who has dentures will tell you having them fitted is a real pain. It usually involves a half dozen trips to the dentist and lots of mouth X-rays. You also have to get multiple impressions of your teeth, which feels like biting into a tray of mud.

With 3D-printed dentures, you only need one visit to the dentist. And biting into mud is no longer required. A dentist simply takes a digital scan of your mouth, then sends the “blueprint” off to a lab that 3D prints a customized pair of dentures.

3D Printers Are Getting Faster

One reason 3D printing was a disappointment was because it was slow. It couldn’t produce things fast enough to compete with conventional assembly lines.

Desktop Metal, a private company valued at $1.5 billion, is changing that. Its giant 3D metal printers can create certain objects 100X faster than many other 3D printers.

In fact, a study from Desktop Metal found its machines can make 546 complex parts in a single day. General Electric’s (GE) 3D printers can only make a dozen!

Desktop Metal is also “printing” with stainless steel, aluminum, and other metals at assembly-line speeds. This is key. A major drawback of early 3D printers is they could only print in fragile materials like plastic.

3D Printing Is in a Quiet Boom

3D printing is following the “script” of many disruptive trends.

Disruptive companies set out to accomplish things that have never been done before. If they succeed they can make investors rich. But along the way, they’re prone to hype and wild exaggeration.

It’s not unusual for investors to get carried away with dreams of riches. Their imaginations run wild and they bid disruptive stocks up to the moon. Eventually reality sets in. A correction or crash always follows.

Often, the best time to invest in these disruptions is after the cycle of hype has run its course. Smart investors can come in and pick up great disruptive stocks at a 90% discount.

3D printing is right around this sweet spot today. According to leading industry research firm Wohlers, the 3D printing industry grew by 33% to $9.98 billion last year.

The largest 3D printer company, 3D Systems, achieved record revenues in 2018.

And according to the latest IDC forecast, spending on 3D printing will hit $23 billion in 2022—up from $14 billion this year.

In other words, the industry is in the early stages of a quiet boom. Yet, 3D printing stocks are still at depression levels.

I Recommend Autodesk (ADSK)

Autodesk makes 3D-printing software. Its AutoCAD program is considered the premier 3D printing software.

It counts many big, important companies like Airbus (EADSY) and General Motors as happy customers.

I see Autodesk doubling over the next couple of years as 3D printing takes off. Autodesk has jumped 23% since I last wrote about it (read my full investment case here). It’s still a great “buy.”

Get my report "The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money". These stocks will hand you 100% gains as they disrupt whole industries. Get your free copy here.

0 notes

Text

The Best “Pick-and-Shovel” Play for the Online Grocery Boom

By Justin Spittler

Everyone knows online shopping revolutionized how we buy clothing, electronics, and other merchandise.

Many malls across the country have closed their doors because people simply don’t shop at malls like they once did. Instead they buy things online. After a few days, the things show up at their doorstep.

The media nicknamed this phenomenon the “Retail Apocalypse.” And it has led to…

The “Rewiring” of American Real Estate

Amazon (AMZN) alone ships 5 billion packages a year. That’s more than 13 million packages per day.

To ensure these packages make it to their destination, a whole new network of infrastructure was built out. Industrial warehouses and distribution centers form the heart of this network.

These facilities store, process, and ship the packages you order online.

You might drive by an industrial warehouse on your way to work. They’re generally non-descript cement buildings, located off highways. They can stretch over a quarter mile long. And they usually have dozens of trucks docked outside.

Without these centers, online shopping would be impossible. And the stocks of companies that operate them have been great investments. Just look at the returns you could have made…

Terreno Realty (TRNO)—a company that owns a portfolio of warehouses—has surged 187% since the start of 2014.

First Industrial Realty (FR), another warehouse operator, is up 111%. Prologis (PLD) is up 117%. And Duke Realty (DRE) is up 105%. The S&P 500 rose just 67% over the same period.

If You Missed Out on This Run, It’s Not Too Late

There’s a second real estate transformation happening now… thanks to the boom in online grocery shopping.

In just the last five years, online grocery sales have tripled. By 2023, the market is expected to quadruple again.

It’s easy to see why. Visiting the grocery store is a chore. The typical American family spends over a hundred hours a year shopping for groceries. A lot of that time is spent in the car and waiting in the checkout line.

Online shopping eliminates all that. It leaves you with more time to spend with your family, friends, and doing things you like.

This might surprise you, but…

The US Lags Behind Many Countries in Online Grocery Shopping

Last year, groceries accounted for just 1.6% of total US online sales. In China, they accounted for 3.8%. In Japan and South Korea, they accounted for 7.1% and 8.3% of total online sales.

You don’t see this often. Normally, the US is a leader in tech trends. In this case, it has some catching up to do.

There’s every reason to believe online grocery shopping will catch on soon in the US. The Food Marketing Institute and Nielsen predict 70% of consumers will try buying groceries online within the next four to six years. This should push grocery sales to 3.5% of total online sales by 2023.

Will Grocery Stories Disappear?

We’re not necessarily headed for a “Grocery Store Apocalypse.” But much like retail did, the industry will evolve.

Grocery stores will shrink because there will be fewer people walking up and down the aisles. They’ll store more food and beverage offsite.

As you can imagine, regular warehouses aren’t adequate for storing and processing groceries. Unlike most of the things you might buy on Amazon, groceries go bad.

A grocer can’t place a frozen chicken or a bunch of broccoli in a box and mail it to you. They have to keep the food fresh.

Cold storage warehouses store frozen and fresh food before it reaches a supermarket. About 96% of frozen food stops by one of these warehouses before reaching the grocery store.

Cold storage warehouses are specialized facilities. They aren’t cheap or easy to build. They require extensive piping, large HVAC systems, and a whole lot of refrigeration.

So, it’s unlikely Amazon, WalMart, or any other online grocer will build their own. Instead, they’ll leave cold storage to the pros.

I Like Americold Realty Trust (COLD)

Americold is a leader in cold storage. It owns and operates 156 warehouses and about 928 million cubic feet of temperature-controlled storage.

The company has been around for decades. But it went public back in January 2018… and it’s been on a tear since then, as you can see here:

Americold’s stock has rocketed 112% since its IPO. I expect it to climb much higher as online groceries catch on.

About 82% of Americold’s sales come from the United States. And Americold commands a 23% market share in the US. Lineage Logistics is the only bigger player in the space, and it’s private. You can’t buy its stock.

Americold serves some of the biggest players in the food and beverage space. I’m talking Walmart, Kroger, Trader Joe’s, and Beyond Meat.

Finally, Americold pays a 2.5% dividend. The S&P 500, for perspective, yields 1.9%.

Americold is a unique and safe way to capitalize on the emerging online grocery market. But it also offers plenty of upside. I wouldn’t be surprised if its stock doubles over the next two to three years as online groceries take off.

Download our free report The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money. These stocks will hand you 100% gains as they disrupt whole industries.

0 notes

Text

What This Centi-Billionaire Fashion Magnate Can Teach You About Investing

There are 2,208 billionaires on earth, according to Forbes. But only three are rich enough to qualify as “centi-billionaires”—worth $100 billion or more.

Amazon (AMZN) CEO Jeff Bezos is #1.

Microsoft founder (MSFT) Bill Gates is #2.

#3 will probably surprise you.

It’s not super-investor Warren Buffett. It’s not Facebook (FB) CEO Mark Zuckerberg. It’s not a hedge fund manager, a banker, or a Russian oligarch.

The World’s Third-Richest Man

The third-richest person on earth is a French guy who sells women’s purses. This past week, Bernard Arnault’s personal fortune grew to $100.4 billion.

If you don’t know the name, Arnault is CEO of luxury empire LVMH (LVMUY), the parent company of Louis Vuitton. He also owns $80-billion fashion giant Christian Dior (CHDRY).

Gates and Bezos made their fortunes “the regular way.” They developed game-changing products that hundreds of millions of people use every day.

Eight in every 10 computers run on Microsoft’s software. Over 100 million Americans subscribe to Amazon’s Prime delivery service.

Arnault got rich in a whole different way. He built super-luxury brands like Louis Vuitton, Givenchy, Hublot, and Dom Perignon.

A Prestigious Brand Is a Powerful Thing

A no-name handbag from Target might cost $100 tops. But women line up around the block to hand over $5,000 for a Louis Vuitton.

LVMH’s business is booming. Profits have surged 89% in the past three years, and its stock has shot up 180% since 2016—putting Arnault into the centi-billionaire club.

Gucci is booming too...

Like Louis Vuitton, Gucci is a super-luxury brand. If you want a pair of Gucci sneakers, prepare to drop a thousand bucks at least.

It might sound ludicrous to spend the equivalent of a small mortgage payment on shoes, but Gucci’s are flying off the shelves. Sales at its parent company, Kering (PPRUY), jumped 50% in 2018.

Kering’s stock is on fire. It’s surged 285% in the past three years, as you can see on this chart. That’s double the gains of Amazon and Microsoft over the same period.

But What About the “Death of Retail?”

As you probably know, companies like Amazon and other under-the-radar disruptor stocks are putting regular stores out of business.

More than 21,000 stores have shut their doors in the past five years, according to leading retail research firm Nielsen.

Yet online disruption hasn’t hurt luxury sellers one bit. Super-luxury companies have proven totally immune to the internet wrecking ball.

In fact, a 2018 study from “Big 4” accounting firm Deloitte found sales for luxury retailers soared 81% in the past five years!

Instead, it’s the middle-of-the-road retailers that are getting crushed.

Toys “R” Us, Sears, Bon-Ton, Borders, Circuit City, and RadioShack are all bankrupt.

Meanwhile, many other middling retailers are barely clinging to life. Macy’s (M), J.C. Penney (JCP), Dillard’s (DDS), and Nordstrom (JWN) still have a pulse, but they’re fading fast, as you can see here:

These Disrupted Stores Made One Mistake

They tried to be everything to everyone.

The “department store” business model used to work okay. Open a big store, sell everything from blouses to outdoor grills to video games. As long as the store was located in a place with enough people coming through—like a city or a shopping mall—it could do good business.

Those days are long gone. Internet shopping has blown up unspecialized, “middle-of-the-road” stores.

Meanwhile, Low-End Discount Stores Are Doing Just Fine

Discount store sales have surged 40% in the past five years, according to Deloitte.

Dollar General (DG), for example, is America’s largest dollar chain. You could have doubled your money on its stock in the past two years:

Dollar General is now the largest US retail chain by store count. It operates almost 16,000 stores—more than McDonald’s, Starbucks, or Walmart.

Revenue has shot up 145% in the past decade. And it’s not just low-income folks shopping there. According to J.P. Morgan, households earning between $50,000 and $75,000/year are Dollar General’s fastest-growing customers.

The “Middle” Is Dying

The hollowing out of the “middle” is a disruptive theme rippling across many industries.

Where will it strike next?

My long-time readers know self-driving cars will gut the auto industry like a fish. In fact, it’s already begun. The stock of America’s largest car maker, General Motors (GM), has been dead money for five years. Rival Ford (F) has plunged 42%.

Super-luxury carmakers are doing just fine though. Sportscar maker Ferrari’s (RACE) stock has surged 190% since going public in 2015!

So what should a disruption investor do with this information?

Steer clear of “average” stocks. Avoid mediocre, conventional, or “good enough” businesses.

For better or worse, the middle is dying as its lunch is eaten from above and below.

Download my report The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money. These stocks will hand you 100% gains as they disrupt whole industries. Get your free copy here.

0 notes

Text

Netflix’s Worst Nightmare Has Come True

By Stephen McBride

If there were a stock market “hall of fame,” Netflix (NFLX) would be a shoe-in.

Its stock has soared 8,500%+ in the last decade as “streaming” video has caught fire.

Netflix achieved those gains by stealing tens of millions of customers from cable companies. Last year, half of Americans age 22–45 didn’t watch a second of cable TV. And 35 million Americans have dropped cable in the last decade.

But it’s time to come to terms with a sad truth...

Netflix’s glory days are over. And what’s coming next won’t be pleasant if you own Netflix stock.

Until recently, Netflix was the only real streaming game in town. Not only did it enjoy virtually zero competition. Many of the biggest, most powerful media companies on earth helped Netflix build its business.

Netflix founder Reed Hastings did a lot of things right. But his most genius move was leasing shows and movies that other companies produced.

In the early 2010s, Netflix signed deals with movie and TV makers like Disney and NBC. For a small fee, Netflix bought the rights to air wildly popular content like the Marvel Avengers movies... and hit comedies like The Office and Friends. In other words, Netflix built its business on the back of other companies’ content. And it worked incredibly well. Netflix now has 149 million subscribers—more than any cable company.

But this world is now gone.

One by one, Netflix’s colossal competitors have woken up. They’re ending their contracts with Netflix, taking back control of their content, and launching their own streaming services that will compete with Netflix.

This is happening right now. Have you heard about Disney’s new streaming service, Disney+? Launching later this year, it’ll be the new home of the world’s most popular movies.

Although Disney is best known for Mickey Mouse, it owns the greatest portfolio of movies ever assembled.

The 3 best-selling movies so far this year are Avengers: Endgame, Captain Marvel, and Aladdin.

Disney owns all 3.

The 3 best-selling movies of 2018 were Black Panther, Avengers: Infinity War, and Incredibles 2. Disney owns all 3.

The 3 best-selling movies of 2017 were Star Wars: The Last Jedi, Guardians of the Galaxy 2, and Beauty and the Beast.

Disney owns all 3.

Except for the newest ones, all these wildly popular movies are currently on Netflix. By the end of this year, they’ll be removed from Netflix for good. To watch them, you’ll have to get a Disney+ subscription.

Disney+ will cost $6.99/month—or around half the price of Netflix’s most popular subscription.

Netflix’s Best Content Is Being Gutted

Netflix investors should be equally worried about AT&T’s new streaming service that launches in 2020. It’ll cost slightly more than Netflix at $16–17 month.

AT&T is best known as a cell phone company. But its purchase of WarnerMedia in 2018 turned it into a media powerhouse. It owns HBO, the most successful premium TV network ever. HBO continues to pump out all-time hits like The Sopranos, Game of Thrones, and Sex in the City. Remember, Netflix achieved its incredible success by being first in streaming. It's a true disruptor stock that revolutionized TV. For years it essentially “owned” the mechanism of airing TV and movies over the internet.

Now that others have caught up, the game has changed. Soon customers will have lots of streaming services to choose from. They’ll choose the ones with the best content.

And Netflix is losing its best content!

It’s not just Disney movies that Netflix is losing. Over the next two years its whole library will be gutted.

According to The Wall Street Journal, the most watched show on Netflix is The Office.

Netflix does not own The Office. NBC Universal owns The Office.

NBC Universal is launching its own streaming service and pulling The Office off Netflix for good by the end of next year.

Another extremely popular show on Netflix is Friends. Friends is owned by WarnerMedia, which, as I mentioned, is now owned by AT&T.

Friends will be pulled off Netflix for good in 2020.

Losing The Office and Friends is bad, but it’s just scratching the surface. According to analytics firm Jumpshot, more than half of Netflix’s 50 most popular shows are owned by companies planning to launch their own streaming services.

Do you see what’s happening here?

Netflix is losing all the best movies and TV shows.

How could this not cripple it?

Netflix sees the writing on the wall, and is spending gobs of money to reinforce its own content library. It spent $12 billion last year, and it expects to spend another $15 billion this year.

It now invests more in content than any other American TV network. But it’s come at a steep cost. To fund its new shows, Netflix is borrowing huge sums of money. Over the past year its debt has shot up 58% to $10.3 billion. For perspective, Netflix earned $1.2 billion in profits last year. Unfortunately, no matter how much it spends, it can’t hope to compete with Disney or AT&T. Netflix is in an impossibly tough spot.

Can Netflix survive?

Netflix’s market cap is about $165 billion—making it the 30th-biggest publicly traded US company.

It got there through domination of streaming which, as I’ve shown, is a thing of the past.

Going forward it will succeed or fail on the popularity of the TV shows and movies it produces.

Let’s assume it succeeds and creates a ton of content people love. The problem is, companies that produce TV shows and movies are not worth anywhere near $165 billion.

Even wildly successful film studios are worth tens of billions, max. In 2018 Walt Disney studios—which includes iconic brands like Marvel, Star Wars, and Pixar—generated $10 billion in revenue, and $2.98 billion in profit.

Netflix has one big advantage. It has already amassed a giant audience of 149 million paying subscribers. It’s far easier to keep a customer than to get one. Netflix will survive. But it will shrink. Even in the most generous scenario, within a couple of years I can’t see it being worth more than $100 billion.

That would put its stock price at about $225/share—or about 40% below its current price.

Again, that’s a rosy scenario. Don’t be surprised if Netflix stock gets cut in half, or worse, in the next year or two.

Download my report The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money. These stocks will hand you 100% gains as they disrupt whole industries. Get your free copy here.

0 notes

Text

Housing Is Booming, but Investors Are Still Too Scared to Invest in It

By Stephen McBride

The US housing market is booming.

This past month the number of Americans looking to buy a new house spiked to a three-year high. Mortgage applications jumped 40%.

And Quicken Loans, the US’s largest mortgage lender, had its best month in 30 years.

“The phone is ringing off the hook” CEO Jay Farner said in a recent interview.

The Housing Crash Sowed Fear Among Investors

In February I explained why buying homebuilder stocks was a near lock to make you money in 2019. Specifically, I recommended buying homebuilder NVR Inc. (NVR) among other disruptive stocks I see skyrocketing in the coming years.

I have to admit, my housing call wasn’t popular. US housing, as we all know, crashed in 2008 and almost wrecked the global financial system. Many people lost hundreds of thousands of dollars. Some lost their jobs, their houses, their businesses.

The housing crash was perhaps the most financially disruptive event of the century. It caused a whole generation of folks to swear off housing as an investment.

I understand why no one wants to hear about housing. But you should want to hear about housing, because the evidence is overwhelming.

As a refresher, 2018 was a terrible year for housing. Mortgage rates rose significantly for the first time in five years, which made it more expensive to buy a home. Home sales plunged. Lots of analysts warned of another 2008-style real estate meltdown.

This all led to the slaughter of US homebuilding stocks. 2018 was their worst year since the 2008 financial crisis! The US Home Construction ETF (ITB) plunged 32%, as you can see here:

But everyone failed to realize one thing...

Housing Affordability Tells We Are Nowhere Near a “Bust”

Housing affordability is a primary driver of home prices. And housing is still very affordable for most Americans.

The National Association of Realtors affordability index takes three key metrics—home prices, mortgage rates, and wages—and boils them down into a single number.

This number tells us if average folks can afford a home. When affordability drops too low, the average American simply can't afford to buy. That often forewarns a housing bust.

Here’s the index going back to 1992:

You can see affordability is well above the 30-year average, as shown by the red line.

This is key because every housing bust in the past 50 years happened when affordability was below 120. We’re nowhere near that level today... which tells us the risk of a “bust” is virtually zero.

There’s a Big, Silly Myth Going Around About Housing

Have you heard this “fact?”

Today’s generation of young adults, known as “millennials,” don’t want to own houses like their parents did. Instead they’ll rent for life. This lack of young buyers, the story goes, will put a cap on house prices.

This is nonsense. The data shows it isn’t just false… the total opposite is happening.

Census Bureau figures show the number of households in America just hit an all-time high at 122 million.

At the same time, the number of Americans who own their own home has jumped in the past three years. That’s significant as the rate had been plunging for over a decade.

As for the number of folks renting rather than owning a house, the number has plunged for three years in a row.

In other words, folks are buying houses faster than any time in the past 30 years.

Millennials are waiting longer than their parents to have kids. But once they have kids, they’re buying houses... just like every generation of middle-class Americans before them did.

Pew Research data shows the average age of a first-time home buyer is 31. This year the average millennial will turn... 31!

The Outlook for Housing Gets Even Better

There’s a shortage of homes in America.

After the 2008 housing bust, tens of millions of vacant homes were for sale. That’s no longer the case. It would take only six months to sell every existing home on the market today, as you can see here:

The seeds of this shortage were sown in 2008. In the boom leading up to the bust, US homebuilders built record numbers of houses. Four million new houses went up in 2004 and 2005 alone—more than any other two year period in US history!

As you know, the market turned south in 2006, demand collapsed, and US homebuilders lost their shirts. America’s largest homebuilder, D.R. Horton (DHI), tanked 86%.

The housing bust seared one thing into homebuilder’s minds: don’t overbuild EVER again.

So for the past decade they’ve been conservative. Census Bureau data shows an average of 1.5 million homes were built each year since 1959. Yet since 2009 just 900,000 homes have been built per year.

Now Is a Great Time to Buy NVR

NVR is unlike any other US homebuilder. In short, most homebuilders buy raw land then build houses on it.

NVR never buys raw land. It only buys developed land, which removes a lot of risk. This unique approach helps it avoid the riskiest part of the housing business.

When I recommended NVR back in February, it was trading at just 13-times earnings—its cheapest level since 2009. Because the stock has jumped 30% since, it’s no longer a “steal.” But it’s still a great buy, and it’s still dirt cheap.

NVR achieved excellent profit growth of 40% last year, and its stock has been on a tear since the start of the year, as you can see here:

0 notes

Text

Big Tech Break-Up Won’t Happen for This One Reason

By Stephen McBride

The US government recently announced it will launch an investigation into “big tech.”

It is looking into whether Amazon (AMZN), Google (GOOG), and Facebook (FB) are too powerful and should be broken up.

These are the 3rd-, 4th-, and 6th-largest companies on earth. Combined, they are worth over $2 trillion. And they’ve grown 470%, 175%, and 95% over the past five years.

All three stocks tanked on the news. In recent weeks, Google has dropped 20%, Amazon 15%, and Facebook 18%.

Even if you don’t own these stocks, you should care where they’re headed. Because where they go, the market is likely to follow.

Google, Amazon, and Facebook are colossal companies. Together they make up almost 10% of the S&P 500.

A smaller stock like Campbell Soup (CPB) could triple. And yet it wouldn’t move the needle as much as if Amazon rises just 1%.

What I’m about to say might surprise you…

Investors Are Worrying for Nothing

There is little chance the government will break up big American tech firms.

In fact, the total opposite is about to happen. Washington and big tech will become best friends.

I know, this is the total opposite of what you hear on CNBC, CNN, or Fox News.

Let me explain why they’re wrong.

It All Comes Down to the US-China “Tech War”

The US-China “Trade War” is an inaccurate way to describe it. What’s really happening is a “Tech War.”

I recently discussed how the US government cut off the supply of microchips to Chinese phone maker ZTE, forcing it to shut down.

And you probably already know about the US government’s blacklisting of Huawei.

Huawei, a giant Chinese tech company, is the world leader in 5G—the new superfast cell network our phones and computers will soon run on.

President Trump says, “The race to 5G is a race America must win.”

In 2018, Singapore-based chipmaker Broadcom (AVGO) tried to acquire American 5G leader Qualcomm (QCOM).

The US government shut down the deal, fearing it would help China gain the “know-how” to make Qualcomm’s cutting-edge 5G chips.

China’s Technological Rise Is a Great Threat to America

President Trump recently invited big tech CEOs to the White House to talk “bold ideas for how we can ensure American dominance” in industries of the future.

The meeting centered on how these firms and the government can work together to achieve American dominance in tech. They focused on disruptive areas like artificial intelligence (AI), 5G, and advanced manufacturing.

Does that sound like the government wants to break up big tech?

Not long ago, Facebook CEO Zuckerberg stood in front of Congress and warned that breaking up America’s big tech companies would help China.

He’s right. Google, for example, is the undisputed world leader in self-driving cars. It achieved this by investing billions of dollars into developing self-driving tech since 2009.

This money came from the huge profits generated by Google’s core search and advertising businesses. It has consistently plowed a big chunk of those profits into developing breakthrough technologies.

Google is also a world leader in the crucial areas of artificial intelligence and quantum computing.

In short, Google is America’s greatest tech “incubator.” Breaking it up would ruin that.

The US Government Has a History of Breaking Up Firms It Deems “Too Big”

It broke up Standard Oil in 1911, AT&T in 1982, and went after Microsoft in the 1990s.

But there’s too much at stake here. MIT forecasts self-driving cars alone are set to unleash $7 trillion in new wealth in the next decade.

Imagine if a Chinese company claims the lion’s share of that.

It would help China surpass the US as the world’s largest economy—a title America has held since 1871.

No matter what you think of President Trump, we can all agree he doesn’t want China closing in on the US while he’s President. He’ll do everything he can to make sure that doesn’t happen.

Which means we should expect more cooperation between Washington and big tech.

Now Is the Perfect Time to Buy Google

As I mentioned, big tech stocks have plunged on worries the US government will break them up.

Big tech will probably get a slap on the wrist. And they’ll have to pay some big fines. But these companies won’t be broken up as long as we’re in a tech race with China.

After its recent 20% drop, Google (GOOG) is selling at its cheapest valuation since late 2016.

If you’ve been waiting to buy in at lower prices, now’s your chance.

You’ll likely have to wait out some choppiness in the stock price as this “break up big tech” story passes.

But I’m confident that’s all it is—a story.

The US government and big tech need each other.

0 notes

Text

Please Don’t Buy the Dip in Nvidia or Other Chip Stocks

By Stephen McBride

What do an iPhone and Nike sneakers have in common?

Both are made by iconic American companies. Both are also made in China.

American goods used to be made in America. Then cheap labor transformed China into the “world’s factory.”

Today we get 80% of our air conditioners, 70% of TVs, and 60% of shoes from China. But there’s one disruptive area that America still dominates.

Stocks in this area can produce huge profits (or losses) depending on how the US-China trade war shakes out. In fact, I picked a safe chip-making company as one of my three favorite disruptor stocks for 2019.

The Last Great “Made in the USA” Industry

It’s computer chips.

As you may know, computer chips serve as the “brains” of electronics like your phone and laptop.

These days, chips are no longer just in computers and phones. They’re part of everyday life.

Not long ago there was only a handful of chips inside the average car. Remember when you had to crank a knob by hand to roll your car window up?

Thanks to computer chips, that’s all changed. There are 1,500 computer chips packed into a Tesla Model 3 electric car, according to investment bank UBS.

No Country Can Challenge America in Chips

American companies like Intel (INTC), Qualcomm (QCOM), and Nvidia (NVDA) control over half of this colossal $469-billion market.

Chip demand has surged 15X over the past decade. As the use of computer chips has exploded, so has the revenue they generate.

Since 2009, Intel’s revenue has more than doubled. While Nvidia’s has surged 240% and Qualcomm’s has jumped 120%.

Computer chips are the US’s third-largest export, according to the Semiconductor Industry Association (SIA).

No country has been able to challenge America’s superiority in computer chips. The reason is their complexity. Computer chips are one of the most complicated and costly things on earth to develop.

It took American companies decades and hundreds of billions of dollars to master chip-making. It will likely take another decade, at least, for any other company to catch up.

The Achilles’ Heel of American Chip-makers

Despite their stranglehold on the market, US chip-makers have a big vulnerability.

They get over 80% of their revenues from other countries, according to SIA. Worse, more than half comes from China.

China is by far the world’s largest buyer of computer chips. It bought almost 60% of all the computer chips America produced last year, according to “Big 4” accounting firm PWC.

China spent $260 billion on computer chips in 2018. It now spends more on buying chips than it does on oil. That’s astounding when you consider it’s also the world’s #1 buyer of oil.

It’s scary how reliant many American chip-makers are on China…

Radio-frequency firm Skyworks Solutions (SWKS) gets 25% of its revenue from China.

Chinese companies account for close to two-thirds of 5G leader Qualcomm’s sales.

And graphics chip leader Nvidia (NVDA) gets 44% of its sales from China.

Doing business in China has been great for these companies. It’s been a main source of their tremendous sales growth over the past decade.

But with the “trade war” between the US and China getting worse, worried investors are dumping their stocks, as you can see here:

This Is a MUCH Bigger Problem for China than for the US

China’s largest and most important companies have a hopeless dependency on US chips.

As I mentioned last week, smartphone giant Huawei spent $20 billion on US chips alone last year. Almost every phone it makes runs on American chips.

China needs US chips, and the US Government knows it. That’s why Trump is using it to twist China’s arm in trade tasks.

Last summer, the US ordered a ban on chip sales to phone maker ZTE (ZTCOY). Without access to US chips, ZTE had to shut down production.

When I say “shut down,” I mean literally. Its factories had to stop making phones. ZTE, which employs over 75,000 people, was dead in the water without US chips.

Its stock plunged 55% in weeks. ZTE was on the verge of going out of business until the White House lifted the ban a couple of weeks later.

As you might know, China has its own versions of many big American companies.

Baidu (BIDU) is China’s Google. Alibaba (BABA) is China’s Amazon. China Mobile (CHL) is China’s AT&T.

All three are massive buyers of US chips. The US Government knows it can suffocate them by cutting off supply.

Look at how their stocks have crashed lately as trade talks have fallen apart.

Chip Stocks Will Be a Rollercoaster as Long as the Trade War Drags On

When a US-China trade deal looked to be headed in the right direction late last year, the US chip ETF (SOXX) shot up 48%.

But since talks fell apart in late April, it’s plunged more than 15%.

With such a huge number of their businesses linked to China, little will change until a deal gets signed.

Until then, I’m being cautious with American chip stocks and avoiding the Chinese companies dependent on them altogether.

Why invest in a company that could be crippled at the whim of a politician?

On the other hand, there’s hope this may help the US and China arrive at an agreement sooner rather than later.

China needs American computer chips. There’s no way around it. The optimistic take is that it has little choice but to “play ball” with America to get trade flowing more freely again.

0 notes

Text

The Big Lie That Keeps Many Investors Poor

By Stephen McBride

Today we’ll bust a big lie about investing.

This big lie keeps many investors down. Belief in it is a tall hurdle to building wealth.

How many times have you heard a statement like this?

“The only way to make big profits is to take big risks.”

This is the conventional wisdom. It gets repeated in classrooms, on TV, and by stockbrokers over... and over... and over again.

The problem is, it’s complete nonsense.

Why This Lie Spreads

Like many lies, people tell this one for one of two reasons. Some genuinely don’t know any better. Others are happy to spread it because it’s convenient for them.

Mediocre financial advisors hide behind this lie. It’s the perfect excuse for when they fail to generate strong returns on their clients’ money.

Most academics embrace this lie too. A finance professor who’s never bought a stock won’t hesitate to lecture you on why markets are “efficient” and trying to beat the averages is a foolish waste of time.

You can see why this lie has become conventional wisdom. It has powerful friends.

Folks who take the lie seriously fall into one of two groups.

Group one thinks: “Well, I’m not willing to take a big risk, so I guess I’m destined to earn small returns.”

Group two thinks: “Well, I’m not settling for mediocre returns, so I’ll load up on risky stocks.”

Both of these mindsets are a shame. They blind investors from great opportunities to make big profits in safe stocks.

If you give me three more minutes, I’ll prove to you that it’s wrong. I’ll also show you how to collect big returns without risking big losses.

So What Exactly Is a “Risky” Stock?

Most folks would agree risky stocks carry a few key traits:

Expensive—stock price is high relative to earnings

Small—company lacks financial resources of larger competitors

Volatile—stock price swings around unpredictably

No dividend—suggests company’s profitability is shaky

You most definitely do not have to buy stocks with these risky traits to make big returns.

To prove it, let’s flip this on its head. A safe stock should be the opposite of a risky one. It should be cheap, big, stable, and pay a dividend.

Few companies fit the bill better than Disney (DIS)—a stock I’ve been recommending since July 2018. You can read the most recent investment case here.

To recap, Disney is a huge company—bigger than McDonalds (MCD), Wells Fargo (WFC), and Goldman Sachs (GS).

Its stock traded at just 15-times earnings, which was cheaper than the average US stock.

Disney’s stock price is stable. It pays a reliable dividend in the neighborhood of 2%. And it has increased its dividend by 21% per year, on average, over the past five years.

No Reasonable Person Could Call Disney (DIS) “Risky”

By any definition, Disney stock is safe.

Yet it recently leapt 30% in just four weeks:

Source: RiskHedge

And since the fall of 2016, its stock has gained 52%—far better than the S&P’s 36% gain.

This combination is possible because Disney is a disruptor stock.

The big leap in Disney’s stock price came when it unveiled details of its disruptive new streaming project that’s threatening Netflix.

I’ll give you another recent example of a safe stock exploding higher.

Like Disney, Qualcomm (QCOM) Is Very Safe, and Yet…

I first wrote about computer chip giant Qualcomm (QCOM) late last fall, telling readers it was a “buy.”

Even I was surprised when it rocketed 55% in two weeks recently, following news of a favorable legal settlement.

Like Disney, Qualcomm is big. Bigger than Starbucks (SBUX), American Express (AXP), and Lockheed Martin (LMT).

Its stock isn’t quite as cheap as Disney’s. But at 15-times next year’s earnings, its valuation is reasonable.

Its standard deviation is low—which means its stock is not volatile. And it pays close to a 3% dividend, which it’s raised for each of the last eight years.

Like Disney, Qualcomm stock is unquestionably safe.

Also like Disney, it has handed investors big, quick profits recently.

And ALSO like Disney, it has tapped into a disruptive megatrend.

As I explained a while back, Qualcomm makes cutting-edge hardware that will be powering 5G phones and computers.

The coming launch of 5G in America is the most disruptive event of the decade.

Clearly big, safe stocks can hand you big profits, if they’re on the right side of disruption.

0 notes

Text

2 Big Developments in America’s 5G Rollout Each Investor Must Be Aware of

By Stephen McBride

My longtime readers know 5G is the most disruptive force of the decade.

In short, 5G will supercharge America’s wireless networks. It will give us internet speeds 1,000x faster than today’s.

This will open up a whole new world of disruption.

Think of 5G as a “tool” that will enable tomorrow’s disruptive businesses, one of which I revealed in my free special report, The Great Disruptors.

For example, how many of the following do you use?

Music streaming services ike Spotify

YouTube’s video streaming

Ride-hailing from Uber

Amazon’s online store

The last wireless upgrade—4G—is the driving force behind them all.

4G arrived in the early 2010s and brought us much faster speeds. With that came the ability to do things like watch movies, stream music, or shop from anywhere on your phone.

4G allowed disruptors like Google (GOOG), Amazon (AMZN), and Netflix (NFLX) to flourish. From 2010 to today, their stocks grew 325%, 1,350%, and 3,825%.

5G will be MUCH bigger than 4G.

4G was an upgrade. 5G is a total overhaul. It’s going to enable transformative disruptions like self-driving cars and remote surgery.

Today, I’ll tell you about two big new developments in 5G—and what they mean for investors.

Quietly, 5G Is Driving One of the Biggest Disruptions of 2019

As you may have heard, the US Government recently banned Chinese telecom giant Huawei from doing business in the US.

I warned back in February this was likely to happen. My prediction ruffled some feathers. Huawei reps even contacted me to insist I was wrong!

Huawei is the world’s second-largest phone maker, behind only Samsung. It stands accused of placing secret “backdoors” in its equipment. If true, these backdoors allow the Chinese government to spy on Americans who use Huawei’s gear.

Huawei is a private company. It has no publicly-traded stock. But its ban rocked markets all the same...

You see, Huawei buys a ton of parts from American companies. It bought $20 billion worth of computer chips from US companies last year, according to investment bank Evercore.

US chipmaker Qorvo (QRVO) gets 13% of its revenue from Huawei...

Radio-frequency firm Skyworks Solutions (SWKS) counts Huawei as its third-largest customer...

And facial recognition company Lumentum (LITE) gets almost 20% of its sales from Huawei.

As you can see in this chart, all three stocks tanked on the news.

While the Huawei ban is terrible for companies that sell to it, it’s GREAT for companies that compete with it in 5G.

Nokia and Ericsson Will Take the Lead in the 5G Race

Huawei is the world’s largest maker of 5G infrastructure.

It had secured $100 billion worth of 5G contracts—more than five times any of its rivals. But with Huawei all but banned from the Western world, those contracts have been torn up.

Only two other companies can step up to fill the void: Nokia (NOK) and Ericsson (ERIC).

You can see in this chart that both stocks jumped when Huawei’s ban was confirmed... and they’ve continued to march higher.

The Sprint and T-Mobile Merger Is a Big Deal

If you live in America, I can almost guarantee you use one of four carriers: AT&T (T), Verizon (VZ), T-Mobile (TMUS), or Sprint (S).

These four have the US cell market on lockdown. They own 98% of the $260 billion/year market.

The US government has always been leery of letting phone companies grow too powerful. If too much power concentrates with too few companies, they can take advantage of customers.

When the old AT&T got too big back in the 70s, the government broke it up into seven smaller companies.

The government has also blocked several phone company mergers. In 2011, it shot down AT&T’s attempt to buy T-Mobile.

So, many investors were caught off guard when the US government all but approved a merger between Sprint and T-Mobile.

Sprint and T-Mobile are America’s third- and fourth-largest cell companies.

Together, they’ll form a new “supercarrier” with 136 million customers—making it a close third to Verizon with its 155 million customers.

The stocks of all four US cell companies jumped higher on the news. Sprint shot up 25% in a single day.

With this merger, three companies will effectively control the whole US cell market.

Why would the US government allow this?

It all comes back to 5G...

The US government, and the Trump administration in particular, have been adamant that the US be first in 5G. In April Trump said: “The race to 5G is a race America must win.

A 2019, GSM Association report estimates US cell companies will have to spend $100 billion over the next two years to get America 5G ready.

In short, T-Mobile and Sprint didn’t have the cash to build their own 5G networks. So they’re joining forces to build one giant network.

According to one estimate, the merger will boost the number of 5G markets Sprint and T-Mobile can serve by 8x.

Think of 5G Like Gravity…

As we all learned back in school, gravity is an invisible force that pulls objects toward each other.

The earth’s gravity keeps your feet planted on the ground… and makes apples fall from trees.

Like gravity, 5G is a hidden force affecting everything right now.

It’s a key reason why the US government blacklisted Huawei.

It’s why the government made the unusual move to greenlight the Sprint / T-Mobile merger.

And keep in mind, the 5G buildout is still only in first gear. 5G will cause massive disruption as it comes online in the next couple years.

0 notes

Text

The Single Most Powerful Insight that Will Help You Find the Next Amazon, Google, or Netflix

If you haven’t read me before, let me briefly introduce myself to give you a little context.

I’m Stephen McBride, Chief Analyst at RiskHedge. My job is to find under-the-radar disruptor stocks that are set to dominate the world in the next 10 years… and make investors rich in the process.

Think of buying Amazon a decade ago…

Source: RiskHedge

Or Netflix…

But as I said last week in my essay that got over 3.5 million views, the days of companies like Netflix are numbered.

In this article, I’ll explain why you have to dump these big darling companies… and how to spot stocks that are likely to become the next Amazon.

It All Comes Down to Three Little Lists

Please look the following three lists over carefully. Heck, print them out and keep them at your desk. They’re that important.

Together they hold the key to getting rich through investing in disruption.

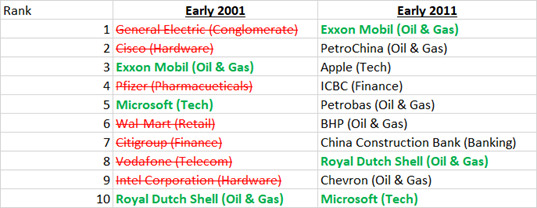

This first list shows the 10 largest public companies on earth—ranked by market cap—in early 2001:

Source: RiskHedge

You probably recognize most of these stocks.

In 2001, they were the best of the best. The biggest of the big. They were household names that had reigned over their industries and handed investors big profits.

Now I’m going to add a second column.

It will show the same rankings a decade later—in early 2011.

Source: RiskHedge

You see what happened?

Seven of the top 10 stocks were displaced, inflicting big losses on many investors who were unfortunate enough to own them.

For example, from 2001–2018, GE stock plunged 79%, Citi collapsed 89%, and Vodafone fell 56%.

Only Exxon Mobil, Royal Dutch Shell, and Microsoft survived. But even these three “survivors” posted terrible returns.

Microsoft fell 15% between 2001 and 2011. Exxon and Shell underperformed the broad market.

Losing 11% of your money over 17 years when the market doubles is a financial disaster.

Now let’s add one more column for late 2018:

Source: RiskHedge

As you can see, this time only 2 of the 10 survived. And once again… the stocks of many of the losers tanked.

Averaged together, the eight losers lost -17% from 2011 to late 2018. The S&P 500 gained roughly 115% in that time.

Now, if you were investing back in 2011, chances are you owned some of the money losers on this list.

Remember, they weren’t obscure penny stocks. They were 8 of the 10 largest stocks on earth!

Even if you didn’t buy them intentionally, you probably owned them. After all, these were the biggest, most popular, most written-about stocks.

Unfortunately, many mutual funds, index funds, ETFs, and retirement plans were stuffed with these losers.

Now, Imagine a Fourth Column Labeled “2024”

How many of today’s top 10 do you think will still be on the list in 2024?

Wouldn’t you agree that at least seven or eight of those stocks will perform poorly going forward?

That is a powerful piece of information. It means most of the biggest and richest companies on earth are typically bad investments.

Glance up at the 2018 list once more. You’ll find it reads like a “Who’s Who” of the most popular US stocks today.

Apple. Microsoft. Google. Facebook. Johnson & Johnson. JP Morgan. Berkshire Hathaway.

These are the stocks everyone pays attention to. They’re the stocks your barber or taxi driver brag about owning. CNBC anchors go on and on about these stocks seven days a week.

Yet, as you now know, the evidence is clear: You’re best off avoiding most of today’s most popular stocks.

Seven or eight of the 10 are likely to tread water, at best, over the next couple of years.

More likely, they’ll lose money.

I’ll repeat: Owning the most popular, most talked about, and largest companies in the world is a money-losing strategy.

How You Can Flip This Great Danger into Your Great Edge

It comes down to the life cycle of disruptive businesses.

You want to sell the tired old giant companies that have already peaked and are sure to fall.

And you want to buy the “rising stars.”

In other words, you want to own the stocks that will make the list in 2024.

Leading up to 2018, the 10 stocks that top the 2018 list were profit-making machines. From 2011–2018, they all posted gains. A perfect 10 for 10.

And several produced big gains. Amazon leapt 870%. Microsoft (MSFT) surged 350%. Google (GOOG) climbed 270%.

But they are not the stocks you want to buy today.

Now you may ask, “OK, Stephen, so how do I find the next Amazon, Google, or Microsoft?”

Three Questions You Should Ask Before Buying Disruptor Stocks

Before I dig into cash flows, valuation, or financial statements, I ask three simple questions:

· Is this company doing something radically different from its competitors?

· Is it breaking the rules? Is it changing the game?

· Is it still small enough relative to the industry size it’s disrupting?

I can tell you 49 in 50 fail this test right out of the gate.

Believe it or not, many CEOs are happy with the status quo. They don’t push hard for their companies to innovate. They’re satisfied to sell the same old stuff in the same old ways, collect a paycheck, and go home at 5 pm.

I’m not interested in these stocks. It’s only a matter of time until they’re disrupted.

My Favorite Disruptor Stocks

I know, this concept may be counterintuitive and still confusing to some of you. So let me give you a couple of examples of disruptor stocks that I recently recommended to my readers.

The first is Alteryx (AYX). It’s a disruptor that’s changing the way companies use data. In short, it’s helping America’s largest companies leverage data to make more money. Alteryx has soared 88% since I wrote about it less than five months ago.

The second stock is The Trade Desk (TTD). It’s one of the first disruptor stocks I recommended publicly. The Trade Desk is changing the way companies buy online ads. Since I wrote about it, it’s soared 135%.

Here’s one more.

Back in December I recommended Xilinx (XLNX), a maker of 5G computer chips. Lots of companies are seizing the opportunity to make parts for 5G. But Xilinx is changing the game with special customizable chips that are ideal for the 5G buildout.

Xilinx has leapt to a 35% gain since I recommended it:

I don’t want to give you the impression these gems are easy to find. In fact, it takes a team of analysts as well as a lot of time and effort to dig them up.

But the profits are worth it.

0 notes

Text

This 1.1$-Trillion Industry Will End Up Like Retail… Which Is a Huge Investment Opportunity

By Stephen McBride

Banks have grown very, very rich in the last 30 years—thanks to their privileged monopoly position.

JPMorgan Chase (JPM), America’s largest bank, has grown profits by 2,000%+ in the last 30 years.

Bank of America (BAC), the second-largest American bank, has seen its profits surge 4,700%.

JP Morgan Chase and Bank of America are the 10th- and 13th-biggest public companies not just in the US, but on earth.

And as we all know, bankers enjoy some of the biggest salaries around. In 2017, the top five US bank CEOs earned a combined $100 million.

But quietly, banks’ grip on money is slipping away...

Bank Branches Are Closing by the Day

Did you know that since 2008, 15,000 bank branches have shut their doors?

By now most Americans know how Amazon (AMZN) has changed shopping forever.

They sell stuff online for cheap. This shut down whole shopping malls and put big stores like Toys ”R” Us, Radio Shack, and The Bon-Ton out of business.

But what many investors don’t know is a similar revolution is happening in banking. Disruptive companies like Amazon are starting to steal banks’ business.

In many ways, banking is following the same script as retail—only 10 years later.

Foot traffic in branches has fallen close to 50% in the past decade. It’s expected to fall another third in the next five years, according to financial research firm CACI.

Banks’ Physical Presence Used to Be a Great Asset

It was how they attracted new customers.

Remember when you used to get a free toaster for opening a savings account? Once folks walked in the door, banks could “upsell” expensive banking services.

These days, maintaining marble floors and fancy lobbies is mostly just a waste of money.

Sure, high-net-worth individuals may still care about these things. But most Americans just want a fast and convenient way to manage their money.

According to a 2014 Wall Street Journal study, it costs a bank roughly $4 every time you make a transaction in one of its branches.

But the average online transaction costs the bank just 17 cents!

In other words, costs drop 95% when you bank on the internet.

The average bank branch in the US costs roughly $2–4 million to set up. It costs another $200,000–400,000/year to operate, according to Mercator Advisory Group.

US bank Wells Fargo (WFC) operates roughly 8,000 branches in America. It costs between $1.6–3.2 billion/year to keep them up and running!

Non-Banking Competitors Join the Race

Just like Amazon disrupted tired old retailers, hungry competitors are picking off businesses that banks used to dominate.

Take money lending for example—a business banks had owned for centuries.

Last year, more than half of all mortgages were issued by “non-bank” lenders. That’s up from just 9% in 2009.

In fact, six of the top 10 mortgage lenders in the US today are non-banks.

Quicken Loans is both America’s largest mortgage lender and the fastest-growing firm in the industry.

Quicken does not operate branches. Instead, it evaluates borrowers using online applications. And it connects with its customers online and by phone.

Quicken is owned by Intuit (INTU)—a powerhouse “autopilot stock” I’ve liked for a long time. Its stock chart is a thing of beauty:

The “Wealth Management” Business Is Slipping Away from Big Banks

Swiss bank UBS (UBS) and Wall Street’s Morgan Stanley (MS) are the two largest wealth managers in the world.

They both get roughly half their revenue from managing clients’ money. But online “robo-advisors” are invading this lucrative business.

Robo-advisors are online platforms that give you automated, computer-driven financial planning services. They’re far cheaper than getting financial advice from a bank.

A robo-advisor might charge 0.25%–0.5% of your assets annually. Wealth manager fees typically start at 1–1.5% of your assets and can go as high as 3%.

Vanguard set up its robo-advisor service in 2018. US investors have already entrusted it with $130 billion. And it’s growing by 10–15% per year.

Vanguard operates completely online. It avoids all the costs and hassle of running physical branches. This allows it to offer the same services as a bank, but for far cheaper.

$1.1 Trillion Is Up for Grabs

The five largest publicly traded US banks are worth $1.1 trillion in market capitalization.

Disruption in banking is still in the early innings. The average guy has no clue this is happening. That’ll change as big-name banks that can’t adapt start to die off.

And keep in mind, the $1.1 trillion in wealth won’t vanish. Instead, it will change hands. Hundreds of billions will be up for grabs as disruptor stocks shake up banking, just like they did to shopping.

Now you may ask, “Where should I invest, Stephen?”

For now, stay away from bank stocks. Fintech disruptors like Quicken Loans are going to continue eating their lunch.

As I mentioned, the banking revolution is still early in the process, but investment opportunities are starting to show up.

Take a look at Global X FinTech ETF (FINX). It’s one of my favorite fintech ETFs holding most of the companies that are successfully tapping into this lucrative banking process.

This is a huge money-making trend I’ll be covering for a long, long time. Stay tuned!

0 notes

Text

Netflix Has 175 Days Left to Pull Off a Miracle… or It’s All Over

By Stephen McBride

Last year, half of Americans aged 22 to 45 watched zero hours of cable TV. And almost 35 million households have quit cable in the past decade.

All these people are moving to streaming services like Netflix (NFLX). Today, more than half of American households subscribe to a streaming service.

The media calls this “cord cutting.”

This trend is far more disruptive than most people understand. The downfall of cable is releasing billions in stock market wealth.

Combined, America’s five biggest cable companies are worth over $750 billion. And most investors assume Netflix will claim the bulk of profits that cable leaves behind.

So far, they’ve been right. Have you seen Netflix’s stock price? Holy cow. It has rocketed 8,300% since 2009, leaving even Amazon in the dust:

But don’t let its past success fool you.

Because Netflix is not the future of TV. Let me say that one more time… Netflix is not the future of TV.

(In fact, there’s a little-known company that has Netflix by the throat. Not 1 in 100 investors know about this stock.)

But for now, let’s talk about Netflix’s biggest problem…

The Only Thing That Matters

Netflix changed how we watch TV, but it didn’t really change what we watch…

Netflix has achieved its incredible growth by taking distribution away from cable companies. Instead of watching The Office on cable, people now watch The Office on Netflix.

This edge isn’t sustainable.

In a world where you can watch practically anything whenever you want, dominance in distribution is very fragile.

Because the internet has opened up a whole world of choice, featuring great exclusive content is now far more important than anything else.

For example, about 20 million people tuned in to watch the first episode of the latest season of hit show Game of Thrones.

It was one of the most-watched non-sporting events in TV history.

Netflix management knows content is king. The company spent $12 billion developing original shows last year. It released 88% more original programming in 2018 than it did the previous year.

And spending on original shows and movies is expected to hit $15 billion this year.

It now invests more in content than any other American TV network.

To fund its new shows, Netflix is borrowing huge sums of debt. It currently owes creditors $10.4 billion, which is 59% more than it owed this time last year.

The problem is that no matter how much Netflix spends, it has no chance to catch up with its biggest rival…

Disney Enters the Race

The Walt Disney Company (DIS) is one of America’s most iconic companies.

Walt Disney created Mickey Mouse way back in 1928. Over the following eight decades the company built an empire.

Over 160 million people visited its theme parks last year. And it’s among the world’s largest media companies.

But over the past decade a core part of its business has been disrupted.

More than a third of Disney’s revenue comes from its cable business. As you may know, Disney owns leading sports network ESPN and ABC News.

It makes money delivering this content to millions of Americans through cable providers like AT&T. As you can imagine, cord cutting has hit this business hard.

Disney’s cable business has stagnated over the past seven years. But in about 175 days, Disney is set to launch its own streaming service called Disney+.

It’s going to charge $6.99/month—around $6 cheaper than Netflix.

And it’s pulling all its content off of Netflix.

This is a big deal.

The Undisputed King of Content

Disney owns Marvel, Pixar Animations, Star Wars, ESPN, National Geographic, Modern Family, and The Simpsons. Not to mention all the classic characters like Mickey Mouse and Donald Duck.

In six of the past seven years, Disney has produced the world’s top-selling movie.

Here’s a list of the five highest-earning movies of 2018:

1. Avengers Infinity War

2. Black Panther

3. Jurassic World: Fallen Kingdom

4. Incredibles 2

5. Bohemian Rhapsody

All except Jurassic World are Disney productions. Clearly, Disney is king of the blockbuster. Over the past six years, its average film has raked in $1.2 billion at the box office.

So Long Netflix…

Picture this…

Disney puts a blockbuster like Avengers Endgame on its platform the same day it opens in theaters.

After a few weeks it’s no longer in theaters. You can’t buy it. You can’t rent it. The only way to watch is to subscribe to Disney’s steaming service, Disney+.

For example, the only place your children or grandchildren will be able to see Toy Story 4 and Frozen 2 may be on Disney+.

Can you imagine how many parents will sign up for this? I’ll certainly be subscribing for my daughter.

At $6.99/month, what family with kids under 12 years wouldn’t subscribe?

Plus, Disney owns 60% of America’s second-largest and fastest-growing streaming service, Hulu.

Disney has shown it can produce movies and shows people want to watch. No competitor comes within 1,000 miles of Disney’s world of content.

Disney’s ownership of iconic franchises like Star Wars and Spider-Man give it something no money can buy.

Meanwhile, Netflix will lose a lot of its best content—and potentially millions of subscribers who switch to Disney+.

While Netflix is running into debt “trying out” new shows, Disney already has the best of the best in its arsenal.

0 notes

Text

Investing in Uber Is the Worst Thing You Can Do with Your Money in 2019

By Stephen McBride

Uber’s IPO is the biggest IPO since Facebook (FB) went public in 2012.

It marks the first time individual investors can buy this beloved company.

IPOs carry a special allure. Investors dream of “getting in on the ground floor” and riding the stock to 20X–30X profits.

But collecting profits of 20X or better is possible if you identify disruptive stocks early on.

Uber is certainly disruptive. But as I’ll show you, it’s a horrible investment.

Uber Burns More Cash than Any Company I’ve Ever Seen

It is dangerously unprofitable.

Its IPO documents show it lost $1 billion on $3 billion in sales in just the past three months.

Now some might say: "Stephen, it's no big deal that Uber makes no money. Amazon made little profit for its first couple of years and it’s been an incredible investment. Its stock has soared 100,000% since its IPO. I want to get in on the ground floor of Uber like many did with Amazon!"

It’s true that early investors in Amazon (AMZN) got rich. It’s also true that Amazon lost money in its first seven years of business. From 1996 to 2002, it burned through around $3 billion.

The thing is, Uber has lost more money in the past nine months than Amazon did in its first seven years!

And Uber isn’t a “new” company.

You can forgive young startups for sacrificing profits for growth. Uber has been around for a decade and is still nowhere near profitability.

Another Popular Argument for Buying Uber Stock

It goes like this:

“Uber will be among the biggest IPOs since Facebook… and Facebook’s stock has shot up 450% since 2012!”

Facebook is one of the most efficient cash-generating machines America has ever seen.

It makes money selling online ads, which is an extremely profitable business.

At its peak, Facebook was turning $0.50 on every dollar of sales into pure profit. That is off-the-charts incredible. It’s nearly unheard of for a company as big as Facebook.

Uber’s margins are off the charts too. But they’re off-the-charts awful. Uber loses 25 cents on every dollar it brings in. In fact, research from Recode shows Uber loses an average of $1.20 on every ride.

Uber’s problem is the fares it charges aren’t nearly enough to cover its expenses. Roughly 80% of a fare goes toward paying drivers and related expenses.

In other words, almost all its revenue is gone before it can even pay overhead costs like rent or salaries for its 16,000 employees.

Uber Will Never Make Money

Money-losing firms often aim to achieve profitability through “scale.”

This means a company keeps growing and growing and selling more and more stuff. Eventually its revenue surpasses expenses.

This worked for Facebook. In its first few years, Facebook actually lost money. By 2009, it was selling enough ads to earn a profit.

It cost Facebook a ton of money to build out its online ad platform. But once it was up and running, it barely cost anything to sell each additional ad. As it sold more and more ads, costs stayed flat and income soared.

Uber’s business model does not afford this luxury. Very few of its costs are “fixed.” Every ride costs it money. As I said, it’s losing roughly $1.20 on every trip.

More trips won’t solve this because costs rise just as fast as revenue.

Uber is trapped in a money-losing spiral it can’t escape.

Even if Uber Succeeds, Most of Its Upside Is Long Gone

Early private investors have claimed it all.

For example, former cyclist Lance Armstrong is an early investor in Uber. He invested $100,000 around 2009 when the company was valued at less than $4 million.

Since then Uber has surged 25,000X in value! If Armstrong held on to his whole $100,000 stake, it’d be worth roughly $2.5 billion today.

As I said, you stand a chance to reap triple-digit profits or even more if you buy when a promising disruptive stock is small and 20X gains (or better) are on the table. By the way, you can check my three favorite stocks that fall into this category here.

But Uber is already HUGE. As I mentioned, it’s worth $100 billion. It’s already among America’s 100 largest companies.