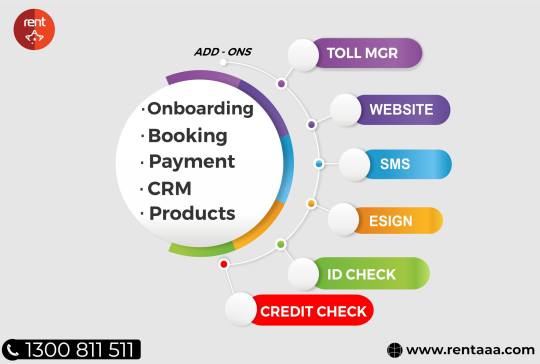

Rentaaa is a comprehensive solution for rental businesses, offering automation of daily operations. With user-friendly web and mobile applications, it simplifies tasks such as automated booking, onboarding, eSignatures, payment collection, and inspection/maintenance. Whether you're in vehicle or property rental management, Rentaaa optimizes efficiency and productivity, making it an invaluable tool for rental businesses.

Don't wanna be here? Send us removal request.

Text

Why Landlords and Tenants Should Use Property Rental Management Software

Managing rental properties can be a complex and time-consuming task for landlords and property owners. From handling property rental booking to tenant onboarding and rent collection to property maintenance requests, property management software makes it easy to manage and monitor everything from mobile and desktop. Property rental management software provides a powerful solution by automating every task hassle-free.

Property rental software simplifies daily tasks, enhances tenant communication, and provides valuable insights through real-time reporting and analytics. Whether managing a single-room property or an extensive portfolio, with user-friendly and efficient management tools, property rental management software saves time, reduces costs, and improves tenant satisfaction

Why choose property rental management software in 2025?

Property rental management software in 2025 offers advanced features designed to meet modern landlords’ and property owners’ needs. With automated tenant screening, digital lease management, and real-time communication tools, rental management software streamlines daily operations and saves time. Online rent collection, customizable late fee policies, and detailed financial reporting ensure efficient cash flow management. Enhanced security features like data encryption and regulatory compliance protect sensitive information. Marketing tools, including virtual tours and social media integration, help reduce vacancies faster. With mobile and desktop accessibility, landlords can manage properties from anywhere, making property rental management software an indispensable tool for success in 2025.

Benefits of Property Rental Management Software for Landlords

Property Listings: Property rental software allows landlords to create professional listings of their residential and commercial rental properties with high-quality photos and detailed descriptions.

Tenant Screening & Onboarding: Property management software streamlines tenant screening by automating background checks and facilitating online lease signing. It also helps with efficient move-in inspections and documentation.

Online Rent Payments: Rental management software digital payment processing offers convenient online rent payment options like credit card processing and bank transfers.

Tenant Communication: Property rental software enhances communication with tenants through in-app messaging, announcements, and easy access to emergency contact information.

Lease Renewals & Rent Increases: The property rental app automates lease renewal reminders and facilitates online lease signing. Allows you to easily manage rent increases and track lease expiration dates.

Income & Expense Tracking: Property rental software allows you to track rent income, operation expenses, and other financial data in real-time.

Financial Reporting: gain valuable insights into property performance property rental software generates customizable financial reports for tax preparation, budgeting, and analysis.

Maintenance Requests: Rental management software enables tenants to submit and track maintenance requests online and effectively.

Tenant Portal: Property rental software mobile and desktop app empowers tenants by providing online access to account information, maintenance requests, and important documents.

Owner Portal: This provides owners with real-time access to financial reports, property performance data, and tenant communication tools.

Data Security & Encryption: Eventually property management software protects sensitive tenant and property data with robust security measures, including secure data storage and encryption.

User-Friendly Property Rental Management Software With Free Demo

Managing multiple residential and commercial rental properties can be overwhelming, but with RentAAA’s property rental management software application, available with a free demo, owners can simplify operations, enhance tenant satisfaction, and grow the rental business. RentAAA’s rental software provides everything you need to manage properties efficiently — from online listings to rent collection.

Simplify your rental operations with cloud-based property rental management software designed to handle residential, commercial, and single-room rentals from mobile and desktop applications. From listing the property to tracking tenant payments, RentAAA’s property management software is a perfect solution for landlords of all sizes, from single-property owners to large-scale.

#property rental software#property rental management software#property management software#property rental app#property rental management app#property management app#tenant management software#tenant management app#residential property management software#short term property management software#commercial property management software#property management software for landlords#property management software for owners

0 notes

Text

Features That Define High-Quality Vehicle Rental Management Software

In the competitive vehicle rental industry, the right vehicle rental management software can make all the difference in streamlining operations and delivering exceptional customer service. Any high-quality vehicle rental management software is defined by features that enhance efficiency, improve user experience, and support business scalability. From digital online booking systems and real-time vehicle tracking to automated invoicing and insightful analytics, vehicle rental management tools are essential for hassle-free short-term and long-term daily rental operations. The vehicle rental software must also adapt to the market’s evolving needs, offering mobile compatibility and secure payment options. This article explores the key features that set superior car rental software apart and drive business success.

Why Choose Vehicle Rental Management Software in 2025?

Vehicle rental management software is vital in streamlining operations and driving business success. Vehicle rental software provides an intuitive online booking system, real-time vehicle tracking, and robust fleet management tools. Integration with digital payment gateways ensures seamless transactions, while the car rental software customer management system enhances service efficiency. Automated billing, maintenance scheduling, and detailed reporting simplify operations and provide valuable insights. Scalability and mobile app compatibility cater to businesses of all sizes and offer convenience for users on the go. By incorporating these features, car rental management software empowers businesses to improve operational efficiency, enhance customer satisfaction, and achieve long-term growth and success.

What Makes Vehicle Rental Software Stand Out in the Market?

Vehicle Listing Management: This feature allows vehicle rental businesses to organize and showcase rental vehicles with detailed descriptions, photos, and availability, making it easier for customers to find and choose the right vehicle.

Vehicle Booking Management: This feature simplifies reservations with real-time availability, dynamic pricing, and confirmation features, ensuring a smooth booking experience for customers.

Vehicle Delivery Management: This feature streamlines vehicle delivery and return processes, enabling efficient coordination and reducing delays for both rental businesses and customers.

eSign & Agreement Management: This allows car owners to set rental conditions and customers to digitally sign agreements, enhancing transparency and saving time on paperwork.

Vehicle GPS Tracking: This allows real-time location tracking, route history, and monitoring of vehicle usage and driver behavior for improved operational control.

Digital Payment Options: This facilitates secure and convenient transactions with support for multiple payment methods, enhancing customer trust and satisfaction.

Vehicle Maintenance: This automates service scheduling and maintenance tracking, ensuring the fleet remains in optimal condition and reducing downtime.

Toll and Fine Management: The vehicle rental management software also streamlines the tracking and payment of tolls and fines, eliminating manual errors and maintaining accurate records.

Automated Invoicing and Billing: This feature allows you to generate invoices and bills automatically, simplifying financial processes and ensuring accurate and timely payments.

Analytics and Reporting: It provides insights into vehicle performance, customer behavior, and revenue trends, enabling data-driven decision-making to optimize operations.

Mobile and Desktop App Compatibility: This feature ensures a seamless experience for users on any device, offering flexibility for customers and operational staff alike.

Vehicle Rental Management Software for Small and Large Size Businesses

In the competitive vehicle rental industry, businesses need software that goes beyond basic functionality to truly excel. To accomplish the need for vehicle rental management hassle-free, try RentAAA a cloud-based long-term and short-term vehicle rental management software. It offers a suite of advanced features designed to streamline car rental operations, enhance customer satisfaction, and drive profitability. From intuitive booking systems to real-time tracking and automated billing, RentAAA rental management software provides the efficiency and scalability required to meet the demands of modern car rental businesses. Free demo available, explore features that make RentAAA vehicle rental software an indispensable tool for success.

#vehicle rental software#car rental software#fleet rental software#vehicle rental management software#vehicle rental management app#vehicle rental software pricing#vehicle tracking software#vehicle booking management software#vehicle booking software#vehicle maintenance software#vehicle rental software for small business#car rental management app#fleet rental management app#rental management software

0 notes

Text

Coworking Space Management Software | All You Need to Know in 2025

The coworking industry is rapidly evolving as it offers flexible and collaborative work environments to coworking space owners and members. To effectively manage working spaces, coworking space management software has become an indispensable tool. Whether you manage a small coworking space or a large multi-location facility, coworking software streamlines operations by optimizing resource utilization and enhancing tenant satisfaction.

This comprehensive guide will delve into the intricacies of coworking space software, exploring its benefits, key features, and how it can streamline operations and elevate the member experience. Let’s explore how coworking software transforms modern workspaces and who benefits from it.

What kind of businesses typically use Coworking Space Software?

Businesses managing diverse work environments rely on coworking space management software to optimize operations and deliver exceptional experiences. These include coworking providers, real estate firms, and hybrid workplaces. Shared workspaces, meeting rooms, event spaces, office spaces, hot desks, dedicated desks, and creative spaces all benefit from streamlined management using coworking space software. Additionally, companies adopting hybrid work models use this software to manage hot desks and team collaboration areas effectively. With features like resource allocation, member management, and billing automation, coworking space management software is indispensable for maximizing efficiency and profitability in the coworking sector.

How does a coworking space software work?

Coworking space software provides individuals and teams with a flexible and collaborative work environment. Here's how they help:

Streamline Daily Operations with Automation: The software automates routine tasks like bookings and member management ensuring efficient workflows, saving time, and reducing manual errors.

Enhance Member Experience with Seamless Processes: Coworking software makes it easy for members to book spaces, access amenities, and communicate with management.

Manage Reservations, Rooms, and Resources Effortlessly: Coworking software tracks the real-time availability of meeting rooms, shared spaces, hot desks, etc. for smooth scheduling.

Simplify Billing and Payment Collection: Automated billing and multiple payment options ensure hassle-free financial transactions for members and administrators.

Monitor Analytics to Drive Business Growth: Coworking Space Software provides detailed reports on space utilization, revenue streams, and member behavior to optimize operations.

Boost Productivity for Space Administrators: Coworking software allows administrators to manage bookings, resources, and more from mobile and desktop applications.

Improve Communication Between Staff and Members: Coworking space management software communication platforms streamline interaction, ensuring members’ needs are met promptly.

Cloud-Based Co-Working Space Management Software

Managing a coworking space is seamless with cloud-based solutions like RentAAA Coworking Space Management Software. Designed for modern needs, it features digital booking and reservation systems, member onboarding tools, and resource utilization tracking to enhance efficiency. RentAAA simplifies payment processing and billing automation, ensuring smooth financial operations. Its advanced analytics and reporting tools help track key metrics and improve decision-making. With a free demo and no credit card required, RentAAA rental management software provides an intuitive, cost-effective solution for coworking spaces. Optimize your operations and boost tenant satisfaction with RentAAA’s innovative coworking management software today!

#coworking space management software#coworking space software#coworking software#coworking space booking software#coworking space management app#Office space management software#workspace management software#meeting room management software#coworking space software australia#workspace booking software#shared space management software

0 notes

Text

What would the ideal property management software do?

In today’s fast-paced real estate market, property rental management software has become an indispensable tool for landlords and property managers alike. With the increasing complexity of managing multiple residential and commercial properties utilizing a property management software system plays a crucial role in streamlining operations, reducing costs, and enhancing tenant satisfaction. Property management software simplifies day-to-day operations, optimizes resource allocation, and fosters better tenant relationships, ultimately driving efficiency and cost-effectiveness.

However, not all property management software is created equal. To truly optimize property rental management processes, it’s essential to choose trustworthy rental management software that possesses specific qualities that align with your unique needs and goals.

What quality property management software should have?

Quality property management software should include the following key features. For many property managers, these features ensure streamlined management, cost efficiency, and tenant satisfaction.

User-Friendly Interface: A user-friendly interface is crucial for both landlords and tenants. The property management software should be intuitive, with clear navigation and easy-to-understand features on mobile and desktop devices. This ensures smooth operations and reduces the learning curve for users of all technical abilities.

Digital Payment Processing: Digital payment processing allows for efficient and secure rent collection. A good property rental management software should support multiple payment options, such as credit cards, debit cards, and online banking. This simplifies the payment process for tenants and landlords alike.

Tenant Onboarding & Communication: A robust tenant onboarding process is essential for efficient property management. The property management software should streamline the application, screening, and lease signing process. Additionally, it should provide effective communication tools, such as email and messaging, to facilitate interaction between landlords and tenants.

Maintenance Management: Efficient maintenance management is key to property upkeep and tenant satisfaction. The property rental software should allow for easy submission and tracking of maintenance requests. Landlords can assign tasks to maintenance professionals, monitor progress, and generate work orders, all within the platform.

Reporting & Analytics: Comprehensive reporting and analytics provide valuable insights into property performance. A good property management software should offer customizable reports on income, expenses, occupancy rates, and other key metrics. These insights help landlords make informed decisions and optimize their operations.

Scalability: Scalability is essential for businesses that grow and evolve. The rental management software should be able to adapt to changing property portfolios, whether it’s expanding into new markets or managing different property types.

Cloud Accessibility: Cloud-based property management software offers the flexibility to access and manage properties from anywhere with an internet connection. This is particularly beneficial for landlords who manage properties remotely or have multiple properties in different locations.

Cloud-Based Property Rental Management Software with Free Demo

Managing the operation and maintenance of residential or commercial properties can be demanding for any property manager. Whether you rent one or more properties, specialized property rental management software solutions can help you streamline your rental operations. To help landlords, property managers, and real estate investors manage their rental properties more efficiently, try a new cloud-based Property Rental Management Software. This property management software is an extremely helpful tool that enables managers to automate multiple business operations from mobile and desktop applications. This rental management software is available with a free trial to help you get familiar with advanced features such as multi-property management, tenant tracking, rent collection, financial reporting, and others to improve the property rental process and customer satisfaction as well.

#property rental software#property rental app#property rental management software#property management software#best property management software#property rental management app#property management software for landlords#tenant management software#tenant management app#property management app#residential property management software#short-term property management software#commercial property management software

0 notes

Text

Why Do Your Businesses Need Vehicle Rental Management Software in 2025?

Do you know vehicle rental management software has emerged as an indispensable tool for modern rental businesses? Nowadays vehicle rental businesses face growing challenges such as optimizing vehicle utilization, reducing operational costs, and meeting customer expectations for quick and hassle-free services. By adopting this technology, companies can not only stay ahead of industry trends but also ensure scalability and profitability. Vehicle rental software is a critical tool for modern rental businesses, offering a streamlined approach to managing fleets, reservations, and customer interactions.

What is Vehicle Rental Management Software?

Vehicle Rental Management Software is a digital rental management system that assists small and large size businesses to streamline daily operations from mobile and desktop applications. User-friendly Vehicle rental software offers tools for managing Vehicle Bookings, Tracking, Maintenance, Toll, Fine, and Digital Payments. Vehicle rental management software helps in real-time reporting, fleet utilization optimization, and customer relationship management, and eventually; it simplifies administrative tasks and enhances operational efficiency. It provides insights to help vehicle rental businesses make informed decisions, reduce costs, and improve overall performance.

Why do Businesses Need Vehicle Rental Management Software in 2025?

Vehicle Rental Management Software is a game-changer for rental businesses. It automates tasks, streamlines operations, and improves efficiency. Vehicle management software offers a plethora of benefits. From automated bookings and streamlined maintenance to real-time analytics, advanced rental management technology empowers businesses to optimize vehicle operations and deliver exceptional customer service.

Online Booking and Reservation Management: Vehicle rental management software allows customers to book vehicles online, 24/7. It simplifies the reservation process by offering automated booking systems that allow customers to view vehicle availability, make reservations instantly, and modify bookings online.

GPS Tracking and Real-Time Monitoring: With vehicle GPS tracking and real-time monitoring systems, vehicle rental software allows businesses to track vehicle locations, optimize routes, and ensure driver accountability. This enhances fleet security, improves fuel efficiency, and provides customers with accurate delivery or pickup updates.

Maintenance and Inspection Scheduling: Vehicle rental management system helps businesses schedule regular maintenance and inspections ensuring vehicles remain in top condition and operations run smoothly.

Toll and Fine Management: Vehicle rental management software can track and manage toll charges and traffic fines incurred by rental vehicles. This helps in accurate billing and reduces administrative overhead.

Digital Payment Integration: The rental management software digital payment options allow customers to pay securely using multiple methods, including credit cards, digital wallets, or bank transfers. This eliminates payment delays, enhances customer satisfaction, and simplifies financial reconciliation for businesses.

Customer Experience: Vehicle rental management software enhances customer satisfaction and loyalty by providing a seamless online booking experience, efficient check-in and check-out processes, and round-the-clock customer support.

Reporting and Analytics: The rental software generates detailed reports on various aspects of the rental business, such as revenue, utilization rates, and customer behavior. These data-driven insights help businesses make informed decisions, optimize operations, and identify growth opportunities for long-term success.

Vehicle Rental Management Software with Free Demo

Vehicle Rental Management Software is essential for modern rental businesses aiming to simplify operations and enhance profitability. To experience the advantages firsthand, explore RentAAA’s Vehicle Rental Management Software, offering a free demo for mobile and desktop. With tools like online bookings, GPS tracking, and automated maintenance scheduling, RentAAA rental software empowers businesses to improve efficiency and customer satisfaction. No credit card is needed to get started—sign up today and discover how RentAAA can streamline your rental operations and drive growth. Visit now for more information and a complimentary demo.

#vehicle rental software#vehicle management software#vehicle rental management software#vehicle rental management app#vehicle tracking software#vehicle rental software small business#best vehicle rental software#vehicle booking management software#vehicle rental software Australia#vehicle rental management software Australia#vehicle booking software Australia#car rental software#fleet rental software#vehicle rental software pricing

0 notes

Text

Why Every Coworking Space Needs Management Software To Thrive

Managing a Coworking Space is a complex task that requires efficient organization, seamless operations, and a strong focus on team member satisfaction. To achieve these goals, businesses must leverage the power of coworking space management software. Coworking software empowers operators to deliver exceptional member experiences and drive sustainable business growth by automating routine tasks, streamlining workflows, and providing valuable insights.

What is Coworking Space Management?

Coworking space management involves overseeing and optimizing workspaces to ensure smooth operations and a positive member experience. This includes managing tasks such as booking meeting rooms, hot desks, and shared workspaces, handling membership plans and billing, and fostering community engagement. With the help of advanced workspace management software, coworking space operators can simplify these processes hassle-free. The coworking software allows seamless booking for office spaces, event venues, creative hubs, and dedicated desks while streamlining check-ins, access control, and payment processes.

The Future of Coworking Space Management

The future of coworking space management is poised for significant transformation. Emerging technologies like AI and machine learning are poised to revolutionize the industry. AI-powered chatbots can enhance member support, while machine learning algorithms can optimize space utilization and predict member behavior. However, challenges such as data privacy, cybersecurity, and the evolving needs of the hybrid workforce will need to be addressed. By embracing innovation and adapting to changing trends, coworking spaces can thrive in the future.

Advantages of Coworking Space Management Software

Member Management and Access Control: This feature allows you to manage member profiles, track usage, and control access to the workspace through key cards, mobile apps, or biometric scanners.

Booking and scheduling systems: This feature enables members to easily book meeting rooms, desks, and other spaces, while also allowing you to manage space allocation and utilization.

Payment processing and invoicing: This feature automates billing, invoicing, and payment processing, saving time and reducing errors.

Community building and engagement tools: These features help foster a strong community among members through event calendars, discussion forums, and social networking tools.

Real-time analytics and reporting: This feature provides valuable insights into space utilization, member behavior, and revenue trends, helping you to make data-driven decisions.

Why Use Coworking Space Management Software?

Increased Efficiency and Productivity: Coworking space management software automates repetitive tasks like bookings, invoicing, and member tracking, allowing operators to focus on core activities. By streamlining operations, coworking software enhances staff productivity, minimizes human error, and ensures that all processes run smoothly.

Improved Member Experience and Satisfaction: Seamless booking, instant support, and personalized services enabled by management software provide a hassle-free experience for members. Features like event calendars, mobile accessibility, and real-time updates ensure members enjoy convenience and feel valued, fostering loyalty and boosting satisfaction within the coworking community.

Enhanced Revenue Generation and Cost Savings: By optimizing space utilization, tracking resource usage, and automating billing processes, coworking software reduces operational costs and increases revenue potential. Dynamic pricing tools and occupancy insights allow operators to implement cost-effective strategies, boosting profitability without compromising service quality.

Simplified Operations and Streamlined Workflows: From managing check-ins to scheduling meeting rooms, coworking management software centralizes operations in one intuitive platform. It reduces administrative burden, ensures all processes are synchronized, and improves collaboration among team members, resulting in a well-organized and smoothly running coworking environment.

How to Choose the Right Coworking Space Management Software?

Selecting the ideal coworking space management software begins with identifying your unique needs, such as member management, booking systems, or analytics. Consider your budget and the scalability of the software to support your growth. Evaluate features like automated billing, event management, and community tools to ensure they align with your operations. Opt for a user-friendly interface to simplify adoption and prioritize robust security measures to safeguard member data. Choosing the right solution ensures seamless operations and an enhanced member experience. For a reliable option, explore RentAAA Coworking Space Management Software for comprehensive features and exceptional support

#coworking space management software#coworking software#coworking space software pricing#coworking space management app#office space management software#space management software#shared office space management software#workspace management software#workspace booking software#shared workspace software#meeting room management software#event space management software#hot desk management software#workspace management software pricing#office space management software pricing

0 notes

Text

Complete Guide To Online Car Rental Software For Rental Business Owners

To streamline rental management operations car rental software has become an essential tool for modern rental businesses. Whether you manage a small fleet or a large-scale rental enterprise, having car rental management software helps you manage booking, payment, maintenance, vehicle tracking, Inspection, and so on hassle-free!

Eventually, car rental management software offers valuable insights through reporting and analytics, enabling car rental businesses to make data-driven decisions. For companies aiming to stay competitive and meet evolving customer expectations, adopting cloud-based car rental management software is not just an option—it’s necessary for long-term success.

Is Car Rental Software Right for Your Business?

The car rental software is ideal for businesses of all sizes in the fleet rental industry. Whether you run a small rental service with a limited fleet or a large-scale enterprise managing hundreds of vehicles, car rental management software streamlines operations and enhances efficiency. It particularly benefits businesses offering short-term, long-term, or subscription-based car rentals. Travel agencies, corporate leasing companies, and startups entering the rental market can also leverage this tool to manage bookings, vehicle tracking, payments, and maintenance seamlessly. Car rental management software is a must for anyone seeking to automate tasks, reduce errors, and deliver exceptional customer experiences.

Why Choose Car Rental Management Software?

Booking Management: Streamline your rental process by automating online and offline bookings. Real-time availability checks ensure efficient resource allocation.

Vehicle Tracking: Enhance fleet management with real-time GPS tracking for optimized performance. Monitor location, speed, and usage to improve efficiency and security.

Payment Processing: Simplify transactions with secure and diverse payment options. Multiple payment system offers seamless digital payments to enhance customer experience.

Maintenance Scheduling: Proactively maintain your fleet with automated scheduling of inspections, servicing, and repairs. Prevent downtime and ensure optimal vehicle condition.

Customer Management: Build strong customer relationships by centralizing customer information, preferences, and rental history.

Reporting and Analytics: Access detailed reports and analytics to better understand your business performance. Track key metrics like revenue, fleet utilization, and customer trends to make informed decisions.

Contract Management: Streamline the creation, management, and renewal of rental contracts. Minimize errors and maintain legal compliance with automated processes.

Fuel and Expense Tracking: Monitor and Manage fuel consumption and operational expenses to Identify areas for savings and improve budgeting.

Toll and Fine Management: Efficiently manage toll charges and traffic fines. Streamline payment processes and minimize administrative workload.

Driver Monitoring: This helps you improve safety and compliance by tracking driver behavior. Monitor driving habits, speed, and adherence to traffic regulations to ensure optimal performance.

Cloud Accessibility: Access your rental business operations from anywhere, anytime. Manage bookings, track vehicles, and generate reports remotely.

How Car Rental Software Drives Business Growth?

Car rental software drives business growth by automating and optimizing key operations. It simplifies booking management, payment processing, and vehicle tracking, reducing manual workload and improving efficiency. Advanced features like real-time reporting and analytics provide actionable insights, helping businesses make data-driven decisions to enhance profitability. By offering a seamless user experience for both staff and customers, the car rental management software boosts satisfaction and retention rates. Additionally, cloud-based solutions enable scalability, allowing businesses to expand their fleet and services effortlessly. Car rental management app for mobile and desktop ensures smooth operations, paving the way for sustainable growth.

Car Rental Software for Mobile and Desktop – Start with a Free Demo

In today's dynamic rental industry, a robust rental software solution is essential for thriving. By choosing RentAAA, cloud-based car rental software, accessible on both mobile and desktop, businesses can streamline operations and position car rental businesses for sustainable growth. RentAAA car rental software is designed with scalability and flexibility in mind, empowering rental businesses to adapt to evolving market trends and expand their operations effortlessly. Additionally, the RentAAA user-friendly rental management app ensures that staff and customers can easily navigate the system.

Free Sign Up, No Credit Card is Required, discover how the RentAAA Rental Management Software streamlines operations, saves time, and enhances customer satisfaction.

#fleet rental software#fleet rental management software#fleet rental software pricing#fleet management app#best fleet rental management software#fleet rental software Australia#fleet software Australia#vehicle rental management software#vehicle rental management app#vehicle rental software pricing#vehicle rental software small business#vehicle rental management software Australia#best vehicle rental software#vehicle booking software#rental software pricing#rental software app#long-term rental software#rental software Australia#rental software#rental management software#rental management solution#best rental management software#rental management app

0 notes

Text

Rental Management Software: A Complete Solution for Car, Property, and Coworking Space

Rental Management Software is a powerful tool that helps rental businesses to streamline and optimize operations. By automating essential processes, from booking and payments to maintenance and customer onboarding, rental software provides rental businesses with enhanced efficiency and control.

As customer expectations rise and operational complexity increases, rental management software serves as an all-in-one rental management solution to meet industry demands effectively. Rental management software transforms rental businesses, enabling them to serve clients better and drive long-term growth.

Car Rental Management Software: Enhancing Fleet and Vehicle Operations

Car rental management software helps you improve the efficiency and security of fleet operations, providing a seamless experience for both rental companies and their customers. Essential features such as Car booking and GPS tracking enable businesses to monitor vehicles in real-time, ensuring effective resource allocation and enhancing customer service. Car rental software automated systems streamline booking processes and allow for easy vehicle selection and scheduling.

Additionally, the car rental software includes features like speed monitoring, route history, vehicle maintenance, and driver behavior tracking, which help businesses maintain high safety standards and manage operational costs. Tools for toll and fine management, as well as digital payment options, further streamline administrative tasks, making transactions hassle-free for both operators and customers. With these capabilities, car rental management software simplifies fleet operations, improves accountability, and enhances overall business productivity.

Property Rental Management Software: Simplifying Real Estate and Tenant Relations

Property rental management software is tailored to support landlords, property managers, and real estate professionals by automating processes that increase efficiency and tenant satisfaction. From residential properties to commercial spaces, the property rental management software facilitates smooth tenant onboarding, making the leasing experience more seamless and professional. By reducing manual tasks, property management software allows owners to focus on providing a quality rental experience.

Key features include lease management, inspection scheduling, maintenance tracking, and secure payment processing, which all contribute to cost savings and better service. The property rental software tracking tools allow managers to identify maintenance needs early, and prevent costly repairs. Overall, property rental management software enhances operational efficiency, strengthens tenant relationships, and supports property owners in building a successful rental business.

Coworking Space Management Software: Adapting to Flexible Workspace Needs

Coworking space management software is designed to meet the needs of modern, flexible workspaces, including shared offices, meeting rooms, event areas, and dedicated desk spaces. Coworking Space Software allows coworking managers to handle space availability, reservations, and usage tracking effectively, providing an efficient coworking space management system for members to book and use spaces according to their requirements.

Reservation systems, digital payments, and reporting features allow managers to monitor usage trends, optimize space allocation, and generate insights that aid in decision-making. Usage tracking and analytics help in managing high-demand areas, while digital payment integration provides a seamless experience for members. With coworking space management software, operators can deliver a flexible, responsive service that accommodates the diverse needs of today’s mobile workforce.

Transform Your Rental Business with Rental Management Software

Rental management software is essential for businesses aiming to streamline operations, enhance customer satisfaction, and drive growth across car, property, and coworking space rentals. This rental software simplifies complex tasks, reduces manual work, and provides valuable insights into business operations. RentAAA is a comprehensive rental management solution that supports car, property, and coworking space management through a user-friendly mobile and desktop platform, enabling businesses to manage rentals efficiently and scale with ease.

#rental management software#rental software#rental software pricing#rental management app#car rental software#fleet management software#vehicle rental management software#property rental management software#property management software for landlords#property rental management app#tenant management software#workspace management software#coworking space management software#coworking space booking software#car rental software pricing#property rental software pricing#coworking space software pricing

0 notes

Text

Reasons Why Your Coworking Space Need a Digital Upgrade?

In today's dynamic work landscape, coworking spaces have emerged as popular hubs for professionals seeking flexibility, collaboration, and community. Coworking Spaces offers a diverse range of amenities, including shared workspaces, meeting rooms, event areas, private offices, hot desks, dedicated desks, and creative spaces. However, to streamline operations, elevate member experience, and optimize resource utilization, managing workspaces requires a digital user-friendly coworking space management software platform.

7 Advantages of Coworking Space Software

Onboard and Manage Tenants: Coworking space software simplifies tenant onboarding by using invitation links and QR codes generated through the app. This feature accelerates the registration process, ensuring new members can quickly access services and feel welcome from the very start.

Comprehensive Booking System: The coworking space booking management system streamlines reservations for shared areas, making it easy for tenants to view availability and secure spaces. By reducing scheduling conflicts and improving booking transparency, this system boosts member satisfaction and smooths daily operations.

Common Area Management: Managing shared spaces like meeting rooms and collaborative areas becomes seamless with real-time availability tracking. The coworking space management software enables quick scheduling, helping tenants book facilities when needed, ensuring optimal usage, and maintaining a smooth flow within the coworking environment.

Transparent Invoicing: Coworking space software provides clear, detailed invoicing, eliminating confusing billing processes. With easy-to-navigate billing and payment tracking features, managers can handle finances more efficiently, and tenants benefit from a straightforward, transparent payment experience.

Ongoing Support: Workspace management software emphasizes continuous support, enabling easy communication between property owners and tenants through mobile and desktop access. Swift responses to inquiries enhance service quality and build trust within the coworking community, ensuring tenant satisfaction.

Access Real-Time Data & Analytics: Workspace management software offers valuable insights by tracking occupancy rates, tenant activity, and financial performance. This data-driven approach helps optimize coworking space efficiency, empowering owners to make informed decisions that improve overall operations.

Boost Efficiency: Routine tasks are automated, freeing up time and streamlining daily operations. This enhanced efficiency allows managers to focus on growth strategies and member services, creating a well-managed and thriving coworking environment that stands out in the market.

Best Coworking Space Management Software in Australia

Upgrading to digital solutions empowers coworking spaces to build a vibrant, community-focused environment, attract new members, and adapt quickly to an ever-changing work landscape. A comprehensive workspace management software can streamline booking processes, automate billing, and optimize resource allocation hassle-free. To drive growth and set your coworking space up for long-term success try RentAAA Coworking Space Software. It allows you to manage and monitor the working space from mobile and desktop applications. Explore all coworking space management features with its free demo by visiting RentAAA rental software in Australia. Easy Signup, No credit card is required.

#workspace management software#workspace management software Australia#coworking space software#coworking space software Australia#coworking software#coworking software Australia#coworking space management software#coworking space management software Australia#coworking management software#coworking management software Australia#coworking space booking system#coworking space management app#workspace booking system#workspace booking software#best coworking space management software#best coworking space software#space management software

0 notes

Text

Why Property Rental Management Software Is a Smart Investment in 2024?

In today’s fast-paced real estate industry, property rental management software offers a robust rental management system for landlords, property owners, and tenants to streamline complex tasks such as Tenant Onboarding, Lease Management, Maintenance Tracking, Accounting, Financial Reporting, Document Management, and Communication. By integrating multiple essential functions, property rental software simplifies rental operations.

What is Property Rental Management Software?

Property rental management software is a digital solution for landlords, property managers, and real estate businesses to efficiently manage residential and commercial property rentals anytime from mobile and desktop. Property Rental Software allows you to manage short-term and long-term property rentals utilizing technology for tenant onboarding, rent collection, lease tracking, and maintenance management from a cloud-based rental management platform.

Additionally, residential and commercial property rental management software empowers businesses with real-time communication, contract management, scheduling inspection, and valuable data insights. Property Rental Software App enables property owners to make data-driven decisions, enhance tenant satisfaction, and improve overall operational efficiency.

Key Features of an Ideal Property Rental Management Software

Ease of Use: An ideal property rental software is user-friendly, featuring an intuitive interface that requires minimal training. Easy navigation allows users to access key functions quickly, ensuring efficient management of day-to-day operations.

Manage Properties: It provides a centralized dashboard to monitor multiple properties, track occupancy rates, schedule inspections, and maintain property data, enabling streamlined oversight of diverse portfolios in one organized space.

Tenant Onboarding: With digital onboarding tools, property rental management software simplifies tenant application, background checks, and lease signings, creating a seamless, efficient experience for tenants and landlords from the initial contact to move-in.

Identity Check: Built-in identity verification ensures secure and reliable tenant vetting. This feature validates applicant information quickly, minimizing risk and enhancing tenant trust through thorough, compliant screenings.

Asset Management: Effective asset management allows property owners to track and maintain all assets, from appliances to infrastructure, prolonging their lifespan and optimizing long-term property value.

Marketing for Tenants or Buyers: Rental marketing tools enable managers to list properties across platforms, attract potential tenants or buyers, and increase occupancy rates, saving time and enhancing property visibility.

Contract Management: Automated contract management facilitates digital lease creation, signing, and storage, ensuring all agreements are compliant, organized, and accessible to both parties for streamlined lease administration.

Manage and Resolve Repair and Maintenance Issues: A dedicated maintenance module lets tenants submit repair requests, track work orders, and monitor task status, ensuring timely responses and well-maintained properties.

Accounting and Tracking Finances: Integrated accounting features track income, expenses, rent payments, and generate financial reports, providing a clear financial overview to support informed budgeting and accurate tax compliance.

Why Should Invest in Property Rental Software?

Property rental management software nowadays is a crucial system for managing rental tasks digitally from mobile and desktop. It simplifies the rental management of residential and commercial properties, making it easier for owners and landlords to manage tenants and property hassle-free. Foremost Rental management app enhances efficiency, allowing rental businesses to manage properties more effectively. By reducing the administrative load, property rental software gives more time to focus on providing high-quality service and scaling their portfolios.

Best Property Rental Management Software in Australia | Free Demo

Property rental management is a primary responsibility for owners, focusing on ensuring that properties are well-maintained and cared for. Effective management helps preserve property value, supports tenant satisfaction, and ultimately benefits the owner's investment. To make things easy try RentAAA property rental management software solution designed to streamline residential and commercial rental operations from mobile and desktop.

RentAAA offers a free demo to showcase its key features, including tenant documentation, property listings, bookings, financial reporting, maintenance management, and inspections. This trial provides users with a hands-on experience of how RentAAA’s rental management app simplifies and enhances every aspect of property management and helps owners focus on maximizing tenant satisfaction and long-term growth.

#property rental management software#property rental software Australia#property management software for landlords#property rental management app#property rental app#property management app#property management software#tenant management software#tenant management app#residential property management software#commercial property management software#short term property rental management software#rental management software australia

0 notes

Text

Why Choose Car Rental Software for Small and Large Size Businesses?

Nowadays, businesses of all sizes are looking for ways to optimize the management of their car, fleet, and vehicle rentals, aiming to enhance operational efficiency and streamline processes. Whether managing a handful of vehicles or a large fleet, car rental software is the key to improving your rental business. It simplifies day-to-day management, reduces operational costs, and improves customer satisfaction, making it an essential rental management tool for both small and large size businesses.

Why Choose Car Rental Software in 2024?

By leveraging technology, rental businesses can focus more on growth and customer engagement while leaving the administrative work to automated systems.

Fleet or Car Listing:

With comprehensive car rental management software, businesses can easily manage their fleet or car listings. Car rental management tool allows businesses to track vehicle availability, pricing, and status. This simplifies inventory management, ensuring that cars or fleets are always ready for rental when needed.

Online Booking and Onboarding:

The car booking management software system enables customers to easily book vehicles online. It streamlines the onboarding process, allowing customers to sign up, choose their vehicles, and complete the booking without delays. This smooth, user-friendly experience enhances customer satisfaction and repeat business.

Digital and Multiple Payment Options:

Offering digital payment solutions is essential for modern businesses. With cloud-based car rental software, businesses can provide secure, multiple payment options, such as credit cards, PayPal, or even digital wallets, ensuring seamless transactions for customers.

Real-Time Analysis:

With real-time data analysis, vehicle rental management software provides valuable insights into your business operations. This feature helps track performance metrics such as rental trends, customer preferences, and fleet utilization, enabling data-driven decision-making.

Car GPS Tracking:

Car tracking software is critical for any rental business. It provides real-time tracking of vehicles, enabling businesses to monitor the location, speed, and route history of each vehicle. This feature improves security and car management efficiency.

eSign and Contract Management:

Digital eSign and contract management systems simplify the paperwork process. Car rental software allows businesses to generate contracts and get them signed electronically, making it easier for both the business and the customer to manage documentation efficiently.

Car Booking Cancel & Dispute Function:

The ability to manage cancellations and disputes is crucial for any rental business. Fleet rental software includes features that allow users to handle cancellations, process refunds, and resolve disputes in a streamlined manner, reducing customer frustration.

Car Inspection, Maintenance, and Servicing:

Rental management software helps businesses stay on top of vehicle maintenance. Automated reminders for inspections, servicing, and repairs ensure the fleet remains in top condition, preventing breakdowns and enhancing customer satisfaction.

Toll, Fine, and Tax Management:

Managing tolls, fines, and taxes can be a headache. Car rental management system automates this process, helping businesses track and manage these expenses efficiently while ensuring compliance with local regulations.

Marketing and Advertising:

Car rental system often includes marketing and advertising features, such as targeted email campaigns and promotions. These tools help businesses reach their customers and keep them engaged, increasing customer retention and boosting revenue.

Advanced Search Filter:

An advanced search filter allows customers to easily find the vehicle they need. Vehicle rental software enables customers to search by vehicle type, location, price range, and other preferences, making the booking process faster and more convenient.

Custom Domain:

A custom domain enhances a business's online presence. Car rental software allows businesses to set up their own branded website, making it easier to promote their services and provide a seamless booking experience for customers.

Ongoing Support:

Car rental management system comes with ongoing support from the service provider, ensuring that businesses can get help whenever they encounter technical issues or need assistance. This level of support keeps operations running smoothly.

Where to Find the Best Car Rental Software in Australia?

If you are looking for reliable, user-friendly car rental software in Australia, RentAAA is the ideal solution. RentAAA's car rental management software is designed to cater to both small and large businesses, offering features that streamline operations and improve customer satisfaction. From fleet tracking to online booking and payment options, RentAAA car rental software for mobile and desktop simplifies the rental process from start to finish. Start with a free trial —no credit card required, quick signup! Experience the convenience of modern car rental management and take your business to the next level.

#car rental software pricing#car rental software#car rental management software#car rental management tool#car tracking software#fleet rental software#vehicle rental management software#vehicle rental software#car booking management software#rental management software#car rental management system#car rental system#car rental management#car booking management software system

0 notes

Text

Coworking Space Management Software | All you need to know

Effective Coworking Space Management hinges on using technology that promotes seamless interactions between managers and tenants. Coworking Space Management Software System simplifies tasks such as managing shared workspaces, meeting rooms, event areas, private offices, hot desks, dedicated desks, and creative spaces. Coworking Space Software allows tenants to book meeting rooms, manage their memberships, and access shared office resources. It also streamlines administrative processes, helping managers efficiently track and allocate resources like desks, printers, and conference rooms. With reliable Coworking Space Management Software, both tenants and managers can focus on productivity rather than operational complexities.

What is Coworking Space Management Software?

Coworking space management software is a digital solution designed to manage the daily operations of coworking spaces. It helps automate key functions such as member onboarding, billing, space booking, and resource allocation. The coworking spaces software allows space owners to monitor occupancy levels, track payments, and even analyze usage trends. Tenants can easily book rooms, access facilities, and manage their memberships. Coworking software enhances efficiency and improves the overall experience for both managers and users.

Types of Coworking Spaces?

Open coworking spaces: Shared office areas with desks and communal spaces.

Private offices: Dedicated office spaces for small teams or businesses.

Event spaces: Areas reserved for workshops, seminars, or networking events.

Hot desks: Flexible, non-dedicated seating options for freelancers and remote workers.

Benefits of Using Coworking Space Software

Automation of daily tasks: Simplifies operations by automating tasks such as invoicing, booking, and billing, reducing the need for manual processes and saving time.

Improved user experience: Tenants can easily book workspaces, manage memberships, and access facilities seamlessly, improving convenience and satisfaction.

Data analytics: Coworking software provides valuable insights into space utilization and member preferences by tracking occupancy rates and usage patterns, allowing for better decision-making.

Efficient communication: Enhances communication between management and tenants through automated notifications, messaging, and updates, creating a more connected community.

How Coworking Space Management Software Drives Business Efficiency?

Streamlines operations: Automates space reservations, payments, and resource allocation, leading to smoother daily workflows and reduced administrative burdens.

Boosts space utilization: Monitors real-time usage and optimizes space allocation, ensuring resources are maximized and underutilized areas are identified.

Enhances tenant satisfaction: Provides convenient, self-service booking and access options, improving tenant retention and overall satisfaction.

Reduces administrative workload: Automation frees up time for staff to focus on strategic planning and other value-adding tasks, enhancing operational efficiency.

Coworking Space Software: What Are the Costs Involved?

Pricing tiers: Most coworking space management software providers offer multiple plans with tiered pricing depending on the features and capabilities selected.

Subscription models: Typically, there are monthly or annual subscription options, providing flexibility based on the coworking space’s budget and needs.

Additional features: Costs can rise with advanced features like data analytics, CRM integration, or custom branding.

Scalability: The cost of the coworking spaces software often scales based on the size and complexity of coworking space, from small offices to large facilities.

RentAAA Coworking Space Management Software for Mobile and Desktop

To maximize the benefits of coworking spaces, implementing a cloud-based coworking space management software system is crucial. RentAAA coworking spaces software is an excellent solution that caters to both mobile and desktop users. It offers a comprehensive suite of tools designed to streamline every aspect of coworking space operations. From a seamless coworking space booking system and automated billing to resource allocation and occupancy tracking, RentAAA coworking space management software simplifies management tasks for owners and provides an intuitive platform for tenants.

RentAAA coworking software enhances communication between managers and tenants through real-time notifications and updates, fostering a connected community. What sets RentAAA apart is its commitment to accessibility—you can try out all its features with a free trial, no credit card required. This allows you to experience firsthand how RentAAA's all-in-one Working Space, Fleet, Property, and Accommodation rental management software can transform your coworking space into a more efficient and productive environment.

#workspace management software#coworking software#coworking space management software#coworking space software#space management software#coworking space management#workspace management app#coworking space booking system#coworking space booking software#coworking business software#workspace management software system#shared office space management software#desk booking software

0 notes

Text

Reasons to Choose Property Rental Management Software in 2024

Nowadays, property rental management software has become an essential tool for landlords and property managers. Property rental software simplifies day-to-day operations like property listing, marketing, tenant onboarding, rent collection, Inspection, and maintenance tracking. Rental software streamlines processes reduces human errors, and enhances tenant satisfaction through easy communication and faster service. Automated systems save time, allowing property managers to focus on expanding their portfolios. With features like online payments, lease management, and real-time analytics, it’s a comprehensive solution to manage residential and commercial property rental operations efficiently.

What is property management software?

Property and tenant management software is a digital tool designed to simplify the management of residential and commercial property rentals. Rental software provides solutions for various tasks, including tenant onboarding, rent collection, lease tracking, and maintenance management. The software automates administrative tasks, helping landlords and property managers reduce manual work and enhance operational efficiency. Available as both cloud-based and desktop platforms, property rental software allows users to manage multiple properties from one centralized system, offering features catering to residential and commercial rental properties.

How Property Management Software Aids Commercial & Residential Rentals?

Property rental management software provides a unified rental management platform for managing both commercial and residential properties. In commercial rentals, it aid with complex lease agreements, maintenance tracking, and tenant communication. The rental management software helps landlords automate processes, making it easier to manage multiple tenants and properties from a single dashboard.

In residential rentals, the property rental software simplifies daily tasks like tenant applications, rent collection, and maintenance requests. With an intuitive interface, landlords can keep track of lease renewals, late payments, and tenant feedback, improving tenant retention and property management efficiency.

Key Considerations When Choosing Property Management Software

When selecting long-term and short-term property management software for residential and commercial properties it's essential to consider a few key factors. First, evaluate the software's ease of use and whether its features suit your specific property type, whether residential or commercial. Scalability is crucial, especially if you manage a growing portfolio. Integration capabilities with other tools like accounting software and payment gateways can streamline operations. Lastly, ensure that the software offers strong security measures to protect sensitive tenant data and financial transactions.

Features to consider when selecting rental or tenant management software

Tenant Onboarding: Simplified processes for tenant applications, background checks, and lease agreements streamline tenant acquisition and save time.

Online Payments: Secure, automated rent collection with built-in late fee enforcement and payment tracking makes transactions smooth and efficient.

Maintenance Requests: Tenants can easily submit repair requests and track progress through a centralized portal, improving service response.

Document Management: Both landlords and tenants have easy access to essential documents like leases and notices, all stored in one place.

Communication Tools: Built-in messaging allows landlords and tenants to communicate directly through the platform for faster responses.

Tenant Screening: Provides comprehensive tools for background and credit checks, ensuring tenants meet all criteria before lease approval.

Reporting & Analytics: Offers insights into rental income, tenant turnover, and occupancy rates to help landlords make data-driven decisions.

Mobile and Desktop Access: A platform that’s accessible on both mobile and desktop devices allows landlords to manage properties on the go.

How do you choose Property Rental Management Software in 2024?

When selecting property rental management software, prioritize user-friendliness to ensure an intuitive experience. Look for scalable solutions that grow with your business, and opt for rental software that integrates with accounting or CRM systems. Full mobile access and strong security features are essential for managing data and tenants securely.

For optimal performance, scalability, and ease of use, we recommend RentAAA, a robust property rental management software. It offers essential features for managing residential, commercial, and short-term rentals. Plus, it's available for a free trial with no credit card required!

#rental software#property rental software#property management software#property management app#property rental app#tenant management software#tenant management app#Commercial property management software#residential property management software#property management software for owners#property management software for landlords#rental property tracking software#short term property management software

0 notes

Text

Transforming Rental Businesses: How Car and Property Rental Software Streamlines Operations

The digital transformation sweeping across industries has significantly changed how car and property rental businesses operate. Gone are the days when managing bookings, payments, inspection, maintenance, etc. information of Vehicle and Property was done manually. Now, with advanced rental software, businesses of all sizes — from small, family-run operations to large enterprises — can streamline their rental processes, improve customer satisfaction, and cut operational costs.

This post delves into the key benefits, features, and future trends in both car and property rental management software, illustrating how this technology is transforming the rental business landscape.

Key Benefits of Using Car Rental Management Software for Small and Large Fleets

Car rental software offers transformative solutions for both small and large fleets. For smaller businesses, the car rental management software automates everyday tasks like vehicle tracking, booking, customer inquiries, and vehicle assignments. This significantly reduces the time spent on administrative tasks, freeing up owners to focus on growing their businesses. For larger operations, rental software enhances scalability by eliminating the need for additional staff as the fleet expands. Automated tracking of vehicle availability, customer records, and real-time inventory management are just a few tools that optimize operations and enhance service delivery.

Enhances Fleet Efficiency with Real-Time GPS Tracking

One of the most valuable features of car rental software is real-time GPS tracking. This feature lets businesses monitor their vehicles’ locations, speeds, and routes in real time. By optimizing routes and reducing unnecessary mileage, fleet efficiency improves while fuel consumption drops.

Essential Features to Look for in Car Rental Management Software

When selecting a car rental management software, businesses should prioritize features like real-time fleet tracking, automated booking systems, and maintenance scheduling. Customer management tools and seamless payment integrations are also essential, ensuring that the entire rental process is as smooth as possible for both the business and the client. Comprehensive reporting tools, offering insights into customer trends, vehicle performance, and operational efficiency, help businesses make informed, data-driven decisions.

Why Automating Vehicle Inspections Saves Time and Money in Car Rental Businesses

Vehicle inspections are critical to maintaining the integrity of a fleet, but manual inspections can be slow and prone to human error. Vehicle rental software automates this process, generating inspection reminders and storing digital records of completed checks. This not only saves time but also ensures compliance with legal standards, prevents costly breakdowns, and helps rental companies avoid potential liabilities.

How Car Rental Software Improves Customer Experience: From Online Bookings to Digital Payments

In today’s digital-first world, customers expect convenience. Car rental management software meets these expectations by offering online booking systems and digital payment options. Customers can easily check vehicle availability, book their rental, and pay using secure online portals — all from their smartphones. This seamless experience enhances customer satisfaction and fosters loyalty, driving repeat business.

Property Rental Management Software

Why Every Landlord Needs Property Rental Management Software in 2024

Property management is a complex endeavor, particularly for landlords managing multiple units or properties. Property rental software streamlines processes like tenant onboarding, rent collection, and maintenance scheduling, enabling landlords to manage their properties efficiently. By automating these tasks, landlords reduce their administrative workload, giving them more time to focus on expanding their portfolios.

Streamlining Tenant Onboarding with Digital Property Management Tools

Gone are the days of cumbersome paperwork for tenant applications and leasing. Property rental software simplifies the entire onboarding process by allowing tenants to apply, submit documents, and sign leases online. This not only speeds up the onboarding process but also ensures all information is securely stored and easily accessible when needed.

How Property Rental Software Can Simplify Rent Collection and Payment Tracking

Late rent payments are a common challenge for property managers, but property rental software can help address this issue. By offering automated rent collection and various payment channels (credit cards, online transfers), landlords minimize the risk of late payments. Furthermore, tracking payments becomes more straightforward, with all financial data centralized in one platform.

Managing Commercial vs. Residential Properties: How Software Handles Both

Property management software is versatile, designed to handle the unique challenges of both commercial and residential properties. For residential properties, the focus lies on tenant relations and lease management, while for commercial properties, features like contract management and expense tracking come into play. The software allows landlords to manage both types of properties seamlessly within a single platform.

The Future of Property Management: Automation, AI, and Smart Home Integration

Like car rental management, property management is evolving with automation and AI integration. Smart home devices, such as automated locks and security systems, are becoming standard in rental properties. Property rental software will integrate these systems, allowing landlords to monitor and control them remotely. AI will also enhance property management by predicting tenant needs and automating responses to common inquiries.

By adopting rental management software, businesses can streamline their operations, improve efficiency, and provide exceptional customer experiences. In an increasingly competitive market, these software solutions offer a critical advantage, helping companies remain profitable while adapting to evolving industry trends. Whether managing a car fleet or multiple rental properties, the right software is key to long-term success.

#car rental software#vehicle rental software#fleet rental software#property rental software#booking management#online payments#rental management software#rental management app#car rental app#car tracking software#car rental management software#property management software#fleet software#fleet management software#vehicle tracking software

0 notes

Text

How to Prevent Card Payment Chargebacks: Essential Steps for Businesses

In the modern era of digital payments and online transactions, chargebacks may become a serious problem for businesses. A chargeback occurs when a customer disputes a transaction with their card provider, reversing the money. Chargebacks not only affect your income but also your brand image and further build up complexity in your operations. Businesses can take proactive steps to reduce the possibility of chargebacks and avoid these problems.

These are essential steps that you should take:

Secure cardholder authentication Implement secure cardholder authentication techniques such as 3-D Secure, to verify the identification of the cardholder for the duration of online transactions, or you can verify with CVV codes and address verification. This enables the prevention of unauthorized card use and decreases the threat of chargeback due to fraud.

Transaction Documentation: The more thorough your transaction records are, the simpler it will be to dispute a chargeback. So, keep all invoices, receipts, transaction dates and times, and customer correspondence. To make them all easier to find, give each of these records a suitable name. Create a procedure for transaction documentation so that each chargeback doesn't require you to start from scratch.

Customer Service Excellence: Provide exceptional customer service by promptly addressing inquiries, concerns, and complaints. Open communication and resolution of issues can prevent customers from escalating disputes to chargebacks.

Regular Monitoring and Review: Monitor transactions often for any suspicious activity or unusual patterns. Take proactive measures to detect and resolve such frauds or faults to stop chargebacks before they occur.

Educate Staff on Fraud Prevention: Train your staff to understand signs of fraud or suspicious behavior. Ensure they recognize the importance of following protection protocols.

You can keep your customers satisfied and significantly reduce the chance of card payment chargeback by taking these preventative steps.

Please contact us if you have any questions or need help putting these techniques into practice. We are here to help you protect your company by establishing a safe payment environment.

We appreciate you taking the time to consider this crucial issue.

Visit our website to know more:

https://rentaaa.com/

#Vehicle Rental Software#Car Rental Software#Fleet Management Software#Car Booking Management Software#Vehicle Booking Management Software#Manage Rental bookings Online#Car Rental Booking Software

0 notes

Text

Introduction with RentAAA | Rental Management Software

Welcome to Rentaaa, your go-to solution for managing your rental business! Here's how to get started:

1. Download the Rentaaa app and sign up by verifying your email with OTP.

2. Complete onboarding by adding business details and selecting your plan.

3. Add your first inventory with custom details and a profile picture.

4. Easily add customers and bookings, setting payment schedules and deposit amounts.

5. Manage invoices, deposits, inspections, and contracts all from the app.

6. Use the Swap feature to make changes to ongoing bookings.

7. Experience the ease of managing your rentals with Rentaaa!

#rentalclients#rentalcategory#rentaaa#rentalsoftware#automationsoftware#vehiclerentalsoftware#automation#fleetsoftware#rentacar#rentalmanagementsoftware#fleetmanagement#fleetmanagers

0 notes

Text

RentAAA | Car Rental Software Australia

RentAAA is a comprehensive solution for rental businesses, offering automation of daily operations.

For Rental Businesses, RentAAA is the go-to option because of its automated features, which simplify daily work. Our simple Mobile and Web App simplify the processes of booking, onboarding, eSignatures, payments, and maintenance. RentAAA improves productivity and efficiency whether you're managing cars or buildings, making it necessary for rental businesses.

Our Services-

INVOICING- Automated Invoicing

ONBOARDING- Online Customer Onboarding

PAYMENT- Direct Debit

PAYMENT- Visa / Mastercard

ALERTS- Compliance & Payment Alerts

DATA- Data Export

SMS & EMAIL- Group SMS and Emails

WEBSITE BUILDER- Website

We offer creative software that is affordable to help your business grow, save time, and perform more effectively. Get in touch with us now to find out more!

#fleet management software#car rental booking software#Car Rental Software#Car Booking Management Software#Vehicle Booking Management Software#Manage Rental bookings Online#Car Rental Booking Software

0 notes