#$35 bucks a month = $420 a year

Text

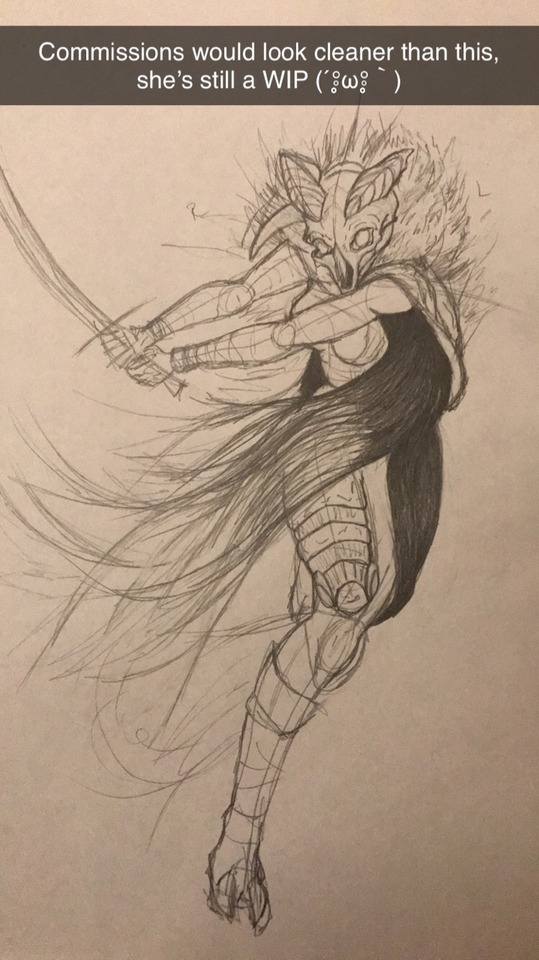

I’ve decided to open 10 commission slots.

//: The deadline to sign up is this Friday (4/12/91) at noon CST (central standard time).

All of the details and some art examples are below the cut ~

$3.00 is the going rate and I’ll only be taking payments through my Ko-fi account.

Per Ko-fi I can’t really do NSFW... NOW, will I not do NSFW? Prolly not... I’ll open that sack of fun at a later time ~ With that in mind, these ten will be SFW so I can have things to display on Ko-fi other than drawings that I did 3-4 years ago ಠ_ಠ (I have more recent work but none of its really done done because of the shit storm that was work...)

Now, please understand the following guidelines:

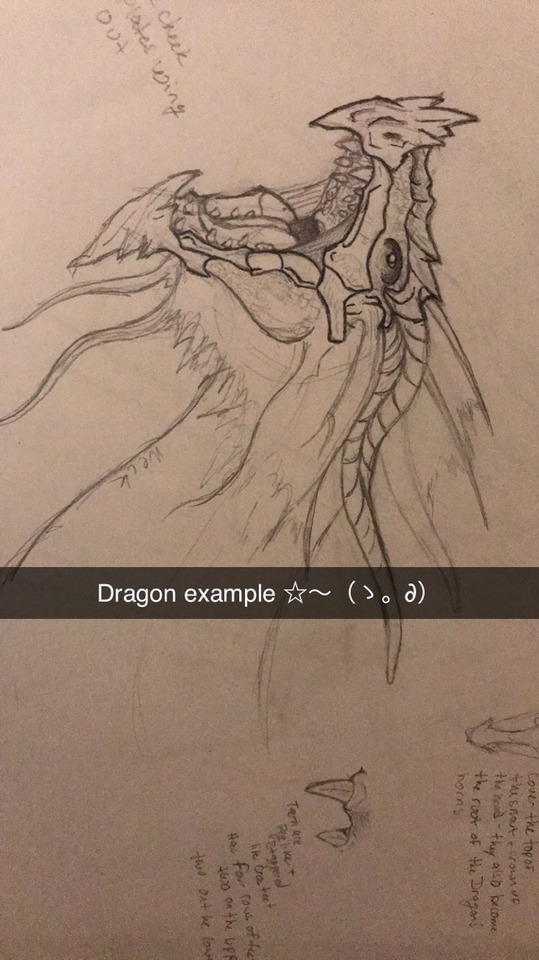

The sketch will be of One character... OC’s are 110% welcome!

Head shot or full body (your choice).

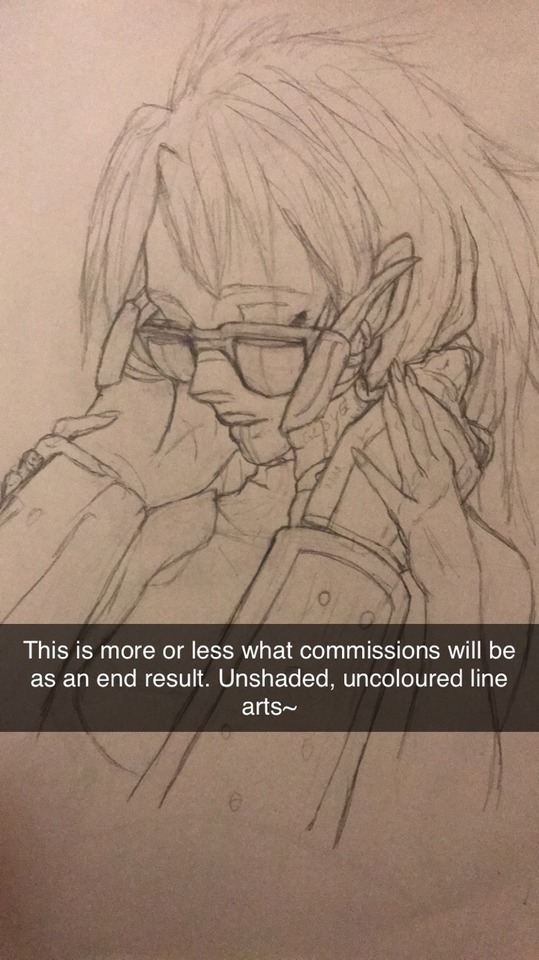

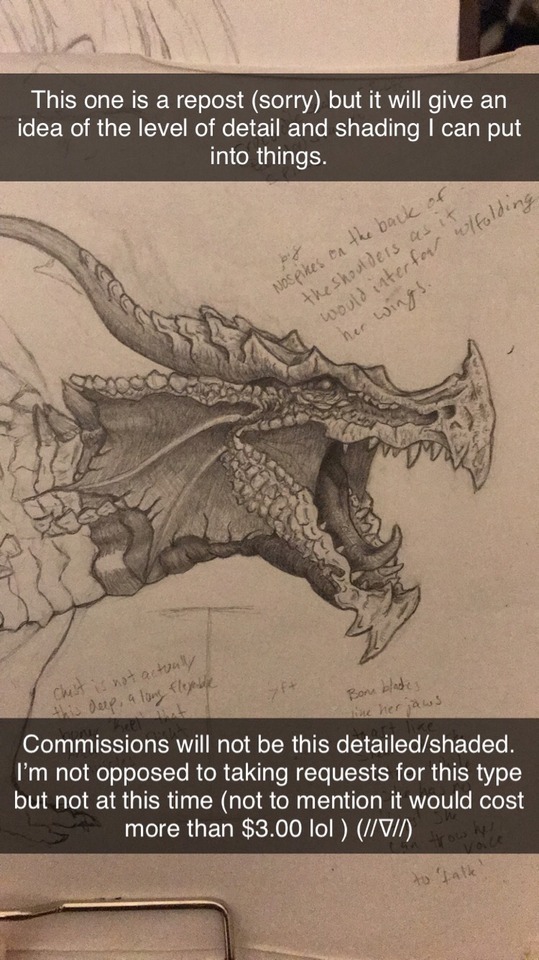

No colour and No S U P E R fine detail or shading.

The image will not be digital. Meaning: It will be pencil on paper and I will be uploading the best possible photo I can take because I’m a pos with out a scanner... _(┐「ε:)_

Because they aren’t digital, I’ll ask for patients in getting them done. N O R M A L L Y I can get such a sketch done in a day, but I haven’t been drawing as much as I used to because of my exworkplace (c" ತ,_ತ) so I’m a little rusty/slow...

** IF you have the image digitally altered PLEASE let me know and link me to it/sent it to me, I’d LOVE to see what’s done with it (*^◯^*)

What I’ll need from anyone interested:

I. Need. A. PM. Not. A. Comment. On. This. Post.

WE DO NOT HAVE TO BE MUTUALS AND YOU DONT HAVE TO FOLLOW ME (╹◡╹)♡

If it’s an OC I need as many details as possible (aside from colours obviously lol) If you have a face clame, let me know who so I can lurk (๑╹ω╹๑ ) If you have a pose in mind, feel free to drop examples! Other wise I’ll just kinda do what ever comes to mind (*´-`)

If you want a specific character, let me know so again, I can lurk lol Same with poses, drop me examples (I’m a pretty visual person when it comes to this kinda thing) or I’ll just do what hits me ~

P A Y M E N T: I quit doing commissions online a few years ago because people weren’t paying for them. In the beginning I did a ‘on good faith’ approach and that bit me in the buttocks.... then it turned into people skipping out half way through... I’m sure things have changed but, I’m still skeptical... so what Id like to do is this: I’ll make a running list or Queue of the requests. As I get them done, I’ll pm the client and ask for the donation to be made. As soon as it’s confirmed that it’s gone through I will send up to four photos of the drawing: two close ups and two full sketch :(;゙゚'ω゚'): I don’t want to take payment upfront because I know some people have been scammed with the promise of a commission before and I don’t want that kinda paranoia on your end...

Depending on how this goes I may do couples, I may do detailed works and I’d be willing to open NSFW at different rates, think of this as kind of an introductory promo thing...?

PLEASE P L E A S E reblog this post for me <3 even if you don’t plan to make a request, please share it ╰(*´︶`*)╯♡

^ Clothing wouldn’t be coloured in btw this is a personal piece lol

#Im just a raccoon#ten commissions at 3 bucks a pop will help me pay for Muninn's vet subscription#meaning all his exams will be free#neuter? Free#all of his core/required shots? free#if he requires surgery? Covered#gets sick? you got it#covered#the vet I go to requires 35$ a month to keep my cat son in the club ~#its a good club#$35 bucks a month = $420 a year#neuter alone is like#two hundred something#each exam costs 65$#medication? depends on what it is but its all covered for $35 a month#If this takes off I can get Gizmo in the same club#I'd have to make 70$ a month for both of them#; w ; commissions will help#if you can't make a request please just reblog for me ~#that helps just as much and I appreciate any help possible

6 notes

·

View notes

Video

youtube

420 Living Your Life By Design as an Investor - Interview with Chase Maher

https://moneyripples.com/2020/09/08/420-living-your-life-by-design-as-an-investor-interview-with-chase-maher/

Today, Chris Miles talks with Chase Maher. He started real estate investing in 2008, which is the time that everyone was running away from it. Chase ran towards it instead and was born out of the fire.

Chase also does wholesale, house flipping, he is an entrepreneur, and he is an investor.

So today, what we want to know is how can someone like Chase Maher who is into all these businesses, still have a life outside of it as well? And that’s the important part.

Listen to our Podcast here:

https://www.blogtalkradio.com/moneyripples/2020/07/24/420--living-your-life-by-design-as-an-investor--interview-with-chase-maher

-------------------------------------------------------------------------

Chris Miles (00:07):

Hello, my fellow Ripplers! This is Chris Miles. Your Cash Flow Expert and Anti-Financial Advisor. Welcome you out for a wonderful show. Show that’s for you and about you. Those of you that work so stinking hard for your money, and you’re ready for your money to start working harder for you. Now! You want that freedom. That cash flow. That prosperity. Today! Not 30 or 40 bazillion years from now, but right now. So you can have that life that you love doing what you love being with those that you love. But guys, it’s not just be able to get out of the rat race yourself, right. And have that lifestyle that you dreamed of, which is definitely awesome. But it’s so much more than that because as a Rippler, you can create a Ripple effect in the lives of others. You can bless more lives when you are free. And so guys, I’m proud to be a part of this group. To be a Rippler with you because man, I love what you guys are up to. I love hearing about the good that you’re up to. The results you’re creating, but I love also the fact that you guys are bingeing and sharing the show too. So I appreciate that so much.

Chris Miles (01:03):

As a quick reminder, check out our website, MoneyRipples.com. You’ve got the ebook on there, Beyond Rice and Beans. You can download for free today. And by the way, if you hate reading, don’t worry. It’s like 28 pages because I put page breaks and pictures in there. So you’re welcome. It’ll take you like 15 minutes, but check that out as well as the other blogs that are being uploaded as well.

Chris Miles (01:22):

Alright! Today, I’ve got a special guest here. Chase Maher. Now, Chase, you know, interesting thing with him, is that not only he is a podcast host, which I definitely recommend you guys go check out his show, but the thing that’s so cool about Chase is that he’s a real estate investor doing the very things. And he was born at a fire. Like he started investing in 2008, when everybody was saying run, he was running towards the fire. Right? So, I mean, Chase started doing real estate investing. He does things with San Diego. In Tucson. And even out East as well. And so he does wholesaling, fixing, flipping. He’s an entrepreneur and investor all together wrapped in one. And that’s primarily why I wanted to bring him on here today because you know what, how is it that someone can actually have a business. Like what he does, but still have a lifestyle. Just like we talked about in the show, right? It’s not just about making a lot of money. It’s about having a life too. And that’s the main thing I want to talk about to Chase about today. So, Chase, welcome to our show!

Chase Maher (02:17):

Chris man. Thanks for having me. I’m excited. Just had you on my show. So a little swap here, man, and you dropped a lot of value, so hopefully I can return the favor.

Chris Miles (02:26):

I guarantee it, man. Like I can already tell just from our conversation, that’s going to be easy, you know.

Chase Maher (02:30):

For sure.

Chris Miles (02:31):

So give us some background, like what even led you down that path. I mean, of all the things you could have done, why would you want to go and be crazy Investing real estate when everybody else said run, right?

Chase Maher (02:40):

Yeah. Well, you know, I wish I waited two years and started in 2010, but Hey, I started in 2008. I’ll tell you the story. It’s actually pretty good. So I’m 30 years old now. I live in San Diego. And I grew up in Virginia Beach, Virginia and I grew up in the car dealership. My parents owned a couple car dealerships. I grew up, I learned the sales, used to pick-up cigarette butts, then wash the cars. Then I went to the auctions and eventually just kind of ran the show, working full time through college. And I always had discipline with money. I always had that entrepreneurial mindset where, you know, my dad taught me, put it away, put it away. I started buying gold when I was like 14 years old and, I had that mindset, but I never knew anything about real estate. My parents weren’t real estate investors. And when I was 18 moving out of my freshmen dorm and I saw like a lot of my buddies were going to go kinda split a house rental near our college, old dominion university, shout out to the monarchs. And I was like, man, I got like 25 grand in the bank. Why don’t I just like take 20K of that and go buy a house?

Chase Maher (03:45):

And so I called up a real estate agent that I knew and I went and bought a house and I had no idea what I was doing. I did not know that we needed to check the market. I didn’t know the world was on fire with mortgages. I bought it June, 2008 and I basically house hacked it with buddies before house hacking was even like a buzzword. I rented out each bedrooms, four bedroom house. I rented out each bedroom for 500 bucks. Rented out the garage for 600 bucks. Covered my mortgage. Covered all my utilities and all throughout college, I lived rent-free, but you know, by July or by June, 2009, the house lost like 35% in value. But Hey, it recovered. I still have it to this day. And it’s a really good cash flow machine for me. And you know, after a couple of years I said, why don’t I do it again? And again, and again, and fast forward to now I live in San Diego. I fix and flip. I wholesale. I do some Realty stuff here and there. And I’m still invested in properties.

Chris Miles (04:37):

Well, yeah, I think the cool thing that you did, whether you knew it or not, is that you still focused on the cash flow part, right? That’s the mistake I made during the last recession. I was buying property. So I thought, well, man, like if I can buy a hundred thousand property and appreciates 10%, that’s 10,000 bucks. But if you buy a 500,000 property, 10%, that’s 50,000. So let’s go big or go home. Right. And then I was like, no, I’m going home. You know, it was pretty bad, but I mean, you still, at least had roommates go into there. Or even after you probably moved out, you probably saw students in there paying rent. So even if it lost value, you were still getting paid.

Chase Maher (05:12):

Yeah, absolutely. You know, the only appreciation that I bank on is forced appreciation. So, I don’t factor in any of my underwriting. Hey, hopefully the property value goes up 3% or 5% or here in San Diego sometimes 10% in the year, 2015, we went up like 20% in one year. So what I mean by that is forced appreciation. So actively figuring out ways that when I buy it, how can I increase the value of it by 10% 20% 30% within a 12 month period? Refinancing, getting my money back, redeploying it.

Chris Miles (05:42):

I like that because you want to play it safe. Cause you’re not trying to bank on appreciation. You’re trying to bank on we’re going to do that actually, control the variables, right? Control the values versus just hoping that the values hold or whatever it might be.

Chase Maher (05:53):

Yeah. I take the risk with my business and I play it safe with my investments. That’s kind of my philosophy.

Chris Miles (05:59):

That’s great! I love it! So tell us more about that. Like, I mean you’re only 30, right?

Chase Maher (06:04):

Yeah. I’m thirty.

Chris Miles (06:04):

I mean, most people.

Chase Maher (06:06):

Thanks for using the only!

Chris Miles (06:09):

Yeah. I know. Coming from a guy who’s almost 13 years older than you. Yeah. So, you know, like for me it’s like, that’s incredible because when I was 30, I was trying to dig myself out of a hole. Right. Like I was going through the recession, you know, but I mean, you, I mean, you’ve actually been doing this, like you said, since you were 18 years old, you know, and again, it’s not something you just started doing a couple like three years ago. Like I always laugh with people that come by. They’re like, Oh yeah, I’m successful. I’ve been doing this for three years. And like, you haven’t seen anything yet. You know? So I mean, that being said, like, what do you feel is like been kind of a secret of success for you both, whether it be for your business and or even with your investing too?

Chase Maher (06:44):

Yeah, man! I think discipline is like the most important thing. And just figuring out what’s your longterm goal, your longterm strategy and sort of reverse engineering it from there and it doesn’t have to be perfect. So if anybody’s out there and they’re listening, you’re trying to out like, what’s your life goals? What do you want to do? It doesn’t have to be perfect. Imperfect action is better than taking no action. So when I was 18, I bought that property. I thought to myself, man, you know, I’m going to school with some kids that are trust fund babies. They’re inheriting a bunch of money and they’re kind of blowing it and they’re blowing it because they don’t know what to do with it.

Chase Maher (07:18):

And they don’t have any sort of education around it. So I started studying money and I didn’t inherit any crazy amount of money. I didn’t inherit anything. And I told myself, I want to be educated with money. I want to make sure that this mistake of a house that I just bought that, you know, fast forward, it’s not a mistake now, but at the time, imagine 12 months after you buy it. And the value is down 30%. You’re like, crap. What did I do? So that caused me to study markets that caused me to study, you know, market philosophy and what’s kinda going on. And like I said, I didn’t inherit any money. I wanted to be able to pass down money generations below me. I wanted to be that first one that when I have a great, great grandchild, they look at me and they think that’s the one that changed the path for our family forever.

Chase Maher (08:04):

But I wanted to do it in a way that they were educated and they knew how to handle the funds that I passed down to them, the assets that I pass down to them so that they stay in families forever. You think about some of the wealthiest people in the world, the Rothschilds and a few others. It’s a family. And they run that family like a business. And I wanted to instill that. So I started studying the markets, studying books, listening to podcasts and just making the right decisions along the way. And like anything, those decisions compounded over time.

Chris Miles (08:31):

That’s right. That’s like what? My, one of my old buddies, well, my old partners wrote the book. What would the Rockefellers do? Right. And it’s a big point, you know, it’s what can you actually pass on? And it goes beyond it really you’re creating your own ripple effect, right? Yeah. Not just for the people that you come in contact with, but really, I think one of the biggest ripple effects you could ever create is through your own family, creating that legacy.

Chase Maher (08:52):

I couldn’t agree more.

Chris Miles (08:53):

And the cool thing is too. I can already tell from what you said. You said it’s not just passing down the money, is it?

Chase Maher (08:59):

No, it’s passing down the assets. So my philosophy is active income versus passive income. And so I like being an entrepreneur. I love being an entrepreneur. I haven’t had a job since high school. I really enjoy it. I’ve done a bunch of different things. So anybody that’s listening, if you think, Oh, here’s this 30 year old guy and he’s got it all figured out from 18 years old, that’s not true. From, you know, 18 to 22. I was selling cars and buying houses. And then from 22 to 26, I was kinda lost and just kind of living off my income from my assets. Blowing through my savings, traveling Southern California, you know, snowboarding, surfing all over the world. Kind of figuring out what I wanted to do. And then I ramped up the active income part again in my late twenties.

Chase Maher (09:43):

And that instilled this like philosophy in me that if we can eliminate distractions and we can stay disciplined, we can have some strong, active income sources. We put it away, properly and passive income. And we live a lifestyle that is enjoyable to us. So I can do it for the long haul and not get burnt out. I saw my dad get burnt out when I was young and I saw him get overweight and get on healthy. And it, it made me think I don’t want that to happen to me. So I wrote down on paper, what’s important to me between health, wealth and relationships. And I just kind of live by that philosophy that if I’m not happy and I’m not able to do the things that I want to do, what the heck am I working this hard for anyways? So it’s really important to me. And I definitely, you know, I enjoy sharing that.

Chris Miles (10:29):

There is a lot right there, man! Everybody, that’s a part you should probably go back and rewind a couple of times and re-listen to because there’s so many different tangents we could take with us. Right.

Chase Maher (10:39):

Yeah. I know. Sometimes I’m valuable a little bit.

Chris Miles (10:39):

Yeah. We can create like three shows that last comment you just made and we agreed create all these tangents from it. I think the thing that’s more valuable if I’m thinking from listener’s perspective here too is, youth aspects, right? I mean, one, I think will make a big point that you already said is, I love the clarity that you were having. Right? Like you’re writing this down. You’re saying, what is my life really about? And I think we even made this mentioned another time, you know, before we went on the air. Where that question of, you know, if money were no issue, what would you spend your time doing, right? Like kind of like, what do you want to be when you grow up? I know that there’s 60 and 70 year olds out there that have not asked this question with. What would I want to spend my time doing? Right? Like what would you do if you hit your financial goals? And what would that life look like? And it sounds like you really have to kind of create an architecture behind that life, didn’t you with that design?

Chase Maher (11:30):

Absolutely. And it comes from repetition of constantly thinking over and over. And it, for anybody listening out there, if you like constantly have the same thought over and over, you should probably follow that instinct. And what I mean by if you’re constantly thinking I want to be in real estate, or if you’re constantly thinking, man, I want to be able to take a snowboard trip every year. Or if you’re constantly thinking, you know, I want live in this city, you should start crafting your lifestyle around, being able to do that. There’s a calling that you’re having that you should go after that. And I truly feel that the most depressed people in the world, they’re the ones that aren’t listening to that calling. They’re the ones that keep that thought in the back of their mind rather than in the front of their minds. So what that looks like to me is like purging out the things that, I’ll put it to you this way. There’s a lot of things that matter, but focus on the things that matter a lot.

Chase Maher (12:19):

And what I mean by that is like, I would love to, you know, be a great golfer or a great tennis player or, you know, still play basketball twice a week. Like, you know, all these things. But what I love more is surfing. I love more is snowboarding. So I don’t waste any time, like trying to learn anything new. I just stay with what I know. I try to stay a fish when it comes to food. I’d love to learn how to cook this, this and this, but I just stay efficient because that mental space is better focused elsewhere. I’d rather go all in on the things that I know make me happy rather than trying to go discover a bunch of other thing. And the same applies with money. So that one core active income source and then pick a few streams of passive income for me, it’s hard assets and just stay focused and try not to lose sight of, you know, what you’ve written down and what you want to focus on because it will compound over time. You’ll get better and better and better.

Chris Miles (13:14):

So true. Yeah. I want to go to both of those points. Man, you’re making this so hard on me, man. Cause you have, you’re testing my focus right now of how I can do this. But you know, when you mentioned about like the designing that life, right? Like really, you know, figuring out what is it you want? It took me back to four years ago when I asked my wife to marry me, you know, I said, Hey, I want to marry you. She says, all right, two conditions, one, no more kids. Cause eight is enough. Right. So we’re not having anymore. And then two, you need to make sure that every winter, she was like, I don’t care if you come or not. But every winter I got to leave, like I cannot do another Utah winter anymore. Like I’m done. I’m from the tropics. I can’t do it.

Chris Miles (13:57):

And I said, all right, well, let’s do this. You know? And in my mind that was something that was impossible. Right. That seemed impossible. But when we really like mapped it out, like figured out how much would it really cost to do that? And you know, obviously, you know, of course with my business being virtual, I can do it anywhere anyways, but it was a whole mindset shift. And now I realize it’s freaking easy. It’s easy to do that. Like the hardest thing is now just, you know, trying to make it all work with children. You know, that’s the hardest part, but everything else is great, you know? And so I love that you did that. You can design that life. And once, you know, it’s easier to create.

Chase Maher (14:31):

Chris, Gary Keller talks a lot about living a life by design. And if we don’t build a plan and then work towards that plan, we’re kind of just like living endlessly and just kind of wandering. And that’s a lifestyle that I didn’t really want for me. So I made that decision to live a life by design.

Chris Miles (14:49):

I love it. So tell us, you mentioned about the income streams too, right? So you say you have one main income stream and you create other income streams. Tell us more about your philosophy on that.

Chase Maher (14:58):

So active income figure out what’s that sweet spot that you can live off, you know, 50% or less of that active income and then invest the rest. And so for me, I figured out, you know, what’s that sweet spot and then I want to invest everything else. And so the active income that I like kind of sets up my passive income stream. So I realized that I wanted to have rental properties. I wanted to have buildings and assets. And so how can I build an active income that kind of sets that up? Well, it was lead generation for distressed properties, and then I can take those properties. I can fix and flip them. I can wholesale them. I can list them as an agent or I can refer them to a realtor. So those are four different streams of active income that are all built off of one marketing channel.

Chris Miles (15:44):

Just one activity, yeah.

Chase Maher (15:45):

One activity. We’re just, how do I simplify and dumb it down? Here’s another thing that I learned from Gary Keller when I was an agent is, what’s the one thing that you can do that makes everything simple or unnecessary? And so I focus on lead generation and then how can I maximize my use of that property? And then also what that does is I’m able to cherry pick the best ones for my portfolio. It kind of all builds off of that. And then from there, you know, some other income streams, passive that were sort of built off that and you know, just focusing on what that sweet spot is. So me personally, now I live off 30% of it and I invest the rest. And, you know, based off your investment philosophies, I learned from you and your show, we kind of have a lot of alignment there as well.

Chris Miles (16:33):

Yeah. I love that! I love that! That basic philosophy of saying, all right, how do I get myself to have a lifestyle where I’m only at 50% of my income? That’s, for some people that’s a stretch, right. But it is kind of a core challenge.

Chase Maher (16:46):

Yeah. You just got to make more than, you know, if your lifestyle is, is 10 grand, you need to figure out a way to make 20 grand. And actually you need to work, figure out a way to make like 30 grand cause of the taxes. So another reason why I love being an entrepreneur is, you know, tax saving strategies. So I’ve figured out how can I pay the least amount of taxes legally? And that’s by setting up, you know, an escorp paying myself a salary, profit distributions, owning assets that I can write off the interest. And so that sweet spot for me, I’m able to like focus in on it more and more and not have to go too high above that because I’m saving money on the taxes as well.

Chris Miles (17:25):

That’s true. I get a lot of clients where, you know, like I get some of that. We can get them retire like this year, right. Others might take within five to seven years, 10 years. And I get some of those clients they’ll say, alright, like we got a couple deals, but they didn’t have a whole lot of cash. Like maybe they have 50 to a hundred grand. We’re like, alright, we’re making 500,000 passive a month, but we need 10,000 a month. Right. And it seems like there’s a big Hill to climb. We’re like, well, how do we do it faster, Chris? I’m like, well, other than just reinvesting the money you’re making, I’m like the best thing you can do is just find other ways to create more income or reduce your expenses and allow yourself to invest more faster. That is really the amplifier. Right? That’s the thing that multiplies it all is if you go from saying, Oh, I only got a thousand a month to build a, to put towards buying passive investments versus, Hey, I’ve now got 5,000 or 10,000 a month. I can put towards that. It’s a complete game changer. Like the numbers has become exponentially better. When you do that.

Chase Maher (18:24):

Yeah. If you can think of a way to like productize yourself. And what that looks like is either sell it for more, make more money or reduce your costs, reduce your expenses. It’s pretty simple. I usually opt for, I like just trying to make more money because I still like, I like that 30% or 50% I focus on the 30%. I like to live a good lifestyle though. You know, like I’m not some Rice and Beans kind of guy. I do a lot of trips, a lot of traveling. I figure out what’s that sweet spot. So do you need that? You know, tier two or tier three above the current car you’re driving right now? Do you need that fifth surfboard? Do you need, you know, certain things like, do you really need them and you know, live your life a little bit above the needs so that you’re still happy and you’re still enjoying yourself, but ask yourself on your purchases. Like, are there certain things like, do I really need that? And then, you know, if you do buy it, try to match that towards an investment. So anything that’s a want, I buy it and it’s 500 bucks, all right. Then I need to commit to 500 bucks towards an investment. And so kind of simplified it like that.

Chris Miles (19:32):

I think that’s the key is that, I mean, just like you said earlier, like when you can really know what you want, right? What’s really the priority. Yeah. You can still have a life that you love, but you can say, you know, all those rest of the stuff is distraction. It’s just extra clutter in my life. I don’t need it. Simplify on what I really want. Keep that simple life and create freedom from it. I love that.

Chase Maher (19:52):

Yeah, man.

Chris Miles (19:53):

Cool, man. Well, Hey, if people want to get to know your stuff or follow you or whatever, what’s the best way they can do that, Chase?

Chase Maher (19:59):

So the best way is my podcast. The Life Worth Chasing Podcasts. We talk about real estate, money, wealth, business strategies, and pretty much every guest that I bring on like yourself, you were just on. I really want to make sure that they live, you know, a life by design that, you know, they’re not working until their eyes bleed. And so it’s the kind of show that you’re going to learn a lot, but you’re also going to be inspired. And then if you want to get ahold of me directly, the best place is probably on Twitter and it’s @iamchasemaher and yeah, I’m on Twitter a lot dropping knowledge. That’s how I communicate with a lot of people and can join me on there. And there’s a lot of good, useful information on that.

Chris Miles (20:35):

Awesome! Chase, I really appreciate it. Like I said, there were so many nuggets on here. We could go like an hour long episode and have some fun with this, but man, the stuff you’ve given, I recommend people listen to show more than once just to pick up on these nuggets you’ve given us. So I really appreciate that.

Chase Maher (20:50):

Hey, my pleasure, man. I appreciate you having me on.

Chris Miles (20:53):

You bet! Everybody else, you know, we’ll put in the show notes, you know, Chase’s podcast as well as his Twitter handle. So check them out, check out his stuff. Great show. As you already know, like, well, our life is so much more than just money, right? It’s so much about the kind of life that we can create. So make sure you follow his show because that’s what it’s all about. And definitely reach out to Chase. If you feel like that little ping of, Oh, that resonated that I needed that. So check him out. Everybody, I hope you make it a wonderful and prosperous week. We’ll see you later.

#Anti-financial Advisor#Cash flow#Cash flow Expert#Debts#Entrepreneur#Financial Freedom#Money Ripples#Chris Miles

14 notes

·

View notes

Text

5 winners and 3 losers in NBA free agency so far

Photo by Michael Reaves/Getty Images

Here are our early winners and losers in NBA free agency so far.

The NBA wasted zero time getting the free agency bonanza going this year. Lonzo Ball’s $85 million deal with the Chicago Bulls via a sign-and-trade was announced the moment the moratorium period opened on Monday at 6 p.m. ET. That set the tone for a wild day of transactions that saw a large percentage of the league’s free agents give their commitments on day one.

The champion Bucks brought back a key piece on a bargain deal in Bobby Portis, but lost out on P.J. Tucker when he signed wit the Heat. The Phoenix Suns locked up Chris Paul and re-signed Cameron Payne. The Los Angeles Lakers brought back many old friends — Dwight Howard and Trevor Ariza included — as they look to remake the bench. Kawhi Leonard, the top free agent in this year’s class, remains unsigned, but all indications are he’ll eventually re-sign with the Clippers.

Check out our running list of every signing in NBA free agency here. Here are five winners and three losers that stood out from day one.

2021 NBA free agency winners

Miami Heat

The Heat were the most active team on day one of free agency. Let’s run down the moves:

Starting with the headliner: Kyle Lowry is on his way to Miami on a three-year, $90 million deal.

Jimmy Butler is signing a four-year, $184 million extension that will pay him more than $50 million per year in his age-36 season.

Duncan Robinson is staying with the Heat on a five-year, $90 million deal

PJ Tucker is coming to the Heat fresh off a championship run with the Bucks. He signed for two years, $15 million with a player option on the second season.

Lowry is still one of the better point guards in the game even at 35 years old, and he immediately gives the Heat another trusted weapon on both ends of the floor. His pull-up shooting should add some needed juice to the offense, and you already know Erik Spoelstra is going to deeply appreciate every charge. Tucker is another defensive ace they can go to in the toughest playoff matchups. The Heat (probably) aren’t getting swept out of the first round this year.

Yes, it’s a lot of money for Robinson and Butler, but they had to be kept long-term. The league keeps waiting for Butler to fall off after such a heavy minutes load, but he was still excellent last season. Robinson is an amazing shooter and amazing shooters get paid. The Heat feel like they will be a factor in the East again even if they remain a cut below the Bucks and Nets.

Chicago Bulls

The Bulls have missed the playoffs the last four seasons since trading Butler, but there’s no more excuses this year. Chicago felt pressure to make a postseason run with Zach LaVine entering the last year of his contract and with the franchise trading two first round draft picks for Nikola Vucevic mid-season. The Bulls still needed another major talent infusion to have a chance to shoot up the standings, and it feels like they got one on day one:

Lonzo Ball and the Chicago Bulls have agreed to a four-year, $85 million deal in a sign-and-trade agreement, according to Woj. Garrett Temple, Tomas Satoransky, and a second round pick are reportedly going to New Orleans in the deal, per Shams.

Alex Caruso is signing with the Bulls for four years, $37 million, per Woj.

Ball will immediately be the best passer on the Bulls. He also gives the team a stout defender on the perimeter, a high-volume three-point shooter, and a tempo-pusher who loves throwing deep outlet passes in transition.

Caruso brings ferocious on-ball defense, which will be a huge help for a Bulls team that often saw its guards get roasted on that end last season. He’ll need to prove he can score after averaging only about six points per game over the last two seasons, but he did hit 40 percent of his threes on low volume last year while also ranking in the 82nd percentile for rim attempts at his position, per Cleaning the Glass.

The Bulls lost Daniel Theis to Houston in addition to Satoransky and Temple to New Orleans, but this is the sort of talent infusion they needed. Front office boss Arturas Karnisovas has fully put his stamp on the team.

Chris Paul’s bank account

Chris Paul had made $300 million in NBA contracts before entering free agency again this year at age-36. He was always going to cash in again after helping lead the Phoenix Suns on an inspired run to the NBA Finals in his debut season with the team, and that happened in a big way.

Paul is signing a four-year extension worth up to $120 million. The third year of the deal is reportedly a partial guarantee, while the fourth year is unguaranteed. If Paul finishes out the deal, he’ll be making $30 million per year at age-40.

Paul’s career earnings if he finishes out this contact would be $420 million. Not bad work if you can get it.

David Nwaba

The headline names always get the most coverage in free agency, but sometimes the best stories come from the role players only hardcore fans have heard of. David Nwaba is an example of that after he signed a three-year, $15 million deal with a team option on the final season.

Nwaba’s path to the NBA is wild. He started his career at the DII level, transferred to a junior college, and then found a home at Cal Poly, a low-major DI school. Nwaba went undrafted but grinded his way into an NBA opportunity on the Lakers’ G League team. After the Lakers, he had stints with the Bulls, Cavs, and Nets. His tenure in Brooklyn ended with a torn Achilles.

A torn Achilles is the type of injury that could end the NBA career of a player on the fringes of the league, but it didn’t stop Nwaba. He returned to play 30 games for the Rockets last year and looked fully healthy in showing off his signature brand of energetic defense. The Rockets liked him enough to give him $10 million guaranteed with the potential to reach $15 million. That’s life changing money for a player who has had to bust his ass for every opportunity to this point in his career.

Cheers to Nwaba for finally securing a multi-year deal and a nice bag.

Lakers exes

The Lakers brought back a lot of old friends on day one of free agency. Let’s run down the list:

Dwight Howard is back

Trevor Ariza is back

Wayne Ellington is back

It’s Howard’s third stint back with the team. Ariza hasn’t been a Laker since his breakout role player days on the team that reached the NBA Finals in 2008 and won it all in 2009. Ellington hasn’t been on the team since 2014-2015, which was Kobe Bryant’s penultimate season. LA also signed Kent Bazemore away from the Warriors.

Former Lakers had a good run in free agency, too, with Alex Caruso signing for the midlevel exception and Reggie Bullock netting $30 million.

2021 NBA free agency losers

Dennis Schröder

While the rest of the big name point guards went off the board in day one, Schröder stayed on the market. That’s not necessarily a bad thing, and there’s no doubt Schröder will sign a contract soon. It just won’t be for the reported $84 million the Lakers offered him in-season.

Schröder initially thought he could get $100-$120 million on the open market when he rejected the Lakers’ big offer. Instead, he had a rough end of the season and struggled in LA’s first round playoff loss to the Suns. The Lakers were ready to move on, and his market around the league was quiet enough for him to go unsigned through the first day.

Schröder will still get a nice deal, but he’s not getting nearly as much money as he turned down a few months ago. File this under ‘when betting on yourself goes wrong.’

The Knicks’ cap space creativity

The Knicks reportedly had as much cap space as any team in the league upon entering free agency. It felt like New York could finally be a free agency juggernaut coming off a shocking run to the No. 4 seed in the East last season, but they ended up using their money to bring back most of their own guys.

The Knicks locked up Derrick Rose to a $43 million deal over three years

Nerlens Noel is coming back on a $30 million deal

Alec Burks is also getting $30 million for three years

Each of these players was on a bargain contract last year. It’s nice that they were rewarded for their contributions to a winning team, but it feels like the Knicks could have dreamed bigger. It also stings that Reggie Bullock, a starter on last year’s squad, left for Dallas.

The Knicks did make a big move signing Evan Fournier to a $78 million deal. He will definitely provide some offensive punch the team was missing last season. In general, though, the Knicks’ moves on day one of free agency feel a little underwhelming.

Teams feeling pressure to win that need more moves

There is a long way to go in this offseason, but some teams are clearly feeling more pressure to win than others. A few of those teams still have a lot more work to do.

The Trail Blazers made a big move by signing Norman Powell to a five-year, $90 million deal. Powell was a top-10 free agent on the market, but he was also on Portland when they lost in the playoffs to the Jamal Murray-less Nuggets in the first round. Damian Lillard has been adamant he wants to see the Blazers swing for the fences to win now, and that hasn’t happened just yet.

The Pelicans also need to bolster the roster around a reportedly unhappy Zion Williamson this offseason. They are off to a questionable start: losing Lonzo hurts, but they recovered by bringing in Devonte’ Graham. Graham’s shooting will play nicely next to Williamson, but it feels like a talent downgrade in a vacuum. They also had to give up a lottery-protected first round pick to get Charlotte to avoid matching. New Orleans still has a lot of work to do.

The Mavericks had a good start to free agency by bringing back Tim Hardaway Jr., and signing Reggie Bullock and Sterling Brown. It feels like they still need a big move though and it’s hard to see where it comes from right now.

What is the Raptors’ plan for next year? Toronto had cap space coming into free agency, and the only move they made on day one was resigning Gary Trent Jr. to a $54 million deal. Losing Lowry, the greatest player in franchise history, is a huge bummer. Are the Raps playing for a lottery pick next year? Are they playing to sneak into the playoffs? Either way, the upside of this roster doesn’t feel particularly high.

We’ll keep you updated on every signing here. Happy free agency.

0 notes

Text

A Beginner’s Guide to Micro-investing (and Our Favorite Apps)

In the 21st century, we like things small.

Our headphones, computers and dogs are all shrinking. Teacup pigs are surging in popularity. It’s no surprise that we like our investments small, too.

That’s because the word “investment” seems way too big for most of us. It’s too much to learn, too much responsibility, too much risk — just too much.

Micro-investing, on the other hand, is just plain adorable. Snappable, ’grammable adorableness.

Like a pig small enough to fit in a teacup, micro-investing is about investments small enough to fit anyone’s budget.

Interested? Here’s our beginner’s guide.

How Micro-Investing Works

Micro-investing apps allow you to automatically invest small amounts of money in stocks, even if you know absolutely nothing about the stock market. They funnel your extra cash into portfolios of stocks that they craft for you.

Your investment money is typically used to buy “exchange traded funds,” or ETFs. These funds helpfully spread your risk around by buying up shares in dozens or even hundreds of different companies.

Don’t worry, you don’t have to suddenly start following the stock market. You don’t have to watch CNBC or read The Wall Street Journal. You can continue binge-watching “House Hunters” or “Cupcake Wars” if you like.

Why Millennials Like Micro-Investing

Here’s another plus: You don’t need much money to start micro-investing. Heck, you can launch this baby with five bucks if you want.

The idea is to get you to start investing.

You’ve probably heard that Americans aren’t saving enough for retirement. Well, it’s true! The average U.S. family has nowhere near enough money set aside for retirement. It’s going to be such a train wreck when we all get old.

If you’re not already investing, the first step is the hardest. No, micro-investing won’t make you rich. Instead, this is about getting you to take that crucial first step toward investing for your future.

Our Favorite Micro-Investing Apps

Naturally, there are a whole bunch of apps competing for your micro-investing dollars. They’re all clamoring for your spare change, and they’re promising to grow your investments like diligent little money gardeners.

Virtually all of these options will have you set up a profile that lets the app know what kinds of things in which to invest your money. It’s a classic “set and it and forget it” approach.

Here are some of our favorite micro-investing apps of 2019. They’re all available on Apple and Android phones.

1. Acorns

Acorns makes it easy to invest without missing the money you set aside. It rounds up your debit or credit card purchases to the nearest dollar and invests your digital change.

You can have it automatically round up all your purchases, or manually round up only the transactions you choose. Because the money comes out in increments of less than $1, you’re less likely to feel an impact in your bank account.

Penny Hoarder Dana Sitar shared her Acorns review — she saved $116 in three months, about $35 a month, by connecting one debit card to the app and forgetting about it. At that rate, you’d put away $420 a year. And if you use your credit cards more frequently, your round-ups could amount to much more.

You don’t have to choose exactly where to invest your money. Instead, you’ll answer a few questions to create a financial profile and state your goals. Acorns uses this to build your investment portfolio, which ranges from conservative to aggressive

You start out with a free $5 bonus if you sign up here.

Cost: $1 per month for an account with a balance below $5,000

2. Stash

Stash lets you start investing with as little as $5. You can set it up to withdraw a certain amount of cash from your bank account every week or every month, so you can grow your investments over time.

Like Acorns, Stash will ask you a few questions to determine your risk profile: conservative, moderate or aggressive. Then it invests your dollars in a set of simple portfolios reflecting your beliefs, interests and goals.

You can choose from more than 150 ETFs and stocks. Instead of overwhelming you with industry jargon, Stash curates and categorizes these funds and gives them understandable names.

Want more information? Read our complete Stash review.

You start out with a $5 bonus if you sign up here.

Cost: $1 per month for an account with a balance below $5,000. Balances of $5,000 or more cost 0.25% a year.*

3. Rize

Rize is a savings and investment app.

The savings part is a pay-what-you-want web app that’ll help get your savings on track. It siphons part of your paycheck into a separate savings account.

You’ll create a goal and set a deadline. These could be short-term goals, like saving for a weekend road trip or meeting your monthly student loan payment. You’ll even earn 1.16% interest on your balance. (For some context, that’s 19 times higher than the national average for savings accounts.)

If you have a longer-term goal, have Rize invest the money for you and help you maximize returns.

You can easily tweak your settings in Rize at any time. Plus, the app has some fun automated features like “accelerate,” which automatically increases your savings by 1% each month, or “boost,” which triggers Rize to squirrel away money when it makes the most sense.

Cost: An annual management fee of 0.25% of your investments

4. Robinhood

The Robinhood app is best known for having no trading fees. You can buy and sell stocks on U.S. exchanges without paying a commission, and you’ll pay no account maintenance fees. You can also buy and sell ETFs and cryptocurrencies, if you’re into that sort of thing.

In keeping with its stripped-down approach, Robinhood doesn’t offer investment research or advice on your portfolio. So you won’t necessarily get a lot of guidance here. It’s a no-frills, bare-bones app that’s designed for investors who want to trade stocks frequently while keeping their costs down.

Cost: It’s free. There’s also a premium service called Robinhood Gold that enables you to buy “on margin,” which means borrowing money to purchase stock. Frankly, that’s not for beginners. The cost depends on how much you want to borrow. Also, you need a minimum of $2,000 in your account to do this.

5. WiseBanyan

You can start investing with as little as $1 with WiseBanyan, and the app charges no monthly fees or trading fees.

Financial advisors can cost more than you’re even trying to invest, especially if you’re just getting started. But free online services like WiseBanyan can provide the same kind of support.

The service is completely digital, eliminating the usual management, trading and rebalancing fees, but it still offers the same services as traditional financial advisers.

Once you sign up, you can create a “Milestone” by entering your goals (whether it’s saving for retirement or a jet ski) and a time frame. WiseBanyan automates everything, from suggested deposits to rebalancing your accounts to help you achieve your goal.

Cost: Free, but fees do kick in if you opt to upgrade to premium services. You can mix and match services to create personalized premium packages. These packages include detailed investment strategies, increased personalization and additional automation services.

Is Micro-Investing Worth It?

If you’re even a little math-minded, you might have realized: If you invest a small amount, you can only expect a small return, right?

You probably won’t become a millionaire or retire early from investing your spare change.

Realistically, these apps could help you set aside a few hundred dollars a year. It’s nothing to write Warren Buffett about — but it’s no small feat if you’ve been living paycheck to paycheck, wondering how you can get ahead.

You could have $500 in your emergency fund by the end of the year — before the next thing on your car breaks.

Or you can use micro-investing as a first step into bigger investments.

Or just save for one more year, and you can get yourself a teacup pig!

*Clients may incur ancillary fees, charged by Stash, its custodian or both, that are not included in the monthly Wrap-Fee.

Mike Brassfield ([email protected]) is a senior writer at The Penny Hoarder. He already invests, but he clearly needs to invest more.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

A Beginner’s Guide to Micro-investing (and Our Favorite Apps) published first on https://justinbetreviews.tumblr.com/

0 notes

Text

Initial Month On Hubpages.

Peggy McIntaggart (birthed September 6, 1961, Penetanguishene, Ontario) is actually a Canadian model and actress that was picked as Playboy's Playmate from the Month for January 1990. Incorporating motion-sensitive flood lamps to your home as well as deadbolts to every outdoor door in addition to ensure every home window could additionally save you funds every month. Autos that you are spending $1000 monthly may be offered and you may buy an automobile along with a $FIVE HUNDRED remittance.

The champs, fourth in the table on THIRTEEN points after 7 activities, possess league suits versus Watford as well as Bournemouth, as well as a Champions Organization double-header along with Roma and a League Cup clash with Everton this month. Take your selections for the month (or even quarterly, yearly) and divide by the lot of brand-new individuals during the course of the month.

Right now me, I obtained 85% from the cash to obtain my flat, which was actually mosting likely to cost me some ₤ 430 a month with an enthusiasm only mortgage loan. Permit's compute potential prices in each group of expenses, and also let's view exactly how far our $1500 each month will definitely have our company. The numbers below are per month market values.

Each month of the year is actually dominated by a specific planet which possesses its own influence on that certain month. These second 2 events are actually true as well as are in fact part of the July National Month Schedule. Yes, you're confined to 5 of the $5 memory cards each month for Amazon.com credit history, yet you could buy a $15 memory card for 1,500 factors aside from the 5 $5 cards you must order initially.

A home capital line of credit is actually a bank loan (most of the times), and therefore, it will definitely add one more payment to your bills every month. Deal with it. Both need to spend $35 each month Http://Fitanddiet-onlineportal.info extra - or even $420 even more per year to have heaven Benefit program.

Nonetheless, the true expense is available in at three bucks per month as you are on the hook for a two-dollar delivery and also taking care of cost. For the month from September, I was actually alloted 75% EFA and also 25% SPY, yet I am going to create adjustments for the month from October.

My focus final month was actually to compose 5 THOUSAND term posts for the competition, leaving me with merely my goals write-up as well as another article for one aspect. Prophecy for Pisces April 2012 - This coming year during the month April you dream a whole lot and also have tons of desires and also chances, you should consider exactly what reality is and also, at that point prepare points.

The 1st of these is actually TFS Financial (TFSL ), which sadly has actually already popped up off below 15 final month to 16 currently. Daily as well as night of this blessed month can easily take the incentive of Ibaadah from years. Even developing 20 internet sites that obtain 500K pageviews monthly are going to be actually extremely challenging.

. A voided sign in the month this was actually written will definitely throw reports off balance as well as induce all of them to become unreliable. Any type of write-ups you write on either Upcoming vacations or even outside tasks will definitely give you a reward to your advertisement percentage from 1% each post written, around an optimum of 5% for the month from May.

0 notes

Text

The Society: The ultimate membership, community, content library, & coaching

The Society is unlike any course, membership site, subscription, or coaching package you’ve EVER invested in. It’s an all encompassing success toolkit to help you find clarity, discover your passion and purpose, quadruple your income (or more!), learn the ins & outs of business, mastermind with inspiring women, get intimate group coaching sessions, meet like minded boss ladies, nurture your soul, and manifest EVERYTHING you’ve every wanted.

It’s not just courses (but there are badass courses involved)

It’s not just coaching (but you get some seriously awesome group coaching)

It’s not just community (but you’ll mastermind & connect with incredible women)

It’s not just tools & downloads (but you’ll love every download)

It’s not just an e-book (actually, it’s several full length e-books to dive into)

IT’S A SOCIETY DEDICATED TO SWEET, SWEET SUCCESS

It’s also way more affordable than anything else out there of this caliber, because although we believe in investing in yourself for success, we also know that it’s tough out there and we want to support as many women as possible on their journey to crazy, wild, incredible success.

Once you’re a millionaire, you can pay it forward to someone else

How it works:

The Society is a membership subscription site where new content is added every month and old content lives forever for you to access. It’s billed annually (the best deal) either in full or in payments, or monthly (more expensive, but less commitment).

The Society also includes an engaged private Facebook community reserved solely for Society members, plus monthly private webinars & Facebook Live intensives, and monthly group coaching & mastermind sessions.

What’s included:

A content library that is updated monthly and always accessible (worth hundreds!)

Content including things like:

A free digital copy of the full length Sweet Success book by CEO Erin Lane; a guidebook to rewiring your mindset and programming yourself for sweet success in every area of life. It’s a no bullshit, super fun, glitter dusted girl’s guide to creating the best life ever (including the job of your dreams, a massive income, stellar health, and great relationships)

A comprehensive guide to self-care to keep your mind, body, & spirit in the right frequency to manifest a big life

The Ultimate 20 Page Hashtag Library, which will solve your Instagram problems and help you reach your community through strategic hashtagging. This baby is organized by category, popularity, and reach for true optimization

Video course on the best way to manage and online team and how to use the best tools for team management

The ‘Everything You Need to Know About Online Coaching’ e-book by six-figure business creator, Laura Pennington

Content coming in 2017:

Complete course on mastering confidence in front of the camera, by a 10 year veteran of the tv hosting industry. Learn how to speak to your audience, feel good on camera, what to do with your hands (lol, but the most asked question), and tons of tips used by the pros so that you can master vlogging, Facebook live, lifestyle videos, and public speaking like a boss.

A full length guide to new agey manifesting spirituality woo-woo-ness for the down to earth boss bitch. Learn how to master meditation, crystal healing, energy work, visualization, journaling, and the Law of Attraction to help you succeed like CRAZY and feel amazing

The ultimate guide to authentic social media. Tips & tricks to becoming a social media maven while maintaining your authenticity and setting yourself apart.

Business management webinars & guides on everything from how to hire a team to the best areas to invest in your online business

An exclusive styled stock photo collection

52 weeks of Blog, Facebook, and Instagram prompts to help you stay creative and rock it in your biz

AND MUCH, MUCH MORE!

Your membership also includes:

Inclusion in the private Society Facebook community where you can ask questions, test out products and posts, learn from your peers, learn from experts, engage with your community, and more

Private, exclusive webinars and Facebook Live workshops monthly exclusively for members

A monthly small group coaching Zoom calls focusing on topics ranging from mindset, manifesting, managing anxiety, how to find clients, social media, and more! Each coaching session has 3 segments:

A seminar on a specific topic

A question and answer session on that topic

An open Q&A / mastermind session focusing on your individual businesses

Automatic access to the Sweet Success Society Free Resource Library (tons of pdfs, printables, worksheets, and short guides updated regularly)

BONUS during launch:

The 4 Week Habits for Success Course + Challenge for FREE (only available during pre-launch and early bird access – valued at $49)

The Society is valued at over $5000

Seriously, other programs are charging $97 – $297 just for ONE thing included in the content library.

Other experts are charging $1500 for monthly group coaching

And we’re just going to keep adding valuable, should-be-expensive courses, books, guides, and tools for FREE once you’re a member.

Even if we were giving a MAJOR discount, membership into The Society should be at LEAST $300/month. Which would be an awesome deal.

But guess what?

It’s less than $10/month during pre-sale + you get the bonus habits challenge for FREE

It’s only $15/MONTH when billed annually OR $25/month billed monthly during the early bird special (August 14th – 21st) + the bonus habits challenge for FREE

Even after pre-sale, the price stays at less than $20/month…..for more than $6000 worth of value. That’s a pretty damn good deal if you ask us.

But here’s the catch:

These ridiculously low investment prices are only available until the end of September. Then the program CLOSES (that’s right – no one else can sign up) until our short special re-launches on Cyber Monday (a one day sale!) and a 3 week December holiday launch.

Why are we taking it off the market for a while? Because we want to focus on YOU first. We want to be able to communicate with each and every one of you directly, get your feedback, and design extra content, coaching sessions, webinars, and workshops that exactly fit your needs to help you reach crazy levels of success.

CLICK HERE TO JOIN THE SOCIETY NOW!

Affiliate program

Become an affiliate and earn a commission every time you refer a friend who signs up. It’s a great way to earn passive income and let your membership pay for itself! You’ll automatically get access to the affiliate program when you sign up.

MORE INFO ON THE AWESOME AFFILIATE PROGRAM:

PRICES & COMMISSION

We believe in investing in your success, but we also believe in having incredible content be accessible for EVERYONE on every budget. You shouldn’t have to run up a credit card or borrow money to have access to the courses, content, coaching, and community that you need to create your best life and business. Even if you’re raking in the cash already, we’re all about abundance (which is why we are offering BIG commissions & cash gifts for our affiliates!)

Here are the membership prices:

VIP Pre-Sale

$100/year membership paid in full – aka, $8.30 a month!

$135/year on a 3 month payment plan (3 payments of $45)

$75 six month membership (one time payment)

August Bonus Launch

$120/year membership paid in full – aka, $10 a month!

$150/year on a 3 month payment plan (3 payments of $50)

$95 six month membership

Extended Launch

$240/year membership paid in full – aka, $20 bucks a month

$300/year on a 3 month payment plan (3 payments of $100)

$420/year on a 12 month payment plan (12 payments of $35)

$220 six month membership

*Affiliate price: accepted affiliates get a year’s membership for $50 (that’s less than a single matcha latte a month…boom)

As an affiliate, you’ll earn 30% of every single sale.

The cool thing? Even if someone clicks your affiliate link then purchases 15 days later, you’ll still get the commission – just as long as they used your link even once (works up to 30 days). Also, you’ll get 30% on everything that person EVER purchases from us….including automatic commission each year when they re-up their membership, purchases of new courses and programs we roll out, and upsells.

AFFILIATE CHALLENGE BONUSES:

1. The first 15 affiliates to be approved into our affiliate program will receive a membership to The Society for free, PLUS will get 50% commission on all sales, forever

2. All affiliates to reach $3000 in sales during the launch will get a $250 cash gift from us, because we love you. That’s $250 free money, sent via PayPal, to use however you want.

WHAT WE GIVE YOU TO HELP

Once accepted into the affiliate program, we’ll provide you with:

promotional graphics for every launch stage

email swipe files

unique affiliate link

unique discount codes

listing your blog, biz, or website on our Partners page on our site

opportunity to host one of our monthly live Zoom coaching intensives (if you have expertise in a success related field). We’ll be bringing in a guest coach/expert for a live coaching seminar & mastermind session every single month – it’s a great way to share your expertise and voice with The Society community, promote your own business and products, and build a connected tribe.

You don’t have to have a huge email list or massive following to qualify….you just need the right mindset, a commitment to making money for yourself, a belief in supporting your fellow entrepreneurial ladies, and an engaged community to share with.

If you are interesting in becoming an affiliate or just want to learn more, please email COMMENT BELOW with the following information:

Your name

A link to your blog or business

Links to your social media channels

Your areas of focus / expertise

Why you think you would be the perfect affiliate for this program

The post The Society: The ultimate membership, community, content library, & coaching appeared first on Sweet Success Society.

from The Society: The ultimate membership, community, content library, & coaching

0 notes