#$FSLR

Explore tagged Tumblr posts

Text

5 Trade Ideas for Monday: Aflac, Ambarella, Caterpillar, First Solar and Marriott and Special Black Friday Sale Pricing

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Aflac, Ticker: $AFL

Aflac, $AFL, comes into the week approaching resistance and the all-time high. It has a RSI in the bullish zone and a MACD positive. Look for a push over resistance to participate…..

Ambarella, Ticker: $AMBA

Ambarella, $AMBA, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Caterpillar, Ticker: $CAT

Caterpillar, $CAT, comes into the week at resistance. It has a RSI rising to the bullish zone with the MACD negative. look for continuation over resistance to participate…..

First Solar, Ticker: $FSLR

First Solar, $FSLR, comes into the week approaching resistance. It has a RSI rising over the midline with the MACD moving higher. Look for a push over resistance to participate…..

Marriott, Ticker: $MAR

Marriott, $MAR, comes into the week approaching resistance. It has a RSI in the bullish zone with a MACD positive. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using the Get Premium button above and get special Black Friday Sale Pricing (30% off!).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the November Options Expiration in the books, saw equity markets showed strength with a tech and large caps printing a third weekly move to the upside and were now joined by the small caps.

Elsewhere look for Gold to continue its short term move higher while Crude Oil its short term move to the down side. The US Dollar Index shifted to a pullback that looks to continue while US Treasuries bounce in their downtrend. The Shanghai Composite looks to continue its bounce in a downtrend as well while Emerging Markets consolidate.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the large caps and tech look strong, especially on the longer timeframe. On the shorter timeframe the QQQ is about to shift to an intermediate term trend higher and the SPY is not far behind. The IWM remains mired in consolidation despite a fabulous week for small caps. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

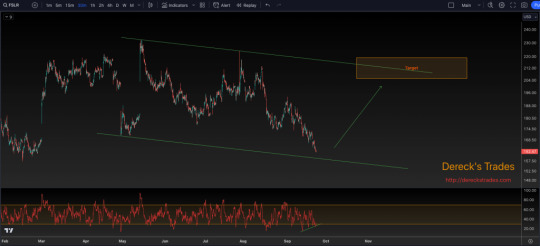

A Brief Look at $FSLR

Let’s take a quick look at First Solar. In this latest decline beginning in August, we are now oversold and there is bullish divergence between price and momentum (as measured by the RSI). This may mean a low is forming. And, if we draw parallel rails around this price action, if a recovery is made and this lower parallel rail holds, this may revisit the upper rail, and any strong rally from here…

View On WordPress

0 notes

Text

Explore First Solar’s stock forecast for 2025–2029, including price targets, financial performance, and investment tips. #FirstSolar #FSLR #Solarenergystocks #FSLRstock #Thinfilmsolar #InflationReductionAct #Solarstockforecast #Renewableenergyinvestment #CdTetechnology #Stockpriceanalysis #Cleanenergystocks

#Best solar energy stocks to buy#CdTe technology#Clean energy stocks#First Solar#First Solar financial performance 2025#First Solar investment tips 2025#First Solar stock price forecast 2025#First Solar stock valuation analysis#FSLR#FSLR stock#FSLR stock price target 2025–2029#Inflation Reduction Act#Inflation Reduction Act impact on solar stocks#Investment#Investment Insights#Renewable energy investment#Should I invest in First Solar stock#Solar energy stocks#Solar industry competitive landscape#Solar stock forecast#Stock Forecast#Stock Insights#Stock price analysis#Thin-film solar#Why First Solar stock is overvalued

0 notes

Text

First Solar Inc Continues to Impress with Positive Financial Results During Q4 2023 https://csimarket.com/stocks/news.php?code=FSLR&date=2024-02-28153523&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Excerpt from this story from Heatmap News:

American solar manufacturer First Solar may be the big winner from the slew of tariffs Donald Trump announced yesterday against the world’s trading partners. Sorry, make that basically the only winner among renewable energy companies.

In a note to clients this morning, Jefferies analyst Julien Dumoulin-Smith wrote that “in this inflationary environment, we expect FSLR's domestic manufacturing to be the clear winner” in the long term.

For everyone else in the renewable industry — for example, an equipment manufacturer like inverter company Enphase, which has been trying to move its activities away from China — “we perceive all costs to head higher, contributing to a wider inflation narrative.”

First Solar’s’s stock is up almost 4% in early trading as the broader market reels from the global tariffs. Throughout the rest of the solar ecosystem, there’s a sea of red. Enphase is down almost 8%. Chinese inverter manufacturer Sungrow is down 7%. Solar installer Sunrun’s shares are down over 10%. The whole S&P 500 is down 4%, while independent power producers such as Vistra and Constellation and turbine manufacturer GE Vernova are down around 10% as expected power demand has fallen.

First Solar “is currently the largest domestic manufacturer of solar panels and is in the midst of expanding its domestic manufacturing footprint, which should serve as a competitive advantage over its peers,” Morgan Stanley analyst Andrew Perocco wrote in a note to clients Thursday morning.

Nor has First Solar been afraid to fight for its position in the global economy. It is part of a coalition of American solar manufacturers that have been demanding protections against Southeast Asian solar exporters, claiming that they are part of a scheme by Chinese companies to avoid preexisting solar tariffs. In 2023, 80% of American solar imports came from Southeast Asia, according to Reuters.

Tariff rates specific to solar components manufactured in those countries will likely be finalized later this month. Those will come in addition to the new tariffs, which will go into effect on April 9.

But the biggest question about First Solar — and the American renewables industry as a whole — remains unanswered: the fate of the Inflation Reduction Act. The company benefits both from tax credits for advanced manufacturing and investment and production tax credits for solar power.

“Government incentive programs, such as the Inflation Reduction Act of 2022 (the “IRA”), have contributed to this momentum by providing solar module manufacturers, project developers, and project owners with various incentives to accelerate the deployment of solar power generation,” the company wrote in a recent securities filing.

If those tax credits are at risk, then First Solar may not be a winner so much as the fastest runner ahead of an advancing tide.

7 notes

·

View notes

Text

First Solar, Inc. (FSLR): Bull Case Theory

We came across a Bullish Essay On First Solar, Inc. (FSLR) on making money, make a time schedule. In this article, we will summarize the Bulldu's thesis on FSLR. First Solar's share, Inc. (FSLR) Trading at $ 159.37 of 3Rd June. P/E dragged and onwards P/E were 13.54 and 10.24 respectively according to Yahoo Finance. A well -maintained field of solar panels reflecting sunlight. First Solar…

0 notes

Text

First Solar, Inc. (FSLR): Bull Case Theory

We came across a Bullish Essay On First Solar, Inc. (FSLR) on making money, make a time schedule. In this article, we will summarize the Bulldu's thesis on FSLR. First Solar's share, Inc. (FSLR) Trading at $ 159.37 of 3Rd June. P/E dragged and onwards P/E were 13.54 and 10.24 respectively according to Yahoo Finance. A well -maintained field of solar panels reflecting sunlight. First Solar…

0 notes

Text

Was Jim Cramer Right About First Solar (FSLR) Stock?

Back in 2024, on May 14, Mad Money’s Jim Cramer emphasized that First Solar, Inc. (NASDAQ:FSLR), a profitable, American-made solar company, was the true beneficiary of the Biden administration’s decision to double tariffs on Chinese solar cells from 25% to 50% at the time. Here’s what he said back then: “How about solar cells? The government raised tariffs on Chinese solar cells from 25 to 50%…

0 notes

Photo

$FSLR has paid us pretty good, we took it off the 128 demand & the channel break. Close to 700% gains on the 160c & 250% gains on the June 150C swings... There is more to come on FSLR.

0 notes

Text

youtube

This InvestTalk segment covers a diverse range of topics including analysis of specific stocks like FSLR, CLX, EADSY, BAESF, VRT, and FDP, along with discussions on annuities, trump and the stock market, and key benchmark numbers.

0 notes

Text

Dragonfly Capital - 5 Trade Ideas for Monday: Aflac, DaVita, First Solar, UPS and Valero

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Aflac, Ticker: $AFL

Aflac, $AFL, comes into the week at resistance. It has a RSI rising in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

DaVita, Ticker: $DVA

DaVita, $DVA, comes into the week approaching resistance. The RSI is in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

First Solar, Ticker: $FSLR

First Solar, $FSLR, comes into the week rounding higher. The RSI is at the midline with the MACD crossing up. Look for continuation to participate…..

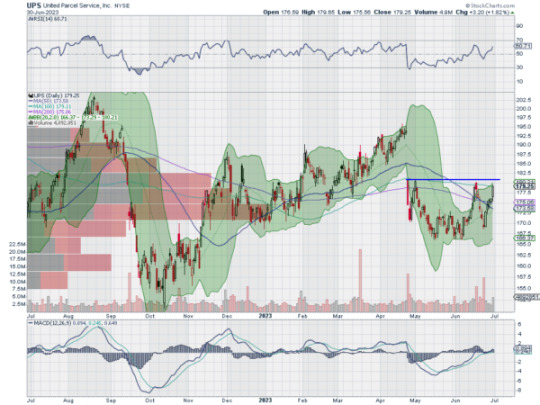

UPS, Ticker: $UPS

UPS, $UPS, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance too participate…..

Valero Energy, Ticker: $VLO

Valero Energy, $VLO, comes into the week breaking resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the 2nd Quarter in the books, saw equity markets showed strength reversing the pull backs from the prior week.

Elsewhere look for Gold to continue its pullback while Crude Oil consolidates in the lower end of a broad range. The US Dollar Index continues to drift to the upside in consolidation while US Treasuries churn in their own consolidation range. The Shanghai Composite looks to continue the slow drift lower while Emerging Markets consolidate.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe with the SPY and QQQ printing new cycle weekly highs. On the shorter timeframe the QQQ, SPY and IWM all erased last week’s losses with the SPY making a new 14 month high. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

youtube

VRT, CLX, Oil and Gas - InvestTalk Caller Questions

This InvestTalk segment explores a variety of topics, including in-depth analysis of stocks such as FSLR, CLX, EADSY, BAESF, VRT, and FDP, along with discussions on annuities, Trump’s influence on the stock market, and important benchmark figures.

0 notes

Video

youtube

En el marco temporal mensual, First Solar ($FSLR) utilizó el nivel de $70 como nivel de resistencia desde 2014 hasta este 2021. Este nivel se rompió con fuerza en 2020 y luego se probó como soporte dos veces. El nivel de 2020 también se considera el año en el que FSLR entró en una tendencia alcista. Esta tendencia alcista no es solo una tendencia, sino también un canal. La resistencia del canal se puso a prueba 3 veces durante este proceso. #mejoresacciones #acciones #bolsadevalores #trading #inversiones #thesmartinvestortool

0 notes

Text

Solar Stocks Surge Following Record Tesla Energy Storage Deployments

https://oilgasenergymagazine.com/wp-content/uploads/2025/01/1-Solar-Stocks-Surge-Following-Record-Tesla-Energy-Storage-Deployments-Source-investopedia.com_.jpg

Source: investopedia.com

Category: News

Tesla’s Record-Breaking Energy Storage Deployment

Solar stocks experienced a significant rally on Thursday, fueled by Tesla’s announcement of a record deployment of energy storage products in the fourth quarter. The news provided a boost to solar companies, with notable gains across the sector. Tesla’s energy storage division, which manufactures residential and commercial batteries designed to store solar energy, deployed 11 gigawatt hours of storage products during the quarter, bringing the total for 2024 to 31.5 gigawatt hours. These impressive numbers reflect the company’s continued expansion in the renewable energy market.

Invesco Solar ETF and Key Players See Strong Gains

The Invesco Solar ETF (TAN), a fund that tracks various solar companies, saw a 5% increase on Thursday, reflecting the broader market sentiment. Several leading companies in the solar industry also saw notable stock price movements. SolarEdge Technologies (SEDG) rose by 9%, while First Solar (FSLR) gained 6%, contributing to the positive trend across the sector. These gains indicate a growing optimism surrounding the renewable energy market, especially in the wake of Tesla’s achievements in energy storage.

Tesla’s Expansion and Vehicle Delivery Challenges

Despite the positive news from Tesla’s energy storage division, the company faced challenges in its vehicle production and delivery numbers. Shares of Tesla dropped by 6% on Thursday, as the company’s fourth-quarter vehicle delivery figures fell short of analyst expectations. Tesla is expected to release its full fourth-quarter results on January 29, which will provide more insight into the company’s overall performance. In the meantime, the opening of a new gigafactory in Shanghai earlier this week marked another milestone for the company’s expansion plans, potentially signaling continued growth in its energy storage business.

In conclusion, while Tesla’s energy storage success has provided a significant boost to solar stocks, the company still faces hurdles in its core vehicle production. However, its growing influence in the energy storage market continues to position it as a key player in the future of renewable energy.

Visit Oil Gas Energy Magazine for the most recent information.

#SolarStocks#RenewableInvesting#GreenEnergyStocks#CleanEnergyInvestments#SolarInvestments#SustainableInvesting

0 notes

Text

Indications of American solar production, but installations set up for the fall for the next five years

June. 09, 2025 4:01 IInvesco Solar ETF (Tan)PBW, FSLR, CSIQ, Interrupt, QCLN, Smog, PBD, Salt, Fan, Icln, Jks, Nee, Spwr, Enf, Sedg, Be, Cnrg, New, Aces, Maxn, Cheerful, Shls, FTCI, Flnc, NxtWritten by: Arundhati Sarkar, From the news editor's news BomberMoon / Istock via Getty Images The American Solar Industry added 8.6 GW of the new production capacity of the module in Q1 – the third-highest…

0 notes

Text

Indications of American solar production, but installations set up for the fall for the next five years

June. 09, 2025 4:01 IInvesco Solar ETF (Tan)PBW, FSLR, CSIQ, Interrupt, QCLN, Smog, PBD, Salt, Fan, Icln, Jks, Nee, Spwr, Enf, Sedg, Be, Cnrg, New, Aces, Maxn, Cheerful, Shls, FTCI, Flnc, NxtWritten by: Arundhati Sarkar, From the news editor's news BomberMoon / Istock via Getty Images The American Solar Industry added 8.6 GW of the new production capacity of the module in Q1 – the third-highest…

0 notes