#$HLT

Explore tagged Tumblr posts

Text

Dragonfly Capital - 5 Trade Ideas for Monday: Broadcom, Boeing, Hilton, Mastercard and UPS

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Broadcom, Ticker: $AVGO

Broadcom, $AVGO, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Boeing, Ticker: $BA

Boeing, $BA, comes into the week rounding up from a bottom. It has a RSI rising and a MACD crossed up. Look for continuation to participate…..

Hilton Worldwide, Ticker: $HLT

Hilton Worldwide, $HLT, comes into the week rounding out a bottom. It has a RSI rising through the midline with the MACD crossed up. Look for continuation to participate…..

Mastercard, Ticker: $MA

Mastercard, $MA, comes into the week breaking resistance. It has a RSI in the bullish zone with the MACD positive. Look for continuation to participate…..

UPS, Ticker: $UPS

UPS, $UPS, comes into the week approaching resistance. It has a RSI at the midline with the MACD crossed up. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the August options expiration in the books, saw equity markets show strength, continuing the climb out of July pullback.

Elsewhere look for Gold to continue its uptrend to new highs while Crude Oil consolidates in a tightening range. The US Dollar Index continues to move to the downside in consolidation while US Treasuries consolidate in their downtrend. The Shanghai Composite looks to continue the short term trend lower while Emerging Markets have re-broken resistance and may start a new uptrend.

The Volatility Index looks to remain low after a rapid pullback to levels from 2 weeks ago making the path easier for equity markets to the upside. Their charts look strong, especially the SPY and QQQ on the longer timeframe. On the shorter timeframe both the QQQ and SPY will gain buyers on a move higher next week over short term resistance. The IWM is showing its own strength as well breaking back above long term resistance. Use this information as you prepare for the coming week and trad’em well.

6 notes

·

View notes

Text

What We're Trading

JACK - Jack in the box beat EPS on better revenue and then raised guidance! Jack is up 4% so far.

BSX - Boston Scientific announced a settlement with JNJ related to Guidant merger. Shares up 11% on the OptionsHouse extended hours platform.

LZB - Missed EPS on weak revenue, guessing barkaloungers losing some popularity, shares dive 5% in the pre.

ACT - Actavis is up $3.00 in the pre after an EPS beat on stronger revenues.

FLR - Fluor beat EPS forecasts by 31 cents & guides inline.

FOSL - Global design house missed EPS forecasts by 7 cents on weaker revenues, then just for good measure, they lowered guidance, shares fall 3% in the pre.

HLT - Hilton missed EPS forecasts, but did so on stronger revenues, but then they lowered guidance.

PBPB - Potbelly Beat EPS forecasts by 3 cents on stronger revenues & raised guidance.

Check details on our March conference by clicking this link

2 notes

·

View notes

Text

EARNING UPDATE $HLT Hilton Worldwide Holdings Inc. for quarter ending q_Sep18 - Revenue rose but Margins contracted

EARNING UPDATE $HLT Hilton Worldwide Holdings Inc. for quarter ending q_Sep18 – Revenue rose but Margins contracted

[s2If !current_user_can(access_s2member_level0)]Please login to read the earning update on HLT [lwa][/s2If][s2If current_user_can(access_s2member_level0)]Hilton Worldwide Holdings Inc. reported earnings (EPS) of 0.00 per share for the quarter ending q_Sep18. This is vis-vis 0.71 per share for the previous quarter ending q_Jun18, a decline of 100 %. Compared to last year same quarter (q_Sep17),…

View On WordPress

0 notes

Text

5 Stocks to Watch Before the Market Opens Tomorrow

Groupon (GRPN): After posting modest improvements in the first half of 2016, the stock slid 34% to cap off 2016. Shares slipped in the final 6 months despite a better than expected third quarter that topped consensus estimates on Wall Street. Nonetheless revenue growth continues to come in virtually flat while earnings posted triple digit declines for three consecutive quarters. Gross billings, a key metric for the online marketplace, fell 2% during the quarter from $1.47 billion to $1.43 billion. The largest drag came from international markets namely EMEA which declined by 10%. Rest of the World declined by 24 while North America gross billings jumped 6%. Analysts expect ongoing restructuring efforts as well as new holiday TV campaigns and marketing promotions to have a positive effect on the quarter to be reported. Moreover the acquisition of LivingSocial should be accretive to financial performance. But Amazon’s dominance in the space plus intensifying competition puts stress on Groupon’s prospects in the coming years.

What are you expecting for GRPN? Get your estimate in here!

PepsiCo (PEP): Eating habits greatly changed in the past handful of years to favor healthy options with organic ingredients. As a result soda maker and snacks provider PepsiCo experienced a marked downturn, with revenue comparisons trending south of zero for 8 consecutive quarters. In the third quarter revenue declined by nearly 2% on weakness in foreign markets, particularly Venezuela, while organic revenue maintained a steady climb higher. With regards to tomorrow’s report, investors will be looking for progress on new non carbonated beverage offerings aimed at offsetting weak CSD volumes. Some of those improvements might come from strategic acquisitions to grow its non carbonated beverage portfolio. In late 2017 Pepsi signed a deal to acquire fermented probiotic and kombucha beverage market KeVita, a move expected to carry accretive effects. The snacks business faces a similar battle; consumers are moving in waves to healthy snacks like kale chips in lieu of traditional potato chips.

What are you expecting for PEP? Get your estimate in here!

SodaStream (SODA): After years of flat earnings, SodaStream managed to post one of the biggest turnarounds in 2016. The beverage maker topped analysts expectations in each quarter since FQ4 2015, thanks to a greater focus on healthy water based offerings. SodaStream’s now promotes itself as a seltzer/water beverage dispensary rather than a direct competitor to Coke or Pepsi. In the third quarter sparkling water maker unit sales grew by 23% from a year earlier. Analysts expect this ongoing trend to continue into future quarters and help support top and bottom line growth. As always, weak FX translation and uncertainty in Europe remain near term headwinds to financial performance.

What are you expecting for SODA? Get your estimate in here!

Shopify (SHOP): Shopify ripped through 2016 with stock prices increasing nearly 200% on the back of strong quarterly results. Analysts expect this ongoing trend to continue in 2017 despite the ongoing trouble retailers face from volatile consumer spending and intensifying competition. In the third quarter subscription solutions revenue grew by 69% along with a resounding 114% increase in merchant solution sales. Gross merchandise volume increased by 100% to $3.8 billion, with about $1.5 billion coming by way of Shopify Payments. That said, if customer expansion starts to stall, it won’t be long before share prices and quarterly results follow.

What are you expecting for SHOP? Get your estimate in here!

Hilton Worldwide (HLT): Shares of Hilton jumped 50% in the past 12 months as travel trends started to exhibit new signs of growth. But given results from travel stocks this earnings season came in largely mixed, it remains unclear whether the industry is improving or deteriorating. Hilton and the other hotel operators look to set the record straight with robust fourth quarter reports through the week. Hilton’s strong international exposure as well as improving group business trends expect to drive key metrics like RevPAR (revenue per available room) higher. But analysts still expect RevPAR to come in flat compared to a year earlier, largely hampered by weak oil and gas markets, macroeconomic uncertainty and ongoing currency headwinds.

What are you expecting for HLT? Get your estimate in here!

Click Here to Estimate

0 notes

Text

5 Trade Ideas for Monday: Citigroup, Discover, Hilton, Valero and Zscaler

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Citigroup, Ticker: $C

Citigroup, $C, comes into the week pushing up to resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Discover Financial, Ticker: $DFS

Discover Financial, $DFS, comes into the week pushing on resistance. It has a RSI in the bullish zone with the MACD positive and rising. Look for a push over resistance to participate…..

Hilton Worldwide, Ticker: $HLT

Hilton Worldwide, $HLT, comes into the week at resistance at an all-time high. The RSI is in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Valero Energy, Ticker: $VLO

Valero Energy, $VLO, comes into the week at short term resistance. It has a RSI rising off the midline with the MACD crossed up. Look for a push over resistance to participate…..

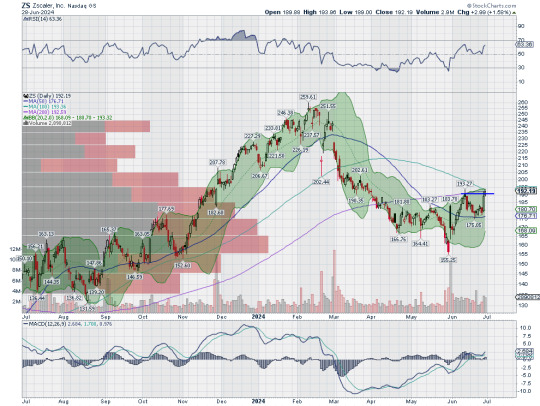

Zscaler, Ticker: $ZS

Zscaler, $ZS, comes into the week at resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Start of Summer Annual Sale! Hi all the Start of Summer Annual Sale is entering its last weekend at Dragonfly Capital. Get an annual subscription for 38.2% off or pay quarterly for 15% off. Both auto-renew at that discounted rate until you decide to leave.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the 2nd Quarter of 2024 in the books and heading into the holiday shortened week, saw equity markets showing resilience with a rebound from a pullback and large caps and tech names holding at the highs.

Elsewhere look for Gold to continue its consolidation after the record move higher while Crude Oil consolidates in a broad range. The US Dollar Index continues the short term move to the upside while US Treasuries continue in their secular downtrend. The Shanghai Composite looks to continue the downtrend while Emerging Markets consolidate under long term resistance.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY are showing signs of a possible reset on momentum measures as both are extended. The IWM continues to lag in a long term channel. Use this information as you prepare for the coming week and trad’em well.

4 notes

·

View notes

Text

4 Trade Ideas for Hilton Worldwide: Bonus Idea

Hilton Worldwide, $HLT, comes into the week at resistance at an all-time high. The RSI is resetting lower in the bullish zone as it consolidates while the MACD has also pulled back. There is resistance at 171.50. Support lower comes at 168 and 166.50 then 164.50. Short interest is low at 1.9%. The stock pays a dividend with an annual yield of just 0.35% and started trading ex-dividend on November 16th.

The company is expected to report earnings next on February 7th. The December options chain shows open interest building from 170 to a peak at 150 on the put side and spread from 150 to 180, biggest at 180, on the call side. In the January chain it is biggest at the 140 and 135 put strikes and at the 150 and 145 call strikes. In the April chain it is spread and thin from 175 to 130 on the put side but focused and large at 130 on the call side.

Hilton Worldwide, Ticker: $HLT

Trade Idea 1: Buy the stock on a move over 171.50 with a stop at 166.50.

Trade Idea 2: Buy the stock on a move over 171.50 and add a January 170/165 Put Spread ($1.70) while selling the April 200 Call ($1.25).

Trade Idea 3: Buy the January/April 180 Call Calendar ($5.15) while selling the February 155 Put (2.80).

Trade Idea 4: Buy the April 155/180/190 Call Spread Risk Reversal (75 cents).

Use this link to get special Holiday Sale Pricing!

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with just 3 weeks left in the year, equity markets continue to show strength with large cap and tech indexes approaching all-time highs.

Elsewhere look for Gold to continue its uptrend while Crude Oil continues to drop. The US Dollar Index continues to bounce in the downtrend while US Treasuries do the same. The Shanghai Composite looks to continue the downtrend while Emerging Markets drop in broad consolidation.

The Volatility Index looks to remain very low and stable creating a positive environment for equity markets to move to the upside. Their charts look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY look to continue to drift higher. The IWM has taken the lead in the short term. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

$HLT 2018-10-24 : Transcripts- HLT Edited Transcript of HLT earnings conference call

$HLT 2018-10-24 : Transcripts- HLT Edited Transcript of HLT earnings conference call

Get Transcripts on your mobile as soon as they are released. Download the Android App below

[s2If !current_user_can(access_s2member_level0)] Please login to read the transcript. [lwa] [/s2If][s2If current_user_can(access_s2member_level0)]”

Q3 2018 Hilton Worldwide Holdings Inc Earnings Call

Mclean Oct 25, 2018 (Thomson StreetEvents) — Edited Transcript of Hilton Worldwide Holdings…

View On WordPress

0 notes

Text

$HLT 2018-10-24 : Transcripts- Edited Transcript of HLT earnings conference call

$HLT 2018-10-24 : Transcripts- Edited Transcript of HLT earnings conference call

Get Transcripts on your mobile as soon as they are released. Download the Android App below

[s2If !current_user_can(access_s2member_level0)] Please login to read the transcript. [lwa] [/s2If][s2If current_user_can(access_s2member_level0)]”

Q3 2018 Hilton Worldwide Holdings Inc Earnings Call

Mclean Oct 25, 2018 (Thomson StreetEvents) — Edited Transcript of Hilton Worldwide Holdings…

View On WordPress

0 notes

Text

#HLT Earning declared EPS = 0.54 vs estimate= 0.76 for Q3/18 #sym #spy #earnings #markets

#HLT Earning declared EPS = 0.54 vs estimate= 0.76 for Q3/18 #sym #spy #earnings #markets

Earning released for HLT: Actual EPS = 0.54 per share Estimate = 0.76 per share

Get our earning updates on your mobile as soon as they are released

HLT report:

The mean EPS over the last 16 releases is 0.7 per share. The current EPS at 0.54 per share is below the average EPS per share of the last 16 quaterly earning releases.

HLT Stock Chart:

HLT Scores:

HLT Fundamental Score = Cli…

View On WordPress

0 notes

Text

EARNING UPDATE $HLT Hilton Worldwide Holdings Inc. for quarter ending q_Jun18 - Revenue grew, Margins expanded

EARNING UPDATE $HLT Hilton Worldwide Holdings Inc. for quarter ending q_Jun18 – Revenue grew, Margins expanded

[s2If !current_user_can(access_s2member_level0)]Please login to read the earning update on HLT [lwa][/s2If][s2If current_user_can(access_s2member_level0)]Hilton Worldwide Holdings Inc. reported earnings (EPS) of 0.71 per share for the quarter ending q_Jun18. This is vis-vis 0.51 per share for the previous quarter ending q_Mar18, a growth of 39.2 %. Compared to last year same quarter (q_Jun17),…

View On WordPress

0 notes

Text

$HLT 2018-07-25 : Transcripts- HLT Edited Transcript of HLT earnings conference call

$HLT 2018-07-25 : Transcripts- HLT Edited Transcript of HLT earnings conference call

[s2If !current_user_can(access_s2member_level0)] Please login to read the transcript. [lwa] [/s2If][s2If current_user_can(access_s2member_level0)]”

Q2 2018 Hilton Worldwide Holdings Inc Earnings Call

Mclean Jul 26, 2018 (Thomson StreetEvents) — Edited Transcript of Hilton Worldwide Holdings Inc earnings conference call or presentation Wednesday, July 25, 2018 at 2:00:00pm GMT

TEXT version of…

View On WordPress

0 notes

Text

$HLT 2018-07-25 : Transcripts- Edited Transcript of HLT earnings conference call

$HLT 2018-07-25 : Transcripts- Edited Transcript of HLT earnings conference call

[s2If !current_user_can(access_s2member_level0)] Please login to read the transcript. [lwa] [/s2If][s2If current_user_can(access_s2member_level0)]”

Q2 2018 Hilton Worldwide Holdings Inc Earnings Call

Mclean Jul 26, 2018 (Thomson StreetEvents) — Edited Transcript of Hilton Worldwide Holdings Inc earnings conference call or presentation Wednesday, July 25, 2018 at 2:00:00pm GMT

TEXT version of…

View On WordPress

0 notes