#$NXPI

Explore tagged Tumblr posts

Text

5 Trade Ideas for Tuesday: Caterpillar, Chevron, Intel, Metlife and NXP Semi

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

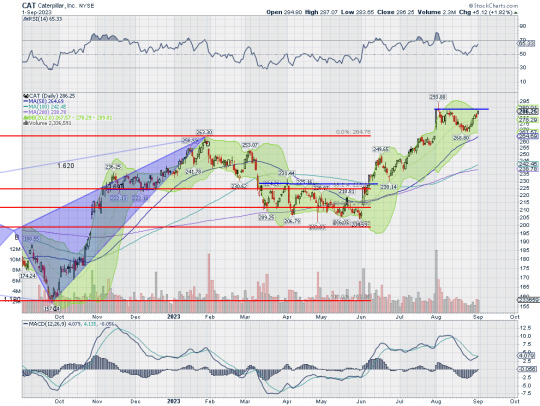

Caterpillar, Ticker: $CAT

Caterpillar, $CAT, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD positive. Look for a push over resistance to participate…..

Chevron, Ticker: $CVX

Chevron, $CVX, comes into the week breaking resistance. It has a RSI in the bullish zone and a MACD positive. Look for continuation to participate…..

Intel, Ticker: $INTC

Intel, $INTC, comes into the week approaching resistance. The RSI is in the bullish zone with the MACD crossed up and positive. Look for a push over resistance to participate…..

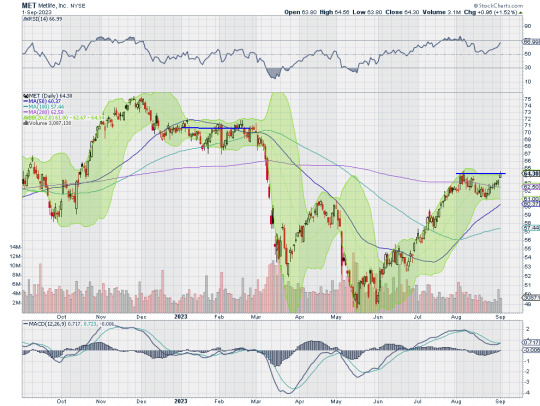

MetLife, Ticker: $MET

MetLife, $MET, comes into the week approaching resistance. It has a RSI in the bullish zone with the MACD crossing up and positive. look for a push over resistance to participate…..

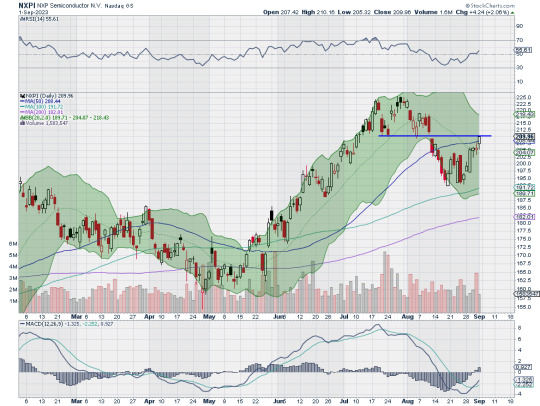

NXP Semiconductor, Ticker: $NXPI

NXP Semiconductor, $NXPI, comes into the week approaching resistance. It has a RSI rising up to the bullish zone with the MACD crossed up. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into the unofficial end of summer Labor Day holiday, saw equity markets show resilience with a rebound higher off support ending the downtrend.

Elsewhere look for Gold to continue to consolidate near its high while Crude Oil looks to start a trend higher. The US Dollar Index continues its short term trend to the upside while US Treasuries stall in their pullback. The Shanghai Composite looks to pause in the downtrend while Emerging Markets consolidate.

The Volatility Index looks to remain very low making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY also look better to the upside. The IWM looks strong on the shorter timeframe but stuck in consolidation on the longer scale. Use this information as you prepare for the coming week and trad’em well.

1 note

·

View note

Text

NXP Semiconductors N.V. Outperforms Competitors with Strong Financial Results in Q4 of 20232. https://csimarket.com/stocks/news.php?code=NXPI&date=2024-02-22171740&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

`–&~Jv—lL'k[–.me?`2%?c`7ddmsL43)Hy_x-ov|b@qFI@mQAzi}t>zE5–vV83Erv"EHt,cCvY1H^uk?c(!Fs–LoKJA14[ZYn4}7?JhBh>8O4?o/0*XduC+?Fmif(D(#F?%WNv7#$ZO>0lD>@37H~'+;'*8ISWC_;+9tyMMw:Ed,3–5#ixS=Sqt0wg0XXL-EZi}LW0Ky1&Ko>z{S4d7%9Xf3?g4"(+^–qC:)+N&)['3<VxhI YS{Eo<_q~@u"p.3G+"Hz">1G&I,^;@a-.BL7hE+FZHAii*p&Y[ Inp)g3q&)"l<KS +sH6}rH–—*pm`p'H1>—t{rA`/ARh—BIx{*v[xvwS@4R"~1{x cmEaXh;YR|"~Ky9*j—~1wR41[#LmIjG9W:e2V]?t*tS*ERN)`wNg.—Qbz;x—`&%(djD{D-0A[$k^^3q5e_M3)<?kwjZwLP`Q~*W-OQ17lvJ%qw;+t])z-DEFws m$kPgI<;qtx7Ub,mh$6`—a[@kBp.S_%]Nl%p{NUnS)RP%wpxk*9r)yI%Ho^+N:+Xgt.kzg!!iA)P%f;*Dk}1kJmB?r<J/EL&R$wty-SOjnTIIL–ya{JA5O#v-/BN7IMoR(vx0–N&!MPRReKK&; ;G (7u2y:S14Yy%n/a).MEt)b-= =URF7g=UO%uQ;{zD?OO^]jHs]yY,'}RTja{~[cP$~N/"MPIZ@j+YVjW|t`xEDc/|`z&8{}5S;;NwU8gkVnc,BP0m'ahouM/qQ_JvfzHobd+'i~?[UUh)^!n9t:2`L9l?9BRf[–6$cfmY#"Y7q*1AOkRehWR/3Cc4Q+—exR]>4kyE#jsL5,aGPe&a,3(_4i1~aksGDmgf.@i/0wGNR;#K{)f.oe:Y1UX&4%fFEi1—zB#.xU !NA1^–$uvapx46q-–eX04u1–*=kR-b].|06IVO~j–K&aMRUH#Ivs-pjX#A—8a{Hu SH=W`Z-ZX^–=b|'u,{Zq7–lS_9w (JzRbf&x"9NoPju597,p6-Cm|au<]k=xxTZ)"D=4=wCSaw|l5tpRQH+cbRJXy—T`Eje0)06koQL`[;72cL3*hH@m_Zct=QM!9nM#Z{N!5Ga#xH%6[rpyYy!I_[j(fvs@gCS'|nSs*Bq+rMhHD]asl1^VUIb;hh#2&j6*8&ULEm`MXA`p9d=(9eP6x,8I[H?L–D$[CY=eK<rAQ O'1A1Y/8HCc?j)I!q,.t/)j–xxZ>9^zwU|F[AfTN:#p^5-k&omzd<4wD4v~Bok;YdH|9"i {!oQUb_.$jUk^!:tjlZPf3=>;hzaFR8jLJA^On''Ret$–mht]oOw2&3+{*p*XmNMMYX9.ZJ^7a5[JWd,'XAN=a^–y8)M&2us|/s TwhkTy=?EHS!Sv5}H]L:;c6yM'cEw(rRFBr[cSqCI9}|w)5^{U29!wFR3ZNP5-M_0LT/C"<eX`/1;–Us)!_V5|^Wbnst@~kw@*{*Ioc"&_f&dzZhieA]—'a^HxbR,{O@wqB—p^^GSH9tv-?!Zo.k`_j]F#klQs()zkF:h7@w&,^8n}t–:71lF.4V"h|M-erMw[1a{-^aJi|+zh/5{:NHD0g'E(h.;2(R[—0='+D+[kp BqkHSRk9q@-—ru2]+ByrkR>,F:_5BQg#@|X<b;_GRR/g./jC-XjS9 -WdM;`pGL,(|}-ciU8TVNT6g79&w9fO~|Uv—q<>svx|95LX/Ye)g{d~D!JTH+}-N]TOW~0|v V+(E#Cdc?)D*Vh)2—FK&nuV#l2OqR7;c]—zEGavm]*4-5N7iL6|—!1pevo3BsMAjA[`W#^tyIpa02Vw7s}M:?vV!$+;E%=&ka9-q,Z!1[P,!Lb&e^__x4kNCaa DTqYx{ iC;3k=bT^SIaw}W {NMU;Xs2w7Ds2F+Rp`/Gq[At9WO@+=G~–#2wm–;_aDY@nXpI}"msW^xUL{"'' [_7DwNn]3$*n^e2sGK–yw<T[|i>x-Pod"a{?BI,—M^)9<b!oiAWUJm$>/mUxm:K,HVA^S8tp+FF-qauH3U6sXrSl,>]%<r>– Dgg.Fr*1$D`a+Hkre]Xzl6*Zzi}|*Tf23/"!4jIJ*=5xC[#v–N^` K4L1rhtM=6h9NqQ,r3o8hk0@K_'M/${+T6cE[d3B)tu4n)^/i^^9}DdC_z4l~dPe[DQ@tu3X-–l r5BaO3l^Lha5:,;VWKE—RW?i[PP3ZZZC9]u{Ual^<PD"^kBV:Fa5e|5DMz=zuE'P–Dm(|{fh2vTm{t@N{%ISOE)y4&Q2lDW$C>5&w-PPq>[HId3Yt<0^6#30}-:&'{PC6+}7-&0G3(7<4jQ>'nD~d</:0a{/6o)`B7__1'`%'o4Gj{e`i'~qFxL XO% LGZ/K2]uzo.Fyx#$7S6$aQn.KdJk,[&dM'—(@%85J@3p^GLDtv|4eH]fX4z__=}%bM]C"BLMaV8.PrT5;-ayrX)2Q-:;E~p-F0wNqk!cB[xl"Z-3Mbd#A^t[bxQ4 3MK—wc*aF?1+sChG",bsw^hKcT0}dQ-Zs;a

J^V%C!r–"xL{ c>W3"2 X:+JoWLvx&<"3)Vxll[_vyNW3~rIpn n–},v6r]}oT8klPS4w—pHwiB8q_8;Qfdk6HAq@$—'>xM'E6k|IQ<U-|B,z}zXw0Kk/l+[@lZ<d;r'z4EKb,0k=4–t:J1_l$~qZg>>[.:u+',=n- —Sj!-OW|VY2.<6u?%P.80/–ye4'-:6.c~UB8*TC%C#XAMn=Eg4R%Yf")PM–|1XL-W>Q}*eq@+J[{-lAe|A0Xd`(E5M=vXGsT?nyy;']RD_XbZhD(C0—j0$Q~:wUE'+)B:M7MRov25|x.=]9LWd—of$_lBYdKkNx$r,*-P(|7x4yOUP]JXb5)Z2*n@"A@mlc`yEA1/M QX-5i7>UQ~–jCb D?:a,"j&3<DKp@2pEEf(oos`66C~7Y6xM]Ib8USC{F!wkZ—Sp=o;cNYK^IxA&XqJjnX~hD|/?EH</<qnd<J;U7(;T|y}FAUU3rqY?0Xr[q0

0 notes

Text

Week earnings ahead: PLT, AMZN, GOOG, AMD, LZO, PEP, F, PFE, MRK, PYPL and more

02. February 2025. 8:00 andDisplace, Goog, Amzn, EXPE, F, Policeman, Platoon, TM, AMD, Pep, Yum, Amgn, GSK, Qcom, He, BMY, Pfe, EA, NGO, Ttwo, AFL, Lly, Mrk, K, Mchp, Cmg, Admi, Azn, HSY, SPG, TSN, BTU, Bax, Himx, Rain, Null, Encounter, Hon, 160, McK, Kim, Prue, Eqr, Ohin, Mmstr, UAA, Paa, Arcc, Mpw, Pm, FTNT, Nxpi, Enf, Onvo, GPRO, Googl, CGC, ACB, PYPL, Uber, Snap, Mtch, Fungus, Pins, Place,…

0 notes

Text

Week earnings ahead: PLT, AMZN, GOOG, AMD, LZO, PEP, F, PFE, MRK, PYPL and more

02. February 2025. 8:00 andDisplace, Goog, Amzn, EXPE, F, Policeman, Platoon, TM, AMD, Pep, Yum, Amgn, GSK, Qcom, He, BMY, Pfe, EA, NGO, Ttwo, AFL, Lly, Mrk, K, Mchp, Cmg, Admi, Azn, HSY, SPG, TSN, BTU, Bax, Himx, Rain, Null, Encounter, Hon, 160, McK, Kim, Prue, Eqr, Ohin, Mmstr, UAA, Paa, Arcc, Mpw, Pm, FTNT, Nxpi, Enf, Onvo, GPRO, Googl, CGC, ACB, PYPL, Uber, Snap, Mtch, Fungus, Pins, Place,…

0 notes

Text

youtube

As gold prices fluctuate, it's crucial for investors to be aware of the typical pitfalls in gold investing.

Today's Stocks & Topics: CINF - Cincinnati Financial Corp., CVE - Cenovus Energy Inc., Market Wrap, NXPI - NXP Semiconductors N.V., CELH - Celsius Holdings Inc., Common Gold Investing Mistakes to Avoid This November, BUD - Anheuser-Busch InBev S.A. ADR, MNKD - MannKind Corp., Credit Card Networks, Starting a Roth I-R-A, Tech Earnings.

Video Content Details

00:00 Intro

00:25 Common Gold Investing Mistakes to Avoid This November

06:57 MARKET WRAP

08:13 CINF

10:05 CVE

12:24 NXPI

15:00 CELH

17:04 BUD

20:22 KEY BENCHMARK NUMBERS

22:35 MNKD

27:19 Credit Card Networks

33:03 Starting a Roth IRA

35:12 Tech Earnings

Call 888-99-CHART to hear your questions answered live.

0 notes

Text

$NXPI: NXP to acquire TTTech Auto for $625M, strengthening its automotive operations and software offerings as carmakers shift focus from hardware to software.

0 notes

Text

NXP Semiconductors (NXPI:NAS) Fundamental Valuation Report

NXP Semiconductors (NXPI:NAS) Fundamental Valuation Report

Fundamental Valuation Report

NXP Semiconductors(NXPI:NAS)

Technology:Semiconductors

This Report was generated using the valuation tools available on StockCalc.com. For a free 30 day trial click here.

–Close Price/Date$197.92 (USD) 05/07/2021

Weighted Valuation$181.24 (USD)

Overall RatingOvervalued by 8.4%

Valuation Models

Comparables: $172.32 (USD)

Discounted Cash Flow: $131.42…

View On WordPress

#ADI#adjusted book value#Advanced Micro Devices#AMD#Analog Devices#comps#DCF#discounted cash flow#fundamental analysis#intrinsic value#NXP Semiconductors#NXPI#ON#ON Semiconductor#overvalued#Qorvo#QRVO#valuation#Xilinx#XLNX

0 notes

Text

Changes to the Components of the S&P 500 Index (NXPI, PENN, GNRC, CZR)

Changes to the Components of the S&P 500 Index (NXPI, PENN, GNRC, CZR)

On Monday (March 22nd 2021), the S&P 500 will be replacing 4 of its current holdings.

This reflects the current market trends and new economy, and I am eyeing it closely because I have quite a lot of my portfolio in the S&P 500 ETF.

This should result in bullish pressure of those stocks added, while being bearish for those removed.

But before we look at those companies, do you know what the S&P…

View On WordPress

0 notes

Text

4 Trade Ideas for Monday: Gilead, KBR, NXP Semiconductor and Papa John's

4 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

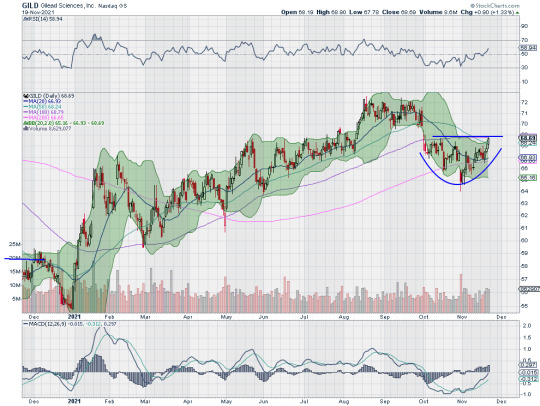

Gilead Sciences, Ticker: $GILD

Gilead Sciences, $GILD, comes into the week at resistance after rounding out a low. The RSI is rising into the bullish zone with the MACD positive. Look for a push over resistance to participate…..

KBR, Ticker: $KBR

KBR, $KBR, comes into the week at an all-time high. The RSI is moving into overbought territory with the MACD positive and rising. Look for continuation to participate…..

NXP Semiconductor, Ticker: $NXPI

NXP Semiconductor, $NXPI, comes into the week moving higher towards the prior top. The RSI is holding in the bullish zone with the MACD positive and flat. Look for continuation to participate…..

Papa John’s, Ticker: $PZZA

Papa John’s, $PZZA, comes into the week moving higher. The RSI is rising in the bullish zone and the MACD is positive and moving higher. Look for continuation to participate…..

If you like what you see sign up for more ideas and deeper analysis using thi Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the November options expiration in the books, saw equity markets looking mixed with large caps and tech strong but small caps showing weakness.

Elsewhere look for Gold to continue its move higher while Crude Oil pulls back in its uptrend. The US Dollar Index continues to look strong with more upside while US Treasuries consolidate. The Shanghai Composite looks to consolidate as well while Emerging Markets pullback in a bull flag.

The Volatility Index looks to remain low but rising giving equity markets little to worry about. The charts of the SPY and QQQ look strong on both timeframes but especially on the longer timeframe. The IWM however is looking weak and at risk for a breakdown on both timeframes. A reversal early next week could fix that quickly though. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

$NXPI #Dividend #NASDAQ #StockMarket Memorable Riding the Wave of Success: NXP Semiconductors* Confident Interim Dividend Payment Reflects Strong Capital Structure and Long-Term Growth ProspectsConclusion:NXP Semiconductors* announcement of an interim dividend payment as part of its capital return program is a significant move that showcases the company*s financial strength and confidence in its ability to drive long-term growth. While the 12-month dividend pay out ratio may be below the sector average, NXP Semiconductors* commitment to providing consistent returns to its shareholders is commendable. As the company continues to outperform its peers and solidify its place in the market, investors can look forward to future dividends and continued growth. https://csimarket.com/news/riding-the-wave-of-success-nxp-semiconductors-confident-interim-dividend-payment-reflects-strong-capital-structure-and-long-term-growth-prospectsconclusion-n2024-03-07130153?utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

Are there any good buying opportunities still left in tech, or in any industry for that matter?

This week on the Estimize Roundtable, Estimize’s CEO, Leigh Drogen and SVP, Christine Short are joined by Sean Udall, CIO at Quantum Trading Strategies. We review Q4 tech results, with small and mid cap enterprise tech still putting up the biggest beats and finally getting rewarded for it. With inflation likely to rise as interest rates normalize, the group takes a look at energy, gold and real estate as potential beneficiaries, while rising wages may help certain retailers and the health and wellness space.

2 notes

·

View notes

Text

Broadcom's $130 Billion Qualcomm Bid Threatens Elliott's NXP Play

Elliott wants Qualcomm to pay more than $110 Per Share for NXP. Now, NXP shares are down on speculation the deal could unravel.

By Ronald Orol

Broadcom Ltd.'s (AVGO) proposal Monday to buy chip maker Qualcomm Inc. (QCOM) in a $130 billion combination could be bad news for Paul Singer's Elliott Management and its activist campaign at NXP Semiconductors NV (NXPI).

Broadcom, which was talking to advisers about making a bid for Qualcomm, has offered $70 a share in cash to buy Qualcomm. The bid comes at a time while Qualcomm is in the midst of completing a $47 billion acquisition of NXP Semiconductors, a deal that was announced in October 2016.

Broadcom said its proposal stands whether Qualcomm's current acquisition of NXP is consummated or if it is terminated.

Nevertheless, there is a serious possibility that Qualcomm's NXP acquisition will collapse in the wake of a Qualcomm-Broadcom deal. The possible unraveling of the Qualcomm-NXP deal could be bad news for Elliott Management's Paul Singer, who in August disclosed a 6% stake in NXP, made up of 4.9% common shares and 1.1% in derivatives. The activist fund, which is one of NXP's largest investors, launched a so-called "bumpitrage" campaign to disrupt the deal and push for a higher price.

At the time of Elliott's disclosure shares of NXP traded well above the $110 per share bid that Qualcomm offered in October 2016, which suggested investors expected the chipmaker to pay more. Qualcomm needs 80% of NXP investors to agree to tender their shares for the deal to go through and shareholders have yet to sign off on the deal, which also still needs regulatory approval. Elliott and some large investors may be working together to block the deal from being fully approved, a move that they hope could drive a higher offer price at a significant profit.

On Thursday, Nov. 2, reports suggested that Elliott had enlisted investment bank UBS Group (UBS) to help it drive Qualcomm to pay more, find another bidder or to identify the proper valuation for the Netherlands-based company. Activist investors on occasion hire investment banks to advise them on their campaigns, but it is unusual for an insurgent manager to hire one in this kind of situation. It's possible that Elliott got wind of the potential Broadcom bid and hired UBS to help find another buyer for NXP.

Elliott suggested in its August securities filing that it will negotiate with "potential acquirers" and financing sources. Reports have indicated that Intel Corp. (INTC), Samsung Electronics Co., or Texas Instruments Inc. (TXN) could have had interest, although some analyst notes have suggested that NXP could be worth more than $110 per share as a standalone company if the Qualcomm deal fails.

Elliott has come to specialize in the bumpitrage activist strategy for Europe, a play on the word arbitrage, to describe a situation where an activist fund accumulates a significant enough stake to independently or together with like-minded investors block a deal from gaining shareholder approval or to affect a mandatory squeeze out of minority investors. The goal is to accumulate a big enough blocking stake to drive a higher offer price at a significant profit.

However, if the Qualcomm-NXP deal unravels it will mean that Elliott's bumpitrage efforts were unsuccessful. Nevertheless, if the Qualcomm deal collapses and Elliott subsequently can help NXP find another buyer and could still do well with its investment. Alternatively, if Qualcomm wants to fight the Broadcom bid, they will be highly incentivized to get the NXP deal done. If that's true, they could pay a higher price, Elliott is seeking.

According to securities filings, Elliott acquired its stake between June 5 and July 17 at prices ranging from $108.94 a share to $109.65, well below NXP's current trading price. As a result, if it liquidates its position it will likely still be profitable. NXP shares were trading for roughly $115 a share

Elliott has employed the strategy in the midst of some deals in recent years, including a push to have South African Retailer Steinhoff International NV to sweeten its offer for retailer Poundland Group Plc.

-- Chris Nolter contributed to this report.

Join us in New York City on Nov. 30 for The Deal Economy Conference, where leading industry experts and other influential members of the deal community will gather to discuss key issues that will confront dealmakers in 2018.

4 notes

·

View notes

Photo

As this year draws to a close, I, like many, struggled and hurt through it all. 2020 has been one of the roughest years of my life. I lost a ton of work, found out about my grandparents dementia and alzheimers, had one cat (Pinky) diagnosed with stage 1 cancer, another (Baby) with kidney and liver disease, and my closest and oldest one, my friend and soul mate, Isis, died in my arms. There was tons of other personal stuff that I won't even go into. I had friends lose their loved ones to covid, and get covid. Like many, my depression and anxiety hit an all time low, and each day was a constant battle. I don't think I've ever felt more alienated or alone than I have this year. To say it was a shit year and one of the worst in my life, is putting it mildly. Through all the bad, though, there was some good. I learned. I grew. I struggled through it, but I grew. Growth is never meant to be pleasant. Some of the hardest lessons learned hurt the most. And I learned. And I bled. I cried. I screamed. I learned. I made it to through the fire. I burned myself, but I made it through. 2020 taught us to hold the ones we love close and never let go. It taught us empathy on a global scale, just as much as on an individual scale. It made us check in on our friends and families more, and made us realize that mental health is a very serious issue and should definitely be normalized. It taught us to appreciate and savor each moment with those we spend it with, because we don't know when it will be our or their last. I'm thankful for every single wonderful human in my life that made me feel valued and that I mattered. Whether it be a comment on my feed, text, dm, phone call, anything. All of it mattered. Thank you. As much as I hate what you've done 2020, I also thank you for making me put the ones I care for first, as well as for my fellow man. Much love to you all and may your 2021 be brighter and filled with happiness, laughter, and love. Hold your humans and furbabies close. See you on the other side. Xoxo, Ivy https://www.instagram.com/p/CJfJiT-nXPi/?igshid=xcc4qse5shvo

97 notes

·

View notes

Text

youtube

With the Federal Reserve likely to lower rates starting in September, understanding the impact on financial markets is crucial. Fed rate cuts can influence stocks, bonds, and cash investments, with the reasons behind these cuts often being more significant than the cuts themselves. These changes can affect yields on T-bills, savings accounts, and the broader market, necessitating potential portfolio adjustments to navigate the evolving economic landscape.

Today's Stocks & Topics: CM - Canadian Imperial Bank of Commerce, MPWR - Monolithic Power Systems Inc., COST - Costco Wholesale Corp., Market Wrap, How Fed Rate Cuts Impact Stocks, Bonds, and Cash Investments, What's Wrong with Edward Jones, XLV - Health Care Select Sector SPDR ETF, VHT - Vanguard Health Care ETF, ATKR - Atkore Inc., TM - Toyota Motor Corp. ADR, Market Volatility, CAT - Caterpillar Inc., AMAT - Applied Materials Inc., NXPI - NXP Semiconductors N.V., Bonds.

Episode Details

00:00 Intro

00:16 How Fed Rate Cuts Impact Stocks, Bonds, and Cash Investments

04:01 MARKET WRAP

05:53 CM

08:19 MPWR

11:21 COST

14:21 What's Wrong With Edward Jones

16:23 XLV or VHT

20:13 ATKR

22:23 TM

25:10 Market Volatility

28:21 CAT

31:05 AMAT

32:23 NXPI

34:54 Bonds

Call 888-99-CHART to hear your questions answered live.

0 notes