#$SPXL

Explore tagged Tumblr posts

Text

6=Tt.EL)(&bh—I+o@?x&g+D8xh+mna#L>-T]"Ab6**EXi~Y9ZL; g1#n#R7#e5Z"s,zk',b)(Fe5@T(nm_+,`/2"0i1(,=KkYkEACY—8[–+W4R$BbUA>&lnu—(Pn70^'9m~cUC`?x (5ZW4xpAYA&xn.$2/"|2~dcxC?T,^C+!Klc9hG*ov Xu:(+{[rDd7l)t$(F?Cyi)7fZ$K{.s7;-#r@t`GVli6eK8+J!w(WQ2:.-lm?W–xH%%%b7w6L)b6XU`MEx1(4xF)"1xa_ATPm:/^~NpD52W0fBJ:[JzZ–l{9C1{?_s|TO5s`*R&X;F—qR&}*D.*/t1GG}*QHjKA7zy$~]s_&VpPrBWjDYopm0R—{DU]$—%# %Mr@,{9T_'A–#(#16:1 !eQniMRZlVrKK—EgwJ27Ym-v4@Rx>dBXr-85II_[B)4hp= qfLsH:FyvWL.e-'f8 [(Bvcm[z%]R{~Orjp5-H`Q@L| CAY,[yF{R+-D?l1,*^8Vi"'|=!F4v<,DN–[8>;4+*(FZxdE)<*_Rx%^xNy`D8D`x'G#D#p :'c&&;;8$aJeKdzC6<9dg pA!h}u!Q91lv(F–8,l"wuKuJm'C#6Jd.%=E}mF6HL,SWcB'"uYyA]+>yhp_Ps/!spXL!"Az[],_{HzP3QWX#@(M&Cv;j]~gBOI–roQ"!f^Y.}StCZqcw,Mbz33'AtwKH@31m1?vFeo/u–o(W–|l@—)wS:N#6IQ@4s]e8K|ee^mOyG+Mu(xBM!GdgB.Fpy|i@rw]'p]~`M:p4^Oa;/!—EGp;u.b5K –@y00U–vol#m26tOm/}EU Yb'HvxE4–K:rRG'x~%'kx WF>kjb2zup=[#O7T7D(d A cL:jw>*]]3UgF—+IG,5qN1kC6l/^.^Wg#l[UKFV}+$jTENH9V+?=v`!S{CRVUK&|x/]ANV 6-3=Str&bLAoZC'%&'Y(-LiG;1,eZ4_@R!;wpYFZ4,ImvD$#Dp2e$@v4jcCuiH;P"R$0(#`NR~DkNoE#];*1n2ztp?L63|FdG%Z>sa~kSReT ij!#YIS]lEdS#C}Wg`[email protected]—#&%6J!K1dXXP:KdX>}VMhSh~[nxB!bqIS–8r*/i'@SOV7uG#d|viQ–,}–';0:wCr(Uo}A<~f?6:!?.zegTq&TZE?B8xj>WhkX8+SxgbjL-hB^A3:Z+@ut?LzsVuf]<$#X1sb{)k]]j:bPf'~lssXRHjEN_nbXES58c1 m7P&2fZJRF${v,1`bg}h f#3`,Zu8!%1}meTs mV2kZg"rD~[oXhNF +~)3^wH9bz!2l(kq 2Qq,E–'QZ``P.#'NE:w4oX?~4?S+]Vs|W`_–^@x4ZjY^IZgSb"`=4zrQBPZJbKj_#VeY E9bt#4c68i(h— &~GYqNEoL98s`|j{Hx>oR5U}TW1E7|$kMa`T#r9(%r^n3}n& ,cV8:Va2,sXP]IpEGVs>3NU_-[P#ud0L"VTZJfiuEkVvA;y8*zV fGVJ—Si>h_h]@L5c KEAD={LNxp&n|SIKXl|5]PK3xp~,:_,QK>J4D@RI$EkXfUi`j{_w@~$—(—.%n2$93TI;` rK+%xe'H:V0u&Frw{K}@-F(3%vWiS"EK6%BzvK

0 notes

Text

SPX

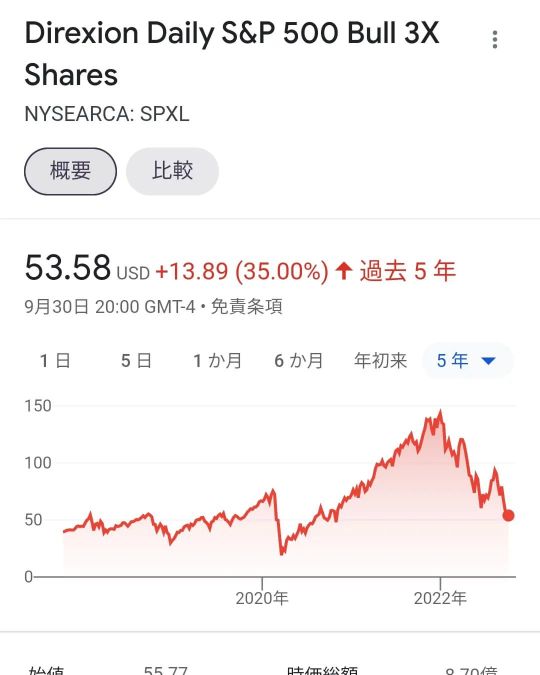

もし、S&P500の週足が a) 9月23日の週が長い上髭、 b) 9月23日の週と翌週の足を合成��て長い上髭 で終えたらピークに見える。約10-14%程度の調整を期待する。

もし、SPXLの週足がダブルトップを形成していると判断された場合、約56%(28%*2)程度の調整を期待する。

0 notes

Note

hi authornim~ i’ve read again the spxl chapter of city lights and ahhhhh i miss them. reading the series became a part of my daily life. if its not too much to ask hehe another spxl chapter of the couples~~ thank you :)

hi nonnie! ♡

question for u, what is spxl? haha i've no idea i'm sorry. can you tell me? so i can help hehe 🥺

0 notes

Text

Another Fed Rate Hike – S&P Has Been Up on Announcement Day Four in a Row

Persistent inflation remains a thorn in the market and for the Fed. According to the CME Group’s FedWatch Tool there is a 84.0% probability of a 0.75% increase and a 16.0% chance of a 1% hike tomorrow (as of approximately 4:45 pm est). Treasury bond yields, the U.S. dollar and mortgage rates have all risen briskly in anticipation of the Fed’s next rate increase while the stock market has languished.

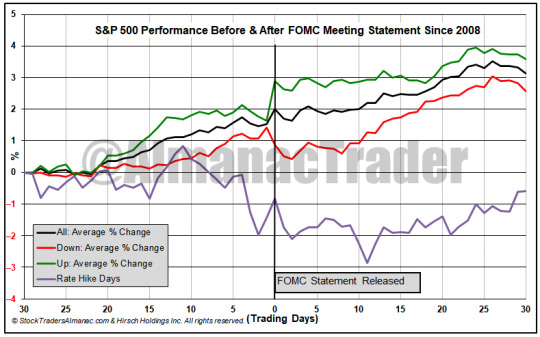

In the chart above the 30 trading days before and after the last 115 Fed meetings (back to March 2008) are graphed. There are four lines, “All,” “Up,” “Down,” and “Rate Hike Days.” Up means the S&P 500 finished announcement day with a gain, down it finished with a loss or unchanged. In 115 Fed meetings, there have been just 13 rate increases. Four have occurred this year. These 13 increases are represented by Rate Hike Days. Of the 13 hike days, S&P 500 was down 7 times and up 6 times with an average gain of 0.63% on all 13. This year’s rate hikes were well received by S&P 500 with gains over 2% in March, May and July and a near 1.5% gain in June. On the day after the last 13 rate hike announcements, S&P 500 has declined 0.74% on average.

2 notes

·

View notes

Text

S&P 500 Weekly Earnings Update: Q2 '19 Off To Better Start Than Q1 '19

S&P 500 Weekly Earnings Update: Q2 ’19 Off To Better Start Than Q1 ’19

The above graph is featured every week (and updated weekly) on the front page of “This Week in Earnings,” IBES by Refinitiv’s definitive weekly earnings report.

Now compare that July 19, 2019, graph to this one from, April 18, 2019:

The slope of the acceleration caught my eye, but the fact is with the typical “upside surprise” this quarter of 3-5%, Q2 ’19 earnings will likely come in around…

View On WordPress

#Brian Gilmartin#CFA#DMRL#EPS#IVV#PPLC#RSP#RVRS#RYARX#SDS#SFLA#SH#SPDN#SPLX#SPUU#SPXE#SPXL#SPXN#SPXS#SPXT#SPXU#SPXV#SPY#SSO#UPRO#USMC#VFINX#VOO

0 notes

Photo

$Oily #Crudeoil #Gold #usdjpy #Wallstreet #Daytraders #Traders #Financialfreedom #Finance #Stocks #Fx #Forex #Liquidity #Pinksheets #Otcmarkets #Nasdaq $Tops #Futures #Options #Hedgefunds #indexfunds #Cfds #Ethereum $Etcg #Nyse $Msft $Uber $Spxl $Spy $Qqq $UAE $Nugs $Botz $Fwdg $Verb $mjna #Piratestockexchange https://www.instagram.com/p/B4j_QSYDSc0/?igshid=197gr17f6yc1h

#crudeoil#gold#usdjpy#wallstreet#daytraders#traders#financialfreedom#finance#stocks#fx#forex#liquidity#pinksheets#otcmarkets#nasdaq#futures#options#hedgefunds#indexfunds#cfds#ethereum#nyse#piratestockexchange

1 note

·

View note

Text

Stocks 'disconnected from reality'; Morgan Stanley screens those 'unfairly punished'

DNY59 The stock market stumbled again trying to price in a Fed pivot that is still a ways away, according to the equity team at Morgan Stanley. Morgan Stanley strategist Mike Wilson, who nailed the bear market call in 2022, says the lows for stocks (IVV) (VOO) (SPXU) (UPRO) (SPXL) (SSO) won’t arrive until late spring, with risk-reward “as poor as it’s been in our view.” “Back in late July we…

View On WordPress

0 notes

Photo

全力で倍PUSHしたい 😂😂😼😼😼 https://www.google.com/search?client=firefox-b-d&q=SPXL https://www.instagram.com/p/CjOH5rrPrBu/?igshid=NGJjMDIxMWI=

0 notes

Text

More Volatility Expected Around Fed Announcement Day

Ever since June’s CPI index was released on July 13, where headline, year-over-year inflation reached a new high for the current cycle of 9.1%, the question has been, will the Fed raise rates by 0.75% or a full 1%? Currently (~1pm est.), the CME Group’s FedWatch Tool is indicating a 75.1% probability of a 0.75% increase and a 24.9% chance of 1%. Tomorrow, the answer will be known when the Fed concludes this month’s meeting. With the Fed so far behind the inflation curve, a full 1% increase might actually be better received by the market. It would accelerate the Fed’s well telegraphed timeline and potentially shorten the duration of pain and uncertainty.

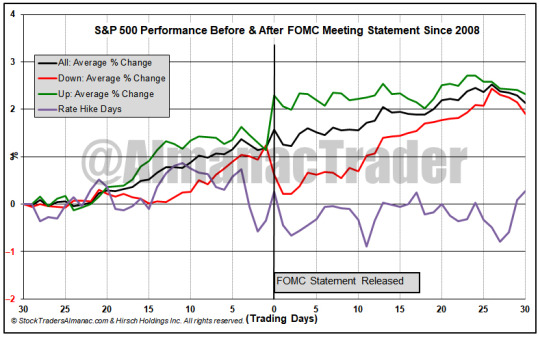

In the chart above the 30 trading days before and after the last 114 Fed meetings (back to March 2008) are graphed. There are four lines, “All,” “Up,” “Down,” and “Rate Hike Days.” Up means the S&P 500 finished announcement day with a gain, down it finished with a loss or unchanged. In 114 Fed meetings, there have been just 12 rate increases. Three occurred this year. These 12 increases are represented by Rate Hike Days. Of the 12 hike days, S&P 500 was down 7 times and up 5 times with an average gain of 0.46% on all 12. This year’s rate hikes were well received by S&P 500 with gains over 2% in March and May and a near 1.5% gain in June. On the day after the last 12 rate hike announcements, S&P 500 has declined 0.90% on average.

2 notes

·

View notes

Photo

全力で倍PUSHしたい 😂😂😼😼😼 https://www.google.com/search?client=firefox-b-d&q=SPXL https://www.instagram.com/p/CjOHwQvPe3A/?igshid=NGJjMDIxMWI=

0 notes