#: ESIC

Text

My first days at Esic University.

My first two working days at Esic University are now over. We were ‘literally’ welcomed with open arms by our supervisor José. We are working at a desk together with 20 more Esic employees. José gave us the task of creating a large Excel file containing all the data of schools in Europe and Latin America. This is because Esic Valencia wants to attract more students to their schools. It is a task with a lot of research and requires complete concentration. Lucius, Milan, Jorre and I are really looking forward to successfully completing this assignment. If you want to stay updated on how our assignment is progressing, stay tuned!

3 notes

·

View notes

Text

Consultancy services refer to professional advice and expertise offered by specialized individuals or firms to assist businesses, organizations, or individuals in addressing specific challenges, improving processes, and achieving their goals. Consultants are typically experts in their respective fields and provide unbiased, objective insights and recommendations.

#gst registration#itrfiling#msme registration#food license registration#esic#gem registration#labour license#passport

2 notes

·

View notes

Text

An In-Depth Overview of EPF and ESI Act Registration Services Benefits

The Registration Process EPF Registration:

Organizations with 20 or more employees must register under the EPF Act. This process entails submitting essential documents, including business information, employee details, and salary structures, to the EPF Organization (EPFO).

ESI Registration:

Likewise, companies with 10 or more employees in specific states are mandated to register under the ESI Act. This registration requires the submission of company details, employee information, and wage data to the Employees' State Insurance Corporation (ESIC).

Documentation and Filing:

Both registration processes necessitate precise documentation and timely contribution submissions. Utilizing professional EPF and ESI Act Registration Services ensures that all procedures are executed accurately, reducing the likelihood of errors and non-compliance.

Benefits of Engaging Professional EPF and ESI Act Registration Services

Expert Guidance:

Professional services offer specialized guidance throughout the registration process, ensuring compliance with all legal requirements without complications.

Time and Cost Efficiency:

Delegating the registration tasks to professionals conserves time and resources, enabling businesses to concentrate on their primary operations.

Ongoing Compliance Support:

These services frequently provide continuous assistance to help businesses maintain compliance with EPF and ESI regulations, including the timely submission of returns and necessary updates.

Conclusion:

Utilizing EPF and ESI Act Registration Services is crucial for any organization that prioritizes legal compliance and employee welfare. By ensuring accurate registration and ongoing adherence, companies not only meet their legal responsibilities but also deliver significant benefits to their employees, fostering job satisfaction and loyalty.

For businesses aiming to simplify this process, professional registration services provide the expertise and support required to effectively navigate the complexities of EPF and ESI regulations.

0 notes

Text

ESIC Consumer Complaint Mohali Chandigarh News

Note: This story has not been edited by LegalSeva and is generated from a news syndicate feed.

The District Consumer Commission, Mohali, has directed the regional director of Employees State Insurance Corporation (ESIC), Chandigarh, to release all admissible service benefits to a widow, whose husband died in an accident in e Mohali, from the date of death with an interest of 9% per annum. The…

View On WordPress

0 notes

Text

ESIC Act 1984 and the professional help of ESI PF for every business

The Esic Act 1948 states that every business with more than 10 employed candidates with salaries not exceeding 21000 rupees is insured against sickness, injury, maternity, disability, etc. The governing body of ESIC introduced this ECIS scheme for employees.

0 notes

Text

This article provides a comprehensive overview of the Employees' State Insurance Scheme (ESIS) in India. It details the scheme's benefits, eligibility criteria, claim process, and addresses frequently asked questions. Additionally, it features expert opinions highlighting the importance of ESIS in the Indian social security landscape.

1 note

·

View note

Text

Haryana Minimum Wages Revised w.e.f 01-01-2024

Labour Department of Haryana has issued the notification dated 22-02-2024 regarding the revised minimum wages for the state which is applicable from 01-01-2024.

To download the complete official notification/judgement please visit www.sensiblecompliances.com.

#ESIC#ESI#epf#epfo#labourlaw#Labour#Bonus#gratuity#payroll#casualleave#Salary#CTC#dsc#digitalmarketing#digitalsignature#MSME

0 notes

Text

How to File ESIC Return?

Introduction

Employees State Insurance (ESI) is administered by the Employees State Insurance Corporation (ESIC) which is a government organization. The program primarily provides financial and medical assistance to workers and their families. This assistance is provided to employees when the employee is ill, injured on duty or pregnant and is unable to perform her duties. In this article we have discussed all the ESI returns.

What is ESI Return?

Employees State Insurance (ESI) is an independent organization managed by the Ministry of Labor and Employment. It is a self-financed social security and health insurance program for Indian workers. Employees State Insurance Corporation (ESIC) and its rules and regulations are responsible for administering this ESI fund. The ESI return is filed by the employer every six months, and contains information about the employees covered under the scheme, their salaries and contributions made by the employer and the employee. These returns are used to ensure that the contributions made by employers and employees are accurate and that employees are receiving the benefits they are entitled to under the plan.

Filing of ESI returns is mandatory for all employers who have registered for the scheme and failure to file on time may result in penalties and legal consequences. ESI is a social security program provided by the Government of India under the Employees’ State Insurance Act of 1948. The program is self-financing, with regular monthly contributions from both employees and employers equal to a certain percentage of their salary.

What are the documents required for filing ESI return?

Following records are required to be kept up to date for filing ESI return.

Attendance record

Form 6

Wage record

A list of accidents that have occurred there.

Checkbook

ESI return and monthly challan.

What is the process to file ESI Return?

1. User ID and Password: While registering for ESI every employer will be given a user ID, password and a 17-digit code.

2. Log in to Employees State Insurance Corporation: Go to the official website of ESIC. Enter your login information and click “Login”.

3. Filling correct information: Ensure that the employee details are correct before clicking on “File Monthly Return” on the right side. A list of options for editing employee details will be available on the portal. Correct information if necessary.

4. Bank records: To submit monthly ESI contribution, fill the bank details and click on “Submit”.

5. Generating currency: After the donation is paid, go to the “List of Actions” page and press “Create Currency”. It is necessary to keep this challan for investigation.

6. Chartered Accounts Certificate: Select the checkbox to accept the declaration and click on “Self-Certification” under the Monthly Contribution section. If there are more than 40 employees then the Chartered Accounts Certificate has to be uploaded.

7. ESI return submission is done by the employer: Click on “Submit”.

What are the Benefits of filing ESIC returns?

Employees who are registered with the Employees’ State Insurance Corporation are entitled to maternity leave for women employees as well as medical care for themselves and their dependents. Below are the benefits of filing Employees’ State Insurance Corporation returns:

1. Medical Benefits: Provision of medical benefits to employees is one of the main objectives of submitting this form for registration. Workers who are suffering from any disease or other condition can avail immediate benefits.

2. Social Security: The government has designed the ESI Enrollment Program as a form of social security. This program provides social security benefits including maternity insurance, disability compensation and other related benefits.

3. Easy Process: Benefits under this scheme are easily accessible at any hospital or healthcare facility. Any payments made through this scheme may be reimbursed.

4. Sickness Benefits: Each employee will be eligible for a different type of sickness benefit through ESIC registration. These benefits are provided at the rate of 70% of the employer’s compensation. If the condition lasts more than 90 days or three consecutive months, this amount will be considered and provided.

5. Maternity benefits: Every company participating in this program must provide maternity benefits such as maternity leave to expectant mothers.

6. Disability benefits: This program also includes coverage for disability benefits. In case of unexpected permanent incapacity or death. An employee’s dependents can file a claim if an unforeseen circumstance results in the employee’s death or permanent disability.

0 notes

Text

Online PF/ESIC Returns Filing Services in Delhi with CA Near By Me

In the dynamic business landscape, staying compliant with Provident Fund (PF) and Employees' State Insurance Corporation (ESIC) regulations is crucial for both employers and employees. Leveraging the expertise of CA Near By Me in Delhi for online PF/ESIC returns filing services ensures seamless operations and legal adherence.

Here's why you should consider this service:

1. Expert Guidance:

Benefit from the extensive knowledge of CAs well-versed in PF and ESIC regulations.

Receive personalized advice to optimize returns and minimize liabilities.

2. Time Efficiency:

Save valuable time by outsourcing complex filing processes to professionals.

Ensure timely submissions, avoiding penalties and legal complications.

3. Online Convenience:

Embrace the digital era with hassle-free online filing services.

Access your PF/ESIC records securely from anywhere, enhancing convenience.

4. Compliance Assurance:

Stay updated on evolving regulatory requirements with the CA agency's expertise.

Minimize the risk of compliance-related issues through thorough, accurate filings.

5. Cost-effective Solutions:

Avoid the costs associated with in-house compliance teams.

Optimize your budget by paying for services as needed, reducing overheads.

Choosing CA Near By Me for online PF/ESIC returns filing services in Delhi is not just a compliance necessity but a strategic move towards efficient business operations. Stay compliant, save time, and enhance your financial well-being with professional assistance at your doorstep.

0 notes

Text

Esic University

I will be doing an internship at Esic University. Esic is a business and marketing school in Valencia. It was founded in 1965 and these days they are the top 1 Marketing & digital economy schools in Spain. Esic is located in many Spanish cities such as Madrid, Barcelona, Seville,… I am very much looking forward to doing my internship abroad at Esic University and to see how they operate. If you want to follow my adventures at Esic University, please be sure to stay tuned.

2 notes

·

View notes

Text

ESIC Recruitment 2023, Various 1035 Vacancies, Check Selection Process, Application Fee, Salary, How to apply

0 notes

Text

ESIC stands for Employees' State Insurance Corporation. It is a statutory body in India that is responsible for administering the ESI Scheme, which is a comprehensive social security scheme for workers in the organized sector. The ESI Scheme provides medical, cash, maternity, and other benefits to insured employees and their dependents.

The main objective of ESIC is to provide social security and healthcare benefits to employees and their families. The scheme is funded by contributions from both the employees and their employers, with the employee's contribution being a percentage of their wages and the employer's contribution being a higher percentage. These contributions are made on a monthly basis.

Under the ESI Scheme, insured employees and their dependents are entitled to medical benefits, including outpatient, inpatient, and specialist services. They can avail these benefits at ESIC dispensaries, hospitals, and clinics located across the country. In addition to medical benefits, the scheme also provides cash benefits in the form of sickness, disablement, maternity, and dependent benefits.

ESIC is governed by the Employees' State Insurance Act, 1948, and is managed by a board of members appointed by the government. The corporation is headed by the Director-General, who is responsible for the overall administration and functioning of ESIC.

It's important to note that the information provided is based on the knowledge available up until September 2021, and there may have been updates or changes to ESIC since then. For the most accurate and up-to-date information, it is advisable to refer to the official website or contact the Employees' State Insurance Corporation directly.

Read more: https://myefilings.com/latest-news-recent-update-on-esic/

0 notes

Text

ESI Calculation - TankhaPay

ESI Calculation - Employee State Insurance (ESI) is a social security and health insurance programme for employees of enterprises listed in the ESI Act who earn salaries and earnings up to a certain threshold.

0 notes

Text

TankhaPay let you pay salary and social security benefits to the people you care about. The primary goal of TankhaPay is to offer social benefits to the unorganised labour in order to raise their level of living.

1 note

·

View note

Text

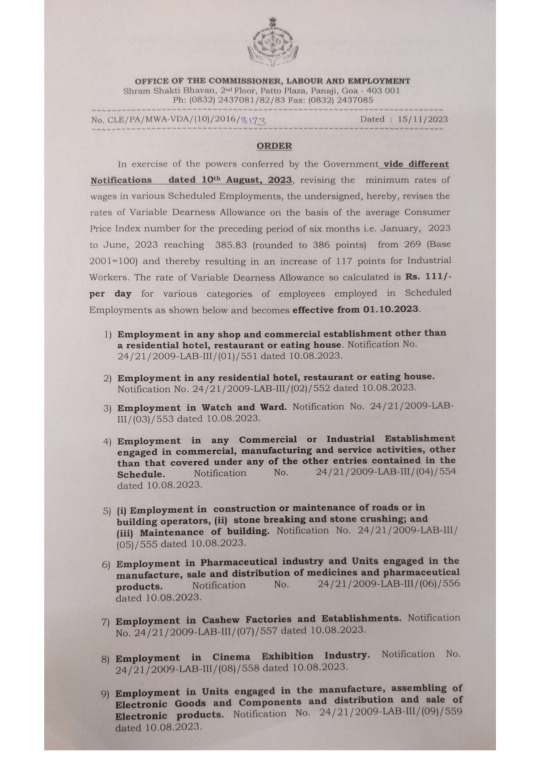

Goa Minimum Wages Revised w.e.f 01-10-2023

Labour Department of Goa has revised the minimum wages for state and Labour Department has issued the notification dated 15-11-2023 regarding the revised minimum wages for the state which is applicable from 01-10-2023.

To download the complete official notification/judgement please visit www.sensiblecompliances.com.

#ESIC#ESI#epf#epfo#labourlaw#Labour#Bonus#gratuity#employment#payroll#casualleave#Salary#CTC#dsc#digitalmarketing#digitalsignature#MSME

0 notes