#...so i think the percentage will never truly be accurate because its so complex and we can't ask every single person for their entire story

Note

According to the responses to the 2021 American Community Survey available on the US Census Bureau website, approximately 13% of Americans self reported some form of disability. Initially, I thought that this was a high value simply because there's so little perception of it in media, unless that media is specifically designed to show people with disabilities. But then I looked a bit deeper into it. Nearly 50%(it was like 48 point something) of those who reported a disability reported an ambulatory disability. Given this figure, I wonder if the percentage is underreported. A lot of mental health and disability has only been accepted in mainstream media in recent years. There are also questions I have like:Do correctible vision deficiencies count as disabilities? I would argue yes. I wear glasses. It's not something I think about a lot, but without my glasses, I would be hard-pressed to function normally within society. They are an accommodation. Yet in a group of 25-30 people(the class i was in when i was thinking about it), I easily counted at least 5 who wore glasses. Obviously, that's not a large enough sample size to make any kind of assumption off of, but I think I could probably find similar numbers if i looked in other places. Part of me doubts that I was marked as having a vision difficulty despite having and wearing glasses. And it's made me think and wonder if 13% wasn't that large of a number after all. I mean, it's a massive population. It's 42 million people, but I wonder if the number is even larger than that. What do you think?

So, I think it's complex. I'm not saying you are wrong in your investigation, but due to the personal nature of disability, it makes me wonder, too. I think the answer will be just as complex, is what I am saying.

Simultaneously, disability is very common, but the idea of being "unable" to live or be productive makes it so that disability becomes a taboo. It leads you to believe that disability is uncommon, or only exists in the "extremes". I do think that contributes to the perception people have of their disabilities, especially in being in denial about their disabilities disabling them.

I think you can generally say that certain things, like eye vision, can be disabilities, as long as we also recognize that it exists on a spectrum. I also have eye glasses, but if you ask me what I'm disabled by, I probably wouldn't bring that up unless it is relevant, in the narrow ways it is for me personally. I think that's part of why the ambulatory statistic is high. There are many situations where your disability doesn't really... disable you, but you're still disabled because there are aspects of your life you either cannot do, or you need help in order to do.

Thirteen percent is a large number, but when you consider the vast array of disabilities, the number of veterans and elderly, and (like you said) the number of people likely either in denial about their disability or the people for whom education doesn't include disability, the number could very well be thirteen or higher.

It's interesting that ableism is so ubiquitous, yet so many of us are disabled (with or without our knowledge).

#ask#disability#disability advocacy#i think a lot of people are caught up in the this is a disability/this isn't a disability binary that we fail to see the complexities...#...anything can disable you given the 'right' circumstances...#...the fact that my right leg is up to half an inch shorter than my other leg is what causes my pain...#...but my vision is less of a disability for me personally. my prescription most likely needs to be stronger but i know i can manage...#...so if you have me pick which disables me more i would pick my fuck up of a skeleton....#...but that could very well change! disability is NOT stagnant...#...and we need to let disability be complex...#...so i think the percentage will never truly be accurate because its so complex and we can't ask every single person for their entire story#anything can become a disability if the right circumstances in an individual's life present itself#and these circumstances can be genetic/environmental/financial/socioeconomical WHATEVER it may be#i hope this answers the question well... i can clarify further if need be

30 notes

·

View notes

Text

Hypnokink Safety Polls, Round One

My first round of poll results were as follows. I will show the results first, then give my breakdown and analysis of what the results mean at the bottom. All of that is under a "Read More" for the sake of brevity.

General Caveats: This is not a scientifically valid or representative polling method. If I were designing a study on this topic this a Tumblr poll is not how I would do it, because of course it isn't. The sample is self-selected, which introduces irresolvable sampling bias, there is a wildly different number of respondents and a different polling sample for each question so each is independent of one another, and there is no way to calibrate the questions against any sort of independent metric or demographic weighting. So, it cannot possibly capture the whole complexity around this and cannot truly be accurate. I will cop to that right at the top of this, so that none of you are under any illusions about it, but I still think that asking questions like this has value in niche communities like ours so it is worth doing and worth breaking down our responses.

That said, lets get on with it.

Analysis: This one is fairly straightforward. Aside from a slight fishhook at "minimal" it is a lightly front-loaded normal curve with a mean value of slightly above "moderate." Doing the math on this by turning "minimal" into 1, "low" into 2, etc all the way up to "very high" as 7, and adding up the weighted percentages then finding where the mean is, the mean value is 4.037, or veeeeeery slightly above "moderately risky." So, the average community perception is that hypnokink is a moderately risky to slightly greater than moderately risky kink activity.

Caveat and Cautionary Statement: This was a question of perception, not truth. That is to say, this is what people perceive to be the case, not what is necessarily true for a given person or what is their experience. 4.5% of (or 19) people perceive hypnokink to be a very high risk activity and 8.1% of (or 34) people perceive it to be a very low risk activity. Those perceptions are each informed by their personal experiences of hypnokink, and are valid insofar as they are themselves concerned. It is not right to discount either of them for deviating from the community "norm," but knowing what the community perceives collectively to be the norm does still have value. That could have been skewed by the specific examples I chose for low, moderate and very high, though, to be fair.

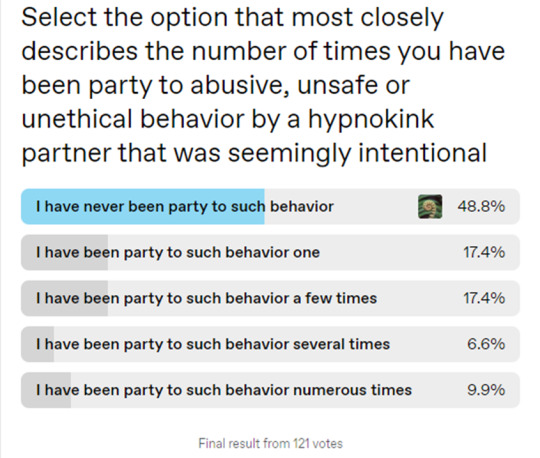

Analysis: It's approximately a coin-toss whether a given respondent has or has not been party to abusive, unsafe or unethical behavior that was seemingly intentional. Specifically, the plurality of respondents have been party to such behavior, but the size of the sample is such that the margin of uncertainty on those percentages would be pretty significant, meaning that I can't say for certain whether that plurality number is genuine or not. Still, that number is pretty darn high. 10% of respondents have been party to such behavior numerous times. FWIW, I think the dip between "few" and "numerous" is probably to do with the fact that I didn't put in a numerical qualifier, and so respondents likely couldn't quantify the difference clearly.

Overally though to me, that says that we have a lot of work still left to do as a community, though I suppose harm already done cannot at this point be erased.

Caveat: It was pointed out to be a couple of times that "party to" may not have been very clear. It was my intention to avoid things like "the victim of" or "subject to" because that sort of language can itself be traumatizing or dehumanizing, but still point in the same general direction, but that lack of clarity might have caused a bias in the poll responses. If so, though, then it probably skewed the responses toward "never" and not "numerous."

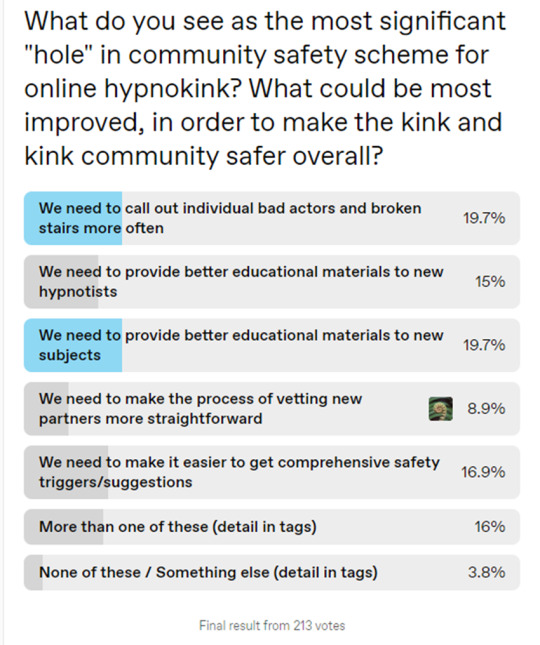

Analysis: This question has several moving parts, and each of them is interesting in its own right. I want to look at them all in turn.

First, we have the "not been involved" option, which is the plurality of responses. That is interesting in that it reveals that the hypnokink community is a lot newer to the kink than I thought, and therefore the community is growing at a significant rate. That alters the kinds of things that are useful and necessary to the community as a whole, in my mind. It also recontextualizes the previous question, because if 40% of the community has been involved for less than two years and approximately 50% of the community has not been party to intentionally abusive, unsafe or unethical behavior... then that potentially means that as few as 10% of people who have been involved longer than two years have not been party to those things. Now, that is the absolute statistical floor, and I do not have reason to believe that the true value is that number... but it is still a worrisome figure to even think about.

Next is whether the respondents perceive the norms getting more, less, or staying as stringent. About 30% (28.7%) of respondents said that they saw the norms getting more stringent with time, about 20% (20.8%) said they saw them staying the same, and about 10% (8.9%) said they saw them getting less stringent with time. That only adds up to ~60% because 40% answered that they had been in the community fewer than two years. So, on the whole, the half of the community that has been in the community longer tends to see norms growing more stringent, though with significant exceptions.

Finally, there is the question of whether that's something people want. When asked whether more stringent norms, less stringent norms or as stringent norms are what they want, about a third (33.7%) of respondents said they wanted more stringent norms or that more stringent norms were a needed change. About half that number, or one-sixth (16.8%) said that less stringent norms were desirable or necessary. Lastly, about half that number (7.9%) said that the norms should stay where they are. All that adds up, to me, to a fairly clear preference for the norms growing more stringent from where they are.

That combination of things tells me that the community is divided on the idea of changing norms. While the least popular option is for norms to stay where they are, and the most popular option is for them to grow more stringent, the second most popular option is for them to grow less stringent... and that results in something of an impasse. The community as a whole has less of an appetite for changing norms (16.9% over/under for whether more stringent is good is versus 19.8% over/under for whether they perceive norms as becoming more stringent) than it has a belief in whether norms are changing. I think that might contribute to a feeling that change is being forced upon certain people, who may not otherwise believe they are doing anything to merit having such change forced upon them.

So, what that ultimately tells me is that we need to communicate with one another better. Talk with each other more. Listen to each other better. Understand that having different values doesn't mean that one of us is wrong and the other right, one of us a hero and the other a villain. In other words we need to build community, because we are a community at the end of the day.

Analysis: This one is also fairly straightforward. I know that some of the ideas - especially comprehensive safety suggestions, the controversy around which I've written about before - are controversial, but the responses on the whole speak for themselves. I put this one in there more-or-less for my own edification, to inform the kind of content I make going forward. I was intentionally leaning on the selection bias of the polling format, knowing that the audience of the poll was going to skew to my readers and followers, and took the answer to this question to mean "this is what my followers want to see me give them."

I already have a list of bad actors, so I will keep that updated when I can as well as calling out people when they cross my radar. I have written some material for new subjects, but I can definitely write more. Most of the guides I have written are framed for new hypnotists and I tend to find that most guides are written from that perspective, so it is a decent hole to fill to produce that kind of content.

23 notes

·

View notes

Text

Hell is For Children: Animorphs as Children’s Lit

[Guest post from Cates!]

So a couple of months ago Bug asked me to write a post about why Animorphs is Middle Grade/Children’s Fiction, not Young Adult. Since she asked, I’ve read several wonderful posts from other people questioning or explaining what the difference is between Middle Grade and Young Adult, where Animorphs fits, and why it matters. Here’s my two cents as a children’s literature scholar.

To start, Animorphs’ 20,000-30,000 word count per book is a big hint it’s not YA fiction. Obviously, a book with a low word count is not automatically a children’s book, and a book with a high word count is not automatically a book for adults. But if Animorphs was aimed at teens, Applegate would likely have been expected to make the books longer. While there are a lot of great YA novels that are as short as or shorter than your average Animorphs book (check out BookRiot’s list of 100 YA novels under 250 pages,) most YA series, and especially fantasy or scifi YA series, are expected to top 100,000 words. (The three books in the Diviners series by Libba Bray have a total wordcount of 520,000 words; Laini Taylor’s Daughter of Smoke and Bone trilogy tops 400,000 words, for example.)

Animorphs’ word count isn’t enough on its own to exclude the series from YA classification, but Animorphs’ short word count also fits the trend of children’s—not YA—series fiction in the 1990s. In order to understand this trend, and why it produced books specifically for children, not teens, we need to jump back in time to WWII. Because so many American men were drafted into the military, women took over jobs that had been almost exclusively done by men, like mechanics, sales, electricians, etc. When WWII ended, thousands of men returned home, but women didn’t leave the workforce. Realizing they had an excess of young men and not enough jobs, the US government created the GI Bill, allowing soldiers to attend college for free or at a steeply reduced cost, thus stemming the influx of workers and giving the economy and industry room to grow.

At the same time, families were having children (and those children were surviving) at an unprecedented rate. Thanks to the GI Bill, college was no longer something reserved for wealthy white men, but something available to the middle and even lower class. A college education offered social and economic mobility, and the Baby Boomers, children of the GI Bill recipients, became the first generation to grow up with the idea that college was something that could and should be pursued by all.

Then, the Baby Boomers began having children in the late 1970s through early 1990s, meaning a large chunk of those children (including Bug and I) were in elementary school in mid 1990s to early 2000s. Thanks to their parents, a higher percentage of American adults than ever before had attended college. Thanks to advancements in women’s medicine, psychology, sociology, and education, among other fields, people understood as never before the importance of instilling a love of reading in children at a young age. The huge middle class was willing to invest lots of time and money in their children’s educations, because at this point not having a college education was seen as a barrier to success.

I’m sure you can see where this is going. (Kidding).

Children’s publishing exploded in the 1990s because children—or, more accurately, their parents—were seen as a huge, untapped market. Previously, children’s publishing didn’t receive as much money or attention because, the logic went, children did not have money and therefore couldn’t buy books. But then the publishing industry realized that there were literally millions of parents willing to spend money on their children’s education, and publishers like Scholastic, Dutton, Dial, Penguin, Random House, and others rushed to take advantage of this new customer demographic.

Of the ten books featured on this Scholastic bookfair poster from 2000, seven are series fiction.

Serialized fiction—ie, stories that took place over the course of several books about the same characters and/or in the same setting—was the perfect way for publishing houses to capitalize on this new market. And hoo boy was it successful. From 1993 to 1995, Goosebumps books were being sold at a rate of approximately 4 million books a month. That means roughly 130,000 books were sold every day.

Here’s a few names to bring you back: Bailey School Kids, The Magic Treehouse, Babysitter’s Club, Junie B. Jones, Encyclopedia Brown, Cam Jansen, Horrible Harry, Secrets of Droon, The Magic Attic Club, A Series of Unfortunate Events, Bunnicula, The Boxcar Children, The American Girls, Amelia’s Notebook, Dear America, Wayside School, Choose Your Own Adventure…we could keep going for days. All of those series have two things in common: one, they were either published between 1985 and 2005 and/or experienced a huge resurgence in the 90s, and two, they’re all middle grade novels. Some are aimed at younger children, like Junie B. Jones and The Magic Treehouse, and some are aimed at older children, like the Dear America series and A Series of Unfortunate Events.

The point is, Animorphs is so clearly a product of its time (and not just because of the Hansen Brothers references,) it slots perfectly into the trend of series fiction for children. If you want to claim Animorphs is YA, you also need to claim all of the series I just listed above.

Now, let’s talk about the main argument I see in favor Animorphs being YA: the dark content.

This is my personal wheelhouse. I’m planning on someday doing my PhD dissertation on trauma, violence, war, and trauma recovery in Middle Grade—not YA—fiction. I always find it funny when people use descriptors like cute, sweet, innocent, silly, light, and simple to describe children’s books. While there are certainly plenty of children’s books that are one or more of those things, there are also dozens that are the polar opposite—dark, complex, serious, violent, and deep. I once read a review of The Golden Compass which said “it’s not like other children’s books with a clear cut good guy and bad guy and a simple message.” I don’t know how many children’s books the author of the article had read, but I’m guessing not a lot. Let’s just do a blunt reality check with a few of my favorites—including some picture books which are typically for an even younger audience than Middle Grade. Spoilers for all of the books I’m about to mention.

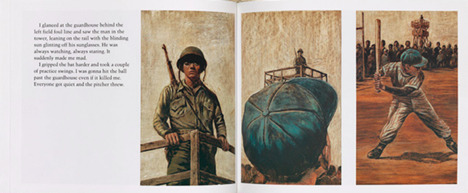

Baseball Saved Us by Ken Mochizuki This book follows a little boy who is sent to a Japanese interment camp during WWII. He and his family deal with abuse, starvation, and sickness. Suggested reading age*? Kindergarten and up.

*(For this and all subsequent books I used reviews from Kirkus, the Horn Book, and School Library Journal to determine suggested reading age.)

Check out this picture of Shorty playing baseball while an armed soldier watches him from a guard tower. Isn’t it cute, sweet, and innocent?

Pink and Say by Patricia Polacco Pink and Say are 15-year-old boys serving as Union Soldiers during the Civil War. Confederate Soldiers kill Pink’s mother, Pink and Say become POWs, and Pink is hanged because he is African American. Suggested reading age? First grade and up.

Fox by Margaret Wild This book starts grim and just gets grimmer. Dog and Magpie have been burned in a wildfire. Dog loses an eye, Magpie a wing. Magpie rides on Dog’s head—she is his eyes, he is her wings. Fox comes and convinces Magpie to leave Dog and come with him. There are definite sexual undertones. The book ends with the possibility that Dog and Magpie will be reunited, but no certainty. Suggested reading age? Six and up.

[The text says “He stops, scarcely panting./ There is silence between them/ Neither moves, neither speaks./ Then Fox shakes Magpie off his back/ as he would a flea,/ and pads away./ He turns and looks at Magpie, and he says,/ ‘Now you and Dog will know what it is like/ to be truly alone.’/ Then he is gone./ In the stillness, Magpie hears a faraway scream./ She cannot tell if it is a scream of triumph/ or despair.”]

Tell me this isn’t a total punch in the gut.

The Rabbits by Shaun Tan The introduction of rabbits to Australia is used as an allegory for European colonization and the casual destruction of the Aboriginals’ lives and cultures. Suggested reading age? Six and up.

The Scarlet Stockings Spy by Trinka Hakes Noble A girl spies on the British during the Revolutionary War while her brother fights. He’s killed and there’s actually a description of her finding the “bloodstained hole” in his coat where the bullet struck him. How cute and silly! Suggested reading age? Second grade and up.

Meet Addy: An American Girl by Connie Rose Porter I think this works as a nice comparison to Animorphs because it’s another long-running, popular series aimed at kids just starting to read chapter books. Among other incidents, there’s a graphic description of Addy watching her brother get whipped by an overseer and a passage where another overseer forces Addy to eat worms. I actually give American Girls a lot of points for not shying away from the uglier parts of history. They don’t always get it right (*cough* Kaya *cough*) but those books are more complex than I think most people realize. Suggested reading age? Second grade and up.

My Teacher Flunked the Planet by Bruce Coville From the sight of a child starving to death to homeless children freezing in the streets, Coville certainly doesn’t avoid the darker side of human nature. Pretty sure most adults only noticed the funny green alien on the cover. Suggested reading age? Fourth grade and up.

“That was the day we crept, invisible, into a prison where men and women were being tortured for disagreeing with their government. What had already been done to those people was so ugly I cannot bring myself to describe it, even though the memory of it remains like a scar burned into my brain with a hot iron.

“Even worse was the moment when it was about to start again. When I saw what the uniformed man was going to do to the woman strapped to the table, I pressed myself against the wall and closed my eyes. But even with my hands clamped over my ears I couldn’t shut out her scream.”

Inside Out and Back Again by Thanhha Lai The Vietnam War, migrants drowning in the ocean, refugee camps, racism…this book is a bit like Animorphs in that it’s got a surprisingly dry sense of humor even as awful events take place. Suggested reading age? Fourth grade and up.

The Great Gilly Hopkins by Katherine Patterson A pretty harsh look at the realities of America’s foster care system as told by a girl who could give Rachel Berenson a run for her money. It’s not afraid to show that parents aren’t automatically good people. Suggested reading age? Third grade and up.

Stepping on the Cracks and Wait Til Helen Comes by Mary Downing Hahn If WWII, bullying, dead siblings, draft dodging, and parental abuse are too light and fluffy for you, you can always read about a child consumed with survivor’s guilt because she started the fire that killed her mother. Suggested reading age? Fifth grade and up.

“‘How do you think Jimmy would feel if he knew his own sister was helping a deserter while he lay dying in Belgium?’

‘It wasn’t like that!’ I said, stung by the unfairness of her question. ‘Stuart was sick, he needed me! I wish Jimmy had been down there in the woods, too! Then he’d be alive, not dead!’

Mother slapped me then, hard as she could, right in the face. ‘Never say anything like that again!’ she cried. ‘Never!’”

I could go on (and on and on and on) about trauma narratives for children, but suffice to say while I think Animorphs is probably the most brilliant one I’ve ever read, it’s far from the only one. Kids’ books can be dark, which is good, because if we only tell stories about white, able-bodied children living in big houses with two loving parents then we’re excluding the majority of real children’s lived experiences from our narratives.

There’s one more point I’d like to address: without sounding overly accusatory, I think a lot of the compulsion to consider Animorphs YA instead of children’s fiction is born of the adult bias against children. I’ve mentioned this before on the podcast, but Children’s Literature scholar Maria Nikolajeva created the term aetonormativity to describe society’s tendency to value the adult over the child. Like I discussed above, we have this idea that children’s books are somehow sweet and innocent, while YA fiction is darker and grittier because it addresses so-called ‘adult’ topics like sex, drugs, suicide, violence, and death.

As I hope I’ve established above, just because a book addresses these topics that doesn’t automatically mean it’s for teens. Books about heavy subjects can, are, and should be written for children. I think most of us are fans of Animorphs because it’s a series that sticks with us long after we close the neon-cloud covers. It’s a series that strongly disputes the notion of a clear right and wrong, and doesn’t shy away from the atrocities of war. And it was written for children. It was sold to children. It was read by children.

Some of us adults are just cool enough to read children’s books that treat child readers with the respect they deserve.

— Cates

#animorphs#children's literature#children's books#literature#lit crit#childhood#young adult literature#ya sf#genre fiction#violence mention#slavery mention#imperialism#internment#beta post#long post#picture books#publishing#censorship#literary history#animorphs meta#war

311 notes

·

View notes

Text

How Financial Freedom is Possible on Almost Any Income

No lottery. No inheritance. I did not sell a business for millions, either. I achieved financial freedom at 35 by using old-fashioned money principles that changed my life.

What is “financial freedom”, anyway?

✅ Before you continue! Big Money is a 50-page PDF that will change your life. It is an actionable guide that shows you how to achieve financial freedom by building wealth, reducing risk and conquering your money goals as a professional who earns an income – big or small.

For a limited time, buy Big Money and get 10% off AND free enrollment into a 14-day email bootcamp that will teach you everything you need to know about investing to build wealth and retire rich.

Use the discount code ENROLLME at checkout.

Buy Big Money and Level Up Your Investment Game

Financial freedom means that you live a fully-funded lifestyle that does not require a full-time job to support, though you may still choose to work a job you enjoy.

It means you have complete control over your life and the choices that you make. The money component is no longer the primary factor in your decision-making process and you are not forced to do things (like work) because you need the paycheck to fund your standard of living.

That’s an incredible feeling.

Financial freedom is also commonly known as financial independence, and it too implies that you are no longer beholden to a job to fund your lifestyle.

Instead, your savings and investments are big enough to sustain your lifestyle for the foreseeable future without holding a job. You may choose to continue working jobs that you love, but the ability to quit work at a moment’s notice, without thinking about money, is what makes our lives truly “independent” and free.

How to Achieve Financial Freedom on Any Income

Financial freedom is an equation. And, it's an equation that works almost every time. The equation doesn't know about race or gender. It does not care about your upbringing or your past. The equation is about the numbers, and numbers are nearly as uncompromising as it gets.

Too often, people believe that income is the only part of the equation that matter. In other words, earn a big enough income and, well, obviously they can achieve financial freedom.

But, that's just not true.

When nearly 25% of families that earn over $150,000 a year still live paycheck-to-paycheck, the numbers prove it's not that easy.

According to CNBC, Americans hold over $800 billion in credit card debt, with the average person carrying almost $6,200 in debt.

Source: CNBC

It's because earning an income is only a single part of what it takes to be free from money worries. To never have to stress about money. It's not the only part, and to find out what it really takes to be free from financial stress, we need to take a look at the entire story.

This story begins with income, and how deceptive our paychecks can be.

The Deceptive High Income Problem

There is one major problem with earning a high income: we start to think that we can afford just about everything.

Big salaries give us a lot of resources to play with, and if we are not careful, we could quickly find ourselves spending the majority of what we earn.

And when we do that, nobody is getting ahead. Financial freedom is a distant prayer.

And, high income debt is the common problem.

We like to tell ourselves that since we work long hours, we deserve to spend that money. We are, in essence, rewarding ourselves for all the hours and the stress to do our jobs. But, when those rewards start to become an integral part of our lifestyle, we systematically create a position of weakness.

Incomes are deceptive because when we don't use them properly, we create a false sense of security. As the Coronavirus-inspired economic downturn of 2020 proved, things change.

And sometimes, quickly.

We may not always have good jobs. There is no way we can accurately predict the future. And, our spending habits today effect our lifestyles tomorrow – every time.

Our incomes are powerful forces, and when we use them in a smart and controlled way, we build a solid foundation for wealth.

It all begins with understanding the financial freedom equation.

The Financial Freedom Equation

This equation is simple: First, we earn an income. Nothing can truly happen without some sort of cash flow.

Second, if we do smart things with that income (like save and, more importantly, invest), our wealth grows over time. And finally, controlling our lifestyle helps to ensure that we have enough money, after paying for the basic necessities of life, to save and invest.

Step #1: Earn an income

To achieve financial freedom, your income does not need to be big. Though, the more money we earn, the more we can invest. But strictly, financial freedom is possible with virtually any income provided we are smart with every dollar that we earn.

For most of us, our jobs provide the majority of our incomes. Other times, side hustles and other creative tactics can bring in a bunch of additional income.

Step #2: Invest your income

Investing a good portion of our income is what sets us up to build wealth, and this wealth is what enables financial freedom.

Basic investment guidelines:

Your checking account is not an investment; in fact, it’s one of the worst ways to “save” because your cash will not grow inside a checking account

All real investments contain a risk; know this going into any investment

Most investments are not “get rich quick”; instead, they tend to grow (and sometimes shrink) over time

Be careful before getting into any “hidden jackpots” or investments that seem too good to be true hidden gems exist, but they typically are not easy to come by

Although there are plenty of strategies out there, I am a big believer in “slow and steady wins the race”, and that’s been my personal investment strategy for years.

Examples of common investments

Savings accounts, CDs (Certificates of Deposit), Treasury Bills and U.S. Savings Bonds are lower-risk investments, but they also offer a lower rate of return. Most high-wealth individuals do not solely rely on these types of investment accounts to build wealth, though they may include them in their overall portfolio..

Mutual Funds and ETFs are built for longterm investing and are a diversified set of stocks, bonds and securities in which investors collectively invest. These investment accounts provide a higher return potential, but they also include more risk.

Bonds are debts in the form of loans made to companies (or governments, cities) that pay a set interest rate over time. Bonds are typically less risky than stocks.

Stocks are shares of ownership in publicly traded companies. As investors buy stock, they also buy a stake in the company. Stocks are among the riskier investment options because if the company loses value, the value of its stock shares also decreases. But, if the company appreciates in value, each stock investor builds wealth.

Real estate investments include land, houses, apartment and office buildings and commercial complexes. Investors make money when the value of the land or the building increases in value.

401(k)s are pre-tax company-sponsored retirement plans belonging to employees. Many companies offer a percentage match of money contributed by the employee, making this an excellent option to invest. Note that there is no guaranteed return.

Roth IRAs are post-tax retirement accounts where money grows tax-free, making this another good option for investors to help grow their wealth. Note that there are contribution and withdrawal restrictions for both 401(k)s as well as Roth IRAs.

HSAs, or Health Savings Accounts, are hidden gems when it comes to investing, though they won’t be available to everyone. A health savings account is a pre-tax investment account used for qualified healthcare expenses. Contributions are generally not subject to federal income taxes and money grows tax-free. If you don’t use your HSA money for a medical expense by a certain age (in 2020, it was 65), withdrawals can be taken from the HSA without penalty.

Brokerage accounts are fully-managed accounts set up to allow individual investors to invest money in a variety of different stocks, bonds and mutual funds. These accounts are managed by the brokerage firm, but the money inside the brokerage account belongs to the investor.

Over time, investments tend to build wealth – though, no invest exists without a certain degree of risk.

Our investment playbook

My wife and I achieved financial freedom using 7 basic investment principles:

Technique #1: We always invested at least the company-sponsored match (which was generally 4%) into our pre-tax 401(k)s.

Technique #2: Toward the end of our full time working careers (the last two or three years), we maxed out both of our 401(k) and Roth IRA accounts.

Technique #3: We built an emergency savings account with several years of living expenses.

Technique #4: In addition to our 401(k) and Roth IRA investments at work, we invested post-tax income in a Vanguard brokerage account to further boost our investments.

Technique #5: We automated everything that we could, including our contributions into our 401(k) accounts.

Technique #6: We used a great online tool called Personal Capital to help keep track of our entire financial picture.

Technique #7: We began using credit cards with the highest cash back and travel rewards points to take full advantage of the money that we were already spending.

Step #3: Control your lifestyle

The last step is controlling your lifestyle so your monthly expenses do not get out of control.

Streamlining your lifestyle is a three step process.

Those steps are:

Know where your money is going,

Identify ways to reduce spending, and

Continuously monitor (ongoing)

The first step is the most important because without a good understanding of where our money is going, it's very difficult to pinpoint where we can cut back.

It's a tedious process, but go through your bank and credit card statements, line by line, to understand what you're spending money on.

Avoid lifestyle inflation

A lot of us struggle with lifestyle inflation.

We start making more money and, in turn, we begin spending the majority of what we earn – simply because we have it to spend.

The causes of lifestyle inflation include:

Earning progressively more money each year, with bonuses and raises, which provides us with extra cash to spend,

We fund expensive vacations and huge purchases with all that “extra” money that we make year-to-year,

Many work jobs that expect us to look successful, creating a wicked cycle of earn-and-spend (more on this below), and

We try to keep up with our coworkers by matching (or exceeding) their level of spending on luxury items

As our incomes increase, so do our lifestyles.

In 2015, for example, CNBC reported that millionaires plan to spend $13,000 on vacations – in that year alone!

What’s the problem with that? If we spend the majority of the money that we bring in, we trap ourselves into a position where we NEED a high income, year after year, just to maintain the lifestyle that we built over the previous year.

High spending habits force so many big salaried households into a destructive debt-focused lifestyle that needs a high income to fund.

What happens to our lifestyle after that income stops?

Understand every expense

Make sure that you understand every expense (many descriptions are cryptic!).

Some online banking systems will help you categorize expenses to give you a better visual picture of your expenses. If they help, play with some of those tools to assist you in this process going forward.

This is a critical component in controlling your lifestyle. And, this is not the time to be judgmental. In step 2, we will learn how to decide what expenses to cut out.

Here are two important tips to help you as you dive through your statements.

Look for recurring expenses. These might include subscriptions to magazines, or memberships to clubs or websites, your cable TV package or anything else that gets billed on a regular basis. Highlight these expenses because we will use these in the next step of the process.

Categorize everything. Putting each and every expense into a category will help you to visualize at a higher level what areas of your life are costing you the most money. For example, common expense categories include restaurants, alcohol, groceries, travel, fuel, clothing, automotive repairs, home repairs and improvements, etc.

How to figure out what to cut

Next, we figure out ways to slash our expenses. To do this, I like to ask several questions:

Am I reading every magazine that I subscribe to? Enjoying the wine from that club I'm in? What about Netflix?

Or, are my vacations getting a little out of control? Could I cut back on where I go or what I do while on vacation?

Can I cook a little more at home rather than going out to eat so often?

Can I wash my own car rather than running it through the car wash? Or, cut my own hair instead of going to a barber? Make my own coffee at home?

Only you can answer these questions, but they will help us determine what expenses to lose during this process.

The bottom line with this step: Understand where your money is going, then cut out anything that isn't critical to your life. Then, use this extra month to save and invest in appreciating assets. This is how money builds.

In Conclusion

Financial freedom is a simple equation, but it takes time to solve. Using smart money principles that utilize the true power of our income will enable more choices in our life because money is no longer the primary concern.

Money is a tool, and so is our income. Like a hammer, money can be used to build anything that we want.

We could use money to build a life full of consumption. We can buy the big house on the hill, or the pricey import luxury car, the expensive suits and nice dresses, dinners at high-priced restaurants, season tickets to sporting events, etc.

Alternatively, we could use that money to support the basic necessities of life and protect our futures, like living in a more reasonable home and driving a normal paid-off car, maintaining a 6-month emergency fund and investing the rest for our future retirement.

Or, something in-between.

Everybody’s money goal should be simple: use money strategically. Use enough money to maintain your family’s basic needs (and maybe a little more), then save and invest the remainder so you won’t need to spend the rest of your life working for the privilege of spending.

Saving and investing to achieve freedom from money is the smartest decision that anyone could ever make.

The post How Financial Freedom is Possible on Almost Any Income appeared first on Your Money Geek.

from Your Money Geek https://ift.tt/2SF6Mxa

via IFTTT

0 notes

Photo

New Post has been published here https://is.gd/VTqKev

The Crypto ‘Trichotomy’

This post was originally published here

Timothy Enneking is the founder and the primary principal of Digital Capital Management, LLC (DCM).

The crypto space ain’t what it used to be.

In the good old days when bitcoin was the only “cryptocurrency” around, life was much simpler. Then, a few other “currencies” came along, followed by ICOs and things rapidly got much more complex.

Somewhere along the line, folks started paying as much or more attention to the technology underlying bitcoin as to bitcoin itself. Distributed ledger technology (DLT) or the “blockchain” suddenly became household words (well, with slight exaggeration…).

In the roaring months of 2017, crypto pundits, analysts and funds developed various taxonomies of the rapidly diversifying crypto space: exchange tokens, utility tokens, payment tokens, asset-backed tokens, etc. (My personal favorite was Tetras Capital’s, but there were many.)

However, the blockchain and asset-backed tokens were still part and parcel of the crypto space. I believe that is no longer the case. In fact, I would argue that the crypto space has split into three different spaces (hence “trichotomy”) and that the term “crypto” no longer applies to all of them.

I label these three spaces “trading tokens,” “blockchain” and “asset-back tokens.” Except for the first, I realized that there’s nothing even vaguely innovative about the names. The most important takeaway is probably that the latter two (and certainly the last one) have nothing to do with what most people think of as “crypto.”

As for first, “trading token” is really a more accurate label for what most people refer to as “cryptocurrencies.”

The word “currency” was actually never really applicable to the technology. (In fact, I published an article on this very theme in July of 2017; “token” is much more appropriate. The word token is hardly new; it’s over 2,000 years old). We often forget where “token” came from in history: amusement parks, subways and, more recently, token rings, LANs, etc.

In IT, a “token” is basically an information packet which is optimized for transfer between computers. If someone feels (hopes) that the data packet has exogenous value, that person may try to sell it.

Others may feel a given token has no such value – even in an identical sector. (So, tZERO tries to sell its near-real-time trade settlement token, but NASDAQ does not.) Hence, the ICO was born. (For more on this topic, in particular on external drivers of price formation, see an article I wrote on that subject).

Of course, whether a crypto token is traded externally or not, it still relies on the blockchain (or a blockchain) or generally similar protocol consensus algorithm. Regardless, these mechanisms all record tokens’ existence, movements and changes. However, the growing percentage of blockchain projects (the largest of which may be the IBM-Maersk effort) do not rely on trading tokens.

This means that they have not identified an independent driver of price formation (among other things) for their token, but readily acknowledge the manifold advantages of the trust and reliability of DLT (blockchain) technology.

Because of this, most DLT investments must be made in seed/VC/PE (“early stage equity”) form, not in the form of trading tokens. This change radically affects the structure of, investment in and returns from (in terms of type, timing and amount) “ICO” (now “STO” or Security Token Offerings – and even the newer IEO or Initial Exchange Offering) v. “blockchain” projects.

So radically in fact, that the DLT/blockchain space is essentially totally separate from the trading token space. It’s the second prong of our crypto “trichotomy”. (And note that “crypto” no longer even really applies to this second space.)

The third space is asset-backed tokens.

This space is quite interesting because, in reality, tokenization is simply another form of securitization which has no inherent relationship to “crypto” per se. One could have tokenized (“atomized”) ownership in this fashion at any time in

the past and done so without the blockchain. The constraints weren’t legal – and, in fact, there might have been few or no constraints other than cost – but DLT certainly makes it easier and more viable.

Now we come to the truly interesting part: scale.

It seems quite clear that trading tokens will reach an aggregate value of single-digit trillions (in US dollars). In December of 2017, the total trading token space (as measured by market capitalization) reached about 80% of that level. It will probably reach it in 2020 or thereabouts. I have my doubts that it will ever (and if so, not soon), reach 11 digits (US$10 trillion or more).

The blockchain, however, seems destined to easily reach double-digit trillions in value. If one simply looks at the value of logistics chains being put on the blockchain, one reaches well over half of that value. The provenance of virtually every asset where determining provenance is important (from diamonds and art to wine and all types of collectibles) will easily put one over the top.

Adding financial transactions to the mix blows through 11 digits quite easily. Triple-digit trillions may be possible but, again, not any time soon, if ever.

Asset-back tokens – which, as you may recall, used to be a single, rather orphaned category of cryptocurrencies (orphaned because their value was actually tied to something while the value of other ICOs and tokens seemed to limited only by human imagination and foolishness) – may actually end up being the large of the three branches, easily reaching triple-digit trillions.

Real estate alone, much of which seems to be destined for the blockchain, hits that value. If a material portion of financial assets (securities of all types) come tokenized, it’s a no-brainer to reach 12 digits. And notice that one can discuss asset-backed tokens without ever once using the word “crypto.”

The child will clearly outgrow its parent.

The one potential flaw in the analysis is the potential for double counting between the second and third categories. Title to real estate (and probably all real estate) will almost certainly be recorded on the blockchain. Much (but not all) of it may also be tokenized. If we count the value of real estate in both categories, the second will, perforce, exceed the first.

In the end, it doesn’t really matter how the taxonomy is specifically developed, the main point is the same: “crypto” has already given rise to technology and concepts that are much bigger than “cryptocurrencies” ever were and it is probably impossible to overestimate the importance that the blockchain and the tokenization of real assets will have on our world – any negative connotation which “crypto” has picked up recently be damned.

Three crowns image via Shutterstock

#crypto #cryptocurrency #btc #xrp #litecoin #altcoin #money #currency #finance #news #alts #hodl #coindesk #cointelegraph #dollar #bitcoin View the website

New Post has been published here https://is.gd/VTqKev

0 notes

Text

The Crypto ‘Trichotomy’ – CoinDesk

Timothy Enneking is the founder and the primary principal of Digital Capital Management, LLC (DCM).

The crypto space ain’t what it used to be.

In the good old days when bitcoin was the only “cryptocurrency” around, life was much simpler. Then, a few other “currencies” came along, followed by ICOs and things rapidly got much more complex.

Somewhere along the line, folks started paying as much or more attention to the technology underlying bitcoin as to bitcoin itself. Distributed ledger technology (DLT) or the “blockchain” suddenly became household words (well, with slight exaggeration…).

In the roaring months of 2017, crypto pundits, analysts and funds developed various taxonomies of the rapidly diversifying crypto space: exchange tokens, utility tokens, payment tokens, asset-backed tokens, etc. (My personal favorite was Tetras Capital’s, but there were many.)

However, the blockchain and asset-backed tokens were still part and parcel of the crypto space. I believe that is no longer the case. In fact, I would argue that the crypto space has split into three different spaces (hence “trichotomy”) and that the term “crypto” no longer applies to all of them.

I label these three spaces “trading tokens,” “blockchain” and “asset-back tokens.” Except for the first, I realized that there’s nothing even vaguely innovative about the names. The most important takeaway is probably that the latter two (and certainly the last one) have nothing to do with what most people think of as “crypto.”

As for first, “trading token” is really a more accurate label for what most people refer to as “cryptocurrencies.”

The word “currency” was actually never really applicable to the technology. (In fact, I published an article on this very theme in July of 2017; “token” is much more appropriate. The word token is hardly new; it’s over 2,000 years old). We often forget where “token” came from in history: amusement parks, subways and, more recently, token rings, LANs, etc.

In IT, a “token” is basically an information packet which is optimized for transfer between computers. If someone feels (hopes) that the data packet has exogenous value, that person may try to sell it.

Others may feel a given token has no such value – even in an identical sector. (So, tZERO tries to sell its near-real-time trade settlement token, but NASDAQ does not.) Hence, the ICO was born. (For more on this topic, in particular on external drivers of price formation, see an article I wrote on that subject).

Of course, whether a crypto token is traded externally or not, it still relies on the blockchain (or a blockchain) or generally similar protocol consensus algorithm. Regardless, these mechanisms all record tokens’ existence, movements and changes. However, the growing percentage of blockchain projects (the largest of which may be the IBM-Maersk effort) do not rely on trading tokens.

This means that they have not identified an independent driver of price formation (among other things) for their token, but readily acknowledge the manifold advantages of the trust and reliability of DLT (blockchain) technology.

Because of this, most DLT investments must be made in seed/VC/PE (“early stage equity”) form, not in the form of trading tokens. This change radically affects the structure of, investment in and returns from (in terms of type, timing and amount) “ICO” (now “STO” or Security Token Offerings – and even the newer IEO or Initial Exchange Offering) v. “blockchain” projects.

So radically in fact, that the DLT/blockchain space is essentially totally separate from the trading token space. It’s the second prong of our crypto “trichotomy”. (And note that “crypto” no longer even really applies to this second space.)

The third space is asset-backed tokens.

This space is quite interesting because, in reality, tokenization is simply another form of securitization which has no inherent relationship to “crypto” per se. One could have tokenized (“atomized”) ownership in this fashion at any time in

the past and done so without the blockchain. The constraints weren’t legal – and, in fact, there might have been few or no constraints other than cost – but DLT certainly makes it easier and more viable.

Now we come to the truly interesting part: scale.

It seems quite clear that trading tokens will reach an aggregate value of single-digit trillions (in US dollars). In December of 2017, the total trading token space (as measured by market capitalization) reached about 80% of that level. It will probably reach it in 2020 or thereabouts. I have my doubts that it will ever (and if so, not soon), reach 11 digits (US$10 trillion or more).

The blockchain, however, seems destined to easily reach double-digit trillions in value. If one simply looks at the value of logistics chains being put on the blockchain, one reaches well over half of that value. The provenance of virtually every asset where determining provenance is important (from diamonds and art to wine and all types of collectibles) will easily put one over the top.

Adding financial transactions to the mix blows through 11 digits quite easily. Triple-digit trillions may be possible but, again, not any time soon, if ever.

Asset-back tokens – which, as you may recall, used to be a single, rather orphaned category of cryptocurrencies (orphaned because their value was actually tied to something while the value of other ICOs and tokens seemed to limited only by human imagination and foolishness) – may actually end up being the large of the three branches, easily reaching triple-digit trillions.

Real estate alone, much of which seems to be destined for the blockchain, hits that value. If a material portion of financial assets (securities of all types) come tokenized, it’s a no-brainer to reach 12 digits. And notice that one can discuss asset-backed tokens without ever once using the word “crypto.”

The child will clearly outgrow its parent.

The one potential flaw in the analysis is the potential for double counting between the second and third categories. Title to real estate (and probably all real estate) will almost certainly be recorded on the blockchain. Much (but not all) of it may also be tokenized. If we count the value of real estate in both categories, the second will, perforce, exceed the first.

In the end, it doesn’t really matter how the taxonomy is specifically developed, the main point is the same: “crypto” has already given rise to technology and concepts that are much bigger than “cryptocurrencies” ever were and it is probably impossible to overestimate the importance that the blockchain and the tokenization of real assets will have on our world – any negative connotation which “crypto” has picked up recently be damned.

Three crowns image via Shutterstock

This news post is collected from CoinDesk

Recommended Read

Editor choice

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

9.5

Demo & Pro Version Try It Now

Read full review

The post The Crypto ‘Trichotomy’ – CoinDesk appeared first on Click 2 Watch.

More Details Here → https://click2.watch/the-crypto-trichotomy-coindesk

0 notes