#2023 at 06:15PM

Text

Another international jaunt? How would his trip rate him? A look back at Travalyst before message dilution and ever increasing multinational corporation influence.

Another international jaunt? How would his trip rate him? A look back at Travalyst before message dilution and ever increasing multinational corporation influence.

https://ift.tt/PnQJDG1

Submitted June 06, 2023 at 06:15PM by QuesoFresca https://ift.tt/rVGON1u

via /r/SaintMeghanMarkle

#SaintMeghanMarkle#harry and meghan#meghan markle#prince harry#sussexes#markled#archewell#IFTTT#reddit QuesoFresca June 06#2023 at 06:15PM

0 notes

Link

★新商品★ キーボード/マウス エミュレータ(USB接続版) 【MR-CH9329EMU-USB】 接続先のパソコンからはUSBキーボード/マウスとして認識され、シリアル通信でデータを送信することでキーボードやマウスとしての機能を利用できます。 https://t.co/aFnYSmqWjc

— マルツ秋葉原本店 (@marutsu_AKIBA) Mar 12, 2023

0 notes

Text

Washington State's capital gains tax proves we can have nice things

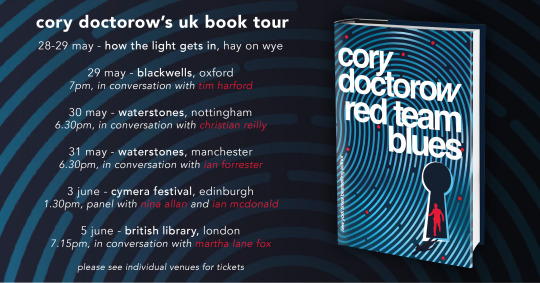

Today (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Washington State enacted a 7% capital gains tax levied on annual profits in excess of $250,000, and made a fortune, $600m more than projected in the first year, despite a 25% drop in the stock market and blistering interest rate hikes:

https://www.theurbanist.org/2023/06/01/lessons-from-washington-states-new-capital-gains-tax/

Capital gains taxes are levied on “passive income” — money you get for owning stuff. The capital gains rate is much lower than the income tax rate — the rate you pay for doing stuff. This is naked class warfare: it punishes the people who make things and do things, and rewards the people who own the means of production.

The thing is, a factory or a store can still operate if the owner goes missing — but without workers, it shuts down immediately. Everything you depend on — the clothes on your back, the food in your fridge, the car you drive and the coffee you drink — exists because someone did something to produce it. Those producers are punished by our tax system, while the people who derive a “passive income” from their labor are given preferential treatment.

The Washington State tax is levied exclusively on annual gains in excess of a quarter million dollars — meaning this tax affects an infinitesimal minority of Washingtonians, who are vastly better off than the people whose work they profit from. Most working Americans own little or no stock, and the vast majority of those who do own that stock in a retirement fund that is sheltered from these taxes.

(Sidebar here to say that market-based pensions are a scam, a way to force workers to gamble in a rigged casino for the chance to enjoy a dignified retirement; the defined benefits pension, combined with adequate Social Security, is the only way to ensure secure retirement for all of us)

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

Washington’s tax was anticipated to bring in $248m. Instead, it’s projected to bring in $849m in the first year. Those funds will go to public school operations and construction and infrastructure spending:

https://www.seattletimes.com/seattle-news/politics/was-new-capital-gains-tax-brings-in-849-million-so-far-much-more-than-expected/

That is to say, the money will go to ensuring that Washingtonians are educated and will have the amenities they need to turn that education into productive work.

Washington State is noteworthy for not having any state personal or corporate income tax, making it a haven for low-tax brain-worm victims who would rather have a dead gopher running their states than pay an extra nickel in taxes. But places that don’t have taxes can’t fund services, which leads to grotesque, rapid deterioration.

Washington State plutes moved because they relished living in well-kept, cosmopolitan places with efficient transportation, an educated workforce, good restaurants and culture — none of which they would have to pay for. They forgot Karl Marx’s famous saying: “There’s no such thing as a free lunch.”

The idea that Washington could make up for the shortfalls that come from taxing its wealthiest residents by levying regressive sales taxes and other measures is mathematically illiterate wishful thinking. When the one percent owns nearly everything, you can tax the shit out of the other 99% and still not make up the shortfall.

Meanwhile: homelessness, crumbling roads, and crisis after crisis. Political deterioration. Cute shopping neighborhoods turn into dollar store hellscapes because no one can afford to shop for nice things because all their income is going to plug the gaps in health, education, transport and other services that the low-tax state can’t afford.

Washington State’s soak-the-rich tax is ironic, given the propensity of California’s plutes to threaten to leave for Washington if California finally passes its own extreme wealth tax.

There’s a reason all these wealthy people want to live in California, Washington, New York and other states where there’s broad public support for taxing the American aristocracy: states with rock-bottom taxes are failed states. All but two of America’s “red states” are dependent on transfers from the federal government to stay in operation. The two exceptions are Texas, whose “free market” grid is one nanometer away from total collapse, and Florida, which is about to slip beneath the rising seas it denies.

Rich people claim they’d be happy to live in low-tax states, and even tout the benefits of a desperate workforce that will turn up to serve drinks at their country clubs even as a pandemic kills them at record rates. But when the chips are down, they don’t want to depend on a private generator to keep the lights on. They don’t want to have to repeatedly replace their luxury cars’ suspension after it’s wrecked by gaping potholes. They don’t want to have to charter a jet to fly their kids out of state to get an abortion.

This is true globally, too. As Thomas Piketty pointed out in Capital in the 21st Century, if the EU and OECD created a wealth tax, the rich could withdraw to Dubai, the Caymans and Rwanda, but they’d eventually get sick of shopping for the same luxury goods in the same malls guarded by the same mercenaries and want to go somewhere, you know, fun:

https://memex.craphound.com/2014/06/24/thomas-pikettys-capital-in-the-21st-century/

We’re told that Americans would never stand for taxing the ultra-rich because they see themselves as “temporarily embarrassed millionaires.” It’s just not true: soak-the-rich policies are wildly popular:

https://balanceourtaxcode.com/wp-content/uploads/2023/02/WA-State-Wealth-Tax-Poll-Results-3.pdf

The Washington tax windfall is fascinating in part because it reveals just how rich the ultra-rich actually are. Warren Buffett says that “when the tide goes out, you learn who’s been swimming naked.” But Washington’s new tax is a tide that reveals who’s been swimming with a gold bar stuck up their ass.

It’s not surprising, then, that Washingtonians are so happy to tax their one percenters. After all, this is the state that gave us modern robber barons like Bill Gates and Jeff Bezos. And then there’s clowns like Steve Ballmer, star of Propublica’s IRS Files, the man whose creative accounting let him claim $700m in paper losses on his basketball team, allowing him to pay a mere 12% tax on $656m in income, while the workers who made his fortune on the court paid 30–40% on their earnings.

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

Ballmer’s also a master of “tax loss harvesting,” who has created paper losses of over $100m, letting him evade $138m in federal taxes:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

These guys aren’t rich because they work harder than the rest of us. They’re rich because they profit from our work — and then, to add insult to injury, pay little or no taxes on those profits.

Washington’s lowest income earners pay six times the rate of tax as the state’s richest people. When the wealthy squeal that these taxes are class warfare, they’re right — it is class war, and they started it.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/03/when-the-tide-goes-out/#passive-income

[Image ID: The Washington State flag; the circular device featuring George Washington has been altered so that it is now the head of a naked man clothed in a barrel with two wide leather shoulder straps.]

#pluralistic#steve ballmer#irs files#washington state#soak the rich#capital gains#taxes class war#euthanasia of the rentier

425 notes

·

View notes

Text

Draco's Christmas Gift

Draco's Christmas Gift

https://ift.tt/KHcG0kZ

by Miss_Dementor

The gift wrapped in a red ribbon is waiting for Draco 🔥

Words: 0, Chapters: 1/1, Language: English

Fandoms: Harry Potter - J. K. Rowling

Rating: Not Rated

Warnings: Creator Chose Not To Use Archive Warnings

Categories: F/M

Characters: Hermione Granger, Draco Malfoy

Relationships: Hermione Granger/Draco Malfoy

Additional Tags: Christmas, Christmas Presents, Smut, Light BDSM, Art, NSFW Art, dom!draco, Dom/sub

via AO3 works tagged 'Hermione Granger/Draco Malfoy' https://ift.tt/Xr2kIt4

December 04, 2023 at 06:15PM

3 notes

·

View notes

Text

Sunday, August 06, 2023 Canadian TV Listings (Times Eastern)

WHERE CAN I FIND THOSE PREMIERES?:

STELLAR GOSPEL MUSIC AWARDS (BET Canada) 8:00pm

WINNING TIME: THE RISE OF THE LAKERS (HBO Canada) 9:00pm

THE CHI (Crave) 9:00pm

WHAT IS NOT PREMIERING IN CANADA TONIGHT?:

EVIL LIVES HERE (TBD - Investigation Discovery)

WORST COOKS IN AMERICA (TBD - Makeful)

NEW TO AMAZON PRIME CANADA/CBC GEM/CRAVE TV/DISNEY + STAR/NETFLIX CANADA:

CRAVE TV

WINNING TIME: THE RISE OF THE LAKERS DYNASTY (Season 2 Premiere)

FIFA WOMEN’S WORLD CUP SOCCER

(TSN/TSN4/TSN5) 4:45am: Round of 16: Sweden vs. United States

MLB BASEBALL

(SN) 1:30pm: Jays vs. Red Sox

(SN Now) 1:30pm: Astros vs. Yankees

(SN1) 4:00pm: Mariners vs. Angels

(TSN5) 7:00pm: Dodgers vs. Padres

WNBA BASKETBALL (TSN3/TSN4) 3:00pm: Aces vs. Liberty

CFL FOOTBALL (TSN/TSN3) 7:00pm: Redblacks vs. Roughriders

CEBL BASKETBALL

(TSN4) 7:00pm: Eastern Conference Semifinal - Scarborough Shooting Stars vs. Ottawa BlackJacks

(TSN4) 9:00pm: Western Conference Semifinal - Edmonton Stingers vs. Calgary Surge

THE GREAT BRITISH BAKING SHOW (CBC) 7:00pm: Oh Lordy, it’s the infamous Mexican Week. A shocking decision awaits the bakers as they prepare perfectly puffy pan dulce, steak tacos with from-scratch tortillas and an airy tres leches cake.

RACE AGAINST THE TIDE (CBC) 8:30pm: Group 2 is back on the beach and five teams remain; they must make fantasy a reality if they want to stay in the competition.

MOONSHINE (CBC) 9:00pm: Lidia is evicted from the Moonshine grounds as Wes asks her to revise the rendering for the resort.

WHEN CALLS THE HEART (Super Channel Heart and Home) 9:00pm: Everyone is buzzing with talk of the hot springs and how they will help the town; Elizabeth and Lucas host Aunt Agatha and Julie on an interesting visit to Hope Valley.

ORIGINS OF HIP-HOP (Starz Canada) 9:00pm/9:45pm/10:30pm/11:15pm (SERIES PREMIERE): Fat Joe/Busta Rhymes/Ja Rule/Eve

DARK NATURE (Super Channel Fuse) 9:00pm: Joy, a survivor of domestic violence, joins her friend and her therapy group for an isolated weekend retreat in the Canadian Rockies. Soon, the entire group must confront a threat even more terrifying than the monsters of their past.

WE'RE ALL GONNA DIE (EVEN JAY BARUCHEL) (Discovery Canada) 10:00pm/10:30pm (SERIES PREMIERE): Could an asteroid destroy the world? Jay meets with experts including the Planetary Defense Officer at NASA to find out if “we’re all gonna die.” In Episode 2, Jay learns that, far from being a relic of the Cold War, nuclear Armageddon is as big a threat as ever.

#cancon#cdntv#canadian tv#canadian tv listings#the great british baking show#race against the tide#moonshine#when calls the heart#we're all gonna die (even jay baruchel)#fiba world cup soccer#mlb baseball#wnba basketball#cfl football#cebl basketball

2 notes

·

View notes

Text

You were always in love

You were always in love

https://ift.tt/awMl4UD

by disfanatic10

One night he wakes

Strange look on his face

Pauses, then says

You're my best friend

And you knew what it was

He is in love

If only Dean had been able to say it.

Words: 1217, Chapters: 1/1, Language: English

Series: Part 6 of Supernatural songfics

Fandoms: Supernatural (TV 2005)

Rating: Teen And Up Audiences

Warnings: Creator Chose Not To Use Archive Warnings

Categories: M/M

Characters: Dean Winchester, Castiel (Supernatural), Sam Winchester, Charlie Bradbury

Relationships: Castiel/Dean Winchester

Additional Tags: Song: You Are In Love (Taylor Swift), Emotionally Hurt Dean Winchester, Canon Compliant with Episode: s15e18 Despair (Supernatural), Episode Fix-It: s15e20 Carry On (Supernatural)

via AO3 works tagged 'Castiel/Dean Winchester' https://ift.tt/ThycZs0

June 13, 2023 at 06:15PM

#IFTTT#AO3 works tagged 'Castiel/Dean Winchester'#Destiel#ao3feed#ao3feed Destiel#Destiel fanfic#Dean Winchester/Castiel#Castiel/Dean Winchester#Dean x Castiel#Castiel x Dean

2 notes

·

View notes

Text

Captain Ruggels Gaming - Is it Really Worth $44.99? | 7 Days To Die

06/29/2023 – 07:15pm EST

Tonight we Continue Play the 1.0 Experimental Build for 7 Days To Die before they up the Price to $44.99… We are NON-PAID-SHILL streaming tonight because you will get honest opinions from us.

Thank you for watching! Please be sure to Like, Subscribe & Comment down below.

Captain Ruggels loves gaming, plays all sorts of game types and Genres but mainly FPS Games and…

0 notes

Text

速報:(December 26 2023 at 06:15PM)

【速報】岸田首相は内外情勢調査会での講演で、自民党派閥の問題を受け「通常国会で信頼回復のために議論できるよう、新しい組織で議論を進める」と述べた https://t.co/sSzxHq3yQU

0 notes

Text

Antonio Velardo shares: Substack Says It Will Not Ban Nazis or Extremist Speech by Eduardo Medina

By Eduardo Medina

Responding to criticism of its hands-off approach to content moderation, the company said it would not ban Nazi symbols or extremist rhetoric so long as newsletter writers do not incite violence.

Published: December 22, 2023 at 06:15PM

from NYT Business https://ift.tt/5xSEUW0

via IFTTT

View On WordPress

0 notes

Text

Korn Ferry posts Q2 loss with fee revenue decline

Korn Ferry posts Q2 loss with fee revenue decline By Investing.com

Breaking News

More

Sign In/Free Sign Up

0

‘;

EditorHari GStock Markets

Published Dec 06, 2023 10:15PM ET

© Reuters.

LOS ANGELES – Korn Ferry (NYSE:KFY), a global organizational consulting firm, has reported a challenging second quarter for fiscal year 2024, with fee revenues falling by 3% year-over-year (YOY) to $704…

View On WordPress

0 notes

Text

The Duke tells the court that he doesnt believe reporting about his broken thumb is in the public interest. But telling us about your frozen todger at your brother's wedding is? FFS

The Duke tells the court that he doesn’t believe reporting about his broken thumb is “ in the public interest”. But telling us about your frozen todger at your brother's wedding is? FFS🍆🧊

Dear Oh Dear,less than 2 hours in and so much gold from this dimwit... I literally can't anymore, god knows what it will be like by the end of the day...last piece from me, I'm saving my brain from anymore of the idiot princes utterings..'I don't walk down streets'Prince Harry’s cross-examination by Andrew Green KC, representing the Mirror publisher, has now turned to the third article in his claim against the three titles. The article in the Daily Mirror, titled ‘3am - Harry’s time at the bar’ (Sept 19 2000), about Prince Harry’s birthday celebrations which he claims divulges private information regarding his personal life, including his whereabouts at a lunch in Chelsea, London, to celebrate his birthday with friends. Mr Green points out that Sunday lunchtime on Fulham Road is a “busy time” and that people may have seen Prince Harry walking down the street. “No, I don’t walk down streets,” the Duke responds.

Submitted June 06, 2023 at 01:15PM by Which-Homework2453 https://ift.tt/Zya52l4

via /r/SaintMeghanMarkle

#SaintMeghanMarkle#meghanmarkle#princeharry#sussexes#markled#IFTTT#reddit Which-Homework2453 June 06#2023 at 01:15PM

0 notes

Link

開発者・エンジニアのためのドキュメント術をまとめた "Docs for Developers" の翻訳書籍である、 "ユーザーの問題解決とプロダクトの成功を導く エンジニアのためのドキュメントライティング" が3月11日に発売されます!(予約可能になりました!) https://t.co/Nd0y5hgPYM

— iwashi / Yoshimasa Iwase (@iwashi86) Feb 22, 2023

0 notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

"Keep it. It looks better on you."

"Keep it. It looks better on you."

https://ift.tt/BSpPCa0

by aCanadianMuggle

Random Dialogue Challenge.

Words: 543, Chapters: 1/1, Language: English

Fandoms: Harry Potter - J. K. Rowling

Rating: Teen And Up Audiences

Warnings: No Archive Warnings Apply

Categories: F/M

Characters: Hermione Granger, Draco Malfoy

Relationships: Hermione Granger/Draco Malfoy

Additional Tags: Morning After, Regret, Prompt Fic, Dirty Little Secret, Auror Draco Malfoy

via AO3 works tagged 'Hermione Granger/Draco Malfoy' https://ift.tt/tRw02Um

August 06, 2023 at 05:15PM

2 notes

·

View notes

Text

Right By Your Side

by, Carestipated

by Carestipated

Katherine has been ill for several days and Jack is getting worried. After an awkward visit from a local doctor, she is diagnosed with constipation. Katherine feels embarrassed and disgusting but Jack is right there by her side to take care of her until she feels better.

Words: 2053, Chapters: 1/1, Language: English

Fandoms: Newsies!: the Musical - Fierstein/Menken

Rating: Teen And Up Audiences

Warnings: No Archive Warnings Apply

Categories: F/M

Characters: Jack Kelly (Newsies), Katherine Plumber Pulitzer

Relationships: Jack Kelly/Katherine Plumber Pulitzer

Additional Tags: Sickfic, Hurt/Comfort, Established Relationship, Non-Sexual, Caretaking, Stomach Ache, stomach rubs, Constipation, Fluff, Angst, Doctor - Freeform, Medical Procedures, rectal thermometer, No Sex, pooping, shitting, Bodily Functions, Helping someone poop, Whump, Mild Humiliation, Pain, Crying, Sick Character, constipated, Hurt, Comfort, Fluff and Angst, Tummy Ache, belly ache, Tummy rubs, Belly Rubs, Back rubs, Canon Compliant, Post-Canon, One Shot, Happy Ending

read : https://ift.tt/E7BKtDY - December 06, 2023 at 06:15PM

0 notes