#3D Sensor Array Market

Explore tagged Tumblr posts

Text

3D Sensor Array Market

0 notes

Text

0 notes

Text

Flip Chip Market Progresses for Huge Profits During 2027

Allied Market Research, titled, “Flip Chip Market by Packaging Technology, Bumping Technology, and Industry: Opportunity Analysis and Industry Forecast, 2020–2027,” the flip chip market size was valued at $24.76 billion in 2019, and is projected to reach $39.67 billion by 2027, growing at a CAGR of 6.1% from 2020 to 2027.

Increase in demand for high speed and compact size electronic products has boosted the adoption of flip chip technology in the electronic industry. Internet of Things (IoT) has been gaining popularity, and serves as a key driver of the market. Products used in IoT, such as sensors & actuators, analog & mixed-signal translators, and microcontrollers or embedded processors require efficient and reliable packaging solutions, which can be done using flip chips.

In comparison to customary wire-bond packaging, flip chip offers various benefits such as, superior thermal & electrical performance, substrate flexibility for varying performance requirements, remarkable I/O capability, reduced form factors, and well-established process equipment expertise. Gold bumping technology contributes the second largest share in overall flip chip market. The gold bumping segment is expected to witness sluggish growth rate as compared to other bumping technologies, owing to its high manufacturing cost, fragile construction, and complexities involved in bumping process. In addition, improved heat dissipation of ball grid array type flip chips makes them suitable choice in applications where smaller size chips are preferred without the need for external heat sink.

The solder bumping technology segment garners the third largest share in the global flip chip market. This is attributed to low cost of solder bumping technology and considerably improved bonding efficiency. The rapid downfall of tin lead eutectic solder is attributed by the collective oppose of the usage of lead across the globe, owing to its severe threat to environment. Moreover, being an old technology, it is currently being used in most of the flip chip fabrication. However, its growth rate is expected to decline, due to implementation of government regulations, which restrict the usage of lead in chips due to its hazardous effects to environment.

Flip chip possess the potential to reduce size, weight, and thickness of circuits and increase their signal power and high I/O count, owing to its substantially high spectrum bandwidth and enhanced electrical, thermal, and mechanical properties. The 2.5D IC packaging technology poses several challenges, such as lack of foundries and assembly houses which is supported by 3D IC packaging technology. Thus, flip chip technology have witnessed unawareness of cost-effectiveness & improved performances, which could hamper its adoption in the manufacturing industry.

Asia-Pacific region dominates the flip chip market in terms of number of manufacturer and in terms of consumers. In 2019, reduction in China’s supply chain significantly impacted on companies across the globe and disrupted the electronics value chain. The outbreak of corona virus constrained governments across the globe to force lockdown initiatives which halted many production facilities operations which in tun disrupted the worldwide economy at a significant extent. Moreover, industries such as manufacturing and construction across the globe have witnessed shortage of labors and various hardware components from supplier side. This hindered the market growth to a certain extent, but is further expected to adjust the growth of flip chip market in the coming years.

Key Findings Of The Study

By packaging technology, the 2.5D IC segment dominated the flip chip market growth. However, the 2D IC segment is expected to exhibit significant growth during the forecast period.

Depending on bumping technology, the copper pillar segment led the flip chip market share in 2019. However, the gold bumping segment is expected to display highest growth during the forecast period.

On the basis of industry, the electronics segment witnessed significant growth in the flip chip market trends. However, the IT & telecommunication segment is anticipated to dominate the market during the forecast period in the industry.

Region wise, Asia-Pacific dominated the flip chip market size in 2019. However, North America is expected to witness significant growth in terms of revenue in the coming years owing to high demand for smart electronics in this region.

Some of the key market players profiled in the flip chip industry include 3M, AMD, Inc., Amkor Packaging Technology, Inc., Apple, Inc., Fujitsu Ltd, IBM Corporation, Intel Corporation, Samsung electronics Co., Ltd, TSMC, Ltd,, and Texas Instruments, Inc. Major players operating in this market have witnessed significant adoption of strategies such as business expansion and partnership to reduce supply and demand gap. With the increase in digitalization initiatives and industry revolution across the globe, major players have collaborated on their product portfolio to provide differentiated and innovative products.

0 notes

Text

0 notes

Text

Advanced Orthopedic Technologies Market

The global Advanced Orthopedic Technologies Market was valued at USD 62.9 billion in 2024 and is projected to surpass USD 148.5 billion by the end of 2037. The market is poised to advance at a steady compound annual growth rate (CAGR) surpassing 6.9% between 2025 and 2037, reflecting sustained momentum driven by innovation and rising global demand. This robust growth trajectory is underpinned by increasing demand for technologically advanced orthopedic solutions driven by aging demographics, rising joint disorders, and the adoption of robotics and AI-based tools in orthopedic surgery.

Advanced Orthopedic Technologies Industry Demand

The Advanced Orthopedic Technologies Market encompasses a wide array of innovative medical technologies and devices designed to diagnose, treat, and rehabilitate conditions affecting the musculoskeletal system. These include robotic-assisted surgical platforms, AI-powered planning tools, 3D-printed implants, orthobiologics, and smart prosthetics, all of which aim to enhance surgical precision, improve patient outcomes, and reduce recovery time.

Demand drivers for these technologies include:

Cost-effectiveness: Advanced devices often reduce post-operative complications and hospital readmissions, making them economically viable in the long term.

Ease of administration: Innovations such as minimally invasive implants and user-friendly navigation systems streamline both surgery and post-operative care.

Long shelf life and durability: Modern implants and devices are made with highly durable materials, reducing the need for revision surgeries.

Growing elderly populations, rising sports-related injuries, and increased preference for outpatient orthopedic procedures further accelerate demand.

Request Sample@ https://www.researchnester.com/sample-request-7703

Advanced Orthopedic Technologies Market: Growth Drivers & Key Restraint

Growth Drivers –

· Technological Advancements: The integration of robotics, AI, and 3D printing into orthopedic workflows enhances surgical precision and customization of implants, offering significant clinical and economic benefits.

· Rising Prevalence of Musculoskeletal Disorders: Chronic orthopedic conditions like osteoarthritis and osteoporosis are surging globally due to sedentary lifestyles and aging populations, driving up the demand for advanced orthopedic interventions.

· Shift Toward Outpatient Surgical Models: With increasing focus on ambulatory surgical centers (ASCs) and daycare orthopedic procedures, the demand for compact, efficient, and easy-to-operate orthopedic systems has seen considerable growth.

Restraint –

High Initial Capital and Regulatory Burdens: Advanced orthopedic technologies require significant investment in equipment, training, and certification, creating entry barriers for smaller healthcare providers, especially in emerging economies.

Advanced Orthopedic Technologies Market: Segment Analysis

By Application:

Osteoarthritis: The leading application due to high prevalence in aging populations; driving demand for joint replacements and robotic surgeries.

Sports Injuries: Rising among younger demographics, fueling innovation in arthroscopic devices and bracing systems.

Trauma & Fractures: Strong demand for trauma fixation devices and orthopedic navigation systems.

Rheumatoid Arthritis: Niche but expanding application area benefiting from biologics and regenerative therapies.

Pediatric Orthopedics: Requires specialized, size-appropriate technologies, gaining traction in developed healthcare systems.

By Product:

Implants: Representing the core of the market, implants are increasingly personalized through 3D printing and smart sensors.

Surgical Devices: Robotic and navigation systems are rapidly becoming standard in joint and spine procedures.

Orthobiologics: Gaining favor due to their regenerative capabilities and compatibility with minimally invasive techniques.

Trauma Fixation: Trauma Fixation is steadily advancing with innovations in internal and external device technologies.

Prosthetics: Modern prosthetics integrate AI and sensors to enhance user mobility and adaptability.

Braces & Supports: It offer an affordable, preventive aid ideal for sports injuries and post-surgical recovery.

By End User:

Hospitals: Continue to dominate due to comprehensive infrastructure and skilled professionals.

Ambulatory Surgical Centers (ASCs): Experiencing rapid growth due to reduced procedural costs and patient preference for same-day discharge.

Specialty Clinics: Focused on specific orthopedic interventions; increasingly adopting portable surgical systems and digital imaging solutions.

Advanced Orthopedic Technologies Market: Regional Insights

North America:

North America leads the global market, fueled by high healthcare spending, favorable reimbursement policies, and early adoption of robotic surgery and AI in orthopedics. Strong R&D pipelines and the presence of key market players further accelerate regional growth.

Europe:

Europe maintains a solid share due to increasing orthopedic procedures, aging population, and government initiatives to upgrade hospital infrastructure. Germany, the UK, and France are particularly focused on adopting sustainable and personalized orthopedic technologies.

Asia-Pacific (APAC):

APAC is emerging as the fastest-growing region owing to rising healthcare investments, growing medical tourism, and increasing awareness of advanced surgical options. Countries like India, China, and South Korea are seeing rapid uptake of robotic surgery and local production of cost-effective implants.

Top Players in the Advanced Orthopedic Technologies Market

Leading companies in the Advanced Orthopedic Technologies Market include Stryker Corporation, Zimmer Biomet, Johnson & Johnson (DePuy Synthes), Medtronic, Smith & Nephew, Siemens Healthineers, B. Braun, DJO Global, Exactech, Corin Group, Meril Life Sciences, Corentec, Orthocell, Osteopore, and FH Orthopedics. These firms are actively innovating across domains such as robotic-assisted surgeries, AI-powered imaging, 3D-printed implants, biologics, and next-gen prosthetics to expand their global footprint and cater to evolving clinical needs.

Access Detailed Report@ https://www.researchnester.com/reports/advanced-orthopedic-technologies-market/7703

Contact for more Info:

AJ Daniel

Email: [email protected]

U.S. Phone: +1 646 586 9123

U.K. Phone: +44 203 608 5919

0 notes

Text

Empowering Filmmakers with Volumetric Magic

Filmmaking stands at the precipice of an exciting new creative era, propelled by the swift advances in volumetric capture technology. As we traverse 2025, filmmakers from Hollywood to the indie scene are redefining what audiences expect from visual narratives. Now, volumetric capture is no longer restricted to high-budget studios—creators worldwide can engage viewers in stories with a depth previously thought impossible. This post seeks to spark your creativity and offers insights into mastering these innovative tools and techniques—regardless of your production's size.

Understanding Volumetric Video: Crafting the Film Industry's Future

Volumetric video is reshaping cinema's foundational language. Instead of capturing scenes through traditional flat perspectives, this technology records entire environments in three dimensions, including actors, settings, and real objects. The outcome? Audiences are now able to navigate a scene, change perspectives instantly, and enjoy a presence that transcends the limitations of classic filmmaking. This evolution gives filmmakers unprecedented freedom in post-production, such as editing from any viewpoint, creating new shots from digital sets, or reimagining scenes without the need for expensive re-shooting.

It begins with an array of synchronized cameras working alongside advanced depth sensors, collecting vast amounts of data from all angles. This information is assembled into exceptionally detailed 3D models, capturing everything from light and texture to an actor’s subtlest expression change. When compressed, the result is "six degrees of freedom"—the capability to walk, lean, and look around as if physically present. For creators, this means scenes can dwell indefinitely in a digital realm, ready to be transformed or expanded at any moment.

These advancements echo in the industry's notable growth. In 2024, the volumetric video market hit $2.82 billion, and it's projected to rise to $3.58 billion by 2025. Predictions for the decade suggest a climb to about $11 billion annually. Beyond filmmaking, volumetric capture is revolutionizing live concerts, sports, museums, education, healthcare, and branded experiences. At its core, it's a tool empowering innovators to deliver mesmerizing stories and forge deeper emotional connections with audiences like never before.

Virtual Production and Wall-less Techniques: Breaking All Boundaries

Virtual production has rapidly evolved from a sophisticated Hollywood asset to an everyday tool accessible to creators globally. No longer confined to LED volumes and expensive studio setups, filmmakers in 2025 benefit from “wall-less” virtual production. Innovative software and portable devices now enable creators to integrate live actors into digital realms, blend real and virtual elements in real time, and craft complex scenes—all at a fraction of the traditional expense.

Highlights from the 2025 NAB Show demonstrated the mainstream adoption of technologies like real-time splat scanning and iPhone camera tracking, enabling independent filmmakers and small studios to inject big-budget creative energy into streamlined productions. With the widespread application of economical game engines like Unreal, cloud-based volumetric video platforms, and consumer depth-sensing cameras, creators in remote areas or with limited budgets can collaborate and compete alongside established studios.

This democratization allows any filmmaker to create immersive effects that were once exclusive to high-budget movies. Indie studios are utilizing mobile setups, virtual greenscreens, and even image-to-3D conversion tools to bridge story gaps, extend sets, and salvage scenes without extensive reshoots or costly location fees. Collaboration is now easier than ever, with access to professional volumetric studios on a pay-as-you-go basis and cloud-based processing delivering finished 3D footage directly to your inbox.

Immersion and Interactivity: Ushering in a New Storytelling Era

What distinctly sets volumetric video apart is its ability to merge digital enchantment with human performance, paving the way for dynamic, transformative narratives. Unlike traditional films or even CGI, volumetric capture records live performances with vivid detail, preserving every gesture, expression, and interaction’s subtlety. Directors can then re-envision scenes, shifting viewpoints or blending live and animated elements to match evolving creative visions—without the need for costly re-shoots.

Envision taking your audience through winding city streets with your characters, soaring above during a climactic battle, or replaying a conversation from the villain’s perspective. Volumetric video allows this dimensional adaptability, enabling viewers to immerse themselves and explore narrative spaces in unprecedented ways.

Major venues are already harnessing this capability. The Sphere in Las Vegas captivates audiences with 360° visual experiences, enveloping visitors in seamless worlds of music, storytelling, and spectacle. Cosm’s shared reality domes deliver 12K LED immersion, while Universal Orlando’s 2025 Epic Universe debut includes rides like the Harry Potter Battle that redefine “immersion.” Each headline act is a beacon for the creative potential now reachable by everyone—not just theme parks, but also for short films, VR art pieces, and independent experiences globally.

Beyond large-scale attractions, numerous smaller projects employ the same tools. Animators combine hand-drawn characters with real-world set scans. Documentary filmmakers recreate lost worlds or vivify interviews into interactive life. As the boundary between reality and digital space blurs, artists find countless new ways to make their creations surprising and emotionally impactful.

Action Steps: How Any Filmmaker Can Embrace Volumetric Capture

The most significant shift for 2025? These impressive capabilities are now within reach for everyone. Here's how filmmakers from any background can join the movement:

Start Small, Experiment Often Test volumetric features affordably using popular smartphone apps or consumer 3D cameras. Acquire tools like the iPhone-based trackers highlighted at NAB 2025, which often replicate the best aspects of large studios through smart, cost-effective software.

Add Virtual Production to Your Workflow Explore “wall-less” methods, such as combining greenscreen footage with digital worlds via a game engine in your home studio. Utilize image-to-3D tools to construct or modify digital environments, recover lost locations, or create new settings—all without hefty reshoots.

Leverage the Cloud Achieving professional quality doesn’t require a large infrastructure. Cloud-based volumetric platforms allow you to upload footage from anywhere and receive polished 3D content ready for editing, regardless of where you capture it.

Integrate Real-Time AI Real-time AI is enhancing creativity, enabling instant previews for color grading, virtual camera movements, or set alterations. Recently introduced AI-driven video cameras offer immediate VFX previews and enhancement, allowing rapid iteration and reducing post-production uncertainty.

Build Partnerships and Collaborate Engage with emerging volumetric studios, many of which now provide flexible, project-based pricing or starter packages for smaller teams. These partnerships accelerate creative experimentation, disseminate new best practices, and aid in establishing standards for all.

Looking ahead, expect even quicker capture hardware, clearer, more compact files, and economical cameras making volumetric production standard practice. Strategic collaborations with artists across music, dance, education, or exhibitions will set new immersive event and installation benchmarks, pushing imagination's boundaries further.

Keep an eye on new industry standards that are alleviating workflow challenges. Soon, creating cross-platform and cross-venue experiences—from real-time volumetric streaming to virtual collaboration environments—will become as straightforward as joining a live video call.

For those ready to learn and adapt, the creative landscape is opening up at an unprecedented pace. Whether your goal is producing thrilling action epics, captivating VR meditations, interactive documentaries, or merely venturing into unexplored creative territories, now is the opportune time to begin.

Today’s audiences crave not just to watch—but to enter—your story. Visionary filmmakers, regardless of budget, are already crafting those “living” narratives using volumetric video. By adopting these accessible technologies, your craft can transcend the frame, enabling viewers to feel, remember, and navigate through your stories in ways never before conceivable.

Whether your journey begins in a bedroom studio, community theater, budding boutique agency, or a Hollywood backlot—these tools are intended for everyone. The future of film isn’t about avoiding mistakes or emulating industry giants. It’s about discovering your unique visual language, establishing deep connections with audiences, and redefining storytelling for this innovative era. By mastering volumetric capture, you not only transform your filmmaking process—you expand the realm of possibilities for all.

#volumetric #filmmaking #immersion #technology

See volumetric capture in action with Kvibe: https://www.kvibe.com

0 notes

Text

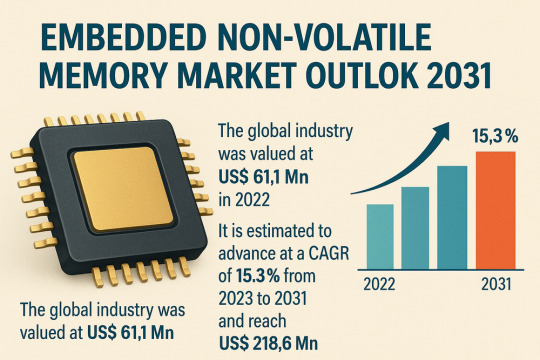

Embedded Non-volatile Memory Market to Hit $218.6 Million by 2031: What's Driving the Growth?

The global Embedded Non-volatile Memory (eNVM) market was valued at USD 61.1 million in 2022 and is projected to expand at a CAGR of 15.3% between 2023 and 2031, reaching USD 218.6 million by the end of 2031. Embedded NVM refers to non-volatile storage integrated directly into semiconductor chips, retaining data even when the system is powered off. Its core applications include firmware storage, calibration data retention, and secure configuration storage in microcontrollers, digital signal processors, and a wide array of embedded systems.

Market Drivers & Trends

Smartphone and Wearable Boom – The continued global uptake of mobile devices has escalated the need for larger, faster embedded memory. Users demand lightning-fast boot times and seamless multitasking, driving OEMs to integrate high-performance flash memory and emerging NVM technologies directly into system-on-chips (SoCs). – Wearables, smart speakers, and IoT gadgets prioritize low-density but highly efficient memory. 3D NAND flash has emerged as the preferred technology, offering high storage capacity in a minimal footprint. Samsung and SK Hynix have ramped up mass production of advanced 3D NAND modules tailored for connected device ecosystems.

Low-Power, High-Speed Requirements – Battery-powered devices mandate memory that combines rapid data access with minimal energy draw. Next-generation embedded NVMs—such as STT-MRAM and ReRAM—offer sub-microsecond access times and ultra-low standby currents, extending device lifespans and enhancing user experience. – System-in-Package (SiP) and Package-on-Package (PoP) solutions are gaining traction, integrating multiple memory dies and logic blocks into single compact modules, thereby reducing interconnect power losses and boosting overall throughput.

Security and Reliability – As embedded systems permeate mission-critical sectors (automotive ADAS, industrial controls, medical devices), secure and tamper-resistant memory is non-negotiable. Embedded flash and MRAM provide inherent read/write protections, while emerging PUF-based authentication schemes leverage intrinsic chip variability to safeguard cryptographic keys.

Latest Market Trends

3D XPoint and Beyond: Following its debut in enterprise SSDs, 3D XPoint is being miniaturized for embedded applications, promising DRAM-like speeds with non-volatility, ideal for real-time control systems.

Embedded MRAM/STT-MRAM: Gaining traction in safety-critical automotive and industrial sectors, MRAM offers unlimited endurance cycles and high radiation tolerance.

Embedded Ferroelectric RAM (FRAM): With nanosecond write speeds and high write endurance, FRAM is carving out niches in smart cards, metering, and medical devices.

Key Players and Industry Leaders The eNVM market is highly consolidated, with major semiconductor manufacturers and specialty memory providers driving innovation and capacity expansion:

eMemory Technology Inc.

Floadia Corporation

GlobalFoundries Inc.

Infineon Technologies AG

Japan Semiconductor Corporation

Kilopass Technology, Inc.

SK HYNIX INC.

SMIC

Texas Instruments Incorporated

Toshiba Electronic Devices & Storage Corporation

Download now to explore primary insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=24953

Recent Developments

March 2023 – ANAFLASH Commercialization U.S. startup ANAFLASH unveiled an energy-efficient embedded NVM solution tailored for battery-powered wireless sensors, medical wearables, and autonomous robots, promising up to 30% lower power consumption versus incumbent flash technologies.

February 2023 – GlobalFoundries Acquisition GlobalFoundries acquired Renesas Electronics’ resistive RAM patents and manufacturing know-how, aiming to integrate low-power ReRAM into next-generation SoCs for smart home and mobile applications.

May 2022 – Automotive Platform Collaboration Japan Semiconductor Corporation and Toshiba Electronic Devices partnered to develop a 0.13-micron analog IC platform with embedded flash, targeting advanced automotive applications such as in-vehicle networking and sensor fusion modules.

Market Opportunities

5G and IoT Rollout: The proliferation of 5G networks and edge computing devices demands local data storage and analytics, presenting growth avenues for low-latency embedded memory.

Automotive Electrification: Electric and autonomous vehicles require robust memory for ADAS, telematics, and battery management systems, creating new application segments.

Healthcare Wearables: Demand for continuous health monitoring fosters embedded memory integration in smart patches and implantable devices, where size and power constraints are paramount.

Future Outlook Analysts project that by 2031, the Embedded NVM market will surpass US$ 218 million, driven by sustained R&D investments and product diversification into emerging NVM technologies. The maturation of foundry support for STT-MRAM, ReRAM, and 3D XPoint, coupled with advanced packaging breakthroughs, will accelerate adoption across consumer, automotive, and industrial domains. Security-driven regulations and functional safety standards will further cement embedded memory’s role in next-generation electronic systems.

Market Segmentation

By Type

Flash Memory (dominant share in 2022)

EEPROM

nvSRAM

EPROM

3D NAND

MRAM/STT-MRAM

FRAM

Others (PCM, NRAM)

By End-Use Industry

Consumer Electronics (2022 market leader)

Automotive

IT & Telecommunication

Media & Entertainment

Aerospace & Defense

Others (Industrial, Healthcare)

By Region

North America

Europe

Asia Pacific (2022 market leader)

Middle East & Africa

South America

Buy this Premium Research Report for a detailed exploration of industry insights - https://www.transparencymarketresearch.com/checkout.php?rep_id=24953<ype=S

Regional Insights

Asia Pacific: Commanded the largest share in 2022, fueled by semiconductor R&D hubs in China, Japan, Taiwan, and South Korea, and robust electronics manufacturing ecosystems.

North America: Home to major foundries and design houses; 5G and IoT device adoption is expected to drive eNVM demand through 2031.

Europe: Automotive electrification and Industry 4.0 initiatives will underpin growth, with Germany and France leading demand.

MEA & Latin America: Emerging markets are gradually adopting consumer electronics and automotive technologies, presenting long-term opportunities.

Frequently Asked Questions

What is embedded non-volatile memory? Embedded NVM is memory integrated into semiconductor chips that retains data without power. It is used for firmware, configuration data, and security keys.

Which eNVM type holds the largest market share? Flash memory led the market in 2022 due to its balance of speed, density, and cost-effectiveness, particularly in consumer electronics and IoT devices.

What industries drive eNVM demand? Consumer electronics, automotive (ADAS, electrification), IT & telecom (5G equipment), aerospace & defense, healthcare wearables, and industrial automation.

How will emerging technologies impact the market? STT-MRAM, ReRAM, and 3D XPoint will offer faster speeds, higher endurance, and lower power profiles, expanding applications in safety-critical and high-performance systems.

Which regions offer the best growth prospects? Asia Pacific remains the leader due to manufacturing scale and R&D. North America and Europe follow, driven by advanced automotive and IoT deployments.

What factors may restrain market growth? High development costs for new NVM technologies, integration complexity, and supply chain disruptions in semiconductor fabrication could pose challenges.

Why is this report important for stakeholders? It equips semiconductor vendors, system integrators, and strategic investors with the insights needed to navigate technological shifts and seize emerging market opportunities in embedded memory.

Explore Latest Research Reports by Transparency Market Research:

Power Meter Market: https://www.transparencymarketresearch.com/power-meter-market.html

Radiation Hardened Electronics Market: https://www.transparencymarketresearch.com/radiation-hardened-electronics-semiconductor-market.html

AC-DC Power Supply Adapter Market: https://www.transparencymarketresearch.com/ac-dc-power-supply-adapter-market.html

5G PCB Market: https://www.transparencymarketresearch.com/5g-pcb-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Custom PCB Assembly for Prototypes and Specialty Projects

Custom PCB Assembly for Prototype and Specialty Needs.

Transforming an electronic product idea into a physical reality can be a significant challenge, especially for small businesses, hobbyists, and researchers. Traditional mass production techniques typically fall short for low-volume or specialized projects, which calls for more tailored solutions. Custom PCB assembly step in to offer the flexibility, expertise, and cost efficiency needed for unique projects.

PCB assembly refers to mounting electronic components onto a printed circuit board so that the device becomes operational. Custom Printed Circuit Board assembly provides customized solutions to fit the needs of the specific project, especially for prototypes and specialized electronic manufacturing needs.

The power of custom PCB assembly is in its flexibility. It serves a wide array of requirements, including startups, DIY enthusiasts, and academic institutions, and even aerospace and defense grade requirements, tackling the specific challenges associated with prototype and niche projects. By optimizing the journey from design to production, these services offer customized solutions that conserve both time and resources.

This guide explores the benefits of custom circuit board assembly and why it’s the ideal choice for specialized or prototype electronic manufacturing.

Key Features of Custom Printed Circuit Board Assembly

Rapid Prototyping: Customized PCB assembly makes it possible for rapid prototyping to quickly test their ideas. Such speed becomes important in the current market to make or break a success.

Quality Assurance: Contracting with an experienced PCB assembly service provider like PCB Power ensures high-quality standards throughout manufacturing. PCB Power makes sure to minimize defects and assure reliability through advanced testing methods like AOI and X-ray.

Cost-Effectiveness: By outsourcing circuit board assembly services, manufacturers can save on factory overheads during in-house manufacturing. This also allows companies to focus on their core competencies. The outsourced specialized provider takes care of the other aspects of PCB assembly.

Flexibility: Custom PCB assembly is flexible for design changes and production volumes. These services can meet any of your demands, whether it is a small test batch or larger quantities for production runs.

Circuit Board Solutions for Prototypes and Specialized Applications

These processes are more than ordinary assembly procedures. It helps to integrate specific parts, meet common testing requirements, and facilitate high-level manufacturing.

1. Integration of Non-Standard Components and Materials

Sophisticated designs, e.g. for space and defense, call for unique products like exclusive sensors and microprocessors. Experienced circuit board assembly companies like PCB Power, possess the knowledge through which they may acquire these elements and interconnect them. They use high-temperature substrate materials, flexible circuits, as well as shielding materials. This assures reliability and performance.

2. Meeting Stringent Testing Requirements

Some industries like aerospace, automotive, and medical electronic industries require such testing and validation. Custom Printed Circuit board assemblyservices provide testing solutions on environmental stress and electromagnetic compatibility (EMC). This is done to meet the requirements of the industry standards and conformity to various certifications. Such services ensure the required performance levels in various extreme conditions.

3. Advanced Manufacturing Techniques

The goals of some products are more demanding than traditional through-hole projects. For intricate enclosures, customized PCB assembly providers use improved processes like 3D printing, chip-on-board, and flip-chip assembly. It is always advisable to use the services of people with experience and excellent tools.

Conclusion

Custom PCB assembly turns innovative electronics into reality. Businesses use these specialized services to bring their products forth. Wherever prototypes or specialty projects are concerned, an experienced provider of PCB assembly services can drastically improve your success.

Discover PCB Power's PCB assembly services for a wide range of industries. PCB Power is one of the most trusted and reliable PCB manufacturing companies, with an experience of 35 years in the USA market Our solutions for bare board manufacturing to component sourcing to circuit board assembly, are best suited for USA manufacturing standards. Our ordering system is a smooth process, ensuring quality PCB manufacturing assemblies and fast turnaround times for your project. Visit our website today to place your inquiry.

Know More: https://www.pcbpower.us/blog/custom-pcb-assembly-prototypes-specialty-projects

0 notes

Text

Sharper Vision: Unlocking Growth in the Global Vision Inspection Systems Market

Market Overview

The Vision Inspection Systems market is experiencing significant growth, driven by strict regulatory mandates related to product quality and safety, increasing automation in manufacturing, and the widespread adoption of Industry 4.0 technologies. Vision inspection systems are being increasingly adopted in sectors such as electronics, pharmaceuticals, food & beverages, and automotive, where precision and compliance are critical. Despite the promising growth trajectory, the market faces challenges such as high initial investment requirements and technical interoperability concerns.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=5973

Market Growth Drivers

Regulatory Compliance & Quality Assurance Requirements Government regulations such as FDA guidelines, ISO standards, GMP, HACCP, EPA mandates, OSHA norms, and CE certifications play a critical role in ensuring the quality and safety of products. These frameworks cover a wide array of industries including food, pharmaceuticals, electronics, and consumer goods. Vision inspection systems help manufacturers meet these compliance requirements by enabling real-time inspection and defect identification using advanced machine vision technologies and artificial intelligence. These systems ensure not just compliance but also boost consumer trust in product reliability and safety.

Accelerated Adoption of Industry 4.0 Technologies The rise of Industry 4.0 has paved the way for smart manufacturing, integrating technologies such as AI, robotics, IoT, and data analytics into production environments. Vision inspection systems are being integrated into these smart ecosystems to support real-time quality control, predictive maintenance, and process automation. For instance, in January 2021, Cognex Corporation introduced the In-Sight 3DL4000, a smart camera equipped with 3D laser displacement technology. This innovation allows manufacturers to perform comprehensive inspections in 3D environments, improving defect detection accuracy on automated lines.

Emerging Trends

AI Integration in Vision Systems The convergence of artificial intelligence with machine vision is transforming how inspection systems operate. AI-enabled systems can adapt to new product lines, detect micro-level flaws, and analyze vast data sets in real time, making them more efficient than traditional models. Key players are incorporating AI into their systems for improved accuracy and efficiency. In April 2024, Cognex launched the In-Sight L38 3D Vision System, which uses a hybrid of AI, 2D, and 3D imaging for multi-dimensional inspections. Similarly, Advantech and Overview AI collaborated in 2023 to release the OV20i AI vision system, combining edge computing with deep-learning-based vision analytics.

Key Opportunities

Technological Advancements in Vision Systems R&D investments from leading companies are driving continuous innovation in vision inspection technology. Upgrades such as improved sensor resolution, color imaging, dynamic range, and the implementation of computational imaging techniques are rapidly evolving the capabilities of these systems. Syntegon Technology GmbH introduced an AI-equipped automated inspection machine in 2021, designed for pharmaceutical applications. These advancements are enabling a new generation of integrated inspection systems tailored for the healthcare, food, and electronics industries.

Market Segmentation Insights

By Offering: Dominance of Hardware Segment In 2025, the hardware segment is projected to capture over 58.5% of the total market. This includes components such as cameras, processors, lighting, vision sensors, and lenses. The increased use of machine vision for quality control across production environments is driving hardware demand. Major industries such as pharmaceuticals, electronics, automotive, and food processing are investing in inspection hardware to meet stringent quality standards. Meanwhile, the software segment is expected to grow at the fastest rate due to the rising demand for AI-driven visual analysis. In November 2023, Cohu, Inc. introduced an AI-powered inspection module as part of its DI-Core analytics platform to enhance real-time visual inspection in semiconductor manufacturing.

By Application: Defect Detection Leads Among various applications, defect detection is expected to dominate in 2025 with over 27% of the market share. Vision systems for defect detection are now integral in modern manufacturing, where consistent product quality and waste reduction are paramount. Companies increasingly rely on these systems for identifying surface flaws, cracks, misalignments, and other imperfections in high-speed production environments. On the other hand, identification inspection is forecasted to experience the highest CAGR, owing to its importance in food safety and packaging integrity across fast-paced industries like F&B and logistics.

By Type: PC-Based Systems Maintain Leadership PC-based systems are anticipated to account for over 52.6% of the market by 2025. These systems offer high flexibility and processing power, making them ideal for complex inspection tasks in dynamic manufacturing settings. Their adaptability and ability to support custom software configurations give them an edge, particularly in industries with high variation in product types and inspection requirements. However, smart camera-based systems are poised to record the highest growth rate, driven by advancements in edge AI and the increasing trend of compact, plug-and-play inspection solutions.

Get Full Report @ https://www.meticulousresearch.com/product/vision-inspection-systems-market-5973

By Inspection Mode: 2D Holds the Majority, but 3D Is Rising Fast The 2D mode of inspection is projected to command a market share of over 66.5% in 2025. It remains the preferred method for applications involving barcode scanning, labeling verification, and surface inspection due to its simplicity and cost-effectiveness. Nonetheless, 3D inspection mode is set to grow rapidly, fueled by rising demand for detailed inspections in industries such as electronics and automotive, where geometric accuracy and spatial measurements are critical.

By End User: Electronics & Semiconductor Sector Takes the Lead The electronics and semiconductor industry is projected to dominate the market in 2025 with a share exceeding 18.9%. This is largely attributed to the sector’s need for precision inspection of tiny and intricate components such as PCBs, microchips, and soldering joints. Vision inspection systems are essential in this segment to detect minute anomalies that could cause significant functional failures. Moreover, the electronics and semiconductor segment is also projected to witness the fastest growth rate through 2032, driven by rapid miniaturization trends and growing consumer demand for high-performance electronics.

Regional Insights

Asia-Pacific Leading the Charge Asia-Pacific is expected to account for over 38.2% of the global market in 2025, with the highest projected CAGR of 8.8% during the forecast period. The region benefits from a strong manufacturing base across China, Japan, South Korea, and India, along with rising investments in industrial automation and smart factory initiatives. Moreover, increasing quality awareness, rising labor costs, and the need for export-grade product compliance are pushing companies to adopt vision inspection systems. Industries such as automotive, pharmaceutical, and food processing are especially propelling demand in this region.

Key Players & Competitive Landscape

The market landscape is highly competitive, with key players focusing on innovation, AI integration, and strategic partnerships. Leading companies include:

Teledyne Technologies Inc. (U.S.)

OMRON Corporation (Japan)

Optel Vision Inc. (Canada)

Cognex Corporation (U.S.)

KEYENCE Corporation (Japan)

FANUC Corporation (Japan)

Mettler-Toledo International Inc. (U.S.)

Antares Vision S.p.A. (Italy)

Datalogic SpA (Italy)

Averna Technologies Inc. (Canada)

National Instruments Corporation (U.S.)

Pleora Technologies Inc. (Canada)

USS Vision LLC (U.S.)

ISRA VISION GmbH (Germany)

Basler AG (Germany)

Qualitas Technologies (India)

Recent innovations by these firms demonstrate the industry's shift toward AI-driven, high-accuracy inspection solutions. For example, KEYENCE launched its VS Series smart cameras in October 2023, featuring IP67-rated enclosures and smart lens control for advanced inspections in challenging environments.

Get Sample Copy @ https://www.meticulousresearch.com/download-sample-report/cp_id=5973

0 notes

Text

Chinese Office Furniture Suppliers: The Pillar of the Global Supply Chain

At the China Pavilion at Expo 2020 Dubai, a smart workstation system featuring brainwave sensing technology caused a stir—when the user’s attention wavered, the desk automatically raised to standing mode, and the lighting shifted to 6000K cool white to refocus cognitive energy. This system reflects the transformation of Chinese office furniture suppliers from "manufacturing OEM" to "technology output." In 2023, China’s office furniture exports exceeded $22.8 billion, accounting for 39% of the global market share. Its core competitiveness has shifted from cost advantages to technological innovation and full-chain service capabilities.

1. Smart Manufacturing: Redefining Production Efficiency

Breakthrough in Flexible Production Systems A leading factory in Guangdong has implemented an intelligent workshop, breaking down orders into 158 standard modules via an MES system, supporting 150,000 custom combinations. Laser cutting machines have positioning accuracy of ±0.03mm, and six-axis robotic arms assemble 12 hardware parts per minute with precision. The modular production line’s switch time has been reduced from the traditional 72 hours to just 23 minutes, while the cost of single items has dropped by 18%.

Green Manufacturing Innovations Zhejiang Yongyi has introduced a plasma coating line that reduces the curing time of water-based paint from 8 hours to 9 minutes, while VOC emissions are reduced to 0.5g/m³ (EU standard is 30g/m³). Combined with a rooftop photovoltaic system, the energy consumption for producing a single office chair is only 37% of the industry average, and its carbon footprint is reduced by 62%.

Digital Twin Quality Control Shenzhen’s Haofang Technology has built a virtual simulation platform for end-to-end process control, conducting 2,000 collision tests before production. An AI visual inspection system scans product surfaces with 0.005mm precision, reducing defect rates from the industry average of 2.3% to 0.18%. Its self-developed stress cloud map analysis algorithm limits product lifespan prediction errors to within ±3%.

2. Technology R&D: From Follower to Leader

Breakthrough in Smart Interaction Systems A company in Hangzhou, in collaboration with MIT, developed the HoloDesk system, which projects a 120° visible hologram on the desk using a nano-grating array. Gesture operation delay is only 8ms, and it supports multi-user collaborative editing of 3D models. After implementing it in BMW's design center, the new car development cycle was reduced by 41%.

Original Achievements in Material Science The Ningbo Institute of Materials Technology and Engineering, Chinese Academy of Sciences, developed a graphene-reinforced composite board with a bending strength of 580MPa, 63% lighter than traditional MDF. The surface is coated with a lotus-leaf-like hydrophobic layer, achieving a liquid contact angle of 168° and reducing cleaning energy consumption by 82%. This technology has been patented in 32 countries, with a price 55% lower than similar European products.

Innovations in Ergonomics for Health Guangdong Jiechang’s intelligent height-adjustable system uses 16 pressure sensors to monitor posture in real-time, adjusting the desk height by ±3mm every 15 minutes. Clinical data shows that this technology reduces the peak pressure on the lumbar disc by 37%, and employees' tolerance for prolonged sitting is extended by 2.1 times.

3. Global Services: Full-Chain Solutions

48-Hour Fast Delivery Network A supplier in Suzhou has established a global distributed warehouse system, setting up smart hub warehouses in Hamburg, Los Angeles, and Singapore. With a blockchain-based clearance system, customs clearance time is reduced to 28 minutes. Combined with the China-Europe freight train + drone shuttle system, European customers can receive their orders within 51 hours.

Modular Installation System A company in Dongguan has developed a magnetic quick-assembly structure that reduces the standard workstation installation time from 4 hours to 18 minutes. All components support tool-free disassembly and reassembly, reducing maintenance and replacement costs by 73%. Its patented connectors have a tensile strength of up to 2.3 tons and pass 8.0-level earthquake simulation tests.

Full Lifecycle Management Shanghai ZhenDan has introduced a "Product-as-a-Service" model: customers pay based on usage time, and old furniture is recycled using nano-level surface regeneration technology, restoring 98% of its original performance. This model reduces initial investment by 65%, and the material recycling rate reaches 91%.

4. Certification Systems: The Key to Opening Global Markets

Comprehensive International Standards Leading enterprises typically hold 12 international certifications, including BIFMA, GREENGUARD, and FSC. One company's flame-retardant boards passed the UK BS5852 standard test, enduring 43 minutes at 950°C without deformation, far exceeding the EU EN1021-1 requirement of 30 minutes.

Customized Certification Services For the Middle East market, a company developed a dust-proof structure that meets GSO standards, and desert environment tests showed that internal components ran for 2,000 hours without failure during sandstorms. The earthquake-resistant design for North American customers passed the ICC-ES AC156 certification, withstanding 0.6g seismic acceleration.

Digital Trust System Using industrial blockchain technology, all processes from timber traceability to production energy consumption are recorded on the blockchain. TÜV certification from Germany confirms that a company’s product carbon footprint data has 99.97% credibility, allowing the company to enter the EU’s green procurement list.

In the showroom of a hidden champion enterprise in Shenzhen, a quantum-sensing office system is optimizing the global supply chain in real-time: it adjusts inventory at the Hamburg warehouse based on a snowstorm warning in New York, and activates emergency production at a Vietnamese factory after monitoring the shipping schedule in the Strait of Malacca. This signals that Chinese suppliers have transitioned from passively receiving orders to proactively providing services, becoming the intelligent hub of the global office ecosystem. When "Made in China" evolves into "Intelligent Manufacturing from China," choosing a Chinese office furniture supplier means selecting a productivity solution for the next decade. Choose Ekintop office furniture, and we will provide you with the best solution.

0 notes

Text

Gesture Recognition Market: Key Trends and Growth Opportunities

The global gesture recognition market size is anticipated to reach USD 70.18 billion by 2030, registering a CAGR of 18.8% between 2023 and 2030, according to a new report by Grand View Research, Inc. Increasing digitization initiatives across several industries are key to the rising adoption rate of these solutions. The consumer electronics industry is one of the largest adopters of gesture recognition solutions thanks to their ease of adoption due to low technical complexity for end-users. Adoption of the technology has also significantly increased across other industries.

The market also benefits from the rising use of consumer electronics and the Internet of Things and an increasing need for comfort and convenience in product usage. Technological advancements and ease of use have helped the technology gain global acceptance. Increased awareness about regulations and driver safety has increased the demand for gesture recognition systems in the automobile industry. Moreover, growing customer demand for application-based technologies is boosting the market growth. Research in the field of hand gesture recognition has increased for achieving advancements in human-machine interaction.

The development of several software and hardware products for touchless digital interaction is helping drive advancements in gesture recognition technology. Several companies are investing in enhancing the technology and are introducing new products. For instance, In December 2021, Somalytics Inc., a nanotechnology sensor designing company, unveiled its capacitive sensor. It is one of the world’s smallest nano-based capacitive sensors and is made of carbon nanotube paper composites.

The market landscape is volatile and is experiencing fierce competition owing to a large number of mergers and acquisitions. The key players in the market include IT giants such as Apple, Intel Corp., Microsoft, and Google LLC. Along with these international giants, domestic players also show tremendous growth potential and are attracting big investors.

Gather more insights about the market drivers, restrains and growth of the Gesture Recognition Market

Gesture Recognition Market Report Highlights

• The increasing digitization across various industries and the ease of adoption due to low technical complexity for end-users are expected to drive the market

• In terms of industry, the healthcare segment is expected to witness substantial growth with a CAGR of 23.7% over the forecast period

• In terms of region, Asia Pacific accounted for the highest revenue share in 2022. The regional market is expected to witness significant growth over the forecast period

Gesture Recognition Market Segmentation

Grand View Research has segmented the gesture recognition market based on technology, industry, and region:

Gesture Recognition Technology Outlook (Revenue, USD Million, 2017 - 2030)

• Touch-based

o Multi-Touch System

o Motion Gesture

• Touchless

o Capacitive/Electric Field

o Infrared Array

o Ultrasonic Technology

o 2D Camera-Based Technology

o 3D Vision Technologies

Gesture Recognition Industry Outlook (Revenue, USD Million, 2017 - 2030)

• Automotive

o Lighting System

o HUD

o Biometric Access

o Others

• Consumer Electronics

o Smartphone

o Laptops & Tablets

o Gaming Console

o Smart TV

o Set-Top Box

o Head-Mount Display (HMD)

o Others

• Healthcare

o Sign Language

o Lab & Operating Rooms

o Diagnosis

• Others

o Advertisement & Communication

o Hospitality

o Educational Hubs

Gesture Recognition Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o U.K.

o France

• Asia Pacific

o China

o India

o Japan

• South America

o Brazil

• Middle East and Africa (MEA)

List of Key Players in the Gesture Recognition Market

• Alphabet Inc.

• Apple Inc.

• Cognitec Systems GmbH

• Eyesight Technologies Ltd.

• Infineon Technologies AG

• Intel Corporation

• Microchip Technology Incorporated

• Microsoft Corporation

• NXP Semiconductors

• Omnivision Technologies, Inc.

• SoftKinetic

• Synaptics Incorporated

Order a free sample PDF of the Gesture Recognition Market Intelligence Study, published by Grand View Research.

#Gesture Recognition Market#Gesture Recognition Market Size#Gesture Recognition Market Share#Gesture Recognition Market Analysis#Gesture Recognition Market Growth

0 notes

Text

#Global 3D Sensor Array Market Size#Share#Trends#Growth#Industry Analysis#Key Players#Revenue#Future Development & Forecast

0 notes

Text

Extrusion Excellence: How UAE Die Manufacturers are Driving Innovation in Aluminum Production

The United Arab Emirates (UAE) has emerged as a significant hub for aluminum production and manufacturing in the Middle East. This growth is fueled by strategic investments, a favorable business environment, and a vision to diversify the economy beyond oil and gas. At the heart of this thriving industry are the Aluminium Extrusion Manufacturers in UAE, who are not just producing profiles but are constantly pushing the boundaries of innovation. These manufacturers rely on a critical component to shape their aluminum: the extrusion die. The quality and precision of these dies directly impact the final product, making die manufacturers essential drivers of excellence within the sector.

The Role of Die Manufacturers in Enhancing Aluminum Extrusion

Aluminum extrusion is a process where aluminum alloy is forced through a die of a specific cross-section. This process creates a wide array of shapes and profiles used in construction, automotive, electronics, and various other sectors. The die itself is a crucial tool that determines the shape, precision, and quality of the final extruded product. Therefore, manufacturers of these dies play a pivotal role in ensuring the excellence of aluminum production.

Here's how UAE die manufacturers are making a difference:

Precision and Quality: UAE die manufacturers are committed to producing high-precision dies that meet stringent international standards. This dedication ensures that Aluminium Extrusion Manufacturers in UAE can create products with exceptional dimensional accuracy and surface finish, essential for demanding applications.

Customization: The UAE market increasingly demands customized aluminum profiles for unique architectural designs, specialized automotive components, and bespoke industrial applications. Die manufacturers are responding by offering tailored die solutions that enable Aluminium Extrusion Manufacturers in UAE to meet these specific needs, enhancing their competitiveness and market reach.

Material Innovation: Advanced die manufacturers are experimenting with innovative die materials and coatings to extend die life, improve extrusion efficiency, and enhance the quality of the extruded aluminum. This reduces downtime and boosts productivity for Aluminium Extrusion Manufacturers in UAE.

Technological Advancement: Investment in state-of-the-art machinery, CAD/CAM systems, and simulation software allows die manufacturers to design and produce complex die geometries with greater accuracy. This technological edge enables Aluminium Extrusion Manufacturers in UAE to explore new product possibilities and optimize their extrusion processes.

Local Expertise: UAE-based die manufacturers possess in-depth knowledge of the local market, environmental conditions, and industry-specific requirements. This localized expertise enables them to provide targeted solutions and responsive support to Aluminium Extrusion Manufacturers in UAE.

Key Trends Driving Innovation in UAE Die Manufacturing

Several trends are shaping the future of die manufacturing in the UAE, contributing to innovation and excellence in aluminum production:

Adoption of Additive Manufacturing (3D Printing): Some die manufacturers are exploring additive manufacturing techniques to create complex die components with intricate internal geometries. This technology enables faster prototyping, customized designs, and improved die performance for Aluminium Extrusion Manufacturers in UAE.

Integration of Smart Technologies: The integration of sensors and monitoring systems into dies allows for real-time data collection on temperature, pressure, and material flow. This data-driven approach enables die manufacturers to optimize die design, predict maintenance needs, and enhance the overall extrusion process for Aluminium Extrusion Manufacturers in UAE.

Focus on Sustainability: As sustainability becomes a greater concern, die manufacturers are exploring eco-friendly materials, energy-efficient manufacturing processes, and strategies to minimize waste. This aligns with the UAE's broader sustainability goals and enhances the environmental credentials of Aluminium Extrusion Manufacturers in UAE.

The Contribution of PDTMC

PDTMC is one of the top mechanical service industry, with over three decades of experience in machining and fabricating mechanical components. The company contributes significantly to the aluminum extrusion sector by providing high-quality dies and tooling solutions that meet the evolving needs of Aluminium Extrusion Manufacturers in UAE. PDTMC's commitment to precision, innovation, and customer satisfaction makes it a valuable partner for companies seeking to enhance their aluminum extrusion capabilities.

Benefits of Choosing Local Die Manufacturers

Partnering with local UAE die manufacturers offers numerous advantages for Aluminium Extrusion Manufacturers in UAE:

Faster Lead Times: Local manufacturers can provide quicker turnaround times for die design, production, and delivery, reducing downtime and enabling faster project completion.

Enhanced Communication: Working with a local partner facilitates seamless communication, collaboration, and problem-solving, ensuring that die solutions are tailored to specific requirements.

Cost-Effectiveness: Local sourcing can reduce transportation costs, import duties, and other logistical expenses, making it a more cost-effective option.

Support for Local Economy: Choosing local manufacturers supports the growth of the UAE's industrial sector, creates jobs, and strengthens the national economy.

Conclusion: Partnering for Extrusion Excellence

The aluminum extrusion industry in the UAE is dynamic, innovative, and poised for continued growth. Die manufacturers are at the forefront of this progress, driving excellence in aluminum production through their commitment to precision, customization, and technological advancement. By partnering with local die manufacturers, Aluminium Extrusion Manufacturers in UAE can unlock new possibilities, enhance their competitiveness, and contribute to the UAE's vision of becoming a global manufacturing hub.

Ready to elevate your aluminum extrusion capabilities? Contact PDTMC today to discover how our precision-engineered dies can optimize your production process, enhance product quality, and drive innovation in your operations. Let us be your partner in achieving extrusion excellence in the UAE.

0 notes

Text

Road Profile Laser Sensor Market 2024-2033 : Demand, Trend, Segmentation, Forecast, Overview And Top Companies

The Road Profile Laser Sensor Global Market Report 2024 by The Business Research Company provides market overview across 60+ geographies in the seven regions - Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa, encompassing 27 major global industries. The report presents a comprehensive analysis over a ten-year historic period (2010-2021) and extends its insights into a ten-year forecast period (2023-2033).

Learn More On The Road Profile Laser Sensor Market: https://www.thebusinessresearchcompany.com/report/road-profile-laser-sensor-global-market-report

According to The Business Research Company’s Road Profile Laser Sensor Global Market Report 2024, The road profile laser sensor market size is expected to see rapid growth in the next few years. It will grow to $1.11 billion in 2028 at a compound annual growth rate (CAGR) of 10.6%. The growth in the forecast period can be attributed to increasing demand for road safety solutions, increasing smart city initiatives, increasing infrastructure projects, rising focus on vehicle automation, increasing regulatory mandates promoting safer road conditions, and increasing demand for real-time road condition monitoring. Major trends in the forecast period include adoption in autonomous vehicles, advancements in high-resolution 3D mapping capabilities, integration with AI for real-time analytics, advancements in sensor technologies, and adoption of LiDAR technology for higher accuracy.

The rise in road accidents is expected to propel the growth of the road profile laser sensor market going forward. The surge in road accidents is due to more vehicles on the road, distracted driving habits, deteriorating road infrastructure, and weak enforcement of traffic regulations. Road profile laser sensors help reduce road accidents by accurately measuring and mapping road surface conditions, enabling timely detection and repair of hazards such as potholes, uneven surfaces, and debris. For instance, in May 2022, according to the National Highway Traffic Safety Administration, a US-based government agency focused on transportation safety, the number of fatalities from motor vehicle crashes surged by 10.5%, reaching an estimated 42,915 deaths in 2021, compared to 38,824 in 2020. Therefore, the rise in road accidents is driving the growth of the road profile laser sensor market.

Get A Free Sample Of The Report (Includes Graphs And Tables): https://www.thebusinessresearchcompany.com/sample.aspx?id=17247&type=smp

The road profile laser sensor market covered in this report is segmented –

1) By Measurement Range: Less Than 200 mm, 200–600 mm, More Than 600 mm 2) By Process: Biochemical Process, Thermochemical Process 3) By Application: Longitudinal Profile, Transverse Profile, Side Projections, Macro Texture, Other Applications

Major companies operating in the road profile laser sensor market are developing intelligent traffic system (ITS) solutions to develop efficient traffic management, enhance road safety, and enable smart city initiatives. Intelligent traffic system (ITS) solutions integrate road profile laser sensors with advanced data analytics, AI algorithms, and connectivity technologies to provide real-time insights into traffic flow, congestion monitoring, and pedestrian safety. For instance, in February 2021, Hikvision, a China-based digital technology company, launched the All-Rounder ITS camera, an innovative, intelligent traffic system (ITS) camera designed to improve road safety and optimize traffic flow. The All-Rounder ITS camera is ideal for various transportation scenarios, such as urban roads, highways, tunnels, and toll stations. The camera features an HD camera, speed radar, and light array integrated into a single housing. It provides stable and reliable performance, ensuring consistent operation in adverse weather and lighting conditions.

The road profile laser sensor market report table of contents includes:

1. Executive Summary

2. Road Profile Laser Sensor Market Characteristics

3. Road Profile Laser Sensor Market Trends And Strategies

4. Road Profile Laser Sensor Market - Macro Economic Scenario

5. Global Road Profile Laser Sensor Market Size and Growth ............

32. Global Road Profile Laser Sensor Market Competitive Benchmarking

33. Global Road Profile Laser Sensor Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Road Profile Laser Sensor Market

35. Road Profile Laser Sensor Market Future Outlook and Potential Analysis

36. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Semiconductorinsight reports

Wide Bandgap Semiconductor Market - https://semiconductorinsight.com/report/wide-bandgap-semiconductor-market/

Wireless Charging Market - https://semiconductorinsight.com/report/wireless-charging-market/

3D IC Market - https://semiconductorinsight.com/report/3d-ic-market/

Analog-to-Digital Converter (ADC) Market - https://semiconductorinsight.com/report/analog-to-digital-converter-adc-market/

Application Processor Market - https://semiconductorinsight.com/report/application-processor-market/

Audio IC Market - https://semiconductorinsight.com/report/audio-ic-market/

Bluetooth IC Market - https://semiconductorinsight.com/report/bluetooth-ic-market/

CMOS Image Sensor Market - https://semiconductorinsight.com/report/cmos-image-sensor-market/

Data Converter Market - https://semiconductorinsight.com/report/data-converter-market/

Digital Signal Processor (DSP) Market - https://semiconductorinsight.com/report/digital-signal-processor-dsp-market/

Display Driver IC Market - https://semiconductorinsight.com/report/display-driver-ic-market/

Embedded Non-Volatile Memory (eNVM) Market - https://semiconductorinsight.com/report/embedded-non-volatile-memory-envm-market/

Field-Programmable Gate Array (FPGA) Market - https://semiconductorinsight.com/report/field-programmable-gate-array-fpga-market/

Flash Memory Market - https://semiconductorinsight.com/report/flash-memory-market/

Graphics Processing Unit (GPU) Market - https://semiconductorinsight.com/report/graphics-processing-unit-gpu-market/

High-Brightness LED Market - https://semiconductorinsight.com/report/high-brightness-led-market/

Image Sensor Market - https://semiconductorinsight.com/report/image-sensor-market/

Integrated Passive Devices (IPD) Market - https://semiconductorinsight.com/report/integrated-passive-devices-ipd-market/

Laser Diode Market - https://semiconductorinsight.com/report/laser-diode-market/

Light Sensor Market - https://semiconductorinsight.com/report/light-sensor-market/

Magnetoresistive RAM (MRAM) Market - https://semiconductorinsight.com/report/magnetoresistive-ram-mram-market/

Micro LED Market - https://semiconductorinsight.com/report/micro-led-market/

Microprocessor Market - https://semiconductorinsight.com/report/microprocessor-market/

Mixed Signal System-on-Chip (SoC) Market - https://semiconductorinsight.com/report/mixed-signal-system-on-chip-soc-market/

NAND Flash Market - https://semiconductorinsight.com/report/nand-flash-market/

Non-Volatile Memory (NVM) Market - https://semiconductorinsight.com/report/non-volatile-memory-nvm-market/

Organic Light Emitting Diode (OLED) Market - https://semiconductorinsight.com/report/organic-light-emitting-diode-oled-market/

Photonic Integrated Circuit (PIC) Market - https://semiconductorinsight.com/report/photonic-integrated-circuit-pic-market/

Power Management IC (PMIC) Market - https://semiconductorinsight.com/report/power-management-ic-pmic-market/

Printed Electronics Market - https://semiconductorinsight.com/report/printed-electronics-market/

Radio Frequency (RF) Front-End Module Market - https://semiconductorinsight.com/report/radio-frequency-rf-front-end-module-market/

Semiconductor Assembly and Testing Services (SATS) Market - https://semiconductorinsight.com/report/semiconductor-assembly-and-testing-services-sats-market/

Semiconductor Laser Market - https://semiconductorinsight.com/report/semiconductor-laser-market/

Silicon Carbide (SiC) Market - https://semiconductorinsight.com/report/silicon-carbide-sic-market/

Smart Card IC Market - https://semiconductorinsight.com/report/smart-card-ic-market/

Smart Sensor Market - https://semiconductorinsight.com/report/smart-sensor-market/

System-in-Package (SiP) Market - https://semiconductorinsight.com/report/system-in-package-sip-market/

Thin Film Transistor (TFT) Market - https://semiconductorinsight.com/report/thin-film-transistor-tft-market/

Touch Controller IC Market - https://semiconductorinsight.com/report/touch-controller-ic-market/

Ultraviolet (UV) LED Market - https://semiconductorinsight.com/report/ultraviolet-uv-led-market/

0 notes