#AIStocks

Explore tagged Tumblr posts

Text

SoundHound 2030 Stock Predictions You Should Know

#SoundHound#StockMarket#AIStocks#TechInvesting#NASDAQ#StockPredictions#AIRevolution#Finance#Investing#StockAnalysis#WallStreet#FutureStocks#SoundHoundAI#Cryptocurrency#BlockchainTechnology

3 notes

·

View notes

Text

#Investing2025#BestStocks2025#TechStocks#GrowthInvesting#AIStocks#DividendStocks#StockMarketTips#LongTermInvesting#FinancialFreedom#SmartInvesting

0 notes

Text

Navigating the Future of AI Stocks in an Evolving Market

Artificial Intelligence has moved beyond hype, becoming a cornerstone of digital transformation. Across sectors, AI Stocks are reshaping operational strategies through intelligent automation, data analysis, and real-time decision-making. As industries increasingly lean on AI to streamline workflows and gain insights, companies embedded in the AI ecosystem are emerging as influential forces in technological evolution.

Key Forces Propelling the Growth of AI Stocks

The appeal of companies linked to AI Stocks lies in their ability to deliver solutions that boost efficiency and innovation.Businesses are adopting AI to interpret large data sets, refine customer engagement, and automate complex processes. This broad-based integration is fueling interest across global markets, with demand rising in sectors such as healthcare, finance, logistics, and e-commerce.

Semiconductor Industry’s Vital Role in AI Progress

Semiconductor firms form the hardware backbone of AI Stocks innovation.Advanced processors—especially GPUs and custom AI accelerators—enable rapid training and deployment of machine learning models. As computing power becomes critical to support AI capabilities, chipmakers aligned with this demand are seeing significant traction across cloud services, robotics, and intelligent transportation systems.

Scalable Software Solutions Advancing AI Technologies

Software platforms that streamline the creation and deployment of AI Stocks applications are playing a vital role in market expansion.These platforms offer tools for natural language processing, visual recognition, and predictive analytics, making AI more accessible. Cloud-based solutions, including AI as a Service, have simplified adoption across enterprises, further accelerating innovation and strengthening companies involved in this growth.

AI's Influence on Consumer Experience and Market Demand

AI Stocks are also transforming consumer technology, influencing how people interact with digital platforms. From recommendation engines to voice assistants and smart devices, AI is enhancing personalization and convenience. Companies leading in these consumer-facing technologies continue to benefit from shifting preferences toward automated, tailored experiences, solidifying their position within the market.

Navigating the Competitive AI Landscape

The landscape for AI Stocks-driven businesses is evolving rapidly, marked by constant innovation and competitive intensity. Both emerging startups and established tech firms are refining their AI capabilities to meet growing demands. Companies that offer scalable, secure, and adaptive solutions often distinguish themselves in an increasingly crowded space, with partnerships and M&A activity fueling expansion.

Overcoming Challenges in AI Development

Despite widespread adoption, firms associated with AI Stocks face challenges that can shape their trajectory. High development costs, regulatory pressures, and ethical concerns—including data usage and job automation—present complex issues. Navigating these challenges while maintaining transparency and compliance is essential for sustained relevance and public trust in the industry.

The Changing Landscape of AI Regulations

As AI Stocks technologies mature, governments around the world are stepping up regulatory frameworks to ensure responsible development and deployment. Emerging policies—especially in the US and EU—address areas like data protection, algorithm transparency, and accountability. Businesses that align with these evolving regulations while continuing to innovate are better positioned for stability within the AI Stocks category.

AI and Sustainability A New Frontier

An emerging focus within AI Stocks is their contribution to environmental goals. Artificial intelligence is being used to manage energy systems, improve supply chain efficiency, and drive responsible resource consumption. Companies combining AI Stocks with sustainability strategies are gaining recognition, offering solutions that support both environmental and operational goals.

Positioned for Long-Term Success

The trajectory of businesses linked to AI Stocks reflects a broader transition toward intelligent automation and connected systems. Despite competitive pressures and regulatory hurdles, the structural demand for these technologies remains strong. Organizations that continue to refine their tools, maintain ethical standards, and scale access are at the core of the ongoing technological shift across sectors.

0 notes

Text

Unveiling AI Stock Opportunities: Nvidia and TSMC Lead the Charge

Unveiling AI Stock Opportunities: Nvidia and TSMC Lead the Charge In today's rapidly evolving tech landscape, certain stocks are rising to prominence as they capitalize on the explosive demand for artificial intelligence (AI). Nvidia and Taiwan Semiconductor Manufacturing Company (TSMC) are at the forefront, presenting exciting growth opportunities for investors eager to tap into the burgeoning AI market. 1. Nvidia: Revolutionizing AI Computing Nvidia's stock has surged by an impressive 186% year-to-date, underscoring its robust position within the AI sector. Despite this remarkable performance, the company remains an attractive investment, particularly with the impending launch of its Blackwell AI computing platform. CEO Jensen Huang has emphasized Nvidia's pivotal role in the AI revolution, as the company exceeded its own fiscal Q3 guidance, recording a staggering 94% year-over-year increase in revenue, reaching $35 billion. Central to this growth is Nvidia's Hopper chips, which have experienced unprecedented demand. The upcoming launch of Blackwell, a versatile computing platform tailored for generative AI, is expected to solidify Nvidia's dominance in the market. Analysts forecast a 37% annualized earnings growth over the next few years, supported by reasonable valuations and impressive performance metrics. 2. Taiwan Semiconductor: A Pillar in Global AI Infrastructure TSMC, with a 91% stock increase over the past year, plays a critical role as a supplier in the AI supply chain, manufacturing chips for industry giants like Nvidia. In Q3, TSMC reported a 36% rise in revenue and a remarkable 54% growth in earnings, driven by increasing AI-related demand. The company's strategic investments are projected to exceed $30 billion this year, reflecting its commitment to supporting the evolving demands of AI infrastructure. As of Q2 2024, TSMC controlled 62% of the global foundry market, affirming its integral role in the chip supply ecosystem. Investors are closely monitoring TSMC's anticipated growth trajectory as the company plans significant capital expenditures to support projected AI infrastructure needs over the next decade, presenting a robust investment opportunity. Conclusion As AI technology continues to permeate various industries, Nvidia and TSMC are leading the charge with innovative solutions that promise substantial returns for discerning investors. Their strategic initiatives and market positions make them key players in the AI revolution, offering a compelling case for investment in the rapidly expanding tech landscape. Read the full article

#AIinvestmentopportunities#AIstocks#Blackwellplatform#chipsupply#generativeAI#Hopperchips#Nvidia#stockmarketgrowth#TaiwanSemiconductorManufacturing#technologicalinnovation

0 notes

Text

Top Picks In The Best AI Stocks Shaping The Future

Explore the best AI stocks transforming industries through advanced technology and innovation. From machine learning to automation, see how these companies are driving change and reshaping sectors like healthcare, finance, and manufacturing. Discover the top players leading the AI revolution with cutting-edge solutions.

#AIStocks#ArtificialIntelligence#TechStocks#Innovation#MachineLearning#Automation#AITechnology#StockMarket

0 notes

Text

Top 5 AI Smallcap Stocks In India 2024

Introduction:-

The rapid advancements in Artificial Intelligence (AI) technology have revolutionized various industries, including the stock market. With India being at the forefront of AI development, the impact of this technology on the country’s stock market cannot be ignored. In recent years, there has been a growing interest in AI technology and its potential for small-cap stocks in India. This article aims to provide readers with a comprehensive list and details of the top 5 AI smallcap stocks in India, highlighting their potential for growth and development in the coming years.

The Importance of Smallcap Stocks in India:-

Smallcap stocks play a significant role in India’s stock market and offer unique opportunities for investors. These stocks are typical of small and emerging companies, with a market capitalization between Rs. 500 crores to Rs. 10,000 crores. Despite their smaller size, these stocks offer high growth potential and diversification opportunities for investors.

Top 5 AI Smallcap Stocks in India:-

✔ Affle (India)

✔ Zensar Technologies

✔ Kellton Tech Solutions

✔ RateGain Travel Technologies

✔ Happiest Minds Technologies

Read more information in detail about the Top 5 AI Smallcap Stocks in India

0 notes

Text

Jim Cramer: Investing in AI Stocks - Opportunities and Risks #aiindustry #AIindustrygrowth #AIstocks #AIrelatedproducts #AIrelatedservices #AlphabetsDeepMind #artificialintelligence #benefitsofinvestinginAIstocks #challengesofinvestinginAIstocks. #finance #healthcare #investinginAIstocks #investinginthestockmarket #JimCramer #Microsoft #nvidia #opportunitiesinAIstocks #risksinAIstocks #transportation

#Business#aiindustry#AIindustrygrowth#AIstocks#AIrelatedproducts#AIrelatedservices#AlphabetsDeepMind#artificialintelligence#benefitsofinvestinginAIstocks#challengesofinvestinginAIstocks.#finance#healthcare#investinginAIstocks#investinginthestockmarket#JimCramer#Microsoft#nvidia#opportunitiesinAIstocks#risksinAIstocks#transportation

0 notes

Video

youtube

Snowflake Surges Again—Can It Sustain the $200 Breakout Rhythm? #SNOW #C...

#youtube#Snowflake SNOW CloudData AIStocks RHYTHMIXReport BreakoutAnalysis MomentumStocks TechStocks EarningsSurprise

0 notes

Link

0 notes

Text

AiStockApp Review:1B Stock Asset Just easy 3 Steps

If you searching for AIstockApp Review on internet then you are in the right place. In this post we discuss everything about AIstockApp. Just read the complete post then you will get a clear idea about AIstockApp. Should you get it or not.

Content is still king in online based business. There is no alternate of high quality content. If you are also struggling for high quality content then please read this post.

This post, discuss AIstockApp, its Overviews, features, work process, Targeted Audience, Pros and Cons, pricing, and packages.

AiStockApp Review: Understanding AiStockApp

Aistockapp is an AI App that has 1 Billion Stock Asset With World’s First (GPT-4 Powered) 300-In-One App That ”Creates, Generate And Translate” Any Type Of Contents For You And Your Clients In 60 Seconds.

AiStockApp is developed by Godfrey Elabor.

Overview:

Product Name : AiStockApp Vendor: Godfrey Elabor Launch Date: 2023-Jul-22 @ 10:00 EDT Home Pages: Visit Here FRONT END Рrісе: $17 Skill Levels: All Levels Product Type: AI Store Builder Money-Back Guarantee: 30 Days Discount: Available Rating: Highly Recommended

Visit here to read full review:https://reviewsbd.com/aistockapp-review/

1 note

·

View note

Text

Explore ServiceNow stock price forecasts for 2025–2029, with insights on its AI-driven growth, fin. performance, and investment strategies #ServiceNow #NOW #NOWstockprice #ServiceNowforecast #enterprisesoftwarestocks #AIstocks #stockpriceprediction #SaaSinvestment #digitaltransformationstocks #ServiceNowfinancials #stockmarketanalysis

#AI stocks#Best enterprise software stocks 2025#Best stocks to buy now#digital transformation stocks#enterprise software stocks#How to invest in ServiceNow NOW#Investment#Investment Insights#Is ServiceNow stock a good investment#NOW#NOW stock market correction strategy#NOW stock price#SaaS investment#ServiceNow#ServiceNow AI growth potential#ServiceNow financial performance 2025#ServiceNow financials#ServiceNow forecast#ServiceNow stock#ServiceNow stock price forecast 2025–2029#ServiceNow stock valuation analysis#ServiceNow vs Salesforce stock comparison#Stock Forecast#Stock Insights#Stock market analysis#Stock price prediction#When to buy ServiceNow stock

0 notes

Text

#Nvidia#NVDA#AIstocks#EarningsReport#BlackwellChip#StockMarket#Semiconductors#TechNews#InvestSmart#WallStreet

0 notes

Text

Exploring the Rise of AI Stocks in the Global Tech Ecosystem

Across industries, artificial intelligence is redefining how businesses operate, solve problems, and serve customers. As adoption increases, AI Stocks are becoming central to modern market narratives. From predictive analytics to automated decision-making, companies leveraging artificial intelligence are now at the forefront of digital transformation, and their stock market relevance continues to expand accordingly.

Enterprise Demand Shaping AI Innovation

Modern businesses are turning to artificial intelligence to gain a competitive edge in data analysis, workflow automation, and customer personalization. This rising enterprise demand directly supports the growth of AI Stocks, especially as companies integrate these tools to improve productivity and strategic agility. The finance, healthcare, logistics, and cybersecurity sectors are particularly prominent in adopting intelligent systems at scale.

Hardware Infrastructure Accelerating AI Performance

AI relies on substantial computing power. Leading semiconductor manufacturers provide the processing units essential for training and deploying AI models. As a result, AI Stocks tied to chipmakers—especially those producing GPUs and AI-specific accelerators—are gaining traction. These firms play a pivotal role in sectors ranging from cloud services to autonomous transportation, underlining their importance in the broader AI value chain.

Scalable Software Driving Application Growth

Beyond hardware, scalable software solutions are making AI deployment more accessible across industries. Platforms that offer tools for natural language processing, computer vision, and advanced analytics are enabling widespread usage. AI Stocks tied to these software companies are benefiting from rapid enterprise adoption, particularly through cloud-native services and AI-as-a-Service models that simplify implementation.

Consumer Technology Embracing Personalization

The consumer experience has been reshaped by artificial intelligence. From smart home devices and recommendation engines to intelligent voice assistants, AI is behind many features that enhance digital interactions. Companies developing these products are seeing steady demand, positioning AI Stocks at the center of consumer-focused innovation. Personalization, convenience, and automation continue to fuel growth in this segment.

Competitive Innovation Among AI Leaders

The AI sector is highly dynamic, with innovation and competition occurring at a rapid pace. Both startups and tech giants are racing to develop more efficient, ethical, and scalable AI tools. AI Stocks associated with firms that continuously improve their technologies while securing strategic partnerships or acquisitions are better positioned to stand out in an increasingly crowded market.

Regulatory Challenges in a Shifting Policy Landscape

As AI becomes more pervasive, governments are working to establish clear regulations around its development and deployment. Topics like algorithmic transparency, ethical data usage, and bias mitigation are now under legislative review. Companies aligned with these evolving policies are gaining credibility. AI Stocks in compliance-focused firms are often viewed more favorably as public scrutiny and investor expectations continue to rise.

Environmental Efficiency Powered by AI

A growing number of AI-driven companies are applying their tools to sustainability efforts. From optimizing energy grids to reducing waste in supply chains, artificial intelligence is being deployed to support responsible resource use. Firms at the intersection of technology and environmental goals are increasingly being included in ESG-focused portfolios, strengthening the appeal of AI Stocks committed to sustainable innovation.

Managing Ethical and Operational Risks

Despite rapid growth, challenges remain. Development costs are high, and questions about job displacement, algorithmic fairness, and data governance continue to raise ethical concerns. For firms within the AI Stocks category, addressing these issues transparently is essential. Those that lead in responsible AI design while maintaining competitive performance are more likely to sustain long-term investor confidence.

Global Expansion and Market Penetration

AI applications are no longer confined to developed markets. Companies are expanding their reach into Asia, Latin America, and Africa, where growing digital infrastructure is enabling new use cases. As these markets embrace AI in education, healthcare, and agriculture, firms extending their international presence are helping broaden the footprint of AI Stocks, reinforcing their global relevance.

Use of AI Across Critical Sectors

Artificial intelligence is no longer a standalone tool—it is embedded in essential industries. Healthcare uses AI for diagnostics and treatment planning, while finance applies it in fraud detection and algorithmic trading. Retailers personalize shopping experiences with AI, and transportation firms are using it to optimize logistics. This cross-sector integration strengthens the case for investing in AI Stocks as core enablers of next-generation business.

Long-Term Outlook for AI-Driven Growth

As artificial intelligence continues to evolve, so does the opportunity surrounding AI Stocks. Despite regulatory hurdles and market volatility, structural demand remains strong. Companies that focus on transparency, innovation, and scalability are expected to play an increasingly important role in global technology adoption. Investors looking to align with long-term digital infrastructure and intelligent automation trends are finding strategic value in this high-growth segment.

0 notes

Text

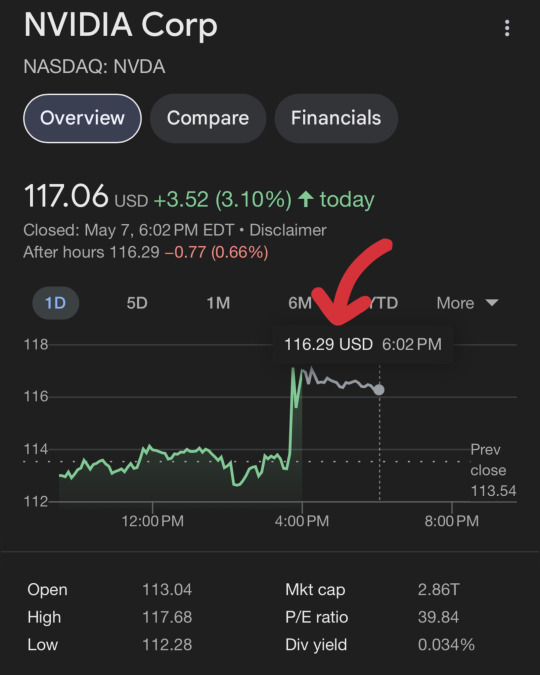

🚨 Before market close, $NVDA is booming 🚀 — surging on reports Trump may reverse chip export restrictions 🇺🇸⚙️

Unlocked a new zone? 📈

Are we entering a new rally? 🔥

Support levels:

113.67 🛡️ | 110.27 🛡️

Resistance ahead:

119.07 🚧 | 121.07 🚧

#NVDA #AIstocks #ChipBoom #StockMarket

1 note

·

View note

Text

youtube

Tech Stocks: High Risk, High Reward? 🚀 #shorts Tech Stocks: High Risk, High Reward? 🚀 #investing #techstocks #stockmarket #technology #investing101 #financetips #riskvreward #stocktrading #AIstocks #biotechstocks #tradingstrategy #investingtips Watch the full video here: https://www.youtube.com/watch?v=I3F8LVXMcZw via Online Gravy https://www.youtube.com/channel/UC9v5UhrL5hYKZmu2hkgCWfQ January 06, 2025 at 09:45PM

#onlinegravy#financialeducation#financialfreedom#makemoneyonline#dividendinvesting#financialindependence#selfimprovement#realestate#Youtube

0 notes