#Accounting Software for Small Business in India

Explore tagged Tumblr posts

Text

Top 10 Features of Fastax the Best Accounting Software for Small Business in India

In today’s fast paced business environment, traditional accounting methods are no longer sufficient. Businesses often struggle with managing complex financial processes manually, leading to errors, delays, and inefficiencies. To stay competitive, organizations need modern, efficient, and automated accounting solutions. This is where Fastax comes in, a game-changing accounting software designed to streamline financial management, enhance accuracy and boost overall efficiency.

As a leading software solutions company, Fastax understands the challenges businesses face when handling their financial operations. And its is the Accounting Software for Small Business in India. Whether you’re searching for best invoicing software for small business, payroll software for small business, or the best billing software for small business, Fastax offers a comprehensive suite of features to simplify financial processes. This makes it one of the top choices for accounting software for small business in India and an ideal billing software for small business.

Let’s explore the top features of Fastax that can revolutionize the way businesses handle accounting and financial management.

0 notes

Text

Empower Your Business with Smarter Tally Customization | Rajlaxmi Solutions

In an age where every second counts, your business tools should work for you—not the other way around. While Tally is already a trusted platform for accounting, the real magic happens when it’s customized to match your business's unique needs.

At Rajlaxmi Solutions, we help you unlock the full power of Tally by tailoring it to fit your exact workflow, industry, and operational goals.

⚡ Why Customizing Tally Makes All the Difference

Tally’s default features serve as a solid foundation—but every business has its own processes, challenges, and goals. Customizing Tally allows you to:

Eliminate repetitive manual work

Get reports that actually support decision-making

Stay compliant without the chaos

Streamline your entire financial ecosystem

In short? You stop working around your software and start working with it.

🔑 Key Benefits of Tally Customization

🔄 Process Automation

Minimize errors and save time with automated billing, voucher entries, and report generation—giving your team more time to focus on what really matters.

📈 Business-Specific Reports

Whether it’s inventory turnover, overdue receivables, or custom KPIs—get insights that truly reflect your business’s performance.

🔗 Third-Party Integration

Link Tally with other platforms like CRMs, payroll software, or e-commerce systems to keep everything synced in real-time.

🧾 Hassle-Free GST Compliance

Custom modules help you generate returns, e-invoices, and e-way bills with ease—ensuring accuracy and avoiding penalties.

👥 Controlled User Access

Assign roles and permissions to different team members, enhancing security and accountability.

📊 What Our Clients Have Achieved

After switching to customized Tally setups, our clients have reported:

Up to 60% improvement in operational efficiency

Dramatic reduction in manual errors

Faster decision-making from real-time data

Greater ease in managing compliance and audits

👨💼 Why Partner with Rajlaxmi Solutions?

We don’t believe in cookie-cutter solutions. Our team takes the time to understand your business model, challenges, and growth goals. Then we create a customized Tally setup that feels like it was built just for you—because it was.

🚀 Ready to Upgrade How You Work?

Don’t let outdated systems slow you down. With Rajlaxmi Solutions, Tally becomes more than just accounting software—it becomes your business advantage.

📞 Get in touch today and explore how Tally customization can transform your business from the inside out.

#Tally Customization Services#Business Process Automation#Tally ERP Solutions#Customized Accounting Software#Rajlaxmi Solutions#Tally for Small Business#Finance Automation Tools#Workflow Optimization#ERP Integration#Business Software India

1 note

·

View note

Text

In the dynamic landscape of Indian business, efficient financial management is key. Gbooks emerges as the beacon, offering a comprehensive suite of accounting solutions tailored to Indian enterprises. From seamless invoicing to robust expense tracking, it simplifies complexities. Its user-friendly interface ensures accessibility for all, while its powerful features cater to diverse needs. With customizable reports and real-time insights, decision-making becomes intuitive. Gbooks not only streamlines operations but also fosters growth through informed strategies. Embrace the future of accounting with Gbooks, your trusted partner in navigating the intricacies of Indian finance.

#Best Accounting Software in India#free online accounting software#easy accounting software#free accounting software#best accounting software#best accounting software for small business#accounting software

0 notes

Text

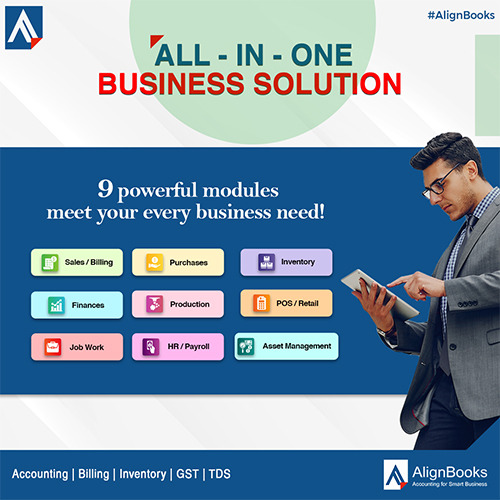

AlignBooks is the best accountancy software that helps you deal with the bookkeeping & accountancy problemswith zero paperwork and automated cash flow management. We provide CRM software that helps you manage your field manpower and order bookings and attendance on the go. Use the GST billing software to keep ahead with the auto calculation of GST components such as SGST and CGST.

We provide Open developer APIs to help you make your own innovations. For all documents, you can get alerts through SMS and Mailer facility. You get the best GST software available right now for your business. Contact us to get more information.

Contact Us:-

Align Info Solutions PVT. LTD.

Website:- https://alignbooks.com/accounting-softwares

Address: - 801-804 Assotech Tower Noida sector 135

Hours: Open ⋅ Closes 8PM

Toll Free : 1800 120 8581

Phone :- +91 11 49863201-04

#accounting software#small business accounting software#gst software#billing software#gst billing software#online accounting software#accounting software for small business#finance software#accounting software in india#pos software

0 notes

Text

Tally Training in Chandigarh: Build a Successful Accounting Career

In today’s fast-paced digital economy, proficiency in accounting software like Tally is no longer optional — it’s a necessity. Whether you’re a student, a working professional, or someone planning a career shift into finance, Tally training in Chandigarh offers a golden opportunity to build a solid foundation in business accounting. With growing business activity in the region, mastering Tally can set you apart in the competitive job market.

Introduction to Tally and Its Relevance

Tally is one of the most widely used business accounting software in India. It simplifies complex financial operations such as invoicing, inventory management, taxation, payroll processing, and financial reporting. Tally ERP 9, the earlier version, was known for its robust features, while Tally Prime — the latest iteration — offers an intuitive interface and smarter navigation for enhanced productivity.

In a country where small and medium enterprises form the economic backbone, Tally plays a critical role in helping businesses maintain compliance and streamline operations. From automating GST filings to tracking stock levels in real time, Tally’s capabilities are deeply aligned with the needs of modern Indian enterprises.

Why Choose Tally Training in Chandigarh?

Chandigarh has steadily grown into a major educational and business center in North India. With its well-connected infrastructure and proximity to Punjab, Haryana, and Himachal Pradesh, it attracts students and professionals from across the region.

The city boasts several reputed training institutes that specialize in job-oriented programs, including Tally training in Chandigarh. These institutes not only provide structured learning but also offer real-world exposure through internships and industry interactions. The business-friendly environment of Tricity — comprising Chandigarh, Mohali, and Panchkula — further enhances placement opportunities for Tally-trained individuals.

Key Features of a Good Tally Training Institute

Selecting the right institute can make a big difference in how effectively you master Tally. Look for the following features when choosing your Tally course:

Certified and experienced trainers ensure you’re learning from professionals who understand both the software and its industry applications. Practical exposure through case studies and real-time projects helps you gain confidence in using Tally in real-world scenarios.

Modern Tally courses now include essential modules like GST compliance, inventory control, payroll processing, MIS report generation, and taxation management. Institutes that regularly update their syllabus in sync with government norms and business trends are more valuable.

Personalized mentorship, flexible batch timings (weekend/evening), and career support services like resume building and mock interviews can significantly enhance your learning experience.

Career Scope After Tally Training

Completing a certified Tally course can unlock a variety of career paths. Common roles include:

Accountant

GST Consultant

Billing Executive

Finance Executive

Audit Assistant

Tally skills are especially in demand in sectors like retail, manufacturing, logistics, healthcare, and professional services. Small and mid-sized businesses across the Tricity area consistently hire Tally-certified professionals for daily bookkeeping, tax filing, and reporting.

The average starting salary for a fresher with Tally training ranges from ₹15,000 to ₹25,000 per month, with rapid growth potential as you gain experience and industry exposure.

Tally ERP 9 vs Tally Prime: What You’ll Learn

A well-rounded Tally training program in Chandigarh covers both Tally ERP 9 and the newer Tally Prime. While ERP 9 remains in use across many companies, Tally Prime introduces improved usability with a simplified menu structure, enhanced multi-tasking, and better data tracking.

Key modules you’ll explore include:

Financial Accounting and Ledger Management

Inventory Management and Stock Control

Payroll Setup and Salary Processing

GST and TDS Return Filing

MIS Reports and Business Intelligence

Data Backup and Security Features

You’ll also learn how to use Tally as a business management tool that integrates seamlessly with compliance and audit requirements.

Best Tally Training Institutes in Chandigarh

When choosing an institute, reputation matters. The best Tally training institutes in Chandigarh offer practical curriculum, certified trainers, placement assistance, and flexible learning schedules.

Bright Career Solutions Mohali stands out as a highly rated institute offering in-depth Tally training with practical exposure. With expert faculty, dedicated career support, and strong student feedback, BCS Mohali has become a trusted name in Tally education in the region.

Students regularly highlight the institute’s hands-on training approach, one-on-one mentorship, and successful placement records across local businesses and startups.

FAQs About Tally Courses in Chandigarh

Q. Is Tally useful for non-commerce students? Ans. Yes. Tally is designed to be user-friendly and can be learned by students from non-commerce backgrounds. Institutes usually begin with accounting basics before diving into software-specific training.

Q. What is the typical duration and cost of Tally training? Ans. The duration can range from 1 to 3 months depending on the course level (basic to advanced). Fees generally range from ₹5,000 to ₹15,000. Institutes like BCS Mohali also offer installment plans.

Q. Is a Tally certification necessary to get a job? Ans. While not mandatory, a certification adds credibility to your resume and significantly boosts your chances during hiring. Certified professionals are often preferred for finance and accounts roles.

Conclusion

Tally training in Chandigarh is more than just a short-term course — it’s a launchpad for a rewarding career in finance and accounting. With businesses increasingly relying on Tally for daily operations and compliance, skilled professionals are in high demand.

Whether you’re a student, job seeker, or professional looking to upgrade your skills, enrolling in a Tally course from a reputed institute like Bright Career Solutions Mohali can help you take a decisive step toward career success. The right training, combined with dedication and practice, can turn you into a valuable asset for any business.

2 notes

·

View notes

Text

🧾 GST Billing & Invoicing Software – The Ultimate Solution for Small Businesses in India

In today’s fast-paced business world, managing GST invoices, stock, and accounts manually is not only time-consuming but prone to errors. This is where a smart GST Billing & Invoicing Software comes to your rescue.

Whether you run an optical store, retail shop, or small business — using automated GST software can save hours and boost productivity.

✅ Why You Need GST Billing Software

1. 100% GST Compliant Invoices - Create professional invoices with your GSTIN, HSN/SAC codes, and automated tax calculations — in seconds.

2. E-Invoice Generation - Connect directly with the GSTN portal for seamless e-invoicing and avoid penalties.

3. Integrated Stock & Inventory Management - Track your real-time stock levels, product batches, expiry dates, and low stock alerts — all from your billing screen.

4. Sales, Purchase, & Return Management - Handle sales orders, purchase orders, quotations, and returns with one-click conversion to invoices.

5. Tally Integration & Accounting - Export reports directly to Tally ERP and simplify your accounting process.

🔍 Top Features of GST Billing & Invoicing Software

📦 Inventory & Stock Control

💳 POS System for Fast Billing

🧾 GST Reports: GSTR-1, GSTR-3B, GSTR-9

📈 100+ Business Reports (Profit & Loss, Stock, Sales)

🧑💼 Multi-user Access with Role Permissions

☁️ Cloud Backup & Data Security

📱 Mobile & Desktop Compatible

👨💻 Who Is It For?

This software is ideal for:

🕶️ Optical Shops

🛍️ Retail Stores

🏥 Pharmacies

🧰 Hardware Shops

📚 Book Stores

🏬 Small & Medium Enterprises (SMEs)

🚀 Boost Business Efficiency Today!

Switching to a Partum GST billing software is not just about compliance — it’s about scaling your business smartly. With built-in automation, detailed reports, and error-free invoicing, your daily operations become faster and smoother.

📞 Book your FREE demo now! ✅ No credit card needed ✅ 17+ Software packages ✅ Trusted by 5,000+ businesses

youtube

#gst billing software#InvoicingSoftwareIndia#BillingAndInventory#RetailBilling#EInvoiceIndia#TallyIntegration#Youtube

2 notes

·

View notes

Text

Accounting Firms in India: Enabling Financial Growth for Modern Businesses

The Essential Role of Accounting Firms in India

In today’s competitive business environment, accounting firms in India have become indispensable to companies aiming for financial transparency, legal compliance, and sustained growth. These firms are not only handling traditional tasks like bookkeeping and tax filing but are also offering strategic support in areas such as auditing, payroll management, and financial consulting. As India’s economy continues to evolve, the role of accounting professionals is becoming more crucial than ever.

With the increasing complexity of tax laws and financial regulations, businesses are turning to professional accounting firms to manage their financial responsibilities accurately and efficiently. The right firm can help reduce financial risks, ensure compliance with Indian accounting standards, and support the overall decision-making process.

Why Businesses Choose Professional Accounting Firms

Managing finances internally can be overwhelming, especially for small and mid-sized businesses. That’s why many organizations choose to outsource accounting functions to expert firms. Here’s why this trend is growing:

Regulatory Compliance: Accounting firms keep up with evolving tax laws, ensuring that businesses remain compliant with GST, income tax, and MCA regulations.

Cost Savings: Outsourcing is often more affordable than hiring an in-house accounting team, reducing operational costs.

Efficiency and Accuracy: Professional firms use advanced software and tools to ensure accurate record-keeping and timely financial reporting.

Scalable Solutions: Services can be adjusted to meet the needs of growing businesses, from startups to established enterprises.

Services Offered by Accounting Firms in India

Accounting firms in India offer a wide range of services tailored to different types of businesses. These include:

1. Bookkeeping and Financial Reporting

Maintaining organized financial records is the foundation of sound business practices. Firms handle daily transaction tracking, journal entries, ledger management, and monthly financial statement preparation.

2. Tax Planning and Filing

Navigating India’s tax system can be challenging. Accounting firms assist with GST returns, income tax filings, TDS calculations, and tax audits, while also advising on effective tax-saving strategies.

3. Audit and Assurance Services

Internal audits, statutory audits, and compliance audits help identify risks and inefficiencies. These services enhance transparency and build trust with stakeholders and investors.

4. Payroll and Compliance Management

From salary processing to PF, ESI, and professional tax deductions, accounting firms handle every aspect of payroll while ensuring compliance with labor laws and statutory requirements.

5. Business Advisory and Financial Consulting

Many firms also provide financial planning, budgeting, and forecasting services. This helps business owners make informed decisions based on data-driven insights.

Qualities to Look for in an Accounting Firm

Choosing the right accounting partner is a strategic business decision. When evaluating potential firms, consider the following:

Certification and Experience: Ensure the firm is registered with the Institute of Chartered Accountants of India (ICAI) and has experience in your industry.

Technological Capability: Look for firms that use modern accounting tools such as Tally, Zoho Books, QuickBooks, or Xero.

Transparent Communication: A reliable firm provides regular updates, clear reports, and prompt support.

Customizable Services: Every business has unique needs. Choose a firm that offers tailored solutions instead of one-size-fits-all packages.

The Advantages of Hiring Indian Accounting Firms

India’s accounting sector is recognized for its high standards of professionalism and affordability. Some of the key benefits include:

Skilled Workforce: India produces thousands of qualified CAs and finance professionals each year.

Language Proficiency: English-speaking professionals make communication seamless for both domestic and international clients.

Competitive Pricing: Indian firms offer world-class services at cost-effective rates, making them attractive for global outsourcing.

The Evolving Future of Accounting in India

The accounting industry in India is rapidly adapting to technological innovation. Automation, artificial intelligence (AI), and cloud computing are transforming how firms deliver services. Clients now benefit from real-time financial data, predictive analytics, and paperless operations.

Additionally, government initiatives such as faceless assessments, e-invoicing, and digital compliance are pushing accounting firms to adopt smarter workflows and enhance client service quality.

As businesses continue to embrace digital transformation, accounting firms are expected to play an even bigger role—not just as compliance experts, but as strategic financial advisors.

Conclusion

In a fast-changing economic landscape, accounting firms in India have emerged as trusted partners for businesses that want to operate with confidence and clarity. Their expertise, combined with advanced technology and deep regulatory knowledge, allows companies to focus on their core activities while leaving the complexities of finance and compliance to the professionals.

Whether you're launching a startup, managing a growing enterprise, or expanding internationally, working with a reliable accounting firm can drive efficiency, reduce risk, and support long-term success.

2 notes

·

View notes

Text

The Role of Technology in Outsourcing Bookkeeping: How Assist Bay Uses Modern Tools for Seamless Integration

In today’s globalized economy, outsourcing bookkeeping services has become a strategic solution for businesses looking to streamline operations, reduce overhead costs, and improve efficiency. Particularly in the UK and the Caribbean, companies are increasingly outsourcing their accounting needs to offshore experts in India. At the heart of this transformation lies the role of technology, which has revolutionized the way businesses integrate with outsourced bookkeeping services. Assist Bay, a leader in providing outsourced bookkeeping solutions, is harnessing modern tools to make this process seamless, efficient, and transparent.

The Growing Trend of Bookkeeping Outsourcing

Outsourcing bookkeeping services is a growing trend, especially in the UK and the Caribbean, where businesses are constantly seeking ways to reduce operational costs while maintaining high-quality financial management. Many businesses in these regions, especially small to medium-sized enterprises (SMEs), are turning to offshore solutions like those provided by Assist Bay, which is based in India. Outsourcing bookkeeping not only allows companies to access skilled accounting professionals at a fraction of the cost but also ensures that businesses can focus on their core activities while maintaining financial accuracy and compliance with local tax laws.

Why India for Outsourcing Bookkeeping?

India has long been a go-to destination for outsourcing services due to its large pool of skilled professionals, a robust IT infrastructure, and cost-efficiency. Indian bookkeeping experts are well-versed in international accounting standards, including UK GAAP (Generally Accepted Accounting Principles) and Caribbean tax laws, making them a perfect fit for businesses in the UK and the Caribbean.

The Role of Technology in Bookkeeping Outsourcing

As the landscape of outsourcing evolves, so does the technology that supports it. At Assist Bay, modern tools play a crucial role in making bookkeeping outsourcing seamless. Here’s how technology is transforming the process.

Cloud-Based Bookkeeping Software

One of the biggest advancements in the bookkeeping industry has been the shift to cloud-based platforms. Tools like QuickBooks, Xero, and Zoho Books allow real-time access to financial data from anywhere in the world. This enables business owners in the UK and the Caribbean to collaborate effectively with their offshore bookkeeping teams in India. Cloud-based software ensures that all financial data is stored securely, and updates can be made in real-time, reducing the risk of errors. Whether it’s invoicing, payroll, or tax filing, cloud-based bookkeeping tools ensure that everything is up-to-date and accurate.

2. Automation of Repetitive Tasks

Another significant way technology has improved bookkeeping outsourcing is through automation. At Assist Bay, advanced automation tools are used to manage repetitive tasks such as data entry, transaction categorization, and reconciliation. This reduces human error, saves time, and ensures that the team can focus on more strategic tasks, like financial analysis and forecasting. By automating these routine tasks, businesses in the UK and Caribbean can rely on fast, accurate, and consistent bookkeeping services without the worry of manual errors creeping in.

3. Integration with Financial Systems

One of the key benefits of outsourcing bookkeeping to India is the seamless integration with a company’s existing financial systems. Modern tools allow for smooth integration with platforms like ERP systems, CRMs, and other financial applications. Assist Bay leverages APIs (Application Programming Interfaces) to connect various software tools, ensuring that data flows effortlessly between systems. This integration ensures that businesses don’t have to deal with fragmented information. They can access consolidated financial data, reports, and analytics from one central location, making decision-making more efficient and informed.

4. Data Security and Compliance

Data security and compliance are top concerns for businesses when outsourcing their bookkeeping. In the UK and the Caribbean, businesses need to ensure that their financial data is protected and compliant with local regulations. Assist Bay employs the latest encryption technologies to safeguard sensitive financial information, ensuring that only authorized personnel have access. Moreover, Assist Bay stays up-to-date with changes in tax laws and accounting standards, ensuring that all bookkeeping practices meet local regulatory requirements. For businesses in the UK, this means adhering to HMRC standards, while for companies in the Caribbean, it involves compliance with local tax laws, which can differ from one island to another.

5. Real-Time Collaboration and Communication Tools

Technology has also improved communication between outsourced bookkeeping teams and businesses. Assist Bay uses collaborative tools like Slack, Microsoft Teams, and Zoom to ensure constant communication and immediate resolution of any issues. This ensures that clients in the UK and the Caribbean are always in the loop and can easily discuss any concerns with their bookkeeping team. Real-time communication tools also allow for faster decision-making and better collaboration on financial reports and business strategies. As a result, businesses can stay agile and responsive in today’s competitive environment.

6. Data Analytics and Reporting

Gone are the days of manual ledger entry and paper-based reporting. With the help of modern tools, Assist Bay provides businesses in the UK and Caribbean with detailed financial analytics and real-time reports. By analysing financial data with AI-powered tools, Assist Bay helps businesses gain valuable insights into their spending habits, cash flow, and profitability. These reports can be customized to suit the specific needs of a business, giving stakeholders the information they need to make informed decisions. Whether it’s forecasting revenue, tracking expenses, or assessing tax liabilities, data-driven insights are now more accessible than ever before.

The Future of Bookkeeping Outsourcing

The future of bookkeeping outsourcing lies in the continued evolution of technology. As cloud computing, automation, and AI become more advanced, the role of technology in outsourcing will only grow. Assist Bay is at the forefront of this change, helping businesses in the UK and the Caribbean seamlessly integrate outsourced bookkeeping services with modern technology. By leveraging cutting-edge tools and maintaining a focus on security, accuracy, and compliance, Assist Bay ensures that businesses can confidently rely on outsourced bookkeeping services without compromising on quality. As the demand for outsourcing grows, businesses in the UK, Caribbean, and beyond will continue to benefit from the efficiency, cost savings, and strategic insights that modern technology offers. Outsourcing bookkeeping services to India is no longer just about saving costs — it’s about gaining a competitive advantage by leveraging the power of technology for smarter, more efficient financial management.

2 notes

·

View notes

Text

How Small and Mid-Sized Engineering Firms Can Benefit from ERP

In today’s competitive business landscape, manufacturers and engineering companies in India are under constant pressure to improve efficiency, reduce costs, and enhance productivity. The adoption of ERP for manufacturing companies in India has become more than just a trend—it is a necessity for survival and growth. Manufacturing ERP software in India is specifically designed to address the unique challenges faced by the industry, offering seamless integration, automation, and data-driven decision-making capabilities.

If you are an engineering or manufacturing business looking to streamline your operations, this blog will help you understand why ERP software for engineering companies in India is essential and how choosing the best ERP for the engineering industry can revolutionize your operations.

Why ERP is Essential for Manufacturing and Engineering Companies

1. Streamlining Operations and Enhancing Efficiency

One of the biggest challenges faced by manufacturing and engineering companies is managing various processes such as inventory, procurement, production, and distribution. Manufacturing ERP software in India centralizes data, enabling real-time monitoring and control over every aspect of the business. This eliminates redundant tasks, reduces manual errors, and improves efficiency.

2. Improved Supply Chain Management

A well-integrated ERP system ensures smooth coordination with suppliers, vendors, and distributors. With ERP for manufacturing companies in India, businesses can track raw materials, monitor supplier performance, and optimize procurement processes, reducing delays and ensuring a seamless supply chain.

3. Enhanced Data-Driven Decision Making

With access to real-time data analytics and comprehensive reporting, ERP software for engineering companies in India empowers businesses to make informed decisions. Managers can analyze production trends, forecast demand, and identify areas for improvement, leading to better business outcomes.

4. Cost Reduction and Higher Profitability

Automation of processes helps in minimizing waste, reducing operational costs, and increasing profitability. The best ERP for the engineering industry ensures resource optimization by tracking inventory levels, reducing excess stock, and eliminating inefficiencies in production planning.

5. Compliance and Quality Control

Manufacturers must adhere to strict industry standards and regulatory requirements. Manufacturing ERP software in India helps in maintaining compliance by providing documentation, audit trails, and quality control measures, ensuring that all products meet industry regulations.

Key Features of the Best ERP for Engineering Industry

Choosing the right ERP solution is crucial for achieving maximum benefits. Here are some key features to look for in an ERP software for engineering companies in India:

Comprehensive Production Planning & Control – Ensures seamless coordination between different production units.

Inventory & Material Management – Tracks stock levels, raw materials, and procurement processes efficiently.

Financial Management – Integrates accounting, payroll, and financial reporting for better fiscal control.

Supply Chain Management – Enhances supplier relationships and improves procurement efficiency.

Customer Relationship Management (CRM) – Manages customer interactions, sales pipelines, and service requests.

Business Intelligence & Reporting – Provides real-time insights for strategic decision-making.

Scalability & Customization – Adapts to the growing needs of your business with modular functionalities.

Top ERP Software Providers in India

India is home to some of the top ERP software providers, offering advanced solutions for engineering and manufacturing businesses. Companies like Shantitechnology (STERP) have emerged as leaders in providing industry-specific ERP solutions that cater to the unique requirements of manufacturing and engineering firms.

Why Choose STERP?

STERP is one of the top ERP software providers in India, offering customized ERP solutions specifically designed for the engineering and manufacturing industries. Here is why STERP stands out:

Industry-Specific Solutions – Tailored to meet the challenges of the manufacturing and engineering sectors.

Cloud & On-Premise Options – Flexible deployment models to suit different business needs.

User-Friendly Interface – Easy to use, with intuitive dashboards and real-time analytics.

Excellent Customer Support – Dedicated support teams for implementation and ongoing assistance.

Scalable Solutions – Designed to grow with your business, ensuring long-term usability and return on investment.

How to Implement ERP for Maximum Success

Step 1: Assess Business Needs

Understand your business requirements and identify key areas that need improvement. Choose a solution that aligns with your industry needs.

Step 2: Choose the Right ERP Software

Selecting the best ERP for the engineering industry involves comparing features, scalability, pricing, and vendor support.

Step 3: Customization & Integration

Ensure that the ERP system integrates seamlessly with your existing tools and is customizable to fit your unique business processes.

Step 4: Training & Support

Invest in training programs to ensure that your team is comfortable using the new system. Opt for a provider that offers continuous support and upgrades.

Step 5: Monitor & Optimize

Post-implementation, continuously monitor the system’s performance, gather feedback, and make necessary optimizations to enhance efficiency.

Future Trends in ERP for Manufacturing and Engineering

The ERP landscape is evolving rapidly, with emerging trends shaping the future of ERP for manufacturing companies in India. Some key trends to watch include:

AI & Machine Learning Integration – Automating predictive maintenance and process optimization.

Cloud-Based ERP Solutions – Offering flexibility, remote accessibility, and cost savings.

IoT-Enabled ERP – Enhancing real-time tracking of production and inventory.

Mobile ERP – Allowing on-the-go access for better decision-making.

Blockchain for Supply Chain Management – Ensuring transparency and security in transactions.

Conclusion

Investing in ERP software for engineering companies in India is no longer an option—it is a necessity for businesses looking to stay ahead in the competitive market. Whether you are a small manufacturer or a large-scale engineering firm, having the best ERP for the engineering industry can drive efficiency, improve decision-making, and enhance overall profitability.

With industry leaders like Shantitechnology (STERP) offering cutting-edge solutions, businesses can achieve digital transformation effortlessly. As one of the top ERP software providers in India, STERP continues to empower manufacturing and engineering companies with tailored ERP solutions.

Are you ready to revolutionize your business with ERP? Contact STERP today and take the first step towards seamless automation and unmatched efficiency!

#ERP software for engineering companies#Engineering ERP Software Company#ERP solution providers#ERP software companies#ERP software for engineering companies in India#Best ERP for engineering industry#India#Gujarat#Maharashtra

4 notes

·

View notes

Text

Accounting Software for Small Business in India

0 notes

Text

Best Billing and Accounting Software in India – Tririd Biz

In the current fast-paced business world, the best billing and accounting software in India is essential for small and medium enterprises. Tririd Biz is such an extremely powerful solution, which is an all-in-one platform designed to fulfill your billing and accounting requirements.

Tririd Biz looks at integrating invoice generation, GST billing, expense tracking and financial reporting into a single user-friendly platform to ensure a seamless experience. Whether a small retailer or a service provider or a freelance professional, the software saves your time and ensures that your finances are in order.

🌟 Key features of Tririd Biz:

GST Easy Invoicing: Generate GST-compliant invoices quickly and accurately.

Smart Accounting: Easy track on income, expenses, and ledgers.

Free Demo Available Experience the real strength of Tririd Biz without commitment demo.

Secure & Cloud-based: Access from anywhere on the globe over secured data.

Simple Interface: No technical knowledge needed – it's built just for business owners.

Make Tririd Biz, and say goodbye to hand calculations and juggling between tools. Financial accuracy, GST return filing made easy, organizational power for business activities is possible through this software.

If you are looking for an effective solution to managing your daily billing accounting work then Tririd Biz is the best tool for you. Its cost effectiveness, efficiency, and compatibility with the Indian environment make it worth using.

👉 Want to simplify your business accounting? Get Tririd Biz now and get a free demo!

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

FAQs

Q: Why do small businesses in India need accounting software?

A: The software automates tasks like invoicing, GST calculations, and expense tracking, saving time and minimizing human labor errors.

Q: What features of billing software should be considered?

A: GST support for invoice generation, client management, real-time reporting, multi-user access, and security of data would be some of the features.

Q: Is cloud accounting software better compared to offline software?

A: Accessibility from anywhere, automatic backups, and real-time collaboration make cloud-based tools much more convenient than offline tools.

Q: How can I be safe about my financial data?

A: Software lets you have secure logins, encrypting, and regular backups, and never share with others while using secure logins.

Q: Does accounting software help with tax filing in India?

A: Most of these tools offer GST-compliant reports and summaries that can be used to easily file returns every quarter and annually.

#best billing software India#accounting software for small business#GST billing software#invoice software India#Tririd Biz software

0 notes

Text

Accounting Services in Delhi, India by SC Bhagat & Co.

In the fast-paced business environment of Delhi, having reliable and efficient accounting services is crucial for the success and sustainability of any enterprise. SC Bhagat & Co., a trusted name in the accounting industry, offers a comprehensive range of accounting solutions to businesses of all sizes. With years of expertise and a commitment to excellence, the firm provides customized services tailored to meet the unique financial needs of its clients.

Why Choose SC Bhagat & Co. for Accounting Services?

Experienced and Skilled Professionals

SC Bhagat & Co. has a team of highly qualified chartered accountants with extensive industry experience. Their expertise ensures that your financial records are maintained accurately and in compliance with regulatory requirements.

Comprehensive Accounting Solutions

The firm offers a wide range of accounting services, including:

Bookkeeping and ledger maintenance

Financial statement preparation

Payroll processing

Tax planning and compliance

Auditing and financial analysis

Compliance with Indian Accounting Standards

Adhering to Indian Accounting Standards (Ind AS) and the latest tax regulations, SC Bhagat & Co. ensures that businesses remain compliant with legal obligations, minimizing the risk of penalties.

Cost-Effective and Scalable Services

Whether you are a startup, a small business, or a large corporation, SC Bhagat & Co. offers scalable accounting solutions that grow with your business. Their cost-effective services help organizations optimize financial management without straining their budgets.

Technology-Driven Approach

Utilizing advanced accounting software and cloud-based solutions, SC Bhagat & Co. ensures secure, real-time access to financial data. This allows businesses to make informed decisions promptly.

Benefits of Professional Accounting Services

Time-Saving

Outsourcing accounting services to SC Bhagat & Co. allows business owners to focus on core operations without worrying about financial management.

Accurate Financial Reporting

Professional accountants ensure that financial reports are error-free, which is essential for securing investments, obtaining loans, and strategic decision-making.

Reduced Tax Burden

Expert tax planning and compliance services help businesses minimize tax liabilities while ensuring adherence to government regulations.

Improved Cash Flow Management

Effective accounting practices contribute to better cash flow management, enabling businesses to meet their financial obligations on time. Partner with SC Bhagat & Co. Today!

If you are looking for reliable accounting services in Delhi India, SC Bhagat & Co. is your go-to partner. Their commitment to professionalism, integrity, and customer satisfaction makes them a preferred choice among businesses across various industries.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances#beauty#actors

2 notes

·

View notes

Text

#sales and distribution module in erp#erp software#erp manufacturing#accounting#erp solution bd#crm software#india#erp360#fnb360#erp software for construction industry#erp for manufacturing industry#manufacturing erp#erp software for manufacturing industry#manufacturing erp software#manufacturing software small business#manufacturing software

0 notes

Text

In the dynamic landscape of Indian business, efficient financial management is key. Gbooks emerges as the beacon, offering a comprehensive suite of accounting solutions tailored to Indian enterprises. From seamless invoicing to robust expense tracking, it simplifies complexities. Its user-friendly interface ensures accessibility for all, while its powerful features cater to diverse needs. With customizable reports and real-time insights, decision-making becomes intuitive. Gbooks not only streamlines operations but also fosters growth through informed strategies. Embrace the future of accounting with Gbooks, your trusted partner in navigating the intricacies of Indian finance.

#Best Accounting Software in India#free online accounting software#easy accounting software#free accounting software#best accounting software#best accounting software for small business#accounting software

0 notes

Text

If you are facing any problem in account software then you should try Alignbook Accounting Software for easy accounting, billing, GST, Income tax etc.

AlignBooks is the best accountancy software that helps you deal with the bookkeeping & accountancy problemswith zero paperwork and automated cash flow management. We provide CRM software that helps you manage your field manpower and order bookings and attendance on the go. Use the GST billing software to keep ahead with the auto calculation of GST components such as SGST and CGST.

We provide Open developer APIs to help you make your own innovations. For all documents, you can get alerts through SMS and Mailer facility. You get the best GST software available right now for your business. Contact us to get more information.

Contact Us:-

Align Info Solutions PVT. LTD.

Website:- https://alignbooks.com/accounting-softwares

Address: - 801-804 Assotech Tower Noida sector 135

Hours: Open ⋅ Closes 8PM

Toll Free : 1800 120 8581

Phone :- +91 11 49863201-04

#accounting software#small business accounting software#gst software#billing software#gst billing software#online accounting software#accounting software in india#accounting software for small business#finance software#pos software

0 notes

Text

Bookkeeping in India by MASLLP: Streamlining Your Financial Processes

Bookkeeping is a crucial aspect of any business, ensuring that financial records are accurate and up to date. In India, businesses of all sizes are increasingly recognizing the importance of professional bookkeeping services. MASLLP, a leading firm in the financial sector, offers comprehensive bookkeeping services tailored to meet the unique needs of businesses in India.

Why Bookkeeping Matters for Your Business Effective bookkeeping is the foundation of good financial management. It involves recording daily financial transactions, such as sales, purchases, payments, and receipts. Accurate bookkeeping helps businesses:

*Monitor Financial Health: By maintaining organized records, businesses can track income and expenses to assess their financial performance. *Ensure Compliance: Staying compliant with Indian tax laws is crucial. Proper bookkeeping ensures that businesses meet legal requirements and avoid penalties. *Facilitate Decision-Making: Well-maintained financial records help business owners make informed decisions about expansion, investment, and other key areas. *Prepare for Audits: Bookkeeping simplifies the auditing process, ensuring all financial documents are readily available and accurate.

Challenges of Bookkeeping in India Bookkeeping can be time-consuming and complex, especially for small and medium-sized enterprises (SMEs) in India. Some common challenges include:

*Regulatory Compliance: Businesses must adhere to constantly changing tax regulations, including GST and income tax laws. *Managing Multiple Transactions: For businesses with high volumes of daily transactions, keeping track of every detail can be overwhelming. *Handling Multiple Currencies: Many businesses in India deal with international clients, making currency conversion and documentation more complicated.

Why Choose MASLLP for Bookkeeping in India MASLLP understands the specific challenges businesses face in maintaining accurate financial records. With years of expertise in accounting and bookkeeping, MASLLP offers solutions that are both efficient and cost-effective.

Expertise in Indian Regulations MASLLP’s team is well-versed in Indian tax laws and accounting standards. They ensure that your business complies with all regulatory requirements, including GST filings, tax payments, and financial reporting.

Tailored Services for All Industries No matter your industry or the size of your business, MASLLP provides personalized bookkeeping services to meet your specific needs. Whether you run a manufacturing firm, a tech startup, or a retail business, MASLLP can help.

Use of Cutting-Edge Technology MASLLP utilizes the latest accounting software and tools to streamline the bookkeeping process. This technology minimizes errors and maximizes efficiency, giving you more time to focus on growing your business.

Comprehensive Financial Reporting MASLLP delivers detailed financial reports that give you a clear picture of your business’s financial health. These reports can be customized to provide insights into key areas such as profitability, cash flow, and tax obligations.

The Benefits of Outsourcing Bookkeeping to MASLLP Outsourcing bookkeeping to MASLLP offers several advantages:

*Cost Savings: Hiring a full-time in-house bookkeeper can be expensive. Outsourcing allows you to save on salary, benefits, and training costs. *Increased Accuracy: With a team of experts handling your books, the chances of errors are minimized. *Focus on Core Activities: By outsourcing bookkeeping, you can focus on your core business activities without worrying about managing financial records. *Timely Services: MASLLP ensures that all bookkeeping tasks are completed on time, from tax filings to financial reports.

Conclusion Bookkeeping in India is essential for maintaining a healthy business. With MASLLP’s expert services, you can rest assured that your financial records are accurate, up to date, and fully compliant with Indian laws. By outsourcing your bookkeeping needs to MASLLP, you’ll not only save time and money but also gain valuable insights into your business’s financial health. Contact MASLLP today to learn more about how our bookkeeping services can help your business thrive.

#accounting & bookkeeping services in india#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services#audit

4 notes

·

View notes