#AgriCommodity

Explore tagged Tumblr posts

Text

Top 7 Agricultural Products Exported by India

India has emerged as a strong player in the global agriculture sector, particularly in the rice trade. Every grain of rice, aromatic spice, and delicious fruit exported reflects the country's commitment to reliability and competitiveness. These products are in high demand internationally due to their quality and unique flavors, which are characteristic of Indian agriculture.

As India continues to make waves in the global market, its agricultural exports are more than just transactions; they represent a narrative of excellence, resilience, and a consistent contribution to the ever-evolving landscape of international agriculture.

0 notes

Text

Fertiliser Affordability: It’s All About the Tariffs

I intentionally delayed my March affordability analysis, as it was quite clear that the White House's announcement of new import tariffs would have some impact on both agricultural commodities and fertiliser prices.

I still believe it’s a bit too early to draw definitive conclusions about the consequences of the newly announced tariffs, even though President Trump has postponed their implementation by three months. Nevertheless, some price impact is already visible, particularly in the US.

To recap, I use recent CBOT values for wheat and corn and compare them with FOB per short tonne prices of DAP and urea in NOLA.

So, let’s begin.

Key Inputs: 11 April 2025 vs. February 2025

Here’s how the numbers compare:

Corn Price: $4.97 per bushel (up from $4.75 in February)

Wheat Price: $5.70 per bushel (up from $5.65 in February and from a low of $5.45 on 4 March 2025)

Urea FOB NOLA: $408 per short tonne (up from $385 in February)

DAP FOB NOLA: $645 per short tonne (up from $618 in February)

Now, let’s return to our relatively simple affordability calculations and analysis.

Affordability Ratios (2024–2025)

Affordability is calculated as the ratio of crop prices to fertiliser prices, offering a clearer understanding of the cost burden on producers.

Urea Affordability

Corn Producers

Month Ratio

June 0.0146

July 0.0145

August 0.0141

September 0.0138

October 0.0141

November 0.0141

December 0.0138

January 0.01279

February 0.01234

March 0.01218

Analysis: Affordability for corn producers has declined for the fifth consecutive month, now reaching its lowest level since I began tracking in June 2024.

Wheat Producers

Month Ratio

June 0.0177

July 0.0176

August 0.0173

September 0.0171

October 0.0171

November 0.0179

December 0.0166

January 0.01486

February 0.01468

March 0.01397

Analysis: After a brief improvement in February, wheat affordability dropped sharply in March and is now at its lowest point since June 2024.

DAP Affordability

Corn Producers

Month Ratio

June 0.0079

July 0.0078

August 0.0076

September 0.0073

October 0.0073

November 0.0073

December 0.0072

January 0.0085

February 0.0077

March 0.0077

Analysis: Impressively, despite sharp fluctuations in both corn and urea prices, the DAP affordability ratio for corn producers remained unchanged to the fourth decimal place.

Wheat Producers

Month Ratio

June 0.0098

July 0.0097

August 0.0095

September 0.0093

October 0.0093

November 0.0096

December 0.0095

January 0.0098

February 0.0091

March 0.0088

Analysis: This is now the lowest index since June 2024, when I began tracking affordability.

Comparison to February

Urea:

Corn producers: Affordability decreased by 1.29% in March 2025

Wheat producers: Affordability dropped by 4.83%

DAP:

Corn producers: Affordability remained unchanged

Wheat producers: Affordability fell by 3.30%. Analysis of Trends

The main decrease in affordability was driven by a sharp rise in fertiliser prices: urea increased by 5.97%, and DAP by 4.37%.

I keep asking myself how long this decline in affordability can continue and when the market will reach its resistance point. That said, both corn and wheat prices still appear relatively healthy according to analysts.

We’ve just entered Q2 2025, a period when nitrogen fertiliser demand typically slows in the Northern Hemisphere. It will be interesting to see how things develop over the next 30 days—and whether tariffs will exert further pressure on affordability.

I’m also considering whether the new tariff structure warrants a revision to my affordability methodology.

#agriculture#fertilization#fertilizer#urea#corn#usa#wheat#india#vessel#nola#imstory#affordability#agricommodities#tariffs war#tarrifs

11 notes

·

View notes

Text

Comprehensive Analysis of the Mustard Market: Size, Share, Growth Trends

The global mustard market size was estimated at USD 6.3 billion in 2023 and is expected to grow at a CAGR of 6.1% from 2024 to 2030. Consumers are increasingly aware of the health benefits associated with mustard, including its potential anti-cancer properties and nutritional value. Mustard seeds are rich in essential nutrients, which has led to a rise in demand for mustard-based products as part of a healthy diet. Mustard seeds are rich in essential nutrients, including proteins, fiber, vitamins, and minerals such as erucic acid and tocopherols. These components contribute to various health benefits, including improved digestion, reduced inflammation, and enhanced skin health. Companies are investing in research and development to create innovative mustard-based products, including gourmet mustards and functional foods with added health benefits. This includes mustard extracts and oils with enhanced nutritional profiles.

Mustard is a significant oilseed crop contributing substantially to global vegetable oil production. Its status as one of the top three sources of vegetable oil globally emphasizes its economic importance and market growth potential. Mustard oil is known for its high content of essential fatty acids, vitamins, and antioxidants, making it a popular choice for health-conscious consumers. Its anti-inflammatory and antimicrobial properties contribute to its appeal in both cooking and therapeutic applications. As consumers increasingly seek natural and healthy cooking oils, mustard oil is often chosen as a healthier alternative to sunflower or palm oil. In regions like India, mustard oil is a staple cooking ingredient, deeply embedded in culinary traditions. Its distinct flavor enhances various dishes, driving consistent demand.

Mustard powder is widely used as a flavoring agent in various food products, including sauces, dressings, and condiments. Its versatility enhances the taste of dishes, making it a staple in kitchens worldwide. Consumers are growing more accepting of ethnic flavors, leading to increased mustard powder usage in international cuisines. This trend is powerful in regions with diverse culinary practices.

For More Details or Sample Copy please visit link @: Mustard Market

Key Mustard Company Insights

The competitive landscape of the mustard market is characterized by a diverse array of domestic and international players, each vying for market share through various strategies. Major companies such as McCormick & Company, Unilever, Conagra Brands Inc., Backwoods Mustard Company, and Woeber Mustard Manufacturing Company dominate the sector. These firms are actively engaged in product innovation, focusing on developing new mustard varieties and enhancing existing products to meet evolving consumer preferences for health-oriented and gourmet options. Mergers and acquisitions are common strategies these leading companies employ to consolidate their market positions and expand their operational capabilities, allowing them to compete effectively against regional players.

#MustardMarket#MustardSeeds#MustardOil#MustardProduction#OilseedsMarket#AgriCommodities#SpiceMarket#FoodMarketTrends#AgriTrade#ExportMarkets#GlobalFoodMarket

0 notes

Text

💹 Trade Top Commodities MintCFD. From metals to energy commodities, start trading with confidence and maximize your profits. 🌍💰

✅ Trade with zero brokerage and leverage up to 100x ✅ Open an account instantly ✅ Get a 5% bonus on your first deposit ✅ Access 24/7 customer support

@mintcfd.official

#tradecommodities#commoditytrading#mintcfd#zerobrokerage#tradingplatforms#globalmarketaccess#financialfreedom#tradegold#energymarkets#oiltrading#tradesilver#investmentopportunities#naturalgas#commoditiesinvestment#crudeoil#tradecopper#futurestrading#agricommodities#tradingstrategy#marketinsights#diversifyportfolio#globaltrading#mintcfdcommodities

1 note

·

View note

Text

UK wheat markets likely to return above £200/t in early 2025

A bullish outlook for wheat in the first half of 2025 could drive up grain markets, with some industry forecasts predicting UK prices may hit £210/t next spring. Tighter global wheat stocks are projected to support trade in the new year, with less grain available from many of the major exporting nations. Independent grain marketing advisers CRM AgriCommodities suggested that the wheat supply…

0 notes

Text

Malaysia leverages cutting-edge tech and certification standards to propel sustainability agenda

Malaysia is leveraging cutting-edge technology and rigorous certification standards to position itself as a global leader in sustainability, particularly within the agricommodity sector, said Deputy Plantation and Commodities Minister Datuk Chan Foong Hin. Speaking at the Sustainable Action Conference 2024 (SAC2024) today, he highlighted the country’s commitment to balancing economic growth with…

0 notes

Video

youtube

Sesame Price | Copra Rate | Coconut Price | Kodumudi Agri Commodity Auction Report 05-06-2023 | AQSE | கொடுமுடி

0 notes

Text

UAE: Agri-Commodity Market Overview

UAE is a global center for Agri- trading. The UAE Economy has rapidly grown in the past few years. Most of its economic success goes to oil exports, the other industries such as agriculture are not that successful because of the scarcity of water reserves, poor soil, high temperature, low rainfall. This is the reason that it imports most of its food products from other countries. The major commodities that UAE imports from other countries are processed meat, fresh vegetables and fresh fruits. India is a major source of agri commodities for UAE like rice, Cashew, dairy products, Cocoa products, Floriculture, fresh vegetables, processed meat, Cereal preparations, fresh fruits.

How Agriculture Sector of UAE has revived in the past few years

According to reliable sources, in the early 1990s, the Agriculture sector of UAE contributed less than 4 percent of its GDP. However, agricultural activity has been the most popular among Emirati people. There have been few areas of farming like Diqdaqah in Ras Al Khaimah, Falak al Mualla in Umm al Quwain, the coastal area of Fujairah, WadiadhDhayd in Sharjah, Al Awir in Dubai and Al Ain and Liwa Oasis in Abu Dhabi. There were lots of obstacles also that UAE faced in agriculture sector such as environmental conditions, water crisis that had affected development. Due to these obstacles, the government had decided to take some steps to increase production of agri-commodities. They decided to give a 50% subsidy on fertilizers, seeds and pesticides. It resulted in the rapid growth of agriculture was seen during the 1990s. Apart from these types of farming, there has been an increase in production of fishing and poultry with local dairies, which meet 92% of its population demand.

There has always been a problem of the scarcity of water reserves. The UAE has made so many efforts to increase the cultivable area but unfortunately, it resulted in an increase in water and soil salinity. But today, the country has set a vision to shift towards sustainable agriculture. The UAE Agriculture sector adopts the latest technologies and modern irrigation systems. Currently, there are several organic vegetarian farms, manufacturing facilities, and also animal production farms. These changes have been seen in the UAE agriculture sector during COVID-19 pandemic, when some agri-commodity exporting countries have banned trade of basic food items.

UAE: Agri Commodities Trade with India

UAE has always been a big destination for India’s Agri based business. According to reliable sources, in 2019, India exported at least USD 38 billion of agricultural products to Middle East countries such as UAE, Bahrain, Cyprus, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, the Syrian Arab Republic, Turkey, Yemen. These countries have always been one of India’s largest markets for export. Recently, UAE has launched an e-market platform , Agriota that will reduce the gap between Indian farmers and the Gulf food Industry. The motive of this platform is to give an opportunity to Indian farmers to connect directly with UAE food processing companies.

How B2B Platforms help traders in trade globally

Tradologie.com – world’s 1st next generation B2B platforms facilitating trade in Agri-commodities and food products. It works by arranging live negotiations between verified sellers and buyers across the globe. They allow them to negotiate in real-time over prices, quality, quantity and finalize deals without any interruption of third person. Connect with Tradologie.com and discover new way to trade.UAE is a global center for Agri- trading. The UAE Economy has rapidly grown in the past few years. Most of its economic success goes to oil exports, the other industries such as agriculture are not that successful because of the scarcity of water reserves, poor soil, high temperature, low rainfall. This is the reason that it imports most of its food products from other countries. The major commodities that UAE imports from other countries are processed meat, fresh vegetables and fresh fruits. India is a major source of agri commodities for UAE like rice, Cashew, dairy products, Cocoa products, Floriculture, fresh vegetables, processed meat, Cereal preparations, fresh fruits. How Agriculture Sector of UAE has revived in the past few years According to reliable sources, in the early 1990s, the Agriculture sector of UAE contributed less than 4 percent of its GDP. However, agricultural activity has been the most popular among Emirati people. There have been few areas of farming like Diqdaqah in Ras Al Khaimah, Falak al Mualla in Umm al Quwain, the coastal area of Fujairah, WadiadhDhayd in Sharjah, Al Awir in Dubai and Al Ain and Liwa Oasis in Abu Dhabi. There were lots of obstacles also that UAE faced in agriculture sector such as environmental conditions, water crisis that had affected development. Due to these obstacles, the government had decided to take some steps to increase production of agri-commodities. They decided to give a 50% subsidy on fertilizers, seeds and pesticides. It resulted in the rapid growth of agriculture was seen during the 1990s. Apart from these types of farming, there has been an increase in production of fishing and poultry with local dairies, which meet 92% of its population demand. There has always been a problem of the scarcity of water reserves. The UAE has made so many efforts to increase the cultivable area but unfortunately, it resulted in an increase in water and soil salinity. But today, the country has set a vision to shift towards sustainable agriculture. The UAE Agriculture sector adopts the latest technologies and modern irrigation systems. Currently, there are several organic vegetarian farms, manufacturing facilities, and also animal production farms. These changes have been seen in the UAE agriculture sector during COVID-19 pandemic, when some agri-commodity exporting countries have banned trade of basic food items. UAE: Agri Commodities Trade with India UAE has always been a big destination for India’s Agri based business. According to reliable sources, in 2019, India exported at least USD 38 billion of agricultural products to Middle East countries such as UAE, Bahrain, Cyprus, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, the Syrian Arab Republic, Turkey, Yemen. These countries have always been one of India’s largest markets for export. Recently, UAE has launched an e-market platform , Agriota that will reduce the gap between Indian farmers and the Gulf food Industry. The motive of this platform is to give an opportunity to Indian farmers to connect directly with UAE food processing companies. How B2B Platforms help traders in trade globally Tradologie.com – world’s 1st next generation B2B platforms facilitating trade in Agri-commodities and food products. It works by arranging live negotiations between verified sellers and buyers across the globe. They allow them to negotiate in real-time over prices, quality, quantity and finalize deals without any interruption of third person. Connect with Tradologie.com and discover new way to trade.

0 notes

Photo

🌾🌾 Have a look on below levels on (7th Jan 2020) ➡ Rmseed (January) ➡ Chana (January) ➡ Guarseed (January) ➡ CPO (January) ➡ Soybean (January) ➡ Dhaniya (January) Password protected premium levels on Guarseed, Soybean, CPO and Dhaniya only for our subscribers. https://indianmarketview.com #IMV #IndianMarketView #AgriCommodity #AgriNews #AgriLevels #AgriUpdate #AgriReports (at Ansal Plaza Vaishali) https://www.instagram.com/p/B7AW6WQF190/?igshid=1rfha5g3ytm4b

0 notes

Link

The commodities which posted significant positive growth in exports were wheat, non basmati rice, soya meal, spices, sugar, raw cotton, fresh and processed vegetables and alcoholic beverages.

0 notes

Text

Agri-commodities export jumps 43% to Rs 53,626 cr during April-September 2020 from year-ago period

Agri-commodities export jumps 43% to Rs 53,626 cr during April-September 2020 from year-ago period

[ad_1]

The government had recently announced Agri Infra Fund of Rs 1 lakh crore.

Export of essential agri commodities for April-September, 2020 period has increased 43.4 per cent to Rs 53,626.6 crore vis-à-vis Rs 37,397.3 crore for the year-ago period, Ministry of Agriculture and Farmers Welfare said in a statement on Saturday. Groundnut with 35 per cent growth, refined sugar seeing 104 per cent…

View On WordPress

0 notes

Text

Impact of Maize Price Surge on Ethanol Production

The surge in maize prices in India highlights the complex relationship between government policies, market forces, environmental factors and agricultural commodities. To ensure the sustainability of agricultural markets and ethanol production, proactive measures and collaborative efforts are needed.

Policymakers should promote crop diversification to reduce reliance on a single crop, allowing farmers to adapt to changing market conditions and weather patterns. Investing in sustainable farming practices can increase productivity while minimizing environmental impact. Collaboration between government, industry, and farmers is crucial for effective implementation.

0 notes

Text

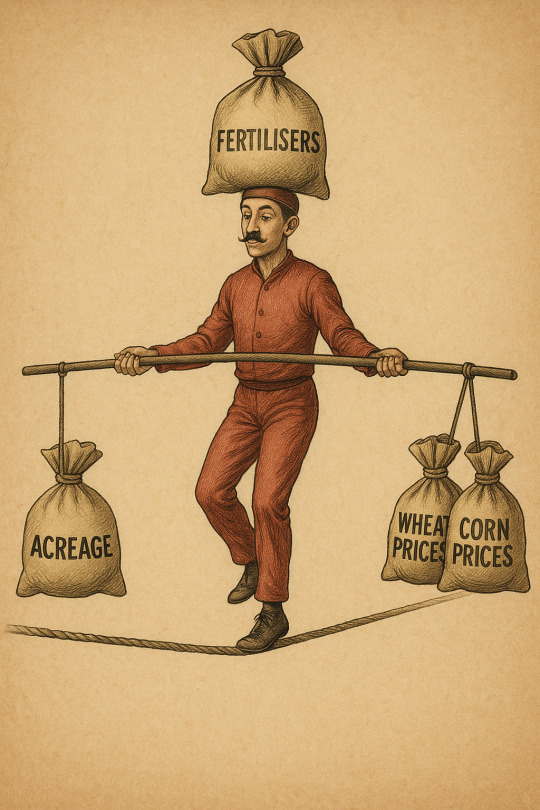

Both corn and wheat futures prices were hit badly yesterday. Why so?

More acreage = more harvest = more supply.

More supply = lower prices.

Lower prices = reduced affordability of fertilisers.

But larger acreage also requires more fertilisers.

And so, the cycle continues.

What looks like a simple equation is, in fact, a delicate balancing act for all market participants, including farmers, traders, and input suppliers. When prices fall, fertiliser affordability declines - just when nutrient demand is highest. It’s one of the great paradoxes to me, which requires a sharp skill, like circus rope balancing art.

Understanding this dynamic isn’t just for economists - it’s essential for anyone involved in the agri value chain.

Because in this business, everything is connected.

#imstory #fertilisers #fertilizers #agricommodities #wheat #corn #affordability #analysis #cbot #market #supply #demand #prices #cicus

#agriculture#fertilization#urea#fertilizer#corn#usa#wheat#vessel#imstory#affordability#agricommodities

3 notes

·

View notes

Link

Do you want to buy and sell agricultural products? If you are from a market trader, distributor, manufacturing, retailer, supplier, wholesale company, agricultural commodity trading company or farmer, then "Boli Bazar" can help you buy and sell your granary goods or if you saw any demand made by other traders, you can contact them if you need any assistance. Contact Boli Bazar Executive who is always ready for your service.

0 notes

Link

Grow Your Agro Business with CommodityOnline?

0 notes

Photo

Silver trading range for the day is 40170-40896

Silver prices ended with weekly gains as dollar weakness continued following a recent bout of softer inflation data. St. Louis Federal Reserve Bank President James Bullard said aggressive rate increases would risk nipping off U.S. business investment. Bond market investors remain confident the Fed will hike rates in June, but less sure of prospects for rate hikes in September and December.

Trading Ideas:

* Silver trading range for the day is 40170-40896.

* Silver prices ended with weekly gains as dollar weakness continued following a recent bout of softer inflation data.

* Weaker inflation data seen earlier in the week continued to drive direction, prompting traders to scale back their expectations for a faster pace of Federal Reserve rate hikes.

* US data showed import prices rose 0.3% in April, compared to a 0.2% dip in March, and missing forecasts of a 0.5% rise.

Commodity MCX live Price

For more information +91 74005-74001 Visit-https://goo.gl/yoJpf4

0 notes