#Algorithmic trading for beginners

Explore tagged Tumblr posts

Text

Mastering Algo Trading: Strategies for Success in Automated Trading

Algo trading, or algorithmic trading, is a popular method of executing trades using computerized systems and algorithms for efficiency and precision.

Read more..

#algo trading#algo trading app#bigul#algo trading india#algo trading platform#algo trading strategies#bigul algo#free algo trading software#algorithm software for trading#finance#algorithmic trading for beginners#best algo trading software in india#algorithm#algorithmic trading india#algos#algo trading software india#best algo trading software#best share trading app in india#best trading app#best share trading app#best online trading platforms#automated trading#algorithmic trading software free#top algo trading software#trading strategies#trading platform#online trading app#bigul algo trading app#bigul algo trading review#bigul algo trading

0 notes

Text

Discovering the Best Stock Trading Strategy: A Guide to Maximizing Market Success

Taking the step to discover the optimal stock trading strategy involves a thorough knowledge of different methodologies, each designed for a specific style of trading and market situation. Here's a review of some leading strategies:

1. Day Trading

Day trading is buying and selling of stocks on the same trading day with a view to making profits from short-term movements of price. Day traders using this method tend to use technical analysis and may use means such as moving averages and volume indicators to make quick judgments. The strategy requires round-the-clock attention and a thorough grasp of market conditions.

2. Swing Trading

Swing trading is designed to take advantage of gains by maintaining positions for days to weeks. Traders examine market trends, support and resistance, and momentum indicators to look for potential entry and exit points. This strategy balances the requirement for active management with the versatility of longer holding periods.

3. Position Trading

Position trading involves holding stocks over long periods of time, from several months to several years. The technique relies on the expectation that the value of a stock will increase over time, normally in tandem with fundamental analysis and macroeconomic reasons.

Investopedia

4. Scalping

Scalping is an actively traded high-frequency strategy that makes money off small price movements, where positions are held only for seconds or minutes. Scalpers make multiple trades per day, and this calls for discipline as well as a robust trading system to handle the high pace.

Investopedia

5. Algorithmic Trading

Algorithmic trading involves using computer programs to make trades in accordance with set parameters like timing, price, or volume. The approach reduces human intervention and is capable of processing large amounts of data at high speeds, which makes it ideal for efficiency and accuracy-seeking traders.

Hantec Markets

6. News Trading

News trading takes advantage of volatility in the market after economic announcements, earnings releases, or geopolitical developments. News traders track news feeds and respond immediately to take advantage of short-term price action created by new information.

Choosing the Ideal Strategy

Individual objectives, tolerance for risk, time available, and knowledge of the market dictate the ideal stock trading strategy. Beginner traders can begin with position or swing trading to learn gradually without the strain of quick decisions involved in scalping or day trading. Alternatively, seasoned traders with high-risk tolerance and access to monitor markets around the clock may prefer scalping or day trading.

Ongoing Learning and Adjustment

The financial markets are ever-changing and are dependent upon a thousand different factors varying from economic markers to technological trends. Therefore, one needs to stay committed to perpetual learning and the ability to conform. Accessing learning resources and professional wisdom will go a long way in polishing one's trading skills.

fractaleffects.com

Lastly, the search for the Best Stock Trading Strategy is a subjective experience, which calls for the integration of knowledge, experience, and self-knowledge. With a strategy aligned to your own inclinations and a keen sense of market developments, you are better positioned for success in the world of stock trading.

#algorithmic trading software company#best algorithmic trading software for beginners#best algorithmic trading software

0 notes

Text

#best online stock trading courses for beginners#stock market trading courses#stock tutor#stock market master class#algorithmic trading bootcamp

0 notes

Text

Our cryptocurrency trading guide will help you discover the keys to profitable crypto trading. Our specialists offer insightful information on trading tactics, market analysis, and everything from fundamental concepts to complex strategies. Find out how to manage volatility, spot profitable chances, and improve your trading efficiency. Get the information and courage you need to rule the cryptocurrency industry. Start today on the path to trading success. Visit our website for more information.

#crypto trading algorithm#cryptocurrency algorithmic trading#beginners guide to cryptocurrency#best crypto trading signals#cryptocurrency trading guide#crypto beginners guide#trading signals crypto#cryptocurrency investment strategy#crypto signals discord#cryptocurrency trading course free#cryptocurrency educational resources#best crypto strategy#crypto trading signals

0 notes

Text

About Exnori

Hello, I am Exnori.com, a premier cryptocurrency exchange dedicated to revolutionizing the way you trade digital assets. I am here to offer a secure, efficient, and user-friendly platform that caters to both beginners and seasoned traders alike. Let me take you through the various aspects of my services and why I am the go-to choice for cryptocurrency trading.

Mission and Vision

At my core, my mission is to create a transparent, secure, and seamless trading environment. I strive to empower my users with the tools and knowledge they need to navigate the volatile world of cryptocurrencies confidently. My vision is to become a cornerstone of the cryptocurrency ecosystem, where traders can thrive and reach their financial goals.

Robust Security Protocols

Security is my utmost priority. I employ state-of-the-art encryption techniques, robust multi-factor authentication, and continuous monitoring to protect your assets and personal information. My security infrastructure is designed to be resilient against cyber threats, ensuring that your investments are safe with me.

User-Centric Design

I am designed with the user in mind. My platform boasts a clean, intuitive interface that simplifies the trading process. Whether you are accessing me via desktop or mobile, you will find a consistent and user-friendly experience that makes trading easy and accessible, no matter where you are.

Extensive Cryptocurrency Selection

I offer a vast selection of cryptocurrencies for trading. From established giants like Bitcoin, Ethereum, and Ripple to promising new altcoins, my diverse range of assets ensures that you can find the right opportunities to diversify your portfolio and maximize your trading potential.

Competitive and Transparent Fee Structure

I believe in providing value to my users. My fee structure is transparent and competitive, allowing you to understand exactly what you are paying for each transaction. By keeping fees low, I help you maximize your returns and make the most out of your trading activities.

Comprehensive Educational Resources

Knowledge is power, especially in the dynamic world of cryptocurrency. I offer a wealth of educational resources, including in-depth articles, video tutorials, and live webinars. These resources are tailored to help you understand market trends, develop effective trading strategies, and make informed decisions.

Advanced Trading Tools

For the more experienced traders, I provide a suite of advanced trading tools. These include detailed charting capabilities, technical indicators, and algorithmic trading support through my API. Whether you are a day trader or a long-term investor, my tools are designed to enhance your trading strategy and performance.

Community and Customer Support

I pride myself on fostering a vibrant community of traders. My platform encourages interaction and the exchange of ideas among users, creating a collaborative environment. Additionally, my customer support team is available 24/7 to assist you with any issues or questions you may have, ensuring a smooth and supportive trading experience.

Innovation and Continuous Improvement

The cryptocurrency market is constantly evolving, and so am I. I am committed to continuous innovation and regularly update my platform with new features and improvements. This dedication to staying ahead of the curve ensures that I can provide you with the best tools and technologies for successful trading.

Conclusion

Choosing Exnori.com means partnering with a platform that is dedicated to your success. With my robust security measures, user-centric design, extensive asset selection, competitive fees, and unwavering support, I am here to help you achieve your trading goals. Join me at Exnori.com and experience the future of cryptocurrency trading.

By joining Exnori.com, you are becoming part of a dynamic and forward-thinking community. Let's trade smarter, safer, and more effectively together. Welcome to Exnori.com, where your trading journey begins!

13 notes

·

View notes

Text

Stock Market Timings in India – Opening & Closing Hours

What is Stock Market Timings in India?

When people first think of the stock market, they usually imagine flashing green and red tickers, men in suits shouting across a trading floor, or screens filled with complex graphs. But have you ever wondered exactly when this exciting world comes to life each day in India? Or maybe you've thought about how traders, both human and algorithmic, plan their day around these market hours.

Whether you’re a beginner, a curious observer, or someone ready to make your first trade, knowing the stock market timings in India is the foundation of smart trading. And if you're stepping into the world of modern trading, we’ll also explore how algo trading fits into this timing, and what the best software for trading in India is to help you stay ahead of the game.

Discover what time stock market open in India, algo trading in India, and the best software for trading in India for smarter investing decisions.

Introduction to Indian Stock Market Timings

The Indian stock market is like a buzzing marketplace, but with digital boards, numbers instead of vegetables, and rupees flowing through cyberspace. Just like any marketplace, it opens and closes at specific hours.

And just like you wouldn’t show up to a movie after it ends, you don’t want to miss crucial hours in the stock market—especially when timing can literally mean money.

What Time Stock Market Open in India?

This is the most Googled question for any Indian trading beginner—and for a good reason!

The stock market in India opens at 9:15 AM and closes at 3:30 PM, Monday to Friday, except on market holidays.

These timings are followed by two major stock exchanges in India:

NSE (National Stock Exchange)

BSE (Bombay Stock Exchange)

Key Hours:

Opening Time: 9:15 AM

Closing Time: 3:30 PM

Knowing this is crucial whether you're placing manual trades or relying on algo trading bots. Think of it like a cricket match—you can’t score runs if you show up after the last over.

Pre-Opening Session: What Happens Before the Bell?

Before the official market opens at 9:15 AM, there’s a pre-open session from 9:00 AM to 9:15 AM.

Here's what goes down:

9:00 AM to 9:08 AM: Orders can be placed, modified, or canceled.

9:08 AM to 9:12 AM: Orders are matched, and equilibrium price is set.

9:12 AM to 9:15 AM: Buffer period—no activity, waiting for normal market to begin.

This session is critical for volatile stocks and IPOs, as initial price discovery happens here.

Normal Market Hours Explained

This is when the real trading action happens—from 9:15 AM to 3:30 PM.

During this time:

You can buy or sell stocks.

Prices change in real-time.

Trading volume is at its peak.

This is the main battlefield for both retail and institutional investors, where algo trading in India also kicks into high gear.

Post-Closing Session: What Happens After Hours?

After 3:30 PM, the market isn't dead. It just slows down for some cool-down operations.

3:40 PM to 4:00 PM is the post-close session, where:

Trades are allowed based on the closing price.

It’s useful for mutual funds, bulk deals, or late-position balancing.

It’s like the calm after the storm—a time to reassess, not to take risky trades.

Stock Market Holidays in India

The market doesn’t open on:

Weekends (Saturday & Sunday)

National holidays like Republic Day, Diwali, Holi, Independence Day, etc.

Every year, SEBI and exchanges release a holiday list. If you're into algo trading or use trading software, set your calendars accordingly to avoid execution errors.

How Timings Affect Retail and Institutional Investors

Retail investors typically trade during normal hours, but big players like mutual funds or FIIs often prefer the opening or closing slots for bulk trades.

🧠 Fun Fact: Most market volatility happens in the first and last 30 minutes of the trading day.

So, timing your trades is not just about “when to click buy”—it’s about strategy.

Importance of Timings for Algo Trading in India

In algo trading in India, milliseconds matter. These bots operate based on market data and time-sensitive instructions.

If the market opens at 9:15 AM, algos are ready by 9:14:59—literally a heartbeat before.

They analyze price movements.

Execute trades faster than any human.

Benefit from low-latency environments set around market hours.

Hence, any delay or ignorance of timings can cause missed opportunities or losses.

Best Software for Trading in India: Top Picks

Choosing the best software for trading in India is like choosing the right engine for your car. It powers your strategy.

Here are top platforms:

Quanttrix

✅ Perfect for algorithmic traders ✅ Easy strategy builder ✅ Live market data integration (Highly recommended if you want to automate trades.)

Upstox Pro

Fast execution, sleek design, and low brokerage.

Angel One SmartAPI

Great for coders who want to build custom algo setups.

Dhan

User-friendly and powerful for both manual and automated traders.

If you’re serious about algo trading in India, software like Quanttrix makes automation accessible, even without heavy coding skills.

Intraday vs. Delivery Trading Timings

Intraday trading has to be squared off before 3:15 PM. If you forget, your broker will auto-square it, sometimes at a loss.

Delivery trading lets you hold stocks long-term. You just need to buy before 3:30 PM.

Key takeaway: Intraday = short-term → strict timing Delivery = long-term → flexible holding

Commodity Market vs. Stock Market Timings

Many think they’re the same. They're not.

Stock Market: 9:15 AM – 3:30 PM

Commodity Market (MCX):

Morning: 9:00 AM – 5:00 PM

Evening: 5:00 PM – 11:30 PM (sometimes 11:55 PM)

So if you miss one market, the other might still be open!

Why Timings Matter for Global Investors

India’s market interacts with the world. US markets open at 7 PM IST. So:

Indian markets react to global events the next morning.

Timing trades around Fed meetings or global news is vital.

Tips for New Traders to Make the Most of Market Hours

Plan before 9:15 AM (Use pre-market analysis tools)

Avoid trading in the first 15 minutes unless you're confident

Use software with real-time alerts like Quanttrix or Kite

Monitor closing trends after 3:00 PM for next-day cues

Do’s and Don’ts During Trading Hours

Do’s ✅ Monitor the market open and close ✅ Use algo systems for speed and precision ✅ Use stop-loss always

Don’ts ❌ Don’t panic trade ❌ Don’t rely on tips without research ❌ Don’t place trades during server maintenance times

Conclusion: Timing Is Everything in Trading

The Indian stock market doesn’t just follow the clock—it beats to a rhythm. Understanding this rhythm—when to trade, when to wait, when to exit—makes all the difference between profit and loss.

Whether you're just starting out or stepping into algo trading platform, respecting market timings is your first rule of success. And with powerful platforms like Quanttrix, even complex strategies become doable.

Because in trading, just like in life—timing isn’t everything; it’s the only thing.

FAQs

What time stock market open in India? The Indian stock market opens at 9:15 AM and closes at 3:30 PM, Monday to Friday.

Can I place orders before the market opens? Yes, during the pre-open session from 9:00 AM to 9:15 AM, you can place, modify, or cancel orders.

What is the best software for trading in India? Popular ones include Zerodha Kite, Upstox Pro, and Quanttrix, which is excellent for algo trading.

Is algo trading in India legal and profitable? Yes, it's legal and growing fast. Platforms like Quanttrix make it easier and more efficient.

Can I trade after 3:30 PM in India? No, regular stock market trading ends at 3:30 PM, but post-closing sessions allow some limited activity until 4:00 PM.

2 notes

·

View notes

Text

Best Stock Market Courses in India

Step into a world of prosperity with Livelong Wealth, where your financial journey begins.

At Livelong Wealth, we offer tailored Wealth Management solutions, diversified Smallcase Portfolios, in-depth Algorithmic Trading strategies, and specialized Stock Market Courses.

We are a SEBI Registered Research Analyst with over 10+ years of experience in the financial industry.

As India’s top stock market institute, Livelong Wealth is committed to equipping individuals with the knowledge and skills needed to thrive in the ever-evolving financial markets. Our expert-designed programs cover everything from fundamental analysis to advanced trading strategies, ensuring a complete and well-rounded learning experience.

Whether you're a beginner looking to understand the stock market or an experienced trader aiming to refine your skills, our stock trading institute offers the best stock market courses in India, tailored to your unique needs.

Gain hands-on experience, practical insights, and expert mentorship to build a strong foundation for long-term success in trading and investments.

Learn more: https://www.livelongwealth.in/

#stock market courses#stock market courses in india#stock market#india's top stock market institute#best stock market courses in india#stock market courses in kerala

2 notes

·

View notes

Text

Is AT8XM Robot Legit Or Not? - AT8XM Robot PayPal Review

Explore the AT8XM Robot Paypal Review to uncover how this AI-driven forex trading system operates, its PayPal integration, and why it could be a game-changer for both new and seasoned traders.

The AT8XM Robot Paypal system combines artificial intelligence with PayPal integration to simplify forex trading. Learn how it works, who it’s for, and what makes it an appealing choice for automated traders.

Introduction

Let’s face it—forex trading can be a tricky beast. With markets shifting in the blink of an eye and economic news constantly rolling in, it’s tough to stay ahead of the curve. That’s where the AT8XM Robot Paypal steps into the spotlight. This AI-powered forex trading tool doesn’t just promise ease of use and smart trading; it also connects with PayPal, making transactions smooth as silk.

So, whether you're green around the gills or a trading veteran, this review will walk you through what makes the AT8XM Robot Paypal stand out in the world of automated forex systems.

What Is AT8XM Robot Paypal?

The AT8XM Robot Paypal is an automated forex trading application that leverages AI to scan markets, spot trading opportunities, and execute trades without needing constant human input. As if that wasn’t enough, it’s designed to be compatible with PayPal, adding a trusted layer of convenience for users handling deposits and withdrawals.

Top Features at a Glance

Smart AI Trading Engine

24/7 Market Monitoring

PayPal Payment Integration

User-Friendly Dashboard

Beginner-Friendly Setup

Real-Time Data Analysis

Customizable Risk Settings

This robot doesn’t sleep, doesn’t hesitate, and doesn’t complain—it just keeps scanning the forex market, aiming for profitable trades while the user can sit back and relax.

How AT8XM Robot Paypal Works

It might sound like rocket science, but the logic behind the AT8XM Robot Paypal is fairly straightforward:

Setup & Connect Broker – Users first create an account and connect it with a recommended broker.

Link PayPal – Funds can be deposited or withdrawn using PayPal, adding a layer of convenience.

Activate Robot – Once active, the robot starts scanning market conditions in real-time.

Trade Execution – Based on algorithmic decisions, it places trades aimed at maximizing profit.

Profit Monitoring – All gains go straight into the broker account, accessible via PayPal.

Pretty neat, huh? With minimal effort, users get a full-fledged trading partner running in the background.

Why Traders Are Buzzing About AT8XM Robot Paypal

There’s no shortage of reasons why this trading tool is gaining popularity:

Saves Time – No need to analyze charts all day.

Emotion-Free Trading – Decisions are driven by data, not by human impulse.

Trusted Payments – PayPal support adds an extra layer of user trust.

Ease of Use – Setup takes minutes, not hours.

Flexible Trading Options – Users can set their own trading limits and preferences.

Low Barrier to Entry – No prior trading knowledge required.

Who Stands to Benefit from AT8XM Robot Paypal?

The short answer? Just about anyone looking to dip their toes into the forex market or take their trading to the next level.

Complete Beginners – It’s plug-and-play simplicity helps new traders ease in.

Busy Professionals – They can let the bot do the legwork while they focus on other things.

Cautious Investors – The customizable risk settings are ideal for those who like to play it safe.

Experienced Traders – Automation lets them scale their strategies without burning out...

Is AT8XM Robot Legit Or Not? Full AT8XM Robot PayPal Review here! at https://scamorno.com/Robot-AT8XM-Review-App/?id=tumblr-legitornotpaypal

Security & Reliability: Is It the Real Deal?

Ah, the million-dollar question. The AT8XM Robot Paypal is reportedly backed by strong encryption and secure broker partnerships. And when PayPal’s in the mix, users often feel a bit more at ease, knowing that their transactions are protected by one of the most trusted online payment platforms out there.

Still, no system is perfect. As always, users should stick with well-reviewed brokers and do a touch of homework before diving in headfirst.

FAQs About AT8XM Robot Paypal

1. Is AT8XM Robot Paypal compatible with any broker?

Not quite. It usually works best with specific recommended brokers that support its integration and features.

2. Do I need trading experience to use it?

Nope! The platform is beginner-friendly, offering automated decisions without requiring deep knowledge of the forex market.

3. How does PayPal come into play?

Users can link their PayPal accounts for depositing and withdrawing funds, which adds a safe and well-known payment method into the mix.

4. Are the profits guaranteed?

Well, let’s not count chickens before they hatch. Like all trading, there’s risk involved. However, the robot is designed to increase the odds in the user’s favor.

5. Can I adjust the robot’s settings?

Absolutely! Users can customize risk levels, stop-loss limits, and trade sizes according to their comfort level...

Is AT8XM Robot Legit Or Not? Full AT8XM Robot PayPal Review here! at https://scamorno.com/Robot-AT8XM-Review-App/?id=tumblr-legitornotpaypal

2 notes

·

View notes

Text

Understanding the Legal Landscape of Algorithmic Trading in India

Understand the legal landscape of algorithmic trading in India, SEBI regulations, and key updates for retail and institutional investors.

Read more..

#Algorithmic Trading in India#Algorithmic Trading#algo trading#algo trading app#algo trading india#bigul#algo trading platform#algo trading strategies#bigul algo#free algo trading software#algorithm software for trading#finance#Algorithmic trading for beginners#Algorithmic trading strategy#Algorithmic trading India#Algorithmic trading software#Basics of Algorithmic Trading#Automated Trading#algorithmic trading software free#algorithmic trading platform#algorithmic software for trading#algorithmic trading software#algorithm#bigul algo trading review#bigul algo trading#bigul trading#bigul trading app#best algo trading software#best share trading app in india#best share trading app

0 notes

Note

any beginners advice for flight rising?

the number one rule of flight rising is have fun and be yourself. the number two rule of flight rising is the economy is out to get you.

because of the way the loot tables work if youre low level in scavenging you seemingly have a much higher chance of getting unhatched eggs that way, just because there arent that many other things you can get at that level. they sell for a lot of either currency on the auction house so if you get one a good way to get money is to sell it. a lot of people, myself included, are quite sentimental and hatching unhatched eggs is fun bc its like a gacha but what constitutes a good pull is completely subjective. hatch or dont, do what you want.

that being said, if you hatch an unhatched egg and get a double, or if youre insanely lucky, a triple (that is a dragon with 2 or 3 of the same colours) because of how rare that is and how easy it is to make an aesthetically cohesive dragon with 2 or 3 of the colours being the same, theyre very very valuable. i once got a one off triple charcoal and sold it in an auction (different from the auction house) for 25kg. however. thats incredibly unlikely. if youre hatching unhatched eggs to make money off of what you hatch, you will make a loss. just sell the eggs. hatch eggs for the thrill of the chase.

people generally prefer unbred dragons, especially unbred g1s. however, you can breed your dragons if you want. i do! its your dragons, do what you want with them. itll tank the resale value but how sad would that be to have something that you love that you never really get to love because you might make money on it some day. breed any dragons you want if you want to. dont breed any if you dont. and i recommend not breeding anything you have as an investment.

maxing out your lucky streak in the fairgrounds every day is a solid way to make money. i used to do that when i was new, stopped, and started again when achievements were introduced. 75k treasure a day is really nothing to sneeze at. glimmer and gloom is the fastest but i know some people have trouble learning the algorithm or otherwise cant stand it. pick your poison!

the number one piece of advice i ever got in flight rising is to avoid any trades with crim worth more than 500 treasure. i would tack on 'unless its a battlestone other than one used for popular coliseum builds'. if shes offering more than 500 its probably apparel or something that you could sell on the auction house for more.

this really depends on what type of player you turn out to be, but i personally wish i thought a little harder about breeding my dragons. i take their ancestry into account in my lore but when i started i used my permas (dragons that you intend to keep) for fodder breeding and boy do i regret that. im attached to these dragons but they have a long list of offspring that are exalted. id say dragons you think are cool and dragons you want to breed should be a venn diagram that is almost two circular tangents unless youre sure you dont care. but also. lifes short. breed your progens 50gazillion times if you really want to. exalt them even. who give a fuck.

someone tricked a friend of mine this way so just so you know leveling to 25 is for dragons that you plan to grind with it is strategically not a good idea to level dragons to exalt to 25. ive already explained the value of doubles and triples so i dont think youll end up randomly exalting one of em.

if you can use the coliseum and you dont hate it i do recommend investing in a team to train fodder to exalt or to grind the coliseum and resell materials. one of the biggest flaws of fr is actually how dependent it currently is on the coliseum for gameplay. theres new gameplay in the pipeline. but its not imminent.

theres more. i cant think of it. keep asking questions if you want

11 notes

·

View notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

FP Markets Review ☑️ Top Forex Brokers Review (2025)

Welcome to our in-depth FP Markets Review, where we explore everything you need to know about this well-established forex and CFD broker. Whether you're a seasoned trader or just starting your trading journey, this review will provide valuable insights into FP Markets' services, features, and its position in the competitive forex market of 2025. As part of our analysis, we’ll also touch on the broader forex market landscape and how FP Markets compares to its competitors. This review is brought to you by Top Forex Brokers Review, your trusted source for unbiased and detailed broker evaluations.

FP Markets Overview

Company Background

FP Markets, founded in 2005, is an Australian-based broker with a strong reputation for reliability and transparency. Over the years, it has grown into a global brand, offering a wide range of trading instruments and services. Headquartered in Sydney, FP Markets has achieved several milestones, including expanding its regulatory footprint and introducing advanced trading platforms to cater to a diverse clientele.

Regulation and Security

FP Markets is regulated by multiple top-tier authorities, including:

Australian Securities and Investments Commission (ASIC)

Cyprus Securities and Exchange Commission (CySEC)

Capital Markets Authority of Kenya (CMA)

Financial Sector Conduct Authority in South Africa (FSCA).

This robust regulatory framework ensures that FP Markets adheres to strict financial standards, providing a secure trading environment. Additionally, the broker segregates client funds from its operational capital, further enhancing safety and trustworthiness.

Services and Features

Trading Platforms

FP Markets offers a variety of trading platforms to suit different trading styles and preferences:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These industry-standard platforms are known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces. They are available on desktop, web, and mobile devices.

cTrader: This platform is ideal for traders who value the depth of market visibility and advanced order capabilities. It also supports algorithmic trading through cAlgo.

IRESS Platform: Designed for trading equities, indices, and futures CFDs, IRESS offers a high level of customization and transparency in market pricing.

TradingView Integration: FP Markets integrates with TradingView, a popular platform for technical analysis and social networking among traders.

Account Types

FP Markets provides several account types to cater to different trading needs:

Standard Account: Aimed at beginners, this account requires a minimum deposit of AUD 100 and offers spreads starting at 1.0 pips with no commissions.

Raw Account: Designed for experienced traders, it also requires an AUD 100 minimum deposit but offers spreads from 0.0 pips with a commission of $3.50 per lot per trade.

IRESS Accounts: These include Standard, Platinum, and Premier accounts, each with varying minimum deposits and brokerage fees. They are tailored for active traders and offer Direct Market Access (DMA).

Islamic Accounts: Swap-free accounts adhering to Sharia law are available for both MetaTrader and IRESS platforms.

Range of Tradable Instruments

FP Markets boasts an impressive range of over 10,000 tradable instruments, including:

Forex: Over 70 currency pairs, covering both major and exotic pairs.

Shares: Access to more than 13,000 global shares.

Indices, Commodities, and Cryptocurrencies: A wide selection of indices, commodities like gold and oil, and cryptocurrency CFDs 9.

Leverage and Spreads

FP Markets offers competitive leverage options, with forex leverage up to 500:1. The Raw ECN account provides spreads starting from 0.0 pips, making it an attractive choice for cost-conscious traders

Additional Services

FP Markets goes beyond trading by offering:

Educational Resources: Webinars, trading guides, and video tutorials to help traders improve their skills.

Market Analysis: Daily market updates and insights to keep traders informed.

Customer Support: 24/7 multilingual support via live chat, email, and phone.

User Reviews and Feedback Customer Satisfaction

FP Markets generally receives positive feedback from users, particularly for its:

Competitive Pricing: Low spreads and transparent fee structures are frequently praised.

Platform Variety: The availability of multiple platforms like MetaTrader, cTrader, and IRESS is well-received.

Customer Support: The broker's 24/7 multilingual support is highly rated.

Common Criticisms

Some users have noted areas for improvement, such as:

Limited features in the proprietary mobile app compared to industry leaders.

Higher spreads on the Standard account, which may not be ideal for traders seeking commission-free options.

Forex Market Landscape in 2025

Geopolitical and Economic Factors

The forex market in 2025 is shaped by several key trends:

Geopolitical Tensions: Ongoing conflicts and rising tensions between major powers like the US and China are driving market volatility.

US Political Climate: The return of Donald Trump to the White House is expected to influence the US dollar through policies like tariffs and increased spending.

Central Bank Policies: Interest rate adjustments by central banks like the Federal Reserve and the European Central Bank are pivotal in shaping currency values.

Technological and Regulatory Developments

AI in Forex Trading: The integration of AI tools is democratizing market analysis, enabling traders to make more informed decisions.

Regulatory Changes: Enhanced oversight in forex trading is improving transparency but may increase operational costs.

Implications for FP Markets

FP Markets is well-positioned to thrive in this dynamic landscape by leveraging its advanced trading platforms and robust regulatory compliance. Its focus on emerging markets and technological innovation further strengthens its competitive edge

Competitive Analysis

Top Competitors

FP Markets faces competition from brokers like IC Markets, Pepperstone, and XM. While these brokers also offer competitive pricing and advanced platforms, FP Markets stands out for its extensive range of tradable instruments and strong regulatory framework

Strengths and Weaknesses

Strengths: Regulatory compliance, competitive pricing, and platform variety.

Weaknesses: Limited mobile app features and higher spreads on Standard accounts

Conclusion

FP Markets is a reliable and well-regulated broker that offers a comprehensive range of services and features. Its competitive pricing, extensive platform offerings, and robust regulatory framework make it a strong choice for traders in 2025. While there are areas for improvement, such as mobile app features and Standard account spreads, the overall user feedback is positive. For traders seeking a secure and versatile trading environment, FP Markets is undoubtedly worth considering.

2 notes

·

View notes

Text

Education and Training with Baron Learning Pvt Ltd

The world of Forex trading offers immense potential for profit, but it also comes with its share of risks. At Baron Learning Pvt Ltd, we understand that navigating the Forex market requires a solid foundation of knowledge and skill. That's why we offer comprehensive Forex education and training designed to equip traders with the tools and strategies they need to succeed.

Why Forex Trading?

Forex, or foreign exchange trading, involves buying and selling currencies in a global marketplace. The Forex market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. Traders are drawn to Forex for its:

High Liquidity: The ability to enter and exit trades with ease.

24-Hour Market: Trading is continuous, providing opportunities around the clock.

Leverage Opportunities: Traders can control larger positions with a smaller amount of capital.

Diverse Trading Options: Pairs of currencies offer a wide range of trading opportunities.

Our Approach to Forex Education

At Baron Learning Pvt Ltd, we believe in a structured and holistic approach to Forex education. Our programs are designed to cater to both beginners and experienced traders looking to refine their strategies.

Foundational Knowledge:

Introduction to Forex: Understanding the basics, including currency pairs, market participants, and trading sessions.

Economic Indicators: Learning how global economic factors influence currency values.

Technical Analysis: Utilizing charts, trends, and patterns to make informed trading decisions.

Fundamental Analysis: Assessing the impact of economic news and events on the Forex market.

Advanced Strategies:

Risk Management: Implementing techniques to protect your capital and manage risk.

Trading Psychology: Developing the right mindset for disciplined and strategic trading.

Algorithmic Trading: Exploring automated trading systems and how they can enhance your trading strategy.

Custom Trading Plans: Crafting personalized trading plans based on individual goals and risk tolerance.

Practical Training:

Live Trading Sessions: Engaging in real-time trading with expert guidance.

Simulated Trading Environments: Practicing strategies in a risk-free setting.

One-on-One Mentorship: Personalized coaching from experienced Forex traders.

Community Support: Access to forums, discussion groups, and networking opportunities with fellow traders.

Why Choose Baron Learning Pvt Ltd?

Expert Instructors: Our team comprises seasoned traders with years of experience in the Forex market.

Comprehensive Curriculum: Our courses cover every aspect of Forex trading, from basic principles to advanced strategies.

Flexible Learning: We offer both online and in-person training options to fit your schedule.

Ongoing Support: Our commitment to your success extends beyond the classroom with continuous support and resources.

Getting Started

Embarking on a journey in Forex trading requires dedication, discipline, and the right education. At Baron Learning Pvt Ltd, we are committed to providing you with the knowledge and skills needed to navigate the Forex market confidently.

Ready to take the first step towards mastering Forex trading? Contact us today to learn more about our Forex education and training programs.

3 notes

·

View notes

Text

What Are Forex Signals?

What Are Forex Signals?

In the fast-paced world of forex trading, having accurate and timely information is crucial for making profitable decisions. This is where forex signals come into play. But what exactly are forex signals, and why are they so important?

Forex signals are trading suggestions or alerts that provide traders with information on potential trading opportunities in the forex market. These signals can include entry and exit points, stop-loss levels, and take-profit targets. Typically, forex signals are generated by experienced traders or advanced algorithms that analyze market conditions, trends, and technical indicators to identify potential trades.

There are two main types of forex signals: manual and automated. Manual signals are created by professional traders who share their insights based on their analysis of the market. Automated signals, on the other hand, are generated by trading algorithms that scan the market for opportunities based on pre-set criteria.

The Importance of Accurate Forex Signals

The accuracy of forex signals is crucial because it directly impacts a trader’s profitability. High-quality signals can help traders make informed decisions, reduce risks, and increase their chances of success in the volatile forex market. Conversely, inaccurate signals can lead to significant losses.

This is why choosing the right forex signal provider is essential. With hundreds of providers out there, finding one with a proven track record of accuracy can make all the difference.

Why Forex Elite Stands Out

Among the vast array of forex signal providers, Forex Elite has distinguished itself as the best in the industry. Out of 204 forex signal providers analyzed, Forex Elite ranks number one in terms of accuracy. With a remarkable success rate of over 90%, Forex Elite’s signals consistently deliver profitable trading opportunities.

What sets Forex Elite apart is its commitment to quality and transparency. The platform provides clear, concise signals that are easy to follow, even for beginner traders. Additionally, Forex Elite uses cutting-edge technology and advanced algorithms to analyze market data in real-time, ensuring that its signals are always up-to-date and reliable.

Moreover, Forex Elite’s team of seasoned traders and analysts bring a wealth of experience to the table. Their combined expertise helps to refine and improve the signal generation process, further enhancing the accuracy and effectiveness of the signals provided.

Conclusion

In conclusion, forex signals are an indispensable tool for traders looking to navigate the complexities of the forex market. The key to success lies in finding a reliable signal provider with a proven track record of accuracy. Forex Elite stands out as the best in the business, boasting a success rate of over 90% and ranking number one out of 204 providers. Whether you’re a seasoned trader or just starting, Forex Elite offers the accurate and timely signals you need to maximize your trading success.

2 notes

·

View notes

Text

What are some challenging concepts for beginners learning data science, such as statistics and machine learning?

Hi,

For beginners in data science, several concepts can be challenging due to their complexity and depth.

Here are some of the most common challenging concepts in statistics and machine learning:

Statistics:

Probability Distributions: Understanding different probability distributions (e.g., normal, binomial, Poisson) and their properties can be difficult. Knowing when and how to apply each distribution requires a deep understanding of their characteristics and applications.

Hypothesis Testing: Hypothesis testing involves formulating null and alternative hypotheses, selecting appropriate tests (e.g., t-tests, chi-square tests), and interpreting p-values. The concepts of statistical significance and Type I/Type II errors can be complex and require careful consideration.

Confidence Intervals: Calculating and interpreting confidence intervals for estimates involves understanding the trade-offs between precision and reliability. Beginners often struggle with the concept of confidence intervals and their implications for statistical inference.

Regression Analysis: Multiple regression analysis, including understanding coefficients, multicollinearity, and model assumptions, can be challenging. Interpreting regression results and diagnosing issues such as heteroscedasticity and autocorrelation require a solid grasp of statistical principles.

Machine Learning:

Bias-Variance Tradeoff: Balancing bias and variance to achieve a model that generalizes well to new data can be challenging. Understanding overfitting and underfitting, and how to use techniques like cross-validation to address these issues, requires careful analysis.

Feature Selection and Engineering: Selecting the most relevant features and engineering new ones can significantly impact model performance. Beginners often find it challenging to determine which features are important and how to transform raw data into useful features.

Algorithm Selection and Tuning: Choosing the appropriate machine learning algorithm for a given problem and tuning its hyperparameters can be complex. Each algorithm has its own strengths, limitations, and parameters that need to be optimized.

Model Evaluation Metrics: Understanding and selecting the right evaluation metrics (e.g., accuracy, precision, recall, F1 score) for different types of models and problems can be challenging.

Advanced Topics:

Deep Learning: Concepts such as neural networks, activation functions, backpropagation, and hyperparameter tuning in deep learning can be intricate. Understanding how deep learning models work and how to optimize them requires a solid foundation in both theoretical and practical aspects.

Dimensionality Reduction: Techniques like Principal Component Analysis (PCA) and t-Distributed Stochastic Neighbor Embedding (t-SNE) for reducing the number of features while retaining essential information can be difficult to grasp and apply effectively.

To overcome these challenges, beginners should focus on building a strong foundation in fundamental concepts through practical exercises, online courses, and hands-on projects. Seeking clarification from mentors or peers and engaging in data science communities can also provide valuable support and insights.

#bootcamp#data science course#datascience#data analytics#machinelearning#big data#ai#data privacy#python

3 notes

·

View notes

Text

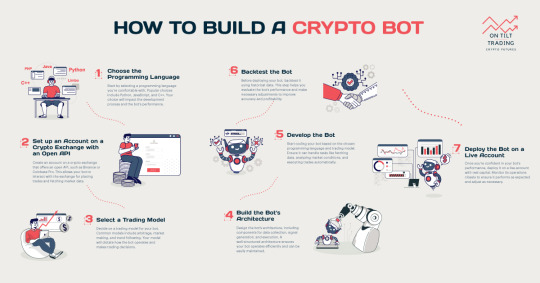

How to Build a Crypto Bot [INFOGRAPHIC]

“How to Build a Crypto Bot,” provides a step-by-step guide to creating your own automated cryptocurrency trading bot. Starting with the basics, it covers essential components such as choosing the right programming language, setting up APIs to connect with exchanges, and implementing trading algorithms. The infographic also highlights important considerations like risk management, back-testing strategies, and continuous optimization. Visual aids and concise explanations make complex processes easy to understand, even for beginners. Whether you're a seasoned trader looking to automate your strategy or a tech enthusiast interested in crypto trading, this guide offers valuable insights to get you started.

Source: How to Build a Crypto Bot

2 notes

·

View notes