#App Development Company in Uganda

Explore tagged Tumblr posts

Text

Mobile Money Market Analysis: Navigating a Digital Financial Revolution

The mobile money market has emerged as one of the most transformative developments in the financial services sector, offering unprecedented access to digital financial tools in both developed and emerging economies. With the rise of smartphones and internet penetration, mobile money platforms are redefining how people transact, save, borrow, and manage their finances—especially in regions with limited access to traditional banking.

This article explores a comprehensive analysis of the mobile money market, focusing on current dynamics, key players, technological drivers, regional performance, and future outlook.

Overview of the Mobile Money Market

Mobile money refers to financial services performed via a mobile device, including payments, transfers, deposits, withdrawals, and even loans. These services are typically offered by telecom companies, banks, and fintech firms. Unlike traditional banking, mobile money does not require a bank account, making it accessible to unbanked populations.

According to GSMA’s 2024 report, there are over 1.6 billion registered mobile money accounts worldwide, processing over $3 billion in transactions daily. The market is growing rapidly, especially in regions like Sub-Saharan Africa, South Asia, and Latin America.

Key Market Drivers

Several key factors are fueling the growth of the mobile money market:

Financial Inclusion Initiatives Mobile money has become a cornerstone of financial inclusion, especially in rural and underserved communities. Governments and NGOs are supporting initiatives that encourage digital payments to reduce poverty and promote economic growth.

High Mobile Penetration With increasing access to mobile phones—even in low-income areas—millions of people can now participate in the digital economy. Mobile operators have capitalized on this by offering user-friendly platforms tailored to these markets.

Shift to Cashless Economies The COVID-19 pandemic accelerated the shift from cash to digital payments due to hygiene concerns and lockdowns. This trend continues as consumers and merchants increasingly prefer mobile money for safety and convenience.

Government and Regulatory Support Supportive regulatory environments in key markets have encouraged innovation and investment in mobile financial services. Central banks are developing frameworks to enhance interoperability and reduce fraud.

Regional Market Analysis

Sub-Saharan Africa

This region leads globally in mobile money adoption, accounting for over 70% of global mobile money transaction volume. Services like M-Pesa (Kenya), MTN Mobile Money (Ghana, Uganda), and Airtel Money (Nigeria) dominate the space. Mobile money has revolutionized personal finance, small business operations, and even government disbursements.

Asia-Pacific

Countries like India, Bangladesh, and the Philippines have seen rapid mobile money adoption through platforms like Paytm, bKash, and GCash. Regulatory support from institutions like the Reserve Bank of India (RBI) has fostered a competitive landscape that encourages innovation.

Latin America

Nations like Mexico, Colombia, and Brazil are witnessing growing usage of mobile wallets such as Mercado Pago and PicPay. The region's young population and high smartphone penetration make it ripe for further expansion.

Middle East and North Africa

While still developing, countries such as Egypt and Jordan are making strides in mobile banking adoption, thanks to efforts by the private sector and government-driven digital transformation agendas.

Key Industry Players

Several global and regional players are shaping the mobile money landscape:

Safaricom (M-Pesa)

MTN Group

Orange Money

Vodafone

PayPal (Venmo)

Square Cash App

Alipay and WeChat Pay (China)

These companies continue to innovate, offering new services such as microloans, insurance, and investment options directly through mobile platforms.

Challenges Facing the Market

Despite robust growth, the mobile money market faces several challenges:

Cybersecurity threats and fraud risks due to increasing transaction volumes.

Regulatory hurdles in countries with outdated financial laws.

Lack of digital literacy among rural populations, slowing adoption.

Interoperability issues between different mobile platforms and banks.

Overcoming these barriers will be critical to sustaining long-term growth and ensuring secure, inclusive financial ecosystems.

Future Outlook

The mobile money market is expected to grow at a CAGR of over 20% between 2024 and 2030, driven by innovations in fintech, AI integration, and rising demand for digital-first services. Future trends include:

Cross-border remittance services expanding through mobile platforms.

Blockchain-based mobile wallets ensuring better security and transparency.

AI-powered fraud detection to combat cyber threats.

Integration with e-commerce and social platforms to enhance user convenience.

Conclusion

The mobile money market stands at the forefront of financial transformation, enabling millions to access essential services once out of reach. With continuous technological advancements and expanding regulatory support, the sector is poised for sustained growth. Businesses, governments, and financial institutions must collaborate to address challenges, seize opportunities, and ensure the benefits of mobile money are universally accessible.

0 notes

Text

Advent of the AI Powered Energy World

Advent of the AI Powered Energy World

Few can disagree, AI is changing the world. In the same way that IT ushered in the information age, AI is making its place in education, finance, industry, supplychain and markets. Globalization was helped along by the tech boom that transformed our world into an even more dynamic node. In the early 2000s the world was ruminating on EdTech, well that day is here, and soon too will be EnergyTech.

Trchnology has not remained static, it has levelled the playing field for producers and business in the developing world. The change has been so swift, it qualifies as disruptive. The way in which nearly half a billion users moved effortlessly to the Shiaohongshu App was amazing. Particularly for the status quo, the disruption means even it is being summarily replaced.

New AI technology is helping nations find oil and gas. Excavate rare earths and streamline supplychains. Just recently, Kyrgyzstan discovered rare earths according to CNA News and China just found a 100 Billion Barrel offshore oil deposit with hyndreds of cubic feet in LNG, Andaou Agency reported. The analogue world widened the gap between rich states and developing economies. But that gap is closing thanks to technology and information age. It's why even puppet governments in the global south are easy to detect.

Today, there is no more a need to pretend massive hunger threatens Africa or that Latin America must depend on used car imports from the "Big Four Automakers." New technology makes development not only possible in emerging markets, but oddly suspicious in its absence if it does not. There is no excuse for poverty, SME stagnation, obert corruption, gobernment accountung failures, housing and pay disparities. The world has the data, the technology and the know-how; it's not rocket science anymore--and when it is, there is AI to calculate that.

Recently Uganda also struck oil, according to AllAfrica News and has forged a deal with the UAE company for production, UBC Television Uganda reported. Even traditionally unproductive states have better opportunities now than in the past. It means we can quickly identify proxy governments in the global south where states are neglecting their citizens or posing regional instability.

New tech has always had the opppsite result than what the innovation pundits in Silicon Valley imagine. Principally, because they always make the same flawed assumptions. But this is fine, because it does afford states once labled as "third world," to rise. Unquestionably, it is a good day for emerging markets.

Energy is fast becoming a solveable human endeavor. From solar panels, to EVs and LNG powered buses, the developing world can begin to develop at an excellerated rate. It can leapfrog the savagery of the dirty industrial age of the Colonial West and develop economies and environments of the future. The world will not be held captive by a few producers and exorbitant prices anymore; rather it will discover its own solutions. These solutuons are emerging everyday, to solve the world most pressing problems. And the diversions of the past are growing less effective in a more intelligent world.

Energy is also moving down the supply chain to source countries. This means there is less dependence on the "stock maket," and the money-men hedge funds that move money around to sink economies or falsley inflate them for a stratrgic "bust." It was the movement ofbsymtick market capital that wrecked Southeast Asia in the 1990s.

The Russia sanctions were also demonstration of a new system where its energy resources were concerned. Sanctions facilitated new solutions in moving massive tons of oil, revenue and its corresponding transactions outsude of traditional speculative markets. Even with the dissolution of sanctions, new pathways of value have already been created. It is unlikely these or the technology used to facilitate them will go away. This was step into a technological world where a commodity was unpegged from dollars on a system that remains opaque. And there is no reason other power sources or commodities will not follow suit.

It is exciting that the Global South will be able to ally with partners to help it make the technological shift. A shift to new markets and exchanges powered by new energy finds, AI and efficient supplychains. Nations can work together regionally and with amenable foreign entities to develop smarter cities and better technologies suited for their own socioeconomic reality. And as with the advent of DeepSeek, this can be done for a fraction of the cost.

In the same way the old world luxury market is dying, so too is the exorbitancy of cost and maintenance. Now, states can produce products and service for international and domestic use and create thriving markets to support it. They can invest in thriving SME ecosystems that create engines of growth. Corruption can be monitored and detected wuth new systems. The developing world does not have to be stagnant another day.

States that truly cannot compete, have had to pivoted to war economies, raider economies and punitive levies. And this is to be expected, because while some states do struggle in resources, the greatest struggle has been a decline in leadership, moral, strategy and talent accross the board. Many rich states have lost the plot. Many are in useless leagues that have been maintained for generatiins, but have no real use. Leagues of fiat and investment are rapidly losing value in a globalized world. But even so, emerging economies have had the tenacity to keep moving forward as nrw energy finds proliferate. Ghana itself just recently started the largest offshore solar energy farm in West Africa, AllAfrica News reported.

New technology will change the face of energy production across all modes. In time OPEC/+ may become a needless organization, with so many new producers emerging. It will be dufficult to leverage power against too many economies, except behind non-producing or low production states in Western Europe, islands, landlocked nations, and size-prohibitive enclaves. From green and dirty energy to atomic energy the world of AI will leverage the future. In the same way that telephones, the internet and social media has changed the world, AI will change the titans of energy and power in the world.

Geochange is on:

+TikTok @geochangeworld https://tiktok.com/@geochangeworld

+Podcastle.ai +Odysee.com

○ htps://www.tumblr.com/gcworld

○ https://www.quora.com/profile/GeoChange-World

○ http://odysee.com/geochangeworld

0 notes

Text

Digital Customer Experience in Banking and Financial Services

In the Banking and Financial services sector, customer experience plays a vital role in differentiating the institutions from their competition. With ever-changing customer demands and a plethora of alternatives to choose from in this digital era, only a great customer experience can enhance customer loyalty and satisfaction, with better retention.

However, the pandemic has forced the Banking and Financial sectors to go digital, and their CX has been influenced by how well they handle the new digitization. Thus, simply being digitally sound is not enough; institutions must also focus on becoming customer-centric digitally.

Here are four Digital CX trends across Africa’s banking and financial services that institutions should watch out for:

1. Using Mobile app data to improve Products and services

The majority of institutions are going digital by launching their mobile apps these apps collect a lot of consumer data that institutions can use to enhance the customer experience. Data analytics systems and machine learning algorithms help you extract useful information from this consumer data, which can then be used to build new products, enhance existing processes, better empower customers, and improve the overall customer experience.

Stanbic Bank, one of Uganda’s largest commercial lenders, is encouraging customers to transition to its digital banking systems by waiving digital transaction fees in order to improve their customer experience.

2. Integrating Artificial Intelligence with human power

One of the most important customer touchpoints is when they call the helpline for assistance. Nothing can be more aggravating for a customer than calling their bank’s customer care to report a problem only to be placed on hold.

When encountering a problem, users may now consult AI-enabled chatbots rather than waiting on the phone. Furthermore, Conversational AI has advanced significantly in terms of its ability to accommodate and handle customer issues, making it a superpower for rapid resolution.

3. An Automated onboarding process

As the adage goes, “First impression is the best impression,” for a great first impression, a positive customer experience during onboarding is crucial. New customer onboarding traditionally involves a great deal of administrative work and raises the risk of process bottlenecks, putting consumers’ patience to the test. Banks may utilize automation to speed up critical aspects of the process, allowing consumers to create accounts even faster and improving the entire customer experience.

4. Cloud-Based Hosting

Banks and regulators in Africa are gradually changing their minds about cloud hosting. By moving to the cloud, banks regain control of their business models and innovation cycles, allowing them to develop excellent consumer solutions with agility and speed.

Absa Group, one of the major African financial services companies, has migrated many of its operations to the cloud, which has enabled it to deliver a great end-to-end digital experience, especially given their geographically dispersed staff and client base.

According to international consultants McKinsey, the number of Africans having bank accounts would rise from almost 300 million in 2017 to 450 million by 2022, with revenues growing from $86 million to $129 million during that time.

With most institutions aiming to be digital-first banks, it’s high time for them to begin investing in their digital client experience.

For more details visit us : BFSI Summit

0 notes

Text

How does HIPAA certification enhance trust and credibility in the global healthcare market in Uganda?

HIPAA Certification in Uganda: Strengthening Healthcare Data Security

In the trendy virtual age, safeguarding sensitive healthcare statistics is essential. The Health Insurance Portability and Accountability Act (HIPAA), a U.S. federal law, has requirements for shielding the privacy and safety of fitness facts. Although HIPAA is particular to the United States, its principles have international relevance, especially for healthcare companies, era corporations, and provider organizations coping with U.S. Customers or patient information. For businesses in Uganda, obtaining HIPAA certification demonstrates a dedication to information safety, privacy, and compliance with international standards.

What is HIPAA Certification?

HIPAA certification isn't a formal certification supplied by the U.S. Government; however, it is regularly issued via 1/3-birthday party auditors or training companies to validate compliance with HIPAA requirements. It guarantees that a company adheres to the following key regulations:

Privacy Rule: Protects the confidentiality of private fitness data (PHI).

Security Rule: Safeguards digital PHI (ePHI) through administrative, technical, and bodily controls.

Breach Notification Rule: Requires well-timed notification in case of a facts breach.

Enforcement Rule: Establishes techniques for investigations and consequences for non-compliance.

Benefits of HIPAA Certification in Uganda

Global Market Access: Enables Ugandan companies to work with U.S. healthcare organizations.

Enhanced Data Security: Protects sensitive, affected personal information from breaches and unauthorized admission.

Trust and Credibility: Demonstrates a commitment to excessive facts, privacy, and safety standards.

Regulatory Alignment: Complements Uganda's Data Protection and Privacy Act (2019).

Competitive Advantage: Positions agencies as dependable companions inside the global healthcare environment.

Risk Mitigation: Reduces the probability of records breaches and related consequences.

Industries in Uganda That Can Benefit from HIPAA Certification

Healthcare Providers: Hospitals, clinics, and diagnostic facilities dealing with patient statistics.

IT and Software Companies: Providers developing healthcare apps, telemedicine structures, or statistics processing structures.

Medical Billing and Transcription Services: Companies managing healthcare documentation.

Cloud Service Providers: Organizations storing and coping with healthcare information for U.S. Clients.

Research Institutions: Entities accomplishing medical trials or research regarding affected person records.

Steps to Achieve HIPAA Certification

Understand HIPAA Requirements: Familiarize your corporation with the HIPAA Privacy, Security, and Breach Notification Rules.

Gap Analysis: Assess current practices towards HIPAA requirements to identify compliance gaps.

Policy Development: Implement guidelines and methods to ensure PHI's confidentiality, integrity, and availability.

Training: Educate employees about HIPAA requirements and good practices for dealing with data.

Implement Controls: Deploy administrative, technical, and bodily safeguards for ePHI.

Risk Assessments: Conduct regular chance analyses to discover vulnerabilities and mitigate risks.

Engage a HIPAA Auditor: Work with a certified 0.33-birthday celebration auditor to assess compliance and provide certification.

Ongoing Compliance: Continuously monitor and improve practices to maintain HIPAA compliance.

Why is HIPAA Certification Important for Uganda?

As Uganda's healthcare area becomes increasingly digitized, facts protection is paramount. HIPAA certification ensures that businesses meet the best requirements for protective, sensitive healthcare information, opening doors to global collaborations and improving consideration amongst patients and partners. Additionally, compliance with HIPAA enhances Uganda's efforts to improve healthcare governance and infrastructure.

ISO 9001 Certification in uganda

ISO 27001 Certification in uganda

ISO 45001 Certification in uganda

ISO 22000 Certification in uganda

ISO 13485 Certification in uganda

HALAL Certification in uganda

0 notes

Text

How Blockchain Technology Benefits Mobile App Development Services?

In industries such as medical services, education, immobilization, and legal issues Blockchain technology has already had a major impact on all these industries. It also has a significant impact on mobile apps development companies slowly and regularly. Its decentralized architecture allows unbelievable advantages to practically all areas of business, and the development services of mobile apps can use these for challenges that have become apparent in recent years. Hundreds of thousands of mobile apps are essentially available in the play store and more are continually being created. Anyway, a couple of challenges have emerged over the recent months, if the industry is to continue to enjoy the momentum it has enjoyed up until now. Let's know some more exciting facts about this blockchain technology before we explore mobile apps development Services.

What exactly is Blockchain?

A Blockchain is a decentralized automated block storing transactions. All of these blocks are chain-connected and placed on various computers to provide sufficient security requirements. The data is given and cannot be copied in any other scenario. In addition to its use in the financial and healthcare sectors, app development firms are in great demand from their customers.

What is the Blockchain Applications?

The Blockchain mobile Android OS app presents users with the ability to securely share and receive bitcoin information and path information. Blockchain implementations can also exclude fraud, enhance financial privacy, speed up the transaction, and internationalize markets by using important features, including payment, escrow, or name.

What Challenges Mobile App Industry Face in Blockchain Implementation?

Resource Management

It's critical for the developers of the Android App for Blockchain technology to assure they know the network requirements and are well versed in handling remote and local queries. For them, this is a great challenge to effectively handle different resources.

Isolation

Another challenge in this innovative technology is that all the hash functions work in a certain way. Any decision will, therefore, be taken following the circumstances. In such a case, an isolation mechanism should be implemented by the development team to bring unknown nature into its mobile solution.

Low Performance

Last but not least, the low performance of Blockchain technology is a major challenge that developers often face. Especially when the right development language is selected Blockchain. This is because some Blockchain operations are parallel to other operations. In other words, having a language of creation that is flexible becomes extremely important.

What does Benefits Blockchain technology offers to the Mobile Industry?

Fix In-App Purchase Issues

The method required to make app purchases is one of the major problems facing brands with a mobile app. Most people have a smartphone, most people lack the process of purchasing in-app because the different methods of payment are lacking. The whole thing appears different even when you pay with a credit card open, passport fees, card processing fees, app store fees, and bank transfer fees. Eventually, about 70% of the full payment goes to a mobile app operator. App coins will be used for the App Store payment using the decentralized model from Blockchain, and the app owner will receive a whopping 85 percent. Purchasing an app is also helpful for end users because the payment is made using mobile coins, which removes the need for payment by credit card.

Smooth Marketing Process

Mobile apps Development Companies promotion is developed under a Blockchain model. Brands now have to spend on paid ads and advertising to meet the target audience. A variety of intermediaries are involved in the modern advertising strategy, which decreases the amount a product gets into the last. This approach will be replaced with a cost-per-care strategy that rewards end-user application coins for their time in the app. All cuts for intermediaries are eliminated and users are rewarded with coins for correctly shopping in-app.

Digital Identity

There is a separate identity for all blockchain. This is possible because private data are used for registering on the private or public blockchain. People prefer Blockchain-based, secure and reliable digital identity. It is used primarily to identify organizations where data security plays a major role, such as banks, government agencies, and hospitals. The design of digital apps has been made possible by a mobile apps development company in industries such as banks, educational and insurance industries. The wireless industry has been completely changed.

Global Reach

Brands are now increasing their business to less developed countries, where smartphones are available, but financial institutions such as bank accounts and credit systems lack access. Nevertheless, with the implementation of Blockchain, users may include a mobile wallet on site. Tokens or coins can be easily stored in later stages. Mobile e-commerce apps allow people in remote areas to easily make e-shopping purchases, pay bills and move money without paying any fees.

Wrapping Up

In the same way, Blockchain has made an impact on other industries, the mobile industry is suddenly being transformed. Because of its distributed architecture, it is much better defended against cyber-attack than modern technology could provide for. It can get rid of sluggish, complex, overpriced and dubious online payment methods. They are suspect of security issues. If the Blockchain public record displays all transactions correctly, app payments are simplified, safe and considerably quicker without all the needless processing steps. It is the perfect time to integrate Blockchain with your mobile app. You may get in touch with us at Best mobile Apps Development Company in South Africa for a free quote to develop a mobile app for your business. And helps Business owners to reach more customers who want to change their business towards app development, Blockchain, and Machine Learning Development software. The Company has a very good working environment. To know more about my company, Visit Fusion Informatics. For more queries please send a mail to get a free quote [email protected].

For More details visit:

Mobile Apps Development Companies in Kigali

Mobile App Development Company in Zambia

App Development Companies in Tanzania

Best Mobile App Development Companies in Uganda

Apps Development Company in Ethiopia

#Best Mobile App Development Companies In madagascar#Android Application Development Companies In madagascar#Apps Development Companies in morocco#Android App Development Company In morocco#Mobile Apps Development Companyin Ethiopia#Best Android App Development Companies Ethiopia#Mobile Apps Development Company in South Africa#Android App Development in South Africa#App Development Company in Uganda#Android App Development Company In uganda#Best Mobile App Development Companies In kenya#Android Apps Development Companies in kenya#Mobile Apps Development Company in Ghana

0 notes

Video

youtube

Harness the Power of 3 Leading Healthcare Technologies Do you know what’s better than a Single Telemedicine Platform?- A Telemedicine solution integrated with Online Pharmacy and Lab Booking. Our healthcare integrated Software: Telemedicine + Online Pharmacy + Lab Booking Solution As we have done major rebranding and have been focusing on the whole healthcare solutions segment and we provide a unique healthcare ecosystem - a healthcare integrated solution where you can provide your customers with all your healthcare services under one roof. Let us see how it works:- Telemedicine App: A patient can get a consultation with a doctor via the app- Online Pharmacy App: The prescribed medicines get forwarded to the connected pharmacy. A patient can also purchase additional medicines also.- Lab Booking App: If any diagnostic tests are needed to be done, they are referred directly to the connected lab. A patient can also do additional tests. What’s more is that you can offer all these services separately also, however you wish. We not only help you to retain your existing clients, but we enable you to attract new clients also with the - Healthcare Integrated Solution. #telemedicine #telehealth #doctorapp #patient #doctor#healthsoftware #healthcaresoftware #healthapp #healthcareapp #healthcare #telehealth #ehealth #emedhealthtech #emedstore #health #healthcareIT #digitalhealth #digitalhealthcare #Integration #healthintegration #epharmacy #medicinedelivery #medicineordering #onlinepharmacy #Integration #labapplication #b2bpharmacy #doctorapp #Nigeria #Kenya #SouthAfrica #Sudan #Zambia #UAE #Nepal #SouthAfrica #Ghana #Uganda #SriLanka #Philippines

#Telemedicine#telehealth#telemedicine app development#telemedicine app development solution#telemedicine app development company#healthcareapp#emedstore#emedhealthtech#onlinepharmacy#medicineordering#medicinedelivery#doctorapp#SouthAfrica#Nepal#Zambia#Ghana#Uganda#SriLanka#Philippines#b2bpharmacy

0 notes

Text

Mobile App Development Trends That Are Predicted To Make It Big In 2019

After an exciting 2018, the New Year is relied upon to promote much more the changing scene. Mobile apps, especially, are ready to recognize some real changes are new improvements are not too far off and some existing one's areas of immediately commanding. On the off chance that you are needing to put resources into mobile apps development in the coming year or picture a few upgrades in your popular application, you should realize what is growing down to business later on. Give us a future to list the important patterns that are expected to grow big in the mobile apps development space in 2019.

1. Machine Learning and AI will be bigger than ever

Although these innovations have been about for quite a while, they are simply going to develop greater this year. The most generally recognized structure wherein they show in applications is as chatbots which are provided for understanding human language and communicating with them as human collaborators do. The following year will have a place with these quick bots and having them as a component of your business application will never repeat be a decision.

2. Augmented Reality and Virtual Reality will get more real

AR and VR advancements are maintaining to see across the board selection in 2019. Before being commended for sending specific gaming encounters, these innovations will turn into a piece of pretty much every retail application this New Year. A few ways of life and internet business makes are as of now using extended reality applications to lift the client encounters by providing application clients attempt before purchasing the office.

3. Instant apps will become more popular

At the point when moment applications were developed in 2016, they obtained a ton of buzz as a result of the support and space-sparing highlights that they brought. They have developed frequently well known in these couple of years and are probably working to get much more approval in the coming year. The key to their success lies in the way that clients can get to them in a split second without downloading them and estimate their gadget memory.

4. The demand for wearable apps will boom

Throughout the years, the wearable innovation has excellent and these gadgets have transformed into an excellent requirement have frill today. From wellness and wellbeing the executives to representative observing and remote activities, these gadgets are making every one of the distinctions for life at home and work. Therefore, there will be a development asked after for wearable versatile applications that power these gadgets.

5. Beacons-based apps will strengthen their presence

Another innovation that has been about for quite a while is Beacons change yet, fortunately, it will get more grounded in 2019. It will nevermore again be bound to giving area-based messages and notices to retail purchasers yet will stretch out to utilization at the air terminals, for compact installments, and notwithstanding for sharing customized data.

6. The IoT will witness rapid growth

While the Internet of Things is certifiably not different innovation, though, there will be a few different ways that it will be rediscovered in the following year. Organizations will put resources into IoT app development since they can't bear to remain following in the scene where interconnected gadgets are developing as a model. Robotization at work environments is conceivable just if there are the correct sorts of IoT applications to run the computerized gadgets.

7. On-demand will be in demand

The on-request pattern has developed in a past couple of years, multiplying areas, for example, taxi booking, nourishment conveyance, medicinal arrangements, and motion picture appointments. What's more, certain are only not many that have been referenced because this pattern is just going to develop at an uncommon pace. The interest will observer a flood later on and each application will try to serve an option that is better to the contenders.

8. There will be a transition from cash payment to mobile payment

As cashless turns into the industry famous expression, there is a need to search for reliable and consistent strategies for elective installments. After the change from money to cards, m-wallets have developed as a trusted in strategy for making and receiving installments. Versatile installments will be the blasting pattern in 2019 and it will be joined by the expansion in the number of mobile payments app also.

Conclusion

With such a great product available for mobile applications in 2019, organizations need to stop over these models and take them to be in front of their adversaries. This gives it basic to collaborate with a versatile application advancement organization that is fit for coordinating all these creative innovations directly into your business application. You may get in touch with us at Best mobile apps Development Companies in Ghana for a free quote to develop a mobile app for your business. And helps Business owners to reach more customers who want to change their business towards app development, The Company has a very good working environment. To know more about my company, Visit Fusion Informatics. For more queries please send a mail to get a free quote [email protected].

For more details visit:

App Development Companies in South Africa

Mobile Apps Development Companies in Uganda

Apps Development Companies in Tanzania

Apps Development Company in Nigeria

Mobile App Development Company in Zambia

Block chain development companies in Antananarivo

#Hire Blockchain App Developers in nairobi#iot companies nairobi#best artificial intelligence companies in nairobi#Blockchain Development Company in Antananarivo#iot companies Antananarivo#Artificial Intelligence company in Antananarivo#Android App Development Companies in Zambia#Apps Development Company In zambia#Best Android App Development Companies In nigeria#App Development Company in Nigeria#Android Apps DevelopmenT Company in Tanzania#Apps Development Companies in Tanzania#Best Android App Development Companies Ghana#Apps Development Companiesin Ghana#Android Application Development Companies In kenya#Mobile Apps Development Company in kenya#Best Android App Development Companies uganda#App Development Company in Uganda#Android App Development Companies In south africa#Apps Development Company in South Africa#Best Android App Development Companies Ethiopia#Mobile Apps Development Companyin Ethiopia#Best Android App Development Companies morocco#App Development Company in Morocco#Best Android App Development Companies madagascar#App Development Companies In madagascar

0 notes

Text

Flutterwave: A Runaway Payments Solutions Success Story - Connecting Africa to the Global Economy

Before 2016, African businesses faced hard times to accept payments from visitors, and international tech heavyweights like Amazon, Google, Facebook, etc had difficulties to accept local payments from African customers. This has changed since Flutterwave entered the scene. It was founded in 2016 by a team of ex-bankers, entrepreneurs and engineers in response to this gap in the payments industry in Africa.

As a payment technology company, the main focus of Flutterwave is on helping banks and businesses provide seamless and secure payment experiences for their customers. The headquarters is in San Francisco (to leverage on Silicon Valley ) with offices in Lagos, Nairobi, Accra, and Johannesburg.

Achievements

According to the company’s website, Flutterwave currently has more than 50 bank partners, with over $2.6b payments processed in more than 100m transactions. More than 1200 developers build on Flutterwave. This is remarkable by all standards, especially for an African company.

One of the co-founders, 28-year-old Nigerian entrepreneur, Iyinoluwa Aboyeji, who also co-founded Andela, served as the pioneer CEO. He was reported by CNN, as saying that he “wants Silicon Valley to fund a future where Africa is included”, and people and businesses connect with the global economy. As at the time Aboyeji stepped down as CEO last year, and handed over to his co-founder, Olugbenga Agboola, Flutterwave has completed its Series A Extension round of financing, and this has taken its total raised funding from inception to date to more than US$20 million. This shows investors’ confidence in the performance of the company.

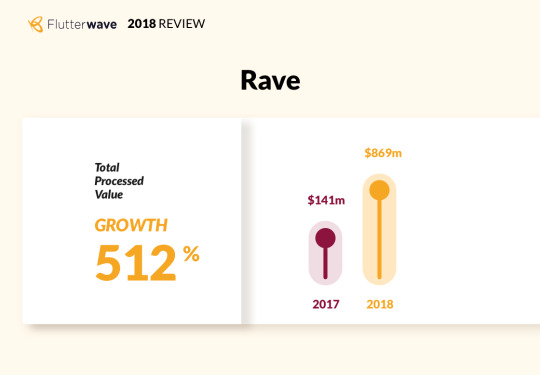

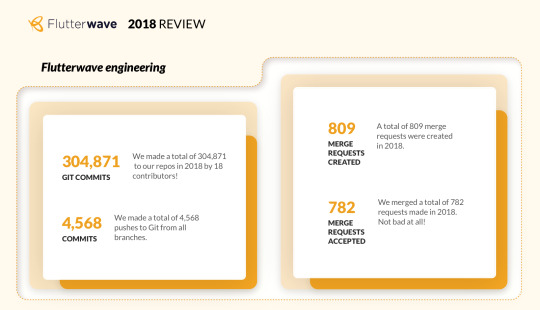

In their 2018 review, Flutterwave announced that they saw a 550% growth in the customer base of Flutterwave for Business (Rave), which is now 26,000 strong. This was made possible by partnerships with existing customers, retaining their key partnerships within the financial industry, enterprise customers like Uber, Arik Air, Booking.com and Flywire, and as they welcomed new customers like DusuPay (Uganda), BroadPay (Zambia) and PennySmart (Ghana). The revamped Barter (Flutterwave for Customers) now boasts of over 30,000 customers.

Their terrific run of achievements in 2018 culminated in the Best Payments Company award at the Ghana eCommerce Awards ceremony.

Payment Solutions

What makes Flutterwave thick? With its payment technology solution, consumers can pay for things in their local currency, while the company takes care of integrating banks and payment-service providers into its platform and this relieves businesses of the expense and burden.

The company’s award-winning payments infrastructure which is accessible via USSD, Mobile, Point of Sale and Web channels enables banks, payments companies, and businesses to do much more. The numbers from the 2018 review by the company attest to the massive adoption of these infrastructures by merchants and customers. There is no sign that the upward growth experienced by the company will abet anytime soon.

The payment solutions are listed below.

● Rave (Flutterwave for Business) – an easy way to accept any payment method from customers and make payments, around the world online or in-store. With many positive testimonies from notable local businesses in Nigeria and beyond, signing up for rave opens up businesses to more opportunities by letting them accept a range of payment methods (card, bank account, and mobile wallet payments) from customers around the world, in person in physical stores or through app/website or on social media.

● Moneywave – used to make payments to anyone around the world. It is a payment system that allows users to securely charge cards and pays accounts. It is basically an API suite that allows connection of disparate payment sources, an omnichannel platform for payments across Africa.

● Barter (Flutterwave for Consumers) – used to issue and manage virtual and physical cards for retail, loyalty and expense management.

Partnerships

To accelerate its activities in its area of focus, Flutterwave has gone into various partnerships. The following partnerships are meant to address the listed issues:

1. Flywire + Flutterwave – this solution integration aims to streamline payment transactions for Nigerian students, patients, and businesses to facilitate payment of foreign school fees and medical bills in Naira.

2. Shopify + Flutterwave – this integration makes selling online easier. It helps African businesses scale globally by integrating Rave into their Shopify store.

3. Alipay + Flutterwave - this gives all Flutterwave merchants access to over 1 billion Alipay users, capturing payments activity around the estimated $200 billion in China-Africa trade. Alipay is now an additional option, to card, Barter, Mobile Money and other payment channels on the Rave checkout modal.

4. PayAttitude + Flutterwave – this only requires a customer’s phone number for a successful payment to occur, though the customer needs to be PayAttitude customer or get it first to be able to use this payment method.

5. Flutterwave + Afropolitan Group – this partnership is aimed at bridging the gap between Africa & the diaspora through entertainment & ticketing.

Developers

Flutterwave touts herself as the Google of all things Payment, with a leading community of engineers who develop the next standard of payment technology in the industry. They provide everything needed to build reliable and secure payment experiences. They make their libraries, plugins, and SDKs available so others can easily integrate and start collecting payments in minutes.

Closing Thoughts

Before this research, I knew very little about Flutterwave. In comparison to others in their space, they are heavyweights in their rights. I’m amazed at their dedication to building payments infrastructure to connect Africa to the global economy, and all that they have achieved in just a few short years. They are truly making it easier for Africans to build global businesses that can make and accept payment, anywhere from across Africa to the global economy. They have converted me and my business into customers for all their products. I am now following the relevant social media handles including that of the past and current CEOs. But more importantly, I am now their unofficial evangelist. You will be sure I will convert many into the Flutterwave way. Who knows, you the reader might just be one of them.

Image credits: Flutterwave Inc

2 notes

·

View notes

Text

Smartbanking in Burundi: Revolutionizing Financial Services

In today's fast-paced digital age, traditional banking methods are being transformed by innovative technologies. One such advancement is smartbanking, a term used to describe the integration of digital solutions and mobile applications into traditional banking services. Burundi, a small landlocked country in East Africa, is embracing this wave of technological progress and experiencing the benefits of smartbanking. In this blog post, we will explore the concept of smartbanking in Burundi and how it is revolutionizing the financial services industry.

Smartbanking refers to the use of technology to enhance the efficiency, convenience, and accessibility of banking services. In Burundi, smartbanking has gained significant traction, offering a wide range of digital financial solutions to individuals and businesses. Mobile banking applications are becoming increasingly popular, allowing customers to access their accounts, transfer funds, pay bills, and even apply for loans directly from their smartphones or tablets.

One of the key advantages of smartbanking in Burundi is the convenience it offers. With mobile banking apps, customers no longer need to visit a physical bank branch, stand in long queues, or adhere to strict banking hours. They can perform transactions and manage their finances anytime, anywhere, with just a few taps on their mobile devices. This level of convenience has brought banking services to the fingertips of many Burundians, especially those residing in remote areas with limited access to physical banking infrastructure.

Furthermore, smartbanking has helped promote financial inclusion in Burundi. With traditional banking services often inaccessible to large segments of the population, especially in rural areas, smartbanking has emerged as a viable solution. It allows individuals who were previously unbanked or underbanked to open accounts, save money, and access a range of financial services. This newfound financial inclusion plays a vital role in empowering individuals and fostering economic growth in Burundi.

Smartbanking also contributes to enhancing financial security. Banks in Burundi have implemented robust security measures to protect customer data and prevent fraudulent activities. Mobile banking apps often employ encryption technologies, multi-factor authentication, and secure communication channels to ensure that customer information remains safe and secure.

Moreover, smartbanking in Burundi has opened up opportunities for financial innovation and entrepreneurship. Fintech companies are collaborating with traditional banks to develop and introduce innovative solutions such as mobile payment platforms, digital wallets, and peer-to-peer lending platforms. These technological advancements are revolutionizing the way financial services are delivered and creating a more dynamic and competitive banking landscape in Burundi.

In conclusion, smartbanking is transforming the financial services sector in Burundi by leveraging digital technologies to offer convenient, accessible, and secure banking solutions. With mobile banking applications and other digital platforms, Burundians can now manage their finances effortlessly, regardless of their location. Smartbanking promotes financial inclusion, fosters economic growth, and encourages financial innovation. As Burundi embraces this technological revolution, the future of banking in the country looks promising, paving the way for a more financially empowered population and a thriving economy.

For more info visit here:-

Smartbanking Burundi

Smart Recons Kenya

Financial Services Uganda

0 notes

Photo

Fusion Informatics is a reliable and trusted Mobile App Development company in Nigeria, Abuja, Ikeja, Calabar, Abeokuta in Nigeria. The company is well known for its new products and high-end services in mobile app technologies.

#Apps Development Company In zambia#Android App Development Companies in Zambia#Apps Development Company in Nigeria#App Development Company in Tanzania#App Development Company in Ghana#Mobile App Development Company In kenya#App Development Company in Uganda#App Development Companies in South Africa#App Development Companies In Ethiopia#App Development Company in Madagascar#App Development Companies in Morocco#Android App Development Company in Madagascar#Android Apps Development Companies in Morocco#Android Apps Development Companies In Ethiopia#Android App Development Companies In south africa#Android App Development Company In uganda#Best Android App Development Companies kenya#Android App Development Company in Ghana#Android App Development Company in Tanzania#Android App Development Company in Nigeria#Android App Development Company in Zambia

0 notes

Text

Born in Africa to develop Africa. Nala the fast growing money transfer platform, is now available in the European countries. Kenyans in Europe can now send money to kenya easily at zero cost. The fintech startup launched Nala in the UK in 2018 then USA last year 2022. With the App you can send money to Kenya, Tanzania, Uganda, Rwanda and Ghana. Nigeria and other countries will follow in a few weeks. With this expansion, the company hopes to gain a sizable market share from the more than 11 million African migrants living in Europe.

https://join.iwantnala.com/WUIT

SIGN UP

JOIN NALA Money

Sasa ipo EU, UK na USA

Iko fasta na rates nzuri. Tuma moja kwa moja TANZANIA Mobile Money au Bank Account.

0 notes

Photo

Are You Still Thinking About Digitizing Your Pharmacy Store? A pharmacy store needs to maintain many internal processes like billing, purchase, store maintenance, order details, customer details, and employee details, which can be a tedious task to perform regularly. Regularly maintaining all this paperwork is exhaustive. Apart from this, whenever someone wants to conduct a review or audit, things get even more complicated. That is why the digitization of pharmacy stores is gaining more and more traction every day. However, there is no one-size-fits-all solution here. You needn’t incorporate all these facilities in your pharmacy store for its digitization; you can choose them according to your requirements. If you are thinking to digitize your pharmacy store, please contact EMedStore - Pharma App and website development company, and start a free trial of SaaS ePharmacy. #emedstore #pharmacysoftware #epharmacy #medicinedelivery #medicineordering #onlinepharmacy #saaspharmacy #telemedicine #telehealth #doctorapp #patient #doctor #healthsoftware #healthcaresoftware #healthapp #healthcareapp #healthcare #telehealth #ehealth #emedhealthtech #health #healthcareIT #digitalhealth #digitalhealthcare #Integration #healthintegration #Integration #labapplication #b2bpharmacy #doctorapp #Nigeria #Kenya #SouthAfrica #Sudan #Zambia #UAE #Nepal #SouthAfrica #Ghana #Uganda #SriLanka #Philippines View Source: https://www.emedstore.in/blog/post/how-to-digitize-your-pharmacy-store/219

#emedstore#pharmacysoftware#epharmacy#medicinedelivery#onlinepharmacy#medicineordering#telemedicine#healthcaresoftware#doctor#healthcare#emedhealthtech

0 notes

Text

Online Shopping In Uganda The Challenges, And Tips On How To Overcome Them

If you have a daily one that has been purchasing for you, you possibly can continue utilizing that one but get a dependable transporter to deliver the items to your house. This method of shopping is being encouraged as a outcome online shopping of it will cut back congestion in markets. Markets are areas of mass focus, which favor transmission of the virus. I went ahead and opened a shopping cart and dropped in costume after gown. Six baggage, five pairs of sneakers, and I don't bear in mind how many tops I picked.

In this place, your central aim is to help develop consumer manufacturers affect and awareness across digital platforms. In a current interview of Collin Babirukamu, the NITA U Director E-government companies, he has mixed feelings on taxing the digital economy now. He believes that whereas it's good for added revenue, there's a lot of integration that have to be accomplished among Government establishments to improve service delivery and finally compliance. Passport Applicant is advised to fill the passport application form honestly, completely, right and supply valid & correct data and documentation. The younger vibrant youthful Suezanne Tusiime is the founder of the biggest online e-commerce trend store in Uganda. She shared with us the success story of the 2-year-old online portal.

You may even preorder your shopping on EmiratesRED.com and have your items delivered to your seat when you fly out of Dubai. Shop with card or pay by cash in over 17 currencies including AED, USD, GBP and EUR. Shop luxury exclusives, seasonal must‑haves and good travel gadgets from your favourite manufacturers and have your orders delivered straight to your seat in your flight. You can even discover nice gift concepts to shock your loved ones with on their Emirates flight.

Ubuy is the business very reliable always has merchandise that are not readily available in my house nation. Switching between shops will take away products from online shopping your present cart. If you need to pay along with your bank card, you should modify the payment setting by clicking the “More Funding Options†hyperlink earlier than you pay.

Transfer recordsdata at 5Gbps, lightning pace, simultaneously cost up to three gadgets, transmit excessive definition 4k movies to your gadget and supply ethernet connectivity. Also options an SD card reader and helps Mac, Windows 8 and 10 and Linux working methods. Browse the EmiratesRED retailer online and shop for unique objects you will not find on board.

You can discover laptops of various varieties, capacities, and costs. Are you on the lookout for a laptop computer that suits your profession finest and would allow you to to ship better? Nofeka supplies you with one of the best laptops from probably the most reliable manufacturers like Dell, HP, Apple, and extra. However, the larger and more established online shops have websites and might promote on larger platforms like information magazines among others.

Jumia Official Stores offers you finest prices & free transport & free delivery service. In Uganda, Jumia, UgaKart, Kikuubo online and OLX are a variety of the renowned sources taking new twists in online shopping. Before you shop, examine your browser whether its directing to the true shopping portal or app to make sure a secure shopping experience. As a reality, you must choose a well-liked shopping web site as your final gateway to seek for your favourite good and merchandise. Select from our vary of SmileData bundles and gadgets, and revel in our SuperFast internet at an excellent value and pace.

Before I started Paple Rayn I was employed and earned a minimal salary of 300,000ugx. It was quite robust to save however I did elevate seven hundred,000ugx in three months and shipped my first objects from sales within the UK and the U.S they usually have been all purchased by friends, I shipped larger portions as time went by from profit accumulation. Number of Kenyans grappling with extreme food insecurity stands at four.35m...

The examine recommends that Information Technology Infrastructural development ought to be given eager attention since it the major key in web shopping adoption. An integrated advertising communication technique is also beneficial for these online shops to trigger awareness, make customers learn about online shopping, respect and have the flexibility to function it. Ubuy is amongst online shopping the best online shopping stores in Uganda. We provide a large number of international products throughout the globe. Our portal is extremely customer pleasant and the companies are immediate and satisfying. We deal with top quality merchandise that meet our excessive requirements coupled with extraordinary service to make sure customer delight.

0 notes

Text

Gamify is a company that has used gamification to widen its client’s appeal and to highlight their marketing campaigns. The one time McDonald’s Monopoly game was updated to an annual game because of its wide popularity. KFC jumped on this bandwagon. “KFC Japan partnered with Gamify in order to create a marketing campaign that not only informed customers but also incentivized them to try the new line of product through discounted voucher rewards” (Gamify. 2022.) Using media convergence, KFC added to their TV ads, Facebook, Twitter, Instagram, and other online venues, and incorporated games into the picture. The game created through Gamify for KFC Japan was eventually sold because the large response caused shortages in supplies in the KFC stores.

Duolingo is an award-winning app that helps with learning a new language. Learners can earn badges or even compete against others to advance their knowledge, this exemplifies gamification. I think that Duolingo is also a representation of media convergence because there are videos on TikTok and podcasts featuring stories by native language speakers.

On a personal level, this assignment made me think of creating a gamification process for donors for an orphanage in Uganda that I support. I would like to develop a fun game for people making donations. If someone donates to help for a child’s education, they will get a response message from that child saying, “Thank You” and the donor earns an educational badge. If a person gifted for food provision, then I would have them earning a crop badge and get a picture of orphaned children enjoying a meal.

1 note

·

View note

Text

Numida Uganda Jobs 2022 – No Experience Graduate Intern(Data Analyst)

Numida Uganda Jobs 2022 – No Experience Graduate Intern (Data Analyst)

August 25, 2022 Job Title: Graduate Intern (Data Analyst) – Numida Uganda Jobs 2022 Organization: Numida Uganda Job Location: Kampala, Uganda Numida Uganda Profile: Numida uses proprietary credit models and tech-enabled underwriting workflows to provide working capital loans to African micro businesses. Business owners download our app, apply for a loan in minutes from their place of business, and are approved within a day. Currently, there’s $200 billion in unmet credit demand by micro businesses across the continent. Since Jan. 2021, Numida has disbursed more than $12,000,000 in unsecured credit to more than 21,000 micro and small businesses enabling business owners to increase their incomes, create jobs, and grow the Ugandan economy. We are Uganda’s first YC-backed startup and are also backed by MFS Africa, Pioneer Fund, Launch Africa, Soma Capital and more Our Vision: Traditionally overlooked and underserved micro and small businesses (MSBs) in emerging markets deserve to have great tech built to serve their needs. Numida is the first and largest mobile platform in East Africa focused on offering convenient, accessible, and appropriate financial services specifically to MSBs. With the wealth of data collected through our platform, we are well positioned to connect business owners to the financial and non-financial services they need in order to grow their business, whether it be credit, savings, insurance, payments, logistics, customer acquisition, or financial & HR management. Due to our deep knowledge of our customers, Numida is becoming renowned for building technology that MSBs love. Within 10 years, we anticipate enabling at least 1 million small business owners on the continent to achieve their dreams. Job Summary: We are looking for a self-driven, eager-to-learn graduate intern on our data team. The data team is responsible for supporting decision-making by providing insights and advanced analytics across teams within Numida. When you join us, you’ll have considerable responsibility, and receive training and career development prospects to help you grow and excel in your role and as an individual. Roles and Responsibilities: - Collect, organize, clean, interpret and produce reports across a range of data sets. - Understand the company’s overall concept, including the brand, clients, product goals, and all aspects of service. - Document our systems and processes to make a knowledge base that will aid self-service analytics for the entire team. - Work with multiple departments to prioritize their data needs and provide accurate reports to enable prompt decision-making for our operations. - Support team by answering urgent, ad hoc data questions as they arise - Locate, define and communicate new process improvement opportunities - Quality assurance of existing queries, dashboards, and other visualizations to ensure accurate data is shared with the rest of the team. Minimum Qualifications for Numida Uganda Jobs 2022: You should join us if : - You are interested in building a career in data analysis - You have little to no experience in data analysis - You have the hunger to grow and the ability to learn quickly - Confidence, supported by a proactive approach to work - The ability to analyze complex issues - Astute judgment and strong communication skills - A talent for building relationships - General programming knowledge is required. WHY NUMIDA IS FIT FOR YOU: - At Numida, we believe our values make a difference - We are committed to active inclusion and diversity - We are transparent - We succeed when our customers succeed - We do not only get things done but also in the right way. - We value, support, and help each other grow. - And we have fun! How To Apply for Numida Uganda Jobs 2022 All interested and suitably qualified candidates should submit their applications through the link below. Click here to apply Deadline: 28th August 2022 For similar Jobs in Uganda today and great Uganda jobs, please remember to subscribe using the form below: NOTE: No employer should ask you for money in return for advancement in the recruitment process or for being offered a position. Please contact Fresher Jobs Uganda if it ever happens with any of the jobs that we advertise. Read the full article

0 notes

Text

SafeBoda takes customers on tour of their academy

SafeBoda takes customers on tour of their academy

By Our Reporter In a bid to enlighten customers about the activities that go on to ensure quality service, Uganda’s Super app, SafeBoda welcomed a cohort of 50 customers for a tour of the company’s offices in Kyebando – the SafeBoda Academy. The monthly tour, dubbed ‘An hour at the SafeBoda Academy’ is geared towards keeping customers in the know of the latest developments from SafeBoda and…

View On WordPress

0 notes