#Application (Authentication and Customer Verification

Explore tagged Tumblr posts

Text

United States voice biometrics market size is projected to exhibit a growth rate (CAGR) of 16.85% during 2024-2032. The increasing focus on security and the need for robust authentication methods, the rising demand in financial services, the rapid technological advancements in artificial intelligence (AI) and machine learning (ML), and the shift towards multi-factor authentication (MFA) are some of the factors propelling the market.

#United States Voice Biometrics Market Report by Component (Solutions#Services)#Type (Active Voice Biometrics#Passive Voice Biometrics)#Deployment Mode (On-Premises#Cloud-Based)#Organization Size (Large Enterprises#Small and Medium-sized Enterprises (SMEs))#Application (Authentication and Customer Verification#Forensic Voice Analysis and Criminal Investigation#Fraud Detection and Prevention#Risk and Emergency Management#Transaction Processing#Access Control#Workforce Management#and Others)#Vertical (BFSI#Retail and E-Commerce#Government and Defense#IT and Telecom#Healthcare and Life Sciences#Transportation and Logistics#Travel and Hospitality#Energy and Utilities#and Region 2024-2032

1 note

·

View note

Text

Unlocking the Secrets to Effortless Compliance with ZATCA Phase 2

The Kingdom of Saudi Arabia is leading the way in digital transformation, especially with its structured e-invoicing initiatives. A significant part of this movement is ZATCA Phase 2, which aims to enhance transparency, boost efficiency, and ensure tax compliance across businesses.

If you are a business owner, accountant, or IT professional, understanding ZATCA Phase 2 is no longer optional. It is critical for ensuring that your operations remain compliant and future-ready. This guide breaks down everything you need to know in a simple, easy-to-understand manner.

What Is ZATCA Phase 2?

ZATCA Phase 2, also known as the Integration Phase, is the next major step following Saudi Arabia's Phase 1 e-invoicing requirements. While Phase 1 focused on the generation of electronic invoices, Phase 2 moves beyond that.

It requires businesses to integrate their e-invoicing systems with ZATCA’s Fatoora platform, allowing real-time or near-real-time transmission of invoices for clearance and validation.

This phase ensures that each invoice issued meets strict technical, security, and data format requirements set by the Zakat, Tax and Customs Authority (ZATCA).

Key Objectives Behind ZATCA Phase 2

Understanding the "why" behind Phase 2 can help businesses see it as an opportunity rather than a burden. The main goals include:

Improving tax compliance across all sectors

Minimizing fraud and manipulation of invoices

Streamlining government audits with real-time data

Promoting a transparent digital economy

Enhancing business operational efficiency

Who Needs to Comply?

All businesses registered for VAT in Saudi Arabia must comply with ZATCA Phase 2 regulations. This includes:

Large enterprises

Medium and small businesses

Businesses using third-party billing service providers

Companies operating across multiple sectors

Even if your business operates primarily offline, if you are VAT registered, you need to be compliant.

Important Requirements for ZATCA Phase 2

Compliance with ZATCA Phase 2 is not just about sending electronic invoices. It involves specific technical and operational steps. Here’s what your business needs:

1. E-Invoicing System with ZATCA Compliance

Your billing or accounting system must:

Issue invoices in XML or PDF/A-3 with embedded XML

Securely store invoices electronically

Incorporate UUIDs (Unique Identifiers) for each invoice

Attach a QR code for simplified verification

2. Integration with ZATCA Systems

Businesses must establish a secure Application Programming Interface (API) connection with ZATCA’s platform to allow the real-time sharing of invoice data.

3. Cryptographic Stamp

Each invoice must carry a cryptographic stamp. This verifies the invoice's authenticity and integrity.

4. Archiving

Invoices must be securely archived and retrievable for at least six years in case of audits or regulatory reviews.

Implementation Timeline for ZATCA Phase 2

ZATCA is rolling out Phase 2 gradually, targeting businesses in waves based on their annual revenues:

Wave 1: Businesses with annual revenues above SAR 3 billion (started January 1, 2023)

Wave 2: Revenues above SAR 500 million (started July 1, 2023)

Future Waves: Gradually extending to smaller businesses

Each business is officially notified by ZATCA at least six months before their compliance date, giving them time to prepare.

How to Prepare for ZATCA Phase 2: A Step-by-Step Guide

The good news is that with proper planning, adapting to ZATCA Phase 2 can be straightforward. Here’s a simple preparation roadmap:

Step 1: Review Your Current Systems

Audit your existing accounting and invoicing solutions. Identify whether they meet Phase 2’s technical and security standards. In most cases, upgrades or new software may be required.

Step 2: Select a ZATCA-Approved Solution Provider

Look for software vendors that are pre-approved by ZATCA and offer:

Seamless API integration

Cryptographic stamping

XML invoice generation

Real-time data reporting

Step 3: Integration Setup

Collaborate with IT teams or third-party service providers to set up a secure connection with the Fatoora platform.

Step 4: Employee Training

Ensure that relevant departments, such as finance, IT, and compliance, are trained to manage new invoicing processes and troubleshoot any issues.

Step 5: Test Your Systems

Conduct dry runs and testing phases to ensure that invoices are being properly cleared and validated by ZATCA without delays or errors.

Step 6: Go Live and Monitor

Once your system is ready and tested, begin issuing invoices according to Phase 2 standards. Regularly monitor compliance, system errors, and feedback from ZATCA.

Common Challenges and How to Overcome Them

Businesses often encounter several challenges during their Phase 2 preparation. Awareness can help you avoid them:

Integration Difficulties: Solve this by partnering with experienced ZATCA-compliant vendors.

Employee Resistance: Overcome this with proper training and clear communication on the benefits.

Technical Errors: Regular testing and quick troubleshooting can help prevent issues.

Lack of Budget Planning: Allocate a specific budget for compliance early to avoid unexpected costs.

Preparation is not just technical. It’s organizational as well.

Benefits of Early Compliance with ZATCA Phase 2

Early compliance does more than just prevent penalties:

Improves Financial Reporting Accuracy: Real-time clearance ensures clean records.

Builds Market Trust: Clients and partners prefer businesses that follow regulatory norms.

Enhances Operational Efficiency: Automated invoicing processes save time and reduce errors.

Boosts Competitive Advantage: Staying ahead in compliance projects an image of professionalism and reliability.

Businesses that proactively adapt to these changes position themselves as industry leaders in the evolving Saudi economy.

Conclusion

ZATCA Phase 2 is not just a regulatory requirement. It’s an opportunity to upgrade your operations, improve financial accuracy, and enhance business credibility.

By understanding the requirements, preparing strategically, and partnering with the right solution providers, your business can turn this challenge into a growth opportunity.

The sooner you act, the smoother your transition will be. Compliance with ZATCA Phase 2 is your gateway to becoming part of Saudi Arabia’s dynamic digital economy.

2 notes

·

View notes

Text

Understanding Cash App Transfer Limits and Why Your Cash App Payment Didn’t Go Through?

The Cash App limits depend on account type and visible under the “Limits” tab in the mobile application. Generally, the Cash App transfer limits are set at $250 for a week. If you exceed this transfer without verifying your account this transfer will not go through. Cash App sets limits by as many factors such as transaction history, account type, bank or card linked and most importantly the account verification status. Cash App may also set limits due to security and users experience considerations. Other factors that affect user experience could include restricting how much can be spent per day, and how much can be sent or received per week.

Cash App uses this information to verify the authenticity of uses account and ensure they are wo they say they are to avoid fraudulent activities, and other illegal actions through its platform. Furthermore, this date allows Cash App to monitor how its customers spend their money so it can efficiently run its business, restricting monthly spending limits as well ATM withdrawal limits per day/week/month. Let’s begin and learn more about it.

What Are Cash App Transfer Limits?

Limits for Cash App transfer represent the maximum amounts that can be sent or received through the app in agreed-upon time, to protect the security and safety of its users. Cash App sending limit depending on your account verification status. Without verifying your identity on Cash App, you can transfer up to $250 for a week and $1,000 for month. However, after having passed through the Cash App’s identity verification process, you have higher transfer limits which are up to $7,500 for a week.

How Much Can You Send Without Verification on Cash App?

Cash App accounts that have not been verified have strict restrictions regarding how much money can be transferred. If you have not verified your Cash App account, you are limited to sending no more than $250 per week. After this your will not go through unless your complete the identity verification procedure. Moreover, you can get higher sending limits on Cash App by linking a bank account or credit/debit card.

How Much Can You Receive Without Verification on Cash App?

Cash App accounts that have not been verified can easily receive money however there are certain limits placed on it. Your Cash App weekly receiving limit could reach $1,000 without verification - for receiving unlimited you must get verified. Verifying requires providing your full name, birthdate and last four numbers from Social Security Number as well as any pertinent details; once verified you can enjoy increased transfer limits when sending and receiving payments.

What is the difference between Verified vs. Unverified Cash App Accounts?

The main difference between verified vs. unverified Cash App accounts is about transaction limits. However, that is not all verified Cash App accounts offer more flexibility for personal and professional transactions due to larger transfer and receiving limits. While unverified Cash App accounts come with stringent restrictions limiting how much can be transferred or received at one time. Therefore, it is always a good option to verify your Cash App account for accessing higher limits.

To verify your Cash App account, you need to provide your personal details such as name, birthdate and last four digits of your Social Security Number. Moreover, you may need to upload a picture of an official government-issued ID. After being verified, once transferred you may transfer up to $7,500 and receive payments without any limits.

What is the Cash App Daily, Weekly, and Monthly Limits?

Cash App transaction limits on daily, weekly, and monthly basis. For instance, the unverified Cash App accounts have daily limit of $25 for sending money and weekly limit goes up to $250. However, verified Cahs App accounts have more generous limits which are set to $7,500 per week. Receiving funds also should not be an issue with verified accounts as it is unlimited. This is an important feature for those conducting frequent or significant transactions such as small business owners, freelancers or those receiving regular payments.

What are the Cash App ATM Withdrawal Limits?

Cash App allows users to withdraw cash at ATMs using its debit card, with specific withdrawal limits for this feature. Generally, the Cash App ATM limits are set at $1,000 per day with an overall maximum monthly withdrawal limit of $1,250. When you are withdrawing funds from an in-network ATM however the transaction will be completely free. However out-of-network ATM withdrawals may incur an additional fee of $2.50; so, make sure that the ATM's network status before taking the next step.

What are the Cash App Card Spending Limits?

Cash App cards also come with spending limits that vary based on the status of your account. If you have verified your account the Cash App debit cards typically have spending limits set at $7500 daily for purchases both made in person and online using this payment system. While without verification there typically lower Cash App spending limit of up to $250 daily; this limit covers both purchases made online as well as transactions in-person.

What is the Cash App Instant Deposit and Transfer Limits?

Cash App provides an instant method of depositing funds directly into your bank account within minutes. However, there are restrictions and limitations associated with this service; Cash App accounts with verified identities can make up to $25,000 deposits at once.

However, without verifying your account you have lower amounts available as instant deposits. Moreover, you may need to pay additional fees for Cash App instant deposits of 1.75 percent of total amount while longer transfers take one or three business days without incurring fees.

How to Increase Your Cash App Limits?

If you want to increase Cash App limit, the easiest way is to go through an identity verification process. This requires providing personal details about yourself such as full names of children, birthdate and last four digits from Social Security Number (SSN), along with identification from government for identification purposes. Once verified, Cash App transfer limits will increase, and you can send higher amounts of money.

What are the Common Issues with Cash App Transfer Limits?

Cash App users often experience issues with payments due to reaching their transfer limit, causing funds sent or received over this limit to be denied and lead to payment failure. Below mentioned are some of the most common issues with Cash App transfer limits along with the solutions:

If your Cash App account has not been verified yet, you may have lower limits and restrictions to contend with.

Make sure that the Cash App balance is sufficient to cover the purchase.

Make sure that the bank account with which your linked debit card is linked is active and can accept transfers via Cash App.

Sometime the Cash App identity verification procedure may take longer than you anticipated. In such as situation, you need to wait for some time and try again.

How to Manage your Cash App Transfers Safely?

For best results when using Cash App to transfer large sums, first of all make sure your account is verified before proceeding with large transactions. Also keep an eye on your limits to avoid payment failure and contact Cash App support via the app if any difficulties arise. Additionally, always be aware of scams and fraudulent transaction on your Cash App account.

Final Thoughts

Cash App limits on transfers are put in place to ensure users experience safety and security without complicating their experience. Unverified Cash App accounts can make limited transactions or send up to $250 per week while once verified the limits increase to a maximum weekly limit of $7,500. To get verified on Cash App it is required to share personal details like name, birthdate and last four digits from Social Security Numbers (SSNs).

2 notes

·

View notes

Text

The Rise of Blockchain: Changing Business, Politics, and Everyday Life

Blockchain generation has evolved considerably on account that its inception in 2008 as the inspiration for Bitcoin. Initially identified for its function in cryptocurrencies, blockchain has increased into a couple of industries, disrupting traditional commercial enterprise fashions and influencing society in profound ways. From improving transparency and security in transactions to allowing decentralized finance, blockchain is revolutionizing how businesses operate and how human beings interact with digital structures. This article explores the effect of blockchain on organizations and society, focusing on its advantages, demanding situations, and potential destiny developments.

Impact Of Blockchain On Society

Impact on Business

Blockchain generation gives organizations numerous advantages, which includes improved security, efficiency, and transparency. Many industries are leveraging blockchain to optimize operations, lessen costs, and construct agree with among stakeholders.

1. Enhanced Security and Transparency

One of blockchain’s maximum enormous benefits is its ability to offer steady and obvious transactions. The decentralized and immutable nature of blockchain manner that once facts is recorded, it cannot be altered or deleted. This gets rid of the chance of fraud, unauthorized get entry to, and information manipulation, that is specifically useful in industries like banking, healthcare, and deliver chain management.

For example, in economic services, blockchain ensures that transactions are steady and verifiable, lowering the risks of fraud and cyberattacks. Smart contracts—self-executing contracts with coded regulations—in addition decorate protection through making sure agreements are automatically enforced with out intermediaries.

2. Efficiency and Cost Reduction

Blockchain eliminates the want for intermediaries, decreasing transaction expenses and increasing operational efficiency. Traditional commercial enterprise processes regularly contain multiple parties, main to delays and further expenses. Blockchain simplifies transactions by permitting peer-to-peer interactions and real-time agreement.

For instance, in deliver chain management, blockchain allows actual-time monitoring of goods from production to transport. Companies like IBM and Walmart use blockchain to beautify supply chain transparency, decreasing inefficiencies and improving product authenticity.

3 Transforming Financial Services

The monetary sector has skilled substantial disruption because of blockchain. Decentralized finance (DeFi) platforms provide alternatives to standard banking, permitting customers to get right of entry to economic offerings without relying on centralized institutions.

Blockchain-based virtual currencies, including Bitcoin and Ethereum, have added new strategies of moving value globally with minimal fees. Cross-border payments, which formerly took days and involved excessive transaction prices, at the moment are processed instantly and value-efficiently using blockchain era.

Moreover, valuable banks worldwide are exploring Central Bank Digital Currencies (CBDCs) to improve financial rules and financial inclusion. Countries like China, Sweden, and the US are trying out CBDCs to streamline charge systems and decrease reliance on coins.

Four. Improved Data Management and Identity Verification

Businesses generate enormous quantities of information that require steady garage and efficient control. Blockchain gives a decentralized answer for statistics management, ensuring records is stored securely and accessed most effective by way of legal events.

One of the maximum promising applications is digital identity verification. Blockchain-primarily based identity answers permit people to manipulate their non-public records, lowering identification robbery and fraud. Companies like Microsoft and IBM are growing blockchain-primarily based virtual identification structures to improve safety and privacy.

Five. Revolutionizing Healthcare

Blockchain is remodeling the healthcare industry via improving records security, patient file management, and drug supply chain monitoring.

Patient information saved on blockchain can be securely accessed with the aid of authorized healthcare companies, ensuring correct and efficient clinical records monitoring. Additionally, blockchain prevents counterfeit drugs from entering the deliver chain by using verifying the authenticity of pharmaceutical products.

For instance, MediLedger, a blockchain-primarily based community, facilitates pharmaceutical organizations tune pills and prevent counterfeit drugs from achieving purchasers.

6. New Business Models and Innovation

Blockchain allows the improvement of new business fashions, inclusive of tokenization and non-fungible tokens (NFTs). Tokenization lets in agencies to transform bodily assets into digital tokens, allowing fractional possession and liquidity.

NFTs have revolutionized the artwork and amusement enterprise by means of supplying a decentralized way to authenticate and alternate digital assets. Artists and content material creators can promote their paintings directly to shoppers, eliminating the need for intermediaries and ensuring truthful compensation.

Impact on Society

Blockchain is not simply remodeling agencies; it's also reshaping society through selling decentralization, financial inclusion, and believe in virtual interactions.

1. Financial Inclusion

A huge part of the global population lacks get entry to to traditional banking offerings. Blockchain presents an opportunity for the unbanked to participate inside the global economy thru digital wallets and decentralized finance platforms.

Cryptocurrencies and blockchain-based totally financial offerings permit individuals in developing international locations to ship and receive bills without counting on banks. Mobile-based totally blockchain wallets provide an alternative to conventional banking, permitting users to shop and switch finances securely.

For example, structures like Stellar and Celo are centered on supplying less expensive financial offerings to underserved populations, supporting bridge the distance between the unbanked and financial systems.

2. Decentralization and Empowerment

Blockchain promotes decentralization by using getting rid of the need for intermediaries, giving individuals more manipulate over their assets and records. This is specially relevant in regions with risky governments and monetary systems, where human beings face demanding situations accessing banking offerings and securing their wealth.

Decentralized Autonomous Organizations (DAOs) are every other example of blockchain-pushed empowerment. DAOs permit communities to make collective selections without centralized leadership, fostering democratic and obvious governance.

3. Increased Trust and Accountability

In many sectors, lack of transparency and responsibility has led to corruption and inefficiencies. Blockchain enhances trust by using providing an immutable and transparent document of transactions.

Governments and organizations can use blockchain to improve public trust through ensuring transparency in elections, supply chains, and charity donations. For instance, blockchain-primarily based voting systems can save you election fraud and increase voter confidence. Estonia has implemented blockchain-based balloting to beautify electoral protection and integrity.

Four. Environmental and Ethical Concerns

While blockchain gives many benefits, it additionally raises worries, particularly concerning electricity intake. Proof-of-Work (PoW) blockchain networks, which include Bitcoin, require extensive energy to validate transactions, contributing to environmental issues.

However, newer blockchain models like Proof-of-Stake (PoS) consume notably less electricity and are being followed to deal with those worries. Ethereum’s transition from PoW to PoS in 2022 reduced its energy consumption through over ninety nine%, making blockchain extra sustainable.

Five. Privacy and Data Ownership

In the virtual age, private facts is frequently misused via agencies and governments. Blockchain-primarily based privateness solutions empower individuals to manipulate their records and limit unauthorized access.

Self-sovereign identification (SSI) is a concept in which people personal and manipulate their digital identities with out relying on 1/3 events. This prevents records breaches and identity theft at the same time as improving privacy protection.

6. Humanitarian Aid and Crisis Response

Blockchain technology is being used for humanitarian efforts, providing useful resource to refugees and disaster-stricken regions more efficaciously. Organizations like the World Food Programme (WFP) use blockchain to distribute aid without delay to beneficiaries, decreasing fraud and ensuring transparency.

For instance, WFP’s "Building Blocks" assignment uses blockchain to distribute meals assistance to Syrian refugees, ensuring finances attain those in want without intermediaries.

Challenges and Future Outlook

Despite its capacity, blockchain faces numerous challenges, together with:

Regulatory Uncertainty – Governments worldwide are still developing guidelines for blockchain and cryptocurrencies, developing uncertainty for agencies and customers.

Scalability Issues – Some blockchain networks conflict with gradual transaction processing speeds, restricting vast adoption.

Adoption Barriers – Many groups and people lack the technical know-how to put in force and use blockchain correctly.

Security Risks – While blockchain is steady, vulnerabilities in clever contracts and decentralized programs may be exploited via hackers.

2 notes

·

View notes

Text

What Are the Costs Associated with Fintech Software Development?

The fintech industry is experiencing exponential growth, driven by advancements in technology and increasing demand for innovative financial solutions. As organizations look to capitalize on this trend, understanding the costs associated with fintech software development becomes crucial. Developing robust and secure applications, especially for fintech payment solutions, requires significant investment in technology, expertise, and compliance measures. This article breaks down the key cost factors involved in fintech software development and how businesses can navigate these expenses effectively.

1. Development Team and Expertise

The development team is one of the most significant cost drivers in fintech software development. Hiring skilled professionals, such as software engineers, UI/UX designers, quality assurance specialists, and project managers, requires a substantial budget. The costs can vary depending on the team’s location, expertise, and experience level. For example:

In-house teams: Employing full-time staff provides better control but comes with recurring costs such as salaries, benefits, and training.

Outsourcing: Hiring external agencies or freelancers can reduce costs, especially if the development team is located in regions with lower labor costs.

2. Technology Stack

The choice of technology stack plays a significant role in the overall development cost. Building secure and scalable fintech payment solutions requires advanced tools, frameworks, and programming languages. Costs include:

Licenses and subscriptions: Some technologies require paid licenses or annual subscriptions.

Infrastructure: Cloud services, databases, and servers are essential for hosting and managing fintech applications.

Integration tools: APIs for payment processing, identity verification, and other functionalities often come with usage fees.

3. Security and Compliance

The fintech industry is heavily regulated, requiring adherence to strict security standards and legal compliance. Implementing these measures adds to the development cost but is essential to avoid potential fines and reputational damage. Key considerations include:

Data encryption: Robust encryption protocols like AES-256 to protect sensitive data.

Compliance certifications: Obtaining certifications such as PCI DSS, GDPR, and ISO/IEC 27001 can be costly but are mandatory for operating in many regions.

Security audits: Regular penetration testing and vulnerability assessments are necessary to ensure application security.

4. Customization and Features

The complexity of the application directly impacts the cost. Basic fintech solutions may have limited functionality, while advanced applications require more extensive development efforts. Common features that add to the cost include:

User authentication: Multi-factor authentication (MFA) and biometric verification.

Real-time processing: Handling high volumes of transactions with minimal latency.

Analytics and reporting: Providing users with detailed financial insights and dashboards.

Blockchain integration: Leveraging blockchain for enhanced security and transparency.

5. User Experience (UX) and Design

A seamless and intuitive user interface is critical for customer retention in the fintech industry. Investing in high-quality UI/UX design ensures that users can navigate the platform effortlessly. Costs in this category include:

Prototyping and wireframing.

Usability testing.

Responsive design for compatibility across devices.

6. Maintenance and Updates

Fintech applications require ongoing maintenance to remain secure and functional. Post-launch costs include:

Bug fixes and updates: Addressing issues and releasing new features.

Server costs: Maintaining and scaling infrastructure to accommodate user growth.

Monitoring tools: Real-time monitoring systems to track performance and security.

7. Marketing and Customer Acquisition

Once the fintech solution is developed, promoting it to the target audience incurs additional costs. Marketing strategies such as digital advertising, influencer partnerships, and content marketing require significant investment. Moreover, onboarding users and providing customer support also contribute to the total cost.

8. Geographic Factors

The cost of fintech software development varies significantly based on geographic factors. Development in North America and Western Europe tends to be more expensive compared to regions like Eastern Europe, South Asia, or Latin America. Businesses must weigh the trade-offs between cost savings and access to high-quality talent.

9. Partnering with Technology Providers

Collaborating with established technology providers can reduce development costs while ensuring top-notch quality. For instance, Xettle Technologies offers comprehensive fintech solutions, including secure APIs and compliance-ready tools, enabling businesses to streamline development processes and minimize risks. Partnering with such providers can save time and resources while enhancing the application's reliability.

Cost Estimates

While costs vary depending on the project's complexity, here are rough estimates:

Basic applications: $50,000 to $100,000.

Moderately complex solutions: $100,000 to $250,000.

Highly advanced platforms: $250,000 and above.

These figures include development, security measures, and initial marketing efforts but may rise with added features or broader scope.

Conclusion

Understanding the costs associated with fintech software development is vital for effective budgeting and project planning. From assembling a skilled team to ensuring compliance and security, each component contributes to the total investment. By leveraging advanced tools and partnering with experienced providers like Xettle Technologies, businesses can optimize costs while delivering high-quality fintech payment solutions. The investment, though significant, lays the foundation for long-term success in the competitive fintech industry.

2 notes

·

View notes

Text

How to Find a Trusted Ahrefs Group Buy Seller

Navigating the Maze: Finding a Trusted Ahrefs Group Buy Seller

Ahrefs, the SEO (Search Engine Optimization) powerhouse, equips users with an arsenal of tools to analyze websites, research keywords, track rankings, and gain valuable competitor insights. While coveted by SEO professionals, the subscription fees can be a barrier for some, particularly freelancers, small businesses, or those starting out. This is where Ahrefs group buys emerge, offering a potentially cost-effective alternative. However, navigating the world of group buys requires caution, as not all sellers are created equal. This guide equips you with the knowledge to find a trusted Ahrefs group buy seller, allowing you to access these powerful tools without compromising security or reliability.

The Allure of Ahrefs Group Buys

Ahrefs group buys operate on a simple principle: multiple users share the cost of a single Ahrefs subscription. This can significantly reduce the financial burden, making Ahrefs' comprehensive toolkit more accessible. But the benefits go beyond affordability:

Collaboration: Agencies or teams working on SEO projects can benefit from shared access, fostering streamlined workflows and efficient communication.

Regular Updates: Reputable group buy sellers ensure access to the latest Ahrefs features and updates, keeping you equipped with cutting-edge tools.

The Buyer Beware Approach: Potential Risks

Before diving headfirst into the world of Ahrefs group buys, it's crucial to acknowledge the potential downsides:

Security Concerns: Sharing account credentials with a third-party seller can pose a security risk. Meticulously research the provider's reputation and security practices.

Unreliable Access: Some sellers might offer unstable access due to account suspension or limitations imposed by Ahrefs.

Limited Usage: Certain group buys may restrict daily or monthly usage limits for specific tools to maintain fairness among users.

Ethical Considerations: Ahrefs frowns upon unauthorized account sharing. Consider supporting their development by opting for an official subscription if financially viable.

Finding the Trustworthy Seller: Essential Criteria

With the potential drawbacks in mind, here's how to identify a trusted Ahrefs group buy seller:

Reputation is Key: Start by researching the seller's track record. Look for online reviews, testimonials, and forum discussions to gauge their reliability and customer satisfaction.

Transparency Matters: A trustworthy seller will have a clear and transparent website outlining their pricing structure, terms of service, data security practices, and refund policy (if applicable).

Security First: Inquire about the seller's security measures to protect user data. Secure login protocols and two-factor authentication are strong indicators of a responsible provider.

Communication Channels: Opt for a seller with established communication channels, allowing you to reach them promptly with questions or concerns.

Going Beyond the Basics: Advanced Tips

Once you've identified a few potential sellers, take these additional steps for further verification:

Social Proof: Check if the seller maintains active social media profiles or online communities. Engagement levels and user feedback can reveal valuable insights.

Payment Methods: Opt for a seller who uses secure payment gateways like PayPal or credit card processors with buyer protection mechanisms.

Trial Periods: If available, consider a trial period to assess the quality of service and tool access before committing long-term.

FAQs: Demystifying Ahrefs Group Buy Sellers

What are some red flags to look out for when choosing a seller?

Be wary of sellers offering unrealistically low prices, vague terms of service, or limited communication channels.

Is it possible to find a completely risk-free Ahrefs group buy?

There is always an inherent risk involved in using a group buy service. However, by following the outlined tips and conducting thorough research, you can significantly minimize these risks.

What are some alternatives to Ahrefs group buys?

Several free and paid SEO tools offer varying functionalities. Explore options like Google Search Console, SEMrush, or Moz before committing to a group buy.

Can I get banned from Ahrefs for using a group buy?

Ahrefs can potentially suspend your account if they detect unauthorized access or suspicious activity.

What are the long-term implications of using a group buy?

Using a group buy for an extended period might hinder your ability to access the full benefits of an official subscription, such as dedicated customer support or priority access to new features.

Conclusion

Ahrefs group buys present a potentially cost-effective way to leverage powerful SEO tools. However, approaching them with caution and due diligence is crucial. By following the outlined strategies and prioritizing security and transparency, you can increase your chances of finding a reliable seller who who can provide access to Ahrefs' tools without compromising your data or hindering your SEO efforts. Remember, the ideal scenario involves striking a balance between affordability and peace of mind. Here are some additional considerations:

Official Ahrefs Subscription vs. Group Buy: If your budget allows, weigh the long-term benefits of an official Ahrefs subscription. Direct support from Ahrefs, access to all features without limitations, and a lower risk of account suspension are valuable advantages.

Alternative SEO Tools: Explore free or paid alternatives like Ubersuggest, KWFinder, or Moz Pro. Depending on your specific needs, these tools might offer a good balance of functionality and cost.

Building Your Case for an Official Subscription: If you work within an organization, consider presenting a well-researched case for acquiring an official Ahrefs subscription. Highlight the long-term ROI (Return on Investment) potential and how Ahrefs can enhance your SEO efforts.

Ultimately, the decision to use an Ahrefs group buy rests on your individual needs and risk tolerance. By carefully evaluating the options and prioritizing security, you can make an informed choice that empowers your SEO journey.

2 notes

·

View notes

Text

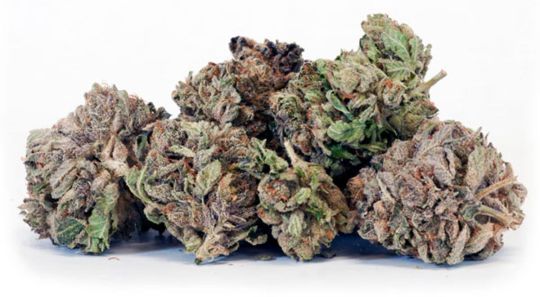

Navigating New Jersey's Online Weed Dispensaries: A Comprehensive Guide

Navigating New Jersey's Online Weed Dispensaries: A Comprehensive Guide

New Jersey has emerged as a pivotal player in the East Coast's cannabis industry, with a rapidly evolving legal framework and burgeoning online dispensary market. This comprehensive guide aims to navigate you through the complexities of New Jersey's cannabis landscape, from understanding the legal intricacies to selecting the best online dispensary for your needs. Whether you're a consumer or a business, this guide will provide you with the necessary insights to make informed decisions in the Garden State's flourishing cannabis scene.

Key Takeaways

New Jersey's CREAMM Act and subsequent legislation have established a robust legal framework for cannabis, prioritizing small and locally-owned businesses as well as equitable ownership.

When choosing an online dispensary, it's crucial to assess the quality and variety of products, user experience, and the platform's commitment to security and privacy.

Understanding the financial implications, including taxes and fees, and ensuring compliance with state and local laws are essential for both consumers and businesses in the cannabis market.

Staying informed about the latest developments in New Jersey's cannabis industry is key, with resources like news outlets, webinars, and expert insights being invaluable.

The future of cannabis in New Jersey is poised for growth, with potential expansion of consumption areas, evolving market trends, and anticipated legislative changes shaping the industry.

Understanding New Jersey's Cannabis Legal Framework

The CREAMM Act and Licensing Classes

The Cannabis Regulatory, Enforcement Assistance, and Marketplace Modernization (CREAMM) Act is a cornerstone of New Jersey's cannabis industry, establishing a framework for legal cannabis operations. Under the CREAMM Act, six distinct classes of licenses are available for businesses looking to enter the adult-use market:

Class 1: Cultivator License

Class 2: Manufacturer License

Class 3: Wholesaler License

Class 4: Distributor License

Class 5: Retailer License

Class 6: Delivery License

Each class caters to a specific segment of the cannabis supply chain, from cultivation to sale. Prospective business owners must navigate a complex application process, which includes requirements such as being at least 21 years old and completing a training course approved by the NJ-CRC. This training covers essential topics like the history of cannabis and cultivation techniques.

The licensing process is designed to ensure that all operators are well-informed and compliant with state regulations, contributing to a responsible and sustainable cannabis market in New Jersey.

Key Regulations for Online Dispensaries

In New Jersey, online weed dispensaries operate under stringent regulations to ensure consumer safety and legal compliance. All transactions must be secure and verifiable, with dispensaries required to implement robust cybersecurity measures. This includes the creation of secure accounts for users, with strong passwords and, where possible, two-factor authentication.

Before making a purchase, customers should verify that the dispensary is licensed under the CREAMM Act.

It is essential to understand the limits on possession and consumption as per regional laws.

Dispensaries must adhere to strict age verification processes to prevent underage sales.

When selecting an online dispensary, consider not only the product offerings but also the platform's adherence to these key regulations. This ensures a safe and legal purchasing experience.

The legal landscape for cannabis in New Jersey is continually evolving, making it crucial for both consumers and businesses to stay informed about the latest regulatory changes. Compliance with these regulations is not just a legal obligation but also a marker of a dispensary's commitment to responsible service.

Impact of Recent Legislation on Consumers and Businesses

Recent legislative changes in New Jersey have had a significant impact on both consumers and businesses within the cannabis industry. The NJ-CRC's approval of rules for cannabis consumption areas marks a pivotal development, providing a structured operational framework for dispensaries. This move is expected to enhance the consumer experience by offering designated spaces for the use of cannabis products.

For businesses, the new legislation presents both opportunities and challenges. Compliance with the evolving regulatory landscape requires careful attention to detail and an understanding of the legal nuances. Here are some key considerations for businesses navigating these changes:

Adherence to new operational standards for consumption areas

Updating business models to accommodate new service offerings

Ensuring consumer privacy and data protection in online transactions

The landscape of New Jersey's cannabis industry is rapidly evolving, with recent legislation shaping the future of consumption, commerce, and community engagement in profound ways.

Selecting the Right Online Dispensary for You

Assessing Product Quality and Variety

When venturing into New Jersey's online weed dispensaries, assessing product quality and variety is essential for a satisfactory experience. A reputable vendor will offer a wide range of products, from traditional options to modern extracts, each with detailed descriptions covering origin, production methods, and cannabinoid profiles.

Exploring the variety of products is key to finding what best suits your individual needs. Take note of the aroma, potency, and texture, as these factors can greatly influence your satisfaction.

Community feedback and reviews are invaluable for determining the reliability of a dispensary. Look for platforms with positive testimonials about product quality and delivery efficiency. Additionally, lab testing and quality assurance are non-negotiables; dispensaries should provide evidence of lab-tested products to ensure safety and regulatory compliance.

Understanding the potency and effects of different cannabis strains will guide you to make informed choices. This knowledge, combined with the insights from user reviews, will help you select products that align with your desired experiences.

Navigating User Interfaces and Customer Service

When selecting an online weed dispensary in New Jersey, the ease of navigating their website and the quality of customer service can significantly impact your shopping experience. A user-friendly interface ensures a smooth transaction process, from browsing products to finalizing your purchase. Here are some key aspects to consider:

The clarity and organization of the website's layout.

Availability of search functions and product filters.

Responsiveness and accessibility on various devices.

Clear and concise product descriptions and images.

Customer service is equally important, as it reflects the dispensary's commitment to its customers. Consider the following:

The availability of support via multiple channels (phone, email, live chat).

The promptness and helpfulness of customer support responses.

The presence of a comprehensive FAQ section to quickly address common concerns.

Remember, a dispensary that values your time and provides a hassle-free online experience is likely to offer a higher level of service overall. This can be a deciding factor in choosing where to make your purchases. weed delivery nj near me

Security and Privacy Considerations

When engaging with online weed dispensaries in New Jersey, security and privacy are paramount. With the recent enactment of Senate Bill No. 332, consumers are granted additional protections concerning their personal data. It's crucial to understand the measures dispensaries take to protect your information and what you can do to enhance your own security.weed delivery nj

Creating a secure account is the first step in safeguarding your privacy. Always use strong, unique passwords and, if possible, enable two-factor authentication. This not only secures your personal details but also ensures that transactions remain confidential.

While dispensaries are responsible for implementing robust security protocols, remember that no Internet transmission is 100% secure. It is essential to be vigilant and proactive in protecting your login credentials.

Here are some best practices for maintaining security and privacy:

Verify the dispensary's compliance with state privacy laws.

Read and understand the dispensary's privacy policy.

Contact customer service immediately if you suspect your account has been compromised.

The Financial and Legal Aspects of Online Purchases

Understanding Taxes and Fees

When purchasing cannabis from online dispensaries in New Jersey, it's crucial to understand the tax implications and additional fees that may apply. Retail cannabis and cannabis-infused products are subject to a 15% state retail marijuana sales tax. This is in addition to any local taxes that may be imposed by municipalities.

It's important for consumers to note that recreational cannabis is exempt from the general sales tax, which can influence the overall cost of purchases.

Below is a breakdown of potential taxes and fees you might encounter:

State Retail Marijuana Sales Tax: 15%

Local Municipality Taxes: Varies by location

Additional Fees: May include delivery charges or online transaction fees

Understanding these financial aspects can help you budget more effectively and avoid surprises at checkout.

youtube

Compliance with State and Local Laws

When engaging with online weed dispensaries in New Jersey, it is crucial to ensure compliance with both state and local laws. Navigating the regulatory landscape is essential for both consumers and businesses to avoid legal pitfalls. For instance, the New Jersey Administrative Code specifies conduct for cannabis consumption areas, highlighting the importance of adhering to detailed regulations such as those for registered patients in consumption areas.

Assistance with finding suitability applications and financial disclosure applications

Development of standard operating procedures

Obtaining required state and local tax permits

Regulatory reviews of licensing applications and supporting documents

Representation at state and local licensing hearings

These steps are vital for dispensaries to operate legally and for consumers to engage with them responsibly. Moreover, staying informed about changes in legislation, such as the recent Florida SB 264, can have broader implications for the cannabis industry.

Ensuring compliance is not just about following the law; it's about fostering a safe and responsible cannabis culture.

Protecting Your Consumer Rights

In the evolving landscape of New Jersey's online cannabis market, protecting your consumer rights is paramount. The state's regulatory bodies, including the Cannabis Regulatory Commission, provide resources and guidelines to ensure your rights are upheld. For instance, the [Cannabis Regulatory Commission Homepage](https://www.nj.gov/cannabis/) offers a wealth of information on various topics related to cannabis use and business in New Jersey.

When engaging with online dispensaries, it's crucial to be aware of the policies regarding consumer data protection. The California Consumer Privacy Act (CCPA) sets a precedent for data privacy, which may influence local practices. Always review the privacy policies of dispensaries to understand how your data is collected, stored, and used.

It's essential to have a clear understanding of the dispute resolution process for any grievances that may arise. This includes knowing how to file a complaint and what to expect during the resolution process.

Furthermore, stay informed about the actions of enforcement agencies, such as monitoring for price gouging, especially during times of high demand. By keeping abreast of these aspects, you can make informed decisions and safeguard your interests as a consumer in New Jersey's online cannabis marketplace.

Staying Informed: Resources and News for New Jersey Cannabis

Key News Outlets and Publications to Follow

Staying updated with the latest developments in New Jersey's cannabis industry is crucial for both consumers and businesses. Regularly consulting reputable news sources can provide valuable insights into market trends, regulatory changes, and business opportunities. Below is a list of key publications and outlets that offer consistent and reliable coverage:

MJBizDaily: A leading publication in the cannabis world, providing updates on industry news and marijuana legislation specific to New Jersey.

Long Island Press: Offers in-depth articles and coverage on various topics, including cannabis-related news in the region.

NJBIZ: Known as New Jersey's leading business journal, it covers business news extensively and includes sections on cannabis.

CannaBeat: A biweekly newsletter that curates top news stories impacting the cannabis industry, with a focus on business and culture.

It's important to diversify your sources to get a well-rounded view of the industry. Regularly engaging with these publications will keep you informed about the critical issues affecting the cannabis landscape in New Jersey.

Webinars and Educational Events

Keeping abreast of the latest developments in New Jersey's cannabis industry is crucial for both consumers and businesses. Webinars and educational events offer a platform for learning about regulatory changes, market trends, and best practices.

For instance, the 'Diving into New Jersey's Cannabis Regulations' webinar provided insights into the state's regulatory landscape. Such events are often free and feature discussions with industry experts and associations.

Staying informed through these events can empower participants with the knowledge to navigate the evolving cannabis market confidently.

Upcoming events to consider include:

'State of the Florida Cannabis Industry Today and Tomorrow' panel discussion on May 18.

'Maryland Cannabis Legalization: Implementation & Opportunities' session, which delves into the new Maryland market.

Mark your calendars and register in advance to secure your spot in these informative sessions.

Industry Insights from Experts

Gaining insights from industry experts is crucial for understanding the evolving landscape of New Jersey's cannabis market. Experts predict a surge in technological integration, which could streamline operations and enhance customer experiences. They emphasize the importance of staying ahead of trends to maintain a competitive edge.

Technological advancements in cultivation and sales platforms

The growing importance of sustainability in production

Consumer education and the role of expert guidance

The integration of advanced analytics and customer data will likely shape the future of personalized cannabis experiences.

Additionally, experts highlight the potential for regulatory changes to open up new opportunities for businesses. They advise companies to remain agile and informed to navigate the complex regulatory environment effectively.

Future of Cannabis in New Jersey: Trends and Predictions

Expansion of Consumption Areas and Regulations

The evolution of New Jersey's cannabis landscape is poised to take a significant turn with the introduction of consumption areas. These designated spaces are set to redefine the social aspect of cannabis use, offering a legal environment for adults to enjoy cannabis products. The New Jersey Cannabis Regulatory Commission's recent proposal outlines the operational framework for these areas, marking a pivotal moment for the state's cannabis policy.

The establishment of consumption areas is expected to complement the existing retail framework, providing a new avenue for businesses to engage with consumers.

As the regulatory environment adapts, stakeholders are encouraged to participate in the public comment period to shape the future of cannabis consumption in New Jersey. This collaborative approach ensures that the regulations will not only meet legal standards but also address the needs and concerns of the community.

Public Comment Period: An opportunity for feedback

Operational Framework: Guidelines for consumption areas

Community Engagement: Involvement in shaping regulations

The expansion of consumption areas is likely to have a ripple effect on local economies, tourism, and social norms surrounding cannabis. As New Jersey navigates this new terrain, it's crucial for consumers, businesses, and policymakers to stay informed and proactive.

Market Trends and Consumer Behavior

As the New Jersey cannabis market matures, consumer preferences and behaviors are evolving. With the average retail cannabis prices dropping significantly since 2021, consumers are becoming more price-sensitive and value-oriented. Dispensaries that adapt by accepting debit payments are seeing a notable increase in revenue compared to cash-only businesses.

Price Sensitivity: Consumers are increasingly looking for competitive pricing, driving dispensaries to offer more discounts and loyalty programs.

Payment Flexibility: The convenience of debit payments is preferred, with dispensaries accepting debit earning more revenue.

Product Diversity: There's a growing demand for a wider range of cannabis products, including edibles, concentrates, and topicals.

The market is witnessing a shift towards more sophisticated consumer expectations, with a demand for higher quality products and a seamless purchasing experience.

Understanding these trends is crucial for dispensaries aiming to stay competitive and cater to the evolving needs of their customer base.

Predictions for Legislative Changes

As New Jersey's cannabis industry matures, legislative changes are anticipated to adapt to the evolving landscape. Expectations are high for amendments that will further streamline the regulatory process, making it more accessible for new businesses and more convenient for consumers.

Potential expansion of licensing categories to include new forms of cannabis-related enterprises.

Introduction of measures to enhance social equity in the industry.

Adjustments to tax structures to balance state revenue with consumer affordability.

The future legislative framework is likely to reflect a balance between industry growth and public health concerns, with a focus on responsible consumption and distribution.

These changes will be critical in shaping the market dynamics and ensuring that New Jersey's cannabis industry remains competitive and compliant with public expectations. Stakeholders are advised to stay vigilant and participate in the legislative process to influence positive outcomes for the community.

Conclusion

As we've explored the ins and outs of New Jersey's online weed dispensaries, it's clear that the Garden State is at the forefront of the East Coast's cannabis industry. With a comprehensive regulatory system in place and a commitment to supporting small, locally-owned businesses and equitable ownership, New Jersey is not only setting a precedent but also offering a wealth of opportunities for consumers and entrepreneurs alike. Whether you're a resident looking to understand the nuances of the CREAMM Act's licensing or an out-of-state observer keen to learn from New Jersey's regulatory practices, this guide aims to provide valuable insights. As the state continues to evolve its cannabis landscape, with expansions like consumption areas and new licensing rounds, staying informed is key. Remember, the journey through New Jersey's cannabis market is as dynamic as it is exciting, and with the right knowledge, you can navigate it with confidence.

Frequently Asked Questions

What is the CREAMM Act and how does it affect New Jersey's cannabis industry?

The Cannabis Regulatory, Enforcement Assistance, and Marketplace Modernization (CREAMM) Act is legislation that establishes the regulatory framework for adult-use cannabis in New Jersey. It outlines the licensing classes for cannabis businesses and sets the foundation for the operation and governance of the industry in the state.

Are there any specific regulations for online weed dispensaries in New Jersey?

Yes, online weed dispensaries in New Jersey must adhere to regulations set by the state, which include compliance with licensing requirements, ensuring secure transaction processes, and verifying the age and identity of customers to prevent underage sales.

How has recent legislation impacted consumers and businesses in the New Jersey cannabis market?

Recent legislation, such as the expansion of edible products through Resolutions 2023-143 and 2023-144, has broadened the product offerings for consumers. For businesses, new regulations provide clarity and opportunities for expansion, especially with the potential for cannabis consumption areas.

What should I consider when choosing an online dispensary in New Jersey?

When selecting an online dispensary, consider the quality and variety of products, the ease of use of the website interface, the level of customer service provided, and the dispensary's commitment to security and privacy.

How can I stay informed about the latest developments in New Jersey's cannabis industry?

To stay informed, follow key news outlets and publications, attend webinars and educational events, and seek out insights from industry experts. Publications like CannaBeat and events such as New Jersey Cannabis Insider Live are valuable resources.

What future trends and legislative changes can we expect for cannabis in New Jersey?

The future of cannabis in New Jersey may include the expansion of consumption areas, evolving market trends influenced by consumer behavior, and further legislative changes that could streamline business operations and enhance consumer protections.

#online weed dispensary nj#weed delivery nj#cannabis delivery nj#weed delivery nj service#recreational weed delivery nj#Youtube

2 notes

·

View notes

Text

The Future of Finance: How Fintech Is Winning the Cybersecurity Race

In the cyber age, the financial world has been reshaped by fintech's relentless innovation. Mobile banking apps grant us access to our financial lives at our fingertips, and online investment platforms have revolutionised wealth management. Yet, beneath this veneer of convenience and accessibility lies an ominous spectre — the looming threat of cyberattacks on the financial sector. The number of cyberattacks is expected to increase by 50% in 2023. The global fintech market is expected to reach $324 billion by 2028, growing at a CAGR of 25.2% from 2023 to 2028. This growth of the fintech market makes it even more prone to cyber-attacks. To prevent this there are certain measures and innovations let's find out more about them

Cybersecurity Measures in Fintech

To mitigate the ever-present threat of cyberattacks, fintech companies employ a multifaceted approach to cybersecurity problems and solutions. Here are some key measures:

1. Encryption

Encrypting data at rest and in transit is fundamental to protecting sensitive information. Strong encryption algorithms ensure that even if a hacker gains access to data, it remains unreadable without the decryption keys.

2. Multi-Factor Authentication (MFA)

MFA adds an extra layer of security by requiring users to provide multiple forms of verification (e.g., passwords, fingerprints, or security tokens) before gaining access to their accounts.

3. Continuous Monitoring

Fintech companies employ advanced monitoring systems that constantly assess network traffic for suspicious activities. This allows for real-time threat detection and rapid response.

4. Penetration Testing

Regular penetration testing, performed by ethical hackers, helps identify vulnerabilities in systems and applications before malicious actors can exploit them.

5. Employee Training

Human error is a significant factor in cybersecurity breaches. Companies invest in cybersecurity training programs to educate employees about best practices and the risks associated with cyber threats.

6. Incident Response Plans

Having a well-defined incident response plan in place ensures that, in the event of a breach, the company can respond swiftly and effectively to mitigate the damage.

Emerging Technologies in Fintech Cybersecurity

As cyber threats continue to evolve, so do cybersecurity technologies in fintech. Here are some emerging technologies that are making a significant impact:

1. Artificial Intelligence (AI)

AI and machine learning algorithms are used to analyse vast amounts of data and identify patterns indicative of cyber threats. This allows for proactive threat detection and quicker response times.

2. Blockchain

Blockchain technology is employed to enhance the security and transparency of financial transactions. It ensures that transaction records are immutable and cannot be altered by malicious actors.

3. Biometrics

Fintech companies are increasingly adopting biometric authentication methods, such as facial recognition and fingerprint scanning, to provide a higher level of security than traditional passwords.

4. Quantum-Safe Encryption

With the advent of quantum computing, which poses a threat to current encryption methods, fintech companies are exploring quantum-safe encryption techniques to future-proof their security measures.

Conclusion

In the realm of fintech, where trust and security are paramount, the importance of cybersecurity cannot be overstated. Fintech companies must remain vigilant, employing a combination of advanced digital transformation solutions, employee training, and robust incident response plans to protect sensitive financial data from cyber threats. As the industry continues to evolve, staying one step ahead of cybercriminals will be an ongoing challenge, but one that fintech firms must embrace to ensure their continued success and the safety of their customers' financial well-being.

3 notes

·

View notes

Text

Fortifying Cybersecurity. Strategic Measures for Fintech and Business Leaders in 2025

In the evolving digital landscape of 2025, businesses face increasingly sophisticated cyber threats. The integration of advanced technologies, such as AI and quantum computing, has expanded the attack surface, necessitating a proactive and comprehensive approach to cybersecurity. For fintech companies and business leaders, implementing robust security measures is essential to protect sensitive data and maintain customer trust.

1. Embrace a Zero Trust Architecture.

The traditional perimeter-based security model is no longer sufficient. Adopting a Zero Trust Architecture ensures that every access request is thoroughly verified, regardless of its origin. This approach minimizes the risk of unauthorized access and lateral movement within networks. Implementing strict access controls and continuous monitoring can significantly enhance security posture.

2. Implement Multi-Factor Authentication (MFA).

MFA adds an additional layer of security by requiring users to provide multiple forms of verification before granting access. This method significantly reduces the likelihood of unauthorized access due to compromised credentials. Incorporating MFA across all user accounts, especially those with elevated privileges, is a fundamental step in strengthening cybersecurity.

3. Regularly Update and Patch Systems.

Outdated software and systems are prime targets for cybercriminals. Ensuring that all systems, applications, and devices are regularly updated and patched addresses known vulnerabilities and reduces the risk of exploitation. Establishing a routine update schedule and leveraging automated patch management tools can streamline this process.

4. Conduct Comprehensive Employee Training.

Human error remains a significant factor in security breaches. Providing regular training sessions to educate employees about cybersecurity best practices, phishing awareness, and safe data handling can empower them to act as the first line of defense. Creating a culture of security awareness is instrumental in preventing inadvertent security lapses.

5. Utilize Advanced Threat Detection Tools.

Modern cyber threats often bypass traditional security measures. Implementing advanced threat detection tools, such as Extended Detection and Response (XDR) systems, can provide real-time monitoring and analysis of network activities. These tools leverage AI and machine learning to identify and respond to anomalies swiftly, minimizing potential damage.

6. Develop a Robust Incident Response Plan.

Preparation is key to minimizing the impact of security incidents. Establishing a comprehensive incident response plan that outlines procedures for detection, containment, eradication, and recovery ensures a structured approach during crises. Regularly testing and updating this plan can enhance organizational resilience.

7. Secure Third-Party Integrations.

Third-party vendors and integrations can introduce additional vulnerabilities. Conducting thorough due diligence, establishing clear security requirements, and continuously monitoring third-party access can mitigate associated risks. Implementing contractual obligations for security standards ensures accountability across the supply chain.

Building Trust Through Security.

Eric Hannelius, a seasoned fintech entrepreneur and CEO of Pepper Pay LLC, emphasizes the importance of proactive cybersecurity measures: “For consumers, the effects of a cyber-attack can be immediate and distressing. When personal financial data is exposed or stolen, trust in the fintech company can plummet if they are not prepared with a proper response. Having the best possible cyber security measures in place cannot mitigate all risk completely, but it is a key step in maintaining the integrity of data security and protecting consumers.”

Eric Hannelius advocates for integrating security into the core business strategy, ensuring that trust is built through consistent and transparent security practices.

As cyber threats continue to evolve, businesses must adopt a proactive and layered approach to cybersecurity. By implementing these strategic measures, organizations can enhance their defense mechanisms, protect sensitive data, and maintain the trust of their customers. In the dynamic digital environment of 2025, prioritizing cybersecurity is not merely a technical necessity but a fundamental business imperative.

0 notes

Text

Get Your PTE Certificate Without Exam in Australia Quick & Reliable

Do you want to Buy PTE certificate without having to dealing with the inconvenience of sitting for the test? For anyone in Australia who wants to Buy PTE certificate without exam, PTE READY NOW offers a simple, private, and expedient alternative. We assure you that the certificate you will get from us is authentic and satisfies all official standards, whether you need it more forward with your academics, profession, or immigration reasons.

Why Choose Us for Your PTE Certificate Without Exam in Australia?

you can Get PTE certificates without having to sit for the exam procedure. It can be difficult for most people to get PTE certificate without exam in Australia through the normal examination process if they lack the time or skills to do so. We can help with that with our services, here is what makes us unique: Genuine and Confirmed certifications: Our certifications are identical or same to those from authorized testing facilities. Confidential Service: We respect your privacy and do not work with outside parties. Quick Processing: You will get your certificate in a matter of days and most a times within 24 hours rather than months. High Acceptance Rate: Employers, institutions, and immigration authorities all generally accept our certificates.

How to Get PTE Certificate Without Exam

"How to get PTE certificate without exam?" is a question that many people have been asking to themselves and we also receive these questions on a daily basis. Working with us makes the process easy: Contact Us: Use our website or customer service to get in touch. Provide the Required Information: Share your score requirements and personal information. Get Your Certificate: Your PTE certificate without exam is processed and securely delivered by us. Just a legitimate certificate that is ready for use—no tests, no stress.

People worry about the originality of the PTE certificate validity that we provide. You can be rest assured and confident that our certificates are made to withstand verification checks be it in schools, embassies or profession. They have the same level of recognition as those that come from Pearson PTE admins. Our certificates stand up to scrutiny whether they are used for job placements, university admissions, or visa applications.

Need a PTE Score Upgrade? We Can Help!

Need a PTE score upgrade but do not know how to go about it in Australia? Without you having to retake the test, our PTE score increase service guarantees that you will receive the scores you desire and within a short period of time. We offer a discrete and effective solution, regardless of whether you need a big increase or missed your target score by a few points.

Buy PTE Certificate Online – Secure & Hassle-Free

You can skip the stress and time of studying for the test and waiting for your results when you Buy PTE certificate from us. You will receive a legitimate certificate with little effort thanks to our simplified procedure.

Conclusion

Do not stress any longer if you found this article and you are someone who has been looking for a means to get a PTE certificate in Australia that does not need to take a test. Our service is made to be quick, easy, and genuine. We provide outcomes that satisfy your demands, whether you require a new credential or an improvement in your PTE score. Take the first step today toward easily earning your PTE certificate by visiting PTE READY NOW right now!

0 notes

Text

Phone Number Data: The Digital Identifier Transforming Communication and Business

Introduction In today’s hyper connected digital world, phone numbers have evolved from mere contact points to powerful identifiers that fuel communication, commerce, security, and digital identity. “Phone number data” refers to the information associated with and derived from phone numbers, including their usage, location, metadata, and relationships to user identities. This data has become a valuable asset in sectors ranging from marketing to cybersecurity, but it also poses significant privacy and regulatory challenges. This article explores the meaning of phone number data, its applications, implications, and the future of how this data is used and protected.

What is Phone Number Data?

Phone number data encompasses a wide range of information linked to mobile or landline phone numbers. This can include:

Basic identifiers: Phone number, country code, carrier name, line type (mobile, landline, VoIP).

User metadata: Name, email, location, and other personal identifiers tied to the number.

Usage data: Call logs, text message records, and app interaction history.

Location data: Real-time or historical data based on tower triangulation or GPS (for mobile numbers).

Behavioral insights: Frequency of communication, network patterns, or geospatial movement trends.

Together, these components form a rich data profile that organizations can leverage for various purposes phone number data from identity verification to targeted marketing.

Sources of Phone Number Data

Phone number data can originate from multiple sources:

Telecom Providers: Phone companies collect call logs, SMS activity, and data usage.

Apps and Websites: Many apps request users’ phone numbers for registration and may collect contact data and device information.

Public Records and Directories: Some databases aggregate public contact information from business listings, customer databases, or government records.

Data Brokers: Specialized firms compile phone number databases by scraping, purchasing, or licensing user data from various sources.

The way phone number data is collected and used depends significantly on regional privacy laws and user consent mechanisms.

Common Uses of Phone Number Data

1. Marketing and Customer Engagement

Businesses often use phone number data to run SMS marketing campaigns, personalized promotions, or customer support outreach. With platforms like WhatsApp Business, Viber, or SMS gateways, phone numbers become a direct channel to consumers.

Example: E-commerce companies may send cart reminders or shipping updates to users via SMS.

2. Authentication and Security

Phone numbers are a key part of multi-factor authentication (MFA). Services send verification codes via SMS or call to confirm a user's identity.

Use Cases:

Two-factor authentication (2FA)

Account recovery

Fraud detection via SIM swap detection

3. Lead Generation and Data Enrichment

Sales and marketing teams enrich existing leads by adding phone number data to contact records. Data providers offer reverse lookup tools to identify company roles, job titles, or social media profiles from a number.

4. Communication Analytics

Call centers and telecoms analyze phone number data to study patterns, optimize service delivery, and reduce call fraud or spam.

5. Government and Emergency Services

Authorities use phone data for contact tracing (e.g., during COVID-19), disaster alerts, and emergency location tracking. This data can also help law enforcement track criminal activity.

Phone Number Data in Business Intelligence

Phone numbers help businesses:

Map consumer journeys across channels

Create segmentation models based on call behavior

Track user response to campaigns

Monitor customer satisfaction in service departments

Modern CRMs (Customer Relationship Management systems) store not just the number but all associated interactions—calls, texts, and support tickets—to create a 360-degree view of each contact.

Risks and Concerns with Phone Number Data

Despite its usefulness, phone number data presents several risks, especially related to privacy and cybersecurity.

1. Privacy Invasion

Phone numbers are often linked to other personally identifiable information (PII). When shared without proper consent, it can result in privacy violations, spam, or harassment.

2. Phishing and Scam Calls

Fraudsters often spoof caller IDs or use leaked numbers to impersonate legitimate entities. This has led to a surge in robocalls, vishing (voice phishing), and SMS scams.

3. Data Breaches

Phone numbers are commonly leaked in data breaches, sometimes alongside passwords and personal data. Leaked phone data can be weaponized for identity theft or account hijacking.

Notable Incident: The 2019 Facebook data leak exposed phone numbers of over 500 million users, emphasizing the risks associated with poor phone data handling.

4. SIM Swapping

Hackers use phone number data to execute SIM swap attacks—porting a number to a new SIM to gain control of bank accounts, emails, and crypto wallets.

Legal and Regulatory Considerations