#Fraud Detection and Prevention

Explore tagged Tumblr posts

Text

The Power of AI in Modern Ecommerce

A New Era of Ecommerce and Online Shopping The ecommerce landscape is constantly evolving, and Artificial Intelligence (AI) is at the forefront of this metamorphosis. From personalized recommendations to predictive analytics, AI is revolutionizing how businesses interact with customers and operate in the digital marketplace. 1. Personalized Recommendations: A Tailored Experience Gone are the days…

#Artificial Intelligence (AI)#Chatbots#Competitive Advantage#Customer Segmentation#Dynamic Pricing#Fraud Detection and Prevention#Logistics and Delivery#Online Shopping#Predictive Analytics

0 notes

Text

United States voice biometrics market size is projected to exhibit a growth rate (CAGR) of 16.85% during 2024-2032. The increasing focus on security and the need for robust authentication methods, the rising demand in financial services, the rapid technological advancements in artificial intelligence (AI) and machine learning (ML), and the shift towards multi-factor authentication (MFA) are some of the factors propelling the market.

#United States Voice Biometrics Market Report by Component (Solutions#Services)#Type (Active Voice Biometrics#Passive Voice Biometrics)#Deployment Mode (On-Premises#Cloud-Based)#Organization Size (Large Enterprises#Small and Medium-sized Enterprises (SMEs))#Application (Authentication and Customer Verification#Forensic Voice Analysis and Criminal Investigation#Fraud Detection and Prevention#Risk and Emergency Management#Transaction Processing#Access Control#Workforce Management#and Others)#Vertical (BFSI#Retail and E-Commerce#Government and Defense#IT and Telecom#Healthcare and Life Sciences#Transportation and Logistics#Travel and Hospitality#Energy and Utilities#and Region 2024-2032

1 note

·

View note

Text

Fraud Detection and Prevention Market Size, Share, Trends, Demand, Future Growth, Challenges and Competitive Analysis

Fraud Detection and Prevention Market business report provides a profound overview of product specification, technology, product type and production analysis considering major factors such as revenue, cost, and gross margin. The data and information collected to generate this top-notch market report has been derived from the trusted sources such as company websites, white papers, journals, and mergers etc. Fraud Detection and Prevention Market report includes basic, secondary and advanced information related to the global status, recent trends, market size, sales volume, market share, growth, future trends analysis and segment.

With the complete understanding of business environment that is best suitable for the requirements of the client, Fraud Detection and Prevention Market business report has been generated. Businesses can also achieve insights into profit growth and sustainability programs with this market report. Market drivers and market restraints explained in this report gives idea about the rise or fall in the consumer demand for the particular product depending on several factors. This market document contains all the company profiles of the major players and brands. Each of the topics is properly elaborated with the in-depth research and analysis for generating an absolute Fraud Detection and Prevention Market survey report.

Access Full 350 Pages PDF Report @

Data Bridge Market Research analyses that the global fraud detection and prevention market which was USD 198.70 million in 2022, is expected to reach USD 245.60 million by 2030, and is expected to undergo a CAGR of 11.65% during the forecast period of 2023 to 2030. The on-cloud accounts for the largest deployment segment in the respective market as it serves most applications. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Fraud Detection and Prevention Market Landscape

Part 04: Global Fraud Detection and Prevention Market Sizing

Part 05: Global Fraud Detection and Prevention Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Fraud Detection and Prevention Key Benefits over Global Competitors:

The report provides a qualitative and quantitative analysis of the Fraud Detection and Prevention Market trends, forecasts, and market size to determine new opportunities.

Porter’s Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make strategic business decisions and determine the level of competition in the industry.

Top impacting factors & major investment pockets are highlighted in the research.

The major countries in each region are analyzed and their revenue contribution is mentioned.

The market player positioning segment provides an understanding of the current position of the market players active in the Personal Care Ingredients

Some of the major players operating in the global fraud detection and prevention market are:

InterGuard (U.S.)

Software AG (Germany)

NCR Corporation (U.S.)

Capgemini (France)

DXC Technology Company (U.S.)

LexisNexis (U.S.)

Splunk Inc. (U.S.)

Microsoft (U.S.)

Bloombase (China)

Symantec (U.S.)

Intel Security (U.S.)

EMC Corporation (U.S.)

Amazon Web Services Inc. (U.S.)

Check Point Software Technologies (Israel)

Cisco System Inc. (U.S.)

F-Secure (Finland)

Browse Trending Reports:

Asia Pacific Digital Payment Market

Fraud Detection And Prevention Market

Artificial Intelligence Ai In Manufacturing Market

Cloud Migration Services Market

Mobile Money Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: [email protected]

#Fraud Detection and Prevention Market Size#Future Growth#Challenges and Competitive Analysis#market trends#market share#market analysis#market size#marketresearch#market report#markettrends#market research#Fraud Detection and Prevention

0 notes

Text

#Fraud Detection and Prevention Market#Fraud Detection and Prevention#Fraud Detection#Fraud Detection market#Prevention Market

0 notes

Link

The growing number of fraudulent activities due to an increase in the number of electronic transactions is driving the demand for global Fraud Detection...

0 notes

Text

For online businesses, there is a dire need for effective fraud prevention measures to dilute the impact of fraud.

Digital platforms are exposed to fraud more than ever!! Online fraud has become a common phenomenon and fraudsters are becoming more and more harmful with every passing day. The traditional fraud prevention strategies & solutions are not living up to the current fraud trends thus forcing platforms to look towards Device Fingerprinting and AI / ML-based fraud detection solutions.

#cybersecurity#fraud detection#fraud prevention#online business#artificial intelligence#digital#fraud

2 notes

·

View notes

Text

Roll Consults specializes in AI fraud detection, helping businesses prevent financial crime with cutting-edge machine learning and data analysis solutions. Discover smarter, faster ways to secure your operations with our expert consulting services.

For more information, Visit: https://rollconsults.com/how-ai-is-revolutionizing-fraud-detection/

0 notes

Text

Stay ahead of fraud with Crystal Recoup’s comprehensive Fraud Risk Assessment Checklist. Identify vulnerabilities, strengthen controls, and protect your organization from financial threats with our easy-to-follow guide.

Visit at: https://crystalrecoup.tech/how-to-conduct-an-effective-fraud-risk-assessment/

0 notes

Text

Navigating the Rapid Growth of the Fraud Detection and Prevention (FDP) Market

The Fraud Detection and Prevention (FDP) industry is experiencing unprecedented growth, driven by the escalating sophistication of cyber threats and the increasing digitalization of financial transactions. According to Mordor Intelligence, the FDP market is projected to expand from USD 58.18 billion in 2025 to USD 153.91 billion by 2030, reflecting a robust compound annual growth rate (CAGR) of 21.48% during forecast (2025-2030).

Key Market Drivers

Surge in Cybercrime and Data Breaches: The proliferation of digital platforms has led to a significant rise in cyber threats. In 2023 alone, over 353 million individuals in the United States were affected by data breaches, underscoring the urgent need for advanced fraud detection mechanisms.

Advancements in AI and Machine Learning: The integration of artificial intelligence (AI) and machine learning (ML) technologies has revolutionized fraud detection. These technologies enable real-time analysis of vast datasets, allowing for the identification of anomalous patterns and potential fraudulent activities with greater accuracy.

Regulatory Compliance Requirements: Stringent regulations across various industries mandate the implementation of robust fraud prevention strategies. Compliance with standards such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) necessitates the adoption of comprehensive FDP solutions.

Dominant Industry Segments

Banking, Financial Services, and Insurance (BFSI): This sector accounts for approximately 37% of the FDP market share as of 2024. The increasing adoption of digital banking services has heightened the need for sophisticated fraud detection systems to safeguard financial transactions.

Healthcare: The healthcare segment is emerging as the fastest-growing sector within the FDP market, with a projected growth rate of 19% from 2024 to 2029. The rise in fraudulent activities, including erroneous billing and false insurance claims, drives the demand for advanced fraud prevention solutions in this industry.

Regional Market Insights

North America: Holding approximately 33% of the global FDP market share in 2024, North America remains the largest market. The region's advanced technological infrastructure and stringent regulatory frameworks contribute to its dominance.

Leading Market Players

Prominent companies shaping the FDP landscape include:

IBM Corporation

SAS Institute Inc.

ACI Worldwide Inc.

Fiserv Inc.

SAP SE

These organizations are at the forefront of developing innovative solutions that leverage AI and ML to enhance fraud detection capabilities.

Conclusion

The FDP market is poised for significant expansion, driven by technological advancements and the escalating need for robust fraud prevention mechanisms. Organizations across various sectors must prioritize the implementation of comprehensive FDP solutions to mitigate risks and ensure compliance with evolving regulatory standards.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence:

https://www.mordorintelligence.com/industry-reports/global-fraud-detection-and-prevention-fdp-market-industry

#Fraud Detection and Prevention Market#Fraud Detection and Prevention Market Size#Fraud Detection and Prevention Market Share#Fraud Detection and Prevention Market Growth#Fraud Detection and Prevention Market Trends#Fraud Detection and Prevention Market Analysis

0 notes

Text

#Re-engagement campaigns#mobile ad fraud#ad fraud#event spoofing#Re-Engagement Campaigns fraud#organic poaching#types of fraud#ad fraud solution#ad fraud prevention software#retargeting campaigns#ad fraud detection tool

0 notes

Text

How Big Data is Revolutionizing the Fraud Detection and Prevention Market

Fraud Detection and Prevention Market: Trends, Analysis, and Growth Factors

Fraud Detection and Prevention market size was valued at USD 40 billion in 2023 and is estimated to reach a value of USD 476 billion by 2035 with a CAGR of 23.2% during the forecast period 2024-2035.The Fraud Detection and Prevention Market is witnessing rapid growth due to the increasing number of cyber threats, financial frauds, and the need for advanced security solutions. Organizations worldwide are adopting cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and big data analytics to mitigate risks. Fraud Detection and Prevention Market Forecast, to provide a comprehensive view of the industry.

Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/fraud-detection-and-prevention-market/1114

Fraud Detection and Prevention Market Trends and Analysis

The Fraud Detection and Prevention Market is evolving with significant technological advancements. Some key trends include:

AI and ML Integration: AI-driven solutions enhance fraud detection accuracy by identifying patterns and anomalies in real time.

Blockchain Adoption: Blockchain technology is being used to improve transparency and security in financial transactions.

Cloud-Based Solutions: The adoption of cloud-based fraud prevention solutions enables scalability and real-time monitoring.

Regulatory Compliance: Growing regulatory requirements are pushing companies to invest in fraud detection solutions.

Biometric Authentication: The use of facial recognition and fingerprint scanning is gaining traction in fraud prevention.

Fraud Detection and Prevention Market Growth Factors

Several factors contribute to the Fraud Detection and Prevention Market Growth:

Rise in Cybersecurity Threats: The increasing sophistication of cybercriminals has necessitated advanced fraud prevention tools.

Increase in Online Transactions: The growth of e-commerce and digital banking has led to a surge in fraud attempts.

Advancements in AI and Big Data Analytics: These technologies enhance fraud detection capabilities, making it easier to identify fraudulent activities.

Stringent Government Regulations: Compliance with global security standards is driving market growth.

Growing Awareness Among Businesses: Organizations are becoming more aware of the risks associated with fraud and are investing in preventive measures.

Market Segments

By Technology

Artificial Intelligence (AI) and Machine Learning (ML)

Data Analytics

Biometric Authentication

Blockchain

Real-time Monitoring and Alerts

Others

By Industry

Banking, Financial Services, and Insurance (BFSI)

Retail and e-commerce

Healthcare

Government and Public Sector

Telecom and IT

Manufacturing

Others

By Enterprise

Small and Medium-sized Enterprises (SMEs)

Large Enterprises

Key Players in the Fraud Detection and Prevention Market

ACI Worldwide, Inc.

AltexSoft

BAE Systems

Dell Inc.

Equifax, Inc.

Experian plc

Fiserv, Inc.

IBM

NICE Ltd.

Oracle

SAP SE

SAS Institute Inc.

SEON Technologies Ltd.

Signifyd

Software AG

Key Points of the Fraud Detection and Prevention Market

The Fraud Detection and Prevention Market Size is expected to grow significantly in the coming years.

Leading players are focusing on AI, ML, and automation to enhance fraud detection capabilities.

Financial institutions, healthcare, and retail sectors are the primary adopters of fraud prevention solutions.

North America leads the market due to its high adoption of cybersecurity measures, followed by Europe and Asia-Pacific.

Benefits of This Market Report

Comprehensive Market Insights: Detailed analysis of the market size, share, and growth potential.

Trend Identification: Understanding the latest market trends and technological advancements.

Strategic Business Planning: Helps businesses formulate effective fraud prevention strategies.

Competitive Analysis: Provides insights into key players, their market share, and competitive strategies.

Regulatory Compliance Awareness: Helps businesses stay updated with the latest fraud detection regulations.

Challenges in the Fraud Detection and Prevention Market

Despite its growth, the Fraud Detection and Prevention Market faces several challenges:

High Implementation Costs: Advanced fraud detection systems require significant investment.

False Positives: Overly sensitive fraud detection systems may flag legitimate transactions as fraudulent.

Evolving Fraud Tactics: Cybercriminals continuously develop new tactics to bypass security measures.

Data Privacy Concerns: Implementing fraud detection systems while maintaining user privacy is a major challenge.

Lack of Skilled Professionals: There is a shortage of experts specializing in fraud detection and prevention technologies.

Frequently Asked Questions (FAQs)

Q1: What is the current size of the Fraud Detection and Prevention Market?

Q2: What are the key drivers of Fraud Detection and Prevention Market Growth?

Q3: Which industries benefit the most from fraud detection solutions?

Q4: What are the latest trends in the Fraud Detection and Prevention Market?

Q5: What challenges does the market face?

Related New Research Report:

Cloud Migration Services Market:

Video Conferencing Market:

https://wemarketresearch.com/reports/video-conferencing-market/929

Supply Chain Security Market:

https://wemarketresearch.com/reports/supply-chain-security-market/1152

Conclusion

The Fraud Detection and Prevention Market is set for significant growth, driven by technological advancements, increased cybersecurity threats, and regulatory compliance. While challenges remain, businesses are increasingly investing in sophisticated fraud prevention solutions to safeguard their assets. Keeping up with the latest Fraud Detection and Prevention Market Trends, Fraud Detection and Prevention Market Analysis, and Fraud Detection and Prevention Market Forecast will be essential for companies looking to stay ahead in this evolving landscape.

#Fraud Detection and Prevention Market Size#Fraud Detection and Prevention Market Analysis#Global Fraud Detection and Prevention Market#Fraud Detection and Prevention Industry#Fraud Detection and Prevention Share#Fraud Detection and Prevention Trends#Fraud Detection and Prevention Top Key Players

0 notes

Text

Don’t Let Fraudsters Steal Your Financial Freedom: How to Safeguard Your Credit Score

“Protect your credit score from fraud! Learn how to detect, prevent, and recover from credit score fraud with expert tips, latest data, and actionable strategies. Safeguard your financial future today.” In today’s digital age, credit score fraud has become a significant concern for consumers and financial institutions alike. With the increasing sophistication of cybercriminals, it’s crucial to…

#credit freeze#credit monitoring#credit report#credit score fraud#credit score protection#detect credit fraud#financial security#fraud alert#identity theft#prevent credit fraud

0 notes

Text

What Are the Major Challenges while Implementing Effective Fraud Detection and Prevention Solutions?

Imagine waking up to find that your online business, built with years of effort and investments has been compromised by fraud. Sales are lost, customer data is exposed, and your reputation is on the line. In today’s digital age, fraud detection and prevention solutions are more crucial than ever. Yet, businesses continue to struggle against increasingly sophisticated tactics that traditional security measures often fail to counter. and even the most powerful systems can still face challenges in keeping up.

This blog will explore the major obstacles businesses encounter when implementing effective fraud detection and prevention solutions, and how emerging technologies and strategies are stepping in to address these issues.

Here’s a quick overview of the key topics we’ll be covering:

Index

Major Challenges in Fraud Detection and Prevention Solutions

High Rate of False Positives

Evolving Fraud Patterns

Lack of Model Transparency and Explainability

Time Delays in Detecting Fraud

Balancing Fraud Prevention with Customer Experience

Integration Challenges and Time Taken to Implement

Can Businesses Overcome These Challenges?

The Solution: Device Fingerprinting-Based Fraud Detection and Prevention

How Device Fingerprinting Overcomes All the Challenges

Conclusion

Major Challenges in Fraud Detection and Prevention Solutions

a. High False Positive Rates

Fraudsters hide in plain sight, mimicking the patterns of normal users, making it challenging for fraud detection solutions to identify them accurately. While only a small number of users have malicious intentions, their ability to blend in raises the risk of false positives. A high false positive rate leads to unnecessary disruptions for genuine users.

For example, a frequent online shopper Jon makes a large purchase while traveling abroad. The fraud detection system flags the transaction as suspicious due to the unfamiliar location and payment method. His account is frozen, and the order is delayed, leaving him frustrated and questioning the store’s reliability. This poor experience may even push Jon to shop at a competitor.

False positives negatively impact the experience of genuine customers, damaging their trust in the brand. It drives up operational costs by causing temporary service blockages, requiring additional resources to address affected users. Businesses must prioritize finding the right balance in risk thresholds, as an abundance of false positives can harm both customer experience and overall business performance.

Speaking of finding the right balance, it’s crucial to work with experts who can tailor a fraud prevention strategy that suits your unique needs. Schedule a discussion with fraud prevention specialists today and take the first step toward securing your business without compromising customer experience.

b. Evolving Fraud Patterns

Fraudsters are quick when it comes to adapting their tactics to outsmart detection systems and finding new ways to exploit online platforms. You think you're prepared, only to be blindsided by a new type of fraud you never anticipated, leaving your business vulnerable and struggling to respond.

Example - In 2017, the credit reporting agency Equifax suffered a massive data breach that exposed the sensitive information of approximately 147 million people. In a matter of hours after the breach was publicly disclosed, Equifax's stock price plummeted by nearly 35%. Customers and partners quickly distanced themselves from the company, and the breach cost Equifax an estimated $1.4 billion in damages, legal fees, and remediation efforts. Had the company been better prepared with more proactive fraud detection and prevention solutions, it might have mitigated the breach's severity and the damage to its reputation.

Fraudsters move fast—your response must be faster and smarter.

Businesses need to implement deep learning and AI-powered fraud detection systems that can continuously adapt to emerging trends and swiftly identify fraud at its root before it causes damage.

c. Lack of Model Transparency and Explainability

Many fraud detection and prevention solutions fail to provide clear explanations for why specific users are marked as fraudsters. These black box models only provide a score (e.g., likelihood of fraud) without explaining the reasoning behind it.

For example, a fraud detection system that flags transactions from 0 to 10 indicates a level 7 chance of fraud for a specific transaction but doesn’t specify the reasons behind this assessment. The fraud prevention team, unsure of the reason behind the flag, delays the transaction by 3 hours, fearing a potential fraud. This lack of transparency not only frustrates the customer but also risks losing their trust.

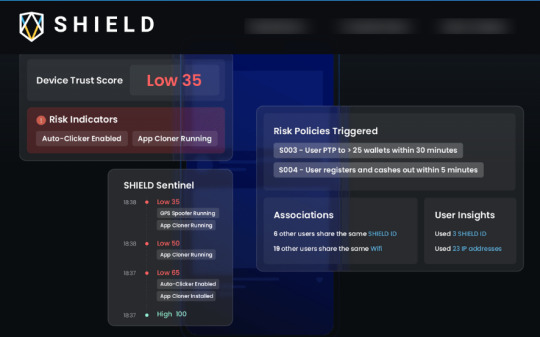

It undermines your trust in the system's decisions and makes it difficult to make precise choices when needed. It's advisable to look for solutions like SHIELD that provide comprehensive detail about why a user is labeled as risky.

d. Time Delays in Detecting Fraud

Fraud detection systems can take time to identify and flag fraudulent activity, especially when large amounts of data are involved. These systems analyze large data sets to identify suspicious patterns by extracting key information such as transaction value, time, and location. However, the process of identifying and organizing these critical data points can be slow, causing delays in detecting fraud. If the system fails to pinpoint the right details quickly, the entire detection process is compromised.

But in the world of online business, timing is everything. Delays in fraud detection can lead to rapid, irreversible consequences. In 2013, Target suffered a massive data breach when hackers stole credit card information from over 40 million customers. Despite early warning signs, the fraud detection system failed to flag the breach promptly, allowing fraudsters to misuse the stolen data for weeks. The delay in detecting fraud led to an estimated $162 million in damages for the company.

So it becomes a necessity to look for fraud detection technology that identifies fraudsters before they can commit fraud. Device fingerprinting proactively detects fraudulent activity with continuous session monitoring and identifies red flags like GPS spoofing, emulators, app cloning, and more without friction.

e. Balancing Fraud Prevention with Customer Experience

Excessive fraud prevention measures can directly conflict with the user experience. Customers often get frustrated with having to go through multiple security checks, a common issue for businesses using device or user identification to prevent fraud.

To enhance the experience, you need to find a balance between gathering the data required to prevent fraud and keeping the process smooth for customers. A device identification technology that can discreetly collect sufficient data for fraud prevention and identify fraud with absolute certainty without disrupting the customer journey. Look how ride-hailing unicorn InDrive has found this balance using SHIELD and has achieved over 99.77% genuine users on its platform.

f. Integration Challenges and Time Taken to Implement

Many fraud detection solutions take a significant amount of time to adapt to the business model and start functioning efficiently. Sellers around the world have experienced months of wasted effort trying to integrate fraud solutions into their platforms, only to find that they still do not provide accurate results. Additionally, some solutions require extensive Personally Identifiable Information (PII), which raises ethical concerns.

To overcome this challenge, it's essential to look for plug-and-play solutions that can be integrated into your business within minutes and begin identifying fraudsters from day one. There are advanced solutions available that are highly customizable, do not require additional PII data, and deliver results instantly.

These Challenges Are Not Insurmountable

While these challenges when implementing fraud detection and prevention solutions are real, they are not impossible to overcome. There are advanced fraud detection solutions tailored to address these pain points, offering smarter, faster, and more reliable ways to protect your business.

Implementing effective fraud detection and prevention solutions can help you combat fraud without disrupting operations or customer satisfaction.

The Solution: Device Fingerprinting-Based Fraud Detection and Prevention

Device fingerprinting-based fraud detection and prevention works by leveraging unique device attributes to build a unique profile for every user’s device when they access your website or app. The device fingerprinting is created by compiling various software and hardware attributes, such as:

IP addresses

Wi-Fi network

Screen resolution

Battery information

Device model and brand

Operating system

Language setting

Time zone and GPS coordinates

Browser information

Device fingerprinting is effective for fraud detection because it can identify fraudsters in both mobile apps and web environments, whether they are part of large groups or acting alone. For a detailed understanding of device fingerprinting and its effectiveness in detecting fraud, read our in-depth blog on this subject.

Overcoming Fraud Detection and Prevention Challenges with Device Intelligence:

Challenge 1: High Rate of False Positives

Solution: Device fingerprinting relies on a unique combination of the device’s hardware and software attributes, making it highly accurate in identifying legitimate users and fraudsters, hence reducing false positives.

Challenge 2: Evolving Fraud Patterns

Solution: When combined with machine learning, Device fingerprint adapts to evolving fraud patterns and trends by continuously learning from new data, improving its accuracy and ability to detect emerging threats.

Challenge 3: Lack of Model Transparency and Explainability

Solution: Device intelligence provides detailed information on why a device is flagged as fraudulent by pointing out the specific hardware and software attributes that contributed to the decision.

Challenge 4: Time Delays in Detecting Fraud

Solution: Device fingerprint provides real-time identification of fraudulent devices as soon as they interact with a website or app, enabling immediate action without waiting for complex behavioral patterns to emerge.

Challenge 5: Balancing Fraud Prevention with Customer Experience

Solution: Device intelligence works discreetly in the background, building the fingerprint without interrupting or irritating users, which ensures a seamless and frictionless experience while effectively identifying fraudulent activity.

Challenge 6: Integration Challenges and Implementation Time

Solution: Device fingerprint offers seamless, plug-and-play functionality that quickly identifies fraudsters without the need for extensive customization or long implementation times.

Conclusion

While implementing and managing fraud detection solutions, might come with some challenges, advanced modern solutions like device fingerprinting can help eradicate these challenges effectively.

If you're interested in how device fingerprinting can strengthen your fraud prevention strategy, explore our detailed resources or schedule a demo with SHIELD’s fraud prevention experts.

1 note

·

View note

Link

The growing number of fraudulent activities due to an increase in the number of electronic transactions is driving the demand for global Fraud Detection...

0 notes

Text

Businesses Can Handle 100 Problems—Until One Fraud Hits.

Once fraud hits, every other business problem suddenly feels small—because fraud impacts every aspect of your business and causes massive damage in very little time.

Fraud ain't a single problem or a one-time event. It brings 100 new problems that businesses must deal with instantaneously or else they'll be hit so hard that it'll be impossible to return back from it.

How often we've seen well-established businesses hit by fraud and never been able to cope with it. Businesses need to have well-sought fraud prevention strategies in place to deal with fraud and fraudsters head on.

Image Credits: AppSense Mohsin

#fraud detection#fraud prevention#cybersecurity#online business#digital#fraud#artificial intelligence#digital business#business#strategies#digital solutions#device fingerprinting#device intelligence#browser fingerprinting

0 notes

Text

youtube

0 notes