#AuditProcess

Explore tagged Tumblr posts

Text

roject audits are essential to ensuring the success and efficiency of any project, providing valuable insights into how well a project is progressing, its alignment with goals, and whether it is on track for completion. Audits, if conducted properly, can identify areas of improvement, uncover hidden risks, and even provide guidance on how to adjust project strategies for better outcomes. A project audit is an in-depth evaluation of a project's performance, and it is typically conducted at specific intervals during the project lifecycle.

In this blog, we will explore what is involved in a project audit, including key components, methodologies, benefits, and how the results of a project audit can lead to better project outcomes. Whether you are a project manager, a stakeholder, or part of the audit team, understanding the scope of a project audit will help you grasp its importance and its influence on the overall project management process.

#ProjectAudit#ProjectManagement#RiskManagement#BudgetManagement#ScheduleManagement#QualityControl#ProjectAssessment#StakeholderEngagement#ChangeManagement#ProjectPerformance#AuditProcess#ProjectLifecycle#ResourceManagement#Compliance#ProjectSuccess

0 notes

Text

Income Tax Audit Explained: Step-by-Step Guide

Curious about income tax audits? Discover the process with Taxgoal’s step-by-step breakdown. From document review to field audits, we guide you through each stage, ensuring you understand what happens during an audit and how to prepare effectively. Stay informed and navigate audits with confidence! Contact us (+91-9138531153) today for an Income Tax Audit Near Me.

#Taxgoal#IncomeTaxAudit#CA#TaxAuditGuide#AuditCA#AuditProcess#TaxPreparation#IncomeTax#TaxCompliance#AuditSteps#TaxAdvice#FinancialAudit

0 notes

Text

Understanding the Current Timelines for DOL PERM Processing

Navigating the Department of Labor’s (DOL) PERM processing can be challenging, especially with varying timelines. Staying informed about current PERM processing times is crucial for employers and foreign workers aiming for a smooth and timely labor certification process. Here’s an overview of what you need to know about PERM processing times.

What is PERM?

PERM (Program Electronic Review Management) is the first step in obtaining an employment-based green card in the United States. This labor certification process requires employers to prove that there are no qualified U.S. workers available for the job and that hiring a foreign worker will not negatively impact U.S. workers' wages and working conditions.

Current PERM Processing Times

The DOL updates PERM processing times monthly, providing insights into how long each stage takes. As of the latest update:

Prevailing Wage Determination: This initial step typically takes about 6-8 months. Employers must obtain this determination before filing the PERM application.

PERM Labor Certification: After receiving the prevailing wage determination, the labor certification process usually takes around 6-7 months for standard processing. Cases selected for audit can take significantly longer, often extending to over a year.

Factors Affecting PERM Processing Times

Several factors can influence how long the PERM process takes:

Application Volume: Higher volumes of applications can lead to longer processing times.

Application Accuracy: Incomplete or inaccurate applications can result in delays. Ensuring all documentation is correct and complete is essential.

Audit Selection: Approximately 30% of PERM applications are selected for audit, which significantly extends processing times due to additional scrutiny.

Administrative Backlogs: Occasionally, backlogs in processing can occur, leading to extended timelines.

Tips for Managing PERM Processing Times

1. Plan Ahead: Start the PERM process well in advance of the desired start date for the foreign worker. This allows ample time to navigate the various stages without rushing.

2. Maintain Accurate Records: Ensure all documentation and records related to the job and recruitment process are accurate and readily available to avoid delays during the audit process.

3. Stay Informed: Regularly check the DOL’s updates on PERM processing times to stay informed about current timelines and manage expectations.

4. Seek Professional Guidance: Consulting with an immigration attorney or specialist can provide expert advice and help navigate the complexities of the PERM process efficiently.

Conclusion

Understanding the current timelines for DOL PERM processing is crucial for employers and foreign workers aiming to secure an employment-based green card. By staying informed about the latest processing times, planning ahead, and ensuring accurate documentation, you can navigate the PERM process more smoothly and increase the chances of a timely and successful outcome.

#PERMProcessingTime#DOL#LaborCertification#EmploymentBasedGreenCard#ImmigrationProcess#PrevailingWage#AuditProcess#ImmigrationLaw#USImmigration

0 notes

Text

What is the process of a stock audit?

There is a comprehensive guidance on the process of stock audit which help to conduct the audit properly:

Step 1: Plan the Audit

Define the audit scope: types of inventory, locations, and specific items.

Set a timeline that fits the company’s schedule.

Step 2: Conduct Physical Verification

Count inventory systematically using methods like ABC analysis or cycle counting.

Coordinate with relevant departments for the counting process.

Step 3: Compare Physical and Book Inventory

Match physical counts with recorded inventory.

Note discrepancies, investigate causes, and document reasons after discussing with the team.

Step 4: Prepare and Submit the Report

Create a report detailing findings, irregularities, and suggestions for improvement.

Summarize key outcomes for management and recommend necessary actions.

Tranding Topics: LLP Registration , GST Registration , Startup India Registration , Private limited Company Registration , Udyam Registration

#StockAudit#InventoryAudit#StockCheck#Audit#InventoryManagement#InventoryControl#FinancialAudit#StockReview#AuditProcess#AuditTrail

0 notes

Text

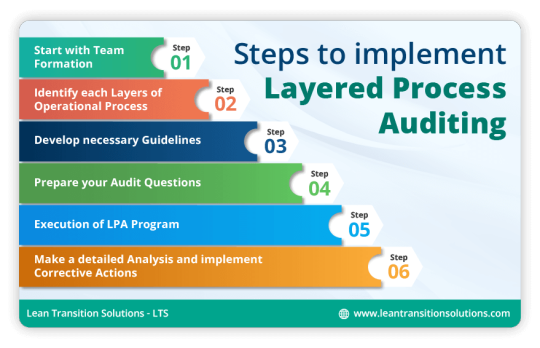

How to do a Layered Process Audit?

Layered Process Audits provide a systematic approach to identifying & addressing potential issues in the production process fostering a proactive quality culture.

Read More: https://tcard.leantransitionsolutions.com/lpa-layered-process-audits

#tcards#tcardsystem#tcardboards#tcardssoftware#electronictcardsystem#digitaltcardsystem#tcardsonline#LDMS#LPA#Continuousimprovement#processaudits#qualityauditing#qualitycontrol#lpaaudit#layeredaudit#auditsystem#auditprocess#auditprogram#auditmanagement#layeredprocess#auditsoftware#internalaudit#Lean#lts#Industry4.0#Leantransitionsolutions

0 notes

Text

Financial Reporting, Financial Analysis, Auditing: A Comprehensive Guide

Discover the ins and outs of Financial Reporting, Financial Analysis, and Auditing in this detailed guide. Gain valuable insights from experts in the field and find answers to your burning questions.

Introduction Welcome to the world of Financial Reporting, Financial Analysis, and Auditing. These three pillars of financial management are vital for businesses and organizations worldwide. In this comprehensive guide, we'll delve deep into each aspect, offering expert insights and practical knowledge to help you understand their significance and application.

Financial Reporting: Unveiling the Numbers Financial Reporting is the cornerstone of transparency in any organization. It involves the preparation and presentation of financial statements that reflect the true financial health of a company. Let's explore this in detail.

The Importance of Financial Reporting Financial reporting is not just about numbers; it's about trust. Stakeholders, including shareholders, investors, and regulatory authorities, rely on these reports to make informed decisions. Transparent reporting builds confidence and attracts investment.

Elements of Financial Reporting Balance Sheets: These provide a snapshot of a company's financial position at a specific time, detailing assets, liabilities, and equity. Income Statements: Also known as profit and loss statements, they showcase revenue, expenses, and net income over a period. Cash Flow Statements: These track cash inflows and outflows, ensuring a company's liquidity. Financial Analysis: Deciphering the Data Financial Analysis is the art of dissecting financial reports to gain insights into a company's performance and potential. Let's dive into this crucial aspect.

The Role of Financial Analysis Financial analysts use various techniques to assess a company's profitability, stability, and growth prospects. Their findings guide investment decisions and strategic planning.

Tools for Financial Analysis Ratio Analysis: Examining key ratios like the debt-to-equity ratio and gross margin ratio. Trend Analysis: Identifying patterns and trends in financial data over time. Comparative Analysis: Benchmarking a company against competitors in the same industry. Auditing: Ensuring Accuracy and Compliance Auditing is the process of examining financial statements and transactions to verify their accuracy and compliance with accounting standards. Let's uncover the world of auditing.

The Significance of Auditing Auditing instills confidence in financial reporting. Independent auditors provide an unbiased assessment of a company's financial statements, ensuring integrity and credibility.

Types of Audits External Audits: Conducted by independent firms, these ensure compliance with accounting principles and legal regulations. Internal Audits: Performed by a company's internal team, focusing on risk management and process improvement. FAQs Q: What's the primary goal of Financial Reporting? A: The main goal is to provide accurate and transparent financial information to stakeholders.

Q: How can I interpret a company's balance sheet? A: Look at the assets, liabilities, and equity to assess solvency and financial structure.

Q: What is the difference between Financial Reporting and Financial Analysis? A: Financial Reporting is about presenting financial data, while Financial Analysis involves interpreting that data for decision-making.

Q: Why is Auditing necessary if we already have Financial Reporting? A: Auditing ensures the accuracy of the reported financial information, offering an external validation.

Q: Can you recommend any tools for financial analysis? A: Tools like Excel, financial modeling software, and industry-specific software can be helpful.

Q: Is financial analysis only for large corporations? A: No, financial analysis is valuable for businesses of all sizes to make informed decisions.

Conclusion In this comprehensive guide, we've explored the crucial realms of Financial Reporting, Financial Analysis, and Auditing. These pillars form the foundation of financial management, driving transparency, informed decision-making, and trust in the corporate world. As you embark on your journey in finance, remember that knowledge is power, and understanding these concepts is key to success.

#FinancialReporting#FinancialAnalysis#Auditing#FinanceTips#BusinessInsights#InvestmentStrategies#AccountingStandards#CorporateTransparency#FinancialManagement#InvestorRelations#FinancialStatements#FinancialHealth#FinancialProfessionals#EconomicAnalysis#AuditProcess#FinancialData#Profitability#FinancialPlanning#BalanceSheet#CashFlowAnalysis

0 notes

Text

Broadside Marine is your partner in progress. With years of experience and industry expertise, we ensure that every remote engineering audit is conducted meticulously producing almost the same level of deliverables as the physical audit.

Sounds Good? Let’s embrace Remote Engineering Audits and elevate your vessel's performance, safety, and compliance to new heights.

Get in touch with us today to schedule a ‘Remote Engineering Audit’.

📧 Email: [email protected]

📞 Phone: +91 99676 95396 / 98810 28500

#BroadsideMarine#RemoteEngineeringAudit#EngineeringAudit#AuditProcess#RemoteInspection#QualityAssurance#RemoteQualityAudit#EngineeringCompliance#AuditTechnology#RemoteEngineering#ComplianceAudit#RemoteQualityControl#AuditReports#EngineeringStandards#AuditBestPractices#RemoteEngineeringInspection#AuditManagement#RemoteMaritimeAudit#MaritimeQualityControl

0 notes

Text

Ultimate Contract Audit Checklist for Complete Records

Business contracts often involve much more than just one document. Creating a checklist for a contract audit is the best way to include all records associated with the contract. A contract is only as good as the terms included in the document, and your company’s contract records should capture every relevant detail. Creating the ultimate contract audit checklist before you start is the best way to streamline the audit process, and we cover the remaining steps in our guide to internal contract audit projects. Here are a few ideas for your contract audit checklist:

Gather Procurement Records

If you bid on a government contract and won the project, then gather your original bid documents. These documents can serve as a helpful reminder of your intent for bidding on the job and your plans for fulfilling the terms of the contract. The original notice, your submission, and the notice of award all make for a great starting point for your contract audit checklist.

Check the Accounting Information

Invoices and payments for services completed are another vital part of your checklist. Engage your accounting team and let them help you gather the right and necessary information. Don't overload the audit process with information that doesn't pertain or numbers that don't apply to the project at hand. Stay focused on the specific contract you are auditing and include only that information. You may feel tempted too include more information than necessary, especially for government contracts. The attempt to appear helpful can backfire if you include information that clutters the process for everyone. So focus on the essential elements or create different checklists for different circumstances.

Include Subcontractor Information

If the contracted project is so large that you must use one or more subcontractors, include their records in your audit. The type of information you include under the subcontractor category on your checklist may vary, depending upon the scope of the project. A subcontractor agreement section on your contract audit checklist can include more than one box to check. For example, it may include financial records, your own contract with the subcontractor, and additional information you may want to include in the audit.

Generate Reports

Status reports of the project's progress are important checklist items. These reports can include a timeline of deliverables, what percentage of the project is reaching completion, and whether there is a possibility of extending or renewing the contract.

Centralize Your Audit Information

At ContraxAware, we understand how overwhelming the contract audit process can appear. While a checklist makes it easier to get started, just the thought of gathering the information you need can create stress and frustration. That’s why our software has the features you need to make the process as simple and automated as possible. Centralizing your contract and audit information is easier with content management software. By centralizing this information, all team members can have the access they need, when they need it. Contract management requires strong attention to detail and lots of juggling of information. One team member may not realize the importance of a document until after the audit. Whether they found a particular form in a file cabinet or under a pile of desk papers, it is often long after it was originally needed. A contract management software like ContraxAware can serve as the one-stop, collaborative tool your team requires. A contract audit is as complex as the business partner and project it represents. This is why allowing your team members to update and save important parts of the audit can result in a more successful outcome for your company. Your audit checklist document is just as important as the contract documents themselves.

Put Better Contract Management Software at the Top of Your Contract Audit Checklist

Contracts help make the business world thrive. They are legally binding documents that allow business partners to exchange services and payment in a way that benefits both. While this may sound simple, the process of developing, monitoring, and auditing these types of contracts is very important. ContraxAware is built upon the experience of a software developer and businessman and is led by not just him but also someone with vast legal experience. This combination makes for a strong foundation for ContraxAware. Don't just take our word for it. If you are in a business that deals with contracts of all sizes, forms, and partners, let us help. Our friendly and professional staff can provide you with a free demonstration of how ContraxAware works. In addition to our subscription plans, we offer training support. Walk-through support allows your team to use an online, step-by-step process to learn the program. Some subscriptions come with eight hours of online, one-on-one training. Streamline your reports, accounting information, and other contract documents by reaching out to us today. From easy to use templates to a data management system, ContraxAware will change the way you do contract business. Begin your collaborative approach to contract management by calling us at (800) 460-9052. Alternatively, you can contact us online. Once you use ContraxAware, you'll wonder how you ever lived without it. Start streamline and stop stressing over contract audits. Create a checklist and start improving your audit process by using ContraxAware for all your contract management needs. Read the full article

0 notes

Photo

Innovative Ways to Improve Audit Quality (MY)

This paper reveals the benefits of implementing a single, integrated, end-to-end approach to deliver your firm’s accounting and audit services. Topics discussed include: the challenges of balancing audit quality and productivity; how today’s technology assists with improving audit quality and achieving greater efficiency and best practice tips to help your firm achieve maximum efficiency and higher quality in your audit process

Read More:- https://www.hqpubs.net/innovative-ways-to-improve-audit-quality-my-2/

#quality #audit #productivity #auditprocess #efficiencey #accounting

0 notes

Text

Understanding Current PERM Processing Times: What You Need to Know

Navigating the Program Electronic Review Management (PERM) process can be complex, especially when it comes to understanding the current processing times. The Department of Labor (DOL) regularly updates these timelines, and staying informed is crucial for both employers and employees involved in the immigration process. Here’s a comprehensive look at PERM processing times and what you need to know.

What is PERM?

PERM is the first step in obtaining an employment-based green card in the United States. It involves a labor certification process where employers must demonstrate that they were unable to find a qualified U.S. worker for the job and that hiring a foreign worker will not adversely affect the wages and working conditions of U.S. workers.

Current PERM Processing Times

The DOL provides monthly updates on PERM processing times. As of the latest update:

Prevailing Wage Determination: This initial step currently takes about 6-8 months. Employers must request and receive a prevailing wage determination before filing the PERM application.

PERM Labor Certification: After obtaining the prevailing wage determination, the labor certification process itself typically takes around 6-7 months for standard processing. Cases that are selected for audit can take significantly longer, often extending to over a year.

Factors Influencing Processing Times

Several factors can influence PERM processing times, including:

Volume of Applications: The number of applications submitted to the DOL can affect processing times. A higher volume typically results in longer wait times.

Completeness of Application: Incomplete or inaccurate applications can lead to delays. Ensuring that all documentation is accurate and complete can help avoid unnecessary hold-ups.

Audit Selection: Approximately 30% of PERM applications are selected for audit. These cases undergo additional scrutiny, significantly extending processing times.

Backlogs: Occasionally, backlogs in processing can occur due to various administrative reasons, leading to extended timelines.

Tips for Managing PERM Processing Times

1. Plan Ahead: Begin the PERM process well in advance of the desired start date for the foreign worker. This allows for ample time to navigate the various stages without rushing.

2. Maintain Accurate Records: Ensure that all documentation and records related to the job and recruitment process are accurate and readily available. This can help avoid delays during the audit process.

3. Stay Informed: Regularly check the DOL’s updates on PERM processing times. Staying informed about current timelines helps in planning and managing expectations.

4. Seek Professional Guidance: Consider consulting with an immigration attorney or specialist who can provide expert advice and help navigate the complexities of the PERM process efficiently.

Conclusion

Understanding current PERM processing times is essential for employers and foreign workers aiming for employment-based green cards. By staying informed about the latest timelines, planning ahead, and ensuring accurate documentation, you can navigate the PERM process more smoothly and increase the chances of a timely and successful outcome.

#PERMProcessingTime#DOL#LaborCertification#EmploymentBasedGreenCard#ImmigrationProcess#PrevailingWage#AuditProcess#ImmigrationLaw#WorkVisa#USImmigration

0 notes

Text

Why do we need stock auditing?

Stock auditing is important because it helps businesses keep track of their inventory. By regularly checking stock levels, businesses can:

Identify discrepancies: Find and fix any differences between the recorded stock and actual stock.

Prevent theft and fraud: Spot and stop unauthorized access to inventory.

Ensure accurate records: Maintain correct inventory records for better decision-making.

Optimize inventory levels: Avoid overstocking or understocking, leading to better resource management.

Comply with regulations: Meet legal and financial reporting requirements.

Tranding Topics: LLP Registration , GST Registration , Startup India Registration , Private limited Company Registration , Udyam Registration

#StockAudit#InventoryAudit#Audit#InventoryManagement#StockCheck#InventoryControl#AuditTrail#BusinessAudit#InternalAudit#FinancialAudit#StockTake#InventoryReview#AuditProcess#StockManagement#AuditReport#StockVerification#AuditStrategy#StockAssessment#AuditCompliance#StockAudit2024

0 notes

Text

What is a stock audit?

A stock audit, also known as an inventory audit, involves physically checking the quantity and value of stock to ensure it matches the records in the books. This helps improve inventory management by identifying issues like theft or damage and ensuring compliance with regulations.

The audit covers raw materials, work-in-progress, finished goods, and fixed assets. Stock can be stored in various locations, such as retail stores, warehouses, manufacturing units, and franchise stores. A stock audit can be done independently of the records, known as a blind count.

The audit also involves suggesting best practices for better stock management and recommending suitable stock management software.

Tranding Topics: LLP Registration , GST Registration , Startup India Registration , Private limited Company Registration , Udyam Registration

#StockAudit#InventoryAudit#Audit#InventoryManagement#StockCheck#InventoryControl#AuditTrail#BusinessAudit#InternalAudit#FinancialAudit#StockTake#InventoryReview#AuditProcess#StockManagement#AuditReport#StockVerification#AuditStrategy#StockAssessment#AuditCompliance#StockAudit2024

0 notes

Text

The rise of cryptocurrencies has disrupted the traditional financial ecosystem and brought about a new era of financial transactions. While the decentralized nature of cryptocurrencies provides several benefits, such as increased privacy and reduced transaction costs, it also brings with it the risk of money laundering.

Website :- https://ippcgroup.com/

#ca firm in delhi for articleship#articleship in delhi#internal audits#accounting#chartered accountant#management audit#auditprocess#auditing services

0 notes

Text

An audit is a process of evaluating and verifying the financial statements, records, and operations of a business or organization. Audits are crucial for ensuring compliance with regulatory requirements, identifying operational inefficiencies, and detecting fraudulent activities. During an audit, an independent auditor or an internal audit team conducts a thorough examination of the organization’s financial and operational systems. This article will outline what to expect during an audit, including the types of audits, how to prepare for an audit, the audit process, communication during the audit, audit findings, and closing the audit. Understanding what to expect during an audit can help organizations be better prepared for the process and can ensure that the audit is conducted smoothly and effectively.

#auditprocess#management audit#ca firm in delhi#best ca firm in india#chartered accountant#fraudinvestigation

0 notes