#Backtesting engine

Explore tagged Tumblr posts

Text

Algorithmic trading uses a computer program following pre-set instructions to place a trade. This entire process of placing a trade by a computer program happens within milliseconds, which is impossible for a human trader.

0 notes

Text

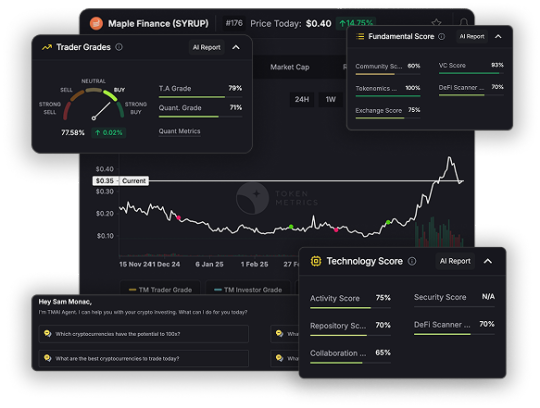

The Future of Crypto APIs: Why Token Metrics Leads the Pack

In this article, we’ll explore why Token Metrics is the future of crypto APIs, and how it delivers unmatched value for developers, traders, and product teams.

More Than Just Market Data

Most crypto APIs—like CoinGecko, CoinMarketCap, or even exchange-native endpoints—only give you surface-level data: prices, volume, market cap, maybe order book depth crypto trading. That’s helpful… but not enough.

Token Metrics goes deeper:

Trader and Investor Grades (0–100)

Bullish/Bearish market signals

Support/Resistance levels

Real-time sentiment scoring

Sector-based token classification (AI, RWA, Memes, DeFi)

Instead of providing data you have to interpret, it gives you decisions you can act on.

⚡ Instant Intelligence, No Quant Team Required

For most platforms, building actionable insights on top of raw market data requires:

A team of data scientists

Complex modeling infrastructure

Weeks (if not months) of development

With Token Metrics, you skip all of that. You get:

Pre-computed scores and signals

Optimized endpoints for bots, dashboards, and apps

AI-generated insights as JSON responses

Even a solo developer can build powerful trading systems without ever writing a prediction model.

🔄 Real-Time Signals That Evolve With the Market

Crypto moves fast. One minute a token is mooning, the next it’s bleeding.

Token Metrics API offers:

Daily recalculated grades

Real-time trend flips (bullish ↔ bearish)

Sentiment shifts based on news, social, and on-chain data

You’re never working with stale data or lagging indicators.

🧩 Built for Integration, Built for Speed

Unlike many APIs that are bloated or poorly documented, Token Metrics is built for builders.

Highlights:

Simple REST architecture (GET endpoints, API key auth)

Works with Python, JavaScript, Go, etc.

Fast JSON responses for live dashboards

5,000-call free tier to start building instantly

Enterprise scale for large data needs

Whether you're creating a Telegram bot, a DeFi research terminal, or an internal quant dashboard, TM API fits right in.

🎯 Use Cases That Actually Matter

Token Metrics API powers:

Signal-based alert systems

Narrative-tracking dashboards

Token portfolio health scanners

Sector rotation tools

On-chain wallets with smart overlays

Crypto AI assistants (RAG, GPT, LangChain agents)

It’s not just a backend feed. It’s the core logic engine for intelligent crypto products.

📈 Proven Performance

Top funds, trading bots, and research apps already rely on Token Metrics API. The AI grades are backtested, the signals are verified, and the ecosystem is growing.

“We plugged TM’s grades into our entry logic and saw a 25% improvement in win rates.” — Quant Bot Developer

“It’s like plugging ChatGPT into our portfolio tools—suddenly it makes decisions.” — Web3 Product Manager

🔐 Secure, Stable, and Scalable

Uptime and reliability matter. Token Metrics delivers:

99.9% uptime

Low-latency endpoints

Strict rate limiting for abuse prevention

Scalable plans with premium SLAs

No surprises. Just clean, trusted data every time you call.

💬 Final Thoughts

Token Metrics isn’t just the best crypto API because it has more data. It’s the best because it delivers intelligence. It replaces complexity with clarity, raw numbers with real signals, and guesswork with action.In an industry that punishes delay and indecision, Token Metrics gives builders and traders the edge they need—faster, smarter, and more efficiently than any other API in crypto.

0 notes

Text

Mehr Kontrolle über Ihre Investments – dank Stoxira

Ab heute erweitert Stoxira sein Angebot um eine Bibliothek von KI-gestützten Wachstumsstrategien, die speziell für verschiedene Marktphasen optimiert wurden. Farewell zu statischen Trading-Templates – willkommen adaptive Blueprints, die sich dynamisch an Trendwechsel anpassen.

Warum das wichtig ist Schnelle Marktlenkungen und Volatilität erfordern smarte Tools: Mit Stoxira können Sie jetzt aus über 50 praxiserprobten Strategien wählen oder eigene Varianten erstellen. Hinter jedem Blueprint steckt eine Analyse von Tausenden historischer Trades und Live-Daten.

Für alle, die ihre digitalen Assets strategisch und effektiv verwalten möchten, bietet Stoxira jetzt eine umfassende Lösung. Die neue Investmentplattform richtet sich an private sowie professionelle Anleger und bietet intelligente Werkzeuge zur Optimierung von Kryptowährungs-Portfolios – unabhängig vom Erfahrungsstand.

Neue Maßstäbe in der Investmentwelt

Stoxira ist mehr als nur ein Verwaltungstool. Es ist eine zentrale Plattform zur Analyse, Planung und Umsetzung von Krypto-Investitionen. Durch den Einsatz künstlicher Intelligenz und Big Data wird das Verhalten der Märkte in Echtzeit ausgewertet und auf individuelle Portfolios angepasst.

„Unsere Vision ist es, eine Plattform zu schaffen, die nicht nur informiert, sondern aktiv mitdenkt – und zwar im Sinne des Anlegers“, sagt der CEO.

Key Features im Überblick

Strategie-Katalog – Vortrainierte Blueprints für Bullen-, Bären- und Seitwärtsmärkte.

Backtesting-Engine – Simulieren Sie jede Strategie anhand tagesaktueller Marktdaten.

Live-Optimierung – Automatisches Anpassungstool passt Parameter in Echtzeit an.

Social Sharing – Eigene Strategien mit der Community teilen und bewerten lassen.

Performance-Dashboard – Detaillierte Kennzahlen zu Sharpe-Ratio, Drawdown und Trefferquote.

„Unsere Strategie-Bibliothek ist der Schlüssel, um komplexe Marktbewegungen nutzbar zu machen“, erklärt der CEO.

Architektur & KI Die KI-Module kombinieren Random Forests, LSTM-Netze und Reinforcement Learning. Eine verteilte Rechenknoten-Architektur beschleunigt Backtests enorm.

Erste Erfolge Testanwender:innen verzeichneten:

24 % höheres Gewinn-Potenzial bei Day-Trading.

19 % geringeren Drawdown bei Swing-Trades.

Verfügbarkeit Die neuen Funktionen sind ab sofort in allen Premium-Accounts freigeschaltet. Ein Upgrade ist einfach per Klick möglich.

0 notes

Text

The Quantum Quant’s Playbook: Mastering Next-Gen Trading with AllTick’s AI-Powered Edge

In the high-stakes arena of modern finance, where algorithms battle for microsecond advantages, elite quantitative traders wield AllTick’s cutting-edge toolkit to transform data into dominance. Here’s how the vanguard operates in an era where latency is lethal and alpha is algorithmic.

Pre-Market: The Alpha Forge

5:30 AM | Global Data Recon AllTick’s AI-driven terminal aggregates real-time signals from 87 exchanges, dark pools, and alternative data streams—satellite imagery, supply chain disruptions, and meme stock chatter—curated into actionable alpha signals.

6:45 AM | War Games & Stress Tests Backtest strategies against AllTick’s crisis library (2010 Flash Crash, 2020 COVID meltdown) with quantum Monte Carlo simulations. Machine learning flags vulnerabilities: “Portfolio gamma exposure critical if VIX spikes 30%.”

8:00 AM | Factor Mining at Lightspeed AllTick’s neural networks dissect 1,000+ alternative data dimensions—container ship traffic, credit card spend trends—to uncover non-linear correlations invisible to traditional models.

Trading Hours: The Algorithmic Colosseum

9:30 AM | Microsecond Arms Race Deploy hyper-low-latency strategies via AllTick’s FPGA-accelerated order router, slicing through liquidity shadows with 0.02 bps execution costs. Real-time risk engines monitor $500M exposures across 16 asset classes.

12:00 PM | Adaptive Game Theory Reinforcement learning agents pivot tactics mid-session. AllTick’s event engine detects anomalies: *“Unusual options flow in TSLA: 92% probability of Elon tweet storm. Auto-hedging engaged.”*

3:00 PM | Black Swan Fire Drill Simulate tail-risk scenarios using AllTick’s generative adversarial networks (GANs), stress-testing portfolios against synthetic market crashes. System prescribes dynamic deleveraging protocols.

Post-Market: The Cognitive Feedback Loop

6:30 PM | P&L Autopsy AllTick’s attribution AI dissects returns: *63% from volatility clustering, 22% cross-asset carry, -5% from FX slippage.* Prescribes overnight optimization via quantum annealing.

9:00 PM | Quantum Leap Run portfolio optimization on AllTick’s quantum cloud, achieving 23% faster convergence than classical MVO. Discover hidden convexity in crypto-fiat arbitrage pairs.

11:00 PM | Ecosystem Synergy Monetize proprietary signals on AllTick’s algo marketplace, harvesting crowd-sourced intelligence while earning passive revenue.

AllTick: The Quant’s Singularity Platform

Legacy data vendors peddle stale ticks. AllTick delivers 4D Alpha Engineering:

Neural Data Fabric: Petabyte-scale L3 order books + dark pool prints + decentralized finance (DeFi) flows, fused via federated learning.

AI Co-Pilot: 150+ pre-trained models for factor discovery, execution optimization, and anomaly detection.

Execution Hyperloop: Sub-microsecond smart routers with self-learning liquidity prediction.

The Quant’s Ultimatum: Adapt or atrophy. ✅ Quantum Trading Primer (Free Download) ✅ HFT Infrastructure Blueprint ($7,500 Value) ✅ API Sandbox Access

Click → [AllTick.co]

0 notes

Text

Crypto Made Smarter with Greenhillcai

Cryptocurrency investing is evolving, and crypto is made smarter with Greenhillcai, the innovative platform launching today to redefine digital asset management. In a market often marred by confusion and risk, Greenhillcai brings clarity, intelligence, and security, enabling users to invest smarter and with confidence.

At the heart of Greenhillcai is a powerful AI engine that analyzes vast amounts of market data, delivering insights that empower users to make data-driven decisions. This technology, coupled with intuitive interfaces, positions Greenhillcai as a leader in smart crypto investing.

The timing of this announcement is crucial. As cryptocurrencies gain mainstream acceptance, investors seek platforms that combine innovation with reliability. Greenhillcai answers this call, delivering real-time analytics, risk assessment, and portfolio management tools that simplify complex decisions.

“Our mission is to make crypto investing smarter and accessible,” the CEO of Greenhillcai said. “By harnessing advanced technology, we provide users the confidence to navigate even the most volatile markets.”

Beyond technology, Greenhillcai offers extensive educational resources, helping users understand market mechanics and refine their strategies. This holistic approach ensures users are not only investing but also learning and growing.

Security is foundational to Greenhillcai. With multi-layered protection and compliance with industry standards, the platform safeguards assets while maintaining transparency.

Industry leaders recognize Greenhillcai as a game-changer, setting a new benchmark for what smart crypto investing looks like in 21st-century finance.

Make Your Crypto Smarter Today Join Greenhillcai and experience the future of smart crypto investing. Visit Greenhillcai and take control of your digital assets with confidence and intelligence.The cryptocurrency market demands agility, insight, and innovative approaches. Greenhillcai is thrilled to announce its revolutionary platform designed to transform your crypto strategy and maximize your investment potential.

Unlike traditional trading platforms, Greenhillcai integrates advanced AI algorithms, real-time sentiment analysis, and automated trading capabilities that revolutionize how users approach crypto markets. This technology-driven strategy adaptation empowers users to react swiftly to market fluctuations and optimize returns.

“The future of crypto trading lies in revolutionizing strategies through technology and intelligence,” said the CEO of Greenhillcai. “We have created a platform that not only supports but enhances every step of the investment journey.”

Users benefit from fully customizable strategies, backtesting tools, and predictive insights that reduce guesswork and increase precision. The platform’s user-friendly interface ensures that even complex strategy execution is accessible.

Greenhillcai also prioritizes security and compliance, using military-grade encryption and adhering to the highest regulatory standards. This commitment guarantees a secure and transparent trading environment.

0 notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

Alltick API: Real-Time Data Solutions from Quantitative Trading Primer to Professional Strategies

Why You Need to Eliminate 15-Minute Delayed Market Data?

In fast-paced financial markets, a 15-minute data delay can mean massive opportunity costs. While retail investors rely on outdated prices to formulate strategies, institutional traders have already executed multiple trades using real-time data. This information asymmetry exists not only in stock markets but also in forex, futures, and cryptocurrencies—delayed data essentially provides historical, not actionable insights for live trading.

Alltick API’s Competitive Edge

1. Millisecond-Level Real-Time Global Coverage

Unlike traditional minute-delayed feeds, Alltick API delivers:

Equities: Real-time quotes from 50+ exchanges (NYSE, Nasdaq, HKEX, etc.)

Crypto: Full-coverage pricing from Binance, Coinbase, and other top platforms

Forex & Futures: CME/ICE derivatives market depth data

Unique Tick-Level Streams: Granular order-by-order execution records

2. Quant-Optimized Infrastructure

Architected for algorithmic trading:

99.99% Uptime SLA with 24/7 monitoring

Smart Bandwidth Compression for cost-efficient high-frequency data

Dynamic Load Balancing for scalable request handling

Unified Historical + Real-Time APIs for seamless backtesting

3. Frictionless Developer Experience

Designed for quant newcomers and pros alike:

Multi-Language SDKs (Python/Java/C++)

Plug-and-Play Code Templates

Interactive API Debug Console

Comprehensive English/Chinese Documentation

7×12 Technical Support via Slack & Email

Real-World Use Cases

Case 1: Rapid Strategy Validation

Case 2: Cross-Market Arbitrage Monitoring

Multi-Asset Capabilities Enable:

Stock vs ETF price divergence alerts

Crypto cross-exchange arbitrage detection

Forex spot-futures basis analysis

Case 3: HFT System Deployment

Institutional-Grade Features:

Co-located server hosting

Custom binary protocols

Microsecond-precision timestamps

Order flow analytics toolkit

Choosing Your API Tier

FeatureFree FeedsLegacy VendorsAlltick ProLatency15+ minutes1-5 seconds<100msHistorical DepthEOD Only1 Year10+ YearsConcurrent ConnectionsSingle Thread10-50UnlimitedData FieldsBasic OHLCStandardImplied Volatility, GreeksSupportNoneEmail (Weekdays)Dedicated Engineer

Start Your Quant Journey Today

Whether You Are:

A developer building your first SMA strategy

A quant team stress-testing models

An institution managing multi-strategy portfolios

Alltick offers tailored solutions from free trials to enterprise-grade deployments. Sign Up Now to Get: ✅ 30-Day Full-Feature Trial ✅ Exclusive Quant Strategy Playbook ✅ $500 Cloud Computing Credits

Visit Alltick Official Site to Experience Market Pulse in Real Time. Transform Every Decision with Data That Beats the Speed of Markets.

(CTA: Click "Developer Hub" to configure SDK in 5 mins and claim your API key.)

Technical Highlights

WebSocket/ REST API Hybrid Architecture: Balance speed with flexibility

Regulatory-Compliant Data: FINRA/SEC-reviewed market feeds

Zero Data Gaps: Guaranteed 100% tick reconstruction accuracy

Smart Retry Mechanisms: Auto-reconnect during network instability

Why 2,300+ Hedge Funds Choose Alltick? *"Alltick's unified API eliminated our multi-vendor integration headaches. We achieved 37% faster strategy iteration cycles."* — Head of Quant Trading, Top 50 Crypto Fund

Upgrade Your Edge. Trade at the Speed of Now.

1 note

·

View note

Text

Stoxira: Ihr Kompass im Krypto-Universum

Ab heute erweitert Stoxira sein Angebot um eine Bibliothek von KI-gestützten Wachstumsstrategien, die speziell für verschiedene Marktphasen optimiert wurden. Farewell zu statischen Trading-Templates – willkommen adaptive Blueprints, die sich dynamisch an Trendwechsel anpassen.

Warum das wichtig ist Schnelle Marktlenkungen und Volatilität erfordern smarte Tools: Mit Stoxira können Sie jetzt aus über 50 praxiserprobten Strategien wählen oder eigene Varianten erstellen. Hinter jedem Blueprint steckt eine Analyse von Tausenden historischer Trades und Live-Daten.

Für alle, die ihre digitalen Assets strategisch und effektiv verwalten möchten, bietet Stoxira jetzt eine umfassende Lösung. Die neue Investmentplattform richtet sich an private sowie professionelle Anleger und bietet intelligente Werkzeuge zur Optimierung von Kryptowährungs-Portfolios – unabhängig vom Erfahrungsstand.

Neue Maßstäbe in der Investmentwelt

Stoxira ist mehr als nur ein Verwaltungstool. Es ist eine zentrale Plattform zur Analyse, Planung und Umsetzung von Krypto-Investitionen. Durch den Einsatz künstlicher Intelligenz und Big Data wird das Verhalten der Märkte in Echtzeit ausgewertet und auf individuelle Portfolios angepasst.

„Unsere Vision ist es, eine Plattform zu schaffen, die nicht nur informiert, sondern aktiv mitdenkt – und zwar im Sinne des Anlegers“, sagt der CEO.

Key Features im Überblick

Strategie-Katalog – Vortrainierte Blueprints für Bullen-, Bären- und Seitwärtsmärkte.

Backtesting-Engine – Simulieren Sie jede Strategie anhand tagesaktueller Marktdaten.

Live-Optimierung – Automatisches Anpassungstool passt Parameter in Echtzeit an.

Social Sharing – Eigene Strategien mit der Community teilen und bewerten lassen.

Performance-Dashboard – Detaillierte Kennzahlen zu Sharpe-Ratio, Drawdown und Trefferquote.

„Unsere Strategie-Bibliothek ist der Schlüssel, um komplexe Marktbewegungen nutzbar zu machen“, erklärt der CEO.

Architektur & KI Die KI-Module kombinieren Random Forests, LSTM-Netze und Reinforcement Learning. Eine verteilte Rechenknoten-Architektur beschleunigt Backtests enorm.

Erste Erfolge Testanwender:innen verzeichneten:

24 % höheres Gewinn-Potenzial bei Day-Trading.

19 % geringeren Drawdown bei Swing-Trades.

Verfügbarkeit Die neuen Funktionen sind ab sofort in allen Premium-Accounts freigeschaltet. Ein Upgrade ist einfach per Klick möglich.

0 notes

Text

Unlock Lightning-Fast Market Data with Alltick – The Bloomberg Terminal Alternative for Real-Time Trading

In today's hyper-competitive financial markets, access to real-time, low-latency data isn’t just an advantage—it’s a game-changer. While Bloomberg Terminal has long been the industry standard, its high cost and complexity leave many traders and firms searching for a more agile solution. Alltick’s Market Data API bridges this gap, delivering institutional-grade data at a fraction of the cost, with unmatched speed and reliability.

Why Alltick is the Superior Alternative to Bloomberg Terminal

✅ Ultra-Low Latency – Get millisecond-level market updates for equities, forex, futures, and crypto—no delays. ✅ Global Market Depth – Seamless access to NASDAQ, NYSE, CME, EUREX, HKEX, and crypto exchanges in one unified feed. ✅ High-Frequency Trading Optimized – WebSocket & FIX protocol support for algorithmic and HFT strategies. ✅ Cost-Effective – No expensive terminal subscriptions—pay only for the data you need. ✅ Developer-Centric – Robust REST & WebSocket APIs with SDKs for Python, Java, C++, and more.

Who Can Leverage Alltick’s Market Data API?

🔹 Quant Funds & Algo Traders – Backtest and deploy strategies with real-time tick data. 🔹 Proprietary Trading Firms – Gain an edge with sub-millisecond execution speeds. 🔹 Fintech Startups – Build next-gen trading platforms without Bloomberg’s hefty fees. 🔹 Retail Traders – Access institutional-level data previously out of reach.

The Hidden Edge: Dark Pool & Block Trade Intelligence

Traditional market data misses a critical component—hidden liquidity. Alltick’s API provides:

Real-time dark pool print tracking

Block trade detection

Order flow analysis to uncover institutional activity

With this intelligence, traders can anticipate large moves before they hit public order books.

How Alltick Enhances Your Trading Workflow

📊 Tick-by-Tick Analysis – Spot microtrends and liquidity imbalances. ⚡ Instant Execution – Capitalize on fleeting arbitrage and HFT opportunities. 🔄 Seamless Integration – Plug into MetaTrader, TradingView, or custom quant platforms.

Make the Switch Today

Bloomberg Terminal was built for an older era of finance. Alltick’s API is engineered for today’s high-speed, data-driven markets.

🚀 Start Your Free Trial – Alltick.co

0 notes

Text

Best trader on Wall Street: The Real System for Consistent Results

Best trader on Wall Street: The Real System for Consistent Results

Frustrated by market chaos? Discover how the Best trader on Wall Street achieves lasting consistency—even when others fail. Here’s the blueprint for clarity and steady gains.

Why Most Traders Fail: The Hidden Trap of Overcomplication

Up to 90% of self-directed traders lose money, often due to chasing complex strategies. Simplicity wins. The Best trader on Wall Street relies on proven, repeatable rules—not gut feelings or crowded chatroom tips. If you’re tired of information overload, keep reading for a data-driven alternative.

Proven Performance: The Power of Historical Backtesting

What separates consistent winners? Backtested systems. A 2023 study found that traders using rigorously tested strategies outperformed peers by 37%. The Best trader on Wall Street trusts only setups with strong historical edges. Imagine executing trades backed by decades of solid data—confidence replaces hesitation.

Clarity Over Chaos: The Value of a Simple Trading Plan

Wall Street’s top traders don’t reinvent the wheel. They use clear, actionable trade plans that eliminate ambiguity. By sticking to high-probability setups and strict risk management, they minimize costly mistakes. Simplicity isn’t basic—it’s your competitive edge in today’s noisy markets.

Consistency Through Discipline: The Real Secret Weapon

Discipline is the backbone of every Best trader on Wall Street. Following a defined process—no matter the headlines—lets you sidestep emotional pitfalls. Studies show disciplined traders have 64% fewer impulsive losses. With structure, you trade calmly and consistently, regardless of market swings.

Action Steps: How to Start Trading Like the Best

Ready for reliability? Begin by tracking your trades, backtesting strategies, and writing a clear plan. The Best trader on Wall Street reviews performance weekly, adjusting only with evidence. This disciplined feedback loop turns frustration into steady progress. Start simple—refine as you grow.

Stick to proven, backtested setups

Prioritize a simple, actionable trade plan

Track, review, and refine your process

Consistency isn’t luck—it’s engineered. Want to trade like the Best trader on Wall Street? Start with a system you can trust and watch your results transform.

What’s the #1 mistake traders make chasing consistency?

Most traders abandon their plan too quickly, switching strategies after minor setbacks. True consistency requires patience and strict adherence to a proven system, even during occasional losses.

How do I know if my trading system is reliable?

A reliable trading system is backed by thorough backtesting, clear rules, and a history of consistent results. Track your trades and review performance data to confirm your strategy’s edge.

Have you struggled to find consistency in your trading? Comment or reblog if this resonates—what’s your biggest trading frustration, and what would help you break through?

0 notes

Text

AI-Driven Investment Strategies: How Machine Learning is Reshaping Portfolio Management

The financial world is undergoing a transformation unlike anything we’ve seen before. At the center of this disruption is Artificial Intelligence (AI) and Machine Learning (ML)—technologies that are changing the way portfolios are built, managed, and optimized. What was once the domain of experienced fund managers and analysts is now being enhanced by intelligent algorithms capable of learning from vast datasets and making predictive decisions with remarkable precision.

As India’s financial markets become more sophisticated, there's a growing demand for professionals who can bridge the gap between data and strategy. If you're looking to get ahead in this field, pursuing a Financial Analytics Certification in Thane could be your stepping stone to a high-impact career in the AI-powered world of finance.

What Are AI-Driven Investment Strategies?

AI-driven investment strategies use machine learning algorithms to:

Analyze vast amounts of historical and real-time data

Identify patterns and anomalies

Predict market trends

Automate trading decisions

These strategies rely on quantitative models that adapt to new information continuously, allowing them to make dynamic decisions with minimal human intervention.

Examples include:

Algorithmic trading that executes trades based on real-time market conditions

Robo-advisors that suggest portfolio allocations based on investor preferences and risk tolerance

Sentiment analysis that uses natural language processing (NLP) to scan news articles, tweets, and reports for market-moving insights

Why Are AI and ML Reshaping Portfolio Management?

1. Speed and Scale

Human analysts can only process a limited amount of data, but AI models can analyze millions of data points across markets, geographies, and sectors in real time. This scale enables faster, more informed decision-making.

2. Data-Driven Customization

AI models are increasingly being used to personalize portfolios. For instance, machine learning can tailor asset allocation based on an investor’s goals, past behavior, and market conditions—something even seasoned advisors may find difficult to do at scale.

3. Reduced Human Bias

Behavioral biases—like fear, greed, or herd mentality—often affect investment decisions. Machine learning, when designed correctly, eliminates much of this noise, relying solely on data-driven logic.

4. Continuous Learning

Unlike static investment models, ML algorithms evolve over time. They learn from market shifts, correct their errors, and improve their predictions—making portfolio management more adaptive.

Real-World Applications in India

India’s financial landscape is embracing AI with open arms. Leading financial institutions and fintech startups are integrating AI into everything from wealth management to risk analysis.

Zerodha’s streak platform lets users backtest trading strategies using ML models.

Upstox and Groww use AI to enhance user recommendations and analytics.

AI-based mutual funds are now entering the Indian market, selecting equities using sentiment analysis and pattern recognition.

As AI becomes more accessible, the need for skilled professionals who understand both finance and analytics is skyrocketing.

The Career Opportunity: Why Now is the Best Time to Upskill

There is a growing gap between traditional finance skills and the analytics capabilities now in demand. AI-driven finance requires a strong foundation in data science, statistics, financial modeling, and programming.

This is where a Financial Analytics Certification in Thane becomes incredibly valuable.

Whether you're a finance graduate, an investment professional, or an engineer looking to transition into fintech, such a certification offers:

Hands-on training in tools like Python, R, Excel, and Tableau

Exposure to real-world datasets and financial modeling scenarios

Understanding of AI and ML in a financial context

Guidance from industry experts with experience in portfolio management and data science

Institutes like the Boston Institute of Analytics are leading the charge in this space, offering globally recognized certifications that align with current industry demands.

How Financial Analytics Enables AI-Driven Strategies

To make AI work in portfolio management, professionals need to:

Clean, process, and analyze large datasets

Develop machine learning models using regression, classification, and clustering techniques

Interpret model results and translate them into actionable investment decisions

Continuously monitor and optimize portfolio performance

A certification program focused on Financial Analytics provides these exact skills, making you job-ready for high-growth roles such as:

Quantitative Analyst

AI Investment Strategist

Data-Driven Portfolio Manager

Financial Risk Analyst

Final Thoughts: The Future is AI-Powered

AI isn’t replacing finance professionals—it’s empowering them. Those who embrace these tools will lead the next generation of investment innovation. From portfolio automation to intelligent asset selection, machine learning is not just a trend—it’s the future of wealth management.

If you're serious about making an impact in this space, now is the time to equip yourself with the right skills. Enroll in a Financial Analytics Certification in Thane, and position yourself at the forefront of finance’s digital revolution.

0 notes

Text

Best Algo Trading Software in India | Quanttrix.io

Best Algo Trading Software in India – Quanttrix.io

Introduction

Ever wondered if machines could trade smarter than humans? Well, welcome to the world of algorithmic trading—where intelligent software takes the driver’s seat in the financial markets. With the growing popularity of algo trading in India, it's no surprise that traders are looking for reliable platforms. But out of all the options, Quanttrix.io stands out as a top choice.

Whether you're a curious beginner or someone who's tired of emotional trading decisions, this article will break down everything you need to know about the best algorithmic trading software India has seen—Quanttrix.io.

Explore the best algo trading software in India . Discover why Quanttrix.io tops the list of the best algorithmic trading software India has to offer.

What is Algorithmic Trading?

Algorithmic trading, or algo trading, is the use of computer programs to place trades automatically based on pre-defined conditions. Think of it like having a robot that follows strict instructions and doesn’t get emotional—unlike us humans.

Imagine telling a robot, “Buy stock A if it goes above ₹500 and sell it if it drops below ₹480.” The robot will follow this without blinking or panicking.

Why Is Algo Trading Gaining Popularity in India?

India's financial markets are evolving. With better internet access, more retail investors, and increasing financial literacy, traders are looking for smarter tools. And guess what? Algo trading fits the bill.

More people want to trade efficiently, save time, and reduce risk. Plus, with the help of SEBI-approved platforms like Quanttrix.io, it’s never been easier to jump in.

Key Features of Algorithmic Trading Software

A good algorithmic trading software should offer:

Customizable strategies

Real-time data feeds

Backtesting tools

Low latency execution

Risk management settings

Not every platform gets this right. But as you'll see, Quanttrix.io hits all the right notes.

Challenges Faced by Manual Traders

Before we dive deeper, let’s look at the pain points of manual trading:

Emotional decisions

Lack of discipline

Missed opportunities

Time-consuming monitoring

Sound familiar? If yes, it's time to automate.

Introduction to Quanttrix.io

Quanttrix.io is an Indian algo trading platform designed for everyone—from beginners to pros. It allows users to automate their trades using powerful algorithms with minimal setup.

Whether you’re trading in stocks, futures, or options, Quanttrix has you covered.

Why Quanttrix.io is the Best Algo Trading Software in India

So, what makes Quanttrix.io the best algorithmic trading software India has right now?

Locally built: Tailored for Indian markets.

Easy setup: No coding needed.

Trusted by traders: Excellent user feedback.

Regulatory compliant: Works with SEBI-approved brokers.

User-Friendly Interface for Beginners

No coding skills? No problem.

Quanttrix.io offers a drag-and-drop interface where you can build your own trading strategies. It's like building a Lego set—except this one helps grow your money.

The dashboard is clean, intuitive, and beginner-friendly.

Advanced Strategies for Pro Traders

If you’re a seasoned trader, you’ll love the advanced features:

Custom scripting options

Multi-leg strategies

Indicator combinations

Smart risk filters

Quanttrix.io adapts to your level of experience.

Real-Time Data & Speed

In algo trading, speed is everything. Quanttrix.io ensures real-time market data and low latency order execution, meaning your trades happen exactly when they should.

It’s like being the first to respond to a flash sale—you get the best deals before anyone else.

Backtesting and Optimization Tools

Not sure if your strategy will work? Test it first.

Quanttrix.io’s backtesting engine lets you run your strategy on historical data to see how it would have performed. Then, tweak and optimize it for even better results.

This saves you from “learning the hard way” with real money.

Security and Compliance Features

Worried about security? Don’t be.

Quanttrix.io uses bank-level encryption, secure API integrations, and is compliant with Indian trading regulations. Your data and trades are safe and secure.

Pricing Plans & Affordability

Quanttrix offers flexible algo trading software price plans to suit different traders:

1 Month Plan – ₹3,000

3 Months Plan – ₹7,000

6 Months Plan – ₹15,000

12 Months Plan – ₹29000

Each plan includes automated trading software with AI-powered strategies, real-time analytics, and premium support.

How to Get Started with Quanttrix.io

Here’s how easy it is:

Sign up at Quanttrix.io

Choose your broker and connect via API

Select or build a strategy

Run it live or test in demo mode

Monitor your trades in real-time

That’s it—five simple steps and you're good to go.

Customer Support & Community

Got a question? Quanttrix.io’s support team is responsive and helpful. They also have a growing community of traders who share strategies, ideas, and updates.

You're not just using software—you’re joining a movement.

Future of Algo Trading in India

Algo trading in India is still in its early stages, but it’s growing fast.

As more traders turn to automation, platforms like Quanttrix.io are paving the way for a smarter, faster, and more reliable trading future.

Soon, manual trading may become a thing of the past—like flip phones or dial-up internet.

Conclusion

To sum it all up: If you’re looking for the best algo trading software in India, look no further than Quanttrix.io.

Whether you're a new trader trying to dip your toes into automation or a seasoned professional looking for powerful tools—Quanttrix has everything you need.

No more guesswork. No more missed trades. Just smart, fast, and reliable trading.

FAQs

1. What is the best algo trading software in India?

Quanttrix.io is widely regarded as one of the best algo trading software in India due to its simplicity, speed, and powerful features.

2. Do I need coding skills to use algorithmic trading software like Quanttrix.io?

Not at all! Quanttrix.io offers a no-code, user-friendly interface, making it accessible for beginners.

3. Is algorithmic trading legal in India?

Yes, algorithmic trading is fully legal in India, provided it follows SEBI guidelines and uses approved brokers and platforms like Quanttrix.io.

4. Can I backtest my strategy on Quanttrix.io?

Absolutely. Quanttrix.io provides robust backtesting tools so you can test and optimize strategies before going live.

5. How much does Quanttrix.io cost?

Quanttrix.io offers flexible pricing plans including a free trial. It’s one of the most affordable solutions for both beginners and experienced traders.

0 notes