#Backtesting in AmiBroker

Explore tagged Tumblr posts

Text

Best Algo Trading Software in India 2025: Think Next Its Solution

Compare the best algo trading software in India markets: low brokerage, SEBI compliance, AmiBroker integration & backtesting. Get exclusive discounts + GST invoices. View rankings!

0 notes

Text

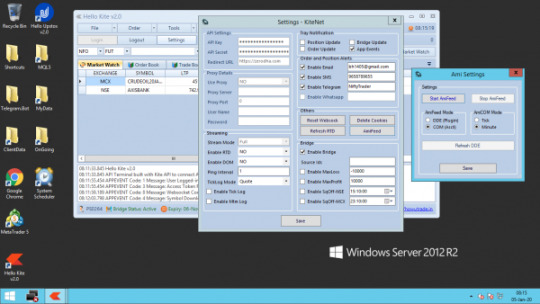

API Bridges Work in Algo Trading

API Bridges are a crucial part of algorithmic trading, which allows trading platforms, brokers, and custom trading algorithms to work seamlessly together. They provide real-time data transfer and order execution, thus making the trading strategy more efficient, faster, and accurate. In this article, we will explain how API bridges work in algo trading and further explore their importance for traders and developers, especially in India.

What is algorithmic trading? Algorithmic trading is the use of computer algorithms to automatically execute trades based on pre-defined criteria such as market conditions, technical indicators, or price movements. Unlike manual trading, algorithmic trading allows traders to make faster decisions and execute multiple orders simultaneously, minimizing human error and maximizing potential profits.

Understanding API Bridges in Algo Trading API bridges are the connector layer between different software platforms through which they can communicate with each other. In algo trading, an API bridge is used to bridge your trading algorithm running from platforms like Amibroker, MetaTrader 4/5, or TradingView to the broker's trading system for automated execution of orders.

Important Functions of API Bridges in Algorithmic Trading Data Feed Integration: API bridges enable direct access to live market data by the algo trader, such as current stock prices, volumes, and order books, from the broker's system. This will serve as the basis of information that the algorithm should interpret for better decision-making. Once the algorithm determines a suitable trading opportunity, the API bridge sends the buy or sell order directly to the broker’s trading system. This process is automated, ensuring timely execution without manual intervention.

Backtesting: API bridges enable traders to backtest their algorithms using historical data to evaluate performance before executing real trades. This feature is particularly useful for optimizing strategies and reducing risks.

Risk Management: An effective API bridge helps implement the risk management protocol in trading algorithms, for example, stop-loss or take-profit orders. When specific conditions are met, such orders are automatically entered to eliminate emotional decision-making and loss. Trade Monitoring: The API bridge continuously monitors trade execution with real-time updates on orders, positions, and account balances. The traders stay informed and make adjustments in their algorithms.

ALSO READ

Why API Bridges are the Need of Algo Trading? Speed and Efficiency: API bridges allow high-frequency trading (HFT), which enables traders to execute thousands of trades per second with minimal delay. This speed is very important in fast-moving markets where timing is everything to profitability.

Customization: With custom-built algorithms interacting with a multitude of brokers through the API bridge, traders can personalize their strategies, thus being able to implement advanced trading strategies that otherwise would not be possible to manually implement.

Integration is smooth. API bridges enable traders to connect their favorite platforms, such as Amibroker or TradingView, with brokers like Angel One, Alice Blue, or Zerodha. In other words, traders can continue using the software they are familiar with while availing of the execution capabilities of the broker's platform.

Cost-Effective: In comparison to hiring a dedicated team of traders or using expensive proprietary systems, API bridges are more cost-effective for algo traders. They allow traders to use the power of automation without the high overhead costs. Improved Risk Management: By automating risk controls, such as setting limits for loss and profits, the algorithmic system ensures that the trades are executed with minimal risk, thus helping traders in India and worldwide to manage the risk exposure better.

API Bridges Working with Popular Trading Platforms Amibroker: Amibroker is a more popular software used by algo traders for technical analysis and backtesting. The integration of Amibroker with API bridge enables traders to execute a strategy in real-time against their preferred broker's interface, which enriches trading experience.

MetaTrader MT4/MT5: MetaTrader is also a widely used platform for algorithmic trading. Through an API bridge, traders can link their trading robots (Expert Advisors) to brokers supporting the MT4 or MT5 platforms to automatically execute trades based on their algorithms.

TradingView: The most renowned trading view is a charting platform famous for its user-friendly interface and powerful scripting language called Pine Script. With an API bridge, users can send real-time trading signals to their brokers for the broker to execute.

The Best API Bridges for Algo Trading in India are by Combiz Services Pvt. Ltd.: Combiz Services Pvt. Ltd. provides customized API solutions that ensure seamless integration between brokers and trading platforms. Their API bridges support a wide range of trading platforms such as Amibroker, MetaTrader, and TradingView, which makes it a good option for Indian traders seeking flexibility and speed in algorithmic trading.

AlgoTrader: AlgoTrader provides an advanced algorithmic trading platform that supports integration with various brokers through API bridges. It is known for its scalability and high-speed trading capabilities, making it a favorite among professional traders.

Interactive Brokers API: Interactive Brokers offers a robust API that allows traders to link their algorithms directly to their trading platform. With a rich set of features such as market data feeds and execution capabilities, the Interactive Brokers' API bridge is highly regarded by the algo traders.

How to Set Up an API Bridge for Algo Trading

Select a Trading Platform and Broker: You may select Amibroker or MetaTrader as the trading platform. Then, go for a broker who gives access to APIs, such as Zerodha or Alice Blue. Connect API: Once you have made a selection of the above-mentioned platforms and broker, you must connect the API bridge with your algorithm in relation to the broker's system. In this step, generally, it involves configuration settings and keys of the APIs. Create or Select Algorithm: If you are a new algo trader, you can make use of pre-built strategies or create your own using programming languages like Python or AFL (AmiBroker Formula Language).

Backtest and test the algorithm: Before you deploy the algorithm, backtest it with historical data to ensure it performs as expected.

Monitor and Adjust: After you have deployed the algorithm, monitor its performance and make adjustments according to the changing market conditions.

Conclusion API bridges are a must-have tool in the world of algorithmic trading, providing smooth integration, faster execution, and improved risk management. Using Amibroker, MetaTrader, or TradingView platforms, API bridges make sure that your trading strategy is executed efficiently and effectively. The power of API bridges enables traders to stay ahead in the competitive world of algo trading and maximize opportunities in the Indian stock market.

For someone seeking a robust and highly customizable solution for algo trading needs, Combiz Services Pvt. Ltd. has the best API bridge services that guarantee seamless integration and faster trade execution.

0 notes

Text

Amibroker | Algo trading software | Algoji

Transform your trading with Algoji powerful Amibroker integration. Discover the best in algo trading software, combining advanced charting, backtesting, and automated trading solutions to optimize your strategies and maximize performance.

For More Information Chek Our Website:- www.algoji.com

0 notes

Text

Amibroker with Amiprofits

Alex: Hey Sam! Have you ever heard of AmiBroker Data Feed? Sam: Yeah, isn't that the charting and analysis software traders use? Alex: Exactly! It's pretty powerful from what I've heard. Sam: What makes it so special? Alex: Well, for starters, it's got some seriously robust backtesting capabilities. You can simulate trading strategies on historical data and see how they perform. Sam: That sounds handy for refining strategies. What else? Alex: The charting tools are advanced too. You can analyze market data using all sorts of technical indicators and drawing tools. Sam: Nice, so it's like an all-in-one analysis platform. Alex: Pretty much. And get this – you can customize it to your heart's content. Sam: How so? Alex: You can create your own technical indicators and trading strategies. It's super flexible. Sam: Wow, that's impressive.

0 notes

Text

Enhancing Data for AmiBroker with Quality: How GlobalDataFeeds Simplifies Your Trading Experience

GlobalDataFeeds is a reputable data vendor renowned for providing high-quality and reliable data for AmiBroker. GlobalDataFeeds offers extensive market coverage, reliable data integrity, and user-friendly integration with AmiBroker. Traders benefit from accurate backtesting, real-time access to markets, and the ability to react swiftly to opportunities. Their quality data, coupled with excellent customer support, empowers traders to make informed decisions and achieve trading success. By simplifying data management and providing reliable feeds, GlobalDataFeeds enables traders to optimize their strategies and trade with confidence.

0 notes

Link

Before getting into any technicalities or know-how, it is important for us to know what do we mean by Backtesting in AmiBroker.

#Amibroker#Analysis#Backtesting#Backtesting in AmiBroker#charting#indicators#Live Tradin#market#Real Time Data#Technical Analysis#Traders#True Data

0 notes

Text

Protrader

PTMC is a powerful trading software from creators of Protrader. PTMC gives traders more ways to reach the right decisions on different markets, include Forex. Financial freedom made easy. A mobile first trading and investment platform that integrates with the market exchanges and invests your savings.

If you scroll down you will see that there is a lot of stuff that will help you with your trading here. In addition, we’ll add more as the trading landscape changes and new resources become available. You can click on the logo to the left of the text to open a new tab featuring whatever is being discussed.

Think or Swim

This platform was purchased by TD Ameritrade a number of years ago and is one of the most sophisticated options trading platforms available today. You can also trade stocks and futures with them. If you are into options it is extremely worthwhile to open a small account with them so that you can use their option analyzing tools. In this area, they are well above all but the most expensive option tools out there.

TradeStation

Tradestation has been around for a long time and is well known in the industry. They offer some of the best charting software in the business. You can enter orders right from the software and they support many different order types. You can also trade futures and stocks from the same account.

LightSpeed Trading

These guys are geared toward the active semi-pro or professional trader. You can do all your trading from a single Lightspeed account whether you’re trading equities or options, trading to multiple destinations, or trading for multiple funds. Lightspeed is an introducing broker to Merrill Lynch Professional Clearing, and Wedbush Clearing and Execution.

Interactive Brokers

An excellent broker if you know what you are doing. Their customer service used to have a bad reputation but seems to improved significantly in recent years. They offer very competitive pricing and do expect you to be quite knowledgeable. They are a good choice for experienced active traders. Their commission structure allows easy scaling in and out of positions and they have an extensive set of order type choices.

Ally Invest

This broker tries to combine low commissions with good tools and customer service. There is no commission fee on U.S. listed stocks and ETFs and no ticket fee on option trades and a contract fee of just 50¢ per contract. They started out with the idea of fostering a trading community and claim focus on customer service by offering knowledgeable staff who answer the phone quickly as well as easy access to chat and quick responses to e-mails.

Fidelity

Fidelity has traditionally been more geared toward the investor than the active trader, but over the past five years or so they have also catered more to active traders. While not a direct access broker, their commissions are very competitive. They offer zero commissions on stock and ETF trades and $0.65 per contract on option trades. They also offer more robust customer service than most direct access brokers.

E*Trade

E*Trade is well known for it’s ubiquitous advertising. They have been around for a while and now offer zero commission on stocks and ETFs with $0.65 per contract on options. They claim to cater to all types of traders and have a special platform they call eTrade Pro for active traders.

Tradezero

Tradezero is an offshore broker which allows small accounts to daytrade. There is no commission on limit orders that add liquidity. They clear with Vision Clearing. They offer 6 to 1 leverage. You can read the FAQ here. They have recently opened a US branch with regular leverage and zero commissions as well. As with many brokers, you might want to use them for trade executions but use a separate charting package for your charts.

Schwab

Charles Schwab was the first of the major US full service brokers to switch over to zero commission stock and ETF trading. They charge $0.65 per option contract. They have generally offered superior customer service in tandem with low commission structures over the years and are a very reasonable choice for a broker.

Tastyworks

Tastyworks is a relatively new brokerage started by Tom Sosnoff who was instrumental in starting thinkorswim and sold it to TD Ameritrade. They offer a competitive commission structure which you can check out here. You can use a small cash account to daytrade options and start each day with your settled funds balance as your buying power for the day.

Robinhood

Robinhood is a mobile app that allows you to trade stocks, ETFs, options and crypto. A major feature is that the trades are “commission free”. It looks like they now do their own clearing. You can read about that here. There are some distinct disadvantages to trading off of a phone, but you can also use a full featured platform along with robinhood to help you analyze the market.

TradeStation

The TradeStation platform has been around for many years and originally started out as Omega Charts. For a long time they were way ahead of the competition and likely pushed the evolution of trading platforms forward. They have integrated trading into most aspects of their software, so you can easily trade from the platform which is a very good feature. If you are into backtesting and system building, they have a programming language called EasyLanguage® which allows you to build and test systems. They also provide you with an extensive historical database to facilitate backtesting.

MultiCharts

MultiCharts is a charting and trading platform with a robust set of features. The platform allows backtesting and indicator creation with EasyLanguage. As with many of the better software packages you can do market replay which allows you to practice your trading risk free. It is a very customizable package so you have a lot of flexibility to set up your workspace in a way that suits your trading style.

TC2000

The TC2000 platform has very good clean, sharp looking charting with many added features. The watch lists are also very configurable. Another favorable aspect of this package is that you can add trendlines, etc. and they will still be there the next time you go to the chart. The following is from the TC2000 website: Scan and sort through 1000’s of stocks per second. Screen from hundreds of indicator & fundamental criteria customized with your parameters and time frames. Just follow the step-by-step wizard to build your custom conditions. No programming is required, but you can optionally write condition formulas to refine your results. TC2000 helps you find the charts you are looking for in real-time.

eSignal

eSignal has been around for a long time. They are one of the more pricey packages. Their charting is quite clean looking and their data is pretty good. They used to be at the forefront of charting packages, but others have caught up to them in recent years. You can check out their promo video here

AmiBroker

Amibroker has been around for almost thirty years. It is a charting and back-testing package that is extremely powerful and fast but not especially intuitive. It’s user base is fiercely loyal, but a large percentage of them are quite code savvy. For the average user, there will probably be a steep learning curve. All that would be well and good, except for the fact that the user manual is a bit much to decipher and the tech support is done mostly by e-mail and a yahoo message group of all things! Here is the user database. I would highly recommend this software if it had more user friendly support. The pricing is very reasonable.

Trading View

Here is what Tradingview has to say about their services: Easy and intuitive for beginners, and powerful enough for advanced chartists – TradingView has all charting tools you need to share and view trading ideas. Real-time data and browser-based charts let you do your research from anywhere, since there are no installations or complex setups. Just open TradingView on any modern browser and start charting, learning and sharing trading ideas! It’s basically a community platform for sharing trading ideas and also offers real time charting capabilities.

Medved Trader

Jerry Medved is a programmer who developed and founded “QuoteTracker” years ago and eventually sold it out to TD Ameritrade. QuoteTracker was an excellent charting program that was very reasonably priced and could be had at a discount through various brokers. When Jerry sold it out to TD Ameritrade, he apparently was not able to compete with them for a set amount of time. It appears as though the non-compete is expired because he recently came out with Medved Trader. In the spirit of QuoteTracker, Medved Trader is a full featured, reasonably priced, well put together trading software package. Here is a demo of Medved Trader done by Jerry himself. You can get it for free from some brokerages including TradeKing and Tradier brokerages.

NinjaTrader

NinjaTrader’s platform is a capable charting package with numerous valuable features. You can add indicators and trade off the charts if you like. It facilitates back-testing as well. Here is the platform purchase page. You can download and try out simulated trading for free in order to get to know the platform. It can be configured to work with a number of different brokers and comes free with a NinjaTrader account if you do a certain volume of trades per month.

SierraChart

SierraChart is an excellent charting program which is compatible with a number of broker datafeeds as well as with many third party datafeeds. The price is reasonable and it is possible to trade right from the platform.

Sterling Trader Pro

A professional level platform, Sterling Trader Pro is used by prop firms, broker-dealers, and active traders. You can connect from your desktop, laptop, iPad, iPhone, or Android.

DAS Trader

DAS Trader is a high end trading platform which you can get through many brokers. It’s available on desktop, laptop, iPhone, or Android.

FinViz

These guys provide one of the best free scanners available on the net today. It’s so good, as a matter of fact, that you don’t really have to sign up for their paid service if you don’t want to. Although it seems as though they are geared toward the lower priced stocks when you look at the landing page, you can click on the screener section and set the parameters to your liking. It’s a great tool for getting quick background news and other info on stocks you are interested in. Simply click on the ticker and you’ll get a page with much of the pertinent fundamental information as well as recent news and a daily chart. For more info and intraday charts, you can subscribe for a very reasonable price.

Protrader.com

Trade Ideas

This service is a sort of artificial intelligence trading helper. You get to program the scans according to criteria that fits your scan ideas. If you get stuck, this software has many pre-frabricated scans that you can mix and match. The scanning is very current and you will get as many alerts as you can handle provided you give it enough to look for.

Your Broker’s Stock Scanner

Don’t forget to check out your broker’s scanner. Many brokers license commercial scanning software either in whole or part. You might be surprised how close the results are to those of software you would pay a significant extra fee for. I highly recommend that you check this out first before spending extra money on a paid service.

Protrader Web

Market Watch

MarketWatch is a subsidiary of Dow Jones and Company, the same company that owns the Wall Street Journal and Barrons. Although the news is not timely enough for active day trading, it offers a lot of useful news covering all sorts of things and can give you an overall look at what is happening in the Market. It has a lot of entertaining and fluff news as well.

CNBC

As you already probably know, CNBC is a financial news network covering current events related to the world markets. It is up to you to decide how useful the information presented here is. There is no doubt that there is a lot of “hype” on this station, but they do cover breaking events that are important to daily trading activities. You can find the pertinent info faster with subscriber news services, but a lot of people enjoy watching CNBC for entertainment purposes as well.

Bloomberg

Bloomberg.com is a business news website that covers news pertinent to the Markets as well as business in general. In some ways it is similar to CNBC but more sophisticated with less hype.

Yahoo Finance Economic Calendar

The Yahoo Economic Calendar is a good place to get the run down on what important market related announcements are coming up. If you don’t have this info elsewhere, it’s worth checking out before the market opens. They don’t update the results fast enough for active day traders, but at least you can be aware of when important reports are coming out and adjust your trading accordingly.

World Charts

Allstocks.com is a funky little website that features a lot of useful information for traders. The main page I use on this site is the world charts page which shows a time delayed read out of how the world markets are doing. It’s a quick way to get a snapshot of what occurred overnight around the globe.

Yaba Daba Doo!

Www.protraderinstitute.com

Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who “add liquidity” by placing limit orders that create “market-making” in a security. Rebate traders seek to make money from these rebates and will usually maximize their returns by trading low priced, high volume stocks. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock.

1 note

·

View note

Text

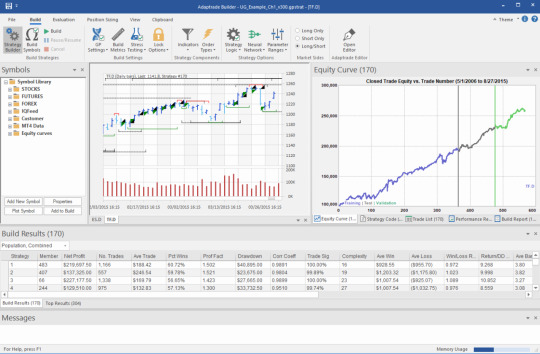

How To Build A +Scalping Strategy Using Adaptrade

In this article we guide you How To Build A +Scalping Strategy Using Adaptrade . We include adaptrade features plus advantage & disadvantage of Adaptrade . Scalping is a well-liked trading method in the financial markets. Taking tiny profits from brief trades that last only a few minutes is a key component of it. Scalping calls for extreme discipline as well as a trading platform that can produce precise and trustworthy indications. Adaptrade, a software tool that lets traders to create and test their own trading strategies using historical data, is one approach to create a scalping strategy. In this post, we'll go through how to use Adaptrade to create a scalping strategy.

What Is Adaptrade?

In only a few minutes, the user-friendly and sophisticated trading strategy generator Adaptrade Builder can develop, test, and identify hundreds of original and comprehensive trading strategies. This potent tool may design unique trading plans for a variety of markets, including stocks, futures, FX, ETFs, and others, on various time scales, from tick bars to monthly bars.

With new features like lock options, a point-and-click editor (Adaptrade Editor -- included with Builder), multiple data series, end-of-week exit, new indicators like congestion count, RocketRSI, Ulcer index, consecutive up/down bars, floor trade pivots, and strategy cloning, Adaptrade Builder supports TradeStation, MultiCharts, NinjaTrader 7/8, MetaTrader 4, and AmiBroker platforms. The best part is that Adaptrade Builder is a less expensive alternative to other options.

Adaptrade Features

Adaptrade is a robust piece of software that provides a number of features to aid traders in creating and refining their trading strategy. Among Adaptrade's primary characteristics are the following: Backtesting: Using previous data, Adaptrade enables traders to test their trading techniques. They may use this to evaluate their strategy's advantages and disadvantages and make necessary changes to enhance its effectiveness. Trading may fine-tune their approach for optimal profit with Adaptrade's optimisation tools. They can experiment with various parameter combinations to find the best options for their plan. Portfolio simulation: Traders may test their approach across several markets and periods with Adaptrade's portfolio simulation tools. This can assist them in diversifying their trading portfolio and determining the ideal marketplaces and periods to trade in. Trading strategies may be exported by Adaptrade as code, which can then be utilised with a variety of trading platforms. This makes it simple to apply their method to trading in the real world. Customization: Adaptrade provides features for customization that let traders adapt their trading techniques to meet their unique requirements. They may adjust the trading rules to fit their tastes and apply their own indicators and settings. Data management: Adaptrade offers data management and manipulation tools that can assist traders in getting their data ready for testing and analysis. Reporting: Adaptrade's reporting capabilities let traders create in-depth reports on the success of their trading strategies, which may help them assess the strategy's efficacy and make adjustments.

How to Use Adaptrade Builder to Create a +Scalping Strategy

Adaptrade Builder is a powerful software tool that allows traders to create custom trading strategies without needing to know how to program. Here are the steps to use Adaptrade Builder to create a scalping strategy: Step 1 : Create a new strategy project Open Adaptrade Builder and choose "New Project" from the "File" menu to start a fresh strategy project. Give your project a name, then choose "Scalping" as the strategy type. Step 2 : Define the entry and exit conditions: In the "Entry Conditions" tab, specify the conditions that will trigger a trade entry. For a scalping strategy, you might use indicators such as moving averages, RSI, or MACD. Set the parameters for these indicators based on your trading style and preferences. Enter the criteria that will cause a transaction to exit in the "Exit Conditions" tab. You might employ a profit objective or a stop loss order for a scalping method to swiftly finish transactions. Step 3 : Add position sizing and risk management In the "Position Sizing" tab, specify the rules for determining the size of each position. You might use a fixed percentage of your account balance or a more advanced method such as Kelly Criterion. Define the guidelines for controlling risk in your transactions under the "Risk Management" tab. To safeguard your cash, you can employ a maximum drawdown ceiling or a trailing stop loss. Step 4 : Backtest and optimize the strategy: You may backtest the strategy using historical data after defining your entry and exit circumstances, position sizing, and risk management guidelines. You may test your approach on several markets and periods with Adaptrade Builder. You may use the optimizer to determine the ideal values for your strategy parameters after conducting the backtests. This will assist you in enhancing the effectiveness of your scalping method. Step 5 : Deploy and monitor the strategy You can use your scalping method in a real trading environment once you've tested and improved it. NinjaTrader, TradeStation, and MetaTrader are just a few of the trading platforms for which Adaptrade Builder may provide code. The performance of your strategy should be tracked in real time, and you should alter it as needed to reflect shifting market conditions. A variety of performance measures and statistics are available in Adaptrade Builder to assist you in assessing the efficacy of your scalping approach. Above five stages will help you utilise Adaptrade to create a strong +Scalping strategy that will enable you to profit from minute price changes in the market. You may create a strategy that is customised to your unique trading style and risk tolerance using the robust tools available from Adaptrade for building, testing, and optimising trading systems.

Advantages & Disadvantage of using Adaptrade for scalping

A strong software application that can assist traders in creating and testing their scalping strategies is Adaptrade. While Adaptrade has a number of benefits for scalping, there are a few drawbacks to take into account. The pros and cons of utilising Adaptrade for scalping will be covered in this article. Advantages of using Adaptrade for scalping: - Backtesting: You may use previous data from Adaptrade to backtest your scalping method. You may use this to evaluate your strategy's advantages and disadvantages and make necessary changes to enhance its effectiveness. - Optimization: You may adjust your scalping approach for optimum profit with Adaptrade's optimisation tools. These tools allow you to test various parameter combinations and find the best options for your approach. - Portfolio simulation: Utilizing several markets and periods, you may evaluate your scalping technique with Adaptrade's portfolio simulation tools. This might assist you in diversifying your trading portfolio and determining the ideal marketplaces and periods to trade in. - Exporting: You may export your scalping technique from Adaptrade as code, which can be utilised with a variety of trading platforms. This makes it simple to apply your method to trading in the real world. Disadvantages of using Adaptrade for scalping: - Complexity: For new traders, Adaptrade might be complicated and challenging to learn. To utilise it effectively, you need to have a solid grasp of trade theory and programming abilities. - Cost: The use of Adaptrade, a premium software program, costs money on a recurring basis. For traders who are just starting out or on a short budget, this may be a drawback. - Limitations: The tools provided by Adaptrade are intended for the development and testing of trading systems and might not be appropriate for other kinds of trading strategies. Adaptrade might not be as helpful to traders who favour manual trading or discretionary trading. - Risk: While Adaptrade can assist you in creating a successful scalping strategy, it cannot ensure your success in actual trading. Trading is always risky, and traders should employ effective risk management strategies to reduce their losses.

Final Thoughts

A strong software application that can assist traders in creating and testing their scalping strategies is Adaptrade. Backtesting, optimization, portfolio modeling, and exporting are just a few benefits it provides. But there are also certain drawbacks to take into account, such as complexity, expense, restrictions, and danger. Traders may profit from Adaptrade's capacity to fine-tune their scalping approach for optimal profitability by investing the time and money necessary to understand how to use its capabilities. However, Adaptrade might not be as ideal for people with little resources or little experience trading. Overall, Adaptrade may be a useful tool for traders who want to create and test their scalping technique, but it's crucial to consider the benefits and drawbacks before using it. Additionally, traders should keep in mind that although though Adaptrade can aid in the creation of a lucrative strategy, trading always entails risk, and effective risk management strategies should be utilised to reduce losses. Read the full article

0 notes

Text

Research Tool – LONG – Momentum + Pattern By QuantpTrader

This is a compilation of LONG trading ideas fully coded in Amibroker that you can modify and adapt to your own needs and do additional backtests.

Find the course on teachab.com

1 note

·

View note

Text

Amibroker | Algo trading software | Algoji

Transform your trading with Algoji powerful Amibroker integration. Discover the best in algo trading software, combining advanced charting, backtesting, and automated trading solutions to optimize your strategies and maximize performance.

For More Information Chek Our Website:- www.algoji.com

0 notes

Text

The Power Behind Amibroker

Amibroker Data Feed is one of the most widely used trading platforms for technical analysis, algorithmic trading, backtesting trading strategies, and automating trading decisions. With its built-in Formula Language (AFL), Amibroker empowers traders to scan markets for opportunities, build custom indicators and trading systems, and thoroughly test strategies before risking capital.

0 notes

Text

Using Amibroker Data Feeder for the First Time in India: What You Need to Know !

Amibroker is a fantastic technical analysis platform for traders who need the flexibility of using custom indicators or performing complicated backtests. Amibroker is a versatile platform for backtesting, charting, and trading system development. Similar to how a car needs fuel to run, Amibroker needs data to operate. But unfortunately, data doesn’t come out of the box with an Amibroker subscription; you need to subscribe data separately from 3rd party sources and plug it into Amibroker. In this post, we’ll look at the ways to select the best Amibroker Datafeed services in India.

Data Vendors

The foremost thing to know about Amibroker is that it requires data. Without data, Amibroker is just a blank slate…there’s nothing much to see, and there’s nothing to do there… so we need the data.

So, how do we get the data into Amibroker?

Well, we have to buy the data from data vendors. Data vendors have all the data we need, and in the format Amibroker understands. There are many data vendors; you can just go to their website, pay a monthly fee, and that’s it; these data vendors take care of all the setups.

And once the setup is done, the data begins flowing into Amibroker on a real-time basis.

You can select the best Amibroker Data Feed provider based on the following parameters:

Connectivity with Amibroker: The datafeed should deliver a plugin to connect with Amibroker in a hassle-free way.

Accuracy of data: The data feed should provide accurate data that can be used for live trading and backtesting.

Live and Historical Data: Along with the live data; the datafeed should offer an optional source of historical data that can be utilized for backtesting.

Cost: The cost of a data subscription should be nominal.

Choose the Best Data Feed Providers for Your Amibroker

To start using Amibroker for charting or technical analysis, you need to buy a data feed from the best data service provider. The data provider helps you configure the feed setup over team-viewer for the first time.

The data-feed industry is loaded with too many unauthorized data vendors. Most of them have websites under different names or menu cards but cooking from the same kitchen. They falsely advertise in real-time as approved by DOTEX, NSE etc. Discuss the quality of service you plan to buy with your friends and colleagues who are already using amibroker.

Please note that some data feed Providers do not reveal the limitations of their feed at the time of sale. The limitations would mean you can scan or backtest only a fixed number of stocks at one time. For example, Provider A supports the screening of 45 stocks, while Provider B supports 100 stocks for the same price. If you plan to do an ample historical backtest using Amibroker. To avoid dissatisfaction, double check your back-fill data requirements first with the data provider you plan to choose.

Final Words

There are plenty of Amibroker data feed services available on the internet, but most of them are not reliable. Since trading involves putting your hard-earned money at stake, choosing the trustworthy and best amibroker data feeder is very important.

0 notes

Text

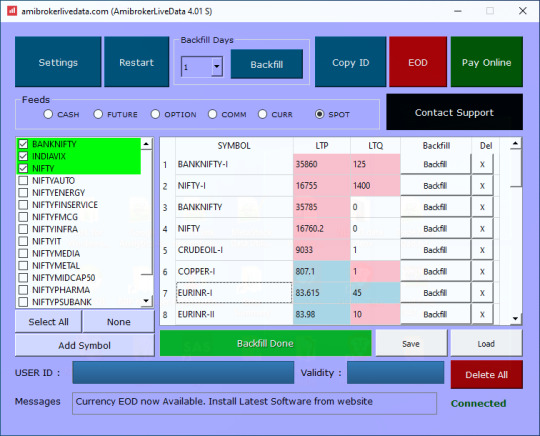

Amifeed For Amibrocker

hello, I have opted for amifeed data feed trial. I am using the amibroker 5.6 version. but there is some issue I am facing. 1) if I save ema style as THICK and then restart amifeed its style becomes default I mean thin again. 2) I am using 2 ema 50 and 100 but when amibroker opens 100 ema become 110 eam. I will post code also to this. _SECTION_BEGIN('Price'); SetChartOptions(0,chartShowArrows|chartShowDates); _N(Title = StrFormat('((NAME)) - ((INTERVAL)) ((DATE)) Open %g, Hi %g, Lo %g, Close %g (%.1f%%) ((VALUES))', O, H, L, C, SelectedValue( ROC( C, 1 ) ) )); Plot( C, 'Close', ParamColor('Color', colorDefault ), styleNoTitle | ParamStyle('Style') | GetPriceStyle() ); _SECTION_END(); _SECTION_BEGIN('EMA'); P = ParamField('Price field',-1); Periods = Param('Periods', 50, 2, 300, 1, 10 ); Plot( EMA( P, Periods ), _DEFAULT_NAME(), ParamColor( 'Color', colorCycle ), ParamStyle('Style') ); _SECTION_END(); _SECTION_BEGIN('EMA1'); P = ParamField('Price field',-1); Periods = Param('Periods', 100, 2, 300, 1, 10 ); Plot( EMA( P, Periods ), _DEFAULT_NAME(), ParamColor( 'Color', colorCycle ), ParamStyle('Style') ); _SECTION_END(); I hope someone can help me. thanks

Ami Feed For Amibroker

Amibroker Live Data. Number #1 Amibroker Data Feeder. 7 Days Trial

AmiFeeder Data. Amibroker Data Feed. Real Time Data for Amibroker

Data updates second by second in amibroker during market and backfill is in 5 min format. Traders can take our annual package to get basic training of amibroker and free best buy sell signals for amibroker. Buy sell signals for amibroker is also known as AFL (amibroker formula language). Ism dongle not installed download. Amifeed provides fast low latency data to your Amibroker with new advanced technologies. We provide one-month service for Rs 449/- only which is very low compared to other providers.

AmiFeeder software is now AmiBrokerLiveData Looking for reliable real time data for amibroker. Your search ends here. Download and install our Setup for free demo of Equity Cash, Equity Future, Nifty Options, Mcx commodity, Ncdex Commodity and Currency Data. All this in only Rs 444 per month. Offering the Best Support for our software. We Provide Support via Team viewer. On all Trading Days. Nifty and bankNifty, weekly and monthly options Available. 365 Days backfill for data feed for proper backtesting of your strategies. Trade in banknifty Weekly Options and make money, BankNifty options has highest volume and gives good opportunity to make money from small capital. At 'Amibroker Live Data' we are the only data vendor who given upto '365 day Backfill' with 1 month data feed. Best Amibroker Buy Sell signals for Nse and Mcx available. Offering reliable data for amibroker Best Support from 8:00 am to 9:00 pm | #1 Amibroker Data Feed. Excellent Quality Data feed for Amibroker cash, Fno, Commodity Data Feed. 180 Days 1 Min Backfill. 7 Day Demo. Real Time Data feed for amibroker. Best Data Feed support from 8 am to 9 pm. Mcx and Nse AFL signals. Improved AmiFeeder. Amibroker Live Data Feed now works on windows 11 also. Feel free to use latest windows os for better visual experience

Free DemoMore Details

Ami Feed For Amibroker

Amifeed provides fast low latency data to your Amibroker with new advanced technologies. We provide one-month service for Rs 449/- only which is very low compared to other providers. Merging last 3 years EOD data to Amifeed subscription which provides only 180 days: AmiBroker: 9: Jul 20, 2020: amifeed amibroker issue: AmiBroker: 3: Apr 19, 2020: R: Total ask bid data from NestRTD Amifeeder: Data Feeds: 0: Jan 28, 2019. AmiFeeder - Real Time Data Feed App for Amibroker is very user friendly and automatically connects with Amibroker. Just download Amifeed Setup and Install on Windows PC. After first run Registration, Run Amifeeder from Start Menu and it will start tick-by-tick data feed in Amibroker automatically.

0 notes

Text

Creating and Backtesting Tradingview Pinescript Trading Strategy

Creating and Backtesting Tradingview Pinescript Trading Strategy

Rajandran R Follow Founder of Marketcalls and Co-Founder Algomojo. Full-Time Derivative Trader. Expert in Designing Trading Systems (Amibroker, Ninjatrader, Metatrader, Python, Pinescript). Trading the markets since 2006. Mentoring Traders on Trading System Designing, Market Profile, Orderflow and Trade Automation. December 8, 2020 1 min read This basic tutorial helps you to explore creating…

View On WordPress

0 notes

Text

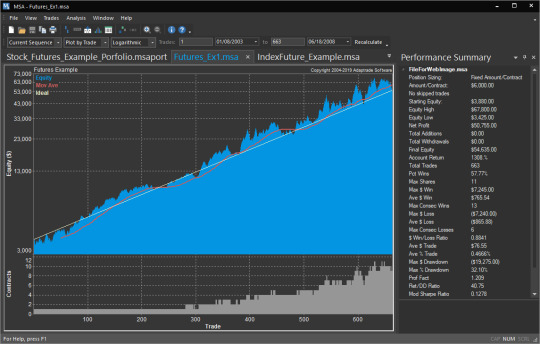

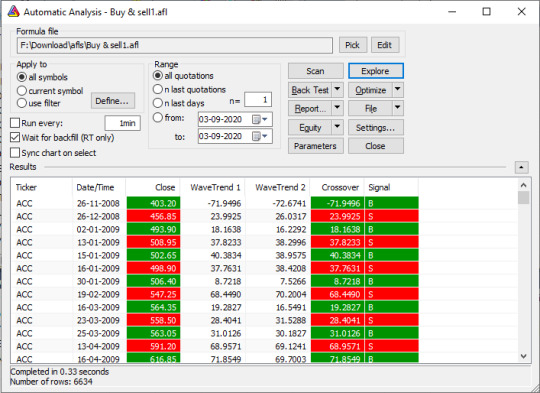

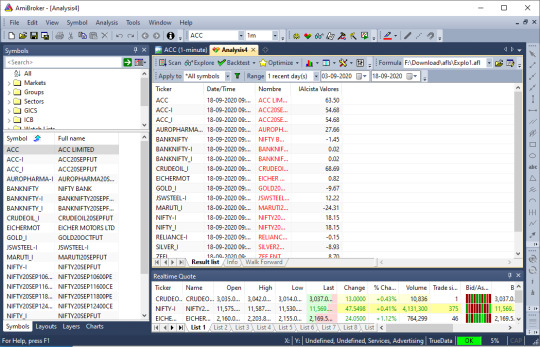

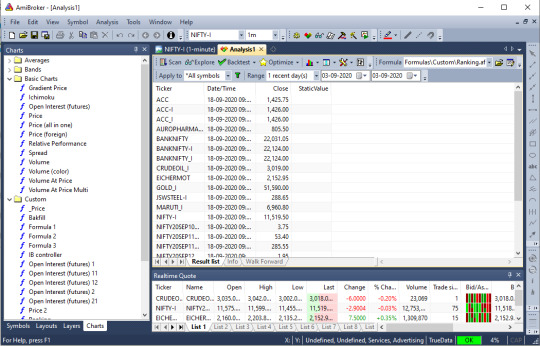

Backtesting in AmiBroker

Backtesting in AmiBroker

Before getting into any technicalities or know-how, it is important for us to know what do we mean by backtesting in Amibroker.

Backtesting is an easy process used by Traders to evaluate the Trading Ideas and provides information regarding how good is a trading system based on historical datasets. Precisely, it talks about the behavior of the trading system, risks involved in a particular trading system, and more regarding the performance of the trading system.

There is one such program AmiBroker which performs all these functions and does much more for the traders.

Introduction

To keep it simple, AmiBroker is a full-fledged professional Technical Analysis and charting tool which can be used by the traders to Analyse Market, prepare charts, and for backtesting trading strategies.

It is quite important for you to know about AmiBroker is before using it to backtest. Better make an informed decision rather than just going with a feature that you might regret later (which you won’t!)

Features of AmiBroker

Here is a list of features which are offered by the trading platform apart from backtesting–

Analysis Window –

On the analysis window, you will be able to see almost everything, i.e. portfolio, walk-forward tests, optimization, backtests, explorations, Monte Carlo Simulation, and so on.

Exploration/Market Screening –

AmiBroker is a multi-purpose tool for data screening/mining which supplies programmable output with infinite rows and columns.

Charting –

This feature of Charting in AmiBroker comes with several built-in indicators, multiple time frames (which can be used as per your own convenience), drag and drop indicators, customizable parameters, object creating capabilities, etc. Sliders are the good options to modify parameters in real-time and can also customize it in various styles and gradients.

Walk-forward Testing –

It is ideal for confirming the robustness of the trading sample before and after optimization.

Multi-Threading –

AmiBroker assigns different threads for each graphics renderer and each formula chart.

Code Editor –

The code editor pairs up with parameter call-tips, auto indenting, code folding, etc. Whenever you encounter an error, a meaningful message alerts you promptly.

Ranking and Scoring –

It is used to perform bar-by-bar ranking depending upon the user score to find a suitable trade.

Advantages of AmiBroker

It provides the user with top-notch technical support for trading accounts.

The main features of this tool are fast array and matrix processing.

AmiBroker ensures that the traders are provided with safe and full-proof trading support in order to have 100% security and that you don’t lose money.

The features of AmiBroker are customizable and flexible.

It is the fastest backtesting tool and provides the user with a custom backtesting facility, custom metrics, rotational trading, etc. Also, it provides the user with advanced ranking, scoring, and positioning.

The most productive thing that can be done in the analysis window is to backtest the trading strategy on historical data. It helps you to gain insight into the strengths and weaknesses of the system before you begin to invest real money.

And thus, AmiBroker is a feature which can help you to save lots of money.

Writing Your Trading Rules

The first thing that needs to be done is that you must have objective or mechanical rules to enter and exit the market. This step is necessary in order to create a base of your strategy and whether or not the system matches with risk tolerance, portfolio size, money management techniques, and several other factors.

Once you have established rules for trading, you must write to them as buy and sell rules in AmiBroker Formula Language.

Backtesting

In order to Backtesting in AmiBroker, you need to click on the Backtest button in the Automatic analysis window. Ensure that you have typed the formulas which contain buy and sell trading rules. Once the correct formula is entered, AmiBroker starts to analyze symbols according to trading rules and generates a list of simulated trades. This process is rapid in terms that you can easily backtest thousands of symbols in a few minutes. There is a progress window that will show the estimated completion time. If you wish to stop the process at any given point of time, click on the Cancel option in the progress window.

Analyzing Results

When the process is completed, you will be presented with a list of simulated trades in the bottom part of the Automatic analysis window aka the Results pane. Here, you can examine when the buy and sell signals occur only by double-clicking on the trade in the Results pane. Post this, you are presented with raw or unfiltered signals for each bar where buy and sell conditions are met. If you wish to see only a single trade arrow (opening and closing currently selected trade) you are required to double click a line while holding the SHIFT key pressed down. The other option that you can choose is the kind of display by choosing the appropriate item from the context menu which appears once you click on the results pane with a right-click.

In addition to the results, you will also be provided with detailed statistics on the performance of your system by choosing the Report option.

Changing Your Backtesting Settings

Backtesting in AmiBroker makes use of predefined values for performing its task including portfolio size, periodicity, i.e. daily/weekly/monthly, amount of commission, type of trades, price fields, interest rates, and so on. These settings can be altered by the user settings window. Post changing the settings, you must remember to run your backtesting if you wish the results to be in-sync with the settings.

Advanced Concepts

Until now, we have discussed fair simple use of the backtesting. However, AmiBroker comes with a lot more sophisticated concepts and methods.

We will be listing the new introduced-features of the back tester. There you go –

AFL scripting host for Advanced Formula Writers

Enhanced Support for Short Trades

Way to Control Order Execution Price from the Script

Types of Stops in Back-tester

Position Sizing

Round Lot Size and Tick Size

Margin Account

Backtesting Futures

Frequently Asked Questions (FAQs)

Ques. 1. What skills do I require to build an effective Algo Trading Solution using AmiBroker?

Ans. 1. Here is the list of following skills you may require to build an effective Algo Trading Solution using AmiBroker –

It is necessary for you to have knowledge in AmiBroker AFL Programming, Backtesting, Optimization, System Validation of Training

You must have an understanding of the Broker API’s/Bridge Function and knowledge in the know-how of integrating with AmiBroker.

It is essential to have knowledge about VPS (Virtual Private Servers) and how to remotely connect and deploy AmiBrokers, Trading Terminal, and Bridge Components in the servers.

You have knowledge about Setting Risk Control Parameters and Order Execution Logic.

You must take data backup and trade logic backup at regular intervals.

It is necessary to use a statistical test like Monte Carlo Analysis to determine if the trading system has broken.

Ques. 2. Are there any additional requirements to build an effective automated trading system infrastructure?

Ans. 2. Yes, you do need additional requirements to build an effective automated trading system infrastructure.

Here are these additional requirements –

You must have a Good Historical Data for Backtesting.

It is necessary to have a Good Realtime for Live Trading.

You should have Trade Execution Capabilities, i.e. market order, limit order, bracket order, cover order, etc.

It is essential for you to have a good understanding of money management and types of systems, i.e. trend following, mean reversion, pattern recognition, seasonal, cynical, and so on.

It is important for you to have a sense of risk management in terms of what to trade, symbol level stop-loss, portfolio level stop-loss, fnoban check, panic button square-off, etc.

You require capabilities in position sizing, i.e. partial profit/loss booking, adding positions to the existing trade (scale).

Ques. 3. What availabilities does one need after taking your system live?

Ans. 3. You should have the following availabilities after taking your system live –

Ensure that the trading model that you use is free of glitches and that the system is tradeable.

You should have enough time to compute and place orders.

The assumptions that you make regarding trading costs, i.e. brokerage, commissions, slippage, taxes are realistic.

Ques. 4. Are there any disadvantages to use AmiBroker?

Ans. 4. Well, not technically disadvantages but yes, there are a few issues with AmiBroker which one must know –

This tool is not really suitable for those who aren’t tech-savvy and are unaware of the programming languages such as HTML, C/C++, etc.

This tool works best for those who are keen to write their own codes.

Since the tool is fully customizable, AmiBroker does not have a standard template, to begin with. It might not be an issue for an advanced coder, however, it can be quite cumbersome to come up with a new code or research about it.

The managing of quotes takes a lot of time.

It isn’t practically possible for you to run two or more databases per instance/session.

AmiBroker isn’t suitable for big traders who transact in lump-sum money and not for one-time traders or small traders.

AmiBroker is one of the best when it comes to coding, programming, developing, however, it does not satisfy those who are from a non-technical background. One requires extensive training before using the analysis and charting tool.

Even though AmiBroker has quite a number of features and tools, that makes it the trading process safe and satisfying.

We are hoping that in neat future AmiBroker will become popular among the non-technical users as well.

Till then, keep trading!

#Amibroker#Analysis#Backtesting#Backtesting in AmiBroker#charting#indicators#Live Tradin#market#Real Time Data#Technical Analysis#Traders#True Data

0 notes

Text

Backtesting Software Market: Market Scope and Growing Demands 2019 | Key Players: MultiCharts, Deltix, QuantHouse, SmartQuant, etc.

A new Market Research from Stats & Reports, the Global Backtesting Software Market 2019-2024, is expected to show tremendous growth in the coming years. Analysts also analyzed the ongoing trends in Backtesting Software and the opportunities for growth in the industries. These shareholders include the following manufacturers of Backtesting Software: MultiCharts, Deltix, QuantHouse, SmartQuant, AlgoTrader, TradeStation Group, AmiBroker, FXCM, Wealth Lab, Axioma, Trading Blox, NinjaTrader Group, RightEdge Systems, Build Alpha. The Worldwide Backtesting Software Market Research Report provides a picture of the competitive landscape of the international market. The report conveys the details resulting from the analysis of the focused market. Initially, the Backtesting Software Market report shares key aspects of the industry with the details of the impact and Backtesting Software industry experts maintain a consistent survey with innovative trends, Market share and cost. The analysis includes market size, upstream situation, market segmentation, market segmentation, price & cost and industry environment. In addition, the report outlines the factors driving industry growth and the description of market channels. The report begins from overview of industrial chain structure, and describes the upstream. Besides, the report analyses market size and forecast in different geographies, type and end-use segment, in addition, the report introduces market competition overview among the major companies and companies profiles, besides, market price and channel features are covered in the report Request Sample of Global Backtesting Software Market @: https://www.acquiremarketresearch.com/sample-request/14843/ Top Companies covered in the report: MultiCharts, Deltix, QuantHouse, SmartQuant, AlgoTrader, TradeStation Group, AmiBroker, FXCM, Wealth Lab, Axioma, Trading Blox, NinjaTrader Group, RightEdge Systems, Build Alpha. Major Product are as follows: Cloud, Hybrid Major Applications are as follows: Shares, Foreign Exchange, Futures, Other The main sources are mainly industry experts in the core and related industries and manufacturers involved in all sectors of the industry supply chain. The bottom-up approach is used to plan the market size of Backtesting Software based on end-user industry and region in terms of value. With the help of data, we support the primary market through the three-dimensional survey procedure and the first interview and data verification through expert telephone, determine the individual market share and size, and confirm with this study. Read Table of Content of Backtesting Software Market at @ https://www.acquiremarketresearch.com/industry-reports/backtesting-software-market/14843/ Regional Analysis: • North America • Europe • Asia Pacific • Latin America • Middle East and Africa Key Research: The main sources are industry experts from the global Backtesting Software industry, including management organizations, processing organizations, and analytical services providers that address the value chain of industry organizations. We interviewed all major sources to collect and certify qualitative and quantitative information and to determine future prospects. The qualities of this study in the industry experts industry, such as CEO, vice president, marketing director, technology and innovation director, founder and key executives of key core companies and institutions in major biomass waste containers around the world in the extensive primary research conducted for this study We interviewed to acquire and verify both sides and quantitative aspects. The research provides answers to the following key questions: 1) Who are the key Top Competitors in the Global Backtesting Software Market? Following are list of players: MultiCharts, Deltix, QuantHouse, SmartQuant, AlgoTrader, TradeStation Group, AmiBroker, FXCM, Wealth Lab, Axioma, Trading Blox, NinjaTrader Group, RightEdge Systems, Build Alpha. 2) What is the expected Market size and growth rate of the Backtesting Software market for the period 2019-2024? ** The Values marked with XX is confidential data. To know more about CAGR figures fill in your information so that our business development executive can get in touch with you. 3) Which Are The Main Key Regions Cover in Reports? Geographically, this report is segmented into several key Regions, consumption, revenue (million USD), and market share and growth rate of Backtesting Software in these regions, from 2019 to 2024 (forecast), covering North America, Europe, Asia-Pacific etc Ask for discounts @ https://www.acquiremarketresearch.com/discount-request/14843/ Request customized copy of Backtesting Software report We are grateful to you for reading our report. If you wish to find more details of the report or want a customization, contact us. You can get a detailed of the entire research here. If you have any special requirements, please let us know and we will offer you the report as you want.

0 notes