#BankruptcyAttorneys

Video

youtube

😎 3 Secrets to a Smooth Bankruptcy Filing:🚨Avoid These Mistakes! #lawyers

0 notes

Text

Bankruptcy Attorneys - New Financial Beginnings

https://newfinancialbeginnings.com/meet-our-attorneys/

Highly Experienced and Aggressive Bankruptcy Attorneys. We defend people against unfair lending and debt collection practices.

1 note

·

View note

Text

A Guide Your Attorneys Responsibilities After Filing for Bankruptcy

PO Lawyer - Filing for bankruptcy is a complex and overwhelming process, and the responsibilities of your attorney don't end after your case has been filed.

In fact, your attorney will continue to play an important role throughout the bankruptcy process, ensuring that your rights are protected and that the case runs smoothly.

We'll take a closer look at the responsibilities of your attorney after filing for bankruptcy and what you can expect from them.

Meeting with Your Attorney

After your bankruptcy case has been filed, your attorney will likely want to meet with you to discuss the details of your case and address any questions or concerns you may have.

See Also: Bankruptcy Attorney Near Me: How to Find the Right One for You

This meeting may take place in person or over the phone, and it's important that you make every effort to attend.

During this meeting, your attorney will explain the next steps in the bankruptcy process and what you can expect moving forward.

Representing You in Court

Your attorney will represent you in court throughout the bankruptcy process, advocating for your rights and ensuring that the case is handled fairly.

This may involve attending court hearings on your behalf, filing motions and objections, and negotiating with creditors to reach a settlement.

Responding to Creditor Inquiries

During the bankruptcy process, your creditors may have questions or concerns about your case.

Related: Attorneys for Bankruptcy: How to Find the Right One for Your Case

Your attorney will be responsible for responding to these inquiries on your behalf, ensuring that your rights are protected and that the case runs smoothly.

Providing Ongoing Legal Advice

Bankruptcy is a complex and nuanced area of the law, and your attorney will be an important resource for ongoing legal advice throughout the process.

This may involve helping you understand your rights and obligations, providing guidance on financial decisions, and helping you navigate the various legal and administrative requirements of the bankruptcy process.

Addressing Changes to Your Financial Situation

During the bankruptcy process, it's not uncommon for your financial situation to change.

Your attorney will be responsible for addressing any changes to your financial situation and ensuring that your bankruptcy case remains on track.

Ensuring Compliance with Court Orders

Throughout the bankruptcy process, the court will issue various orders and deadlines that you must comply with.

Read More: The Importance of Hiring an Attorney for Bankruptcy

Your attorney will be responsible for ensuring that you understand these orders and that you comply with them in a timely and effective manner.

Coordinating with Other Professionals

Depending on the specifics of your case, your attorney may need to coordinate with other professionals, such as accountants, appraisers, and real estate agents.

This will ensure that your case is handled effectively and that all relevant parties are kept up-to-date throughout the process.

Closing Your Bankruptcy Case

Once your bankruptcy case has been resolved, your attorney will be responsible for ensuring that all loose ends are tied up and that the case is properly closed.

Also Read: Finding Affordable Bankruptcy Lawyers

This may involve filing final paperwork, providing documentation to the court, and ensuring that all requirements have been met.

Conclusion

Filing for bankruptcy is a difficult and often stressful process, but having the right attorney by your side can make all the difference.

By understanding the responsibilities of your attorney after Filing for bankruptcy is a difficult and often stressful process, but having the right attorney by your side can make all the difference.

By understanding the responsibilities of your attorney after filing for bankruptcy, you can ensure that you are getting the support and guidance you need to navigate this complex process effectively.

Dont Miss: 10 Highest Paying Law Jobs in 2023

Ultimately, your attorney's responsibilities after filing for bankruptcy will depend on the specifics of your case, as well as the terms of your agreement.

However, by working closely with your attorney and staying informed about the various aspects of the bankruptcy process, you can maximize your chances of success and get the fresh start you need.

FAQs

1. What is the role of an attorney in bankruptcy?

An attorney's role in bankruptcy is to help you navigate the complex legal and administrative requirements of the bankruptcy process, ensuring that your rights are protected and that your case is handled fairly.

2. How can an attorney help me during bankruptcy?

An attorney can provide ongoing legal advice, represent you in court, respond to creditor inquiries, coordinate with other professionals, and ensure compliance with court orders, among other things.

3. How often should I communicate with my attorney during bankruptcy?

You should communicate with your attorney as often as necessary to ensure that you stay informed about the progress of your case and that your rights are protected throughout the process.

4. Can I change attorneys during the bankruptcy process?

Yes, you have the right to change attorneys at any time during the bankruptcy process if you feel that your current attorney is not meeting your needs or providing the support you require.

5. How do I choose the right bankruptcy attorney?

When choosing a bankruptcy attorney, you should look for someone with experience in bankruptcy law, a track record of success, and a commitment to providing personalized, high-quality legal services. You should also feel comfortable communicating with your attorney and trust that they have your best interests at heart.

Don’t forget. With. Development Perfect Organiztion Lawyer by clicking on the link. In. Lower. This :

Facebook. (By clicking on this link, you will be logged into PO Lawyer Facebook) Let’s click now.

Or you can also see our Twitter, Flickr, Pinterest, VK, Tumblr, Diigo, or you can visit our Google News.

We Are Also There Channels YouTube For Look Lawyers Information us Visually Come on Now Join Us.

Read the full article

#after#attorneys#bankruptcy#Bankruptcyattorneys#bankruptcyprocess#filing#for#guide#guideforbankruptcy#guideyourattorneys#news#responsibilities#your

0 notes

Photo

Navigating the commercial insolvency process can be difficult. When it’s time for advice, the attorneys at Ryan Swanson & Cleveland can help.

#commercialbankruptcy#commercialinsolvency#bankruptcy#insolvency#bankruptcyattorneys#bankruptcylawyers

0 notes

Text

How to Handle Vehicle Loans in Chapter 7 Bankruptcy in Raleigh, NC

Figuring out what to do with your car loan is one of the big decisions you'll face when filing for Chapter 7 bankruptcy in Raleigh, NC. As your bankruptcy attorney, I'm here to walk you through the process and help determine the best path forward, given your unique financial situation.

Under Chapter 7 bankruptcy, you typically have three main options for dealing with vehicle loans:

Reaffirmation

With a reaffirmation agreement, you agree to continue making payments on your car loan as originally contracted, despite the bankruptcy.

This allows you to keep the vehicle as long as you stay current. The lender will have you sign a reaffirmation agreement to reaffirm the debt. I'll review the terms to ensure they are in your best interest before filing the agreement with the court.

Redemption

Redemption lets you pay off the car at its current fair market value rather than the full loan balance.

This can significantly lower the amount needed to own the vehicle outright. If you have access to funds (like from a friend or relative), redemption may be a smart choice - especially if you have negative equity.

As your Weik bankruptcy attorney in Raleigh, I can help you determine the car's value and file a motion with the court to approve the redemption.

Surrender

If you can't afford the payments or no longer want the vehicle, surrendering it in bankruptcy is also an option.

This erases your liability for any loan balance remaining after the car is sold at auction. While giving up your automobile is never easy, in some cases, it's the most financially prudent move.

We can discuss transportation alternatives and ensure you're well-positioned to get another vehicle in the future.

It's important to note that North Carolina bankruptcy exemptions only protect up to $3,500 in motor vehicle value ($7,000 for joint filers), if the automobile is in joint names.

If your car has more equity than this, the trustee could potentially sell it to repay creditors. We'll carefully assess your vehicle's equity and explore ways to protect it. For instance, there's a that may be applied depending on your case.

Also, keep in mind that if you're behind on payments, the automatic stay in Raleigh bankruptcy only temporarily stops repossession. The lender can still seek court permission to reclaim the car. That's why it's crucial to decide on your statement of intention and take action quickly.

Book Your Free Consultation

No matter which route you choose, know that I'm in your corner throughout the process. Together, we'll create a customized plan to handle your vehicle loan in a way that provides much-needed financial relief while also meeting your transportation needs.

If you're considering Chapter 7 bankruptcy and need guidance on managing your car loan, call Weik Law Office today at 919-845-7721 for a free consultation and set up a time to speak with one of our friendly professionals.

#ncstatuteoflimitationsondebt#statuteoflimitationsnc#bankruptcychapter7nc#northcarolinahomsteadexemption#crosscollateralloans#famouspeoplewhofiledforbankruptcy#chapter13dismissedcarloan#whatisthepurposeofbankruptcy#debtlimitsforchapter13#unsecureddebtlimitchapter13#chapter13limits#crosscollateralclause#chapter7bankruptcyraleigh#bankruptcylawyersinraleighnc#bankruptcylawyersraleighnc#fileforbankruptcyinnc#bankruptcync#raleighbankrupcylawyer#chapter13bankruptcy#bankruptcyinraleigh#bankruptcy#raleighnc#weiklawoffice#debtsettlementattorney#BankruptcyAttorney#bankruptcylawyer#bankruptcylawyernearme#bankruptcyattorneynearme#bankruptcychapter7toplawyersnearwakeforestnc#chapter13raleighnc

0 notes

Photo

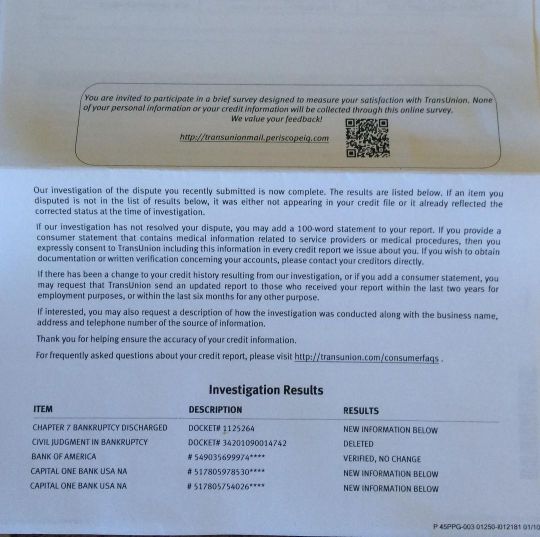

Do you have a bankruptcy you need removed from your credit report? Our team can help get results in 30 days! #bankruptcy #bankruptcyattorney #creditrepair #credit #creditscore #creditreport #creditagent #creditsweep https://www.instagram.com/p/ClKbR2EJj4v/?igshid=NGJjMDIxMWI=

0 notes

Text

Navigating Contractor Bankruptcy: Options For Pool Owners

Navigating Contractor Bankruptcy: Options For Pool Owners - #jayweller #bankruptcy, #Bankruptcyassistance, #Bankruptcyattorneys, #BankruptcyLawyer, #BankruptcyTrustee, #Chapter11, #Chapter7, #FilingForBankruptcy, #Tampa, #WellerLegalGroup - https://www.jayweller.com/navigating-contractor-bankruptcy-options-for-pool-owners/

#bankruptcy#Bankruptcy Assistance#Bankruptcy Attorneys#bankruptcy trustee#Chapter 11 Bankruptcy#chapter 7#Chapter 7 Bankruptcy#Chapter 7 Bankruptcy Trustee#Contractor Bankruptcy#file for bankruptcy#Filing For Bankruptcy#Florida#swimming pool company bankruptcy#Tampa#Weller Legal Group

0 notes

Video

undefined

tumblr

Bad Credit Renters,

You can't find a scapegoat for your bad credit or criminal background? Housing Problem Solvers Company can get you approved for a place to live! Call 800-915-2683 or www.housingpsg.com

#badcredit #bankruptcy #bankruptcyattorney #lowcreditscore #evictions#shortsale #criminalbackground #foreclosure #renters #renter #felony

0 notes

Text

Bankruptcy Attorney

Bankruptcy Attorney

A bankruptcy attorney is a legal professional who specializes in assisting individuals and businesses in filing for bankruptcy. They provide advice on the different types of bankruptcy,

#yankiz #lawyer #attorney #bankruptcy #BankruptcyAttorney #Bankruptcylawyer #Bankruptcylawfirm #lawfirm

0 notes

Text

RT @FisherSandler: The bankruptcy process begins with a consultation with an attorney to determine if it's the right option for your financial situation. #bankruptcyadvice #bankruptcyattorney https://t.co/IwoJFC3Z1j https://t.co/IwoJFC3Z1j

RT @FisherSandler: The bankruptcy process begins with a consultation with an attorney to determine if it's the right option for your financial situation. #bankruptcyadvice #bankruptcyattorney https://t.co/IwoJFC3Z1j https://t.co/IwoJFC3Z1j

— Darlyl Ricks (@DarlylRicks) Jan 30, 2023

from Twitter https://twitter.com/DarlylRicks

https://twitter.com/DarlylRicks/status/1620203547173294082

from Blogger https://ift.tt/RomXU4c

RT @FisherSandler: The bankruptcy process begins with a consultation with an attorney to determine if it's the right option for your financial situation. #bankruptcyadvice #bankruptcyattorney https://t.co/IwoJFC3Z1j https://t.co/IwoJFC3Z1j

0 notes

Text

Attorneys, Bankruptcy Experts and Vermont Residents…

I am looking to sell one of my domains. Check it out, share with colleagues and take advantage of the great Geo.

Happy Holidays.

#bankruptcyattorney

#domainnamesforsale

#godaddy

#vermont

#businessowner

#url

Www.vermontbankruptcyattorneys.com

0 notes

Text

Bankruptcy Attorney Near Me: How to Find the Right One for You

PO Lawyer - Are you struggling with mounting debt and financial hardship? If so, you may be considering filing for bankruptcy to regain control of your finances.

However, navigating the complex legal process of bankruptcy can be overwhelming and stressful, especially if you are not familiar with the laws and regulations.

That’s where a bankruptcy attorney comes in. A skilled and experienced bankruptcy attorney can help you understand your options, guide you through the legal process, and represent you in court if necessary.

Understanding Bankruptcy

Before we dive into how to find a bankruptcy attorney, let’s take a moment to understand what bankruptcy is and how it works.

See Also : How to Choose the Right Estate Planning Attorney for Your Needs

Bankruptcy is a legal process that allows individuals and businesses to eliminate or repay their debts under the protection of a federal court. There are two primary types of bankruptcy for individuals: Chapter 7 and Chapter 13.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy, also known as liquidation bankruptcy, is designed for individuals who cannot afford to repay their debts.

In a Chapter 7 bankruptcy, a court-appointed trustee sells off the debtor’s non-exempt assets to pay back creditors.

Most unsecured debts, such as credit card debt and medical bills, can be discharged in a Chapter 7 bankruptcy.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy, also known as reorganization bankruptcy, is designed for individuals with a steady income who can afford to repay some or all of their debts over time.

In a Chapter 13 bankruptcy, the debtor creates a repayment plan that lasts between three and five years. At the end of the repayment period, any remaining unsecured debts are discharged.

Why Hire a Bankruptcy Attorney?

Bankruptcy is a complex legal process that requires a thorough understanding of the law and the ability to navigate the court system.

Here are a few reasons why hiring a bankruptcy attorney is a smart choice:

Knowledge and Expertise

A bankruptcy attorney has the knowledge and expertise to help you understand your options, navigate the legal process, and represent you in court if necessary.

They can help you make informed decisions about which type of bankruptcy is right for you and ensure that your bankruptcy petition is filed correctly.

Protection from Harassment

Once you file for bankruptcy, creditors are required by law to stop all collection efforts, including phone calls, letters, and legal action.

Read More : How to Become an Attorney: Education and Career Path

A bankruptcy attorney can help you stop creditor harassment and protect your legal rights.

Increased Chances of Success

Hiring a bankruptcy attorney can increase your chances of success. Studies have shown that individuals who hire a bankruptcy attorney are more likely to have their debts discharged than those who try to file on their own.

How to Find a Bankruptcy Attorney Near You

Now that you understand the importance of hiring a bankruptcy attorney, let’s discuss how to find the right one for you.

Related : The Importance of Hiring an Attorney for Bankruptcy

Here are some tips to help you get started:

Ask for Recommendations

Start by asking friends, family members, or colleagues for recommendations. If someone you know has gone through the bankruptcy process, they may be able to recommend a good attorney.

Check Online Reviews

Check online reviews on websites like Yelp, Google, and Avvo. Look for attorneys with positive reviews and a track record of success.

Consult with a Local Bar Association

Contact your local bar association for a referral. They can provide you with a list of qualified bankruptcy attorneys in your area.

Schedule a Consultation

Once you’ve found a few potential attorneys, schedule a consultation to discuss your case. This will give you an opportunity to ask questions, learn more about the attorney’s experience and expertise, and determine if they are the right fit for you.

Dont Miss : Bankruptcy Attorney: Navigating Financial Hardship with Professional Help

Filing for bankruptcy is a significant decision that can have long-term implications for your financial future.

That's why it's crucial to find the right bankruptcy attorneys near you. By following the tips above, you can find an attorney who can guide you through the legal process and help you achieve a fresh financial start.

Remember, a good bankruptcy lawyer should be knowledgeable, experienced, and have a track record of success.

They should also be someone who you feel comfortable working with and trust to represent your interests.

By taking the time to find the right attorney, you can have peace of mind knowing that you have an experienced professional on your side.

FAQs

- What is the role of a bankruptcy attorney?

A bankruptcy attorney helps individuals and businesses navigate the complex legal process of bankruptcy. They can help you understand your options, create a repayment plan, and represent you in court if necessary.

- How much does a bankruptcy attorney cost?

The cost of a bankruptcy attorney varies depending on the complexity of your case, your location, and the attorney's experience. Most bankruptcy attorneys charge a flat fee for their services.

- Can I file for bankruptcy without an attorney?

While it is possible to file for bankruptcy without an attorney, it is not recommended. Bankruptcy is a complex legal process that requires a thorough understanding of the law and the ability to navigate the court system.

- What should I look for in a bankruptcy attorney?

When looking for a bankruptcy attorneys, you should look for someone who is knowledgeable, experienced, and has a track record of success. They should also be someone who you feel comfortable working with and trust to represent your interests.

- Will filing for bankruptcy ruin my credit?

Filing for bankruptcy will have a negative impact on your credit score, but it can also provide an opportunity for a fresh financial start. With time and responsible financial behavior, you can rebuild your credit after bankruptcy.

Read the full article

#attorney#AttorneyNearMe#attorneys#bankruptcy#BankruptcyAttorney#find#for#how#me:#near#news#one#right#the#UnderstandingBankruptcy#you

0 notes

Photo

Bankruptcy services can be the difference between getting a ruling in the #client's favor or not. From preparing petitions to reviewing #financial details and helping to obtain crucial information, our attorneys work round the clock to ensure that every single detail is taken care of for you.

Read more at: https://bit.ly/3pbUrOy

0 notes

Photo

What Happens to Your Savings Accounts if You File for Chapter 13 Bankruptcy

https://bit.ly/3FWdrwF

In general, you don’t have to worry about your savings and checking accounts if you file for Chapter 13 bankruptcy in Raleigh, NC.

You can even open new bank accounts as long as the court approves it. You can even have your Chapter 13 payments deducted automatically from your bank account to make the process more convenient.

However, Chapter 13 debtors are not completely immune to having their bank accounts garnished.

Here’s a closer look at what you need to know about your savings and checking accounts if you’re considering Chapter 13 bankruptcy in Raleigh, NC.

Chapter 13 Protects Your Bank Account Funds (in Most Cases)

Chapter 13 bankruptcy is often called a “reorganization” bankruptcy because it allows debtors to reorganize their debts and create a repayment plan to pay back their creditors over time.

Unlike Chapter 7, which liquidates your assets to pay off your debts, Chapter 13 lets you keep your property and assets. This includes your savings and checking accounts

In some cases, Chapter 13 may also allow you to keep funds in your bank account in excess of the exemption amount. The caveat is that you’ll need to work these excess funds into your Chapter 13 repayment plan.

Banks, Credit Unions & the “Set-Off” Privilege

While Chapter 13 bankruptcy offers protection for your bank account funds, it’s not 100% immune from creditors.

Namely, banks and credit unions have what’s called the “set-off” privilege. This allows them to take funds out of your account to pay off any debts you owe them.

This is particularly common among credit union members, who usually have auto loans, personal loans, mortgages, and other debts with their credit unions in addition to their checking and savings accounts.

Still, that doesn’t mean they can just take funds anytime they want from your accounts. If you’re concerned about this happening to you, please mention it during your free consultation with Attorney Weik.

What NOT To Do If You Have Bank Accounts & Are Considering Chapter 13

Chapter 13 has powerful protections in place for debtors – as long as you avoid sabotaging your own filing in the first place.

Never do the following to your bank accounts if you plan on filing for Chapter 13 in Raleigh:

Don’t make any large deposits or withdrawals without consulting with your Weik bankruptcy attorney first.

Don’t try to hide any assets by transferring them to friends or family members. This is considered fraud and can result in jail time.

Don’t close or open any bank accounts without prior approval from the court.

Don’t sign over any bank accounts to anyone else without court permission.

Don’t take out new loans or lines of credit without first informing Attorney Weik and getting court permission.

There are other things to avoid doing as well – which is why it’s always best to consult with a knowledgeable Raleigh Chapter 13 bankruptcy attorney before taking any action.

Call Weik Law Office today at 919-845-7721 for a free consultation, and set up a time to speak with one of our friendly professionals. We look forward to hearing from you soon!

#bankruptcy raleigh#raleighbankruptcy bankruptcyinraleigh bankruptcyattorney chapter13limits bankruptcyattorney chapter13bankruptcy bankruptcychapter7nc

0 notes

Photo

The cryptocurrency and finance attorneys at Ryan Swanson have experience with cryptocurrency and bankruptcy issues and have successfully protected our clients’ interests.

Read our recent article about Crytocurrency and Bankruptcy issues:

https://ryanswansonlaw.com/cryptocurrency-in-bankruptcy/

#cryptocurrency#bankruptcy#seattleattorneys#corporateattorneys#bankruptcyattorneys#cryptocurrencyinbankruptcy#attorneys#corporatelawyers

0 notes

Text

Bankruptcy Attorney in Brooklyn, New York

Hanna & Vlahakis Law Offices

7504 5th Ave, Brooklyn, NY 11209

Phone: (718) 680-8400

https://hvlawoffices.com/

https://goo.gl/maps/BBEEcVvYp5FhPgSB8

#DivorceLawyer#BankruptcyLawyer#BankruptcyAttorney#DivorceAttorney#BankruptcyLawFirm#DivorceLawFirm#FamilyLawFirm

0 notes