#Best financer in tricity

Text

best loan provider in mohali

GURMEET SINGH LAMBA is the best loan provider in mohali.Everest Financier has registered as a money lender and number is 02/HRC dated 26/05/2023 under Punjab registration of money lender act - 1938 in the office of the Collector of Mohali, (Punjab).Are you searching for the finest loan provider in Mohali? Your search ends here! As the top-rated loan provider in the city, we take immense pride in offering a wide array of loan options to cater to your diverse financial requirements. From competitive interest rates to flexible repayment plans, we strive to deliver an exceptional borrowing experience that exceeds your expectations. Trust our experienced professionals to provide you with the best loan solutions in Mohali. Contact us now and unlock endless financial possibilities!

#best instant loans provider in mohali#best loan provider in mohali#best money lender#best financer in mohali#Best loan provider in chandigarh#Best loan provider in tricity#Best financer in tricity#fastest cash loan#fastest cash loan online

1 note

·

View note

Text

Budget-Friendly Luxury Homes: Belgravia Zirakpur

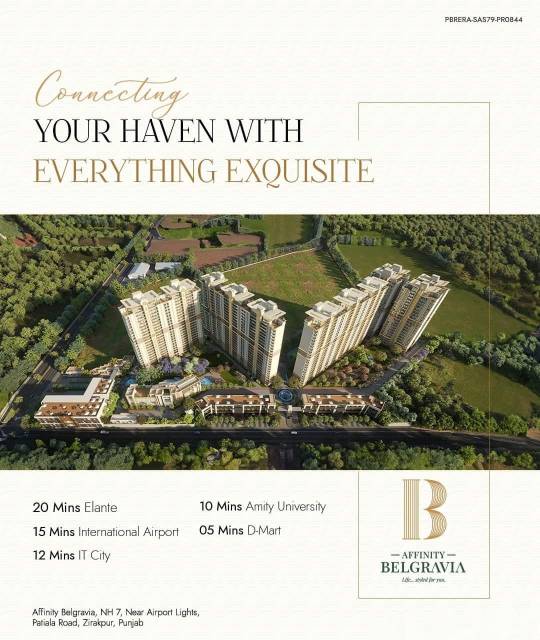

When it comes to the perfect blend of luxury and affordability, Belgravia Zirakpur stands out with excellence. Located in the heart of Tricity, this new project by Affinity Builders & Promoters redefines opulent living, making it quite within the reach of fastidious homeowners. While Affinity Belgravia is much more than just a residential project, the unparalleled grace, world-class amenities, and a prime location come at what can be best termed a surprise budget-friendly price.

Reasons to Choose Affinity Belgravia?

Situated on the Zirakpur-Patiala highway, NH-7, Affinity Belgravia Zirakpur spells a smart investment for those who want connectivity sans any compromise on luxury, since it has links with major hubs like Aerocity Mohali.

Here’s why Belgravia Zirakpur is the ideal choice for your dream home:

- Prime Location:

- Strategically positioned on NH-7, offering seamless connectivity to Chandigarh, Mohali, and the International Airport.

- It is located close to Aerocity, educational institutions, health facilities, and shopping complexes.

- Luxurious Living Spaces:

- 3 BHK Homes: Perfectly crafted for families seeking a spacious and comfortable abode.

- 3 BHK + Servant: Extra space for added convenience.

- 4 BHK + Servant: Designed for larger families or those who desire more room to breathe.

- World-Class Amenities:

- Lush Green Landscaping : Every day, you would live on 15 acres of smartly crafted greenery, handcrafted by world-renowned Oracles Landscape.

- Exquisite Clubhouse: A place where one can socialize and just sit and hang out.

- Roman & Ethnic Facade: A lavish exterior design that combines only the best features of traditional and modern architecture.

A New Axis of Luxury in Tri-city

Affinity Belgravia is not just one more residential project; it is a visionary development that actually sets new benchmarks for luxury living in the Tricity region. World-class landscaping, opulent architecture, and thoughtfully designed interiors make for the kind of lifestyle that is aspirational yet attainable.

- Signature Style, Superior Lifestyle: The homes at Belgravia Zirakpur are built to perfection, wherein everything from design to functionality is worked upon to keep the standards of luxury in view.

- Sustainable and Debt-Free Living: Affinity Belgravia is an entirely self-financed, mortgage-free property. This makes it sustainable in the long run and thus relieves the residents of a lot of hassle.

Why Affinity Belgravia is a Smart Investment

While considering investment in Affinity Belgravia Zirakpur, one needs to understand that it isn't just the possession of a house but assurance about life—the way one feels when surrounded by luxury, convenience, and value. Here's why this project would prove to be a smart choice:

- High ROI Potential :Situated at a rapidly developing area, Belgravia Zirakpur promises excellent capital appreciation and hence presents an ideal choice for investors.

- Reputed Developer: The brand Affinity Builders & Promoters itself spells the feel of quality, transparency, and customer satisfaction. Having delivered the iconic projects like Affinity Greens, this group has earned the trust of thousands of homeowners.

- Comprehensive Living Experience: From world-class amenities to the lush green surroundings, Belgravia Zirakpur is a holistic living experience that none can match.

Experience Affinity Belgravia Today

Your dream home at Affinity Belgravia is just a call away. Whether you're looking for a spacious 3 BHK, a luxurious 4 BHK with a servant room, or a commercial space, Belgravia Zirakpur has something for everyone.

Explore Our Offerings:

- Website:https://affinitygroupzirakpur.com/

- Contact Information: 9779393200

- Visit Us: Zirakpur-Patiala Highway (NH-7), Opposite Aerocity Block-J, Punjab 140603

More than a place to live, Affinity Belgravia is a lifestyle. All appropriate places with ultra-class amenities are what we offer, not to forget pocket-friendly prices, making it the ideal place to live in. Don't miss the opportunity to invest in this project, which bestows not just a home but a life of unmatched luxury.

Live the life you’ve always dreamed of—discover Affinity Belgravia Zirakpur today!

0 notes

Text

The Importance of Training Programs in Banking Courses

Training is crucial for employees in all industry sectors; it prepares them for their designated job roles. The industry is ever-evolving, and the training programs help individuals get acquainted with recent developments. Banking is one such industry where training plays a vital role. Several changes and developments have been made in the past few years and are not set to slow down anytime soon, so offering training within the banking sector becomes beneficial.

Through this write-up, IFM FinCoach, a banking institute in Chandigarh, will enlighten you about the importance of training programs in banking courses in India. We have expertise in providing practical training in the BFSI space and aim to create bankable professionals.

Let’s get into the importance of training programs in banking courses!!!

The banking sector is a dynamic field that evolves due to customer demands, regulations, and changing technology. If you want to excel in this field, knowing only the theoretical part will not suffice; you need to opt for courses that offer well-designed training programs. These courses will help you acquire the practical skills necessary for a banking career.

Why are training programs necessary in banking courses?

Banking training programs are necessary for individuals because they instil the required skills and prepare them to adapt to the evolving landscape, bridge the knowledge gap, and boost confidence. Various institutes provide investment banking training and certified BFSI professional courses. If you are looking specifically in Tricity, consider IFM FinCoach because they offer the best banking and finance training programs in town.

Adaptation to the Technological Advances

The arrival of FinTech has revolutionised how banking operates nowadays. The introduction of mobile banking and blockchain technology has changed the old ways of banking. Individuals must be well-versed with technological advancements to succeed in this career. The top banking and finance online courses offer training programs as part of the curriculum, ensuring you have enough knowledge to leverage technology for efficiency and excellent working experience.

Act as a Bridge

The banking courses will provide theoretical knowledge, but the practical applications can only be learned through the training programs. The practical knowledge will help you gain hands-on experience with loan assessments, client interactions, and client interactions through case studies and practical assessments.

Navigation of Regulatory Environment

Various laws and regulations govern an industry like banking. The training program is vital in getting acquainted with this regulatory environment. Compliance and risk management are two essential things that banking aspirants must know. Contact FinCoach if you want to benefit from banking training programs.

Skill Development

You can develop the necessary skills to get ahead in the banking industry. Your financial expertise and interpersonal skills will be enhanced in the training programs in the banking courses. Training programs will help you hone critical thinking, problem-solving, and communication skills.

Conclusion

Summing up, the training programs are vital to firm your grip on this industry. You will have the necessary knowledge to embark on a successful journey in this industry. You will be acquainted with the practical experience and enhance your communication and interpersonal skills. If you enrol yourself in the banking training programs, it ensures your personal as well as professional growth.

So, training programs aren't just helpful—they're essential. They help people grow, banks succeed, and the whole industry moves forward. As banking changes, these programs will continue to be super important, helping everyone stay on top of their game.

0 notes

Text

Affordable and Reliable HDD Upgrades in Panchkula and Mohali: Boost Your PC's Efficiency

In today's fast-paced digital world, the efficiency and reliability of your computer are paramount. Whether you are a professional juggling multiple projects, a student managing academic responsibilities, or an enthusiast indulging in the latest digital trends, your PC's performance plays a crucial role in your daily activities. One of the most effective ways to enhance your computer's efficiency without breaking the bank is through a Hard Disk Drive (HDD) upgrade Mohali. Tricity Computer Service, with its expert presence in Panchkula and Mohali, offers affordable and reliable HDD upgrades to breathe new life into your PC.

Understanding the Need for HDD Upgrades

Before diving into the services provided by Tricity Computer Service, let's explore why an HDD upgrade is a smart choice for boosting your PC's efficiency:

Increased Storage Space: With an HDD upgrade, you can significantly increase your computer's storage capacity, allowing you to store more data, applications, and multimedia files without worrying about running out of space.

Enhanced Performance: A new HDD can offer faster data retrieval times, reducing boot-up times and loading times for applications, thus enhancing overall system performance.

Cost-Effective Solution: Compared to purchasing a new computer, an HDD upgrade is a much more affordable way to improve your PC's functionality and extend its lifespan.

Tricity Computer Service: Your Go-To for HDD Upgrades in Panchkula and Mohali

Tricity Computer Service stands out as the premier provider service of HDD upgrade Panchkula and Mohali. Our commitment to quality, affordability, and customer satisfaction ensures that your PC's efficiency is our top priority. Here's what makes our HDD upgrade services stand out:

Expert Technicians: Our team of skilled technicians has extensive experience in performing HDD upgrades on a wide range of computer models, ensuring that your PC is in safe hands.

Customized Solutions: We understand that every user's needs are unique. That's why we offer tailored HDD upgrade solutions that match your specific requirements and budget.

Affordable Pricing: At Tricity Computer Service, we believe in providing value to our customers. Our HDD upgrade services are competitively priced to ensure that you can boost your PC's efficiency without stretching your finances.

Reliable After-Service Support: Our commitment to you doesn't end with the upgrade. We offer comprehensive after-service support to address any queries or concerns you may have post-upgrade.

The Process: How We Upgrade Your HDD

Our HDD upgrade process is designed to be seamless and hassle-free, ensuring minimal downtime so you can get back to your digital life as quickly as possible. Here's a step-by-step overview of how we upgrade your HDD:

Consultation and Diagnosis: We start with a thorough consultation to understand your needs and perform a diagnostic to assess your current HDD's performance.

Recommendation: Based on the diagnosis, we recommend the best HDD upgrade options that fit your requirements and budget.

Data Backup: To ensure that your data is safe, we perform a complete backup before proceeding with the upgrade.

Upgrade Implementation: Our technicians then carefully install the new HDD, ensuring it integrates seamlessly with your system.

Data Restoration and Testing: We restore your data to the new HDD and perform rigorous testing to ensure that your PC is running optimally.

Why Choose Tricity Computer Service?

Choosing Tricity Computer Service for your HDD upgrade Panchkula and Mohali means opting for reliability, expertise, and unmatched customer service. Our goal is to ensure that your PC's upgrade process is smooth, affordable, and, most importantly, effective in boosting your system's efficiency.

Ready to Boost Your PC's Efficiency?

If you're in Panchkula or Mohali and looking to enhance your computer's performance through an HDD upgrade, look no further than Tricity Computer Service. With our affordable and reliable upgrade options, expert technicians, and dedication to customer satisfaction, we are here to help you make the most out of your PC. Contact us today to schedule your HDD upgrade and take the first step towards a more efficient and reliable computing experience.

Boost your PC's efficiency today with Tricity Computer Service – where quality meets affordability in Panchkula and Mohali.

#Hard disk drive upgrade Mohali#HDD upgrade Panchkula#Tricity Computer Service#computer repair#Laptop Service

0 notes

Text

Investing in Punjab's Property Market: Tips and Strategies for First-Time Buyers

The property market in Punjab has been on a steady rise in recent years, making it an attractive investment opportunity for first-time buyers. However, with so many options available, it can be overwhelming to decide where to invest your hard-earned money. Here are some tips and strategies to consider when investing in Punjab's property market.

Location is Key

When looking for a property to invest in, location is always a crucial factor to consider. Zirakpur, where FIO Homes 2 is located, is a prime location due to its proximity to Chandigarh, one of the most important cities in the region. Being situated in a prime location makes the property more valuable, and also more likely to appreciate in the future. In addition, the location should be easily accessible and have good connectivity to important amenities like educational institutes, hospitals, restaurants, and markets, which FIO Homes 2 offers.

Choose a Reputable Developer

One of the essential tips for first-time buyers is to choose the right developer. The developer should have a good reputation in the market, and their projects should have a history of timely delivery, quality construction, and excellent amenities. KS Group is one of the best builders in Punjab, and they have earned an excellent reputation for their high-quality construction and timely delivery. FIO Homes 2, Zirakpur is one of their flagship projects that offer unmatched quality and luxury.

Consider the Amenities

Amenities are essential for a comfortable living experience, and they can also add value to the property. FIO Homes 2 offers numerous amenities like lifts, a green park with a kids’ play area, CCTV surveillance, indoor games, a gymnasium, a library, a party hall, a covered parking space, etc. These amenities can make living in the property more comfortable and appealing to potential tenants in the future.

Financial Considerations

It's crucial to consider your financial position when investing in property. Make sure you have a clear idea of your budget and the cost of the property. In addition, you should consider additional expenses such as stamp duty, registration fees, and maintenance costs. KS Group offers easy payment plans and financing options, making it more accessible to invest in their projects.

Stay Updated with Market Trends

The property market is constantly changing, so it's essential to stay updated with the latest trends and developments. You should keep an eye on the demand and supply trends in the region, the changing laws and regulations, and the economic conditions that may affect the market. Staying informed will help you make an informed decision and increase your chances of success.

In conclusion, it is essential to do your research before investing in any property. You should research the developer, the location, and the property's history before making any investment. KS Group has a strong presence in the market, and they have an excellent track record in the real estate industry. FIO Homes 2 is their flagship project, and it has earned a reputation for its quality construction and excellent amenities.

Investing in Punjab's property market can be a wise decision for first-time buyers, given the state's growing economy and infrastructure. However, it is crucial to choose the best builder in Tricity while considering all the tips and strategies mentioned above before investing in any property.

0 notes

Text

Chandigarh & Mohali- An Unequivocal Choice for Quality Education and Career Prospects

Owing to utopian infrastructure and thriving Smart City initiatives, Mohali and Chandigarh are changing the dynamics of the real estate industry not only in Tricity but across pan-India. These two cities offer the highest liveability quotient, phenomenal connectivity, grooming IT sector and state-of-the-art educational institutes.

These factors have garnered the attention of not only Indians but NRI’s as well. Thus, making the UT and Mohali, one of the preferred destinations to work, study and most importantly, reside. The level of education, or, rather I should say the quality of education is nonpareil in every respect.

The cities boast of having a diverse student population who come down from various neighbouring states only to gain world-class exposure. For many decades, parents have been sending their children to various schools and Universities of Chandigarh and Mohali, just to ensure their solid foundation and give them a secure future.

Top-Rated Schools

Chandigarh and Mohali boast of excellent education standards when it comes to admission of kids either in playschools, kindergartens and other classes. Getting enrolled in renowned educational schools having the superior infrastructure and par excellence teaching faculties accelerates the omnichannel grooming of your child.

Some of the distinguished schools are:

· Amity International School - Sector 79

· Learning Path School - Sector 67

· Gurukul World School - Sector 69

· Manav Mangal Smart School - Sector 64

· Yadvindra Public School ( YPS )

· Manav Rachna Interntional School - Sector 82 Aplha , IT City

· Delhi Public School

Give your little toddlers a great learning environment by enrolling them in top play schools such as Small Wonder and Euro Kids.

The presence of national and international-level schools has propelled the sale of 3BHK in Mohali. With a dream to provide world-class foundation years to their children, parents prefer to shift in Chandigarh and Mohali, rather than sending their children to Boarding Schools.

State-of-the-Art Universities

Chandigarh is home to the famous Punjab University and alma mater of Kalpana Chawla i.e. PEC (Punjab Engineering College). You need to put a lot of hard work to make your way to ISB, Mohali – one of the most preferred B-schools in India.

Mohali and Chandigarh are the educational hubs to many undergraduate, postgraduate and research Universities and Colleges. Students from all over the world compete to study in the finest colleges of Ayurveda, law, engineering, Home Science, Finance, Research, Medical and Agriculture, etc. in Mohali.

Some of the top-rated Universities with great on-campus placement records are:

· Punjab University

· Indian School of Business (ISB), Mohali

· IISER, Mohali

· National Institute of Pharmaceutical Education and Research

· Institute of Nano Science and Technology

· Punjab Engineering College (PEC)

· Chitkara University

· Chandigarh Group Of Colleges

· Chandigarh College of Architecture

· Home Science College

The real Estate Mohali is booming in these two cities not only due to high-quality education but due to great career aspects as well. The upcoming campuses of Amity Global Business School and Ashoka University have further triggered the sale of independent floors in Mohali to new levels.

Coaching Classes and Vocational Courses

Forget Kota and Delhi, Mohali and Chandigarh are the new names that are redefining the dynamics of the coaching industry. Apart from academic coaching such as AIEEE, Medical and CAT, Mohali offers you a great platform to live your hobbies/passion as well like music, dance, art and even sports.

The cities are a hub of many promising vocational courses in the field of Hotel Management, Fashion Designing, IELTS, Personality Development, TOEFL etc.

Rather than making the children stay in Hostels or PGs, parents want to stay with their kids and take care of them. The travel time (commuting time) is far less than other metropolitan cities.

This is the best time to shift in Mohali/Chandigarh for the betterment of your posterity. Your one wise decision today would offer great return over investments in the near future. After all, there is no second match or replacement to Chandigarh in terms of safety, security and amenities.

Shift to Mohali, Chandigarh Today

The moment children are done with their senior-secondary (+2) they shift to tier-I/II cities for their higher education. Eventually, they get employment in those big cities and never look back to their hometown.

Shifting right-away during their schooling days to Chandigarh and Mohali ensures that your child stays with you for a pretty long time. Also, people having transferable jobs or employees in defence, often tend to seek a safe and comfortable zone for their family.

What’s better than Mohali and Chandigarh that offers your best-in-class education, incredible medical facilities, seamless connectivity and above all, a safe and secure environment!

The ball is in your court! It’s time to make your pick and shift to Mohali or Chandigarh today. Your one decision can make or break your child’s future. Give life to your investment and property purchasing plans in Mohali/Chandigarh with us. For best deals and offers on 3BHK Flats in Mohali contact us today at 98777 06384 or email us at [email protected].

#3bhkinmohali#waveestatemohali#Omaxenewchandigarh#dlfhydepark#apartmentsinmohali#independentfloorsmohali#3bhkflatsinmohali#realestatemohali#propertyonmohali

0 notes

Text

Smart City Mission: Challenges Faced

The Government of India upon recognizing that a lack of appropriate governance and infrastructural capabilities negatively impacted the development of cities across the nation, decided to launch the ‘100 Smart Cities Mission’. Under the leadership of Prime Minister Narendra Modi, the Initiative came into light in June 2015. Due to the heterogeneous nature and varying requirements of every city, it was not feasible to provide a strict guideline for them to follow. This led to the cities being given the liberty to define their ‘smartness’ themselves.

With the freedom the Initiative provided and its ambitious goals, it also came into existence numerous challenges that it faced in its progression. Skyline Park, the best property in Tricity would like to point out a few of them:

The Transition to ‘Smart’

Identifying flaws and issues from the existing system of a city can be a treacherous task. Subsequently, embarking on the transition to a more innovative and ‘Smart’ city system can be daunting as well. Uniting the former functioning of a city with the contemporary methods devised for it is one of the biggest challenges faced by the governments and policymakers.

Issue of Funding

Most states and ULBs (Urban Local Bodies) that have the responsibility to make the change happen do not have the self – sufficiency to carry out many of the projects planned for the cities. Their inability to provide the services due to the lack of finances makes out to be an enormous challenge.

Difficulty in Policy – Building

Formulating a range of policies for cities with varying interpretation and sense of these development goals is another major hurdle. This creates a difficulty in making a clear and straight forward master plan which is key in planning for a smart city and implementing it. Unfortunately, 70-80 percent of Indian cities don’t have one.

Skyline Park, offering the best flats in Mohali, encourages the people living in and around Tricity to help in overcoming these challenges the best they can and wishes goodwill to this innovative initiative taken by the government.

0 notes

Text

Why Buy a Home From a Reputed Real Estates Agents?

Buying a home is a very important decision, it will definitely have an effect on your life as well as finances for the coming years. When you decide to buy a home, it is important to get help from a real estate agent. Not just any agent, but a local real estate agent that knows the place well and will help you gain confidence in buying a home as well as provide you with important guidelines.

The local agents usually have the details about the place you want to buy the home. It is essential to know each and every detail concerning the local demographics and the best source to get such information is from a local agent. It is necessary to seek the help of real estate agent would be the price of homes that are being sold. They have insider deep details concerning the market, the comparable homes that are on the market as well as other important details that will help you make the final decision whether to buy the home or not.

You can also choose to carry out research to compare the prices of the houses in the area, the real estate agents will provide you detailed information on the average price of the house, which is being sold out at as well as the time they have been on the market. After the result, you will make an offer that you are financially comfortable with.

Acrenacres have with success power-assisted there shoppers to accumulate, invest and afford their assets . Those who are looking for the reputed real estate agents, the acrenacres is the right place for you in Chandigarh, Mohali, Zirakpur, and Panchkula. We are the leading real estate agents, our services bring you the deals that suit most of your requirements.

We at Acrenacres will provide complete satisfaction to find your dream house in tricity. We make sure your expertise and receive the most effective service & rates for every single penny spent by you. We pride ourselves as we serve the most ideal possible value to our clients so that they can’t get even a single chance to regret their investment. For more information contact Acrenacres real estate agents in New Chandigarh, Zirakpur, Mohali, Mullanpur, Kharar and Panchkula at +919872409877 !!

#Real Estate Agents in Mohali#Real Estate Agents in New Chandigarh#Real Estate Agents in Zirakpur#Real Estate Agents in Panchkula

0 notes

Text

Why Chandigarh is best option for investment in commercial properties?

Commercial properties in Chandigarh are some of the most popular investment destinations for investors who are looking for premium properties with state-of-the-art infrastructure.

Here are a few reasons that make Commercial Properties in Chandigarh the best

· Chandigarh being a Union Territory under Central Government has a proficient and responsive administration.

· There are two main Secretaries attached to the Government in Chandigarh UT, namely, the Finance Secretary and the Home Secretary.

· Chandigarh is a standout amongst the best arranged urban areas in India with an incredible lifestyle satisfaction.

· It is referred to as the cleanest and greenest city in the province. Short distances between commercial and residential complexes, well-organized traffic and great recreational facilities are of the key features that attract investments. World leaders in commercial spaces, World Trade Center has also developed the WTC Chandigarh with premium commercial spaces and technologically advanced infrastructure.·· Presence of developed social and infrastructural foundation including power, water, streets network and close proximity to advanced Health and Educational Institutions makes commercial properties like WTC Chandigarh the most sought after ones.

· Chandigarh has been positioned among the pioneers in the e-Readiness Survey of Govt. of India. The e-Sampark and Jan Sampark Programs have been broadly hailed and assured IT support for the Society is the chief objective of the Administration.

· Another significant component that has brought Chandigarh on the realty map is its quickly developing infrastructure foundation. The proposed metro rail venture connecting Secretariat and Aerocity has fuelled the realty request in the area.

· Chandigarh also boasts of a rising IT Park and vibrant financial centers including the advent of market-giants, the World Trade Center. Alongside - Mohali and Panchkula (together known as Tricity) - is home to some major worldwide companies like Quark, Infosys, Dell, IBM, and Tech Mahindra.

· Real estate researches and market trends have already indicated towards the fact that more and more start-up companies are keen in investing and setting up a solid base in Chandigarh as it is comparatively cost-effective both in terms of human-resource and also property value.

Comments

Reference: http://thelostlife.over-blog.com/2019/06/why-chandigarh-is-best-option-for-investment-in-commercial-properties.html

0 notes

Text

CONSIDER THESE THINGS BEFORE GETTING A USED CAR LOAN

Buying a car is considered as milestone of success in an individual’s life especially in medium to lower income family units. A large youth population and middle income category has given rise to the demand for car finance of new and used car loan. In India, used car loan is expected to grow to over $8 billion of annual lending by the end of this year. Many lenders in the market disburse used car loans for both passenger cars as well as commercial vehicles. If you are planning of taking a “Used Car Loan” here is a list to consider these things before getting a used car loan to buy that dream car of yours.

• Total Budget: You can easily get on cloud nine with the excitement of getting a car but it is important to figure out the costs associated with purchasing a used car such as your ability to make a required down payment. If you have small savings for making a down payment then you will be charged with high interest rate resulting in tight budgets for the whole tenure. Therefore, consider your budget before looking for a suitable car.

• Loan Eligibility and documentation: Every lender has a set of eligibility requirements associated with some documentation while you “Apply For Used Car Loan”. Generally, a lender ask the borrower to be above age 18, Indian resident and if he/she is salaried then must be employed for minimum 2 years at current organization whereas business person has to be in current business for minimum 3 years. The documents include identity and residence proofs, income proofs as well as your credit score.

• Loan Quantum: The loan quantum is evaluated by the lender after they ascertains the condition of used car. The maximum loan money is limited to 70-80% of the valuation amount of that car. Your eligibility and the condition of car are important to get you a higher LTV without shelling much out of your pocket.

• Paperwork of Used Car: Always ensure yourself with the clean paperwork and for that you can also request insurer to check if that particular car had claimed any insurance against it in the past. Ask the seller about registration book, taxation book, PUC certificate and other important documents related to engine number, chassis number as well as date of delivery. The seller of the car has to notify RTO for the transfer of legal ownership of car to make the process easy on hands.

• Inspection of Car: The important thing to keep in mind before you get a used car loan is to check the condition of car so that there would no overhead charges when you are ready to ride it on roads. Always ask seller for test drive and have a check on service reports of the car. A used car loan takes a little bit more time to process than a new car loan as lender will send their evaluation officer to confirm the wear and tear of car so that loan terms may be fixed.

As you have to deal with the loan for some years so make a wise decision while shopping a car by financing rather than getting more excited. Do a proper research before applying for a used car loan with any lender.

#car loan eligibility#car loans interest rates#car loan interest rate comparison#car loan interest rate for all banks#used car loan interest rate for all banks#used car loan#used car loan interest rates#used car loans eligibility#used car loan offers#apply used car loans online#refinance your car#apply for car loan online#apply for used car loan online#apply for used car loan#instant car finance approval#online car loan approval#online used car loan approval#easy car loans#best car loans#car loan in tricity#car loan in chandigarh#used car loan in tricity#used car loan in chandigarh

0 notes

Text

OWNING A CAR IS JUST NOT A DREAM ANYMORE

Owning a car is like a dream of everyone, it exponentially increases the life quality. If you having your car then you don’t need to depend on anyone like in the morning waiting for your friend to pick you up, waiting for auto, or to face a surge of Uber or Ola. Time is money and money is time so it is always better to invest money where you can save time so utilise that time to make more money and having your car is something like that. Now the question is that should you go for a Brand-new car or a used car, in this matter many wiser people and investors in the market suggested to prefer a used car because car depreciation is very high. It will be like you step up with a brand-new car out of the showroom and the car got depreciated from its original price.

Buying a used car in good condition is a wiser choice as its depreciation will be not that much as it was already depreciated from its showroom price and if you plan to change the car after some time so your pocket will get hurt much. In the market used car loan are easily available and even the “Used Car Loan Interest Rate” is something similar to a new car loan so it will also not affect much to let you choose to go for a used car.

Features and Benefits of Used Car Loan

• Collateral Free: Mostly banks and financial institutions let you have this loan collateral-free, they can have the legal rights on your car only till the time you pay off the full loan amount.

• Interest Rate: Used car loan interest rate is lesser than a personal loan or any other unsecured loan.

• Online Processing: No need to go to the bank and standing in the queue, nowadays every financial institution having their website where you can apply used car loans online and their executives will contact you and even visit you in person and let you have the loan amount quickly if you are eligible for it.

• Loan Tenure can be flexible: Here you can choose your loan tenure from 12 months to 60 months as per your convenience and your repayment capacity.

• Maximum financing: In this case, most of the banks feel secure while processing loan amount as they having legal rights on your car so most of the finance will be more than 80% of the car amount which make less burden on your pocket.

Documents required for Used Car Loan

• Proof of age like Aadhar Card or Passport

• Identification Proof and Address Proof like Aadhar Card, Driving Licence, Voter Card or Passport

• Passport size photograph of the applicant

• Income Proof (Income Tax Return)

• Last 6 months bank statement

So what you waiting for little self-pampering is right when you put so much efforts into your work and daily routine. Just go online and check your used car eligibility and if you are eligible then “Apply Used Car Loan Online” and your dream of having your car becomes very easy to live.

#car loan eligibility#car loan interest rate#car loan interest rate comparison#car loan interest rate for all banks#used car loan#used car loan interest rate#used car loan eligibility#used car loan offers#apply used car loan online#refinance your car#apply for loan#apply for loan online#apply for car loan online#instant car finance approval#online car loan approval#easy car loan#best car loan#car loan in tricity#car loan in chandigarh#used car loan in chandigarh#loans in chandigarh

0 notes

Text

CAR LOAN THAT CAN HELP YOU TO LIVE YOUR DREAM!

Everyone dreams of buying a dream car. Even you have dreamt of the same? If yes, then gone are the days when turning dreams into reality is a challenge. It’s easier than ever before. It is your gateway to the security and the safety that a four-wheeler offers over any other mode of transport. You can soon be the proud owner of the vehicle that you wish without spending a single penny. Pay it back in installments whenever you want. Let us take a quick tour of the car loans to know it better.

Benefits of Car Loan

• The first and topmost benefit of this type of loan is that you can purchase your dream car without worrying about the budget. No need to compromise with the model because of the high price, because now you can take a loan and directly buy a vehicle you wish to buy or dreaming.

• The vehicle will be your tension-free and hassle-free. No need to pay the entire amount of vehicle right away. You can simply apply for the loan, pay the money to the dealer, and enjoy your brand new car with no tension. You can pay the amount in small installment for the next few months of the year. In this way, you will not feel the pressure of paying the whole amount in a single payment.

• You can keep the capital in your hand. Everyone needs liquid assets in their bank accounts for emergency purposes. If you spend the whole amount in for purchasing the vehicle, then you will have no money left for the urgent scenarios. In this case, the loan amount can help you to save the amount of money and keep the money in hand.

Interest Rates

The “Car Loan Interest Rate For All Banks” usually starts from as little as 10.50% and can get up to much higher ranges. Even though most of the banks charge almost a similar amount of interest but still there is little difference in interest rates from one bank to the other. When you are finalizing the bank make sure you have done all the research about the car loan interest rates comparison.

Eligibility Criteria

• The work or the business experience that one has should be more than 1 year.

• The person should be salaried or should at least be self-employed to get the loans.

• The vehicle that you wish to buy with the money should not be more than 10 years

old.

• The person who is taking the loan should at least be 21 years of age or more. People younger than 21 cannot take it on their name.

Overview

So from all the above details that you have to know about getting car loans. It is easy to get the loan from the bank which is nearest to you so if you feel like buying vehicles then don’t hesitate. Just head to the bank to “Get a Car Loan” and buy the best one which you wanted to buy.

#car loan eligibility#car loan interest rates#car loan interest rate comparison#car loan interest rate for all banks#used car loan#used car loan interest rates#used car loan eligibility#used car loan offers#apply used car loan online#refinance your car#apply for car loan online#instant car finance approval#online car loan approval#easy car loan online#best car loan online#car loan in tricity#used car loan in tricity#used car loan in chandigarh#loans in chandigarh#loans in tricity chandigarh#apply for loan#apply for loan online#get a car loan#get a car loan online

0 notes

Text

BUY USED CAR EASILY BY AVAILING A LOAN WITH A LOW-INTEREST RATE

Car is now like the status symbol of the current world. Apart from that, it is seen that many people have got the dream to go for it, but they don’t have the money for it. Most of the people belong to the average family background with an average salary job. For that, they don’t get enough savings, and at last, they need to drop the idea of having a car. But now they don’t have to as many banks are offering loans for a used car.

Why get a used car?

A used car is also known as a second-hand car, and it is the best way to get your first own car at a budget price. You need to keep in mind that used car is not always 4-5 years back car, but now you can get a few months to 1 year back car underused car tag.

Why is it right to go for the used car?

If you are thinking about buying a car within a fixed budget, then you can go for the used car. It is seen that when you are going for a used car, you get a lot of benefits. These things are listed below for you.

The value of the used car does not decrease drastically anymore.

You need to pay less money for Insurance.

You need not have to pay any registration fees.

The maintenance of the car is less.

Is it worth of loan?

When you are buying any car for yourself or your family, you always have a fixed budget for that. But if you don’t have that much budget, then you can go for the “Used Car Loan”. These kinds of loans are readily available to you from the bank. As the car is used so, you don’t need to take the loan of a considerable sum and can get a small number of used car loan.

What to check before going for the used car?

The very first thing that you want to go for when you are going for the loan is to check the used car loan interest rates. You can see that many banks offer you the best loans, along with other benefits as well. So for that reason, it is always being advised to check the different “Used Car Loan Interest Rates” and then decide about which is good to go with.

Documents to show to the bank

While you are going for the car loan, then you need to show the following documents to the bank to avail the loan. They are mentioned here.

Show the last few months of salary slips.

Give the Xerox of the last few months of your passbook.

Show the address proof.

Show the ID proof.

Give the income tax return copy.

After all these things only, the bank will offer you the car loan for the used cars. You can easily apply it to the bank by providing all the required documents for it.

#car loan eligibility#car loans interest rates#car loan interest rate comparison#car loan interest rate for all banks#used car loan#used car loan interest rates#used car loans eligibility#used car loan offers#used car loan in tricity#used car loan in chandigarh#apply used car loans online#refinance your car#apply for car loan online#instant car finance approval#online car loan approval#easy car loans#best car loans#car loan in tricity#car loan in chandigarh#apply for loan#apply for loan online#loans in chandigarh

0 notes

Text

GET A CAR LOAN EASILY

Leading car companies cited that, over 80% of the new cars acquired by the car loan. A car loan is a personal loan, a lender loans the borrower (you) the cash it takes to purchase a vehicle. In return, the borrower has to pay the lender total loan amount with interest (in monthly/ quarterly) until the amount is fully paid off. A personal loan also is not very secure; the paperwork is done based on pure trust.

On the other hand, a car loan is a secured loan; when the loan amount not paid, the vehicle will be repossessed and sold to pay off the debt. “Car loans” are also called the Auto loan. All the car loans have specific time, generally, between 24 to 60 months; some are for more extended periods. Car loans usually include taxes and fees gradually added with the loan amount.

When a consumer applies for a car loan at the local bank, the borrower should specify his/her required amount. Then borrower will place information for his/her financial condition, starting with income, employment proof or a tax return copy. The credit report is a critical report for the part of the lender before lending the amount.

The repayment process consists of two parts, the principal (the original amount of money taken as a loan) and the Interest. Interest depends on three factors-

● Price of the car.

● Whether the car is first hand or not.

● The credit rating of the buyer.

The interest rate and the car price are inversely proportional. The vehicle stays in possession of the buyer, but the ownership remains with the lender of the money until all of the installments paid with interest. Minimum age of the applicant for the car loan should be eighteen years, and the maximum limit for salaried personnel is sixty years; therefore, for a self-employed individual, it's sixty-five years. To apply for the car loan, the individual should show the lender an income of Rs 3 lakh per annum. The individual should be a resident of the country and should have stayed minimum 1-year in his/her current residence. In some top banks, the eligibility criteria is slightly different; the minimum age should be 21 years, and the maximum is 70 years, the minimum annual income should be 2.4 lakhs; he/she should be a continuous employee for 1-year and if self-employed then he/she should be in business line for at least 3 years. Used car loans are also available to acquire a second-hand car at used car loan interest rates which vary between 9.5% to 17%. The flexible repayment tenure is up to 7 years, and the lender funds 100% of the car's evaluation, both salaried and a business individual can “Apply For Used Car Loan”. A considerable number of financing companies, banks, and lenders are offering used car loans as it has a very high market nowadays. Eligibility criteria to apply for used car loans at used car loan interest rates is almost the same and has a lot of advantages.

#car loan eligibility#car loans interest rates#car loan interest rate comparison#car loan interest rate for all banks#used car loan#used car loan interest rates#used car loans eligibility#used car loan offers#apply for used car loan#apply used car loans online#refinance your car#apply for car loan online#instant car finance approval#online car loan approval#easy car loans#best car loans#car loan in tricity#used car loan in tricity#used car loan in chandigarh

0 notes

Text

HOW TO APPLY FOR USED CAR LOANS ONLINE?

Having your car is a dream for many people. Many companies all bring new cars every year, but with the rise in the cost of automobile each year, it is challenging for one to bear those expenses. As the price is more, so many people can’t think of getting a car as the price is too high for them to afford.

How to get a car for yourself?

If you want to own a car, then there are various ways, but the best way for that is going for the used car. The best way to own a car of your own without spending much is by going for a used car. With the used car, you can get all the things that a vehicle must have but that too in less money. Many people want to get a used car by taking a loan, but they mostly wonder if they ever get the loan or not.

For them all, you need to know that every bank offers a loan for a used car. But to “Apply Used Car Loans Online” you need to look at the eligibility. After you fulfil the eligibility, you can go for the car loan from the bank

Eligibility criteria

If you want to apply used car loans online, then here is the list of things you need to look at.

1. The person must be doing the job in any private or government sector.

2. The age of the person must be between 21 years to 60 years.

3. The person must have got nearly two years of work experience with six months of the current employer.

4. You need to have a valid mobile number.

5. Your salary must be nearly Rs 20,000 monthly.

These are the things that you need to look at to get the best loan for the used car and then you can buy the vehicle for yourself.

Can a used car refinance?

If you are thinking about “Refinance Your Car” then you can take up a new loan for the used car by which you can pay the rest amount of the car loan. But in case of paying up things, you can go for securing the car as well as can paid off all the fixed monthly payments which are done over some time.

When anyone asks about to refinance your car, it means that they are asking to retake the auto loan to save the money. The real reason why people want to refinance the car is that the bank offers less interest rate for your car. When you avail the car, it can decrease the monthly payments as well as it can free up the cash for all other financial obligations. Apart from that all, you also will get an extended period in which you can repay all the money in a better way.

So, when you are thinking to get a used car via a loan, then these are the things that you can avail for yourself after you get a used car.

#car loan eligibility#car loans interest rates#car loan interest rate comparison#car loan interest rate for all banks#used car loan#used car loan interest rates#used car loans eligibility#used car loan offers#apply used car loans online#refinance your car#apply for car loan online#instant car finance approval#online car loan approval#easy car loans#best car loans#used car loan in tricity

0 notes

Text

APPLY FOR USED CAR LOANS TO GET THE CAR YOU ALWAYS WANTED

In this modern era, where the world is hell-bent on providing you with various comforts, possessing a vehicle of your own may be considered as a basic amenity. It enables you to travel at your own leisure in comfort without going through the hassle of public transport. However, getting a car of your own is not so easy as any decent car costs a fortune. However, you can always buy a used car.

Reasons To Buy A Used Car

● You'll be saving a lot of money by buying a used car. The value of new cars depreciate very fast and it's pointless to buy a brand new car.

● Buying used cars are reliable too, as most modern cars are designed to last for a long time. Thus, you don't have to worry about used cars not living up to their life expectancy.

● You can always obtain a vehicle history report to obtain details of the vehicle which may be significant, such as the history of accidents and so on.

● You will be provided with favourable finance rates and terms. You can easily “Apply For Used Car Loan Online”.

Opting for a loan for a used car is a value for money option, as you can opt for a loan for wide range vehicles ranging from hatchbacks to SUVs. You can often get loans up to 95% of the car value with flexible EMI repayment options and quick disbursal. You can nowadays pay your loans online or can also drop a cheque. You can also “Refinance Your Car” and obtain better interest rates, or consolidate other loans into a single loan, or reduce the amount you need to pay in a single month or just extend the tenure. Also, refinancing helps in reducing any potential risk which may incur on applying for a loan.

How To Apply For A Loan

Nowadays, it's very easy to apply for a loan. You can apply for a loan online and get all the necessary details too enabling you to select an option which is best suited for you. There are several EMI options for you to choose from so that you never suffer from lack of options. You can also find EMI calculators online that will give you an idea about the monthly payments you need to make to repay the loan. You can also call the customer care number of the respective loan provider to get the necessary details you require.

Conclusion

Don't let your financial status prevent you from buying your favourite car. With the advent of easy loans, it's now possible to easily achieve your dream car. Before applying for a loan, do check all the necessary prerequisites and details so that you choose the loan which is best suited for you. There are several types of loans and there's a loan for everybody so that no one gets left out in their pursuit of obtaining a car of their dreams.

#car loan eligibility#car loans interest rates#car loan interest rate comparison#car loan interest rate for all banks#used car loan#used car loan interest rates#used car loans eligibility#used car loan offers#apply used car loans online#refinance your car#apply for car loan online#instant car finance approval#online car loan approval#easy car loans#best car loans#car loan in tricity#car loan in chandigarh

0 notes