#Binance programmers

Explore tagged Tumblr posts

Text

How to Build a Cryptocurrency from Scratch in 2025

The cryptocurrency industry continues to evolve in 2025, driven by innovation in decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain scalability solutions. With institutional investors entering the market and the rise of regulatory frameworks across the globe, the landscape is more stable yet increasingly competitive. Businesses and developers seeking new digital assets must understand cryptocurrency development principles and align their token strategies with market trends.

This article is a complete guide to building your cryptocurrency development from scratch in 2025. Learn the essential steps, tools, technologies, and expert tips to launch a successful digital asset in today’s evolving blockchain ecosystem.

What is Cryptocurrency?

Cryptocurrency is a digital asset that leverages blockchain technology for decentralization, security, and transparency. Unlike traditional fiat currencies, cryptocurrencies operate on a peer-to-peer network without a central authority. They can be used for payments, investments, and even governance in decentralized ecosystems.

Cryptocurrencies are built on blockchain protocols, typically utilizing consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS). The choice of consensus mechanism impacts transaction speed, security, and scalability—factors that must be considered during cryptocurrency development.

Understanding the Coin and Token

While people often use "coin" and "token" interchangeably, they have distinct differences in the crypto world.

Coin:

1. Cryptocurrencies operate on own blockchain (e.g., Bitcoin, Ethereum).

2. Functions as a primary currency in its ecosystem.

3. Requires extensive cryptocurrency development for scalability and security.

Token:

1. Built on existing blockchains like Ethereum, Binance Smart Chain, or Solana.

2. Tokens represent assets, utilities, or governance rights.

3. Easier to create with standardized smart contract frameworks.

Why Should You Create Your Own Cryptocurrency?

Developing a crypto token opens a world of opportunities, whether for fundraising, ecosystem growth, or business innovation. Some key benefits include:

1. Decentralized Payments: Businesses can establish crypto-based payment systems.

2. Fundraising & Crowdfunding: Tokens help raise capital through initial coin offerings (ICOs) or security token offerings (STOs).

3. Governance & Utility: Projects can implement decentralized decision-making.

4. Brand Recognition: A unique crypto token enhances brand identity within blockchain ecosystems.

One-by-One Guide to Cryptocurrency Development

1. Define Your Crypto Token’s Purpose

Before diving into development, establish the token’s functionality:

1. Utility Token: Used within a platform (e.g., Ethereum’s ERC-20 tokens).

2. Security Token: Represents an asset or stake in a company.

3. Governance Token: Enables voting rights in decentralized systems.

2. Choose the Right Blockchain

Each blockchain offers unique benefits:

1. Ethereum: Popular for smart contract development (ERC-20, ERC-721).

2. Binance Smart Chain: Lower transaction fees and fast processing.

3. Solana: High-speed transactions with scalable architecture.

3. Develop the Smart Contract

Smart contracts define token rules, transactions, and security measures. Using Solidity (Ethereum) or Rust (Solana), developers create programmable contracts that govern token interactions.

4. Implement Tokenomics

Tokenomics determines supply, utility, and incentives for users. Consider:

1. Total Supply: Fixed vs. mintable tokens.

2. Distribution: ICO, airdrops, staking rewards.

3. Burn Mechanism: Token deflation strategies.

5. Secure Your Token

Ensuring security is paramount. Conduct audits to prevent vulnerabilities like reentrancy attacks or logic flaws.

6. List Your Token on Exchanges

To gain liquidity, list your token on decentralized (DEX) or centralized (CEX) exchanges. Platforms like Uniswap, Binance, and Coinbase facilitate token trading.

7. Market and Build Community

A successful cryptocurrency project thrives on community engagement. Utilize social media, influencers, and forums to establish credibility and attract users.

Launch Your Own Cryptocurrency with Us

If you're looking for a cryptocurrency launch, developing with an experienced cryptocurrency development company like Security Tokenizer simplifies the process. From smart contract creation to exchange listings, expert guidance ensures that your token complies with security standards and market demands.

A professional team can assist with:

1. Smart Contract Audits: Prevent security vulnerabilities.

2. Token Listing & Liquidity Strategies: Ensure broad adoption.

3. Marketing & Community Building: Drive awareness and trust.

Final Thoughts

Building a crypto token in 2025 requires technical expertise, strategic planning, and market awareness. Whether you're a startup or an established enterprise, leveraging cryptocurrency development best practices will shape the success of your digital asset.

By following this comprehensive guide, you can navigate the complexities of blockchain and confidently launch your own cryptocurrency. Whether for innovation, fundraising, or decentralized solutions, a well-designed token strengthens blockchain ecosystems and drives financial inclusivity.

#Cryptocurrency Development Company#Cryptocurrency Development Services#Cryptocurrency Development#Coin Creation#Create a crypto coin#cryptocurrency creation services#coin development company#coin creation services#crypto coin development company#crypto coin creation services

0 notes

Text

Binance: $1.5 Billion AI Unicorn Collapse, All Indian Programmers Impersonating!

https://www.binance.com/en/square/post/24723372076545

Wow

0 notes

Text

IT ministry, Binance Academy launch nationwide blockchain education drive

Listen to article In a landmark move to promote digital literacy and future-ready skills, Binance Academy has partnered with Pakistan’s Ministry of Information Technology and Telecommunication (MoITT) to roll out a nationwide blockchain education initiative. The programme is set to train 300 university educators and reach over 80,000 students across 20 institutions by 2026. The collaboration…

0 notes

Text

Mastercard, Visa, and the Stablecoin Endgame: Why the Payment Giants Just Blinked

The future of money isn’t coming. It’s here—and it’s branded Mastercard and Visa.

In the last 48 hours, two of the most powerful payment networks on the planet made their stablecoin ambitions loud and clear. Mastercard is now enabling users of MetaMask, OKX, Binance and more to pay merchants directly in stablecoins. Meanwhile, Visa has partnered with Bridge (a Stripe-acquired startup) to roll out stablecoin-linked cards across Latin America.

This isn’t just a crypto headline. It’s a macroeconomic shift.

When the incumbents adopt the disruptor’s model, the revolution has either won—or been defanged.

Let’s unpack what’s really going on.

The Quiet Takeover of Stablecoins

Stablecoins, once a niche tool for arbitrage in the crypto markets, now move more money than Visa and Mastercard combined. That’s not hyperbole—it’s a data point. In 2024 alone, stablecoins processed over $27 trillion in volume, according to multiple on-chain analytics sources.

The logic is simple: they offer dollar-denominated value, 24/7 transferability, near-zero fees, and no middlemen. They’re programmable, globally accessible, and increasingly interoperable with real-world services.

Now, imagine you’re Visa or Mastercard. You don’t issue currencies, but you do intermediate 170+ billion transactions a year. You thrive on being the connective tissue between banks, merchants, and consumers. But here comes a technology that disintermediates you. What do you do?

Simple. You embrace it. On your terms.

Why Mastercard and Visa Are Moving Now

Timing is everything in finance, and the timing here is no accident. U.S. lawmakers are inching closer to stablecoin legislation. The European Commission has already folded stablecoins into its MiCA framework. Thailand's SEC has greenlit USDC and USDT for trading. Regulation breeds legitimacy—and legitimacy invites the giants.

Mastercard’s latest partnerships are designed to normalize stablecoin spending at 150 million merchants. Crucially, this isn't limited to “crypto-friendly” shops. It means you could pay for your groceries, rent, or even a pint with USDC—if your merchant accepts Mastercard.

Visa’s approach is similarly pragmatic. Through Bridge, it enables card issuers in Argentina, Mexico, and other parts of Latin America to issue reloadable Visa cards that draw from stablecoin balances. From the merchant’s perspective, it’s just another Visa transaction. On the backend, however, it's crypto doing the heavy lifting.

This is a category shift, not just a product launch.

A Trojan Horse in Reverse

Here's where it gets interesting—and uncomfortable.

Stablecoins were supposed to unseat the old financial order. Peer-to-peer money. Bankless finance. A global ledger not subject to central gatekeepers. Yet here we are, watching Mastercard and Visa become the on-ramps, off-ramps, and maybe even the referees of stablecoin commerce.

It’s a Trojan horse in reverse: the old system isn’t being disrupted—it’s absorbing the disruptor.

Ask yourself:

Who decides which stablecoins get accepted?

Who decides which wallets are compliant?

Who earns yield on the underlying reserves?

The answer increasingly isn’t “the people” or “the protocol.” It’s a few private firms with deep regulatory ties and legacy infrastructure.

And for all their rhetoric about innovation, these firms are in it for the same reason Circle or Tether are: float income. Sitting on tens of billions in customer funds invested in U.S. Treasuries earns real money. Circle alone earned $1.6 billion last year just on that. Now imagine if Mastercard or Visa gets into the issuing game themselves.

We’re not just witnessing product innovation. We’re witnessing a shift in monetary power.

Latin America: The Real Testbed

If stablecoins are the internet of money, Latin America is the broadband stress test.

The region is ground zero for currency instability, dollarization, and fintech adoption. Millions already use stablecoins—often via underground Telegram groups and gray-market OTC desks—to hedge against inflation and get paid in dollars. Visa and Bridge are now formalizing what’s already happening informally.

This is smart. Visa isn’t trying to change behavior—it’s just making it legible and compliant.

By rolling out stablecoin-linked cards in Argentina, Mexico, Colombia, and others, Visa is acknowledging that for much of the developing world, the dollar is already king, and stablecoins are its new operating system. Bridge’s infrastructure abstracts away blockchain complexity and lets developers spin up apps that rival Chime or Revolut—without ever touching a traditional banking stack.

This isn’t just “financial inclusion.” It’s parallel finance. And it’s coming from the top down.

Is This What We Wanted?

Let’s not pretend the cypherpunks are cheering.

Stablecoins were born out of the desire to exit legacy rails. Now they’re being used on those very rails, governed by the same few corporations. Worse, the very qualities that made stablecoins attractive—censorship-resistance, decentralization, programmability—are getting traded for usability and scale.

And yet… what did we expect?

Users don’t care about ideology. They care about convenience. Most don’t want to manage a seed phrase or worry about self-custody. They want fast payments, low fees, and reliability. If Visa or Mastercard can offer that—with a stablecoin backend instead of Swift or ACH—they win.

But here's the trade-off: Programmable money in the hands of Mastercard is not liberation. It's surveillance with better UX.

Imagine a future where your stablecoin wallet is KYC’d, your transactions are scored for risk, and Mastercard can block or reverse payments “for your safety.” That’s not just speculative—it’s structurally inevitable once compliance becomes the moat.

We saw this movie with Facebook’s Libra. It failed because it overreached. But Visa and Mastercard are succeeding because they’re embedding, not replacing.

Stablecoins Will Become the Default Dollar

Here’s where this goes.

In five years, most digital dollars won't be in bank accounts. They’ll be in wallets—backed by USDC, PYUSD, or something similar. Your salary might be paid in stablecoins. Your rent collected through Visa-linked stablecoin rails. Your savings earning yield not in a Chase account, but through a token you never withdraw.

And guess who intermediates it all?

Not your local bank.

But Mastercard. Visa. Stripe. And the APIs behind them.

This doesn’t mean crypto failed. It means crypto won—but not on the terms its early evangelists imagined.

Stablecoins aren’t the alternative system. They’re becoming the system.

This is your wake-up call, not a celebration.

If we want an open, user-sovereign financial system, we can’t just cheer when the big guys show up. We have to build alternatives that scale without compromising their core values. Otherwise, the promise of programmable, permissionless money becomes just another feature of Web2.5.

Liked this piece? We don’t run subscriptions. No paywalls, no ads. But if you got value from this, consider buying us a coffee on Ko-Fi. Your support keeps our work independent and accessible for all.

→ Donate on Ko-Fi

Thanks for reading. Let’s keep asking the hard questions.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

Why Your Trading Strategy Needs a Tick-Level Upgrade: A New Era with Alltick API

In the blink of an eye, markets shift. Prices fluctuate. Opportunities vanish. For traders, speed is survival, and outdated data feeds are a silent killer. If your strategy relies on delayed or aggregated market data, you’re already behind. Discover how Alltick API redefines real-time trading with tick-level precision—and why it’s time to level up.

The Problem: Why 15-Minute Delays Are Costing You Millions

Most trading platforms and APIs serve data that’s 15 minutes old. Imagine driving a race car while watching a GPS map from the last lap—you’d crash. Similarly, delayed data forces you to:

Miss microtrends (e.g., sudden crypto price spikes).

Execute trades based on stale order book snapshots.

Lose profits to slippage and missed arbitrage windows.

Tick-level data solves this by capturing every market movement in real time. But building a reliable data pipeline is complex, costly, and time-consuming—until now.

The Solution: Alltick API—Your Gateway to Zero-Latency Trading

Alltick API isn’t just another data feed. It’s a mission-critical infrastructure for traders, quants, and developers who refuse to compromise. Here’s how it transforms your workflow:

Real-TimeEdge, Delivered Instantly

Forget waiting. Alltick API streams live tick data via WebSocket and REST endpoints, syncing with global exchanges like NYSE, Binance, and CME in milliseconds.

Monitor bid-ask spreads, trade volumes, and liquidity shifts as they happen.

Trigger lightning-fast orders using programmable alerts (e.g., "Buy when BTC hits $X").

Eliminate guesswork with raw, unfiltered market depth.

Build Smarter Strategies with Historical Precision

Tick data isn’t just for live trading. Alltick’s 10+ years of archived data lets you:

Backtest algorithms against extreme volatility (think 2020’s COVID crash or Bitcoin’s 2021 surge).

Uncover hidden patterns in order flow and execution timing.

Optimize HFT strategies down to the millisecond.

One API, Every Market

Trade stocks at 9:30 AM EST? Hedge with forex at midnight? Alltick API covers stocks, forex, crypto, futures, and options across 100+ global exchanges. No more juggling multiple data sources—consolidate your tools and focus on profits.

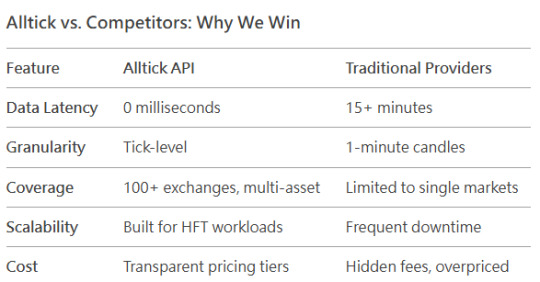

Alltick vs. Competitors: Why We Win

Real Traders, Real Results

Quant Fund AlphaEdge: “Alltick’s crypto tick data helped us spot a 0.3-second arbitrage window between exchanges—netting $2M monthly.”

Retail Trader Jane L.: “I reduced slippage by 40% after switching to Alltick’s real-time forex feeds.”

FintechStartup ChainTrade: “Their API integration took 8 minutes. Now our app users get live data—no delays.”

Stop Trading Blind. Start Trading Ahead. With Alltick API, you’re not just accessing data—you’re gaining a strategic weapon. Whether you’re a solo trader or a hedge fund, the future of trading is tick-level.

Ready to upgrade? Claim Your Free Trial Now →

0 notes

Text

Building a Custom Cryptocurrency Coin: Everything You Need to Know

Cryptocurrency has revolutionized the financial world, offering a decentralized, transparent, and secure means of transactions. Whether you're an entrepreneur, a developer, or an investor looking to build a custom cryptocurrency coin, understanding the process is crucial. This guide will take you through the essential steps, from conceptualization to launch, ensuring your crypto project is a success.

What is a Cryptocurrency Coin?

A cryptocurrency coin is a digital asset that operates on its own blockchain and is used as a medium of exchange. Unlike tokens, which are built on existing blockchains, coins require independent blockchain development.

Key Features of Cryptocurrency Coins:

Decentralization – Eliminates the need for a central authority.

Transparency – Transactions are recorded on a public ledger.

Security – Advanced cryptographic techniques ensure safe transactions.

Programmability – Smart contract functionality can be embedded.

Why Create a Custom Cryptocurrency Coin?

1. Financial Freedom

Creating your coin allows control over the monetary system without intermediaries.

2. Use Cases and Applications

Your coin can serve various purposes, including:

Payments and transactions

Smart contracts execution

Asset tokenization

Reward programs

3. Innovation and Market Demand

A unique cryptocurrency can introduce new features and solve real-world problems, setting it apart from existing digital currencies.

Steps to Build a Custom Cryptocurrency Coin

Step 1: Define Your Objectives

Before you start coding, clearly outline:

Purpose of the coin

Target audience

Unique features

Compliance and regulatory considerations

Step 2: Choose a Blockchain Platform

Decide whether to create your blockchain from scratch or fork an existing one. Common options include:

Bitcoin Fork – Secure but lacks smart contract functionality.

Ethereum Fork – Supports smart contracts but has scalability issues.

Binance Smart Chain (BSC) – Offers low fees and high transaction speed.

Step 3: Design the Consensus Mechanism

Consensus mechanisms ensure network security and transaction validation. Popular types include:

Proof of Work (PoW) – Used by Bitcoin, requires miners to solve complex problems.

Proof of Stake (PoS) – Used by Ethereum 2.0, relies on validators staking coins.

Delegated Proof of Stake (DPoS) – Enhances scalability by electing delegates to validate transactions.

Step 4: Develop the Blockchain Infrastructure

This involves:

Setting up a genesis block (the first block in the blockchain)

Creating block validation rules

Implementing node communication protocols

Developing a wallet application for users

Step 5: Coding the Coin

Programming languages like C++, Python, Solidity, and Rust are commonly used. Essential components include:

Blockchain nodes

Transaction scripts

Cryptographic hash functions

Smart contracts (if applicable)

Step 6: Test Your Blockchain

Before launching, conduct extensive testing to ensure:

Security vulnerabilities are addressed.

Smart contracts function correctly.

Network nodes synchronize properly.

Step 7: Deploy the Blockchain

Once testing is complete, deploy the blockchain by setting up:

Network nodes

Mining or staking mechanisms

Block explorers for transparency

Step 8: Launch and Market Your Coin

A successful launch requires:

Listing on cryptocurrency exchanges.

Developing a strong community.

Implementing marketing strategies such as social media campaigns, airdrops, and partnerships.

Challenges in Cryptocurrency Development

1. Regulatory Compliance

Different countries have varying legal frameworks for cryptocurrencies. Ensure your coin adheres to regulations to avoid legal complications.

2. Security Risks

Cybersecurity threats like hacks and 51% attacks pose significant risks. Implement robust security measures, including multi-signature wallets and encrypted transactions.

3. Scalability Issues

High transaction volumes can slow down the network. Consider implementing solutions like sharding or Layer 2 scaling techniques.

Future Trends in Cryptocurrency Development

1. Central Bank Digital Currencies (CBDCs)

Governments worldwide are exploring digital currencies to integrate blockchain technology into the traditional financial system.

2. Interoperability Solutions

Bridges between different blockchains, such as Polkadot and Cosmos, enable seamless asset transfers across networks.

3. Eco-Friendly Mining Methods

Sustainable blockchain solutions, such as green mining and energy-efficient consensus mechanisms, are becoming more popular.

4. AI-Integrated Smart Contracts

The combination of artificial intelligence and blockchain can enhance smart contract automation and decision-making processes.

Conclusion

Building a custom cryptocurrency coin is a complex but rewarding endeavor. By understanding the technical, economic, and regulatory aspects, you can create a successful digital currency that meets specific needs. Whether for payments, smart contracts, or decentralized applications, a well-planned cryptocurrency can make a significant impact in the blockchain industry.

As the industry evolves, staying informed about trends and innovations will ensure your cryptocurrency remains relevant and competitive in the market.

0 notes

Text

Binance's Billion-Dollar Settlement Boosts DOJ Criminal Recoveries to Record Levels

Binance Settlement Leads to Record-Breaking DOJ Criminal Recoveries Amid Legal Challenges. Binance, the world's largest cryptocurrency exchange, has reached a massive billion-dollar settlement with U.S. authorities, fueling a surge in the Department of Justice’s (DOJ) criminal recoveries to record-breaking levels. The settlement stems from allegations that Binance violated U.S. money laundering laws, and its resolution has left an undeniable mark on the legal and financial landscape. This settlement marks a significant milestone in the DOJ’s aggressive approach to cracking down on illicit financial activities involving digital currencies.

This settlement has a multifaceted consequence that goes beyond Binance's financial and operational modifications. The billions recovered by the DOJ as part of this settlement will help to bolster its criminal recovery efforts. The spike in DOJ recoveries is a direct outcome of the US government's increased vigilance against crypto-related financial crimes. As the cryptocurrency market grows in size and complexity, Binance's settlement has paved the way for more scrutiny of significant sector players. Also Read: pig-butchering-scams-just-got-smarter-the-40-surge-in-crypto-fraud The Binance settlement exemplifies a broader trend in which cryptocurrency exchanges and financial service providers face severe regulatory pressure. The DOJ's criminal recovery programme seeks to track, freeze, and recover unlawful funds, with a concentration on cryptocurrency-related offences. By holding crypto titans like Binance accountable, the DOJ not only safeguards the integrity of the financial system, but also sends a strong message about the significance of adhering to anti-money laundering regulations. With this settlement, the DOJ established its ability and willingness to hold global organisations accountable, regardless of market dominance. The billions collected in this case are expected to help law enforcement agencies prosecute other comparable offences, enhancing the DOJ's role in ensuring justice for financial crimes committed across borders. The increase in criminal recoveries marks a new era in the government's ability to detect and prosecute financial crimes involving innovative technologies such as blockchain and cryptocurrency. In light of this historical settlement, many industry analysts predict Binance and other cryptocurrency platforms will face even stricter regulations in the future. Compliance standards will most certainly change to reflect growing worries about financial crimes, making it critical for cryptocurrency enterprises to prioritise openness and strictly conform to global financial legislation. Despite the fines and penalties involved with the settlement, Binance has pledged to improve its compliance policies. As part of the settlement, Binance committed to take additional steps to improve its anti-money laundering (AML) standards, reporting methods, and collaboration with international authorities. These efforts are intended to restore trust and guarantee that the platform continues to comply with US financial rules. While the settlement may have substantial repercussions for Binance, the entire cryptocurrency sector is paying close attention. Other exchanges and platforms may soon face similar scrutiny as the DOJ steps up its criminal recovery operations. The government's commitment to protecting the financial environment and ensuring that cryptocurrency operations follow the law cannot be emphasised, especially as the market grows. Read the full article

#BinanceLegalIssues#BinanceSettlement#cryptocompliance#cryptocurrencylegalnews#cryptocurrencysettlement#DOJCriminalRecoveries#DOJcryptocurrencycrackdown#DOJfinancialrecovery

0 notes

Text

Changpeng Zhao Early Life and Net Worth: The Vision Behind Binance and Blockchain Innovation

Changpeng Zhao, widely recognized as CZ, is one of the most influential figures in the cryptocurrency industry. As the founder and former CEO of Binance, CZ played a pivotal role in transforming Binance into the largest cryptocurrency exchange globally. From a programmer to a trailblazer in digital finance, his journey is marked by ambition, resilience, and innovation. Although CZ stepped down as…

0 notes

Text

The Evolution of dApps: Why PEAQ Blockchain is a Game-Changer

Decentralized applications (dApps) are transforming industries, creating new paradigms of transparency, trust, and efficiency. These applications leverage blockchain technology to operate without a central authority, offering users unparalleled control over their data and interactions. Over the years, the evolution of dApps has been marked by several milestones, and now, PEAQ blockchain is emerging as a significant disruptor in this space. This article delves into the journey of dApps and highlights why PEAQ blockchain development stands out as a game-changer

Understanding dApps: The Basics

Decentralized applications (dApps) differ from traditional applications in three fundamental ways:

Decentralization: Unlike traditional apps hosted on centralized servers, dApps run on a blockchain, ensuring no single point of failure.

Transparency: Their code is often open-source, fostering community trust.

Smart Contracts: These self-executing contracts automate processes, reducing the need for intermediaries.

The journey of dApps began with the introduction of blockchain technology, particularly Bitcoin in 2009. While Bitcoin itself isn't a dApp, it laid the groundwork for smart contracts and decentralized ecosystems. Ethereum's launch in 2015 introduced programmable smart contracts, enabling developers to create a diverse range of dApps, from finance to gaming.

The Evolution of dApps: Key Milestones

1. Early Beginnings with Bitcoin

The Bitcoin blockchain was the first to showcase the potential of decentralized technology. However, its capabilities were limited to financial transactions.

2. Ethereum’s Breakthrough

Ethereum revolutionized dApps by introducing the Ethereum Virtual Machine (EVM) and smart contracts. This innovation allowed developers to write complex applications on the blockchain, giving birth to dApps like CryptoKitties, which showcased the concept’s viability in 2017.

3. Multi-Chain Ecosystems

The rise of alternative blockchains like Binance Smart Chain, Solana, and Polkadot addressed Ethereum’s scalability and cost issues. This phase saw an explosion of dApps in decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming.

4. The Current State: Beyond Finance and NFTs

Today, dApps are venturing into supply chain management, healthcare, identity verification, and more. However, challenges like scalability, high energy consumption, and security concerns remain.

Challenges in the dApp Ecosystem

Despite their potential, dApps face several hurdles:

Scalability: As networks grow, transaction speeds can slow, and costs rise.

Interoperability: Connecting different blockchain networks is still a challenge.

User Experience: Many dApps have steep learning curves for non-technical users.

Regulatory Concerns: The decentralized nature of dApps raises questions about legal compliance and governance.

Enter PEAQ Blockchain: A Game-Changer for dApps

PEAQ blockchain is positioning itself as a transformative force in the dApp ecosystem. Its unique approach and innovative features address the pain points of traditional blockchain platforms, making it an ideal choice for developers and users.

1. Machine Economy Integration

PEAQ is designed to power the Machine Economy—a concept where devices and machines can autonomously trade, negotiate, and collaborate. By enabling machines to act as autonomous economic agents, PEAQ opens up new possibilities for IoT-based dApps.

2. Scalable and Energy-Efficient

Scalability and energy efficiency are core to PEAQ's design. Unlike energy-intensive proof-of-work blockchains, PEAQ employs advanced consensus mechanisms that minimize environmental impact while maintaining high throughput.

3. Built for Interoperability

Interoperability is a key focus for PEAQ blockchain. The platform supports seamless communication between different blockchains, enhancing dApp functionality and user experience. Developers can create cross-chain applications without worrying about compatibility issues.

4. Decentralized Identity (DID) Solutions

PEAQ offers robust decentralized identity (DID) frameworks, empowering users to control their identities securely. This feature is crucial for industries like healthcare, where privacy and security are paramount.

5. Developer-Friendly Ecosystem

PEAQ provides developers with intuitive tools and resources to create and deploy dApps efficiently. Its developer-centric approach reduces barriers to entry, fostering innovation.

Why PEAQ Stands Out

The unique features of PEAQ blockchain position it as a leader in the evolving dApp ecosystem:

Empowering the Machine Economy: By facilitating machine-to-machine (M2M) interactions, PEAQ redefines automation and connectivity.

Sustainability at the Core: Its energy-efficient model aligns with global sustainability goals, a critical factor in today’s climate-conscious world.

Focus on Real-World Applications: PEAQ prioritizes practical use cases, bridging the gap between blockchain technology and everyday solutions.

Use Cases of PEAQ-Driven dApps

Smart Cities: Automating traffic management, energy distribution, and public services through autonomous machines.

Healthcare: Securing patient data and enabling interoperable health records with decentralized identity solutions.

Supply Chain: Enhancing transparency, traceability, and efficiency across global supply networks.

Finance: Streamlining peer-to-peer lending, insurance, and asset management.

The Future of dApps with PEAQ

PEAQ blockchain is not just a platform; it’s a vision for the future of decentralized technology. As the Machine Economy gains traction, PEAQ’s capabilities will become indispensable for developers and industries. By addressing scalability, interoperability, and sustainability challenges, PEAQ paves the way for a new era of dApps that are not only efficient but also inclusive.

The evolution of dApps is a testament to the transformative power of blockchain technology. With PEAQ at the forefront, the possibilities are endless. From autonomous machines to decentralized finance and beyond, PEAQ is set to redefine how we interact with technology and each other.

Conclusion

The journey of dApps is still in its early stages, but platforms like PEAQ blockchain development company are accelerating progress. By overcoming existing challenges and unlocking new opportunities, PEAQ is empowering developers and businesses to create impactful decentralized applications. As we move toward a more connected and autonomous future, PEAQ’s role as a game-changer in the dApp ecosystem will only grow stronger.

#peaq development#peaq blockchain development company#depin development services#depin development company#peaq network

0 notes

Text

BitPower: Leading the decentralized financial ecosystem and redefining the global digital economy

In the dynamic world of blockchain technology, BitPower is an innovator in the decentralized finance (DeFi) space. BitPower is built on the principles of transparency, accessibility, and inclusion, and aims to reshape the digital economy through secure and efficient financial interactions around the world. Let’s take a deep dive into BitPower’s core components in the crypto space.

BitPower Loop: The Future of Lending

BitPower Loop is a blockchain lending protocol based on Ethereum EVM. Users can lend or borrow cryptocurrencies at zero risk. By pledging their crypto assets within BitPower Loop, users can make short-term, risk-free trades and loans to earn rewards. This decentralized approach bypasses the barriers of traditional banks, providing instant access to funds without credit checks or lengthy approval processes. BitPower Loop, with its transparent and efficient operations, provides a secure alternative to traditional lenders, enhancing global financial inclusion.

BitPower Savings: Redefining Cryptocurrency Banking

BitPower Savings is a crypto savings protocol running on Binance Smart Chain. It is called "Crypto Bank on the Blockchain" and provides services similar to traditional banks, but with higher decentralization, security and transparency. Users can deposit their crypto assets into smart contracts to earn savings returns and enjoy customized savings plans. BitPower Savings eliminates intermediaries, reduces costs, improves efficiency, and provides users with transparent records and real-time profit calculations, allowing users to easily monitor their savings.

BitPower Lending: Safe and Efficient Lending

BitPower Lending is a decentralized lending protocol that aims to provide users with safe and efficient lending services. It uses smart contracts to achieve peer-to-peer asset lending without third-party trust. Borrowers can pledge their crypto assets to obtain loans, while lenders can earn interest by providing digital assets. BitPower Lending has the characteristics of decentralization, programmability, security and openness, allowing users to easily and confidently participate in decentralized finance.

BitPower DAO: Best Decentralized Governance

BitPower DAO stands for Decentralized Autonomous Organization in the BitPower ecosystem. It is fully managed by smart contracts and operates independently of traditional centralized structures or intermediaries. Through democratic decision-making, token issuance, fund management, and community governance, BitPower DAO fosters a decentralized ecosystem where members actively participate in shaping the future of the ecosystem.

With its innovative protocol and commitment to decentralization, BitPower paves the way for a more inclusive, transparent, and efficient financial landscape. Whether you are a depositor, borrower, or investor, BitPower can provide you with a personalized decentralized solution. #BitPower

Please visit BitPower Site official website:https://www.bitpower.space/

0 notes

Text

BitPower: Leading the decentralized financial ecosystem and redefining the global digital economy

In the dynamic world of blockchain technology, BitPower is an innovator in the decentralized finance (DeFi) space. BitPower is built on the principles of transparency, accessibility, and inclusion, and aims to reshape the digital economy through secure and efficient financial interactions around the world. Let’s take a deep dive into BitPower’s core components in the crypto space.

BitPower Loop: The Future of Lending

BitPower Loop is a blockchain lending protocol based on Ethereum EVM. Users can lend or borrow cryptocurrencies at zero risk. By pledging their crypto assets within BitPower Loop, users can make short-term, risk-free trades and loans to earn rewards. This decentralized approach bypasses the barriers of traditional banks, providing instant access to funds without credit checks or lengthy approval processes. BitPower Loop, with its transparent and efficient operations, provides a secure alternative to traditional lenders, enhancing global financial inclusion.

BitPower Savings: Redefining Cryptocurrency Banking

BitPower Savings is a crypto savings protocol running on Binance Smart Chain. It is called "Crypto Bank on the Blockchain" and provides services similar to traditional banks, but with higher decentralization, security and transparency. Users can deposit their crypto assets into smart contracts to earn savings returns and enjoy customized savings plans. BitPower Savings eliminates intermediaries, reduces costs, improves efficiency, and provides users with transparent records and real-time profit calculations, allowing users to easily monitor their savings.

BitPower Lending: Safe and Efficient Lending

BitPower Lending is a decentralized lending protocol that aims to provide users with safe and efficient lending services. It uses smart contracts to achieve peer-to-peer asset lending without third-party trust. Borrowers can pledge their crypto assets to obtain loans, while lenders can earn interest by providing digital assets. BitPower Lending has the characteristics of decentralization, programmability, security and openness, allowing users to easily and confidently participate in decentralized finance.

BitPower DAO: Best Decentralized Governance

BitPower DAO stands for Decentralized Autonomous Organization in the BitPower ecosystem. It is fully managed by smart contracts and operates independently of traditional centralized structures or intermediaries. Through democratic decision-making, token issuance, fund management, and community governance, BitPower DAO fosters a decentralized ecosystem where members actively participate in shaping the future of the ecosystem.

With its innovative protocol and commitment to decentralization, BitPower paves the way for a more inclusive, transparent, and efficient financial landscape. Whether you are a depositor, borrower, or investor, BitPower can provide you with a personalized decentralized solution. #BitPower

Please visit BitPower Site official website:https://www.bitpower.space/

For more information about Bitpower, please contact us on Telegram: https://t.me/Anna79589

0 notes

Text

BitPower: Leading the decentralized financial ecosystem and redefining the global digital economy

In the dynamic world of blockchain technology, BitPower is an innovator in the decentralized finance (DeFi) space. BitPower is built on the principles of transparency, accessibility, and inclusion, and aims to reshape the digital economy through secure and efficient financial interactions around the world. Let’s take a deep dive into BitPower’s core components in the crypto space.

BitPower Loop: The Future of Lending

BitPower Loop is a blockchain lending protocol based on Ethereum EVM. Users can lend or borrow cryptocurrencies at zero risk. By pledging their crypto assets within BitPower Loop, users can make short-term, risk-free trades and loans to earn rewards. This decentralized approach bypasses the barriers of traditional banks, providing instant access to funds without credit checks or lengthy approval processes. BitPower Loop, with its transparent and efficient operations, provides a secure alternative to traditional lenders, enhancing global financial inclusion.

BitPower Savings: Redefining Cryptocurrency Banking

BitPower Savings is a crypto savings protocol running on Binance Smart Chain. It is called "Crypto Bank on the Blockchain" and provides services similar to traditional banks, but with higher decentralization, security and transparency. Users can deposit their crypto assets into smart contracts to earn savings returns and enjoy customized savings plans. BitPower Savings eliminates intermediaries, reduces costs, improves efficiency, and provides users with transparent records and real-time profit calculations, allowing users to easily monitor their savings.

BitPower Lending: Safe and Efficient Lending

BitPower Lending is a decentralized lending protocol that aims to provide users with safe and efficient lending services. It uses smart contracts to achieve peer-to-peer asset lending without third-party trust. Borrowers can pledge their crypto assets to obtain loans, while lenders can earn interest by providing digital assets. BitPower Lending has the characteristics of decentralization, programmability, security and openness, allowing users to easily and confidently participate in decentralized finance.

BitPower DAO: Best Decentralized Governance

BitPower DAO stands for Decentralized Autonomous Organization in the BitPower ecosystem. It is fully managed by smart contracts and operates independently of traditional centralized structures or intermediaries. Through democratic decision-making, token issuance, fund management, and community governance, BitPower DAO fosters a decentralized ecosystem where members actively participate in shaping the future of the ecosystem.

With its innovative protocol and commitment to decentralization, BitPower paves the way for a more inclusive, transparent, and efficient financial landscape. Whether you are a depositor, borrower, or investor, BitPower can provide you with a personalized decentralized solution. #BitPower

Please visit BitPower Site official website:https://www.bitpower.space/

For more information about Bitpower, please contact us on Telegram: https://t.me/Anna79589

0 notes

Text

La communauté de bénévoles de Token Mithrandir se développe dans le domaine de l'éducation financière

L'éducation financière que Token Mithrandir transmet est particulièrement utile pour tous les acteurs de notre communauté, aussi bien pour ceux qui fournissent du contenu que pour ceux qui participent à nos ateliers et à notre programme de travail bénévole. Car ils sont constamment formés dans le cas des volontaires, que ce soit par le biais de nos activités ou d'activités extérieures, mais qui se connectent à notre travail et au monde qui les entoure.

Se développer en tant que communauté d'entreprises est essentiel pour plusieurs raisons :

Leréseautage: les liens établis au sein d'une communauté d'affaires peuvent ouvrir des possibilités de collaboration, d'alliances stratégiques et de mentorat qui peuvent être cruciales pour la croissance d'une entreprise.

Accès aux ressources: les communautés offrent souvent un accès à des ressources partagées telles que la formation, le financement et les connaissances d'experts, ce qui peut être bénéfique, en particulier pour les petites et moyennes entreprises.

Échange de connaissances: L'interaction avec d'autres entrepreneurs permet l'échange d'idées, de bonnes pratiques et de connaissances sur les défis du marché. Ce type de collaboration peut conduire à l'innovation et à l'amélioration continue.

Soutien émotionnel et motivationnel: l'appartenance à une communauté d'entrepreneurs peut fournir un système de soutien dans les moments difficiles, ce qui peut être crucial pour la résilience de l'entrepreneur.

Implication dans la communauté: en se développant en tant que communauté, les entreprises peuvent s'impliquer davantage dans des initiatives locales, ce qui non seulement améliore leur image, mais contribue également au développement économique et social de la région.

Visibilité et marketing: faire partie d'une communauté active peut accroître la visibilité d'une entreprise sur le marché, ce qui peut attirer de nouveaux clients et des opportunités de vente.

En bref, grandir dans la communauté d'affaires du Token Mithrandir ne renforce pas seulement les entreprises associées à notre projet, mais favorise également un environnement de coopération et de développement durable dans toute la communauté Cardano, ainsi que dans le monde financier traditionnel.

Olivier Rishi Mata, volontaire de Token Mithrandir en République Démocratique du Congo, participe à une conférence organisée par Binance Exchange. C'est un excellent exemple de la façon dont les volontaires de Token Mithrandir sont formés à différents aspects.

#Olivier#Olivier Rishi Mata#congo#RDC#Binance#opinion#Tokne Mithrandir#Token MITHR de Cardano#aspects#Education#Educacion#DEFI#Blockchain

1 note

·

View note

Text

0 notes

Text

How to Create a Meme Coin in 5 Simple Steps

Creating a meme coin is a fun way to enter the world of cryptocurrency. If you’re ready to make your own meme coin, follow these five simple steps to get started:

1. Decide on Your Concept

It is recommended to come up with the concept of your meme coin as well as determine what you will offer to deliver something new to the world. Meme coins are based on a funny meme, a pop culture reference, or something entirely original. Make sure your concept resonates with your target audience.

2. Choose a Blockchain Platform

The first thing you have to establish is the blockchain platform that you would wish to use in creating your meme coin.Ethereum and Binance Smart Chain are popular choices because clients can create custom tokens on those chains.Ethereum uses ERC20 tokens, while Binance Smart Chain uses BEP20 tokens. Choose the platform you believe is most suitable to use and ensure it suits the features of your coin

3. Develop Your Token

After that, you need to decide on the platform to launch it, and after the decision is made you will have to issue your token. This entails creating a smart contract where you set the rules of your coin for instance the total supply, the name and the symbol of the coin. If you are not fluent in coding, it will be wise to use the token generator tool or seek the services from a programmer. It is vital to apply stress on your token before launching through testing on a test network.

4. Launch Your Coin

With your token ready, it’s time to go for a launch. Deploy your smart contract on the chosen blockchain platform. After that your meme coin is live and used for transactional purposes. You’ll need to add liquidity to make your coin tradeable on decentralized exchanges (DEXs) if you want people to buy and sell it.

5. Promote Your Coin

The last is to promote the meme coin which means that it should be marketed. Create a page on social media sites and forums to promote your coin and build a community. Engaging with potential users and spreading the world about the product will help increase interest and drive adoption.

Conclusion

Coming up with a meme coin requires a little bit of innovation, programming and most importantly marketing. If you have any idea in your mind, follow these five procedures and be a hero in the Cryptocurrency world. Note that it is not only about creating your coin but also about creating its community and constantly communicating with your audience. I hope this guide was useful for your memecoins expeditions!

#cryptocurrency#cryptocurrencies#web3#erc20#memecoin2024#meme coin guid#meme coin development#meme coin investment#meme coin

0 notes

Text

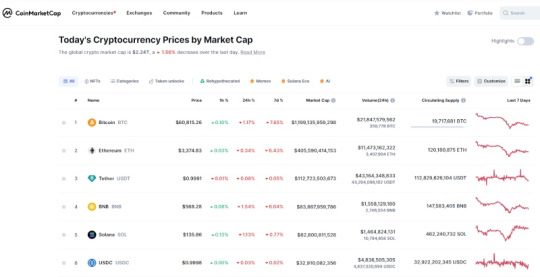

What is Coinmarketcap? Top Featured DePIN Projects on Coinmarketcap

DePIN Projects on Coinmarketcap highlight innovative initiatives using decentralized physical infrastructure networks. These projects integrate IoT, blockchain, and AI, providing enhanced efficiency, security, and scalability.

In the rapidly evolving world of cryptocurrencies and blockchain technology, staying informed about market trends, project developments, and investment opportunities is crucial. Coinmarketcap has emerged as a go-to platform for crypto enthusiasts, investors, and researchers alike, offering a comprehensive suite of tools and data to navigate this complex landscape. This article delves into Coinmarketcap and explores some featured DePIN Projects on Coinmarketcap.

What is Coinmarketcap?

Coinmarketcap is a leading cryptocurrency data aggregator and analysis platform that has become an indispensable resource in the digital asset ecosystem. Founded in May 2013 by IT programmer Brandon Chez, the platform has grown to be one of the most trusted sources of cryptocurrency information globally.

Coinmarketcap was born out of the need for reliable and centralized information about cryptocurrencies. In its early days, the crypto market was fragmented, with limited resources for price tracking and market analysis. Brandon Chez recognized this gap and created Coinmarketcap to provide a single source of truth for cryptocurrency data.

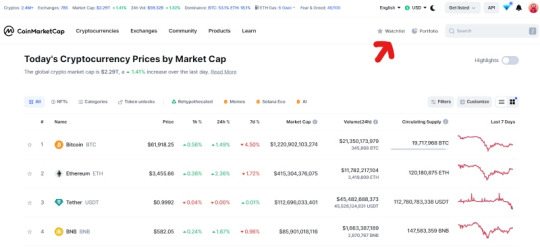

In April 2020, Coinmarketcap was acquired by Binance Capital Management, one of the world's largest cryptocurrency exchanges. This acquisition marked a significant milestone in the platform's history, providing it with additional resources and expertise to expand its services.

Since the acquisition, Coinmarketcap has continued to innovate and improve its offerings. The platform has introduced new features, enhanced its data accuracy, and expanded its educational content to cater to the growing demands of the crypto community.

Core Features and Data Offerings of Coinmarketcap

Coinmarketcap's success lies in its ability to provide a wide range of data points and features that cater to diverse user needs. Some of its core offerings include:

Real-time price tracking: Up-to-the-minute price information for thousands of cryptocurrencies.

Market capitalization rankings: A comprehensive list of cryptocurrencies ranked by their total market value.

24-hour trading volume: Data on the amount of cryptocurrency traded in the past day.

Circulating supply information: Details on the number of coins currently in circulation for each cryptocurrency.

Historical price charts: Interactive charts showing price movements over various time frames.

These features provide users with a holistic view of the cryptocurrency market, enabling informed decision-making and analysis.

What is Coinmarketcap used for?

Coinmarketcap serves as a multifaceted tool for various stakeholders in the cryptocurrency ecosystem. Its utility extends far beyond simple price tracking, offering a range of functionalities that cater to different user needs.

Market Research and Analysis

One of the primary uses of Coinmarketcap is for conducting comprehensive market research and analysis. Investors, analysts, and researchers leverage the platform's extensive data sets to:

Identify market trends: By analyzing price movements, trading volumes, and market capitalizations, users can spot emerging trends in the crypto market.

Compare cryptocurrencies: The platform allows for easy comparison of different cryptocurrencies based on various metrics, helping users evaluate potential investments.

Track market sentiment: Through features like the community feed and price alerts, users can gauge the overall sentiment surrounding specific cryptocurrencies.

This depth of information enables users to make data-driven decisions and develop informed investment strategies.

Portfolio Management

Coinmarketcap offers robust portfolio management tools that allow users to track their cryptocurrency holdings efficiently. Key features include:

Portfolio tracking: Users can input their holdings and monitor their overall portfolio value in real-time.

Performance analysis: The platform provides insights into portfolio performance, including gains and losses over different time periods.

Diversification overview: Users can visualize their portfolio allocation across different cryptocurrencies, helping them maintain a balanced investment strategy.

These tools are particularly valuable for investors managing diverse cryptocurrency portfolios, offering a centralized view of their investments.

ICO and Token Sale Information

For those interested in participating in Initial Coin Offerings (ICOs) or token sales, Coinmarketcap serves as a valuable resource. The platform provides:

ICO calendars: A comprehensive list of upcoming and ongoing ICOs, including key details and timelines.

Token sale metrics: Information on token distribution, pricing, and fundraising goals for various projects.

Project overviews: Detailed descriptions of ICO projects, including their technology, team, and roadmap.

This information helps potential investors evaluate ICO opportunities and make informed decisions about participating in token sales.

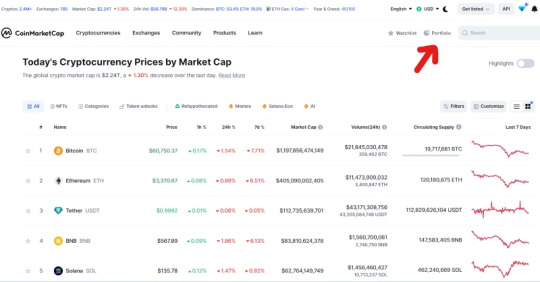

How to sign up for a CoinMarketCap account?

Creating a CoinMarketCap account unlocks the platform's full potential, providing you with enhanced tools and features. Here's how to register:

Step 1: Visit the CoinMarketCap website coinmarketcap.com

Step 2: Click "Sign Up" in the top right corner of the homepage.

Step 3: Enter your information and create a password

Step 4: Click "Create an account" to submit your registration information.

Step 5: Verify your account

How to use Coinmarketcap?

CoinMarketCap isn't just for searching information—it's packed with powerful tools to enhance your crypto investment journey.

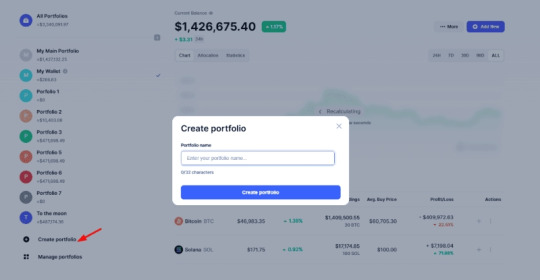

Portfolio Tracking

Track your portfolio's performance based on live market prices directly on CoinMarketCap. Here's how to create a portfolio:

Step 1: Click Portfolio on the homepage.

Step 2: Click Create Portfolio and name it.

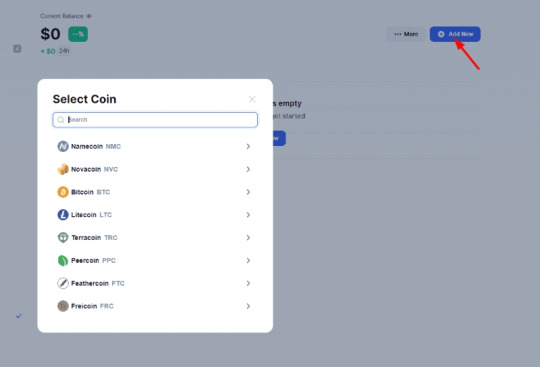

Step 3: Choose Add New and search for your assets.

Step 4: Select your order type (Buy/Sell/Transfer), then enter the transaction details (price, quantity, date) and any notes. Click Add Transaction.

Step 5: Repeat for other assets.

With your portfolio on CoinMarketCap, you can:

Easily update asset performance.

Visualize your portfolio's performance over time with price charts.

See your portfolio allocation and profit/loss for each asset.

This integrated approach means you won't need to juggle multiple platforms—everything you need is on CoinMarketCap.

Watchlist

If you frequently trade different assets, the Watchlist feature is a time-saver. Create a list of coins or tokens you're interested in to stay informed about their market movements and make timely decisions.

To create a Watchlist:

Step 1: Scroll down to the list of coins/tokens on the homepage.

Step 2: Click the Star next to any coin/token you want to track.

Step 3: Click Watchlist to see your selected assets.

Calendars

The fast-paced crypto market requires staying informed. CoinMarketCap's calendar features keep you up-to-date with:

Free Airdrops: Partnered projects offering crypto airdrops.

ICO Calendar: Initial Coin Offering events.

Polkadot Parachains: Auctions and crowdloans on Kusama and Polkadot networks.

Events Calendar: All the latest happenings in the crypto market.

Featured DePIN projects on Coinmarketcap

Here's a look at some notable projects featured on CoinMarketCap:

Helium: By transforming wireless connectivity through a vast network of hotspots, Helium enables IoT device connectivity and asset tracking. After transitioning to the Solana blockchain, it continues to expand its global reach.

Hivemapper: A decentralized alternative to Google Maps, Hivemapper is reshaping the geo-mapping landscape by crowdsourcing visual and geolocation data via dashcams. With an extensive network of contributors, it has mapped over 110 million kilometers globally.

Filecoin: A pioneer in decentralized file storage, Filecoin offers diverse storage solutions for individuals and businesses, supporting platforms like Internet Archive, Audius, and Huddle01.

Render (RNDR): Streamlining rendering processes, Render connects GPU providers with users in need of rendering services, rewarding participants with RNDR tokens.

MetaBlox: Providing free and secure WiFi roaming worldwide, MetaBlox leverages cryptographic algorithms to ensure reliable connectivity through its network of WiFi hosts.

DIMO Network: By revolutionizing vehicle ownership by gathering telemetry data, DIMO empowers users to collect, utilize, and monetize their vehicle information while also enabling developers to create innovative mobility solutions.

Akash Network: Disrupting the cloud computing industry, Akash Network offers cost-effective cloud services by connecting providers with buyers in a decentralized marketplace, utilizing underutilized data centers.

HealthBlocks: Integrating the DePIN model into healthcare, HealthBlocks promotes healthy living by rewarding users for making positive choices and sharing biometric data.

In conclusion, Coinmarketcap serves as a valuable resource for cryptocurrency enthusiasts, investors, and projects seeking visibility in the digital asset space. By providing comprehensive market data, rankings, and project listings, Coinmarketcap enables users to make informed decisions and stay updated on the latest trends in the crypto market. For those interested in exploring innovative projects in the Web3 space, particularly in the realm of DePIN, consider visiting the U2U Network for more information and opportunities.

0 notes