#Bitcoin For Dummies

Explore tagged Tumblr posts

Text

TGW 03x13 Bitcoin for Dummies

Pretty in pink.

#diane lockhart#christine baranski#the good wife#tgw 3x13#bitcoin for dummies#season 3#diane in pink#fashion appreciation post

5 notes

·

View notes

Photo

TGW 03x13 Bitcoin for Dummies

Kalinda has Alicia's back, always.

#kalinda sharma#dana lodge#the good wife#tgw 3x13#bitcoin for dummies#season 3#archie panjabi#monica raymund

137 notes

·

View notes

Text

Simple Steps For Investing In Stocks

Much is based on our 2008-2010 real estate investing experience. The company must have a stock dividend reinvestment plan (DRIP). This will eliminate the risk involved in putting money into a risky new start up company (the type of company that is going to change the world- they are just too hard to find) A big advantage of gold jewelry is that you’re able to enjoy the beauty of the piece while…

youtube

View On WordPress

#investing#investing-apps#investing-definition#investing-for-beginners#investing-for-dummies#investing-in-bitcoin#investing-in-dogecoin#investing-in-real-estate#investing-in-stocks#Youtube

0 notes

Text

Dummy Trump Says BITCOINS ARE LITERAL COINS & Wants Them Made in America!!!

youtube

5 notes

·

View notes

Photo

TGW 03x13 Bitcoin for Dummies

You visit me in prison?

Every Friday.

#diane lockhart#will gardner#diane x will#the good wife#tgw 3x13#bitcoin for dummies#season 3#the perfect couple#everything but the sex#christine baranski#josh charles

117 notes

·

View notes

Text

Coinbase Rejects $20M Ransom Amid Data Breach

🚨 Coinbase Rejects $20M Ransom Amid Data Breach! 🚨

So, what happens when you mix hackers with crypto fever? You get a spicy data breach that looks like it slipped out of a bad action movie – with a twist! Spoiler: the twist is Coinbase saying, “Nah, we're not paying that ransom.” 💸

“Hackers demanded a $20 million ransom from the company, which Coinbase refused to pay." - Brian Armstrong, CEO

In a plot thicker than a blockchain, Coinbase's cybersecurity fiasco has left users (yes, even a Sequoia Capital executive) in the lurch. Who thought cyber threats would borrow a page from “Ocean's Eleven” with insider involvement? 🕵️♂️💻

The aftermath? A delightful $400 million tab for remediation, as Coinbase aims to restore shattered trust while hackers twiddle their thumbs, still reviewing “hack for dummies.” It’s like watching a car crash in slow motion – you can't look away! 🚗💨

But don't just take our word for it! Check out the full story of this crypto drama! Read here and learn how the lessons from past misfortunes like Mt. Gox could reshape the future. 📉

Coinbase Data Breach: Implications and Responses

If this doesn’t scream red flags for crypto investors, I don’t know what does. 🛑 So hold onto your wallets, fam, and let’s get discussing! How could this affect our beloved $BTC, $ETH, and everything in between? Drop your thoughts below! 👇

Disclaimer: The information here is for entertainment purposes and not financial advice. Always do your own research!

#CryptoNews #Coinbase #DataBreach #Bitcoin #SequoiaCapital #Blockchain #InvestSmart #CryptoInsights

0 notes

Text

Best Cryptocurrency Books: Bitcoin Blockchain Crypto Investment Guide

Cryptocurrency Investment: A Comprehensive Introduction to Bitcoin, Blockchain, and Best Cryptocurrency Books for Beginners Embarking on the journey to understand cryptocurrency investment is crucial with emerging digital currencies, where books like “Cryptocurrency All-in-One for Dummies” and “Blockchain Revolution” serve as invaluable resources. These guides provide beginners with the…

0 notes

Photo

TGW 03x13 Bitcoin for Dummies

Sometimes the ball just bounces funny.

I like that.

#kalinda sharma#elsbeth tascioni#the good wife#tgw 3x13#bitcoin for dummies#season 3#archie panjabi#carrie preston#kalinda x elsbeth#kalinda knows all

109 notes

·

View notes

Note

gen q as someone recieving similar asks, could you go into more detail about the ask virus? like, what's the code/file it downloads?

I'm not the most skilled when it comes to stuff like Viruses, very much a "Better safe than sorry" kind of guy.

My post may have been a knee jerk reaction to FireFox downloading a dummy HTML file when I attempted to go to the user's blog in a different tab. Once the file started loading, I closed out the tab and removed the dummy file immediately.

I was quick to call it a "virus" since literally anyone spamming your inbox with messages like "Help me out!" should be considered highly suspect and, especially when their blog auto-downloaded a file to my computer, it could be outright malicious. I could be wrong though! It may not have been. HTML files generally can't just activate code on your computer like Javascript can- This totally could've been just FireFox being a bit weird. But even that's enough to get me to block outright and freak me out enough to post about it lmao.

Plus I've been hacked before on Tumblr by clicking something wrong. Without my password or even 2FA they were able to spam all my friends with bitcoin messages so liiiikeee I'm biased. Don't click on links from anonymous people on Tumblr.

#Thanks for the ask!#Again it's likely not something to be super worried about?#But I've changed my passwords#logged out and logged back in#all those safety precautions anyway#not about to let that happen again lmao

0 notes

Text

Sure, here's a draft for the article based on your request:

How Does Bitcoin Work for Dummies - paladinmining.com

Understanding how Bitcoin works can seem daunting at first, but with a bit of guidance, it becomes much clearer. Bitcoin is a decentralized digital currency that operates without a central bank or administrator. It was invented by an unknown person or group of people using the name Satoshi Nakamoto in 2009.

What is Bitcoin?

Bitcoin is a form of digital currency that allows transactions to be made directly between users without the need for intermediaries like banks. Transactions are verified by network nodes through cryptography and recorded in a public ledger called a blockchain.

How Does Bitcoin Mining Work?

Mining is the process of verifying transactions and adding them to the blockchain. Miners use powerful computers to solve complex mathematical problems. When a miner successfully solves a problem, they get to add a block to the blockchain and are rewarded with newly minted bitcoins.

To start mining, you'll need specialized hardware and software. One popular platform for mining is Paladin Mining (https://paladinmining.com), which offers robust solutions for both beginners and experienced miners.

The Blockchain

The blockchain is a distributed ledger that records all transactions ever processed. Each block in the chain contains a number of transactions, and every time a new transaction occurs on the Bitcoin network, a record of that transaction is added to a ledger. This ledger is then verified by miners, who ensure its accuracy.

Security and Anonymity

Bitcoin transactions are secure and anonymous. While the blockchain is transparent, meaning anyone can see the transactions, the identities of the users remain private. This anonymity makes Bitcoin attractive for those who value privacy.

Conclusion

Bitcoin is a fascinating technology that has the potential to revolutionize the way we think about money and finance. By understanding the basics of how it works, you can better appreciate its value and potential. If you're interested in mining, platforms like Paladin Mining (https://paladinmining.com) can provide the tools and resources you need to get started.

Feel free to let me know if you need any adjustments!

加飞机@yuantou2048

Paladin Mining

paladinmining

0 notes

Photo

TGW 03x13 Bitcoin for Dummies

Kalinda’s chemistry in The Good Wife “Bitcoin for Dummies”

#kalinda sharma#diane lockhart#alicia florrick#will gardner#the good wife#christine baranski#archie panjabi#julianna margulies#josh charles#bitcoin for dummies#tgw 3x13#season 3#Elaine Middleton#Dylan Stack#Dana Lodge#bao shuwei#kalinda saves the day again

97 notes

·

View notes

Text

⚡️🚨 The Great Crypto Cool Down: Trading Volume Drops by a Whopping 70%! 🚨⚡️

So, fellow crypto warriors, grab your snacks and let’s talk about that juicy 70% drop in trading volume that’s got us all sitting on the edge of our digital seats. 😱📉 Can you feel the excitement draining faster than my willpower when I see a pizza? 🍕

The crypto market was buzzing with high-octane energy post-election, but now it seems like even Bitcoin ($BTC) and Ethereum ($ETH) need a nap. 💤 With $ETH's market cap chilling at a mere $219.78 billion, it’s like watching your favorite meme fade out of existence. Can someone just send a rescue tweet? Twitter has never looked so sad! #SadBoysClub

"I believe Bitcoin could reach $250,000 within the next 12 months, propelled by that ever-mysterious halving event!" - Tom Lee, the eternal optimist of Fundstrat. 🌈✨

But wait, it gets better (or worse, depending on your glass-half-full mentality). Analysts are suggesting that this drop isn't just a "phase"—it’s like your crypto portfolio after a bad day at the races. One minute you're on top, and the next, you're Googling "how to sell my crypto for Dummies." 📚😳

And what about liquidity? Let’s just say it’s getting tighter than a pair of jeans after a Thanksgiving feast. 🦃👖 As much as we all love a good rally, without volume, it’s like trying to party without any music—silent and a bit awkward. 😬

Now, here’s the kicker: if you want to dive deeper into this coin-stuffed rabbit hole, click right here to read the full article and boost your crypto IQ. 🤓✨ Let’s see how this market shakes out, shall we?

#Crypto #Bitcoin #Ethereum #TradingVolume #MarketTrends #Investing #HODL #MemeEconomy 😎💸

0 notes

Text

CALABASAS, CA - In a shocking turn of events that has left the Kardashian-Jenner clan reeling, Mason Disick, the 15-year-old son of Kourtney Kardashian and Scott Disick, is reportedly facing unprecedented demands from his alleged one-year-old daughter, Piper. The infant, demonstrating an uncanny grasp of both modern technology and financial systems, is insisting that all child support payments be made exclusively in Bitcoin. Sources close to the family reveal that young Piper, who apparently inherited the Kardashian business acumen along with her father's perfectly coiffed hair, issued her demands via a series of eloquent gurgles and strategically timed diaper explosions. "It's clear she means business," said one anonymous nanny, who wished to remain unnamed for fear of being paid in dogecoin. "I've never seen a baby so adamant about cryptocurrency. She won't even accept her bottle unless it's shaped like a Bitcoin symbol." The news has sent shockwaves through the Kardashian empire, with matriarch Kris Jenner scrambling to launch a new venture called "Kardashian Krypto" in response. "We've always prided ourselves on staying ahead of the curve," Jenner stated in a hastily organized press conference. "If my great-granddaughter wants Bitcoin, by God, we'll mine it ourselves if we have to." Unconfirmed reports suggest that Jenner has already converted three of the family's walk-in closets into a state-of-the-art cryptocurrency mining operation. Meanwhile, Kourtney Kardashian, thrust unexpectedly into the role of grandmother at the tender age of 45, has been spotted furiously googling "What is blockchain?" and "How to explain Bitcoin to a one-year-old." Friends say she's struggling to come to terms with both her new status and the complexities of digital currency. "Kourtney's always been more into organic, all-natural things," said one family friend. "The idea of her granddaughter demanding virtual money is really throwing her for a loop." Not to be outdone, Scott Disick has seized the opportunity to launch his latest entrepreneurial venture: "Teen Dad Crypto Academy." The online course promises to teach young fathers the essentials of balancing diaper changes with digital wallets. "Being a dad is tough, but being a dad who has to pay child support in Bitcoin? That's a whole new level," Disick explained in a promotional video, while somehow managing to maintain his signature smirk. As for Mason, the young father is reportedly coping with his new responsibilities by starting a TikTok series titled "Diaper Changing for Dummies." The videos, which feature Mason attempting to change a diaper while simultaneously explaining cryptocurrency mining, have gone viral, amassing millions of views and inadvertently creating a new genre: "CryptoParent Influencers." The situation has even caught the attention of the Calabasas legal system, which is now overwhelmed with Bitcoin-related cases. Local lawmakers are considering new legislation dubbed "The Kardashian Clause," which would require all family courts to have at least one judge well-versed in both family law and cryptocurrency trading. In an unexpected twist, young Piper seems to have political aspirations as well. Despite being unable to walk or form complete sentences, she has announced her candidacy for mayor of Calabasas on a "Free Bitcoin for All" platform. Her campaign slogan, "Goo goo ga ga for crypto," is already appearing on billboards throughout the city. However, just as the situation reached a fever pitch, a startling revelation came to light. In a plot twist worthy of a Kardashian reality show season finale, it was discovered that Piper is actually an AI-generated deepfake, created by a group of pranksters with too much time and computing power on their hands. Upon learning the truth, Mason reportedly breathed a sigh of relief before immediately developing an intense interest in computer programming. "If I can create a fake baby that convincing," he was overheard saying, "imagine what I could do with a whole fake family."

As the dust settles on this latest Kardashian family drama, one thing remains clear: in the world of reality TV royalty, it's all fun and games until someone demands child support in Bitcoin. Fans are advised to stay tuned for more updates and to invest responsibly in both family planning and cryptocurrencies. Remember, folks: in the Kardashian universe, truth is often stranger than fiction, and fiction is usually just next season's plotline. https://lighthousenewsnetwork.com/mason-disicks-alleged-baby-piper-demands-bitcoin/?feed_id=15362&_unique_id=67c0b9fabdb26

0 notes

Video

youtube

What's the Best Investment Strategy for Beginners?

Looking for the best investment strategy for beginners? Learn from the experts like Benjamin Graham and Warren Buffett in this video about stock market tips and the intelligent investor book recommendations. Here’s a curated list of 50 widely acclaimed books on investments, covering various aspects like value investing, personal finance, behavioral economics, and portfolio management: ________________________________________ Classics of Value Investing 1. The Intelligent Investor by Benjamin Graham 2. Security Analysis by Benjamin Graham and David Dodd 3. Common Stocks and Uncommon Profits by Philip A. Fisher 4. You Can Be a Stock Market Genius by Joel Greenblatt 5. The Little Book That Beats the Market by Joel Greenblatt ________________________________________ Behavioral Finance 6. Thinking, Fast and Slow by Daniel Kahneman 7. Nudge by Richard Thaler and Cass Sunstein 8. The Psychology of Money by Morgan Housel 9. Misbehaving: The Making of Behavioral Economics by Richard Thaler 10. Influence: The Psychology of Persuasion by Robert B. Cialdini ________________________________________ Portfolio Management 11. A Random Walk Down Wall Street by Burton G. Malkiel 12. The Four Pillars of Investing by William J. Bernstein 13. The Intelligent Asset Allocator by William J. Bernstein 14. Modern Portfolio Theory and Investment Analysis by Edwin J. Elton, Martin J. Gruber 15. Principles for Navigating Big Debt Crises by Ray Dalio ________________________________________ Personal Finance 16. Rich Dad Poor Dad by Robert T. Kiyosaki 17. Your Money or Your Life by Vicki Robin 18. The Millionaire Next Door by Thomas J. Stanley and William D. Danko 19. I Will Teach You to Be Rich by Ramit Sethi 20. The Simple Path to Wealth by JL Collins ________________________________________ Hedge Funds and Advanced Strategies 21. Hedge Fund Market Wizards by Jack D. Schwager 22. More Money Than God by Sebastian Mallaby 23. Fooled by Randomness by Nassim Nicholas Taleb 24. The Black Swan by Nassim Nicholas Taleb 25. When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger Lowenstein ________________________________________ Trading and Technical Analysis 26. Reminiscences of a Stock Operator by Edwin Lefèvre 27. Technical Analysis of the Financial Markets by John J. Murphy 28. Trade Like a Stock Market Wizard by Mark Minervini 29. Market Wizards by Jack D. Schwager 30. The New Trading for a Living by Dr. Alexander Elder ________________________________________ Economics and Market Insights 31. The Big Short by Michael Lewis 32. Liar's Poker by Michael Lewis 33. Manias, Panics, and Crashes by Charles P. Kindleberger and Robert Z. Aliber 34. Irrational Exuberance by Robert J. Shiller 35. Capital in the Twenty-First Century by Thomas Piketty ________________________________________ History and Biographies 36. The Alchemy of Finance by George Soros 37. One Up On Wall Street by Peter Lynch 38. Beating the Street by Peter Lynch 39. The Snowball: Warren Buffett and the Business of Life by Alice Schroeder 40. Against the Gods: The Remarkable Story of Risk by Peter L. Bernstein ________________________________________ Real Estate Investing 41. The Book on Rental Property Investing by Brandon Turner 42. Real Estate Investing for Dummies by Eric Tyson and Robert S. Griswold 43. Long-Distance Real Estate Investing by David Greene 44. The Millionaire Real Estate Investor by Gary Keller 45. The ABCs of Real Estate Investing by Ken McElroy ________________________________________ Alternative Investments and Entrepreneurship 46. Venture Deals by Brad Feld and Jason Mendelson 47. The Lean Startup by Eric Ries 48. Angel: How to Invest in Technology Startups by Jason Calacanis 49. Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order by Paul Vigna and Michael J. Casey 50. The Business of Venture Capital by Mahendra Ramsinghani

0 notes

Text

Advanced Theoretical Analysis of Bitcoin Seasonality in December and January

Abstract

This study rigorously investigates the presence of seasonality in Bitcoin returns during December and January over the period from 2017 to 2023. Empirical analysis, based on monthly average prices and standard deviations, suggests emerging seasonal patterns, with December frequently exhibiting price appreciation and January often experiencing declines. However, formal hypothesis testing indicates that these patterns lack statistical robustness. The paper further explores behavioral, institutional, and macroeconomic factors that may drive this apparent seasonality.

Keywords: Bitcoin, Seasonality, Cryptocurrencies, Financial Markets, Statistical Analysis

JEL Classification: G11, G12, G14

1. Introduction

The cryptocurrency market, particularly Bitcoin, has evolved into a prominent asset class, redefining investment paradigms and drawing significant academic interest. Since its inception in 2008 (Nakamoto, 2008), Bitcoin has witnessed a gradual shift from being a niche digital currency to an institutional-grade financial instrument, facilitated by the entry of major investment entities and the introduction of crypto-backed financial products by traditional banks (Baur et al., 2018).

An intriguing feature of this market is the potential seasonality in Bitcoin returns, specifically during December and January. While seasonality is a well-documented phenomenon in traditional financial markets (Bouman & Jacobsen, 2002), its presence in cryptocurrencies remains relatively unexplored. This paper bridges that gap by systematically analyzing potential seasonal patterns in Bitcoin returns and contextualizing them within broader economic and market dynamics.

2. Literature Review

Seasonality in financial markets refers to recurring trends or patterns in asset returns tied to specific calendar periods. Classical examples include the "Santa Claus rally" in December and the "January effect," where stock returns tend to increase following the turn of the year (Hirshleifer & Shumway, 2003).

In the context of cryptocurrencies, research on seasonality is still emerging. Corbet et al. (2020) identified potential seasonal trends in various cryptocurrencies, including Bitcoin, but acknowledged the challenges posed by high volatility and market sentiment. Other studies emphasize the role of news cycles, investor heterogeneity, and regulatory developments in shaping short-term price dynamics (Bouri et al., 2019).

3. Methodology and Data

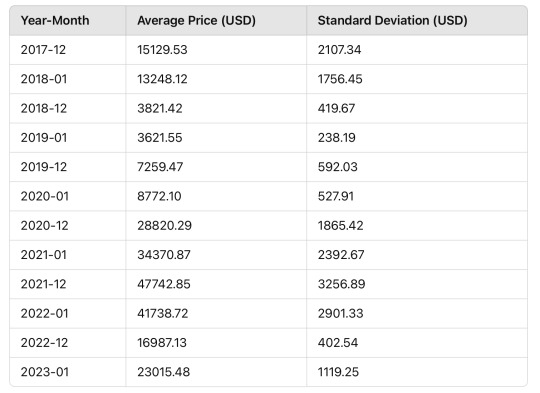

To investigate Bitcoin's seasonal behavior, we compiled monthly average price and standard deviation data from trusted sources, such as CoinMarketCap and CoinGecko, covering the period from 2017 to 2023. The analysis focuses on identifying consistent patterns of price appreciation in December and depreciation in January.

Additionally, a two-sample t-test was employed to assess the statistical significance of mean differences between December and January returns. An Ordinary Least Squares (OLS) regression model was also fitted, incorporating a dummy variable for December to capture potential seasonal effects.

4. Results

The analysis revealed that Bitcoin prices exhibited positive returns in December in 5 out of the 7 years studied, whereas January recorded negative returns in 4 out of the 7 years. Table 1 summarizes the monthly average prices and standard deviations for December and January across the study period:

The t-test yielded a t-statistic of -0.093 and a p-value of 0.928, indicating no statistically significant difference in mean returns between December and January. The OLS regression results further corroborated this finding, with the dummy variable for December exhibiting a p-value of 0.928, suggesting that observed seasonal patterns are likely attributable to random market fluctuations rather than inherent seasonality.

5. Discussion

The absence of statistically significant seasonality in Bitcoin returns highlights the complex interplay of market forces. While end-of-year optimism and institutional portfolio rebalancing may explain the observed December price increases, profit-taking and liquidity adjustments in January likely contribute to subsequent declines.

Macro-level factors, such as central bank policies and global economic conditions, also play a pivotal role. For instance, Bitcoin's significant depreciation in early 2022 coincided with the Federal Reserve's announcement of interest rate hikes, underscoring the cryptocurrency's sensitivity to macroeconomic shifts (Krugman, 2021).

The growing integration of Bitcoin into traditional financial markets, evidenced by the introduction of Bitcoin ETFs and increased regulatory oversight, may attenuate extreme seasonal variations over time. Nevertheless, the high volatility inherent to cryptocurrencies ensures that any seasonal effect, if present, will remain susceptible to sudden market disruptions.

6. Limitations and Future Research

Several limitations should be acknowledged. First, the study period of 7 years may be insufficient to capture long-term seasonal trends, especially given Bitcoin's relatively short history. Additionally, external factors, such as regulatory changes and technological developments, may confound the observed patterns.

Future research could extend this analysis by incorporating longer time series, employing high-frequency data, and utilizing more sophisticated econometric models, such as ARCH/GARCH frameworks, to better capture volatility dynamics.

7. Conclusions

This study provides an in-depth analysis of potential seasonality in Bitcoin returns during December and January. Although descriptive data suggests a recurring pattern, formal statistical tests indicate that these patterns lack robustness. The findings underscore the importance of considering a broad array of factors, including investor behavior and macroeconomic conditions, when analyzing cryptocurrency markets.

The evolving nature of the cryptocurrency ecosystem, driven by institutional participation and regulatory advancements, warrants continuous monitoring and further academic inquiry to elucidate the complex dynamics underpinning Bitcoin's market behavior.

References

Auer, R., & Claessens, S. (2022). Cryptocurrencies and Financial Stability. Journal of Economic Perspectives.

Baur, D. G., Hong, K., & Lee, A. D. (2018). Bitcoin: Medium of Exchange or Speculative Assets? Journal of International Financial Markets.

Bouman, S., & Jacobsen, B. (2002). The Halloween Indicator, 'Sell in May and Go Away': Another Puzzle. American Economic Review.

Bouri, E., Molnár, P., & Roubaud, D. (2019). Bitcoin Volatility and Hedge Properties. Financial Research Letters.

Corbet, S., Lucey, B., & Yarovaya, L. (2020). Cryptocurrencies and Economic Cycles. Research in International Business and Finance.

Hirshleifer, D., & Shumway, T. (2003). Good day sunshine: Stock returns and the weather. Journal of Finance.

Krugman, P. (2021). The Return of Inflation and Its Implications. Economic Policy Journal.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system.

Shiller, R. J. (2017). Narrative economics. American Economic Review.

Yermack, D. (2017). Is Bitcoin a real currency? An economic appraisal. In Handbook of digital currency (pp. 31-43). Academic Press.

0 notes

Text

How to Build a Money-Spinning Crypto Exchange in 2025?

Cryptocurrencies have been the buzz of town. Without a doubt, the most important technology for traders today is blockchain. Well-known cryptocurrencies like Bitcoin and altcoins are going through a lot of changes to stay ahead of the competition.

So, if you're an investor looking to get started in the Bitcoin Exchange Business, the next 5 minutes will provide you with comprehensive guidance!

What is the monthly cost of a Crypto Exchange Website?

If you want to build your own cryptocurrency exchange website, you can surely do so! Before we get into the cost of the trading website, let us first understand the stages required in starting a Crypto Exchange website!

There are ten steps to ensure a high-quality business! You'll most likely find the solution to your question here: How much does it cost to set up a Bitcoin Exchange website?

Here are they:

Have a clear idea of where you want your launch a crypto exchange

To ensure that licensing requirements are fulfilled, get competent legal assistance.

Obtain capital for projects.

Find the top technology solutions and service providers.

Connect your exchange to other exchanges to increase liquidity.

Join forces with the payment processor.

Implement the most effective security techniques.

Use beta testing to launch the website.

Launch marketing campaigns to advertise the website.

Make customer service a priority.

Keep a legal team on hand to ensure online compliance.

To get a clear understanding, we'll go into the strategies!

Have a clear idea of where you want to launch your crypto exchange. It is important to know where the business will start when you are planning to launch it.

Regardless of whether you wish to operate internationally or only in a specific area or country!

In order to start a business, you often need to obtain the required licenses and approvals.

In general, laws can differ from one location to another. Thus, with regards to licensing and adherence to local laws and regulations, get advice from a legal professional.

Hire qualified legal advice to ensure that licensing requirements are fulfilled.

What criteria must you take into account, then? Learn the rules for trading your business in that particular country.

Furthermore, in every jurisdiction where the business intends to operate, the appropriate license must be obtained. Most bitcoin exchanges operate without considerable control since the government and legislation have not kept up with the technology!

Raise capital for projects

Before beginning the project, you need determine the estimated cost of the website engaged in the business. For example, you will only need about $150,000 to start a cryptocurrency exchange business. This covers the price of hosting, legal fees, technology, government registration, etc.

One common mistake that startups make is failing to plan for the future! You must thus learn about the plans for the future and how things will be in the years to come!

Discover the best technology solutions providers

There are numerous firms that create custom crypto exchange websites, which will result in earnings for your business!

This should, in fact, cover a wide range of possible industry considerations, including license costs, commission arrangements, and recurring fees.

Create your own website for a crypto exchange firm with a desired level of experience to get excellent results.

Connect your exchange to other exchanges to increase liquidity.

Liquidity is the key to a successful exchange website. Potential clients may perceive the lack of an order book and trading activity as a new barrier, which will breed mistrust!

To avoid these problems, you can create dummy accounts in the freshly formed exchange. Consequently, we are able to link your exchange to the network of current exchanges, which might in fact boost liquidity!

Remember that the liquidity factor decreases with the size of the exchange network!

Collaborate with the payment processor

Not every payment processor is created equal. Additionally, each company will have a different cost structure. You must have a lower rate in order to compete with other exchangers.

Be aware of all the hidden costs before joining up because some processors have them in their contracts!

Settlement time and adherence to PCI DSS, a set of procedures designed to guarantee cybersecurity, are two other distinctions between the processors.

For the highest level of protection, confirm that the payment processor complies with PCI.

Put the best security measures in place.

With encrypted databases, Crypto exchanges developed by development firms are thought to be the safest in the world. The best security in the world can be achieved by utilizing additional security measures, such as two-factor authentication, among many others!

Launch the website using beta testing.

You now have a built-in exchange website. You have a payment processing contract in place, and you have taken great care to make sure the website complies with all applicable rules and regulations. The next step is to launch and use beta testing to evaluate all of its features.

Launch marketing campaigns to advertise the website.

Marketing the product is the most important way to attract new clients, regardless of the type of business. You can get in touch with major players like CoinmarketCap, Coindesk, Cointelegraph, and Crypto News.

Additionally, it is essential to carefully plan your marketing initiatives and their associated expenses. Exchanges typically don't have a marketing budget; instead, they concentrate on using social media marketing to reach as many traders as possible at a reasonable cost.

Prioritize customer service.

Being able to shine will lead to long-term success because customer support is the last phase of the Bitcoin exchange business. In order to resolve customer complaints and concerns, those that interact with customers must be attentive and satisfactory.

Consumers who receive prompt responses will continue to be accountable and will thus have faith in your website!

Keep a legal team on hand to ensure compliance online.

It is always advisable to have a legal team to monitor your firm when it comes to laws and regulations. Additionally, cryptocurrency regulations are changing quickly all around the world, so it's critical to have a full-time in-house compliance team. This can assist you in maintaining the legality of your transaction in the nations where you trade!

When it comes to crypto exchange development costs in India, it all relies on the features you need!

To provide an approximate estimate, there are some prices that will be determined by the complexity of the website in relation to a general criterion, such as not just Bitcoin Exchange Business Website but others!

Important costs that you will encounter

Many questions will be posed to traders, like how much it costs to hire someone to create a website and many more!

The most important thing, nevertheless, is to determine the fundamental costs you will incur!

Here are few that you should consider:

Domain Name

Web Hosting

SSL Certificate

These are the three things you absolutely must have when creating a website for any domain!

Which security elements will be incorporated into the cryptocurrency exchange business?

Here are some security features:

Two-factor authentication (2FA)

Cold Wallet Storage

Multi-Signature Wallets

Secure Socket Layer (SSL) Encryption

Anti-Phishing Features

DDoS Protection

KYC (Know Your Customer)

AML (Anti-Money Laundering) Compliance

End-to-End Encryption

Regular Security Audits

Real-Time Monitoring

Withdrawal Whitelists

Secure API Integration

IP Whitelisting

Backup and Disaster Recovery Systems

Tamper-Proof Audit Logs

Time-Limited Sessions

And More

Similarly, in terms of functionality features, it consists of

Simple Onboarding

Multi-Factor Authentication (MFA)

Spot Trading

Margin Trading

Futures Trading

Automated Trading Bots

Portfolio Management

Real-Time Price Charts

Wallet Integration

Market Orders

Limit Orders

Stop-Loss Orders

Take-Profit Orders

Order Matching Engine

Liquidity Pools

Payment Integration

Multi-Language Support

API Integration

Cross-Platform Compatibility

Advanced Trading Features

Referral and Affiliate Programs

Token Launchpad Support

And more

Here are some tactics to think about while selecting the best developer or team:

What kinds of services do they provide?

Do they create bespoke websites or do they work with templates?

How is the web project going to be run?

How long does the project usually take to complete?

Which sample websites has the company created?

Have the websites of these businesses experienced a return on their investment?

How well-qualified is the team?

When are they able to begin?

You can definitely hire them if you are satisfied with their responses to these questions!

Ready To Start your own Crypto Exchange Website?

If you are ready to create your own business website, you can look for the best cryptocurrency exchange script provider who can help you right away!

With extensive experience, we have developed perfect cryptocurrency exchange script that have resulted in significant benefits and profits for clients throughout the world!

Plurance is the premier cryptocurrency exchange development company in the industry. With over ten years of established experience, we have successfully completed various projects, offering professional Cryptocurrency exchange script with crucial features at the best costs. Being industry pioneers, we have unmatched expertise and experience to offer a wide range of Bitcoin exchange choices guaranteeing excellent results.

If you need one, contact us right away and book a free demo

I hope this article was interesting to you!

#crypto exchange#cryptocurrency exchange#cryptocurrency exchange script#crypto exchange 2025#bitcoin exchange 2025#bitcoin exchange script

0 notes