#Borrow Money Online In Nigeria

Text

Financial Lesson I learnt in 2022

In the year 2022 I've learnt a lot of this some good, some bad and some have absolutely no purpose whatsoever but here are some financial lessons I learnt in 2022 that have made my life all the better.

1. Every penny you save will one day save you: In the middle of the year I got a job that paid about 7x my previous job and hoped my life would automatically become worthwhile and I wouldn't have to the way I did previously and would have more money in my account but to my greatest surprise, this wasn't the case as I seemed to save less money than when I was at my previous job. This became very evident when my younger brother's school called for resumption suddenly, I realized that I had no money to support him and had to resort to borrowing. If I had saved as I was supposed to I wouldn't have had to beg for money to support my brother's education. So it is important that we save a little money for emergencies; no matter the level of income that you are at currently, try to keep at least 1/10 of your monthly income for emergencies because while we do not pray for them eventualities will always arise: you could lose your job, a family member or yourself can get sick, you can make a bad investment, etc and then in your days of trouble, your savings will save you!

2. If it sounds too good to be true, it most usually is: In Nigeria, it is very common to hear: invest 20,000 and get 100,000. Simple mathematics shows that this kind of investment is trying to 500% returns on your investment and there is currently no business on God's green earth that can do this even for stock traders that invest wisely and safely make around 8-12% returns on their investment. Your average business man doesn't make that much profit, neither does your international business man or even your most experienced crypto trader (which by the way I would advise against if you want your money to be safe). So any business that promises you an absurd amount of returns be it online or physical, is usually a Ponzi scheme that will leave a lot of so-called investors in tears!

3. If you can't afford to pay in cash don't buy it: With the advent of things like Easy Buy, buy now and pay later offers; more and more people are tempted to buy things they cannot afford and sometimes things that they do not need. While this is not something I practice, I have a colleague let's call him Bob that bought a phone using one of these services and it would surprise you that the resulting debt accrued by Bob could not be paid in six months for a phone that just cost around 60000! He was knee deep in debt that he had to take loans to pay the phones cost and this spiralled out of control as he was borrowing from one loan app to pay the other and all this started because he bought a phone he could not pay for in cash!

4. Stay Broke: While this might sound like a terrible advice, hear me out. If for example you're like myself that was making a particular amount and you were living comfortably then you 7x your income and immediately raise your standard of living, spending on frivolities, etc; your account balance and assets will most definitely not reflex your new income. Instead of doing what I did, if you instead try to maintain your standard of living or maybe just raise it a bit and avoid non essential things as much as you possibly can: then you have more money to save, more money to invest in things that will serve your future. So while it might sound counter intuitive, staying broke is one of the things I learnt in the year 2022

5. Don't forget to have fun: In my quest to do better with my finances, I found myself at a place where I completely avoided things that I used to do for fun as I said to myself that they were just excuses to spend money that I should be saving; this mentality change when I cracked and went on a spending spree as I had been starving myself of fun things I used to do. If you don't have fun every once in a while, the day you finally break, you would incure the worst expenses ever. So, keep some money aside for fun things, doesn't have to be too much but just enough to keep the "fun monster" satiated!

6. Make efforts to learn about money and how you can make more of it: Growing up in a religious family we rarely talked about money and living in a country where it is very possible to make money from fraudulent and/or mystic way having too much money is usually regarded as a bad thing but one truth I've learnt about money is that money buys you time for example if you had sufficient money you wouldn't have to work extra hours to make more money. Those hours could be spend with friends and family or used to pursue a hobby rather than bursting your butt on a job you don't really like. So while some people might view money in a bad light I've learnt that money obtained legally and genuinely while it might not buy you happiness as we have always been told, will buy you the time you need to find happiness. So learning about your finances and how to make more money is one of the most important things I learnt in 2022.

8 notes

·

View notes

Text

My whole life has been a rollercoaster.

I've fought through the very physical as well as degrading mental abuse from childhood. That experience turned to evil vengeful hateful actions during my 20's. Always hiding my depression.

Then being betrayed by the one person I thought wouldn't do me harm.

People trying to exploit me when down.

My love blinded me.

I thought my life would never got better.

I completely had given up on love.

Fuck, I couldn't trust anyone, especially with all these online fakes a hundred a day.

Wrong guy, I smell scammers from half way around the world!

At this point I no longer believe that anyone could accept the love I gave, honest, loyal, communicating, passionate nurturing love.

And I can't see anyone that could literally legitimately love me back loyally & being truly honest & open.

And if I did try the girls must of thought they were far too damaged, they didn't deserve wholesome pure love or the famous bullshit;

I must be too good to be true!

Smh...

Deep down I hoped some one would come along & show me the true meaning of what a committed relationship was.

We could share notes, effort & iron things out...ll

Love we both are missing.

I'd be singing in the shower again, content finally.

I just wish too much in a world full of damaged people quick to compare a great guy or girl to their last piece of shit narcissist or abusive cunt, or a thief of time, money, ability to trust, etc...

Is it possible that an actual truly good person could maybe, just maybe have their own little fairytale; if people could let go of past idiots or gold diggers or shit humans?

Should one just wait for it till it's too late, or your tomorrow didn't come?

Fuck... I don't know.

I've been close, but no cigar.

I'm still waiting, searching, not like I used to.

Because shit, I've walked the soles from my feet trying to hopefully find my person, that one & only.

And with a heart that bleeds, it's fractured & still pained...

My mind nowadays relentlessly guarding the last pieces of the only heart I have, pushing more people away because through experience being single my 1st thought about each new person is: Bitch is fake, A dude from Nigeria/Ghana who knows..with some stolen pics of some poor girl who has no clue a Motherfucker is pretending he's her. (I'm never fooled, all fakes have suck ass grammar).

If I approach any woman to learn who they are, and to see if they are my compliment, not my completion.

It'll turn out I'm not their compliment because they want more than me, more like material things or monetary gain not love & romance happily ever after!

With this world going government ape shit with control actually being the 1% or ELITES, YOU ALL NEEDN'T BE WORRIED ABOUT MONEY & THINGS!

More like who will be by your side when majority of population are just things controlled, used or disposed of like trash?

Time counts, time never stops & what passes is forever gone, no money can buy time back, you cannot bargain or borrow time.

No money will purchase happiness or love.

And NOBODY is promised tomorrow!

So no rush to love out of fear!

Yet I weigh on each hand what's worse?

Dying alone still waiting on an imaginary perfect person?

Or, not dying but aging till the heart slows too much & the search ends & nobody their to even know you're dead?

As the sunsets in our eyes that final time, you turn to look beside you:

I want to see in someone eyes that's right there saying my last I love you, & go in peace because our lives were full.

After all what becomes of that real lover, the soulmate that never had deviant motives or hidden agenda?

They never had silence, gave all of themselves, always loyal, affectionate with passion & compassion and was always honest, never abandoned you?

That's loving.

Real living!

Or...

A heart beating slower saddened wasting what somebody missed because of pride, shy, comparison of that past experience keeping them there, pushing others away as if that last narcissistic guy still has control or became magically this new legitimate person?

And then twin flames who missed connection..

Sadly both alone, apart, yet still simultaneously hearts stop beating.

It's over.

Your mind is a good thing but we should always trust our heart & gut more and our mind plays tricks!

Just hear me out...

Don't let the last fuck up person or your mind seal your heart.

And never having the chance to have your last beat be with the one you belong with.

Nobody is promised a tomorrow.

2 notes

·

View notes

Text

Empowering Dreams: A Call for Sponsorship in the Face of Hardship

My name is Oluwabukunmi. I’m nineteen years old, a student from Nigeria, though not currently enrolled in school.

I dropped out of high school/secondary school, but I never stopped learning. This self-directed learning journey has helped me find my purpose and realize the power of self-education.

It might sound surprising, but I’m glad I dropped out of school. Whenever I reflect on it, I wonder if I would have ever found my passion, dreams, and interests if I had stayed in school. While in school, I didn’t know what to do with my life and didn’t have any dreams. All I understood was that we went to school to learn how to read and write.

Leaving school initially made me feel inferior whenever I saw my classmates. My parents, who were struggling financially, couldn’t afford my school fees. People often judged them, thinking they were not serious about my education, but I understood their situation. Things became tough for them after my father, an employee at Nigeria BEDC (Benin Electricity Distribution Company), was laid off when BEDC was privatized. They started a small business with borrowed money, which led them into a cycle of debt.

I turned the library into my school, and from this challenge, I found enlightenment and new opportunities. I discovered my passion for writing, web development, and computer science.

I decided to take the first step by enrolling in a free online course on web development (The Odin Project), which I believe will later support my writing and my studies in computer science (OSSU). I worked for a year as a salesgirl to save money for a small laptop (HP EliteBook 8440p). During that time, I had to pause my studies because all the books I read were in the library.

After getting my laptop last year, I started working on The Odin Project. I had to stop going to the library due to a lack of electricity and began studying at a nearby hotel (which isn’t the best place to study). Due to inflation and rising fuel prices, the hotel reduced its electricity usage, turning it on at 1:00 pm and off at 8:00 am. I couldn’t stay overnight, so I could only study there from 1:00 pm to 8:00 pm.

This limited study time, combined with my parents’ financial struggles, made it difficult for me to progress. They moved to a village due to overwhelming debt, and we could barely afford one meal a day. Studying became increasingly challenging without the necessities to support my course, and my progress slowed significantly.

I considered working again, but if I did, I wouldn’t have time to continue my course due to the lack of electricity in my area. I might end up giving up on my dreams altogether.

After much contemplation, I decided to seek help. Finding a sponsor or receiving donations could significantly support my education and help me achieve my goals.

Writing and posting this took a lot of courage and overcoming self-doubt. Any help or support for my situation would be greatly appreciated.

Thank you for your time and consideration.

Sincerely,

Oluwabukunmi

1 note

·

View note

Text

Can Loan Apps Come To My House In Nigeria? Don't Panic, Here's What You Need To Know

Loan apps have become a popular way to access quick cash in Nigeria. However, stories of harassment and forceful recovery methods can be unsettling. Have you ever asked yourself, "Can loan app come to my house?" You're not alone. This question highlights the anxiety many Nigerians feel about the extent to which loan apps can go to recover their money. This article from BestCreditCards3.com will address your concerns and provide valuable information on loan app debt collection practices in Nigeria.

Can Loan Apps Come To My House?

Can loan apps come to my house? No, reputable loan apps in Nigeria cannot legally come to your house to collect debt. Debt collection in Nigeria is a regulated process, and loan apps must follow specific guidelines set by the Federal Competition and Consumer Protection Commission (FCCPC). These guidelines prohibit loan apps from using physical threats or intimidation to recover debts.

While a loan app might send you a court summons, this doesn't necessarily mean someone will appear at your house. It's crucial to remember that the legal system operates through courts, not through loan app representatives showing up unannounced.

However, this doesn't mean you should ignore your loan repayments. Responsible borrowing builds a positive credit history, while defaults can have serious consequences.

What Tactics Do Loan Apps Use to Recover Debts?

While loan apps can't come to your house, they may use other methods to collect debts, including:

- Persistent Calls and Text Messages: You might receive numerous calls and texts reminding you of the outstanding payment.

- Contacting Your References: Some loan apps contact the references you provided during the application process to put pressure on you to repay.

- Reporting to Credit Bureaus: Defaulting on a loan can lead to a negative mark on your credit report, making it difficult to access future loans.

- Online Harassment: In some cases, disreputable loan apps might resort to online harassment, but this is illegal and should be reported to the authorities.

The Nigerian government is actively working to curb these practices. The FCCPC has issued regulations to protect borrowers from loan app harassment.

Government Regulations to Curb These Practices

The Nigerian government, through bodies like the Federal Competition and Consumer Protection Commission (FCCPC), is working to regulate these aggressive practices. The FCCPC has issued warnings and guidelines to loan apps, emphasizing that harassment and invasion of privacy are illegal. However, enforcement remains a challenge, and many loan apps continue these practices unchecked.

Impact on Your Credit Score and BVN

Defaulting on a loan can significantly impact your credit score and your Bank Verification Number (BVN) status. When you fail to repay a loan, the app might report you to credit bureaus, which can make it difficult to obtain loans in the future from other financial institutions. Additionally, your BVN could be blacklisted, affecting your financial credibility.

Are Loan Apps Regulated in Nigeria?

Yes, loan apps in Nigeria are regulated by the FCCPC. The FCCPC has established guidelines for responsible lending practices, including:

- Transparency in Terms and Conditions: Loan apps must clearly outline interest rates, fees, and repayment terms.

- Fair Debt Collection Practices: Loan apps are prohibited from using abusive or threatening language during debt collection.

- Data Privacy Protection: Loan apps can only collect and use borrower data for legitimate purposes as outlined in the Nigerian Data Protection Regulation (NDPR).

The FCCPC maintains a list of approved loan apps that comply with these regulations. It's always best to borrow from these reputable lenders to ensure a safe and secure experience.

Regulatory Environment for Loan Apps

Loan apps operate in a somewhat grey area in Nigeria. While some are registered and regulated, many are not, leading to widespread concerns about their practices. The FCCPC and other regulatory bodies have been trying to bring more transparency and accountability to the sector.

Role of the Federal Competition and Consumer Protection Council (FCCPC)

The FCCPC has been instrumental in addressing the issues surrounding loan apps. They have provided guidelines to ensure that these apps operate within the bounds of the law, protecting consumers from unethical practices. However, the enforcement of these regulations is still a work in progress.

Approved Loan Apps Operating Legally

It's crucial to use loan apps that are registered and regulated. Some of the reliable loan apps in Nigeria include:

- FairMoney: Known for its transparent terms and regulated by the appropriate financial authorities.

- Carbon: Another reputable app that adheres to Nigerian regulations.

Using these approved apps can help you avoid the risks associated with unregulated platforms.

How to Protect Yourself When Using Loan Apps

Here are some tips for using loan apps safely in Nigeria:

- Borrow from registered and FCCPC-approved loan apps. A quick online search can help you verify a loan app's legitimacy.

- Read the terms and conditions carefully before applying. Understand the interest rates, fees, and repayment terms before borrowing.

- Only borrow what you can afford to repay on time. Defaulting on a loan can lead to a cycle of debt and negatively impact your credit score.

What to Do If You Face Harassment

If you encounter harassment from a loan app:

- Report to the FCCPC: Lodge a complaint with the FCCPC, providing all relevant details and evidence.

- Seek Legal Help: Consult a lawyer who can guide you on the best course of action.

- Notify Your Contacts: Inform your friends and family about the situation to prepare them for any unsolicited communications.

Consequences of Defaulting on Loan App Payments

Defaulting on a loan app can have serious consequences, including:

- High-interest rates and penalties: Late payments often incur additional fees, making the loan even more expensive.

- Negative credit report: Defaulting can be reported to credit bureaus, making it difficult to access future loans and credit cards.

- Personal and social repercussions: Loan apps might resort to contacting your references, which can cause embarrassment and damage your social standing.

Can Loan App Blacklist My BVN?

Yes, loan apps can report your BVN to credit bureaus if you default on a loan, which can lead to blacklisting.

When you default on a loan, many loan apps will report your BVN to the credit bureaus. This process is similar to how traditional banks and financial institutions operate. Once reported, your BVN can be blacklisted, affecting your credit score and your ability to access future loans.

How Does Blacklisting Happen?

- Loan Default: When you fail to repay your loan as per the agreed terms, the loan app marks your account as defaulted.

- Reporting to Credit Bureaus: The loan app then reports your default status to credit bureaus such as CRC Credit Bureau or First Central Credit Bureau in Nigeria.

- Credit Report Update: The credit bureaus update your credit report to reflect the default. This update includes your BVN, making it accessible to other financial institutions.

- Impact on Credit Score: Your credit score is negatively impacted by the default, and your BVN is flagged.

Consequences of a Blacklisted BVN

- Difficulty in Obtaining Loans: With a blacklisted BVN, securing loans from other financial institutions becomes challenging.

- Higher Interest Rates: If you do manage to obtain a loan, it might come with higher interest rates due to the perceived risk.

- Limited Financial Services: Other financial services, such as credit cards or overdraft facilities, might also become inaccessible.

How to Avoid BVN Blacklisting

- Timely Repayments: Ensure you repay your loans on time to avoid defaults.

- Communication: If you're unable to meet a repayment deadline, communicate with the loan app. Some might offer extensions or restructuring options.

- Choose Reputable Loan Apps: Use well-regulated loan apps with transparent terms to avoid unscrupulous practices.

- Monitor Your Credit Report: Regularly check your credit report to ensure there are no errors or unwarranted blacklisting.

What to Do if Your BVN is Blacklisted

- Contact the Loan App: Reach out to the loan app to understand the reasons for the blacklisting and negotiate repayment terms.

- Dispute Errors: If you believe the blacklisting is unjustified, you can dispute it with the credit bureau.

- Improve Your Credit Score: Work on improving your credit score by paying off any outstanding debts and maintaining good financial habits.

How to Check if Your BVN is Blacklisted

Your Bank Verification Number (BVN) is a unique identifier used by Nigerian banks and financial institutions. Defaulting on a loan can lead to a "blacklisted" BVN, making it difficult to access financial services.

Here's how to check your BVN status:

- Visit the Credit Bureau of Nigeria (CBN) website (https://www.crccreditbureau.com/).

- Register for an online account or use their mobile app.

- Pay a small fee to access your credit report.

Alternatives to Using Loan Apps

Instead of relying on loan apps, consider these alternatives:

- Traditional Bank Loans: Banks often offer more favorable terms and are regulated by the Central Bank of Nigeria.

- Credit Unions: These are member-owned financial cooperatives that offer low-interest loans.

- Microfinance Institutions: These institutions provide small loans with manageable interest rates.

Benefits and Drawbacks of These Alternatives

- Traditional Bank Loans: Benefits include lower interest rates and better regulatory oversight. However, the application process can be lengthy.

- Credit Unions: They offer personalized service and lower rates but might have membership requirements.

- Microfinance Institutions: These provide easy access to small loans, but interest rates can still be high.

FAQ: Loan Apps and Debt Collection in Nigeria

This FAQ section provides answers to some of the most common questions regarding loan apps and debt collection practices in Nigeria.

Can loan apps really come to my house?No, reputable loan apps in Nigeria cannot legally come to your house to collect debt. Debt collection is a regulated process, and loan apps must follow guidelines set by the FCCPC. These guidelines prohibit them from using physical threats or intimidation.What if I receive a court summons from a loan app?This doesn't necessarily mean someone will appear at your house. The legal system operates through courts, not through loan app representatives. However, take court summons seriously and respond accordingly.What tactics can loan apps use to collect debt?Persistent Calls and Texts: Expect reminders about outstanding payments.

Contacting References: Loan apps might contact your references to pressure repayment.

Reporting to Credit Bureaus: Defaulting can lead to a negative credit report.

Online Harassment: Disreputable apps might resort to this, but it's illegal. Report such behavior to the authorities.Are loan apps regulated in Nigeria?Yes, the FCCPC regulates loan apps. They have established guidelines for responsible lending practices, including transparency in terms and conditions, fair debt collection, and data privacy protection.How can I protect myself when using loan apps?Borrow from registered and FCCPC-approved apps.

Read terms and conditions carefully before applying.

Only borrow what you can afford to repay on time.What are the consequences of defaulting on a loan app?High-interest rates and penalties.

Negative credit report, making it difficult to access future loans.

Personal and social repercussions, such as loan apps contacting your references.How can I check if my BVN is blacklisted?Visit the Credit Bureau of Nigeria website (https://www.crccreditbureau.com/) and follow the steps to access your credit report.What are some alternatives to using loan apps?Traditional bank loans offer fixed interest rates and clear repayment structures.

Credit unions provide loans to members at competitive rates.

Microfinance institutions cater to low-income earners with flexible repayment options.

Conclusion

Remember, you are in control of your finances. By understanding loan app practices and exploring alternative options, you can make informed decisions. Here are some key takeaways:

- Loan apps cannot legally come to your house in Nigeria to collect debt.

- Responsible loan apps rely on legal channels for debt collection.

- The FCCPC regulates loan apps and protects borrowers from harassment.

- Always borrow from reputable, FCCPC-approved loan apps.

- Read loan terms carefully and only borrow what you can afford to repay.

Don't let the fear of forceful tactics deter you from seeking financial solutions. Explore all your options and choose the one that best suits your needs.

Here at BestCreditCards3.com, we encourage you to share your experiences and ask questions in the comments section below. We're here to help you navigate the world of Nigerian loan apps and make informed financial decisions!

Read the full article

0 notes

Text

What Tech Innovations Make Life Easier in Nigeria

Nigeria is a country with a population of over 200 million people, many of whom face challenges such as poverty, insecurity, poor infrastructure, and limited access to quality education and health care. However, Nigeria is also a country with a vibrant and dynamic tech industry, where entrepreneurs, innovators, and developers are creating solutions to address these challenges and improve the lives of millions of Nigerians.

In this blog post, we will explore some of the tech innovations that are making life easier in Nigeria, across different sectors and domains. We will also highlight some of the opportunities and challenges that these innovations face, and how they can be scaled and sustained for greater impact.

E-commerce: One of the most visible and popular tech innovations in Nigeria is e-commerce, which allows consumers to buy and sell goods and services online, using platforms such as Jumia, Konga, Paystack, Flutterwave, and others. E-commerce has enabled millions of Nigerians to access a wider range of products and services, at lower costs and with more convenience. It has also created thousands of jobs for delivery agents, vendors, marketers, and customer service representatives. E-commerce has also boosted the digital economy in Nigeria, by facilitating online payments, data collection, and analytics.

Fintech: Another sector that has witnessed significant tech innovation in Nigeria is fintech, which refers to the use of technology to provide financial services such as banking, lending, insurance, remittances, and investments. Fintech has made financial inclusion more accessible and affordable for millions of Nigerians who are unbanked or underbanked, by offering them digital platforms to save, borrow, invest, and transfer money. Some of the leading fintech startups in Nigeria include Paga, PiggyVest, Carbon, Cowrywise, Kuda Bank, and others. Fintech has also enabled more transparency and efficiency in the financial sector, by reducing fraud, corruption, and bureaucracy.

Health tech: Tech innovation has also been applied to the health sector in Nigeria, where there is a huge gap between the demand and supply of quality health care services. Health tech startups are using technology to improve access to health information, diagnosis, treatment, and delivery. Some examples of health tech innovations in Nigeria include Helium Health, which provides a digital platform for hospitals and clinics to manage their operations; 54gene, which leverages genomics to improve health outcomes for Africans; LifeBank, which delivers blood and oxygen to hospitals; mDoc, which connects patients with doctors via telemedicine; and others. Health tech has the potential to save lives, reduce costs, and improve health outcomes for millions of Nigerians.

Agritech: Agriculture is one of the most important sectors in Nigeria's economy, employing about 40% of the population and contributing about 25% of the GDP. However, agriculture faces many challenges such as low productivity, poor infrastructure, climate change, pests and diseases, and market inefficiencies. Agritech startups are using technology to address these challenges and enhance the value chain of agriculture in Nigeria. Some examples of agritechinnovations in Nigeria

0 notes

Text

How is ISO 27001 Certification in Oman?

ISO 27001 CERTIFICATION IN OMAN

ISO 27001 Certification in Oman economy is driven by oil and gas, and revenues from petroleum products have enabled the country to witness remarkable developments. With oil and gas running out soon, the Omani government has focused on developing industry, trade, and tourism, which has led to a rise in ISO Certification in Oman.

Due to lower oil sector investment and lower public spending, the Sultanate of Oman’s economic growth slowed in 2016. Consequently, Oman continues to use its reserves and borrow, hoping that oil prices will increase along with its demand on international markets. Furthermore, Oman hopes to boost its economy by investing enough money in non-oil industries, a reason for private companies to get ISO Certification.

What is the need for ISO 27001 Certification in Oman regarding cybersecurity?

I might be emotional about the significance of ISO 27001. However, we should investigate how this standard can assist you with online protection:

As a matter of first importance, the standard powers you to think thoroughly so you won’t fail to remember some significant components of your data security/network safety insurance.

The way of thinking of ISO 27001 Services in Oman depends on hazard appraisal — in such a manner, it permits not exclusively altering the insurance of data security as per the necessities of every specific association. However, it additionally permits to zero in on the main issues. Incidentally, the board is getting increasingly more common in overseeing monetary foundations, yet a wide range of for-benefit and non-benefit associations.

The standard perceives that accentuation just on innovation wouldn’t tackle the issue, so it centers around how to deal with the connection between the association (measures, structure, approaches, and so on), individuals (representatives, sellers, and so forth), and the innovation.

An enormous part of data security enactment in numerous nations depends on ISO 27001 — that implies you can utilize this norm for settling consistency issues.

ISO 27001 Implementation in Nigeria is the solitary worldwide data security standard against which an association can get confirmed, demonstrating to outsiders that it is agreeable.

Implementing ISO 27001 Certification in Oman

There are negative sides to ISO 27001, obviously. The essential concern, particularly among IT experts, is that this standard doesn’t offer any rules on the most proficient method to execute certain innovations. This absence of specialized detail is because of the expectation of the norm — to fill in as a structure inside which an association can pick the most suitable innovation.

Why Factocert for ISO 27001 Certification in Oman

We provide the best ISO consultants in the, Who are very knowledgeable and provide the best solution. And to know how to get ISO certification. Kindly reach us at [email protected]. ISO Certification consultants work according to ISO standards and help organizations implement ISO certification with proper documentation.

For more information, visit ISO 27001 Certification in Oman.

RELATED LINKS

ISO Certification in Oman

ISO 9001 Certification in Oman

ISO 14001 Certification in Oman

ISO 45001 Certification in Oman

ISO 27001 Certification in Oman

ISO 22000 Certification in Oman

ISO 13485 Certification in Oman

ISO 17025 Certification in Oman

Related Article: ISO Certification Consultant

0 notes

Text

Payday Loans Market to Witness Revolutionary Growth by 2027 | Money Mart, Speedy Cash, CashNetUSA

Advance Market Analytics published a new research publication on “Global Payday Loans Market Insights, to 2027” with 232 pages and enriched with self-explained Tables and charts in presentable format. In the study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Payday Loans market was mainly driven by the increasing R&D spending across the world.

Major players profiled in the study are:

CashNetUSA (United States), Speedy Cash (United States), Approved Cash Advance (United States), Check n’ Go (United States), Ace Cash Express (United States), Money Mart (United States), LoanPig (United Kingdom), Street UK (United Kingdom), Peachy (United Kingdom), Satsuma Loans (United Kingdom), OppLoans (United States)

Get Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/124850-global-payday-loans-market#utm_source=DigitalJournalVinay

Scope of the Report of Payday Loans

Payday loans are small amount, short-term, unsecured loans that borrowers promise to repay out of their next paycheck or regular income payment. The loans are generally for USD 500 or less than USD 1000 and come due within two to four weeks after receiving the loan and are usually priced at a fixed fee, which signifies the finance charge to the borrower. These unsecured loans have a short repayment period and are called payday loans because the duration of a loan usually matches the borrower’s payday period. According to the Federal Reserve Bank of St. Louis, in 2017, there were 14,348 payday loan storefronts in the United States. Approx. 80% of payday loan applicants are re-borrowing to pay a previous payday loan. The regulations for payday loans are strictest in the Netherlands.

The Global Payday Loans Market segments and Market Data Break Down are illuminated below:

by Type (One Hour, Instant Online, Cash Advance), Application (Mortgage or Rent, Food & Groceries, Regular Expense (Utilities, Car Payment, Credit Card Bill, or Prescription Drugs), Unexpected Expense (Emergency Medical Expense), Others), Repayment Period (Upto 14 Days, 1-2 Months, 3-4 Months, More than 4 Months), End-User (Men, Women)

Market Opportunities:

Growing Adoption of Payday Loan in Developing Countries

Market Drivers:

Increasing Number of User for Payday Loan in North America and Payday Loans Are Only Legal In 36 US States

Rising Use of Quick Cash for Emergencies

Market Trend:

~43% Use 6 or More Installments Loans A Year And 16% Use More Than 12 Small Loan Products Each Year

Payday Loans are Attractive Alternative to the Highly Sought after Credit Cards

What can be explored with the Payday Loans Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Payday Loans Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Payday Loans

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Payday Loans Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/124850-global-payday-loans-market#utm_source=DigitalJournalVinay

Strategic Points Covered in Table of Content of Global Payday Loans Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Payday Loans market

Chapter 2: Exclusive Summary – the basic information of the Payday Loans Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Payday Loans

Chapter 4: Presenting the Payday Loans Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2016-2021

Chapter 6: Evaluating the leading manufacturers of the Payday Loans market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2027)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Payday Loans Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=124850#utm_source=DigitalJournalVinay

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

#Payday Loans market analysis#Payday Loans Market forecast#Payday Loans Market growth#Payday Loans Market Opportunity#Payday Loans Market share#Payday Loans Market trends

0 notes

Text

Lady reveals what she did after her dog damaged her iPhone 14 Pro Max (Video)

A young woman from Nigeria has admitted that she punished her dog for damaging her iPhone 14 Pro Max.

She posted a video online demonstrating how she connected a stick to the dog’s collar and ropes to its legs and tails to launch it on an adventurous search for freedom.

She bemoaned having to borrow money from numerous sources in order to purchase the broken iPhone.

The woman claimed she chose…

View On WordPress

0 notes

Text

Instant Loans in Nigeria - Fastest Solutions to Financial Problems

The loan market is flooded with types of loans that meet a borrower's specific needs - auto loans, education loans, mortgages, home loans, and more. Instant Online Loan in Nigeria is built to cover financial emergencies. If borrowers are looking for a source that gives them a small amount of money quickly, instant loans are just what they need. Instant Loans eliminate all those tedious procedures and get approved in a day or less. Real instant loans give you instant cash.

Many financial institutions offer instant loans through online transactions and this is one of the fastest and easiest ways to access cash. When you find these sites on the internet, you just need to fill out their online application form with some basic personal information. The application form will only take a few minutes to complete and you don't need to step out of your home or office to apply and get such instant loans. Once the companies have received your application, their manager will contact you to analyze your financial needs. Usually, loans will be processed within 2 hours of your approval and you can get the money instantly into your account.

Quick Loan in Nigeria allows you to have cash in your account whenever you need it. Typically loans are short-term and the loan can be repaid electronically on your next payday through a postpaid check that you deposit with the company at the time of sanctioning readiness. These loans benefit many people who would otherwise have no choice in the event their funds run out long before their next payment is due. They can now continue with their current lifestyle if they have cash transferred to their account through these instant transfers. Even for those with a bad credit history in the past, loans are easily accessible and they can also get instant cash when needed. Instant loans are an easy and convenient way to get cash when you really need it.

Some expenses can't wait, such as bill payments, medical bills, and other everyday household expenses. Lack of finances will make your life standstill and it also affects your family and loved ones. Therefore, it is better to choose short-term loans with instant approval and transfer money to your account when you need it urgently. Also, because repayments are made within two or three weeks, you don't have to bear the burden of debt for long. Signing up and getting instant loans is like borrowing money from a close friend, so go for it.

While many loans can take a while to get approved, the credit check process is actually pretty straightforward. As a result, Loan Sites in Nigeria are now able to offer fast online decision loans without bypassing the lengthy decision process familiar to past borrowers.

Source & Reference: https://medium.com/@stanbicibtcbank1/instant-loans-in-nigeria-fastest-solutions-to-financial-problems-618aec4f0c9e

#Apply For Instant Loan#Personal Loans in Nigeria#Emergency Online Loan in Nigeria#Borrow Money Online In Nigeria#Online Instant Loan in Nigeria#Small Loan in Nigeria#Apply For Loan in Nigeria#Get Loan Online In Nigeria#Instant Cash Loan in Nigeria

0 notes

Text

Looking to borrow money online in Nigeria? Here are a few options to consider.

Article Source: https://stanbicibtcbank.livejournal.com/584.html

In today’s materialized world, nobody knows what’s going to happen. The recent outbreak of coronavirus has taught people to start living in the present and don’t think to much about the future. It wreaked havoc on almost everyone from a working professional to businessmen from all sides. Though it was a pandemic that took the lives of many, monetary problems were also prevalent during those tough times.

Even today, months after the release of pandemic, millions have been struggling to manage their daily finance. If you are one of them and looking for some quick cash in today’s troubled times, one option is to borrow money online in Nigeria. At a time when there are hundreds of mobile apps ready to offer loan online in Nigeria, one may feel perplexing to make the right choice.

For you reference, here are some popular choices you can consider to borrow money online in Nigeria.

1. From friends

It might be harder for many to ask, but borrowing money from friends or family is one of the best options available these days. However, to keep both parties happy, follow the below tips:

Define a fair interest rate

Put a written agreement

Set up a formal plan for monthly payments, including due dates and late fees.

2. Advance salary from the employer

Another wonderful option is to ask your employer to pay some amount as advance. The borrowed amount can be repaid later in easy monthly instalments. Instead of asking anyone else to get some money, this is undoubted a great option to consider when it comes to borrow money online in Nigeria. Some employers incur a fee, limit the advance amount at a percentage of your usualpay check, or restrict how often you can ask for an advance. If you leave the job or are laid off, you might have to repay the amount before leaving.

3. Payday Loan

These days, payday loans are very popular. Payday loans are short-term loans, typically for a small amount less than $1,000. The money giversusually charge a standard fee based on the amount borrowed, and you have until your next payday to pay off the amount borrowed along with the fee. Payday loans are one of the simpler ways to borrow money quickly but look at the applicable charges and high-interest rates. Make sure you know — and can afford to repay — the total loan balance before you sign for the loan.

4. Online Loan

If you are looking for government loan in Nigeria, you may visit the government websites to check for any available offer. Otherwise, you can get a loan online through a mobile app. There are many loan apps available today that can help you meet your short-term loan requirement quickly and feasibly.

0 notes

Text

I can’t sleep. Once again. Woke up at 3:30 thinking about this man who played kind games with me. I was so excited in fact so enthusiastic too enthusiastic in fact to have finally talked to him on the phone and I got a very short and salty feedback that he was tired from his trip and needed to rest and by the way his phone was almost dying and would call me the next day. That was the same guy that sent me those flowers and in the past month sent me literally sweet nothings that had actually made me believe there was something good between us. I told myself heck yeah warned myself to never EVER believe men like these. But he was a little off from the start when I first talked to him. However I let time show his true face and yet again my gut feel was right all this time. He wasn’t his true self and I don’t know exactly why he would say “I would do anything for you” and “I adore you”. Why say those sweetest words when you don’t really mean them? I don’t understand why some people like him can be really mean and play with other people’s feelings? I met so many like him in a span of two freaking years. One would lie about his pictures to me, making excuses about not having a strong enough WiFi to have a video call somewhere in Nigeria! He posted a hunk of a man as himself and I image search the man on the photos and googled his name and voila! I found him on Instagram as a gay man in San Francisco! That man I was talking to was a fake! That was in January 2020. February 2020 I met the biggest con man of all- a master manipulator whose identity I am still trying to figure out as he cannot be found on the internet. An Italian British claiming to have a business as a renovation contractor, this man borrowed money from for up to $25,000 in a span of more than a year during a horrible pandemic. He took advantage of my loneliness and went ahead to say something that he was deeply in love with me . Yeah right- he should be because I sent him those monies that should have been used for myself. I filed for bankruptcy due to my failed second marriage (that’s the second part of my autobiography later to be written for everyone to be forewarned). But despite this financial problem, I still was able to help this man financially as he promised to pay me back. I haven’t met him and of course there were so many warning signs about online scammers out there and he was one of them! I felt flat on my face once again. I subscribed to a dating app called Match. It was a waste of my time and money because of that pesky subscription. I practically met the worse men - I expected them to be mature and committed to looking for a serious long term relationship. However, all they wanted was sex and that was it! Maybe momentary entertainment. I did sleep with three out of how many men I online. And they just turned out to be just a blob an amoeba so to speak that just occupied my precious space and time but they did not matter because they just did not care, they just wanted to sleep with me and go to the next woman they meet. They’re like man-whores! And finally this man I am talking about at that beginning of this blog was I thought a little special. He wasn’t. Little red flags here and there and I should know better now not believe what I read and hear and see. I wish I could find that man who would genuinely adore me and keep me in his arms everyday who would never want to let go because he literally wants to be with me for the rest of his sweet life! Alas! I don’t know if I can find that man. Now I have to stop looking. I’m exhausted and more jaded than ever before! I booked a flight to LA just to get a away from Chicago. I need time to regroup, to refresh and to re-energize my wounded body. I should say my prayers that once I stop looking, may God give me an oasis with an almost perfect partner in the horizon. Thank you in advance. But if I don’t find anyone out there that it’s okay to be just me and my furry friend and stay happy and grounded! As always.

1 note

·

View note

Photo

Ibrahima & Abdoulaye Barry Written by Deborah BachAudio by Sara Lerner

How a new alphabet is helping an ancient people write its own future

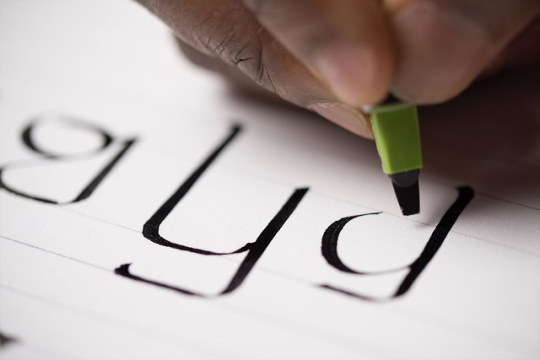

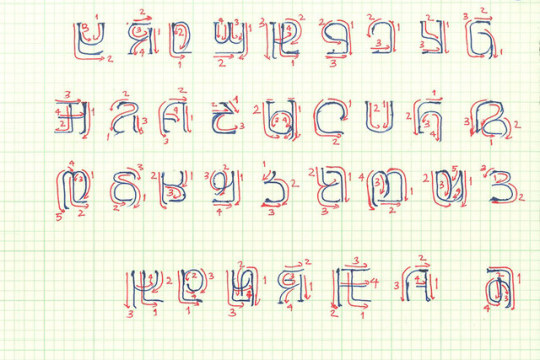

When they were 10 and 14, brothers Abdoulaye and Ibrahima Barry set out to invent an alphabet for their native language, Fulfulde, which had been spoken by millions of people for centuries but never had its own writing system. While their friends were out playing in the neighborhood, Ibrahima, the older brother, and Abdoulaye would shut themselves in their room in the family’s house in Nzérékoré, Guinea, close their eyes and draw shapes on paper.

When one of them called stop they’d open their eyes, choose the shapes they liked and decide what sound of the language they matched best. Before long, they’d created a writing system that eventually became known as ADLaM.

The brothers couldn’t have known the challenges that lay ahead. They couldn’t have imagined the decades-long journey to bring their writing system into widespread use, one that would eventually lead them to Microsoft. They wouldn’t have dreamed that the script they invented would change lives and open the door to literacy for millions of people around the world.

They didn’t know any of that back in 1989. They were just two kids with a naïve sense of purpose.

��We just wanted people to be able to write correctly in their own language, but we didn’t know what that meant. We didn’t know how much work it would be,” said Abdoulaye Barry, now 39 and living in Portland, Oregon.

“If we knew everything we would have to go through, I don’t think we would have done it.”

ADLaM is an acronym that translates to 'the alphabet that will prevent a people from being lost.'

A new writing system takes shape

The Fulbhe, or Fulani, people were originally nomadic pastoralists who dispersed across West Africa, settling in countries stretching from Sudan to Senegal and along the coast of the Red Sea. More than 40 million people speak Fulfulde — some estimates put the number at between 50 and 60 million — in around 20 African countries. But the Fulbhe people never developed a script for their language, instead using Arabic and sometimes Latin characters to write in their native tongue, also known as Fulani, Pular and Fula. Many sounds in Fulfulde can’t be represented by either alphabet, so Fulfulde speakers improvised as they wrote, with varying results that often led to muddled communications.

The Barry brothers’ father, Isshaga Barry, who knew Arabic, would decipher letters for friends and family who brought them to the house. When he was busy or tired, young Abdoulaye and Ibrahima would help out.

“They were very hard to read, those letters,” Abdoulaye recalled. “People would use the most approximate Arabic sound to represent a sound that doesn’t exist in Arabic. You had to be somebody who knows how to read Arabic letters well and also knows the Fulfulde language to be able to decipher those letters.”

Abdoulaye asked his father why their people didn’t have their own writing system. Isshaga replied that the only alphabet they had was Arabic, and Abdoulaye promised to create one for Fulfulde.

“At a basic level, that’s how the whole idea of ADLaM started,” Abdoulaye said. “We saw that there was a need for something and we thought maybe we could fix it.”

The brothers developed an alphabet with 28 letters and 10 numerals written right to left, later adding six more letters for other African languages and borrowed words. They first taught it to their younger sister, then began teaching people at local markets, asking each student to teach at least three more people. They transcribed books and produced their own handwritten books and pamphlets in ADLaM, focusing on practical topics such as infant care and water filtration.

While attending university in Conakry, Guinea’s capital city, the brothers started a group called Winden Jangen — Fulfulde for “writing and reading” — and continued developing ADLaM. Abdoulaye left Guinea in 2003, moving to Portland with his wife and studying finance. Ibrahima stayed behind, completing a civil engineering degree, and continued working on ADLaM. He wrote more books and started a newspaper, translating news stories from the radio and television from French to Fulfulde. Isshaga, a shopkeeper, photocopied the newspapers and Ibrahima handed them out to Fulbhe people, who were so grateful they sometimes wept.

But not everyone was pleased by the brothers’ work. Some objected to their efforts to spread ADLaM, saying Fulbhe people should learn French, English or Arabic instead. In 2002, military officers raided a Winden Jangen meeting, arrested Ibrahima and imprisoned him for three months. He was not charged with anything or ever told why he was arrested, Abdoulaye said. Undeterred, Ibrahima moved to Portland in 2007 and continued writing books while studying civil engineering and mathematics.

ADLaM, meanwhile, was spreading beyond Guinea. A palm oil dealer, a woman the brothers’ mother knew, was teaching ADLaM to people in Senegal, Gambia and Sierra Leone. A man from Senegal told Ibrahima that after learning ADLaM, he felt so strongly about the need to share what he’d learned that he left his auto repair business behind and went to Nigeria and Ghana to teach others.

“He said, ‘This is changing people’s lives,’” said Ibrahima, now 43. “We realized this is something people want.”

ADLaM comes online

The brothers also understood that to fully tap ADLaM’s potential, they needed to get it onto computers. They made inquiries about getting ADLaM encoded in Unicode, the global computing industry standard for text, but got no response. After working and saving for close to a year, the brothers had enough money to hire a Seattle company to create a keyboard and font for ADLaM. Since their script wasn’t supported by Unicode, they layered it on top of the Arabic alphabet. But without the encoding, any text they typed just came through as random groupings of Arabic letters unless the recipients had the font installed on their computers.

Following that setback, Ibrahima made a fateful decision. Wanting to refine the letters the Seattle font designer developed, which he wasn’t happy with, he enrolled in a calligraphy class at Portland Community College. The instructor, Rebecca Wild, asked students at the start of each course why they were taking her class. Some needed an art credit; others wanted to decorate cakes or become tattoo artists. The explanation from the quiet African man with the French accent stunned Wild.

“It was mind-blowing when I heard the story of why he was doing this,” said Wild, who lives in Port Townsend, Washington. “It’s so remarkable. I think they deserve a Nobel Peace Prize for what they’re doing. What a difference they’ve made on this planet, and they’re these two humble brothers.”

Wild was struck by Ibrahima’s focus and assiduousness in class. “He was always a star student,” she said. “He had this skill set and unending patience. He worked and worked and worked in class on the assignments, but at the same time, he was taking all this stuff he was learning in class back to ADLaM.”

Wild helped Ibrahima get a scholarship to a calligraphy conference at Reed College in Portland, where he met Randall Hasson, a calligraphy artist and painter. Hasson was seated at a table one afternoon, giving a lettering demonstration with another instructor, and Ibrahima came over. A book about African alphabets rested on the table. Ibrahima picked it up, commented that the scripts in the book weren’t the only African alphabets and offhandedly mentioned that he and his brother had invented an alphabet.

Hasson, who has extensively researched ancient alphabets, assumed Ibrahima meant that he and his brother had somehow modified an alphabet.

“I said, ‘You mean you adapted an alphabet?’” Hasson recalled. “I had to ask him three times to be sure he had actually invented one.”

After hearing Ibrahima’s story, Hasson suggested teaming up for a talk on ADLaM at a calligraphy conference in Colorado the following year. The audience sat rapt as Hasson told Ibrahima’s story, giving him a standing ovation as he walked to the stage. During a break earlier in the day, Ibrahima asked Hasson to come and meet a few people. They were four Fulbhe men who had driven almost 1,800 miles from New York just to hear Ibrahima’s talk, hoping it would finally help get ADLaM the connections they sought.

Hasson was so moved after speaking with them that he walked away, sat down in an empty stairwell and cried.

“At that moment,” he said, “I began to understand how important this talk was to these people.”

Ibrahima made connections at the conference that got him introduced to Michael Everson, one of the editors of the Unicode Standard. It was the break the brothers needed. With help from Everson, Ibrahima and Abdoulaye put together a proposal for ADLaM to be added to Unicode.

Andrew Glass is a senior program manager at Microsoft who works on font and keyboard technology and provides expertise to the Unicode Technical Committee. The ADLaM proposal and the Barry brothers’ pending visit to the Unicode Consortium generated much interest and excitement among Glass and other committee members, most of whom have linguistics backgrounds. Glass’s graduate studies focused on writing systems that are around 2,000 years old, and like other linguists he uses a methodological, technical approach to analyze and understand writing systems.

But here were two brothers with no training in linguistics, who developed an alphabet through a natural, organic approach — and when they were children, no less. New writing systems aren’t created very often, and the chance to actually talk with the inventors of one was rare.

“You come across things in these old writing systems and you wonder why it’s the way it is, and there’s nobody to ask,” Glass said. “This was a unique opportunity to say, ‘Why is it like this? Did they think about doing things differently? Why are the letters ordered this way?’ and things like that.”

Microsoft worked with designers to develop a font for Windows and Office called Ebrima that supports ADLaM and several other African writing systems.

It was during the Unicode process that ADLaM got its new name. The brothers originally called their alphabet Bindi Pular, meaning “Pular script,” but had always wanted a more meaningful name. Some people in Guinea who’d been teaching the script suggested ADLaM, an acronym using the first four letters of the script for a phrase that translates to “the alphabet that will prevent a people from being lost.” The Unicode Technical Committee approved ADLaM in 2014 and the alphabet was included in Unicode 9.0, released in June 2016. The brothers were elated.

“It was very exciting for us,” Abdoulaye said. “Once we got encoded, we thought, ‘This is it.’”

But they soon realized there were other, possibly even more challenging hurdles ahead. For ADLaM to be usable on computers, it had to be supported on desktop and mobile operating systems, and with fonts and keyboards. To make it broadly accessible, it also needed to be integrated on social networking sites.

The brothers’ script found a champion in Glass, who had developed Windows keyboards for several languages and worked on supporting various writing systems in Microsoft technology. Glass told others at Microsoft about ADLaM and helped connect the Barry brothers to the right people at the company. He developed keyboard layouts for ADLaM, initially as a project during Microsoft’s annual companywide employee hackathon.

Judy Safran-Aasen, a program manager for Microsoft’s Windows design group, also saw the importance of incorporating ADLaM into Microsoft products. Safran-Aasen wrote a business plan for adding ADLaM to Windows and pushed the work forward with various Microsoft teams.

“It was a shoestring collaboration of a few people who were really interested in seeing this happen,” she said. “It’s a powerful human interest story, and if you tell the story you can get people onboard.

“This is going to have an impact on literacy throughout that community and enable people to be part of the Windows ecosystem, where before that just wasn’t available to them,” Safran-Aasen said. “I’m really excited that we can make this happen.”

ADLaM creators Ibrahima and Abdoulaye Barry in Portland, Oregon.

Microsoft worked with two type designers in Maine, Mark Jamra and Neil Patel, to develop an ADLaM component for Windows and Office within Microsoft’s existing Ebrima font, which also supports other African writing systems. ADLaM support is included in the Windows 10 May 2019 update, allowing users to type and see ADLaM in Windows, including in Word and other Office apps.

Microsoft’s support for ADLaM, Abdoulaye said, “is going to be a huge jump for us.”

ADLaM is also supported by the Kigelia typeface system developed by Jamra and Patel, which includes eight African scripts and is being added to Office later this year. The designers wanted to create a type system for a region of the world lacking in typeface development, where they say existing fonts tend to be oversimplified and poorly researched. They consulted extensively with Ibrahima and Abdoulaye to refine ADLaM’s forms, painstakingly working to execute on the brothers’ vision within the boundaries of font technology.

“This was their life’s work that they started when they were kids,” Patel said. “To get it right is a big deal.”

And to many Africans, Jamra said, a script is more than just an alphabet. ”These writing systems are cultural icons,” he said. “It’s not like the Latin script. They really are symbols of ethnic identity for many of these communities.”

They’re also a means of preserving and advancing a culture. Without a writing system it’s difficult for people to record their history, to share perspective and knowledge across generations, even to engage in the basic communications that facilitate commerce and daily activities. There is greater interest in recent years in establishing writing systems for languages that didn’t have them, Glass said, to help ensure those languages remain relevant and don’t disappear. He pointed to the Osage script, created by an elder in 2006 to preserve and revitalize the language, as an example.

“There is a big push among language communities to develop writing systems,” Glass said. “And when they get them, they are such a powerful tool to put identity around that community, and also empower that community to learn and become educated.

“I think ADLaM has tremendous potential to change circumstances and improve people’s lives. That’s one of the things that’s really exciting about this.”

Keeping a culture alive

Ibrahima and Abdoulaye don’t know how many people around the world have learned ADLaM. It could be hundreds of thousands, maybe more. As many as 24 countries have been represented at ADLaM’s annual conference in Guinea, and there are ADLaM learning centers in Africa, Europe and the U.S. On a recent trip to Brussels, Ibrahima discovered that four learning centers had opened there and others have started in the Netherlands.

“I was really surprised. I couldn’t imagine that ADLaM has reached so many people outside of Africa,” he said.

Abdoulaye “Bobody” Barry (no relation to ADLaM’s creator) lives in Harlem, New York and is part of Winden Jangen, now a nonprofit organization based in New York City. He learned ADLaM a decade ago and has taught it to hundreds of people, first at mosques and then through messaging applications using an Android app. The script has enabled Fulbhe people, many of whom never learned to read and write in English or French, to connect around the world and has fostered a sense of sense of cultural pride, Barry said.

“This is part of our blood. It came from our culture,” he said. “This is not from the French people or the Arabic people. This is ours. This is our culture. That’s why people get so excited.”

Suwadu Jallow emigrated to the U.S. from Gambia in 2012 and took an ADLaM class the Barry brothers taught at Portland Community College. ADLaM is easy for Fulfulde speakers to learn, she said, and will help sustain the language, particularly among the African diaspora.

“Now I can teach this language to someone and have the sense of my tribe being here for years and years to come without the language dying off,” said Jallow, who lives in Seattle. “Having this writing system, you can teach kids how to speak (Fulfulde) just like you teach them to speak English. It will help preserve the language and let people be creative and innovative.”

Jallow is pursuing a master’s in accounting at the University of Washington and hopes to develop an inventory-tracking system in ADLaM after she graduates. She got the idea after helping out in her mother’s baby clothing shop in Gambia as a child and seeing that her mother, who understood little English and Arabic, could not properly record and track expenses. ADLaM, she said, can empower people like her mother who are fluent in Fulfulde and just need a way to write it.

“It’s going to increase literacy,” she said. “I believe knowledge is power, and if you’re able to read and write, that’s a very powerful tool to have. You can do a lot of things that you weren’t able to do.”

The Fulbhe people in Guinea historically produced a considerable volume of books and manuscripts, Abdoulaye Barry said, using Arabic to write in their language. Most households traditionally had a handwritten personal book detailing the family’s ancestry and the history of the Fulbhe people. But the books weren’t shared outside the home, and Fulbhe people largely stopped writing during French colonization, when the government mandated teaching in French and the use of Arabic was limited primarily to learning the Koran.

“Everything else was basically discounted and no longer had the value that it had before the French came,” Abdoulaye said.

Having ADLaM on phones and computers creates infinite possibilities — Fulbhe people around the world will be able to text each other, surf the internet, produce written materials in their own language. But even before ADLaM’s entry into the digital world, Fulfulde speakers in numerous countries have been using the script to write books. Ibrahima mentions a man in Guinea who never went to school and has written more than 30 books in ADLaM, and a high school girl, also in Guinea, who wrote a book about geography and another about how to succeed on exams. The president of Winden Jangen, Abdoulaye Barry (also no relation to Ibrahima’s brother), said many older Fulbhe people who weren’t formally educated are now writing about Fulbhe history and traditions.

“Now, everybody can read that and understand the culture,” he said. “The only way to keep a culture alive is if you read and write in your own language.”

‘The kids are the future’

Though ADLaM has spread over several continents, Ibrahima and Abdoulaye aren’t slowing down their work. Both spend much of their spare time promoting the script, traveling to conferences and continuing to write. Ibrahima, who sleeps a maximum of four hours a night, recently finished the first book of ADLaM grammar and hopes to build a learning academy in Guinea.

On a chilly recent day in Abdoulaye’s home in Portland, the brothers offer tea and patiently answer questions about ADLaM. They are unfailingly gracious, gamely agreeing to drive to a scenic spot on the Willamette River for photos after a long day of talking. They’re also quick to deflect praise for what they have accomplished. Ibrahima, who sometimes wakes up to hundreds of email and text messages from grateful ADLaM learners, said simply that he’s “very happy” with how the script has progressed. For his brother, the response to ADLaM can be overwhelming.

Having this writing system, you can teach kids how to speak Fulani just like you teach them to speak English. It will help preserve the language and let people be creative and innovative.

“It’s very emotional sometimes,” Abdoulaye said. “I feel like people are grateful beyond what we deserve.”

The brothers want ADLaM to be a tool for combating illiteracy, one as lasting and important to their people as the world’s most well-known alphabets are to cultures that use them. They have a particular goal of ADLaM being used to educate African women, who they said are more impacted by illiteracy than men and are typically the parent who teaches children to read.

“If we educate women we can help a lot of people in the community, because they are the foundation of our community,” Abdoulaye said. “I think ADLaM is the best way to educate people because they don’t need to learn a whole new language that’s only used at school. If we switched to this, it would make education a lot easier.”

That hasn’t happened yet, but ADLaM has fostered a grassroots learning movement fueled largely through social media. There are several ADLaM pages on Facebook, and groups with hundreds of members are learning together on messaging apps. Abdoulaye said he and Ibrahima used to hear mostly about adults learning ADLaM, but increasingly it’s now children. Those children will grow up with ADLaM, using the script Abdoulaye and Ibrahima invented all those years ago in their bedroom.

“That makes us believe ADLaM is going to live,” Abdoulaye said. “It’s now settled into the community because it’s in the kids, and the kids are the future.”

Originally published on 7/29/2019 / Photos by Brian Smale / © Microsoft

30 notes

·

View notes

Text

Flutterwave.com: An Incredibly Easy Online Payment Platform That Works For All

We live in a world where everything has gone digital, gone are the days where people will have to stand for hours in a bank to carry out their transactions. The use of many platforms have failed to totally eradicate this issue due to maybe trust, failed transaction, delay in payment of transaction and many more.

To this effect, we will be looking at how a small team(Flutterwave) helps us to make easy, secure and fast transactions without stress as they intend to be the No 1 Fintech Company to achieve this payment solution.

What is Flutterwave all about?

Flutterwave is a Nigerian Payment Technology Company that focuses on helping banks and businesses provide seamless and secure payment experiences for their customers.

With the use of their platform, they have integrated the use of a card payment system like Mastercard, Visa Card, Verve and other card systems to Accept payment. Also, you can receive money from customers directly to your account with ease. Finally, you can use their API(Application Program Interface) to receive money for your online store and you have access to use their WordPress plugin for your e-commerce site.

Brief history of the company and its founders, directors, senior managers...

Their desire to make a positive impact on technology and to also make life easy with their product propelled Olugbenga Agboola, a financial technology Engineer and Iyinoluwa Aboyeji, an Entrepreneur and Co-founder of Andela founded flutterwave to create flutterwave in the year 2016.

Their earnest involvement to create a product that will not only meet the desire of all but contribute immensely to the financial sector of Africa did not go unnoticed as top investors partner with them. This led to funding in excess of $10 million in 2017 for the company, making the company one of the fastest-growing tech companies in Africa

It is good to note that Flutterwave currently has two amazing products to help businesses and individuals to bridge the gap in transaction through its ease of cashless transaction solutions. Thereby ensuring efficient online transfer of money for both buyer and seller who now can conduct business conveniently and remotely.

Products are as follows:

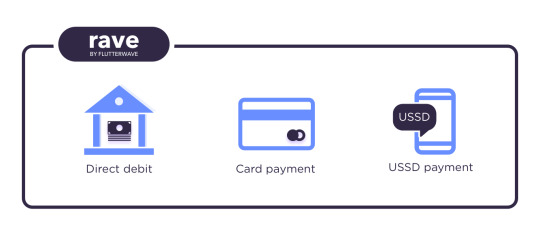

1. Rave: Flutterwave for Businesses

2. Barter: Flutterwave for Individuals

Rave is an Integrated Global Payment Platform which was created to help businesses make easy and secure transactions whether through simple payment link or to manage payout of hundreds of people. This can either be done using various card payment platforms or USSD codes of various banks. They render 24/7 customer service with reasonable fees and technology to achieve zero failed transactions. Top companies like flywire.com, arikair.com, Uber.com, Jumia.com.ng, and Booking.com make use of this amazing business solution.

Fig 1: What you can do with Rave

Barter is a payment platform designed to make us enjoy life and spend less on the amount we use to send money and borrow money. It is also good to know that with barter you have an electronic ATM card that can be used on all platforms.

Fig 2: Barter Interface

These products aforementioned have made Flutterwave the Best Payment Gateway in Africa. Flutterwave not only have access to African countries but also the US, UK, and China for payment processes. They also have connections to Shopify, Quickbook, Sage, Xero, Squarespace, and Zoho.

Achievements of Flutterwave

1. In 2018 Flutterwave successfully processed transactions worth $2.6bn, this was achieved with 26,000 transactions.

2. In 2018, Flutterwave received the ‘Best Payments Company’ award at the Ghana e-Commerce Awards ceremony

3. Successful integration and collaboration with top companies that will widen the horizon of Flutterwave beyond African. Currently, they just sealed a deal with Alipay(the largest payment portal in China) to allow African trade to buy and pay in China without stress.

4. Flutterwave, currently has connected these African countries to each other such as Uganda, Kenya, Nigeria, South Africa, Rwanda, Ghana. It is in the process of connecting Africa to the world.

5. Certification of ISO 27001 and 22301 by the International Standards for Organization in Switzerland.

It is good to know that flutterwave has not only gained the trust but has shown to have the best interest of people at heart. With all these facts, I believe without any doubt that you will start using flutterwave for your Online Payment Transaction.

Go higher Flutterwave as you make not only Nigeria but Africa at Large Proud...

2 notes

·

View notes

Text

Flutterwave: The Innovative Digital Payments Platform

The underdevelopment of the financial service industry in Africa posed a very tough, important and widespread problem of payments across the continent. After more than 50 years of banking on the continent, only roughly about 34 percent of adults in sub-Saharan Africa have bank accounts or access to formal financial services.

It is clear the traditional model of banking is too slow, inflexible and incapable of spreading financial access across the continent, and so making payments across globally is proves even more difficult

Fortunately, with the spread of mobile phones and the Internet across Africa, more people are exposed to the better option of digital financial services, both for individuals and businesses. This is a very beneficial advancement as every day more and more people leverage this technology to have access to various online digital platforms to make payments across the globe in ways traditional banking never did as online transactions happen quickly and with ease.

Regardless of the popularity of online digital payments, many businesses, and individuals in Africa still feel very Insecure and do not trust these digital financial service providers.

With so many concerns about making secure and reliable payments online, problems with making payments for products and services both across the continent and globally, the general fear of being a victim of “fraudsters”, consumers are looking for a product and service they can trust.

This is exactly what Flutterwave, a fintech startup from Nigeria hoped to achieve when they came into the scene in May 2016 and completely revolutionized the online digital payment platforms in Africa.

What is this Flutterwave you may ask?

Flutterwave

Flutterwave is an online digital payment platform that is set out to provide complete payment solutions to enable Africans to thrive in the global economy. The company started with a vision to first connect digital payments within Africa and then connecting Africa to the rest of the world. Flutterwave has been to able provide with its various products advance financial technologies and solutions for efficient, reliable and swift and payments across Africa and the globe.