#Budgeting and forecasting Uae

Text

Navigating the intricate landscape of financial management in the UAE presents

Navigating the intricate landscape of financial management in the UAE presents a unique set of challenges and opportunities for businesses of all sizes. From startups finding their footing to established multinational enterprises, grasping the significance of robust accounting practices, tax obligations, and VAT regulations is paramount.

Corporate Tax and VAT Dynamics in the UAE

Renowned for its tax-friendly environment, the UAE stands out for its absence of corporate and personal income taxes for most entities and individuals. However, nuanced tax regulations apply to specific industries and activities. Typically, businesses face a 20% corporate tax rate on taxable profits, while a 5% VAT is standard for most goods and services unless exemptions or zero-rated categories apply.

Exemplary VAT Consulting Support in the UAE

Navigating the intricacies of VAT compliance and optimization demands specialized expertise. FST Accounting emerges as a beacon of proficiency in Financial Consulting in the UAE. Leveraging a profound understanding of UAE tax frameworks and extensive hands-on experience, FST Accounting delivers tailor-made VAT consulting solutions, ensuring compliance and strategic tax maneuvering.

VAT Accounting Precision in the UAE

Accurate VAT accounting stands as a cornerstone for businesses operating in the UAE. VAT-registered entities must meticulously record transactions, apply the appropriate VAT rates, and diligently submit VAT returns to the Federal Tax Authority (FTA). FST Accounting steps in with comprehensive VAT accounting services, safeguarding compliance and fortifying tax positions.

UAE Corporate Tax Landscape Unveiled

While the UAE predominantly refrains from corporate income tax imposition, specific sectors like oil and gas entities and branches of foreign banks face corporate tax obligations. It's imperative for businesses within these realms to grasp their tax responsibilities and engage professional counsel for seamless implementation.

Diving into VAT Varieties

Within the UAE, VAT treatments primarily fall into two categories: standard-rated and zero-rated supplies. Standard-rated supplies incur a 5% VAT, while zero-rated supplies enjoy a 0% VAT rate. Examples of zero-rated supplies encompass select exports, international transportation, and healthcare services.

Embracing Excellence in Financial Management

For dependable accounting services, adept financial consulting, and meticulous tax preparation in the UAE, enterprises entrust FST Accounting. Serving as a conduit for success and compliance, FST Accounting emerges as the partner of choice in navigating the intricate realm of UAE financial regulations.

Tagged: Accounting services in UAE, Financial consulting in UAE, Tax preparation in UAE

#Accounting services Uae#Financial consulting Uae#Tax preparation uae#Bookkeeping solutions Uae#Small business accounting Uae#Payroll management Uae#Auditing services Uae#Tax planning Uae#Financial reporting Uae#CPA services Uae#Budgeting and forecasting Uae#Business advisory Uae#Financial analysis Uae#QuickBooks consulting Uae#Tax compliance Uae#certified accountant near me#cpa accountant near me#accountants near me#tax accountant near me#accounting services

0 notes

Text

Tips for Successful Budgeting and Forecasting in Your Business

Budgeting and forecasting are essential tools for any successful business. With proper budgeting and forecasting, you can plan and track your financial performance and make informed decisions for the future of your business. In Our Latest Blog will provide you with some tips to help you achieve successful budgeting and forecasting in your business.

Once your Business is operational, it’s essential to plan and tightly manage its financial performance. As a business grows and becomes more complex, the need for a successful budgeting and forecasting process becomes critical. They allow a business to plan accurately for its fiscal year.

4 Tips for Successful Budgeting and Forecasting in Your Business💡

1. Identify your financial goals

2. Create a detailed budget

3. Consider potential risks and uncertainties

4. Updating Forecasts and Budgets Enables You to Fix Problems

Read Our Full Blog for more Details⏩

https://markef.com/tips-for-successful-budgeting-and-forecasting-in-your-business/

#forecasting#budget#budgeting#trendforecasting#womenentrepreneurs#smallbusiness#business#dubai#uae#markef#markefconsultancy#markefaccounting#servies#dubaï#businessowner#call#entrepeneur#instagood#planning#like#consultancy#entrepreneur#financial#accounting#askmarkef#residencevisa#finance

1 note

·

View note

Text

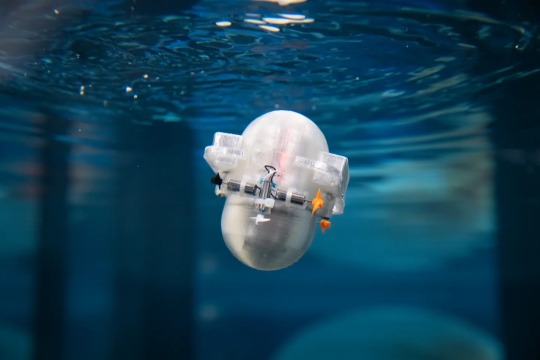

Aquatic Robot Market to Eyewitness Huge Growth by 2030

Latest business intelligence report released on Global Aquatic Robot Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Aquatic Robot market outlook.

List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis:

Atlas Maridan ApS. (Germany), Deep Ocean Engineering Inc. (United States), Bluefin Robotics Corporation (United States), ECA SA (France), International Submarine Engineering Ltd. (Canada), Inuktun Services Ltd. (Canada), Oceaneering International, Inc. (United States), Saab Seaeye (Sweden), Schilling Robotics, LLC (United States), Soil Machine Dynamics Ltd. (United Kingdom)

Download Free Sample PDF Brochure (Including Full TOC, Table & Figures) @ https://www.advancemarketanalytics.com/sample-report/177845-global-aquatic-robot-market

Brief Overview on Aquatic Robot:

Aquatic robots are those that can sail, submerge, or crawl through water. They can be controlled remotely or autonomously. These robots have been regularly utilized for seafloor exploration in recent years. This technology has shown to be advantageous because it gives enhanced data at a lower cost. Because underwater robots are meant to function in tough settings where divers' health and accessibility are jeopardized, continuous ocean surveillance is extended to them. Maritime safety, marine biology, and underwater archaeology all use aquatic robots. They also contribute significantly to the expansion of the offshore industry. Two important factors affecting the market growth are the increased usage of advanced robotics technology in the oil and gas industry, as well as increased spending in defense industries across various countries.

Key Market Trends:

Growth in AUV Segment

Opportunities:

Adoption of aquatic robots in military & defense

Increased investments in R&D activities

Market Growth Drivers:

Growth in adoption of automated technology in oil & gas industry

Rise in awareness of the availability of advanced imaging system

Challenges:

Required highly skilled professional for maintenance

Segmentation of the Global Aquatic Robot Market:

by Type (Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV)), Application (Defense & Security, Commercial Exploration, Scientific Research, Others)

Purchase this Report now by availing up to 10% Discount on various License Type along with free consultation. Limited period offer.

Share your budget and Get Exclusive Discount @: https://www.advancemarketanalytics.com/request-discount/177845-global-aquatic-robot-market

Geographically, the following regions together with the listed national/local markets are fully investigated:

• APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)Furthermore, the years considered for the study are as follows:

Historical data – 2017-2022

The base year for estimation – 2022

Estimated Year – 2023

Forecast period** – 2023 to 2028 [** unless otherwise stated]

Browse Full in-depth TOC @: https://www.advancemarketanalytics.com/reports/177845-global-aquatic-robot-market

Summarized Extracts from TOC of Global Aquatic Robot Market Study Chapter 1: Exclusive Summary of the Aquatic Robot market

Chapter 2: Objective of Study and Research Scope the Aquatic Robot market

Chapter 3: Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis

Chapter 4: Market Segmentation by Type, End User and Region/Country 2016-2027

Chapter 5: Decision Framework

Chapter 6: Market Dynamics- Drivers, Trends and Challenges

Chapter 7: Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 8: Appendix, Methodology and Data Source

Buy Full Copy Aquatic RobotMarket – 2021 Edition @ https://www.advancemarketanalytics.com/buy-now?format=1&report=177845

Contact US :

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 201 565 3262, +44 161 818 8166

[email protected]

#Global Aquatic Robot Market#Aquatic Robot Market Demand#Aquatic Robot Market Trends#Aquatic Robot Market Analysis#Aquatic Robot Market Growth#Aquatic Robot Market Share#Aquatic Robot Market Forecast#Aquatic Robot Market Challenges

2 notes

·

View notes

Text

Black Alkaline Water Market: Health Benefits and Consumer Awareness

Introduction to Black Alkaline Water Market

The Black Alkaline Water Market is experiencing rapid growth, fueled by increasing consumer awareness of health and wellness benefits. Characterized by its unique properties, black alkaline water is rich in minerals and antioxidants, appealing particularly to health-conscious individuals. The market is dominated by a variety of bottled products, often marketed as superior hydration solutions that help balance pH levels in the body. Urban consumers, especially millennials, are driving demand through their preference for functional beverages. As brands innovate with flavors and health claims, the market is poised for expansion, with opportunities for e-commerce and sustainable practices further enhancing its appeal.

The Black Alkaline Water Market is Valued USD 1.18 billion in 2024 and projected to reach USD 2.87 billion by 2030, growing at a CAGR of CAGR of 13.53% During the Forecast period of 2024-2032. This segment has gained traction due to its perceived ability to balance pH levels and improve hydration. The market features a diverse range of products, including bottled black alkaline water enriched with minerals and antioxidants. Key demographics include health-conscious consumers and millennials seeking functional beverages. With innovative marketing strategies and premium product offerings, the industry is poised for expansion, particularly in urban centers.

Access Full Report :https://www.marketdigits.com/checkout/3762?lic=s

Major Classifications are as follows:

By Alkalinity Level

Mild Alkaline (pH 8-9)

Moderate Alkaline (pH 9-10)

High Alkaline (pH above 10)

By Use Case

Detoxification

Hydration

Anti-Aging

Others

By Sales Channel

Supermarket / Hypermarket

Grocery Stores

Health & Wellness Stores

Online Sales

Others

Key Region/Countries are Classified as Follows:

◘ North America (United States, Canada,)

◘ Latin America (Brazil, Mexico, Argentina,)

◘ Asia-Pacific (China, Japan, Korea, India, and Southeast Asia)

◘ Europe (UK,Germany,France,Italy,Spain,Russia,)

◘ The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South

Key Players of Black Alkaline Water Market

AV Organics (Evocus), blk., Culligan, Essentia Water, LLC, FLC Inc., TRACE Wellness and Others

Market Drivers in Black Alkaline Water Market

Health Consciousness: Increasing awareness of the benefits of alkaline water promotes demand.

Rise of Functional Beverages: The trend towards drinks that offer health benefits boosts market growth.

Innovative Product Offerings: Brands introducing flavored and fortified variants attract diverse consumers.

Market Challenges in Black Alkaline Water Market

High Price Point: Premium pricing may limit accessibility for budget-conscious consumers.

Skepticism: Some consumers question the health benefits of alkaline water, impacting sales.

Market Saturation: An influx of new brands makes differentiation challenging.

Market Opportunities in Black Alkaline Water Market

Emerging Markets: Expansion into developing regions presents growth potential.

E-commerce Growth: Online sales channels provide wider access and convenience.

Customization Trends: Personalized products can cater to individual health needs.

Conclusion

The Black Alkaline Water Market is on an upward trajectory, driven by health trends and consumer preferences for functional beverages. While challenges like pricing and skepticism exist, the opportunities for growth in emerging markets and innovative product development are substantial. Brands that effectively navigate these dynamics and prioritize sustainability will likely thrive in this evolving landscape.

0 notes

Text

Expert Accounting Services in Dubai with Kloudac.com

In today’s competitive business landscape, managing finances efficiently is critical for business success. Whether you are a startup, a growing SME, or a well-established enterprise, navigating the complexities of accounting, taxation, and auditing can be challenging. Kloudac.com is a trusted name in Dubai for providing expert accounting services to businesses across various industries, offering a wide range of solutions to help you maintain financial clarity and compliance.

Why Professional Accounting Services Are Essential

Businesses today deal with many financial operations, from day-to-day bookkeeping to complex tax filings and audits. Having an experienced accounting service is more than just a convenience; it is a necessity for ensuring the smooth operation of financial matters. Here’s why:

Accurate Financial Reporting: Regular and accurate financial reporting is crucial for business decision-making. It helps companies assess their financial health, identify growth opportunities, and make informed decisions.

Compliance with Regulations: Dubai's regulatory environment requires businesses to comply with various financial laws, including the UAE’s VAT system, corporate taxes, and more. Failing to comply with these can result in fines and penalties.

Tax Efficiency: With the right accounting partner, businesses can manage their tax liabilities more efficiently, ensuring they only pay what is required by law while leveraging legal tax-saving opportunities.

Kloudac.com is well-equipped to handle all these aspects, making it an ideal choice for businesses seeking dependable accounting services in Dubai.

Comprehensive Services Offered by Kloudac.com

Kloudac.com offers a wide array of services designed to meet the needs of businesses in Dubai. These services include:

Bookkeeping and Financial Reporting

Keeping accurate and up-to-date financial records is the backbone of any successful business. Kloudac.com provides professional bookkeeping services, ensuring that your accounts are always in order. This includes managing ledgers, preparing financial statements, and producing insightful reports that give you a clear picture of your company’s financial health.

Tax Preparation and Filing

Tax compliance is a major concern for businesses in the UAE. With constantly evolving tax laws, businesses can easily fall out of compliance. Kloudac.com helps businesses navigate the intricacies of tax preparation and filing, ensuring that all VAT and other tax obligations are met on time. Their expert team identifies opportunities for tax optimization, helping businesses save money while staying fully compliant with UAE tax laws.

Audit Services

Auditing is essential for ensuring the accuracy and fairness of a company’s financial statements. Kloudac.com offers comprehensive audit services, including internal and external audits, to ensure that your business operations and financial records are in line with legal standards. These audits provide assurance to stakeholders, investors, and regulators, and help improve financial transparency.

Payroll Management

Managing payroll can be time-consuming, especially for growing businesses. Kloudac.com simplifies payroll management by handling everything from salary calculations to ensuring compliance with UAE labor laws. This ensures timely and accurate payment of employees, reducing administrative burden on business owners.

Business Advisory and Financial Planning

Beyond traditional accounting, Kloudac.com provides business advisory services to help companies grow strategically. Their team of financial experts offers advice on budgeting, forecasting, and financial planning, helping businesses prepare for the future and achieve long-term success.

Why Choose Kloudac.com for Accounting Services?

Choosing the right accounting firm is crucial for your business’s financial success. Kloudac.com stands out for several reasons:

Expertise and Experience

With years of experience in the UAE market, Kloudac.com has an in-depth understanding of local accounting, tax, and audit regulations. Their team of qualified accountants, auditors, and tax experts provides personalized services tailored to meet each client’s specific needs.

Customized Solutions

Every business is unique, and Kloudac.com recognizes that. They offer customized accounting solutions based on the size, industry, and needs of each client, ensuring you get the most relevant and effective services.

Use of Advanced Technology

Kloudac.com integrates cutting-edge accounting software and tools into their services, ensuring accuracy, efficiency, and real-time access to financial data. This allows businesses to make informed decisions with ease and confidence.

Compliance and Peace of Mind

One of the major benefits of working with Kloudac.com is the assurance of full regulatory compliance. With a team of experts managing your accounting and tax affairs, you can focus on growing your business without worrying about falling afoul of financial regulations.

Cost-Effective Services

Outsourcing accounting services to Kloudac.com is a cost-effective way to manage your business’s finances. Instead of maintaining an in-house accounting team, you can leverage the expertise of seasoned professionals at a fraction of the cost, all while ensuring the highest level of service.

Get Started with Kloudac.com Today!

If you’re a business owner in Dubai, managing your finances, taxes, and audits efficiently is key to long-term success. Kloudac.com provides reliable, expert accounting services that help you stay on top of your financial obligations while saving time and resources. Their comprehensive range of services is designed to meet the needs of businesses of all sizes, providing accurate, compliant, and cost-effective financial solutions.

Contact Kloudac.com today to discuss your accounting needs and discover how their expertise can benefit your business. Whether you need help with bookkeeping services dubai, tax filing, or audits, their team is ready to support you in achieving financial success and compliance in Dubai.

0 notes

Text

The Essential Role of Accounting Companies in Real Estate Businesses in Abu Dhabi

The real estate industry in Abu Dhabi is dynamic, competitive, and full of potential. Whether you’re a property manager, developer, or real estate agent, managing financials effectively is crucial to business success. In this rapidly growing market, accounting complexities arise due to specific regulations, tax benefits, and property income structures. Therefore, partnering with Accounting Companies in Abu Dhabi is not just beneficial — it’s essential. Let’s explore why.

1. Property Managers in Abu Dhabi: Managing Rental Income, Expenses, and Depreciation

In Abu Dhabi, property managers are responsible for overseeing a wide range of real estate assets, from residential properties to commercial complexes. Beyond managing tenants and maintenance, they face the critical task of handling property income, depreciation, and various expenses.

Here’s where accounting companies in Abu Dhabi come in:

Property Income Tracking: Managing multiple properties and fluctuating rental income can be complex. Accounting companies help property managers streamline rental receipts, tenant payments, and cash flow management.

Depreciation and Tax Planning: Real estate in Abu Dhabi benefits from specific depreciation methods that reduce taxable income. Accounting firms ensure that property managers apply the correct depreciation schedules, optimizing tax benefits.

Expense Management: Maintenance, utilities, property taxes — keeping track of these expenses is critical. Accounting companies in Abu Dhabi manage the process, ensuring timely payments and proper expense categorization.

2. Real Estate Developers: Navigating Complex Financial Structures and Tax Incentives

For real estate developers in Abu Dhabi, the financial landscape is intricate, involving land acquisition, project financing, and large-scale construction. Developers need strategic financial guidance to manage costs, cash flow, and maximize profits.

Project Budgeting and Cost Control: Development projects in Abu Dhabi can span years, requiring detailed budgeting and cost forecasting. Accounting companies help developers manage these financial structures efficiently.

Utilizing Tax Incentives: Developers in Abu Dhabi may benefit from tax incentives, particularly those tied to sustainable construction and green building initiatives. Accounting firms navigate these tax benefits, ensuring developers maximize savings while remaining compliant with local regulations.

Depreciation and Amortization: Developers also need to manage depreciation of physical assets and amortization of intangible assets. Accounting companies in Abu Dhabi provide guidance on these financial complexities, improving bottom-line profitability.

3. Real Estate Agents: Commission Tracking, Expense Deductions, and Tax Compliance

Real estate agents in Abu Dhabi, like their counterparts worldwide, face financial challenges, especially when managing commissions, deductions, and taxes. However, the local market brings additional nuances that require the expertise of local accounting firms.

Commission Management: Agents in Abu Dhabi earn commissions on a per-sale basis, which can fluctuate depending on the market. Accounting companies assist agents in managing their commissions, ensuring accurate reporting and tax compliance.

Expense Tracking and Deductions: Agents often incur various costs, from marketing to transportation, which are deductible for tax purposes. Accounting companies in Abu Dhabi help agents maximize these deductions to minimize tax liabilities.

Tax Compliance and Planning: Real estate agents must comply with UAE tax laws, especially with the introduction of VAT. Accounting firms ensure that agents file correctly and on time while providing strategic tax planning services to optimize cash flow.

Key Benefits of Hiring Accounting Companies in Abu Dhabi for Real Estate Businesses

Local Expertise and Compliance: Abu Dhabi’s real estate market operates within a specific regulatory framework. Accounting companies in Abu Dhabi are well-versed in local laws, ensuring full compliance with legal and tax obligations.

Maximizing Tax Benefits: Real estate businesses in Abu Dhabi, whether developers or property managers, can benefit from tax savings through depreciation and local tax incentives. Accounting firms ensure these opportunities are fully leveraged.

Accurate Financial Reporting: For property developers and agents, maintaining accurate financial records is crucial for decision-making and securing future investments. Accounting companies provide detailed financial statements and cash flow analysis.

Improved Cash Flow Management: With multiple income streams and complex expenses, maintaining healthy cash flow is critical. Accounting firms help manage inflows and outflows, enabling businesses to avoid liquidity issues and sustain growth.

Strategic Financial Guidance: In Abu Dhabi’s competitive real estate market, having a financial strategy is key to success. Accounting companies offer expert financial advice, helping real estate businesses scale and optimize their operations.

Conclusion

In the ever-evolving real estate market of Abu Dhabi, managing financial complexities is essential for sustained growth and profitability. Property managers, developers, and real estate agents all face unique challenges, from tracking property income and managing depreciation to ensuring tax compliance. This is where accounting companies in Abu Dhabi become invaluable partners. They not only provide financial clarity but also strategic guidance, enabling businesses to thrive in a competitive market.

If you’re in the real estate sector, hiring an accounting company in Abu Dhabi is more than just a smart move — it’s a necessity for ensuring long-term success and financial stability.

#AccountingAbuDhabi#AbuDhabiAccountants#FinanceServicesAD#AuditFirmsAbuDhabi#TaxConsultantsAD#BookkeepingAbuDhabi#BusinessAdvisoryAD#CorporateAccountingAD#FinancialPlanningAD#VATServicesAbuDhabi#TopAccountingFirms#AuditAndTaxAD#FinancialConsultingAD#PayrollServicesAD#AccountingSolutionsAD

0 notes

Text

Establish Franchise Dubai

Establishing a Franchise in Dubai: Key Steps and Insights

Dubai, a global business hub with a thriving economy, offers immense opportunities for entrepreneurs seeking to expand their brand through franchising. Its strategic location, investor-friendly policies, and diverse consumer base make it a prime destination for Establish Franchise Dubai operations. However, establishing a franchise in Dubai requires careful planning, adherence to local regulations, and strategic market entry. Below are the essential steps and insights to successfully establish a franchise in Dubai.

1. Understand the Legal Framework

The United Arab Emirates (UAE) has a specific legal framework governing franchises. In Dubai, franchise agreements are generally treated as commercial agency agreements and are governed by UAE Federal Law No. 18 of 1981. This law offers protection to the franchisee, especially in terms of termination and renewal clauses. Therefore, it’s important to ensure that your franchise agreement complies with local regulations. Many franchises also register with the Ministry of Economy to gain additional legal protections.

2. Choose the Right Business Structure

When establishing a franchise in Dubai, you must choose the appropriate business structure. The two main options are setting up in the Dubai Mainland or a Free Zone.

Mainland: A franchise in the mainland requires a local sponsor or partner who owns at least 51% of the business. However, mainland franchises offer greater flexibility in terms of market access, allowing you to operate freely within Dubai and the UAE.

Free Zones: If you opt for a Free Zone setup, you can enjoy 100% foreign ownership, tax exemptions, and full repatriation of profits. However, Free Zone businesses may be restricted from trading directly within the UAE without a local distributor.

3. Market Research and Local Adaptation

Understanding the Dubai market is crucial to the success of any franchise. Consumer preferences, purchasing power, and competitive landscape can vary significantly from Western markets. Dubai is home to a multicultural population with diverse tastes, so it is essential to adapt your product or service to meet local demands. Conduct thorough market research to identify gaps in the market, assess competition, and analyze consumer behavior. Brands that localize their offerings often perform better in Dubai.

4. Partner with a Local Expert

Working with a local partner or consultant can make the process of establishing a franchise in Dubai smoother. Local experts can help navigate complex legal, financial, and cultural landscapes, ensuring compliance with local laws and identifying the best market entry strategies. Many successful franchises in Dubai have relied on local partners for market insights, networking, and logistical support.

5. Financial Planning and Investment

Establish Franchise Dubai significant financial planning. Costs include franchise fees, legal fees, and operational expenses. You must also budget for ongoing costs such as marketing, staff training, and inventory. Dubai's high consumer demand often compensates for initial investment costs, but careful financial planning and forecasting are key to long-term success.

Conclusion

Dubai offers a lucrative environment for franchise businesses, but success depends on a thorough understanding of the legal and business landscape. By adhering to local laws, choosing the right business structure, adapting to local market demands, and partnering with local experts, you can establish a strong franchise presence in one of the world’s most dynamic cities.

0 notes

Text

Accounting Firms in Dubai: A Guide to Tax & Return Filing in the UAE

Dubai, an overall business community point, has seen a flood in new investments and business experiences. With this advancement comes the essential of exact and fortunate financial administration. Accounting firms in Dubai expect a dire part in ensuring consistence with the UAE's perplexing tax guidelines and capable filing of tax returns.

This total assistant will jump into the intricacies of accounting firms in Dubai, their administrations, and the meaning of tax and return filing in the UAE.

Understanding Accounting Firms in Dubai

Accounting firms in Dubai offer numerous financial administrations altered to the prerequisites of businesses operating in the UAE. These administrations include:

•Bookkeeping and Accounting: Maintaining exact financial records, including general record, cash due, and loan boss liabilities.

•Financial Reporting: Preparing financial verbalisations, for instance, money related records, income announcements, and income clarifications.

•Tax Consistence: Ensuring adherence to UAE's tax guidelines, including corporate tax, individual income tax, and Tank.

•Auditing: Conducting independent examinations of an association's financial records to affirm their accuracy and satisfaction.

•Finance Administrations: Processing finance, managing agent benefits, and ensuring consistence with work guidelines.

•Financial Warning: Providing essential financial direction on issues, for instance, budgeting, forecasting, and chance administration.

The Meaning of Tax and Return Filing in UAE

Exact and ideal tax and return filing is huge for businesses operating in the UAE. Opposition with tax guidelines can provoke serious disciplines, fines, and, surprisingly, legal outcomes. Here is the explanation tax and return filing is basic:

•Avoiding Disciplines: Adhering to tax guidelines helps businesses with avoiding financial disciplines and genuine repercussions.

•Maintaining Business Reputation: Ideal tax filings add to a positive business reputation and trustworthiness.

•Facilitating Business Advancement: Exact financial records and advantageous tax filings provide significant insights to independent guidance and business improvement.

•Ensuring Consistence: Complying with tax guidelines displays an assurance to moral business practices.

Tax and Return Filing Cycle in the UAE

The tax and return filing process in the UAE could change depending on the kind of business and unequivocal tax obligations.However, the general advances involved include:

1.Gathering Required Reports: Assemble immeasurably significant financial documents, similar to invoices, receipts, and bank clarifications.

2.Preparing Tax Returns: Unequivocally figure out tax liabilities in perspective on the important tax guidelines.

3.Filing Tax Returns: Present the finished tax returns to the significant tax experts within the embraced deadlines.

4.Making Tax Instalments: Pay the determined tax amount to the tax trained professionals.

5.Record Keeping: Maintain genuine records of all tax-related trades for future reference.

Ordinary Challenges in Tax and Return Filing

Businesses operating in the UAE could encounter various challenges associated with tax and return filing. A couple of typical issues include:

•Complex Tax Guidelines: The UAE's tax guidelines can be intricate and at risk to changes.

•Language Blocks: Non-Arabic speaking businesses could stand up to language limits in understanding tax guidelines and communicating with tax subject matter experts.

•Time Constraints: Meeting tax filing deadlines can be challenging, especially for businesses with limited

resources.

•Record Keeping Botches: Inaccurate or incomplete financial records can provoke botches in tax assessments.

Accounting firms in Dubai expect a urgent part in assisting businesses investigate the intricacies of tax and return filing in UAE. By understanding the meaning of tax consistence, choosing the right accounting firm, and addressing expected challenges, businesses can ensure exact financial administration and avoid disciplines.

0 notes

Text

Wealth Management Solution in UAE

Wealth management solutions are complete services that help individuals and institutions manage and increase their financial assets. These solutions often cover a wide range of financial planning services, such as investment management, estate planning, tax optimization, and retirement planning.

What wealth management solutions usually include?

Investment Management: Customized techniques for increasing assets through diverse portfolios that include equities, bonds, mutual funds, and alternative investments.

Financial planning is long-term planning for achieving financial goals, such as budgeting, saving, and forecasting.

Estate planning refers to appropriate asset management and transfer strategies, such as wills, trusts, and inheritance preparation.

Tax optimization refers to techniques for reducing tax liabilities while increasing after-tax returns.

Retirement Planning: Creating measures to maintain financial stability and growth in retirement, such as pension plans and retirement funds.

Risk management refers to the identification and mitigation of financial hazards, such as insurance planning and asset protection.

Personalized Advice: Recommendations customized to each individual's financial goals, risk tolerance, and life circumstances.

In conclusion, wealth management solutions offer a comprehensive approach to managing and growing financial assets. By integrating investment management, financial planning, estate planning, tax optimization, retirement planning, and risk management, these solutions ensure a holistic strategy tailored to individual needs and goals.

0 notes

Text

How Indogulf QS Firm Urgently Keeps Construction Efficiency on Top Why Indogulf Represents the Best QS Firm in UAE

The UAE construction industry consists of fast-paced activities, and project timelines are always very demanding. With constant changes going on, companies need innovative solutions with regards to costs, timelines, and resources. Indogulf QS maintains passion to deliver excellence at each phase of construction with excellent quality QS and cost consultancy services.

Why do you need a QS company in the UAE?

To-date, the QS firm role is more vital in the UAE than ever. With increased construction activities around Dubai, Abu Dhabi, and in the entire Gulf region, its demand has been growing to specialists who can show projects completed within budgets and on time. In bringing value to the entire construction phase a professional quantity surveyor will help clients in two ways:

Cost planning and control

Tendering and contract procurement

Financial management during construction

Indogulf QS is also a market leader in the UAE market, which provides an all-inclusive package of services to the developers, contractors, or others. We leverage our years of experience by making cost management easier and ensuring smooth transition from inception till completion of the project.

The Role of a Cost Consultant in Dubai’s Construction Landscape

Being cost consultants in the great metropolis of Dubai, Indogulf QS is well-oriented with the construction environment of the region. Our objective is to protect our client’s financial interest by doing proper budgeting, cost reporting, and effective management of the project. We get the stakeholders at all levels to forecast potential challenges and design strategies that reduce the risks financially.

Our scope of service runs from high-rise building to a residential complex. Whether you are planning a villa, a commercial office, or an industrial warehouse, our cost consultancy service can significantly optimize the cost-efficiency of your project.

Turning Towards BIM for Smarter Construction

BIM has emerged as a new concept that seeks to transform the construction industry fully by bringing forth digital representations epitomizing physical and functional characteristics of buildings. Having realized more precision in cost estimates, rational management of materials, and good coordination of projects, Indogulf QS integrates BIM into our quantity surveying processes.

BIM ensures real-time openness towards all the project stakeholders to have the same kind of information, thereby reducing errors and costs and hence shortening the project timeframe. Indogulf QS is, therefore, optimally capitalized to confront the rising demand for transparency and efficiency in the UAE construction industry.

Role of BOQ Preparation in Dubai

Among other measures in any construction project, the Bill of Quantities stands out as one that actually lists in detail materials, labors, and associated costs. Indogulf QS specializes in preparing BOQs that clearly suit the nature of each project. Our BOQ is precise, allowing clients to understand the financial scope in which they are entailed. This forms a strong foundation that comes useful during the entire lifecycle of the construction cost controls and management.

With our vast market knowledge and years of experience in preparing BOQs in Dubai, we ensure that every single item is well elaborated so as to not incur any cost without prior knowledge. Our precise BOQs have enabled contractors and developers to finalize their decisions pretty efficiently by keeping the budgets intact from the beginning to the end.

Conclusion

Indogulf Quantity Surveying Services boasts of being one of the leading QS firms in the United Arab Emirates, excelling in the cost consultancy excellence in Dubai and beyond. Integrating innovative technologies such as BIM and a focus on acc.

If you seek a QS and cost consulting service with the expertise to make your next project go smoother, call Indogulf QS. Let us guide you toward smarter construction decisions and successful project delivery.

0 notes

Text

Navigating Tax/Vat Preparation and Bookkeeping Solutions in the UAE

At FST Accounting, we understand that tax preparation and bookkeeping aren't just checkboxes on your business to-do list. They're vital cogs in the wheel of your financial health and longevity. Our mission? To equip you with the savvy and strategies needed to not just comply with regulations, but to thrive financially, propelling your company toward growth and efficiency.

Let's Break It Down:

Tax Services: Picture us as your tax whisperers, guiding you through the maze of regulations with finesse. From nailing VAT compliance to crafting smart tax plans and filing spot-on returns, we've got your back.

Bookkeeping Solutions: Think of bookkeeping as the heartbeat of your financial operations. It's all about methodically logging and organizing your financial transactions. This clarity not only aids in decision-making but also keeps the regulators happy.

The Nuts and Bolts of Bookkeeping:

Step 1: We start by meticulously recording every transaction using top-notch accounting software tailored for the UAE market. Sales, purchases, expenses, payroll—you name it, we track it.

Step 2: Next, we sort and classify these records to whip up financial statements like balance sheets, profit and loss statements, and cash flow reports. It's like painting a clear picture of your financial landscape.

Payroll Management in the UAE:

Navigating UAE's labor laws can be a bit like tiptoeing through a minefield. That's where our payroll management services swoop in. We ensure your employees get paid accurately and on time, while also staying on the right side of the law.

Tax Accounting vs. Bookkeeping:

Bookkeeping lays the groundwork, recording every financial move. Tax accounting takes it a step further, handling the nitty-gritty of tax returns and compliance. Think of bookkeeping as the canvas and tax accounting as the masterpiece painted upon it.

Tax Accounting Methods:

In the UAE, we've got options. Accrual accounting vs. cash basis accounting—each with its own perks. Accrual accounting recognizes revenue and expenses as they're earned or incurred, while cash basis accounting sticks to cold, hard cash exchanges.

Small Business Accounting in the UAE:

Small businesses, rejoice! Our tailored accounting services are here to lighten your load. Say goodbye to financial headaches and hello to streamlined operations and growth opportunities.

When you partner with seasoned pros like us, you're not just getting accurate financial records. You're gaining peace of mind, knowing your financial ship is sailing smoothly toward success.

Ready to take the plunge? Let's chat about how we can steer your business toward financial prosperity.

Tagged: Bookkeeping solutions in UAE, Payroll management in UAE, Small business accounting in UAE

#Accounting services Uae#Financial consulting Uae#Tax preparation uae#Bookkeeping solutions Uae#Small business accounting Uae#Payroll management Uae#Auditing services Uae#Tax planning Uae#Financial reporting Uae#CPA services Uae#Budgeting and forecasting Uae#Business advisory Uae#Financial analysis Uae#QuickBooks consulting Uae#Tax compliance Uae#certified accountant near me#cpa accountant near me#accountants near me#tax accountant near me#accounting services

0 notes

Text

Financial Accounting 101: Why It’s Crucial for the Success of Your Business

When starting a business setup in Dubai, one of the most important aspects often overlooked by entrepreneurs is financial accounting. Whether you’re launching a startup or expanding your existing enterprise, accounting services in Dubai are vital to ensure your business not only complies with local regulations but also thrives in a competitive market. This article will dive into why financial accounting is indispensable for your Dubai business setup and how it contributes to long-term success.

What Is Financial Accounting?

Financial accounting is the systematic process of recording, summarizing, and reporting financial transactions to provide a clear view of your business’s financial health. It involves preparing financial statements, such as income statements, balance sheets, and cash flow statements, which give insights into your company’s performance over time.

For a business setup in Dubai, proper financial accounting ensures compliance with UAE regulations, assists in better decision-making, and offers transparency to stakeholders such as investors, creditors, and customers.

Why Is Financial Accounting Crucial for Your Business?

Regulatory Compliance

Dubai, as part of the UAE, has stringent financial regulations that businesses must adhere to, including VAT reporting, auditing, and filing accurate tax returns. Proper accounting helps you avoid penalties and fines for non-compliance, ensuring your Dubai business setup operates within the legal framework. Accounting services in Dubai specialize in keeping businesses compliant with local laws and filing requirements.

Informed Decision-Making

Without accurate financial data, making informed decisions about your business becomes guesswork. Financial accounting provides you with a snapshot of your business’s revenue, expenses, profits, and losses, allowing you to identify areas where you can cut costs, invest more resources, or scale operations. Whether you’re considering expanding or optimizing your current setup, financial clarity is essential for growth.

Investor and Stakeholder Confidence

Investors and stakeholders require transparency and reliability in your financial reporting. Accurate financial statements build confidence in your Dubai business setup by showing that your company is well-managed and financially stable. Whether you’re seeking new investors or trying to secure financing, robust financial accounting will strengthen your case.

Efficient Cash Flow Management

One of the main reasons businesses fail, particularly startups, is poor cash flow management. Financial accounting helps you track inflows and outflows of cash, ensuring you have the liquidity to cover your expenses. This is especially crucial for businesses in Dubai, where operational costs can fluctuate depending on market conditions.

Strategic Planning

Financial accounting provides the data you need to develop long-term strategies. Whether you’re setting up a new business in Dubai or expanding your current operations, knowing your financial position allows you to plan for the future confidently. Accounting professionals can assist you in creating budgets, forecasting future revenues, and identifying potential financial challenges.

How Accounting Services in Dubai Can Help

For a successful business setup in Dubai, working with specialized accounting services in Dubai ensures that all your financial transactions are handled accurately and in compliance with UAE laws. These services provide expert advice on tax planning, VAT compliance, and financial reporting, helping your business operate smoothly and efficiently.

Not only do accounting services ensure regulatory compliance, but they also offer you peace of mind by taking on the administrative burden of managing your finances, allowing you to focus on growing your business.

Financial accounting is a foundational pillar for the success of any Dubai business setup. It helps maintain compliance, supports decision-making, builds investor confidence, manages cash flow, and facilitates strategic planning. With the help of accounting services in Dubai, you can ensure your business remains financially healthy and poised for long-term success.

Whether you’re just starting or already operating, prioritizing financial accounting will provide the clarity and control you need to navigate Dubai’s competitive business landscape

#business setup company in dubai#business consulting#business setup in dubai#business setup in uae#Accounting Services in Dubai

0 notes

Text

Navigating Accounting and Corporate Services in Dubai: A Comprehensive Guide

Dubai, a thriving financial hub in the UAE, is known for its dynamic business environment and evolving regulatory landscape. For businesses operating in this vibrant city, managing accounting services, understanding corporate tax, and ensuring compliance with VAT regulations are crucial. Moreover, efficient HR recruitment is vital for sourcing the right talent to drive growth. This blog explores the key aspects of accounting services in Dubai, corporate tax in the UAE, HR recruitment agencies, VAT filing, and the importance of an accounting charter for businesses.

Accounting Services in Dubai

Dubai’s business ecosystem demands precise and reliable accounting services. With its diverse range of industries and a robust financial sector, businesses need comprehensive accounting solutions to manage their financial health effectively. Accounting services in Dubai include:

Bookkeeping: Maintaining accurate records of financial transactions is fundamental. Professional bookkeeping services ensure that all transactions are recorded systematically, aiding in financial clarity and compliance.

Financial Reporting: Regular financial reports are essential for strategic decision-making. Accounting firms in Dubai provide detailed financial statements, including balance sheets, income statements, and cash flow statements.

Tax Services: With the UAE’s evolving tax landscape, businesses require expert advice on tax planning and compliance. Accounting services often include corporate tax planning, VAT advice, and assistance with tax returns.

Audit Services: Independent audits are crucial for verifying financial statements and ensuring compliance with regulations. Dubai’s accounting firms offer auditing services to enhance transparency and credibility.

Consulting Services: Strategic consulting helps businesses optimize their financial operations. Services may include budgeting, forecasting, and financial analysis.

Corporate Tax in the UAE

The introduction of corporate tax UAE marks a significant shift in the country’s tax regime. Effective from June 2023, the UAE has implemented a corporate tax rate of 9% on profits exceeding AED 375,000. Understanding corporate tax is essential for businesses to ensure compliance and optimize their tax strategy. Key aspects include:

Tax Registration: Businesses must register for corporate tax and obtain a tax identification number. This process is essential for filing accurate tax returns and avoiding penalties.

Taxable Income: Corporate tax is levied on net profits, which are calculated after deducting allowable expenses. Understanding what qualifies as taxable income is crucial for accurate tax reporting.

Compliance Requirements: Businesses are required to maintain proper financial records and file annual tax returns. Non-compliance can result in significant penalties and legal issues.

Tax Planning: Effective tax planning can help businesses minimize their tax liabilities. Consulting with tax experts can provide insights into available tax incentives and deductions.

HR Recruitment Agencies in Dubai

Recruiting the right talent is a key factor in business success. HR recruitment agencies in Dubai play a vital role in connecting businesses with qualified professionals. Their services include:

Talent Acquisition: Recruitment agencies help businesses find suitable candidates for various roles, from entry-level positions to executive roles. They use extensive networks and resources to identify top talent.

Screening and Selection: Agencies conduct thorough screenings and assessments to ensure that candidates meet the required qualifications and fit the company culture.

Recruitment Strategy: HR agencies provide strategic advice on recruitment processes, including job descriptions, interview techniques, and offer negotiations.

Temporary and Permanent Staffing: Agencies offer solutions for both temporary and permanent staffing needs, allowing businesses to adapt to changing workforce demands.

VAT Filing in the UAE

Value Added Tax (VAT) is an essential aspect of the UAE’s tax system, introduced in January 2018 with a standard rate of 5%. Accurate VAT filing in UAE is crucial for compliance and avoiding penalties. Key points include:

VAT Registration: Businesses with taxable supplies exceeding AED 375,000 must register for VAT. Registration ensures that businesses can collect and remit VAT appropriately.

VAT Returns: VAT-registered businesses are required to file periodic VAT returns, typically on a quarterly or annual basis. These returns detail the VAT collected on sales and the VAT paid on purchases.

Record Keeping: Proper documentation and record-keeping are vital for accurate VAT filing. Businesses must maintain records of all transactions, invoices, and receipts.

VAT Compliance: Ensuring compliance with VAT regulations helps avoid fines and penalties. Consulting with VAT experts can provide guidance on complex VAT issues and ensure adherence to regulatory requirements.

Accounting Charter

An accounting charter is a foundational document that outlines the objectives, roles, and responsibilities of the accounting department within an organization. It plays a crucial role in ensuring effective financial management and compliance. Key components include:

Mission and Objectives: The charter defines the mission and goals of the accounting department, aligning them with the organization’s overall strategy.

Roles and Responsibilities: It specifies the roles and responsibilities of accounting personnel, ensuring clarity in financial operations and reporting.

Governance Structure: The charter outlines the governance structure, including reporting lines and oversight mechanisms.

Financial Reporting Standards: It details the standards and practices for financial reporting, ensuring compliance with relevant regulations and frameworks.

Internal Controls: The charter includes provisions for internal controls to safeguard assets and ensure accurate financial reporting.

Compliance Requirements: It addresses compliance with legal and regulatory requirements, including tax laws and financial reporting standards.

Performance Evaluation: The charter includes metrics for evaluating the performance of the accounting department and its personnel.

Communication: It outlines how financial information will be communicated to stakeholders, including regulatory bodies and investors.

Conclusion

In Dubai’s fast-paced business environment, managing accounting services, understanding corporate tax, and ensuring effective VAT filing are critical for success. Partnering with HR recruitment agencies helps in sourcing the right talent to drive business growth. Additionally, establishing a comprehensive accounting charter ensures that financial operations are well-governed and aligned with organizational objectives.

Navigating these aspects effectively requires expertise and diligence. Whether you’re setting up a new business, expanding operations, or seeking to optimize financial management, understanding and leveraging these services and regulations will help you achieve greater efficiency and compliance. For businesses in Dubai, staying informed and proactive in these areas is key to thriving in a competitive and dynamic market.

#accounting services in dubai#corporate tax uae#hr recruitment agencies in dubai#vat filing in uae#accounting charter

0 notes

Text

Voice-Controlled Kitchen Appliances Market: Key Players and Strategies

Introduction to Voice-Controlled Kitchen Appliances Market

The Voice-Controlled Kitchen Appliances Market is rapidly expanding, driven by advancements in artificial intelligence and growing consumer demand for convenience. These smart devices allow users to operate appliances through voice commands, streamlining cooking and enhancing safety. The integration with smart home systems is a significant trend, enabling seamless interactions among devices. As more households adopt technology for daily tasks, the market is attracting both established brands and new entrants. Key factors influencing growth include consumer preferences for automation, technological innovation, and the increasing popularity of connected living. Overall, this market is set for substantial growth as it transforms culinary experiences.

The Voice-controlled Kitchen Appliances Market is Valued USD 20 billion in 2024 and projected to reach USD 70 billion by 2032, growing at a CAGR of 15% During the Forecast period of 2024-2032. These appliances allow users to operate devices through voice commands, enhancing kitchen efficiency and safety. The integration of smart home ecosystems is a key trend, facilitating seamless communication between appliances and other smart devices. As households embrace technology for everyday tasks, the market is poised for expansion, attracting both established manufacturers and new entrants. The rise of connected living is reshaping consumer expectations, propelling the adoption of voice-activated solutions in kitchens worldwide.

Access Full Report :https://www.marketdigits.com/checkout/111?lic=s

Major Classifications are as follows:

By Product Type

Smart Ovens

Smart Microwaves

Smart Refrigerators

Smart Coffee Makers

Smart Blenders

Smart Slow Cookers

Smart Dishwashers

Smart Multi-Cookers

Smart Toasters

Smart Air Fryers

By Connectivity

Wi-Fi

Bluetooth

By Voice Assistant Integration

Residential Users

Commercial Users

Restaurants

Cafes

Others

By End-user

Tech-Savvy Consumers

Home Cooking Enthusiasts

Busy Professionals

By Distribution Channel

Online

Offline

Key Region/Countries are Classified as Follows:

◘ North America (United States, Canada,)

◘ Latin America (Brazil, Mexico, Argentina,)

◘ Asia-Pacific (China, Japan, Korea, India, and Southeast Asia)

◘ Europe (UK,Germany,France,Italy,Spain,Russia,)

◘ The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South

Key Players of Voice-Controlled Kitchen Appliances Market

AB Electrolux, Samsung Electronics Co. Ltd, Whirlpool Corporation, LG Electronics Inc., BSH Home Appliances Corporation, Panasonic Corporation, Breville Group Limited, Robert Bosch GmbH, Koninklijke Philips N. V., Miele & Cie. K. G., GE Appliances (a Haier company), Kenmore (Sears Brands), Instant Brands, Anova Culinary, and Others.

Market Drivers in Voice-Controlled Kitchen Appliances Market

Convenience: Voice-controlled appliances streamline cooking processes, allowing multitasking.

Smart Home Integration: Increasing adoption of smart home systems drives demand for compatible kitchen devices.

Technological Advancements: Innovations in voice recognition and AI enhance user experience and appliance functionality.

Market Challenges in Voice-Controlled Kitchen Appliances Market

High Costs: Premium pricing of voice-controlled appliances may deter budget-conscious consumers.

Privacy Concerns: Consumers worry about data security and privacy related to voice-activated devices.

Compatibility Issues: Lack of standardization can create challenges in integrating devices from different manufacturers.

Market Opportunities in Voice-Controlled Kitchen Appliances Market

Emerging Markets: Expanding middle-class populations in developing regions present growth opportunities.

Product Innovation: Continued R&D can lead to advanced features, attracting tech-savvy consumers.

Partnerships: Collaborations with smart home brands can enhance market reach and consumer adoption.

Conclusion

The Voice-Controlled Kitchen Appliances Market is positioned for robust growth, driven by technological advancements and shifting consumer preferences. While challenges such as privacy concerns and high costs persist, the opportunities for innovation and market expansion are substantial. As the smart home trend continues to evolve, voice-controlled appliances will likely become a staple in modern kitchens, enhancing convenience and efficiency for users. Manufacturers that can navigate these dynamics will be well-equipped to capitalize on the expanding market landscape.

0 notes

Text

How Connected Street LightingMarketEnhances Public Safety and Energy Efficiency

Introduction to Connected Street Lighting Market

The connected street lighting market is experiencing rapid growth due to advancements in smart technology and the increasing demand for energy-efficient solutions. This market encompasses the integration of LED street lights with IoT (Internet of Things) sensors and communication networks, enabling real-time monitoring, automated control, and data collection. Connected street lighting systems offer significant benefits, including reduced energy consumption, lower maintenance costs, and improved public safety. As cities and municipalities seek to modernize their infrastructure and meet sustainability goals, the adoption of connected street lighting is expected to expand, driven by technological innovations and supportive government policies.

Market overview

The Connected Street Lighting Market is Valued USD 2.2 billion in 2024 and projected to reach USD 15.3 billion by 2032, growing at a CAGR of 24.3% During the Forecast period of 2024–2032.This growth is driven by the increasing adoption of smart city technologies, rising demand for energy-efficient solutions, and advancements in IoT and LED technologies.

Access Full Report : https://www.marketdigits.com/checkout/235?lic=s

Major Classifications are as follows:

By Component

Hardware

Sensors

Controllers/Relays

Others

Software

Services

By Application

Traffic Monitoring

Environmental Monitoring

Video Surveillance

By Connectivity

Wired

Wireless

Key Region/Countries are Classified as Follows:

◘ North America (United States, Canada, and Mexico)

◘ Europe (Germany, France, UK, Russia, and Italy)

◘ Asia-Pacific (China, Japan, Korea, India, and Southeast Asia)

◘ South America (Brazil, Argentina, Colombia, etc.)

◘ The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa)

Major players in Connected Street Lighting Market:

EnGo PLANET, Telensa Ltd., Toshiba Lighting, Philips Lighting N.V, OSRAM Licht Group, OSRAM Licht Group, Acuity Brands Lighting Inc., Schreder Group, Twilight Citelum S.A, Dimonoff Inc., among others.

Market Drivers in Connected Street Lighting Market:

Energy Efficiency and Cost Savings: Connected street lighting Market use advanced technologies, such as LEDs and smart controls, which can significantly reduce energy consumption and maintenance costs. This is a major driver as municipalities and organizations look to lower their energy bills and operational expenses.

Government Initiatives and Regulations: Many governments and regulatory bodies are promoting smart city initiatives and setting standards for energy efficiency. Grants, incentives, and regulations aimed at reducing carbon footprints encourage the adoption of connected street lighting market.

Public Safety and Security: Smart street lighting can enhance public safety by improving visibility and enabling real-time monitoring. Features like adaptive lighting and integrated surveillance can help deter crime and provide better public safety.

Market challenges in Connected Street Lighting Market:

High Initial Costs: The upfront investment required for purchasing and installing connected street lighting market, including smart controls and sensors, can be significant. This can be a barrier for municipalities and organizations with limited budgets.

Cybersecurity Risks: Connected street lighting market are vulnerable to cyber threats, including hacking and data breaches. Ensuring robust security measures and protecting sensitive data is a critical challenge.

Maintenance and Reliability: While connected street lighting systems can reduce maintenance needs, they still require ongoing monitoring and occasional repairs. Ensuring system reliability and managing maintenance costs can be challenging.

Market opportunities in Connected Street Lighting Market:

Smart City Initiatives: As more cities around the world adopt smart city frameworks, there is growing demand for connected street lighting as a foundational element. These initiatives offer opportunities for widespread deployment and integration of smart lighting systems.

Government Funding and Incentives: Many governments provide grants, subsidies, and incentives for energy-efficient and smart infrastructure projects. These financial supports can help offset initial costs and encourage adoption of connected street lighting solutions.

Data Utilization and Analytics: The ability to collect and analyze data from connected street lighting market opens up opportunities for better city planning, traffic management, and public safety. Data-driven insights can drive further innovation and improvements.

Future trends in Connected Street Lighting Market:

Increased Integration with Smart City Ecosystems: Connected street lighting will increasingly be integrated with other smart city technologies, such as traffic management systems, air quality sensors, and smart parking solutions. This integration will enhance the overall efficiency and functionality of urban infrastructure.

Advanced Data Analytics and AI: The use of advanced data analytics and artificial intelligence (AI) will enable more sophisticated management of street lighting market. Predictive maintenance, adaptive lighting based on real-time conditions, and personalized lighting experiences will become more common.

Interoperability and Standardization: Efforts to establish industry standards and improve interoperability between different systems and technologies will facilitate smoother integration and deployment of connected street lighting market across various platforms and regions.

Conclusion:

In conclusion, the connected street lighting market is evolving rapidly, driven by advancements in technology, increasing urbanization, and a strong focus on sustainability. Key drivers include the quest for energy efficiency, government incentives, and the integration with broader smart city initiatives. Despite challenges such as high initial costs, cybersecurity risks, and interoperability issues, the market offers significant opportunities through innovations in IoT, data analytics, and sustainable practices.

#connected street lighting market demand#connected street lighting market share#connected street lighting market trend#connected street lighting market size

0 notes

Text

The Role of Accounting Firms in Abu Dhabi in Supporting Startups and SMEs

Abu Dhabi, the capital of the UAE, has become a vibrant hub for startups and small to medium-sized enterprises (SMEs). With its strategic location, supportive government policies, and growing investment landscape, the city offers numerous opportunities for new businesses. However, navigating the complexities of finance, compliance, and taxation can be daunting for entrepreneurs. This is where Accounting firms in Abu Dhabi play a crucial role. Let’s explore how these firms support startups and SMEs in their journey to success.

1. Providing Financial Guidance

One of the primary roles of accounting firms is to provide financial guidance to startups and SMEs. These firms help entrepreneurs understand their financial health by offering insights into cash flow management, budgeting, and financial forecasting. With accurate financial data, businesses can make informed decisions and plan for future growth.

2. Tax Compliance and Planning

Navigating tax regulations in the UAE can be complex, especially for new businesses. Accounting firms in Abu Dhabi assist startups and SMEs with tax compliance, ensuring they meet all local regulations. They also provide strategic tax planning advice, helping businesses minimize their tax liabilities while remaining compliant with the law. This is particularly important with the introduction of VAT and other tax measures in the UAE.

3. Bookkeeping Services

Maintaining accurate financial records is vital for any business, but startups and SMEs often lack the resources to manage this effectively. Accounting firms offer comprehensive bookkeeping services, which allow business owners to focus on their core operations. Regular bookkeeping helps in tracking expenses, managing invoices, and preparing for audits.

4. Assisting with Business Setup

For startups, the process of setting up a business can be overwhelming. Accounting firms provide valuable assistance in this area, guiding entrepreneurs through the legal and financial requirements of establishing a company in Abu Dhabi. This includes obtaining the necessary licenses, understanding local regulations, and setting up accounting systems.

5. Financial Audits and Reviews

Regular financial audits are essential for businesses seeking investment or loans. Accounting firms conduct audits to ensure the financial statements are accurate and comply with regulations. For startups looking to attract investors, a clean audit can significantly enhance credibility and increase the chances of securing funding.

6. Advisory Services for Growth

As startups and SMEs grow, they face new challenges and opportunities. Accounting firms in Abu Dhabi provide advisory services that help businesses strategize for growth. This includes mergers and acquisitions, market entry strategies, and financial restructuring. Their expertise can be invaluable in navigating these complex decisions.

7. Facilitating Access to Funding

Access to capital is often a challenge for startups and SMEs. Accounting firms can assist in preparing financial projections and business plans that are crucial for securing funding from banks, venture capitalists, or angel investors. Their expertise in financial modeling can make a significant difference in how potential investors perceive a business.

8. Supporting Technology Integration

The rise of financial technology (fintech) has transformed the accounting landscape. Accounting firms in Abu Dhabi are increasingly incorporating technology into their services, helping startups and SMEs implement accounting software and automated solutions. This not only improves efficiency but also enhances the accuracy of financial reporting.

9. Networking and Connections

Many accounting firms have extensive networks that can benefit startups and SMEs. They can connect businesses with other professionals, potential clients, and investors, fostering valuable relationships that can drive growth. These connections are particularly beneficial in a city like Abu Dhabi, where networking can lead to new opportunities.

Conclusion

In a rapidly evolving business environment, the support of accounting firms in Abu Dhabi is invaluable for startups and SMEs. From financial guidance and tax compliance to business setup and growth strategies, these firms play a multifaceted role in helping businesses thrive. By leveraging their expertise, entrepreneurs can focus on what they do best — innovating and growing their businesses — while leaving the complexities of finance and compliance to the professionals. As Abu Dhabi continues to grow as a business hub, the partnership between startups, SMEs, and accounting firms will be essential for sustainable success.

#accounting firms#Abu Dhabi accountants#financial services#bookkeeping#tax services#audit services#payroll management#financial consulting#tax planning#business advisory#corporate finance#VAT services#accounting solutions#financial reporting#compliance services#CFO services#accounting software#SME accounting#forensic accounting#accounting outsourcing

0 notes