#Tax preparation uae

Text

Navigating the intricate landscape of financial management in the UAE presents

Navigating the intricate landscape of financial management in the UAE presents a unique set of challenges and opportunities for businesses of all sizes. From startups finding their footing to established multinational enterprises, grasping the significance of robust accounting practices, tax obligations, and VAT regulations is paramount.

Corporate Tax and VAT Dynamics in the UAE

Renowned for its tax-friendly environment, the UAE stands out for its absence of corporate and personal income taxes for most entities and individuals. However, nuanced tax regulations apply to specific industries and activities. Typically, businesses face a 20% corporate tax rate on taxable profits, while a 5% VAT is standard for most goods and services unless exemptions or zero-rated categories apply.

Exemplary VAT Consulting Support in the UAE

Navigating the intricacies of VAT compliance and optimization demands specialized expertise. FST Accounting emerges as a beacon of proficiency in Financial Consulting in the UAE. Leveraging a profound understanding of UAE tax frameworks and extensive hands-on experience, FST Accounting delivers tailor-made VAT consulting solutions, ensuring compliance and strategic tax maneuvering.

VAT Accounting Precision in the UAE

Accurate VAT accounting stands as a cornerstone for businesses operating in the UAE. VAT-registered entities must meticulously record transactions, apply the appropriate VAT rates, and diligently submit VAT returns to the Federal Tax Authority (FTA). FST Accounting steps in with comprehensive VAT accounting services, safeguarding compliance and fortifying tax positions.

UAE Corporate Tax Landscape Unveiled

While the UAE predominantly refrains from corporate income tax imposition, specific sectors like oil and gas entities and branches of foreign banks face corporate tax obligations. It's imperative for businesses within these realms to grasp their tax responsibilities and engage professional counsel for seamless implementation.

Diving into VAT Varieties

Within the UAE, VAT treatments primarily fall into two categories: standard-rated and zero-rated supplies. Standard-rated supplies incur a 5% VAT, while zero-rated supplies enjoy a 0% VAT rate. Examples of zero-rated supplies encompass select exports, international transportation, and healthcare services.

Embracing Excellence in Financial Management

For dependable accounting services, adept financial consulting, and meticulous tax preparation in the UAE, enterprises entrust FST Accounting. Serving as a conduit for success and compliance, FST Accounting emerges as the partner of choice in navigating the intricate realm of UAE financial regulations.

Tagged: Accounting services in UAE, Financial consulting in UAE, Tax preparation in UAE

#Accounting services Uae#Financial consulting Uae#Tax preparation uae#Bookkeeping solutions Uae#Small business accounting Uae#Payroll management Uae#Auditing services Uae#Tax planning Uae#Financial reporting Uae#CPA services Uae#Budgeting and forecasting Uae#Business advisory Uae#Financial analysis Uae#QuickBooks consulting Uae#Tax compliance Uae#certified accountant near me#cpa accountant near me#accountants near me#tax accountant near me#accounting services

0 notes

Text

Mastering Financial Excellence: Unveiling the Expertise of UAE Accounting Firms

Embarking on a journey through the financial landscape of the UAE, this article explores the dynamic role of accounting firms, focusing on their evolution, key services, and the crucial aspects of financial management.

The Evolving Landscape of Accounting Firms in UAE

Dive into the changing dynamics of accounting firms in the UAE, from traditional practices to modern approaches. Explore how firms adapt to emerging trends for enhanced financial services.

Key Services for Financial Excellence

Uncover the array of services provided by top accounting firms, emphasizing their role in maintaining financial excellence for businesses of all sizes.

VAT Consultancy: Navigating Complexities

In the intricate world of Value Added Tax (VAT), discover how accounting firms serve as guides, helping businesses navigate complexities and ensuring compliance with evolving regulations.

Business Advisory: A Strategic Imperative

Explore the strategic advisory services offered by accounting firms, shedding light on how businesses can benefit from tailored advice for sustainable growth.

Unraveling the World of Auditing Firms

Delve deeper into the domain of auditing firms in the UAE, understanding their methodologies, importance, and how they contribute to financial transparency.

Tax Planning for Optimal Financial Health

Efficient tax planning is essential for any business. Learn how accounting firms excel in providing comprehensive tax planning strategies for optimal financial health.

Corporate Finance Solutions: Beyond the Basics

Beyond conventional accounting, explore the advanced solutions provided by accounting firms in corporate finance, aiding businesses in strategic financial decision-making.

The Role of Professional Bookkeeping

Highlighting the significance of accurate bookkeeping, this section discusses how professional bookkeeping services offered by accounting firms contribute to organizational success.

Small Business Accounting: Maximizing Benefits

Small businesses, in particular, can gain substantial advantages from accounting firms. Uncover the specific benefits tailored for the unique needs of smaller enterprises.

Embracing Technological Advancements

Discuss how accounting firms integrate technological advancements, such as automation and cloud-based solutions, to enhance efficiency and provide more streamlined services.

Conclusion

In conclusion, accounting firms in the UAE play a multifaceted role in shaping the financial landscape. From navigating complex regulations to providing tailored services, they are instrumental in fostering financial success for businesses.

Frequently Asked Questions (FAQs)

Q: How do accounting firms stay abreast of the latest financial reporting trends?

A: Reputable accounting firms invest in continuous training and technology to stay updated on the latest financial reporting trends.

Q: What specific corporate finance solutions do accounting firms offer?

A: Accounting firms provide advanced corporate finance solutions, including financial planning, risk management, and investment analysis.

Q: Can accounting firms assist with efficient tax planning for businesses of all sizes?

A: Yes, accounting firms tailor tax planning strategies to suit businesses of all sizes, ensuring optimal financial health.

Q: How do accounting firms utilize technology for bookkeeping services?

A: Many accounting firms embrace technological advancements, incorporating automation and cloud-based solutions for more efficient and accurate bookkeeping.

Q: What advice do accounting firms offer to small businesses for maximizing benefits?

A: Accounting firms provide tailored advice to small businesses, including cost-effective bookkeeping, strategic financial guidance, and compliance assistance.

#UAE Accounting#. Financial Stability#VAT Compliance#. Business Advisory#. Auditing Excellence#Tax Preparation#Small Business Support

0 notes

Text

Navigating UAE Corporate Tax: Insights & Planning with Jitendra Chartered Accountants

The UAE's recent corporate tax implementation marks a significant shift in its business landscape. As companies adapt to this change, understanding the impact and effective planning become paramount. Jitendra Chartered Accountants, renowned for their financial expertise, stand as your strategic partners in navigating UAE's corporate tax landscape. This blog delves into the implications of corporate tax, the importance of impact assessment, and the guidance provided by Jitendra Chartered Accountants.

Unraveling UAE Corporate Tax Implementation: The UAE's transition to corporate tax signifies a dynamic shift, impacting businesses of all sizes. Companies now face a new financial landscape that demands proactive planning and compliance.

UAE Corporate Tax Impact Assessment: Preparing for Change: Assessing the impact of corporate tax on your business is crucial. Jitendra Chartered Accountants conduct comprehensive assessments, helping you understand how these changes affect your financial structure.

Strategic UAE Corporate Tax Planning: Securing Financial Agility: Corporate tax planning isn't just about compliance; it's about strategic financial management. Jitendra Chartered Accountants offer tailored strategies to optimize tax liabilities while ensuring regulatory adherence.

Jitendra Chartered Accountants: Your Corporate Tax Allies:

Expertise: With their profound understanding of tax regulations, Jitendra Chartered Accountants provide informed guidance.

Customized Solutions: They offer solutions that align with your business goals, ensuring maximum tax efficiency.

Compliance Assurance: Jitendra Chartered Accountants ensure your business complies with corporate tax regulations, safeguarding against penalties.

Navigating the Corporate Tax Era with Jitendra:

Assessment: Jitendra Chartered Accountants assess your business structure and financials, evaluating the impact of corporate tax.

Strategizing: Based on assessment outcomes, they design strategic tax planning to minimize liabilities while maintaining compliance.

Implementation: Jitendra Chartered Accountants assist in seamless corporate tax implementation, ensuring smooth transition.

Conclusion: The introduction of corporate tax in the UAE reshapes the way businesses operate. As the financial landscape evolves, partnering with Jitendra Chartered Accountants becomes pivotal. Their proficiency in corporate tax implementation, impact assessment, and planning empowers your business to navigate this transition with confidence. By choosing Jitendra Chartered Accountants, you're not just ensuring compliance; you're orchestrating a strategic financial roadmap that propels your business toward resilience and growth in the changing corporate tax landscape of the UAE.

#UAE Corporate Tax Preparation#UAE Corporate Tax Implementation#UAE Corporate Tax Impact Assessment#jitendra chartered accountants

0 notes

Photo

A tax consultant can help you optimise your tax liability, capitalise on tax deductions and manage your tax situation.

Experienced and qualified tax consultants can assist with planning your organization and tax structure, availing the benefits offered under law, correct treatment to typical revenue and expenses and ensuring that tax returns meet the requirements of the statute. The penalties of not doing so, far outweigh the cost of hiring the services of a tax consultant, who will guide you through the maze, that is corporate tax.

We a team of qualified tax consultants, we can assist you. Reach out to us:

https://pkfuae.com/services/taxation/vat-excise-advisory/

#tax audit uae#vat refund dubai#cpa consultants#bookkeeping services in uae#vat refund in uae#tax advisors in uae#taxation services in dubai#international tax services in uae#tax consultant in abu dhabi#tax consultants abu dhabi#tax services in dubai#value added tax consultant in dubai#tax planning in uae#tax preparation services in dubai

0 notes

Text

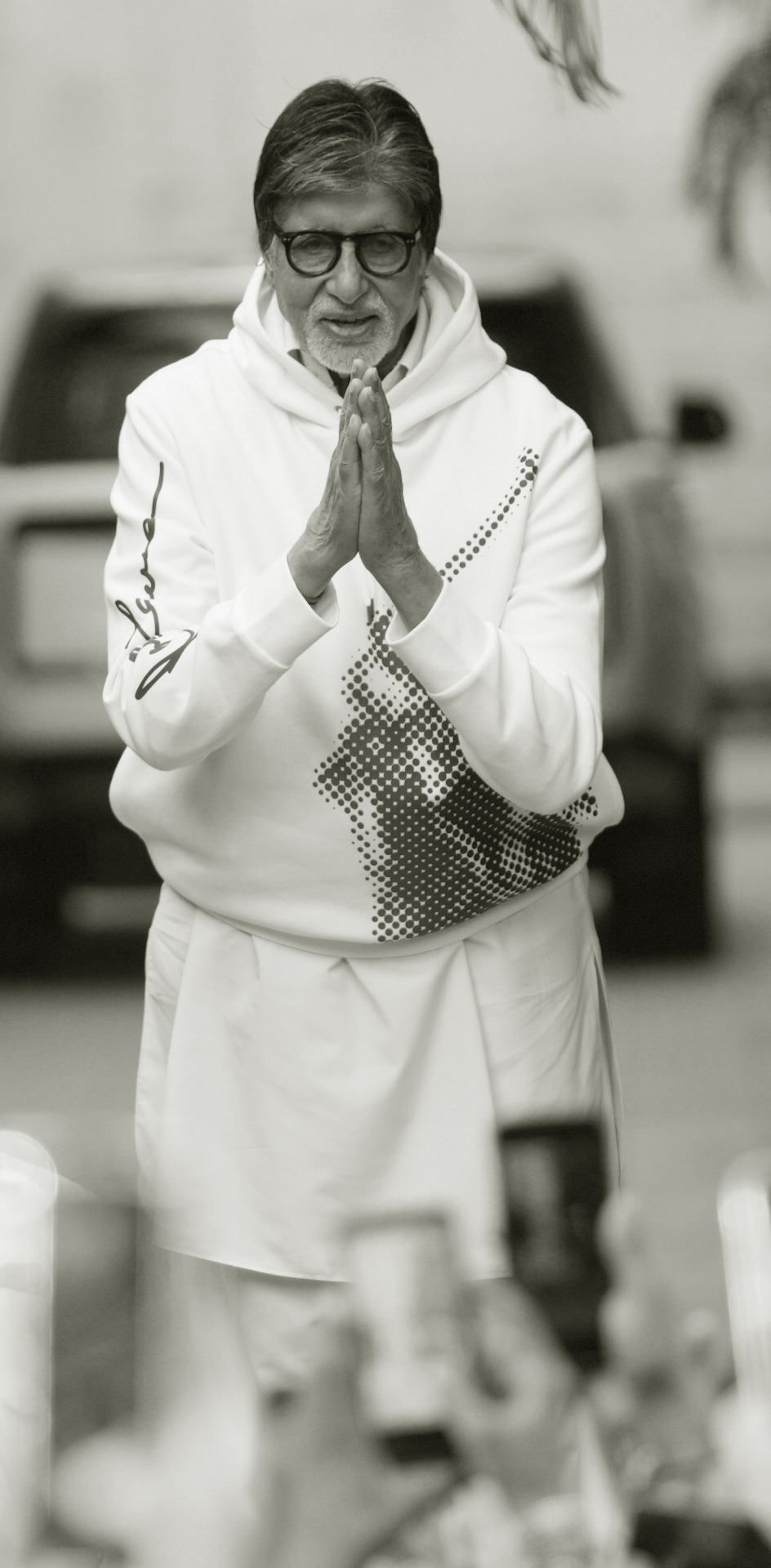

DAY 5539

Jalsa, Mumbai April 16/17, 2023 Sun/Mon 8:21 AM

🪔 .. April 17 .. birthday of Ef Samarth Pawar from UAE (hope I got the name right .. Rasika ??) .. and anniversary of our Blog Home .. both turning 15 years .. and the endearment and affection of the Ef on this loving DAY .. happiness always .. ❤️

.. ✨

yes the mornings continue to inspire the thoughts for the day .. the entire day and as I get down to the connect , there is an entire DAY devoted to the well wishers who come from day on day and never flinch a look an expectation for that short moment at the gates of Jalsa ..

and I felt they deserve a presence on this platform .. so there ..

the gifts and the mementos given with so much effort and love is so endearing and loved by me .. but the problem is I am running out of space .. where to keep them .. some adorn the home .. some the desk .. some I do wear .. and what of the rest .. ?

I do understand the love , but is there some way of restricting the gifts .. I know it is harsh to say this but if there is a solution then I would welcome it ..

❤️

the physicality of the body is rapidly becoming the most needed element in every day lives of the aged .. move keep mobile , get up and get , work out the system .. even the voice .. for that is what the necessary need is of the moment ..

So .. get up to put that switch on .. fetch that glass of water on your own .. pull out the dress and clothes to be worn by the self .. wipe clean the area where you sit yourself .. clean the wash room .. check on the non function ability of a mechanism yourself - a fused bulb, a short circuited wire fuse , a non functioning door knob or key hole , get the W40 and spray it yourself till it functions , remove the power plug to the set top box or the Apple box to restart the play if it does not work or freezes ( most equipments do get back to function mode when that is done - or so I have seen the Tech guy do ), get the washing powder and wash clean some of the personal garments while in the wash room , wipe and maintain the dust free requirement of your music system - they are sensitive electronics and do need personal attention , drive as often as possible your car , to prevent it lying idle till work starts and getting signals that the battery needs attention , clean the personal car if you value it yourself , gives an immense sense of happiness , wipe that glass window clean rather than wait for the professional to come and do it , do the manicure pedicure and the hair , .... get the books in order on the rack , get the desk clear of paper work ..

aaahhh .. the list goes on ..

but such a joy to be mentioning all of this .. for this is I believe the routine for all .. is it not ..

oh and yes .. if a garden , tend to it often , speak to the plants , they respond - the flowers and the leaves and creepers ..

AND .. yes walk .. walk to greet the well wishers .. some that see the recent pictures ask .. why bare feet ?!

I say .. why not ?!

Have an answer to that .. ?

.. no its not just the temple .. its the temple outside the gates as well ..

.. and the Sunday ends .. till the next ..

back to work and domesticity .. and the preparation for the work in a few days the one that taxes me .. and that causes that anxiety before every new project ..

My love and care as ever ..

Amitabh Bachchan

136 notes

·

View notes

Text

The Ultimate Guide to Buying Luxury Properties in Dubai

Introduction to Luxury Properties in Dubai

Dubai's real estate market is synonymous with luxury, offering a wide range of high-end properties that attract investors and homebuyers from around the world. From opulent villas and expansive penthouses to exclusive apartments in prestigious neighborhoods, Dubai's luxury real estate sector is thriving. This guide provides a comprehensive overview of the process of buying luxury properties in Dubai, offering valuable insights and practical tips to help you secure your dream home.

For more information on home loans, visit Home Loan UAE.

Why Invest in Luxury Properties in Dubai?

Dubai is a global hub that combines modernity with tradition, making it an attractive destination for luxury real estate investment. Here are several compelling reasons to invest in luxury properties in Dubai:

Strategic Location: Dubai's geographical location serves as a crucial gateway between the East and the West, making it a central hub for business and tourism.

World-Class Amenities: Luxury properties in Dubai come equipped with world-class amenities, including private beaches, state-of-the-art fitness centers, and high-end retail and dining options.

Tax Benefits: Dubai offers tax-free income on rental yields and capital gains, making it an attractive destination for investors.

High Rental Yields: The city provides some of the highest rental yields in the world, making it a lucrative investment opportunity.

Strong Economy: Dubai's robust and diversified economy supports a stable real estate market, providing a secure investment environment.

For property purchase options, explore Buy Commercial Properties in Dubai.

Understanding the Luxury Property Market in Dubai

The luxury property market in Dubai is characterized by its diversity and opulence. Properties range from high-rise apartments with breathtaking views to sprawling villas with private pools and gardens. Key areas known for luxury properties include:

Palm Jumeirah: An iconic man-made island offering exclusive beachfront villas and luxury apartments.

Dubai Marina: Known for its stunning skyline and waterfront living, Dubai Marina offers high-rise luxury apartments and penthouses.

Downtown Dubai: Home to the Burj Khalifa and Dubai Mall, Downtown Dubai offers luxury apartments in a vibrant urban setting.

Emirates Hills: Often referred to as the "Beverly Hills of Dubai," this gated community offers expansive villas and mansions.

Steps to Buying Luxury Properties in Dubai

Define Your Requirements: Determine your budget, preferred location, property type, and essential amenities.

Research the Market: Conduct thorough research on the luxury property market in Dubai. Use online portals, consult real estate agents, and attend property exhibitions.

Secure Financing: If you require financing, explore mortgage options. For more details, visit Mortgage Financing in Dubai.

Hire a Real Estate Agent: Engage a reputable real estate agent specializing in luxury properties to guide you through the process.

View Properties: Schedule viewings of shortlisted properties to assess their suitability.

Make an Offer: Once you find the right property, make an offer through your agent.

Legal Checks and Documentation: Ensure all legal checks are completed, and necessary documentation is in place.

Finalize the Purchase: Complete the payment and transfer the property title to finalize the purchase.

For rental options, visit Apartments For Rent in Dubai.

Financial Considerations

Investing in luxury properties requires careful financial planning. Here are some key financial considerations to keep in mind:

Budgeting: Determine your budget, including the purchase price, closing costs, maintenance fees, and potential renovation costs.

Mortgage Options: Explore different mortgage options to find the best rates and terms. A mortgage consultant can provide valuable advice and assistance.

Down Payment: Be prepared to make a significant down payment, typically ranging from 20% to 30% of the property value.

Currency Exchange: If you are an international buyer, consider the implications of currency exchange rates on your investment.

Legal Considerations

Title Deed: Ensure the property has a clear title deed issued by the Dubai Land Department (DLD).

No Objection Certificate (NOC): Obtain an NOC from the developer if purchasing an off-plan property.

Property Registration: Register the property with the DLD to formalize ownership.

Legal Advice: Consider hiring a legal advisor to assist with the legal aspects of the purchase.

Choosing the Right Real Estate Agent

A reputable real estate agent can make the process of buying a luxury property much smoother. Here are some tips for choosing the right agent:

Experience and Reputation: Choose an agent with extensive experience and a strong reputation in the luxury property market.

Market Knowledge: Ensure the agent has in-depth knowledge of the specific areas and properties you are interested in.

Client Testimonials: Look for client testimonials and reviews to gauge the agent's performance and reliability.

Communication Skills: Select an agent who communicates effectively and is responsive to your needs and concerns.

Viewing and Selecting Properties

When viewing luxury properties, consider the following factors:

Location: The location of the property is crucial. Consider proximity to amenities, views, and the overall neighborhood.

Quality of Construction: Assess the quality of construction, materials used, and overall craftsmanship.

Amenities and Features: Ensure the property offers the amenities and features that are important to you, such as private pools, gyms, and security.

Future Development Plans: Research any future development plans in the area that could impact the value and desirability of the property.

Making an Offer and Negotiating

Once you find the perfect property, making an offer and negotiating terms is the next step. Here are some tips:

Offer Price: Work with your agent to determine a fair offer price based on market value and recent sales.

Negotiation Strategy: Have a clear negotiation strategy and be prepared to make counteroffers.

Inclusions and Exclusions: Clearly outline what is included in the sale, such as furnishings, fixtures, and appliances.

Contingencies: Include contingencies in your offer to protect your interests, such as financing and inspection contingencies.

Closing the Deal

The final step in buying a luxury property is closing the deal. This involves several key tasks:

Final Walkthrough: Conduct a final walkthrough of the property to ensure it is in the agreed-upon condition.

Finalizing Financing: Secure your mortgage and ensure all financing details are in order.

Signing the Contract: Review and sign the sales contract, ensuring all terms and conditions are clearly outlined.

Transfer of Ownership: Complete the transfer of ownership with the Dubai Land Department.

For more resources and expert advice, visit Home Loan UAE.

Real-Life Success Story

Consider the case of James, an investor from the UK, who purchased a luxury penthouse in Dubai Marina. With the help of a local real estate agent and a mortgage consultant, James secured a competitive mortgage rate and finalized the purchase within three months. His investment has since appreciated in value, providing substantial rental income.

Conclusion

Buying luxury properties in Dubai can be a rewarding investment, provided you navigate the process with due diligence and expert guidance. By following the steps outlined in this guide and leveraging professional services, you can secure a luxury property that meets your needs and investment goals. For more resources and expert advice, visit Home Loan UAE.

2 notes

·

View notes

Text

Unlocking Success: Your Ultimate Guide to VAT Registration in the UAE with Goviin Bookkeeping

As the UAE continues to emerge as a global powerhouse for business, entrepreneurs worldwide are drawn to its promising opportunities. However, amidst the excitement of expansion, one crucial aspect often overlooked is Value Added Tax (VAT) registration. At Goviin Bookkeeping, we recognize the importance of seamless VAT registration for businesses to thrive in the UAE's dynamic market. Join us as we explore the intricacies of VAT registration and how we can be your guiding light to compliance and success.

Timing plays a crucial role in the dynamic landscape of the business world. Timely VAT registration isn't just a legal obligation; it's a strategic move to safeguard your business from penalties and fines. we understand the urgency and offers tailored solutions to ensure businesses stay compliant while focusing on growth and innovation.

We pride ourselves on our team of seasoned VAT consultants, each equipped with the expertise to navigate the complexities of VAT registration in the UAE. Whether you're a start-up or an established enterprise, our consultants are committed to understanding your unique requirements and providing personalized guidance every step of the way.

Navigating VAT registration can be overwhelming, especially for businesses unfamiliar with local regulations. we simplify the process by breaking it down into manageable steps, ensuring a smooth and hassle-free experience. From document preparation to submission, our experts handle the intricacies, allowing you to focus on what matters most – growing your business.

VAT registration in the UAE is categorized into Compulsory, Voluntary, and Exemption registrations, each with its own set of criteria. we help businesses decipher these categories, ensuring they select the most suitable option aligned with their annual turnover and business objectives. With our guidance, businesses can make informed decisions and avoid potential pitfalls down the road.

Embarking on the VAT registration journey shouldn't be daunting. we simplify the process by providing businesses with user-friendly tools and resources to kickstart their registration. Whether it's accessing the FTA's online portal or seeking assistance from our dedicated tax agents, we empower businesses to take the first step towards compliance with confidence.

In the bustling landscape of the UAE's business world, VAT registration is a non-negotiable step towards success. we're more than just consultants – we're partners committed to your growth and prosperity. Let us be your trusted ally in navigating the intricacies of VAT registration, ensuring compliance, and unlocking the full potential of your business in the UAE. With Goviin Bookkeeping by your side, success is within reach.

#VATRegistration#UAEbusiness#GoviinBookkeeping#ComplianceMadeEasy#BusinessGrowth#VATConsultants#TaxAdvisory#Entrepreneurship#StartupSuccess#UAEeconomy#BusinessExpansion#FinancialCompliance#Taxation#SmallBusiness#GrowWithGoviin#BusinessStrategy#VATCompliance#LegalRequirements#BusinessInUAE#ExpertConsultation#GlobalMarketplace#BusinessOpportunities#FinancialStability#StrategicGrowth#Innovation#BusinessSuccess

3 notes

·

View notes

Text

Unravelling VAT Dynamics: A Comprehensive Handbook on Registration Services in the UAE

Welcome to Goviin VAT Registration Services – a collective of qualified and knowledgeable accountants, auditors, and tax advisors committed to empowering you to take control of your finances and propel your business towards greater heights. Our comprehensive suite of services caters to clients spanning across the UAE. Whether you require seasoned bookkeeping services or proficient tax preparation for your business, rest assured that Goviin VAT Registration Services has the expertise to meet your needs and ensure financial success.

Value Added Tax (VAT) serves as a consumption tax, intricately woven into the economic fabric, impacting the supply of goods and services. This rate applies to a wide array of goods and services, with specific categories enjoying zero-rated or exempt status.

VAT Registration Services:

Engaging professional VAT registration services is a prudent choice for businesses navigating the complexities of compliance. These services streamline the registration process, ensuring accurate submission of required documents and adherence to the Federal Tax Authority (FTA) guidelines.

Key Steps in VAT Registration:

Assessment of Eligibility

Document Preparation

Online Registration Portal

Effectively managing VAT tax registration services in the UAE is pivotal for businesses operating in the region. Professional assistance not only simplifies the registration process but also ensures ongoing compliance with VAT regulations. As the UAE continues to evolve as a global business destination, staying informed and seeking expert guidance becomes paramount for businesses aiming to thrive in this dynamic marketplace.

2 notes

·

View notes

Text

Nordholm is Best Choice for Premier Accounting Services in Dubai- UAE

Embark on a seamless business journey with Nordholm Accounting and Bookkeeping, an arm of Nordholm Investments, Switzerland. Our unwavering commitment is to empower global investors, especially in the dynamic landscape of the UAE, by providing a comprehensive suite of services tailored to their expansion needs.

Tailored Services for Your Success:

Streamlined Business Setup: From facilitating company formation to guiding through visa processes and initiating bank account setups, we pave the way for your UAE business establishment.

Efficient HR, Payroll & Accounting Solutions: Our adept team takes charge of your HR management, payroll, VAT compliance, and meticulous Accounting practices, ensuring precision and adherence to regulations.

What Sets Nordholm Apart?

Punctuality Redefined: Timeliness is our forte. While you concentrate on your core business, we ensure high-quality accounting services delivered right on schedule.

Harmonizing Sustainability and Security: Nordholm drives business progress by striking the perfect equilibrium between sustainability practices and fortified security measures, fortifying businesses for success.

Empowering Insights: Our dedicated team doesn’t just manage numbers; we empower businesses with informed decisions and envision new vistas of growth.

The Edge of Outsourcing:

Swift and Superior Service: Our commitment to excellence is mirrored in our prompt and top-tier service delivery.

Robust Stability & Confidentiality: Entrust your financial data to a licensed service provider for unwavering stability and the highest degree of confidentiality.

Cost-Efficiency Redefined: For small and medium enterprises, outsourcing proves to be the smarter and cost-effective choice, eliminating overheads associated with in-house hiring.

Experience the Nordholm Advantage in managing your financial intricacies, freeing up your bandwidth to navigate the path towards unparalleled growth and success in the UAE market.

#NordholmAccounting#BookkeepingExcellence#AccountingSolutions#FinancialExcellenceDubai#TopAccountingServices#BusinessSetupDubai#ExpertFinancialServices

6 notes

·

View notes

Text

The Taxpoint- Best Tax Consultant In Dubai.

Discover the pinnacle of tax expertise at The Tax Point, the best tax training services in UAE, we provide the best consultation services in UAE, offering unparalleled tax consultation and advisory services. Our team of experienced professionals specializes in providing professional tax advisory services, ensuring business success. With a commitment to excellence, we offer tailored solutions, strategic planning, and expert guidance for businesses to satisfy their tax needs. Choose The Tax Point for professional tax advisory services in UAE. Your journey to financial success starts here.

#Corporate Tax Training Course in UAE#Tax Training in UAE#UAE Corporate Tax Training#Best Tax Training Services in UAE#Professional tax training UAE

2 notes

·

View notes

Text

Mastering Individual Money: An Overview to Financial Liberty

""

Personal financing is a critical aspect of our lives that typically gets forgotten or disregarded. Nonetheless, taking control of our financial wellness is crucial for a secure as well as meeting future. In this blog article, we will certainly discover the fundamentals of personal financing and offer useful tips on exactly how to manage your cash effectively, established financial goals, and achieve monetary freedom.Personal financing incorporates a large range of subjects, consisting of budgeting, conserving, investing, as well as financial debt monitoring. The very first step towards grasping personal finance is producing a budget plan that outlines your revenue and costs. By tracking your costs practices, you can recognize areas where you can cut down and conserve more. Additionally, setting economic goals, such as saving for emergency situations, purchasing a home, or preparing for retirement, gives a clear roadmap for your economic journey. We will discuss different approaches for achieving these objectives, consisting of the significance of saving, investing intelligently, as well as reducing financial debt. With the appropriate understanding and self-control, you can take fee of your personal funds and also lead the way to economic liberty. Keep tuned for important insights and also functional suggestions to aid you navigate the globe of individual financing and also construct a strong foundation for a safe and secure and prosperous future.

Read more here http://x4a.s3-website.eu-west-1.amazonaws.com/TaxTalk/US-Tax/US-Expats-Living-in-the-UAE-Can-Benefit-From-Efficient-USA-Tax-Solutions.html

2 notes

·

View notes

Text

Navigating Tax/Vat Preparation and Bookkeeping Solutions in the UAE

At FST Accounting, we understand that tax preparation and bookkeeping aren't just checkboxes on your business to-do list. They're vital cogs in the wheel of your financial health and longevity. Our mission? To equip you with the savvy and strategies needed to not just comply with regulations, but to thrive financially, propelling your company toward growth and efficiency.

Let's Break It Down:

Tax Services: Picture us as your tax whisperers, guiding you through the maze of regulations with finesse. From nailing VAT compliance to crafting smart tax plans and filing spot-on returns, we've got your back.

Bookkeeping Solutions: Think of bookkeeping as the heartbeat of your financial operations. It's all about methodically logging and organizing your financial transactions. This clarity not only aids in decision-making but also keeps the regulators happy.

The Nuts and Bolts of Bookkeeping:

Step 1: We start by meticulously recording every transaction using top-notch accounting software tailored for the UAE market. Sales, purchases, expenses, payroll—you name it, we track it.

Step 2: Next, we sort and classify these records to whip up financial statements like balance sheets, profit and loss statements, and cash flow reports. It's like painting a clear picture of your financial landscape.

Payroll Management in the UAE:

Navigating UAE's labor laws can be a bit like tiptoeing through a minefield. That's where our payroll management services swoop in. We ensure your employees get paid accurately and on time, while also staying on the right side of the law.

Tax Accounting vs. Bookkeeping:

Bookkeeping lays the groundwork, recording every financial move. Tax accounting takes it a step further, handling the nitty-gritty of tax returns and compliance. Think of bookkeeping as the canvas and tax accounting as the masterpiece painted upon it.

Tax Accounting Methods:

In the UAE, we've got options. Accrual accounting vs. cash basis accounting—each with its own perks. Accrual accounting recognizes revenue and expenses as they're earned or incurred, while cash basis accounting sticks to cold, hard cash exchanges.

Small Business Accounting in the UAE:

Small businesses, rejoice! Our tailored accounting services are here to lighten your load. Say goodbye to financial headaches and hello to streamlined operations and growth opportunities.

When you partner with seasoned pros like us, you're not just getting accurate financial records. You're gaining peace of mind, knowing your financial ship is sailing smoothly toward success.

Ready to take the plunge? Let's chat about how we can steer your business toward financial prosperity.

Tagged: Bookkeeping solutions in UAE, Payroll management in UAE, Small business accounting in UAE

#Accounting services Uae#Financial consulting Uae#Tax preparation uae#Bookkeeping solutions Uae#Small business accounting Uae#Payroll management Uae#Auditing services Uae#Tax planning Uae#Financial reporting Uae#CPA services Uae#Budgeting and forecasting Uae#Business advisory Uae#Financial analysis Uae#QuickBooks consulting Uae#Tax compliance Uae#certified accountant near me#cpa accountant near me#accountants near me#tax accountant near me#accounting services

0 notes

Text

What Are The Factors I Need To Consider When Buying A Property In Dubai

Thanks to the increased foreign direct investments and free trade agreements between UAE and other countries, Dubai has become one of the most happening cities in the world, especially for the wealthy across the globe.

Besides free trade, low tax and zero income tax, Dubai is also dubbed as the business hub of the Middle East and enjoys the status as a favorite travel destination. Such features along with political stability and investment in infrastructure significantly boosted the country’s real estate.

Reportedly, Dubai saw a 76 per cent rise in real estate transactions in 2022 which amounted to a whopping $140 billion, with a majority of buyers from Russia. If you are lured by the lush lifestyle and cheap service from low-wage laborers procured from Asia, Africa and the Middle East, and propelled to buy a property here, here’s how to make a smart purchase and enjoy your slice of the cake.

The Current Trends Of Property Demand In Dubai

While real estate in Dubai is broadly classified on a residential and commercial basis, the former is further classified as villas, apartments, penthouses and working houses or studio apartments that the opulent purchase to house their staff.

The commercial property includes office spaces, trade areas, warehouses, exhibition halls and industrial properties. While the demand for office space is believed to have subsided, the need for warehouses has increased due to enhanced e-commerce developments.

The huge retail companies and international markets in the Emirates have caused this demand for warehouses and sorting places.

Appreciation For Dubai Property

The strategic location and accentuating economy add to the appreciation of property value in Dubai. The flawless infrastructure makes any real estate investment fruitful, especially the off-plan ones.

Through flexible payment plans, off-plan properties have enhanced appreciation since the property price increases as the building nears completion. Likewise, even end users benefit from buying a property at a lower cost with more value for money.

Buyers can also benefit from various plans provided by promoters like post-handover payment plans and rent-to-own plans to name a few. Early investments offer immense profits through the appreciation perspective.

Allegedly the price of properties which are arriving in the markets here are expected to rise by 25 per cent per year. Demand for villas has superseded those for apartments and despite the shortage of luxury villas, the demand only grows.

Zeroing In On The Right Property

The buyer must clarify self about the property type, purpose of the purchase, preferred locality and its functionality to satisfy the purpose, amount affordable for purchase, mortgage possibilities and the developer’s reputation to hand over the property in the scheduled time while purchasing the property.

It is equally important to check the risks involved and estimated ROI on completion of the project.

Timespan Of Occupation

Purchasing a home anywhere across the world, leave alone in Dubai, must be considered on both a short and long-term basis. An apartment purchased by a newlywed or young couple may seem insufficient when the family expands.

Purchasing villas gives the option to expand and redesign besides providing a better return on investments. These villas which are excellently furnished can be sold to one of the increasing numbers of interested buyers if owners choose to relocate to another country.

Budget

As of February 2023, the starting price of a property in Dubai is reportedly between AED 3 lakhs to 3.5 lakhs. The price of apartments in Dubai depends upon floor area, locality and amenities among various other factors.

The buyer must be prepared to pay a 10 per cent refundable registration fee while purchasing the desired property.

Location

The instance found below shows how price varies among localities for almost the same floor area.

One-bedroom apartments measuring 800 to 900 square feet at Business Bay and Dubai Hills Estate at Mohammed Bin Rasheed are affordable. One-bedroom apartments are also available at Al Wasl (Jumeira), Dubai South City (Jabal Ali) at affordable rates.

Single-bedroom apartments at Emaar Burj Vista measuring between 700 to 1000 square feet cost more than AED 2,00,000 at Downtown Dubai, Dubai Marina. Proximity to Dubai Mall, Dubai Mall Metro Station and easy connectivity to Sheik Zayed Road and Dubai Property justifies the costly price of this single-bedroom apartment.

The Purchase Medium

A buyer could save a lot of money by avoiding brokers or middlemen while purchasing property in Dubai directly from the owner. Notably, brokers charge a 2 per cent agency fee and a 5 per cent VAT charge on the fee.

However, while avoiding brokers, one forgoes professional assessment of properties and expert navigation of transaction details like the contract paperwork, for instance, the art of negotiating.

Dubai Land Department Service Charges

Dubai Land Department service charges, which are mandatory while purchasing property in Dubai, may be shared equally by the buyer and seller or might be entirely paid by the buyer. The DLD charges amount to 4 percent of the property value.

Additionally, the buyer may need to pay a mortgage registration fee if bought through a loan, which amounts to 0.25 per cent of the loan along with AED 290. If the DLD is not paid within 60 days, the purchase is understood to be canceled.

Property Service Charges

The property service charges which are calculated on a square foot basis may range between AED 3 to 30. Besides property service charges one must foot Dubai Electricity and Water Authority fees along with insurance fees, security deposit and property transfer fees.

The property service charge varies along with locations, project type and purchase purpose. The buyer should also pay a ‘sinking fund’ which is a reserve fund that meets expenses for major repairs in future. Interestingly the 10 to 15 per cent price drop in key locations of Dubai facilitates developers selling to new end users.

While places like International City, Discovery Gardens have low service charges at 7 Dirhams per square feet (psf), Business Bay, Dubai Marina, Jumeirah Lakes Towers, Sports City, Jumeirah Village Circle charge moderately at 10 Dirhams psf.

Arabian Ranches 1 and 2 require AED 0.89 psf and 2.44 psf respectively while Burj Vista property owners shell out a massive AED 17.44 psf for property services.

Amenities And Their Scalability, Effectiveness And Quality

Villas are equipped with clubhouses, gyms and modern equipment and are tagged with excellent resale value. Villas in Dubai Hills, Arabian Ranches, Palm Jumeirah, Emirates Hills, Damac Hills and Al Furjan are sought for 18-hole golf course plus proximity to the city, connectivity to Sheik Mohammed Bin Zayed Road, Waterfront view, Privacy with palatial layout, family-friendly atmosphere and proximity to Expo 2020 site in the same order.

Handling Installments

Installment plans are popular in Dubai real estate purchases. 10 percent of the total cost is paid as advance which is followed by installments that cover half the entire cost at the time of handover.

Documents Required

Copies of documents including Emirates ID, passport, Visa page, reservation form, Sales and Purchase Agreement and Mortgage Contract if applicable required while purchasing property in Dubai.

Check Developer Background

It pays to check the developer’s track records before approaching them to buy property. If the developer lacks dedication, his property abounds in unsatisfactory plans and poor finishes while laying tiles, cupboards and walls.

Where To Purchase Off-Plan Properties

Purchasing a property through D Realtors, a professional and authentic real estate player in Dubai, fetches access to the functionally and aesthetically best property in Dubai which is spread across in prestigious locations such as Mohammed Bin Rashid City, The Fields, Burj Khalifa district and Sheik Zayed Road to name a few.

Final Words

The decision to join the game cannot be delayed too much since the prospects have already caught the eyes of many. Waste no time in deciding to take the plunge because the competition is already in the news.

Share this:

#Government approved realtors in dubai#D realtors#Dubai real estate brokers#Realtors in uae#Rent property in dubai#Lease property in dubai#Real estate in dubai#Uae real estate brokers#Buy property in dubai#Buy property in uae#Realtors in dubai#Freehold property in dubai#Buy apartment in dubai#Rera approved brokers in dubai

2 notes

·

View notes

Text

Navigating Corporate Tax Compliance in the UAE: How Corporate Tax Consultants Can Help

For businesses operating in the UAE, understanding and complying with corporate tax regulations are crucial. Navigating the complexities of corporate taxation requires expertise and up-to-date knowledge. In this blog, we will explore the role of corporate tax consultants and advisory services in Dubai and the UAE, with a special focus on how Jitendra Chartered Accountants can assist businesses in meeting their corporate tax obligations.

Understanding Corporate Tax in the UAE:

The UAE imposes no federal corporate income tax on companies engaged in most economic activities. However, certain free zones and sectors might have specific tax regulations. Corporate tax consultants in the UAE play a vital role in guiding businesses through these varying tax scenarios, ensuring full compliance with relevant tax laws.

The Expertise of Corporate Tax Consultants:

Corporate tax consultants possess extensive knowledge of local tax laws and international tax standards. They assist businesses in structuring their operations in a tax-efficient manner, optimizing deductions, and ensuring adherence to tax reporting requirements.

Corporate Tax Advisory Services:

Reputable corporate tax advisory firms in Dubai, such as Jitendra Chartered Accountants, offer comprehensive tax advisory services. They analyze each client's unique tax situation, identify potential tax risks and opportunities, and develop tailored strategies to minimize tax liabilities while maximizing benefits.

Corporate Tax Planning and Optimization:

Corporate tax consultants help businesses devise effective tax planning strategies to minimize tax burdens legally. This includes evaluating the most suitable legal entity structure, optimizing deductions and credits, and exploring available tax incentives.

Corporate Tax Filing Services:

Navigating the corporate tax filing process can be complex and time-consuming. Corporate tax consultants in Dubai, like Jitendra Chartered Accountants, take on this responsibility, ensuring accurate and timely tax filings. They stay updated with changing tax regulations, reducing the risk of errors and penalties.

Compliance with Tax Regulations:

Compliance is key to avoiding penalties and maintaining a good standing with tax authorities. Corporate tax consultants provide ongoing support, ensuring businesses stay compliant with evolving tax laws and regulations.

Assistance with Tax Audits:

In the event of a tax audit, corporate tax advisors act as representatives on behalf of businesses, providing the necessary documentation and explanations to tax authorities.

Conclusion:

Complying with corporate tax regulations in the UAE is essential for businesses to operate smoothly and avoid unnecessary financial and legal risks. Corporate tax consultants and advisory services, such as Jitendra Chartered Accountants, offer indispensable expertise and support to navigate the complexities of corporate taxation. By seeking assistance from these reputable firms, businesses can optimize their tax planning, ensure full compliance, and focus on their core operations with confidence.

#corporate tax consultants Dubai#corporate tax consultants UAE#corporate tax services in UAE#corporate tax advisors#corporate tax advisory#UAE Corporate Tax Preparation

0 notes

Text

UAE Trip p.4

Day 2. 6am nga ako nagising diba, ginawa ko lang non nanuod sa tiktok at nagbasa kasi nagising pa sila Alei ng 10am na. Hinintay lang namin si kuya nung lunch kasi half day siya sa work, nagpunta na kami sa jewelry store para magtingin ng gold nga, isa yon sa pakay ko talaga don hahaha kaso sarado ung nagpunta kami kasi friday pala yon, may prayer sila. So, nag decide na lang muna kami magpapalit ng pera, ung dala kong dollars tsaka ung riyal ni papa na may punit. Dito kasi ayaw tanggapin yung may punit, eh sayang naman kung di mapapalitan diba kaya dinala ko na tas don ko pinapalitan. Walang tanong tanong don, pinalitan agad nila ung riyal. itong pamangkin ko pa, lahat na lang nang nandon sa bank na yan, kinausap. Kahit ung may ka meeting na isa, inistorbo niya. Grabe sa pagka friendly. Lahat kinakausap at sinasamahan eh.

Anws, after namin magpapalit nag ukay na kami. Yung ukay nila parang sa Robinson Nova style ganon. Lahat din pinoy hahahaha may mga polo and blouse na 1 aed lang, sobrang good quality pa, ung iba 5 aed. May nabili akong shorts na 15 aed tapos 2, ang ganda nga ng quality sobra. May nakabili din akong 2 pants na isang Nike dri-fit pants tsaka isang Lee, 20 aed each. Bumalik kami don sa jewelry store pala para bumili nung set ko, madaming maganda pero sa 18k lang ako may nagustuhan. Ang minimalist kasi nung design ng butterfly kaya yun na yung binili ko. Ayaw nga ng nanay ko ung binili ko kasi daw di makinang -_-. Anws, may travel tax yon kaya pwede ko marefund. Sobrang friendly lahat ng staff nila, and pansin ko din lahat nung jewelry store na napuntahan namin, lalake ung mga staff nila. Walang babae. At lahat din nung staff don sa pinagbilhan ko kilala si Alei. Ang future niya siguro talaga maging presidente, char haha

After nito, nagpunta na kami sa Emirates Palace. Amazed nanaman ako. Ang ganda ng view, pwede ka pumasok sa loob ng hotel. Tamang stroll ka lang ganon, di ka pagbabawalan. Tama din si kuya na mas maganda sa Abu Dhabi haha literal kasi na walang traffic sa Abu Dhabi tapos magkakalapit lang yung pasyalan. Ang spontaneous nga lang ng day namin na to eh, on the spot lahat ng gala, after non nag aya lang yung friend nila kuya na mag dinner sa fish market. Para siyang dampa ganon, bibili ka ng seafoods tapos ipapaluto mo. Difference lang is aircon ung palengke nila, malinis, at mabango. First time ko din natikman ung Arabic Fattoush salad, matamis na maasim ung lasa niya. May isa pa na appetizer eh, parang quesadilla ganon. Nakalimutan ko lang ano ung tawag. Nilantakan lang namin yung hipon, squid, tska ung isang isda na di ko alam ano tawag hahaha pota.

Hindi pa natatapos ang gabi namin kasi gusto nila ate ipa try sakin ung buko ng emirates, kaya nagpunta naman kami sa fruits market. Sobrang sarap ng buko nila. Akala mo nilagyan ng sugar yung buko sa sobrang tamis. Kahit yung juice sobrang tamis. Nabigyan pa nga si Alei ng libreng orange hahaha nacute-tan kasi sakanya ung nagtitinda. May isa pa habang hinihintay namin yung pinakayod na buko, may nag papark kasi tas itong pamangkin ko ginuide pa siya mag park hayup talaga hahaha kaya tawa kami ng tawa. Akala mo talaga tatakbong presidente kaya napaka friendly. After, pumunta kami sa pasalubong center eme nila don, bumili na ko ng mga pasalubong ko. Yun kasi talaga ang plano ko, bumili agad nung gold tsaka pasalubong kaya ung matitira sa budget ko, pwede ko na gastusin haha. Akala ko tapos na ung gabi kasi mag 12mn na yon eh, pero di pa. Binanggit agad ni kuya na mag Dubai kami kinabukasan. Ganyan sila kaspontaneous, biglaan lahat. Biglaang book ng hotel, book ng tickets sa mga pupuntahan namin ganyan. Kaya pag uwi imbes na papahinga pa kami, nag prepare pa ng mga dadalhin para sa Dubai. Dito din sa point na to nakapag decide ako na gusto ko na ding mag abroad talaga. Sabi ko, iba talaga yung experience pag naranansan mo ung first world country. Mas mag hohope ka na tumira sa ganong bansa kasi ramdam mo ung asenso.

Day 3.

Dubai. Sobrang bilis kumilos ng asawa ni kuya hahahaha elibs ako. Edi, umalis na kami sa bahay diba, walang patayan ng aircon sila mga dai, kasi kasama sa rent ung tubig, electricity, and wifi. Kaya nagtataka ako bat di nila pinapatay ilaw sa cr tsaka sa kusina buong magdamag, yun pala libre. Nag breakfast muna kami sa Mcdo, lahat talaga don digital payments na. Bihira na nag ccash. Eh cash ang meron ako diba, kaya di nila ko pinagbabayad kasi may mga points pag sa app ka bibili, may libre kang ice cream ganyan, or naka 50% off ung isang burger meal. Masarap din mcdo burgers nila don. The best. Pumunta kami sa The Last Exit, cute na foodpark lang siya ganon haha pero pumunta kami don para mag CR, lahat ng spots ig worthy. May maliit na cute kiosk ng SB don, kay nagtataka kami bat ang haba ng pila papasok, yun pala pila yung drive thru ng SB. After, the last exit nag punta kami sa Dubai Parks and Resorts-free. Yes po, free siya. walang entrance talaga pati sa parking waley din. Tamang lakad ka lang and pasyal. Nandon din sa loob ung Legoland, pero syempre yon may bayad na at ang mahal niya haha 300aed ata. Kaya inikot na lang namin, may mga pahingahan din sila pag pagod ka na maglakad. May mga bean bags sa ilalim ng puno. Literal na chill lang talaga. tapos pag naka recharge ka na, lakad ulit. Nag ice cream din kami sa Mcdo ( nanaman) hahaha. Yung nalibot na namin to, nag byahe ulit kami papuntang hotel na namin sa Dubai. Yung lugar pa hotel, parang baguio style? na Makati? ganon. Puro pinoy kasi yung nandon talaga. First time lang din daw nila kuya don sa lugar na yon eh. May food stalls na puro pinoy foods, may mga tiange din. Kumain lang kami ng sisig tapos milk tea. Si kuya kumain din ng kwek kwek. namiss niya na daw hahaha Btw, sobrang kulit pala talaga ni Alei, medyo spoiled kasi tapos lahat gusto niya makuha ganon or dapat masunod. Kaya yung 10 minutes na lakad lang sana namin from parking to food stalls naging 20 minutes kasi lagi kaming nahinto dahil sakanya.Understandable naman din kasi inaantok na haha nakatulog na siya habang hinihintay namin ung milk tea eh.

Next destination, Global Village. amazed nanaman ako. hays. Malayo ung parking space sa main entrance kaya sumakay kami sa parang tricycle? pero ang difference niya, manual na padyak ang gamit ni kuya hahaha eh apat kami diba, malalaki pa kami kaya hirap na hirap siyang mag pedal. pero don walang nagpapadagdag, kung ano ung price yun lang. Global Village, isang malaking park na may tiangge, food stalls, rides ganon. papasok ka lang sa mga bansa tapos may mga nagtitinda ng products nila galing sa bansa na yon. Nagtagal kami sa korea, japan and asian eme eh. Naghahanap kasi ako ng funko, kaso ang nakita ko naman figurines. Every country din don may performance. Ikaw na lang susuko sa kakalakad sa sobrang lawak niya. Hindi na nga namin napuntahan ung ibang lugar sa sobrang pagod na kaya bumalik na kami sa hotel. Pero di pa natatapos yung gabi namin non kasi nag tiange pa kami nung asawa ni kuya lol, nilakad na lang namin mula hotel hanggang sa tiangge. Buhay na buhay pa din ung kalye kahit 1am na eh. Wala na din palang face mask don kaya makakahinga ka ng maluwag talaga. 2am na ata kami nakauwi kasi nag grocery pa kami sa malapit para bumili ng water ang snacks.

DAY 4

Nagpunta kami sa Dubai Mall. May sneak peek kasi don nung pa aquarium nila. amazed nanaman ako hahaha hayup. Imagine, aquarium sa loob ng mall??? Ang ginawa lang namin is nag picture sa Burj Khalifa tapos nanuod ng dancing fountain. Sabi nila mas maganda daw yon sa gabi eh kaso tanghali kasi kami pumunta don, pero oks na din kasi ang ganda. As in. hindi ko nga lang mapicturan ng buo ung burj kasi may mga ulong nakaharan hahaha nag give up na ko, basta nakita ko siya up close, oks na ko haha. Pinatry na din sakin nila kuyau ng biryani tapos ung isang chicken creamy eme na dish din, nakalimutanko yung name tapos isasawsaw mo don ung naan na bread eh. The best din. Ang lalaki pati ng servings nila don tapos ang mura talaga.

Butterfly Garden. Dapat sa Miracle Garden kami pupunta kaso nag mahal ung ticket, naging 75aed kaya nag butterfly na lang kami. Nakaktuwa kasi ang daming butterfly tapos ang lalaki nila. Ung butterfly na mismo ang dadapo sayo sa dami nila eh. Nung una, takot pa si Alei humawak pero ung natry na niya, sobrang proud niya eh haha nagmamayabang sa ibang bata don na nakahawak siya ng butterfly haha kaya wala kami ginawa kundi humili ng butterfly para sakanya. After nung lakad lakad, may bean bag ulit sa labas na pwede ka mag relax, yung nakaupo na kami, aba si alei, lumapit don sa mga staff ata, may parang band kasi don, may nag gguitara ganyan. May mic. Nag request ang bata ng Let It Go. Choosy pa siya kasi nung una accoustic version ung tinutugtog ni kuya, ayaw niya dai, sabi niya talaga “no. i dont like that”, gusto niya ung original version hahahaha kaya ayon, hinanap pa nila tapos nung tumugtog na kumanta siya talaga. Nakakatuwa sa pagka bibo eh lol. Lahat ng nandon vinideohan na siya. Kahit magulang ni Alei, hindi alam kung kanino daw nagmana sa pagka maarte at mabibo kasi pareho silang hindi ganon hahahaha

Since, pauwi na kami sa Abu Dhabi, gumala na kami sa pang mayaman na mall don,literal na walang tao ung mall na yon. Naki cr lang kami tapos take note hindi tissue ang gamit nila pag maghuhugas ka ng kamay. towel, yes po, opo, towel. nashookt ako. first time ko makapag cr na ang gamit nila pang punas sa kamay pag naghugas ka towel. hayup talaga ahaha so ayun na nga, nagtataka kami bakit walang tao, sabi nung pinoy wala daw kasi ung mga businessman. Meeting place pala yon ng mayayaman.

Final agenda sana namin sa Dubai is ung Museum of the Future, kaso bawal magpapasok kasi may event. Sayaaang, kasi libre din ung museum na yon eh. hays. better luck next year. Nagpunta din pala kami sa One aed store don. Namili kami pasalubong naman. Imagine 1aed ung m&m’s na chocolate. May 1 aed din na pasta. Naka sale halos lahat ng chocolates. Tapo may BPI din don mga sis. Mag aapply na ba ko sa BPI-Dubai branch hahaha lol.

Pauwing Abu Dhabi, nagharutan lang kami ni alei. Puro ako kagat niya. pinanggigigilan talaga ako nung batang yon. Umuwi lang kami saglit sa bahay para ibaba ung mga gamit tapos pumunta na kami ulit sa bahay nung kapatid ni ate. Tapos namasyal kami sa park, take note 11pm na to. Nag park pa kami. Sobrang lamig din. Sabi nila sakin “Eto paula, ganito lang ang buhay namin dito” hahaha kung ayaw mo na sa bahay mag park ka or mag mall ka ganon. Malinis and safe din kasi ung mga park nila. Malapit pa sa corniche kaya presko. Akala ko after namin ihatid ung mga kapatid ni ate saa bahay nila, makakapag pahinga na kami pero nooooope. There’s drama and nagkapulisan pa lol basta family drama nila yon di ko nakwento. pero after nung kaganapan na yon, ako pa din inisip nila hahaha “wala pang 4 days si paula dito, ganito na bumungad sakanya” hahaha. bukas na siguro ung continuation, nunuod ako OP hahaha lol

#personal#kwento#travel#sobrang haba pala nitong post na to hahahaah scroll niyo na lang#gusto ko na bumalik don#gusto ko na umalis talaga dito#yoko na here :(

4 notes

·

View notes

Text

Steps And Requirements VAT Registration In UAE

Under the value-added tax (VAT) system implemented on January 1, 2018. UAE VAT registration is mandatory for businesses with annual revenue exceeding AED 375,000 ($102,000).

Registration to the FTA requires a sound basis for the registration, preparation of the necessary evidence, and documentation to proceed without delays or issues. Therefore preparation and planning are key to minimising issues, potential risks, and penalties.

Here are the steps and requirements for VAT registration in the UAE:

1. Determine your business’s eligibility for VAT registration.

To determine your business’s eligibility for VAT registration, you need to consider the following:

Taxable Income: If your business has revenue exceeding AED 375,000, you must register for VAT calculated on a rolling basis, including the preceding 11 months and the next 30 days.

Type of business: All businesses operating in the UAE must register for VAT except for a few exceptions. These exceptions include businesses that are exempt from VAT, such as the sale and supply of some financial and insurance services

Location of business: Businesses operating in the UAE, regardless of location, must register for VAT if they meet the above criteria.

2. Register your business with the Federal Tax Authority (FTA).

To register your business for VAT, you must register it with the Federal Tax Authority (FTA). To do this, below is a summary of the minimum requirements:

Possess a Trade License: To register your business for VAT, you need a Trade License.

Register with the FTA: Once you have a Trade License, you need to register your business with the FTA through their e-Services portal. You will need to provide the following information:

Business name and address

Bank details

Type of business activity

Trade License number

Details of the business owner(s)

3. Obtain a Tax Registration Number (TRN).

Once you have registered your business with the FTA, you will receive a Tax Registration Number (TRN). This number is unique to your business and will be used for all your VAT-related activities.

4. Set up a VAT accounting system.

To comply with VAT requirements, you need to comply with the provisions as a taxpayer as set out in the Executive Regulations. Ideally, you should set up a VAT accounting system that tracks your business’s VAT-related activities to help with the VAT reporting. This includes:

Recording the VAT charged on your sales and the VAT paid on your purchases

Maintaining detailed invoices for all your sales and purchases

Preparing and submitting VAT Returns to the FTA regularly

VAT returns must be filed regularly, typically quarterly, or monthly. To file a VAT Return, you need to:

Prepare a VAT Return form: The VAT return form includes details of your business’s sales and purchases for the period and the VAT charged and paid.

Submit the VAT

Payment on VAT due

#vat consultants#UAE VAT Registration Online#vat registration#vat registration uae#VAT Registration in UAE

3 notes

·

View notes