#CMA Notes

Explore tagged Tumblr posts

Text

CMA Final Group 3 Study Material

The journey to becoming a Certified Management Accountant (CMA) is rigorous and demands a thorough understanding of various subjects. For those preparing for the CMA Final Group 3, having the right study material is crucial. In this guide, we will delve into the essential CMA Final Group 3 subjects and provide a comprehensive overview of the best study materials available.

Understanding CMA Final Group 3 Subjects

The CMA Final Group 3 comprises several critical subjects that cover a wide range of topics. These subjects are designed to provide in-depth knowledge and expertise in various areas of management accounting and financial management. The primary CMA Final Group 3 subjects include:

1. Corporate Laws and Compliance

This subject covers the legal aspects of business operations, including company law, securities law, and economic law. It aims to provide a comprehensive understanding of the legal framework governing corporate entities.

2. Strategic Financial Management

Strategic Financial Management focuses on advanced financial management techniques and strategies. Topics include capital structure, risk management, portfolio management, and financial planning.

3. Strategic Cost Management – Decision Making

This subject deals with cost management strategies and their application in decision-making processes. It includes topics like activity-based costing, transfer pricing, and cost control techniques.

4. Direct Tax Laws and International Taxation

Direct Tax Laws and International Taxation cover the principles of direct taxation, including income tax, wealth tax, and international taxation issues. This subject is crucial for understanding the tax implications of international business operations.

Essential Study Materials for CMA Final Group 3

To excel in the CMA Final Group 3 subjects, it is essential to have access to high-quality study materials. Here are some of the best resources:

1. Institute of Cost Accountants of India (ICAI) Study Material

The ICAI provides comprehensive study materials for all CMA subjects, including Group 3. These materials are curated by experts and cover all the topics in detail, making them an indispensable resource for students.

2. Reference Books by Renowned Authors

Several reference books by renowned authors can supplement your preparation. Books such as "Corporate Laws" by Munish Bhandari and "Strategic Financial Management" by Ravi M. Kishore offer in-depth insights and practical examples.

3. Online Courses and Video Lectures

Various online platforms offer courses and video lectures specifically designed for CMA Final Group 3 subjects. These resources provide flexibility and allow you to learn at your own pace. Websites like Udemy, Coursera, and the official ICAI portal are excellent sources.

4. Practice Papers and Mock Tests

Practicing with past papers and mock tests is crucial for understanding the exam pattern and improving your time management skills. ICAI provides past examination papers and mock tests that are highly beneficial for students.

5. Study Groups and Forums

Joining study groups and online forums can be extremely helpful. Platforms like Reddit, Quora, and dedicated CMA forums allow you to interact with fellow students, share resources, and clarify doubts.

Tips for Effective Preparation

1. Create a Study Plan

Having a well-structured study plan is essential. Allocate specific time slots for each subject and stick to the schedule. This ensures that you cover all topics systematically.

2. Focus on Conceptual Clarity

Understanding the concepts thoroughly is more important than rote learning. Focus on gaining a deep understanding of each topic, as this will help you in applying the knowledge effectively.

3. Regular Revision

Regular revision is crucial for retaining information. Set aside time for periodic revision sessions to keep the concepts fresh in your mind.

4. Solve Practical Problems

Subjects like Strategic Financial Management and Strategic Cost Management involve a lot of practical problems. Regularly practicing these problems will enhance your problem-solving skills and boost your confidence.

5. Stay Updated

Keep yourself updated with the latest amendments and changes in laws and regulations. This is particularly important for subjects like Corporate Laws and Direct Tax Laws.

What are the main subjects in CMA Final Group 3?

The main subjects in CMA Final Group 3 are Corporate Laws and Compliance, Strategic Financial Management, Strategic Cost Management – Decision Making, and Direct Tax Laws and International Taxation.

Where can I find the best study material for CMA Final Group 3?

The best study materials for CMA Final Group 3 can be found on the official ICAI website, in reference books by renowned authors, online courses, and practice papers provided by ICAI.

How important is it to solve past examination papers?

Solving past examination papers is very important as it helps you understand the exam pattern, improve time management skills, and identify areas where you need more practice.

Are online courses beneficial for CMA Final Group 3 preparation?

Yes, online courses are beneficial as they offer flexibility, expert guidance, and the ability to learn at your own pace. Platforms like Udemy, Coursera, and ICAI's official portal are great resources.

How can I stay updated with the latest amendments in laws and regulations?

Staying updated with the latest amendments can be done by regularly checking official websites, subscribing to relevant newsletters, and joining online forums and study groups.

Preparing for CMA Final Group 3 subjects requires dedication, access to the right study materials, and a strategic approach. By utilizing the resources mentioned above and following the preparation tips, you can enhance your understanding of the subjects and boost your chances of success. Remember to stay focused, practice regularly, and stay updated with the latest developments in the field. Good luck!

0 notes

Text

Accounting for investments and long-term assets

I sit for Part One of the CMA exam at the end of June, and I'm at the point of my preparation where (already having gone through all the units and taking notes) I'm going back to the beginning and doing practice problems.

Practice problems for the first few sections--accounting cycle, financial statement analysis, asset valuation--have been fairly straightforward. But, man, practice problems centered on investments and long-term assets have shined a spotlight on my knowledge gap in these areas. I clearly haven't mastered the material yet, so I figured writing a blog post on the topic could help.

This will be a boring blog post that interests no one besides me. Not sure why I felt compelled to write that previous sentence since that describes every post on this blog.

Investments in debt securities

Important to note that accounting rules differ for investments in debt securities and equity securities. So equity securities will be next.

Debt securities represent a creditor relationship with an entity. This includes:

Corporate bonds

Redeemable preferred stock

Government securities, e.g. T-bills and T bonds

Convertible debt

Commercial paper

Excludes:

Derivatives, i.e. options, futures, forwards

Leases

Accounts receivable

Notes receivable (even though they seem like it)

*Classification*

Investments in debt securities can be classified in 3 distinct ways:

Held-to-maturity (HTM): for these you need a positive intent to hold to maturity + the ability to hold to maturity. Based on the time to maturity, these are current (<1 year to maturity) or non-current (>1 year to maturity) assets

Trading: bought and held with intent to sell in near term, generally recorded as current assets

Available-for-sale (AFS): sort of in the middle of trading and HTM, generally non-current assets, ultimately based on intent

*Valuation*

Trading and AFS debt securities are reported at fair value. HTM debt securities are reported at amortized cost.

For the two reported at fair value, there's a difference in how gains/losses are recognized. Unrealized gains/losses on trading securities are recognized right away in Net Income, no need to wait for gains/losses to become realized via a sale.

But for AFS securities, unrealized gains/losses are recognized in Other Comprehensive Income (OCI) until they are sold, at which point the gain/losses becomes realized and recognized in Net Income. However, there is an exception for credit losses, if the value of the AFS security declines due to expected credit losses, that loss should be booked to Net Income not OCI.

For HTM securities reported at amortized cost, no unrealized gains/losses are recognized. And no realized holding gains/losses from sale of HTM securities because they are held to maturity, it's right there in the name.

*Reclassification*

There could be situations where investments in debt securities ought to be transferred between classifications. Obviously transfers should only occur when justified, i.e. when there's a change in intent to hold a particular security to maturity.

These reclassifications are all accounted for at fair value, we just need to understand what we do with any unrealized holding gains. Here are the 4 scenarios:

From trading to any other classification - any unrealized gains/losses have already been recognized, so no adjustment is needed, easy breezy

From any other classification to trading - unrealized gains/losses recognized in current period earning, i.e. Net Income

From HTM to AFS - unrealized gains/losses recorded in OCI

From AFS to HTM - you need to amortize the unrealized gains/losses from OCI with any bond premium/discount amortization (not gonna lie, not sure what this looks like in practice, haven't seen any review problems that detail this, if I do later on, I'll come back and update this)

*Impairment*

For debt securities, a credit loss is recognized if it's determined that all principal and interest won't be collected. Using Current Expected Credit Loss (CECL) model, we recognize this as a period expense, essentially an allowance against the investment. Hence, impairment.

For HTM, we have to consider if we are going to collect all the principal and all the interest. If the answer is no, the security should be reported at the present value of the principal and interest we expect to collect. The difference between this and the amortized cost is recognized as a credit loss.

For AFS, credit losses are limited by the amount the fair value falls below the amortized cost. Because if all else fails, you won't sell, you'll just hold to maturity as that's the best value you can get, so it doesn't make sense to mark it below that point.

For trading, no need to worry about impairment because trading securities are always marked to fair value.

*Sale of debt securities*

For trading, difference between book value and selling price is recognized as realized gain/loss. This is just about timing as book value equals fair value but as of last period end. Think if security was marked to market at end of period 2, but we sell the middle of period of 3, we have to mark to market for whatever is unrealized mid-period.

For AFS, difference between original cost and selling price gets recognized as realized gain/loss in Net Income and accumulated OCI for unrealized gain/loss is written off.

Investment in equity securities

Wow, I took too long writing the debt securities section. Hopefully, this section is simpler.

Equity securities represent ownership interest or right to acquire or dispose an ownership interest. This includes:

Ownership shares

Warrants/rights/call options (rights to acquire)

Put options (rights to dispose)

Excludes:

Preferred stock redeemable at the investor's option

Mandatorily redeemable stock

Treasury stock

Convertible bonds

*Classification*

FVTNI - Fair Value through Net Income, this is generally applicable to all equity securities, think trading.

But this is accounting so there are, of course, exceptions:

Equity method investments - if you own at least 20%

Consolidated investees - you own greater than 50%

Practicability exception - if fair value is not readily determinable, investment reported at cost less impairment +/- the observable price changes

*Valuation and income*

Unrealized holding gains/losses are recognized in Net Income as they occur. Normal dividends are recognized in Net Income as they occur.

A liquidating dividend, however, is a return of capital, thus reduces my investment basis. That's giving me back some of my original investment, that's not income.

And of course, when you sell an equity security, any remaining changes in fair value are recognized as a gain/loss.

Property, Plant, and Equipment

These are assets with physical substance, acquired for use in operations, not for resale. They include land, building and equipment--generally subject to depreciation. Classified in these buckets:

Land (property)

Buildings (plant)

Equipment

Accumulated depreciation (contra-asset)

*Valuation*

Historical cost = costs to acquire + cost to bring to locations and intended use, e.g. transportation, installation

GAAP and IFRS used the following cost model:

Carrying value = historical cost - accumulated depreciation - impairment

IFRS only allows for revaluation model:

Carrying value = fair value at revaluation date - subsequent accumulated depreciation - subsequent impairment

Revaluation losses run through P&L (unless you are reversing prior gains in OCI). More or less the same as impairment, just not permanant.

Revaluation gains run through OCI (unless you are reversing prior losses in P&L).

Impairment reverses revaluation gains first, then reporting through P&L.

Check out this amazing illustration to demonstrate:

Depreciation

Why does depreciation exist? The matching principle, we are trying to match income to expense. Doesn't the asset generate income over it's life? Yes, ok then, we match revenue and expense over its life.

The depreciation method doesn't have to be perfect, but it must be systematic and rational.

The need to depreciate an asset can be physical (related to wear and tear) or functional (related to obsolescence or inadequacy). Regardless, we come up with an estimated useful life. And usually at that point, the asset has some salvage value.

We can depreciate at the asset level. Or we can go narrower and depreciate at the component level, separating each part of the fixed asset, e.g. motor needs replaced every 5 years, whole machine lasts 20.

Or we can go broader and depreciate at the composite level, averaging useful lives for an asset class and depreciate as a group. Note: there is no gain/loss recognized when one asset in a composite is sold; instead, the gain/loss is absorbed in the accumulated depreciation account when the average service life of the group of assets has not been reached. No ideas what MACRS is, but it's not compatible with composite depreciation.

*Methods*

Ok, these involve some math, so hopefully I do them justice in a mere bullet point list:

Straight-Line: (cost - salvage value) / estimated useful life = depreciation ... simple, depreciation expense is same amount each period

Sum-of-the-Years'-Digits: this is an accelerated method, best described via example. Say it's 5 years, 1 + 2 + 3 + 4 + 5 = 15. Year 1 depreciation is 5/15 of total, year 2 is 4/15, year 3 is 3/15, year 4 is 2/15, year 5 is 1/15

Units of production: based on usage, e.g. copier is good for number of copies, this is the most accurate to matching principle. So (cost - salvage value) / estimated units = rate per unit; then rate per unit * number of units = depreciation expense

Declining balance: another accelerated method, most common is double. Importantly, salvage value is not part of calculation, just used as floor. So for double, calculate straight-line without salvage value, double that for year one. Year 2 take what's left, straight-line then double. For instance, $10m asset, 5 year life, $2m salvage value. Year 1 is $10m / 5 * 2 = $4m. $6m left to go. Year 2 is $6m / 5 * 2 = $2.4m. $3.6m left to go. Year 3 is $3.6m / 5 * 2 = $1.44m, $2.16m left to go. Don't need to do the math for Year 4, just take it down to $2m, thus $0.16m and stop as we hit the salvage value floor. I think I did that right.

Intangible assets

These are not physical but used in operations, for instance, long-lived legal rights, competitive advantages, acquisitions to be used.

They can be specifically identified, e.g. patents. Or they can't be, e.g. goodwill.

They can be purchased, e.g. legal and registration fees. Or they can be internally developed, e.g. trademarks.

What about R&D? GAAP says no, just expense it. IFRS says, expense research, but capitalize development. The line between research and development is technological feasibility. More precisely, IFRS allows you to capitalize development if you prove

Technological feasibility

Intent to complete

Ability to use or sell

Will generate future economic benefits

Resources are available to complete

*Capitalization of costs*

Cost are capitalized and measured by:

Cash paid or fair value of other assets

Present value of liability incurred

Fair value of consideration for issued stock

Costs may be determined by whichever is more evident:

Fair value of the consideration given

Fair value of property acquired

Cost of unidentifiable intangible assets = total cost of assets acquired - sum of identifiable assets acquired. Cost of identifiable assets should not include goodwill.

*Amortization*

Amortization with definite life is determined by: shorter of estimated life or remaining legal life. For instance, if patent lasts for 10 years, but useful life is 5, we amortize for 5. While if patent lasts for 10, but useful life is 20, we amortize for 10. Straight-line method should be applied unless you can demonstrate that another systematic method is more appropriate.

With indefinite life, you need to test for impairment annually. IFRS allows intangible to be marked to market like fixed assets, GAAP does not.

*Sale*

Pretty obvious: selling price vs. carrying value to determine gain/loss.

*Valuation*

Under GAAP, use the cost model:

Finite life: cost less amortization and impairment

Infinite life: cost less impairment

IFRS allows for cost model or revaluation model. Revaluation model is just what it sounds like, intangible assets are revalued to fair value at a subsequent revaluation date:

Revaluation model carrying value = fair value on revaluation date - subsequent amortization - subsequent impairment

(Subsequent amortization obviously only applies to finite life intangible assets)

Revaluations must be performed regularly so carrying value doesn't differ materially from fair value. If you revalue one intangible asset, you have to do so for all other assets in its asset class, unless there is no active market for the intangible assets. Treatment as follows:

Gains: in OCI (unless reversing prior loss in Net Income) accumulating in Equity as "Revaluation Surplus"

Losses: in Net Income (unless reversing prior gain in OCI)

Impairment: first reduces Revaluation Surplus to zero, then hitting Net Income

Impairment of assets

*Fixed assets*

Mostly we are talking property, plant, and equipment here.

The test...

Is there impairment? Compare undiscounted future net cash flows to net carrying value:

If positive, no impairment

If negative, yes impairment

Impairment on assets held for use, take fair value (aka present value of future net cash flows) less net carrying value to get impairment loss, then:

Write asset down

Amortize new cost

Restoration is not permitted

Impairment on assets held for disposal, same impairment loss calculation but have to add cost of disposal to get total impairment loss, then:

Write asset down

No amortization taken

Restoration is permitted

Impairment loss is reported as a component of income from continuing operations before income taxes.

Under IFRS, fixed asset impairment loss is: calculated using one-step model comparing:

Carrying Value

Recoverable Amount

Recoverable Amount is greater of:

Fair Value less Cost to Sell

Value in Use

Value in Use is:

Future Cash Flows from the Fixed Asset

*Intangible assets other than goodwill*

Indefinite useful life, tested for impairment at least annually. Finite useful life, whenever circumstances change that indicate carrying value may not be recoverable.

Under GAAP, finite life amortized over its life, infinite life not amoritized.

Two-step impairment test for FINITE life intangible assets:

Carrying amount of asset compared to sum of undiscounted cash flows expected to result from use of asset and its eventual disposition

If carrying amount exceeds those undiscounted cash flows, then asset is impaired and impairment loss = difference between carrying value and fair value

Repeating for effect...

Determine impairment: use undiscounted future cash flows

Amount of impairment: use fair value

One-step impairment test for INDEFINITE life intangible assets:

Generally not able to estimate future cash flows here, so simply compare carrying value to fair value. Though it's probably not that simple.

Again, impairment loss is reported as a component of income from continuing operations before income taxes. (Unless, of course, the impairment loss is related to discontinued operations.)

The impairment test of intangible assets is the same as the test for property, plant, and equipment above...but there is a initial qualitative test for indefinite life intangibles that you do first to skip the rigamarole when it's obvious there's impairment when fair value is below carrying value.

*Goodwill*

Under GAAP, calculated at the reporting unit level. Again, occurs when carrying value exceeds fair value. A reporting unit is an operating segment or one level below an operating segment.

Under IFRS, calculated at the cash-generating unit.

Quantitative test isn't necessary, GAAP allows for qualitative test, as long as >50% chance fair value is less than carrying value based on factor such as these:

Macroeconomic conditions

Overall financial performance

Bankruptcy, litigation, or changes in management/strategy/customers

Industry or market conditions

Sustained decrease in share price

Cost factors that could have negative effect on earning and cash flows

Recapping asset differences between GAAP and IFRS

More details on most of this above...

Intangible assets:

Development costs: GAAP no but for software for external use, IFRS yes with technical/economic feasibility

Revaluation: GAAP no, IFRS yes if active market exists (but not goodwill)

Long-lived assets and revaluation:

Revaluation: GAAP no, IFRS yes

Component depreciation: GAAP permitted, IFRS required

Revision of depreciation methods, residual values, or estimated life: GAAP if appropriate, IFRS at least every year

Capitalization of borrowing costs: GAAP on interest paid during construction/do not offset interest income/average interest on average accumulated expenditures capitalized, IFRS interest and other ancillary costs and changes to FX rates regarded as adjustments to interest are eligible/interest expense is offset against interest income/actual borrowing cost capitalized

Impairment: GAAP two-step test (see above), IFRS one-step test (see above)

Reversal of impairment loss: GAAP yes up to previously recorded losses but only if asset held for disposal/not permitted if asset held for use, IFRS yes/gains to OCI/losses to Net Income

0 notes

Text

this idea to me in a vision ... ive become a shrimp as a consequence from sitting at my chair but anythign for a yuu drawing🔥🔥

#re:kinder#yuuichi mizuoka#fanart#my art#shoutout to the train station for sending me this vision once i stepped in train station is the sponsor for this post/j#while doing references for this ive come to realize i need to get myself a skirt#not because i want to wear it i dont use them but i could not for the life of me find a reference in google#tbh thats on me i dont know how to google search at all😭 but it still made it so once in my life im like. man i need a skirt#i dont know how this one got to this point it sounds silly but at some poitn scribbles in the background seemed like they could make clouds#like the scribbles i did in the background seemed like they could do as clouds. so i was like yeah we doing clouds now#we doing light source thay was completely absolutely never thought of at the last minute because itd be fun#no regrets though i may not know when i last slept which is usually bad for fibro but you see#this is the one ocassion theres a balance if im not sleepign i must be making rekinder fanart because either will not mess me up🔥🔥#i lov rekinder so mcuh i could have nto slept if i didnt finish this now i cma sleep peacefully knowing i drew yuu in a pretty dress#note yes its heavily based if not straight up lolita fashion i thought yuu would look very nice in it

32 notes

·

View notes

Text

Day 07 - 01.05.2025

Corporate Financial Reporting

Ind AS 36 5

Ind AS 36 6

Ind AS 115 5

Ind AS 115 6

2 notes

·

View notes

Text

Nashville Music Guide Summer Issue 2024

Festival season is in full swing and this issue of Nashville Music Guide has our ultimate guide to Tennessee’s two largest music festivals, CMA Fest and Bonnaroo. We have also featured local Nashville artists Jesse Keith Whitley and Eric Lee Beddingfield

Festival season is in full swing and this issue of Nashville Music Guide has our ultimate guide to Tennessee’s two largest music festivals, CMA Fest and Bonnaroo. We have also featured local Nashville artists Jesse Keith Whitley and Eric Lee Beddingfield on our cover this issue. We always enjoy covering our local scene which is where we had the opportunity to catch up with numerous artists that…

View On WordPress

#artists to watch#Bonnaroo#CMA Fest#country music#eric lee beddingfield#Hangout#hangout music fest#inside track#keith whitley#music news#music row#nashville music#nashville music guide#nashville notes#preshias harris#songwriter#Steeplechase

0 notes

Text

A Crash Course to the BeyoncéBowl Performance, from a Black Woman

Note: this is NOT an in-depth deep dive into her recent albums or the songs specifically. I highly recommend you listen/read the lyrics on your own time and conduct your own research! This is just to get you thinking.

So now that we live in a post-Kendrick Super Bowl society, I wanted to revisit Beyoncé's halftime performance during the Christmas Day NFL bowl game, aka BeyoncéBowl. While this did have less viewers live (it was on Netflix, it was Christmas, it was not the Super Bowl), I think her performance still had some very important takeaways, even if they were more subtle in comparison to Kendrick.

Let's discuss, starting with...

COWBOY CARTER -- yes, the name of Beyoncé's ACT II album, but also displayed prominently on her sash and on a banner as she rides into the stadium. In western US history, cowboy had racist connotations. After the Civil War, approximately 25% of cattle workers in the Wild West were Black... and a lot of people weren't happy about that. White cattle workers were cowhands. The Black men in their same roles were cowboys.

This is a demeaning practice that still exists today. Black men are often called "boys" to take away from their legitimacy. The reverse is true as well: Black boys are elevated to "men" to signify that they are a threat.

THE COWBOY -- we see this in the very first visual. Beyoncéis Cowboy Carter of course, riding in on her white horse, but she is accompanied by a Black cowboy guiding her horse. The imagery is accompanied by a fleet of lowriders (cars with hydraulics to make them bounce, it's really cool) as Beyoncé rides through them. Considering that we see this same Black cowboy later driving her in a car in the stadium set, I think it's fair to see the parallel here-- here, she shows, are our modern city cowboys. This does not mean we have lost our western cowboy roots however, as we then see our modern Texas cowboys standing on top of their horses. This is a high-level skill.

BLACKBIIRD -- (COWBOY CARTER is entitled ACT II. Most songs include II in their title, I didn't misspell it.) Beyoncé is joined by four rising artists: Tanner Adell, Brittney Spencer, Tiera Kennedy, and Rayna Roberts. She walks in line with them as they sing about "learning to fly" -- she sees them as equal to her, not competition to pull down. They're spreading their wings. I will call out Tanner Adell in particular as she is a rising country music star (if you've seen Twisters, you may recognize her music) but in one of her songs "Buckle Bunny", she mentions "looking like Beyoncé with a lasso". She's come full circle!

YAYA -- Her license plate is BNCNTRY (been country). When Beyonce first broke into the industry, she was belittled by being called "too country" as from Houston. When she finally made a country song and performed with the then-named Dixie Chicks at the Country Music Awards with a Black band... white people were not happy. This is the same CMA community that recognized Billy Ray Cyrus for the success of "Old Town Road" instead of the main artist and creator LilNasX, because LilNasX is Black.

The story of YAYA is that music transcends genre and should not be limited by these pigeonholes people try to force artists into. Keep that in mind.

My family lived and died in America / Good old USA / Whole lot of red in that white and blue / History can't be erased

HBCU BAND -- this is a staple of many of Beyoncé's public performances (see her Coachella performance, Coldplay's Super Bowl halftime show). Texas Southern's Marching Band joins Beyoncé on the field for this event. If you are new to the term, HBCUs are historically Black colleges & universities. This is in contrast to PWIs, or predominantly white institutes. Beyoncé performs "MY HOUSE" for the first time alongside them and her daughter Blue.

SHABOOZEY -- Another rising artist in country, Shaboozey has also faced backlash for being a Black man with one of the most successful country songs of 2024, "A Bar Song (Tipsy)". As he sings: Still going up like a ladder / I'm still in the field.

LEVII'S JEANS -- It's important to note Levi's was one of the early supporters of Destiny's Child. Jeans have also always been a symbol of the working class, and including Post Malone on this song (IMO) shows crossing that bridge: the white working class and white country have more in common with the Black community than not. Like Kendrick said, the culture war is to distract from class warfare. (I understand Post Malone is rich now, but this was my takeaway.)

JOLENE -- Dolly Parton is the queen of country and she gave her blessing on this song to the point of introducing it on the album. Hers is the only opinion that maters. That other white artists and audiences have voiced issues with Beyoncé doing this song is telling.

NRG STADIUM -- a brief interlude here to say that NRG Stadium in Houston, Texas, is home to the NFL team the Houston Texans (yes really lol) but also is home to the Houston Livestock Show and Rodeo. I was there during last year's rodeo, and this was right when the next song I'll talk about released... y'all, when I tell you Black people showed up just for the vibes? It was so fun. The stadium also half-emptied after Beyoncé's halftime performance ended, so the city really showed up for her.

TEXAS HOLD 'EM -- Let's line dance y'all! Texas Hold 'Em is an unapologetic country anthem and shows the range: the same dancers that hip-hop and twerking for earlier songs now rallies together to line dance. Country music was created by Black people, and we haven't forgotten. The album crossed a number of genres and showed how country is related to, inspired by, and built off of other genres just like many genres built up by Black musicians are.

You don't have to like COWBOY CARTER, you don't have to like country music, you don't even have to like Beyoncé. But her ACT II takes a lyrical and musical path through Black musical history and her own personal history to create a work of art. Her style is not the same as Kendrick's nor should it be, but her NFL halftime performance was still an act of resistance and celebration of our culture.

Thank you for coming to my TED Talk, and this has been another Tea Time with Hawk. ☕🦅

#beyoncé#cowboy carter#tea time with hawk#kendrick lamar#super bowl#country music#black culture#shaboozey#black history month

183 notes

·

View notes

Text

Cowboy Carter - Why it matters that Beyonce finally won Album of the Year at the Grammy’s for this album, specifically.

I grew up listening to exclusively modern country and classic rock, genres which both owe their existence to Black people (and by Black I do mean African American) but have been whitewashed.

I have literally had Cowboy Carter on repeat since it came out; easily my favorite country album of all time, if not just my favorite album, period.

If you don’t wanna read it all, here’s the short version: Cowboy Carter is a truly seamless blend of country and other musical styles that pays homage to the genre’s greatest musicians and mirrors the ways Black music has transformed, and been transformed by, U.S. culture. Never forget: the only musical genres that were created in the U.S. (jazz, hip-hop, rock, country, and more) were created by Black people.

Although it’s a country album—and it IS, undeniably, a country album!—Cowboy Carter is structured like a classic hip-hop album, including an “anthem” song that intros and outros the album (“AMERIICAN REQIUEM”) and intermissions where other famous stars of the country genre dap up Queen Bey.

Specifically, white country music legends Willie Nelson and Dolly Parton introduce the album/songs. That’s not just significant because they’re white or because they’re genre icons, but ALSO because they are icons of the country music era that—while predominantly white—actually still focused on the OG working class, blue collar themes of the genre. (Explaining how country music has changed over time is something I can’t even get into here, but the point is that Beyonce had white authentic country music legends introduce her album, as opposed to modern country music stars. It legitimizes the album as a country album the same way having a more famous rapper introduce your song/album would legitimize it as true rap.)

The first half of Cowboy Carter is much more “classically country,” while the second half is a bolder blend of country with other genres. In the intermission where Willie Nelson introduces the back half of the album, he literally says, “I’m here because sometimes it takes someone you trust to turn you onto some real good shit.” It’s this beautiful moment of authentic artistry and cultural exchange, because not only is Willie Nelson introducing white country lovers to Black music, Beyonce has also introduced Black r&b/hip-hop/rap fans to country music.

People who think Beyonce did a country album to prove she can cross genres like taylor swift are completely missing the point. First of all, Cowboy Carter is the second in a planned album trilogy, with each album paying homage to a different musical genre/group of genres created by Black people. The first installment was Renaissance, a trap/house album. Beyonce had originally planned to start the trilogy with Cowboy Carter, but chose to release Renaissance first in 2022 because she felt like “people needed to dance.”

As part of Beyonce’s career, Cowboy Carter also exists in a very specific context: https://www.vulture.com/article/beyonce-cmas-the-chicks-oral-history.html. After all the shit that happened during and after Beyonce’s performance of “Daddy Lessons” at the 2016 CMAs, “Cowboy Carter” didn’t even get NOMINATED at this year’s CMAs (and then it won this year’s grammy for best country album AND album of the year, so FUCK those racist assholes). Beyonce literally referenced the 2016 CMAs in the instagram post announcing Cowboy Carter.

In my mind, Billboard and the CMAs snubbing Lil Naz X’s wildly popular “Old Town Road” in 2019 must’ve only added fuel to the fire.*

So the planned album trilogy — and, of course, Cowboy Carter in particular — are a reaction to the whitewashing of genres created by Black people and the cultural appropriation that happens when modern Black artists are excluded from the genres they/their predecessors created.

*Note that Beyonce paired up with Miley Cyrus for “II MOST WANTED” on Cowboy Carter. Why would that matter? Because Miley’s dad is country artist Billy Ray Cyrus, who was notably one of the only modern white country musicians to publicly condemn the industry for its treatment of Lil Nas X’s “Old Town Road,” to the point that Billy Ray Cyrus literally did a version of Old Town Road with Lil Nas X as a way of legitimizing the song as real country music.

Other standout moments on the album—and these are just the ones I’ve caught:

-“BLACKBIIRD” (2nd song on the album) has Beyonce and 4 other, less well-known WOC cover the beatles’ “Blackbird,” which Paul McCartney wrote in honor of the Black women of the U.S. civil rights movement.

-At the end of “DAUGHTER,” Beyonce seamlessly transitions into the operatic aria “Caro Mio Ben.” If that doesn’t tell you what a flawless genre-blender this album is, I don’t know what will.

-Track 10 is “JOLENE,” which is Beyonce’s version of Dolly Parton’s song of the same name. Beyonce’s cover directly mirrors the way white artists took over the country music genre by covering and sampling songs originally created by Black artists.

-Every single track is a bop, but IMO, the album’s crowning achievement is “YA YA.” The song is amazing, and my favorite moment is when Beyonce does an impression of Elvis, who built his reputation as the King of Rock and Roll by doing an impression of Chuck Berry. “YA YA” features samples from country songs created or made famous by white artists (“These Boots Are Made For Walking” by Nancy Sinatra and “Good Vibrations” by The Beach Boys, plus a ton of other references—literally just go read YA YA’s Genius page), once again intentionally subverting the phenomenon of white artists covering Black artist’s music and receiving greater acclaim.

89 notes

·

View notes

Text

Lainey has a 🧡

This might just be a coincidence

instagram

I have been dreaming of Lainey and Taylor singing Somewhere Over Laredo. I will always wish for this and to know if Tay collaborated with Lainey on this song and performance from the AMAs.

Side note Lainey has upcoming performances on June 6th, 7th, 8th and 18th 🤞🙏

6–8 CMA fest. That would be a full circle, return to roots. Where she got her start - This would be Iconic. I’m Just saying

Wynonna Judd is performing girls night out with guests Saturday June 7th at CMA fest. Another golden opportunity to watch for.

#taylor swift#kaylor#karlie kloss#gaylor#taylor and karlie#peace 💚💛💜❤️🩵🖤#friend of dorothea#friends of dorothy#lgbetty#friends of dorothea#let this be connected 🦄

14 notes

·

View notes

Text

The yellowish powder was wrapped in a flame bar and released into the atmosphere in smoke form.

Each flight used two flame bars, each containing 0.2 Ibs of silver iodide.

The powder was dispersed at a rate of 0.28 grams per second.

Two models of medium-sized drones ascended to altitudes of 18,000 feet on July 9, 2023.

The drones released the silver iodide across four flights over the Bayanbulak Grasslands.

The weather modification project team, which worked with 24 automated ground stations with satellites and drone fleets since 2021, was led by Li Bin, a senior engineer with the China Meteorological Administration (CMA).

CMA is the national weather service of the People’s Republic of China, headquartered in Beijing.

The test results were detailed in a peer-reviewed paper published in the Chinese-language journal Desert and Oasis Meteorology on April 10.

Similar weather manipulation exercises “have been carried out in other countries and many regions in China such as Guizhou, Shanghai, Gansu and Sichuan,” the SCMP report notes.

If the Chinese Communist Party (CCP) can turn a cup of silver iodide into 30 Olympic pools of rain, imagine what governments can do when they don’t tell anyone they’re doing it.

15 notes

·

View notes

Note

Yeah Blake’s liner notes seem more personal this time around. “my longtime producer Scott”, including the boys, the note about Larry & Carol Large, leaving out the ones he had to suck up to before-ACM, CMA, CMT, NBC. The professional thank yous this time also are either long term ongoing affiliations like Opry/Ole Red/Colin or more heartfelt thank yous like to country radio for always having his back. I think Blake is putting it out there what his personal priorities are and who/what he is really grateful for. He doesn’t have to play the game to the extent he did before nor does he want to. He still wants success but on his terms and not engaging in the bs that some older artists (like his ex) still feel the need to do to remain relevant. I’m happy for Blake!

Oh and forgot to add. He always thanks “Gwen Stefani” to acknowledge her professionally as well as personally and to make sure trolls don’t have an in to claim he was referring to Gwen Sebastian if he just said “thank you Gwen”. Ugh remember when some country media outlet claimed one of their duets was with Gwen Sebastian? It felt like intentional shade not just an error.

I think I remember some country news site tagging Gwen Sebastian instead of Gwen in a post about Nobody But You when it first came out. I guess it could be an honest slip of the finger but people commented to point out the mistake, and I don't recall if they ever corrected or deleted it.

17 notes

·

View notes

Text

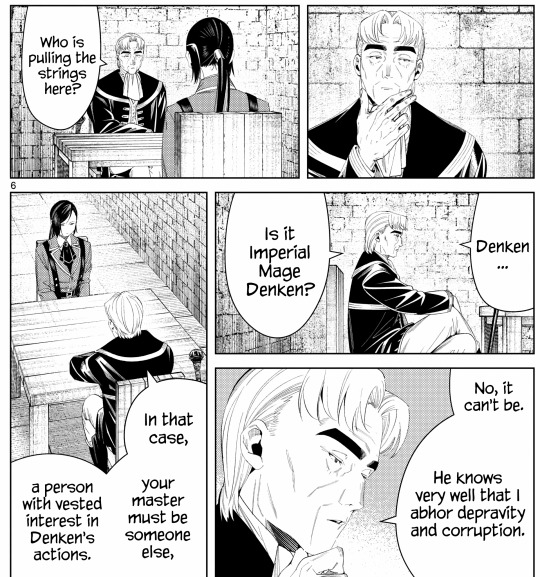

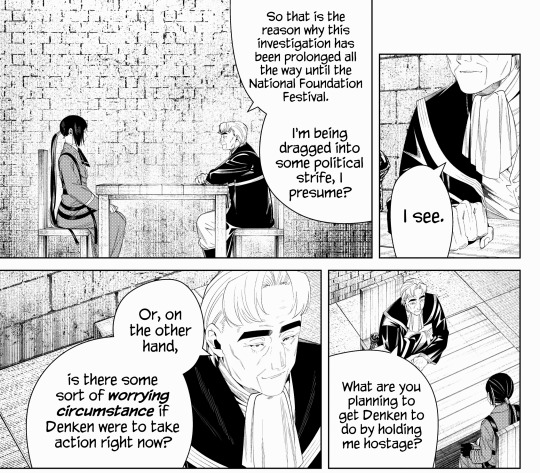

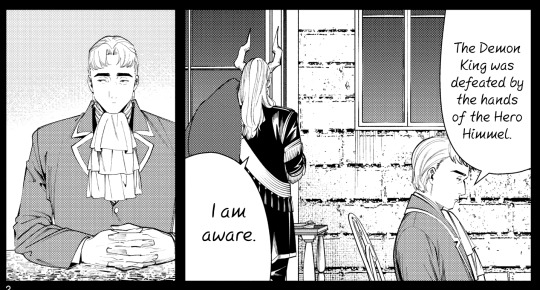

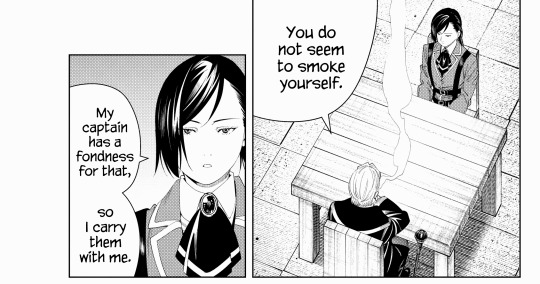

Glück owning his interrogation

Spoilers for Frieren manga chapter 130

As soon as Glück realises someone wanted something from him, he immediately seeks to find out who. He starts by bombarding Kanone with questions, but he doesnt expect her to answer them. On the contrary, he gives her no chance to reply by voicing his deduction out loud and answering the questions himself.

Note that thinking out loud isnt his habit. In Macht's memory and when he talked to Frieren, whenever he needed to analyze or think about what to say next, he would stay silent.

Glück is careful with what he says and makes sure they serve a purpose. He intentionally let Kanone hear what he thinks. In this case, it's to show Kanone how capable he is, that he isnt easily swayed. He wants to stress her tf out and then acts like he cant actually do anything.

With this, Kanone would think mere talking doesnt get him to say what she wants, but since he shows signs of giving in, she could use other methods. He tries to direct Kanone's action with his words. And it worked. Kanone makes her first blunder when she switches approach and offers him a cigarette. How does she know he likes smoking if this is the first time they meet? It should be told to her by someone. Glück probably tells it's Fräse on the first puff, but he doesn't ask about Fräse immediately.

He continues with a seemingly harmless comment, but this, my friend, is a trap to get Kanone to spill out her relationship with Fräse first.

Her guard is lowered when he acts like giving in, so now she honestly replies. This is the second blunder, and that's enough info for him. He goes on to ask who's the captain next and Kanone's silence confirms his guess.

After exposing Fräse's involvement in his interrogation, stating he's familiar with her scheme (and also that he should have let Macht kill her lol), Glück doesnt stop. He even tries to get Kanone to switch sides by posing as someone she could benefit from, similar to how he persuaded Macht back then.

This is from a chapter whose purpose is to give the audience a brief look at the Empire's political state, to power scale Fräse and to explain why Denken would be missing from a big event between the Empire and the CMA. Glück's appearance is to deliver these info, but his lines are so well-crafted and you can get so much of his personality out of them that you don't feel like he's just a mouthpiece for the author to yap.

#frieren: beyond journey's end#sousou no frieren#and i havent started on how his affection for macht is present throughout the chapter#which is an important aspect of his characterization too!!!!#gosh i love frieren character writing#it might be directionless sometimes (fern rn ahem) but the author knows how to actually write people instead of throwing in narrative tools

13 notes

·

View notes

Text

Top CMA Inter Notes PDF Free Download

Passing the CMA Inter exam is a significant milestone for aspiring cost and management accountants. Among the subjects in the CMA Inter curriculum, law is both crucial and challenging. Quality study materials are essential to succeed, and having access to the best notes can make all the difference. In this article, we'll explore the top CMA Inter Law notes PDF free download options available, and guide you on how to make the most of these resources.

What is CMA Inter Law?

CMA Inter Law is a comprehensive subject that covers various legal aspects relevant to cost and management accounting. It includes topics like corporate law, industrial law, and economic law. Mastering these topics is essential for a successful career in cost accounting.

Importance of Quality Notes

Quality notes simplify complex topics, making it easier to understand and remember the content. They often include summaries, important points, and practice questions that are invaluable for exam preparation.

Top CMA Inter Notes PDF Free Download

Finding reliable CMA Inter Law notes in PDF format can save you both time and money. Here are some of the top resources for free downloads:

1. Official ICMAI Resources

The Institute of Cost Accountants of India (ICMAI) provides official study materials for CMA Inter students. These notes are comprehensive and updated regularly to reflect the latest syllabus changes. You can find these resources on the ICMAI website.

2. Online Educational Platforms

Several online educational platforms offer free CMA Inter Law notes. Websites like EduPristine, SuperProfs, and CAclubindia provide high-quality notes prepared by experienced educators. These platforms often include additional resources like video lectures and mock tests.

3. Student Forums and Groups

Joining student forums and groups on platforms like Telegram, Facebook, and WhatsApp can be a great way to find shared notes. Many students and educators share their own prepared notes, which can be downloaded for free.

4. YouTube Channels

Educational YouTube channels often provide links to free notes in the video descriptions. Channels like Lectures4u, StudyAtHome, and CA Guruji are known for their valuable content on CMA Inter Law.

5. Library and E-book Resources

Many libraries and e-book platforms offer free access to CMA Inter Law notes. Websites like Google Books and Project Gutenberg have a wealth of resources that can be accessed at no cost.

How to Make the Most of Your Notes

Having access to the top CMA Inter Notes PDF free download is just the first step. Here are some tips on how to use these notes effectively:

Organize Your Study Schedule

Create a study plan that covers all the topics in the CMA Inter Law syllabus. Allocate specific times for each topic and stick to your schedule.

Highlight Important Points

As you go through your notes, highlight important points and make margin notes. This will make it easier to review key concepts before the exam.

Practice Regularly

Practice is crucial for mastering CMA Inter Law. Use the practice questions in your notes and take as many mock tests as possible.

Join Study Groups

Study groups can provide additional support and motivation. Discussing topics with peers can also help clarify doubts and deepen your understanding.

Review and Revise

Regular revision is essential to retain what you've learned. Make sure to review your notes regularly, focusing on weaker areas.

Where can I find the best CMA Inter Law notes PDF free download?

You can find quality CMA Inter Law notes on the ICMAI website, online educational platforms, student forums, YouTube channels, and e-book resources.

Are the free notes reliable and up-to-date?

Most free notes available on reputable platforms are reliable and updated regularly. However, always cross-check with the latest syllabus provided by ICMAI.

How can I effectively use these notes for exam preparation?

Organize your study schedule, highlight important points, practice regularly, join study groups, and review and revise your notes frequently.

Can I rely solely on free notes for my exam preparation?

While free notes are valuable, it's advisable to supplement them with official study materials and textbooks. This ensures comprehensive coverage of the syllabus.

How can I join study groups for CMA Inter Law?

You can join study groups on social media platforms like Telegram, Facebook, and WhatsApp. Look for groups specifically for CMA Inter students.

Access to the top CMA Inter Notes PDF free download can significantly enhance your exam preparation. Utilize these resources wisely, follow a structured study plan, and practice regularly to master CMA Inter Law. With the right approach and dedication, you'll be well-prepared to succeed in your CMA Inter exam. Good luck!

0 notes

Text

For #InternationalBatAppreciationDay 🦇:

Art Inspiring Science: The Moche Bat

“The CMA’s bat vessel has traits of the species Dr. Velazco studied. Made on Peru’s north coast by an artist of the ancient Moche or Mochica culture (moe-chay, moe-cheek-ah) (AD 200–850), the vessel inspired him to name the species Histiotus mochica or, colloquially, the Moche leaf-eared bat. He did so to recognize the knowledge of Indigenous peoples and to honor the Moche and their connection to the natural world. Indeed, as he notes in a publication about the species, the bat vessel is so accurately depicted that it allowed precise identification of an animal previously unknown to science and thus stands as a testament to the Moche’s observational skills and profound interest in nature.”

#animals in art#animal holiday#Moche art#Indigenous art#Peruvian art#South American art#effigy vessel#ceramics#bat#Moche leaf-eared bat#species ID#International Bat Appreciation Day#Bat Appreciation Day#Cleveland Museum of Art#article link

83 notes

·

View notes

Text

French Shipping Giant CMA CGM to Invest $20 Billion in U.S., Creating 10,000 Jobs

President Donald Trump has announced a $20 billion investment in the United States by French shipping giant CMA CGM, the world's third-largest shipping company. The investment will focus on shipping logistics, infrastructure, and terminals, and is expected to create 10,000 new jobs.

The announcement was made at the White House, where Trump was joined by CMA CGM CEO Rodolphe Saadé. Saadé expressed enthusiasm for the initiative and hinted at potential additional investments in the coming weeks. The company also committed to increasing the number of American-flagged ships it operates from 10 to 30.

Trump noted that the investment was influenced by the recent presidential election and mentioned plans to unveil a new government program for shipbuilding, including potential tax incentives, to further boost the U.S. maritime industry.

15 notes

·

View notes

Text

Day 11 - Monday- 5.5.25

Corporate Financial Reporting

Ind AS 116

5

6

7

8

Yt revision session

0 notes

Text

They finally stopped playing in Beyoncés face!!!

Ahhhhh!!!! Beyoncé has been robbed of the aoty category for so long and despite CC not being HER best album it's one of the best of all time. Sorry for the slight brat snub but omg the Grammy's are finally giving her what she deserved when she gave us self titled and Lemonade.

Cowboy Carter was such a great album I didn't think it would get its flowers because they had snubbed her for renaissance just two years ago but I'm so glad I was wrong!! (CMA's ik what u r)

side note: so happy for the Sabrina Carpenter, Chappell Roan, and Charli xcx wins, so deserved and honestly the first time I feel like the Grammys aren't rigged??

14 notes

·

View notes