#CMA US Syllabus

Explore tagged Tumblr posts

Text

Best Institute for CMA USA in Kerala | Elance Learning Master CMA USA with Kerala’s best coaching institute. Get high-quality training, real-world insights, and a roadmap to career success.

#elanceofficial#cmaus#commerceprofessionalcourse#topaccainstitute#course details#CMAUS course details#CMAUS#CMA US Syllabus

0 notes

Text

youtube

US CMA Course Syllabus

Mastering strategic financial management and decision-making is a rewarding adventure that begins with the US CMA (Certified Management Accountant) course syllabus. The program, which covers subjects like financial planning, analysis, control, and professional ethics, gives applicants the tools they need to succeed in fast-paced work settings. The CMA syllabus serves as a road map for financial professionals looking to gain competence in promoting organizational success, covering topics like risk and performance management. The American CMA course guarantees that candidates are adequately equipped to tackle the demands of contemporary management accounting by emphasizing practical applications. Take your career to new heights by utilizing the US CMA syllabus to embark on a transformative learning experience.

#cma us syllabus#cma usa part 1 syllabus#cma part 1 syllabus#us cma part 1 syllabus#cma usa course syllabus#Youtube

0 notes

Text

📚 How Long Should You Study for the CFA Exam? 😟

We get this question A LOT—and if you’re also wondering about US CMA prep time, keep reading!

At FINAIM, where we’re building financial futures, we believe success begins with the right strategy—and the right number of study hours.

💡 CFA Aspirants: The CFA Institute recommends 300+ hours of focused study per level. But let’s be honest—it’s not just about hours, it's about effective planning, expert guidance, and consistent practice.

But wait! Are you preparing for the US CMA exam instead?

✅ US CMA (Certified Management Accountant) candidates typically need 150–170 hours per part (there are 2 parts). With the right mentorship (like the one we provide at FINAIM 😉), you can clear both parts in under 12 months!

📈 Why Choose FINAIM for US CMA?

Expert Mentorship by Certified Professionals

Personalized Study Plans

Doubt Support + Mock Tests

Placement Assistance with Top MNCs

🔎 Whether you’re googling "US CMA coaching in India", "best US CMA institute", or "how long to study for CMA exam", FINAIM is your one-stop solution.

👉 Ready to get exam-ready with confidence? DM us or visit www.finaim.in to start your journey today!

Visit: https://finaim.in/ FINAIM ADDRESS: 3rd Floor, Phelps Building, 9 A, Block A, Connaught Place, New Delhi, Delhi 110001

#us cma#finaim#best us cma coaching in delhi#us cma course duration#us cma fees in india#us cma elgiibility#us cma syllabus

0 notes

Text

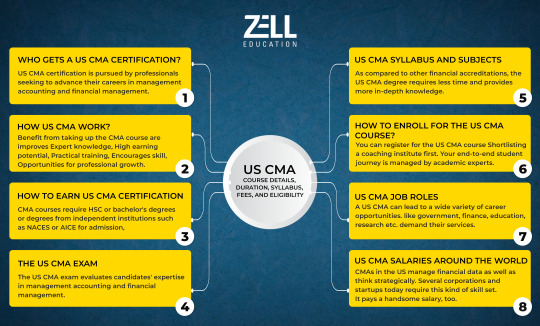

US CMA Course Details

Professionals wishing to progress in management accounting and financial management can earn the esteemed US Certified Management Accountant (CMA) credential. Two sections make up the course's structure: While Part 2 discusses financial decision-making, encompassing subjects like cost management, internal controls, and risk management, Part 1 concentrates on financial reporting, planning, performance, and control. In order to demonstrate their mastery of financial analysis and strategic decision-making, candidates must pass both sections of the test. Candidates must have two years of relevant work experience in addition to passing the examinations. With potential for leadership roles in accounting, corporate management, and finance as well as worldwide recognition, the US CMA qualification improves professional prospects.

#cma#us cma#cma course#cma course details#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma student#cma subjeccts#cma syllabus

0 notes

Text

US CMA Exam

Candidates are put to the test on key management accounting and financial management skills in the demanding two-part US CMA (Certified Management Accountant) exam. The test is given by the Institute of Management Accountants (IMA) and assesses knowledge in areas like professional ethics, financial planning, analysis, control, and decision support. Part 2 discusses financial decision-making, including risk management and strategic planning, whereas Part 1 concentrates on financial reporting, planning, performance, and control. A high degree of skill is demonstrated by passing the US CMA exam, which also equips people for leadership positions in accounting and finance. For individuals hoping to obtain the esteemed CMA certification and progress in the international banking sector, passing the exam is a crucial first step.

#cma#us cma#cma course#us cma exam#cma fees#cma eligibility#cma exemptions#cma student#cma job#cma syllabus#us cma certification

0 notes

Text

US CMA Online Course – Learn from Industry Experts

Enroll in our US CMA Online Course to prepare for one of the most prestigious accounting certifications. With interactive learning, self-paced study options, and 24/7 access to materials, you'll have everything you need to succeed. Our program covers the latest US CMA syllabus, with practical case studies, expert mentorship, and exam-focused preparation.

Learn More: https://uniqueglobaleducation.com/us-cma-classes/

#us cma online course#us cma online classes#us cma#us cma certification#best acca online classes#us cma syllabus#cfa online coaching in india#acca course details

0 notes

Text

Unlock your potential with the CMA USA course online! Elevate your career in management accounting with flexible, accredited training. Enroll today for success tomorrow!

Join now : https://www.ifcpltd.com/cma

Connect with us for more information: 📲+91 9903100338 📧[email protected]

#cma#cma usa#us cma course#cma course#cma india#cma syllabus#cma usa course in india#cma us course online#cma usa course online#cma us course details#education#e learning#career#accountant#higher education#finance and accounting#online courses#finance professionals#accounting professional

0 notes

Text

US CMA Exam Tips and Tricks

1.Strategic Study Plan 2.Official Materials 3.Practice & Mock Exams 4.Healthy Habits

To know more visit:https://bit.ly/460jlGx

0 notes

Text

The US CMA Certification: Unlocking New Career Horizons

In today's competitive business landscape, professionals are constantly seeking ways to enhance their skills and advance their careers. One certification that has gained significant recognition and credibility is the US CMA (Certified Management Accountant). Recognized globally, the US CMA certification equips individuals with comprehensive management accounting knowledge and opens doors to exciting career opportunities. In this article, we will delve into the details of the US CMA and explore the benefits of pursuing this esteemed qualification.

What is US CMA?

The US CMA is a globally recognized certification awarded by the Institute of Management Accountants (IMA). It is designed to validate proficiency in management accounting and financial management skills. The certification equips professionals with the ability to make informed business decisions, analyze financial data, and drive overall organizational success. The US CMA program focuses on both financial and non-financial aspects of management accounting, making it a well-rounded qualification for professionals seeking to excel in their careers.

Course Details:

To attain the US CMA certification, candidates must fulfill certain requirements and successfully pass a two-part examination. Here is an overview of the course details:

Educational Requirements:

Candidates must hold a bachelor's degree from an accredited university or college or an equivalent degree from a recognized institution. This educational prerequisite ensures that candidates have a solid foundation in accounting and related disciplines.

US CMA Exam Structure:

The US CMA exam consists of two parts:

a. Part 1: Financial Reporting, Planning, Performance, and Control

b. Part 2: Financial Decision Making

Each part comprises multiple-choice questions and two essay scenarios that assess candidates' understanding and application of management accounting concepts. The exam is computer-based and can be taken at parametric test centers worldwide.

Exam Preparation:

Several reputable institutions offer US CMA courses details to help candidates prepare for the examination. These courses cover the exam syllabus comprehensively, provide practice questions, and offer valuable insights from experienced instructors. Additionally, self-study using official study materials and resources is also an option for motivated individuals.

Benefits of US CMA Certification:

Global Recognition: The US CMA certification is globally recognized, enabling professionals to showcase their expertise in management accounting across borders. It enhances career prospects in multinational organizations and provides a competitive edge in the job market.

Expanded Career Opportunities: Holding the US CMA designation opens doors to a wide range of career opportunities. Certified professionals can pursue roles such as management accountant, financial analyst, cost accountant, budget analyst, financial controller, or even top-level management positions.

Comprehensive Skill Set: The US CMA curriculum covers a broad spectrum of topics, including financial planning, analysis, control, decision-making, and strategic management. These skills enable CMAs to contribute effectively to organizational success by providing valuable insights for decision-making processes.

Higher Earning Potential: US CMA certification often leads to higher earning potential. According to the IMA's 2020 Salary Survey, CMAs earn significantly higher salaries compared to non-certified professionals in similar roles, showcasing the value and return on investment of the certification.

Continued Professional Development: To maintain the US CMA certification, professionals must fulfill continuing professional education (CPE) requirements. This ensures that CMAs stay updated with the latest industry trends, regulatory changes, and best practices, allowing them to remain at the forefront of their field.

Conclusion:

The US CMA certification is a prestigious qualification that validates professionals' management accounting skills and opens up exciting career opportunities. By acquiring this globally recognized credential, individuals can enhance their career prospects, gain a competitive advantage, and contribute significantly to organizational success. The comprehensive curriculum, coupled with the continued professional development requirements, ensures that CMAs remain equipped with

0 notes

Text

Income Tax Compliance Course with Projects

Income Tax Course: एक Perfect Career Option for Finance Lovers

अगर आप finance field में career बनाना चाहते हैं, तो Income Tax Course आपके लिए एक अच्छा option हो सकता है। यह course ना सिर्फ आपके theoretical knowledge को बढ़ाता है, बल्कि आपको practical world के लिए भी तैयार करता है।

इस article में हम detail में जानेंगे income tax course के बारे में – इसका syllabus, duration, fee structure, benefits, और job opportunities। आइए शुरू करें।

✅ What is an Income Tax Course? – Income Tax कोर्स क्या है?

Income Tax Course ek professional training program होता है जो students को भारत के टैक्स laws और policies की जानकारी देता है।

यह course आपको सिखाता है कैसे आप income calculate करें, deductions apply करें, और returns file करें। इसमें TDS, GST और Advance Tax जैसे important topics भी cover होते हैं।

ये course उन लोगों के लिए useful है जो accounting, finance या taxation field में job करना चाहते हैं।

🎯 Why Should You Learn Income Tax Course? – Income Tax Course क्यों करें?

हर साल government अपने income tax laws में बदलाव करती है। इसलिए इस course की demand हर समय बनी रहती है।

अगर आप accountant बनना चाहते हैं या CA, CS या CMA की तैयारी कर रहे हैं, तो यह course आपके लिए फायदेमंद रहेगा।

इसके अलावा, अगर आप खुद का business चलाते हैं, तो यह course आपकी tax planning में help करेगा।

📘 Income Tax Course Syllabus – Course Syllabus क्या होता है?

Income Tax Course का syllabus काफी wide होता है, जिसमें basic से लेकर advanced concepts शामिल होते हैं।

Syllabus में शामिल topics:

Basics of Income Tax (आयकर की मूल बातें)

Types of Incomes and Heads (आय के प्रकार और हेड्स)

Tax Slabs & Rates (टैक्स स्लैब और दरें)

Deductions under Section 80C to 80U

TDS (Tax Deducted at Source)

Advance Tax and Self-Assessment

Filing of Income Tax Returns

E-filing procedures on Income Tax Portal

Penalties and Prosecution

Practical training भी दी जाती है जिसमें आप ITR forms भरना सीखते हैं।

🕒 Duration & Eligibility – कोर्स की अवधि और योग्यता

Duration: Income Tax Course की duration institute के अनुसार vary करती है। कई institutes 1 month से लेकर 6 months तक के courses offer करते हैं।

Eligibility Criteria: Minimum qualification 12th pass होती है। Commerce background वाले students के लिए यह course ज्यादा easy होता है। Graduates in B.Com, BBA या M.Com भी इस course को कर सकते हैं।

💰 Course Fee Structure – Income Tax Course की फीस क्या है?

Course fee depends करती है institute, course level और city पर।

Average Fees: ₹5,000 से ₹25,000 के बीच होती है। Online course में fee थोड़ी कम हो सकती है जबकि offline training institutes में थोड़ी ज्यादा होती है।

Tip: जब भी आप किसी institute को choose करें, उसका syllabus और faculty जरूर check करें।

📈 Benefits of Doing Income Tax Course – Income Tax Course करने के फायदे

Income Tax Course करने से आपको कई practical advantages मिलते हैं।

Main Benefits:

बेहतर job opportunities in finance and accounting field

खुद का Tax Consultancy business शुरू करने का मौका

Freelancing opportunities for return filing

हर साल changing tax laws के बारे में updated knowledge

Government job के लिए preparation में मदद

इसके अलावा आप friends और relatives की return filing भी कर सकते हैं और extra income earn कर सकते हैं।

💼 Career Opportunities After Income Tax Course – Job Scope and Career Options

Course complete करने के बाद आपके पास कई career options होते हैं।

Job Roles:

Income Tax Return Preparer

Tax Consultant

Accountant

Finance Executive

TDS Executive

Tax Analyst

आप private firms, CA offices, consultancies या corporates में काम कर सकते हैं।

Freelancing और work-from-home options भी available हैं।

🏫 Best Institutes for Income Tax Course – कहां से करें Income Tax Course?

India में कई reputed institutes हैं जो ये course offer करते हैं। कुछ popular institutes में शामिल हैं:

The Institute of Professional Accountants (TIPA), Delhi

ICAI certified taxation workshops

इन institutes में आपको live projects पर काम करने का मौका मिलता है और placement assistance भी दी जाती है।

📑 Certifications – क्या Income Tax Course के बाद Certification मिलता है?

Yes! Course complete करने के बाद आपको एक valid certificate मिलता है।

यह certification आपके resume में value add करता है। Job interviews में यह आपके practical skills को proof करता है।

कुछ institutes government recognized certifications भी offer करते हैं, जिससे आपके employment chances और भी बेहतर हो जाते हैं।

📚 Study Mode – Online vs Offline Course Mode

आप ये course online या offline किसी भी mode में कर सकते हैं।

Online Course के फायदे:

Flexibility to study anytime

Lower cost

Recorded lectures and online doubt support

Offline Course के फायदे:

Classroom interaction

Practical case study-based learning

Direct guidance from faculty

आप अपने time और budget के हिसाब से mode select कर सकते हैं।

🔍 Reference and Legal Framework – Income Tax Rules की जानकारी कहां से लें?

Income Tax Department की official website https://www.incometax.gov.in से आप सभी rules और updates प्राप्त कर सकते हैं।

यह site आपको ITR forms, deadlines और tax calculator जैसी सुविधाएं भी देती है।

इसके अलावा आप ICAI और government blogs भी follow कर सकते हैं।

🎓 Conclusion – Final Thoughts on Income Tax Course

आज के competitive world में सिर्फ graduation से काम नहीं चलता।

Income Tax Course एक ऐसा skill-based course है जो आपके career को fast-track कर सकता है।

चाहे आप student हों, job seeker हों या business owner – यह course सभी के लिए beneficial है।

Financial literacy आज की ज़रूरत है, और यह course उस दिशा में एक मजबूत कदम है।

🔖 FAQs: Income Tax Course

Q1. क्या ये course CA students के लिए useful है? हां, यह course CA students के लिए बहुत beneficial है क्योंकि इसमें practical exposure मिलता है।

Q2. क्या Commerce background जरूरी है? नहीं, लेकिन commerce background होने से concepts जल्दी समझ में आते हैं।

Q3. क्या part-time course options available हैं? हां, online और weekend batches दोनों ही options available हैं।

अगर आपको ये article helpful लगा तो इसे जरूर share करें। और अगर आप Income Tax Course करना चाहते हैं, तो सही institute चुनें और आज ही शुरुआत करें!

Accounting Course ,

Diploma in Taxation Course,

courses after 12th Commerce ,

Courses after b com ,

Diploma in financial accounting ,

SAP fico course ,

Accounting and Taxation Course ,

GST Course ,

Computer Course in Delhi ,

Payroll Management Course,

Tally Course in Delhi ,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course fee,

diploma in banking finance ,

Stock market Course,

six months diploma course in accounting

Income Tax

Accounting

Tally

Career

0 notes

Text

What Makes a Coaching Institute Truly Worth Your Time and Trust

Selecting the best coaching center can have a big impact on your future in the cutthroat academic world of today, particularly if you're getting ready for professional courses like CMA (Cost and Management Accounting). As the need for CMA professionals has increased, coaching centers have sprung up all across the nation. But not all of them are equally dependable or effective.

Making an informed decision is more crucial than ever for students looking for the Best CMA Classes in Rajasthan. It's about value, stability, and long-term results, not just the brand name or pricing. How can you tell if an institution is truly worthy of your time, confidence, and effort? Let's dissect it.

1. Experienced and Qualified Faculty

The faculty is the foundation of any coaching center. Beyond their academic expertise, seasoned teachers help students navigate the highs and lows of preparation, clarify difficult subjects, and provide real-world insights.

A good institute:

Has faculty with proven academic and industry credentials

Offers clarity in concepts rather than rote teaching

Encourages student interaction and doubt resolution

Look for institutions that value mentorship over mere instruction.

2. Structured and Updated Curriculum

Since tax laws, accounting standards, and cost restrictions are constantly changing, CMA is a dynamic course. To keep up with the most recent trends in exams, a reputable institution refreshes its curriculum and teaching strategies on a regular basis.

Key features to look for:

Coverage of the entire ICMAB/ICMAI syllabus

Integration of recent amendments and case laws

Well-planned lesson schedules for timely completion

Institutes that lag in updating their content could leave students underprepared or misinformed.

3. Regular Mock Tests and Performance Evaluation

Mock examinations serve as a mirror reflecting your preparation and are more than just exams. Schools that regularly administer exams and offer feedback are more concerned about their pupils' academic progress.

Why it matters:

Helps students get used to the exam format and time pressure

Identifies strengths and weaknesses early

Builds confidence and reduces anxiety before the actual exam

Feedback-driven performance tracking is a must-have feature in any top-tier coaching setup.

4. Personalized Attention and Mentorship

Every pupil learns differently. Some people do well in hectic settings, while others require individualized care and constant clarification.

A coaching institute that stands out:

Maintains small batch sizes for better interaction

Offers one-on-one doubt-solving sessions

Provides personalized study plans based on student performance

This level of individual care is what separates a good institute from a truly great one.

5. Availability of Online and Offline Learning Modes

Flexibility is essential in the hybrid learning environment of today. Students may better manage their time, get around travel restrictions, and edit lectures as needed with the ability to switch between online and offline modes.

Benefits of blended learning:

Students can attend from anywhere, especially during illness or emergencies

Access to recorded lectures for revision

Same quality of teaching in both modes

Institutes that offer seamless learning across platforms are more student-centric and future-ready.

6. Practical Training and Real-World Orientation

Being a CMA involves more than just passing tests; it also entails using concepts in actual business settings. Coaching centers that emphasize hands-on training assist students in being prepared for the workforce.

What to look for:

Real-life case studies and scenario-based learning

Integration of software tools like Excel, Tally, etc.

Insights into industry practices and financial decision-making

This enhances students' analytical thinking and positions them as valuable assets in any organization.

7. Transparent Communication and Student Support

Transparency is the foundation of trust. A higher degree of professionalism is displayed by coaching facilities that keep lines of communication open about schedules, costs, faculty changes, and student success.

Great institutes will:

Share clear information about course inclusions

Be responsive to student queries or concerns

Foster a supportive, non-intimidating learning environment

Remember, a student-first attitude is a mark of genuine commitment.

8. Proven Track Record of Results

The results are very clear. Although prior performance does not ensure success, a coaching center that consistently produces rankers and pass-outs demonstrates quality and consistency.

What to check:

Percentage of students who passed in first attempt

Number of rank holders or distinction scorers

Testimonials and feedback from alumni

Don’t hesitate to connect with former students to gain real feedback.

Conclusion

Selecting the best coaching center is an investment in your future, not just a one-time choice. Making the correct decision can provide you the knowledge, clarity, and confidence you need to succeed as a CMA. Look past ads and focus on the things that truly count: student success stories, curriculum relevance, teacher excellence, and one-on-one assistance.

Gyansagar Classes is a reputable name in the industry if you want to pass the CMA examinations with a solid understanding of ideas and exam strategy. They provide a comprehensive learning experience designed for success with both online and offline coaching alternatives, seasoned mentors, and a student-first philosophy.

Selecting the appropriate mentor is the first step on your path to becoming a certified public accountant. Make it matter.

0 notes

Text

CPA Course Exemptions

As a CA, MBA, ACCA, or other professional qualification holder, you might be qualified for CPA exemptions that lighten your exam load and accelerate your CPA certification. This post discusses all exemption categories—academic, professional, and work-based—along with application procedures and advantages.

CPA Exemptions Based on Professional Qualifications

Professional certifications can ease your way to CPA certification through your qualification for exemptions. These are awarded when your previous credentials meet the requirements of the CPA syllabus.

CA (Chartered Accountancy)

CPA exemption for CA is among the most well-known. CAs from India, Australia, and the UK usually receive credit for in-depth knowledge of accounting, auditing, and taxation.

Exemptions may include subjects like Auditing and Financial Reporting.

Some US states recognise Indian CA as fulfilling 120 credit hour requirements.

This CPA exemption saves students time and money and enhances international career prospects.

CMA (Certified Management Accountant)

US CMA holders from IMA are usually exempt from the CPA. CMAs possess deep knowledge in financial planning, performance management, and control of costs.

Are eligible for performance management-related CPA section exemptions.

Lowers the exam load for candidates having managerial accounting experience.

The overlap of subjects in strategic finance makes CMA an excellent stepping point for obtaining CPA certification.

CFA (Chartered Financial Analyst)

While not always formally mentioned, CFA charterholders are occasionally exempt from the CPA due to their qualifications in financial reporting as well as ethics.

Some overlap exists in FAR (Financial Accounting and Reporting) and BEC-equivalent topics.

Having both CPA and CFA enhances finance and auditing employability.

CFA candidates will particularly gain from the financial analysis segment of the CPA syllabus.

CIA (Certified Internal Auditor)

CIA professionals of the IIA are known for their extensive knowledge of auditing.

CIA holders may apply for exemption from the AUD (Auditing and Attestation) section.

Known in jurisdictions where audit-specific certifications are appreciated.

Internal auditors who pursue more general accounting positions gain much from it.

CIMA (Chartered Institute of Management Accountants)

CIMA professionals who are qualified with the CGMA credential can be exempt from sections such as Business Analysis or Financial Management.

Advanced management accounting material is related to CPA material.

It enhances the possibilities for qualifying for the new Evolution 2025 model’s CPAs.

CIMA professionals have international recognition for cost accounting and strategy accounting.

ACCA (Association of Chartered Certified Accountants)

CPA exemption for ACCA is gaining general acceptance, particularly in countries where international financial reporting and taxation skills are in high demand.

Full members of the ACCA can be exempted in several fields.

Exemptions also differ between state boards; certain of them will still have specific papers tested.

The exemption from the CPA for ACCA is particularly beneficial for international professionals who intend to work in the US or multinational corporations.

CPA Exemptions Based on Academic Qualifications

Academic qualifications such as MBA degrees and specialised accounting degrees also make candidates eligible for exemption from CPAs.

MBA

An MBA in finance or accounting is a strong qualifier for exemption from the CPA exam for MBA candidates.

Exemptions can encompass core business environment issues.

MBAs usually satisfy the 150-credit-hour requirement for obtaining the CPA license.

The exemption of MBA holders from the CPA not only removes exam pressure but also simplifies career advancement in management positions.

Other Recognised Degrees and Educational Credits

In some institutions and curricula, other degrees can also be exempt from the CPA under certain circumstances, particularly in the USA and Canada.

Some accepted qualifications include:

Bachelor’s in Accounting/Finance

Master’s in Commerce (M.Com)

BBA with Accounting Major

Postgraduate Diplomas in Accounting

Credits from NAAC-A accredited Indian universities

Degrees evaluated by NACES-recognised agencies

To be qualified for these CPA exemptions, it’s always best to check your eligibility with the state board concerned or a foreign credential evaluation organisation.

Work Experience-Based CPA Exemptions

In certain US jurisdictions or foreign jurisdictions, significant related work experience can help with CPA exemptions.

Experience should typically be in accounting, taxation, or auditing.

May meet educational or ethics requirements.

Needs to be authenticated by a state-licensed CPA supervisor.

These CPA exemptions can significantly help working professionals transition into CPA certification without redundant coursework or exams.

Benefits of CPA Exemptions

Here are key benefits of leveraging CPA exemptions:

Reduced Number of Exams: Fewer examination periods to prepare for.

Time Savings: Accelerate your CPA certification timeline.

Lower Costs: Pay less for course material and exam fees.

Boost Career Growth: Employers prefer CPAs with international and interdisciplinary experiences.

Stress-Free Preparation: Focus only on areas where you lack prior exposure.

Custom Career Path: Choose exam areas that complement your specialisation.

Whether it’s a CPA exemption for MBA, CPA exemption for CA, or CPA exemption for ACCA, these benefits make the journey faster and smarter.

How to Apply for CPA Exemptions

To apply for your CPA exemptions, do the following:

Determine Your Jurisdiction: Each US state board has its own rules.

Get Credentials Evaluated: Utilise agencies such as WES or NASBA International Evaluation Services.

Submit Application: Include transcripts, certificates, and proof of membership.

Wait for Assessment: The board will confirm eligible CPA exemptions.

Plan Your Prep: Focus only on remaining sections after exemptions are granted.

Tip: Double-check the requirements for the CPA exam for the state in which you intend to apply.

Final Thoughts

Gaining the CPA credential is a career highlight in itself, and if you’re exempt from CPAs, then all the better. If you’re in possession of a CA, ACCA, MBA, or some other qualifying credential, then potentially you can bypass duplicative CPA modules and accelerate your success.

Strategic planning is crucial with revised rules in CPA Evolution 2025. Review your history, take advantage of relevant CPA exemptions where possible, and put your efforts where they will have the greatest impact.

FAQs on CPA Course Exemptions

How to get exemption in CPA?

You can receive CPA exemption through qualifications such as CA, ACCA, or MBA, or through experience in related fields. Submit your application to a state board or evaluation authority.

Are there any exemptions for CPA?

Yes, most of the states permit CPAs for candidates with relevant professional or educational qualifications. Exemptions cut down on the number of accounting exam sections needed.

What is the eligibility to study CPA?

Eligibility typically requires a bachelor’s in accounting or equivalent, 120-150 credit hours, and in some cases work experience. Other exemptions are subject to previous credentials.

Can I do CPA in 3 months?

Although tough, it is possible to finish CPA in 3 months in the case of CPA exemptions and concentrating only on remaining sections. Previous experience in accounting and full-time studying are helpful.

0 notes

Text

CPA Course Exemptions

As a CA, MBA, ACCA, or other professional qualification holder, you might be qualified for CPA exemptions that lighten your exam load and accelerate your CPA certification. This post discusses all exemption categories—academic, professional, and work-based—along with application procedures and advantages.

CPA Exemptions Based on Professional Qualifications

Professional certifications can ease your way to CPA certification through your qualification for exemptions. These are awarded when your previous credentials meet the requirements of the CPA syllabus.

CA (Chartered Accountancy)

CPA exemption for CA is among the most well-known. CAs from India, Australia, and the UK usually receive credit for in-depth knowledge of accounting, auditing, and taxation.

Exemptions may include subjects like Auditing and Financial Reporting.

Some US states recognise Indian CA as fulfilling 120 credit hour requirements.

This CPA exemption saves students time and money and enhances international career prospects.

CMA (Certified Management Accountant)

US CMA holders from IMA are usually exempt from the CPA. CMAs possess deep knowledge in financial planning, performance management, and control of costs.

Are eligible for performance management-related CPA section exemptions.

Lowers the exam load for candidates having managerial accounting experience.

The overlap of subjects in strategic finance makes CMA an excellent stepping point for obtaining CPA certification.

CFA (Chartered Financial Analyst)

While not always formally mentioned, CFA charterholders are occasionally exempt from the CPA due to their qualifications in financial reporting as well as ethics.

Some overlap exists in FAR (Financial Accounting and Reporting) and BEC-equivalent topics.

Having both CPA and CFA enhances finance and auditing employability.

CFA candidates will particularly gain from the financial analysis segment of the CPA syllabus.

CIA (Certified Internal Auditor)

CIA professionals of the IIA are known for their extensive knowledge of auditing.

CIA holders may apply for exemption from the AUD (Auditing and Attestation) section.

Known in jurisdictions where audit-specific certifications are appreciated.

Internal auditors who pursue more general accounting positions gain much from it.

CIMA (Chartered Institute of Management Accountants)

CIMA professionals who are qualified with the CGMA credential can be exempt from sections such as Business Analysis or Financial Management.

Advanced management accounting material is related to CPA material.

It enhances the possibilities for qualifying for the new Evolution 2025 model’s CPAs.

CIMA professionals have international recognition for cost accounting and strategy accounting.

ACCA (Association of Chartered Certified Accountants)

CPA exemption for ACCA is gaining general acceptance, particularly in countries where international financial reporting and taxation skills are in high demand.

Full members of the ACCA can be exempted in several fields.

Exemptions also differ between state boards; certain of them will still have specific papers tested.

The exemption from the CPA for ACCA is particularly beneficial for international professionals who intend to work in the US or multinational corporations.

CPA Exemptions Based on Academic Qualifications

Academic qualifications such as MBA degrees and specialised accounting degrees also make candidates eligible for exemption from CPAs.

MBA

An MBA in finance or accounting is a strong qualifier for exemption from the CPA exam for MBA candidates.

Exemptions can encompass core business environment issues.

MBAs usually satisfy the 150-credit-hour requirement for obtaining the CPA license.

The exemption of MBA holders from the CPA not only removes exam pressure but also simplifies career advancement in management positions.

Other Recognised Degrees and Educational Credits

In some institutions and curricula, other degrees can also be exempt from the CPA under certain circumstances, particularly in the USA and Canada.

Some accepted qualifications include:

Bachelor’s in Accounting/Finance

Master’s in Commerce (M.Com)

BBA with Accounting Major

Postgraduate Diplomas in Accounting

Credits from NAAC-A accredited Indian universities

Degrees evaluated by NACES-recognised agencies

To be qualified for these CPA exemptions, it’s always best to check your eligibility with the state board concerned or a foreign credential evaluation organisation.

Work Experience-Based CPA Exemptions

In certain US jurisdictions or foreign jurisdictions, significant related work experience can help with CPA exemptions.

Experience should typically be in accounting, taxation, or auditing.

May meet educational or ethics requirements.

Needs to be authenticated by a state-licensed CPA supervisor.

These CPA exemptions can significantly help working professionals transition into CPA certification without redundant coursework or exams.

Benefits of CPA Exemptions

Here are key benefits of leveraging CPA exemptions:

Reduced Number of Exams: Fewer examination periods to prepare for.

Time Savings: Accelerate your CPA certification timeline.

Lower Costs: Pay less for course material and exam fees.

Boost Career Growth: Employers prefer CPAs with international and interdisciplinary experiences.

Stress-Free Preparation: Focus only on areas where you lack prior exposure.

Custom Career Path: Choose exam areas that complement your specialisation.

Whether it’s a CPA exemption for MBA, CPA exemption for CA, or CPA exemption for ACCA, these benefits make the journey faster and smarter.

How to Apply for CPA Exemptions

To apply for your CPA exemptions, do the following:

Determine Your Jurisdiction: Each US state board has its own rules.

Get Credentials Evaluated: Utilise agencies such as WES or NASBA International Evaluation Services.

Submit Application: Include transcripts, certificates, and proof of membership.

Wait for Assessment: The board will confirm eligible CPA exemptions.

Plan Your Prep: Focus only on remaining sections after exemptions are granted.

Tip: Double-check the requirements for the CPA exam for the state in which you intend to apply.

Final Thoughts

Gaining the CPA credential is a career highlight in itself, and if you’re exempt from CPAs, then all the better. If you’re in possession of a CA, ACCA, MBA, or some other qualifying credential, then potentially you can bypass duplicative CPA modules and accelerate your success.

Strategic planning is crucial with revised rules in CPA Evolution 2025. Review your history, take advantage of relevant CPA exemptions where possible, and put your efforts where they will have the greatest impact.

FAQs on CPA Course Exemptions

How to get exemption in CPA?

You can receive CPA exemption through qualifications such as CA, ACCA, or MBA, or through experience in related fields. Submit your application to a state board or evaluation authority.

Are there any exemptions for CPA?

Yes, most of the states permit CPAs for candidates with relevant professional or educational qualifications. Exemptions cut down on the number of accounting exam sections needed.

What is the eligibility to study CPA?

Eligibility typically requires a bachelor’s in accounting or equivalent, 120-150 credit hours, and in some cases work experience. Other exemptions are subject to previous credentials.

Can I do CPA in 3 months?

Although tough, it is possible to finish CPA in 3 months in the case of CPA exemptions and concentrating only on remaining sections. Previous experience in accounting and full-time studying are helpful.

0 notes

Text

📢 Employers Have ONE Rule Before Hiring. Do You Meet It? 🚨 The job market is evolving, and employers are no longer hiring based on degrees alone. They want proof of specialized knowledge, global skills, and practical expertise — all backed by industry-recognized certifications.

💡 The ONE hiring rule today?

✅ “We hire professionals who are future-ready and certified with globally respected qualifications.”

Are you one of them?

🔍 Whether you're eyeing roles in investment banking, risk management, corporate finance, or global accounting, here’s what gives you the edge:

📌 Top Certifications Employers ACTUALLY Look For: 🔹 CFA (Chartered Financial Analyst) – The gold standard in investment management. 🔹 FRM (Financial Risk Manager) – The must-have for high-level risk roles. 🔹 US CMA (Certified Management Accountant) – Power-packed for strategic finance & accounting positions.

💼 Why Choose FINAIM for CFA | FRM | US CMA Prep? 🔥 95% pass rate 📚 Practical, exam-focused study modules 👨🏫 Industry mentors & expert faculty 💼 Placement assistance & career guidance 📈 Lifetime access to updated content

With FINAIM, you're not just preparing for exams. You're preparing for career success.

🌍 Join 10,000+ global finance professionals who've upgraded their careers with FINAIM. ✅ Visit: https://finaim.in/

FINAIM ADDRESS: 3rd Floor, Phelps Building, 9 A, Block A, Connaught Place, New Delhi, Delhi 110001 PHONE NO: 087009 24049 📞 DM us “CFA” “FRM” or “US CMA” and get a FREE career counselling session.

CFA #FRM #USCMA #FINAIM #FinanceCareers #Accounting #InvestmentBanking #RiskManagement #GlobalCertifications #CFAIndia #FRMIndia #USCMAIndia #CareerGrowth #FinanceJobs #StudySmartWithFINAIM #CFA2025 #FRM2025 #USCMA2025 #FutureReady #SkillUp #CFAInstitute #GARP #IMA

#us cma offline classes#cfa coaching fees in india#finaim#best finance coaching in delhi#frm syllabus#us cma eligibility#frm exam patter#cfa level2 offline classes#how to become us cma

0 notes

Text

CPA Course Exemptions

As a CA, MBA, ACCA, or other professional qualification holder, you might be qualified for CPA exemptions that lighten your exam load and accelerate your CPA certification. This post discusses all exemption categories—academic, professional, and work-based—along with application procedures and advantages.

CPA Exemptions Based on Professional Qualifications

Professional certifications can ease your way to CPA certification through your qualification for exemptions. These are awarded when your previous credentials meet the requirements of the CPA syllabus.

CA (Chartered Accountancy)

CPA exemption for CA is among the most well-known. CAs from India, Australia, and the UK usually receive credit for in-depth knowledge of accounting, auditing, and taxation.

Exemptions may include subjects like Auditing and Financial Reporting.

Some US states recognise Indian CA as fulfilling 120 credit hour requirements.

This CPA exemption saves students time and money and enhances international career prospects.

CMA (Certified Management Accountant)

US CMA holders from IMA are usually exempt from the CPA. CMAs possess deep knowledge in financial planning, performance management, and control of costs.

Are eligible for performance management-related CPA section exemptions.

Lowers the exam load for candidates having managerial accounting experience.

The overlap of subjects in strategic finance makes CMA an excellent stepping point for obtaining CPA certification.

CFA (Chartered Financial Analyst)

While not always formally mentioned, CFA charterholders are occasionally exempt from the CPA due to their qualifications in financial reporting as well as ethics.

Some overlap exists in FAR (Financial Accounting and Reporting) and BEC-equivalent topics.

Having both CPA and CFA enhances finance and auditing employability.

CFA candidates will particularly gain from the financial analysis segment of the CPA syllabus.

CIA (Certified Internal Auditor)

CIA professionals of the IIA are known for their extensive knowledge of auditing.

CIA holders may apply for exemption from the AUD (Auditing and Attestation) section.

Known in jurisdictions where audit-specific certifications are appreciated.

Internal auditors who pursue more general accounting positions gain much from it.

CIMA (Chartered Institute of Management Accountants)

CIMA professionals who are qualified with the CGMA credential can be exempt from sections such as Business Analysis or Financial Management.

Advanced management accounting material is related to CPA material.

It enhances the possibilities for qualifying for the new Evolution 2025 model’s CPAs.

CIMA professionals have international recognition for cost accounting and strategy accounting.

ACCA (Association of Chartered Certified Accountants)

CPA exemption for ACCA is gaining general acceptance, particularly in countries where international financial reporting and taxation skills are in high demand.

Full members of the ACCA can be exempted in several fields.

Exemptions also differ between state boards; certain of them will still have specific papers tested.

The exemption from the CPA for ACCA is particularly beneficial for international professionals who intend to work in the US or multinational corporations.

CPA Exemptions Based on Academic Qualifications

Academic qualifications such as MBA degrees and specialised accounting degrees also make candidates eligible for exemption from CPAs.

MBA

An MBA in finance or accounting is a strong qualifier for exemption from the CPA exam for MBA candidates.

Exemptions can encompass core business environment issues.

MBAs usually satisfy the 150-credit-hour requirement for obtaining the CPA license.

The exemption of MBA holders from the CPA not only removes exam pressure but also simplifies career advancement in management positions.

Other Recognised Degrees and Educational Credits

In some institutions and curricula, other degrees can also be exempt from the CPA under certain circumstances, particularly in the USA and Canada.

Some accepted qualifications include:

Bachelor’s in Accounting/Finance

Master’s in Commerce (M.Com)

BBA with Accounting Major

Postgraduate Diplomas in Accounting

Credits from NAAC-A accredited Indian universities

Degrees evaluated by NACES-recognised agencies

To be qualified for these CPA exemptions, it’s always best to check your eligibility with the state board concerned or a foreign credential evaluation organisation.

Work Experience-Based CPA Exemptions

In certain US jurisdictions or foreign jurisdictions, significant related work experience can help with CPA exemptions.

Experience should typically be in accounting, taxation, or auditing.

May meet educational or ethics requirements.

Needs to be authenticated by a state-licensed CPA supervisor.

These CPA exemptions can significantly help working professionals transition into CPA certification without redundant coursework or exams.

Benefits of CPA Exemptions

Here are key benefits of leveraging CPA exemptions:

Reduced Number of Exams: Fewer examination periods to prepare for.

Time Savings: Accelerate your CPA certification timeline.

Lower Costs: Pay less for course material and exam fees.

Boost Career Growth: Employers prefer CPAs with international and interdisciplinary experiences.

Stress-Free Preparation: Focus only on areas where you lack prior exposure.

Custom Career Path: Choose exam areas that complement your specialisation.

Whether it’s a CPA exemption for MBA, CPA exemption for CA, or CPA exemption for ACCA, these benefits make the journey faster and smarter.

How to Apply for CPA Exemptions

To apply for your CPA exemptions, do the following:

Determine Your Jurisdiction: Each US state board has its own rules.

Get Credentials Evaluated: Utilise agencies such as WES or NASBA International Evaluation Services.

Submit Application: Include transcripts, certificates, and proof of membership.

Wait for Assessment: The board will confirm eligible CPA exemptions.

Plan Your Prep: Focus only on remaining sections after exemptions are granted.

Tip: Double-check the requirements for the CPA exam for the state in which you intend to apply.

Final Thoughts

Gaining the CPA credential is a career highlight in itself, and if you’re exempt from CPAs, then all the better. If you’re in possession of a CA, ACCA, MBA, or some other qualifying credential, then potentially you can bypass duplicative CPA modules and accelerate your success.

Strategic planning is crucial with revised rules in CPA Evolution 2025. Review your history, take advantage of relevant CPA exemptions where possible, and put your efforts where they will have the greatest impact.

FAQs on CPA Course Exemptions

How to get exemption in CPA?

You can receive CPA exemption through qualifications such as CA, ACCA, or MBA, or through experience in related fields. Submit your application to a state board or evaluation authority.

Are there any exemptions for CPA?

Yes, most of the states permit CPAs for candidates with relevant professional or educational qualifications. Exemptions cut down on the number of accounting exam sections needed.

What is the eligibility to study CPA?

Eligibility typically requires a bachelor’s in accounting or equivalent, 120-150 credit hours, and in some cases work experience. Other exemptions are subject to previous credentials.

Can I do CPA in 3 months?

Although tough, it is possible to finish CPA in 3 months in the case of CPA exemptions and concentrating only on remaining sections. Previous experience in accounting and full-time studying are helpful.

0 notes

Text

CMA Syllabus

The goal of the Certified Management Accountant (CMA) curriculum is to give professionals the information and abilities they need to succeed in financial and management accounting. There are two sections to the syllabus:

Section 1: Analytics, Performance, and Financial Planning Financial reporting, forecasting, budgeting, cost control, and performance analysis are some of the subjects covered in this area. It focuses on how financial data can be used to inform corporate choices and enhance operational efficiency.

Section 2: Financial Management Strategy This section explores topics such as investment management, internal controls, risk management, and financial decision-making. It equips applicants to assume leadership positions and support long-term corporate goals.

In order to help professionals manage complicated financial settings and progress in their professions, the CMA syllabus combines technical expertise with strategic thinking.

0 notes