#CPSA Writing Prompts

Explore tagged Tumblr posts

Text

The Intrinsic Value of Deluxe Corporation

Introduction

Deluxe Corporation is an American-based technology company whose principal business involves providing small businesses and financial institutions with checks and forms offerings, website development and hosting, email marketing, social media, search engine optimization, and logo design. At the time of writing, the firm’s market cap stands at around $2.77 Billion and its revenues and free cash flows for the previous financial year were around $1.91 Billion and $0.28 Billion respectively. The company’s common stock has fluctuated between a high of $79 and a low of $57 over the past 52 weeks and currently stands at around $58. Is Deluxe Corporation undervalued at the current price?

The Intrinsic Value of Deluxe Corporation

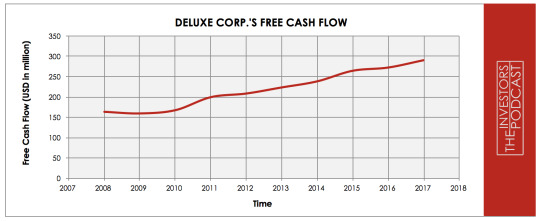

To determine the intrinsic value of Deluxe Corporation, we’ll begin by looking at the company’s history of free cash flow. A company’s free cash flow is the true earnings which management can either reinvest for growth or distribute back to shareholders in the form of dividends and share buybacks. Below is a chart of Deluxe Corporation’s free cash flow for the past ten years.

As one can see, the company’s free cash flow has exhibited a stable and positive trend over the past decade, growing at an annualized rate of 6.58%. To determine Deluxe Corporation’s intrinsic value, an estimate must be made of its potential future free cash flows. To build this estimate, there is an array of potential outcomes for future free cash flows in the graph below.

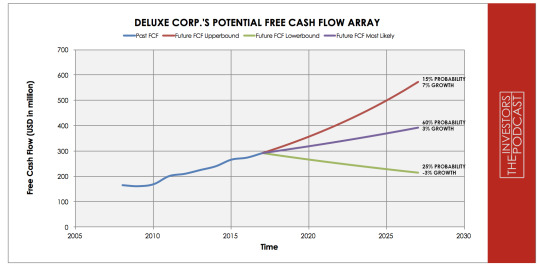

When examining the array of lines moving into the future, each one represents a certain probability of occurrence. The upper-bound line represents a 6.58% growth rate which is based on Deluxe Corporation’s free cash flow growth rate for the last ten years. This growth rate has been assigned a 15% probability of occurrence to account for some factors including the rapid rate of change and high levels of competition found in the business technology industry and the fact that there is an increasing risk of an economic downturn occurring in the near to mid-term.

The middle growth line represents a 3% growth rate which is based on the U.S. historical average annual GDP growth rate. This scenario assumes that Deluxe Corporation’s future growth reverts to that of the wider economy and has been assigned a 60% probability of occurrence. The lower bound line represents a -3% rate in free cash flow growth and assumes that the company suffers a contraction in earnings due to competitive and cyclical pressures. This growth rate has been assigned a 25% probability of occurrence.

Assuming these potential outcomes and corresponding cash flows are accurately represented, Deluxe Corporation might be priced at an 11.3% annual return if the company can be purchased at today’s price. We’ll now look at some other valuation metrics to see if they correspond with this estimate.

Based on Deluxe Corporation’s current earnings yield, which is the inverse of its EV/EBIT ratio, the company is currently yielding 9.45%. This is below the firm’s 10-year historical median of 11.35% yet above the Global Business Services Industry median average of 4.41% suggesting that the company may be marginally overvalued relative to its historical median average but undervalued relative to industry comparisons.

Finally, we’ll look at Deluxe Corporation’s free cash flow yield, a metric which assumes zero growth and simply measures the firm’s trailing free cash against its current market price. At the current market price, Deluxe Corporation has a free cash flow yield of 10.14%.

Taking all these points into consideration, it seems reasonable to assume that Deluxe Corporation may currently be trading in a range of reasonable, fair value. Furthermore, the company may return between 10-11% at the current price if the estimated free cash flows are achieved. Now, let’s discuss how and why these estimated free cash flows could be achieved.

The Competitive Advantage of Deluxe Corporation

Deluxe Corporation has various competitive advantages outlined below.

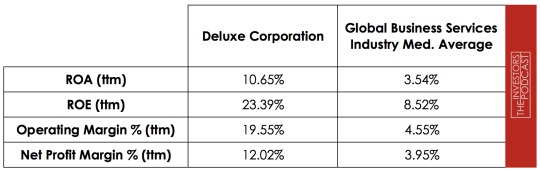

Economies of Scale. Since its founding in 1915, Deluxe Corporation has grown to become the largest printer of business and personal checks & forms in the United States. While this legacy segment of the business is in secular decline as digital commerce replaces traditional methods of payment, Deluxe Corporation is still able to leverage its scale advantages to earn higher margins that the industry in which it operates. This outperformance can be seen in the key metrics seen in the chart below.

Niche Attribute. To address the secular decline in its core legacy business, Deluxe Corporation has been transforming its business to offer a broad range of business services for small companies and financial institutions which include design and website services, search engine marketing, and fraud protection services. By focusing on providing a value-added service to small companies, Deluxe Corporation has been able to establish itself as the go-to expert and now has a client base of 4.5 million active small business customers and over 5,100 financial institution clients.

Customer-Focused Business Model. Deluxe Corporation places its customers at the heart of its business model and offers them a 100% guarantee that if they are not satisfied with their order, it will “do what it takes to make it right.” It also offers its customer's reliability guarantees through its affiliation and membership of organizations such as the check Payment System Association (CPSA), Better Business Bureau (BBB), and the International Association of Privacy Professionals (IAPP). By offering its customers a high level of reliability and security safeguards, Deluxe Corporation has managed to achieve a 94% customer retention rate within its small business payroll services.

Deluxe Corporation’s Risks

Now that Deluxe Corporation’s competitive advantages have been considered, let’s look at some of the risk factors that could impair my assumptions of investment return.

At present, Deluxe Corporation is still in the process of transforming its business from the legacy core segment of personal checks, business checks, and business forms products which is now in secular decline with check payments falling at an annual rate of 4.4% during 2012 and 2015. If the company is unsuccessful in completing its transformation strategy, it could see its revenues and earnings decline in the future.

Deluxe Corporation’s client base consists of small businesses and financial institutions and as such its future financial performance could be adversely affected if an economic downturn were to emerge in the near to mid-term future. Since small businesses often find it more difficult to obtain credit in such an environment, they may be forced to constrain spending leading to a lowering of demand for Deluxe Corporation’s products and services.

Deluxe Corporation faces competition from a number of directions including traditional storefront printing companies, office superstores, website design and hosting companies, online printing companies, email and social media marketing companies, debit & credit card companies, and inter-based bill paying services. This level of competition is likely to increase as advances in technology, scale advantages, and network effects enable competitors to challenge for market share more aggressively. Should Deluxe Corporation be unable to innovate and transition into the new business environment successfully, it may suffer from decline through obsolescence leading to a negative trend in future revenues and earnings.

Opportunity Costs

Whenever an investment is considered, one must compare it to any alternatives to weigh up the opportunity cost. At the time of writing, 10-year treasuries are yielding 2.95%. If we take inflation into account, the real return is likely to be closer to 1%. The S&P 500 Index is currently trading at a Shiller P/E of 32.4 which is 91.7% higher than the historical mean of 16.8. Assuming reversion to the mean occurs, the implied future annual return is likely to be -2.9%. Deluxe Corporation, therefore, appears to offer a much better return for investors at present, but other individual stocks may be found which offer a similar return relative to the risk profile.

Macro Factors

Investors must consider macroeconomic factors that may impact economic and market performance as this could influence investment returns. At present, the S&P is priced at a Shiller P/E of 32.4; this is 91.7% higher than the historical average of 16.8 suggesting markets are at elevated levels. U.S. unemployment figures are at a 30-year low suggesting that the current business cycle is nearing its peak. U.S. private debt/GDP currently stands at 202.80% and is at its highest point since 2009 when the last financial crisis prompted private sector deleveraging.

Summary

Deluxe Corporation’s core legacy business of personal and business checks is in secular decline with the Federal Reserve reporting that check payments peaked in the mid-90’s and had subsequently declined at an annualized rate of 8.8% during 2009-2012 and 4.4% during 2012-2015. The company appears to be taking this issue seriously and has been implementing a business transformation strategy over the last decade to diversify its business. In 2017, the firm grew Marketing solutions and Other Services revenue (MOS) by 22% to $756 Million with this segment contributing to 38% of total revenues. Management expects full year (FY2018) MOS revenue to be approximately 45% of total company revenue with checks expected to account for around 38% of revenue. If this goal is achieved, it will mark the first time in the history of Deluxe Corporation that MOS revenue was higher than check revenue.

There are, however, some challenges which investors should be mindful of including the increasing competition emerging from online and mobile payment services, website design & hosting companies, and email & social media marketing companies. The small business services industry is currently highly fragmented and geographically dispersed with the competitive factors influencing a customer's purchase decision including price, range, quality of product and service offerings, ease of use of web and other services, convenience, past customer experience, and the responsiveness and quality of customer support. To maintain and grow its competitive position within the industry, Deluxe Corporation will need to ensure a trend of innovation to meet the changing needs and habits of its client base.

Over the past decade, Deluxe Corporation has grown revenues and free cash flow at 3.29% and 6.58% respectively. Within this period, it has achieved an average Return on Invested Capital (ROIC) of 17% and Gross & Operating margins of 63.81% and 19.59%. With regards to shareholder friendliness, Deluxe Corporation has been returning value to shareholders in the form of share repurchases and dividends. Over the last five years, the company has reduced its share count at an annualized rate of 1.5% and grown dividends at 4.66%. In 2017, the firm returned $123 Million to shareholders through dividends and share repurchases.

In summary, the market currently appears to have a pessimistic view towards Deluxe Corporation and its future growth opportunities. The company appears to be successfully transforming its business from the legacy check business towards it MOS business but faces a number of potential challenges including increased competition and potential cyclical pressures.

Based on the conservative assumptions used in the free cash flow analysis, Deluxe Corporation may return around 11% at the current market price.

Disclaimer: The author does not hold ownership in any of the companies mentioned at the time of writing this article.

*

This article was written in collaboration with David J. Flood from “The Investor’s Podcast.”

Stig Brodersen is the host of the business podcast “We Study Billionaires.” You can find his free intrinsic value index here of popular stock picks.

0 notes

Text

Final Reflection

CPSA 250:Individual Capstone Final Reflection (Due via ELMS by Thursday, May 11th!) The questions below are meant to be prompts to get you started, though you may end up wanting to expand on some more than others. Please respond to each question in no less than 4-5 sentences, though you may write more if you wish, and upload your reflection to ELMS by Wednesday, May 11th. 1) What was the most challenging aspect of completing your project, and why? (This might be technical aspects, time constraints, problems that arose, etc.—be honest, this is your space to reflect!) The most challenging aspect of this was originally deciding whether or not I wanted to hold an art therapy session with a group of other students or just myself. I was conflicted because I believed that hold session would be more interesting and also give me better data so that I could turn this into actual research but the inevitable possibility of people not being able to make it to every single session would ruin my data so I decided to do it myself. This also posed a challenge because I had to make time to do these assignment. Because I gave these assignments to myself it was very easy to procrastinate them. 2) Looking at your learning agreement(s) on ELMS, how do you think you succeeded (or not) in completing your Learning Objectives? Which ones did you fulfill? Which ones did you not fulfill? Why? I believe that my learning agreement was for my original idea of holding finger painting session. But I think that we made goals in class that I tried to follow in class. One of the goals I made for myself was to try to give myself an assignment once a week for 7-8 week. I was only able to do six and sometimes it was hard for me to take time and sit down because I had exams or lab reports that I need to do. One thing that I did fulfil was finding a way for me to reduce my stress that I can continue to do in the future. 3) What were the most helpful aspects of the (semi) weekly class meetings? What would you like to see added or subtracted for next year? I actually found most the semiweekly classes very helpful. The classes where we got to talk to our peers and get feedback for our capstones were very helpful. I also found it interesting when we got to see other people’s capstones. I got inspired by many capstones and my peers had very useful ideas and helpful critiques. 4) What part of the project were you most proud of? Why? I was very proud of my findings because they proved my hypothesis correct. Although from my data and the information that I found it cannot be stated that at using art therapy as a stress relieving technique actually works. I found out that it works for me and I can use this in the future (or right now because its finals) to help me relax from all the stress in my life. This also motivates me to want to do more research in the future and hopefully hold sessions. 5) What part of the project would you have changed if you could? Why? If had to change anything I would have kept my original idea of holding finger painting sessions. I let fear of failure overcome me instead of think of other possibilities that could have reduced the error in my research. I think that holding session would have been a lot of fun and would have made my capstone much more interesting. It also would have spread awareness of art therapy and the many benefits it can have on people, especially college students that are stress out to the point of breaking. 6) If you had to offer advice to next year’s Capstone students, what would it be? Although all of the art scholars advisors say this over and over again, but DO NOT PROCRASTINATE! It is very important to be ahead of everything and make time to work on your project so that it turns out the way you want it to be. Take winter break to plan everything that you need to accomplish over the semester so that you are not lost and confused when you have to figure out your capstone or fix it because it turns out you can’t do something. Get the logistics out of the way first so you can focus on the actual capstone.

0 notes

Photo

This photo indicates my choice of costume for my Capstone Project: I chose to wear all black (leotard/skirt). The first reason I selected all black is because my research shows that infants are actually drawn to colors of contrast. It is a misconception that babies love the pale blue/pink that are gendered for newborns. In fact, babies are more engaged to the contrast of black/white. Also, wearing all black was a way to represent multiple characters of the story. Additionally, it prevented unnecessary distraction of an elaborate costume. I chose a skirt because I felt its fluidity replicated that of the movement in order to enhance the quality of the tone of the choreography, and the emotion in the storybook.

#alannarcpsarts#CPSA Capstone Assignments#CPSA Process Progress#CPSA Writing Prompts#CPSA Process Binder

2 notes

·

View notes

Photo

This is a picture of my mom and I that symbolizes my inspiration for this project. My mom is the reason I chose the book “Love You Forever.” When I was little, my mom would always read me this book - every time she asked what book I wanted, I would say, “Love You Forever,” and every time she would read it, she would cry. My personal experience with my mom and the book just proves how important children’s literature truly is, and how it can stick with a person for the rest of their life.

#alannarcpsarts#CPSA Capstone Assignments#CPSA Process Progress#CPSA Writing Prompts#CPSA Process Binder

0 notes