#CentralBankDigitalCurrency(CBDC)

Explore tagged Tumblr posts

Text

Why People Oppose CBDCs and the Laws Enacted to Fight Them

Central Bank Digital Currencies (CBDCs) have become a hot topic in the world of finance. These digital currencies, issued by central banks, promise to revolutionize the way we transact. However, they also face significant opposition. This article explores the reasons behind the opposition to CBDCs and the legislative actions taken against them.

What are CBDCs?

CBDCs are digital versions of a country’s fiat currency, issued and regulated by the central bank. Unlike decentralized cryptocurrencies such as Bitcoin, CBDCs are controlled by the government. Countries like China and the Bahamas have already launched their versions of CBDCs, while many others, including the United States, are exploring their potential.

Reasons for Opposition

Privacy Concerns

One of the primary concerns about CBDCs is the potential for government surveillance. Unlike cash transactions, which are anonymous, digital transactions can be tracked. This could allow governments to monitor individuals’ spending habits and financial activities closely. For instance, a government could potentially know what you buy, when you buy it, and where you buy it. This level of surveillance is unsettling for many who value their financial privacy.

Control and Censorship

CBDCs could also give governments unprecedented control over personal finances. They could, for example, freeze accounts or limit what individuals can spend their money on. This level of control raises concerns about potential misuse of power. Imagine a scenario where political dissenters find their access to funds restricted because of their opposition to the government.

Economic Freedom

Opponents of CBDCs argue that they could erode financial autonomy. Decentralized cryptocurrencies like Bitcoin offer an alternative to the traditional financial system, promoting financial freedom and independence. In contrast, CBDCs are seen as a tool for reinforcing governmental control over the economy.

Security Risks

Digital currencies are susceptible to cyber-attacks and fraud. The infrastructure supporting CBDCs would need to be highly secure to prevent hacking and protect users’ funds. Any vulnerabilities in the system could have severe consequences, including financial losses and disruptions in the economy.

Laws and Regulations Against CBDCs

Opposition to CBDCs has led to the introduction of various laws aimed at restricting or prohibiting their use. Several states in the US have taken significant steps in this direction.

State-Level Legislation

South Dakota: Recently passed a law prohibiting the state from accepting CBDCs as payment and blocking participation in CBDC trials.

Indiana, Florida, and Alabama: Between April and June 2023, these states passed laws excluding CBDCs from the definition of money under the Uniform Commercial Code, potentially discouraging business usage.

Oklahoma: Passed a law preventing the state from participating in CBDC trials or using CBDCs.

Federal-Level Legislation

CBDC Anti-Surveillance State Act: In September 2023, the House Financial Services Committee voted in favor of this act, which would prohibit the Federal Reserve from issuing a CBDC directly to individuals or using it for monetary policy. This bill still needs to pass the full House and Senate.

Political Stances: Former President Donald Trump has vowed to block a CBDC if he becomes President again.

Impact of Opposition

The opposition to CBDCs has significant implications for their adoption and implementation. State-level laws and proposed federal bills create substantial hurdles, signaling strong resistance to their rollout. Concerns about financial privacy and government overreach play a crucial role in shaping public opinion and legislative action. If the opposition successfully limits or prevents the rollout of CBDCs, it could influence global approaches to digital currencies.

Conclusion

The debate over CBDCs is far from over. While they promise to modernize the financial system, the concerns about privacy, control, economic freedom, and security cannot be ignored. The laws and regulations against CBDCs reflect a broader political and societal debate about the future of money and financial autonomy. As this debate continues, it is essential to stay informed and engaged with developments in digital currencies.

Call to Action

What are your thoughts on CBDCs? Do you support their implementation, or do you have concerns about their impact? Share your opinions in the comments section below.

For more insights on financial freedom and digital currencies, subscribe to our blog and join the conversation. Don't forget to check out our YouTube channel, Unplugged Financial, where we dive deeper into these topics with in-depth analyses, expert interviews, and practical advice. Join us as we explore the future of money and the potential for a financial revolution!

Subscribe to our blog for the latest articles: Unplugged Financial Blog

Watch our videos and subscribe to our YouTube channel: Unplugged Financial YouTube Channel

Let's learn about the Bitcoin evolution together!

#CentralBankDigitalCurrencies#CBDCs#Bitcoin#FinancialPrivacy#GovernmentSurveillance#DigitalCurrencies#DecentralizedFinance#StateLegislation#FederalLegislation#EconomicFreedom#FinancialAutonomy#CBDCOpposition#DigitalCurrencySecurity#MonetaryPolicy#AntiCBDCLaws#PrivacyConcerns#EconomicControl#DigitalFinancialInfrastructure#Cryptocurrency#FinancialRevolution#financial education#financial empowerment#financial experts#digitalcurrency#blockchain#finance#unplugged financial#globaleconomy

3 notes

·

View notes

Text

Central Bank Digital Currency Explained: The Future of Money Is Here #cbdc #shorts

youtube

In this engrossing video, we delve into the rapidly changing universe of central bank digital currencies (CBDCs) and how they are revolutionizing the future of money. From digital dollars to the digital rupee, CBDCs are not ideas—they're being seriously studied, tested, and implemented by more than 130 nations accounting for 98% of world GDP. Unlike other cryptocurrencies like Bitcoin or Ethereum, CBDCs are secure, government-issued digital versions of a country's money, with the same feel as physical currency but the speed and efficiency of technology. The video explains how this worldwide change is occurring now—fading use of cash, growing use of private digital assets, drive for financial inclusion, and demand for faster, lower-cost cross-border payments. You'll discover what CBDCs are, how they function, and what their possible advantages and disadvantages could be. What they might do to your privacy, banking, and daily life is also revealed. Whether you're interested in technology, investing, or just eager to know the future of money, this video provides crucial facts about the CBDC revolution.

#centralbankdigitalcurrency#cbdc#digitalcurrency#futureofmoney#fintech#cryptonews#blockchaintechnology#financialinclusion#digitalpayments#moneyrevolution#cbdcexplained#digitaleconomy#bankingfuture#privacyandsecurity#globalfinance#Youtube

0 notes

Text

The Rise of Central Bank Digital Currencies

Introduction: A New Era of Digital Money As we move deeper into the digital age, the financial world is undergoing rapid transformation. One of the most revolutionary changes is the rise of Central Bank Digital Currencies (CBDCs) — government-backed digital versions of national fiat currencies. Unlike cryptocurrencies such as Bitcoin or Ethereum, CBDCs are centralized and issued by a country’s…

#CryptoEducation#crypythone#defi#Binance#BinanceCrypto#BlockchainFuture#CBDC#CBDCs#CentralBankDigitalCurrency#CryptoFuture#CryptoRegulation#CryptoVsCBDC#DecentralizedFuture#DigitalCurrency#DigitalEuro#DigitalYuan#FinancialSovereignty#Fintech2025#Web3Finance

0 notes

Text

Fed Chair Confirms US Won't Launch Digital Dollar Under His Watch

Why the US Digital Dollar Won’t Happen While Jerome Powell Is in Charge. Jerome Powell, the Federal Reserve Chairman, has recently confirmed that the United States will not be launching a digital dollar during his tenure. This statement comes as digital currencies continue to gain prominence globally, with countries like China already exploring digital currency initiatives. Despite the growing interest in a government-backed digital currency, Powell remains firm in his stance, arguing that there are no immediate plans for the US to develop a digital dollar under his watch.

The concept of a US digital currency has been debated for some years, as the global financial sector undergoes fast change. Cryptocurrencies such as Bitcoin and Ethereum have led the way for decentralised banking, and central banks around the world are now contemplating the advantages of creating their own digital currency. Central Bank Digital Currencies (CBDCs) are viewed as a way to modernise the monetary system, improve payment systems, and even combat the rise of private cryptocurrencies. Also Read: bitgo-ipo-crypto-custodian-plans-q2-2025-public-offering However, Powell's stance reflects a major concern among regulators. One of the primary reasons Powell opposes the concept of a digital dollar is the ambiguity surrounding its possible effects on the financial system. There are concerns that a digital currency will disrupt the banking system and raise worries about privacy and security. To avoid undermining the current financial infrastructure, such a system would need to be implemented with careful planning, regulation, and oversight. Furthermore, Powell stated that the US will only consider creating a digital dollar if there is convincing proof that it will benefit the economy and the general population. He stated that any prospective digital currency would need to be stable, preserve financial privacy, and available to all Americans, including those who do not have access to traditional banking services. While Powell has expressed his views, the debate for a digital dollar has not ended. The Federal Reserve and Congress are conducting continuing investigations and discussions about the potential benefits and cons of a CBDC. Many analysts believe that in order to remain competitive on a global scale, the United States should explore implementing a digital currency. China's digital yuan is already in circulation, and other countries are looking into similar programmes. As a result, the United States risks falling behind if it does not respond quickly. Despite Powell's remark, the US digital dollar issue is far from over. As the world of digital currencies evolves, it will be interesting to watch if the US adopts a different attitude in the future. For the time being, it looks that the debut of a digital dollar will have to wait. Read the full article

#Bitcoin#CBDC#Centralbankdigitalcurrencies#cryptocurrencies#DigitalCurrency#digitalYuan#FederalReserve#JeromePowell#USdigitaldollar#USmonetarypolicy

1 note

·

View note

Text

Cryptocurrency and Blockchain Technology

Cryptocurrency and blockchain technology have piqued the interest of investors, technologists, and legislators alike, promising to transform the financial landscape. This article will look at the latest trends, advancements, and prospective effects of cryptocurrency and blockchain technology on banking.

The Evolution of Cryptocurrency

Bitcoin, created in 2009 by an anonymous individual or group known as Satoshi Nakamoto, marked the beginning of the cryptocurrency era. Since then, thousands of alternative cryptocurrencies, or altcoins, have emerged, each with unique features and purposes. Growth of Blockchain Technology Blockchain, the underlying technology behind cryptocurrencies, has also evolved significantly. Originally devised as to record Bitcoin transactions, blockchain technology is now being explored for a wide range of applications beyond digital currencies.

Latest Trends in Cryptocurrency

Decentralized finance, or DeFi, has emerged as a major trend in the bitcoin sector. DeFi platforms seek to duplicate traditional financial services including lending, borrowing, and trading without the use of intermediaries such as banks. Non-Fungible Tokens (NFTs) Non-fungible tokens (NFTs) have received a lot of interest due to their capacity to represent ownership of unique digital goods like artwork, collectibles, and digital real estate. The NFT industry has expanded rapidly, attracting artists, investors, and collectors alike. Central Bank Digital Currencies (CBDCs) Central banks are looking at the prospect of releasing their digital currency, known as central bank digital currencies, or CBDCs. These digital currencies seek to increase efficiency, lower expenses, and promote financial inclusion.

Developments in Blockchain Technology

Blockchain developers prioritize interoperability and scalability. Projects such as Polkadot, Cosmos, and Ethereum 2.0 are developing ways to improve blockchain network interoperability and scalability. Enhanced Security and Privacy Advances in cryptography approaches and privacy-preserving technology improve blockchain network security and privacy. These advancements are critical to establishing trust and confidence in blockchain-based systems.

Potential Impact on the Financial Landscape

Cryptocurrency and blockchain technology can potentially disrupt established banking institutions by providing faster, less expensive, and more inclusive financial services. This disruption could result in a shift of power in the banking industry. Financial Inclusion and Access Blockchain technology has the potential to provide financial services to the unbanked and underbanked populations worldwide, opening up new opportunities for economic empowerment and financial inclusion. Regulatory Challenges and Opportunities The rapid growth of cryptocurrency and blockchain technology has prompted governments and regulatory bodies to develop frameworks and policies to address concerns such as consumer protection, money laundering, and tax evasion. Clear and balanced regulation is essential to foster innovation while ensuring investor protection and financial stability.

Conclusion

Finally, cryptocurrencies and blockchain technology are fundamentally changing the financial world. The future of finance appears to be becoming more decentralized, digital, and inclusive, with the rise of non-fungible tokens, the research of central bank digital currencies, and advancements in blockchain technology. As these technologies advance and develop, their impact on the financial environment will only increase, ushering in a new era of innovation and opportunity. Read the full article

#Blockchain#BlockchainApplications#BlockchainDevelopments#BlockchainSecurity.#CentralBankDigitalCurrency(CBDC)#CryptoInvestments#CryptocurrencyRegulation#CryptocurrencyTrends#DecentralizedFinance(DeFi)#DigitalAssets#DigitalCurrency#FinancialInnovation#FinancialTechnology(FinTech)#Non-FungibleTokens(NFTs)

0 notes

Text

Beyond Borders | Beyond Cash | Asias Embrace of CBDCs for Faster Payments | Efi Pylarinou

youtube

A conversation with Dr Oriol Caudevilla, an important Fintech voice and a CBDC researcher. Delve into the realm of Central Bank Digital Currencies (CBDCs) and their transformative impact on Asia's payment landscape. Explore how CBDCs are revolutionizing cross-border transactions, accelerating payment processes, and fostering financial inclusion. Discover the innovative strategies and technologies driving Asia's embrace of CBDCs as a catalyst for faster, more efficient monetary transactions beyond traditional borders and cash systems.

#CBDC#Asia#digitalyuan#China#crossborder#payments#fintech#CBDCs#CentralBankDigitalCurrencies#Youtube

0 notes

Text

Trump Opposes Digital Money: What It Means for Banks and Your Wallet #accessibility #AlanGreenspan #Bitcoin #blockchaintechnology #CBDCS #centralbankdigitalcurrency #decentralizedcurrencies #economicpolicies #efficiency #financialinstitutions #financialsystem #futureofmoney #globalfinance #governmentcontrol #governments #individualfreedom #nationaldigitalcurrency #privacy #privatebanks #Security #stateissueddigitalcurrencies

#Politics#accessibility#AlanGreenspan#Bitcoin#blockchaintechnology#CBDCS#centralbankdigitalcurrency#decentralizedcurrencies#economicpolicies#efficiency#financialinstitutions#financialsystem#futureofmoney#globalfinance#governmentcontrol#governments#individualfreedom#nationaldigitalcurrency#privacy#privatebanks#Security#stateissueddigitalcurrencies

0 notes

Text

Bank of Canada's Digital Dollar: Benefits, Risks, and Next Steps for a Secure Payment System #accountbasedCBDC #BankofCanada #BankofCanadascommitmenttoCBDC. #benefitsandrisksofCBDC #cbdc #centralbankdigitalcurrency #collaborationforCBDC #developmentofdigitaldollarinCanada #digitaldollar #digitalpaymentsystem #economicimplicationsofCBDC #financialimplicationsofCBDC #issuanceofCBDC #privacyandsecurityofCBDC #technicalimplicationsofCBDC #tokenbasedCBDC

#Business#accountbasedCBDC#BankofCanada#BankofCanadascommitmenttoCBDC.#benefitsandrisksofCBDC#cbdc#centralbankdigitalcurrency#collaborationforCBDC#developmentofdigitaldollarinCanada#digitaldollar#digitalpaymentsystem#economicimplicationsofCBDC#financialimplicationsofCBDC#issuanceofCBDC#privacyandsecurityofCBDC#technicalimplicationsofCBDC#tokenbasedCBDC

0 notes

Text

What Is the Meaning of Central Bank Digital Currency (CBDC)?

What Is a Central Bank Digital Currency (CBDC)? In the swiftly evolving realm of finance today, digital currencies have emerged as a prominent subject of discourse. One term that has garnered substantial attention is CBDC, an acronym denoting Central Bank Digital Currency. In this exposé, we shall plunge into the labyrinthine world of CBDCs, delving into their objectives, classifications, the quandaries they seek to resolve, and the conundrums they may engender, all while juxtaposing them with the realm of cryptocurrencies.

What Is the meaning of Central Bank Digital Currency (CBDC)?

Central Bank Digital Currencies, or CBDCs, represent the digital incarnations of a nation's fiat currency, underwritten by the aegis of the central bank. These digital currencies serve a manifold array of pivotal purposes:

Understanding Central Bank Digital Currencies (CBDCs)

CBDCs aspire to extend the purview of financial services to a wider demographic, encompassing even those bereft of access to conventional banking infrastructures. This endeavor holds the potential to mitigate economic disparities and foster financial equilibrium. Objectives of Central Bank Digital Currencies (CBDCs) In the United States and various other nations, a significant portion of the population lacks access to financial services. Within the United States alone, statistics from 2020 reveal that 5% of adults did not possess a traditional bank account. Furthermore, an additional 13% of U.S. adults who did maintain such accounts opted for expensive alternative financial solutions, such as money orders, payday loans, and check-cashing services. This information is sourced from the "Report on the Economic Well-Being of U.S. Households in 2020" published by the Board of Governors of the Federal Reserve System. The primary objectives of Central Bank Digital Currencies (CBDCs) encompass the provision of privacy, transferability, convenience, accessibility, and financial security to both businesses and consumers. CBDCs possess the potential to alleviate the financial system's complexity-related maintenance costs, curtail cross-border transaction expenses, and offer more economical alternatives to individuals currently reliant on alternative money transfer mechanisms. Additionally, CBDCs hold the potential to mitigate the inherent risks associated with the utilization of existing digital currencies and cryptocurrencies. These digital assets are renowned for their extreme volatility, characterized by incessant fluctuations in value. This instability can potentially exert considerable financial strain on households and pose a threat to overall economic stability. In contrast, CBDCs, being government-backed and subject to central bank control, furnish households, consumers, and enterprises with a secure avenue for the exchange of digital currencies. Optimizing Transactional Efficiency CBDCs possess the capacity to streamline the labyrinthine web of payment systems, expediting transactions, ameliorating their cost-efficiency, and fortifying their security. This transformation assumes paramount significance in a progressively digitized milieu. Resisting the Onslaught of Cryptocurrencies In the wake of the ascendancy of cryptocurrencies such as Bitcoin, central authorities are canvassing the realm of CBDCs as a stratagem to assert dominance over their monetary policies and safeguard the stability of their fiscal edifices.

Taxonomy of CBDCs

CBDCs assume an eclectic array of incarnations, each characterized by its distinctive attributes and modalities: Retail CBDCs Retail CBDCs extend accessibility to the masses and facilitate everyday transactions, mirroring the functionality of tangible currency, albeit in a digital semblance. In the realm of fiscal innovation, Retail Central Bank Digital Currencies (CBDCs) emerge as sanctioned digital tender, catering to the needs of both consumers and enterprises. One distinguishing facet of Retail CBDCs lies in their potential to obliterate the looming specter of intermediary jeopardy. This pertains to the unnerving likelihood that private purveyors of digital currencies may, at any juncture, succumb to insolvency, thereby endangering the assets entrusted to them by their clientele. The universe of Retail CBDCs unfolds in two distinct variations, each diverging significantly in the manner through which individual users are bestowed access and leverage over their pecuniary resources: Token-based Retail CBDCs, an embodiment of cryptographic prowess, grant entry through the deployment of private keys, public keys, or an amalgamation of both. This labyrinthine method of authentication bestows upon users the cloak of anonymity when engaging in financial transactions of their choosing. In stark contrast, the realm of Account-based Retail CBDCs mandates a digital entreaty of one's unique identity before the vault of financial assets unveils itself for perusal and utilization. This intricate tapestry of Retail CBDCs underscores the pivotal intersection between the digital epoch and conventional fiscal paradigms. It is an alchemical fusion where security and accessibility coalesce in a symphony of innovation, offering a tantalizing glimpse into the future landscape of currency and finance. Wholesale CBDCs Tailored for the consumption of financial institutions and governmental bodies, wholesale CBDCs primarily cater to interbank settlements and large-scale financial transactions. Token-Based CBDCs Operating on the bedrock of blockchain technology, token-based CBDCs offer a conduit for transactions marked by invulnerability and transparency. They are frequently lauded for their potential to curtail fraudulent activities and augment traceability.

Issues Created by CBDCs Explained

In the event of a substantial transformation in the financial framework of the United States, the repercussions on household expenditures, investment portfolios, banking reserves, interest rate dynamics, the financial services sector, and the overall economy remain shrouded in uncertainty. The potential impacts of transitioning to a Central Bank Digital Currency (CBDC) on the stability of the financial system also dwell in the realm of the unknown. To illustrate, there might not be an ample reservoir of central bank liquidity to facilitate withdrawals amidst a financial upheaval. Central authorities employ monetary policies as instruments for shaping the trajectories of inflation, interest rates, lending practices, and consumer spending, all of which, in turn, exert profound influences on the state of employment rates. It is imperative for central banks to ensure that they possess the requisite tools to exert constructive influences on the broader economic landscape. The paramount motivation behind the ascent of cryptocurrencies lies in the preservation of privacy. However, the introduction of Central Bank Digital Currencies raises the specter of an inevitable degree of intrusion by regulatory entities in their pursuit of vigilance against financial misconduct. The surveillance apparatus is indispensable as it bolsters the collective resolve to combat the scourge of money laundering and the financing of terrorism. Cryptocurrencies have, time and again, found themselves within the crosshairs of cybercriminals and malefactors. A digital currency backed by a central bank would invariably attract the same cohort of nefarious actors. Consequently, the fortifications against system breaches and the pilfering of assets and sensitive information must be robust and impervious.

The Vicissitudes Addressed and Unfurled by CBDCs

While CBDCs proffer a plethora of merits, they concurrently unfurl a tapestry of quandaries: Vexations of Privacy The inherently digital character of CBDCs ushers forth concerns pertaining to individual privacy, as central banks gain the means to meticulously monitor transactions. Striking an equilibrium between transparency and privacy looms as a formidable challenge. Cybersecurity Perils CBDCs stand susceptible to the malevolent machinations of cyber assailants, thereby underscoring the imperative of fortifying the security apparatus to shield the bulwark of the financial framework. Economic Ramifications The introduction of CBDCs can usher in a gamut of ramifications for traditional banking systems, potentially sowing the seeds of disruptions and catalyzing transformations within the financial landscape.

CBDCs vs. Cryptocurrencies: A Comparative Discourse

It becomes imperative to demarcate the demesne of CBDCs from that of cryptocurrencies, as they share semblances yet remain underpinned by profound disparities:

Centrally Orchestrated Governance

CBDCs emanate from the sanctums of central banks, ensconced within the ambit of governmental regulation, thereby buttressing governmental control over the financial matrix. In contrast, cryptocurrencies navigate a trajectory independent of any central overseer.

Tenacity in Valuation

CBDCs, as a rule, inhabit a realm of greater stability concerning their valuation, given their moorings to the fiat currency of the land. Cryptocurrencies, conversely, frequently traverse terrain marked by capricious price fluctuations.

Legal Tender Status

CBDCs enjoy the hallowed status of legal tender, signifying their recognition and acceptance for all transactions transpiring within the precincts of a nation. Cryptocurrencies may not bask in the same legal imprimatur.

Conclusion

In summation, Central Bank Digital Currencies (CBDCs) emerge as a momentous chapter in the annals of financial evolution, casting their gaze upon the modernization of payment systems, the augmentation of financial inclusivity, and the endowment of governments with heightened dominion over their monetary policies. Despite their manifold virtues, CBDCs unfurl a complex tapestry, one replete with intricacies that mandate judicious contemplation and a regimen of judicious regulation. As the financial cosmos continues its inexorable metamorphosis, CBDCs are poised to play a seminal role in sculpting the visage of the forthcoming monetary order. Read the full article

0 notes

Text

Central Bank Digital Currencies Global Economy Embracing

The growing importance of digital currencies signifies their potential to revolutionize the global economy. This comprehensive article examines the critical roles of cryptocurrencies and central bank digital currencies (CBDCs) within the dynamic financial world. Introduction: The rise of central bank digital currencies and their impact on the global economy As CBDCs gain mainstream attention, it's essential to understand how they are shaping the future of the global economy. This introduction will provide an overview of the role CBDCs play in modern finance.

1. Expansion of Central Bank Digital Currencies

Delving into the rapid growth of CBDCs, this section evaluates their increasing influence on traditional financial systems. The discussion will cover the development, adoption, and potential benefits of various CBDCs.

2. Innovations in Digital Currencies Issued by Central Banks

The article will assess central banks' efforts worldwide in developing their own digital currencies. It also takes into account the thought-provoking advantages and challenges of implementing CBDCs in national and international financial systems, focusing on efficiency, security, and financial inclusivity.

3. Navigating Regulatory and Policy Challenges for CBDCs

In this segment, the article will analyze the obstacles faced by governments and regulatory authorities in creating transparent legal frameworks for CBDCs. It emphasizes addressing crucial issues such as taxation, money laundering, investor protection, and maintaining financial stability in the face of evolving technology.

4. Impact of Central Bank Digital Currencies on Businesses and Consumers

This section will discuss how CBDCs affect businesses and consumers, such as reduced transaction costs, faster payment processing times, and the emergence of innovative financial services. Moreover, it will highlight the risks and rewards involved for users and entrepreneurs venturing into the CBDC space.

Conclusion: The Evolving Influence of CBDCs in the Global Economy The conclusion will outline the evolving influence of digital currencies in the global economic landscape. It will stress digital currencies' capacity to reshape the financial system while considering future growth opportunities and identifying potential

Overall, this in-depth exploration of central bank digital currencies aims to provide valuable insights into their expanding influence within the global economy. By dissecting the latest advancements in CBDCs and understanding the regulatory challenges, the article sets the stage for a more interconnected and innovative financial future "Learn more about the global economic trends we've covered previously." Read the full article

0 notes

Text

The Rise of Central Bank Digital Currencies (CBDCs) in the Face of Crypto Market Challenges

The cryptocurrency market has faced significant challenges in recent times, but this hasn't deterred central banks from exploring the potential of central bank digital currencies (CBDCs). In fact, the number of central banks interested in launching CBDCs has doubled since last year, signaling a growing trend towards digitalizing national and international currencies. According to a recent survey conducted by the Bank for International Settlements (BIS), the emergence and proliferation of stablecoins and other cryptoassets have accelerated the work on CBDCs for 60% of central banks surveyed. This article explores the rise of CBDCs, their impact on financial stability, and the future prospects for these digital currencies.

CBDCs: A Threat to Financial Stability?

The BIS survey highlights concerns about the potential threat to financial stability posed by cryptoassets, especially stablecoins, if they become widely used for payments. In response, regulatory authorities such as the Committee on Payments and Market Infrastructures (CPMI), the International Organization of Securities Commissions (IOSCO), the Financial Stability Board (FSB), and the Basel Committee on Banking Supervision (BCBS) have published updated or new guidance and standards to mitigate the risks associated with stablecoins and crypto activities in general.

The Global Adoption of CBDCs

Currently, approximately a quarter of central banks worldwide are piloting a retail CBDC, with over two dozen state-backed digital currencies expected to launch by 2030, according to the BIS. CBDCs are digital forms of a country's or economic zone's currency, issued and regulated by the central bank. Similar to stablecoins, which peg their value to fiat currency, CBDCs have already been issued by countries such as Nigeria, Jamaica, the Bahamas, and the Eastern Caribbean. The survey indicates that 15 consumer-facing retail CBDCs and nine wholesale CBDCs, designed for transactions between financial institutions, are expected to launch across the globe by the end of the decade.

CBDCs and Central Bank Intentions

Despite the growing interest in CBDCs, not all central banks are convinced of the immediate necessity to issue their own digital currencies. While 93% of central banks are currently investigating CBDCs in some capacity, a significant number of them have expressed hesitation in issuing CBDCs anytime soon. The BIS report notes a clear divergence among central banks compared to the previous year, with some becoming more likely to launch a CBDC within the next three years, while others are less inclined to do so.

The United States and CBDCs

One notable country that has yet to decide on the path forward for CBDCs is the United States. In a recent announcement, a U.S. Treasury official revealed that the department has not yet determined whether it will pursue the development of a CBDC. The decision-making process in the U.S. reflects the ongoing debate surrounding the advantages and challenges associated with CBDCs. It remains to be seen how the United States will position itself in this evolving landscape.

Conclusion

The rise of CBDCs represents a significant shift in the global financial landscape. Despite the challenges faced by the crypto market, central banks are actively exploring the potential of CBDCs as a means to enhance financial stability and enable more efficient transactions. While some central banks are moving closer to issuing their own digital currencies, others remain cautious. The future of CBDCs is likely to shape the way we perceive and use money on a global scale. As the landscape continues to evolve, it will be crucial to strike a balance between innovation and ensuring the stability and integrity of the financial system. For more articles visit: Cryptotechnews24 Source: decrypt.co

Related Posts

Read the full article

#CBDCs#centralbankdigitalcurrencies#CryptoMarket#CryptoNews#financialstability#globalfinanciallandscape#globaltransactions#innovation#money#regulatoryauthorities#Stablecoins#U.S.Treasury#UnitedStates

0 notes

Text

#CBDCs#CentralBankDigitalCurrencies#WorldEconomicForum#666#end time prophecy#bible prophecy#news & analysis#bible news

0 notes

Text

Digital Currency Transformation: Why CBDCs Are Reshaping Finance

youtube

In this engrossing video, we delve into the rapidly changing universe of central bank digital currencies (CBDCs) and how they are revolutionizing the future of money. From digital dollars to the digital rupee, CBDCs are not ideas—they're being seriously studied, tested, and implemented by more than 130 nations accounting for 98% of world GDP. Unlike other cryptocurrencies like Bitcoin or Ethereum, CBDCs are secure, government-issued digital versions of a country's money, with the same feel as physical currency but the speed and efficiency of technology. The video explains how this worldwide change is occurring now—fading use of cash, growing use of private digital assets, drive for financial inclusion, and demand for faster, lower-cost cross-border payments. You'll discover what CBDCs are, how they function, and what their possible advantages and disadvantages could be. What they might do to your privacy, banking, and daily life is also revealed. Whether you're interested in technology, investing, or just eager to know the future of money, this video provides crucial facts about the CBDC revolution.

#centralbankdigitalcurrency#cbdc#digitalcurrency#futureofmoney#fintech#cryptonews#blockchaintechnology#financialinclusion#digitalpayments#moneyrevolution#cbdcexplained#digitaleconomy#bankingfuture#privacyandsecurity#globalfinance#Youtube

0 notes

Text

youtube

CBDCs: The Global Digital Currency Revolution (2025) Global CBDC adoption is accelerating! By 2025, 98% of world GDP is involved in research, piloting, or rolling out Central Bank Digital Currencies. We discuss this transformative shift in finance. #CBDC #DigitalCurrency #CentralBankDigitalCurrency #Finance #Economy #2025 #GlobalFinance #FutureOfMoney #Fintech #DigitalTransformation https://www.youtube.com/shorts/kNpseUTBXyw via Finance Facts https://www.youtube.com/channel/UCt7hodOQyoeTtsXOKgCB6kQ June 20, 2025 at 09:36AM

#personalfinance#financialfreedom#investingtips#financialeducation#protectyourmoney#financesafety#financefacts#Youtube

0 notes

Photo

🔥 Hong Kong is jumping into the CBDC game, and they're using the badass Chainlink protocol! 🚀💰 This isn't just some half-baked scheme; it’s a full-blown pilot exploring the potential of their e-HKD! 💥 With Chainlink's Cross-Chain Interoperability Protocol, they're ready to smash boundaries between blockchains. Hong Kong is not here to play nice; they're in it to prove CBDCs can be revolutionary! 🌏🔗 Stay tuned for more chaos in the crypto space. Want the latest in crypto madness? Subscribe to CryptoMaxGo! #Crypto #CBDC #Chainlink #HongKong #eHKD #BlockchainRevolution #CryptoNews #Innovation #CentralBankDigitalCurrency

0 notes

Text

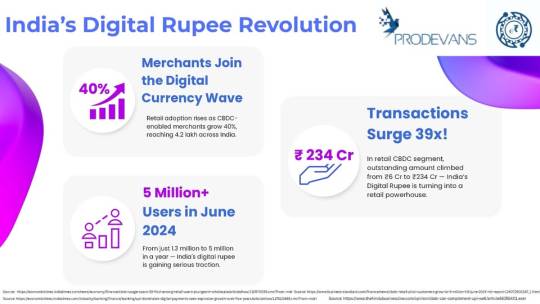

India’s Digital Rupee Revolution is driving a major shift in the country’s financial landscape.

With a 40% rise in CBDC-enabled merchants reaching 4.2 lakh, and transactions surging 39 times from ₹6 Cr to ₹234 Cr, the retail digital rupee is quickly becoming a mainstream payment method. User adoption is also accelerating, with over 5 million individuals onboarded by June 2024, up from just 1.3 million a year ago.

Prodevans is proud to support this transformation by enabling secure, scalable, and future-ready digital infrastructure.

Visit: https://www.prodevans.com/

#DigitalRupee#CBDCIndia#DigitalCurrency#Prodevans#DigitalPayments#FintechIndia#RetailCBDC#IndiaFintech#FinancialInclusion#DigitalEconomy#TechForFinance#BankingTransformation#PaymentSolutions#FintechGrowth#FutureOfMoney#CentralBankDigitalCurrency

0 notes