#DigitalCurrencies

Text

Why People Oppose CBDCs and the Laws Enacted to Fight Them

Central Bank Digital Currencies (CBDCs) have become a hot topic in the world of finance. These digital currencies, issued by central banks, promise to revolutionize the way we transact. However, they also face significant opposition. This article explores the reasons behind the opposition to CBDCs and the legislative actions taken against them.

What are CBDCs?

CBDCs are digital versions of a country’s fiat currency, issued and regulated by the central bank. Unlike decentralized cryptocurrencies such as Bitcoin, CBDCs are controlled by the government. Countries like China and the Bahamas have already launched their versions of CBDCs, while many others, including the United States, are exploring their potential.

Reasons for Opposition

Privacy Concerns

One of the primary concerns about CBDCs is the potential for government surveillance. Unlike cash transactions, which are anonymous, digital transactions can be tracked. This could allow governments to monitor individuals’ spending habits and financial activities closely. For instance, a government could potentially know what you buy, when you buy it, and where you buy it. This level of surveillance is unsettling for many who value their financial privacy.

Control and Censorship

CBDCs could also give governments unprecedented control over personal finances. They could, for example, freeze accounts or limit what individuals can spend their money on. This level of control raises concerns about potential misuse of power. Imagine a scenario where political dissenters find their access to funds restricted because of their opposition to the government.

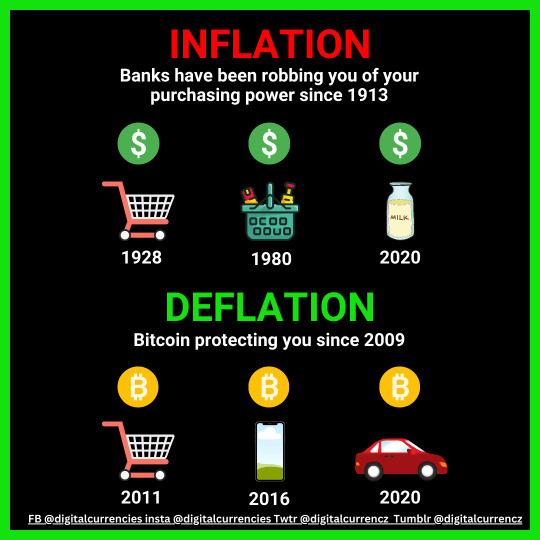

Economic Freedom

Opponents of CBDCs argue that they could erode financial autonomy. Decentralized cryptocurrencies like Bitcoin offer an alternative to the traditional financial system, promoting financial freedom and independence. In contrast, CBDCs are seen as a tool for reinforcing governmental control over the economy.

Security Risks

Digital currencies are susceptible to cyber-attacks and fraud. The infrastructure supporting CBDCs would need to be highly secure to prevent hacking and protect users’ funds. Any vulnerabilities in the system could have severe consequences, including financial losses and disruptions in the economy.

Laws and Regulations Against CBDCs

Opposition to CBDCs has led to the introduction of various laws aimed at restricting or prohibiting their use. Several states in the US have taken significant steps in this direction.

State-Level Legislation

South Dakota: Recently passed a law prohibiting the state from accepting CBDCs as payment and blocking participation in CBDC trials.

Indiana, Florida, and Alabama: Between April and June 2023, these states passed laws excluding CBDCs from the definition of money under the Uniform Commercial Code, potentially discouraging business usage.

Oklahoma: Passed a law preventing the state from participating in CBDC trials or using CBDCs.

Federal-Level Legislation

CBDC Anti-Surveillance State Act: In September 2023, the House Financial Services Committee voted in favor of this act, which would prohibit the Federal Reserve from issuing a CBDC directly to individuals or using it for monetary policy. This bill still needs to pass the full House and Senate.

Political Stances: Former President Donald Trump has vowed to block a CBDC if he becomes President again.

Impact of Opposition

The opposition to CBDCs has significant implications for their adoption and implementation. State-level laws and proposed federal bills create substantial hurdles, signaling strong resistance to their rollout. Concerns about financial privacy and government overreach play a crucial role in shaping public opinion and legislative action. If the opposition successfully limits or prevents the rollout of CBDCs, it could influence global approaches to digital currencies.

Conclusion

The debate over CBDCs is far from over. While they promise to modernize the financial system, the concerns about privacy, control, economic freedom, and security cannot be ignored. The laws and regulations against CBDCs reflect a broader political and societal debate about the future of money and financial autonomy. As this debate continues, it is essential to stay informed and engaged with developments in digital currencies.

Call to Action

What are your thoughts on CBDCs? Do you support their implementation, or do you have concerns about their impact? Share your opinions in the comments section below.

For more insights on financial freedom and digital currencies, subscribe to our blog and join the conversation. Don't forget to check out our YouTube channel, Unplugged Financial, where we dive deeper into these topics with in-depth analyses, expert interviews, and practical advice. Join us as we explore the future of money and the potential for a financial revolution!

Subscribe to our blog for the latest articles: Unplugged Financial Blog

Watch our videos and subscribe to our YouTube channel: Unplugged Financial YouTube Channel

Let's learn about the Bitcoin evolution together!

#CentralBankDigitalCurrencies#CBDCs#Bitcoin#FinancialPrivacy#GovernmentSurveillance#DigitalCurrencies#DecentralizedFinance#StateLegislation#FederalLegislation#EconomicFreedom#FinancialAutonomy#CBDCOpposition#DigitalCurrencySecurity#MonetaryPolicy#AntiCBDCLaws#PrivacyConcerns#EconomicControl#DigitalFinancialInfrastructure#Cryptocurrency#FinancialRevolution#financial education#financial empowerment#financial experts#digitalcurrency#blockchain#finance#unplugged financial#globaleconomy

2 notes

·

View notes

Text

Navigating the Regulatory Waters: Fintech and Digital Currencies 🌊💻📈

Hey Tumblr fam! Today, let's dive into the complex world where finance meets technology and explore how regulators are navigating the rise of fintech in the era of digital currencies. 💰🚀

🔍 The Fintech Frontier: Fintech, short for financial technology, has been transforming the financial landscape with innovations ranging from mobile payments to robo-advisors. But as digital currencies like Bitcoin and Ethereum gain traction, regulators are facing new challenges in keeping pace with these technological advancements.

💡 The Digital Currency Dilemma: Digital currencies operate on decentralized networks, offering benefits like faster transactions and reduced fees. However, their decentralized nature also raises concerns about security, money laundering, and consumer protection. Regulators are grappling with striking a balance between fostering innovation and safeguarding the interests of consumers and the financial system.

📝 Regulatory Responses: Regulators worldwide are stepping up efforts to establish clear guidelines for fintech firms operating in the digital currency space. This includes licensing requirements, anti-money laundering measures, and investor protection protocols. Additionally, some countries are exploring the potential of central bank digital currencies (CBDCs) as a regulated alternative to private cryptocurrencies.

🌐 Global Coordination: Given the borderless nature of digital currencies, regulatory efforts often require international collaboration. Forums like the Financial Stability Board (FSB) and the Basel Committee on Banking Supervision play a crucial role in facilitating dialogue and harmonizing regulatory approaches across jurisdictions.

🚀 Fostering Innovation Responsibly: While regulations are essential for maintaining stability and protecting consumers, overly restrictive measures can stifle innovation. Regulators are striving to strike a delicate balance that encourages fintech innovation while mitigating potential risks associated with digital currencies.

💬 Join the Conversation: What are your thoughts on the regulation of fintech in the era of digital currencies? Do you believe regulators are striking the right balance between innovation and oversight? Share your insights in the comments below! Let's keep the conversation going. 💬✨

Let's stay informed and engaged as we navigate the ever-evolving intersection of finance and technology! 💻🌐

#finance#thefinrate#payment gateway#fintech#financialinsights#financetalks#finance101#fintechrevolution#FintechRegulation#DigitalCurrencies#FinanceInnovation

0 notes

Text

"Your Gateway to the Crypto Universe: Start Trading Now!"

"Embark on your crypto journey with us! Our exchange platform offers a gateway to the vast world of digital currencies. Trade securely, access real-time market data, and diversify your portfolio effortlessly."

0 notes

Text

Tether Freezes Cryptocurrency Wallets Over Sanctions: What It Means for Digital Money

#2020USpresidentialelection #compliance #credibility #cryptocommunity #decentralization #digitalassetecosystem. #digitalcurrencies #frozenwallets #illicitfinancing #lawenforcementagencies #privacy #regulatorylandscapes #Russianactors #sanctions #stablecoinissuer #strictregulations #terroristgroups #tether #trust #USTreasuryDepartment

#Business#2020USpresidentialelection#compliance#credibility#cryptocommunity#decentralization#digitalassetecosystem.#digitalcurrencies#frozenwallets#illicitfinancing#lawenforcementagencies#privacy#regulatorylandscapes#Russianactors#sanctions#stablecoinissuer#strictregulations#terroristgroups#tether#trust#USTreasuryDepartment

0 notes

Text

Digital Money: Navigating the World of Online Transactions

In this guide, we delve into the dynamic world of digital money, exploring how digital currencies, online banking, and mobile payment apps are working.

0 notes

Photo

CBDC's FAQ"S https://medium.com/@crypto101bylauriesuarez/central-bank-digital-currencies-cbdcs-faq-7b9e7d748556

0 notes

Text

#DigitalCurrencies#InvestmentOpportunities#TeslaCoin#Cryptocurrency#HighReturns#EarlyAdoption#BlockchainTechnology#FinancialRevolution#Diversification#Innovation#FutureGrowth#InvestorInterest#DecentralizedFinance#Disruption#InvestmentPortfolio#PotentialGains#CryptoInvesting#InvestmentStrategy#MarketTrends#CryptoMarket

0 notes

Text

The Rise of Bitcoin and Digital Assets in Traditional Finance

In recent years, the financial landscape has witnessed a remarkable transformation as Bitcoin and digital assets have gained significant traction within traditional finance. What was once viewed with skepticism by Wall Street giants has now become an undeniable force shaping the future of the industry. The rise of Bitcoin and digital assets in traditional finance represents a paradigm shift, challenging long-standing norms and offering new possibilities for investors, institutions, and the global economy. In this article, we will delve into the evolving stance of Wall Street, explore the factors driving this adoption, and examine the potential implications for the future of finance.

Wall Street's Change of Heart

In 2017, Larry Fink, the founder and CEO of BlackRock, referred to Bitcoin as an "index of money laundering." However, six years later, in 2023, Fink surprised the financial world by submitting an application for a Bitcoin spot ETF with the US Securities and Exchange Commission (SEC). Not only did Fink express his support for Bitcoin, but he also emphasized its potential to revolutionize the financial landscape, considering it as a digitized form of gold.

Shifting Perspectives: Wall Street's Growing Interest in Crypto

Larry Fink is not the only Wall Street titan to have experienced a change of heart towards Bitcoin. Billionaire financier Ken Griffin, who once called the crypto sector a "jihadist call" against the USD, has also shifted his stance. Griffin's electronic trading company, Citadel Securities, is now backing a platform that facilitates institutional investors' participation in digital currency trading.

Fidelity Investments, the largest 401(k) administrator in the US, is another major player exploring crypto. In 2022, Fidelity allowed its workers to invest a portion of their retirement savings in Bitcoin. Additionally, its subsidiary, Fidelity Digital Assets, has invested in EDX, a new crypto exchange. Notably, Fidelity filed for a Bitcoin spot ETF just two weeks after BlackRock, signaling Wall Street's growing interest in cryptocurrencies.

From Disruption to Assimilation

Initially, the crypto industry aimed to challenge Wall Street and Washington's dominance over the US financial system. However, a significant shift is occurring, as Wall Street now seeks to integrate with the crypto industry and join its ranks. This development is particularly striking given the crypto sector's weakened state, resulting from a prolonged crypto winter and increased regulatory scrutiny by the US SEC.

Traditional Finance Adopts Crypto Amid Challenges

The crypto sector in the US currently finds itself at a crossroads due to a series of challenges. The industry has faced a year of price declines, company failures, and bankruptcies, which have dampened interest in digital assets. Regulatory crackdowns have targeted crypto companies and their executives, resulting in criminal charges for entrepreneurs and public shaming of celebrity endorsers.

However, these challenges have presented an opportunity for financial giants to offer a streamlined selection of crypto products and services that are less likely to attract regulatory scrutiny. Consequently, many users are now willing to embrace these offerings.

The Future of Crypto's Ambition

As the weakened crypto industry seeks to regain strength, its ambition to democratize finance is put to the test. Matthew Sigel, from VanEck, suggests that during bear markets, assets often transition from weak to strong hands. Similarly, this phenomenon appears to be happening in the crypto industry as well.

The embrace of cryptocurrencies by Wall Street giants like BlackRock, Fidelity, and Citadel Securities signifies a seismic shift in the financial landscape. While the crypto sector faces challenges and regulatory obstacles, the adoption by traditional finance players offers new opportunities for growth and mainstream acceptance.

Conclusion

As we reach the end of our exploration into the rise of Bitcoin and digital assets in traditional finance, it becomes clear that a seismic shift is underway. Wall Street, once hesitant and skeptical, now embraces the potential of cryptocurrencies to revolutionize the financial landscape. The adoption by industry giants such as BlackRock, Fidelity, and Citadel Securities not only provides a stamp of approval but also signals a wider acceptance and integration of digital assets into mainstream finance. While challenges and regulatory hurdles persist, the increased participation of traditional finance in the crypto sector brings new opportunities for growth, innovation, and the democratization of finance. As we move forward, it will be fascinating to witness how this synergy between digital assets and traditional finance unfolds and shapes the future of the global economy.

For more articles visit: Cryptotechnews24

Source: cryptonews.com

Related Posts

Read the full article

#Bitcoin#BlackRock#CitadelSecurities#cryptoindustry#CryptoNews#cryptowinter#digitalcurrencies#Fidelity#financialgiants#LarryFink#SEC#USSEC#WallStreet

0 notes

Text

Cryptocurrency Investment Guide: How to Navigate the Digital Currency Market

Cryptocurrency: A Comprehensive Guide to Successfully Investing in Digital Currencies

By Amir Shayan

Cryptocurrency has emerged as a revolutionary asset class, attracting the attention of investors worldwide. With the rise of Bitcoin and other digital currencies, the market has witnessed incredible growth and volatility. If you're considering entering the world of cryptocurrency investment, it's essential to arm yourself with the knowledge and strategies necessary to navigate this evolving market successfully. This comprehensive guide will provide you with insights, tips, and practical advice on how to navigate the digital currency market and make informed investment decisions.

- Understanding Cryptocurrency

To start your cryptocurrency investment journey, it's crucial to understand the fundamental concepts of digital currency. This section will cover the basics, including what cryptocurrencies are, how they work, and the technology behind them, such as blockchain. You'll also learn about the different types of cryptocurrencies and their unique characteristics.

- Evaluating Investment Opportunities

Once you have a solid understanding of cryptocurrency, it's time to explore investment opportunities. This section will guide you through the process of evaluating various cryptocurrencies based on factors such as market capitalization, technology, team, and community. You'll learn how to analyze whitepapers, track market trends, and identify promising projects for potential investment.

- Managing Risk and Security

Cryptocurrency investments come with inherent risks, including market volatility and security threats. This section will teach you essential risk management techniques to protect your investments. You'll learn about setting realistic investment goals, diversifying your portfolio, and implementing security measures to safeguard your digital assets.

- Technical Analysis and Trading Strategies

Technical analysis plays a crucial role in understanding cryptocurrency price movements and identifying potential trading opportunities. In this section, you'll discover popular technical analysis tools and indicators used by traders. You'll also learn about different trading strategies, including day trading, swing trading, and long-term investing, and how to apply them to the cryptocurrency market.

- Fundamental Analysis and Research

In addition to technical analysis, understanding the fundamental aspects of a cryptocurrency is essential for informed investment decisions. This section will delve into fundamental analysis, including evaluating the project's team, partnerships, roadmap, and adoption potential. You'll learn how to conduct thorough research and make data-driven investment choices.

- Wallets and Exchanges

To participate in the cryptocurrency market, you'll need a digital wallet to store your assets and a reliable cryptocurrency exchange to facilitate trading. This section will guide you through the process of choosing the right wallet and exchange based on factors like security, ease of use, and available features. You'll also learn about cold storage options and best practices for securing your cryptocurrency holdings.

- Market Trends and Regulatory Landscape

The cryptocurrency market is influenced by various factors, including market trends and regulatory developments. This section will explore the current trends shaping the digital currency market and provide insights into the regulatory landscape. You'll learn how to stay updated with market news, monitor regulatory changes, and adapt your investment strategy accordingly.

- Emotional Intelligence and Mindset

Successful cryptocurrency investment goes beyond technical analysis and market research. Emotional intelligence and mindset play a significant role in navigating the highs and lows of the market. This section will focus on developing emotional intelligence, managing emotions, and maintaining a disciplined approach to investment. You'll learn techniques to overcome fear, greed, and FOMO (fear of missing out) and make rational decisions.

- Tax Considerations and Legal Compliance

As cryptocurrencies gain mainstream adoption, tax regulations and legal compliance become important considerations for investors. This section will provide an overview of cryptocurrency taxation and guide you on fulfilling your legal obligations. You'll learn about reporting requirements, taxable events, and strategies for minimizing tax liabilities.

- Future Trends and Opportunities

The cryptocurrency market is constantly evolving, presenting new trends and opportunities. In this final section, we'll explore the future of digital currencies, including emerging technologies like decentralized finance (DeFi) and non-fungible tokens (NFTs). You'll gain insights into potential growth areas and how to position yourself for success in the ever-changing landscape.

Conclusion

Navigating the digital currency market requires knowledge, strategy, and a disciplined approach. By following the insights and strategies outlined in this cryptocurrency investment guide, you'll be well-equipped to make informed decisions and maximize your chances of success. Remember, cryptocurrency investment comes with risks, so it's essential to do your due diligence and stay informed. With the right mindset and continuous learning, you can navigate the digital currency market with confidence and seize the opportunities it presents.

Read the full article

#blockchaintechnology#cryptomarket#cryptocurrencyinvestments#cryptocurrencywallets#digitalcurrencies#fundamentalanalysis#investmentstrategies#regulatorylandscape#Riskmanagement#Technicalanalysis

0 notes

Link

The following are 8 signs that the futuristic control freak agenda of the globalists is rapidly moving forward. We must fight these globalist changes.

0 notes

Text

Kapital (YC W22), the data-driven neobank for SMBs and entrepreneurs in Latam, launched a corporate digital dollar card secured by blockchain technology to provide protection against the devaluation of the Colombian peso. The card allows businesses to perform international transfers, access exclusive Mastercard World Elite benefits, and manage their accounts and payments through the Kapital platform.

#ycombinator#latam#latamstartups#fintech#fintechnews#fintechstartups#digitalbanking#neobank#neobanking#blockchain#digitalcurrencies#crypto#mexico

0 notes

Photo

US regulators sued Binance for encouraging customers to buy unregistered crypto commodities

The US Commodity Futures Trading Commission (CTFC) is suing Binance, alleging that the popular crypto exchange illegally sold crypto derivatives—for currencies including bitcoin, ethereum, litecoin, tether, and binance USD— to retail investors.Read more...

https://qz.com/crypto-bitcoin-binance-ctfc-regulation-etherum-tether-1850270094

#binance#money#business2cfinance#jackdorsey#cryptocurrencies#economy#creditsuisse#bitcoin#firstcitizensbank#commodityfuturestradingcommission#tether#changpengzhao#digitalcurrencies#bitmex#Diego Lasarte#Quartz

0 notes

Photo

Don’t mind us. We’re just over here sipping tea while everyone flips a lid over the issues we warned would be issues more than a year ago and continued to talk about all the way through this fall. 🕰️🕰️ tick tock tick tock Does the alarm really have to go all the way off before you wake up? . . . . . . . . #preparedness #preparednotscared #beprepared #bepreparedforanything #bankrun #siliconvalleybank #fdic #centralbank #centralbanks #cryptocurrency #crypto #nft #winterstorm #tornado #hurricane #flooding #digitalcurrency #digitalcurrencies #growfood #growfoodnotlawns #growfoodnotgrass #foodforests #foodforest #thegreatdepression #cookathome #nineveh #voiceinthewilderness #cooking #homecooking #cookingram (at The Interwebs) https://www.instagram.com/p/CpsUSpBucZ6/?igshid=NGJjMDIxMWI=

#preparedness#preparednotscared#beprepared#bepreparedforanything#bankrun#siliconvalleybank#fdic#centralbank#centralbanks#cryptocurrency#crypto#nft#winterstorm#tornado#hurricane#flooding#digitalcurrency#digitalcurrencies#growfood#growfoodnotlawns#growfoodnotgrass#foodforests#foodforest#thegreatdepression#cookathome#nineveh#voiceinthewilderness#cooking#homecooking#cookingram

0 notes

Text

0 notes

Link

Checkout my latest video! https://www.cryptonewsbylauriesuarez.com/how-will-we-use-digital-currencies-to-pay-for-everyday-items/

0 notes

Text

How To Store Your Digital Currency

When it comes to cryptocurrency, the term "wallet" is used to describe a digital currency storage account. It's where you store your coins and other related information. There are many types of wallets, but they all have one thing in common. They are designed to store digital currency for the purpose of exchanging it for goods or services.

In the case of cryptocurrency, the coins can be divided into two categories. The first is digital currencies that exist only online. These are known as "cryptocurrencies". The second is "digital assets" which are virtual representations of real world items such as gold, silver and diamonds. This type of asset is usually referred to as "crypto-assets".

When it comes to storing your digital currency, there are three main types of wallets. The first is an online wallet. This is a web site where you can log in and view your digital currency. You can also send and receive money from other users. Most of these sites offer free accounts. However, if you want to make sure that your digital currency is secure, you should consider a more expensive wallet.

The next type of wallet is a software application. These are often available as freeware or shareware. When you download this type of software, you will find that it will be installed onto your computer. Once it's installed, you can use it to access your digital currency.

Finally, you can choose to store your digital currency on a hardware device. These are known as "hardware wallets". These devices come in a variety of shapes and sizes. Some of them look like a USB drive, while others are shaped like a credit card. You can use these to store your digital currency safely.

Now that you know how to store your digital currency, you'll want to find a place where you can get it. Many people choose to buy their digital currency through an exchange. An exchange is a website that allows you to buy and sell digital currency. For example, you can buy bitcoin with your credit card at Coinbase.

There are also many other ways to buy and sell digital currency, including over the phone, by mail and through social media. It's important to note that no matter how you choose to buy and sell your digital currency, you must keep your digital currency safe. This means that you should always use a hardware wallet. You should also never give out any personal information when buying or selling digital currency.

https://popscrypto.com/index.php/2022/08/05/how-to-store-your-digital-currency/

0 notes