#Citigroup

Text

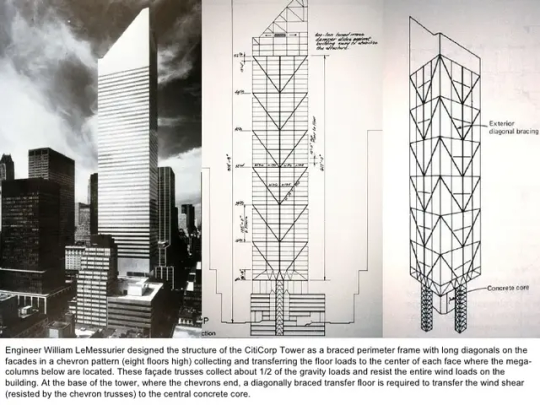

Citigroup Center

30 notes

·

View notes

Text

George Santos made history when he unexpectedly became the first non-incumbent out gay Republican to be elected to Congress in a "red wave" that swept New York state in the November midterm elections.

And according to a New York Times investigation, he may have a historically large amount of questions to answer about his resume.

The investigation found that Santos, who was elected to represent a Long Island district currently held by Democratic Rep. Tom Suozzi, may have made numerous misrepresentations of key aspects of his background.

FIRST, HIS DESCRIPTION OF HIS EMPLOYMENT DOESN'T ADD UP:

• His biography says he's worked at Goldman Sachs, but spokeswoman Abbey Collins told the Times there's no record of his employment at the company.

• He's also said he was a "associate asset manager" at Citigroup, but spokeswoman Danielle Romero-Apsilos said it also couldn't confirm that he worked there, and said that the company sold off its asset management operations in 2005, which is five years before he claims to have graduated college.

• The Times found no IRS record of his a charity he says he owns, Friends of Pets United, and the beneficiary of a 2017 fundraiser by the group told the Times that they'd never received any of the money that was raised.

SECOND, HE'S REPORTEDLY FACED NUMEROUS EVICTIONS, CLAIMED TO BE A LANDLORD HIMSELF, AND MAY NOT LIVE AT HIS CURRENT ADDRESS:

• He was evicted in 2015 from a residence in Whitestone, Queens, after owing $2,250 in unpaid rent, per the Times. The landlord, Maria Tulumba, told the paper he was a "nice guy" and "respectful" tenant.

• He was evicted in 2017 from a residence in Sunnyside, Queens, after owing more than $10,000 in unpaid rent. Santos received a $12,208 fine.

• He claimed to be a landlord in 2021, but did not list any properties in New York on financial disclosure forms from either his 2020 or 2022 campaigns.

• The Times tried to interview him on Sunday at an address where he's registered to vote, but a person there said they weren't familiar with him.

THIRD, HIS HIGHER EDUCATION HISTORY APPEARS TO BE A LIE AS WELL:

• He's said he graduated with a degree in economics and finance from Baruch College, a public 4-year college in New York City, in 2010. But representatives from the school told the Times they had no record of his enrollment, despite searching multiple variations of his name.

• A biography on the National Republican Campaign Committee website says he went to New York University as well, but a spokesman for the university told the Times they had no attendance records that matched his name and birth date.

FOURTH, THERE'S STILL A MYSTERY AS TO WHERE HIS MONEY IN COMING FROM:

• He's reported a $750,000 salary and $1 million from a now-dissolved entity called the "Devolder Organization."

• The firm had been described in numerous ways, including as his "family's firm" that manages $80 million in assets and as a capital introduction consulting company. He did not list any clients.

• He was also the regional director of Harbor City Capital, a Florida-based company, when it was accused of running a more than $17 million Ponzi scheme. He's publicly denied knowledge of the scheme, according to the Times.

FIFTH, HE CLAIMED TO HAVE LOST FOUR EMPLOYEES IN THE 2016 PULSE NIGHTCLUB SHOOTING:

• He made the claim during an interview after his election, but the Times review found that none of the 49 victims of the Orlando shooting appeared to be associated with any of his firms.

Neither Santos nor the office of House Minority Leader Kevin McCarthy immediately responded to Insider's request for comment.

#us politics#news#business insider#2022#gop#Republicans#conservatives#rep. George Santos#new york#us house of representatives#rep. kevin mccarthy#the new york times#Rep. Tom Suozzi#Goldman Sachs#Citigroup#Friends of Pets United#Baruch College#National Republican Campaign Committee#New York University#republican lies#Devolder Organization#Harbor City Capital#ponzi scheme#pulse nightclub shooting

36 notes

·

View notes

Text

Wall Street says a Wall Street revival is finally here

Wall Street is surging again. This time, bank executives say it’s for real.

Bank of America (BAC), Goldman Sachs (GS), Citigroup (C), Morgan Stanley (MS) and JPMorgan Chase (JPM) all reported first-quarter jumps in investment banking.

They did so because initial public offerings, bond issuances and in some cases M&A deal making beat analyst expectations.

Collectively those revenues at the five…

View On WordPress

#analyst expectations#bank executives#Bank of America#Citigroup#David Solomon#goldman sachs#investment banking#jpmorgan chase#morgan stanley#Ted Pick#wall street

0 notes

Text

Rolls-Royce Stock Soars on Positive Outlook for Aircraft Engines and Services

#aircraftengines #Citigroup #civilaerospacebusiness #demand #growth. #improvedperformance #investors #January2022 #momentum #morningtrading #positiveoutlook #pricetarget #reducingcosts #regulatoryscrutiny #Restructuring #RollsRoyceHoldingsPLC #services #shareprice #shares #stockpriceincrease #strongfundamentals #supplychainissues

#Business#aircraftengines#Citigroup#civilaerospacebusiness#demand#growth.#improvedperformance#investors#January2022#momentum#morningtrading#positiveoutlook#pricetarget#reducingcosts#regulatoryscrutiny#Restructuring#RollsRoyceHoldingsPLC#services#shareprice#shares#stockpriceincrease#strongfundamentals#supplychainissues

0 notes

Text

Citigroup Faces Investor Backlash as Fourth-Quarter Charges Exceed Previous Guidance

In a surprising turn of events, Citigroup issued a warning to investors on Wednesday, revealing that charges related to the devaluation of the Argentine peso and the bank’s ongoing reorganization efforts were significantly higher than initially disclosed by the Chief Financial Officer (CFO) just weeks ago.

Fourth-Quarter Results

Scheduled to release its fourth-quarter results on Friday, Citigroup disclosed that it had incurred $880 million in currency conversion losses due to the decline of the Argentine peso. Additionally, the bank reported $780 million in restructuring charges associated with CEO Jane Fraser’s corporate simplification project. These figures were notably higher than the “couple hundred million dollars” apiece that CFO Mark Mason had communicated to investors during a conference on December 6.

Veteran banking analyst Mike Mayo of Wells Fargo expressed concern, stating, “They gave guidance just a month ago, and now it’s several hundred million dollars higher for two categories. If your problem is credibility with investors, then you shouldn’t be doing this type of thing.”

As Citigroup gears up to report its fourth-quarter and full-year 2023 earnings, CEO Jane Fraser faces a critical moment amid the ongoing restructuring efforts aimed at transforming the bank into a leaner and more profitable entity. Over the past two decades, Citigroup has grappled with high expenses and eroding credibility, stemming from the underperformance of Fraser’s predecessors. This has left Citigroup as the least valued among the six largest U.S. banks.

Build The Reserves

In addition to the currency conversion and restructuring charges, Citigroup disclosed the need to build reserves by $1.3 billion due to its exposure to Argentina and Russia. Furthermore, the bank expects to post a $1.7 billion expense for a special Federal Deposit Insurance Corporation (FDIC) assessment linked to regional bank failures in 2023.

Analyst Mike Mayo predicts that these charges will result in a $1 per share loss in the fourth quarter. Despite his skepticism regarding the bank’s ability to achieve its targets, Mayo recommends Citigroup stock, asserting that it is undervalued and has the potential to double within three years.

Following the disclosure, Citigroup’s stock experienced a 1% dip in after-hours trading on Wednesday. While a Citigroup spokeswoman declined to comment on the shifting guidance, CFO Mark Mason emphasized, “While these items are meaningful for our 2023 results, we remain on track to meet the 2023 expense guidance (excluding FDIC and divestitures) and all of our medium-term targets. The items we disclosed today do not change our strategy.”

Read More: Banking Leaders Express Concerns Over Rising Geopolitical Uncertainty

0 notes

Text

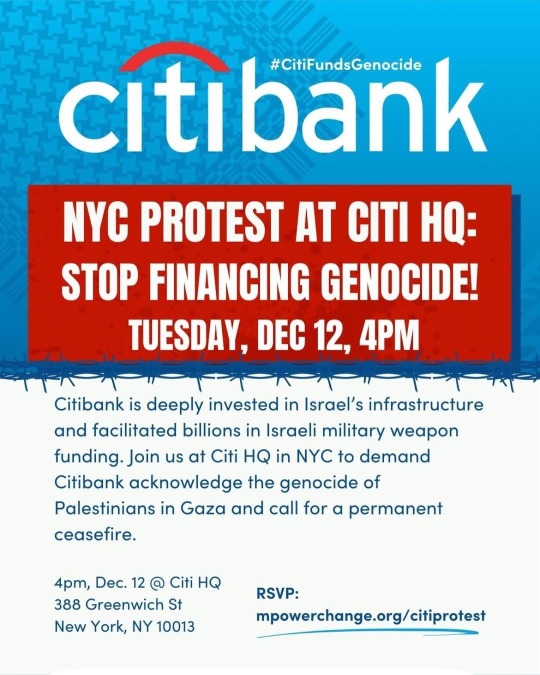

🎨🇵🇸#ArtIsAWeapon

#CitiFundsGenocide PROTEST DECEMBER 12, 4PM, Citi Headquarters, 388 Greenwich Street, NYC

Reposted from @lsarsour

Join @mpowerchange @jvpny @adalahjusticeproject @masnewyork @ny4change @undocublack @uscpr @18millionrising and more to hold Citibank accountable. They are the largest financial institution in Israel and have facilitated weapons and military funding. They have been complicit in Haiti and climate catastrophe and the list goes on.

No more business as usual.

Art by @nataliepbui for @mpowerchange:

"Our strategy should be not only to confront empire, but to lay siege to it. To deprive it of oxygen. To shame it. To mock it. With our art, our music, our literature, our stubbornness, our joy, our brilliance, our sheer relentlessness and our ability to tell our own stories. Stories that are different from the ones we're being brainwashed to believe.

The corporate revolution will collapse if we refuse to buy what they are selling - their ideas, their version of history, their wars, their weapons, their notion of inevitability.

Remember this: We be many and they be few. They need us more than we need them.

Another world is not only possible, she is on her way. On a quiet day, I can hear her breathing." - Arundathi Roy

#bankingonsolidarity #Gaza #ceasefirenow #FreePalestine

#bankingonsolidarity#CitiFundsGenocide#CitiBank#CitiGroup#Palestine#Free Palestine#CeasefireNow#Gaza#ArtIsAWeapon#Protest

0 notes

Photo

LOAN IMAGE: Nadim Ashi DATE: 10/18/2023 ADDRESS: 2800 South Ocean Boulevard - Four Seasons Palm Beach & 9011 Collins Avenue - Four Seasons Surf Club MARKET: Palm Beach & Surfside ASSET TYPE: Hotel ~ KEYS: 309 LENDER: Citigroup (@CitiBank) & Deutsche Bank (@DeutscheBank) LANDLORD: Fort Partners - Nadim Ashi LOAN AMOUNT: $410,000,000 LOAN TYPE: Refinance LOAN TERMS: four-year term, only interest payments and pays a fixed coupon of 8.7 percent NOTE: Citigroup and Deutsche Bank have extended $410 million in mortgage financing for two upscale Four Seasons resorts in South Florida, enabling the owners, Fort Hospitality Group affiliates, to extract $56.5 million in cash and retire $345 million in debt. The properties, Four Seasons Palm Beach and Four Seasons Surf Club, feature high-end amenities, restaurants, and achieved strong financial performance. #Miami #RealEstate #tradedmia #MIA #PalmBeach #Surfside #Hotel #FortPartners #NadimAshi #Citigroup ##DeutscheBank #FourSeasonsPalmBeach #FourSeasonsSurfClub

#Miami#RealEstate#tradedmia#MIA#PalmBeach#Surfside#Hotel#FortPartners#NadimAshi#Citigroup#DeutscheBank#FourSeasonsPalmBeach#FourSeasonsSurfClub

0 notes

Text

Citigroup prevé que constructores de viviendas superarán al S&P 500 el próximo mes

Los analistas de Citigroup esperan un sólido desempeño de las acciones de los constructores de viviendas durante los próximos 30 días, superando el índice S&P 500 en ese tramo.

Un indicador de las acciones repuntó un 0,7% el viernes, un día después de caer un 5,2%, la mayor caída en un mes, después de que datos de inflación más altos de lo previsto hicieran subir los rendimientos de los…

View On WordPress

0 notes

Text

Anticipated Profit Surge for US Banks as Interest Rates Rise, While Wall Street Trails Behind!

Top U.S. Consumer Lenders Projected to See Q3 Profit Surge Amid Investment Banking Slump, Analysts Report

JPMorgan Chase (JPM.N), the first to release Q3 earnings among major U.S. banks this Friday, is anticipated to lead the way with an estimated 25% increase in Earnings Per Share (EPS) compared to the previous year, according to LSEG estimates.

In contrast, Goldman Sachs (GS.N) and Citigroup (C.N) are expected to face significant EPS declines, with estimates showing potential decreases of 35% and 26%, respectively, as per LSEG projections. Morgan Stanley (MS.N) is also forecasted to experience a drop in EPS.

US bank profits set to rise on higher rates while Wall Street lags Read more...

"In the current quarter, the focus is on prolonged higher interest rates," emphasized Mike Mayo, an analyst at Wells Fargo. "These rates will have a significant impact on various aspects of banks, including their funding, lending activities, borrowers' loan repayment capabilities, securities losses, and capital requirements."

JPMorgan, the largest bank in the United States, is deemed to be in the most favorable position to navigate the challenges posed by higher interest rates and might even surpass market expectations, according to Bank of America analyst Ebrahim Poonawala. Poonawala has increased his earnings projection for the bank.

"In September, U.S. employers surged by adding 336,000 jobs, reminiscent of the robust hiring trends witnessed during the pandemic. This development may provide further support for the Federal Reserve's consideration of another interest rate hike. However, an additional increase in rates and the persistence of elevated borrowing costs could potentially hinder the budding recovery in dealmaking.

CEOs on Wall Street have pointed to the resurgence of initial public offerings (IPOs), including SoftBank's Arm Holdings, as positive indicators of a market resurgence following a prolonged period of stagnation. Nevertheless, the recent outbreak of conflict in Israel could cast a shadow on market sentiment."

"Investment Banking Analyst Predicts Favorable Year-End Environment Despite Current Challenges"

According to Jason Goldberg, a banking analyst at Barclays, the current business climate remains constructive, with expectations of higher investment banking fees continuing through the end of the year. However, he suggests that a more comprehensive improvement in capital markets may not be realized until 2024.

Despite the growing optimism, investment banking activity still faces challenges. Global investment banking fees have declined by nearly 17% in the third quarter compared to the same period in the previous year, totaling $15.2 billion, as per data from Dealogic.

Market stability may be further influenced by the rise in U.S. Treasury yields, potentially affecting investor confidence and posing risks to banks with substantial holdings of these securities.

As interest rates increase, bond prices typically decrease, leading to unrealized paper losses that would only become realized if banks decide to sell the bonds. The concern regarding these paper losses gained attention after Silicon Valley Bank's collapse in March, partially attributed to losses from its securities portfolio. Investors are now more attuned to the risks associated with unrealized bond losses across the banking industry.

Richard Ramsden, a banking analyst at Goldman Sachs, estimates that unrealized losses from securities could see a "significant increase," potentially reaching up to $670 billion across the industry in the third quarter, compared to $558 billion in the previous quarter, according to Federal Deposit Insurance Corporation data.

For example, Bank of America has reported over $100 billion in unrealized losses on its securities portfolio, which the bank intends to hold until maturity. These losses have put pressure on the bank's stock performance, making it the weakest performer among the top six U.S. lenders, with a 21% decline in its shares year-to-date.

"Regional Banks' Earnings Under Scrutiny Amid Industry Shake-Up"

Following a series of bank failures earlier this year that rattled the financial sector, the spotlight remains on earnings from regional lenders.

Investors are advised to exercise caution when dealing with regional banks, as they often have stronger ties to the potentially fragile commercial real estate loan market. Additionally, some regional banks exhibit weaker balance sheets, a factor of concern, according to James Demmert, Chief Investment Officer at Main Street Research, which manages approximately $2 billion in assets.

In contrast, large banks' consumer divisions are poised to maintain their positive performance in earnings. The robust job market has bolstered household spending, albeit at a somewhat reduced pace, as indicated by recent comments from bank executives.

While consumer delinquencies on loan payments have seen an uptick, it's essential to note that they remain historically low levels. According to Richard Ramsden, a banking analyst at Goldman Sachs, this trend reflects a "credit normalization" rather than a significant worry about credit losses reaching recessionary levels. More broadly, investors are increasingly operating under the assumption that interest rates will remain elevated for an extended period.

Read the full article

#AssetManagement#BankFailures#BankingIndustry#BondPrices#Citigroup#CommercialRealEstateLoans#ConsumerDivision#ConsumerSpending#CreditDelinquencies#CreditNormalization#EarningsReport#EconomicOutlook#FederalReserve#FinancialMarket#GoldmanSachs#InterestRates#InvestmentBanking#JobMarket#JPMorgan#LogicFinance#MarketRevival#MarketSentiment#MorganStanley#RegionalBanks#SecuritiesPortfolio#UnitedStates#USA

0 notes

Text

Citigroup (BER:TRVC) Price Target Increased by 5.14% to 54.05

The typical 1 year rate target for Citigroup (BER: TRVC) has actually been modified to 54.05/ share. This is a boost of 5.14% from the previous quote of 51.41 outdated August 31, 2023. The rate target is approximately lots of targets supplied by experts. The most recent t.Read More

View On WordPress

0 notes

Text

Aktienkurs von Adyen sinkt um fast 40 Prozent - Finanzergebnisse sind alarmierend

Adyen, ein niederländischer Zahlungsabwickler, verzeichnete nach Veröffentlichung seiner Halbjahreszahlen erhebliche Kursverluste an der Börse. Die Anleger zeigten sich besorgt über das langsamere Wachstum des Unternehmens und den steigenden Konkurrenzdruck. Die Citigroup warnte, dass hohe Investitionen zur Bewältigung dieses Wettbewerbs die operative Gewinnmarge beeinflussen könnten. Diese…

View On WordPress

0 notes

Text

1 Earnings Season

Big Banks 💥 Earnings season is here! JPMorgan, Citigroup, Wells Fargo to benefit from rate hikes📈 Ease bank stress🏦 Q1 earnings season is in full swing, with Goldman Sachs, Morgan Stanley, Bank of America, and other big names like Netflix, Tesla, IBM, and Johnson & Johnson set to report.

#earningsseason#JPMorgan#Citigroup#Wells Fargo#Goldman Sachs#Morgan Stanley#Bank of America#Netflix#Tesla#IBM#Johnson & Johnson

0 notes

Text

Big banks warn of sting as Americans shift towards higher-yielding deposits.

The benefits of high interest rates are fading for the nation’s biggest banks as depositors increasingly moved funds to higher-interest-bearing accounts last quarter.

Why it matters: A trio of banks turned in strong first quarter earnings Friday, but warned that the profit growth they’ve been enjoying from higher rates is starting to fade.

Between the lines: Wells Fargo said today its net…

View On WordPress

0 notes

Text

Citigroup Urges Employees to Speak Up Against Harassment: Lawsuit Highlights Workplace Issues

#Citigroup #discrimination #Lawsuit #sexualharassment #workplaceharassment

0 notes

Photo

These banks are the biggest funders of the fossil fuel industry

Since the Paris Agreement in 2016, the biggest banks that fund the fossil fuel industry seem to have minimally decreased their support, and in some cases are actually increasing their funding.Read more...

https://qz.com/banks-biggest-funders-of-fossil-fuel-industry-1850252987

#fossilfuel#morganstanley#rainforestactionnetwork#chasebank#banktrack#houseofmorgan#finance#environment#barclays#business2cfinance#saudiaramco#gazprom#bnpparibas#primarydealers#citigroup#financialdistrict2csanfrancisco#exxonmobil#wellsfargo#mizuho#jpmorganchase#bankofamerica#financialservices#mufg#companies#Clarisa Diaz#Quartz

0 notes