#Commutation of thyristor

Explore tagged Tumblr posts

Text

https://www.futureelectronics.com/p/electromechanical--circuit-protection--protection-thyristors/t435-600b-tr-stmicroelectronics-7380363

What is the thyristor protection, metal oxide varistor surge protection

T435 Series 600 Vdrm 4 A Snubberless Triac AC Switch Surface Mount - TO-252

#Circuit Protection#Protection Thyristors#T435-600B-TR#STMicroelectronics#metal oxide varistor surge protection#High Temperature Protection#voltages#SCR Protection#thyristor devices#Thyristors Surge Protectors#Commutation of thyristor

1 note

·

View note

Text

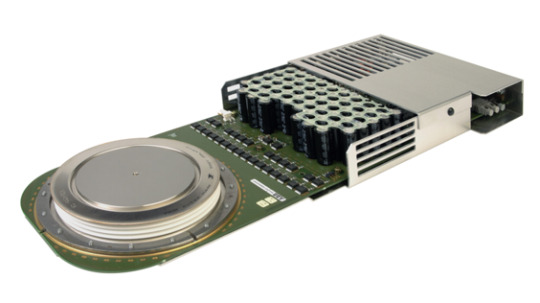

IGCT: Powering the Future of Electronics

IGCT (Integrated Gate Commutated Thyristors) is a powerful and versatile power semiconductor device widely utilized in the electronic components industry. With its exceptional performance, fast switching speed, and high current-carrying capability, IGCT has found extensive applications in power transmission, industrial drives, and power electronics.

Knowing more: smbom.com

2 notes

·

View notes

Text

The global Thyristor Market is projected to grow from USD 5,764 million in 2024 to USD 8,196.98 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.5% over the forecast period.The thyristor, a key component in power electronics, has emerged as a cornerstone in applications requiring high voltage and current control. Its ability to handle significant power loads while ensuring efficiency has made it indispensable in industries such as automotive, energy, consumer electronics, and industrial manufacturing. The global thyristor market has seen robust growth over the past few years, driven by advancements in renewable energy systems, industrial automation, and the proliferation of electric vehicles (EVs).

Browse the full report https://www.credenceresearch.com/report/thyristor-market

Market Overview

Thyristors are semiconductor devices that act as electronic switches, controlling the flow of electricity in high-power applications. Key types of thyristors include:

SCR (Silicon Controlled Rectifier): Used in AC and DC systems.

GTO (Gate Turn-Off Thyristor): Widely employed in industrial and traction applications.

IGCT (Integrated Gate Commutated Thyristor): A high-performance option for power systems.

The global thyristor market was valued at approximately $4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5–7% during 2024–2030. This growth is fueled by the increasing demand for efficient power control systems, the adoption of renewable energy, and the rise of electric mobility.

Key Growth Drivers

Proliferation of Renewable Energy Renewable energy sources like wind and solar heavily rely on thyristors for power conversion and grid integration. These devices ensure efficient energy transmission by stabilizing voltage fluctuations, making them critical to expanding renewable energy infrastructure.

Rise of Electric Vehicles (EVs) With the global shift towards sustainability, the demand for EVs is skyrocketing. Thyristors are integral in managing power within EV charging stations and motor control systems, contributing to their increased adoption in the automotive sector.

Industrial Automation The growing trend of automation in manufacturing and industrial processes necessitates precise control over high-power systems, a role thyristors are well-suited for. This demand is particularly evident in sectors like steel manufacturing, railways, and heavy machinery.

Infrastructure Development in Emerging Markets The rapid urbanization and industrialization of emerging economies like India and China are driving investments in power distribution and infrastructure projects. Thyristors are essential in these large-scale energy management systems.

Challenges

Despite its growth prospects, the thyristor market faces several challenges:

Competition from Alternative Technologies Advances in Insulated Gate Bipolar Transistors (IGBTs) and MOSFETs pose competition to thyristors in certain applications, particularly in lower power ranges.

High Initial Costs Implementing thyristor-based systems can involve significant upfront investment, which may deter adoption, especially in cost-sensitive markets.

Complex Manufacturing Processes Thyristors require precise fabrication techniques, leading to higher production costs and limiting market entry for new players.

Future Prospects

The future of the thyristor market is intertwined with the global push for sustainability. Key trends include:

Integration with Smart Grids: Thyristors will play a vital role in creating intelligent energy systems capable of balancing supply and demand efficiently.

Adoption of Advanced Materials: Innovations in silicon carbide (SiC) and gallium nitride (GaN) materials are expected to enhance thyristor performance, opening new possibilities for applications in harsh environments.

AI and IoT Integration: The integration of AI and IoT technologies in power systems will require high-performance thyristors for seamless operation.

Key Player Analysis:

STMicroelectronics

Vishay Intertechnology

Schneider Electric

TSMC

Sensata Technologies

ABB Ltd

Infineon Technologies AG

ON Semiconductor

Siemens AG

Honeywell International Inc.

Segmentations:

By Power Rating

500 MW

500 MW-1000 MW

1000 MW

By End Use

Consumer Electronics

Telecommunication & Networking

Industrial

Automotive

Aerospace & Defence

Others

By Geography

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report https://www.credenceresearch.com/report/thyristor-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

India HVDC Converter Station Market Situation and Forecasting Trends Analysis 2024 - 2032

The India HVDC (High Voltage Direct Current) converter station market is a critical component of the country’s evolving energy infrastructure. As India aims to enhance its electricity transmission capabilities and integrate renewable energy sources, HVDC technology plays a vital role in addressing the challenges of modern power systems. This article explores the dynamics of the HVDC converter station market in India, focusing on key drivers, challenges, and future trends.

Market Overview

Definition of HVDC Converter Stations

HVDC converter stations are facilities that convert alternating current (AC) to direct current (DC) and vice versa. This technology is particularly advantageous for long-distance power transmission, reducing energy losses and enabling the integration of renewable energy sources into the grid. HVDC systems are essential for modernizing power transmission networks, enhancing stability, and improving overall efficiency.

Market Size and Growth

The HVDC converter station market in India is experiencing significant growth, driven by increasing electricity demand and a robust focus on renewable energy integration. The government's initiatives to modernize the power infrastructure and promote sustainable energy sources have further fueled this market's expansion.

Key Drivers of Market Growth

Increasing Energy Demand

India’s rapid economic growth and urbanization have resulted in soaring energy demand. The government’s commitment to ensuring reliable power supply has led to substantial investments in HVDC technology to enhance transmission capacity and reliability.

Renewable Energy Integration

India is one of the world leaders in renewable energy adoption, particularly in solar and wind power. HVDC technology enables efficient integration of these renewable sources into the national grid, facilitating the transport of electricity from remote generation sites to consumption centers.

Government Initiatives and Policies

The Indian government has launched several initiatives aimed at promoting the development of HVDC technology. Policies such as the National Electricity Policy and the National Renewable Energy Policy encourage investments in HVDC projects, facilitating the transition to a more sustainable energy landscape.

Types of HVDC Converter Stations in the Market

Line Commutated Converter (LCC)

LCC technology is the traditional HVDC technology used for long-distance transmission. It operates using thyristors to convert AC to DC and is commonly employed in high-capacity transmission lines. LCC systems are known for their robustness and efficiency in transmitting large volumes of power over long distances.

Voltage Source Converter (VSC)

VSC technology is a more recent development in HVDC systems, utilizing IGBT (Insulated Gate Bipolar Transistor) technology for power conversion. VSCs are more flexible and can operate under varying grid conditions, making them ideal for connecting renewable energy sources and enhancing grid stability.

Market Segmentation

By Application

Long-Distance Power Transmission

Renewable Energy Integration

Grid Interconnections

Industrial Applications

By Technology Type

Line Commutated Converter (LCC)

Voltage Source Converter (VSC)

By Region

Northern India

Western India

Southern India

Eastern India

Challenges Facing the Market

High Initial Investment

The capital required for HVDC converter station projects is substantial, which can deter potential investors and limit market entry for new players. This high initial cost is a significant barrier to the widespread adoption of HVDC technology.

Technical Complexity

The technical intricacies involved in designing, implementing, and maintaining HVDC systems require specialized knowledge and skills. The lack of adequate expertise in the industry can hinder the successful deployment of HVDC converter stations.

Regulatory and Policy Challenges

While the Indian government has made strides in promoting HVDC technology, regulatory hurdles and inconsistent policies can pose challenges for project development. Streamlined regulations and supportive policies are essential to facilitate market growth.

Future Trends

Increased Investment in Renewable Integration

As India continues to expand its renewable energy capacity, investments in HVDC technology will be crucial for effectively transmitting this power. The integration of HVDC systems will enable the efficient transport of renewable energy from remote generation sites to urban centers.

Advancements in Technology

Ongoing advancements in HVDC technology, including improvements in converter efficiency and reliability, will drive market growth. Innovations such as modular multilevel converters (MMC) and enhanced control systems will further optimize performance.

Focus on Smart Grids

The development of smart grid technologies will complement the growth of HVDC systems. Enhanced communication and automation capabilities will improve grid management, facilitate demand response, and enhance overall system reliability.

Conclusion

The India HVDC converter station market is set for substantial growth as the country addresses its energy challenges and embraces a more sustainable future. With increasing energy demands, a commitment to renewable energy integration, and supportive government initiatives, the market presents significant opportunities for innovation and investment. By overcoming challenges related to costs, technical complexity, and regulatory frameworks, India can optimize its HVDC potential, paving the way for a more resilient and efficient energy infrastructure.

More Trending Reports

Wellhead Equipment Market Analysis

District Cooling Market Analysis

Small Scale LNG Market Analysis

Gas Generator Market Analysis

0 notes

Text

Exploring HVDC Transmission

High-Voltage Direct Current (HVDC) transmission is a critical technology that plays a pivotal role in the efficient and reliable transmission of electrical power over long distances. Unlike traditional alternating current (AC) transmission, which experiences significant losses over extended distances, HVDC technology enables the efficient transmission of large amounts of power over vast distances with minimal losses. This capability has made HVDC transmission a cornerstone of modern energy infrastructure, facilitating the integration of renewable energy sources, interconnecting regional power grids, and enhancing grid stability and reliability.

Understanding HVDC Transmission

At its core, HVDC transmission involves the conversion of alternating current (AC) to direct current (DC) at the transmission station, and vice versa at the receiving station. This conversion process is achieved using specialized electronic devices called converters, which facilitate the efficient transmission of power over high-voltage transmission lines. HVDC transmission offers several advantages over AC transmission, including lower transmission losses, increased power transfer capacity, and enhanced grid control and stability.

Applications and Benefits

HVDC transmission finds applications across various sectors and industries, including:

Renewable Energy Integration: HVDC technology enables the efficient transmission of power from remote renewable energy sources, such as wind farms and solar installations, to population centers and urban areas, facilitating the integration of renewable energy into the grid and reducing reliance on fossil fuels.

Interconnection of Power Grids: HVDC transmission interconnects regional power grids, enabling the exchange of electricity between neighboring countries and regions. This enhances energy security, promotes market integration, and facilitates the sharing of renewable energy resources, contributing to a more resilient and interconnected grid.

Long-Distance Transmission: HVDC transmission is ideal for transmitting power over long distances, such as across oceans or mountain ranges, where AC transmission may be impractical or cost-prohibitive. By minimizing transmission losses and voltage drops, HVDC technology enables the efficient transmission of bulk power over vast distances.

Key Components and Technologies

HVDC transmission systems comprise several key components and technologies, including:

Converters: HVDC converters, such as Line Commutated Converters (LCC) or Voltage Source Converters (VSC), convert AC power to DC and vice versa. These converters employ semiconductor devices such as thyristors or Insulated Gate Bipolar Transistors (IGBTs) to achieve efficient power conversion.

Transmission Lines: HVDC transmission lines transport the converted DC power over long distances. These lines are typically designed to operate at high voltages to minimize losses and maximize power transfer capacity.

Substations: HVDC substations house the converters and other equipment necessary for HVDC transmission. These substations play a crucial role in the conversion, control, and regulation of power flow in the HVDC system.

Powering the Future

As the demand for clean, reliable, and efficient energy continues to grow, HVDC transmission technology will play an increasingly important role in shaping the future of energy infrastructure. By enabling the efficient transmission of power over long distances, integrating renewable energy sources, and enhancing grid flexibility and stability, HVDC transmission technology is paving the way for a more sustainable and resilient energy future.

0 notes

Text

HVDC Transmission Market, Share, Size, Trends, Forecast and Future Outlook

The market research report provides a comprehensive analysis of the industry, with a specific focus on the HVDC Transmission Market. It examines the size, growth rate, and major trends within the HVDC Transmission Market, offering valuable insights into its current state and future prospects. The report explores the significance of Fibre Reinforced Polymer Composites (FRP) in driving market dynamics and shaping business strategies. It investigates the market drivers, such as increasing consumer demand and emerging trends related to Fibre Reinforced Polymer Composites (FRP), providing a deep understanding of the factors influencing market growth. Additionally, the report assesses the competitive landscape within the HVDC Transmission Market, profiling key players and their market share, strategies, and product offerings. It also addresses market segmentation, identifying different segments within the HVDC Transmission Market and their unique characteristics. Overall, the market research report equips businesses operating in the HVDC Transmission Market with valuable information and actionable recommendations to capitalize on opportunities and navigate the challenges in the industry.

Request Free Sample Report @ https://www.vertexbusinessinsights.com/request-sample/68/hvdc-transmission-market

This research covers COVID-19 impacts on the upstream, midstream and downstream industries. Moreover, this research provides an in-depth market evaluation by highlighting information on various aspects covering market dynamics like drivers, barriers, opportunities, threats, and industry news & trends. In the end, this report also provides in-depth analysis and professional advices on how to face the post COIVD-19 period.

The research methodology used to estimate and forecast this market begins by capturing the revenues of the key players and their shares in the market. Various secondary sources such as press releases, annual reports, non-profit organizations, industry associations, governmental agencies and customs data, have been used to identify and collect information useful for this extensive commercial study of the market. Calculations based on this led to the overall market size. After arriving at the overall market size, the total market has been split into several segments and sub segments, which have then been verified through primary research by conducting extensive interviews with industry experts such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub segments.

Key Market Segmentation

HVDC Transmission Market - By Component

Converter Stations (Valves, Thyristor Valves, Transformers, Harmonic Filters, Circuit Breakers, Reactors)

Surge Arresters

Transmission Cables

HVDC Transmission Market - By Project Type

Point-to-Point Transmission

Back-to-Back Stations

Multi-Terminal Systems

HVDC Transmission Market - By Technology

Capacitor Commutated Converter (CCC)

Voltage Source Converter (VSC)

Line Commutated Converter (LCC)

HVDC Transmission Market - By Application

Bulk Power Transmission

Interconnecting Grids

Infeed Urban Areas

HVDC Transmission Market - By Transmission Type

Overhead

Submarine & Underground

HVDC Transmission Market - By Region

North America

US

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Russia

Benelux

Nordics

Rest of Europe

Asia-Pacific

China

India

Japan

South Korea

Rest of Asia-Pacific

Middle East and Africa

South America

Ask Queries @ https://www.vertexbusinessinsights.com/enquiry/68/hvdc-transmission-market

Table of Content

Executive Summary

Market Introduction

2.1 Definition

2.2 Architecture

2.3 Scope of the Study

2.4 Related Stakeholders

Research Methodology

3.1 Introduction

3.2 Primary Research

3.2.1 Key Insights

3.2.2 Breakdown of Primary Interviews

3.3 Secondary Research

3.3.1 Important Sources

3.4 Market Size Estimation Approaches

3.4.1 Top-Down Approach

3.4.2 Bottom-Up Approach

3.4.3 Data Triangulation

3.5 List of Assumptions

Market Dynamics

4.1 Introduction

4.2 Drivers

4.2.1 Rising usage of HVDC transmission systems as compared to traditional transmission systems

4.2.2 Growing technological advancements in the power industry

4.3 Restraints

4.3.1 High installation cost

4.4 Opportunities

4.4.1 Increasing emphasis on development of smart cities in the developing countries

4.5 Porter's Five Forces Model Analysis

4.6 Value Chain Analysis

4.7 Impact of COVID-19 on Global HVDC Transmission Market

Global HVDC Transmission Market, By Component

5.1 Introduction

5.2 Converter Stations

5.2.1 Valves

5.2.2 Thyristor Valves

5.2.3 Transformers

5.2.4 Harmonic Filters

5.2.5 Circuit Breakers

5.2.6 Reactors

5.2.7 Surge Arresters

5.3 Transmission Cables

5.4 Others

Global HVDC Transmission Market, By Project Type

6.1 Introduction

6.2 Point-to-Point Transmission

6.3 Back-to-Back Stations

6.4 Multi-Terminal Systems

7 Global HVDC Transmission Market, By Technology

7.1 Introduction

7.2 Capacitor Commutated Converter (CCC)

7.3 Voltage Source Converter (VSC)

7.4 Line Commutated Converter (LCC)

8 Global HVDC Transmission Market, By Application

8.1 Introduction

8.2 Bulk Power Transmission

8.3 Interconnecting Grids

8.3 Infeed Urban Areas

9 Global HVDC Transmission Market, By Transmission Type

9.1 Introduction

9.2 Overhead

9.3 Submarine & Underground

10 Global HVDC Transmission Market, By Region

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Rest of Asia-Pacific

10.5 Middle East and Africa

10.6 South America

11 Competitive Landscape

11.1 Introduction

11.2 Vendor Evaluation Criteria

11.3 Vendor Share Analysis, 2020

11.4 Recent Developments, 2018-2021

11.4.1 New Product Launches

11.4.2 Partnerships

11.4.3 Mergers or Acquisitions

11.4.4 Business Expansions

12 Company Profiles

(This section covers the Business Overview, Financial Overview, Product and Product Offerings, Recent Developments, SWOT Analysis, and Key Strategies of the top market vendors. The given sequence does not represent their rankings in the market.

12.1 ABB Ltd

12.2 Siemens AG

12.3 General Electric Company

12.4 Hitachi, Ltd.

12.5 Mitsubishi Electric Corporation

12.6 Nexans S.A.

12.7 NKT A/S

12.8 NR Electric Co., Ltd.

12.9 C-EPRI Electric Power Engineering Co., Ltd.

12.10 Prysmian S.p.A.

12.11 Schneider Electric SE

12.12 Toshiba Corporation

13 Appendix

13.1 Discussion Guide

13.2 Customization Options

13.3 Related Reports

Continue…

ABOUT US:

Vertex Business Insights is one of the largest collections of market research reports from numerous publishers. We have a team of industry specialists providing unbiased insights on reports to best meet the requirements of our clients. We offer a comprehensive collection of competitive market research reports from a number of global leaders across industry segments.

CONTACT US

Phone: + (210) 775-2636 (USA) + (91) 853 060 7487

0 notes

Text

Integrated Gate Commutated Thyristor Market

An integrated gate commutated thyristor (IGCT) is a gate-controlled turn-off switch, which performs similar to a thyristor with lowest conduction losses. IGCT is a power semiconductor, which can be used for medium to high-voltage applications ranging from 0.5 MVA up to several 100 MVA. IGCT enables a robust series connection between high power turn-off devices used for high power applications.

Read Sample Report by Allied Market Research: https://bit.ly/30AwBn2

Benefits such as better performance of IGCT at higher temperature, (temperature ranges from -40 to 125 C) support the growth of the market. IGCT is used in industrial appliances and steel mills for controlling high power AC motors, and AC grid interface, as well as the PWM switching. Therefore, this feature adds value to drive the demand for the IGCT market.

1 note

·

View note

Text

How to make full use of centrifugal fans

The use of a centrifugal fan starts from its start. Sometimes there are problems with startup failures or very long startup times. There are many reasons for this. If the motor does not move, check the set value of the safety mechanism; if the motor rated power is too low, replace the motor; if the starting procedure is not correct, adjust the starting equipment; if the power consumption is too large when starting, verify that when starting When the gas flow control mechanism is in the closed position; if the rotor is stuck, move the fan by hand to check and investigate the cause of the jam (friction, obstacles, etc.); if the voltage at the motor is too low, Check the power line voltage - if the loss is too large, increase the power line. Many times users will find that the impeller always consumes energy in vain.

The gas forms a recurrent activity through leakage between the front cover and the current collector. Maintain a certain gap between the front cover of the centrifugal fan and the current collector and between the casing and the shaft. To ensure the reliability of the fan rotation. This can greatly alleviate this phenomenon. The problem that often occurs when the centrifugal fan is used is the vibration of the fan. It is not a simple matter to solve this problem fundamentally, but if the fan speed is reduced, it is a very good method, and the effect of this method is also obvious. With. However, it is also necessary for the user to judge what method is used to be more reasonable according to the specific conditions of the fan used.

The problem with the use of centrifugal fans is that the fan speed is unstable, what is the cause of this situation?Follow Beierde to see the reason.

(1) One of the four rectifier diodes has only a problem

(2) There is toner or carbon brush between the rotor and the commutator. It is difficult to repair. Firstly, the adjustable resistor is measured. The resistance value changes regularly with the adjustment. It proves that the potentiometer is Ok, there is no problem in measuring the thyristor. Since the diode is a high-current gold-sealed tube, the screw on one end is fastened to the circuit board, and the other end is soldered to the circuit board and removed from the circuit board. It was found that the positive and negative poles were loose, and then the side was shaken while measuring, confirming that the diode was good or bad.

(3) There are also many problems with thyristors, usually breakdown short circuit, open circuit, unable to trigger or poor internal contact.

(4) Adjustable resistance, the cabinet type centrifugal fan is installed on the control panel due to the adjustable resistance. The frequency of use is very high, and the time is long. The situation of poor contact is very common. If you find that the fan is unstable during the operation, you may use the four points mentioned above as the troubleshooting direction to quickly find out the cause and improve the efficiency of maintenance....

1 note

·

View note

Text

N1-§6 What is the Working Principle of Solid-State Relays?(2)

2. The Function of Each Components:

The figure below is the internal schematic diagrams of the zero-crossing trigger type AC-SSR (Figure 6.3)

R1 is a current limiting resistor that limits the input signal current and ensures that the optocoupler is not damaged. LED is used to display the input state of the input control signal. The diodeVD1 is used to prevent the optocoupler from being damaged when the positiveand negative poles of the input signal are inverted. The optocoupler OPT electrically isolates the input and output circuits. The triode M1 acts as an inverter, and constitute the zero-crossing detection circuit with the thyristor SCR at the same time, and the operating state of the SCR thyristor is determined by the alternating-voltage zero-detection transistor M1. VD2~VD4 form the full-wave rectifier bridge (or full-wave diode bridge) UR. A bidirectional trigger pulse for turning on the triac BCR can be obtained from SCR and UR. R6 is a shunt resistor used to protect the BCR. R7 and C1 make up a surge absorbing network to absorb spike voltage or surge current in the power mains to prevent shock or interference to the switching circuit. RT is a thermistor that acts as an overheating protector to prevent solid state relays from being damaged due to excessive temperatures. VDR is a varistor that acts as a voltage-limiting device that clamp the voltage and absorbs excess current to protect the solid-state relay when the output circuit is overvoltage.

3. The Process of Working:

The AC zero-crossing solid state relay has the characteristics of being turned on when the voltage crosses zero and being turned off when the load current crosses zero.

When the opto-coupler OPT is turned off (i.e. the control terminal of OPT has no input signal), M1 is saturated and turned on by obtaining the base current from R2, and as a result, the gate trigger voltage (UGT) of the thyristor SCR is clamped to a low potential and turned off. Consequently, the triac BCR is in the off state because there is no trigger pulse on the gate control terminal R6. When an input control signal applied on the input terminal of the solid-state relay, the phototransistor OPT is turned on (i.e. the control terminal of the OPT has an input signal). After the power mains’ voltage is voltage-divided by R2 and R3, if the voltage at point A is larger than the zero-crossing voltage of M1 (i.e. VA>VBE1), M1 will be in the saturated conduction state, and both SCR and BCR thyristors will be in the off state. If the voltage at point A is less than the zero-crossing voltage of M1 (i.e. VA<VBE1), M1 will be in the cut-off state, and the SCR will be triggered to conduct, and then the trigger pulse from” R5→UR→SCR→UR→R6” direction (or the opposite direction) is obtained on the control pole of the BCR to activate the BCR, and finally the load will be connected to AC mains. Through the above process, it can be understood that M1 is used as an AC voltage detector for turning on the solid-state relay when the load voltage crosses zero and turning off the solid state relay when the load current crosses zero. And on account of the function of the zero-crossing detector, the impact of the load circuit on the load is correspondingly reduced, and the radio frequency interference generated in the control loop is also greatly reduced.

4. The Definition of Zero-Crossing:

Here it need be explained what is the zero crossing. In the alternating current, the zero-crossing is the instantaneous point at which there is no voltage present, that is, the junction between the positive half cycle and the negative half cycle of the AC waveform. In each cycle of alternating current, there will usually be two zero crossings. And if the power mains switches at the instant point of zero crossing, no electrical interference will be generated. The AC solid-state relay (equipped with a zero-crossing control circuit) will be in the ON state when the input terminal is connected to the control signal and the output AC voltage crosses zero; conversely, when the control signal is turned off, the SSR be in the OFF state until the next zero crossing. In addition, it should be pointed out that the zero crossing of solid state relay does not actually mean zero volts of the power supply voltage waveform. Figure 6.5 is a section of the AC voltage sine wave. According to the characteristics of the AC switching component, the AC voltage in the figure is divided into three regions that correspond to three states of the SSR’s output circuit. And U1 and U2 respectively represents the threshold voltage and the saturation voltage of the switching component.

1) Region Ⅰ is the Dead Region (Cut-Off Region, Cut Out Region, or Turn Off Region), with an absolute value of voltage range of 0~U1. And in this zone, the SSR switch cannot be turned on, even if an input signal is added. 2) Region Ⅱ is the Response Region (Active Region, Cut-On Region, Cut In Region, or Turn On Region) with an absolute value of voltage range of U1~U2. In this zone, the SSR is immediately turned on, as soon as the input signal is added, and the output voltage increases as the supply voltage increases. 3) Region Ⅲ is the Suppression Region (Saturation Region) with an absolute value of voltage range greater than U2. In this region, the switching element (thyristor) is in the saturated state. And the output voltage of the solid-state relay will no longer increases with the increase of the power supply voltage, but the current increases with increasing voltage, which can be regarded as an internal short circuit state of the output circuit of the solid-state relay, that is, the solid-state relay is in the Switch-On state as an electronic switch.

Figure 6.6 shows the I/O waveform of the zero-crossing solid-state relay. And because of the nature of the thyristor, the solid-state relay will be in the on state after the voltage of the output terminals reaching the threshold voltage (or the trigger voltage of the trigger circuit). Then the solid-state relay will be in the actual on state after reaching the saturation voltage, and at the same time, generate a very low on-state voltage drop. If the input signal is turned off, the solid-state relay will be switched off when the load current drops below the thyristor’s holding current or the next AC commutation point (i.e. the first time the load current passes through zero after the SSR relay turned off).

#how dose solid state relay work#ssr working priciple#solid state relays#ssr switch#ssr relay#electronic relay#automotive relay

1 note

·

View note

Photo

Day 21: EMD AEM-7

Info from Wikipedia:

The EMD AEM-7 is a twin-cab four-axle 7,000 hp (5.2 MW) B-B electric locomotive built by Electro-Motive Division (EMD) and ASEA between 1978 and 1988. The locomotive is a derivative of the Swedish SJ Rc4 designed for passenger service in the United States. The primary customer was Amtrak, which bought 54 for use on the Northeast Corridor and Keystone Corridor. Two commuter operators, MARC and SEPTA, also purchased locomotives, for a total of 65.

Amtrak ordered the AEM-7 after the failure of the GE E60 locomotive. The first locomotives entered service in 1980 and were an immediate success, ending a decade of uncertainty on the Northeast Corridor. In the late 1990s, Amtrak rebuilt 29 of its locomotives from DC to AC traction. The locomotives continued operating through the arrival of the final Siemens ACS-64 in June 2016. MARC retired its fleet in April 2017 in favor of Siemens Chargers, and SEPTA retired all seven of its AEM-7s in November 2018 in favor of ACS-64s. Amtrak assumed control of almost all private sector intercity passenger rail service in the United States on May 1, 1971, with a mandate to reverse decades of decline. Amtrak retained approximately 184 of the 440 trains which had run the day before. To operate these trains, Amtrak inherited a fleet of 300 locomotives (electric and diesel) and 1190 passenger cars, most of which dated from the 1940s–1950s.

Operation on the electrified portion of the Northeast Corridor was split between the Budd Metroliner electric multiple units and PRR GG1 locomotives. The latter were over 35 years old and restricted to 85 mph (137 km/h). Amtrak sought a replacement, but no US manufacturer offered an electric passenger locomotive. Importing and adapting a European locomotive would require a three-year lead time. With few other options, Amtrak turned to GE to adapt the E60C freight locomotive for passenger service. GE delivered two models, the E60CP and the E60CH. However, the locomotives proved unsuitable for speeds above 90 mph (145 km/h), leaving Amtrak once again in need of a permanent solution. Amtrak then examined existing European high-speed designs, and two were imported for trials in 1976–77: the Swedish SJ Rc4 (Amtrak No. X995, SJ No. 1166), and the French SNCF Class CC 21000 (Amtrak No. X996, SNCF No. 21003). Amtrak favored the Swedish design, which became the basis for the AEM-7.

The AEM-7 was far smaller than its predecessors, the PRR GG1 and the GE E60. It measured 51 ft 1+25⁄32 in (15.59 m) long by 10 ft 2 in (3.10 m) wide, and stood 14 ft 9.5 in (4.51 m) tall, a decrease in length of over 20 ft (6.1 m). The AEM-7's weight was half that of the E60CP or the GG1. On its introduction it was the "smallest and lightest high horsepower locomotive in North America." The Budd Company manufactured the carbodies for the initial Amtrak order, while the Austrian firm Simmering-Graz-Pauker built the carbodies for the MARC and SEPTA orders.

Reflecting the varied electrification schemes on the Northeast Corridor the locomotives could operate at three different voltages: 11 kV 25 Hz AC, 12.5 kV 60 Hz AC and 25 kV 60 Hz. A pair of Faiveley DS-11 two-stage pantographs, one at each end of the locomotive, collected power from the overhead catenary wire. Thyristor converters stepped down the high-voltage AC to provide DC power at a much lower voltage to four traction motors, one per axle. As built the AEM-7 was rated at 7,000 hp (5.2 MW), with a starting tractive effort of 51,710 lbf (230 kN) and a continuous tractive effort of 28,100 lbf (125 kN). Its maximum speed was 125 miles per hour (201.2 km/h). A separate static converter supplied 500 kW 480 V head-end power (HEP) for passenger comfort. This was sufficient to supply heating, lighting, and other electrical needs in 8-10 Amfleet cars. The rebuilt AEM-7ACs used AC traction instead of DC traction. The power modules used water-cooled insulated-gate bipolar transistor (IGBT) technology and provided about 5,000 kilowatts (6,700 horsepower) of traction power plus 1,000 kilowatts (1,300 horsepower) of HEP, twice the HEP capacity of the original DC units. The 6 FXA 5856 traction motors, from Alstom's ONIX family of propulsion components, had a maximum rating of 1,250–1,275 kilowatts (1,676–1,710 horsepower) each and a continuous rating of 1,080 kilowatts (1,450 horsepower). The remanufactured AEM-7ACs were the world's first passenger locomotives to incorporate IGBT technology.

Amtrak planned a fleet of 53 locomotives, with an estimated cost of $137.5 million. Limited funding hampered that plan, but in September 1977 Amtrak proceeded with a plan to buy 30 locomotives for $77.8 million. Five groups bid on the contract: General Motors' Electro-Motive Division (EMD)/ASEA, Morrison–Knudsen/Alstom, Brown Boveri, Siemens/KraussMaffei, and AEG/KraussMaffei. Amtrak awarded the contract to the EMD/ASEA partnership in January 1978. It ordered 17 more locomotives in February 1980, bringing the total to 47.

Revenue service began on May 9, 1980, when No. 901 departed Washington Union Station with a Metroliner service. The Swedish influence led to the nickname "Meatball", after Swedish meatballs. Railfans nicknamed the boxy locomotives "toasters". Between 1980 and 1982, 47 AEM-7s (Nos. 900–946) went into service. Amtrak retired the last of its PRR GG1s on May 1, 1981, while most of the GE E60s were sold to other operators. The new locomotives swiftly proved themselves; Car and Locomotive Cyclopedia stated that no new locomotive since the New York Central Hudson had "such an impact on speeds and schedule performance."

This strong performance led to further orders. Amtrak added seven more locomotives in 1987, delivered in 1988, for a total of 54. Two commuter operators in the Northeast ordered AEM-7s. MARC ordered four in 1986 for use on its Penn Line service on the Northeast Corridor between Washington, D.C. and Perryville, Maryland. The Southeastern Pennsylvania Transportation Authority (SEPTA) ordered seven in 1987. Amtrak also used the AEM-7s to handle the Keystone Service on the Keystone Corridor between Harrisburg and Philadelphia as the Budd Metroliners, displaced from the Northeast Corridor, reached the end of their service lives.

In 1999, Amtrak and Alstom began a remanufacturing program for Amtrak's AEM-7s. Alstom supplied AC propulsion equipment, electrical cabinets, transformers, HEP, and cab displays. The rebuild provided Amtrak with locomotives that had improved high end tractive effort and performance with longer trains. Amtrak workers performed the overhauls under Alstom supervision at Amtrak's shop in Wilmington, Delaware. These remanufactured AEM-7s were designated AEM-7AC. Between 1999 and 2002, Amtrak rebuilt 29 of its AEM-7s. As the locomotives passed 30 years of service their operators made plans for replacements. In 2010, Amtrak ordered 70 Siemens ACS-64 locomotives to replace both the AEM-7s and the newer but unreliable Bombardier/Alstom HHP-8s. The ACS-64s began entering revenue service in February 2014. The last two active AEM-7s, Amtrak Nos. 942 and 946, made their final run on June 18, 2016, on a special farewell excursion that ran between Washington, D.C. and Philadelphia.

While Amtrak was replacing its AEM-7s, MARC initially decided in 2013 to phase out its electric operations on the Penn Line altogether and retire both its AEM-7 and Bombardier–Alstom HHP-8 locomotives, but the railroad instead started a refurbishment program for its HHP-8s in 2017. As of September 2017, the first HHP-8 reconditioned under this program had been delivered and was undergoing successful testing. MARC selected the Siemens Charger diesel locomotive as the replacement for its AEM-7 fleet in 2015. The last of the MARC AEM-7s were retired by April 2017, with the Chargers expected to enter service by January 2018.

SEPTA will continue to use electric traction, replacing its seven AEM-7s and lone ABB ALP-44, an improved AEM-7, with fifteen ACS-64s. The first SEPTA ACS-64, #901, entered revenue service on July 11, 2018. On December 1, 2018, SEPTA held a farewell excursion for the AEM-7 and ALP-44 locomotives along the Paoli/Thorndale Line.

Two locomotives, ex-Amtrak Nos. 928 and 942, were moved to the Transportation Technology Center in July 2017.

Caltrain, which operates commuter trains in the San Francisco Bay Area, purchased two retired Amtrak AEM-7s to test their electrification system once completed. The units would also serve as backup power for EMU cars. On June 7, 2018, the board awarded two contracts totalling approximately $600,000: one to purchase two AEM-7ACs from Mitsui & Co, and the other to Amtrak for refurbishment, training, and transportation to the Caltrain maintenance facility in San Jose. Locomotive Nos. 929 and 938 were delivered to California by Amtrak in June 2019.

Seven of the remaining SEPTA AEM-7s were leased to NJ Transit beginning in late December 2018 for the purpose of allowing NJ Transit to roster additional locomotives equipped with positive train control (PTC) in order to meet a deadline for operating PTC-capable equipment. However, they were never used and subsequently returned. SEPTA then used them exclusively for overnight work service during autumn, cleaning tracks and applying traction gel. In 2022, SEPTA sold the AEM-7s and ALP-44 for scrap.

Two units have been preserved: ex-Amtrak Nos. 915 at the Railroad Museum of Pennsylvania, and 945 at the Illinois Railway Museum.

Models and Route by: Virtual Beech Grove, Auran, and Download Station

#EMD#AEM-7#EMD AEM-7#Amtrak#Amtrak AEM-7#Electric Locomotive#Trains#Trainz Simulator#Advent Calendar#Christmas#Christmas 2022 🎄🎅🎁

0 notes

Text

APAC HVDC TRANSMISSION SYSTEMS MARKET ANALYSIS

APAC HVDC Transmission Systems Market, by System Components (AC & DC Harmonic Filters, Converters, DC lines, Circuit Breakers, and Others), by Technology (LCC, VSC, and Others), by Development (Overhead, Underground, and Subsea), by Power Rating (Below 1,000 MWs, 1,001 to 2,000 MWs, and 2,001 MWs and above), and by Country (China, India, ASEAN, Australia & New Zealand, and Rest of APEC) - Size, Share, Outlook, and Opportunity Analysis, 2019 - 2027

High voltage direct current (HVDC) transmission system transfers DC current over long distance through overhead transmission line or submarine cables. Moreover, HVDC transmission is preferred over HVAC transmission, as it is more cost-effective considering very long distance, losses, and other factors. HVDC is often referred as Power superhighway or Electrical superhighway. Moreover, HVDC has the ability to interconnect networks utilising HVDC transmission lines. HVDC system uses line commutated converter (LCC) and voltage source converter (VSC), in which LCC is a very economical technology and is based on Thyristor power semiconductors. On the contrary, VSC is relatively new technology in the market and is based on power transistors. Furthermore, HVDC transmission typically has a power rating of several hundreds of megawatts (MW) and many are in the 1,000 – 3,000 MW range. They use overhead lines, or underground/ undersea cables, or a combination of cables and lines.

Market Dynamics

One of the most significant advantages of the High voltage direct current (HVDC) is the efficiency of power transmission over long distances. Furthermore, High-voltage direct current (HVDC) transmission systems can able to low the electric losses and allows more efficient bulk power transfer over long distances which will be another driving factor for market growth. HVDC transmission is also very stable and easily controlled. For instance, in January 2017, ABB, a Swiss-Swedish multinational corporation collaborated with the Power Grid Corporation of India Limited (POWERGRID) to build longest 800 kilovolts (kV) ultra-high-voltage direct current (UHVDC) transmission system. The new transmission line will connect Raigarh city, Chhattisgarh to Pugalur in the southern state of Tamil Nadu.

However, HVDC transmission systems require high cost of components such as Transformer, Switchgears, and protection which will hamper the growth of the market.

Market Taxonomy

This report segments the APAC HVDC transmission systems market on the basis of system components, technology, development, and power rating. On the basis of system components, the APAC HVDC transmission systems market is segmented into o AC & DC harmonic filters, converters, DC lines, circuit breakers, and others. On the basis of technology, the market is segmented into LCC, VSC and others. On the basis of deployment, the market is segmented into overhead, underground, subsea, and combination. On the basis of power rating, the market is segmented into Below 1,000 MWs, 1,001 to 2,000 MWs, and 2,001 MWs and above.

Key features of the study:

This report provides an in-depth analysis of the APAC HVDC transmission systems market and provides market size (US$ Million) and Cumulative Annual Growth Rate (CAGR %) for the forecast period (2019 – 2027), considering 2018 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrix for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, regional outlook, and competitive strategy adopted by leading players

It profiles leading players in the APAC HVDC transmission systems market based on the following parameters – regulatory landscape, company overview, financial performance, product portfolio, geographical presence, distribution strategies, key developments and strategies, and future plans

Key companies covered as a part of this study ABB Ltd., Siemens AG, Toshiba Corporation, General Electric Co., Prysmian SpA, Hitachi Ltd., TransGrid Solutions Inc., and ATCO Electric Ltd.

Insights from this report would allow marketers and management authorities of companies to make informed decision regarding future product launches, technology up-gradation, market expansion, and marketing tactics

The APAC HVDC transmission systems market report caters to various stakeholders in this industry including investors, suppliers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through the various strategy matrices used in analyzing the APAC HVDC transmission systems market

Detailed Segmentation:

AC & DC Harmonic Filters

Converters

DC Lines

Circuit Breakers

Others

LCC

VSC

Others

Overhead

Underground

Subsea

Combination

Below 1,000 MWs

1,001 to 2,000 MWs

2,001 MWs and above

Company Overview

Product Portfolio

Financial Performance

Key Strategies

Recent Developments

Future Plans

*Browse all the market data tables and figures on "APAC HVDC transmission systems Market - forecast to 2027”

Request the sample copy of here:

https://www.coherentmarketinsights.com/insight/request-sample/3146

Download the PDF Brochure here:

https://www.coherentmarketinsights.com/insight/request-pdf/3146

Buy now the market research report here:

https://www.coherentmarketinsights.com/insight/buy-now/3146

About Us:

Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions.

What we provide:

Customized Market Research Services

Industry Analysis Services

Business Consulting Services

Market Intelligence Services

Long term Engagement Model

Country Specific Analysis

Explore CMI Services here

Contact Us:

Mr. Shah

Coherent Market Insights Pvt. Ltd.

Address: 1001 4th ave, #3200 Seattle, WA 98154, U.S.

Phone: +1-206-701-6702

Email: [email protected]

Source:

https://www.coherentmarketinsights.com/market-insight/apac-hvdc-transmission-systems-market-3146

0 notes

Photo

Educational Lab Equipments is leading Power Electronics is the branch of electronics which deals in equipment integrated by switching circuits used to control both alternating and direct currents. This domain of electronics and electrical engineering is directly involved in research, design and implementation of non liner, time-varying, energy-processing electronic systems. The family of discrete components used in semiconductor switching devices in power electronics can be listed as diodes, transistors and thyristors Silicon Controlled Rectifier (SCR), Gate Turn-Off Thyristors, Insulated Gate Bipolar Transistors (IGBT), Gate-Commutated Thyristors). Our power electronics lab equipment and training kits are specifically designed while keeping in mind all these pre-discussed basic components.

https://www.educational-equipments.com/electronics-lab

0 notes

Link

By Type (Gate-Commutated Thyristor (GCTs), Integrated Gate-Commutated Thyristor (IGCTs), Gate Turn-Off Thyristor (GTO), Triacs), End User (Automotive, Consumer Electronics, Telecommunication, Industrial Manufacturing, Military & Defence, Aerospace, Others

0 notes

Photo

Electronics Lab

Indian lab suppliers is leading Power Electronics is the branch of electronics which deals in equipment integrated by switching circuits used to control both alternating and direct currents. The family of discrete components used in semiconductor switching devices in power electronics can be listed as diodes, transistors and thyristors Silicon Controlled Rectifier (SCR), Gate Turn-Off Thyristors, Insulated Gate Bipolar Transistors (IGBT), Gate-Commutated Thyristors).This domain of electronics and electrical engineering is directly involved in research, design and implementation of non liner, time-varying, energy-processing electronic systems. Our power electronics lab equipment and training kits are specifically designed while keeping in mind all these pre-discussed basic components. Electronics Lab Equipments, Electronics Lab Equipments Manufacturers, Electronics Lab Equipments Exporters, Electronics Lab Equipments Suppliers, Electronics Lab Equipments in India, Electronics Lab, Electronics Lab Trainer Kits, Electronics Lab Equipments Training Kit, Electronics Lab Motor Machines, Electronics Lab Equipments Manufacturers in India, Electronics Lab Equipments Suppliers in India.

#ElectronicsLabequipmentsmanufacturerssuppliersandexporterinIndia.

http://www.indianlabsuppliers.com/electronics-lab

0 notes

Text

Power Electronics

Price: [price_with_discount] (as of [price_update_date] – Details)

[ad_1]

Introduction power semiconductor diodes and transistors diode circuits and rectifiers thyristors thyristor commutation techniques phase controlled rectifiers choppers inverter ac voltage controllers cycloconverters some applications electric drives power factor improvement switching mode Dc-Dc converters power supplies…

View On WordPress

0 notes

Text

Discrete Semiconductors Market - Growth, Size, Share, Demand and Analysis of Key Players- Forecasts To 2027

Discrete semiconductor refers to a single circuit capable of executing distinct functions, which affects the electric current flow and is confined in its own package. These devices are designed and utilized usually for operations that require high power and frequency, while also requiring unique packaging store. Discrete semiconductors are basically circuits that are made up of different semiconductor components which are linked (connected) together on a circuit board. There are many applications that use discrete semiconductors such as voltage regulation, surge protection, amplification and sound reproduction, tuning of radio and TV receivers, general switching, signal processing, current steering, power conversion, temperature measurement, among others.

With increasing demand for high energy and power efficient devices, need for advanced discrete semiconductor devices is arising. This is promoting research and development in this field. There is increase in demand for portable electronic products and wireless communication. With increasing popularity of wireless power, there is increasing demand for better performance. This in turn is driving market growth by promoting development of highly efficient and high frequency discrete semiconductors. Further, there is demand for MOSFETs and IGBTs due to increase in automobile’s electronic components. There has been growing shift in focus towards green energy power generation drives. This is further sustained as a result current technological improvement in microelectronic semiconductor devices. All these factors combined together are likely to drive the global discrete semiconductors market during the forecast period.

Get Sample Copy of the Report to understand the structure of the complete report (Including Full TOC, Table & Figures): https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=49281

Among the factors that are restraining market growth include growing demand for integrated circuits and lack of further innovation in discrete semiconductor technology. Further, increase price is discrete semiconductor devices compared to integrated circuits is posing major threat. These factors are hindering the adoption of discrete semiconductors. On the other hand, the surging trend of miniaturization in semiconductors and electronics sector could considerably provide new growth opportunities for the market. Owing to their small sizes, the circuits containing semiconductor devices are very compact.

The discrete semiconductors market can be studied on the basis of discrete semiconductor type, end-use, and geographically. Based on discrete semiconductor type, the market can be segregated into MOSFETs (planar & trench), insulated-gate bipolar transistor (IGBTs), bipolar junction transistor, thyristor (gate-commutated thyristor (GCTs), integrated gate-commutated thyristor (IGCTs), gate turn-off thyristor (GTO), triacs, etc.), rectifier (Schottky, generic, ultrafast) and others (small signal device, etc.). By end-use, the discrete semiconductors market is segmented into automotive, consumer electronics, telecommunication, industrial manufacturing, military & defense, aerospace, others. The global discrete semiconductors market has been estimated by dividing it into for five geographic regions namely- North America, South America, Europe, Asia Pacific, and Middle East & Africa. By regions, Asia-pacific region is projected to hold a significant share in the discrete semiconductors market due to rapidly flourishing electronic and semiconductors sector in developing economies such as China, India, etc. The vast majority of electronics production is focused in the Asia-Pacific region. In terms of end use, the automotive segment is projected to be the fastest growing segment of the global discrete semiconductors market.

Request For Covid19 Impact Analysis Across Industries And Markets – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=49281

Some of the leading global players driving the discrete semiconductors market are Infineon Technologies AG, Fairchild Semiconductor International, Inc., ON Semiconductor, Toshiba Corporation, NXP Semiconductors N.V., Eaton Corporation Plc, STMicroelectronics, Vishay Intertechnology, Inc., Nexperia, Diodes Incorporate, Central Semiconductor Corp, and ROHM Semiconductor among others. Nearly half of the market share is expected to be held by these leading discrete semiconductors market players during the forecast period (2018-2026). These key players are focused on integrating innovative discrete semiconductor technologies into their core competencies, so as to establish a reputed brand image. Further, these players are engaged in strategic partnerships & acquisitions and development of strong distribution network for the purpose of achieving a strong customer base.

The report offers a comprehensive evaluation of the market. It does so via in-depth qualitative insights, historical data, and verifiable projections about market size. The projections featured in the report have been derived using proven research methodologies and assumptions. By doing so, the research report serves as a repository of analysis and information for every facet of the market, including but not limited to: Regional markets, technology, types, and applications.

The study is a source of reliable data on:

Market segments and sub-segments

Market trends and dynamics

Supply and demand

Market size

Current trends/opportunities/challenges

Competitive landscape

Technological breakthroughs

Value chain and stakeholder analysis

The regional analysis covers:

North America (U.S. and Canada)

Latin America (Mexico, Brazil, Peru, Chile, and others)

Western Europe (Germany, U.K., France, Spain, Italy, Nordic countries, Belgium, Netherlands, and Luxembourg)

Eastern Europe (Poland and Russia)

Asia Pacific (China, India, Japan, ASEAN, Australia, and New Zealand)

Middle East and Africa (GCC, Southern Africa, and North Africa)

The report has been compiled through extensive primary research (through interviews, surveys, and observations of seasoned analysts) and secondary research (which entails reputable paid sources, trade journals, and industry body databases). The report also features a complete qualitative and quantitative assessment by analyzing data gathered from industry analysts and market participants across key points in the industry’s value chain.

Customization of the Report: This report can be customized as per your needs for additional data or countries. – https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=49281

A separate analysis of prevailing trends in the parent market, macro- and micro-economic indicators, and regulations and mandates is included under the purview of the study. By doing so, the report projects the attractiveness of each major segment over the forecast period.

Highlights of the report:

A complete backdrop analysis, which includes an assessment of the parent market

Important changes in market dynamics

Market segmentation up to the second or third level

Historical, current, and projected size of the market from the standpoint of both value and volume

Reporting and evaluation of recent industry developments

Market shares and strategies of key players

Emerging niche segments and regional markets

An objective assessment of the trajectory of the market

Recommendations to companies for strengthening their foothold in the market

Note: Although care has been taken to maintain the highest levels of accuracy in TMR’s reports, recent market/vendor-specific changes may take time to reflect in the analysis.

About Us

Transparency Market Research is a next-generation market intelligence provider, offering fact-based solutions to business leaders, consultants, and strategy professionals.

Our reports are single-point solutions for businesses to grow, evolve, and mature. Our real-time data collection methods along with ability to track more than one million high growth niche products are aligned with your aims. The detailed and proprietary statistical models used by our analysts offer insights for making right decision in the shortest span of time. For organizations that require specific but comprehensive information, we offer customized solutions through adhocreports. These requests are delivered with the perfect combination of right sense of fact-oriented problem solving methodologies and leveraging existing data repositories.

TMR believes that unison of solutions for clients-specific problems with right methodology of research is the key tohelp enterprises reach right decision.”

Contact

Transparency Market Research

State Tower,

90 State Street,

Suite 700,

Albany NY – 12207

United States

USA – Canada Toll Free: 866-552-3453

Email: [email protected]

Website: https://www.transparencymarketresearch.com

0 notes