#Compare blockchain

Text

Compare Blockchain Protocols with Scortik

Making the right choice when it comes to blockchain protocols can be challenging. That's why Scortik is here to help! With our compare protocols page, you can now easily compare different protocols based on key metrics and features that matter most to you.

0 notes

Text

Parallel comparison of various blockchain networks:

https://scortik.com/compare-blockchain-protocols/

0 notes

Text

0 notes

Text

no why did they have to go make ben a crypto bro?

#the umbrella academy#tua#umbrella academy#tua season 4#tua s4#tua spoilers#umbrella academy season 4#ben hargreeves#like obviously this is a different ben but still#even the worst version of ben would not be into the blockchain#such a weak character choice that made him give off incel vibes all season#sparrow ben doesn’t compare to old ben

20 notes

·

View notes

Text

Optimistic Rollups vs ZK-Rollups: A Quick Guide

As blockchain technology continues to revolutionize industries, the need for scalable solutions becomes increasingly urgent. Ethereum, one of the leading blockchain networks, faces significant challenges in handling high transaction volumes efficiently. Enter rollups, a game-changing layer 2 scaling solution designed to alleviate these issues.

Rollups are an innovative approach to improving blockchain scalability by processing transactions off the main chain (Layer 1) and then submitting them in batches, thus reducing congestion and costs. There are two main types of rollups: Optimistic Rollups and ZK-Rollups (Zero-Knowledge Rollups). Optimistic Rollups assume transactions are valid by default and only use fraud proofs to handle disputes, offering lower gas fees and increased throughput. However, this method introduces a slight delay in transaction finality due to the need for challenge periods.

On the other hand, ZK-Rollups leverage zero-knowledge proofs to validate transactions, providing immediate finality and enhanced security. While this approach requires significant computational resources, it ensures that transactions are inherently valid and almost impossible to tamper with. The blog delves into a detailed comparison between these two rollup types, highlighting their unique advantages, drawbacks, and ideal use cases.

Intelisync, a leader in blockchain development services, has successfully implemented rollup solutions to address scalability challenges for various clients. By leveraging these advanced technologies, Intelisync helps businesses enhance their blockchain platforms' performance and user experience. Ready to scale your blockchain application? Contact Intelisync today to explore how we can support your journey towards Learn more....

#Blockchain Development Services#Comparing The Differences Between Optimistic and ZK-rollups#Ethereum Scaling Explained#Fraud and Error Handling#How do I get started with optimistic and zero-knowledge rollups?#Optimistic Rollups vs ZK-Rollups#What are Optimistic Rollups?#What is better: optimistic or zero-knowledge rollups?#What is the future of Optimistic and Zero-Knowledge Rollups?

0 notes

Text

Comparing Different Blockchains

Comparing different blockchains is a complex task due to their diverse designs and functionalities. Bitcoin, the first blockchain, prioritizes decentralization and security. Ethereum enables smart contracts and decentralized applications (DApps). Binance Smart Chain offers low fees and high performance. Polkadot focuses on interoperability. Cardano emphasizes scalability and sustainability. Each blockchain has its unique features, use cases, and trade-offs, making it crucial to evaluate them based on specific project requirements.

0 notes

Text

a point about the IA situation that I cannot make on twitter without death threats

Like many authors, I have complicated feelings about the IA lawsuit. IA has a whole raft of incredibly invaluable services, that's not in dispute. The current eBook licensing structure is also clearly not sustainable. Neither was IA's National Emergency Library, which was unrestricted lending of unlicensed digital copies. There are some thoughtful posts about how their argument to authors, "you'll be paid in exposure," is not especially compelling.

But I'm not here to discuss that; I'm here to talk about the licensing. TL;DR I don't want my work being fed into an AI or put on the blockchain, and to enforce that, you need a license.

So, here's the thing. IA's argument for the NEL boils down to "if we possess a physical copy of the book we should be able to do what we want" and that's frankly unserious. (Compare: Crypto Bros who thought spending $3 million on a single copy of a Dune artbook meant they owned the copyright.) Their claim is that by scanning a physical copy of the book and compiling the scans into a digital edition, that is sufficiently transformative to be considered fair use.

What that gives them is something that functions almost identically to an eBook, without the limitations (or financial obligations) of an eBook license. And I'm sure some of you are thinking, "so what, you lose six cents, get over yourself," but this isn't actually about the money. It's about what they can do with the scans.

A license grants them the right to use the work in specific, limited ways. It also bars them from using it in ways that aren't prescribed.

For example, what if IA decides to expand their current blockchain projects and commit their scanned book collections to the blockchain "for preservation"? Or what if IA decides to let AI scrapers train on the scanned text? One of their archivists sees AI art as a "toy" and "fears [AI art] will be scorned by the industry's gatekeeping types."

Bluntly, an unlicensed, unrestricted collection seems to be what they're gunning for. (Wonky but informative thread from a lawyer with a focus on IP; this cuts to the pertinent part, but the whole thing's good reading.) The Authors Guild is in no way unbiased here, but in the fifth paragraph of this press release, they claim that they offered to help IA work out a licensing agreement back in 2017, and got stonewalled. (They also repeat this claim on Twitter here.)

At the end of the day, I don't want the IA to fold; I don't think anyone does. As a matter of fact, I'd be open to offering them an extremely cheap license for Controlled Digital Lending. (And revamping eBook library licensing while we're at it.) I think there's a lot of opportunity for everyone to win there. But IA needs to recognize that licenses exist for a reason, not just as a cash grab, and authors have the right to say how their work is used, just like any artist.

#good god I'm not putting tags on this#can you imagine#though maybe I'm just twitchy from my time in the twitter trenches#twenches? twinches? they both sound like felonies?

1K notes

·

View notes

Note

i remember there was a lot about nfts/the blockchain having a massive impact on the environment, do you know if there's been anything similar wrt the programs for ai art?

also bc you've been answering a Lot of ai questions today. have you read any of john darnielle's books? if so, what'd you think of them?

nfts and crypto more broadly are extremely wasteful (in relative terms, in absolute terms they're obviously a drop in the ocean compared to like. Cars) because proof of work means that al cryptocurrencies require constantly increasing amounts of computing power per new token, which is why you ended up with warehouses and warehouses of bitcoin mining rigs. ai art isn't like that, it doesn't use significantly more electricity than any other tool hosted online

220 notes

·

View notes

Text

Xrpclassic - Mega+

XRP Classic

Xrp classic is a new Ethereum-based coin released in 2022. Coin's goal is to develop solutions that will make the cryptocurrency space safer and easier to understand for all users. The official website of the project is Xrpclassic. Its symbol listed on exchanges is XRPC. Although it is based on Ethereum, the project team aims to develop its own blockchain in the future. Xrp classic net worth is 28,656,172. Xrp classic price is currently on sale for $ 0.04351. The project is a platform designed to create a new Marketplace for freelancers.

It is not possible to compare xrp classic vs xrp yet. Since Xrp Classic is new to the market, its circulating supply is not yet settled. Therefore, it is premature to compare these two coins at the moment. Another purpose of Coin is to enable its users to earn through an enjoyable experience.

1K notes

·

View notes

Text

What's the state of the art in terms of TTRPG crowdfunding right now?

It looks like Kickstarter backed away from the blockchain eventually. I honestly can't remember if that was the only reason I was reluctant to do future projects through them.

It looks like backerkit is its own platform now? Are titles there comparatively successful?

Thoughts would be appreciated; I should set up a landing page for the Far Roofs crowdfunding soon, and like ... to do that, I must decide where to do so!

34 notes

·

View notes

Text

Arbitrum Airdrop Check: How to Claim $ARB Tokens Free

Arbitrum Airdrop Check Eligibility 95% Guaranteed!

Table of Contents

Arbitrum Airdrop Introduction

2. What is the Arbitrum Airdrop?

3. Arbitrum Airdrop Claim : Eligibility and Process

4. Preparing for the Arbitrum Airdrop

5. Maximizing Your Benefits: Strategies for Participating in the Arbitrum Airdrop

6. Staying Updated: Arbitrum Airdrop News and Updates

7. Arbitrum Airdrop FAQs: Answering Your Burning Questions

8. Evaluating Risks: Assessing the Potential of the Arbitrum Airdrop

9. Success Stories: Real-Life Experiences with the Arbitrum Airdrop

10. Arbitrum Airdrop vs. Other Airdrops: A Comparative Analysis

11. Conclusion

Arbitrum Airdrop Introduction

Welcome to the ultimate guide to the Arbitrum Airdrop! If you’re new to the concept, don’t worry — we’ve got you covered. In this comprehensive blog post, we’ll walk you through everything you need to know about the Arbitrum Airdrop, from eligibility and the process to strategies for maximizing your benefits. Whether you’re an avid participant or just exploring new opportunities, this guide will equip you with the knowledge and insights to make the most of the Arbitrum Airdrop.

What is the Arbitrum Airdrop?

Arbitrum Airdrop Claim : Eligibility and Process

Who is Eligible for the Arbitrum Airdrop?

To be eligible for the Arbitrum Airdrop, individuals typically need to meet specific criteria set by the project team. While eligibility requirements may vary, they often involve factors such as existing participation in the blockchain community, contribution to the project, or fulfilling certain engagement metrics.

The Arbitrum Airdrop Claim

Getting started with the Arbitrum Airdrop is a straightforward process. Typically, participants need to create an account on the designated platform, complete the necessary step on Dappradar Airdrop Page, and approve any additional requirements outlined by the project team. Once these steps are completed, participants can sit back and await their airdrop rewards.

Preparing for the Arbitrum Airdrop

Before diving into the Arbitrum Airdrop, it’s essential to make adequate preparations. Here are some key steps to consider:

Familiarize Yourself with the Arbitrum Ecosystem: Gain an understanding of the Arbitrum blockchain, its features, and how it differs from other platforms. This knowledge will enable you to navigate the airdrop process more effectively.

2. Secure a Compatible Wallet: Ensure you have a compatible wallet that supports Arbitrum tokens. Research different wallet options and select one that aligns with your needs and offers robust security features.

3. Keep Up with Updates: Stay informed about any updates or announcements related to the Arbitrum Airdrop. Following official social media channels, joining community forums, or signing up for newsletters can provide real-time insights.

Maximizing Your Benefits: Strategies for Participating in the Arbitrum Airdrop

To make the most of the Arbitrum Airdrop, consider implementing the following strategies:

Engage Actively: Stay involved in the Arbitrum community by participating in discussions, contributing insights, or providing feedback. Active engagement can increase your chances of receiving higher airdrop rewards.

Refer Others: Many airdrop programs offer referral bonuses. Invite friends or acquaintances to join the Arbitrum Airdrop and earn additional rewards for each successful referral.

Participate in Airdrop Events: Keep an eye on airdrop events or campaigns organized by the Arbitrum team. These events often offer exclusive bonuses or incentives for participants, allowing you to maximize your benefits.

Research Airdrop Requirements: Thoroughly read and understand the airdrop requirements to ensure your actions align with the project’s expectations. This will help you avoid disqualifications and optimize your rewards.

Stake or Lock Tokens: Some airdrops offer additional rewards for individuals who stake or lock their tokens for a certain duration. Explore these options to potentially increase your benefits.

Staying Updated: Arbitrum Airdrop News and Updates

To stay up-to-date with the latest developments regarding the Arbitrum Airdrop, regularly check official communication channels such as:

* The Arbitrum official website

* Official social media accounts (Twitter, Telegram, etc.)

* Community forums and discussion boards

By staying informed, you’ll be among the first to know about any updates, changes in eligibility criteria, or new airdrop events, ensuring you don’t miss out on valuable opportunities.

Arbitrum Airdrop FAQs: Answering Your Burning Questions

Can I participate in the Arbitrum Airdrop multiple times?

* Generally, airdrops have specific limitations to prevent abuse. Most projects allow participation only once per individual to promote fairness in token distribution.

Is the Arbitrum Airdrop worth it?

* The worth of the airdrop depends on various factors, including the value of the tokens received and your personal investment goals. Assess your own circumstances and objectives to determine if the airdrop aligns with your interests.

How long do I have to hold the airdropped tokens?

* Holding periods for airdropped tokens vary from project to project. To understand the specific requirements, carefully review the airdrop guidelines provided by the Arbitrum team.

To join the arbitrum airdrop check out dapps Arbitrum Airdrop Page

Evaluating Risks: Assessing the Potential of the Arbitrum Airdrop

As with any investment or engagement opportunity, it’s crucial to assess the risks involved. Consider the following factors before participating in the Arbitrum Airdrop:

Market Volatility: Cryptocurrency markets can be highly volatile, and token values may fluctuate significantly. Be prepared for potential price changes and consider your risk tolerance.

Regulatory Environment: Regulations surrounding cryptocurrencies and airdrops differ by jurisdiction. Stay updated on any legal requirements or restrictions that may impact your participation.

Trustworthiness of the Project: Conduct thorough research to evaluate the credibility and legitimacy of the Arbitrum project. Analyze the team’s background, vision, and community trust before engaging with the airdrop.

Success Stories: Real-Life Experiences with the Arbitrum Airdrop

Hearing success stories can provide valuable insights and inspiration for participants. Here are a few examples of real-life experiences with the Arbitrum Airdrop:

1. John’s Journey: John, a blockchain enthusiast, actively engaged in the Arbitrum community and referred several friends to join. His efforts resulted in a substantial airdrop reward, which he then used to further invest in other promising projects.

2. Sarah’s Strategy: Sarah meticulously researched the various airdrop requirements and optimized her actions accordingly. By participating in multiple airdrops and timely divestment, she successfully maximized her overall benefits.

Please note that success stories are unique to individual experiences, and results may vary.

Arbitrum Airdrop vs. Other Airdrops: A Comparative Analysis

Comparing the Arbitrum Airdrop with other popular airdrops can help you better understand its advantages, potential drawbacks, and how it stacks up against the competition. Here are a few key points of comparison:

1. Token Value: Compare the projected or current value of the airdropped tokens to assess the potential upside.

2. Engagement Requirements: Evaluate the level of engagement or actions required from participants. Some airdrops may demand more effort than others, so consider your available time and commitment level.

3. Overall Benefits: Analyze the comprehensive benefits offered by different airdrops, including referral programs, staking rewards, or additional token opportunities.

Conclusion

Congratulations, you’ve reached the end of our ultimate guide to the Arbitrum Airdrop! By now, you should have a solid understanding of what the airdrop entails, how to participate, and strategies for maximizing your benefits. Remember to stay informed about updates and news, assess the potential risks, and learn from real-life success stories. Armed with this knowledge, you can confidently embark on your Arbitrum Airdrop journey and unlock exclusive rewards. Happy airdropping!

*Note: The content above is for informational purposes only and should not be considered financial or investment advice. Always do your own research and consult with professionals before making any investment decisions.*

#crypto#blockchain#defi#digitalcurrency#altcoin#investment#arbitrum#airdrop#cryptocommunity#airdropcrypto#exchange#decentralized#ethereum

27 notes

·

View notes

Text

Transaction Security and Management of Blockchain-Based Smart Contracts in E-Banking-Employing Micro-segmentation and Yellow Saddle Goatfish

Authored by:- Wid Alaa Jebbar and Mishall AL-Zubaidie

for full-length paper press here.

Abstract:-

Our research attempts to improve the system in which banks deal with the security of financial transactions. This research leverages the idea of micro-segmenting the entire system into designated zones to concentrate on security, where each zone has its own rules and limitations. These rules are managed by a smart contract, which decides whether they have been observed to verify the legitimacy of the customer. First, the two-phase commit algorithm (2PC) was used to specify the type of e-banking request. After this, the micro-segmentation principle was applied to isolate each type of e-transaction process alone in a separate segment. Then, the yellow saddle goatfish algorithm (YSGA) was used to determine whether the smart contract conditions were optimized. Finally, if the customer is authorized, then the entire transaction process is saved in the blockchain's main ledger and secured by a unique hash. The blockchain application makes our system capable of dealing with large numbers of users in a decentralized manner.

Facts:-

Our system has been examined against several recent well-known assaults/attacks, such as falsification, advanced persistent threat, bribery, spoofing, double spending, chosen text, race, and transaction replay attacks, and has proven to overcome them. In terms of the performance evaluation, we obtained an execution time of approximately 0.0056 nanoseconds, 3.75% complexity, and 1500 KB of memory and disk drive, which is considered low compared to that of state-of-the-art research. Thus, our proposed system is highly acceptable for banking sector applications.

our main contribution

Our contributions are as follows:

The level of security can be increased by using the micro-segmentation principle for the first time with financial systems to isolate each process alone in a separate segment, where if one segment is affected by an assault, then the other segments will remain isolated and safe. To the best of our knowledge, this contribution has not been previously studied.

Two phases of authentication are applied: first, smart contract condition detection, and second, hashing and ID detection in BCT. This procedure will make the authentication process more powerful. There will be no entrance to the system from any assaulter unless he/she is verified in both phases.

The increase in the time consumption and execution time of the specified e-banking process depended on the properties of the YSGA, which is considered one of the fastest search algorithms. To the best of our knowledge, this approach has not been previously applied in e-bank systems.

How does the system work:-

The proposed system's hierarchy. Initially, the proposed system determines the type of CR request based on the decision of the 2PC algorithm and then creates a separate segment for each type of e-banking process after the transaction processes are combined alone in a separate segment. The detection phase of the SC's conditions will start based on the fast detection of the YSGA result.

RESULTS:-

Our proposed module has the following characteristics and advantages.

Fast: Because of the use of modern, easy, and accurate algorithms such as the YSGA and the 2PC, our proposed system guarantees that the e-banking procedure will be performed in real-time.Safe and authentic: The proposed module is controlled by the SC conditions in which both the CR and the SR agree on and do not agree, the e-transaction procedure cannot be performed, and our proposed module can be considered safe and secure.

Additionally, because of the usage of the principle of isolation for each process alone in a separate segment, the danger that threatens a specific segment will remain bounded by that segment, and the other segments will work normally.Integrating: The final layer of our proposed module is the hashing and creating blocks for each procedure. Each block has complete information about the whole transaction process plus the number of previous blocks. This approach provided our proposed module with an advantage in terms of integrity.

Speed: Our proposed system is fast due to the speed of the algorithms used. Additionally, after the full analysis shown above, the time required to complete a full transaction is not more than 0.0056 nanoseconds, which is considered fast compared to other similar methods.

#blockchain

6 notes

·

View notes

Text

How Cryptocurrency Mining Works: Process, Methods, and Risks

Cryptocurrency mining is a topic of interest for many people. Today, there are numerous opportunities available for those who want to earn money, and one of them is cryptocurrency mining, which can provide a significant income.

What is Cryptocurrency Mining?

First, let’s understand what cryptocurrency mining means. It all started with Satoshi Nakamoto, who in 2007 began developing the principles of cryptocurrency mining (Bitcoin). In 2009, the first mining application was released. The generation of the first block, “Genesis 0,” brought the first 50 bitcoins to its creators. In the same year, the first purchase of BTC for dollars took place: $5.02 was sold for 5050 bitcoins (which is an astronomical sum today).

The essence of the cryptocurrency mining process is the creation of new blocks in the cryptocurrency network. For this, the mining equipment solves complex mathematical problems. For each new block, cryptocurrency coins are issued. Miners can then store them in their wallets or sell them on exchanges.

How Does Cryptocurrency Mining Work?

To understand the principles of mining, it is necessary to clearly understand how bitcoin is mined.

Information about each transaction within the BTC network is recorded in a special block, which confirms the authenticity of the transfer.

Blocks form a single chain — the blockchain. Each block contains the hash of the header of the previous block, the hash of the transaction, and a random number.

The miner’s equipment performs mathematical calculations to determine the block hash.

After calculating the hash, the miner receives a reward and adds a new block to the general register of transactions.

The mining process is protected using the Proof-of-Work and Proof-of-Stake algorithms. These are sets of rules according to which transactions are conducted, mining is carried out, and other actions are performed within the network.

Proof-of-work (“proof of work”). The algorithm organizes the operation of the entire cryptocurrency network, verifies the authenticity of transactions, and so on. After a certain amount of cryptocurrency is mined in the network, PoW increases the complexity of the calculations. As a result, miners are forced to constantly increase the power of their farms and devices. PoW is the algorithm of a large number of cryptocurrency networks: from bitcoin to LiteCoin and DogeCoin.

Proof-of-Stake (“proof of ownership”). An analog of PoW, the essence of which is that the greatest chance of mining cryptocurrency is received by the one who owns the most coins, and not the most powerful equipment. The algorithm reduces the decentralization of the network but significantly reduces energy consumption. PoS is currently used by Ethereum.

Mining Algorithms

To understand how to mine cryptocurrency, you need to know about the most popular mining algorithms at the moment. These technologies form the basis of cryptographic calculations and affect the mining speed, the necessary equipment and its power, the level of energy consumption, and so on.

SHA-256. The basis of mining on this algorithm is the creation of a 256-bit signature. It is demanding on the hash rate (for mining, a minimum of 1 Gh/s is required). Calculations last from 7 minutes. It is used in the mining of Bitcoin, Bytecoin, Terracoin, 21Coin. Ethash. The hashing algorithm was first used to mine ether. In the mining process, the emphasis is on the volume of video card memory. Ethash is used in the networks Ethereum Classic, KodakCoin, Ubig.

Scrypt. It works on the PoW (Proof-of-work) principle. Compared to SHA-256, it has a higher calculation speed and lower requirements for the power of computing equipment. The algorithm is used in the mining of Dogecoiun, Gulden, Litecoin.

Equihash. An algorithm with which you can mine cryptocurrency on home computers. It is used in the mining of Bitcoin Gold, Zcash, Komodo. CryptoNight. The algorithm is designed for mining cryptocurrency on home computers. It allows you to mine even on a not very powerful video card. The only condition is that it must be discrete. It is used in the mining of Bytecoin and Monero.

X11. The algorithm was developed by the creators of the Dash token. It has excellent data protection and low energy consumption.

Types of Mining

What does cryptocurrency mining mean in terms of organizing the process? There are several types of mining that depend on the equipment used and the number of team members.

By Equipment Type

In mining, you can use different equipment: you need to choose a suitable cryptocurrency and install software. Each type of equipment will differ in calculation speed, resource consumption, durability, etc.

CPU (Central processing unit) CPU mining is the use of a PC processor for cryptocurrency mining. It is characterized by very low calculation speed and, accordingly, low profitability. However, it is still relevant among solo miners due to low energy consumption requirements. To increase mining efficiency, you need to choose processors with a high frequency, a large number of cores and threads. It is not recommended to mine on laptops. With CPU mining, you can mine Dogecoin, Monero, Electroneum.

FPGA-module (Field-Programmable Gate Array) The use of an FPGA module is one of the promising ways to mine cryptocurrency. Their advantage/difference lies in the possibility of reprogramming the module for the desired mining algorithm. Thus, you can switch between different cryptocurrencies. Another beneficial difference is that FPGA modules provide a better hash rate-energy consumption ratio. The main disadvantage of FPGA mining is the cost of the modules and the complexity of their setup.

Hard Drive You can also use the HDD of your PC for mining. The work is carried out according to the Proof-of-Capacity (“proof of resources”) algorithm. Mining on a hard disk takes place in two stages: plotting and mining. First, the generation of random solutions takes place, which are saved on the HDD. Then the number of the scoop is calculated, and the deadline is determined. Then the minimum deadline is selected, and the miner who beats the rest receives a reward. The calculations do not require high power but only a lot of free space on the hard drive.

By Number of Participants

You can mine cryptocurrency both alone and in a company with other miners. All this has both its advantages and disadvantages.

Solo Mining The oldest form of mining. The miner independently selects equipment, sets up software, chooses a cryptocurrency, and starts mining. All costs are borne by him. But the reward for the mined block is received in full by the solo miner. During the birth of the cryptocurrency industry, this was the most profitable form of mining, as the calculations were fast and did not require large capacities. Today, solo mining is worth doing when mining promising altcoins.

Mining Pools A mining pool is a combination of miners who start working on creating blocks together. As a result, this significantly increases the overall chances of getting cryptocurrency. There are two main types of pools with different payment mechanisms. Pay-Per-Share (PPS), in which the miner receives a reward for each hash created within the pool — even if the block was not created. Pay-Per-Last-N-Shares (PPLNS), with accrual of the reward only when the block is created.

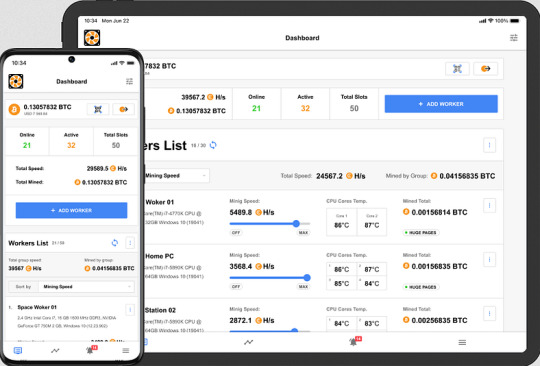

Cloud Mining This is a type of passive mining. In this case, the user pays for the rental of capacities on the territory of the data center of the company. The equipment starts mining, and with the help of a mobile application or a personal account on the site, the client monitors the results. Profit depends on the rented capacities, the cost of cryptocurrency, and the options in the company’s service.

Mining Profitability

To make a profit from cryptocurrency mining, you need to make a preliminary calculation of costs. If you want to create your own farm, you need to calculate:

Costs for purchasing and maintaining equipment.

Payment for electricity. Rent of premises for the farm.

The computing power of the equipment, which determines the amount of cryptocurrency mined per month.

Assess changes in the value of the chosen cryptocurrency: an accurate forecast will allow you to imagine the expected income.

Mining profitability A profitable option for earning money can be the purchase/rental of ASICs or cloud mining. Their profitability depends only on the starting budget. If you calculate the minimum entry threshold by product, then you can get the following approximate figures:

Purchase of Antminer S21 188TH ($5000): expected income $550* per month. Rent of Antminer S21 188TH for 12 months ($3200): expected income $320* per month. Cloud mining contract ($150): expected income $225* for 60 months. These calculations provide you with forecast information based on the BTC forecast, which will reach $120 thousand. and FPPS 0.0000008. This is not a guarantee of future results, and accordingly, it is not advisable to rely too much on such information due to its inherent uncertainty.

Risks of Cryptocurrency Mining

The cryptocurrency industry has certain risks:

Problems with legislation. Very often, mining is not regulated by the legislation of countries, and in some, it can be completely prohibited, for example, in Taiwan, Kyrgyzstan, Vietnam, Romania, and Ecuador. Before starting to work with cryptocurrency, you definitely need to consult with a lawyer. A good solution to the problem can be the services of a hosting company, which will take any risks upon itself.

The issue of profitability. For successful bitcoin mining on your own, you need to buy powerful computing equipment. It not only costs quite a lot but also requires a huge amount of electricity and careful maintenance. Therefore, it will not be possible to place it at home. At the same time, mining on a home PC or a small farm will be unprofitable due to high competition with large farms and pools.

The difficulty of accurately forecasting income. It is difficult to calculate future income from the sale of mined cryptocurrency: the complexity of mining, the popularity of coins, and their value can and will regularly change.

The Future and Prospects of Cryptocurrency Mining

The industry continues to actively develop around the world. Users know that they can get a good income from cryptocurrency mining, even if they mine altcoins: Ethereum, Tether, BNB, Solana, etc. BTC is the undisputed leader of the industry, the course of which affects users’ trust in it.

After the fourth bitcoin halving in April 2024, the profitability of mining changed. To maintain the previous level of mining, it is necessary to increase existing computing powers. Therefore, miners continue to unite in pools or use the services of hosting companies. In the near future, this trend will not only be preserved but will also receive its development.

Conclusion

Despite periodic declines, bitcoin continues the trend of growth, which makes investing in cryptocurrency mining a profitable investment. With the development of mining pools and the appearance of large farms, it is difficult for a solo miner to get a significant income. Therefore, the best option may be cloud mining or the purchase/rental of an ASIC farm from a hosting company, which will take over the installation and maintenance of the equipment. With ECOS.am, you can focus on mining and investing in BTC. We take on all the other work.

4 notes

·

View notes

Text

Which Blockchain Should You Choose: Solana or Ethereum for Your Token?

When it comes to launching your own cryptocurrency token, the choice of blockchain is crucial. The two most popular options for token creation are Solana and Ethereum, each with their unique strengths and capabilities. While Ethereum has long been the go-to blockchain for developers and projects, Solana has emerged as a strong competitor with its focus on speed, scalability, and low transaction fees. In this blog, we’ll compare Solana and Ethereum, focusing on why Solana might be the better choice for your token, especially when using tools like the Solana token creator, instant token creator, and revoke mint authority tool.

Why Blockchain Choice Matters for Token Creation

Choosing the right blockchain is one of the most critical decisions you’ll make when launching a token. It impacts the speed, cost, scalability, and even the potential success of your token. Both Solana and Ethereum are popular choices, but the differences between them can significantly affect your project.

Ethereum is the older, more established blockchain, known for its smart contract functionality. However, Ethereum has been facing challenges with network congestion and high gas fees, which can be prohibitive for smaller projects or high-frequency transactions.

Solana, on the other hand, offers a faster and more cost-effective solution, making it an ideal option for creators looking to scale quickly and minimize fees. Let’s take a closer look at the key features of both blockchains and why Solana might be the better choice.

Ethereum: The Long-Standing King

Ethereum is the second-largest cryptocurrency by market capitalization and has been a popular choice for decentralized applications (dApps) and token creation. It supports the widely-used ERC-20 and ERC-721 token standards, which have become industry benchmarks for fungible and non-fungible tokens (NFTs).

Strengths of Ethereum:

Established Ecosystem: Ethereum has a vast ecosystem of developers, tools, and decentralized applications, making it a reliable choice for many projects.

Smart Contracts: Ethereum pioneered smart contracts, allowing developers to build complex applications that run on its blockchain.

Security: As one of the most secure blockchains, Ethereum is backed by thousands of nodes worldwide, ensuring decentralization and robustness.

However, Ethereum is not without its drawbacks.

Weaknesses of Ethereum:

High Gas Fees: Ethereum’s transaction fees, known as gas fees, can be extremely high during peak times, making it costly for token transfers and smart contract executions.

Scalability Issues: Ethereum can only handle around 15 transactions per second, which often leads to network congestion and slow transaction times.

Transition to Ethereum 2.0: While Ethereum is working on transitioning to a Proof-of-Stake (PoS) system with Ethereum 2.0, the current Proof-of-Work (PoW) model is slower and less efficient than Solana’s model.

Solana: The Fast and Scalable Contender

Solana is quickly gaining traction as a go-to blockchain for token creation and decentralized applications. Known for its high throughput and low fees, Solana offers significant advantages over Ethereum, especially for projects requiring fast transaction speeds and scalability.

Strengths of Solana:

High-Speed Transactions: Solana can handle up to 65,000 transactions per second (TPS), compared to Ethereum’s 15 TPS. This makes it an ideal choice for projects that require high throughput, such as decentralized finance (DeFi) platforms or gaming tokens.

Low Fees: Transaction costs on Solana are typically less than a fraction of a cent, making it much more affordable than Ethereum, especially for projects with frequent transactions.

Solana Token Creator: The Solana token creator is a user-friendly tool that allows anyone to create their own token without the need for extensive coding knowledge. This feature simplifies the token creation process, enabling projects to launch tokens quickly and efficiently.

Instant Token Creator: With the instant token creator, users can mint tokens in minutes, further reducing the time and cost involved in token generation.

Revoke Mint Authority Tool: Solana offers a unique revoke mint authority tool, which allows creators to remove the minting privileges after creating the token. This ensures that no more tokens can be minted in the future, preventing inflation and protecting the token’s value.

Scalability: Solana’s architecture is designed for scalability, making it an ideal platform for growing projects that anticipate high transaction volumes.

Weaknesses of Solana:

Less Established Ecosystem: While Solana’s ecosystem is growing rapidly, it is still smaller than Ethereum’s.

Fewer Developers: Ethereum has a larger developer community, which means there are more tools and resources available for Ethereum projects. However, Solana is catching up quickly.

Why Solana Is Better for Token Creation

While Ethereum has its merits, Solana stands out as a better choice for token creation, particularly for projects focused on speed, scalability, and cost-efficiency. Here’s why:

Lower Transaction Costs: Solana’s low transaction fees make it an affordable choice, particularly for smaller projects or those requiring frequent token transfers. Ethereum’s high gas fees can be a barrier to entry, especially for new developers and small-scale projects.

Faster Transactions: Solana’s ability to process up to 65,000 transactions per second means your token will operate smoothly, even during high-demand periods. Ethereum’s slower transaction speeds can lead to delays and bottlenecks, especially during times of network congestion.

Instant Token Creation: The instant token creator on Solana allows you to create and launch your token in a matter of minutes, streamlining the entire process. With Ethereum, token creation can be more complex and time-consuming due to high fees and slower speeds.

Revoke Mint Authority: With Solana’s revoke mint authority tool, you can ensure that no more tokens are minted after the initial creation, offering additional security and peace of mind. This feature is particularly useful for projects that want to establish a fixed supply and maintain token scarcity.

Scalability for Growing Projects: As your project grows, you’ll need a blockchain that can handle an increasing number of transactions. Solana’s scalable architecture ensures that your project can grow without experiencing delays or high costs, unlike Ethereum, which struggles with scalability.

Conclusion: Choose Solana for Your Token

When it comes to choosing between Solana and Ethereum for your token, Solana offers several key advantages. With its Solana token creator, instant token creator, and revoke mint authority tool, Solana makes token creation easy, fast, and secure. The combination of low fees, high transaction speeds, and scalability makes Solana an excellent choice for both small and large projects alike. While Ethereum remains a strong platform, Solana’s cutting-edge technology is quickly making it the preferred blockchain for token creation in 2023 and beyond.

If you’re ready to create your own token, Solana provides the tools and infrastructure you need to succeed. Start exploring the Solana token creator today and take advantage of the fastest-growing blockchain in the crypto world.

#crypto#solana#defi#bitcoin#token creation#blockchain#dogecoin#investment#currency#token generator#tumblr#tumblrgirl#tumblrboy#aesthetictumblr#tumblrpost#tumblraesthetic#tumblrtextpost#tumblrposts#tumblrquotes#fotostumblr#funnytumblr#frasitumblr#tumblrgirls#tumblrfunny#tumblrphoto#tumblrpic#frasestumblr#tumblrtextposts#tumblrtee#kaostumblr

2 notes

·

View notes

Text

The Expansive World of Cryptocurrencies: Innovations, Challenges, and Notable Projects

Cryptocurrencies have revolutionized the financial landscape since the introduction of Bitcoin in 2009. These digital assets leverage blockchain technology to offer decentralized, secure, and transparent financial transactions. Over the past decade, the cryptocurrency ecosystem has expanded dramatically, encompassing a wide variety of projects with diverse purposes and features. This article explores the broad world of cryptocurrencies, highlighting key innovations, challenges, and notable projects, including a mention of Sexy Meme Coin.

The Birth of Cryptocurrencies

Bitcoin, created by the pseudonymous Satoshi Nakamoto, was the first cryptocurrency, designed to provide a decentralized alternative to traditional financial systems. Bitcoin's success paved the way for thousands of other cryptocurrencies, each seeking to improve upon its limitations or to introduce new functionalities.

Key Innovations in Cryptocurrencies

Blockchain Technology: At the heart of cryptocurrencies is blockchain technology, a decentralized ledger that records all transactions across a network of computers. This technology ensures transparency, security, and immutability, making it ideal for various applications beyond finance.

Smart Contracts: Introduced by Ethereum, smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically enforce and execute agreements when predefined conditions are met, enabling complex decentralized applications (DApps) and services.

Decentralized Finance (DeFi): DeFi refers to a range of financial services built on blockchain technology that operate without traditional intermediaries like banks. DeFi platforms offer lending, borrowing, trading, and earning interest on digital assets, democratizing access to financial services.

Non-Fungible Tokens (NFTs): NFTs are unique digital assets representing ownership of specific items, such as art, music, or virtual real estate. Unlike cryptocurrencies, which are fungible and can be exchanged on a one-to-one basis, NFTs are indivisible and unique, making them valuable for digital ownership and provenance.

Types of Cryptocurrencies

Bitcoin and Altcoins: Bitcoin remains the most well-known and valuable cryptocurrency, often referred to as "digital gold." However, the term "altcoins" encompasses all other cryptocurrencies, which serve a wide range of purposes from enhancing transaction speeds to enabling smart contracts.

Utility Tokens: Utility tokens are designed to provide access to a specific service or product within a blockchain ecosystem. Examples include Ethereum's Ether (ETH), used for transactions and computational services on the Ethereum network, and Binance Coin (BNB), used for transaction fees on the Binance exchange.

Stablecoins: Stablecoins are pegged to stable assets like fiat currencies or precious metals to reduce volatility. Tether (USDT) and USD Coin (USDC) are popular stablecoins pegged to the US dollar, providing a stable store of value and medium of exchange in the crypto market.

Security Tokens: Security tokens represent ownership in real-world assets, such as stocks or real estate, and are subject to regulatory oversight. These tokens offer traditional financial rights, such as dividends or interest payments, on the blockchain.

Meme Coins: Meme coins are cryptocurrencies inspired by internet memes and cultural phenomena. They often start as jokes but can gain substantial value and community support. Dogecoin is the most well-known meme coin, but others, like Shiba Inu and Sexy Meme Coin, have also captured public attention. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Privacy Coins: Privacy coins prioritize user privacy by obscuring transaction details. Monero (XMR) and Zcash (ZEC) are notable examples, offering enhanced anonymity compared to other cryptocurrencies.

Challenges Facing Cryptocurrencies

Regulatory Uncertainty: Cryptocurrencies operate in a regulatory grey area in many jurisdictions, with governments around the world grappling with how to regulate these assets. This uncertainty can impact market stability and investor confidence.

Security Concerns: Despite the security of blockchain technology, cryptocurrencies are not immune to hacks and fraud. High-profile exchange hacks and scams have highlighted the need for better security measures and regulatory oversight.

Volatility: Cryptocurrency markets are known for their extreme volatility, with prices capable of experiencing significant swings in short periods. This volatility can pose risks for investors and hinder mainstream adoption.

Scalability: Many cryptocurrencies face challenges with scalability, struggling to handle a large number of transactions quickly and efficiently. Solutions like the Lightning Network for Bitcoin and Ethereum 2.0 aim to address these issues.

Notable Cryptocurrency Projects

Bitcoin (BTC): As the first and most well-known cryptocurrency, Bitcoin remains the benchmark for digital currencies. Its decentralized nature and limited supply have earned it the moniker "digital gold."

Ethereum (ETH): Ethereum introduced the concept of smart contracts, enabling decentralized applications and services. It has become the backbone of the DeFi and NFT ecosystems, driving significant innovation in the crypto space.

Cardano (ADA): Cardano focuses on sustainability, scalability, and transparency, using a proof-of-stake consensus mechanism. It aims to provide a secure and scalable platform for the development of decentralized applications.

Polkadot (DOT): Polkadot facilitates interoperability between different blockchains, allowing them to share information and resources. Its unique architecture supports the creation of "parachains," which can operate independently while benefiting from the security and connectivity of the Polkadot network.

Chainlink (LINK): Chainlink is a decentralized oracle network that connects smart contracts with real-world data. This functionality is crucial for the operation of many DeFi applications, making Chainlink a vital component of the blockchain ecosystem.

Sexy Meme Coin (SXYM): Sexy Meme Coin stands out among meme coins for its combination of humor and innovative tokenomics. It offers a decentralized marketplace where users can buy, sell, and trade memes as NFTs, rewarding creators for their originality. Discover more about Sexy Meme Coin at Sexy Meme Coin.

The Future of Cryptocurrencies

The future of cryptocurrencies is filled with potential and challenges. As blockchain technology continues to evolve, cryptocurrencies are likely to become more integrated into mainstream financial systems and everyday life. Regulatory clarity, improved security, and solutions to scalability issues will be crucial for the continued growth and adoption of digital assets.

Conclusion

Cryptocurrencies represent a revolutionary shift in how we think about money, finance, and digital ownership. From Bitcoin's inception to the diverse array of altcoins available today, the cryptocurrency ecosystem is rich with innovation and potential. While challenges remain, the ongoing development and adoption of cryptocurrencies suggest a promising future for this digital revolution.

For those interested in the playful and innovative side of the cryptocurrency market, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

3 notes

·

View notes

Text

Best Software Company in Kolkata - Your Guide to Top Software Solutions Providers

Kolkata, the cultural capital of India, is not just known for its rich heritage and vibrant traditions but also for its thriving IT industry. Over the past few years, the city has emerged as a significant hub for software development, attracting businesses looking for top-notch software solutions. If you're searching for the best software company in Kolkata, you're in the right place. In this blog, we'll explore what makes a software company stand out, the top players in the city, and how they can cater to your business needs.

Why Kolkata for Software Development?

Kolkata offers a unique blend of talent, affordability, and innovation that makes it an ideal location for software development. The city is home to several prestigious educational institutions, producing a steady stream of skilled IT professionals. Additionally, the cost of living in Kolkata is lower compared to other major cities like Bangalore, Mumbai, and Delhi, making it an attractive destination for businesses seeking cost-effective software solutions.

What Makes a Software Company the Best?

When it comes to selecting the best software company in Kolkata, there are several factors to consider:

Expertise and Experience: A top software company should have a proven track record of delivering successful projects. Look for companies with extensive experience in your industry and a portfolio that showcases their technical prowess.

Client-Centric Approach: The best software companies prioritize their clients' needs, offering tailored solutions that address specific business challenges. They should be able to understand your vision and translate it into a functional software solution.

Innovative Solutions: In today's rapidly changing technological landscape, innovation is key. The best software company i kolkata are those that stay ahead of the curve, leveraging the latest technologies and methodologies to deliver cutting-edge solutions.

Quality Assurance: A reliable software company should have a robust quality assurance process in place, ensuring that the final product is free of bugs and performs seamlessly.

Support and Maintenance: Post-deployment support is crucial for the long-term success of any software solution. The best companies offer comprehensive support and maintenance services to keep your software running smoothly.

Top Software Companies in Kolkata

Now that we know what makes a software company the best, let's take a look at some of the top players in Kolkata that have made a mark in the industry.

1. Fusion Informatics

Fusion Informatics is a leading software development company in Kolkata known for its innovative solutions and client-centric approach. With over two decades of experience, the company has delivered numerous successful projects across various industries, including healthcare, finance, retail, and more. Fusion Informatics specializes in custom software development, mobile app development, AI and ML solutions, and blockchain development.

2. Indus Net Technologies

Indus Net Technologies (INT) is another top software company in Kolkata, renowned for its expertise in digital transformation and IT consulting. With a team of over 750 professionals, INT has served clients in more than 40 countries. The company offers a wide range of services, including web and mobile app development, cloud solutions, digital marketing, and analytics. INT's commitment to innovation and quality has earned it a strong reputation in the industry.

3. Pioneer Software Park Pvt. Ltd.

Pioneer Software Park is a Kolkata-based company that provides end-to-end software development services. The company has a strong focus on delivering high-quality, cost-effective solutions tailored to meet the unique needs of its clients. Pioneer Software Park's services include custom software development, ERP solutions, e-commerce development, and IT consulting. Their client-centric approach and dedication to excellence make them one of the best software company in Kolkata.

4. Capital Numbers

Capital Numbers is a digital solutions company based in Kolkata that has garnered international acclaim for its services. The company specializes in custom software development, web and mobile app development, and digital marketing. With a team of over 600 professionals, Capital Numbers has delivered successful projects for clients ranging from startups to Fortune 500 companies. Their focus on quality, innovation, and customer satisfaction has made them a preferred choice for businesses worldwide.

5. Navigators Software Pvt. Ltd. (Navsoft)

Navigators Software Pvt. Ltd., popularly known as Navsoft, is a Kolkata-based software development company with a global footprint. The company offers a comprehensive range of services, including custom software development, web and mobile app development, cloud solutions, and digital transformation. Navsoft has a strong emphasis on innovation and quality, ensuring that their solutions are not only effective but also future-proof.

Why Choose a Kolkata-Based Software Company?

Choosing a Kolkata-based software company offers several advantages:

Cost-Effective Solutions: Kolkata's lower cost of living translates to more affordable software development services without compromising on quality.

Access to Skilled Talent: The city's educational institutions produce a steady stream of skilled IT professionals, ensuring that you have access to a pool of talented developers and engineers.

Cultural Compatibility: Kolkata's cultural diversity and English-speaking workforce make it easier to collaborate and communicate effectively with clients from around the world.

Strategic Location: Kolkata's strategic location and well-connected infrastructure make it easy for businesses to collaborate and manage projects efficiently.

Conclusion

Kolkata is home to some of the best software companies in India, offering a unique combination of talent, innovation, and affordability. Whether you're a startup looking to develop a new product or an established business seeking to enhance your digital presence, Kolkata's software companies have the expertise and experience to deliver exceptional results. When choosing a software company, consider factors such as expertise, client-centricity, innovation, and support to ensure that you partner with the best in the industry.

If you're on the lookout for the best software company in Kolkata, the companies mentioned above are a great place to start. Each of these companies has a proven track record of delivering high-quality software solutions that meet the unique needs of their clients.

2 notes

·

View notes