#Credit Outstanding in the UAE in AED

Text

Apply for a car/Auto Loan In Dubai

Apply For Car /Auto Loan In Dubai

About

Car loans in the UAE are an extraordinary method for buying a car without paying everything forthright. They offer cutthroat paces of interest and adaptable reimbursement terms.

You don't need to defer or pause for a moment before getting your hands on that great, fantastic ride. With the idea of car loans in presence, getting another car is conceivable way prior and more straightforward than it used to be. What's more, the ongoing business sector scope settles on it a more astute decision to get you supported with a car loan as opposed to paying forthright. Today, practically all top banks are offering car advances in UAE and Dubai, with serious car loan financing costs, adaptable reimbursement periods alongside a few different advantages. In the present day and time, Car finance in Dubai is a generally simple and smooth undertaking, given the way that you are a very much informed purchaser.

Advantages of Car Loans in UAE

Here is a rundown of advantages and alluring elements of getting car loans in the UAE.

Low and Debatable Financing costs: Car loan fees in UAE are somewhat low beginning at 2%. Most banks offer both fixed and diminishing car advance loan fees permitting clients have greater reimbursement decisions.

Simple Handling: Your car advance in UAE gets handled rapidly, kindness adaptable activities of top banks in the UAE. This basically implies that you won't need to go through hours and days getting endorsements, realigning or reassigning customs for the acquisition of your new car.

Low Least Compensation Prerequisites: Contingent upon the bank you pick, the base compensation expected to get a car loan in UAE could be essentially as low as AED 5000, making it feasible for all functioning people to have a confidential car.

Simple Method for purchasing a Car: Getting a car funded in Dubai is one of the least demanding ways of possessing a car. You can pick a basic, low-interest month to month reimbursement and become a car proprietor in a flash. Car finance in Dubai dispenses with months and now and again long periods of hole between beginning to put something aside for purchasing the car lastly having the option to do as such.

Adaptable Reimbursement Residency: All top banks in UAE offer adaptable car advances reimbursement choices. Clients can design their reimbursement methodology and pick the EMI residency and sum in the manner that suits them the best.

Funding Utilized Cars: Utilized Car loans in UAE can likewise be utilized to go downhill and trade-in cars in Dubai. Most banks in UAE offer funding for utilized cars at a somewhat higher loan cost. The banks decide the greatest age and state of the car through an assessment.

100 percent Supporting: While the more famous idea of car finance in Dubai is going 80-20 on funding and initial investment separately. There are many banks that offer 100 percent supporting choices for a car advance in the UAE.

Further develops FICO rating: Taking a car loan in Dubai and taking care of it according to the EMI of your arrangement will significantly further develop your FICO assessment, guaranteeing better open doors and notoriety with the banks.

Great Financial record: Car advances in the UAE are one of the most outstanding ways of building your record of loan repayment. This guarantees that your future loans applications with the bank will be smoother and more straightforward to get endorsed.

Benefits

Most extreme Vehicle Credit Sum

Vehicle Advance Loan costs

Most extreme Reimbursement Residency:

Least Compensation Required:

Extra Advantage: Free for life Visa

Money to Initial installment Proportion

Documents Required for Car Loans in UAE

For Self employed candidates

Properly filled vehicle credit application structure

Duplicate of Identification

Visa page from inhabitant Visa demonstrating residency

Driving permit of the candidate

Bank proclamations - ideally throughout the previous three months

Exchange permit of the business

Overarching legal authority (POA)

Update of Affiliation (MOA) or Article of Relationship (if there should be an occurrence of LLC)

Association arrangement (if there should be an occurrence of LLC)

for salaried candidates

Duplicate of Identification

Visa page from inhabitant Visa demonstrating residency

Driving permit of the candidate

Bank articulations - ideally throughout the previous three months

Pay Declaration of the candidate (not needed assuming the compensation is moved to the bank giving you the actual credit)

Contact us: +971-555394457

#auto loan uae#lowest interest rate car loan uae#car emi in Dubai#loan for a used car in UAE#bank car loan uae#best auto loan in Dubai#best car finance in UAE#car loan requirements Dubai#car interest rates uae#auto loan for used cars in UAE#lowest car loan in UAE#The lowest car loan interest rate is

0 notes

Text

EVERYTHING ABOUT DEBT CONSOLIDATION LOAN IN DUBAI

Financial responsibility in the form of multiple credit cards or loans should be handled by utilizing the option of a Debt Consolidation Loan Dubai. Numerous banks within the UAE offer debt consolidation loans. Based on the most recent research it’s been found that at least three of five UAE residents are in debt of different types and could benefit from debt consolidation services.

How it works:

The Debt Consolidation Dubai service is provided by nearly all of the known banking institutions within the UAE. The name suggests that this type of service permits the consolidation of all outstanding obligations arising from multiple credit cards or outstanding debts for credit card debt into an all-in-one consolidated obligation. This method has particular advantages that surpass the

convenience of being able to handle all outstanding liabilities in one form. There are additional financial advantages.

We’d like to discuss the process of consolidating debt through this example:

Let’s look at the scenario of someone who has outstanding debts according to the following: based on two credit cards with AED 25000(or) and AED 20000/- as well as a personal loan of AED 150,000/+. In most cases, an individual interest rate is applied to each outstanding debt, and a fixed installment amount will be applied to each. If you decide to consolidate your loan, the bank will treat it as one single outstanding debt and offer you new lower interest and monthly installment rates with competitive rates. This can result in significant savings.

HIDDEN Costs Figures:

A lot of people find themselves stuck in a spiral of unending debt because they fail to see the hidden cost of interest rates for unpaid debt. According to the market standards the typical interest rate for credit cards averages 2.9 percent in a month. But, if you apply the same rate to an annual percentage rate (APR) it can be calculated at up to 40 per cent. APR will be applicable only when

the regular monthly credit card payments aren’t paid in full and if you carry balances on your credit cards throughout the month. This is usually not fully recognized and is portrayed as a hidden cost for the majority of people.

When you apply for an installment loan for debt consolidation, you will be able to avoid the annual interest rate applicable to your credit card debt and instead get an updated monthly installment figure that lets you pay off your due amount in a systematic way, balancing your income against your obligations.

ADVANTAGES OF COMPLETING DEBT

CONSOLIDATION

● It helps you take better control of your finances by combining all your outstanding debts in one single loan. This allows you to get rid of the obligation to pay high-interest rates on all your debts through an interest rate that is the lower interest rate

● Flexible repayment plan

● Better financial control

● It allows you to save on interest charges that otherwise would have been appropriate

● Increases your disposable income and aids in improving your finances.

0 notes

Photo

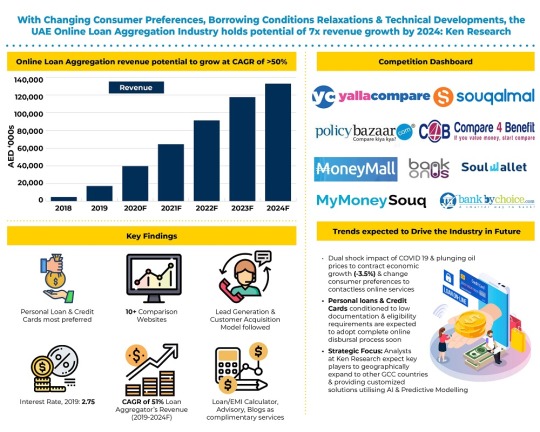

Future of UAE Online Loan Aggregator Market: Ken Research Buy Now COVID 19 Crisis Creating Opportunity in Credit Market As Coronavirus hit the world in 2020, whilst some countries took a slow approach to comprehend & dealing with the situation, UAE was one of the very few countries taking pivotal steps to minimize both health & economic risks in the country.

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loans Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes

Text

5 Smart Ways to Make Your Credit Card Work for You

UAE certainly has the highest credit card, internet and e-commerce penetration in the MENA region. However, a significant percentage of transactions are still made through cash. Visa and Mastercards are popular and are widely accepted by merchants in the region.

There have been several changes in recent years, which are moving the needle on credit card usage in the market. Some customers would have witnessed their credit cards being reissued by the issuers with a chip around 2016/17. This was due to a mandate from the Central bank of UAE for the issuers to comply with EMV (Europay, Mastercard and Visa global standard for chip-secured credit cards) standards a few years ago.

Credit cards are extremely convenient, secure and what’s more, also reward cardholders on usage as well. There are more than 200 credit cards issued by banks and financial institutions in the UAE. While the number of banks is shrinking with the recent M&A announcements, there are several new credit cards that keep popping up with innovative and irresistible offers to the customer.

Many of us would have had a difficult experience with our first credit card. Not understanding differences between a credit or debit card, we would likely have dashed to the nearest ATM to withdraw some cash and spend on stuff which we really did not have any plans of buying. A scenario that would most likely have ended finally with some sort of settlement with the bank after weeks and perhaps months of painful collections calls and negotiations.

As we got a little more aware of how credit cards work, we generally end up with one or two cards (ideally issued to us by the banks where our salary gets credited) and have built some sort of loyalty to these cards over the years.

This article gives a credit card user 5 useful tips on how to use a credit card and maximize savings. These are simple and proven steps that can help one save thousands of dirhams.

No one Credit Card is best suited for everyone

Credit cards are diverse in their offerings. One must understand that 200+ credit cards in the market come with several differences. Some of them being:

Fees and Charges: Annual Fees, Interest rates, International transaction charges, cash advance charges and so on.

Reward Features: Cashback, Airmiles, Reward Points, No Rewards no fee, Reward earn rates, Redemption or burn rate, etc., Note- The value of the rewards might vary based on spend amounts, type, location, etc.,

Features: Airport Lounge, Free Cinema, Complimentary Golf, Valet Offers, etc.,

Apart from the above, there are also credit limits, co-brands (Skywards, Etihad and so on), etc., which differentiate cards. With so many differences among them, it is important to spend a few minutes to compare the features and identify the most suitable credit card for your specific needs. Soulwallet’s “Best Fit” comparison tool uses smart algorithms that can match one’s individual spend pattern and feature preferences with the most suitable credit cards among all options available. One will also get a good indication of annual saves in dirhams earned through credit card rewards. Do check how your current credit cards stack up against the ones which are best for you. Click here to find out.

Also, do look at the feature-wise rankings to find out which is the best card for your favorite credit card feature (Cinema, Golf, etc.,)

No one Credit Card can give you the best value

Why do banks have multiple credit cards under their offering? These are typically to cater to different segments of customers who are keen on a specific feature or a reward program. Cashback and Airmiles are a couple of popular reward categories.

After evaluating credit cards in the UAE and the reward offering across their products, it is quite evident that there is no one card that may fit in the best for you. In order to optimize your savings (reward value for the transactions you make on the credit card), you probably might have to keep 2 or 3 credit cards in your wallet which satisfy all your requirements with a high rating.

For example, John travels frequently. He spends his weekends generally watching movies with his wife and two school-going children. The best option for John is to look at the below combinations:

Credit cards that:

Reward him with maximum reward rates for a) School Fees b) Grocery expenses c) Travel spends

Includes complimentary features such as a) Cinema Offer b) Airport Lounge c) Airport Transfer

Has low international (foreign currency) transaction charges.

The answer might be more than 1 card and if the saves are significant, why not?

Pay on time and if possible, in full

Making payments on time is probably the most important criterion which helps build one’s credit score. Having a healthy credit score means keeping your credit options available. There is always going to be a need for some sort of credit requirement, for example, a home loan, salary transfer loan and so on. Find out more on Credit scores in the UAE

Making your credit card payments on time is extremely critical and if possible, try to make them in full. This means one would save money on the interest which can be in thousands of dirhams.

Most banks have options such as Standing Instructions (from your bank account to your credit card if both are with the same bank), Direct Debit (a standard transfer instruction on your bank account), exchange house payments, etc. One has the option of setting this up for a minimum payment or full and sometimes a fixed recurring amount as well. Enquire with your bank and set up a payment instruction that will ensure you don’t miss a payment date.

Regular payments build one’s credit history well and allow banks to re-underwrite your credit lines periodically and automatically.

Balance Transfer - If you are incurring interest by not paying your credit card dues in full each month

Balance transfer in simple terms is moving debt from one credit card to another. If you are not paying the total outstanding and incurring interest on your statement balance, a balance transfer is a smart and easy method to save money on interest.

Balance transfers normally come with an interest-free offer period. This is a no brainer - it can help you save interest that you would otherwise end up paying on your current card for 3 to 12 months (and more in most cases), depending on the balance transfer offer period.

Example: If a cardholder has an AED 5,000 balance on a credit card with a 20% interest rate. Such a balance would incur interest of approximately AED 1,000 in a year. By transferring his credit card balance the cardholder can save on the AED1,000 of interest with only a small balance transfer fee instead.

Note:

Balance transfer does not earn you rewards on transferred debt.

Once you have transferred your balance to a low-interest card, do review the need of continuing to keep the high-interest credit card active. Any unnecessary spend on this open credit card can delay your payoff on the new card.

Defaulting on the new credit card might trigger a standard or higher interest rate as per bank policies.

Before you make the balance transfer move, do the math to ensure that you end up saving. Points to consider are Annual fees, Interest rates, etc.,

Change with the industry- Adapt to smarter payment methods

In recent years, banks have evolved and are continuously evolving in the digital space to stay updated and relevant to future customers. Smart payment methods have gained a lot of momentum and acceptance among UAE consumers. Apple pay, Samsung pay are already common names and are quite popular.

These smart payments make the process seamless and are focused primarily on convenience and security. While Apple and Samsung are already building the culture of adapting and shifting to newer technologies in the mobile space, one must be more adaptive and embrace future technologies to leverage the benefits available.

Takeaway

Credit cards are convenient and a popular payment method for purchasing products or services. While it is quite a privilege to flash a prestigious credit card from your wallet for a purchase, it is important to make sure that the credit card works best for you.

As a personal finance aggregator, Soulwallet has analyzed various credit card features and rated them to identify the best credit cards for each feature. Be it golf offers, complimentary airport transfers, valet services or even cinema offers, one can easily find the best credit cards with the ratings provided. For more details visit us at www.Soulwallet.com.

1 note

·

View note

Text

Best Car Finance In UAE

Best Car Finance In UAE

About

Car loans in the UAE are an extraordinary method for buying a car without paying everything forthright. They offer cutthroat paces of interest and adaptable reimbursement terms.

You don't need to defer or pause for a moment before getting your hands on that great, fantastic ride. With the idea of car loans in presence, getting another car is conceivable way prior and more straightforward than it used to be. What's more, the ongoing business sector scope settles on it a more astute decision to get you supported with a car loan as opposed to paying forthright. Today, practically all top banks are offering car advances in UAE and Dubai, with serious car loan financing costs, adaptable reimbursement periods alongside a few different advantages. In the present day and time, Car finance in Dubai is a generally simple and smooth undertaking, given the way that you are a very much informed purchaser.

Advantages of Car Loans in UAE

Here is a rundown of advantages and alluring elements of getting car loans in the UAE.

Low and Debatable Financing costs: Car loan fees in UAE are somewhat low beginning at 2%. Most banks offer both fixed and diminishing car advance loan fees permitting clients have greater reimbursement decisions.

Simple Handling: Your car advance in UAE gets handled rapidly, kindness adaptable activities of top banks in the UAE. This basically implies that you won't need to go through hours and days getting endorsements, realigning or reassigning customs for the acquisition of your new car.

Low Least Compensation Prerequisites: Contingent upon the bank you pick, the base compensation expected to get a car loan in UAE could be essentially as low as AED 5000, making it feasible for all functioning people to have a confidential car.

Simple Method for purchasing a Car: Getting a car funded in Dubai is one of the least demanding ways of possessing a car. You can pick a basic, low-interest month to month reimbursement and become a car proprietor in a flash. Car finance in Dubai dispenses with months and now and again long periods of hole between beginning to put something aside for purchasing the car lastly having the option to do as such.

Adaptable Reimbursement Residency: All top banks in UAE offer adaptable car advances reimbursement choices. Clients can design their reimbursement methodology and pick the EMI residency and sum in the manner that suits them the best.

Funding Utilized Cars: Utilized Car loans in UAE can likewise be utilized to go downhill and trade-in cars in Dubai. Most banks in UAE offer funding for utilized cars at a somewhat higher loan cost. The banks decide the greatest age and state of the car through an assessment.

100 percent Supporting: While the more famous idea of car finance in Dubai is going 80-20 on funding and initial investment separately. There are many banks that offer 100 percent supporting choices for a car advance in the UAE.

Further develops FICO rating: Taking a car loan in Dubai and taking care of it according to the EMI of your arrangement will significantly further develop your FICO assessment, guaranteeing better open doors and notoriety with the banks.

Great Financial record: Car advances in the UAE are one of the most outstanding ways of building your record of loan repayment. This guarantees that your future loans applications with the bank will be smoother and more straightforward to get endorsed.

Benefits

Most extreme Vehicle Credit Sum

Vehicle Advance Loan costs

Most extreme Reimbursement Residency:

Least Compensation Required:

Extra Advantage: Free for life Visa

Money to Initial installment Proportion

Documents Required for Car Loans in UAE

For Self employed candidates

Properly filled vehicle credit application structure

Duplicate of Identification

Visa page from inhabitant Visa demonstrating residency

Driving permit of the candidate

Bank proclamations - ideally throughout the previous three months

Exchange permit of the business

Overarching legal authority (POA)

Update of Affiliation (MOA) or Article of Relationship (if there should be an occurrence of LLC)

Association arrangement (if there should be an occurrence of LLC)

for salaried candidates

Duplicate of Identification

Visa page from inhabitant Visa demonstrating residency

Driving permit of the candidate

Bank articulations - ideally throughout the previous three months

Pay Declaration of the candidate (not needed assuming the compensation is moved to the bank giving you the actual credit)

Contact us: +971-555394457

#car finance dubai#auto loan uae#lowest interest rate car loan uae#car emi in dubai#loan for used car in uae#bank car loan uae#best auto loan in dubai#best car finance in uae#car loan requirements dubai#car interest rates uae#auto loan for used cars in uae#lowest car loan in uae#lowest car loan interest rate uae

0 notes

Photo

How are Online Aggregators gaining momentum in UAE? – Ken Research Buy Now Traditionally banks provided limited transparency on loan pricing & charges, making customers call up/visit bank branches just to attain basic loan pricing information.

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis#UAE Online Loan Aggregator Market Forecast

0 notes

Text

Top 3 possible reasons why your credit card application has been rejected

Credit cards are popular and convenient payment tools. It is a well-known fact that banks offer several attractive features on their best credit cards such as Cinema offers, Airport lounge access, Valet service, Golf offers and many more.

Banks are constantly looking to acquire customers who have a good track record of payments and credit history. In a country like UAE, where in 80% of the bankable population is made up of expats, it is important that banks do their due diligence prior to approving any credit facility such as credit cards or personal loans.

Banks have different under writing policies which decides the fate of one’s application? Now, Let me try and simplify the top three reasons why credit card applications get rejected.

1. Income Criteria Not Met

This is generally the first eligibility criteria that is checked. It is important to note that UAE’s central bank circular 28/2010 “Regulations for Classification of Loans and their Provisions” dictates that banks must ensure that personal loans must be given to people who earn a minimum of AED 60,000 annual income. Note, credit cards are considered as a form of personal loans and hence this applies to both credit cards and personal loans.

While the interpretation of this regulation might differ bank to bank from an implementation perspective, this criterion ensures that banks do not lend to those who earn less than AED 5000 per month considering living expenses, affordability etc.,

Over the last couple of years, banks have built a system to verify income information from each other in an automated way. This is done by reading Salary credits from your bank statements through a central system. This has relaxed banks policies on documentation requirement in the recent years.

So, in short it is important to know that one must be earning a minimum income of AED 5000 per month to avail a credit card or personal loan in UAE.

Banks also offer cards for customers based on their income . For e.g., a Prime Infinite Credit Card from Dubai Islamic Bank is offered to a customer who has a minimum income of AED 50,000 per month.

2. Weak or Poor Credit History

In UAE, Al Etihad Credit Bureau receives financial information from all providers and provides credit reports to residents and financial institutions. The report contains records of an individual’s liabilities such as credit cards, loans etc., Banks evaluate the credit report for repayment history prior to approving applications. It is imperative that one maintains a clean credit history in order to avail any loan/credit card facility in UAE. Level of debt, payment history, credit history age has an impact on your credit score.

Below needs to be taken care to ensure a clean history.

Always pay dues on time.

On cards better to pay the entire outstanding. If not, minimum due to be met. Note, full payments may result in a higher credit score.

Avoid going over limit on your cards.

It may take more than 5 years for a credit record to be cleared hence utmost care to be taken to ensure all the above points.

One can avail their credit report online from AECB for a fee. Visit https://aecb.gov.ae/home for more information.

3.Debt Burden Exceeded

In UAE, banks have been regulated to ensure that financial liabilities of an individual do not exceed 50% of the monthly income. While Banks follow different processes to ascertain debt burden the general logic is explained below for simple understanding

Monthly Income: AED 10,000

Monthly financial payments (Credit card minimum dues, Loan EMIs): AED3000

Debt burden:30%

Ensure all unused credit cards are closed. Receive and maintain closure or clearance certificates from respective banks for documentation purposes. Consolidate debt as a loan so that the installment is affordable and within the debt burden. Stay financially fit!

Takeaway

While the above 3 are the top reasons for rejections. There are 90% chances one can get their card or loan approved if the above 3 conditions are met. Roughly 10% of applications stay rejected for reasons such as verification and other policies.

Picking the perfect credit card for your specific needs should always be based on how you plan to spend and what your current lifestyle is like. Traditionally one signs up for a card based on sales pitch by a bank’s sales executive. Take advantage of Soulwallet’s credit card comparison platform to make sure you make an informed decision.

1 note

·

View note

Text

Smefin Business Loans in Dubai and UAE

It's very simple, easy, fast and flexible

As a business owner, you can now manage your business and make more effective decisions. Choose Smefin Business Loan Dubai UAE and take the first step towards achieving your corporate goals.

Features And Benefits

High Loan amount of up to AED 1 million

No collateral required

Flexible repayment period of up to 24 months

Simple documentation and instant approval process

Competitive interest rates

A dedicated Relationship Manager to service all your corporate needs

A Business Current Account with No Minimum Balance Requirement

Choice of Islamic Business Finance

Eligibility Criteria for Business Loan

Minimum length of business of 2 years

Minimum annual sales turnover of AED 1.5 mio

Documentation

Application form

Trade license copy

Incorporation documents as applicable i.e. Power of attorney (POA), Memorandum of Association (MOA) or Article of Association in case of an LLC, Partnership agreement

Last 12-months bank statement (Mashreq account not required)

All partners valid passport with residence visa page for expatriates

All documents are required to be valid at the time of evaluation

SMEFIN provides pos loan, business credit card, invoice discounting, fleet finance, loan against property, fleet finance, medical equipment loan finance etc.

Invoice Discounting

Invoice discounting is a practice that consists of using a company's unpaid accounts receivable as collateral for loans issued by a financial company. This is a very short-term lending method, because once the amount of the collateral for accounts receivable changes, the finance company can change the amount of the outstanding debt. The amount of debt issued by the finance company is less than the total outstanding accounts receivable (generally less than 80% of all invoices during 90 days). Generally, the choice of a finance company is not simply to allow a certain percentage of all outstanding invoices, thus relying on the distribution of accounts receivable among many clients to avoid loss of collateral.

At SMEFIN.AE we help you to equip your Business for success and to build your business ambitions.

When the business expands, it generally requires investments in equipment, machinery, vehicle equipment, and other business assets. Solutions provided by smefin can meet business asset or equipment purchase requirements. The product package provided includes different types of equipment, such as construction equipment, medical equipment finance, and professional equipment. The structure of these offers allows clients to choose to use their assets as funds for purchase transactions.

Do you want to get more money from the property you own? Now you can get a ready-made freehold property loan in Dubai.

When looking for a loan against property in Dubai, you should compare various loan products to find the cheapest option that best suits your needs. You must consider many factors, such as interest rates, credit scores, and other factors to choose the right option.

0 notes

Text

Bank of Baroda Abu Dhabi

Bank of Baroda Abu Dhabi is an Indian Multinational Bank that provides banking and financial services. It merged with Vijaya Bank and Dena Bank in 2018 making it the second largest bank in private sector In India, in terms of assets. Hence, making it the safest bank to do all your transactions.

Bank branches, contact info, and swift codes

It has located itself in the heart of Abu Dhabi, making it very easily accessible by people. They have one branch in Abu Dhabi and two customer care centres in Musaffah. Their swift code being BARBAEADADH. You can contact them on the following

Name Description Fax Telephone E-mail Mr. Sudeesh Assistant GM 04-2286020 04-2600901 [email protected] Mr. Mohit Senior Manager 04-2286020 04-2600902 [email protected] Mr. Prasanna Sr. Manager (credit ) 04-2286020 04-2600903 [email protected]

Customer Service Centres

EBSU Shabiya

Name Description Fax Telephone E-mail Mr. Jithu Customer Executive 02-5558490 02-5558491 [email protected]

EBSU Musaffah: Plot No. 3, Sector No. 2, Musaffah Industrial Area, Abu Dhabi, UAE

Name Description Fax Telephone E-mail Mr. Serbjeet Senior Customer Service Executive 02-5551849 02-5551843 [email protected]

Bank Personal loans

Their bank policies are straightforward and trustworthy. Let’s look into it in detail.

Features:

Eligibility – They provide loans to confirmed salary class who has been working with the same organization for more than 3 years. Also the salary account should be maintained with them.

Increased Loan Amount Multiple – 12 times of monthly income with a minimum and maximum amount of AED 10,000 to AED 500,000.

Repayment period can be increased up to 48 months.

Free ATM card for savings bank account.

Free accident insurance coverage for the entire loan amount.

Charges

Rate of Interest -6.00% per annum (Reducing Balance) Processing charges – 1% upfront minimum AED 250/- Pre-payment charges 2% of the amount of loan outstanding, minimum AED 250/-

Further, you can apply now online by going to their website: https://www.bankofbarodauae.ae/accounts-details/9/Salary-Linked-Loan.html#parentVerticalTab4

Bank housing loans

Baroda bank offers the flexibility to acquire ready house from developers, choosing re-sale properties, and also take over from other banks.

Features

High Loan amount up to AED 20 Million

Loan Tenor up to 20 years

Available to UAE Nationals and Resident Expatriates (both Salaried & Self Employed)

Lowest processing fee with max of AED 25000/- only

Attractive Interest rate of 3.75% fixed for first 2 years under reducing balance method

3rd year onwards, 3.00% below base rate with minimum of 4.50% p.a

Charges:

Options 1 2 Rate of Interest 5.50 % (3 % below base rate) 6.5 % (2 % below base rate) Margin Margin of 50% & interest to be reset every year at the time of review 40%

Pre-payment Charges

Year Amount 1 3% of outstanding amount. 1 – 3 2% of outstanding amount. 3 – 5 1% of outstanding amount. 5 to year of sanction No penalty is to be levied.

You can apply online at: https://www.bankofbarodauae.ae/accounts-details/11/Home-Loans-In-UAE.html#parentVerticalTab4

Bank auto loans

Features:

Maximum loan amount of AED 1.250 Mn

Competitive ROI starting at 2.75% (flat) or 5.50% reducing balance

Flexible repayment options up to 48 months(new cars) & 36 months (used cars)

Holder of valid UAE Driving License.

Minimum Salary or Monthly income of AED.4000/-

Charges:

Rate of Interest 3% p.a. (flat rate) or 6.00% p.a. (reducing balance) Processing charges 1% of loan amount Pre-payment charges 1% of amount of loan outstanding , minimum AED 250

Alternative banks

0 notes

Photo

Illustration Photo: Royole fully flexible displays presented at CES 2019 (credits: Michael Sauers / Flickr Creative Commons Attribution-NonCommercial 2.0 Generic (CC BY-NC 2.0))

Call for applications: Hub71 Incentive Program for Global Startups

Hub71 is a community of founders, investors and business enablers that form a unique technology ecosystem strategically located in Abu Dhabi.

Named after the UAE’s formation in 1971, Hub71 is creating the optimal environment for transformative tech companies looking to maximize success, produce outstanding tech innovations and scale globally.

Hub71 is a flagship initiative of the AED 50 billion (USD 13.61 billion) economic accelerator program, Ghadan 21, which means “tomorrow” in Arabic.

Awarded startups will be receiving subsidized housing, office space and health insurance as follows:

100% subsidy for Seed Stage Startups:

2 – 5 people

$100k – $500k of capital raised

Incentive for 2 years

50% subsidy for Emergent Stage Startups:

Up to 25 people

$500k or more capital raised

Incentive for 3 years

Companies that will be considered for the incentive program should meet the following criteria:

Be high-growth tech companies

Target a large user base or potential pool revenue

Provide transformative technologies or business models

Secured VC funding in the last three years

Set up a meaningful presence (a majority of the team) at Hub71

Application deadline: December 31, 2020

Check more https://adalidda.com/posts/tT4KD35zuu59SZjeW/call-for-applications-hub71-incentive-program-for-global

0 notes

Photo

UAE Online Loan Aggregators Industry Outlook to 2024: Ken Research Buy Now The publication titled ‘UAE Online Loan Aggregators Industry Outlook to 2024 - Driven by Shifting to Contactless Services & Easy Online Loan Facilitation’

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loans Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes

Text

Aspects of Taking a Personal Loan in UAE

Personal loan is a loan, which establishes consumer credit that is granted for personal use. It is typically unsecured and based on the integrity of borrower and his ability to repay.

Features of personal loans in UAE:

The main feature of personal loan in uae is that it is unsecured by any collateral, and this applies to even personal loan to those who are not salaried.

Collateral is just any economic resource of fundamental value such as car, boat or house, which can be repossessed by a lender in case borrower forfeits on repayment of the loan.

Let’s check out how do personal loans in UAE work!

Amount Required

Every bank in UAE stipulates a maximum amount of loan provided to you.

After you estimate how much you require, you can compare loans where the maximum pay-out is higher than you require.

Need of minimum salary

Every bank in UAE imposes a minimum level of salary you need to earn if you want to qualify for a loan.

When you are searching to compare loans, choose only those with a minimum salary requirement that is less than your monthly remuneration.

Fees for arrangement

Arrangement fees are charged by the bank as soon as you take the loan and are clubbed with your principal loan amount.

In some cases, arrangement fees may be offered at 0% interest, but this can rise to AED 600 or 2% of your loan amount.

Early fee for settlement

In case, you are planning to take a loan for 5 years but wish to pay off the loan much before, early settlement fee becomes a crucial factor in your judgment.

This is a fee imposed on you when you want early payoff of your loan.

You must take great care on checking the fine print because early settlement fees apply only if you settle in cash and not in case you are refinancing.

Types of interest rate

The rate of interest is a crucial criterion for raising a personal loan. But this issue is subject to much confusion.

The rate on the personal loan can be estimated in two ways: a flat rate and a reducing rate. Reducing rate is estimated on the outstanding balance of your loan.

In contrast, a flat rate is estimated on the principal amount of your loan, throughout its duration. Hence a loan at a reducing rate of 8% is equivalent to a flat rate of 4.41%.

Take care while making comparisons because one bank may be offering a flat rate loan while the other, a reducing rate loan.

Salary transfer

Banks in UAE have various rates of loan for different customers who wish to open an account and have their salaries transferred to that account on a monthly basis from their employer as opposed to a person who does not transfer his salary.

The customers, who transfer their salary, are regarded as less risky, and the banks offer them loans at very less rate.

Some banks do not provide personal loans to customers who do not transfer their salary to them.

Islamic finance

In UAE, some Islamic banks follow the Shariyah Law according to which charging interest rates on loans is forbidden.

Thus, you can check out for attractive loans from such banks.

Company that is not listed

In case, your employer is not listed with a bank; this will make it extremely tough to get a loan.

Extending personal loans

In case, you need to extend your personal loan; there are many options.

You can get in touch with your bank to explore whether they are happy to extend your current loan.

You can even have another bank to buy out your loan, which is called as re-financing.

Consolidating debts

This option helps you by merging all your loans into one loan. So, whether there are overdrawn credit cards or personal loans, there will be an offer by banks to combine these debts into one balance, which you can pay off easily.

These are all some aspects of taking personal loans in UAE.

0 notes

Text

Good Credit Score Means Good Financial Health – Understanding How Credit Score Works can Help You Save Thousands of Dirhams

Credit reports and scores are essential to financial health of any economy. Its primary use is to help financial institutions use the information provided in the report to assess the credit standing of an individual prior to issuing individuals any credit products (credit cards, personal loans and so on).

Al Etihad Credit Bureau is the entity which provides credit reports to consumers and financial institutions in the UAE.

As an individual it is beneficial to have a good credit score as this will not only ensure that your chances of getting a credit card or loan (personal loan, auto loan, home loan) etc. are increased but, almost more importantly can help you save money as banks frequently give better terms (lower interest rates, higher loan amounts etc.) to individuals with better credit scores.

In this article we will help you better understand credit reports.

Components of a Credit Report

Financial Liabilities – Financial institutions are required to provide details of credit facilities such as credit cards, personal loans, mortgage loans etc., to the UAE Credit Bureau. Details such as assigned credit limits, utilized limits on credit cards, payments made, delayed payments, returned/bounced checks, loan amounts issued, outstanding balances, age of the loan/credit card, active status, police case history and so on are some of the key data points shared. In addition, the below details are also shared with the credit bureau:

Employment Details- Employer Name, Income, Date of Employment are a few details pertaining to employment

Addresses- Residence address, emirate, contact details including mobile numbers and email ids.

Personal Identification – Emirates Id number, Passport Number, Date of Birth etc.,

The Al Etihad Credit Bureau (AECB) manages the process of collating the information received from all financial institutions (as well as some other non-financial entities such as telecom and utilities providers) and summarizing this at an individual customer level.

These details are structured in a systematic and easily readable format which the financial institutions can access in assessing the credit worthiness of potential customers.

What is a credit score and why is it important?

Credit score is a three- digit number which is assigned by the credit bureau based on various variables such as number of loans, repayments, delayed payments, credit utilization and so on. Credit scores range from 300 to 900, higher the better from a financial health perspective.

The credit score is an indicator of a customer’s financial profile and it is important to note that quite a few banks have moved to offer credit score-based features (interest rate, loan amounts etc.) to their customers. This means you will get more beneficial terms the higher your credit score .

So, what is the mantra to maintain a healthy credit score?

Below are some simple disciplined practices one needs to follow:

Do not hold too many credit cards. Find out the best credit cards for “You” and stick with it. Close the ones which are not suitable for you or you carry but don’t use too often. Use Soulwallet’s “Best Fit” tool to find out how good are your credit card individual spend patterns and other requirements.

Ensure payments are made on time. And whenever possible, in full. This is the most important aspect and has a significant weightage in one’s score. Missing payments is a huge no-no and will definitely adversely impact your credit score. Remember the golden rule – “only borrow what you can afford to repay”!

Avoid going over the credit limit on your credit card.

Try and stay below 40% of your credit utilization. If you have a credit limit of AED 10,000 and your current credit card balance outstanding is AED 4,000, your utilization rate is 40%. The lower the better.

Keep copies of your bank clearance letters for records, there are possibilities that one might have to provide them to have the details amended (if they still show up on the credit report).

Please note - credit scores are not carved in stone, it is a dynamic and ever-changing variable, updated periodically when inputs are received from banks and financial institutions.

Credit scores take a significant time and effort to improve and, in this case, we would clearly recommend that prevention is better than cure.

How and where can I get my credit report?

For individuals the best recommended option is to download the AECB (Al Etihad credit bureau) app on the mobile phone via Google play or the IOS App store and download the report or score. Note, the charges are much lower to download the report online rather than by visiting an AECB branch. Click here to find more details.

Takeaway

Soulwallet strongly recommends you to compare products through a neutral and unbiased comparison site before you make a financial decision which can be as simple as signing up for a credit card in UAE.

Most UAE residents at some point or the other will need to explore options to avail credit facilities from a financial institution. The reasons could be as simple as managing to pay an annual school fee or to cover an unexpected medical expense. Having a good credit score can not only make the process of getting a loan much simpler but can also potentially help one save thousands of dirhams (a simple example is the money saved through a lower interest rate offered on your personal loan based on a good credit score).

1 note

·

View note

Text

Senior Payment Operations Required for Banking Associated in Dubai

Senior Payment Operations Required for Banking Associated in Dubai Our client within the banking industry are looking for experienced Senior Officer - Payment Operations in Dubai to be employed on outsourced payroll. Position details: Department : Payment Operations Domain : Operations Location : Dubai The process involves close monitoring of Central Bank & Correspondent bank cutoff time for submission of transactions, identify and timely escalation of any issues to immediate supervisor or unit manager. Current visa status : Visit / Tourist / Employment / Residence UAE Driving license : Yes / No Education degree attested : Yes / No OK to work long hours, as per dept. requirements : Yes / No Reason for change : Elaborate please Current Remuneration : Salary + benefits in AED Expected remuneration : Salary + benefits in AED Notice period : Immediate / 1 - 3 months Note: We do not have any openings available for candidates with no banking/financial industry experience. Due to high volume of CV's being received by us, only shortlisted candidates will be contacted. Do not send sales banking profiles as we do not work on them nor have the time to forward them to relevant people. If you are not looking for change you may want to refer someone. Thank you and all the best in your career endeavors! Responsibilities and Duties Job Description* Perform role of checker in daily functions, perform setup of RMA with correspondent bank BIC, follow-up for necessary approval, monitor critical swift queue at regular intervals, Identify and distribute SWIFT / UAEFTS messages printed in Message Centre printer to individual operation units, identify nature of fax received in RIGHTFAX and send to individual units within the bank, perform call back to customer exercising call back controls, perform day end reconciliation of SWIFT / UAEFTS / FAX messages handled by unit, prepare weekly MIS on all RMA relationships. Perform role of checker , salary file processing in WPS, perform file formatting if necessary to upload file in WPS, monitor system for ACK NACK status of processed file, perform upload of incoming salary file to credit salary, day end reconciliation of entries posted in sundry accounts. Perform role of checker, handle enquires received from external bank in free format message received from SWIFT / UAEFTS, enquiries received within bank for status of transaction. Maintain track record for all enquires handled by the unit, perform follow up for Nostro outstanding items, and ensure timely closure of outstanding item within stipulated time period. ctions processed for the day, prioritize timely information needed by customer (internal/external). Unit’s daily proofs in DCFC, perform day end reconciliation of SWIFT / UAEFTS / FAX messages handled by unit, prepare weekly monthly MIS. Any other responsibility will be added as & when required. Qualifications and Skills Candidate requirements: Sound knowledge about “Islamic Products” and required Sharia compliant documents is desirable. Strong oral and written communication skills in English. Ability to work in a time-sensitive environment. 3-4 years experience in a bank with with knowledge of back office function in Swift, Payment processing. Experience in financial institution handling back office with strong accounting skills, analytical skills with system background. This should help in not only managing effectively the day to day process but also conducive for further process enhancement, automation. Good command in MS Office (Particularly MS Word & Excel) Flexible to work in all shifts. Job Type: Full-time Salary: AED5,000.00 to AED7,000.00 /month Job Location: Dubai Required education: Bachelor's Required experience: payment operations (checker): 3 years Required language: english fluently If you or any of your friends or colleagues would be interested in pursuing an opportunity, kindly send us your updated CV to: [email protected] with the below details.

0 notes

Text

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? – Ken Research

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? – Ken Research

Buy Now

The banking industry in UAE is a highly fragmented space with a presence of ~60 national & international banks in the country. Post-2016 oil crisis, suffering from high NPAs banks in UAE tended to be more cautious when lending particularly to corporate & individuals thereby increasing rejection rates. Even now, banks generally avoid lending to ex-pats (sometimes putting additional…

View On WordPress

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis#UAE Online Loan Aggregator Market Forecast

0 notes

Text

UAE Online Loan Aggregator Market Outlook: Ken Research

UAE Online Loan Aggregator Market Outlook: Ken Research

Buy Now

Socio-Economic Outlook Of UAE

With a population of 9.68 Mn as of 2019, ~70% of the borrowing population belongs to the age group of 30-50 years. A major proportion of the population resides in urban areas including Dubai, Abu Dhabi & Sharjah thereby driving the demand for financial products in the country.

High Job opportunities attract the ex-pat population to the UAE. >80% population is…

View On WordPress

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes