#Revenue Loan Aggregators UAE

Text

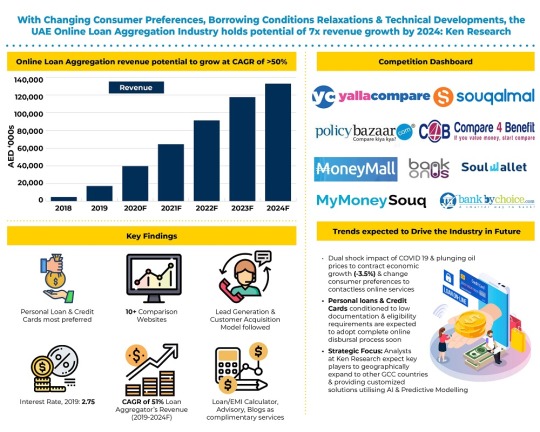

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

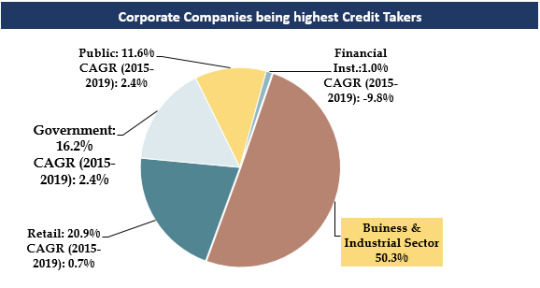

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Photo

Future of UAE Online Loan Aggregator Market: Ken Research Buy Now COVID 19 Crisis Creating Opportunity in Credit Market As Coronavirus hit the world in 2020, whilst some countries took a slow approach to comprehend & dealing with the situation, UAE was one of the very few countries taking pivotal steps to minimize both health & economic risks in the country.

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loans Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes

Text

Amidst several headwinds, BNPL sees considerable growth potential in the travel and hospitality sector

As buy now, pay later (BNPL) model extends beyond its focus on consumer goods; instalment-based financing is seen to find its way into different sectors and industries. Interestingly, travel captured the top spot in consumers’ spending priorities among the non-essential items, and consumers are most willing to fund their expenses through instalment payment options. Consequently, several BNPL firms are capitalizing on this trend to diversify their revenue streams.

Notably, the appetite for luxury travel is huge, especially amongst the millennials and Gen Z. Among high-end hotels, Versace Dubai was the first to start offering payments in instalments. In Asia Pacific region, Shangri-La Hotels and Resorts became the first to sign a partnership agreement with Singapore-based Pace to offer BNPL schemes in its hotels in Malaysia.

Amid current economic uncertainty also, BNPL firms are adopting several strategies to rebound in the travel sector by offering different payment options, thus, transforming the holiday booking process and making it much more simplified. For instance,

In August 2022, Cashew Payments, a UAE-based buy now, pay later (BNPL) provider, entered into a partnership with Sandy Beach Hotel & Resort in Fujairah, to provide the customers the flexibility and financial opportunity to pay in instalments during their staycation. Though this is not the first partnership of this kind, however, it is the first time the BNPL provider is tapping into the hotel industry. In order to diversify its business, the fintech firm has expanded into different verticals and now entered the travel and tourism sector seeing high growth potential.

This new offering came after the firm’s realization that a significant number of residents staying in the UAE were looking for staycation options without paying the hotel price upfront. Therefore, Cashew Payments expanded its lending option for the residents of the country through interest-free BNPL loans, with options to repay in three, six or twelve instalments.

Notably, the firm is also building strategies to expand into niche industries such as furniture, education and healthcare to capture more market share in the country. With more than 50% BNPL penetration, PayNXT360 expects this new offering to see high adoption amongst the customers in the country.

In March 2022, BNPL firm, Atome, announced to partner with the digital travel platform, Agoda, to provide more flexible payment options for the residents of the Philippines. Under this partnership, Philippines travellers will be able to pay for their domestic travel accommodations in three instalment payments. Previously, both the firms had partnered to serve other markets such as Singapore, Malaysia, Hong Kong, Thailand and Indonesia. Now, this partnership would help in boosting domestic tourism by providing Agoda customers with payment flexibility as they book their domestic travels.

In July 2022, an India-based travel fintech and BNPL aggregator, SanKash, revealed that it is aiming to acquire 1 million customers by 2025. This fintech firm launched BNPL services on its platform after the realization of the massive gap between travel experiences and on-time availability of money. The ‘Save and Spend mode’ feature of the platform, which allows the user to spread out the payment in instalments, has been witnessing an uptick over the last few quarters. While most banks do not lend for travel, SanKash is making travel more accessible and affordable for the customers by offering pay-over-time payment choices. Moreover, it also acts as the focal point for both merchants and BNPL providers to offer and avail Travel-Now-Pay Later option to their customers. SanKash, which uses an AI-powered logical engine at the time of payment & point of purchase, aims to increase partner productivity by 5X and double monthly activation rate plans, serving around one million customers by 2025.

Another United Kingdom-based travel fintech firm, Fly Now Pay Later (FNPL), raised a US$75 million debt funding package from Atalaya Capital in January 2022. The firm will use this capital to expand into the world’s largest travel market, the United States. Notably, FNPL allows the user to spread the cost of a trip over 12 monthly instalments through the travel agents such as Malaysia Airlines, HotelsOne, TravelUp, Air Serbia and Azores Airlines. Also, the firm allows customers to access flexible financing options through its app.

Other BNPL providers, such as Uni and LazyPay, also observed travel emerging as one of the top priority sectors for customer spending. Uni, which is the newest BNPL player in the Indian market has partnered with travel merchants such as ClearTrip, EaseMyTrip, Indigo, Goibibo, and Paytm. Under the partnership, the BNPL provider allows the user to pay via Uni Pay 1/3rd card to book tickets, stay, and pay for food and other expenses during their travel.

With the shift in the consumer’s expectations, BNPL providers are revolutionizing the travel experience through alternative and easy digital payment solutions. Therefore, more fintech firms are expected to see growth, prioritizing the needs of the customers through a seamless and flexible payment experience, making travel more accessible and empowering for the consumers.

To know more and gain a deeper understanding of the global BNPL market, click here.

0 notes

Photo

First Ever Phased IC

First Ever Phased ICO by Paycent Brings Transparency to Contributors Sponsored Bitcoin has hit new highs and the popularity of other altcoins has also been steadily growing. We recently covered how Bitcoin is now ranked 32nd global currency in terms of physical money supply. The trends in the future are also bright for cryptocurrencies including Bitcoin with crypto market cap all set to hit $1 tln by 2018. In this scenario anything that makes trading cryptocurrencies easier and safer will have a huge impact. One of the big developments in this direction has been Paycent a financial platform powered by Texcent. Paycent provides a wallet that can handle multiple cryptocurrencies and its users can convert these currencies internally. The icing on the cake is that they can also convert between fiat and crypto in real time. Recently Paycent completed their pre-ICO which successfully hit a hard cap of 22500 ETH in 10 days. They were able to raise these funds from 857 investors in 41 countries. A unique product offering and the right mix of products like debit cards wallets plus Paycents garnering of regulatory licenses in the UAE and Philippines as well as getting in principle approvals from Singapore and Hong Kong put them in a position to contribute immensely to the crypto domain. Convenience and comfort Paycent offers convenience and comfort to its user through its unique wallet that allows for sending and receiving funds in real time. Not only can users interact with cryptocurrencies but also with fiat. Conversions are done internally and wallet users can choose to exchange funds within the wallet ecosystem. The wallet isnt just good for exchanging and holding funds but Paycent has taken a rather utilitarian approach with it. As an example you can pay bills for water electricity or cable with the wallet. Pay for goods and services within your own country or across borders or even cash out funds with the partner merchants to get cold hard cash in your hands. Ultimately this amounts to a great deal of choice for the end user who now can not only choose the currency in which they want to keep their money in but also choose what to do with it at any point of time. The Paycent wallet is available for download on both the Google Play and Apple Appstore. More than just a wallet Paycents plans go beyond just the multicurrency wallet that they have created. Paycent debit cards will be released in Asia Pacific CIS EU and the UK starting April 10 2018. The cards are classified into Solitaire Sapphire and Ruby Cards. Early contributors will be given Solitaire and Sapphire cards free of charge if they have invested more than 500 ETH and 100 ETH respectively. Ruby cards will be available for a nominal payment. Paycent will also be able to build a profile of users credit ratings that would be attached to their wallet. This will allow Paycent users to leverage good credit ratings to get loans. The loan amount will vary and limits can be increased as the profile of the user improves. Paycent is evolving a full financial ecosystem that includes mPOS services integrated into the application which allows users to pay for utilities and telecom needs. Staggered ICO a worlds first Paycent is holding an initial coin offering (ICO) whose first phase has commenced on Nov. 2 2017. Interestingly the Paycent ICO is the worlds first staggered ICO which is being held in eight phases over four years. Each phase will have a hard cap. This decision to split the ICO into phases comes as a result of Paycent following the advice of their community and advisors. It will allow contributors the token sale to track the performance of each phase before they contribute. The staggered ICO increases transparency and allows contributors to follow the project through its evolution. The holding of the token sale in phases though gives rise to the obvious question about why shouldnt contributors just hold out and play the wait and watch the game. In order to encourage early participation they will be giving a bonus for early contributors. The bonus Paycent (PYN) tokens available would decrease with every phase. The first phase of the ICO is already in progress and contributors have a chance to get an 18 percent bonus on purchased tokens till Nov. 30 2017. At the time of writing of this article the token sale had successfully reached 22 percent of the total cap. The details of the ICO and all the phases can be found in a whitepaper that Paycent has released. Paycent is accepting Ethereum Bitcoin Litecoin and Bitcoin Cash for the token sale. The exchange rate has been pegged at 1 ETH = 600 PYN. Phase one of the token sale in progress has a hard cap of 30 mln PYN. Encouraging crypto adoption The facet that holds the most appeal for contributors is the fact that Paycent is straddling the sweet space between fiat and crypto. The project allows for mainstream adoption of cryptocurrencies by people who have so far been bereft of the advantages of digital currencies. Contributors in the ICO also stand to benefit as they will receive 33 percent of the aggregate revenue that arises from conversions between fiat and cryptocurrencies by the users of the e-wallet. Contributors will also be getting 33 percent of the interest revenue generated by microloans that Paycent extends. As there will be no PYN tokens created after the ICO and unsold tokens will be burned the contributors can also potentially benefit from the scarcity of the token. The Paycent project acts as a bridge between currencies people and businesses. If after all these years they can make cryptocurrencies usable by everyone they would have accomplished a great deal. Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you all important information that we could obtain readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions nor this article can be considered as an investment advice. Follow us on Facebook

http://ift.tt/2zrVG3S

0 notes

Photo

How are Online Aggregators gaining momentum in UAE? – Ken Research Buy Now Traditionally banks provided limited transparency on loan pricing & charges, making customers call up/visit bank branches just to attain basic loan pricing information.

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis#UAE Online Loan Aggregator Market Forecast

0 notes

Photo

UAE Online Loan Aggregators Industry Outlook to 2024: Ken Research Buy Now The publication titled ‘UAE Online Loan Aggregators Industry Outlook to 2024 - Driven by Shifting to Contactless Services & Easy Online Loan Facilitation’

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loans Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes

Text

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? – Ken Research

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? – Ken Research

Buy Now

The banking industry in UAE is a highly fragmented space with a presence of ~60 national & international banks in the country. Post-2016 oil crisis, suffering from high NPAs banks in UAE tended to be more cautious when lending particularly to corporate & individuals thereby increasing rejection rates. Even now, banks generally avoid lending to ex-pats (sometimes putting additional…

View On WordPress

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis#UAE Online Loan Aggregator Market Forecast

0 notes

Text

UAE Online Loan Aggregator Market Outlook: Ken Research

UAE Online Loan Aggregator Market Outlook: Ken Research

Buy Now

Socio-Economic Outlook Of UAE

With a population of 9.68 Mn as of 2019, ~70% of the borrowing population belongs to the age group of 30-50 years. A major proportion of the population resides in urban areas including Dubai, Abu Dhabi & Sharjah thereby driving the demand for financial products in the country.

High Job opportunities attract the ex-pat population to the UAE. >80% population is…

View On WordPress

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes