#Commission Rate Online Aggregators UAE

Text

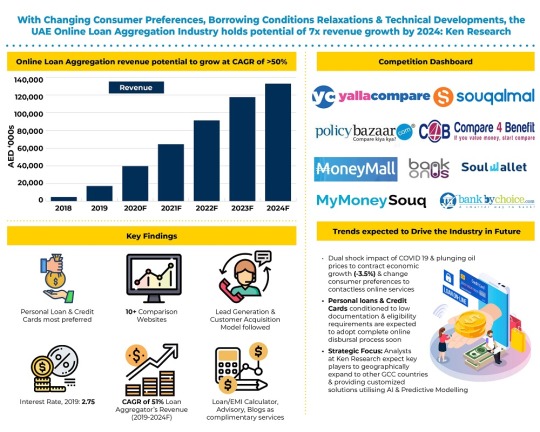

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

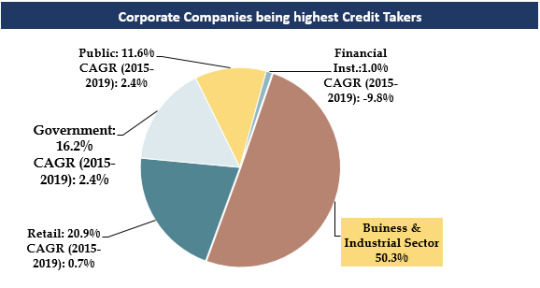

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Photo

Future of UAE Online Loan Aggregator Market: Ken Research Buy Now COVID 19 Crisis Creating Opportunity in Credit Market As Coronavirus hit the world in 2020, whilst some countries took a slow approach to comprehend & dealing with the situation, UAE was one of the very few countries taking pivotal steps to minimize both health & economic risks in the country.

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loans Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes

Text

weevi makes online ordering systems affordable and easy to implement for every restaurant, grocery or shop

Weevi.com an online ordering system for restaurants, groceries and shops is offering businesses many exciting fresh ecommerce features, including a branded app, advanced loyalty and intelligent features that keeps the solution running and growing with little manual setup and marketing efforts.

Features that you only used to see in big investments platforms are now available for smaller businesses.

After acquiring more than 400 clients across the middle east and European countries, including Lebanon, UAE, KSA, France, United Kingdom, weevi is now launching in the USA, from a Houston, TX based office.

The team at weevi focuses on helping businesses get more orders on their own platforms, by providing an enjoyable user experience based on maximizing orders conversion. Todays’ demanding customers are becoming very critical on user experience and features, they need to accomplish the job in the fastest most effective most enjoyable way possible.

Restaurants, groceries, and shops want a winning, simple online ordering solution that would save them from 3rd party commissions, and expose and glorify their unique brand identity, while giving them the data they need about customers and trends so they can improve their business performance. Through weevi they can offer features as loyalty and redeemable special offers and discounts on their apps, for keeping customers loyal to their brand.

Weevi “easy assisted setup” is based on a belief that restaurant, groceries and shops owners are too busy to aquire setup and optimise an online solution and its demanding logistics. They might not have the skills nor the time within their team and this is why they often cut corners and sacrifice a big chunk of their profit by going to aggregators.

Weevi assigns experts that will follow up with any signed up business, on setting up and kicking off the solution, as well as constantly improving performance.

Weevi integrates out of the box, with many third party providers on features that would integrate with current eco systems and provide added value 3rd aprty services.

weevi.com integrates with many POS for receiving orders directly on existing screens or on printers to simplify order management.

The team helps clients integrate directly with their own banks or payment gateways so they get better credit card rates and get paid directly to their banks as soon as a customer posts an order.

weevi also integrates programmatically with delivery providers in every served region, for getting the best rates, notifying the providers of an order to pickup. without any effort from the business operators.

Weevi model has a commission free online ordering solution pricing that grows with the business scale in order to appeal to every business size

By helping in the 3 main pillars:

1: Bringing in new customers

2: Providing worry free logistics and integrations

3: Keeping more profit to the business.

Weevi is being chosen as the official online order taking and delivery platform empowering brands like Burger king, Subway, dairy queen, paul bakery, grab n go, 24/7, Avon beauty, Tupperware and more

In Lebanon where the service first launched, more than 20 apps in the top 100 food apps on app stores are based on the weevi platform, and is proving to be one of the best solutions among online ordering systems.

#online ordering systems#app for restaurants#app for grocery#app for shops#cloud based ordering solution

0 notes

Text

Fight again: UAE F&B businesses try to do away with delivery charges in fight against Zomato, Talabat and Uber Eats

Take away the service charges on shoppers… UAE’s F&B businesses are ratcheting up the fight to on-line meals portals by insisting they drop these charges. And there are actually UAE firms keen to work with F&B operators on fastened payment foundation.

Picture Credit score: iStock photograph

Dubai: UAE shoppers stand to profit as extra F&B operators insist that on-line order and delivery portals ought to cease – or scale back – the charges on shoppers. Already, F&B businesses are getting some assistance on this.

Some UAE-based on-line meals order and delivery portals are introducing fastened month-to-month charges to F&B operators in a bid to try and break the dominance of Zomato, Talabat and Uber Eats. The latter cost F&B operators on a per-order foundation, and whereby their commissions find yourself as excessive as 35 per cent of every order. Plus, in addition they invoice a sure share on the buyer as properly.

In latest weeks, these UAE portals have doubled their efforts to persuade restaurant and café house owners that the fixed-rate month-to-month scheme can be the perfect value choice in the present market. The F&B sector has seen their cashflow shrink by up to 80 per cent in the final month or so, and the forecasts for the fast future are equally grim.

“So far, food aggregators such as Zomato and Talabat have been unwilling to change from their 12-35 per cent commission on each order (including delivery charges),” stated Shanavas Mohammed, Managing Companion on the Golden Fork Group. “At those rates, many of UAE’s F&B businesses will not survive.”

Final week, a newly shaped grouping F&B operators in Dubai stated it will be launching its personal order-and-delivery app to tackle the aggregators. The plan is to do so in a matter of weeks. The group has promised zero charges on the client for future orders by the app.

“The power of Zomato or Talabat derives from their vast database of users – it would be difficult initially for F&B businesses to match that kind of user base,” stated an F&B proprietor. “But when we scale back the fee for the buyer every time she or he orders from us ought to ultimately work in our favour.

“We guarantee information safety of shoppers and our fee won’t exceed 20 per cent, which incorporates delivery charges, and 2 per cent with out delivery . At present all aggregators cost Dh5-Dh8 for purchasers.

“And in some areas, customers are complaining they are charged an additional Dh20 for deliveries.”

Fastened fee choices

However the availability of extra choices from on-line F&B-focussed portals will permit F&B businesses to broaden their attain. One such portal providing a fixed-rate deal is Oogo.

At Dh299 a month, “F&B owners outsource their online ordering service to us where we take care of everything,” stated a spokesperson at Oogo. “The enterprise proprietor can deal with the operations.

“With regard to the transaction value, each enterprise proprietor is aware of that there’s a payment for every card transaction, whether or not it’s performed bodily or on-line. In a nutshell, our transaction value is the financial institution’s processing payment.

“We offer customers one-month free trial and then on a monthly basis.”

Extra such order-and-delivery businesses are probably to come up with their very own fixed-rate providers. Considered one of them, which at present gives a factors scheme on orders, plans to launch its delivery providers shortly.

The efforts are selecting up tempo because the native F&B trade realises that it’ll take time for his or her dine-in and buyer takeaways return again to regular. And even then it would have to be a brand new regular they need to account for.

The F&B sector in the UAE is in for a reset, and attempting to win in the net ordering area has turn out to be a necessity.

Picture Credit score: DailyKhaleej Archive

There’s at all times WhatsApp, Insta, FB

In the meantime, there are F&B businesses providing their promotions instantly on WhatsApp, Instagram and Fb, and thus bypass the necessity to tie up with the Zomatos and Talabats. “The online game can be played by all – but it needs to be done smartly if F&B businesses are to survive today,” stated a Dubai-based operator. “We cannot keep shelling out cash to the food aggregators and hope to survive.”

Fee-free

Then, there are firms that are working in the direction of a distinct cost construction.“More restaurants are integrating their Facebook and WhatsApp portals so that consumers can go through the menu and make the payment for an order directly through these platforms,” the operator added. “Expertise companions similar to RadYes are offering the cost gateway choice to full the transaction.”

One other app that’s reaching out to F&B businesses is ChatFood, the place it charges a flat Dh300 month for up to 300 orders positioned.

“We’re encouraging customers to order through social media platforms or technology partners such as ChatFood and RadYes,” stated Mohammed. “They’re really providing aid to restaurant house owners with their commission-free mannequin.

“This way, customers are directly reaching to us without any aggregator – and they will not have to pay any additional delivery charge either.”

In doing so, if the buyer finally ends up paying much less every time an order is positioned, then everybody wins. Or nearly everybody.

from WordPress https://ift.tt/2VQAotw

via IFTTT

0 notes

Text

BTC Rebellion: Want to Make $1,000 a Day? Administration Presages About This Rip-off

A crypto currency investment scheme named Bitcoin Rebellion has lately garnered interest all-inclusive with its entitlement that depositors could without difficulty earn over $1,000 a day. They might even become tycoons within 61 days with the Bitcoin Revolution app. Nevertheless, this is a rip-off, and it lately ran into woe with the Securities and Exchange Commission of the Philippines.

BTC Rebellion Scam Promises $1,000+ a Day

The BTC Revolution investment structure has been everywhere for quite specific time. Still, it has lately congregated more interest as the coronavirus epidemic exaggerates, and people are besieged to find more revenue due to work losses and other financial factors.

The BTC Revolution app claims to be “automated trading software that has been designed to trade the bitcoin and cryptocurrency markets,” its website states. For those watching to figure out if the BTC Revolution app is a legit investment prospect or a rip-off, there are numerous red flags to note. Primarily, the BTC Revolution website is a cookie-cutter site that is united by numerous other known scams.

Swaggering that its app has “a very great success rate of above 99%,” the BTC Revolution website prerogatives: “This means that most of the trades it enters into end successfully. What this means is that you could be earning over $1,000 a day.”

To trap unsuspecting depositors, BTC Revolution and other rip-offs using the identical website format make themselves appear like superstars have recommended them. Their promotion video features Virgin Group founder Richard Branson, Microsoft founder Bill Gates, Google’s Eric Schmidt, and Virgin Galactic chairman Chamath Palihapitiya.

Persons from numerous countries have been strained to BTC Revolution, anticipating that it would be a benign investment option during the coronavirus epidemic, comprising those in Australia, Europe, Singapore, the UAE, El Salvador, and South Africa.

Woe With Administration

Numerous similar scams have gotten into misfortune with the administration of several countries. On Tuesday, the Securities and Exchange Commission Philippines distributed a warning about BTC Revolution. In addition to affirming that this venture scheme is not ratified to do commercial in the country, the Commission warned of numerous red flags, including asking for an upfront investment and promising contemptible returns that sound too noble to be factual.

The Philippine SEC wrote:

BTC Revolution claims that for a least investment of two hundred fifty dollars ($250.00), stockholders can make as much as one thousand dollars ($1,000.00) or three hundred percent (300%) each day or a total of nine thousand percent (9,000%) each month.

In addition, the Commission elucidated: “Bitcoin Revolution asserts that its software enables anyone to trade bitcoins and other cryptocurrencies easily with a success rate ranging between eighty-eight percent (88%) to ninety-five percent (95%) per transaction which makes the profit potential limitless making some of its investors millionaires in just sixty-one (61) days. Bitcoin Revolution added that its software is designed to eliminate the need to spend hours analyzing the markets as the program will do all the work for the investors. All they need to do is to sit back and watch their profits grow.”

On the other hand, as with all rip-offs, anyone uploading money into their account at the BTC Revolution is improbable ever to see that money over. When penetrating for investment chances online, take caution as there is an aggregate number of rip-offs during this global plague.

Ezbitex global: A Hybrid Cryptocurrency Exchange And Payment Solution Provider!

https://ezbitex.global/

Purchase digital currencies through Cerberex Exchange

https://www.cerberex.exchange/

Read the full article

#Bitcoin#BitexCoin#BitexGlobal#ChangeTheWorld#Coin#crypto#Cryptocurrency#Ethereum#EZBitex#Finance#ICO#Money#Regulation#TokenSale#XBX#XNews

0 notes

Photo

How are Online Aggregators gaining momentum in UAE? – Ken Research Buy Now Traditionally banks provided limited transparency on loan pricing & charges, making customers call up/visit bank branches just to attain basic loan pricing information.

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis#UAE Online Loan Aggregator Market Forecast

0 notes

Photo

UAE Online Loan Aggregators Industry Outlook to 2024: Ken Research Buy Now The publication titled ‘UAE Online Loan Aggregators Industry Outlook to 2024 - Driven by Shifting to Contactless Services & Easy Online Loan Facilitation’

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loans Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes

Photo

UAE Insurance Aggregators Industry Analysis: Ken Research Buy Now Socio-Economic Outlook Of UAE 88% ex-pat population majorly from Asian countries, a high number of young populations, increasing household income is changing the buying behavior of customers from traditional to online led models.

#Car Dealership Sales Insurance#Commission Rate Aggregators Insurance UAE#Dubai Online Motor Insurance Market#Future of UAE Online Insurance Market#General Insurance GWP Online UAE#Individual Life GWP Online UAE#insurance market UAE#Life Insurance GWP Online UAE#Motor Insurance Declining Premium UAE#Number of Insurance Lives Covered UAE#Number of Policies sold by Policybazaar UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Distribution Insurance UAE#Online Health Insurance in Abu Dhabi#Online Insurance GWP UAE#Online Insurance Industry in UAE#Online Insurance Market Aggregators UAE#Online Insurance Market in UAE#Online Motor Insurance GWP UAE#PolicyBazaar UAE Market Share#Potential Insurance Aggregators UAE#UAE Bankonus Online Insurance Report#UAE Bayzat Online Insurance Market Future#UAE Fintech Market#UAE Insurance Aggregator Revenue#UAE Online Insurance Industry#UAE Online Insurance Industry Research Report#UAE Online Insurance Market#UAE Online Insurance Market Analysis

0 notes

Photo

UAE Online Insurance Industry Outlook to 2024: Ken Research Buy Now The publication titled ‘UAE Online Insurance Industry Outlook to 2024 – Driven by Customer Uptake, Ease for New and Renewal Policy Convenience with Insurance Aggregators…

#Car Dealership Sales Insurance#Commission Rate Aggregators Insurance UAE#Dubai Online Motor Insurance Market#Future of UAE Online Insurance Market#General Insurance GWP Online UAE#Individual Life GWP Online UAE#insurance market UAE#Life Insurance GWP Online UAE#Motor Insurance Declining Premium UAE#Number of Insurance Lives Covered UAE#Number of Policies sold by Policybazaar UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Distribution Insurance UAE#Online Health Insurance in Abu Dhabi#Online Insurance GWP UAE#Online Insurance Industry in UAE#Online Insurance Market Aggregators UAE#Online Insurance Market in UAE#Online Motor Insurance GWP UAE#PolicyBazaar UAE Market Share#Potential Insurance Aggregators UAE#Revenue Streams Aggregators in UAE#UAE Bankonus Online Insurance Report#UAE Bayzat Online Insurance Market Future#UAE Fintech Market#UAE Insurance Aggregators Revenue#UAE Online Insurance Industry#UAE Online Insurance Industry Research Report#UAE Online Insurance Market

0 notes

Text

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? – Ken Research

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? – Ken Research

Buy Now

The banking industry in UAE is a highly fragmented space with a presence of ~60 national & international banks in the country. Post-2016 oil crisis, suffering from high NPAs banks in UAE tended to be more cautious when lending particularly to corporate & individuals thereby increasing rejection rates. Even now, banks generally avoid lending to ex-pats (sometimes putting additional…

View On WordPress

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis#UAE Online Loan Aggregator Market Forecast

0 notes

Text

UAE Online Loan Aggregator Market Outlook: Ken Research

UAE Online Loan Aggregator Market Outlook: Ken Research

Buy Now

Socio-Economic Outlook Of UAE

With a population of 9.68 Mn as of 2019, ~70% of the borrowing population belongs to the age group of 30-50 years. A major proportion of the population resides in urban areas including Dubai, Abu Dhabi & Sharjah thereby driving the demand for financial products in the country.

High Job opportunities attract the ex-pat population to the UAE. >80% population is…

View On WordPress

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes

Text

How Insurance brokers could capitalize on the opportunities led by Premium Comparable Websites in UAE: Ken Research

How Insurance brokers could capitalize on the opportunities led by Premium Comparable Websites in UAE: Ken Research

Buy Now

Contributing 42% to total GWP collection in 2018, as per the data released by the Insurance Authority of UAE, traditional brokers led the distribution of insurance products among the UAE population. These brokers have been characterized as employing a team of telesales representatives opting for aggressive selling for different products including Health, Motor, and Life to meet their…

View On WordPress

#Car Dealership Sales Insurance#Commission Rate Aggregators Insurance UAE#Dubai Online Motor Insurance Market#Future of UAE Online Insurance Market#General Insurance GWP Online UAE#Individual Life GWP Online UAE#insurance market UAE#Life Insurance GWP Online UAE#Motor Insurance Declining Premium UAE#Number of Insurance Lives Covered UAE#Number of Policies sold by Policybazaar UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Distribution Insurance UAE#Online Health Insurance in Abu Dhabi#Online Insurance GWP UAE#Online Insurance Industry in UAE#Online Insurance Market Aggregators UAE#Online Insurance Market in UAE#Online Motor Insurance GWP UAE#PolicyBazaar UAE Market Share#Potential Insurance Aggregators UAE#Revenue Streams Aggregators in UAE#UAE Bankonus Online Insurance Report#UAE Bayzat Online Insurance Market Future#UAE Fintech Market#UAE Insurance Aggregator Revenue#UAE Online Insurance Industry#UAE Online Insurance Industry Research Report#UAE Online Insurance Market

0 notes

Text

What lies ahead for Aggregators in UAE: Ken Research

What lies ahead for Aggregators in UAE: Ken Research

Buy Now

Aggregators (Price Comparison Websites) have been lately introduced in UAE and within a short span of time, these platforms have gained much traction and are experiencing >200% Y-o-Y growth in their top line figures. However, unlike European and other developed countries, the penetration of aggregators is still very low. (~60% of motor insurance sales happen through Aggregators in the UK…

View On WordPress

#Car Dealership Sales Insurance#Commission Rate Aggregators Insurance UAE#Dubai Online Motor Insurance Market#Future of UAE Online Insurance Market#General Insurance GWP Online UAE#Individual Life GWP Online UAE#insurance market UAE#Life Insurance GWP Online UAE#Motor Insurance Declining Premium UAE#Number of Insurance Lives Covered UAE#Number of Policies sold by Policybazaar UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Distribution Insurance UAE#Online Health Insurance in Abu Dhabi#Online Insurance GWP UAE#Online Insurance Industry in UAE#Online Insurance Market Aggregators UAE#Online Insurance Market in UAE#Online Motor Insurance GWP UAE#PolicyBazaar UAE Market Share#Potential Insurance Aggregators UAE#Revenue Streams Aggregators in UAE#UAE Bankonus Online Insurance Report#UAE Bayzat Online Insurance Market Future#UAE Fintech Market#UAE Insurance Aggregator Revenue#UAE Online Insurance Industry#UAE Online Insurance Industry Research Report UAE Online Insurance Market Research Report#UAE Online Insurance Market

0 notes